Exness Review

Overall, Exness is very competitive in terms of its trading fees and spreads with a multi-regulated forex broker headquartered in Cyprus. The broker is regulated by FSA CBCS FSC FSC BVI FSCA CySEC and FCA with a Trust Score of 97% out of 100. Exness is currently not regulated by the MFED, BoB, or NBFIRA of Botswana

- Louis Schoeman

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

$10 / 134 BWP

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

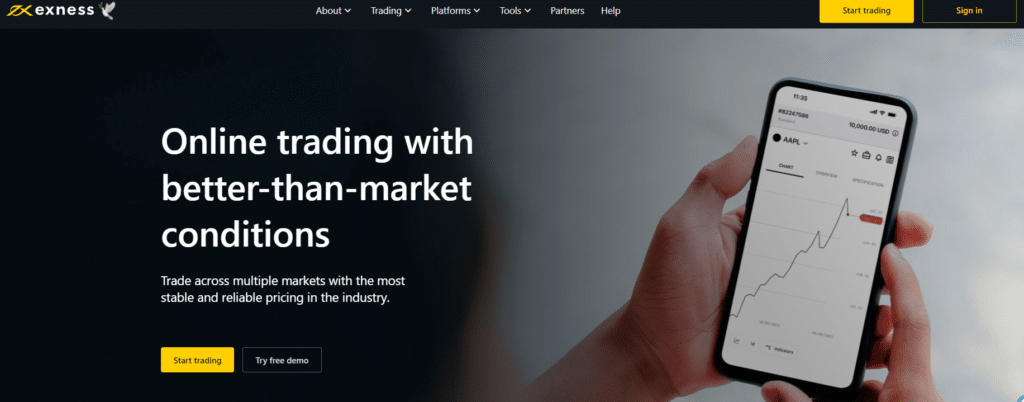

Overview

Overall, they are considered low-risk, with an overall Trust Score of 97 out of 100, and are licensed by one Tier-1 Regulator (high trust), two Tier-2 Regulators (average trust), and four Tier-3 Regulators (low trust). The Broker offers five different retail trading accounts namely a Standard Account, Standard Cent Account, Raw Spread Account, Zero Account, and Pro Account.

They accept Botswanan clients and have an average spread of 0.0 pips with commissions from $0.1 per lot, per side and have an unlimited maximum leverage ratio and there is a demo and Islamic account available. MT4, MT5, and platforms are supported. The broker is headquartered in Cyprus and regulated by FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, and FCA.

A multi-regulated forex broker having offices in the United Kingdom, Seychelles, South Africa, the British Virgin Islands, and Curaçao. The broker is linked with respected companies such as Nymstar Limited, Tortelo Limited, and Vlerizo (Pty) Limited through which it provides its services.

Botswanans who become traders with the broker will meet a safe and simplified trading environment that spans both the MT4 and MT5 platforms. In addition, they can also expect attractive trading conditions including low spreads and ECN account availability.

The firm’s divisions provide customized financial services and investment solutions to clients all over the world, in addition to the firm’s worldwide brand, which attracts a wide variety of retail and corporate customers.

The monthly trading volume exceeds $1.5 trillion per day, and as of January, over 257,000 active customers are enrolled with the company. Their service provides traders with several advantages, including low fees, instantaneous order execution, and the possibility to withdraw funds immediately via instant withdrawal alternatives.

This review for Botswana will provide local retail traders with the details that they need to consider whether the broker is suited to their unique trading objectives and needs.

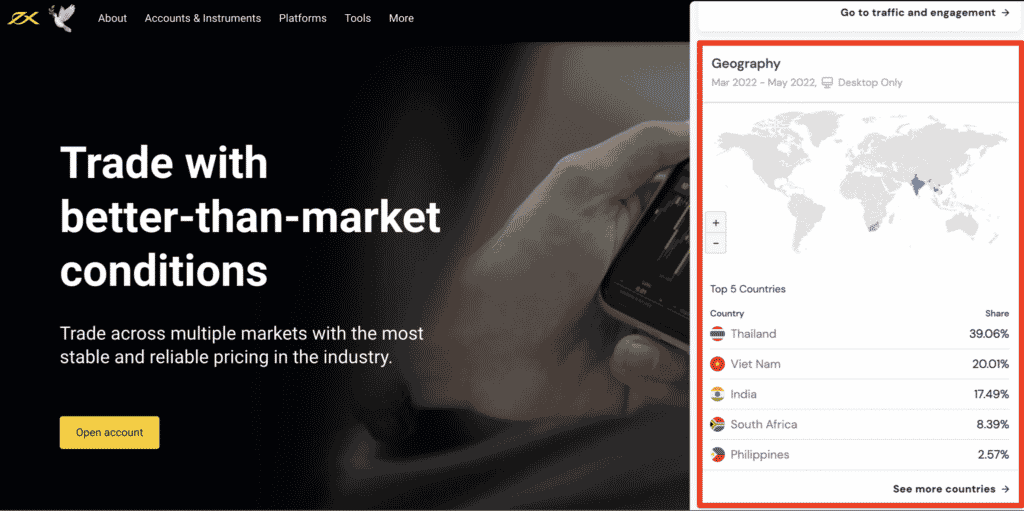

Distribution of Traders

Currently has the largest market share in these countries:

Popularity among traders

Even with a market share of less than 5% in Botswana, they are still one of the most active forex brokers in Africa, making it one of the Top 20 forex brokers for Botswanan traders.

Is this broker a regulated broker?

Yes, they are a regulated broker. It is authorized and regulated by top-tier financial authorities, including the Financial Conduct Authority (FCA) in the United Kingdom and the Cyprus Securities and Exchange Commission (CySEC) in Cyprus. Being regulated means that they must adhere to strict financial standards and client protection measures, providing traders with a more secure and transparent trading environment.

What trading instruments are available?

Metals: Access precious metals like gold and silver, which are often used as safe-haven assets. Energies: Trade energy commodities like crude oil and natural gas, providing exposure to the global energy markets. Indices: Speculate on the performance of global stock market indices, representing a basket of stocks from various industries and regions.

At a Glance

| 🏛 Headquartered | Cyprus |

| 🌎 Global Offices | South Africa, Cyprus, United Kingdom, Seychelles |

| 🏛 Local Market Regulators in Botswana | • Ministry of Finance and Economic Development (MFED) • Bank of Botswana (BoB) • Non-Bank Financial Institutions Regulatory Authority (NBFIRA) |

| ✔️ Accepts Botswana Traders? | Yes |

| 📊 Year Founded | 2008 |

| 📞 Botswana Office Contact Number | None |

| 📱 Social Media Platforms | • Facebook • YouTube |

| ⚖️ Regulation | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA |

| 1️⃣ Tier-1 Licenses | Financial Conduct Authority (FCA) |

| 2️⃣ Tier-2 Licenses | • Cyprus Securities and Exchange Commission (CySEC) • Financial Sector Conduct Authority (FSCA) |

| 3️⃣ Tier-3 Licenses | • Financial Services Authority (FSA) Seychelles • Financial Services Commission of the British Virgin Islands (FSC BVI) • Financial Services Commission (FSC) Mauritius • Central Bank of Curaçao and Sint Maarten (CBCS) |

| 🪪 License Number | • Seychelles – SD025 • Curaçao – 0003LSI • British Virgin Islands – SIBA/L/20/1133 • Mauritius – GB20025294 • South Africa – FSP 51024 • Cyprus – 178/12 • United Kingdom – 730729 |

| ⚖️ MFED, BoB, or NBFIRA Regulation | None |

| ✔️ Regional Restrictions | The United States |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 5 |

| ✔️ PAMM Accounts | No |

| ✔️ Affiliate Program | Yes |

| 📱 Order Execution | Market |

| 📊 Starting spread | 0.0 pips EUR/USD |

| 📉 Minimum Commission per Trade | From $0.1 per side, per lot |

| 💰 Decimal Pricing | 5th decimal pricing after the comma |

| 📞 Margin Call | 60% |

| 🛑 Stop-Out | 0% |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | Unlimited |

| ✔️ Offers a BWP Account? | No |

| 📉 Dedicated Botswana Account Manager? | No |

| 📈 Maximum Leverage | Unlimited |

| 📊 Leverage Restrictions for Botswana? | No |

| 💳 Minimum Deposit (BWP) | 188 or an equivalent to $10 |

| ✔️ Botswana Pula Deposits Allowed? | Yes |

| 📊 Active Botswana Trader Stats | 250,000+ |

| 👥 Active Botswana-based Exness customers | Unknown |

| 🔁 Botswana Daily Forex Turnover | Unknown, Forex overall is $6.6 Trillion |

| 💰 Deposit and Withdrawal Options | • Debit Card • Credit Card • Internet Banking • Skrill • Neteller • Bank Wire |

| 💻 Minimum Withdrawal Time | Instant |

| ⏰ Maximum Estimated Withdrawal Time | Up to 72 hours |

| 💳 Instant Deposits and Instant Withdrawals? | Yes |

| 🏛 Segregated Accounts with Botswana Banks? | No |

| 📱 Trading Platforms | • MetaTrader 4 • MetaTrader 5 • Terminal • Trader app |

| 💻 Tradable Assets | • Forex • Metals • Energies • Indices • Stocks |

| ✔️ Offers USD/BWP currency pair? | No |

| 📊 USD/BWP Average Spread | N/A |

| ✅ Offers Botswana Stocks and CFDs | No |

| 💻 Languages supported on the Website | English, French, Indonesian, Portuguese, Spanish, Vietnamese, Arabic, Thai, Chinese (Simplified), Japanese, Korean, Urdu, Bengali, Hindi |

| ☎️ Customer Support Languages | Multilingual |

| 👥 Copy Trading Support | Yes |

| ⏰ Customer Service Hours | 24/7 |

| 📞 Botswana-based customer support? | No |

| 💸 Bonuses and Promotions for Botswanans? | No |

| 📚 Education for Botswanan beginner traders | No |

| 📱 Proprietary trading software | Yes |

| 🤝 Most Successful Trader in Botswana | Unknown |

| ✔️ Is the broker a safe broker for Botswana Traders? | Yes |

| 🎖 Rating for Exness Botswana | 8/10 |

| 🥇 Trust score for Exness Botswana | 97% |

| 👉 Open Account | 👉 Open Account |

Regulation and Safety of Funds

Regulation in Botswana

While the Broker does not hold local licenses or authorization to provide derivatives trading in Botswanan, they are a safe and reputable broker.

Global Regulations

Globally-based, multi-regulated broker and business that operates through several global entities with regulations and authorization as follows:

➡️ The Financial Services Authority (FSA) in Seychelles oversees and regulates Nymstar Limited under license number SD025, with the entity known as a reputable Securities Dealer in the region.

➡️ The Central Bank of Curacao and Sint Maarten (CBCS) in Curacao regulates and authorizes B.V as a Securities Intermediary. B.V. operates under license number 0003LSI, and it provides services to persons and territories outside the European Economic Area (EEA).

➡️ VG Limited is approved and regulated by the Financial Services Commission (FSC) of the British Virgin Islands, with registration number 2032226 and license number SIBA/L/20/1115.

➡️ The Financial Services Commission (FSC) of Mauritius authorizes and regulates Tortelo Limited under registration number 176967, with the subsequent license number GB20025294. Tortelo Limited identifies it as an Investment Dealer or Full-Service Dealer excluding underwriting.

➡️ Vlerizo (Pty) Limited is licensed by the Financial Sector Conduct Authority (FSCA) in South Africa as a genuine and reputable Financial Services Provider (FSP) with license number 51024.

➡️ Under license number 178/12, the Cyprus Securities and Exchange Commission (CySEC) regulates and authorizes Exness (Cy) Ltd.

➡️ In the United Kingdom, Exness (UK) Limited is licensed as well as overseen by one of the most demanding market regulators today namely the Financial Conduct Authority (FCA). Exness (UK) Limited operates under Financial Services Register number 730729 to operate as an Investment Firm.

Client Fund Security and Safety Features

The Broker maintains all customer monies in segregated accounts at top-tier institutions in all locations where the broker provides services.

The Broker is furthermore a member of the Financial Commission. The Financial Commission is responsible for resolving disputes in the financial services sector, with a particular emphasis on the foreign currency market.

The Financial Commission offers a variety of services, including a compensation fund that might be seen as an insurance policy for the clients of its members. The Financial Commission’s coverage per customer is up to €20,000.

Is this broker a regulated broker?

Yes, they are a regulated broker. It is authorized and supervised by reputable financial regulatory authorities.

How does Exness ensure the safety of the client’s funds?

They place a high priority on the safety and security of clients’ funds. They implement several measures to safeguard clients’ deposits.

Reputable Banking Partners: the Broker works with reputable banking institutions for handling client funds. Regular audits and oversight by the regulatory authorities help ensure that these standards are upheld.

Awards and Recognition

An award-winning broker that has previously been rewarded as the Best Global Forex Customer Service Broker in 2019, Best Global Forex Trading Experience in 2019, and more.

Has Exness received any awards for its services as a broker?

Yes, they have received several awards and recognition for their services as a broker. Over the years, the broker has been acknowledged by various industry-leading organizations and publications for its achievements in different areas, including trading conditions, customer service, and technological innovation.

Regulatory Compliance: As a regulated broker, the broker must comply with strict regulatory requirements related to capital adequacy, risk management, and client protection. Regular audits and oversight by the regulatory authorities help ensure that these standards are upheld.

What are some of the notable awards and recognition received by Exness?

Best Forex Broker, the broker has been honored with awards for being the best forex broker, recognizing its excellence in providing forex trading services and conditions.

The broker has been recognized for its outstanding customer support and dedication to meeting clients’ needs.

The broker has received awards for its innovative trading technology and platform solutions, providing traders with advanced and user-friendly tools.

Exness Account Types and Features

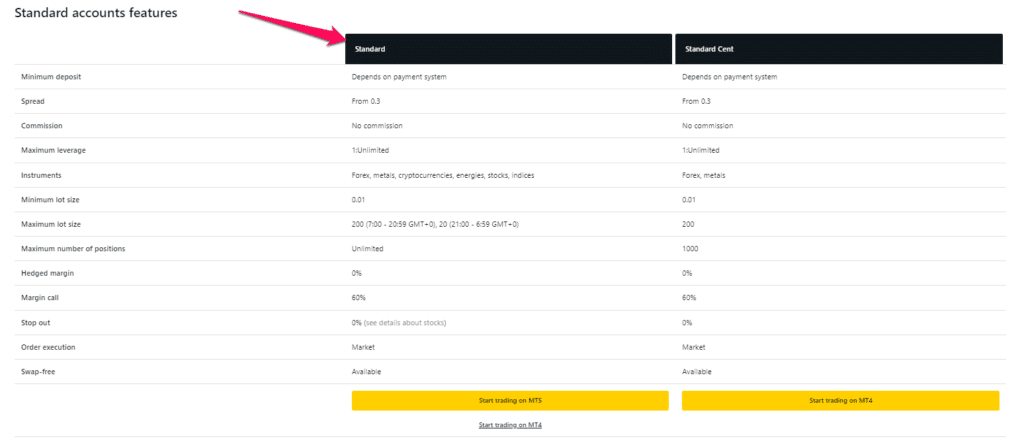

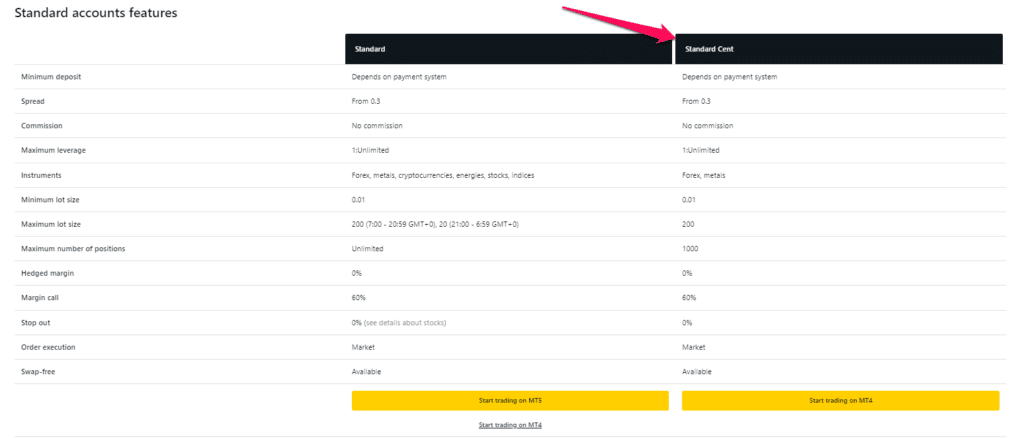

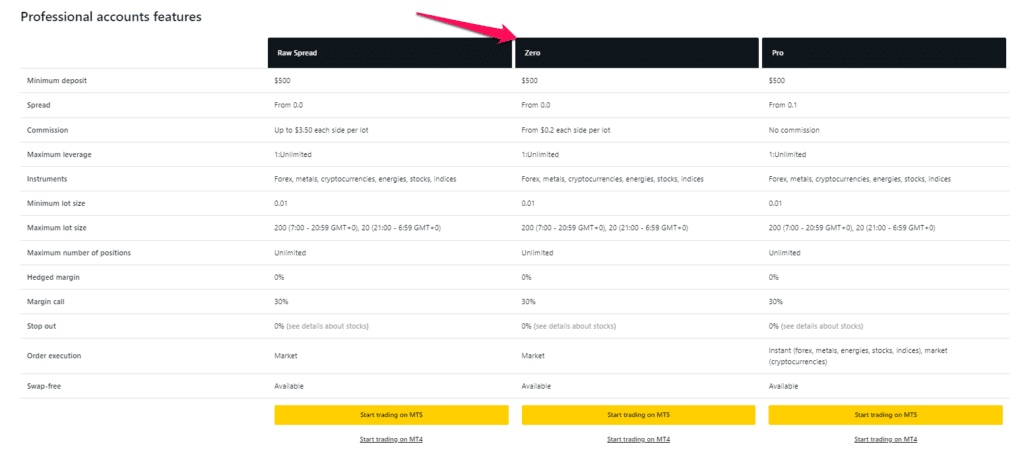

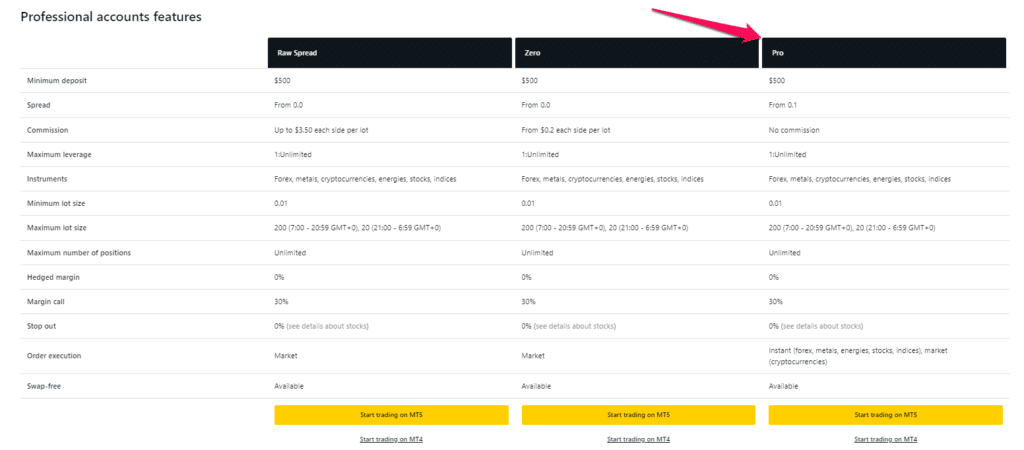

They provide two kinds of live trading accounts: Standard Accounts and Professional Accounts. Each of these two categories provides account choices that are suited to various degrees of expertise and kinds of traders based on their trading demands and trading styles.

Live trading accounts include the following:

➡️ Standard Account

➡️ Standard Cent Account

➡️ Raw Spread Account

➡️ Zero Account

➡️ Pro Account

| 💻 Live Account | 📉 Minimum Dep. | 📊 Average Spread | 💰 Commissions | 💸 Average Trading Cost |

| ➡️ Standard | 133 BWP/$10 | 0.3 pips | None | 10 USD |

| ➡️ Standard Cent | 133 BWP/$10 | 0.3 pips | None | 10 USD |

| ➡️ Raw Spread | 9476, BWP or $500 | 0.0 pips | $3.5 | 7 USD |

| ➡️ Zero | 9476, BWP or $500 | 0.0 pips | $0.1 | 7 USD |

| ➡️ Pro | 9476, BWP or $500 | 0.1 pips | None | 6 USD |

Live Trading Accounts

Standard Account

The Standard Account is suitable for all sorts of traders, regardless of their trading experience, skill level, or trading style. This account has the following features:

| Account Feature | Value |

| 📉 Minimum Deposit Requirement | 133 BWP or an equivalent to $10 |

| 📊 Spreads | Variable, from 0.3 pips |

| 💰 Account Base Currency | AED, ARS, AUD, AZN, BDT, BHD, BND, BRL, CAD, CHF, CNY, EGP, EUR, GBP, GHS, HKD, HUF, IDR, INR, JOD, JPY, KES, KRW, KWD, KZT, MAD, MXN, MYR, KES, NZD, OMR, PHP, PKR, QAR, SAR, SGD, THB, UAH, UGX, USD, UZS, VND, XOF, ZAR |

| 💳 Commission Charges | None |

| 📈 Maximum Leverage offered | Unlimited leverage |

| 🔨 Instruments Available | • Forex major pairs • Minor currency pairs • Exotic Forex pairs • Energies • Stocks • Indices |

| 📉 Minimum lot size | 0.01 lots |

| 📈 Maximum Lot Size | • 200 lots from 7 am to 8h59 pm (GMT +0) • 20 lots from 9 pm to 6h59 am (GMT +0) |

| 💻 Maximum positions | Unlimited |

| 📊 Hedged Margin (%) | 0 |

| 📞 Margin Call (%) | 60 |

| 🛑 Stop-out Level (%) | 0 |

| 📱 Order Execution | Market Execution |

| ☪️ Islamic Account | Yes |

Standard Cent Account

The minimum deposit for a Cent account is 133 BWP or an equivalent of $10, making it possible for Botswanans to start trading with small amounts of capital.

Using the Standard Cent MT4 account, you can easily establish trading positions with smaller position sizes, making this account ideal for beginners who are learning to trade and experts who are testing their trading strategies.

The Cent account has unlimited leverage ratios when compared to other brokers’ accounts. You will have infinite leverage on your Cent account.

| Account Feature | Value |

| 📉 Minimum Deposit Requirement | 133 BWP or an equivalent to $10 |

| 📊 Spreads | Variable, from 0.3 pips |

| 💰 Account Base Currency | USC, EUC, GBC, CHC, AUC, CAC |

| 💳 Commission Charges | None |

| 📈 Maximum Leverage offered | Unlimited leverage |

| 🔨 Instruments Available | • Forex • Metals |

| 📉 Minimum lot size | 0.01 lots |

| 📈 Maximum Lot Size | • 200 lots from 7 am to 8h59 pm (GMT +0) • 20 lots from 9 pm to 6h59 am (GMT +0) |

| 💻 Maximum positions | 1000 |

| 📊 Hedged Margin (%) | 0 |

| 📞 Margin Call (%) | 60 |

| 🛑 Stop-out Level (%) | 0 |

| 📱 Order Execution | Market Execution |

| ☪️ Islamic Account | Yes |

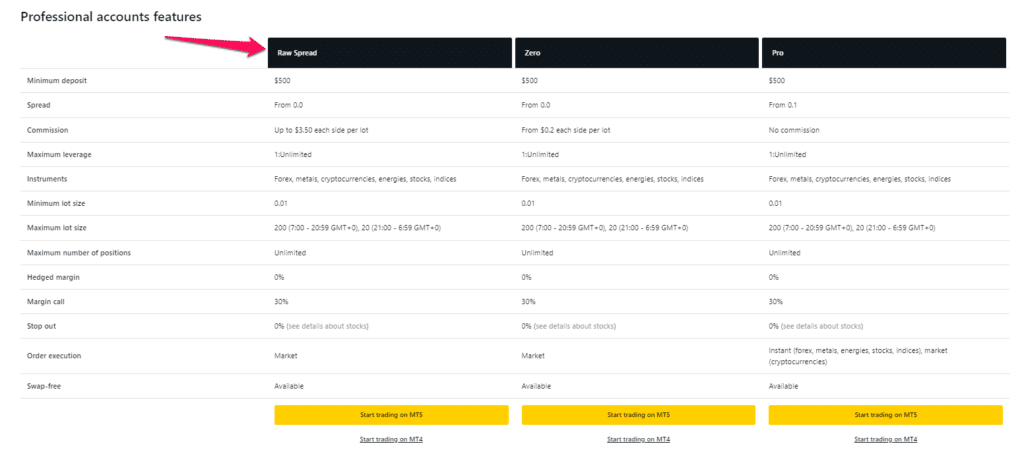

Raw Spread Account

A trading account with competitive and tight spreads is ideal for scalpers, day traders, and algorithmic traders who are looking for competitive and tight spreads.

| Account Feature | Value |

| 📉 Minimum Deposit Requirement | 9476 BWP or an equivalent to $500 |

| 📊 Spreads | Variable, from 0.0 pips |

| 💰 Account Base Currency | AED, ARS, AUD, AZN, BDT, BHD, BND, BRL, CAD, CHF, CNY, EGP, EUR, GBP, GHS, HKD, HUF, IDR, INR, JOD, JPY, KES, KRW, KWD, KZT, MAD, MXN, MYR, NGN, NZD, OMR, PHP, PKR, QAR, SAR, SGD, THB, UAH, UGX, USD, UZS, VND, XOF, ZAR |

| 💳 Commission Charges | Up to $3.5 per side, per lot |

| 📈 Maximum Leverage offered | Unlimited leverage |

| 🔨 Instruments Available | • Forex • Metals • Energies • Stocks • Indices |

| 📉 Minimum lot size | 0.01 lots |

| 📈 Maximum Lot Size | • 200 lots from 7 am to 8h59 pm (GMT +0) • 20 lots from 9 pm to 6h59 am (GMT +0) |

| 💻 Maximum positions | Unlimited |

| 📊 Hedged Margin (%) | 0 |

| 📞 Margin Call (%) | 30 |

| 🛑 Stop-out Level (%) | 0 |

| 📱 Order Execution | Market Execution |

| ☪️ Islamic Account | Yes |

Zero Account

No requotes are guaranteed while trading with the Zero Account. It also has among the most competitive spreads and costs possible when compared to similar accounts offered by other brokers.

| Account Feature | Value |

| 📉 Minimum Deposit Requirement | 9476 BWP or an equivalent to $500 |

| 📊 Spreads | Variable, from 0.0 pips |

| 💰 Account Base Currency | AED, ARS, AUD, AZN, BDT, BHD, BND, BRL, CAD, CHF, CNY, EGP, EUR, GBP, GHS, HKD, HUF, IDR, INR, JOD, JPY, KES, KRW, KWD, KZT, MAD, MXN, MYR, NGN, NZD, OMR, PHP, PKR, QAR, SAR, SGD, THB, UAH, UGX, USD, UZS, VND, XOF, ZAR |

| 💳 Commission Charges | From $0.1 per side, per lot |

| 📈 Maximum Leverage offered | Unlimited leverage |

| 🔨 Instruments Available | • Forex • Metals • Energies • Stocks • Indices |

| 📉 Minimum lot size | 0.01 lots |

| 📈 Maximum Lot Size | • 200 lots from 7 am to 8h59 pm (GMT +0) • 20 lots from 9 pm to 6h59 am (GMT +0) |

| 💻 Maximum positions | Unlimited |

| 📊 Hedged Margin (%) | 0 |

| 📞 Margin Call (%) | 30 |

| 🛑 Stop-out Level (%) | 0 |

| 📱 Order Execution | Market Execution |

| ☪️ Islamic Account | Yes |

Pro Account

Professional Accounts are intended for Botswanan traders who have a thorough grasp of the financial markets. This account type offers trading conditions and benefits that professionals need to add a competitive edge to their trading.

| Account Feature | Value |

| 📉 Minimum Deposit Requirement | 9476 BWP or an equivalent to $500 |

| 📊 Spreads | Variable, from 0.1 pips |

| 💰 Account Base Currency | AED, ARS, AUD, AZN, BDT, BHD, BND, BRL, CAD, CHF, CNY, EGP, EUR, GBP, GHS, HKD, HUF, IDR, INR, JOD, JPY, KES, KRW, KWD, KZT, MAD, MXN, MYR, NGN, NZD, OMR, PHP, PKR, QAR, SAR, SGD, THB, UAH, UGX, USD, UZS, VND, XOF, ZAR |

| 💳 Commission Charges | None |

| 📈 Maximum Leverage offered | Unlimited leverage |

| 🔨 Instruments Available | • Forex • Metals • Energies • Stocks • Indices |

| 📉 Minimum lot size | 0.01 lots |

| 📈 Maximum Lot Size | • 200 lots from 7 am to 8h59 pm (GMT +0) • 20 lots from 9 pm to 6h59 am (GMT +0) |

| 💻 Maximum positions | Unlimited |

| 📊 Hedged Margin (%) | 0 |

| 📞 Margin Call (%) | 30 |

| 🛑 Stop-out Level (%) | 0 |

| 📱 Order Execution | Instant Execution on Forex currency pairs, metals, energies, stocks, and indices |

| ☪️ Islamic Account | Yes |

Base Account Currencies

When Botswanan traders register a live trading account, they can choose from an impressive range of base currencies.

While BWP is not one of these, Botswanans can open an account in AED, ARS, AUD, AZN, BDT, BHD, BND, BRL, CAD, CHF, CNY, EGP, EUR, GBP, GHS, HKD, HUF, IDR, INR, JOD, JPY, KES, KRW, KWD, KZT, MAD, MXN, MYR, NGN, NZD, OMR, PHP, PKR, QAR, SAR, SGD, THB, UAH, UGX, USD, UZS, VND, XOF, or ZAR.

Demo Account

- A demo account is a practice account that offers traders a certain amount of virtual funds that they can use, allowing them to enter the live market without risking their capital.

- There is a certain degree of risk involved when trading financial markets and offers its clients a risk-free platform where they can test strategies, practice trading, and explore what the broker offers in a safe trading environment with actual market conditions.

- The demo account has all the features available on their live accounts. Before signing up for an actual account, you should make use of their demo account.

- However, like with every other broker, Botswanan traders should note that the environment (especially the spread or bid/ask pricing) on a demo account might be different from the environment on live accounts at times.

- Therefore, you should only utilize the trial account for developing your trading technique or to get an idea of how live trading works, and not to try and get an accurate idea of actual live spreads.

Islamic Account

- Depending on the trading style and the trading strategy of the forex trader, they may keep their trading positions open for longer than 24 hours on a trading day.

- This means that the trader could incur an overnight or rollover fee. This is a type of interest that is prohibited by the Riba principles of Sharia law, which means that Muslim traders are often restricted in forex trading.

- The Islamic Account option is available on all live trading accounts, ensuring that Muslim traders of all experience levels, regardless of their trading goals, can engage in a variety of financial markets without the danger of being exposed to various sorts of interest.

What types of trading accounts does the broker offer, and what are their key features?

The Broker provides various types of trading accounts, each designed to cater to the diverse needs and preferences of traders.

Standard Account: The Standard account is suitable for traders who prefer a more traditional trading environment. It offers variable spreads, meaning the spread may fluctuate based on market conditions. This account type is commission-free, and traders can access a wide range of financial instruments.

Pro Account: The Pro account is tailored for more experienced traders and those who prefer tighter spreads and lower trading costs. It operates on a commission-based model, where traders pay a fixed commission per lot traded. The Pro account typically offers lower spreads compared to the Standard account.

Can I open multiple trading accounts, and are there any advantages to doing so?

Yes, traders can open multiple trading accounts. Having multiple accounts can offer certain advantages and flexibility in managing trading activities.

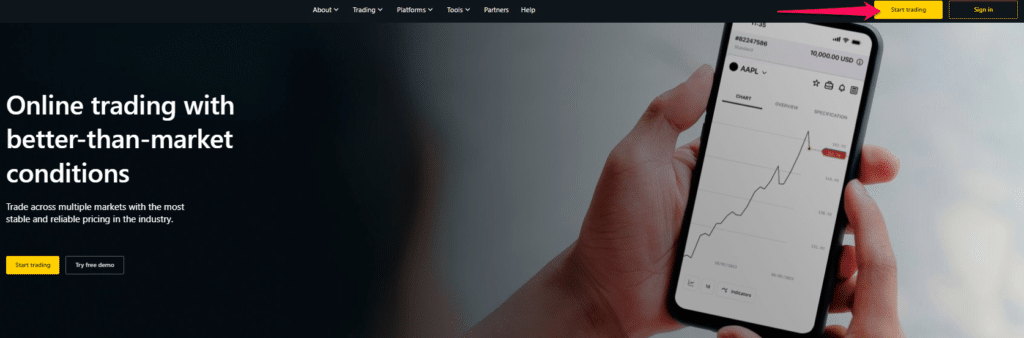

How to open an Account with Exness in Botswana

To register an account Traders can follow these steps:

Step 1. Visit the Website

Start by going to the home page and clicking on Start Trading. The website will take you to the Registration page, where you will be required to provide your General and Personal Information.

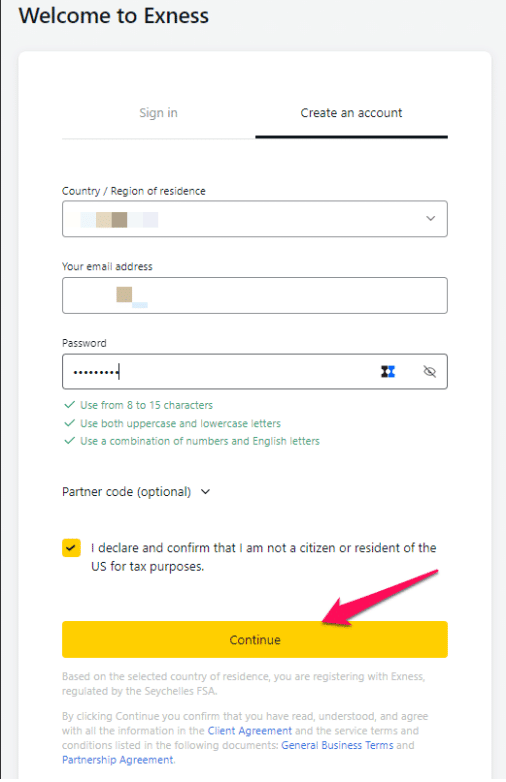

Step 2. Create an Account

Start by going to the home page and filling out the information in the New Account Section.

After you have filled out the necessary information, you must choose the kind of trading account with which you want to register by clicking on Open New Real Account and then choosing the trading account type. Enter your email address. Create a password for your account following the guidelines shown.

Enter a partner code (optional), which will link your account to a partner in the Partnership program.

Tick the box declaring you are not a citizen or resident of the US, if this applies to you.

Click Continue once you have provided all the required information.

Congratulations, you have successfully registered a new Account and will be taken to your new Personal Area.

Please keep in mind that it may take up to 24 hours to validate the papers. Once your account has been authenticated, you will get an email confirming your registration.

Exness Vs FBS Vs AvaTrade – Broker Comparison

| Exness | FBS | AvaTrade | |

| ⚖️ Regulation | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA | IFSC, CySEC, ASIC, FSCA | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, FRSA, CySEC, ISA |

| 📱 Trading Platform | MetaTrader 4 MetaTrader 5 | • MetaTrader 4 • MetaTrader 5 • FBS Trader • CopyTrade | AvaTradeGO AvaOptions AvaSocial MetaTrader 4 MetaTrader 5 DupliTrade ZuluTrade |

| 💰 Withdrawal Fee | No | Yes | No |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 133 BWP | 12 BWP | 0,71 BWP |

| 📊 Leverage | Unlimited | Up to 1:3000 | 1:400 |

| 📊 Spread | Variable, from 0.0 pips | From 0.0 pips | Fixed, from 0.9 pips |

| 💰 Commissions | From $0.1 per side, per lot | From $6 | None |

| ✴️ Margin Call/Stop-Out | 60%/0% | 40% and 20% | 25%/10% |

| 💻 Order Execution | Market | STP, ECN | Instant |

| 💳 No-Deposit Bonus | No | Yes | No |

| 📊 Cent Accounts | Yes | Yes | No |

| 📈 Account Types | Standard Account Standard Cent Account Raw Spread Account Zero Account Pro Account | • FBS Cent Account • FBS Micro Account • FBS Standard Account • FBS Zero Account • FBS ECN Account • FBS Crypto Account | Standard Live Account Professional Account Option |

| ⚖️ CBN Regulation | No | No | No |

| 💳 BWP Deposits | Yes | Yes | No |

| 📊 Botswanan Pula Account | No | No | No |

| 👥 Customer Service Hours | 24/7 | 24/7 | 24/5 |

| 📊 Retail Investor Accounts | 5 | 6 | 1 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 📉 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | Unlimited | 500 lots | Unlimited |

| 💰 Minimum Withdrawal Time | Instant | 15 to 20 minutes (maximum 48 hours) | 24 to 48 Hours |

| 📊 Maximum Estimated Withdrawal Time | Up to 72 hours | Up to 7 days | Up to 10 days |

| 💸 Instant Deposits and Instant Withdrawals? | Yes | Instant Deposits | No |

Exness Trading Platforms

The broker offers Botswana Traders a choice between these trading platforms:

➡️ MetaTrader 4 on mobile, desktop, and web terminals

➡️ MetaTrader 5 on mobile, desktop, and web terminals

➡️ Trader App

➡️ Web Terminal

Desktop Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4

The broker allows Botswanan traders to trade on MetaTrader 4 according to their trading preferences. There are two execution options available when trading CFDs: Instant Execution and Market Execution. Regardless of the complexity of the trading strategy, Botswanans may trade their preferred financial products with ease with the desktop interface of MetaTrader 4.

MetaTrader 5

MetaTrader 5 offers a specialized MetaEditor tool for building trading robots and technical indicators. Due to the tool’s contact with the platform, new applications will automatically appear in MetaTrader 5 and can be used immediately.

The desktop trading platform MetaTrader 5 has the following features:

➡️ Access to a range of tradable instruments

➡️ Spreads from as low as 0.0 pips

➡️ 21 timeframes along with 3 chart types

➡️ Different order types

➡️ A comprehensive hedging system

➡️ 38 built-in indicators, and more

WebTrader Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ Terminal

MetaTrader 4

- Multiple instruments, including flexible trading techniques, algorithmic trading, and mobile trading, are now accessible on the terminal, allowing Botswanan traders of varying levels of expertise to engage in the financial markets.

- Botswanans may discover entry and exit locations, as well as market trends, with the assistance of MetaTrader 4 WebTrader.

MetaTrader 5

- MetaTrader 5 is a platform for trading equities, options, and futures. WebTrader provides access to fundamental and technical research, trading signals, algorithmic trades, and other tools for fundamental and technical analysis.

- Investors in Botswana can easily stay updated with the latest financial news by listening to live radio broadcasts of financial news updates.

- Expert Advisors analyze market quotations and trade on the financial markets to automate trading on the MT5 platform, and then execute transactions on the financial markets.

Terminal

- The Terminal provides traders with a full trading experience by way of its user-friendly interface and robust, innovative charting capabilities. The terminal provides aggressive traders with over 50 drawing tools and over 100 indicator types.

- In addition, TradingView provides charts on Terminal, which was developed by the company’s brilliant programmers and designers. Additionally, the Terminal is a reliable, quick, and user-friendly HTML 5 web application.

Trading App

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ Trader app

MetaTrader 4 and 5

- The MetaTrader 4 and 5 trading terminals are compatible with Windows, macOS, and Linux desktop PCs.

- Additionally, they are compatible with mobile devices. Due to the mobile trading capability accessible on iOS and Android smartphones and tablets, users with a packed schedule may trade while on the move.

- Traders in Botswana now have access to a wide range of essential components associated with both MetaTrader 4 and MetaTrader 5. This comprehensive range includes trading orders, interactive charts, and popular analytical tools, and can monitor their trading accounts and engage in mobile trading with a single click.

- Trading may also get push alerts and interact with other traders using these iOS and Android mobile apps.

Trader app

- Thanks to Trader, Botswanans can easily trade with confidence from any location around the globe. Traders can optimize their trading by using rapid deposits and withdrawals, in addition to on-demand customer service, while selecting from more than 200 instruments.

- The Trader platform makes it easy for Botswanans to get started since it includes all the required tools, like candlestick charts, indicators, and computational tools. CFDs on a variety of markets, including forex, gold, oil, and indices, may be discovered on the trading app.

- Additionally, traders may effortlessly switch between several charts while keeping a continual eye on all trading activities.

What trading platforms are offered to their clients?

MetaTrader 4 (MT4):

MetaTrader 4 is a widely acclaimed platform known for its powerful charting tools, technical analysis indicators, and expert advisors (EAs). It is suitable for traders of all experience levels and offers a seamless trading experience across various devices.

MetaTrader 5 (MT5):

MetaTrader 5 is the successor to MT4 and comes with advanced features such as more timeframes, additional technical indicators, and the ability to trade a broader range of financial instruments. MT5 is particularly popular for traders interested in CFDs on stocks and commodities.

Can I use automated trading strategies on trading platforms?

Yes, the broker supports automated trading strategies on both MT4 and MT5 platforms. Traders can develop and use automated trading strategies by creating Expert Advisors (EAs) on MT4 or using MetaQuotes Language 5 (MQL5) to code EAs on MT5. These EAs enable traders to execute trades automatically based on predefined conditions and trading algorithms.

Range of Markets

Botswana Traders can expect the following range of markets:

Financial Instruments and Leverage offered

| 🔨 Instrument | 📱 Number of Assets Offered | 📈 Max Leverage Offered |

| Forex | 100 | • Equity 0 – 999: Unlimited • 0 – 4,999: 1:2000 • 5,000 – 29,999: 1:1000 • 30,000+: 1:500 |

| Precious Metals | 4 | • Equity 0 – 999: Unlimited • 0 – 4,999: 1:2000 • 5,000 – 29,999: 1:1000 • 30,000+: 1:500 |

| Indices | 11 | • 1:400 (US30, US50, USTEC) • 1:200 all other Indices |

| Stocks | 100+ | 1:20 |

| Energies | 2 | 1:200 |

Broker Comparison for a Range of Markets

| 🥇 Exness | 🏅 FBS | 🥉 AvaTrade | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | No | Yes |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Options | No | No | Yes |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | No | Yes |

What is meant by the “range of markets” in trading?

The term “range of markets” refers to the variety of financial instruments or assets that traders can trade within a particular brokerage or trading platform. It includes all the different types of markets and assets available for trading.

Why is a broad range of markets important for traders?

Diversification: A diverse range of markets allows traders to spread their investments across different asset classes. Diversification helps reduce risk by ensuring that a downturn in one market does not negatively impact the entire portfolio.

Opportunities in Volatile and Stable Markets: Different markets behave differently under various market conditions. Traders can find opportunities in both volatile markets and more stable markets (like major currency pairs).

Trading and Non-Trading Fees

Spreads

The spreads that Botswanan traders will be charged will vary depending on the kind of account that they choose to use since each account is designed to accommodate a particular sort of trader. The following are the typical spreads that traders may anticipate seeing include:

| 💰 EUR/USD | 💰 XAGUSD | 💰 BTC/USD | 💰 US Oil | 💰 AAPL | 💰 USTEC | |

| ➡️ Standard Account | 1 pip | 3.8 pips | 496 pips | 9.5 pips | 0.9 pips | 55 pips |

| ➡️ Standard Cent Account | 1 pip | 3.8 pips | – | – | – | – |

| ➡️ Raw Spread Account | 0 pips | 1.9 pips | 193 pips | 4.4 pips | 0.5 pips | 10 pips |

| ➡️ Zero Account | 0 pips | 0.1 pips | 193 pips | 2.3 pips | 0.3 pips | 8.5 pips |

| ➡️ Pro Account | 0.6 pips | 2.4 pips | 310 pips | 5.9 pips | 0.6 pips | 34 pips |

Commissions

A flat rate commission is imposed on some accounts to guarantee that the broker is compensated for the services provided in facilitating the deal. In this case, the commissions are levied on the following accounts:

➡️ Raw Spread Account – Up to $3.50 per side, per lot

➡️ Zero Account – From $0.1 per side, per lot

Overnight Fees, Rollovers, or Swaps

While holding positions overnight, traders may expect to incur expenses that vary based on a range of factors, including the financial instrument being held, the length of time spent holding it, the size of the position, and the interbank rates at the time.

The following are some examples of typical overnight fees that Botswanan traders should expect:

➡️ EUR/USD – a long swap of -0.63356 pips and a short swap of 0.14698 pips

➡️ XAG/USD – a log swap of -0.0857 pips and a short swap of -0.0597 pips

➡️ US OIL – a long swap of 0.65 pips and a short swap of -3.9 pips

Deposit and Withdrawal Fees

The broker does not charge Botswanan traders any deposit or withdrawal fees.

Inactivity Fees

There are no fees charged on any inactive accounts.

Currency Conversion Fees

When Botswanan traders deposit or withdraw funds in BWP, they could face currency conversion funds.

What are the trading fees charged by the broker?

Spread: The difference between the buy (ask) and sell (bid) price of an asset. It is the primary way brokers make money from clients’ trades, especially in the Forex market.

Commission: Some brokers charge a fixed or percentage-based commission per lot traded, particularly in commission-based account types like the Pro account.

Swap or Overnight Fees: Also known as rollover fees, these are charges for holding positions overnight and can be earned or incurred depending on the interest rate differentials between the currency pairs.

Slippage: The difference between the expected price of a trade and the price at which it is executed, often seen during high market volatility.

What are non-trading fees, and how do they impact traders?

Non-trading fees are charges imposed by brokers for various services or administrative activities that are not directly related to executing trades in the financial markets. accounts.

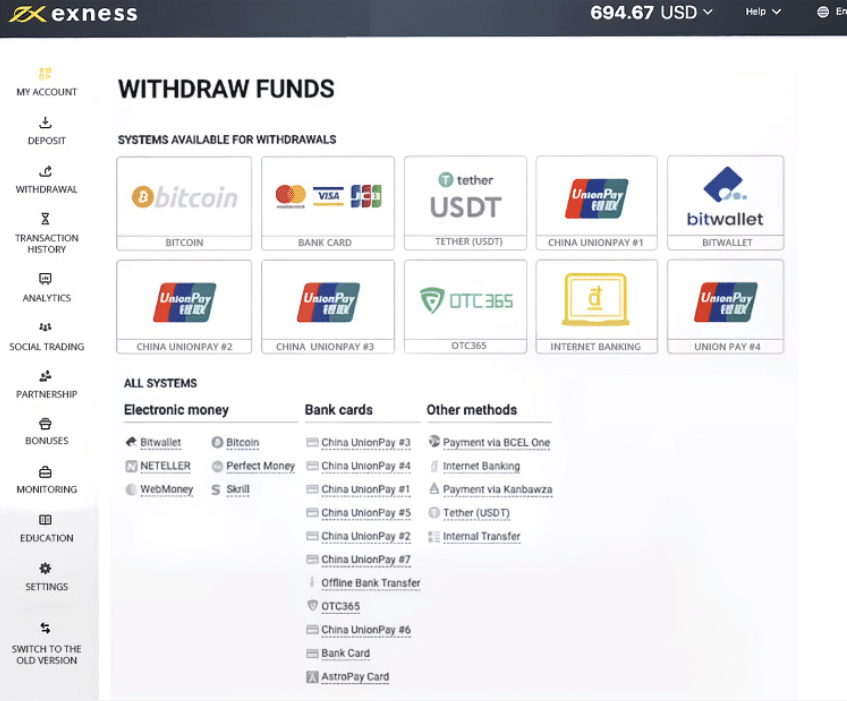

Exness Deposits and Withdrawals

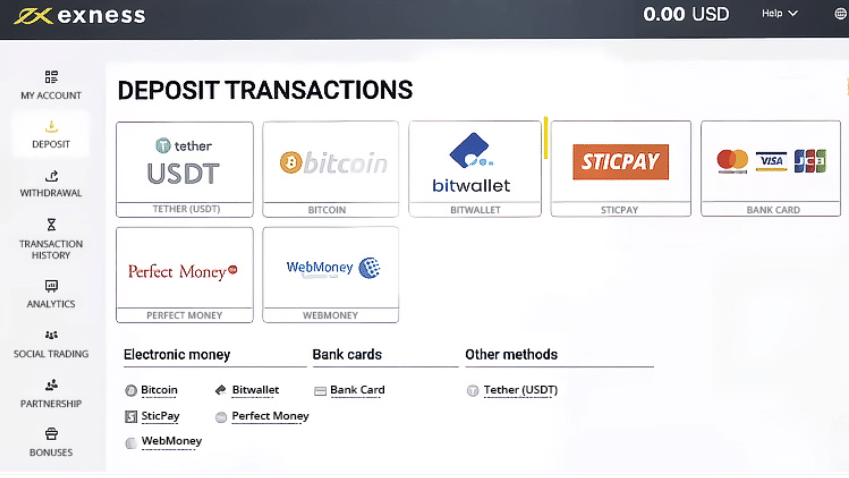

Offers the following deposit and withdrawal methods:

Comparison: Deposit and Withdrawals

| 🥇 Exness | 🏅 FBS | 🥉 AvaTrade | |

| Minimum Withdrawal Time | Instant | 15 to 20 minutes (maximum 48 hours) | 24 to 48 Hours |

| Maximum Estimated Withdrawal Time | Up to 72 hours | Up to 7 days | Up to 10 days |

| Instant Deposits and Instant Withdrawals? | Yes | Instant Deposits | No |

Payment Method, Minimum Deposit and Withdrawal, and Processing Times

| 💰 Payment Method | 🔁 Deposit Processing | 💳 Withdrawal Processing | 💸 Min Deposit | 📉 Min Withdrawal |

| Debit Card | Instant | Up to 72 hours | $10 | $3 |

| Credit Card | Instant | Up to 72 hours | $10 | $3 |

| Internet Banking | Instant | Up to 72 hours | $10 | $4 |

| Skrill | Instant | Instant | $10 | $10 |

| Neteller | Instant | Instant | $10 | $4 |

| Bank Wire | Instant | Instant | $10 | $2 |

What deposit methods are supported, and are there any associated fees?

- The broker offers a variety of deposit methods to accommodate clients from different regions. The available deposit methods may include bank wire transfers, credit/debit cards, electronic wallets (e-wallets), and local payment options. The specific deposit methods available to clients can depend on their country of residence.

- As for fees generally, the broker does not charge any fees for depositing funds into trading accounts. However, it’s essential to check with your payment provider or financial institution, as they may apply fees for deposit transactions.

What deposit methods are supported, and are there any associated fees?

- The broker offers a variety of deposit methods to accommodate clients from different regions. The available deposit methods may include bank wire transfers, credit/debit cards, electronic wallets (e-wallets), and local payment options. The specific deposit methods available to clients can depend on their country of residence.

- As for fees, generally, the broker does not charge any fees for depositing funds into trading accounts. However, it’s essential to check with your payment provider or financial institution, as they may apply fees for deposit transactions.

How to Deposit Funds

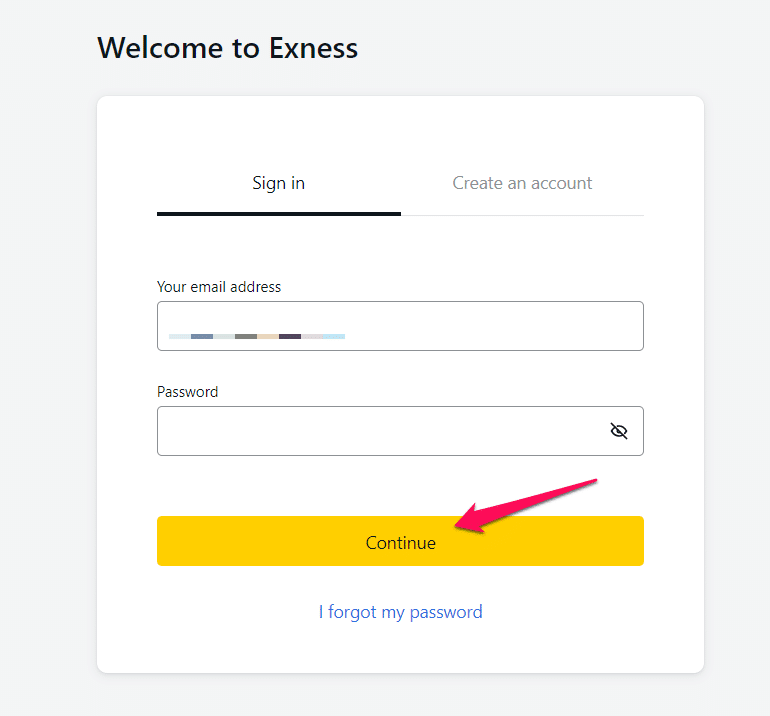

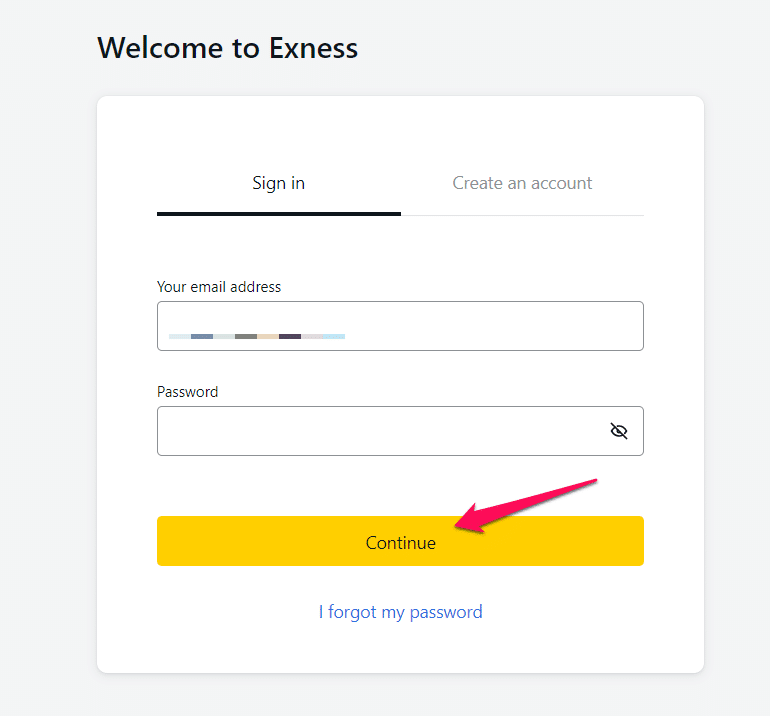

Step 1. Log In

Head over to Exness’ official website and log in to your Personal Area. If you don’t have an account yet, you can create a new account first.

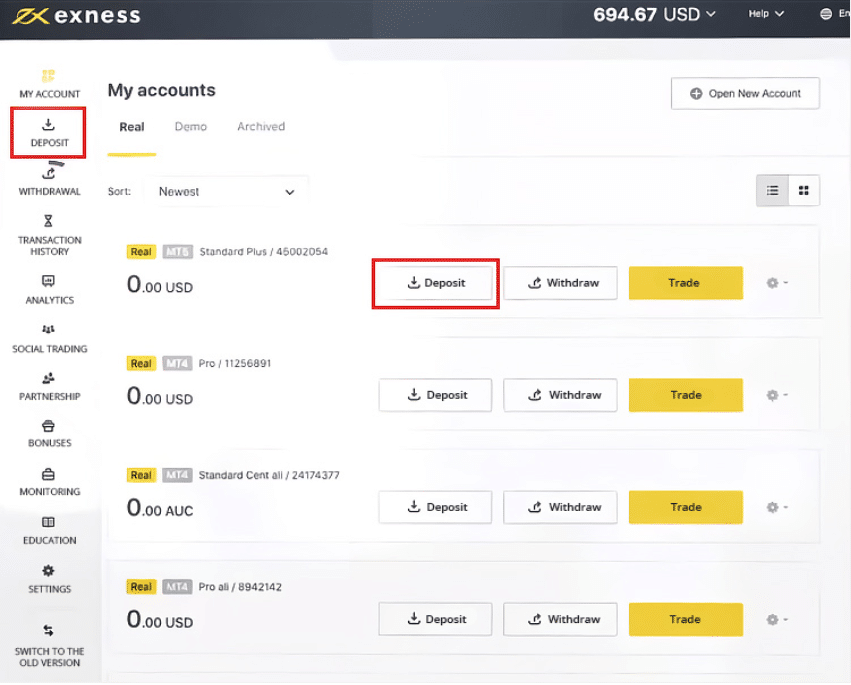

Step 2. Deposit

Once you’re logged in, click “Deposit” on the side menu.

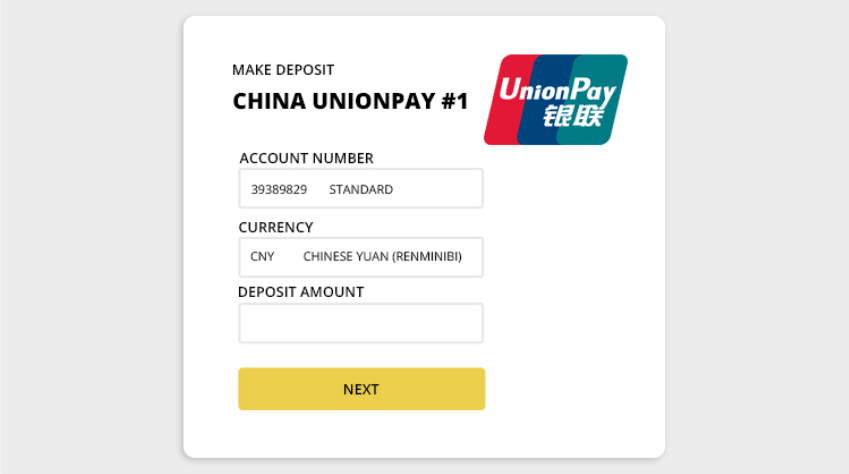

Step 3. Preferred Payment

Choose your preferred payment method.

Step 4. Enter Your Information

Enter your account number in Exness, currency, and deposit amount. Once you’re done, click “Next”.

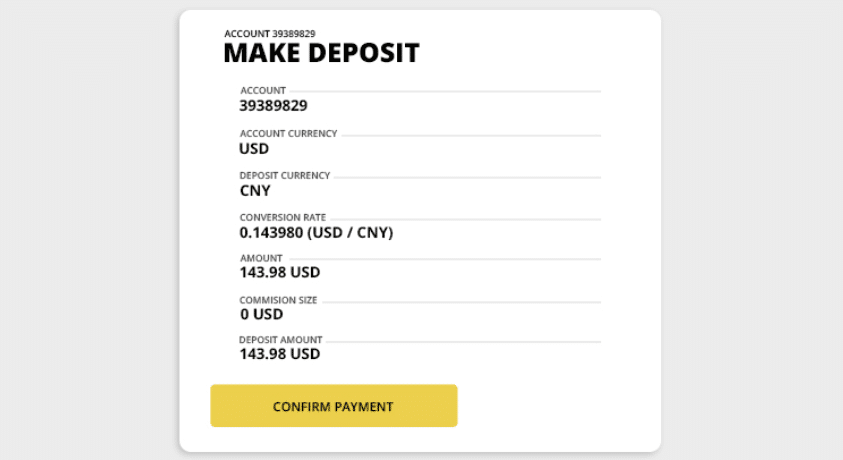

Step 5. Confirm Payment

Double-check the deposit details and click “Confirm Payment”.

Your browser will be redirected to your payment provider. Follow the instructions on the screen and accept the payment request (this may be different for each payment method). After that, your funds will be processed and reflected in your account as soon as possible.

Does Exness charge any fees for depositing funds into my trading account?

Generally does not charge fees for depositing funds into trading accounts.

How do I deposit funds into my Exness trading account?

Login: Login to your account using your registered credentials on the official Exness website or through the trading platform.

Confirmation: Once the transaction is successfully completed and confirmed, the deposited funds will be credited to your trading account. You can verify the deposit by checking your account balance.

Fund Withdrawal Process

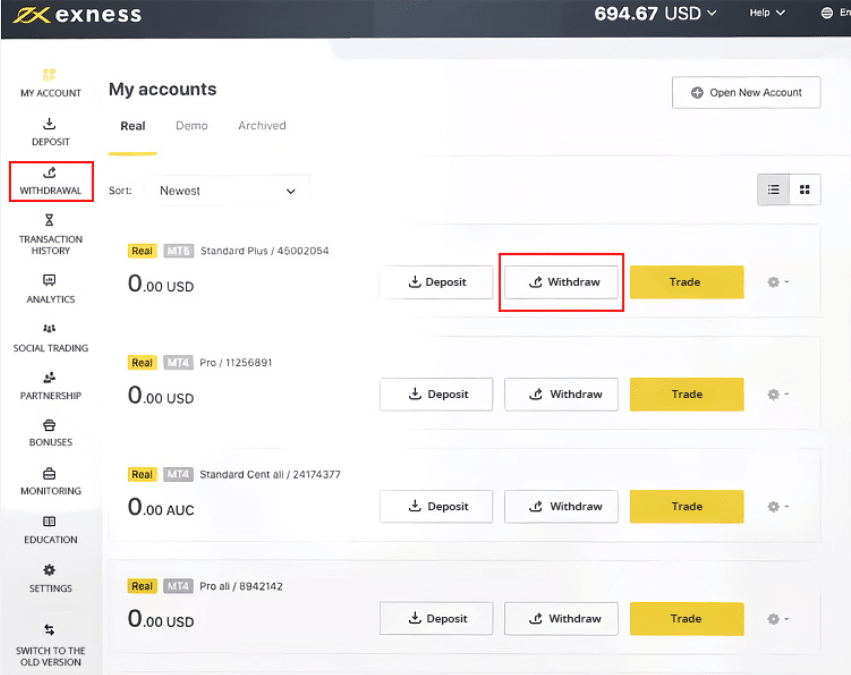

Step 1. Log In

Head over to Exness’ official website and log in to your Personal Area. If you don’t have an account yet, you can create a new account first.

Step 2. Withdraw

Click the “Withdraw” button on the side menu on the left side.

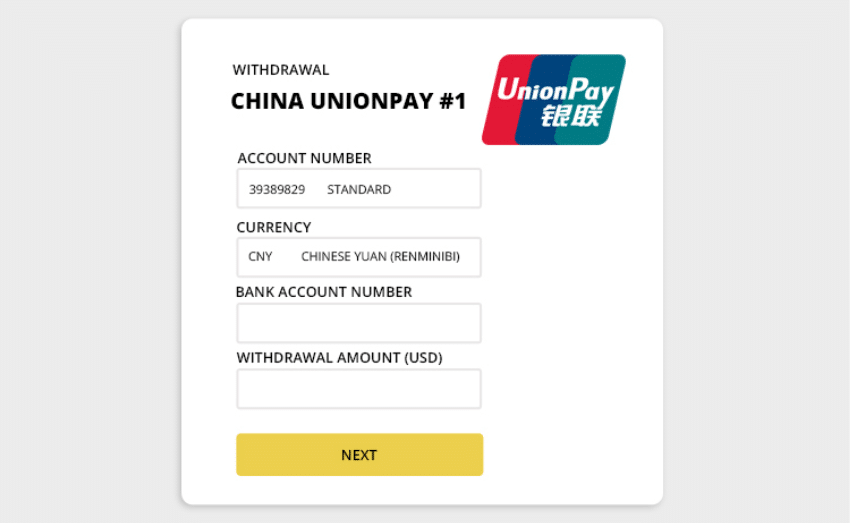

Step 3. Payment Methods

Choose from the available payment methods.

Step 4. Click Next

Enter your account number in Exness, currency, and withdrawal amount in USD. Then, click “Next”.

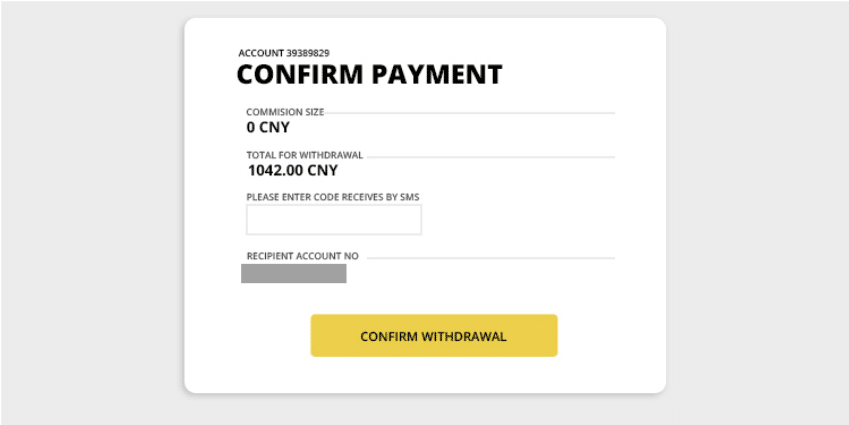

Step 5. Confirm Payment

Check the details of your withdrawal request and enter the code received by SMS. Click “Confirm Payment”.

Enter the credentials of your target account such as bank name and account name, and complete the transaction. Your funds will be transferred as soon as possible.

How do I initiate a fund withdrawal from my trading account?

- Login: Login to your account using your registered credentials on the official Exness website or through the trading platform.

- Ensure the amount does not exceed your available account balance and consider any applicable withdrawal limits.

Confirm Withdrawal: Review the withdrawal details and confirm the transaction. If you have multiple withdrawal methods, select the one you wish to use for this specific transaction. - Processing: Exness will process your withdrawal request based on the chosen withdrawal method.

How long does it take for Exness to process a fund withdrawal request?

Withdrawal Method: The withdrawal method you choose can impact the processing time.

Account Verification: prioritizes the security of funds, and account verification is a crucial step in the withdrawal process.

Requests made outside of regular business hours or during holidays may experience delays.

Education and Research

The broker does not offer any basic educational materials but offers these trading tools and resources:

➡️ Analytical Tools

➡️ Trader’s Calculator

➡️ Economic Calendar

➡️ Currency Converter

➡️ Tick History

Research and Trading Tool Comparison

| 🥇 Exness | 🏅 FBS | 🥉 AvaTrade | |

| ➡️ Economic Calendar | Yes | Yes | Yes |

| ➡️ VPS | Yes | Yes | No |

| ➡️ AutoChartist | No | No | No |

| ➡️ Trading View | Yes | No | No |

| ➡️ Trading Central | Yes | No | Yes |

| ➡️ Market Analysis | Yes | Yes | Yes |

| ➡️ News Feed | Yes | Yes | Yes |

| ➡️ Blog | Yes | Yes | Yes |

Does Exness provide educational resources and research materials for traders?

Yes, the broker offers a range of educational resources and research materials to support traders in their journey toward improving their trading skills and knowledge. These resources are designed to cater to traders of all experience levels, from beginners to advanced traders.

Does Exness provide free access to its educational and research materials?

Yes, the broker offers free access to its comprehensive range of educational and research materials for all registered clients.

10 Best Forex Brokers in Botswana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

Bonuses and Promotions

Exness does not currently offer any bonuses or promotions to Botswanan traders.

How to open an Affiliate Account with Exness

To register an Affiliate Account, Botswana Traders can follow these steps:

➡️ Navigate to the official website and hover over the “More” tab at the top of the toolbar.

➡️ Select “Partnership Program” from the list of options.

➡️ Click on the “Start Now” banner.

➡️ Complete the registration if you have not yet registered for the client area, or sign in.

➡️ Complete the Affiliation registration form and submit it for review.

➡️ Once your application is completed you can access the comprehensive affiliate package that Exness offers.

Affiliate Program Features

The broker is an industry leader in terms of appealing and regularly scheduled payouts. The broker provides its partners compensation of up to $1,770 for each referred customer that becomes an active client.

Exness pays for both initial deposits (CPA) and leads (CPL), with CPA, defined as follows:

➡️ The broker pays up to $1,770 based on the platform, the referrer’s place of residence, and the amount of their initial deposit with a $10 minimum.

➡️ Exness welcomes traffic from more than 40 countries globally

➡️ The broker provides regular monthly payouts and extra incentives for the greatest overall performance.

The CPL plan provides the following benefits:

➡️ Up to $25 per registration, based on the referred user’s country of residence and the platform they employ.

➡️ The payout will rise according to the registration rate.

➡️ Exness welcomes visitors from more than 40 countries worldwide.

➡️ There are solid and consistent monthly payouts.

➡️ Optional bonuses are available for the greatest overall performance.

➡️ Botswanans must note that they need to contact the Exness Affiliate Department to pick this plan.

How does the Exness Affiliate Account program work?

The Affiliate Account program allows individuals or entities to partner with Exness and earn commissions by referring new clients to the brokerage.

Are there any requirements to become an Affiliate?

The requirements to become an Affiliate are generally straightforward, but they may vary depending on specific regional regulations and policies.

Customer Support

Traders who join Exness will find that the broker has award-winning, dedicated, and prompt customer support available through several communication channels.

| Customer Support | Exness’ Customer Support |

| ⏰ Operating Hours | • 24/5 for 15 languages • 24/7 for English and Chinese |

| 🗣 Support Languages | English, Chinese, Japanese, Portuguese, Thai, Vietnamese, and others |

| 🗯 Live Chat | Yes |

| 📧 Email Address | Yes |

| ☎️ Telephonic Support | Yes |

| 📞 Local Support in Botswana? | No |

| 🥇 Overall quality of Exness Support | 3/5 |

How can I reach customer support, and what are their available contact channels?

The broker provides multiple avenues for clients to reach their customer support team and receive assistance with their inquiries or concerns.

Live Chat: Clients can access the live chat feature on the website or trading platform.

Does Exness offer multilingual customer support to clients from various regions?

Yes, they provide multilingual customer support to cater to clients from different regions and linguistic backgrounds. The broker understands the importance of clear communication in the trading process and aims to assist clients in their preferred languages.

Some of the common languages in which they offer customer support include:

- English

- Spanish

- Arabic

- Chinese Russian

- Thai

- Hindi

- Urdu

- Bengali

- Malay

Corporate Social Responsibility

The broker has been providing investment services since its inception in 2008. CEO Petr Valov is excited about the company’s commitment to Corporate Social Responsibility (CSR) and the chance to give back to people around the globe.

To assist people to attain their full potential in both professional and personal life, Exness provides a constant support system. This includes education, the environment, and tackling social and medical issues in the communities where people live and work.

The broker is helping to provide educational possibilities that are relevant to future vocations for today’s youth.

Our Verdict

Exness has received various accolades as a retail broker because it provides solid and dependable brokerage services in a trading environment designed to accommodate the most demanding traders. Even with Standard accounts, the standard spread is low.

Furthermore, the spread is even narrower for Pro and Raw Spread accounts. The broker also provides Botswanan traders with a wide variety of account kinds to accommodate all experience levels.

Exness also offers instantaneous withdrawal alternatives, a characteristic uncommon among forex brokers. Deposits and withdrawals are both free, so you do not have to pay any extra costs other than the banking fees levied by your payment provider.

What is the overall verdict on Exness as a forex broker?

Our verdict is that it is a well-established and reputable forex broker with a strong global presence. The broker’s multi-regulated status, extensive range of trading instruments, and user-friendly trading platforms make it an attractive choice for traders of varying experience levels. the broker prioritizes transparency, security, and client protection, evident through its regulatory compliance, negative balance protection, and robust risk management practices.

Is Exness recommended for beginners in the forex trading world?

Yes, the broker can be considered a suitable choice for beginners entering the forex trading world. The broker provides a user-friendly trading environment with popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which offer intuitive interfaces and a wide range of educational resources.

You might also like: Exness Minimum Deposit

You might also like: Exness Sign Up Bonus

You might also like: Exness Account Types

You might also like: Exness Demo Account

You might also like: Exness Fees and Spreads

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The broker has a global presence and has authorization and regulation with market regulators around the globe | There is a limited selection of tradable instruments and only a few asset classes |

| Offers instant withdrawals and deposits | There are only a few funding options offered |

| Botswanan traders have a choice between several dynamic account types | |

| Client fund safety is guaranteed and there is investor protection offered | |

| Offers 24/7 customer support that is both prompt and helpful | |

| There are tight and variable spreads offered with competitive commissions |

Frequently Asked Questions

Is Exness regulated?

Yes, the broker is regulated. Exness is licensed by one Tier-1 Regulator, two Tier-2 Regulators, and four Tier-3 Regulators (low trust).

How long does an Exness withdrawal take?

Withdrawal requests are handled either immediately or within 72 hours. The withdrawal request is then routed to processors and your bank, and it may take anywhere from one to fourteen working days for the cash to appear in your bank account.

Is Exness good for beginners?

Yes, the best forex broker for beginners. They provide many account options, including Standard Cent, Standard, Pro, and Zero. Their accounts provide very low spreads on the most popular currency pairings.

Does Exness have Nasdaq?

Yes, the broker provides access to Nasdaq via US TEC with spreads beginning from 6.5 pips and charges of $1 on the Raw Spread Account.

What is the minimum deposit for Exness?

The bare minimum deposit amount necessary to open a live trading account is ten dollars ($10 minimum), or the equivalent of 120 BWP depending on the current exchange rate between the USD and BWP.

Does Exness have Volatility 75?

No, Exness does not now provide the VIX 75, but it does offer numerous other popular indexes such as the AUS200, FR40, HK50, UK100, and several other options.

Conclusion

Now it is your turn to participate:

➡️ Do you have any prior experience with Exness?

➡️ What was the determining factor in your decision to engage with Exness?

➡️ Was it because of the minimum deposit, regulation, retail trading accounts, or any other factors?

➡️ Have you experienced any issues with Exness such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

Regardless, please share your thoughts in the comments below.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review