FP Markets Review

Overall, FP Markets is considered a safe and trustworthy broker 1 Tier-1 and 1 Tier-2 regulator. FP Markets offers 4 retail accounts and has a high Trust Score of 81% out of 100. FP Markets is currently not regulated by the MFED, BoB, or NBFIRA of Botswana

- Louis Schoeman

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

100 USD/1 343 BWP

Regulators

ASIC, CySEC, FSCA, CMA

Trading Desk

MetaTrader 4, MetaTrader 5

Crypto

Yes

Total Pairs

63

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

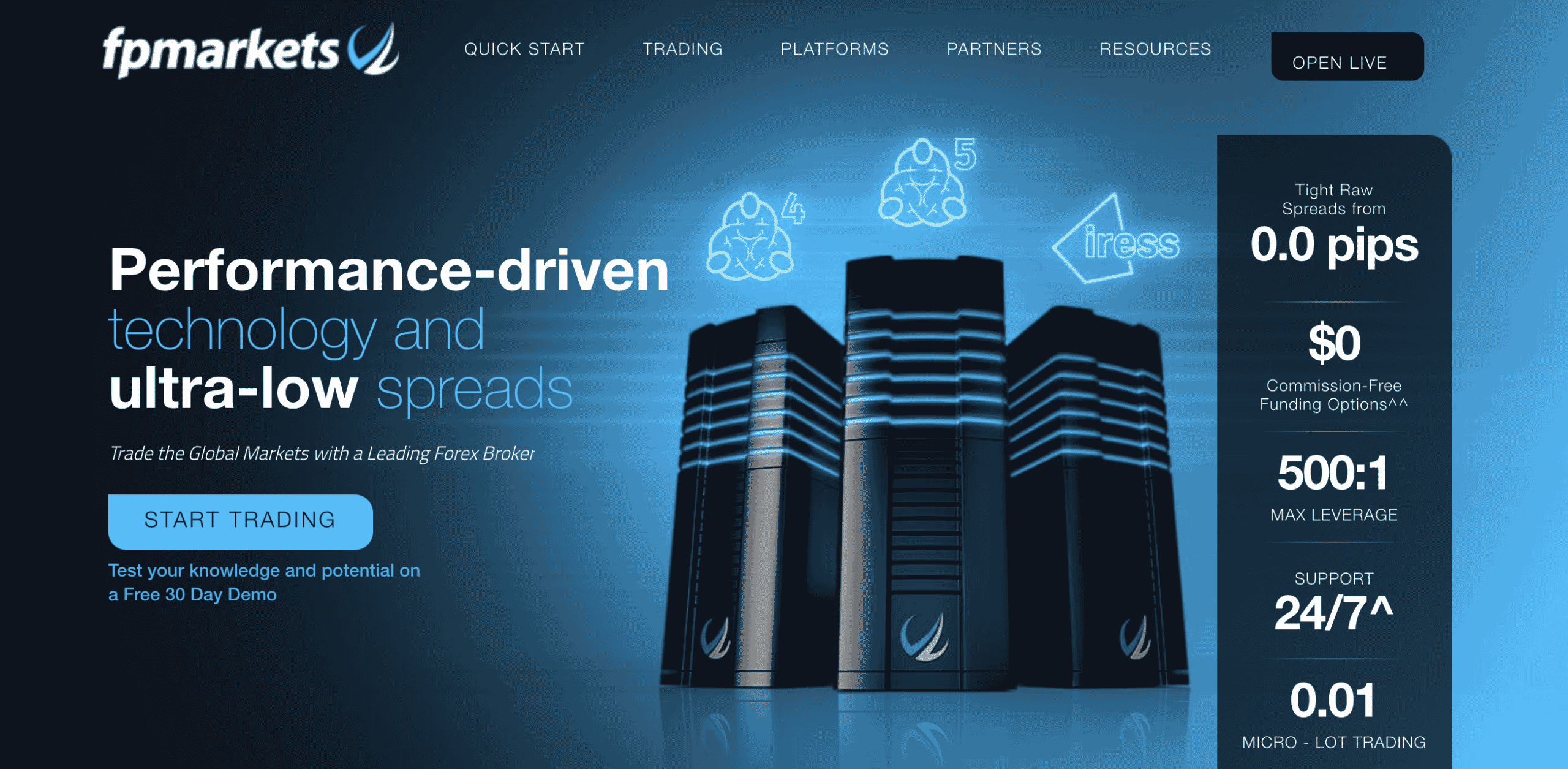

Overview

Overall, FP Markets is considered low-risk, with an overall Trust Score of 82 out of 100. FP Markets is licensed by one Tier-1 Regulator (high trust), one Tier-2 Regulator (average trust), and zero Tier-3 Regulators (low trust). FP Markets offers four different retail trading accounts namely an MT4/5 Standard Account, MT4/5 Raw Account, MT4/5 Islamic Standard Account, and a MT 4/5 Islamic Raw Account.

FP Markets accepts Botswanan clients and has an average spread from 0.0 pips with US$6 commission round turn ($3 per side). FP Markets has a maximum leverage ratio up to 1:500 and there is a demo and Islamic account available. MT4, MT5, Myfxbook, FP Markets platforms are supported. FP Markets is headquartered in Australia and is regulated by ASIC and CySEC.

FP Markets (Pty) Ltd is a Financial Services Provider authorized and regulated by the Financial Sector Conduct Authority in South Africa (FSP Number 50926).

Since its inception in 2005, FP Markets has served customers from around the globe, giving it extensive knowledge of the industry. As a major advantage, FP Markets employs electronic bridges and sophisticated trading technology to boost its proposition, as well as invest in its innovation.

FP Markets has its main office in Sydney, Australia, and is governed by the Australian Securities and Investments Commission (ASIC). To top it all off, FP Markets has expanded its offering by opening a European Cyprus branch, making it eligible for trading throughout the EEA zone.

FP Markets is popular for using ECN technology that provides direct access to liquidity providers via Equinix NY4 Data Centers without dealer interference and executes orders at the highest feasible price within offering for the given asset, which is another strong element of their proposition.

Therefore, Botswanan traders can take advantage of this technology as gives exceptionally rapid execution speeds as well as the most attractive quotations with spreads as low as 0.0 pips.

This FP Markets review for Botswana will provide local retail traders with the details that they need to consider whether FP Markets is suited to their unique trading objectives and needs.

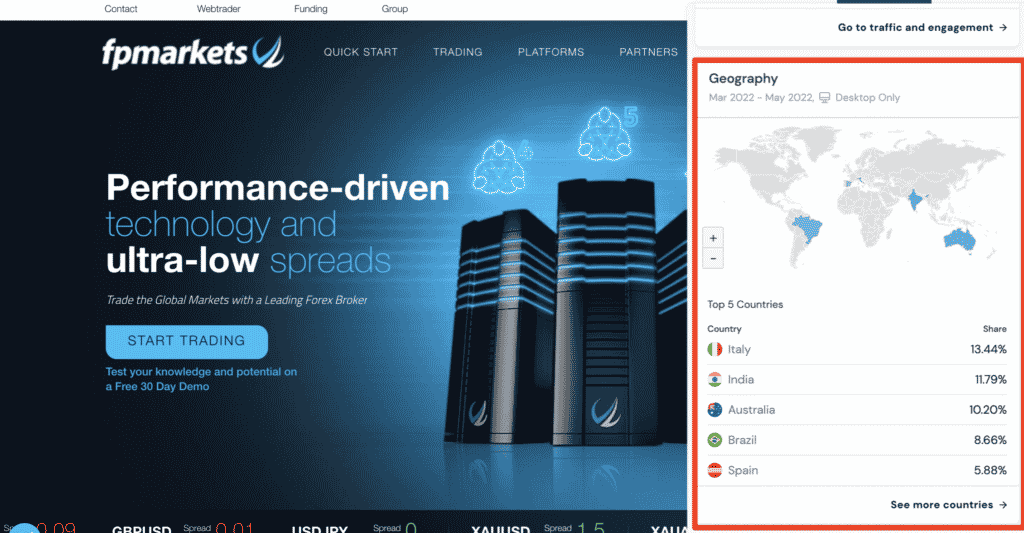

Distribution of Traders

currently has the largest market share in these countries:

➡️ Italy – 14.3%

➡️ India – 13.1%

➡️ Australia – 12.2%

➡️ United Kingdom – 5.6%

➡️ Spain – 5.5%

Popularity among traders

🥇 The forex broker FP Markets does not have a dominant position in the Botswanan forex market, but it is nonetheless ranked in the top 50 brokers for Botswanan traders.

FP Markets At a Glance

| 🏛 Headquartered | Australia |

| 🌎 Global Offices | Australia and Cyprus |

| 🏛 Local Market Regulators in Botswana | • Ministry of Finance and Economic Development (MFED) • Bank of Botswana (BoB) • Non-Bank Financial Institutions Regulatory Authority (NBFIRA) |

| 💳 Foreign Direct Investment in Botswana | 115.89 BWP Million in 2021 |

| 💰 Foreign Exchange Reserves in Botswana | 5270 USD Million in 2021 |

| ✔️ Local office in Gaborone? | No |

| 👨⚖️ Governor of SEC in Botswana | None, Moses Dinekere Pelaelo is the Governor of the Bank of Botswana |

| ✔️ Accepts Botswana Traders? | Yes |

| 📊 Year Founded | 2005 |

| 📞 Botswana Office Contact Number | None |

| 📱 Social Media Platforms | • Facebook • YouTube • Telegram |

| ⚖️ Regulation | ASIC, CySEC, FSCA, CMA |

| 1️⃣ Tier-1 Licenses | • Australian Securities and Investments Commission (ASIC) |

| 2️⃣ Tier-2 Licenses | • Cyprus Securities and Exchange Commission (CySEC) |

| 3️⃣ Tier-3 Licenses | None |

| 🪪 License Number | • Australia – ABN 16112600281 • Cyprus – 371/18 |

| ⚖️ MFED, BoB, or NBFIRA Regulation | No |

| ✔️ Regional Restrictions | United States, Japan, New Zealand |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 4 |

| ✔️ PAMM Accounts | Yes |

| 💻 Liquidity Providers | Barclays, BNP Paribas, Commerzbank, Credit Suisse, Goldman Sachs |

| ✔️ Affiliate Program | Yes |

| 📱 Order Execution | Market |

| 📊 Starting spread | 0.0 pips |

| 📉 Minimum Commission per Trade | US$3 per side |

| 💰 Decimal Pricing | 5th decimal pricing after the comma |

| 📞 Margin Call | 100% |

| 🛑 Stop-Out | 50% |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | 50 lots |

| ✅ Crypto trading offered? | Yes |

| ✔️ Offers a BWP Account? | No |

| 📉 Dedicated Botswana Account Manager? | No |

| 📈 Maximum Leverage | 1:500 |

| 📊 Leverage Restrictions for Botswana? | No |

| 💳 Minimum Deposit (BWP) | 1352 BWP or an equivalent to AU$100 |

| ✔️ Botswana Pula Deposits Allowed? | Yes |

| 📊 Active Botswana Trader Stats | 250,000+ |

| 👥 Active Botswana-based FP Markets customers | Unknown |

| 🔁 Botswana Daily Forex Turnover | Unknown, Forex overall is $6.6 Trillion |

| 💰 Deposit and Withdrawal Options | SticPay, PerfectMoney, DragonPay, Rupee, Pagsmile, Rapyd, Rapid, XPay, Finrax, LetKnowPay, LuqaPay, PayRetailers, ApplePay, GooglePay, VirtualPay |

| 💻 Minimum Withdrawal Time | Instant |

| ⏰ Maximum Estimated Withdrawal Time | Up to 5 working days |

| 💳 Instant Deposits and Instant Withdrawals? | Yes, Sticpay wallet withdrawals |

| 🏛 Segregated Accounts with Botswana Banks? | No |

| 📱 Trading Platforms | • MetaTrader 4 • MetaTrader 5 • Myfxbook AutoTrade • FP Markets App |

| 💻 Tradable Assets | • Forex • Shares • Metals • Commodities • Indices • Cryptocurrencies • Bonds • ETFs |

| ✔️ Offers USD/BWP currency pair? | No |

| 📊 USD/BWP Average Spread | N/A |

| ✅ Offers Botswana Stocks and CFDs | No |

| 💻 Languages supported on the Website | English, Arabic, German, Portuguese, Vietnamese, Indonesian, French, Malay, Italian, Russian |

| ☎️ Customer Support Languages | Multilingual |

| 👥 Copy Trading Support | Yes |

| ⏰ Customer Service Hours | 24/7 |

| 📞 Botswana-based customer support? | No |

| 💸 Bonuses and Promotions for Botswanans? | No |

| 📚 Education for Botswanan beginner traders | Yes |

| 📱 Proprietary trading software | Yes |

| 🤝 Most Successful Trader in Botswana | Unknown |

| ✔️ Is FP Markets a safe broker for Botswana Traders? | Yes |

| 🎖 Rating for FP Markets Botswana | 9/10 |

| 🥇 Trust score for FP Markets Botswana | 81% |

| 👉 Open Account | 👉 Open Account |

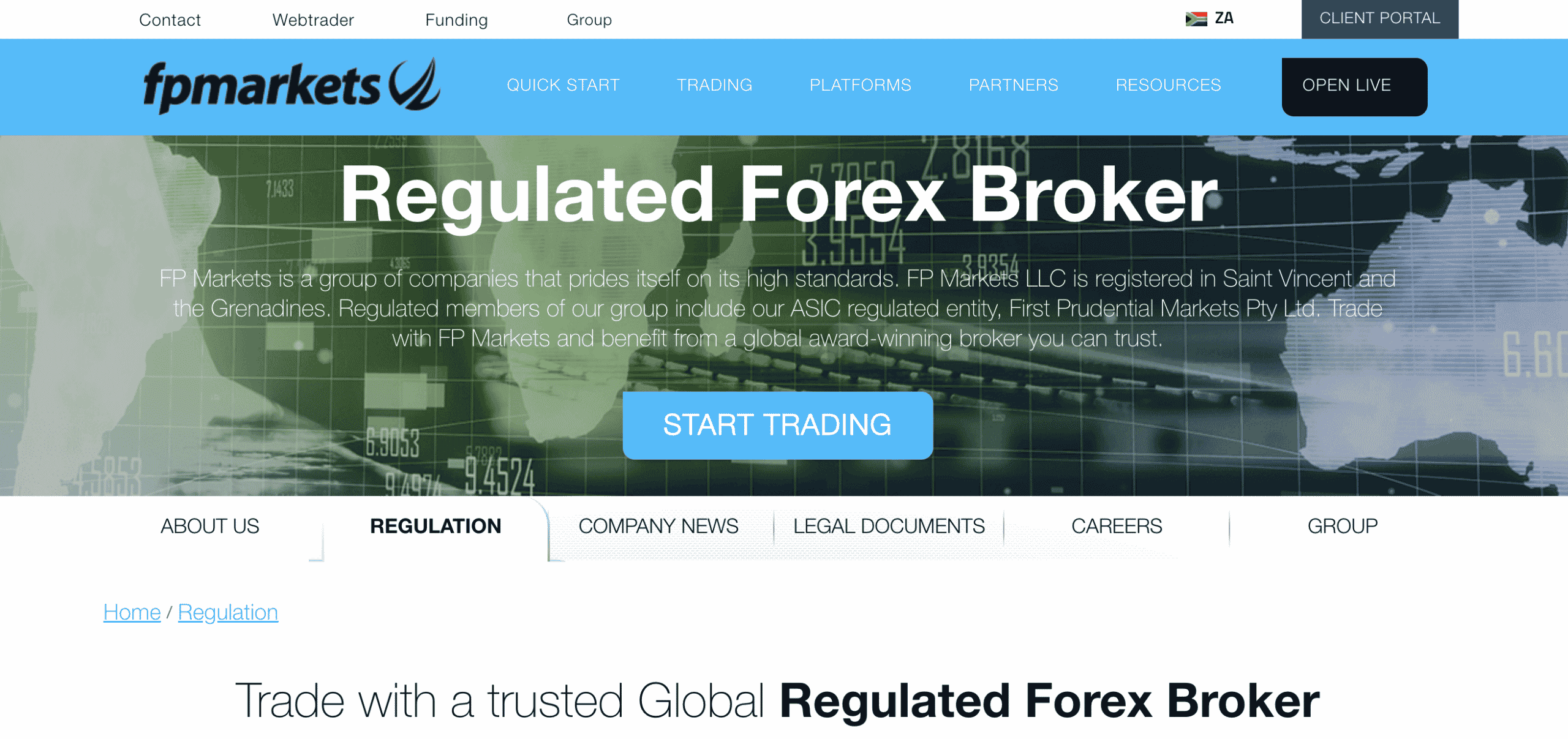

Regulation and Safety of Funds

Regulation in Botswana

FP Markets does not currently have any local regulations or licenses with market regulators in Botswana.

Global Regulations

FP Markets is a financial services company that is approved and regulated by the Australian Securities and Investment Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC) FP Markets is also regulated by the CMA.

Client Fund Security and Safety Features

Strong regulations means that FP Markets is required to adhere to stringent rules and regulations, which provides you with the peace of mind that you are dealing with a respectable and trustworthy trading broker that will do business with the highest levels of honesty and transparency.

In addition, client funds are housed in segregated accounts with top-tier banks, where they are kept separate from the company’s finances to prevent them from being utilized for any other reason.

There is no negative balance protection available for ASIC and St Vincent customers. However, negative balance protection is only accessible if you have an account with FP Markets under CySEC regulation.

Residents of the United States, Japan, and New Zealand, as well as any other nation or jurisdiction where limitations are imposed by local laws and regulations, cannot use the services or products offered by FP Markets.

Is FP Markets a regulated broker, and which regulatory authorities oversee its operations?

Yes, the broker is a regulated broker committed to ensuring the safety and security of its clients. The company operates under the oversight of multiple regulatory authorities to maintain transparency and uphold industry standards. FP Markets is regulated by the Australian Securities and Investments Commission (ASIC) in Australia and the Cyprus Securities and Exchange Commission (CySEC) in Cyprus.

How does FP Markets ensure the safety of client funds?

The broker prioritizes the safety of client funds through various protective measures. Firstly, as a regulated broker, the company adheres to the stringent requirements set by regulatory authorities such as ASIC and CySEC.

Awards and Recognition

FP Markets Awards: Best Global Forex Value Broker, Best Forex Broker Australia, Outstanding Value CFD Provider, Best Forex Partners Programming in Asia, Best Education Material, Most Satisfied Traders

Has FP Markets received any notable awards for its services in the financial industry?

Yes, the broker has received recognition and awards for its outstanding services in the financial industry. The platform has been acknowledged in various categories, including trading services, customer support, and technological innovations.

How is FP Markets regarded in the financial industry, and what does its reputation suggest about the platform?

The broker enjoys a positive reputation within the financial industry, emphasizing its dedication to transparency, customer satisfaction, and innovation.

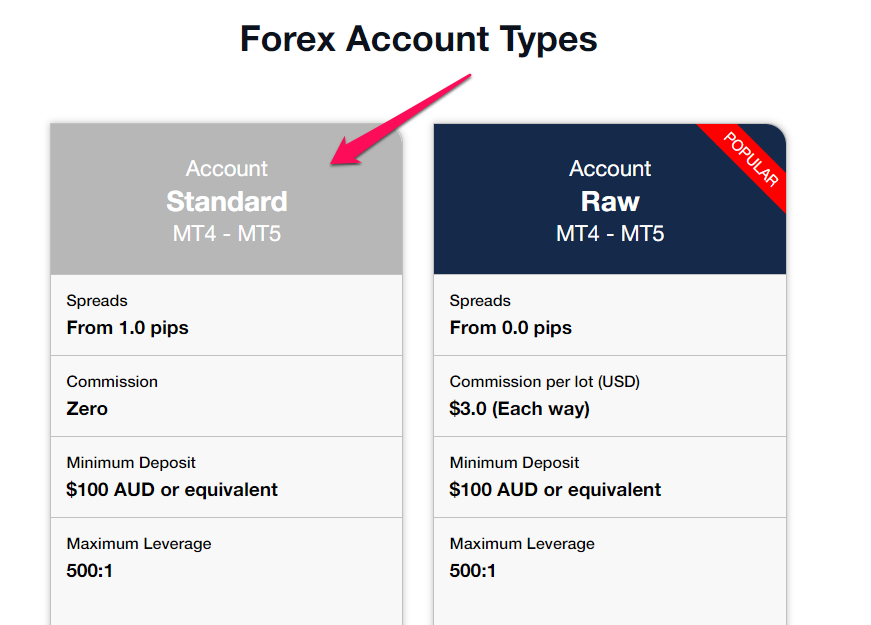

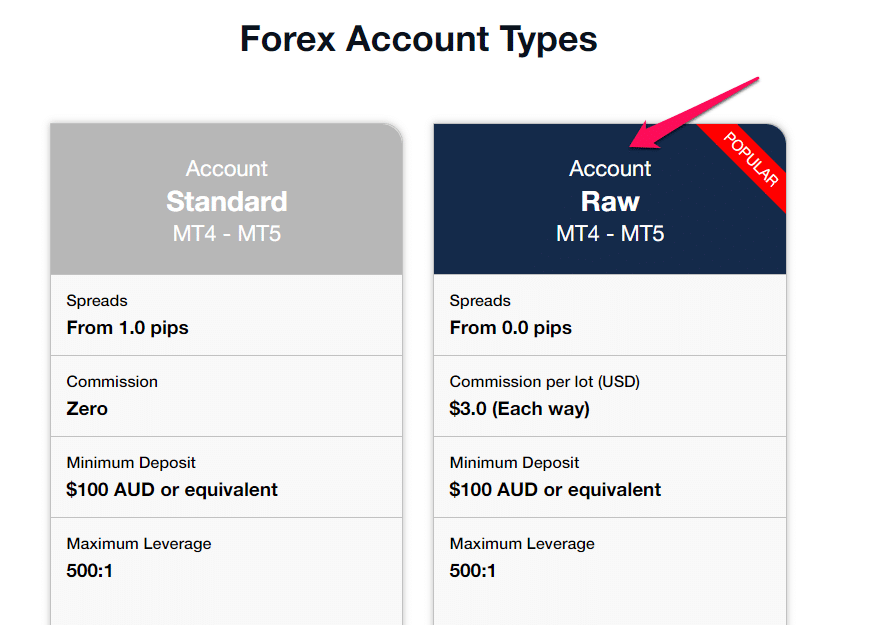

FP Markets Account Types and Features

offers Botswanan traders a choice of four live trading accounts, each of which is tailored to the demands of a particular kind of trader with a varying degree of trading expertise. These account types are:

➡️ MT4/5 Standard Account

➡️ MT4/5 Raw Account

➡️ MT4/5 Islamic Standard Account

➡️ MT4/5 Islamic Raw Account

| 💻 Live Account | 📉 Minimum Dep. | 📊 Average Spread | 💰 Commissions | 💸 Average Trading Cost |

| ➡️ Standard | 1352 BWP/100 AUD | 1 pip | None | 10 USD |

| ➡️ Raw | 1352 BWP/100 AUD | 0.0 pips | US$3 per side | 7 USD |

| ➡️ Islamic Standard | 1352 BWP/100 AUD | 1 pip | None | 10 USD |

| ➡️ Islamic Raw | 1352 BWP/100 AUD | 0.0 pips | US$3 per side | 7 USD |

Live Trading Accounts

MT4/5 Standard Account

This account is an excellent choice for Botswanan traders who wish to take advantage of the most competitive trading conditions available.

| Account Feature | Value |

| 📉 Minimum Deposit Requirement | 1352 BWP or an equivalent to AU$100 |

| 📊 Spreads | Variable, from 1 pip |

| 🔨 Instruments Available | • 60+ Forex pairs • Precious Metals • Indices • Commodities |

| 💳 Commission Charges | None |

| ✔️ Markets Offered | • 50+ FX Pairs including major, minor, and exotic pairs • Shares • Indices • Commodities • Cryptocurrencies |

| 📈 Maximum Leverage offered | 1:500 |

| 📈 Access to Trading Tools | Yes |

| 💻 Base Account Currencies | AUD, USD, EUR, GBP, NZD, CAD, SGD, CHF, HKD |

| ✔️ Expert Advisors Offered? | Yes |

| 📱 Scalping Allowed? | Yes |

| ✅ VPS Available? | Yes |

MT4/5 Raw Account

Trading accounts for Botswana traders may be opened on either MetaTrader 4 or MetaTrader 5, and they benefit from ultra-low spreads and the best trade execution speeds available.

| Account Feature | Value |

| 📉 Minimum Deposit Requirement | 1352 Botswanan Pula or an equivalent to AU$100 |

| 📊 Spreads | Variable, from 0.0 pips |

| 🔨 Instruments Available | • 60+ Forex pairs • Precious Metals • Indices • Commodities |

| 💳 Commission Charges | US$3 per side |

| 📈 Maximum Leverage offered | 1:500 |

| 📈 Market Execution | ECN |

| ✔️ Expert Advisors Offered? | Yes |

| 📱 Mobile App Offered? | Yes |

| ✅ VPS Available? | Yes |

MT4/5 Islamic Standard Account

This is a typical and standard account specifically designed for Muslim traders in Botswana, offering them competitive trading conditions as well as the chance to use a variety of trading tactics and tools.

| Account Feature | Value |

| 📉 Minimum Deposit Requirement | 1352 Botswanan Pula or an equivalent to AU$100 |

| 📊 Spreads | Variable, from 1 pip |

| 🔨 Instruments Available | • 60+ Forex pairs • Precious Metals • Indices • Commodities |

| 💳 Commissions | None |

| 📈 Maximum Leverage offered | 1:500 |

| 📈 Market Execution | ECN |

| ✔️ Expert Advisors Offered? | Yes |

| 📱 Mobile App Offered? | Yes |

| ✅ VPS Available? | Yes |

Base Account Currencies

offers several base account currency options but does not accommodate BWP as one of these currencies.

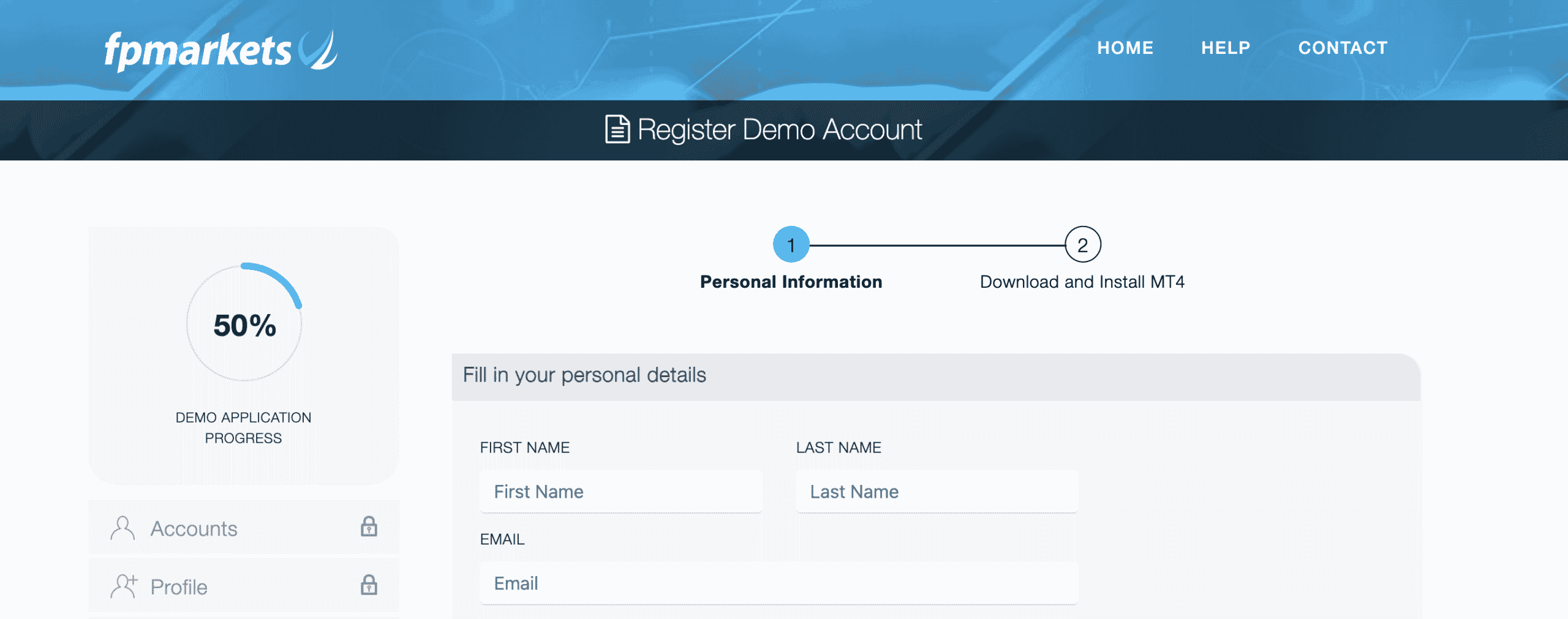

Demo Account

A demo account is a practice account that offers traders a certain amount of virtual funds that they can use, allowing them to enter the live market without risking their capital.

There is a certain degree of risk involved when trading financial markets and FP Markets offers its clients a risk-free platform where they can test strategies, practice trading, and explore what the broker offers in a safe trading environment with real market conditions.

FP Markets offers a trial account with $100,000 in virtual money, or the equivalent in your base account currency, for people interested in checking out the platform.

Demo accounts are intended to simulate the conditions that would occur on a genuine account, and traders may choose between Standard and Raw Accounts on both the MT4 and MT5 platforms. FP Markets offers an unlimited demo account if Botswanan traders use the account frequently.

Any inactive demo accounts will automatically be terminated after 30 days of inactivity, which means that traders must register again if they want to use the demo account.

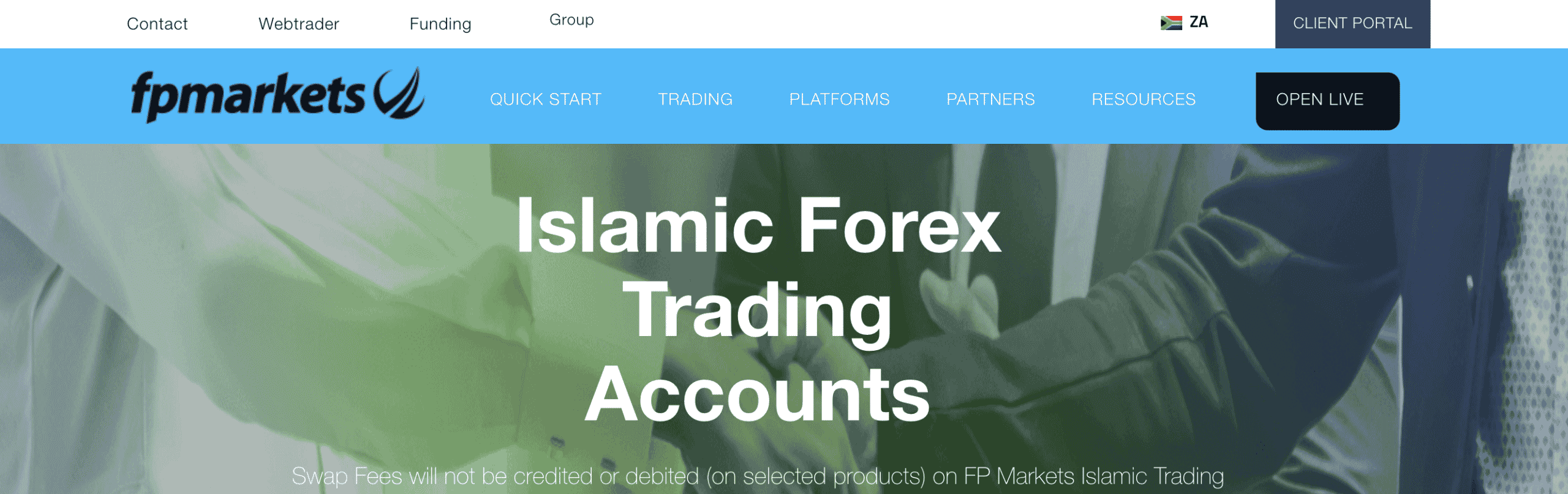

Islamic Account

Depending on the trading style and the trading strategy of the forex trader, they may keep their trading positions open for longer than 24 hours on a trading day.

This means that the trader could incur an overnight or rollover fee. This is a type of interest that is prohibited by Riba principles of Sharia law, which means that Muslim traders are often restricted in forex trading.

As an Islamic Account option, FP Markets provides Muslim Botswanan traders with the Standard and Raw accounts. Each of these accounts offers competitive trading conditions and benefits, allowing Muslim traders to get a competitive advantage in their trading.

Traders who utilize this option, however, should be aware that there are administrative costs imposed in USD per lot, each night. The following are the fees:

| 📱 Instrument | 💰 Admin Fee Charged |

| AUS200, CHINA50, FRA40, GER30, HK50, JP225, US100, EURO50, UK100 | $1 |

| AUD/USD, EUR/USD, GBP/USD, USD/CAD, USD/CHF, USD/JPY, NZD/USD, XAG/USD, XAU/USD | $5 |

| AUD/NZD, US500, LTC/USD, XRP/USD | $2 |

| US30, EUR/SEK, USD/SGD | $3 |

| AUD/SGD, CAD/JPY, EUR/CHF, EUR/JPY, GBP/CAD, NZD/SGD | $4 |

| AUD/CAD, CAD/CHF, CHF/JPY, EUR/DKK, EUR/GBP, NZD/CAD, USD/THB, XAG/AUD, USD/CZK | $5 |

| BTC/USD, GBP/JPY, GBP/SEK, XAU/AUD, XPT/USD | $6 |

| AUD/JPY, EUR/CAD, GBP/CHF, NZD/JPY | $7 |

| AUD/CHF, EUR/SGD, GBP/AUD, GBP/PLN, NZD/CHF, USD/CNH, USD/PLN, USD/SEK | $8 |

| CHF/SGD, EUR/AUD, EUR/NOK, EUR/NZD, EUR/PLN, GBP/DKK, GBP/SGD, GBP/NZD, USD/DKK, USD/NOK, XTI/USD, EUR/HUF, USD/HUF, EUR/CZK | $10 |

| EUR/ZAR, USD/MXN, USD/ZAR, XBR/USD, XTI/USD, XPD/USD | $20 |

| EUR/MXN, GBP/MXN, USD/RUB | $30 |

| EUR/TRY, GBP/TRY, USD/TRY | $70 |

| XNG/USD | $80 |

What types of trading accounts does FP Markets offer to its clients?

The broker caters to a diverse range of traders by offering various account types. The two primary account classifications are the Standard Account and the Raw Account. The Standard Account is designed for traders seeking competitive spreads without a commission per trade. On the other hand, the Raw Account is tailored for those who prefer tighter spreads and are comfortable with a commission structure per trade.

What features are included with FP Markets trading accounts?

The broker trading accounts come with a range of features to enhance the trading experience. Across both Standard and Raw Accounts, traders have access to the industry-leading MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, offering advanced charting tools, automated trading capabilities, and comprehensive market analysis.

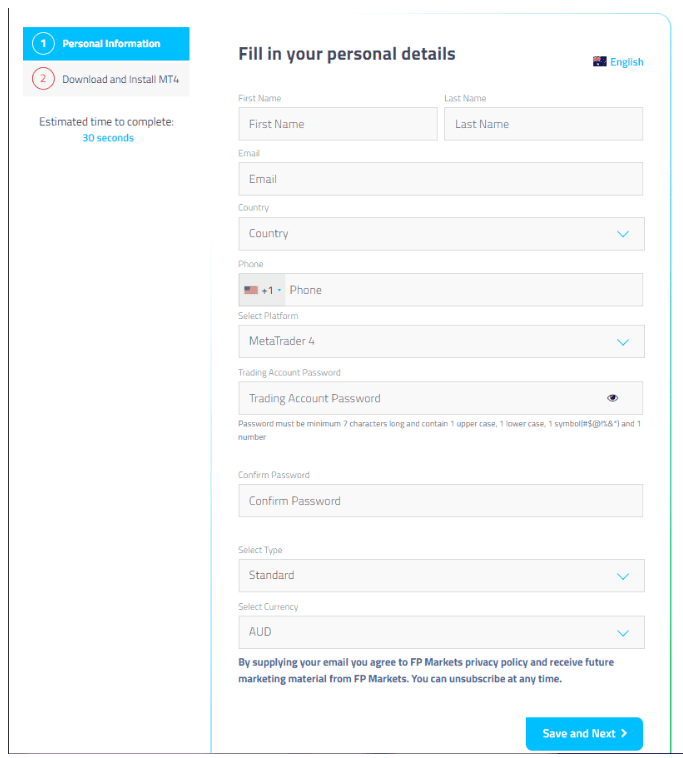

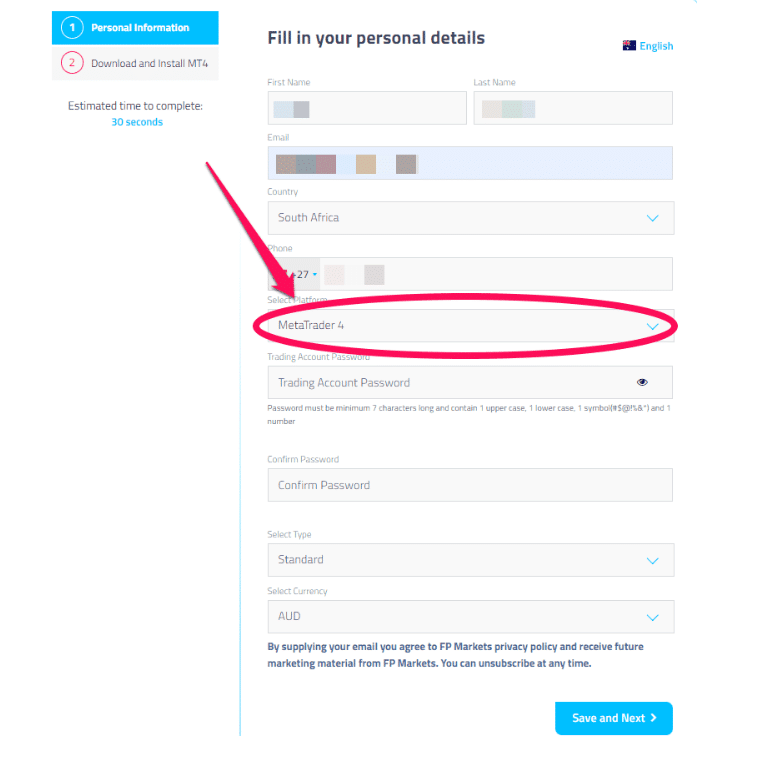

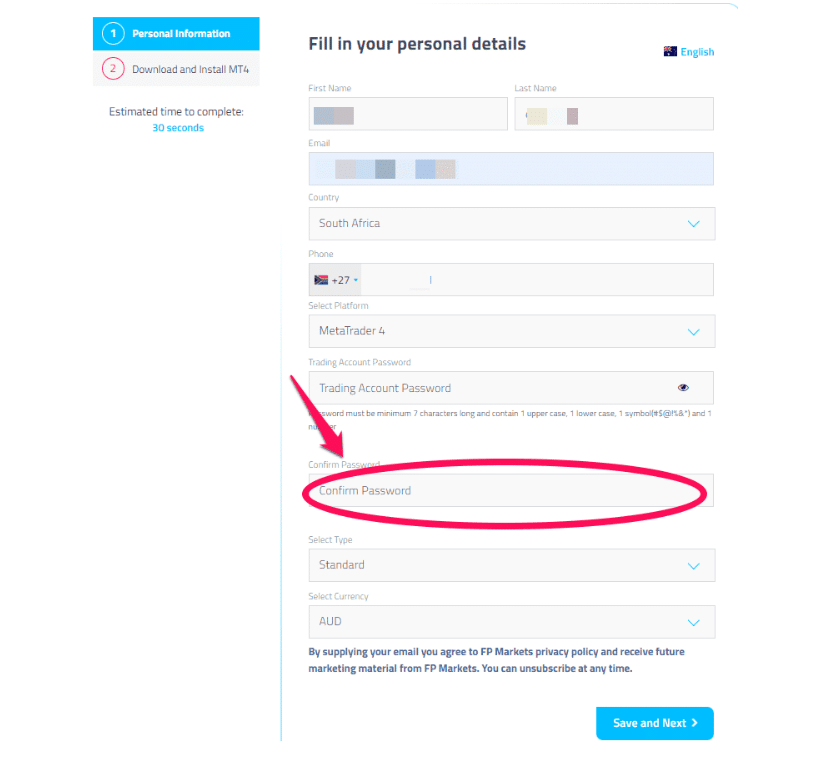

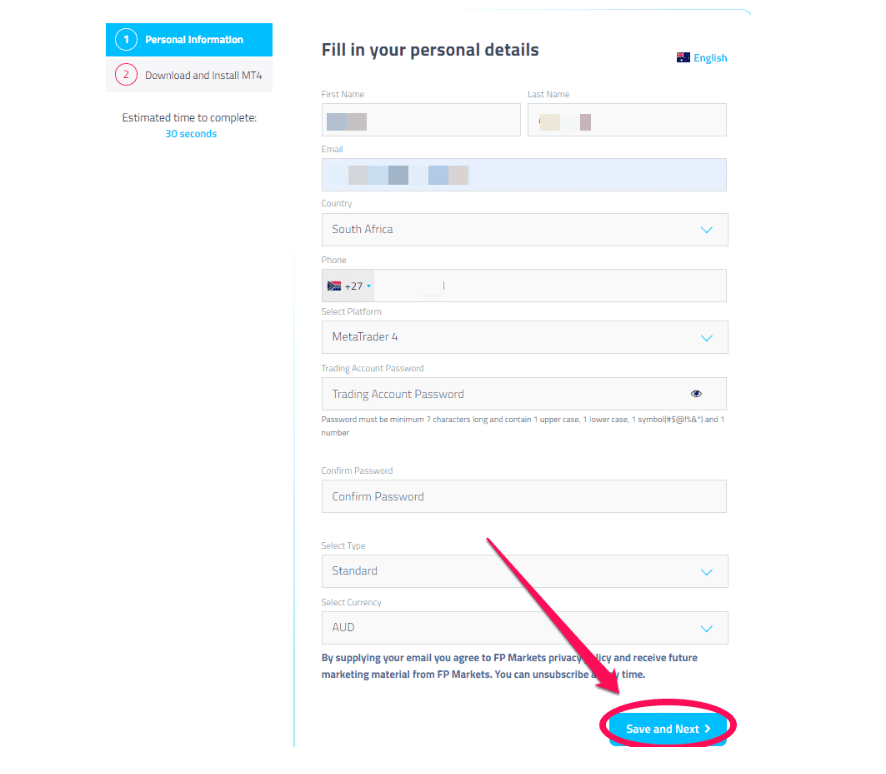

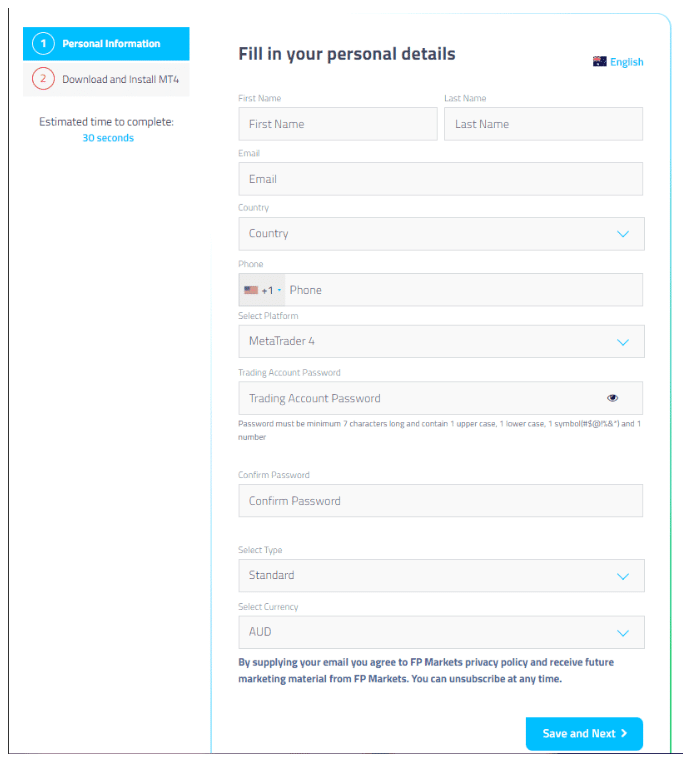

How to set up a FP Markets Demo Account – Step by Step

Traders can sign up for a demo account by taking the following simple steps:

Navigate to the demo account registration portal by selecting “Try a Demo” from the dropdown sheet on the homepage of the broker’s website.

Provide your personal details on the registration page. These will include your full name, contact number, country of residence, and email address.

Select your preferred trading platform. Users can choose between MetaTrader 4 or Press.

Create and confirm your password.

Select the account type for which you would like to create the demo version and your preferred account currency.

Click “Save and Next” to process to the second step, which is to download and install the trading platform.

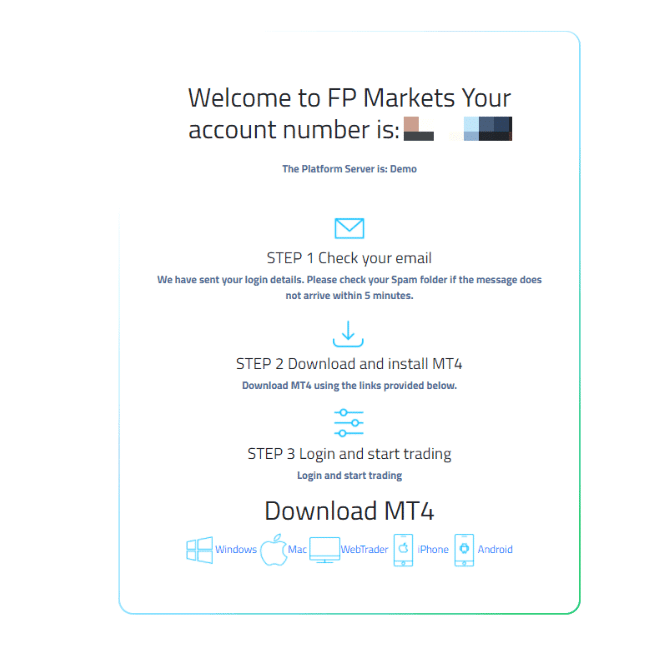

After this step has been completed, you will be sent the full login details for your demo account.

FP Markets Vs FXCM Vs eToro – Broker Comparison

| 🥇FP Markets | 🥈 FXCM | 🥉 eToro | |

| ⚖️ Regulation | CySEC, FSCA, ASIC, FSC, FSA | SVG FSA | None |

| 📱 Trading Platform | • MetaTrader 4 • MetaTrader 5 • Myfxbook AutoTrade • FP Markets App | • MetaTrader 4 • MetaTrader 5 • AMarkets Trading App | • MetaTrader 4 • MetaTrader 5 |

| 💰 Withdrawal Fee | Yes | Yes | No |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 1352 BWP | 1,200 BWP | 300 BWP |

| 📊 Leverage | 1:500 | 1:1000 | 1:500 |

| 📊 Spread | 0.0 pips | From 0.0 pips | From 0.4 pips |

| 💰 Commissions | From US$3 | $2.5 per lot | From $1 |

| ✴️ Margin Call/Stop-Out | 100%/50% | • 50% • 20% to 40% | 100%/70% |

| 💻 Order Execution | Market | Market, Instant | Market |

| 💳 No-Deposit Bonus | No | No | No |

| 📊 Cent Accounts | No | No | No |

| 📈 Account Types | • MT4/5 Standard Account • MT4/5 Raw Account • MT4/5 Islamic Standard Account • MT4/5 Islamic Raw Account | • Fixed Account • Standard Account • ECN Account • RAMM Account | • Standard Account • PRO Account • VAR Account • Mini Account |

| ⚖️ CBN Regulation | No | No | No |

| 💳 BWP Deposits | Yes | Yes | No |

| 📊 Botswanan Pula Account | No | No | No |

| 👥 Customer Service Hours | 24/7 | 24/5 | 24/7 |

| 📊 Retail Investor Accounts | 4 | 4 | 4 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 📉 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | 50 lots | Depends on the Account Balance | 1,000 lots |

| 💰 Minimum Withdrawal Time | Instant | Instant | Instant |

| 📊 Maximum Estimated Withdrawal Time | Up to 5 working days | 3 to 5 Business Days | Up to 3 hours |

| 💸 Instant Deposits and Instant Withdrawals? | Yes, Sticpay wallet withdrawals | Yes | Yes |

Trading Platforms

offers Botswana Traders a choice between these trading platforms:

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ Myfxbook AutoTrade

➡️ FP Markets App

Desktop Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4

There are more than 50 built-in indicators for market analysis in MetaTrader 4 (MT4), one of the most popular trading platforms in the world, to help you make better trading choices.

As well as all of this, FP Markets provides its Botswanan customers with a first-rate trading experience by providing a wide range of sophisticated charting tools, technical indicators, and news and analysis, all of which can be accessed via the desktop interface.

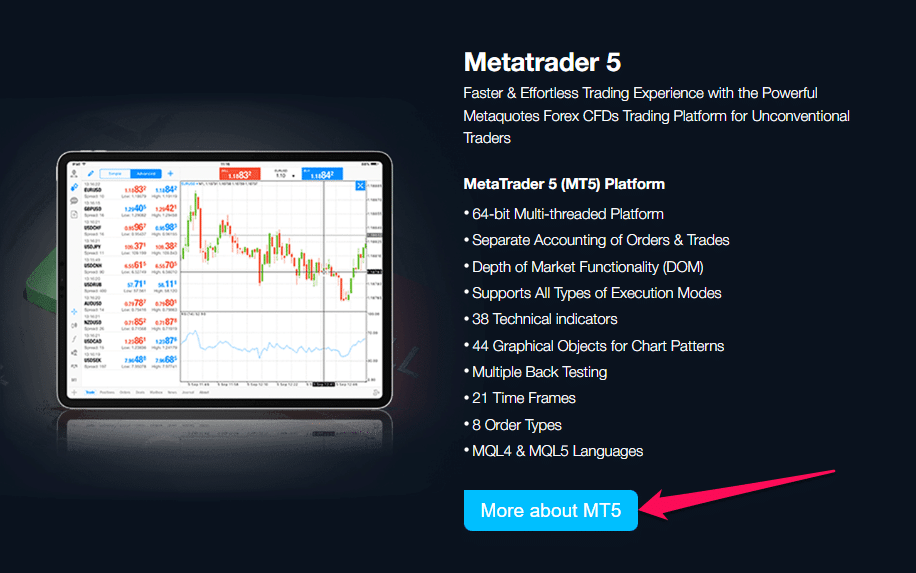

MetaTrader 5

More indicators, market depth display, 21-time frames, a built-in economic calendar, and an upgraded strategy tester are some of the new features of MetaTrader 5. If you are looking for an easy way to trade in Forex, stock indexes and metals, as well as commodities and currencies, FP Markets’ MT5 platform is for you.

WebTrader Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ Myfxbook AutoTrade

MetaTrader 4

FP Markets MT4 uses an ECN exchange mechanism to expedite order processing. It is possible to display various charts and market data at the same time, making it easier to keep an eye on different instruments. With one-click trading, you may place a variety of orders straight on live charts.

In addition, with the Web version of MetaTrader, you may join the MQL5 community for free and have access to a plethora of additional indicators as well as the trading strategies of other members. There are several signs, robots, and signals to be found.

MetaTrader 5

MT5 has one of the most comprehensive sets of integrated indicators and graphical elements available, as well as the ability to visualize currency market depth. MetaTrader 5 has the additional advantage of allowing for a high degree of versatility in trading.

FP Markets is compatible with a wide range of operating systems, including the Mac OS X operating system. Access to WebTrader, a web-based trading platform, may be accomplished using any major web browser.

Myfxbook AutoTrade

Users of FP Markets’ MetaTrader 4 (MT4) live accounts may utilize the AutoTrade function to examine the historical success of trading techniques and then replicate them in their accounts. AutoTrade is great for scalping since it is particularly created for the MetaTrader 4 trading platform.

Trading App

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ FP Markets App

MetaTrader 4 and 5

Through MetaTrader 4 and MetaTrader 5, FP Markets provides mobile trading platforms for iOS and Android devices with alerts and push notifications, as well as complete control over your trade and account from your mobile device.

On the MetaTrader 5 trading platform website, Botswanan traders may do market research. Complete charting and technical analysis tools, currency indicators, and improved pending order capabilities round out the list of new features.

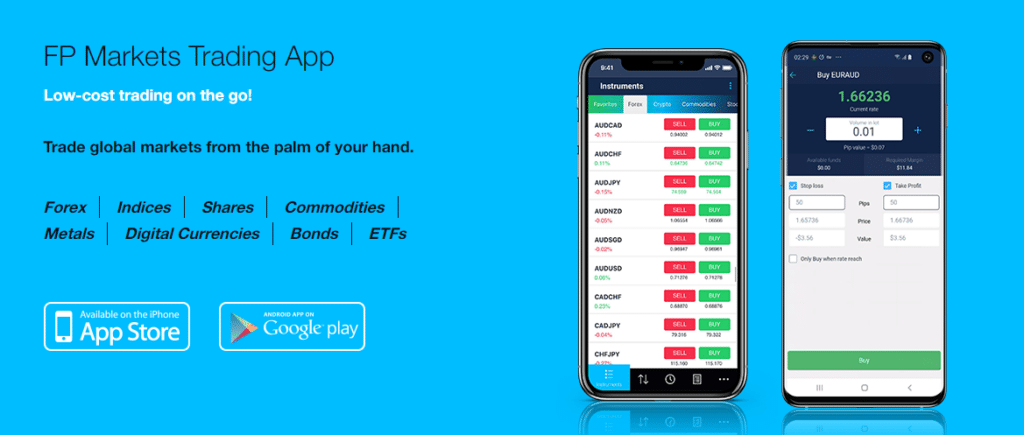

FP Markets App

FP Markets has developed a customized trading software that allows you to trade Forex and CFDs across a wide range of assets including stocks, indices, commodities, futures, and cryptocurrencies, all from the palm of your hand. You can quickly access all your favorite trading items from one easy app and one account, saving you time and money.

Trades may be placed, monitored, and reviewed in seconds using the FP Markets mobile application. Traders may also do research and technical analysis with the use of a variety of trading instruments available to them.

The feature-rich FP Markets Trading App puts you in complete control of your trading experience, and it is available for download on all Apple and Android smartphones.

What trading platforms does FP Markets offer to its clients?

The broker provides its clients with access to the widely acclaimed MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms are known for their user-friendly interfaces, advanced charting tools, and extensive capabilities for both manual and automated trading.

Can I trade on FP Markets using my mobile device, and what features are available on the mobile platforms?

Yes, the broker recognizes the importance of mobile trading in today’s dynamic markets. Traders can access their accounts and execute trades on the go using the mobile versions of MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Range of Markets

Botswana Traders can expect the following range of markets from FP Markets:

➡️ Forex

➡️ Shares

➡️ Metals

➡️ Commodities

➡️ Indices

➡️ Cryptocurrencies

➡️ Bonds

Financial Instruments and Leverage offered

| 🔨 Instrument | 💰 Number of Assets Offered | 📈 Max Leverage Offered |

| ➡️ Forex | 60 | 1:500 |

| ➡️ Precious Metals | 3 | 1:500 |

| ➡️ Indices | 17 | 1:200 |

| ➡️ Stocks | • DMA: 10,000+ • MetaTrader: 1,000+ | 1:20 |

| ➡️ Cryptocurrency | 11 | 1:5 |

| ➡️ Energies | 4 | 1:200 |

| ➡️ Bonds | 2 | – |

| ➡️ Agricultural Commodities | 5 | 1:200 |

What financial instruments can I trade on FP Markets?

The broker offers a comprehensive range of financial instruments, allowing traders to diversify their portfolios across various markets. In the forex market, traders can access major and minor currency pairs, including EUR/USD, GBP/USD, and USD/JPY.

What cryptocurrencies are available for trading on FP Markets?

The broker recognizes the growing interest in cryptocurrencies and provides traders with the opportunity to trade a selection of digital assets. Cryptocurrencies available on the platform include popular options like Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and Litecoin (LTC).

Broker Comparison for Range of Markets

| 🥇 FP Markets | 🏅 FXCM | 🥉 eToro | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | Yes | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | No | Yes | Yes |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | Yes | No |

Min Deposit

100 USD/1 343 BWP

Regulators

ASIC, CySEC, FSCA, CMA

Trading Desk

MetaTrader 4, MetaTrader 5

Crypto

Yes

Total Pairs

63

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

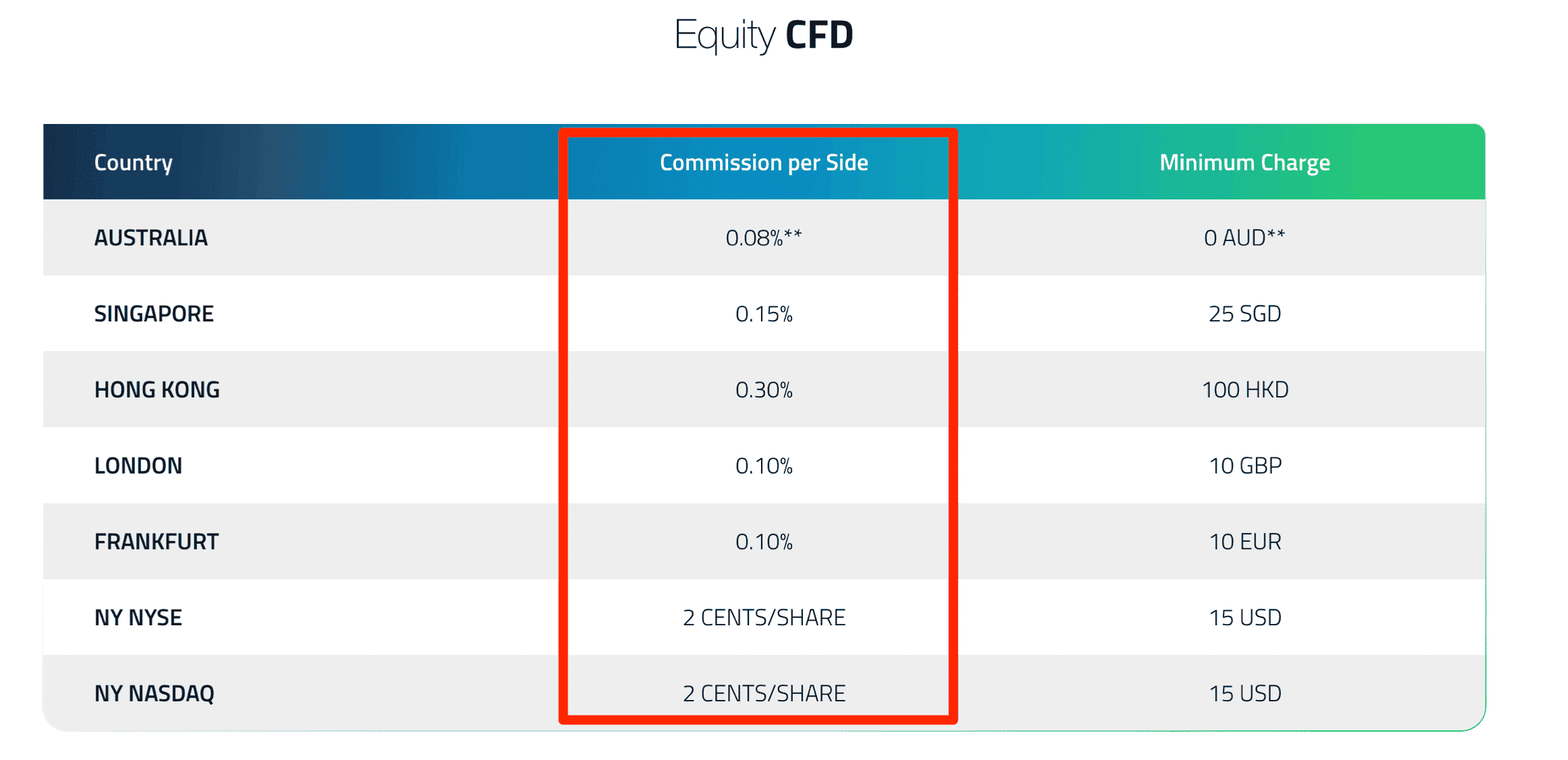

Trading and Non-Trading Fees

Spreads

The broker is an ECN and STP broker that charges varied spreads across all its trading accounts in the following ways:

➡️ MT4/5 Standard Account – 1 pip EUR/USD

➡️ MT4/5 Raw Account – 0.0 pips EUR/USD

➡️ MT4/5 Islamic Standard Account – 1 pip EUR/USD

➡️ MT4/5 Islamic Raw Account – 0.0 pips EUR/USD

Commissions

While FP Markets offers Botswanan traders some commission-free options, there are commission fees applied to the zero-spread accounts to cover the broker’s fee for facilitating the trade. These commissions are applied as follows:

➡️ MT4/5 Raw Account – US$3 per side

➡️ MT4/5 Islamic Raw Account – US$3 per side

Overnight Fees, Rollovers, or Swaps

FP Markets’ website provides all exchange rates for each instrument, which is a great sign of transparency. FP Markets calculates swap costs using current bank interest rates plus additional mark-up that forms part of the overall broker fees.

FP Markets uses the trading platforms’ timestamp to calculate overnight fees, which are implemented at the stroke of midnight. Overnight fees are only applied on positions that have been open for more than 24 hours and might be negative or positive depending on the interest rate differential between the two currencies.

Investors in certain currency pairs should be aware of the possibility of negative exchange rates. Instead of traders having to worry about swap computation, MetaTrader 4 and 5 handle it automatically.

For each currency pair, FP Markets calculates overnight costs using a standard lot size of 100,000 base units. FP Markets traders, in our experience, will be charged the following overnight fees:

➡️ EUR/USD – a long swap of -5.50 and a short swap of 0.38

➡️ BTC/USD – a long swap of -20.00 and a short swap of -20.00

➡️ US100 – a long swap of -1.07 and a short swap of -0.94

➡️ XAG/USD – a long swap of -1.36 and a short swap of -0.78

➡️ XAU/USD – a long of -4.88 and a short swap of -1.82

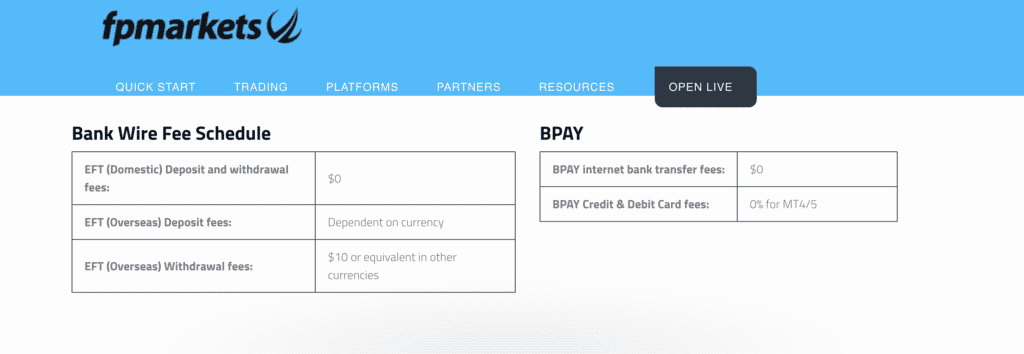

Deposit and Withdrawal Fees

When Botswanan traders make deposits to their trading accounts FP Markets does not apply any deposit fees. However, when withdrawing funds, Botswanan traders must note that the following withdrawal fees are charged:

➡️ International Bank Wire other than AUD – 10 AUD

➡️ Neteller – 2% up to 30 USD in addition to country fees

➡️ Skrill – 1% and country fees

➡️ Fasapay – 0.50%

➡️ PayTrust – 1.5%

➡️ Dragonpay – 1.5%

➡️ Perfect Money – 0.5%

➡️ Asian, African, and Latam Payments – 2%

➡️ Cryptocurrency Payments – Blockchain fees

➡️ MPSA – 7.25%

➡️ FairPay – 0.5% plus an additional flat fee of 10 USD

➡️ Paylivre – 1.5%

➡️ Finrax – Blockchain fees

➡️ Sticpay – 5% for bank wire and 2.5% for wallet fees

➡️ Thai Pay – 0.5%

➡️ Virtual Pay – 2%

➡️ XPAY – 1.5%

Inactivity Fees

One advantage of FP Markets is that there is no inactivity cost, so if you do not use your account for an extended period, you will not be charged any fees or penalties.

Currency Conversion Fees

While FP Markets does not list any further costs, Botswanan traders may be charged currency conversion fees when depositing or withdrawing in BWP, depending on the payment method they choose.

What are the trading fees associated with FP Markets?

The broker employs a transparent fee structure primarily based on spreads for forex trading. The spread is the difference between the buying (ask) and selling (bid) prices of a financial instrument.

Are there any non-trading fees on FP Markets, and what should I be aware of?

In addition to trading fees, FP Markets may charge non-trading fees that traders should be aware of. These may include overnight financing fees (swap rates) for positions held overnight, withdrawal fees, and inactivity fees for dormant accounts.

Deposits and Withdrawals

FP Markets offers the following deposit methods:

➡️ Debit Card

➡️ Bank Transfer

➡️ Neteller

➡️ Skrill

➡️ PayTrust

➡️ Sticpay

➡️ Fasapay

➡️ Virtual Pay

➡️ Rupee Payments

➡️ Dragonpay

➡️ Perfect Money

➡️ Asian, African and Latam Payments

➡️ Paylivre

➡️ Cryptocurrency (LetKnowPay)

➡️ Rapyd Bank Transfer

➡️ Rapid Transfer

➡️ Finrax

➡️ MPSA

➡️ Nganluong

➡️ XPAY

➡️ Broker to Broker

When withdrawing funds from a trading account, Botswanan traders can choose from these methods:

➡️ Debit Card

➡️ Credit Card

➡️ Domestic Bank Wire

➡️ International Bank Wire

➡️ Neteller

➡️ Skrill

➡️ Fasapay

➡️ PayTrust

➡️ Dragonpay

➡️ Perfect Money

➡️ Cryptocurrency

➡️ MPSA

➡️ FairPay

➡️ Paylivre

➡️ Finrax

➡️ Sticpay

➡️ Rupee Payments

➡️ Rapid

➡️Virtual Pay

➡️ XPAY

Broker Comparison: Deposit and Withdrawals

| 🥇 FP Markets | 🥈 FXCM | 🥉 eToro | |

| Minimum Withdrawal Time | Instant | Instant | Instant |

| Maximum Estimated Withdrawal Time | Up to 5 working days | 3 to 5 Business Days | Up to 3 hours |

| Instant Deposits and Instant Withdrawals? | Yes, Sticpay wallet withdrawals | Yes | Yes |

How can I make a deposit into my FP Markets trading account, and what payment methods are supported?

Making a deposit into your FP Markets trading account is a straightforward process. The platform supports various payment methods, including bank wire transfers, credit/debit cards, and popular e-wallet options such as Neteller and Skrill.

How can I initiate a withdrawal from my FP Markets trading account, and what withdrawal options are available?

Withdrawing funds from your FP Markets trading account is a user-friendly process. Simply log in to your account, go to the withdrawal section, and select your preferred withdrawal method. FP Markets supports various withdrawal options, including bank transfers and e-wallets, providing flexibility for users. For security reasons, withdrawals are typically processed using the same method that was used for the initial deposit.

FP Markets Deposit Currencies, Deposit and Withdrawal Processing Times

| 💳 Payment Method | 💰 Deposit Currencies | 🔁 Deposit Processing | 💳 Withdrawal Processing |

| Credit Card | AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, USD, CZK, PLN, AED | Instant | 1 business day |

| Debit Card | AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, USD, CZK, PLN, AED | Instant | 1 business day |

| Bank Transfer | AUD, USD, EUR, GBP, SGD, HKD | 1 business day | – |

| Neteller | AUD, CAD, CHF, EUR, GBP, JPY, INR, BRL, SGD, USD | Instant | 1 business day |

| Skrill | AUD, CAD, EUR, GBP, INR, USD, BRL | Instant | 1 business day |

| PayTrust | MYR, IDR, VND | Instant | 1 business day |

| Sticpay | JPY, EUR, GBP, USD, HKD, TWD, KRW, SG | Instant | Wallet: Instant Bank Wire: 1 – 5 days |

| Fasapay | USD, IDR | Instant | 1 business day |

| Virtual Pay | KES, UGX, TSH | Instant | 1 business day |

| Rupee Payments | INR | Instant | 1 – 2 business days |

| Dragonpay | PHP, AUD, CAD, CHF, EUR, GBP, HKD, SGD, USD | Instant | 1 business day |

| Perfect Money | USD | Instant | 1 business day |

| Asian, African and Latam Payments | USD, GBP, EUR, African and Asian Currencies | Instant | 1 business day |

| Paylivre | BRL, USD | Instant | 1 – 2 business days |

| Cryptocurrency (LetKnowPay) | ADA, BCH, BTC, DASH, ETH, LTC, PAX, XRP, TUSD, USDC, USDT (ERC20), USDT (TRC20), ZEC | Up to 1 hour | 1 business day |

| Rapyd Bank Transfer | BRL, MXN, COP, CLP | Instant | – |

| Rapid Transfer | EUR, DKK, SEK, HUF, GBP, PLN, NOK | Instant | 1 – 2 business days |

| Finrax | BTC, ETH, LTC, XRP, BAT, BNT, CVC, ENJ, FUN, LINK, MITH, MTL, OMG, REP, XLM, BCH, USDT | Instant | 1 business day |

| MPSA | INR | Instant | 1 – 2 business days |

| Nganluong | VND | Instant | 1 business day |

| XPAY | IDR, MYR, THB, VND | Instant | 1 business day |

| Broker to Broker | AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, USD | 1 business day | – |

| Domestic Bank Wire | AUD | – | 1 business day |

| International Bank Wire | All except AUD | – | 1 business day |

| FairPay | BRL, CLP, COP, CRC, GTQ, MXN, PEN, USD | – | 1 – 2 business days |

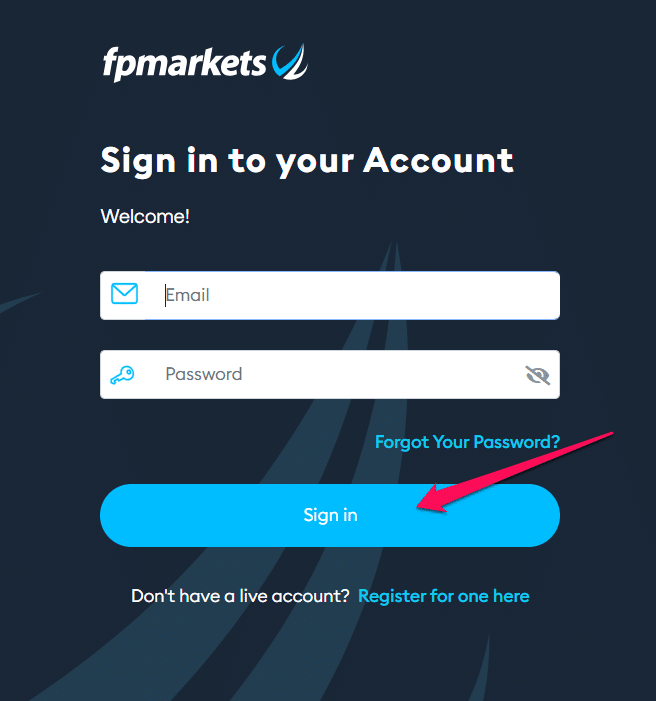

How to Deposit Funds with FP Markets

Depositing funds with FP Markets is a straightforward process that consists of the following simple steps:

Locate FP Markets website and click the ‘log in’ option.

On the left side of the screen click on “Funding”

Select your preferred deposit method, whether by wire transfer, credit card or debit card

Select the trading account to which you wish to deposit and click “Submit”

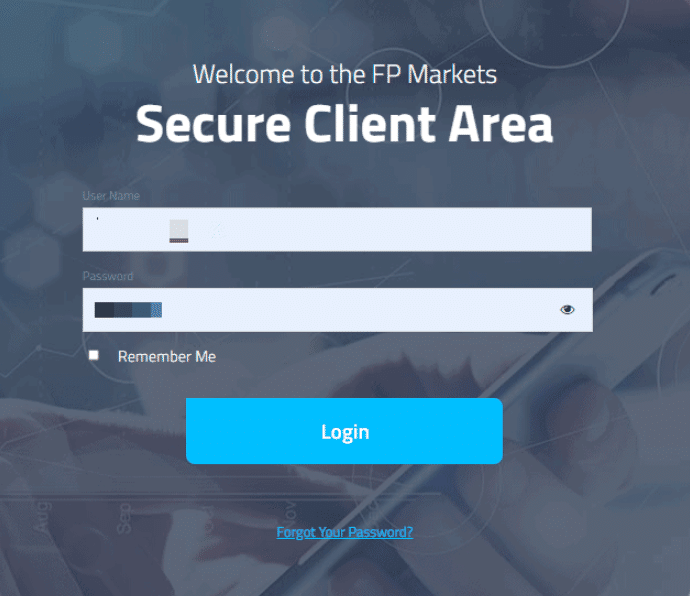

FP Markets Fund Withdrawal Process

To withdraw funds from an account with FP Markets, Botswana Traders can follow these steps:

Step 1: Log into your Client Area

Log into your Client Area and select “Funding” from the left hand panel followed by “Withdraw.”

Step 2: Withdrawal Methods

Complete the form that loads and use the same method that you used with your fund deposit first before choosing another method.

Botswanan traders must note that there are limits on the number of funds that they can withdraw according to the amount that they deposited. For instance, if a trader has deposited 100 BWP by using a credit or debit card, they can only withdraw that exact amount using the same method used with deposits.

When Botswanan traders fund the trading account in several ways, they must use the same withdrawal methods and subsequent withdrawal amounts in the same sequence that deposits were made.

Once these options have been exhausted traders can use other withdrawal methods. However, this is subject to FP Markets’ approval.

Min Deposit

100 USD/1 343 BWP

Regulators

ASIC, CySEC, FSCA, CMA

Trading Desk

MetaTrader 4, MetaTrader 5

Crypto

Yes

Total Pairs

63

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

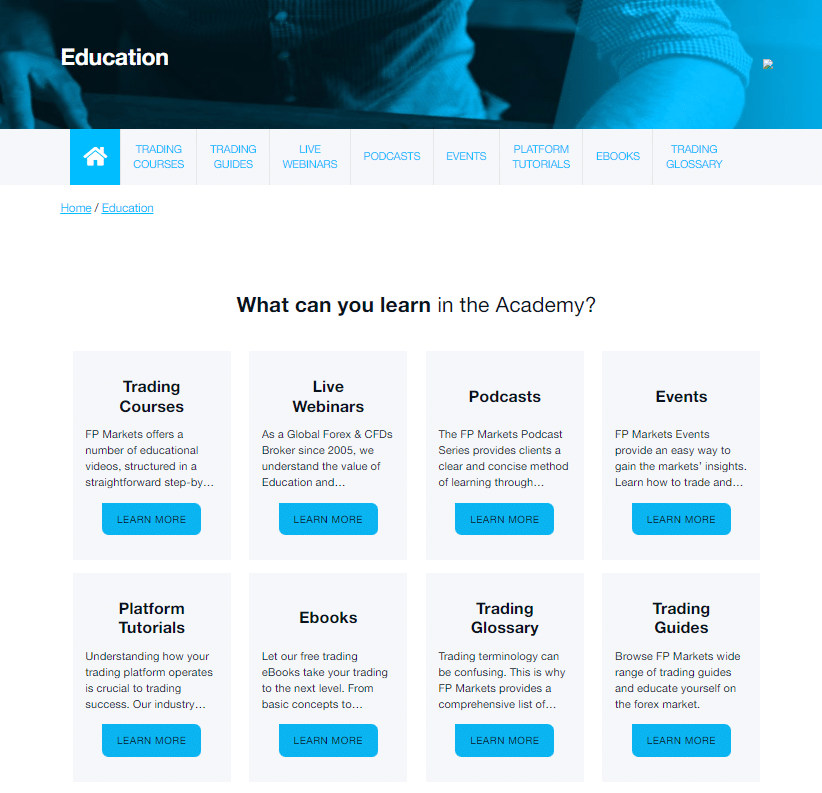

Education and Research

Education

offers the following Educational Materials:

➡️ Trading Courses Videos

➡️ Webinars

➡️ Podcasts

➡️ Events

➡️ Platform Video Tutorials

➡️ eBooks

➡️ Glossary

➡️ Newsletter

➡️ FP Markets Academy

Research and Trading Tool Comparison

| 🥇 FP Markets | 🥈 FXCM | 🥉 eToro | |

| ➡️ Economic Calendar | Yes | Yes | No |

| ➡️ VPS | Yes | Yes | No |

| ➡️ AutoChartist | Yes | Yes | No |

| ➡️ Trading View | No | No | No |

| ➡️ Trading Central | No | No | No |

| ➡️ Market Analysis | Yes | Yes | Yes |

| ➡️ News Feed | Yes | Yes | Yes |

| ➡️ Blog | Yes | Yes | Yes |

offers Botswana Traders the following Research and Trading Tools:

➡️ Trader’s Hub

➡️ Trading Knowledge

➡️ Technical Analysis

➡️ Fundamental Analysis

➡️ Economic Calendar

➡️ Forex Calculator

➡️ Traders Hub Blog

What educational resources does FP Markets offer to traders?

The broker is committed to enhancing the trading knowledge and skills of its clients. The platform provides a variety of educational resources, including webinars, video tutorials, and articles covering a wide range of topics.

What research tools are available on FP Markets to assist traders in their decision-making process?

The broker equips traders with a suite of research tools designed to provide insights and aid in decision-making. The platform offers daily market analysis, economic calendars, and expert commentary to keep traders informed about market trends and events.

10 Best Forex Brokers in Botswana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

Bonuses and Promotions

FP Markets does not currently indicate any active bonuses or promotions for Botswanan traders.

How to open an Affiliate Account

To register an Affiliate Account, Botswana Traders can follow these steps:

➡️ Go to the official FP Markets website and scroll down to “Partners.”

➡️ Select an option and wait for a new page to load.

➡️ Click on the red “Join Now” banner and choose “Affiliate” from the dropdown menu.

➡️ Include your first and last name, a valid email address, your country of residence, and your cell phone number.

➡️ Next, enter a Username and a password chosen by the user.

➡️ Next, describe how you intend to advertise FP Markets through your website, social media, as a signal provider, Google, PPC, or any other means.

➡️ Enter your social media connections and website URLs here.

➡️ Indicate whether you are an associate with other brokers and the number of customers you recommend monthly.

➡️ Choose your estimated total deposits and mention how long you have been an associate (if you are an existing affiliate with other brokers).

➡️ Specify the areas you want to target.

➡️ Finally, read and agree to the Affiliate Terms and Conditions before clicking “Apply Now.”

Affiliate Program Features

Overall, FP Markets has one of the most successful partnership programs in the industry, which is intended to reward and compensate brokers who refer new customers to FP Markets, as well as partners who refer new clients to FP Markets.

In addition to offering affiliates the opportunity to earn up to $800 CPA, FP Markets also provides the following bonuses and features:

➡️ Real-time tracking technology that is robust.

➡️ Advanced and transparent reporting is available 24 hours a day, five days a week

➡️ Access to a dedicated conversion consultant on demand

➡️ Marketing materials that are multilingual and can be easily translated

➡️ Personalized agreements, as well as payment schemes

➡️ Introducing Broker and innovative Affiliate portals.

➡️ Payments are made quickly and easily, and commissions are generous.

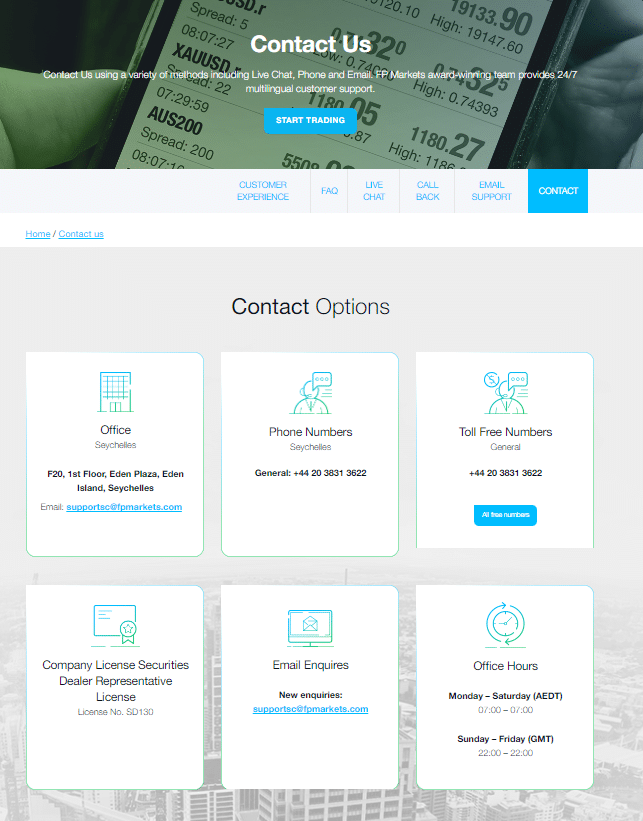

Customer Support

FP Markets is well-known for offering dedicated, helpful customer support that can be accessed 24 hours, 5 days a week over several channels.

| Customer Support | FBS’ Customer Support |

| ⏰ Operating Hours | 24/5 |

| 🗣 Support Languages | English, Arabic, Indonesian, Vietnamese, Portuguese, Thai, Malay, Japanese |

| 🗯 Live Chat | Yes |

| 📧 Email Address | Yes |

| ☎️ Telephonic Support | Yes |

| 📞 Local Support in Botswana? | No |

| 🥇 Overall quality of FP Markets Support | 4.2/5 |

Corporate Social Responsibility

There is currently no information relating to FP Markets’ CSR initiatives or active projects.

Our Verdict

Overall, FP Markets has been recognized as one of the most well-regarded CFD and FX trading platforms. As a result of its superior technology, FP Markets has developed direct access to markets and offers a diverse choice of instruments to trade at cheap prices.

FP Markets is appropriate for traders of varying sizes and levels of skill, while FP Markets is a dependable brokerage, which is enhanced by the fact that they are governed by CySEC and ASIC rules.

With superb research tools and detailed analysis appropriate for beginner traders as well as assisting daily trading, FP Markets offers a wide range of services such as market outlooks, news feeds and trading ideas, amongst others.

Aside from the favorable and high appreciation that customers have for the company, FP Markets offers a variety of languages, allowing you to always rely on high-quality service. With the reimbursement of VPS purchases, FP Markets is seeking to give back to its clientele.

To qualify for a cash pay-out back into the trading account, the customer must join up with a preferred VPS provider and trade at least 10 lots on RAW FX, with the maximum cash reward per month being 50 dollars.

Overall, there are a variety of variables that have contributed to FP Markets’ respectable position in the market, as well as its recognition by a variety of publications and reputable editions, among others.

The proof that FP Markets is a legit and trusted institution can be found in the perfection of the service they provide, as well as in the trading conditions they provide and the high esteem they get from the traders.

You might also like: FXCM Review

You might also like: FBS Review

You might also like: FOREX.com Review

You might also like: AvaTrade Review

You might also like: Alpari Review

Pros and Cons

| ✔️ PROS | ❌ CONS |

| fpmarkets is a well-established Australian broker regulated by ASIC and CySEC | Fixed spreads are not available |

| Botswanan traders can choose from an impressive range of markets that can be traded through powerful platforms | There are withdrawal fees charged on most payment methods that are supported |

| fpmarkets offers comprehensive mobile trading opportunities | There are administration fees which apply to the Islamic accounts and trading |

| Botswanan traders can expect superior ECN pricing that includes raw and tight spreads and low commissions | |

| fpmarkets is known for its fast trade execution that is delivered through the Equinix servers | |

| There are commission-free accounts offered that still feature competitive spreads | |

| There are dedicated Islamic accounts for Muslim traders | |

| fpmarkets offers a range of educational materials and advanced trading tools |

Frequently Asked Questions

Is FP Markets a good broker?

Yes, FP Markets is classified as a low risk and high trust broker that offers a large range of tradable instruments, a choice between retail accounts and powerful trading platforms.

FP Markets also offers ECN technology and trading conditions that ensure that Botswanan traders get the best from their trading.

Is FP Markets regulated?

Yes, the Australian Securities and Exchange Commission (ASIC) regulates FP Markets in Australia, while the Cyprus Securities and Exchange Commission (CySEC) regulates FP Markets in Cyprus.

Is FP Markets regulated in the UK?

No, FP Markets is not regulated in the UK but Australia and Cyprus.

What is the withdrawal time with FP Markets?

This will be determined by the mode of withdrawal selected. Withdrawals through Sticpay’s wallet are immediate, but bank wire transfers might take up to three business days to process.

Traders should plan on waiting up to 10 days for overseas bank withdrawals to be processed.

Is FP Markets safe or a scam?

FP Markets is regarded safe since it has a long track record and is regulated by the top-tier Australian Securities and Investments Commission (ASIC) and CySEC in Cyprus, which is a Tier-2 market regulator with average trust.

How do I deposit into an FP Markets account?

You can use any of the supported payment methods offered by FP Markets including Credit/Debit Card, bank transfer, Neteller, Skrill, PayTrust, and several others.

Does FP Markets have a no-deposit bonus?

No, FP Markets does not have a no-deposit bonus and does not currently have any other active bonuses or promotions.

Does FP Markets have Nasdaq?

Yes, FP Markets offers Nasdaq, and you can also have access to other popular stock exchanges, including the ASX, NASDAQ, and NYSE.

Does FP Markets have Volatility 75?

Yes, FP Markets is one of few brokers that offers access to the Volatility 75 index.

Conclusion

Now it is your turn to participate:

➡️ Do you have any prior experience with Exness?

➡️ What was the determining factor in your decision to engage with Exness?

➡️ Was it because of the minimum deposit, regulation, retail trading accounts, or any other factors?

➡️ Have you experienced any issues with Exness such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

Regardless, please share your thoughts in the comments below.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review