FBS Review

Overall, FBS is a licensed international broker that caters to Botswanan traders and investors. FBS offers choose from Five trading account type and is regulated by one Tier-1 (High-Trust) and two Tier-2 (Medium Trust) regulators. FBS has a Trust Score of 75% out of 100. FBS is currently not regulated by the MFED, BoB, or NBFIRA of Botswana

- Louis Schoeman

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Overview

Overall, FBS is considered average risk, with an overall Trust Score of 75 out of 100. FBS is licensed by one Tier-1 Regulator (high trust), two Tier-2 Regulators (average trust), and one Tier-3 Regulator (low trust). FBS offers five different retail trading accounts namely an Cent Account, Standard Account, Pro Account, Demo Account and Islamic Account.

FBS accepts Botswanan clients and has an average spread from 0.0 pips with $6 commissions round turn. The broker has a maximum leverage ratio up to 1:3000 and there is a demo and Islamic account available. MT4, MT5, FBS Trader platforms are supported. The broker is headquartered in Belize and is regulated by IFSC, CySEC, ASIC, and FSCA.

As an international broker with customers in over 150 countries, FBS has won multiple major accolades and utilizes innovative technology in the Forex Market to demonstrate its superiority.

The FBS CFD trading platform was founded in 2009 by investors who were interested in trading research and technical analysis. FBS provides global markets with transparent and trusted applications for more than 27M CFD traders.

Today, FBS is an international brand present in over 150 countries. The brand unites several companies offering their clients opportunities to trade Margin FX and CFDs. The companies include FBS Markets Inc. (licensed by IFSC), Tradestone Ltd. (licensed by CySEC), Intelligent Financial Markets Pty Ltd. (licensed by ASIC), and TRADE STONE SA (PTY) LTD. (licensed by FSCA).

FBS started as a Belize-based broker but has now expanded to include a Cyprus branch. In addition to these branches, FBS also operates through subsidiaries in Australia and South Africa. This helps and encourages the expansion of its service to a global audience for both novice and experienced traders.

FBS has been in operation for many years and provides a reliable trading environment. The company offers favorable trading conditions.

This broker review for Botswana will provide local retail traders with the details that they need to consider whether the broker is suited to their unique trading objectives and needs.

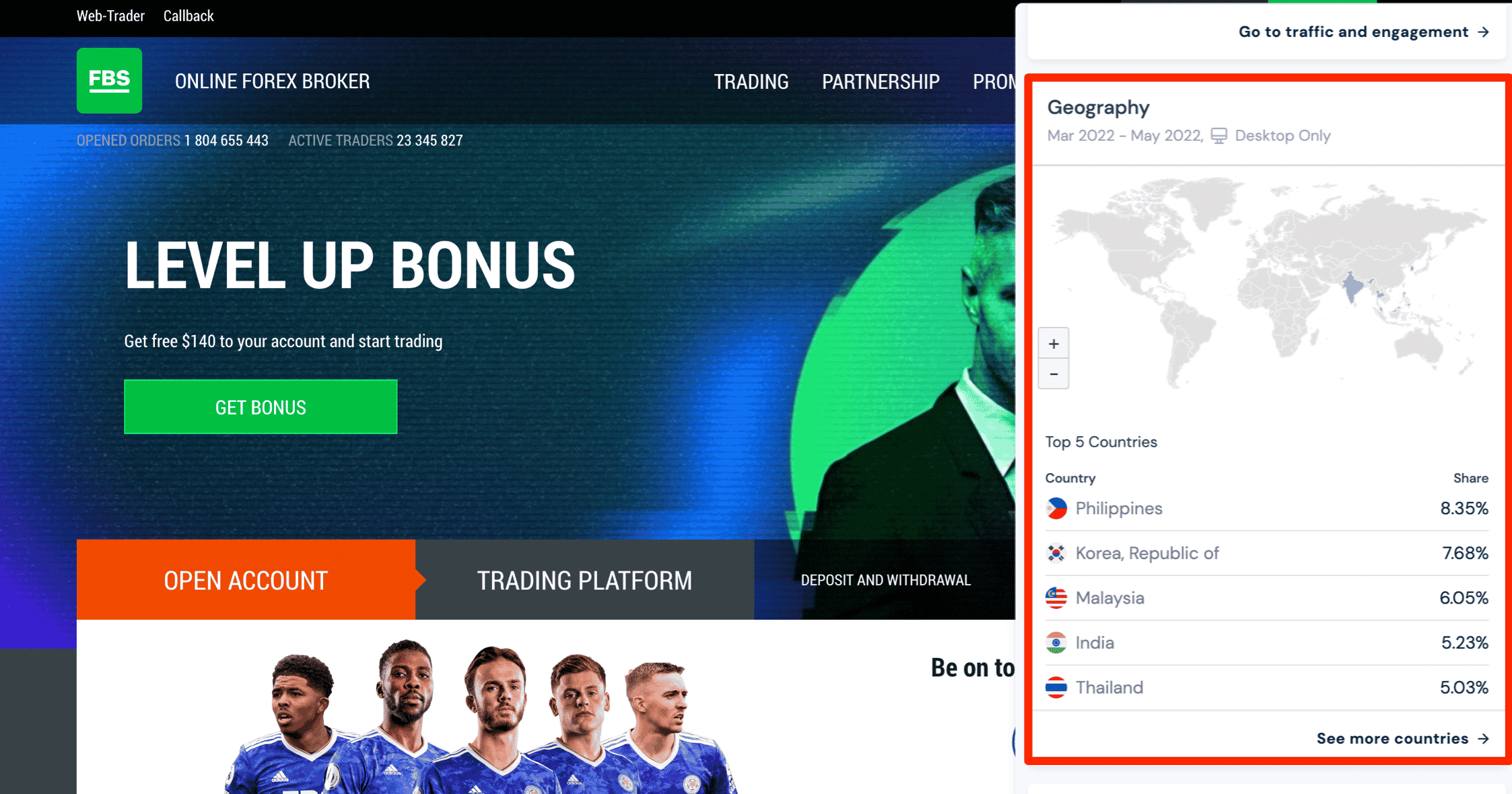

Distribution of Traders

Currently has the largest market share in these countries:

➡️ Philippines – 10.2%

➡️ Malaysia – 8.1%

➡️ India – 6.6%

➡️ Republic of Korea – 5.25%

➡️ Qatar – 4.45%

Popularity among traders

As a CFD and Forex broker in Botswana, the broker does not yet command a major portion of the local forex and CFD market. However, despite this, they continues to be one of the top 50 forex and CFD brokers for Botswanan traders.

FBS At a Glance

| 🏛 Headquartered | Belize |

| 🌎 Global Offices | Malaysia, Laos, Thailand, Dubai, Brazil, Turkey |

| 🏛 Local Market Regulators in Botswana | • Ministry of Finance and Economic Development (MFED) • Bank of Botswana (BoB) • Non-Bank Financial Institutions Regulatory Authority (NBFIRA) |

| 💳 Foreign Direct Investment in Botswana | 115.89 BWP Million in 2021 |

| 💰 Foreign Exchange Reserves in Botswana | 5270 USD Million in 2021 |

| ✔️ Local office in Gaborone? | No |

| 👨⚖️ Governor of SEC in Botswana | None, Moses Dinekere Pelaelo is the Governor of the Bank of Botswana |

| ✔️ Accepts Botswana Traders? | Yes |

| 📊 Year Founded | 2009 |

| 📞 Botswana Office Contact Number | None |

| 📱 Social Media Platforms | • Facebook • Telegram • YouTube |

| ⚖️ Regulation | IFSC, CySEC, ASIC, FSCA |

| 1️⃣ Tier-1 Licenses | • Australian Securities and Exchange Commission (ASIC) |

| 2️⃣ Tier-2 Licenses | • Cyprus Securities and Exchange Commission (CySEC) • Financial Sector Conduct Authority (FSCA) |

| 3️⃣ Tier-3 Licenses | • International Financial Service Commission (IFSC) in Belize |

| 🪪 License Number | • Belize – 000102/198 • Cyprus (Tradestone) – 331/17 • Australia (IFM) – 426359 • South Africa (Tradestone) – 50885 |

| ⚖️ MFED, BoB, or NBFIRA Regulation | None |

| ✔️ Regional Restrictions | Japan, United States, Canada, United Kingdom, Myanmar, Brazil, Malaysia, Israel, the Islamic Republic of Iran |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 3 |

| ✔️ PAMM Accounts | No |

| 💻 Liquidity Providers | Currenex |

| ✔️ Affiliate Program | Yes |

| 📱 Order Execution | Market |

| 📊 Starting spread | 0.0 pips |

| 📉 Minimum Commission per Trade | From $6 |

| 💰 Decimal Pricing | 5th decimal pricing after the comma |

| 📞 Margin Call | 40% |

| 🛑 Stop-Out | 20% |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | Unlimited |

| ✅ Crypto trading offered? | Yes |

| ✔️ Offers a BWP Account? | No |

| 📉 Dedicated Botswana Account Manager? | No |

| 📈 Maximum Leverage | 1:3000 |

| 📊 Leverage Restrictions for Botswana? | No |

| 💳 Minimum Deposit (BWP) | 96 Botswanan Pula or an equivalent to $5 |

| ✔️ Botswana Pula Deposits Allowed? | Yes |

| 📊 Active Botswana Trader Stats | 250,000+ |

| 👥 Active Botswana-based customers | Unknown |

| 🔁 Botswana Daily Forex Turnover | Unknown, Forex overall is $6.6 Trillion |

| 💰 Deposit and Withdrawal Options | • Credit Card • Debit Card • Neteller • Sticpay • Skrill • Perfect Money • Local Exchanges |

| 💻 Minimum Withdrawal Time | 15 to 20 minutes (maximum 48 hours) |

| ⏰ Maximum Estimated Withdrawal Time | Up to 7 days |

| 💳 Instant Deposits and Instant Withdrawals? | Instant Deposits |

| 🏛 Segregated Accounts with Botswana Banks? | No |

| 📱 Trading Platforms | • FBS Trader • MetaTrader 4 • MetaTrader 5 |

| 💻 Tradable Assets | • Forex • Precious Metals • Indices • Energies • Stocks • Exotic Forex • Cryptocurrencies |

| ✔️ Offers USD/BWP currency pair? | No |

| 📊 USD/BWP Average Spread | N/A |

| ✅ Offers Botswana Stocks and CFDs | No |

| 💻 Languages supported on the Website | English, German, Spanish, French, Italian, Portuguese, Indonesian, Malay, Vietnamese, Turkish, Korean, and others |

| ☎️ Customer Support Languages | Multilingual |

| ⏰ Customer Service Hours | 24/7 |

| 📞 Botswana-based customer support? | No |

| 💸 Bonuses and Promotions for Botswanans? | Yes |

| 📚 Education for Botswanan beginner traders | Yes |

| 📱 Proprietary trading software | Yes |

| 🤝 Most Successful Trader in Botswana | Unknown |

| ✔️ Is FBS a safe broker for Botswana Traders? | Yes |

| 🎖 Rating for FBS Botswana | 9/10 |

| 🥇 Trust score for FBS Botswana | 75% |

| 👉 Open Account | 👉 Open Account |

Regulation and Safety of Funds

Regulation in Botswana

While the broker does not have local offices in Botswana with respective regulation or authorization through local market regulators, the broker is a reputable and trusted broker.

Global Regulations

The European part of the brokerage is owned and run by ‘Tradestone Ltd,’ a financial investment services company located in Cyprus that provides financial and investment advisory services.

Cypriot regulators, the Cyprus Securities and Exchange Commission (CySEC), oversee the operations of Tradestone Ltd. under registration and license number 331/17.

The International Financial Services Commission (IFSC) in Belize regulates the operation of the worldwide website, which is run by FBS Markets Inc, a Belize-based company, under license number 000102/198.

FBS Oceania, now known as Intelligent Financial Markets Pty Ltd is an Australian-based entity that is well-regulated and authorized by the Australian Securities and Investments Commission (ASIC) under AFSL number 426359 and with ABN number 48155185014. FBS Oceania has held this license since February 2021.

In South Africa, Trade Stone SA (Pty) Ltd is regulated and authorized by the Financial Sector Conduct Authority (FSCA) as a Financial Service Provider or FSP. Under license number FSP 50885, FBS can provide its services to traders in Africa.

Client Fund Security and Safety Features

The FBS Know Your Client approach applies to all traders who open a trading account. Traders must verify trading accounts by submitting proof of their identity and residency.

All Botswanan traders must be aware that FBS adheres to Anti-Money Laundering regulations, which are reflected in the requirements of traders for deposits and withdrawals from/to unknown accounts.

Retail investors’ trading accounts are protected from going into a negative if they suffer a substantial loss thanks to a feature known as negative balance protection. When traders employ significant amounts of leverage to enhance the size of their positions, and the market goes against them, this is frequently the outcome that occurs.

Top-tier banks are entrusted with the safekeeping of all FBS customer funds. Subsequently, customer money cannot be utilized for FBS’ day-to-day operations or to assist the company meets its debt commitments.

Because of the Investors’ Compensation Fund (ICF), European customers are provided with insurance. This means that eligible traders will be compensated up to a maximum of €20,000 if the broker goes bankrupt for whatever reason, or if the broker is otherwise unable to fulfill its financial obligations.

Is FBS a regulated forex broker, and how does it ensure the safety of client funds?

The broker is a regulated forex broker in several jurisdictions. The specific regulatory authorities overseeing there operations may vary depending on the region in which a trader resides or chooses to open an account. The broker typically complies with the regulatory requirements of these authorities, which include maintaining segregated client accounts to keep client funds separate from company funds.

What steps does FBS take to ensure the security and safety of client funds beyond regulatory compliance?

In addition to regulatory requirements, the broker typically employs several security measures to safeguard client funds. These measures often include advanced encryption technologies to protect data transmission and secure online transactions.

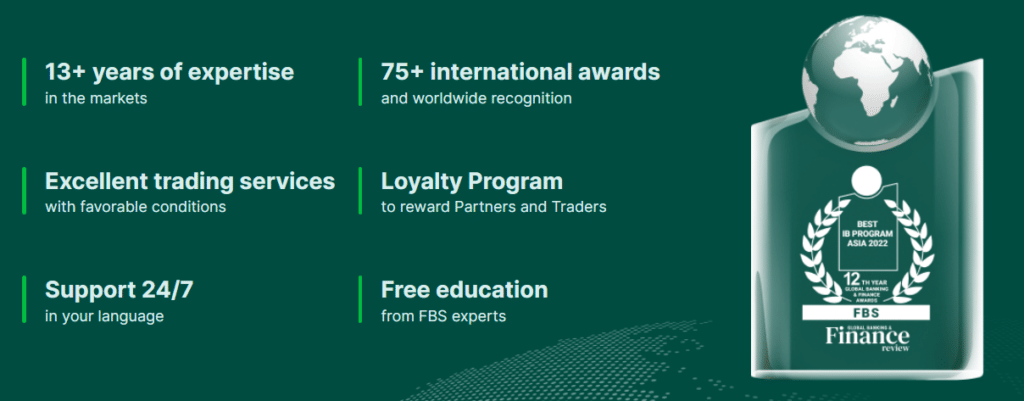

Awards and Recognition

Since 2009, when FBS was founded, we have received over 70 international awards.

The broker is an international broker with more than 150 countries of presence. 23 000 000 traders and 410 000 partners have already chosen FBS as their preferred Forex company.

To provide the best customer experience the broker organizes seminars and special events, providing its clients with training materials, cutting-edge trading technologies and latest strategies on the Forex market. Both newbie and professional traders will find these sessions useful. Every event is thoroughly planned and prepared in advance to make sure everything goes perfect. During the break guests are offered delicious food and coffee. All meetings take place in a family-like atmosphere, where everyone is welcome and can enjoy the company of the best FBS traders and partners. And most importantly, participation in all our events is absolutely free.

The broker values diversity of there clients and understand that different categories of customers have different demands. Specially for Muslim traders we provide swap-free accounts (also known as Islamic accounts), that do not contradict with the teachings of Islam.

If you are looking for a reliable and honest broker, consider opening an account at FBS. You will be surprised how easy and comfortable trading on Forex can become when there is a professional company standing behind you.

Has FBS received any notable awards or recognitions in the forex industry, and what are they known for?

The broker has garnered recognition in the forex industry through various awards and accolades. The broker is known for its commitment to providing competitive trading conditions, excellent customer service, and a range of trading instruments. Some common awards include titles like “Best Forex Broker Asia,” “Best Customer Service Broker,” and “Best Mobile Trading Platform.” These accolades are typically awarded by industry organizations and publications that assess and acknowledge the performance of forex brokers.

What do FBS’s awards and recognitions mean for traders, and how can traders benefit from choosing an award-winning broker?

The brokers awards and recognitions can be indicative of the broker’s reliability, quality of service, and competitive offerings.

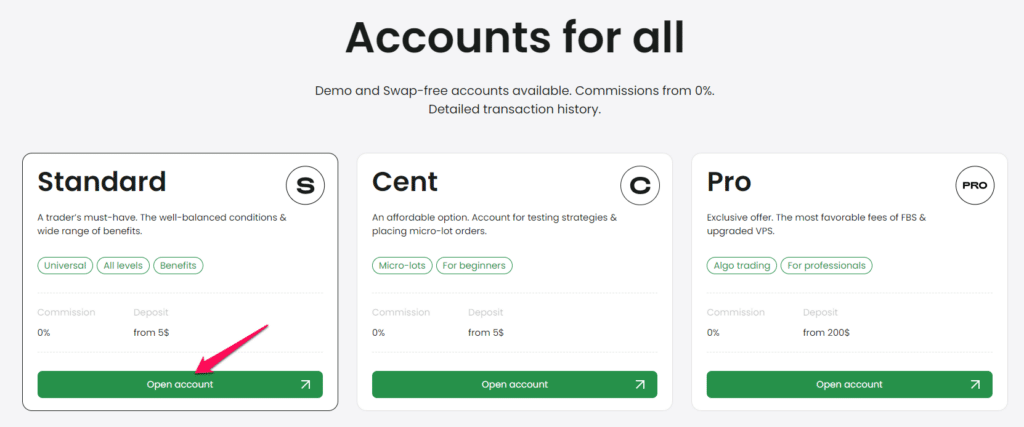

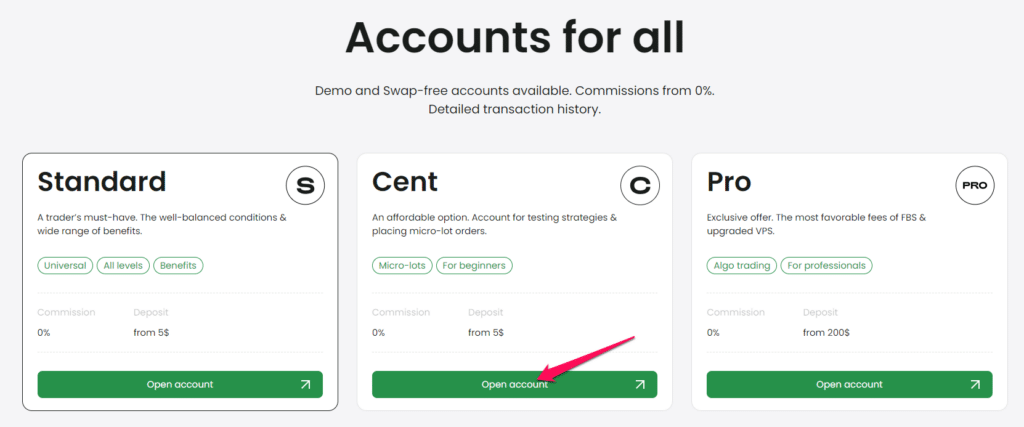

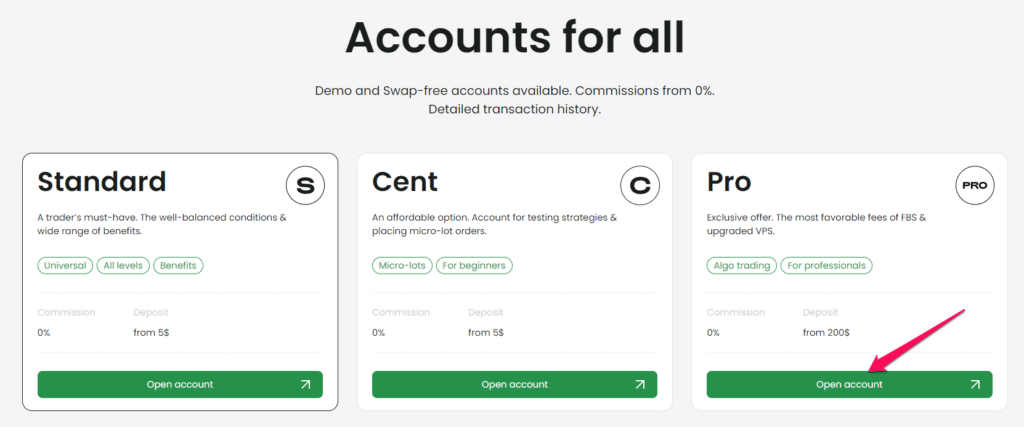

Account Types and Features

Botswanan traders and investors may choose from five different FBS retail accounts, each of which connects them to a different financial market. For novice and expert traders alike, The broker has some of the most flexible trading conditions in the market.

Cent Account – Micro-lots

Standard Account – Industry classic

Pro Account – Algo trading

| 💻 Live Account | 📉 Minimum Dep. | 📊 Average Spread | 💰 Commissions | 💸 Leverage |

| ➡️ Standard | 96 BWP / $5 | from 0.7 pips | $0 | up to 1:3000 |

| ➡️ Cent | 96 BWP / $5 | from 0.7 pips | $0 | up to 1:1000 |

| ➡️ Pro | 3850 BWP / $200 | from 0.5 pips | $0 | up to 1:2000 |

Live Trading Accounts

Standard Account

This account type is designed for Botswanan traders who want a more traditional forex trading environment. The Standard account provides attractive spreads as well as commission-free trades.

A standard account is ideal for traders looking for traditional trading experience. The Standard account offers competitive spreads without any commissions. At FBS, you are free to select any leverage that fits your trading strategy — up to 1:3000.

Cent Account

Cent account is a trading account on which the balance is displayed in cents, and transactions are carried out in cents as well. It means that if you deposit $10, you will have 1000 cents in your account. Trading on the Cent account is low-risk. Therefore, it is an excellent choice for Forex novices. Moreover, this type of account can be an attractive option for experienced traders who want to check new strategies. The Cent account allows people to trade smaller lot sizes and open an account with a lower initial deposit than any other account.

Pro Account

The Pro trading account is designed to meet the needs of the most sophisticated traders.

With unlimited open orders and lower spreads, you can execute complex trading strategies and save money on large orders. And with lower margin requirements, you have greater control over your positions and risk management.

Demo Account

A demo account is a practice account that offers traders a certain amount of virtual funds that they can use, allowing them to enter the live market without risking their capital.

There is a certain degree of risk involved when trading financial markets and they offer its clients a risk-free platform where they can test strategies, practice trading, and explore what the broker offers in a safe trading environment with real market conditions.

Demo accounts are available for all the account types listed on the brokers website. Demo or trial accounts can be especially useful for practicing online trading and for testing trading techniques in a risk-free environment that simulates real-time market conditions.

Islamic Account

Depending on the trading style and the trading strategy of the forex trader, they may keep their trading positions open for longer than 24 hours on a trading day.

This means that the trader could incur an overnight or rollover fee. This is a type of interest that is prohibited by Riba principles of Sharia law, which means that Muslim traders are often restricted in forex trading.

All account types can be converted into a swap-free account once the live trading account has been verified and approved.

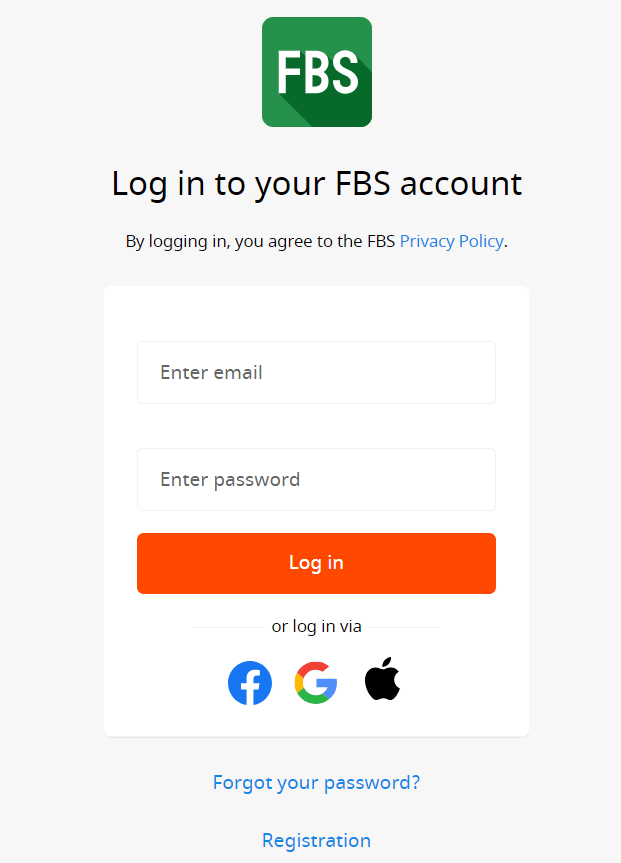

How to open an Account with FBS in Botswana

To register an account, Botswanan traders can follow these steps:

Step 1. Open Account

Click on the Open Account on right side.

Step 2. Register as Trader

Enter your valid email and full name. Make sure to check that the data is correct; it will be needed for verification and a smooth withdrawal process. Then click on the “Register as Trader” button.

Step 3. Temporary Password

You will be shown a generated temporary password. You can continue using it, but we recommend you to create your password.

Step 4. Confirmation Link

An email confirmation link will be sent to your email address. Make sure to open the link in the same browser your open Personal Area is.

As soon as your email address is confirmed, you will be able to open your first trading account. You can open a Real account or Demo one.

FBS Vs FXCM Vs eToro – Broker Comparison

| 🥇 FBS | 🥈 FXCM | 🥉 eToro | |

| ⚖️ Regulation | IFSC, CySEC, ASIC, FSCA | FCA, ASIC, CySEC, FSCA | CySEC, FCA, ASIC, FSA, NFA, FinCEN, FINRA, SIPC |

| 📱 Trading Platform | • MetaTrader 4 • MetaTrader 5 • FBS Trader • CopyTrade | • Trading Station • MetaTrader 4 • NinjaTrader • ZuluTrade • Capitalise AI • TradingView Pro • QuantConnect • MotiveWave • AgenaTrader • Sierra Chart • SeerTrading • NeuroShell Trader | eToro proprietary platform |

| 💰 Withdrawal Fee | Yes | Yes, bank wire | Yes |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 96 BWP | 610 BWP | 2,400 BWP |

| 📊 Leverage | Up to 1:3000 | • 1:30 (FCA) • 1:400 (Other Reg) | • 1:30 (Retail) • 1:400 (Professional) |

| 📊 Spread | From 0.0 pips | From 0.2 pips | From 1 pip |

| 💰 Commissions | From $6 | $25 per $1m traded | None |

| ✴️ Margin Call/Stop-Out | 40%/ 20% | 100%/50% | None indicated |

| 💻 Order Execution | Market | Market | Market/Instant |

| 💳 No-Deposit Bonus | Yes | No | No |

| 📊 Cent Accounts | Yes | No | No |

| 📈 Account Types | • FBS Cent Account • FBS Standard Account • FBS Pro Account | • Spread Betting • CFD Trading • Active Trader • Professional Trader | • Retail Account • Professional Account |

| ⚖️ CBN Regulation | No | No | No |

| 💳 NGN Deposits | Yes | No | No |

| 📊 Botswanan Naira Account | No | No | No |

| 👥 Customer Service Hours | 24/7 | 24/5 | 24/6 |

| 📊 Retail Investor Accounts | 6 | 3 Retail, 1 Pro | 1 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 📉 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | 500 lots | 50 million per trade on Forex | Depends on the instrument and account balance |

| 💰 Minimum Withdrawal Time | 15 to 20 minutes (maximum 48 hours) | Instant | Instant |

| 📊 Maximum Estimated Withdrawal Time | Up to 7 days | Up to 7 days | Up to 10 days |

| 💸 Instant Deposits and Instant Withdrawals? | Up to 7 days | Up to 2 working days | Up to 10 Working Days |

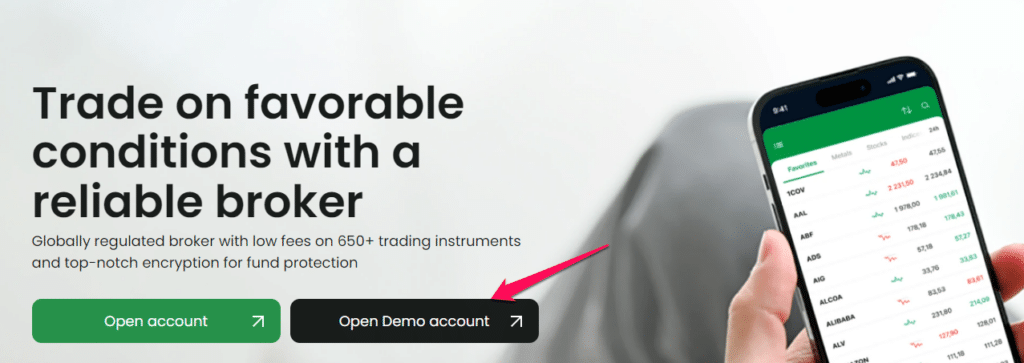

Trading Platforms

offers Botswanan traders a choice between these trading platforms:

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ FBS Trader

Desktop Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4

As the industry standard, MetaTrader 4 (MT4) is the most trusted and widely used trading platform. Its user-friendly atmosphere and straightforward interface are vital for online trading success. Fast execution, a large variety of charting tools, algorithmic trading, and the flexibility to customize are all well-known features.

There are more than 30 languages supported by MT4 and some of the platform’s most prominent features include:

➡️ A built-in library of over 50 indications and tools for speeding up the research procedure

➡️ For each financial instrument, a comprehensive set of analytical tools is accessible across nine different timescales.

➡️ Any trading technique may be formalized and executed by an Expert Advisor using algorithmic trading.

➡️ Customizable alerts.

➡️ Access to the MQL4 community and the MetaTrader market.

MetaTrader 5

Forex companies are increasingly embracing the MT5 trading platform. In addition to a more up-to-date user interface and the ability to utilize as many charts as you want, this version now displays Depth of Market and includes an integrated Economic Calendar.

A built-in chat system and more pending order types than MT4 are also included in this trading platform. More complex charting features are available in MT5, which uses the MQL5 scripting language, while MT4 used the MQL4 scripting language. FBS’ MT5 has additional features such as:

➡️ More than 90 indicators and tools are available.

➡️ The ability to show up to 100 charts at once.

➡️ There are a total of 21 distinct periods.

➡️ Access to the depth of market.

➡️ Buy and Sell Stop Limit orders are two of six pending stop order types.

➡️ Enhanced algorithmic trading and expert advisers (EAs) strategy tester.

WebTrader Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

The WebTrader solution makes MT4 and MT5 accessible in any browser, without the need for a download. Every element of the original program may be accessed using this service, which runs on all major operating systems.

Metatrader 4 and 5 are fully supported by FBS, and third-party platforms like MT4 and MT5 provide traders with the ability to take their customise versions with them when they switch brokers.

Trading App

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ FBS Trader

MetaTrader 4 and 5

Mobile trading applications for MT4 and MT5 are available from FBS for both Android and iOS users. Although there are fewer charting choices and shorter periods than on desktop trading platforms, traders can still cancel and alter their current orders, calculate profit and loss, and trade on the charts.

FBS Trader

When compared to the normal MT4 mobile app, FBS’ version is easier to use. To ensure compatibility with the desktop MT4 program, it has an easy-to-use trading interface.

Open and close positions, add stops, and cancel working orders may all be done in real-time by traders. Information on different contract types, order volume, current bid/ask prices, as well as take profit and stop loss may be accessed through the trading platform.

What trading platforms does FBS offer to its clients, and are they accessible on various devices?

The broker typically provides traders with access to popular trading platforms, such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are known for their powerful charting tools, technical indicators, and algorithmic trading capabilities.

Does FBS offer any proprietary trading platforms, or are traders limited to using third-party platforms like MT4 and MT5?

They primarily offers the widely used MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms.

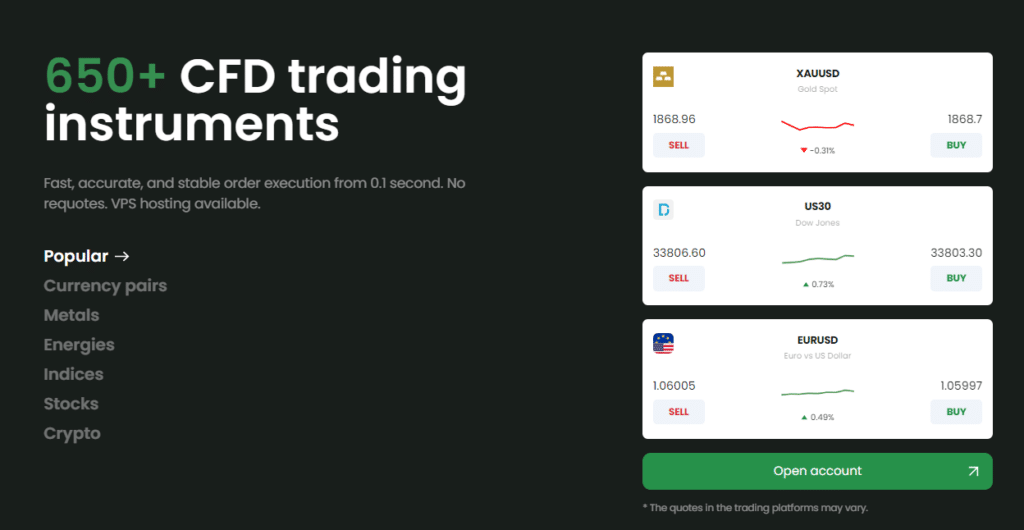

Range of Markets

Botswanan traders can expect the following range of markets:

➡️ Forex

➡️ Precious Metals

➡️ Indices

➡️ Energies

➡️ Stocks

➡️ Exotic Forex

➡️ Cryptocurrencies

What financial instruments can traders access through FBS, and does the broker offer a diverse range of markets?

FBS typically provides traders with access to a diverse range of markets, including forex currency pairs, commodities, indices, and cryptocurrencies. The broker offers a wide selection of currency pairs, allowing traders to engage in major, minor, and exotic forex trading. Additionally, FBS often includes CFDs (Contracts for Difference) on various commodities like gold, silver, and oil, as well as indices representing different global markets. In recent years, FBS has expanded its offerings to include popular cryptocurrencies like Bitcoin and Ethereum.

Are there any limitations or restrictions on trading specific markets or instruments with FBS?

While FBS typically offers a broad range of trading instruments, it’s important to be aware that certain limitations or restrictions may apply. These limitations can include factors such as regional regulations, trading hours, and market availability.

Broker Comparison for Range of Markets

| 🥇 FBS | 🥈 FXCM | 🥉 eToro | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | No | Yes |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | No | Yes |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | No | Yes |

Trading and Non-Trading Fees

Spreads

The spreads traders might anticipate while using FBS vary on the financial item traded, the account type used, and market circumstances (in the case of variable spreads). FBS offers the following spreads:

➡️ FBS Cent Account – Variable, from 1 pip

➡️ FBS Micro Account – Fixed, from 3 pips

➡️ FBS Standard Account – Variable, from 0.5 pips

➡️ FBS Zero Account – Fixed, 0 pips

➡️ FBS ECN Account – Floating, -1 pips

➡️ FBS Crypto Account – Floating, from 1 pip

Commissions

Commissions are charged on the following retail investor accounts:

➡️ FBS Zero Account – from $20 per lot

➡️ FBS ECN Account – $6

➡️ FBS Crypto Account – 0.05% for opening as well as 0.05% for closing positions

Overnight Fees, Rollovers, or Swaps

When traders maintain positions for more than 24 hours, they may incur overnight fees or interest. Depending on the trader’s position, the fees are either credited or debited. Typical overnight costs for EUR/USD, for example, on a 100,000-standard lot in EUR are as follows:

➡️ Long swap of -6.37 pips

➡️ Short swap of -0.69 pips

Other typical overnight fees that Botswanan traders can expect are:

➡️ XAG/USD – a long swap of -1.77 and a short swap of -1.24

➡️ XAU/USD – a long swap of -2.12 and a short swap of -1.35

➡️ US100 – a long swap of -85.91 and a short swap of -117.2

Deposit and Withdrawal Fees

Charges deposit fees of 2.5% plus $0.3 for Sticpay payments. These payment systems are subject to withdrawal fees:

➡️ Credit Card – $1 commission

➡️ Debit Card – $1 commission

➡️ Neteller – 2% with a minimum of $1 and a maximum of $30

➡️ Sticpay – 2.5% + $0.3 commission

➡️ Skrill – 1% + $0.32 commission

➡️ Perfect Money – 0.50% commission

Inactivity Fees

If a live trading account is inactive for more than 180 days, a $5 fee will be charged to the account.

Currency Conversion Fees

Botswanans should also be aware that when they deposit or withdraw funds in BWP, they will be charged a currency conversion fee because the only indicated deposit currencies are EUR and USD.

What are the trading fees associated with trading on FBS, and how do they vary between different account types?

FBS typically charges trading fees in the form of spreads, which are the differences between the buying (ask) and selling (bid) prices of trading instruments. The specific spreads can vary based on the account type chosen by the trader.

What non-trading fees should traders be aware of when using FBS, and are there any deposit or withdrawal charges?

Non-trading fees at FBS can include charges related to deposit and withdrawal transactions, as well as potential fees for account inactivity. FBS typically does not charge fees for standard deposits and withdrawals, but traders should be aware that third-party payment processors, banks, or intermediaries may impose fees on certain transactions.

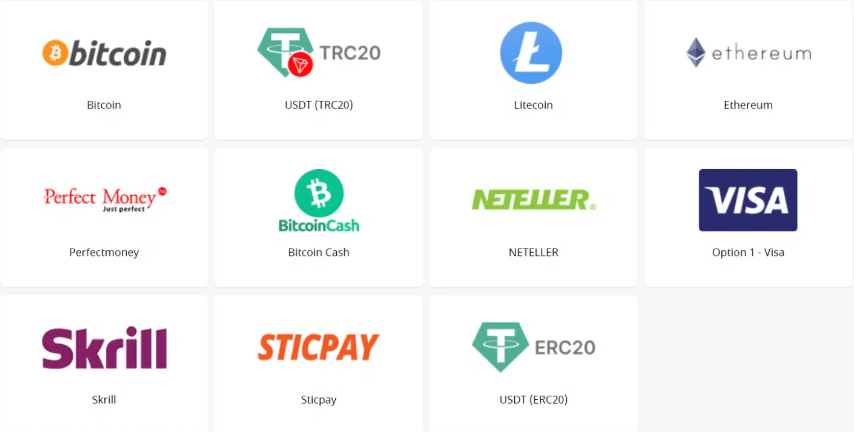

Deposits and Withdrawals

Offers the following deposit and withdrawal methods:

➡️ Credit Card

➡️ Debit Card

➡️ Neteller

➡️ Sticpay

➡️ Skrill

➡️ Perfect Money

➡️ Local Exchanges

Broker Comparison: Deposit and Withdrawals

| 🥇 FBS | 🥈 FXCM | 🥉 eToro | |

| Minimum Withdrawal Time | 15 to 20 minutes (maximum 48 hours) | Instant | Instant |

| Maximum Estimated Withdrawal Time | Up to 7 days | Up to 2 working days | Up to 10 Working Days |

| Instant Deposits and Instant Withdrawals? | Instant Deposits | Yes | Yes |

What deposit methods are available for funding an FBS trading account, and are there any deposit fees?

FBS typically offers a variety of deposit methods to accommodate traders’ preferences. These methods can include bank wire transfers, credit/debit card payments, electronic payment systems like Skrill and Neteller, and even cryptocurrency deposits.

What is the process for withdrawing funds from an FBS trading account, and are there any withdrawal fees?

To withdraw funds from an FBS trading account, traders usually need to log in to their account through the broker’s platform or website, access the withdrawal section, and follow the provided instructions. FBS typically offers various withdrawal methods, including bank wire transfers, credit/debit card withdrawals, and electronic payment systems.

Deposit Currencies, Deposit and Withdrawal Processing Times

| 💳 Payment Method | 💰 Deposit Currencies | 🔁 Deposit Processing | 💳 Withdrawal Processing |

| Credit Card | USD, EUR | Instant | • 15 to 20 Minutes, maximum 2 days • The bank process is between 5 to 7 days |

| Debit Card | USD, EUR | Instant | • 15 to 20 Minutes, maximum 2 days • The bank process is between 5 to 7 days |

| Neteller | USD, EUR | Instant | 15 to 20 Minutes Maximum 48 hours |

| Sticpay | USD | Instant | 15 to 20 Minutes Maximum 48 hours |

| Skrill | USD, EUR | Instant | 15 to 20 Minutes Maximum 48 hours |

| Perfect Money | USD, EUR | Instant | 15 to 20 Minutes Maximum 48 hours |

| Local Exchanges | – | – | – |

How to Deposit Funds with FBS

To deposit funds to an account with FBS, Botswanan Traders can follow these steps:

Step 1. Log In

Log into your personal account

Step 2. Personal Area

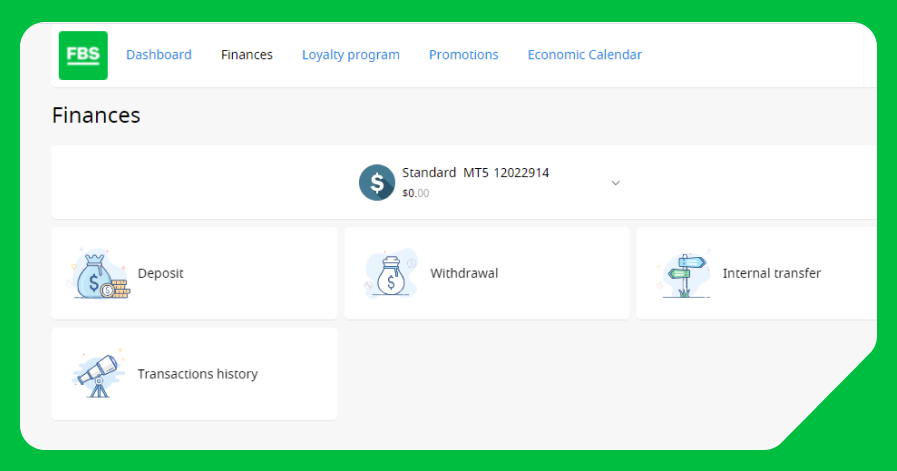

You need to open the “Finances” tab in your personal area. After that, click the “Deposit” button.

Then you need to choose the preferred deposit method. FBS gives access to depositing your account through local banks, different payment systems, bank cards, bank wire transfers, and exchangers. You can deposit cryptocurrencies as well.

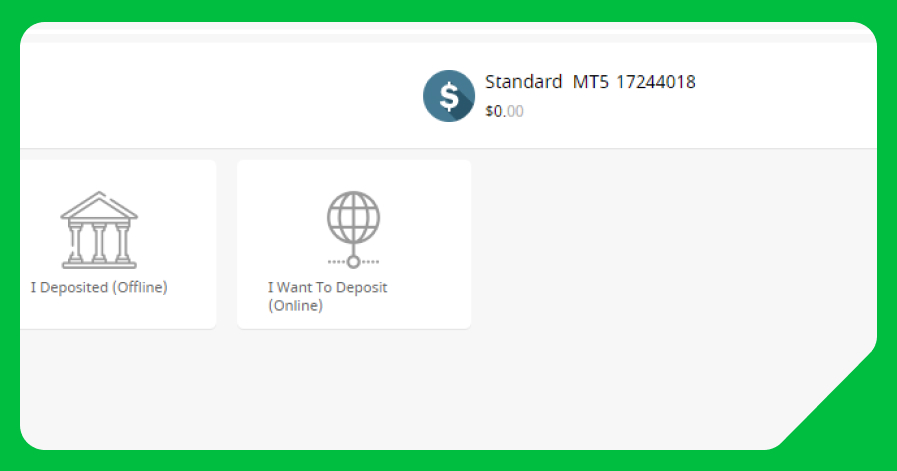

Step 3. Need to Decide

In the next step, you need to decide whether you prefer dealing with online payments, or you want to make an offline transaction.

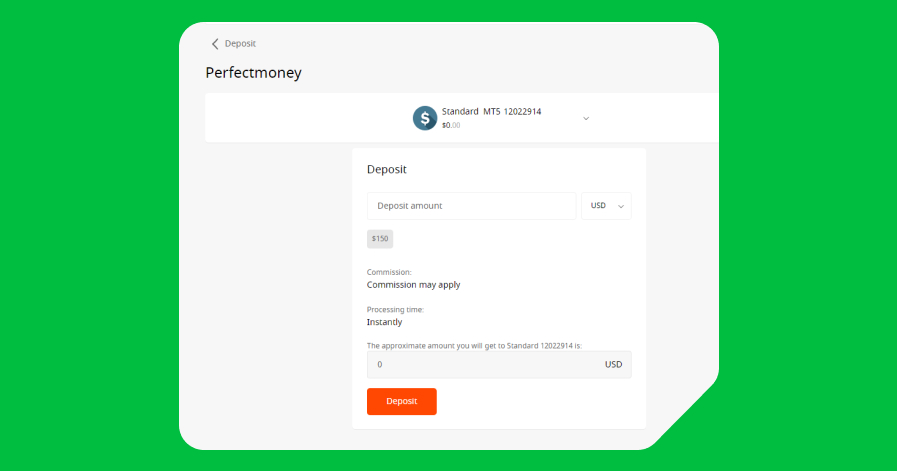

Step 4. Deposit

This step is the most important one, as you need to select an account for depositing and enter the sum of money you wish to deposit.

Finally, you need to confirm the action by clicking deposit and do the steps your payment systems ask you to.

Most of the payment systems provide instant deposits to an account. However, there are some exceptions, including local banks, where this process may take about 15-20 minutes (but no longer than 72 hours).

FBS Fund Withdrawal Process

To withdraw funds from an account with FBS, Botswanan Traders can follow these steps:

Step 1. Personal Area

You can withdraw money from your account in your Personal Area.

Click on “Finances” in the menu on top of the page. Choose “Withdrawal”.

Step 2. Suitable Payment

Choose a suitable payment system and click on it.

Step 3. Confirm withdrawal

Specify the trading account you want to withdraw from. Specify information about your e-wallet or payment system account.

For withdrawal via card click on “+” sign to upload back and front sides of your card copy. Type the amount of money you want to withdraw.

Click on the “Confirm withdrawal” button.

Please, kindly take into consideration, that withdrawal commission depends on the payment system you choose.

Withdrawal process time also depends on the payment system.

You will be able to monitor the status of your financial requests in the Transaction History.

Botswanan traders need to note that their accounts must be verified before they can submit a withdrawal. Requests will be processed in the order in which they are received by FBS. The monies will be released by the FBS team after the withdrawal requests have been accepted by the bank.

However, Botswanan traders must remember that various payment methods have varying processing times, with bank wire taking the longest (up to 10 working days) and others requiring anything from immediate to up to 4 business days (for example, credit card).

Education and Research

Education

FBS offers the following Educational Materials to Botswanan traders:

➡️ Forex Guidebook

➡️ Tips for Traders

➡️ Webinars

➡️ Educational Video Lessons

➡️ Seminars

➡️ Glossary

➡️ FAQ

Research and Trading Tool Comparison

| 🥇 FBS | 🥈 FXCM | 🥉 eToro | |

| ➡️ Economic Calendar | Yes | Yes | No |

| ➡️ VPS | Yes | Yes | No |

| ➡️ AutoChartist | No | No | No |

| ➡️ Trading View | No | Yes | Yes |

| ➡️ Trading Central | No | No | No |

| ➡️ Market Analysis | Yes | Yes | Yes |

| ➡️ News Feed | Yes | Yes | Yes |

| ➡️ Blog | Yes | Yes | Yes |

FBS offers Botswanan traders the following Research and Trading Tools:

➡️ Forex News Feed

➡️ Daily Market Analysis

➡️ Forex TV

➡️ VIP Analytics

➡️ Economic Calendar

➡️ Forex Calculators

➡️ Currency Converter

What educational resources and tools does FBS offer to help traders improve their skills and knowledge?

FBS typically provides a range of educational resources to assist traders in their learning journey. These resources often include articles, tutorials, webinars, video lessons, and e-books covering various topics related to forex trading.

Does FBS offer research and market analysis tools to help traders make informed trading decisions?

Yes, FBS often provides traders with market analysis tools and research materials to aid in making informed trading decisions. These tools may encompass daily market analysis, economic calendars, technical and fundamental analysis reports, as well as insights into market trends and events.

Bonuses and Promotions

FBS offers Botswanan traders the following bonuses and promotions:

➡️ FBS Traders Parties

➡️ Get a Car from FBS

➡️ Level-up Bonus

➡️ 100% Deposit Bonus

➡️ Cashback bonus

➡️ Quick Start Bonus

➡️ Referral Program

➡️ Risk-free investments

➡️ Loyalty Program

➡️ Trade to Help

➡️ FBS Winning Season

➡️ FBS Leaders’ Summit

➡️ FBS League

➡️ FBS Gift Season

What types of bonuses and promotions does FBS offer to its traders, and how can traders participate in them?

FBS typically offers a variety of bonuses and promotions to its traders. These can include deposit bonuses, no-deposit bonuses, cashback offers, and trading contests, among others. Traders can usually participate in these promotions by meeting specific requirements outlined by FBS.

Are there any restrictions or considerations that traders should be aware of when participating in FBS’s bonuses and promotions?

Yes, there may be certain restrictions and considerations associated with FBS’s bonuses and promotions. These can include trading volume requirements, time limits for meeting bonus conditions, and limitations on withdrawing bonus funds.

How to open an Affiliate Account with FBS

To register an Affiliate Account, Botswanan traders can follow these steps:

➡️ Prospective affiliates may visit the official FBS website and choose “Partnership” from the homepage’s main menu.

➡️ A drop-down menu will appear, where potential affiliates may choose “Affiliate Program” under “General Information.”

➡️ Next, Botswanans can click the green “Register a Partner Account” banner.

➡️ The partner registration form will load on a new page. Here, potential affiliates may input a valid email address and their complete name before clicking the orange “Register as Partner” button. Botswanans can also register using their Google and Facebook credentials, as well as their Apple ID.

➡️ Prospective affiliates can then join FBS using a valid email address and will be instantly logged into the trader’s cabinet, where they can pick “Partner Area” from the top menu.

➡️ Here, Affiliates may see their partner account number, balance, Partner ID, and overall progress.

➡️ This part also gives affiliates a variety of advertising materials, referral links, detailed reports, and incentives.

Affiliate Program Features

FBS provides a complete partnership program that may increase the revenue of partners. FBS provides a $15 fee per lot on EUR/USD pairings, and the broker promises regular commission pay-outs.

In addition, partners that join the affiliate program have access to customer care 24 hours a day, 7 days a week, as well as the assistance of a dedicated affiliate manager. In addition, the following are available when selecting the FBS Partnership Program:

➡️ It enables partners to grow their enterprises and accumulate long-term wealth.

➡️ Affiliates of FBS can benefit from risk-free features.

➡️ Partners can earn up to $80 for every lot traded by their clients.

➡️ It gives partners complete control over their earnings, and the more active they are in generating customers, the more they might make.

➡️ A variety of promotional items are available.

➡️ Partners can get special promotional materials for offline advancement.

Customer Support

FBS is well-known for having customer service that is both helpful and courteous around the clock, and it can be reached online or by phone in several different ways.

| Customer Support | FBS’ Customer Support |

| ⏰ Operating Hours | 24/7 |

| 🗣 Support Languages | English, Portuguese, Indonesian, Malay, Vietnamese, Arabic, Hindi, Chinese, and more |

| 🗯 Live Chat | Yes |

| 📧 Email Address | Yes |

| ☎️ Telephonic Support | Yes |

| 📞 Local Support in Botswana? | No |

| 🥇 Overall quality of FBS Support | 4.7/5 |

Corporate Social Responsibility

The most important thing for FBS is that those who use their trading services benefit from the financial freedom FBS provides. FBS also works with charity organizations to help those in need across the globe.

A monthly social media campaign called Desires Come True allows Botswanan traders to express their most treasured wishes with FBS, and the broker will endeavour to make them come true. Every year, the FBS team sees how the contest’s random acts of kindness change people’s lives.

In addition, FBS organizes a yearly charity trade promotion with local and international organizations. A trader’s deposit is double, and any commissions earned are given to a charity, showing a collective effort to improve the planet.

Our Verdict

As one of the world’s largest online STP/ECN brokers, FBS offers five different live trading accounts, each with its own unique set of trading circumstances, making it ideal for both new and experienced traders alike.

Minimum deposits and micro-lot trading are available at entry-level accounts, while low spreads are available to those who deposit more. However, FBS levies hefty withdrawal costs and only accepts USD and EUR as currency options.

It is also worth noting that the FBS customer service department is open twenty-four hours a day, seven days a week to tend to customer complaints, questions, and queries.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| There is a very low minimum deposit required | Several regions are restricted from service |

| FBS is an online broker with regulation through IFSC and the Cyprus Securities and Exchange Commission | The spreads on some accounts are very high |

| There is a choice between investor accounts | Inactivity fees apply to dormant accounts |

| Traders have access to fast, flexible payment methods | The demo account expires after 40 days |

| The trading conditions are favourable and competitive | Withdrawal fees and deposit fees are charged |

| There are demo accounts and Islamic Accounts | There is a limited selection of funding options and there are only two base account currencies |

| Customer service is available 24/7 | Currency conversion fees are charged on deposits made in currencies other than USD and EUR |

| The broker is reputable and has a high trust score | |

| FBS is an official trading partner that offers a comprehensive affiliate program | |

| There are several bonuses and promotions offered |

You might also like: FBS Account Types

You might also like: FBS Demo Account

You might also like: FBS Minimum Deposit

You might also like: FBS Islamic Account

You might also like: FBS Sign Up Bonus

Conclusion

Now it is your turn to participate:

➡️ Do you have any prior experience with FBS?

➡️ What was the determining factor in your decision to engage with FBS?

➡️ Was it because of the minimum deposit, regulation, retail trading accounts, or any other factors?

➡️ Have you experienced any issues with FBS such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

Regardless, please share your thoughts in the comments below.

Frequently Asked Questions

Is FBS regulated?

Yes, FBS is well-regulated by one Tier-1 regulator namely the ASIC, two Tier-2 regulators namely CySEC and FSCA, and one Tier-3 regulator namely the IFSC in Belize.

What is the withdrawal time with FBS?

FBS processes all withdrawals instantly since the finance department is open 24 hours a day, seven days a week. Deposits and withdrawals made using an electronic payment system might take up to 48 hours to complete. Bank wire transfers might take anywhere from one day to seven business days to process.

What is a cent account in FBS?

It is a trading account where the balance is presented and transactions are carried out in cents, and it is a cent account. In other words, if you invest $10, you will get back $1000. It is easy to lose money while using the Cent account.

The fact that amateurs can use it makes it a great alternative for them as well.

Is FBS safe or a scam?

No, FBS is not a scam. FBS is a brand name used by Trade Stone Limited, a South Africa and Cyprus-based entity, in addition to being an EU and MiFID-regulated investment business registered with CySEC. FBS is also well-regulated by ASIC under Intelligent Financial Markets Pty Ltd and IFSC in Belize.

Does FBS have negative balance protection?

Yes, all retail trading accounts are protected from negative balances with FBS.

What is the minimum deposit for FBS?

The minimum deposit for FBS is $5.

Does FBS have Nasdaq?

Yes, FBS includes Nasdaq on its list of indices that can be traded. The NASDAQ is an index of the Nasdaq Stock Market’s 100 biggest non-financial firms. It focuses on the top-performing sectors, such as technology (54%), consumer services (25%), and healthcare (21%).

Does FBS have Volatility 75?

No, FBS does not currently offer access to Volatility 75, also known as VIX.

How do I trade Nasdaq with FBS?

The easiest way to trade Nasdaq with FBS is through the FBS Trader mobile app. Simply select “Indices” and the required CFD contract for Nasdaq will appear in the dropdown menu.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review