- Fully Regulated

- Expertly Reviewed

- Secure & Trusted

- Transparent Fees

- Mobile Friendly

Find The Best Botswana Forex Broker For Your Trading Level.

Forex Trading Brokers in Botswana

We explore everything from A -Z how to become a skillful trader and who are the best forex brokers in Botswana for your style of trading.

For Botswanan Investors, forex trading can be a way to diversify.

Best Forex Brokers in Botswana

Forex Trading Basics

Forex Terminology

Currency Pairs

How to Start Trading in Botswana

Forex Trading Strategies

Forex Trading Platforms

Forex Charting

Forex Trading Risk Management

Pros and Cons of Forex Trading

Forex Brokers in Botswana

💵 Forex Broker 👉 Open An Account ✔️ Accepts Botswanans ⚖️ Regulation 📊 Max Leverage 💰 Min Deposit

Exness 👉 Open Account ✔️ Yes FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA Unlimited $10 / 135 BWP

AvaTrade 👉 Open Account ✔️ Yes CBI, BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC • 1:30 (Retail)

• 1:400 (Pro)$100 / 1903 BWP

HFM 👉 Open Account ✔️ Yes FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA 1:2000 $0 / 0 BWP

Axi 👉 Open Account ✔️ Yes ASIC, SVG, FCA, FMA, DFSA 1:500 $0 / 0 BWP

InstaForex 👉 Open Account ✔️ Yes BVI FSC, CySEC, FSA SVG 1:100 $1 / 19 BWP

IG 👉 Open Account ✔️ Yes FCA, BaFin, CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, FMA, CFTC, NFA, BMA. • 1:30 (Retail, UK)

• 1:50 (Pro)$250 / 4758 BWP

XM 👉 Open Account ✔️ Yes FSCA, IFSC, ASIC, CySEC, DFSA 1:1000 $5 / 95 BWP

FXTM 👉 Open Account ✔️ Yes CySEC, FSCA, FCA, FSC Mauritius 1:2000 $10 / 190 BWP

Axiory 👉 Open Account ✔️ Yes IFSC Belize, FSC Mauritius, FCA 1:777 $10 / 190 BWP

Admirals 👉 Open Account ✔️ Yes FCA, ASIC, CySEC, EFSA, JSC, FSCA • 1:30 (Retail)

• 1:500 (Pro)$25 / 475 BWP

10 Best Forex Brokers in Botswana

Rank

Broker

Review

Regulators

Min Deposit

Official Site

You’ll learn all you need to know about being a great trader and which forex brokers in Botswana are best suited for your style of trading in this comprehensive guide. Botswanan traders can easily take advantage of the competitive, exciting environment offered by forex trading as it is accessible to all over the age of 18.

Foreign exchange trading is legal in Botswana and must be carried out by licensed and regulated forex brokers.

➡️ Botswana is ranked one of the least corrupt countries in Africa, which is extremely advantageous for foreign investment.

➡️ While forex trading can be difficult in some African countries, Botswana has enough governmental support for foreign exchange activities.

➡️ Botswanans can use the services of international forex brokers to connect them to the forex market, given that the broker is well-regulated.

➡️ Carry trading, short trading, and binary options are three of the most popular ways through which Botswanans interact with the forex market.

How profitable is forex trading for individuals and retail traders? How much do you need to start trading forex in Botswana? Can you keep your full-time job while you trade forex part-time? What are the significant risks involved with trading forex in Botswana?

These are just a few questions that many Botswanan traders may have as beginner forex traders. Explore our website to find the answers to these questions and more.

Foreign Exchange Trading is a legal activity in Botswana that is governed by the Ministry of Finance and Economic Development (MFED), the Bank of Botswana (BoB), and the Non-Bank Financial Institutions Regulatory Authority (NBFIRA).

While these market regulators do not officially regulate forex brokers who carry out financial activities, regulators such as the FSCA, FCA, CySEC, and others, provide Botswanans with protection.

We reveal the best brokers with verified regulations who offer their services locally in Botswana. Botswanans can rest assured that these are trusted and legitimate brokers that garner a high trust score and/or rating.

Exness

Min Deposit

$10 / 134 BWP

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overview

Exness is a multi-regulated forex and CFD broker that was founded in 2008, which shows its long-standing history as being one of the top brokers. Exness is headquartered in Cyprus with offices based in South Africa, the United Kingdom, Seychelles, the British Virgin Islands, and Curaçao.

While the worldwide brand offers a wide variety of opportunities for retail and corporate consumers, the firm’s subsidiaries also provide customized financial services and investment solutions for clients across the world.

Why we choose Exness

Features

| Feature | Information |

| ⚖️ Regulation | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Standard Account, Standard Cent Account, Raw Spread Account, Zero Account, Pro Account |

| 📊 Trading Platform | MetaTrader 4, MetaTrader 5, Exness Terminal, Exness Trader app |

| 💰 Minimum Deposit | $10 / 134 BWP |

| 💰 Trading Assets | Forex minor pairs, forex major pairs, forex exotic currency pairs, Metals, Crypto, Energies, Indices, Stocks |

| 🔎 Botswanan Pula-based Account? | No |

| 💳 BWP Deposits Allowed? | Yes |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 0.0 pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | No |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Exness is a reputable international broker authorized by several reputable market regulators | There is a limited selection of tradable instruments in only a few financial markets |

| The broker offers some of the tightest spreads across all types of accounts | There is a limited selection of funding options offered |

| There are several account types to choose from, each accommodating different types of traders | |

| There are various market metrics available including exchange rates, overall trading activities available, current market conditions, and more. | |

| Exness is ideal for any Botswanan beginner traders and institutional investors | |

| There are solutions offered for any type of professional trader who needs advanced options | |

| There is a powerful proprietary mobile app offered | |

| Client fund safety and investor protection is guaranteed | |

| Multilingual 24/7 customer support is offered | |

| Instant withdrawal methods are available |

AvaTrade

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overview

AvaTrade is a multi-award-winning trading broker that is regulated in six countries and offers more than 1250+ trading products across numerous marketplaces.

Some of the greatest trading conditions in the world are provided to retail traders throughout the globe, including cheap fees, a competitive spread, rapid execution speeds, different account types, diverse financing methods, exceptional customer service, and much more.

Why we choose AvaTrade

Features

| Feature | Information |

| ⚖️ Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, FRSA, CySEC, ISA |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Retail Investor Account, Professional Account Option |

| 📊 Trading Platform | AvaTradeGO, AvaOptions, AvaSocial, MetaTrader 4, MetaTrader 5, DupliTrade, ZuluTrade |

| 💰 Minimum Deposit (BWP) | $100 / 1343 BWP |

| 💰 Trading Assets | Foreign currencies, Cryptocurrencies, Commodities, Treasuries, Bonds, Indices, Stocks, ETFs, Options, CFDs, Precious Metals |

| 🔎 Botswanan Pula-based Account? | No |

| 💳 BWP Deposits Allowed? | No |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 0.9 pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| AvaTrade is multi-regulated and one of the most trusted online trading brokers in the world | Variable spreads are not offered |

| There is a wide range of financial instruments that can be traded across financial markets | There is a limited choice between account types |

| There are several technical indicators, economic indicators, and other solutions for advanced traders | Inactivity fees are applied |

| There are several trading platforms to choose from | Currency conversion fees may be applied |

| There is a decent selection of educational material that helps beginner traders navigate complex instruments and lower the degree of risk they are often exposed to | There is a limited number of base currency options offered on accounts |

| There is a multitude of social trading opportunities offered | |

| The broker accepts any trading strategy including automated trading, expert advisors, scalping, hedging, and others. |

HFM

Min Deposit

USD 0

Regulators

CySEC, FCA, DFSA, FSCA, FSA, CMA

Trading Desk

MT4, MT5, HFM APP

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

0

Account Activation Time

24 Hours

Overview

HFM has been around for more than 12 years and as award-winning forex and CFD trading broker, HFM has been recognized as one of the trading providers with some of the best benefits for Botswana traders.

Why we choose HFM

Features

| Feature | Information |

| ⚖️ Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, with registration in ACPR, BaFin, MNB, CONSOB, CNMV, FI, FMA, FSC, and other regions |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | MT5/MT 4 Micro Account, Premium Account, HFcopy Account, Zero Spread Account, Auto Account |

| 📊 Trading Platform | MetaTrader 4, MetaTrader 5 |

| 💰 Minimum Deposit | 0 Botswanan Pula equivalent to $0 |

| 💰 Trading Assets | Forex Currency Pairs, Precious Metals, Energies, Indices, Shares, Commodities, Cryptocurrencies, Bonds, Stocks DMA, ETFs |

| 🔎 Botswanan Pula-based Account? | No |

| 💳 BWP Deposits Allowed? | No |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 0.0 pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Well-regulated in several global regions | There are no variable spread accounts |

| Offers some of the lowest spreads in the forex market on major currency pairs | There is a limited selection of funding options and withdrawal methods. |

| There are several account types to choose from | |

| HotForex accommodates all types of traders despite their trading strategies | |

| Low minimum deposit requirement | |

| Beginner traders and professional investors are both welcome | |

| Educational tools, advanced trading tools, and several other comprehensive solutions are offered | |

| There is a comprehensive market analysis offered | |

| Technical analysis and fundamental analysis offered |

Axi

Min Deposit

USD 0 / 0 BWP

Regulators

FSA, FCA, ASIC, DFSA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

66

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overview

Axi is a member of the AxiCorp Group, which was established in 2007 in Sydney, Australia, and has since evolved to become one of the world’s biggest online brokers, specializing in retail traders’ goods and services with customers in more than 150 countries, including Botswana.

While Axi is well regulated by the ASIC and FCA. In addition, traders can still access international customer support through the online website and other communication channels.

In 2020, Axi was rebranded to Axi, and the broker was initially established by a group of traders, they understand what traders need and hence provide tight spreads with low slippage, rapid execution speeds, multi-lingual worldwide 24-hour customer care, and a secure and highly-regulated environment.

Features

| Feature | Value |

| 💳 Account setup costs | None |

| 📈 Average spreads | From 0.4 pips |

| 💸 Commissions on trades | None |

| 📈 Minimum Position Size | 0.01 lots |

| 💵 Minimum deposit requirement | $0 / 0 BWP |

| 💰 Range of markets | All |

| 📲 Mobile trading offered? | Yes |

| 📱 MT4 NextGen offered? | Yes |

| 🚀 Leverage offered? | Yes, 1:500 |

| 💸 Account Base Currency | AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, USD |

| ✔️ Demo trading availability | 30 Days |

| 📈 VPS | Yes, free |

| 🤝 Expert Advisors offered? | Yes |

| 📉 AutoChartist | Yes |

| 💻 Myfxbook AutoTrade offered? | Yes |

| 💳 PsyQuation offered? | Yes |

| 💰 PsyQuation Premium offered? | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Axi is a multi-regulated and award-winning CFD and forex broker | There are inactivity fees charged |

| The platforms are user-friendly and available across devices | There is limited leverage offered to retail clients |

| Botswana can deposit funds in Botswana Pula using local deposit methods | Deposit and withdrawal fees can be applied |

| There are no account fees charged | There is only one trading platform offered |

| AutoChartist, MetaTrader 4 NextGen, and PsyQuation are offered | The demo account expires after 30 days |

| There is a comprehensive trading academy provided | |

| There is an active and helpful Axi community provided | |

| Signal providers and free VPS is offered |

InstaForex

Min Deposit

USD 1

Regulators

CySEC, FSC

Trading Desk

MetaTrader 4

MetaTrader 5

MultiTerminal

WebTrader

Crypto

Yes

Total Pairs

100

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overview

InstaForex, a multi-award-winning, licensed broker, was established in 2007 and has grown to be one of the biggest in the industry. Additionally, they provide a wide variety of account kinds and features, as well as popular forex trading platforms, technical analysis tools, and resources for traders of all skill levels.

Copy-trading solutions, easy deposit/withdrawal methods, and committed support staff are all available to Botswana clients.

Why we choose InstaForex

Features

| Feature | Information |

| ⚖️ Regulation | FSC, SIBA, BVI |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Insta.Standard, Insta.Eurica, Cent.Standard, Cent.Eurica |

| 📊 Trading Platform | MetaTrader 4, MetaTrader 5, InstaForex Platform |

| 💰 Minimum Deposit | 19 Botswanan Pula equivalent to $1 |

| 💰 Trading Assets | Currency Pairs, Share CFDs, Precious Metals, Futures CFDs, Cryptocurrencies, InstaFutures, Commodity Futures, Energies |

| 🔎 Botswanan Pula-based Account? | No |

| 💳 BWP Deposits Allowed? | Yes |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 0.0 Pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons | |||

| The broker offers commission-free trading | There are restrictions on leverage for European Union clients | |||

| MetaTrader 4 and 5 are both offered, available across devices | US clients are not accepted | |||

| The broker is well-regulated and offers competitive trading conditions | ||||

| There is a choice between retail investor accounts, each suited to different types of traders | ||||

| There is a wide range of tradable assets offered |

IG

Min Deposit

USD 0 / 0 BWP

Regulators

IGRs

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overview

IG is the oldest forex and CFD broker with the longest history in providing excellent trading solutions and conditions to traders around the world. IG has an impressive trust score of 99% and offers Botswanan traders over 17,000 tradable markets.

As the world’s first spread betting organization, IG (IG) was established in 1974 by Stuart Wheeler as part of IG Holdings Plc, a publicly listed company (LSE: IGG). IG is a reputable entity that enables knowledgeable, decisive, adventurous individuals to tap opportunities in the financial markets.

IG has a global presence and while the broker does not have offices in Botswana or regulation through the Central Bank of Botswana (CBU), IG is one of the best brokers that welcomes Botswana traders.

Why we choose IG

➡️ IG offers a wide variety of robust trading platforms, including MetaTrader, proprietary software, and direct market access through FIX API, to trade a wide variety of assets.

➡️ For traders of all skill levels, IG has a wide range of trading tools and instructional materials available. Account types can be customized to meet every trader’s specific needs, and there are a variety of handy ways to fund and withdraw funds.

Features

| Feature | Value |

| ⚖️ Regulation | FCA, BaFin CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, FMA, CFTC, NFA, BMA |

| 📱 Trading Platform | • MetaTrader 4 • IG Platform • ProRealTime (PRT) • L2 Dealer • FIX API |

| 💰 Withdrawal Fee | No |

| 📈 Demo Account | Yes |

| 📊 Min Deposit | USD 250 / 3 363 BWP |

| 💰 Leverage | 1:100 |

| 💳 Spread | From 0.1 pips DMA |

| ✴️ Commissions | From AU$7 |

| 💳 Margin Call/Stop-Out | 100%/50% |

| 📊 Order Execution | Market |

| 💳 Botswanan Naira Account | No |

| 🛍 Retail Investor Accounts | 8+ |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| IG offers competitive spreads that ensure that traders receive the best pricing in a competitive market | IG requires a high minimum deposit |

| There are several educational resources offered by IG | There are currency conversion fees and inactivity fees charged |

| IG offers flexible forex and CFD trading over several trading platforms | There is a limited range of funding and withdrawal options offered by IG |

| IG offers one of the largest portfolios of tradable instruments | There is a restriction on the leverage level that traders can expect from IG |

| IG’s customer support is available around the clock | |

| There are several account types to choose from according to the trader’s country of residence and market regulator | |

| There are several reliable funding options offered by IG | |

| IG offers an Islamic account and a demo account |

XM

Min Deposit

USD 5

Regulators

IFSC, CySec, ASIC

Trading Desk

Meta Trader 4

Total Pairs

55

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overview

XM is a well-established market maker forex broker that has been in operation since 2009. XM is a well-known name in the trading industry known for its no-requotes and no rejections policy. XM offers access to robust trading technology and comprehensive trading solutions tailored to different types of traders from around the world.

Why did we choose XM

Features

| Feature | Information |

| ⚖️ Regulation | FSCA, IFSC |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | $5 / 67 BWP |

| Average spread from | 0.0 pips EUR/USD |

| 📈 Maximum Leverage | 1:1000 |

| 👥 Customer Support | 24/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Negative balance protection is applied to retail investor accounts | US clients are restricted from accessing XM’s trading services |

| There are several secure payment methods to choose from | There are no fixed spread accounts offered |

| The broker is known for low spreads, low commissions, and reliable trade execution speeds | There is an inactivity fee applied to dormant accounts |

| Traders can use hedging, scalping, and expert advisor trading strategies | |

| The broker offers personal customer service to its clients |

FXTM

Min Deposit

USD 10

Regulators

CySec, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

60

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overview

With over 250+ trading products and stringent regulations in several countries, FXTM is an award-winning and reliable broker for beginners that has won many accolades. Beginner and expert traders may make use of a wide range of low-cost trading options, as well as intuitive desktop, mobile, and web-based forex trading platforms.

Why we choose FXTM

Features

| Feature | Information |

| ⚖️ Regulation | CySEC, FSCA, FCA, FSC Mauritius |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Micro Account, Advantage Account, Advantage Plus Account |

| 📊 Trading Platform | MetaTrader 4, MetaTrader 5, FXTM Trader |

| 💰 Minimum Deposit | 134 Botswanan Pula equivalent to $10 |

| 💰 Trading Assets | Precious Metals, Stock Trading, Stock CFDs, Indices, Forex Indices, Forex Currency Pairs (including minor, major, and exotic pairs), Commodities, Stock Baskets |

| 🔎 Botswanan Pula-based Account? | Yes |

| 💳 BWP Deposits Allowed? | Yes |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 0.0 pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| FXTM is a multi-regulated and a reputable broker that has gained a high level of trustworthiness | Inactivity fees apply when the retail investor account becomes dormant |

| Dedicated customer support offered for Botswanan traders Several deposit options and withdrawal methods offered | |

| There is a low minimum deposit requirement | |

| Commission-free trading is offered | |

| Deposit fees are not charged on any payment methods | |

| Withdrawal processing times are quick | |

| There are several educational tools offered | |

| There is an exclusive risk management tool offered |

Axiory

Min Deposit

10 USD / 133 BWP

Regulators

IFSC, MFSC and FSC

Trading Desk

MetaTrader4, MetaTrader5, CopyTrade and cTrader

Crypto

No

Total Pairs

62

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overview

Axiory, formed in 2011, gives worldwide traders a knowledgeable, courteous, and straightforward environment to enter the FX and CFDs market. The basic concept of Axiory discovered is built on transparent providing to the customers and trading community, while traders will obtain matchless and well-developed technology for its higher performance.

While Axiory is a reputable and well-regulated CFD and forex broker.

Axiory has worldwide exposure because it has been in operation for a very long time, forming part of the world of trading in addition to maintaining a representative office in Dubai, which offers access to both EEA customers and the Middle East as well.

Why we choose Axiory

➡️ Axiory is a multi-regulated broker that provides its clients access to some of the most liquid and complex instruments across several asset classes. In addition, Botswana also have the option of investing through Axiory, giving them access to hundreds of exchange stocks and Exchange-Traded Funds (ETFs).

➡️ Axiory offers high maximum leverage ratios, tight and competitive spreads, positive slippage, and low commission charges, with the option of commission-free trading. In addition, Botswana traders can rest assured that they are dealing with a legitimate broker that ensures client funds security, helps with risk management and is audited by reputable third parties frequently.

➡️ To keep up with the times, the broker has adopted new technologies. Fast, secure, and well-protected, its servers are the best in the business. For sophisticated chart analysis, order processing, and automated trading, Axiory’s platforms are both strong and user-friendly.

Features

| Feature | Value |

| 💳 Minimum Deposit Requirement | $10 / 134 BWP |

| 📈 Platforms Available for Account Type | MetaTrader 4 |

| 📊 Average Spreads on Major Forex Pairs | None |

| 🚀 Maximum Leverage Ratio | 1:777 |

| 🔎 Commission Charges on Trades | From $1.5 per lot |

| 📈 Commissions on Stock CFDs | None |

| 💰 Account Base Currency Options | EUR or USD |

| 🔨 Negative Balance Protection Offered | No |

| 💸 Minimum Forex Trading Volume | 1 Lot |

| 💵 Islamic Account Conversion Offered? | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Axiory is well-regulated and a member of the Financial Commission | Botswana traders do not have access to local deposit and withdrawal options |

| Axiory guarantees client fund safety and provides investor protection | Botswana Pula is not a supported base account currency |

| Traders have a choice between retail investor accounts and powerful trading platforms | Botswana cannot deposit funds in local currency |

| There is a range of tradable instruments offered | Crypto trading is not supported |

| There is an Islamic account offered and an unlimited demo account | There are holding commissions applied to the Islamic Account |

| There is unlimited access to AutoChartist | |

| Traders can use a range of trading strategies | |

| The broker accepts Botswana traders |

Admirals

Min Deposit

339 BWP or an equivalent of $25

Regulators

FCA, ASIC, CySEC, EFSA, JSC

Trading Desk

MT4, MT5, Admirals Mobile App

Crypto

Yes

Total Pairs

35 Forex Currency Pairs

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Overview

Admirals Markets brand has been in business since 2001 and is a leader in investment financial services, with offices in the UK, Cyprus, Estonia, and Australia. The Admirals headquarters are in the UK, but the broker has offices all over the globe.

Admirals are well regulated by reputable regulatory entities such as FCA, ASIC, CySEC, EFSA, and JSC.

The overall goal of Admirals is to provide the trading community with access to functioning software and high-quality products via transparent pricing and execution.

Why we choose Admirals

➡️ Admiral Markets is an award-winning and licensed broker that provides a broad range of trading instruments on innovative trading platforms with customizable accounts, competitive spreads, rapid execution, and a variety of account funding alternatives.

➡️ Admiral is a highly regulated corporation and a well-known supplier of internet trading services. Admirals enable traders to trade with deep liquidity conditions from top-tier providers with its lightning-fast order executions, cheap initial deposit, and competitive pricing approach.

➡️ Technical solutions and improvements are carried out with utmost care while using the industry-proven MetaTrader 4 and 5 platforms along with the Admirals trading app.

Features

| Feature | Value |

| 💳 Minimum Deposit Requirement | 475 BWP equivalent to $25 |

| 📈 Platforms Available for Account Type | MetaTrader 4, cTrader |

| 📊 Average Spreads on Major Forex Pairs | 0.3 pips |

| 🚀 Maximum Leverage Ratio | • 1:30 (Retail) • 1:500 (Pro) |

| 🔎 Commission Charges on Trades | $6 per lot |

| 📈 Commissions on Stock CFDs | $0.04 per CFD with a minimum of $6 |

| 💰 Account Base Currency Options | EUR or USD |

| 🔨 Negative Balance Protection Offered | Yes |

| 📱 Is Hedging Allowed? | Yes |

| 💸 Minimum Forex Trading Volume | 0.01 lots |

| 💵 Islamic Account Conversion Offered? | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Admirals is well-regulated in several regions globally | There is an inactivity fee charged |

| Admirals offers commission-free options | Botswana traders are subject to currency conversion fees |

| The broker accepts Botswana traders despite their trading skills or trading strategies | There are deposit and withdrawal fees charged |

| There are user-friendly platforms available across devices | There are admin fees charged on the Islamic account |

| There is a wide range of tradable markets, complex instruments, and leveraged products | There is only one account type that can be converted to an Islamic Account |

| Admirals offers the MetaTrader Supreme Edition | |

| Traders are given access to premium analytics | |

| There are several educational materials, resources, and tools offered |

Forex Trading Pros and Cons

| ✔️ PROS | ❌ CONS |

| Forex is the world’s second-largest and most liquid market | Because the forex market is mostly unregulated and controlled by brokers, it is possible to trade against the pros. The forex market may not be completely transparent because it is broker-driven |

| For those with a background in finance, forex trading has become a popular career choice because of its high liquidity, round-the-clock availability, and ease of entry. | If you are new to forex trading, it might be tough to get a handle on the many elements that affect the currency’s value |

| Trading foreign exchange may be a profitable, flexible, and gratifying career path | The ability to trade forex on high leverage means that a trader’s profit or loss risk may be multiplied several times over |

| Trading foreign exchange may be done at a reasonable cost (brokerage and commissions) | Portfolio managers, trade advisors, and relationship managers may be hired to help a trader with their investments. |

| For short-term traders, this is a huge benefit since the forex markets are open 24 hours a day, allowing them to make transactions whenever they choose | The extremely volatile currency market may quickly result in enormous losses if one does not influence macroeconomic and geopolitical events |

| The forex market is a global over-the-counter market since there is no central exchange or regulation | |

| The main currencies tend to fluctuate wildly in value. High volatility presents huge profit-making opportunities if trades are executed appropriately | |

| A total of 28 significant currency pairings are made up of eight major currencies. | |

| A little quantity of starting cash is all that is required to begin forex trading because of the low pip spreads | |

| If you are looking to trade forex for the short term, you have access to a wide range of technical indicators, while long-term investors have access to various theories and tools related to fundamental research |

Step-by-Step on How to Start Trading Forex in Botswana

➡️ Step 1 – Learn about Forex Trading

➡️ Step 2 – Learn the Basic Forex Trading Terminology

➡️ Step 3 – Register a Demo Account with A Broker of Your Choice

➡️ Step 4 – Learn about the Risks of Forex Trading

➡️ Step 5 – Learn about different Trading Strategies

➡️ Step 6 – Use Your Demo Account to Practise Trading

➡️ Step 7 – Register a Real Account when You Are Ready

➡️ Step 8 – Choose a Trading Platform

➡️ Step 9 – Deposit Funds into the Account and Start Trading

Step 1 – Learn about Forex Trading

Forex investors should familiarize themselves with the industry’s fundamentals before deciding on a brokerage business. When it comes to investing in the financial markets, it pays dividends to put money into a solid forex education.

Professional forex traders often make the error of believing they no longer need to gain extra resources.

Both new and seasoned traders alike should make an investment in educational resources related to the FX market. As a result of the fact that all markets are always changing, there are a few things to keep in mind.

Step 2 – Learn the Basic Forex Trading Terminology

The Forex market is full of terms like “pips,” “cross-pairs,” and “margin” that you are likely to stumble across in an article or forum post.

All traders who participate in the global Forex market should be conversant with this basic jargon. Additionally, you should be conversant with the following terms:

➡️ Currency

➡️ Currency Pair

➡️ Exchange Rate

➡️ Bid/Ask Price

➡️ Spread

➡️ Pip

➡️ Going long/short

➡️ Leverage

➡️ Margin

➡️ Lot Size

Step 3 – Register a Demo Account with A Broker of Your Choice

For novice traders, a demo account is an ideal method to get a feel for the market. There is no difference between a demo and a genuine account except that you use virtual money to trade.

This allows you to practice Forex trading on a demo account, utilizing all the trading capabilities available on your chosen platform.

Step 4 – Learn about the Risks of Forex Trading

In foreign exchange trading, one currency is valued against another to generate a profit. Margin trading is the most common method of FX trading. To trade, a modest collateral deposit equal to a portion of the overall deal’s value is needed.

Knowledge, investigation, and constant monitoring are required for international currency trading. An investment in foreign currency futures and options on margin is one of the riskiest types available.

Using borrowed money to trade boosts the risks and you will be accountable for any losses. In addition, you may end up spending more than your original expenditure on this.

Some of the typical risks that Botswanans may encounter include:

➡️ The smallest changes in the market may have a significant effect. There is a great deal of leverage in most FX instruments. Even when there is no upfront payment, you are still accountable for the whole value of the deal.

➡️ Exchange rates are quite erratic. Even in the span of a few minutes, they are constantly changing, either upwards or downwards. Currency fluctuations might work against you and cause you to lose money while investing.

➡️ The currency markets are incredibly difficult to anticipate and exchange rates are influenced by a wide range of variables.

➡️ Systematic risk management provides extremely limited protection. Stop-loss orders will only limit the amount of money that you lose. You may also pay a fee to ensure that your stop-loss order is properly executed.

➡️ Trader scams and fraud are common in the forex market. Many traders still lose significant amounts of capital because scammers can replicate legitimate websites. However, there are some tell-tale signs of a scam that you must know to protect yourself.

➡️ Risks involving the forex provider. As an FX customer, you may not get any of your money back if you lose your FX provider regardless of whether they go out of business, they are a scam broker, or any other reason.

➡️ Delays in the trading process may have a significant impact on the outcome. The lack of liquidity in the market, execution risk, or computer system difficulties may prevent you from making transactions when you want to.

Step 5 – Learn about different Trading Strategies

In the forex market, you must take a disciplined approach, execute buy and sell orders according to the facts, and avoid allowing your emotions to influence your decisions.

Decide which currency pairings you would want to trade and then develop a trading strategy that matches your unique trading style in those pairs of currencies. For new traders, it is an suitable idea to start with a single currency pair and not put more money on the line than you are ready to lose.

If you do not think you have the mental fortitude to succeed in the stock market, you may want to consider ‘copy trading.’

Step 6 – Use Your Demo Account to Practise Trading

Investment in trading practice will help you get invaluable experience. Virtual sample trading accounts are offered by a wide variety of brokers, making them free.

Make use of the provided practice account before putting any of your own money in danger. Impatience and lack of expertise are two of the most common reasons new traders fail in forex.

It is quite common for FX ‘gun slingers’ to rush into the market and lose their capital before they can earn any money. Experienced traders insist on regular practice since it helps them avoid costly mistakes and protect their profits in the event of a loss.

Step 7 – Register a Real Account when You Are Ready

Using a demo account allows you to evaluate whether a broker’s trading conditions are what they claim to be on their website. Thus, suggested that you use a demo account with a broker before deciding whether to open a real account with them.

Botswana’s forex traders are urged to only use a licensed forex broker’s services. Personal information, contact data, the location of their home and their place of work, as well as their financial and trading history, must be provided to open a live trading account in Botswana.

As well as filling out an application, Botswanan traders must also go through a “Know Your Client” (KYC) procedure, which verifies their identity and proof of residency.

Traders in Botswana may use the following to confirm their identity:

➡️ Identity document, book, or card copy

➡️ Driving license copy

➡️ Passport copy

The proof of address that Botswanan traders must provide includes any of the following:

➡️ An updated utility bill

➡️ A bank or credit card statement

➡️ Any other document that indicates your residential address and your full name and surname

Step 8 – Choose a Trading Platform

You may begin downloading your trading platform once your broker’s customer support team has examined and accepted your application and all accompanying paperwork.

Desktop, mobile or web-based browsers may all be used to access this service without the need to download or install anything, and some popular options include MetaTrader 4, MetaTrader 5, cTrader, and many others.

Once your account has been validated and authorized, you may log in using the credentials you registered with or those you got from your broker.

Step 9 – Deposit Funds into the Account and Start Trading

You must first deposit money into your trading account before you can begin trading. You may only use the payment methods accepted by your broker and shown on the broker’s website when you replenish your account.

Because most brokers demand a certain amount of money to open an account, this guarantees that you can meet the margin requirements for any trades that you wish to make.

Additionally, you may use leverage to open larger trading positions despite your initial commitment if the minimum deposit is minimal.

4 Best Currency Pairs for Beginner Botswanans to Trade

Contrary to what many people believe, determining which currency pairs are most advantageous to trade in when you are just starting is not a simple task.

Many new traders make the common error of investing in the very first currency pair that comes to mind, only to later learn that doing some research is required to identify the finest currency pair for beginners to trade in the foreign exchange market.

The following currency pairings are recommended for forex beginners:

➡️ EUR/USD – This currency pair is the most liquid, has moderate volatility, and is underpinned by a solid economic framework.

➡️ USD/JPY – It has competitive spreads and a trend that is more predictable than other currencies. This combination offers traders exceptional and lucrative opportunities. It contributes to 17 percent of all Forex market transactions, making it the second most liquid instrument in the business.

➡️ USD/CHF – Our pair is simpler than the others that are indicated on this list for novices to comprehend. Conversely, the pair proves difficult to traders who depend only on technical analysis.

➡️ EUR/GBP – This currency pair’s predictability makes it great for beginners. The Euro is a currency pair that is less volatile than all others. Recessions and economic crises, for instance, have a substantial influence on currency prices, therefore traders should be vigilant about their occurrence.

4 Best Currency Pairs for Professional Botswanans to Trade

More competent and professional Botswanan traders have a better understanding of how to successfully manage their risk and transform unpredictable market situations into trading opportunities with higher potential profits.

Because of this, the following currency pairings are highly recommended for professional traders operating in Botswana:

➡️ USD/JPY – It follows a linear pattern and has more volatility than the EUR/USD pair. This foreign exchange currency pair generates profitable pip opportunities and in-depth market evaluations, making it an excellent choice for experienced traders.

➡️ USD/CAD – The price of Canadian crude oil has a significant impact on this currency pair. The value of the Canadian dollar rises as oil prices in Canada rise, while the value of the Canadian dollar falls when oil prices fall.

➡️ GBP/JPY – You may be interested in trading this pair for a few reasons, including the high volatility, the ability to monitor risk, and the abundance of trading tools. When trading the GBP/JPY currency pair, it is important to keep in mind that the connection between the yen and the price of energy may have a considerable influence on the value of the British pound.

8 Best No-Deposit Forex Brokers in Botswana

By taking advantage of a forex no-deposit bonus, also known as a free initial deposit, offered by your broker, you will can enter the foreign exchange market without putting any of your own money at risk.

Beginner traders who are still developing their trading skills and who might profit from receiving free trading credit are the target audience for no-deposit bonuses.

➡️ Trade Nation – 1,000 points when Botswanans register an account

➡️ Tickmill – 10% Reward

➡️ SuperForex – $88 No-Deposit Bonus

➡️ MTrading – $30 No-Deposit Bonus

➡️ FBS – Up to $100 Quick Start and $140 Level-Up Bonus

➡️ XM – $30 No-Deposit Bonus

➡️ RoboForex – $30 No-Deposit Bonus

➡️ InstaForex – $1,000 No-Deposit Bonus

Trade Nation

Min Deposit

USD 0

Regulators

FSCA, SCB

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

33

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Trade Nation provides Botswanans with a loyalty program through which they may earn one thousand trading points after registering their trading account and verifying their identity.

In addition to this, Botswanans who make trades using a Trade Nation Account are eligible to accumulate points for each unit of base currency that they transact.

Tickmill

Min Deposit

$100 / 1 343 BWP

Regulators

CySEC, FCA, FSA, FSCA, Labuan FSA

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

62

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

If you are a first-time trader and you sign up for an account with Tickmill, you will be eligible for a $30 Welcome Account bonus. You will not be required to make an initial deposit.

This program is exclusively available to new customers and enables customers to cash out any gains they make while using the bonus money.

SuperForex

Min Deposit

USD 1

Regulators

IFSC

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

300

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

After a client has registered a live trading account with SuperForex and had their account fully verified, they are eligible for an 88 USD bonus that does not need a deposit.

After confirming their accounts, traders just need to click the banner that says “Get the No Deposit Offer” to be eligible for the bonus, which does not need them to make an initial deposit.

MTrading

Min Deposit

USD 10

Regulators

Not Regulated

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

–

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Traders from Botswana who sign up for an account with MTrading are eligible to get a $30 welcome bonus with no minimum deposit required. However, for Botswanans to be eligible for this bonus that does not need a deposit, they will need to complete the whole verification procedure.

FBS

Min Deposit

USD 5 / 67 BWP

Regulators

IFSC, FSCA (South Africa), ASIC, CySEC

Trading Desk

MetaTrader 4, MetaTrader 5, FBS Trader – all in one mobile trading platform.

Crypto

Yes

Total Pairs

250

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

The Quick Start Bonus and the Level Up Bonus are the two distinct types of no-deposit incentives that are offered by FBS. Retail traders in Botswana can receive the $100 Quick Start incentive by registering for an account using the FBS mobile app.

They will be led through a seven-step program in which they will be instructed on how to trade without taking any unnecessary risks.

Traders could sign up for the Level Up incentive, which entitles them to a free credit of $140 in the Personal Area after their account has been validated.

When a trader maintains their account for 20 days in a row, they are eligible to get an extra $70, which enables them to take whatever winnings they have earned.

XM

Min Deposit

USD 5 / 67 BWP

Regulators

IFSC, CySec, ASIC

Trading Desk

Desktop MT4 and MT5, Mobile MT4 and MT5, XM mobile app, Web platform

Total Pairs

57

Islamic Account

Yes

Trading Fees

No (Just spread)

Account Activation Time

24 Hours

XM offers all newly registered accounts a $30 incentive to test how well their platform functions in a real-world trading scenario. After you have validated your account and claimed your bonus, it will be promptly credited to your trading account.

There is no upper limit on the amount of money that may be withdrawn from your trading account; however, every time cash is withdrawn, your trading bonus will be null and worthless.

RoboForex

Min Deposit

USD 10

Regulators

IFSC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

36

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

RoboForex offers a $30 welcome bonus to verified traders who establish a live trading account with the company. This benefit does not need the trader to make an initial commitment.

InstaForex

Min Deposit

USD 1

Regulators

CySEC, FSC

Trading Desk

MetaTrader 4

MetaTrader 5

MultiTerminal

WebTrader

Crypto

Yes

Total Pairs

100

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

The No-Deposit Bonus provided by InstaForex is an excellent means of getting started in the foreign exchange market. This is your pass into the world’s largest and most liquid market, which is where a sizeable number of traders now earn most of their livelihood.

Because of the $1,000 reward, you will not have to risk any of your own money to judge our unrivalled order execution quality in real-world trading conditions. The bonus is immediately applied when the request has been made and may be put to immediate use in trading.

Forex Trading VS Stock Trading VS Cryptocurrency Trading Compared

| 💰 Forex Trading | 💸 Stock Trading | 🔐 Crypto Trading | |

| Market Hours | 24/5 | 9 am – 3 pm (GMT+3) Monday to Friday | 24/7 |

| Trading Speed | Instant | Slow | Instant |

| How is it traded? | OTC | Exchanges | OTC/Exchanges |

| Price Fluctuation | Fast | Slow | Fast |

| Min. Trade Size | 0.01 lots | 1 share or fractions | 1 lot or fractions |

| Volatility | High | Low | High |

| Liquidity | Very High | Blue Chip Stocks are the most liquid | Only major crypto e.g. BTC, ETH, LTC, DOGE, etc. |

| Trading Volume | High | High | Medium |

| Regulation | $6.6 Trillion | 7,369,200 | $500 Billion+ |

| Investment Horizon | Short, Medium, Long-Term | Medium and Long-Term | Short, Medium, Long-Term |

| Average Leverage Ratios | 1:100 – 1:3000+ | <1:100 | <1:10 |

| Susceptibility to Macroeconomic Factors | Rarely as turbulent as Crypto | Yes, Economic Performance | Yes Consumer Behaviour Supply and Demand |

How to Choose a Forex Broker in Botswana

For those who are new to forex trading, choosing a broker is one of the most important decisions you will ever make. All your trading cash is being transferred to that firm, and you believe that it will be available to trade with and withdraw after you have made a profit.

If your broker steals your money, all your efforts and countless hours studying will be in vain, regardless of how good your forex tactics are.

To locate a quality forex broker, you can use the following guideline so that you end up with the proper broker that suits your demands without exposing you to frauds.

Discover what your needs are

Before researching brokers, evaluate your individual demands. Here are some considerations:

➡️ Will you engage in day trading often or infrequently?

➡️ Trade very minor movements or seize larger ones?

Consider using an ECN broker if you often engage in day trading and want to capitalize on modest price fluctuations. You will be charged a fee on transactions, but the spreads are significantly narrower, which is important for trading tiny price fluctuations. Only search for “ECN Forex Brokers”

If you do not believe you will require an ECN broker, you still have access to many prospective brokers. However, if you want to engage in scalping, you will need an ECN broker.

How much capital do you have? You must exchange micro-lots with a limited quantity of capital. If you have above $5,000, you may begin trading micro lots daily. Open a basic lot account only if you have a minimum of $50,000.

Choose a broker and account type (lot size) according to your financial resources. When it comes to depositing and withdrawing cash from your account, brokers provide a range of options. Choose a broker who meets your requirements.

What should you look for in a broker?

Now that you know what you want and have cut down the list of brokers, search for the following in the remaining brokers:

➡️ A no “dealing desk.” There are several advantages to trading directly with the market, rather than submitting your order to a broker who then places it in the market for you. Therefore, “re-quotes” are common but if the price has changed after you place your order, the broker will notify you and ask whether you still want to go forward with the transaction or not. Subsequently, many trade opportunities may have been lost due to the time delay.

➡️ A well-established financial system and a licensed broker are both important considerations when choosing a broker.

➡️ A broker with spreads that are as narrow as possible for day traders. You should anticipate the spread on a non-ECN account to be about one pip when trading EUR/USD during a large session, for example. This broker’s spread is extremely wide and will not help your trading strategy. ECN accounts should have a spread of half a pip or less during the most active trading hours.

➡️ Choose a broker that will always be there for you. Open a practice account with each broker you are considering, and then bombard them with emails filled with questions about their services. Keep an eye on their response time and thoroughness. If you cannot get decent service from a broker, cross them off your list and move on.

Be careful when you consult broker reviews

Look for written reviews and discussion forums as part of your study on a broker before deciding.

However, you should use caution while dealing with such individuals. Most forums are not reputable sources, so you are more likely to uncover bogus reviews, both favourable and bad, if you are looking for information.

Many day traders will lose money, and because most traders cannot acknowledge it to themselves, they blame others when it occurs to them.

Even if the author may place the responsibility on the broker, the fact that someone complains about losing money does not automatically imply that the broker they used is poor. You can find out what others are saying but keep your perspective. False information is widely disseminated because it lacks a reliable source.

Test the broker out for yourself

➡️ To begin, establish a practice account and familiarize yourself with the trading terms. As soon as you place an order, it should be processed immediately. The platform should be reliable and not crash often.

➡️ Open a genuine account with a portion of the money you plan to deposit if the demo works successfully for a few weeks. If you have $10,000 to deposit, for example, you should only deposit $1,000 at first.

➡️ You should trade the real account for at least two weeks using your half deposit. It is an innovative idea to keep testing customer service, asking them questions and seeing how fast they react.

➡️ You may request a withdrawal for a portion of your accumulated cash. You may have to pay a few dollars for this, depending on your withdrawal method, but knowing whether withdrawals are simple is worth it.

➡️ You have done your due diligence if everything is fine at this point, allowing you to deposit the balance of your money and resume trading as normal.

Pay attention to Regulations, Legal Issues, and overall Safety of Funds

To ensure the integrity of brokerage activities, an official regulator should always be in place for a trustworthy broker. The selling of futures and options should not be subject to any form of abuse since traders should be safeguarded against both fraud and manipulation.

For example, a US broker must be registered as a commercial and retail Forex dealer with the US Commodity Futures Trading Commission (CFTC). It must also be a member of the National Futures Association (NFA).

This information can typically be found on the broker’s “About Us” section on the company’s website. Every nation in the world has a trade organization or regulatory body like this.

When determining their broker’s location, traders should do due diligence and seek these qualifications. Researching when the broker received its license is also worthwhile in this regard, as it may have some relevance in terms of the broker’s general reputation and operating history.

Brokers who are subject to regulation must follow a set of guidelines intended to protect the assets of investors. It is for this reason that regulation is so crucial, and a “Net Capital Rule” mandates that licensed brokers maintain a certain level of liquid capital.

If a broker is forced to shut down, investors have a “safety net” in place. Regulated brokers in most countries are also obliged to retain all client money in segregated accounts so that customer funds cannot be accidentally (or purposefully) utilized for any other purpose.

In certain jurisdictions, such as the United Kingdom, licensed brokers may provide their customers with government-backed deposit insurance so that they can get their money back if the broker manages to steal it.

Trade Execution and Overall Execution Policy

When you are trading in a market that moves quickly, such as the foreign exchange market, you must choose a broker that can carry out your deals quickly and effectively. Any delays in the execution are likely to result in issues otherwise, costing you more money.

Trading and non-trading Fees

It is the broker’s job to facilitate transactions between buyers and sellers by charging a fee for the service it provides. This price varies depending on the sort of service that the trader is signing up for, as well as the broker type.

Dealing Desk Brokers charge simply spread, whereas ECN brokers charge both spread and commission fees. For retail traders, this is the easiest way to convey the issue.

Fees are a one-time payment, while commissions fluctuate based on the supplied financial product and the quantity of the transaction.

This is an important distinction for all traders to grasp. As a trader, you must maintain a “minimum balance” on your account to obtain the services you have signed up for and keep your account active, with smaller amounts the most beneficial for the Botswanan trader.

Trading Platform

The top foreign exchange brokers will have the most advanced trading platforms available. An efficient and reliable trading platform incorporates investor insights and a gateway for market participants.

As a foreign exchange trader, it is your responsibility to guarantee that the software and trading platform you use is furnished with the fundamental, technical, and centralized analytical tools you will need.

In addition, you need to examine the convenience with which transactions may be entered and exited.

A trustworthy platform will provide you with prompt access to both fundamental and technical analysis, an exceptional safety system, automated trading, and visual elements such as graphs and charts, and it should always be user-friendly.

Currently, the advanced MetaTrader 4 trading platform is the industry standard that is offered by most forex brokers in Botswana.

Deposits and withdrawals

You must choose a forex broker that allows for fast and simple deposits and withdrawals so that you can maximize both your benefits and your convenience.

You can bolster your trading position and take advantage of possibilities that may unexpectedly present themselves in the market when you make quick deposits.

If you need to withdraw your cash for any reason, the withdrawal procedure should likewise be quick and straightforward, allowing your money to be returned to you in no more than a few business days at the most.

Account features

Having a selection of different sorts of accounts available to pick from is always a benefit. Because the financial capabilities, requirements, and goals of each trader are unique, a broker needs to provide a diverse selection of account types so that they can meet the requirements of their clientele.

The most reputable forex brokers will be aware that the power of choice can take a business a long way; investors are more likely to thrive in an environment of freedom than one of the constraints.

Range of Markets

When it comes to trading foreign currency, having a larger number of trading instruments available to you may provide you with more opportunities.

Choose a broker that not only offers to trade in the main currency pairings but also offers trading in the minor currency pairs, exotic currency pairs, precious metals, and other commodities.

Gold, for example, tends to be a very sought-after commodity during periods when both the economy and the political climate are unstable.

Demo Account

It is essential to practice trading with a demo account before moving on to trade with a real account. If a forex broker does not provide demo accounts, you should immediately turn away from them.

Demo accounts allow traders to practice their skills under genuine market circumstances but with fictitious funds; this eliminates any potential monetary loss.

This is the most effective method for putting your trading technique to the test as well as being familiar with the ins and outs of the trading process.

You can learn about both your strengths and shortcomings as a trader, and you should not start live trading unless you are sure of yourself and are prepared to do so.

Education and Research

To aid their clients in becoming more knowledgeable traders, brokers often provide educational opportunities and research.

This may be accomplished in a variety of ways, ranging from simple blog postings to e-books, courses, and even full online academies taught in conjunction with subject-matter experts.

It is also usual practice for traders to participate in live seminars as well as online webinars to get assistance with their professional growth.

Before You Start Trading, Read these Few Basics to Forex Trading

One of the most prominent features of the forex market is that it is a 24-hour market, even though it is open every day of the week except for Friday evening through Sunday evening.

The trading sessions in Europe, Asia, and New York are all conducted simultaneously. Despite some overlap, the most significant currencies in each market tend to be traded during those hours.

Currency trading may only be done in pairs. Trading in the forex market necessitates purchasing one currency and selling it for another. A fourth decimal place has been added to the value of all currencies.

A pip or percentage point is the smallest increment in price that may be traded at a given price. One pip is typically equal to one-hundredth of one percent. A variety of lot sizes are available for trading in the foreign exchange market, including:

➡️ A nano lot is 100 units of the base currency

➡️ A micro lot is 1,000 units of the base currency

➡️ A mini lot is 10,000 units of the base currency

➡️ A standard lot is 100,000 units of the base currency

Only 18 currency pairings account for the great bulk of currency trading activity, in contrast to the hundreds of businesses available on global equities markets.

Many of the same factors that affect the stock market also affect the currency market, which is attracting a growing number of stock traders.

The forex market’s currency values are heavily influenced by the forces of supply and demand. In other words, the dollar’s value rises when people want it more, and its value falls when people have too much of it and supply exceeds demand.

Other elements, such as interest rates, new economic data from big countries, and geopolitical worries, may influence currency values.

20 Forex Terms you Must Know

The forex market has a language of its own and beginner Botswanan traders must familiarize themselves with some of the following terms that they will come across:

➡️ Pip

➡️ Bid, Ask and Spread

➡️ Leverage

➡️ Volume

➡️ Slippage

➡️ Base and Counter Currency

➡️ Long and Short Positions

➡️ Value Dates and Rollovers

➡️ Appreciation

➡️ Arbitrage

➡️ Bear Market

➡️ Bull Market

➡️ Currency Pair

➡️ Economic Calendar

➡️ Margin and Margin Call

➡️ Over the Counter

➡️ Resistance

➡️ Round Trip

➡️ Tomorrow Next

➡️ Volatility

Pip

This is the smallest possible change in the currency quotation. One-tenth of the stated currency is referred to as a “pip.” To have an impact on Forex rates, a currency must fluctuate by at least 0.00001 percent of its value.

The term “pips” has entered the lexicon of the Forex trader. Pips are used to represent price changes and even profit margins. However, since the pip may relate to a variety of different monetary values, it takes some practice to figure out what is being said.

Bid, Ask and Spread

It is market makers that manage the forex markets. They act as a constant two-way market for all currencies, no matter what time of day or night it is.

Because of this, they give purchase and sell prices. If you want to purchase anything, you must pay less than you want to sell it for. By owning a volatile asset over an uncertain length of time, the difference is expected to pay the investors for their risk.

Their willingness to acquire at one price and their willingness to sell at another is referred to as their “bid price” and “ask price, respectively.” The difference between the bid price and the ask price is referred to as the bid-ask spread.

Leverage

It is the amount of money utilized in a transaction divided by the amount of money needed for the transaction. When it comes to trading, this is the percentage or fractional growth in your available money that you can make.

It gives dealers the ability to trade higher-than-capital values. You may trade with a notional value 100 times bigger than the capital in your trading account if you have a leverage ratio of 100:1.

Volume

The term “volume” in your platform’s order window refers to the amount of product that will be bought or sold. The term “volume” relates to the number of lots, where 100,000 units make up one lot.

Different currencies provide different lot sizes. Market makers provide more flexibility in exchange rates for currencies that have a higher level of liquidity.

Slippage

When you are trading, you may sometimes see a minute disparity between the price you anticipate and the price at which the deal is performed (the price when the trade is executed). Slippage is the term that is used to describe what happens when this occurs.

As a trader, you will come into this phenomenon at some point, and depending on how you choose to react, it may result in either favorable or bad outcomes. The most common causes of slippage are fluctuations in the market and slow execution rates.

Base and Counter Currency

Botswanans can sell their security on the stock and bond markets. This indicates that they can exchange their security for monetary compensation. In the foreign exchange market, one makes simultaneous purchases of currency and sales of currency.

This indicates that one makes a transaction in which one type of money is traded for another. Because of this, the values of currencies are usually expressed in terms of pairs.

The price is the amount of the first currency, denoted in the second currency, that one is ready to pay to acquire the second currency.

Because the price is consistently stated in terms of the initial currency, that currency has earned the designation of “base currency.” The term “counter currency” refers to the other currency that is being discussed in the pair.

For instance, in a currency pair denoted by the symbols USD/EUR, the United States Dollar would be considered the “base currency,” while the Euro would be considered the “counter currency.”

Long and Short Positions

The foreign exchange, or forex, markets enable traders to take both long and short positions, as the bond and stock markets. On the other hand, the definitions of long and short positions shift often throughout this market.

This is the case once again attributed to the reason that currency pairs are exchanged. Therefore, beginner Botswanan investors often have trouble understanding what takes place when they go long and what it means to go short.

Going long in the foreign exchange market involves purchasing units of the base currency while simultaneously selling units of the counter currency.

For instance, if you wanted to take a long position on the USD/EUR pair, you would have to make a market transaction in which you sold EUR and bought USD.

In the same vein, selling units of the base currency on the foreign exchange market and simultaneously purchasing units of the counter currency is referred to as going short. Going shorter is adding to a short position and the opposite of going longer.

Therefore, if you were to take a short position in the USD/EUR pair, you would have to sell the USD while concurrently purchasing EUR to close the position.

Squaring off is another term that describes the process of returning to a zero position after being in a long or short position. If you are long, you need to close out your position by selling, but if you are short, you need to close out your position by buying.

Value Dates and Rollovers

An agreement to pay financial obligations is said to be “value-dated” if both parties to a transaction have agreed on that date. Therefore, all open positions in derivative contracts are automatically closed at their respective value dates. As the valuation date approaches, contracts become increasingly volatile.

Traders may also elect to extend the term of their contracts by rolling them over. In other words, instead of settling their contracts on the current value date, they choose the following value date.

A charge based on interest rate discrepancies between the currencies must be agreed upon by both parties for this to work.

Appreciation

When the price of a financial product rises as a direct result of increased demand in the market, this phenomenon is referred to as “appreciation.”

Arbitrage

The act of purchasing or selling a financial instrument simultaneously to profit from minute price differences across marketplaces.

Bear Market

A market that is considered a bear market is one in which prices are falling.

A bear market is when the market has been trending downward for an extended period, and traders have either truly little optimism or very much pessimism, making it difficult for the market to stage a rebound.

Bull Market

A market in which prices are consistently going up is known as a bull market. It is a widespread practice to refer to a market, instrument, or industry that is experiencing an upward trend as a “bull market.”

Although “bull market” may be used to refer to any significant market activity, it is most often used in the money markets when the price of an asset increases by at least 20 percent from its most recent low. Bull markets may also refer to any robust market activity.

A bull market occurs when investors are optimistic about the future profitability of an asset or the performance of market indexes as a whole.

Although a 20% increase in market prices is often regarded to signal the beginning of a bullish trend, most indicators of an impending bull market are less visible.

Traders apply technical analysis to help them recognize bullish indicators. Technical indicators include Bollinger Bands, Moving averages (MAs), the Moving Average Convergence Divergence (MACD), stochastic, and the Relative Strength Index (RSI).

Bear markets are the antithesis of bull markets and occur when investors are pessimistic about the market’s future.

Currency Pair

A price quotation of the exchange rate between two distinct currencies that are exchanged on the foreign exchange market is referred to as a currency pair. Foreign exchange trading, sometimes known as forex trading, involves buying and selling currencies simultaneously.

When you purchase or sell anything on the foreign exchange market, you do it in currency pairings. A three-letter code represents each of the currencies that make up the pair.

The name of the nation is indicated by the first two letters, and the name of the currency used in that country is indicated by the third letter, which is often the first letter of the currency’s name. For instance, the currency code for the Botswanan Pula is BWP.

Economic Calendar

The dates and times of important news releases and events that may have an impact on the dynamic exchange rates of currencies along with the overall financial market are listed on an economic calendar.

Financial markets and currency volatility are often affected by these occurrences. Traders might plan their strategies based on the information provided by an economic calendar. Monetary and fiscal policy statements have the greatest impact on the FX market.

By keeping an eye on the economic calendar, traders may keep track of any events that might influence their open positions and plan trades accordingly.

Margin and Margin Call

To trade in Forex, a margin is needed. The minimal amount of collateral or deposit might be referred to as a margin. This margin gives you the ability to take out a ‘loan,’ or a bigger sum of money.

If you do not have enough money in your trading account to cover open positions, you will get a margin call. A situation in which you have a higher level of floating losses than the needed minimum buffer.

Over the Counter

There is a type of trading known as OTC trading that is not done on a regulated exchange, like share trading. A dealer network is often used to facilitate OTC deals, which typically include just two parties.

Unlike exchange-based trading, OTC deals are not subject to the same regulations, allowing for a wide variety of possibilities, but also a wide range of hazards. Trading over the counter (OTC) frequently involves seeing two prices listed namely one for buying and one for selling.

Resistance

This is a term used in technical analysis to describe the point at which an asset’s value reaches a point where market participants no longer want to acquire it. When supply builds up around a certain price point, it acts as a barrier to upward movement.

There comes a point at which the price increase is stymied by an increasing number of sellers who desire to sell at that price, known as resistance. There will be a rise in the number of selling when the price approaches the level of resistance.

Round Trip

A round trip is a process that involves both the buying and selling of a certain amount of currency.

Tomorrow Next

This refers to traders avoiding the delivery of cash by exchanging currencies. It also refers to the Botswanan trader’s ability to keep a posture for an entire day without having to worry about delivery.

Volatility

Measures how much price swings over a certain time. Volatility is a measure of this. Volatility in forex trading is a measure of the size of the currency pair’s upswings and downswings. Volatility refers to a currency’s ability to change in price.

Low volatility refers to currency pairs that do not vary as much. Before making a deal, it is crucial to know how volatile a currency pair is. When determining the size of your trade and the level at which you want to place a stop loss, always keep volatility in mind.

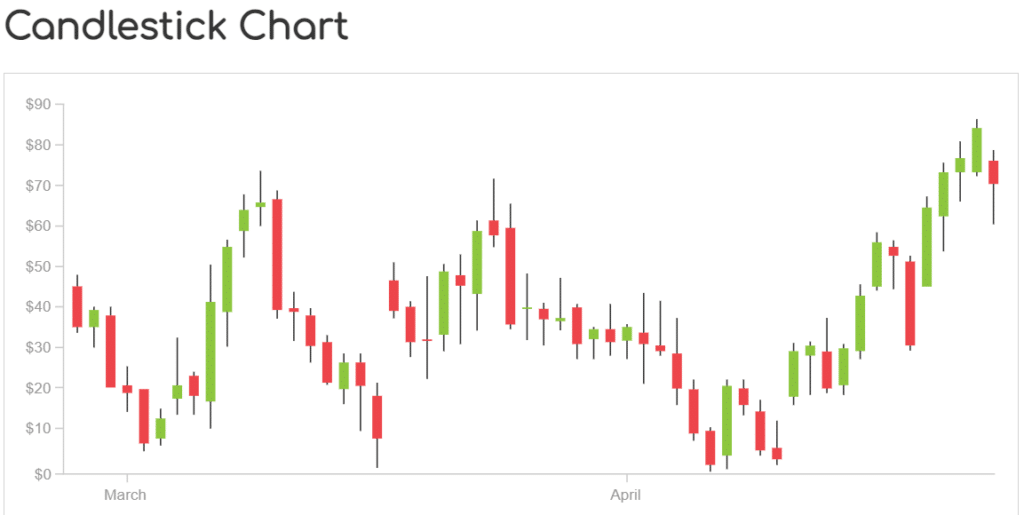

Understanding Forex Charting

Using a forex chart, you can see how the value of two currencies has fluctuated over time. These charts can assist you to comprehend the markets if you are just starting forex trading. Depending on the time range you choose, a forex chart will display a different amount of time.

By default, many forex charts display trade data for 24 hours across a daily time range. Other time ranges, such as minutes or months, are also available for selection.

Advanced forex live charts and real-time trading charts may help you recognize patterns and take advantage of profit possibilities.

Line charts, bar charts, and candlestick charts are the three most common kinds of Forex charts. Forex charts may take a variety of shapes these three are the most common, and we will be exploring them in detail below.

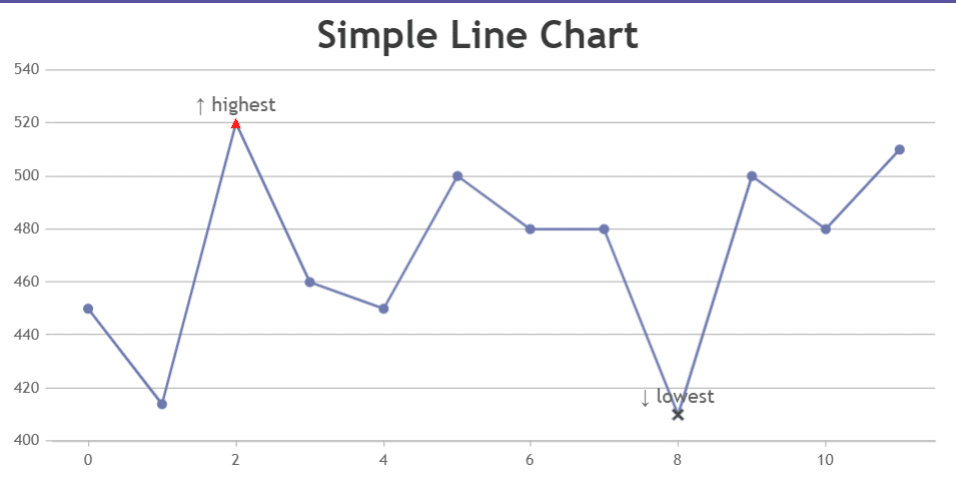

Line Charts

As the first chart kind to be devised, this one is the most basic and least informative. The diagram is drawn simply. When a new period begins, the open price and the closing price are the two most important characteristics to consider.

On a line chart, each of these criteria is represented by a dotted line, which connects to a dot for the open price. A line is formed by connecting dots recursively.

The following are the primary characteristics of the price chart visualization type:

➡️ One cannot use the Line chart to trade the FX market using simple geometric forms as a basis for price patterns.

➡️ To design trendlines that resemble price ranges, you will need to know the price range’s key features while using this forex trading chart, which is best used for lengthier periods beginning at D1.

➡️ Price charts and EMA indicator schemes commonly employ this form of display to offer more precise indications for entering and exiting a trade.

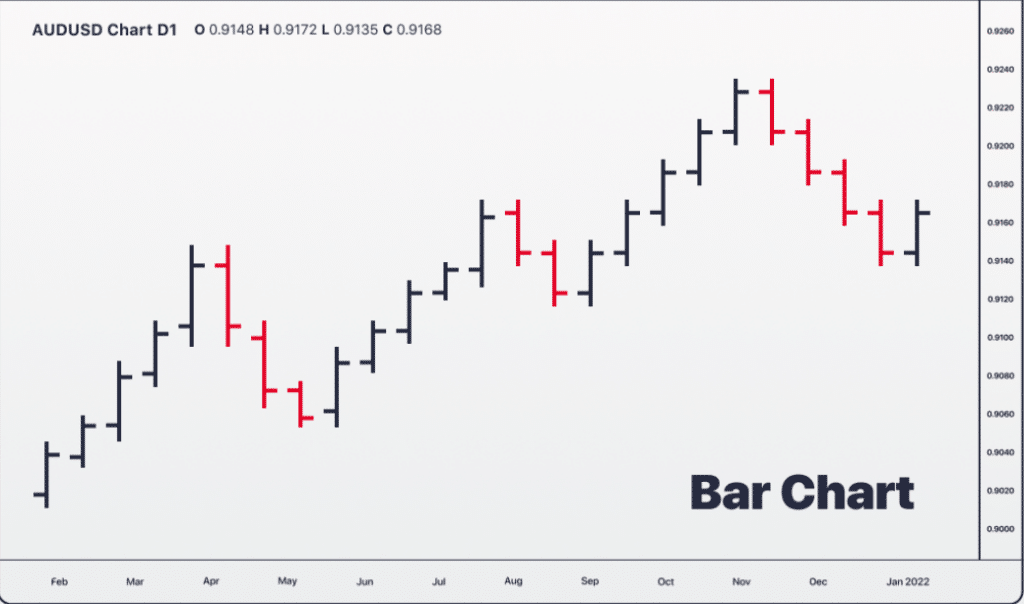

Bar Charts

Forex Line charts of price were followed by bar charts of the same data. In-depth and difficult to understand, this style of forex chart is more useful. These vertical lines, known as bars, make up the bar chart.

The low and high of the day are used to form vertical bars on a bar chart, which represent each trading period. The highs and lows of the price, as well as the open and closing prices, are all included in a bar chart, which is a more detailed version of a line chart.

You are aware that the price might rise above the closing price numerous times throughout the movement. During the time a bar was developing, its price rose to its maximum level, which is represented by its price high.

Only the lowest tiers are examined in this case. As a trader, it is critical to be able to see the price trend over a certain length of time to properly analyse forex charts. the main characteristics of the bar graphs:

➡️ The horizontal dash on the left side of the horizontal line indicates the initial price, while the right side of the line indicates the closing price.