GO Markets Review

Overall, GO Markets is very competitive in terms of its trading fees and spreads. GO Markets is a multi-regulated forex broker. GO Markets offer 2 retail accounts as well as a demo account and has a Trust Score of 98% out of 100. GO Markets is currently not regulated by the MFED, BoB, or NBFIRA of Botswana

- Louis Schoeman

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

USD 200 / 2 690 BWP

Regulators

ASIC, CySec, FSC, FSA, SCA

Trading Desk

Hybrid

Crypto

Yes

Total Pairs

600+

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overview

Overall, GO Markets is considered low-risk, with an overall Trust Score of 98 out of 100. GO Markets is licensed by one Tier-1 Regulator (high trust), one Tier-2 Regulator (average trust), and two Tier-3 Regulators (low trust). GO Markets offers two different retail trading accounts namely a Standard Account and a GO+ Account.

GO Markets accepts Botswana clients and has an average spread from 0.0 pips with US$5 commission round turn/US$2.5 per side. GO Markets has a maximum leverage ratio up to 1:500 and there is a demo account but no Islamic Account. MT4 and MT5 platforms are supported. GO Markets is headquartered in Australia and regulated by ASIC, FSA Seychelles, FSC Mauritius, and CySEC.

GO Markets is a well-known and well-respected broker that is fully regulated and licensed at the highest level. GO Markets offers a wide variety of free training courses, including webinars, for both novice and experienced traders.

Additionally, they provide a variety of trading tools, such as MetaTrader Genesis, AutoChartist, VPS, Trading Central, and more. The MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms are also available to Botswanan clients on desktop, web browsers, and all mobile devices that run iOS or Android.

Customers come first at GO Markets, which strives to be the broker of choice for traders of all skill levels by providing dependable customer support, transparent pricing, low-latency trade execution, and platform reliability while consistently bringing innovative trading technologies to customers.

This GO Markets review for Botswana will provide local retail traders with the details that they need to consider whether GO Markets is suited to their unique trading objectives and needs.

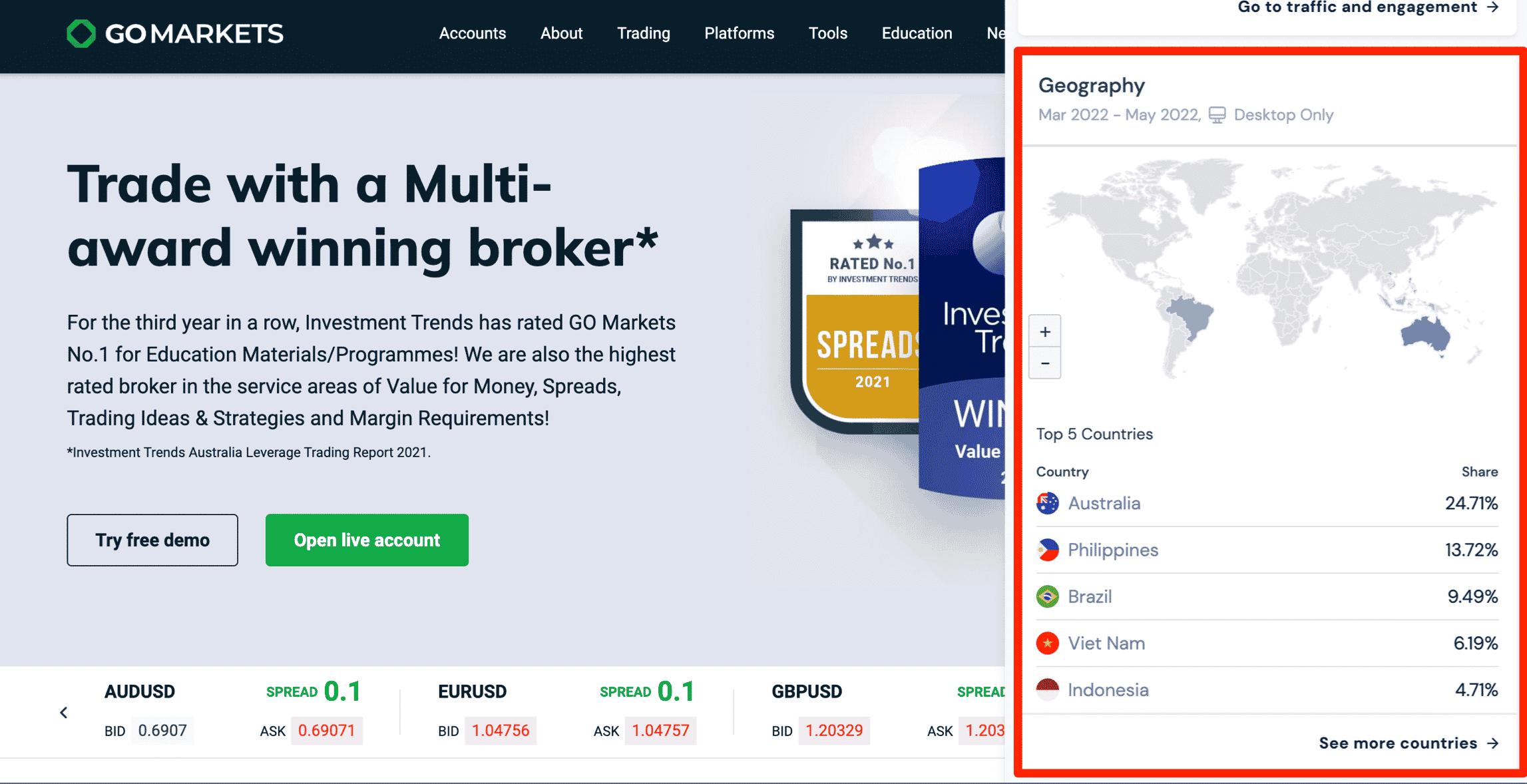

Distribution of Traders

Currently has the largest market share in these countries:

➡️ Australia – 28.8%

➡️ Philippines – 17.9%

➡️ United Kingdom – 7.4%

➡️ Indonesia – 6.5%

➡️ Brazil – 5.8%

Popularity among traders

🥇 Although GO Markets does not have a significant portion of the market in Botswana, the brokerage firm is ranked among the Top 100 firms that can serve Botswanan customers.

GO Markets At a Glance

| 🏛 Headquartered | Australia |

| 🌎 Global Offices | Australia, Hong Kong, United Kingdom, Taipei |

| 🏛 Local Market Regulators in Botswana | • Ministry of Finance and Economic Development (MFED) • Bank of Botswana (BoB) • Non-Bank Financial Institutions Regulatory Authority (NBFIRA) |

| 💳 Foreign Direct Investment in Botswana | 115.89 BWP Million in 2021 |

| 💰 Foreign Exchange Reserves in Botswana | 5270 USD Million in 2021 |

| ✔️ Local office in Gaborone? | No |

| 👨⚖️ Governor of SEC in Botswana | None, Moses Dinekere Pelaelo is the Governor of the Bank of Botswana |

| ✔️ Accepts Botswana Traders? | Yes |

| 📊 Year Founded | 2006 |

| 📞 Botswana Office Contact Number | None |

| 📱 Social Media Platforms | • Facebook • YouTube • Telegram |

| ⚖️ Regulation | ASIC, FSA Seychelles, FSC Mauritius, CySEC |

| 1️⃣ Tier-1 Licenses | • Australian Securities and Investments Commission (ASIC) |

| 2️⃣ Tier-2 Licenses | • Cyprus Securities and Exchange Commission (CySEC) |

| 3️⃣ Tier-3 Licenses | • Financial Services Authority (FSA) • Financial Services Commission (FSC) |

| 🪪 License Number | • Australia – ABN 24 653 400 527, AFSL 254963 • Seychelles – SD043 • Mauritius – GB 19024896 • Cyprus – 322/17 |

| ⚖️ MFED, BoB, or NBFIRA Regulation | No |

| ✔️ Regional Restrictions | USA, Canada, New Zealand, Belgium, Japan, Israel, Turkey, Vietnam, Puerto Rico, Afghanistan, Azerbaijan, Bosnia and Herzegovina, Burundi, Central African Rep, Congo, Cote D’Ivoire , Ethiopia, Eritrea, Egypt, Gaza Strip, Haiti, Iran, Iraq, Lebanon, Libya, Myanmar, North Korea, Pakistan, Serbia, Sierra Leone, Somalia, Sri Lanka, Sudan, South Sudan, Syria, Trinidad and Tobago, Tunisia, West Bank, Ukraine, Vanuatu, Venezuela, Yemen, Zimbabwe. |

| ☪️ Islamic Account | No |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 2 |

| ✔️ PAMM Accounts | No |

| 💻 Liquidity Providers | Over 22 liquidity providers |

| ✔️ Affiliate Program | Yes |

| 📱 Order Execution | Instant |

| 📊 Starting spread | 0.0 pips |

| 📉 Minimum Commission per Trade | From US$2.50 |

| 💰 Decimal Pricing | 5th decimal pricing after the comma |

| 📞 Margin Call | 80% |

| 🛑 Stop-Out | 50% |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | 250 lots |

| ✅ Crypto trading offered? | No |

| ✔️ Offers a BWP Account? | No |

| 📉 Dedicated Botswana Account Manager? | No |

| 📈 Maximum Leverage | 1:500 |

| 📊 Leverage Restrictions for Botswana? | No |

| 💳 Minimum Deposit (BWP) | 2 690 BWP equivalent to AU$200 |

| ✔️ Botswana Pula Deposits Allowed? | No |

| 📊 Active Botswana Trader Stats | 250,000+ |

| 👥 Active Botswana-based GO Markets customers | Unknown |

| 🔁 Botswana Daily Forex Turnover | Unknown, Forex overall is $6.6 Trillion |

| 💰 Deposit and Withdrawal Options | • Credit Card • Debit Card • POLi • Skrill • Neteller • Bank Wire Transfer • BPAY • Fasapay |

| 💻 Minimum Withdrawal Time | Instant |

| ⏰ Maximum Estimated Withdrawal Time | 1 to 3 business days |

| 💳 Instant Deposits and Instant Withdrawals? | Yes |

| 🏛 Segregated Accounts with Botswana Banks? | No |

| 📱 Trading Platforms | • MetaTrader 4 • MetaTrader 5 |

| 💻 Tradable Assets | • Forex CFDs • Share CFDs • Index CFDs • Metal CFDs • Commodity CFDs |

| ✔️ Offers USD/BWP currency pair? | No |

| 📊 USD/BWP Average Spread | N/A |

| ✅ Offers Botswana Stocks and CFDs | No |

| 💻 Languages supported on the Website | English, Spanish, Italian, Portuguese, Arabic, Indonesian, Thai |

| ☎️ Customer Support Languages | Multilingual |

| 👥 Copy Trading Support | Yes, Myfxbook AutoTrade |

| ⏰ Customer Service Hours | 24/5 |

| 📞 Botswana-based customer support? | No |

| 💸 Bonuses and Promotions for Botswanans? | No |

| 📚 Education for Botswanan beginner traders | Yes |

| 📱 Proprietary trading software | Yes |

| 🤝 Most Successful Trader in Botswana | Unknown |

| ✔️ Is GO Markets a safe broker for Botswana Traders? | Yes |

| 🎖 Rating for GO Markets Botswana | 8/10 |

| 🥇 Trust score for GO Markets Botswana | 98% |

| 👉 Open Account | 👉 Open Account |

Regulation and Safety of Funds

Regulation in Botswana

The broker is well-regulated in several regions, but not in Botswana by the Ministry of Finance and Economic Development (MFED), Bank of Botswana (BoB), or the Non-Bank Financial Institutions Regulatory Authority (NBFIRA).

Global Regulations

The broker is not regulated or authorized locally in Botswana. However, with the following regulations and licenses, they can provide trading solutions and services to Botswanan traders:

➡️ The Australian Securities and Investments Commission (ASIC) regulates and authorizes GO Markets in Australia. GO Markets operates under the trade name GO Markets Securities Pty Ltd. This organization has an Australian Business Number (ABN) of 24 653 400 5277 and an Australian Financial Services License (AFSL) number of 254963.

➡️ GO Markets International Ltd is a registered and well-regulated securities dealer in Seychelles, and the company operates under Securities Dealer number SD043.

➡️ GO Markets operates in Mauritius via GO Markets Pty Ltd (MU), which is a company that is well-regulated by the Financial Securities Commission and is registered with the FSC under the number GP19024896.

➡️ GO Markets does business in Cyprus under the name GO Markets Ltd., a company that is supervised by the Cyprus Securities and Exchange Commission (CySEC) and is well-regulated by the organization. The license number for this firm is 322/17.

Client Fund Security and Safety Features

The money belonging to Go Markets’ customers is kept in separate trust accounts at top-tier banks, where the company maintains various client accounts denominated in a variety of currencies. Since customer money is kept separate from company funds under this segregation, customer funds are not used for any other objectives, including the expenses of operating a firm.

Before beginning to trade, customers can visit the GO Markets website to view a variety of highly helpful and instructive extensive legal material. This documentation must be read through by Botswanan traders and traders must ensure that they fully understand it before they establish an account with GO Markets.

How does GO Markets ensure the safety of client funds?

The broker prioritizes the safety of client funds through various protective measures. As a regulated broker, GO Markets adheres to strict regulatory standards set by ASIC. Client funds are held in segregated bank accounts, ensuring they are kept separate from the broker’s operational funds.

Is GO Markets a regulated broker, and which regulatory authorities oversee its operations?

Yes, the broker is a regulated broker, and its operations are overseen by reputable regulatory authorities. GO Markets Pty Ltd, the Australian entity, is regulated by the Australian Securities and Investments Commission (ASIC).

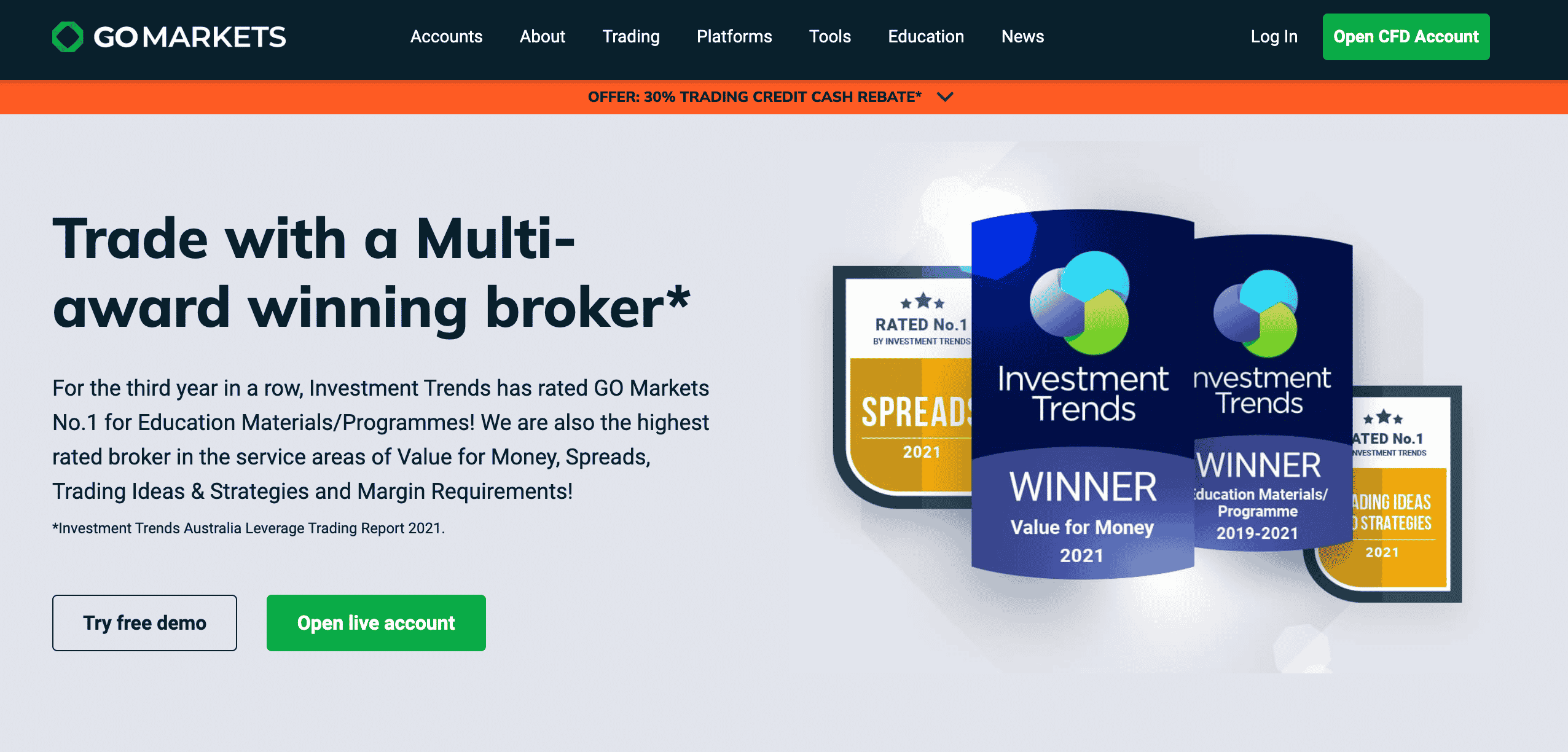

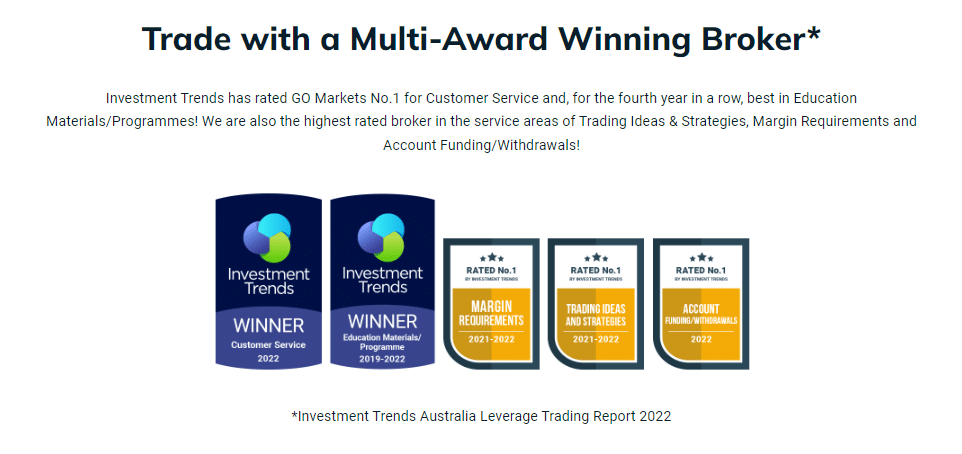

Awards and Recognition

Since the company’s inception, GO Markets has been the recipient of several prestigious industry awards, including the award for Best Customer Service in 2019 presented by Investment Trends as well as the award for Best Educational Materials and Programs in 2019, which was also presented by Investment Trends.

Has GO Markets received any notable awards for its services in the financial industry?

Yes, the broker has been recognized with notable awards for its outstanding services in the financial industry. Awards may vary across categories, including trading platforms, customer service, and overall excellence.

How is GO Markets regarded in the financial industry, and what does its reputation suggest about the platform?

The broker enjoys a positive reputation within the financial industry, reflecting its commitment to transparency, customer satisfaction, and technological innovation. The platform’s receipt of awards and positive reviews from traders underscores its success in delivering a reliable and user-friendly trading experience.

Account Types and Features

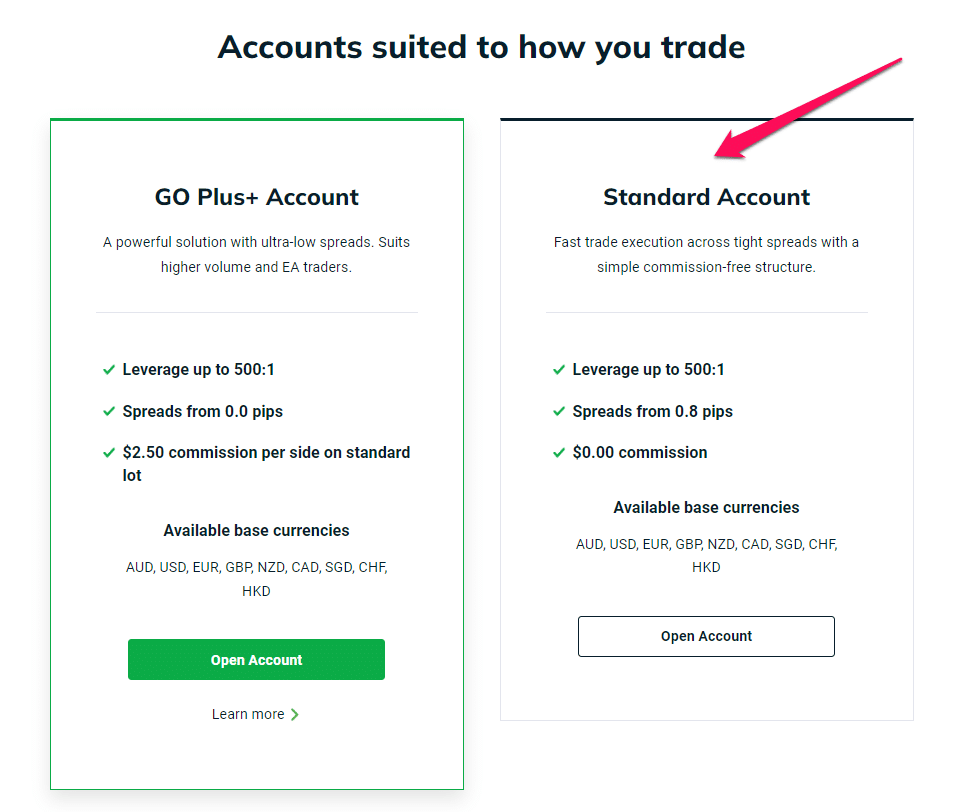

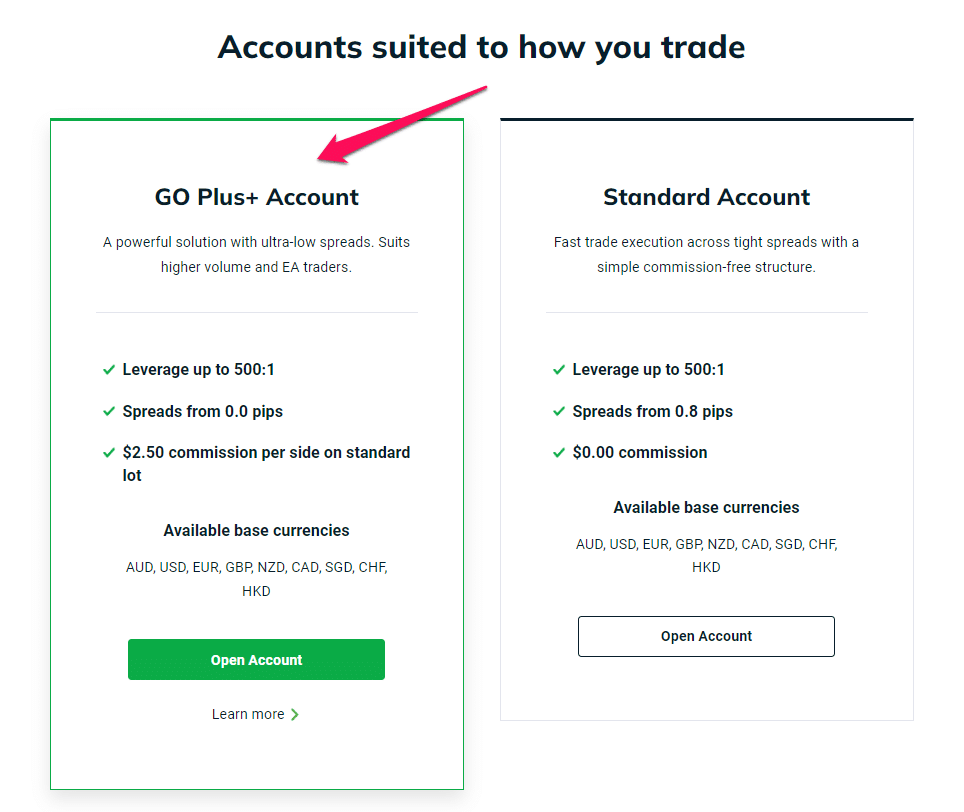

Standard and GO Plus accounts are the two kinds of trading accounts that Botswanan traders can open with GO Markets.

The most significant difference between the accounts is that the regular account does not charge a fee, but the spreads are wider, but the Plus account does charge a commission of $3 each side every standard lot ($6 round turn), but the spreads are much narrower.

In addition, both accounts come with a dedicated account manager who is available to assist you in getting set up, if necessary.

| 💻 Live Account | 📉 Minimum Dep. | 📊 Average Spread | 💰 Commissions | 💸 Average Trading Cost |

| ➡️ Standard | 2 690 BWP/200 AUD | 1 pip | None | 10 USD |

| ➡️ GO+ | 2 690 BWP/200 AUD | 0.0 pips | AU$3 per side | 6 USD |

Live Trading Accounts

Standard Account

This is the basic account type that is offered by GO Markets and it is based on spreads and commission-free trading.

Because GO Markets offers variable spreads, it means that spreads will often be wider, beginning at 1.0 pips and being aggregated from more than 22 different liquidity sources. The initial deposit requirement for this account is a minimum of AU$200, which is higher than what most other brokers typically require.

If your trading technique does not depend on narrow spreads and you hold positions open for weeks or months at a time, then this account is going to be more advantageous for you than the GO+ Account.

| Account Feature | Value |

| 📉 Minimum Deposit Requirement | 2 690 BWP or an equivalent to AU$200 |

| 📊 Spreads | Variable, from 1 pip |

| 🔨 Instruments Available | • 60+ Forex pairs • Precious Metals • Indices • Commodities |

| 💳 Commission Charges | None |

| ✔️ Markets Offered | • 50+ FX Pairs including major, minor, and exotic pairs • Shares • Indices • Commodities • Cryptocurrencies |

| 📈 Maximum Leverage offered | 1:500 |

| 📈 Access to Trading Tools | Yes |

| 💻 Base Account Currencies | AUD, USD, EUR, GBP, NZD, CAD, SGD, CHF, HKD |

| ✔️ Expert Advisors Offered? | Yes |

| 📱 Scalping Allowed? | Yes |

| ✅ VPS Available? | Yes |

GO+ Account

The GO Markets Plus account provides raw spreads beginning at 0 pips and a fee rate of $6 charged per lot each round turn, making it one of the most competitive options available.

To open this account, you will need to make an initial deposit of at least AU$200. If your trading strategy calls for narrow spreads, you should use this account instead of the Standard Account.

Scalpers, day traders, high-frequency traders, and algorithmic traders are the types of traders that would benefit most from using this kind of account since it offers tight spreads and quick execution speeds.

| Account Feature | Value |

| 📉 Minimum Deposit Requirement | 2 690 BWP or an equivalent to AU$200 |

| 📊 Spreads | Variable, from 0.0 pips |

| 💳 Commission Charges | AU$3 per side on a standard lot |

| ✔️ Markets Offered | • 50+ FX Pairs including major, minor, and exotic pairs • Shares • Indices • Commodities • Cryptocurrencies |

| 📈 Maximum Leverage offered | 1:500 |

| 📈 Access to Trading Tools | Yes |

| 💻 Base Account Currencies | AUD, USD, EUR, GBP, NZD, CAD, SGD, CHF, HKD |

| ✔️ Expert Advisors Offered? | Yes |

| 📱 Scalping Allowed? | Yes |

| ✅ VPS Available? | Yes |

Base Account Currencies

Traders from Botswana who sign up for an account with GO Markets have the option of selecting one of the following base currencies in which the account will be denominated:

➡️ AUD

➡️ USD

➡️ EUR

➡️ GBP

➡️ NZD

➡️ CAD

➡️ SGD

➡️ CHF

➡️ HKD

Demo Account

A demo account is a practice account that offers traders a certain amount of virtual funds that they can use, allowing them to enter the live market without risking their capital.

There is a certain degree of risk involved when trading financial markets and GO Markets offers its clients a risk-free platform where they can test strategies, practice trading, and explore what the broker offers in a safe trading environment with real market conditions.

Creating a demo account with GO Markets is an automated procedure that can be completed in a matter of minutes and involves very little effort. Traders have the choice of testing one of the two live trading accounts that are provided with either MetaTrader 4 or MetaTrader 5, depending on which platform they choose.

Traders are given an environment in which there is no risk involved so that they may research the services offered by the broker and try out the various trading platforms. Traders can test out the platform’s distinctive features and functions before deciding whether to sign up for a real trading account.

Both practice and real-money trades may be executed on the trading platforms MetaTrader 4 and MetaTrader 5, which are now two of the most popular and commonly utilized trading platforms available.

When it comes to personalizing their respective features, each trading platform offers a comprehensive selection of tools and charts from which to choose.

Islamic Account

Depending on the trading style and the trading strategy of the forex trader, they may keep their trading positions open for longer than 24 hours on a trading day.

This means that the trader could incur an overnight or rollover fee. This is a type of interest that is prohibited by Riba principles of Sharia law, which means that Muslim traders are often restricted in forex trading.

The broker does not currently offer an Islamic account option to Muslim traders. This means that Muslim traders who choose to trade through GO Markets must close their positions at the end of the trading day to avoid being subject to overnight fees.

What types of trading accounts does GO Markets offer to its clients?

The broker caters to the diverse needs of traders by offering a range of trading accounts. The two primary account types are the Standard Account and the GO Plus Account.

What features are included with GO Markets trading accounts?

The brokers trading accounts come with a range of features aimed at enhancing the overall trading experience. Across both Standard and GO Plus Accounts, traders have access to the popular MetaTrader 4 (MT4) trading platform, renowned for its user-friendly interface and advanced charting tools.

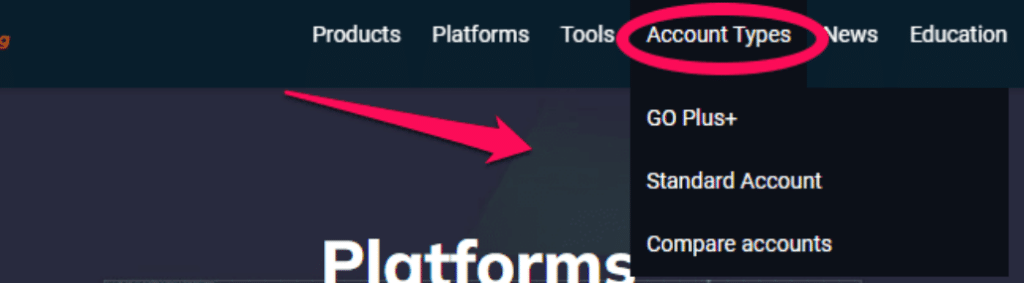

How to open an account with GO Markets

Step 1: Navigate to the GO Market homepage

Select the “Account types” bar and trading account you would like to open with Go Markets

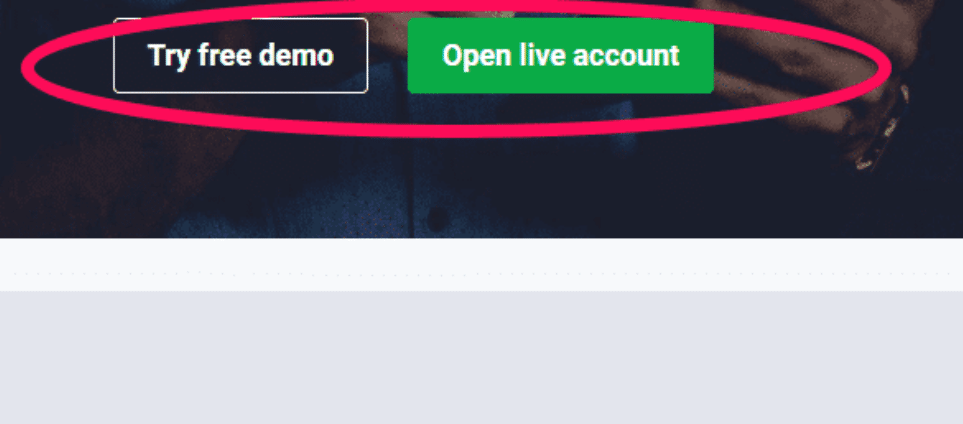

Step 2: Choose between a demo account or opening a live account.

Open the GO Markets account page and can then select the option ‘Try free demo’ from the homepage to sign up for the GO Market demo account.

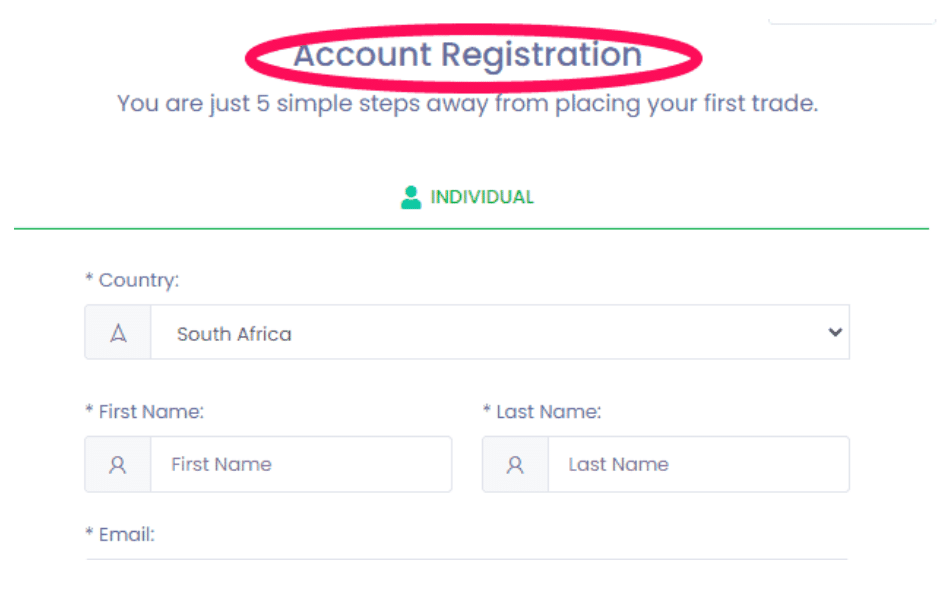

Step 3: Fill in Your Personal Details.

Once redirected to the accounts registration page containing the online application form. Traders must complete the required fields with their First and Last Name, email address, mobile number, preferred trading platform, account type, and base currency.

Step 4: Confirmation of Registration.

A password will be SMSed to your mobile number. A download for the trading platform the trader chose will automatically start and details can be filled in below to start trading.

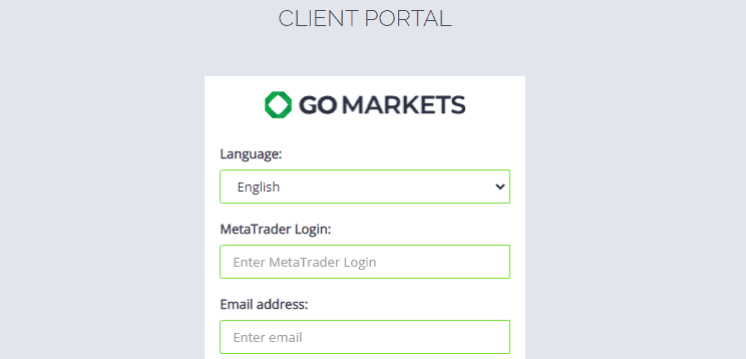

Step 5: Log in to the Client Portal with your details to start trading.

GO Markets Vs eToro Vs RoboForex – Broker Comparison

| 🥇 GO Markets | 🥈eToro | 🥉 RoboForex | |

| ⚖️ Regulation | ASIC, FSA Seychelles, FSC Mauritius, CySEC | CySEC, FCA, ASIC, FSA, NFA, FinCEN, FINRA, SIPC | IFSC |

| 📱 Trading Platform | • MetaTrader 4 • MetaTrader 5 | • eToro proprietary platform | • MetaTrader 5 • MetaTrader 5 • cTrader • R StocksTrader • RoboForex Terminal • CopyFX App |

| 💰 Withdrawal Fee | No | Yes | Yes |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 2 690 BWP | 1,200 BWP | 0 BWP |

| 📊 Leverage | Up to 1:500 | • 1:30 (Retail) • 1:400 (Professional) | 1:2000 |

| 📊 Spread | From 0.0 pips | From 1 pip | 0.0 pips |

| 💰 Commissions | From US$2.50 | None | $3 to $4 |

| ✴️ Margin Call/Stop-Out | 80%/50% | None indicated | Stop-out 100% to 10% |

| 💻 Order Execution | Instant | Market, Instant | Market |

| 💳 No-Deposit Bonus | No | No | Yes |

| 📊 Cent Accounts | No | No | No |

| 📈 Account Types | • Standard Account • GO+ Account | • Retail Account • Professional Account | • RoboForex Prime Account • RoboForex ECN Account • RoboForex R StocksTrader Account • RoboForex ProCent Account • RoboForex Pro Account |

| ⚖️ CBN Regulation | No | No | No |

| 💳 BWP Deposits | No | No | Yes |

| 📊 Botswanan Pula Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/6 | 24/7 |

| 📊 Retail Investor Accounts | 2 | 1 | 5 |

| ☪️ Islamic Account | No | Yes | Yes |

| 📉 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | 250 lots | Depends on the instrument and account balance | 10,000 (Cent) |

| 💰 Minimum Withdrawal Time | Instant | Instant | Up to 24 hours |

| 📊 Maximum Estimated Withdrawal Time | 1 to 3 business days | Up to 10 Working Days | Up to 3 working days |

| 💸 Instant Deposits and Instant Withdrawals? | Yes | Yes | Yes, Skrill and Neteller |

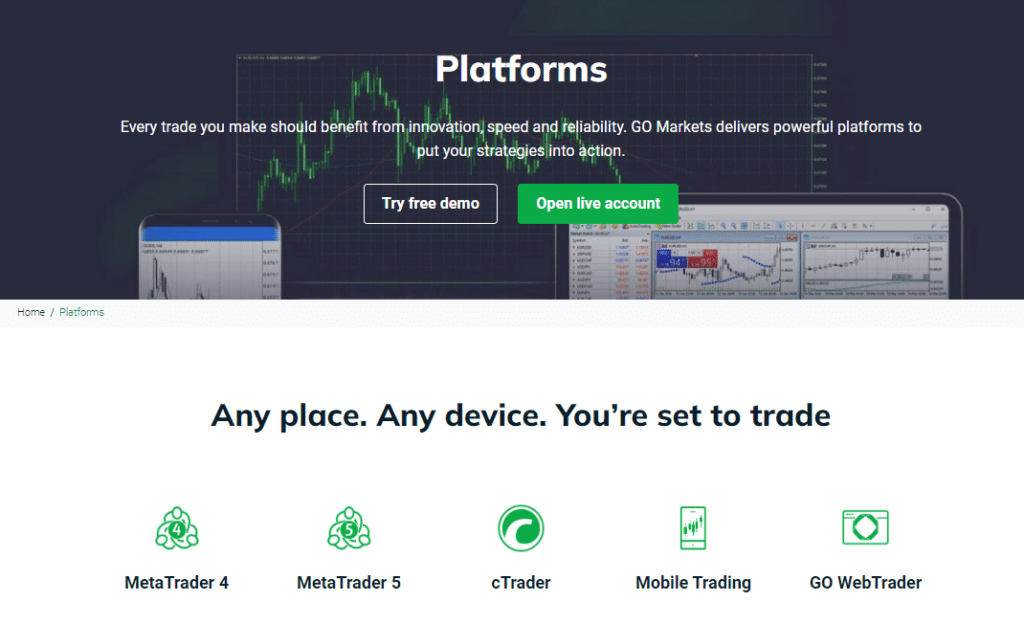

GO Markets Trading Platforms

Offers Botswana Traders a choice between these trading platforms:

➡️ MetaTrader 4

➡️ MetaTrader 5

Desktop Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4

MT4 is widely recognized as the industry standard for foreign exchange trading, and as a result, GO Markets decided to make it their primary trading platform. Even though MT4 can differ from one company to the next because brokers can add a variety of extensions to enhance the trading platform’s capabilities, GO Markets chose MT4 as their primary trading platform.

Because it is the most popular trading platform, MT4 comes in versions that are compatible with both Mac and PCs. These versions are an absolute must for experienced or active traders.

You may make use of all of GO Markets’ desktop platform’s features, including its extensive customization options and comprehensive set of sophisticated tools, such as MT4 Genesis, including complete capabilities and superb personalization.

This makes it easier to travel across worldwide markets and is also computable with automated trading made possible by Expert Advisors and many built-in indicators. Some key features of MetaTrader Genesis include:

➡️ Within the confines of the terminal’s display, you can easily manage both your transactions and your account.

➡️ There is an innovative mini terminal that allows for the organization of charts as well as immediate access to trade management features from inside the charts

➡️ There are market sentiment indicators that can be used to gather market knowledge

➡️ There is an innovative correlation trader that can identify potential opportunities for profits.

➡️ An interactive session map that allows you to keep track of the sessions taking place in London, New York, Tokyo, and Sydney

➡️ Market manager window that allows users to do other things while the platform is still active

➡️ Notification system for alarm management

➡️ To keep up with the most recent market developments, an economic calendar is provided.

➡️ A correlation matrix can be used to determine the degree to which different types of instruments have a relationship with one another over a certain amount of time.

MetaTrader 5

Additionally, GO Markets broadens its offering by including MetaTrader 5, a more recent and improved version of the well-liked MT4 one, in their proposition. MetaTrader 5 is a trading platform. Therefore, if you like this program, go ahead and use it.

Additionally, copy and social trading alternatives are available to you via Myfxbook, which is a world-leading network with over 90,000 individuals who enable traders to copy trading pros or be copied by them for mutual gain.

Myfxbook AutoTrade is a social trading community that functions as a worldwide copy trading platform. It is simple to link with your GO Markets Standard trading account, and it now has over one million consumers. This gives users the ability to do the following things:

➡️ Follow the trades of pre-screened investors who have a proven track record of profitable investments.

➡️ Establish a connection to Myfxbook directly from inside a web browser.

➡️ Get access to a wide variety of precise studies and data.

➡️ Maintain simple commands over transactions that are automatically replicated.

WebTrader Platforms

➡️ cTrader

➡️ cTrader Copy Trading

➡️ GO WebTrader

cTrader

A user-friendly yet powerful platform that combines advanced customization and order capabilities with education and analysis tools to enhance your trading experience.

cTrader Copy Trading

Harness the expertise of top-performing traders through an advanced, flexible, and secure system that automates trading strategies, saving valuable time and effort while maintaining control.

Harness the expertise of top-performing traders through an advanced, flexible, and secure system that automates trading strategies, saving valuable time and effort while maintaining control.

GO WebTrader

This web-based MT4 and MT5 version lets you place and monitor trades where you don’t have the platform downloaded. Great for when you’re on the move, or manual trading.

Mobile Trading App

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4 and 5

Because every platform has a mobile trading app, you may utilize mobile devices to trade, which gives you complete independence from traditional constraints.

GO Markets’ mobile platform and its seamless versions are included in both the MT4 and MT5 platforms, and they are all connected to a single account.

What trading platforms does GO Markets offer to its clients?

The broker provides its clients with access to the widely acclaimed MetaTrader 4 (MT4) trading platform and MetaTrader 5 (MT5)

Can I trade on GO Markets using my mobile device, and what features are available on the mobile platforms?

Yes, the broker recognizes the importance of mobile trading in today’s fast-paced markets. Traders can trade on the go using the mobile version of MetaTrader 4 (MT4). The mobile platform is available for both iOS and Android devices, offering features such as real-time price quotes, interactive charts, and the ability to execute trades from anywhere with an internet connection.

Range of Markets

You may trade a diverse selection of goods with a single account, and there are more than 600+ instruments accessible across numerous asset classes, including:

➡️ 49 Forex pairs across majors, minors, and forex exotics

➡️ Share CFDs

➡️ 15 Index CFDs spread across global stock market indices

➡️ Precious Metal CFDs spread across gold, silver, and more.

➡️ 6 Commodity CFDs

Contracts for Difference, often known as CFDs, are derivative products that enable investors to bet on the future direction of the price of a financial instrument. This allows investors to benefit from both rising and falling markets.

You also have the option to trade on margin, which allows you to hold a larger position while only making a smaller initial deposit, which can magnify both your earnings and your losses.

When compared to what is offered by the broker’s other businesses, the selection of items that may be traded by GO Markets Ltd, the European entity, is more restricted.

Through GO Markets Pty Ltd, for instance, you will have access to more than 400 different shares originating from Australia, Hong Kong, and the United States. In addition, this trading arm of GO Markets also gives investors access to real equities to trade in in addition to cryptocurrency contracts for difference (CFDs).

Financial Instruments and Leverage offered

| 🔨 Instrument | 💰 Number of Assets Offered | 📈 Max Leverage Offered |

| ➡️ Forex | 50+ | 1:500 |

| ➡️ Precious Metals | 2 | 1:100 |

| ➡️ Indices | 15 | 1:100 |

| ➡️ Stocks | 499 | 1:20 |

| ➡️ Energies | 4 | 1:30 |

What financial instruments can I trade on GO Markets?

The broker offers a comprehensive range of financial instruments across various asset classes. Traders can participate in the dynamic foreign exchange market (forex) with a wide selection of currency pairs, including majors, minors, and exotic pairs.

Does GO Markets offer cryptocurrency trading, and what cryptocurrencies are available on the platform?

Yes, they recognize the growing interest in cryptocurrencies and provides traders with the opportunity to trade a selection of popular digital assets. Cryptocurrencies available on the platform include Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC).

Broker Comparison for Range of Markets

| 🥇 GO Markets | 🏅 eToro | 🥉 RoboForex | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | Yes | Yes |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | No | Yes | Yes |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | No | No |

GO Markets Trading and Non-Trading Fees

Spreads

The spreads are customized based on the account that is being used. Traders with a Standard account will get a little larger spread, while GO+ traders enjoy interbank rates but must pay a fee for each transaction.

The average spreads that traders might anticipate from GO Markets are as follows:

➡️ AUD/USD – From 0.1 pips

➡️ USD/CAD – From 0.2 pips

➡️ EUR/USD – From as low as 0.0 pips with an average of 0.1 pips

➡️ USD/JPY – From 0.2 pips

➡️ USD/CHF – from 0.3 pips

➡️ GBP/USD – from 0.2 pips

Commissions

The pricing at GO Markets is mostly constructed into spreads, and the Standard account does not have any commission fees because of this. Therefore the spread on the Standard Account starts from 1 pip, and it is the ideal fit for beginning trading with the fewest possible hassles.

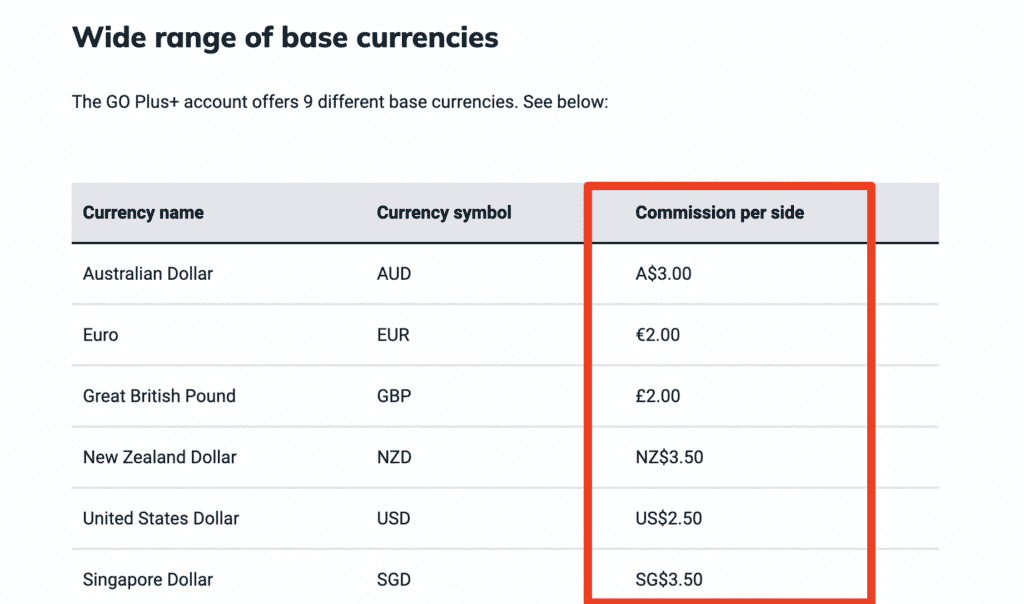

However, the GO Plus Account is an option for experienced traders or those whose trading strategy requires lower spreads that begin at 0.0 pips, which is why the following commissions are applied to this trading account per the base account currency:

➡️ Australian Dollar (AUD) – AU$3.00

➡️ Euro (EUR) – €2.00

➡️ Great British Pound (BP) – £2.00

➡️ New Zealand Dollar (NZD) – NZ$3.50

➡️ United States Dollar (USD) – US$2.50

➡️ Singapore Dollar (SGD) – SG$3.50

➡️ Swiss Franc (CHF) – FR$2.50

➡️ Canadian Dollar (CAD) – CA$3.00

➡️ Hong Kong Dollar (HKD) – HK$20

Overnight Fees, Rollovers, or Swaps

Overnight fees are charged to Botswanan traders who maintain open positions for more than 24 hours. The trader’s stance will determine whether these costs are subtracted from the deal total or repaid (whether long or short).

In addition, the fees are based on the interbank rates, the kind of financial instrument, the size of the position, as well as the length of time that the position is kept. The following are some examples of the overnight costs that Botswanan traders might anticipate paying while using GO Markets:

➡️ EUR/CHF – -0.178 short swap and -0.073 long swap

➡️ EUR/USD – 0.085 short swap and -0.378 long swap

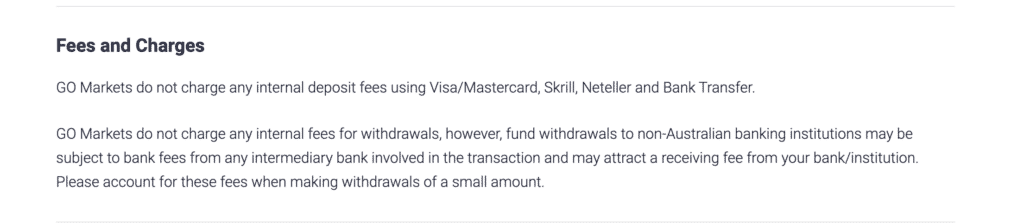

Deposit and Withdrawal Fees

The broker does not impose any fees associated with either deposits or withdrawals. Traders from Botswana should be aware that their payment provider may charge them a processing fee regardless of the method that they choose to make deposits or withdrawals.

Inactivity Fees

When a live trading account has been inactive for a long length of time, they will not apply any fees or penalties to the account holder.

Currency Conversion Fees

The brokers customers from Botswana will be subject to additional costs for currency conversion if they make a deposit or withdrawal in a currency that is different from their base account currency.

Deposits and Withdrawals

Offers the following deposit and withdrawal methods:

➡️ Credit Card

➡️ Debit Card

➡️ POLi

➡️ Skrill

➡️ Neteller

➡️ Bank Wire Transfer

➡️ BPAY

➡️ Fasapay

Broker Comparison: Deposit and Withdrawals

| 🥇 GO Markets | 🥈 eToro | 🥉 RoboForex | |

| Minimum Withdrawal Time | Instant | Instant | Up to 24 hours |

| Maximum Estimated Withdrawal Time | 1 to 3 business days | Up to 10 Working Days | Up to 3 working days |

| Instant Deposits and Instant Withdrawals? | Yes | Yes | Yes, Skrill and Neteller |

Deposit Currencies, Deposit and Withdrawal Depositing Times

| 💳 Payment Method | 💰 Deposit Currencies | 🔁 Deposit Processing | 💳 Withdrawal Processing |

| Credit Card | AUD, USD, GBP, EUR, NZD, SGD, CAD, CHF, HKD | Instant | Instant |

| Debit Card | AUD, USD, GBP, EUR, NZD, SGD, CAD, CHF, HKD | Instant | Instant |

| POLi | AUD | Instant | Instant |

| Skrill | AUD, USD, GBP, EUR, NZD, SGD | Instant | Instant |

| Sticpay | USD | Instant | Instant |

| Neteller | AUD, USD, GBP, EUR, SGD | Instant | Instant |

| Bank Wire Transfer | AUD, USD, GBP, EUR, SGD, NZD, HKD, CAD, CHF | Instant | Instant |

| BPAY | AUD | Instant | Instant |

| Fasapay | USD | Instant | Instant |

What are the trading fees associated with GO Markets?

The broker employs a transparent fee structure primarily based on spreads for forex trading. The spread is the difference between the buying (ask) and selling (bid) prices of a financial instrument.

Are there any non-trading fees on GO Markets, and what should I be aware of?

In addition to trading fees, GO Markets may charge non-trading fees that traders should be aware of. These may include overnight financing fees (swap rates) for positions held overnight, withdrawal fees, and inactivity fees for dormant accounts.

How to Deposit Funds with GO Markets

Step 1: Log into your Go Markets client portal.

Once the registration process is completed, make the minimum deposit by logging into Go Markets Client Portal on the website.

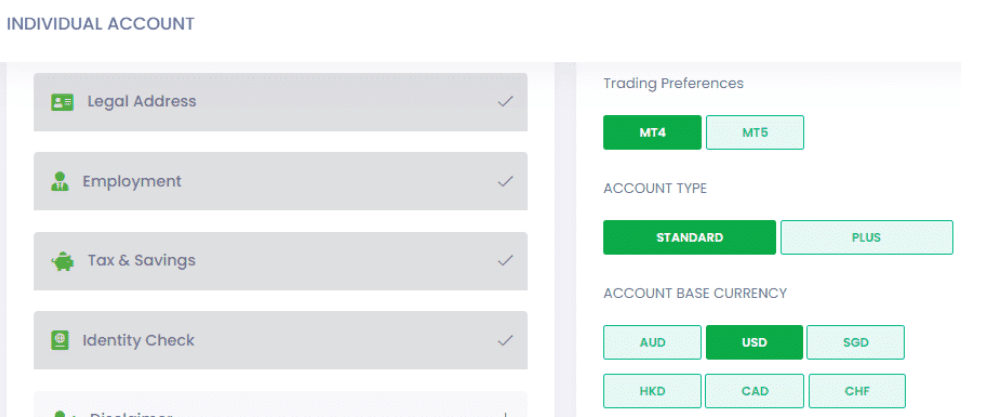

Step 2: Register your individual account details

Once you are redirected to a new page where you will be required to register an individual account by filling in their legal address, employment information, tax and savings, identity check, and trading preferences.

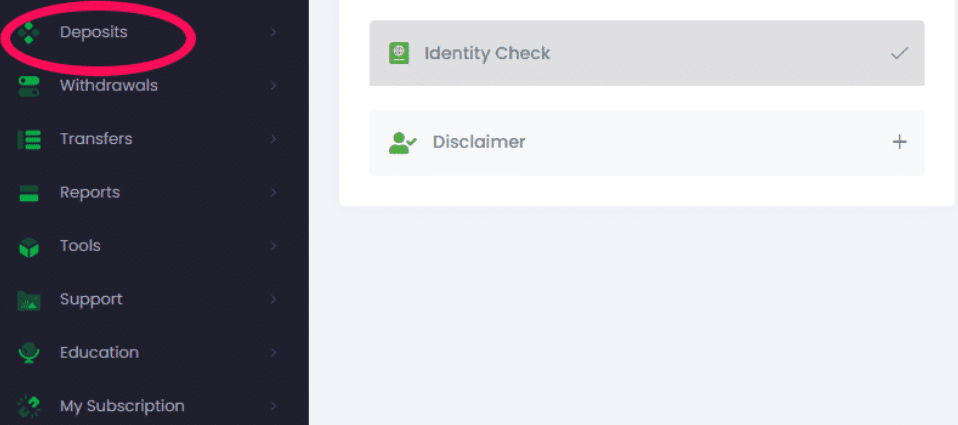

Step 3: Locate Deposits on Go Markets Dashboard.

Once the individual account on the trading platform is complete, access the Deposit option on the Go Markets Dashboard – deposits can be made from here, or they can be made directly into the trading account by making use of the trading platform that the trader chose to use.

GO Markets Fund Withdrawal Process

Step 1: Log into your Go Markets client portal.

Once the registration process is completed, log into the Client Portal and click on “Withdrawal”.

It is quick and easy to withdraw funds from your GO Markets trading account. For your convenience, withdrawal requests are submitted online through the secure Client Portal. You may withdraw funds from your account at any time.

Select your preferred method, enter the amount you wish to withdraw and click the “Confirm” button. We will process your withdrawal request within one to two business days whenever possible. If you encounter any issues, please feel free to contact us.

Education and Research

Education

GO Markets provides its customers with a dedicated education center that features a variety of learning opportunities designed to assist them to increase their trading skills regardless of their existing level of experience.

The GO Markets education program compiles a variety of high-caliber educational materials that are offered at no cost to students. GO Markets offers the following Educational Materials:

➡️ GO Trade Academy and introduction to forex

➡️ Educational courses and webinars

GO Trade Academy

Botswanan traders get free access to high-quality, content-rich education from GO Markets provided by the GO Trade Academy. This education is appropriate for traders of all experience levels and offers education programs and courses that are both rich in material and thorough, catering to both inexperienced and seasoned traders alike.

When it comes to trading Forex and CFDs, GO Markets’ purpose is to contribute to your trading knowledge, improve your trading skills, and build your confidence in your abilities.

The GO Trade Academy makes use of a one-of-a-kind learning management system that keeps track of your progression as you go through the various courses and tests your knowledge at various points to help you retain the information you have acquired.

Every single one of the courses comes with supplementary support in the form of access to simulated trading platforms, help with accounts and platforms, as well as webinar sessions for group coaching.

Educational Courses and Webinars

GO Markets provides educational courses that may assist you in gaining knowledge about trading and advancing through the beginner, intermediate and expert levels of the course curriculum.

The Inner Circle is a group coaching program that is meant to give ongoing weekly education and market reviews to boost your knowledge and confidence while also helping you network with other traders. The goal of the program is to help you become a better trader overall.

You can provide comments and make ideas as you go through the different modules, which might include the subjects that you are interested in learning more about. Another benefit of the educational courses offered is that they can be customized to meet your specific needs.

Research and Trading Tool Comparison

| 🥇 GO Markets | 🥈 eToro | 🥉 RoboForex | |

| ➡️ Economic Calendar | Yes | No | Yes |

| ➡️ VPS | Yes | No | No |

| ➡️ AutoChartist | Yes | No | No |

| ➡️ Trading View | Yes | Yes | No |

| ➡️ Trading Central | No | No | No |

| ➡️ Market Analysis | Yes | Yes | Yes |

| ➡️ News Feed | Yes | Yes | Yes |

| ➡️ Blog | Yes | Yes | Yes |

Offers Botswana Traders the following Research and Trading Tools:

➡️ AutoChartist

➡️ MT4 and 5 Genesis

➡️ VPS

➡️ a-Quant

➡️ Social Trading through MyFXBook

➡️ Trading Central

➡️ Daily News

➡️ Weekly Summaries

➡️ Articles

➡️ Economic Calendar

AutoChartist

Customer accounts with a minimum account balance of 6,100 BWP or an equivalent to $500 at GO Markets are eligible for the AutoChartist trading program, which gives real-time trading alerts, price movement signals as well as volatilities and events. It is one of the most widely used charting applications for MT4 and MT5.

The following are a few of AutoChartist’s most notable features:

➡️ Auto-scan a variety of financial assets to detect commonalities or differences.

➡️ Analysis of charts for patterns is a time-consuming and difficult task.

➡️ Any time patterns are detected, whether developing or already complete, send out automated audio and visual notifications.

➡️ Analyse several periods of market data in real-time.

MT4 and 5 Genesis

After ten years of supplying customers with MetaTrader, GO Markets recognized a group of essential add-ons that may aid traders in making trades, managing risk, and locating chances for trading. This resulted in the development of the MetaTrader Genesis platform.

The MT4 and MT5 trading platforms now have access to a more sophisticated add-on called MetaTrader Genesis. It is a complete and well-crafted set of trading tools that, when used in the form of expert advisors, have the potential to boost the functionality of your conventional MetaTrader platform.

VPS

The broker provides customers with a virtual private server (VPS) that allows them to use the MT4 and MT5 platforms remotely around the clock without the requirement for their own computer to be turned on. Botswanan traders who have a slow internet connection and those who need to run expert advisers around the clock may benefit from this feature the most.

With GO Markets’ VPS, you will have direct access to market liquidity if you use the GO Markets VPS solution since it is physically situated near the area where the bulk of transactions take place.

If you have a minimum monthly trading volume equivalent to about 5 round turn lots, you are eligible to apply for a complimentary membership to a VPS. However, if the required monthly volume is not achieved, a service fee, beginning with $10, will be applied.

a-Quant

Innovators at a-Quant have created innovative trading tools with their combined expertise of over 25 years in the financial technology industry. Using machine learning, artificial intelligence algorithms, sentiment analysis, and technical analysis, they have created a unique signal service.

Social Trading through MyFXBook

Myfxbook is home to one of the most robust and active online trading communities. Clients of GO Markets who maintain a balance of at least 12,200 BWP or an equivalent to $1,000 in their accounts are eligible to use the AutoTrade feature offered by Myfxbook.

AutoTrade is a copy trading service that duplicates other people’s transactions straight into your account. This service is popular all around the globe.

You can see and choose among thousands of trading accounts that have already been pre-approved, each of which comes with a comprehensive set of data and analysis to guarantee that they meet your standards.

It is very important to emphasize that one’s prior success in no way, shape, or form may be used to predict future results.

Trading Central

Your whole trading experience can be improved with the help of the pattern recognition software that is provided to you by GO Markets because of their partnership with Trading Central.

Trading Central is a suite of products that are completely compatible with MetaTrader 4 as well as MetaTrader 5. They provide round-the-clock coverage of several assets, in-depth technical and fundamental research, and trading systems that have been historically proven.

Daily News

GO Markets’ website has a section that is solely devoted to covering the most recent market news. Expert analysis is used to routinely update it, and it provides coverage of many markets along with extensive analysis of each.

Weekly Summaries

The weekly summaries that are offered by GO Markets provide weekly insights into certain financial events from around the world that could affect the trading activities of Botswanan traders.

Articles

The GO Markets website dedicates a specific section to frequent articles that cover what happens in the financial sector around the world. These articles indicate occurrences that could affect financial markets, making it a valuable tool for Botswanan traders who carry out fundamental analysis.

Economic Calendar

The most recent economic data releases are shown on the GO Markets economic calendar, along with the date and hour of the release, the nation it originated from, an effect rating, and the actual, anticipated, and prior outcomes.

Your preferences can be used to filter the information on the calendar, which is a crucial tool to employ as part of fundamental analysis.

Margin Call Podcast

There is a new audio series, Margin Call, that provides you with an inside look at the Forex and CFD sector. The GO Markets team talks to the people who keep the program running, with Jordan Michaelides serving as a guest presenter for this show, which is produced by the Neuralle Media team.

Botswanan traders who are interested in this podcast can find it on:

➡️ Google Podcasts

➡️ Spotify

➡️ PCA

➡️ Podbean

➡️ Overcast FM

What educational resources does GO Markets offer to traders?

The broker is committed to supporting the educational needs of traders. The platform provides a range of educational resources, including webinars, video tutorials, and informative articles. These materials cover various topics, from basic trading concepts to advanced strategies, catering to traders of different experience levels.

What research tools are available on GO Markets to assist traders in making informed decisions?

The broker equips traders with a variety of research tools designed to facilitate informed decision-making. The platform offers daily market analysis, economic calendars, and expert commentary to keep traders updated on market trends and events.

Bonuses and Promotions

The broker does not currently offer any bonuses or promotions to Botswanan traders.

Affiliate Program Features

Trading services are available in a variety of countries, with GO Markets Pty Ltd, its connected businesses and subsidiaries constituting the GO Markets Group (GO Markets) having licenses and satisfying requirements in those jurisdictions.

Some of the features of the Affiliate Program include:

➡️ A well-regulated and trusted trading environment

➡️ On-going market-leading commissions

➡️ Excellent support

➡️ Marketing materials that include banners, links, widgets, and more

The commission tiers as per the GO Markets Affiliate Guideline are as follows:

| ✔️ Tiers | 💰 Initial Qualification | 💵 Secondary Qualification | 💸 Total |

| Tier 1 | $400 | 300 | $700 |

| Tier 2 | $275 | 300 | $575 |

| Tier 3 | $150 | 300 | $450 |

How does the GO Markets Affiliate Program work, and what are its key features?

The Affiliate Program is designed to provide partners with a straightforward and rewarding way to earn commissions. Affiliates can refer clients to GO Markets through unique tracking links, and they earn commissions based on the trading activity of the referred clients.

What support and resources are available to affiliates within the GO Markets program?

The broker is committed to the success of its affiliates and provides a range of support and resources. Affiliates have access to a dedicated affiliate manager who can assist with any queries and provide guidance on optimizing performance.

Customer Support

The broker offers dedicated customer support to all traders, with customer service hours matching with those of the FX market, allowing Botswanan traders to contact support 24 hours a day, five days a week.

| Customer Support | GO Markets’ Customer Support |

| ⏰ Operating Hours | 24/5 |

| 🗣 Support Languages | English, Vietnamese, Indonesian, Arabic, Thai, Portuguese, Chinese, Spanish |

| 🗯 Live Chat | Yes |

| 📧 Email Address | Yes |

| ☎️ Telephonic Support | Yes |

| 📞 Local Support in Botswana? | No |

| 🥇 Overall quality of GO Markets Support | 4/5 |

Corporate Social Responsibility

The broker does not currently indicate any information on its Corporate Social Responsibility (CSR) initiatives or projects.

Our Verdict

With several advantages and an impressive number of awards from industry publications and traders worldwide, GO Markets is an ideal choice for anybody looking for a straightforward trading platform.

Go Markets has a wide variety of trading instruments, as well as some of the best costs in the CFD and Forex industry. The no-commission trading account and the availability of an Account Manager make it an excellent choice for those just starting in the trading world.

Tutorials for the MetaTrader 4 platform are available, even though it is meant for expert traders. Desktop trading platforms and a variety of account types with commission-free and commission-based trading options will appeal to more experienced traders.

Pros and Cons

| ✔️ PROS | ❌ CONS |

| GO Markets is a multi-regulated and multi-asset CFD and Forex broker that has a high trust score | There is a high minimum deposit requirement on both accounts |

| Both MetaTrader 4 and 5 are offered to Botswanan traders | There are only two trading accounts offered and no Islamic account option |

| There are tight spreads offered on the GO+ Account, making it ideal for scalpers and other high-frequency traders | There are no BWP-denominated trading accounts offered |

| Advanced traders are given access to a range of useful tools such as Trading Central, Myfxbook, AutoChartist, a-Quant, and more | |

| There is a demo account provided | |

| There is a choice between deposit and withdrawal options, with no fees charged on either | |

| Beginner Botswanan traders are given access to a range of educational materials |

You might also like: Axiory Review

You might also like: eToro Review

You might also like: Exness Review

You might also like: FBS Review

You might also like: FOREX.com Review

Conclusion

Now it is your turn to participate:

➡️ Do you have any prior experience with GO Markets?

➡️ What was the determining factor in your decision to engage with GO Markets?

➡️ Was it because of the minimum deposit, regulation, retail trading accounts, or any other factors?

➡️ Have you experienced any issues with GO Markets such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

Regardless, please share your thoughts in the comments below.

Frequently Asked Questions

Is GO Markets regulated?

Yes, GO Markets is well-regulated in Australia, Cyprus, Mauritius, and Seychelles by respective market regulators including ASIC, CySEC, FSC, and FSA.

What is the minimum deposit for GO Markets?

The minimum deposit for GO Markets is 1,600 Botswanan Pula or an equivalent to 200 Australian dollars, depending on the current exchange rate between BWP and AUD.

What is the withdrawal time with GO Markets?

The withdrawal time with GO Markets ranges from instant withdrawals on bank cards and electronic payments, and up to 3 days on bank wire transfers.

Does GO Markets have negative balance protection?

Yes, GO Markets applies negative balance protection to retail trading accounts.

In live market conditions, Botswanan traders can lose more than their account balance, especially if the market moves swiftly or gaps. This can be prevented by negative balance protection, and under regulations, as a trader, you have a right to protect yourself from negative balances.

Is GO Markets safe or a scam?

Based on GO Markets’ regulatory status it is a safe and reputable broker.

Does GO Markets have Nasdaq?

Yes, GO Markets offers Nasdaq as part of its extensive portfolio of Index CFDs that can be traded.

Does GO Markets have Volatility 75?

No, GO Markets does not currently offer Volatility 75 (VIX) to Botswanan traders.

Is GO Markets a Market Maker broker?

No, GO Markets is not a Market Maker broker but an ECN and STP broker that operates a No-Dealing Desk (NDD) model. GO Markets offers variable spreads and sends the orders of its clients to reputable liquidity providers where these orders are filled at the best pricing.

Does GO Markets have an Islamic Account?

No, GO Markets does not currently offer an Islamic Account or Islamic trading conditions to Muslim traders in Botswana.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review