IC Markets Review

Overall, IC Markets is very competitive in terms of its trading fees and spreads. IC Markets is regulated by one Tier-1 (High-Trust), one Tier-2 (Medium-Trust) and four Tier-3 (Low-Trust) regulators. IC Markets offers three retail investor accounts as well as a demo and Islamic Account. IC Markets has a Trust Score of 86% out of 100. IC Markets is currently not regulated by the MFED, BoB, or NBFIRA of Botswana

- Louis Schoeman

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Overview

Overall, IC Markets is considered low-risk, with an overall Trust Score of 86 out of 100. IC Markets is licensed by one Tier-1 Regulators (high trust), one Tier-2 Regulator (average trust), and two Tier-3 Regulators (low trust). IC Markets offers three different retail trading accounts namely a cTrader Account, Raw Spread Account, and Standard Account.

IC Markets accepts Botswanan clients and has an average spread from 0.0 pips with $6 or $7 commission round turn. IC Markets has a maximum leverage ratio up to 1:500 and there is a demo and Islamic account available. MT4, MT5, and cTrader platforms are supported. IC Markets is headquartered in Australia and is regulated by ASIC, CySEC, FSA, and SCB.

In 2007, a group of financial industry experts based in Sydney, Australia established IC Markets to provide trading solutions to both retail and institutional clients. IC Markets achieves this by bridging the gap between the two types of customers.

In recent years, IC Markets has grown to become one of the major trading providers in Australia. Additionally, they have expanded beyond as they now service international and European entities, as well as established a Chinese Support Center and present truly competitive trading terms.

IC Markets is the largest true electronic communication network (ECN) trading broker in the world. The company gives its customers access to the most popular trading platforms and a wide variety of trading goods that can be used to trade in a variety of markets.

In addition to providing you with access to trade with low spreads beginning at 0.0 pips, IC Markets also provides you with access to deep liquidity from a wide selection of liquidity providers. This ensures that you are always able to achieve quick transaction execution speeds at the best prices that are currently accessible.

This IC Markets review for Botswana will provide local retail traders with the details that they need to consider whether IC Markets is suited to their unique trading objectives and needs.

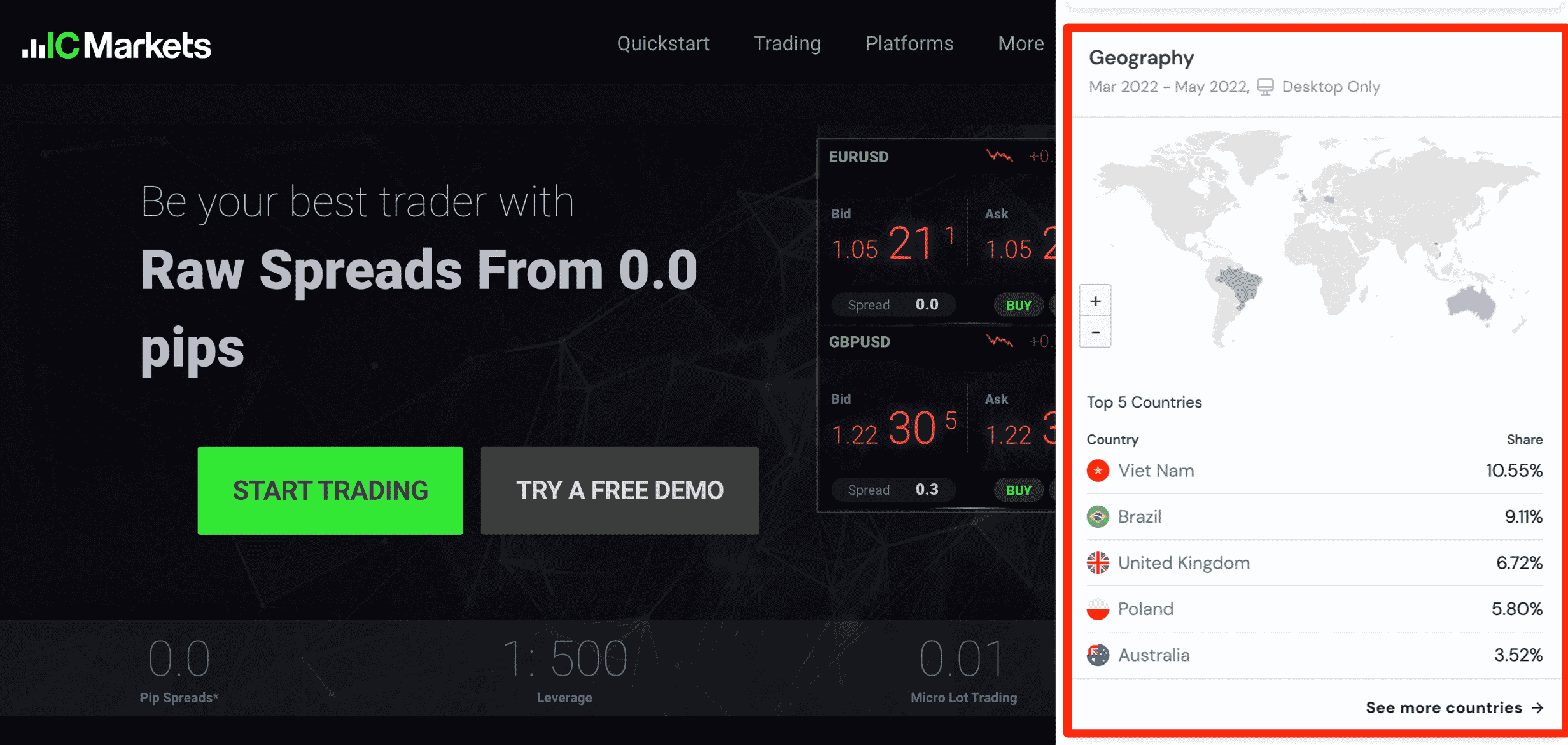

Distribution of Traders

Currently has the largest market share in these countries:

➡️ Vietnam – 11.7%

➡️ Brazil – 8.9%

➡️ United Kingdom – 6.5%

➡️ Poland – 5.6%

➡️ Australia – 3.9%

Popularity among traders

IC Markets is a broker that has its operations based in Australia, with a <5% market share in the Botswanan derivatives market. Subsequently, IC Markets holds a position in the top 40 brokers available to traders in Botswana.

IC Markets At a Glance

| 🏛 Headquartered | Sydney, Australia |

| 🌎 Global Offices | Australia |

| 🏛 Local Market Regulators in Botswana | • Ministry of Finance and Economic Development (MFED) • Bank of Botswana (BoB) • Non-Bank Financial Institutions Regulatory Authority (NBFIRA) |

| 💳 Foreign Direct Investment in Botswana | 115.89 BWP Million in 2021 |

| 💰 Foreign Exchange Reserves in Botswana | 5270 USD Million in 2021 |

| ✔️ Local office in Gaborone? | No |

| 👨⚖️ Governor of SEC in Botswana | None, Moses Dinekere Pelaelo is the Governor of the Bank of Botswana |

| ✔️ Accepts Botswana Traders? | Yes |

| 📊 Year Founded | 2007 |

| 📞 Botswana Office Contact Number | None |

| 📱 Social Media Platforms | • Facebook |

| ⚖️ Regulation | ASIC, CySEC, FSA, SCB |

| 1️⃣ Tier-1 Licenses | • Australian Securities and Investments Commission (ASIC) |

| 2️⃣ Tier-2 Licenses | • Cyprus Securities and Exchange Commission (CySEC) |

| 3️⃣ Tier-3 Licenses | • Financial Services Authority (FSA) • Securities Commission of the Bahamas (SCB) |

| 🪪 License Number | • Seychelles – SD018 • Australia – AFSL 335692 • Cyprus – 362/18 • Bahamas – SIA-F214 |

| ⚖️ MFED, BoB, or NBFIRA Regulation | No |

| ✔️ Regional Restrictions | United States, Canada, Iran, Yemen, and OFAC countries |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 3 |

| ✔️ PAMM Accounts | MAM Accounts |

| 💻 Liquidity Providers | 25 |

| ✔️ Affiliate Program | Yes |

| 📱 Order Execution | Market |

| 📊 Starting spread | 0.0 pips |

| 📉 Minimum Commission per Trade | From $3 to $3.5 |

| 💰 Decimal Pricing | 5th decimal pricing after the comma |

| 📞 Margin Call | 100% |

| 🛑 Stop-Out | 50% |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | Unlimited |

| ✅ Crypto trading offered? | Yes |

| ✔️ Offers a BWP Account? | No |

| 📉 Dedicated Botswana Account Manager? | No |

| 📈 Maximum Leverage | 1:500 |

| 📊 Leverage Restrictions for Botswana? | No |

| 💳 Minimum Deposit (BWP) | 3850 Botswanan Pula or an equivalent to $200 |

| ✔️ Botswana Pula Deposits Allowed? | No |

| 📊 Active Botswana Trader Stats | 250,000+ |

| 👥 Active Botswana-based IC Markets customers | Unknown |

| 🔁 Botswana Daily Forex Turnover | Unknown, Forex overall is $6.6 Trillion |

| 💰 Deposit and Withdrawal Options | • Credit Card • Debit Card • PayPal • Neteller • Neteller VIP • Skrill • UnionPay • Bank Wire Transfer • Bpay • FasaPay • Broker to Broker • POLi • Thai Internet Banking • Vietnamese Internet • Banking • Rapidpay • Klarna |

| 💻 Minimum Withdrawal Time | Instant |

| ⏰ Maximum Estimated Withdrawal Time | Up to 14 business days |

| 💳 Instant Deposits and Instant Withdrawals? | Yes, on PayPal, Neteller, and Skrill |

| 🏛 Segregated Accounts with Botswana Banks? | No |

| 📱 Trading Platforms | • MetaTrader 4 • MetaTrader 5 • cTrader |

| 💻 Tradable Assets | • Forex • Commodities • Indices • Bonds • Cryptocurrencies • Stocks • Futures |

| ✔️ Offers USD/BWP currency pair? | No |

| 📊 USD/BWP Average Spread | N/A |

| ✅ Offers Botswana Stocks and CFDs | No |

| 💻 Languages supported on the Website | English, Spanish, Russian, Thai, Malay, Vietnamese, Italian, Portuguese, and several others |

| ☎️ Customer Support Languages | Multilingual |

| 👥 Copy Trading Support | Yes |

| ⏰ Customer Service Hours | 24/7 |

| 📞 Botswana-based customer support? | No |

| 💸 Bonuses and Promotions for Botswanans? | No |

| 📚 Education for Botswanan beginner traders | Yes |

| 📱 Proprietary trading software | No |

| 🤝 Most Successful Trader in Botswana | Unknown |

| ✔️ Is IC Markets a safe broker for Botswana Traders? | Yes |

| 🎖 Rating for IC Markets Botswana | 9/10 |

| 🥇 Trust score for IC Markets Botswana | 86% |

| 👉 Open Account | 👉 Open Account |

Regulation and Safety of Funds

Regulation in Botswana

IC Markets has regulations from around the world but not that of Botswanan regulators. However, IC Markets is still a trusted option for Botswanan traders.

Global Regulations

IC Markets is a worldwide provider of CFDs and operates offices in several different jurisdictions to better serve your requirements. When you sign up for an account, you will be given the option to select which company you would want to have your trading account held with.

The primary distinctions between the broker organizations are who regulates them and the kinds of financial instruments to which their clients have access. Your decision will be influenced by whatever factors are most important to you, whether that be leverage, regulation, or the instruments that are accessible.

You need to assess the necessity of regulation against the freedom to trade whenever you see fit because some authorities place restrictions on the services that brokers can provide for their clients.

In terms of IC Markets, the following market regulators oversee and authorize the broker to operate globally:

➡️ Tier-1 – The Australian Securities and Investments Commission (ASIC).

➡️ Tier-2 – The Cyprus Securities and Exchange Commission (CySEC).

➡️ Tier-3 – The Seychelles Financial Services Authority (FSA).

➡️ Tier-3 – The Securities Commission of The Bahamas (SCB).

Client Fund Security and Safety Features

Because of stringent regulations, you should be able to have the confidence that the broker you are working with is trustworthy, reputable, and transparent. In terms of IC Markets, the broker is among the most regulated brokers that are now available.

IC Markets is required to comply with stringent financial criteria because it is an entity that is regulated by ASIC, which means that the regulator guidelines include capital adequacy and audit requirements.

In compliance with the regulations governing the handling of client money in Australia, client funds are kept in separate bank accounts in Australia.

Because of this, customer payments are kept in a separate account from the finances of the company and therefore cannot be utilized for any other reason. They additionally employ independent external auditors to ensure that all regulatory requirements are met.

The broker welcomes customers from all over the world, apart from some nations on the OFAC list as well as the United States of America, Canada, Israel, New Zealand, Japan, and Iran. Because of US CTFC legislation, US customers are unable to trade with brokers located in other countries.

Is IC Markets regulated, and how does it ensure the safety of client funds?

The broker is a globally recognized and regulated Forex broker. It operates under strict regulatory oversight from multiple financial authorities, including the Australian Securities and Investments Commission (ASIC) and the Seychelles Financial Services Authority (FSA).

What steps can I take to verify the safety of my funds with them?

Ensuring the safety of your funds with IC Markets is a top priority. To verify the safety of your funds, you can start by checking the broker’s regulatory status on their official website.

Awards and Recognition

Over the years, the broker has received various industry awards, including Best Forex MT5 Broker 2020 (FX Scouts) for its exceptional execution speeds and trading flexibility on the MT5 platform, further enhancing its reputation as a reputable broker.

What awards and recognition has IC Markets received in the financial industry?

They have earned numerous awards and recognitions in the financial industry, highlighting its commitment to excellence and client satisfaction. These awards often include recognition for Best Forex Broker, Best CFD Broker, and Best Trading Conditions from prestigious organizations and publications. IC Markets has been acknowledged for its trading platforms, customer service, and competitive pricing.

Do these awards and recognitions indicate the quality of there services?

Yes, the awards and recognitions received by IC Markets are indicative of the high quality of services the broker provides.

Account Types and Features

IC Markets provides retail investors with the option to choose from three various accounts, each of which comes with a distinctive set of features and trading conditions that are tailored to a specific type of trader.

➡️ cTrader Account

➡️ Raw Spread Account

➡️ Standard Account

| 💻 Live Account | 📉 Minimum Dep. | 📊 Average Spread | 💰 Commissions | 💸 Average Trading Cost |

| ➡️ cTrader | 3850 BWP/$200 | 0.0 pips | $3 or $6 per side | 6.02 USD |

| ➡️ Raw Spread | 3850 BWP/$200 | 0.0 pips | $3.5 or $7 per side | 7.02 USD |

| ➡️ Standard | 3850 BWP/$200 | 0.6 pips | None | 6.30 USD |

Live Trading Accounts

cTrader Account

cTrader is a major trading platform that was developed to cater to CFD trading. It offers traders a variety of advanced trading tools, charting options, and more.

cTrader was developed to cater to CFD trading and Botswanan traders who use this account can take advantage of the following unique features:

| Account Feature | Value |

| ✔️ Full Account Verification Needed? | No, not for account deposits under 100,000 BWP or an equivalent to $9,000 |

| 📊 Average Spreads | Variable, from 1 pip |

| 💸 Commissions (Per 1 mil traded) | None |

| 📈 Maximum Leverage | 1:200 |

| 📉 Minimum lot size | 0.01 lots |

| 🔨 Instruments | 81 |

| 🛑 Stop-Out (%) | 50% |

| 📱 One-Click Trading offered? | Yes |

| ✅ Strategies allowed | All |

| 💰 Base Account Currency | USD, EUR, HKD, SGD |

Raw Spread Account

The Raw Spread Account features the industry’s most competitive spreads and only levies a little commission cost on trades. Additionally, this account is well-known for its extensive liquidity as well as its consistent execution speeds.

Botswanan day traders, expert adviser traders, high-frequency traders, and scalpers will find that this account meets their needs.

| Account Feature | Value |

| 💻 Trading Platform | MetaTrader 4 and 5 |

| 💳 Commissions | $3.5 per side and $7 per round turn |

| 📊 Average Spreads | 0.0 pips |

| 📉 Minimum Deposit Requirement | 2,400 Botswanan Pula equivalent to $200 |

| 📊 Leverage | 1:500 |

| 📈 Maximum positions per account | 200 lots |

| 📍 Server Location | New York |

| ➡️ Micro trading allowed? | Yes |

| 📈 Currency Pairs | 64 |

| 📉 Index CFD Trading | Yes |

| 🛑 Stop-Out (%) | 50% |

| 📱 One-Click Trading offered? | Yes |

| ☪️ Islamic Accounts | Yes |

| ✔️ Trading Styles accepted | Scalping, hedging, expert advisors, algorithmic strategies, etc. |

| 💻 Programming Language | MQL4 |

| ✅ Suitable for | Expert advisers, scalpers |

| ✔️ Demo Account offered? | Yes |

Standard Account

High execution speeds, all-inclusive spreads, and the absence of commissions are available to traders with an IC Markets Standard Account. This account typically caters to most Botswanan traders despite their trading needs or objectives.

| Account Feature | Value |

| 💻 Trading Platform | MetaTrader 4 and 5 |

| 💳 Commissions | None |

| 📊 Average Spreads | 0.6 pips |

| 📉 Minimum Deposit Requirement | 2,400 Botswanan Pula equivalent to $200 |

| 📊 Leverage | 1:500 |

| 📈 Maximum positions per account | 200 lots |

| 📍 Server Location | New York |

| ➡️ Micro trading allowed? | Yes |

| 📈 Currency Pairs | 64 |

| 📉 Index CFD Trading | Yes |

| 🛑 Stop-Out (%) | 50% |

| 📱 One-Click Trading offered? | Yes |

| ☪️ Islamic Accounts | Yes |

| ✔️ Trading Styles accepted | Scalping, hedging, expert advisors, algorithmic strategies, etc. |

| 💻 Programming Language | MQL4 |

| ✅ Suitable for | Discretionary Traders |

| ✔️ Demo Account offered? | Yes |

Base Account Currencies

IC Markets provides Botswanan traders with these options for the base currency of a trading account:

➡️ EUR

➡️ USD

➡️ GBP

➡️ AUD

➡️ SGD

➡️ NZD

➡️ JPY

➡️ CHF

➡️ HKD

➡️ CAD

Demo Account

A demo account is a practice account that offers traders a certain amount of virtual funds that they can use, allowing them to enter the live market without risking their capital.

A certain degree of risk is involved when trading financial markets. IC Markets offers its clients a risk-free platform where they can test strategies, practice trading, and explore what the broker offers in a safe trading environment with real market conditions.

Traders have access to an unlimited and free demo account through IC Markets. You can create as many different demo accounts as you like within the trader’s dashboard of the IC Markets site.

Botswanan traders are strongly encouraged to utilize it before beginning to trade with real money since it provides a 1:1 simulation of the experience of trading with real money. In addition, the demo account is the most effective tool for gaining familiarity with new trading tactics and market environments.

IC Markets also allows Botswanans to register a demo account on either MetaTrader 4, MetaTrader 5, or cTrader.

Islamic Account

Depending on the trading style and the trading strategy of the forex trader, they may keep their trading positions open for longer than 24 hours on a trading day.

This means that Botswanan traders could be subject to an overnight or rollover fee. This is a type of interest that is prohibited by Riba principles of Sharia law, which means that Muslim traders are often restricted in forex trading.

If you are a CFD and forex trader who adheres to Sharia Law, IC Markets offers an Islamic Account with cTrader, Raw or Standard pricing and no interest-based swap rates.

While CFD and forex trades held open for more than one day pay or receive a swap rate (also known as an overnight financing fee) generated from interest rates, Islamic accounts conform with Islamic finance standards by paying flat-rate admin fees instead of swap rates.

What types of trading accounts does IC Markets offer, and what are their key features?

IC Markets offers a range of trading account types to cater to diverse trading preferences. These include the Standard Account, Raw Spread Account, and cTrader Account, each with distinct features.

Can I change my trading account type after opening it?

Yes, the broker allows traders to change their account type if they wish to do so. The process involves contacting the broker’s customer support or account management team to request the change.

How to open an account with IC Markets in Botswana

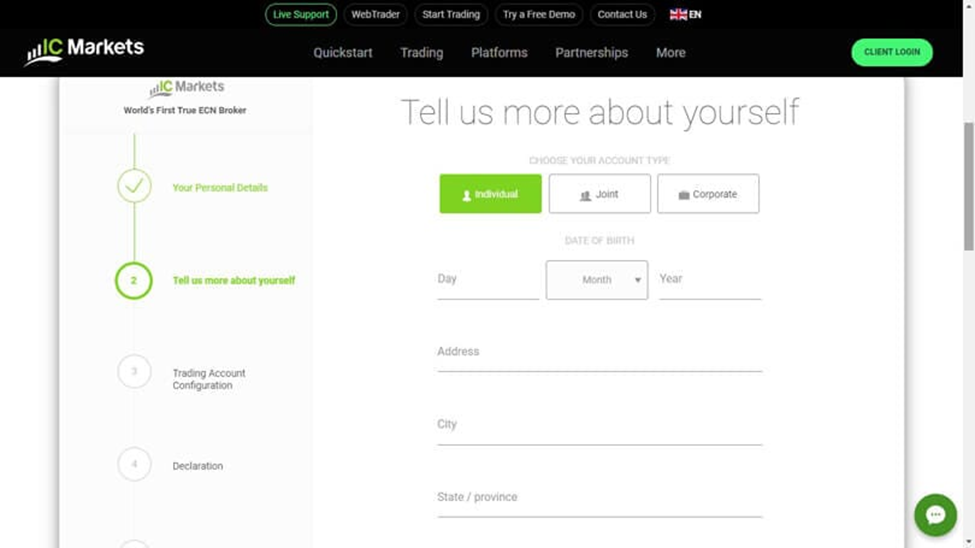

To register an account with IC Markets, Botswana Traders can follow these steps:

In this ICMarkets Account Opening Guide, we’ll look at the important steps involved in opening an account and identifying what to expect. To open a standard account, you’ll need to have at least one form of a photo ID and a document verifying Proof of Residence. Your documents must contain your full name and date of birth. You may open an IC Markets demo account at first and after that, you can also create an IC Markets live account for live trading.

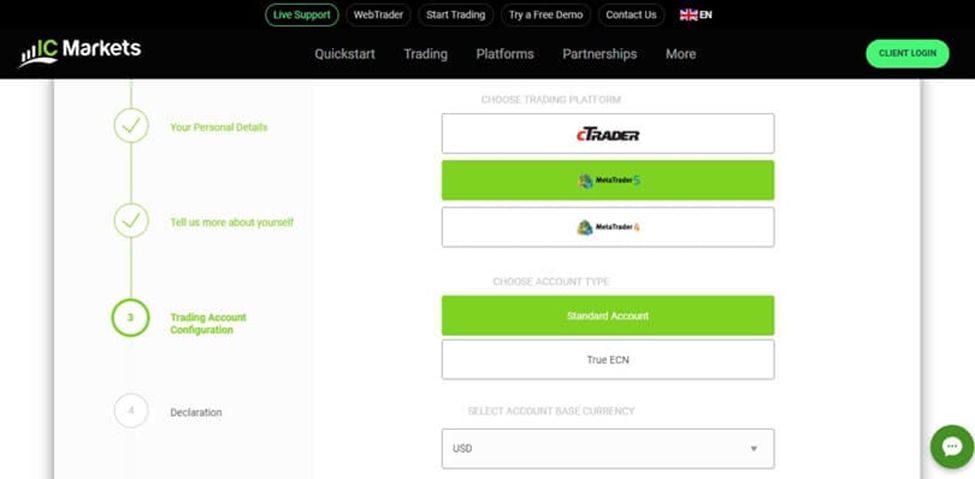

Step.1 Select a user account

Make sure you have chosen the appropriate type of brokerage account for you before providing any of your personal information.

Step.2 Include personal data

The next step is to complete the questionnaire for basic information. You will be required to give information such as your name, birthdate, residence, nationality, place of employment, and other details. The broker you selected will determine how difficult this stage will be. Along with answering security questions to confirm that you have the proper authorization to trade, you will also be asked about your trading history.

Step.3 Add money to your account

You can start trading as soon as your account has been verified and opened. Transfer the required amount to your broker account, or any amount if none is required, and then start trading.

IC Markets Vs HF Markets Vs FP Markets – Broker Comparison

| 🥇 IC Markets | 🥈 HF Markets | 🥉 FP Markets | |

| ⚖️ Regulation | ASIC, CySEC, FSA, SCB | FSCA, CySEC, DFSA, FSA, FCA, FSC, and CMA with registration in ACPR, BaFin, MNB, CONSOB, CNMV, FI, FMA, FSC, and other regions | ASIC, CySEC |

| 📱 Trading Platform | • MetaTrader 4 • MetaTrader 5 • cTrader | • MetaTrader 4 • MetaTrader 5 • HF App | • MetaTrader 4 • MetaTrader 5 • Myfxbook AutoTrade • FP Markets App |

| 💰 Withdrawal Fee | No | No | Yes |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 3850 BWP / $ 200 | 0 BWP / $ 0 | 1925 BWP / $ 100 |

| 📊 Leverage | 1:500 | 1:1000 | 1:500 |

| 📊 Spread | From 0.0 pips | 0.0 pips | 0.0 pips |

| 💰 Commissions | From $3 to $3.5 | $3 to $4 | From US$3 |

| ✴️ Margin Call/Stop-Out | 100%/50% | • 40%/10% • 50%/20% | 100%/50% |

| 💻 Order Execution | Market | Market | Market |

| 💳 No-Deposit Bonus | No | No | No |

| 📊 Cent Accounts | No | No | No |

| 📈 Account Types | cTrader Account Raw Spread Account Standard Account | CENT Account ZERO Account PREMIUM Account PRO Account | MT4/5 Standard Account MT4/5 Raw Account MT4/5 Islamic Standard Account Islamic Raw Account |

| ⚖️ CBN Regulation | No | No | No |

| 💳 BWP Deposits | No | No | No |

| 📊 Botswana Pula Account | No | No | No |

| 👥 Customer Service Hours | 24/7 | 24/5 | 24/7 |

| 📊 Retail Investor Accounts | 3 | 4 | 4 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 📉 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | Unlimited | 60 lots | 50 lots |

| 💰 Minimum Withdrawal Time | Instant | 10 Minutes | Instant |

| 📊 Maximum Estimated Withdrawal Time | Up to 14 business days | 10 business days | Up to 5 working days |

| 💸 Instant Deposits and Instant Withdrawals? | Yes, on PayPal, Neteller, and Skrill | No | Yes, Sticpay wallet withdrawals |

Trading Platforms

Clients of the broker have unrestricted access to MetaTrader 4, MetaTrader 5, and cTrader. These three trading platforms are currently the most well-known and easiest to use on the market. The True ECN trading mechanism is available at no additional cost to all traders on all platforms.

Desktop Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ cTrader

MetaTrader 4

Because of its ease of use, feature-rich environment, and automated trading capability, MetaTrader 4 (MT4) is the world’s most popular trading platform for forex traders. The MT4 trading platform has evolved into a global community where technology vendors may cater to the needs of all sorts of traders.

IC Markets intends to make available to Botswana traders the most recent version of the MetaTrader 4 platform, which was created expressly to aid Botswana traders in sharpening their trading strategies.

Among the features are MT4 platform are:

➡️ 50+ technical indicators that are preinstalled

➡️ 24 charting tools for analysis

➡️ Three kinds of charts

➡️ Nine different timeframes.

➡️ The ability to trade within a single click

➡️ Traders can create their own indicators and Expert Advisors using MetaTrader’s MQL

MetaTrader 5

IC Markets is confident that the newly released MetaTrader 5 trading platform provides Botswanan traders with all they need for profitable market trading. MetaTrader 5’s improved charting technology and order management tools enable traders to monitor and manage their open positions more efficiently.

This enables traders to make better trading judgments. It is a sophisticated trading platform that includes a slew of brand-new features meant to enhance the trading experience.

cTrader

Botswanan traders also have access to cTrader, a complete trading platform that is distinguished by its ability to integrate the most desirable characteristics of both speed and liquidity. It employs tried-and-true technologies that will allow Botswanan traders to take their trading to a whole new level.

Another of cTrader’s many original features is the cIAgo interface and platform. Using the source code editor and the programming language C#, you can generate customized technical indicators that can be used for technical analysis.

WebTrader Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ cTrader

MetaTrader 4 and 5

Millions of traders worldwide use MT4 as their primary trading platform. If traders do not want to download or install any additional software, they can execute it directly from a web browser without downloading or installing anything.

Traders can use MetaTrader 5 as an all-in-one trading platform to access the full array of instruments offered by IC Markets. Furthermore, due to the broker’s raw spreads, MetaTrader 5 has become one of the most powerful trading platforms for aggressive traders via IC Markets.

cTrader

cTrader Web is a program that combines the speed and simplicity of web-based software with the order execution capabilities of cTrader. This program is designed to run in a web browser and may be downloaded for free.

Trading with IC Markets is now easier than it has ever been because of a new trading tool called cTrader Web, which is a web-based trading platform that is straightforward to use.

Trading App

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ cTrader

MetaTrader 4 and 5

The MetaTrader 4 (MT4) and MetaTrader 5 (MT5) mobile trading applications are both available for free download from the Google Play Store and the Apple App Store, respectively. On these trading platforms, several built-in tools may be utilized for chart analysis to identify potential trading opportunities that are dispersed throughout a diverse selection of markets.

cTrader

cTrader is a high-speed trading software that was developed specifically for internet trading in marketplaces all over the world. Botswanan traders who trade on their own time favour it over other platforms since it has an eye-catching design, an interface that is simple to navigate, and an enormous range of sophisticated capabilities.

Using the cTrader mobile app, it is now possible to trade while travelling. If traders have access to the internet, they can log into their trading accounts and handle their open positions regardless of where they are physically located.

What trading platforms are available at IC Markets, and do they support automated trading?

IC Markets provides traders with access to a range of trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the cTrader platform.

Is IC Markets’ trading platform available on mobile devices?

Yes, IC Markets’ trading platforms are fully compatible with mobile devices. Traders can access their accounts and trade on the go using mobile versions of MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms.

Range of Markets

Botswana Traders can expect the following range of markets from IC Markets:

➡️ Forex

➡️ Commodities

➡️ Indices

➡️ Bonds

➡️ Cryptocurrencies

➡️ Stocks

➡️ Futures

Financial Instruments and Leverage offered by IC Markets

| 🔨 Instrument | 💰 Number of Assets Offered | 📈 Max Leverage Offered |

| ➡️ Forex | 64 | 1:500 |

| ➡️ Precious Metals | 22 | 1:100 |

| ➡️ ETFs | 25 | 1:200 |

| ➡️ Stocks | 1,600 | 1:20 |

| ➡️ Cryptocurrency | 18 | 1:5 |

| ➡️ Futures | 4 | 1:200 |

| ➡️ Bonds | 11 | 1:200 |

What financial markets can I trade on with IC Markets?

IC Markets offers a diverse range of financial markets for trading. These include Forex (currencies), which covers major, minor, and exotic currency pairs. Additionally, IC Markets provides access to a wide variety of CFDs (Contracts for Difference), allowing traders to speculate on price movements in indices, commodities, precious metals, energies, and cryptocurrencies.

Can I trade cryptocurrencies with IC Markets, and which cryptocurrencies are available?

Yes, IC Markets offers cryptocurrency trading, allowing traders to access the crypto market.

Broker Comparison for Range of Markets

| 🥇 IC Markets | 🥈 HF Markets | 🥉 FP Markets | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | No | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | Yes | Yes |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | Yes | No |

Trading and Non-Trading Fees

Spreads

IC Markets offers variable spreads, and the charges will differ depending on the type of account that is utilized, the financial instrument that is being traded, and the conditions of the market on the day that the deal is executed. The following is a rundown of the typical spreads that investors can anticipate while trading EUR/USD:

➡️ cTrader Account – 0.0 pips

➡️ Raw Spread Account – 0.0 pips

➡️ Standard Account – 0.6 pips

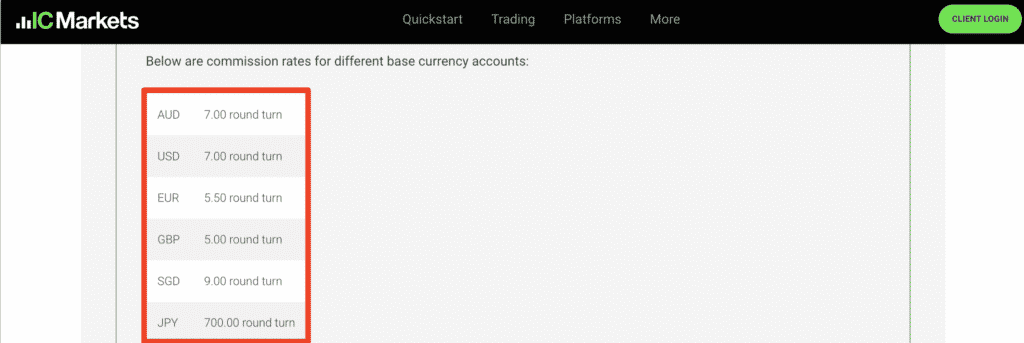

Commissions

To cover the broker’s fee for arranging the trade, IC Markets requires customers with zero-spread accounts to pay commissions. The following is a list of the live trading account commissions that retail traders from Botswana could anticipate from IC Markets:

➡️ cTrader Account – $3 per side and $6 per round turn

➡️ Raw Spread Account – $3.5 per side and $7 per round turn

In addition, to compensate for the absence of overnight costs, IC Markets applies commissions to Islamic accounts. These commissions can range anywhere from $5 to $80 and are deducted from the account balance.

Overnight Fees, Rollovers, or Swaps

In derivatives trading, the interest that is added to or withdrawn from trade to keep it open overnight is referred to as a swap rate or rollover. The variations in the interest rates that apply overnight between two currencies are considered when determining whether a currency pair is long or short.

Traders need to be aware that swaps will be applied to their positions if they hold on to them until the next forex trading day. There is the possibility that certain financial instruments could have swap rates that are negative on both sides of the deal.

The value of a swap is determined in points, and the trading platform will automatically convert those points into the base currency of the account. Some of the usual overnight costs charged by IC Markets are as follows:

➡️ EUR/USD – a long swap of 3.9 and a short swap of 0.75

➡️ GBP/USD – a long swap of -1.82 and a short swap of -3.91

➡️ USD/JPY – a long swap of 1.75 and a short swap of -4.6

➡️ XAU/USD – a long swap of -3.5 and a short swap of -0.8

➡️ XAG/USD – a long swap of -0.98 and a short swap of -0.2

➡️ USTEC – a long swap of -1.12 and a short swap of -1.06

➡️ XBR/USD – a long swap of 7.04 and a short swap of -10.9

➡️ XTI/USD – a long swap of 6.01 and a short swap of -8.82

Deposit and Withdrawal Fees

Neither deposits nor withdrawals are subject to fees at IC Markets. Botswanan traders, on the other hand, could be charged processing fees by their payment providers.

Inactivity Fees

There are no inactivity fees indicated for IC Markets when a live trading account goes dormant after an extended time.

Currency Conversion Fees

Non-trading costs are not charged by IC Markets, but Botswanan traders may incur currency conversion if they deposit in a currency other than AUD, USD, EUR, CAD, GBP, SGD, NZD, JPY, HKD, or CHF. These are the accepted base account currencies, and BWP deposits and withdrawals must be converted at an extra cost.

What are the trading fees associated with IC Markets?

IC Markets employs a transparent fee structure that primarily includes spreads and, in some cases, commissions. The spread is the difference between the buying (ask) and selling (bid) prices of an asset and varies depending on the account type and specific trading instrument. IC Markets offers both Raw Spread accounts with ultra-low spreads and Zero Spread accounts with a commission fee per lot traded.

Are there any non-trading fees that traders should be aware of when using IC Markets?

IC Markets generally does not charge non-trading fees such as account inactivity fees or deposit/withdrawal fees for standard payment methods.

Deposits and Withdrawals

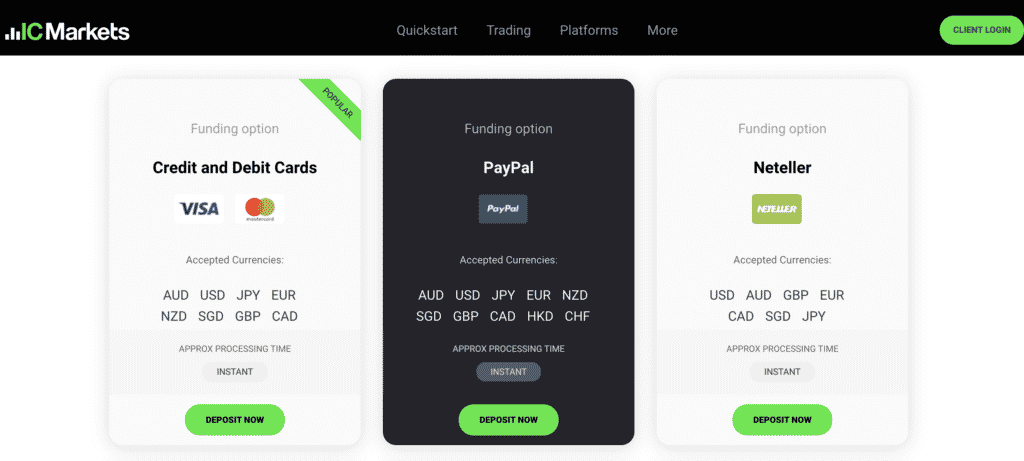

IC Markets offers the following deposit and withdrawal methods:

➡️ Credit Card

➡️ Debit Card

➡️ PayPal

➡️ Neteller

➡️ Neteller VIP

➡️ Skrill

➡️ UnionPay

➡️ Bank Wire Transfer

➡️ Bpay

➡️ FasaPay

➡️ Broker to Broker

➡️ POLi

➡️ Thai Internet Banking

➡️ Vietnamese Internet Banking

➡️ Rapidpay

➡️ Klarna

Broker Comparison: Deposit and Withdrawals

| 🥇 IC Markets | 🥈 HF Markets | 🥉 FP Markets | |

| Minimum Withdrawal Time | Instant | 10 Minutes | Instant |

| Maximum Estimated Withdrawal Time | Up to 14 business days | 10 business days | Up to 5 Days |

| Instant Deposits and Instant Withdrawals? | Yes, on PayPal, Neteller, and Skrill | No | Yes, Sticpay wallet withdrawals |

IC Markets Deposit Currencies, Deposit and Withdrawal Processing Time

| 💳 Payment Method | 💰 Deposit Currencies | 🔁 Deposit Processing | 💳 Withdrawal Processing |

| Credit Card | AUD, USD, JPY, EUR, NZD, SGD, GBP, CAD | Instant | 3 to 5 working days |

| Debit Card | AUD, USD, JPY, EUR, NZD, SGD, GBP, CAD, HKD, CHF | Instant | 3 to 5 working days |

| PayPal | USD, AUD, GBP, EUR, CAD, SGD, JPY | Instant | Instant |

| Neteller | AUD, GBP, EUR, CAD, SGD, JPY | Instant | Instant |

| Neteller VIP | AUD, GBP, EUR, CAD, SGD, JPY | Instant | Instant |

| Skrill | AUD, USD, JPY, EUR, SGD, GBP | Instant | Instant |

| UnionPay | RMB | Instant | Instant |

| Bank Wire Transfer | AUD, USD, JPY, EUR, NZD, SGD, GBP, CAD, CHF | 2 to 5 working days | Up to 14 days |

| Bpay | AUD | 12 to 48 hours | 2 to 3 working days |

| FasaPay | USD | Instant | 3 to 5 working days |

| Broker to Broker | AUD, USD, JPY, EUR, NZD, SGD, GPB, CAD, CHF, HKD | 2 to 5 working days | 3 to 5 working days |

| POLi | AUD | Instant | 2 to 3 working days |

| Thai Internet Banking | USD | 15 to 30 minutes | One business Day |

| Vietnamese Internet Banking | USD | Instant | One Business Day |

| Rapidpay | EUR, GBP | Instant | 3 to 5 working days |

| Klarna | EUR, GBP | Instant | 3 to 5 working days |

How can I make deposits and withdrawals with IC Markets?

IC Markets offers a variety of convenient methods for both depositing and withdrawing funds. Traders can choose from options like bank wire transfers, credit/debit card payments (Visa and MasterCard), and a range of popular e-wallet services, including Neteller, Skrill, and PayPal. Additionally, IC Markets supports local deposit methods in select regions, making it even more convenient for clients to fund their accounts using their preferred payment methods.

Are there any fees associated with deposits and withdrawals at IC Markets?

IC Markets typically does not charge fees for deposits or withdrawals made by its clients using standard payment methods. The broker aims to provide a cost-effective trading environment, and most deposit and withdrawal options are free of charge from their side.

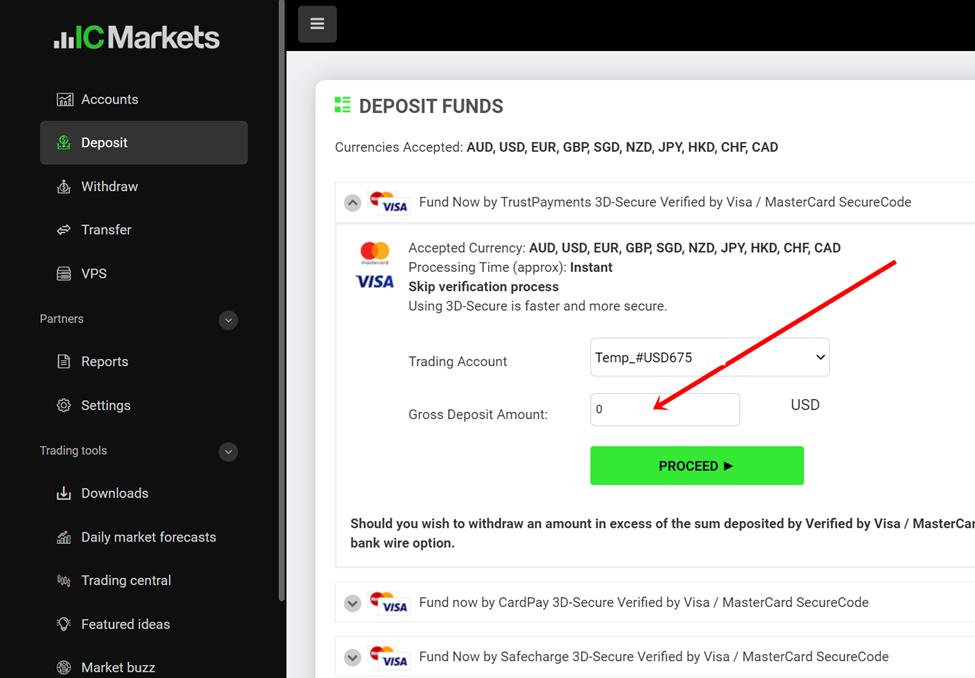

How to Deposit Funds

To deposit funds to an account with IC Markets, Botswana Traders can follow these steps:

Step 1. Make a Deposit

To make a deposit at ICMarkets, we must go to the menu where it says Transfers >> Deposit Funds. Remember that the minimum amount to fund our account is $200.

Step 2. Deposit Methods

There are many deposit methods for you to choose from. Please choose the method that is convenient for you.

The deposit methods can be one or more of the following:

- Bank transfer (sometimes called wire transfer): you have to add your bank account number in the deposit interface. The bank account has to be in your name. After this, you need to start a bank transfer from your bank. The broker will give you a reference number that you’ll have to enter as a comment in your transaction. This will allow them to identify your deposit.

- Credit or debit cards: just as with a normal online purchase, you are required to enter the regular card details. However, unlike any other online purchase, it’s required to use a card that’s in your name. In some cases, like with IC Markets, you’ll also need to verify your card by scanning it and sending it to the broker. This is yet another anti-money laundering measure on their end. Card payment is usually the preferred and most convenient way of depositing. On the other hand, some brokers define a cap for card deposits, so for a larger amount you might have to use the bank transfer.

- Online wallets like Paypal, Skrill, Neteller, etc.: it works just like any other online purchase. The interface of the wallet will pop up where you’ll have to enter your credentials (username and password) and carry out your transaction.

Step 3. Review your transaction

Depending on the method you chose, it might take a couple of days for your deposit to show up on your brokerage account. When it happens, the brokers usually send you an email to confirm the receipt of the deposit.

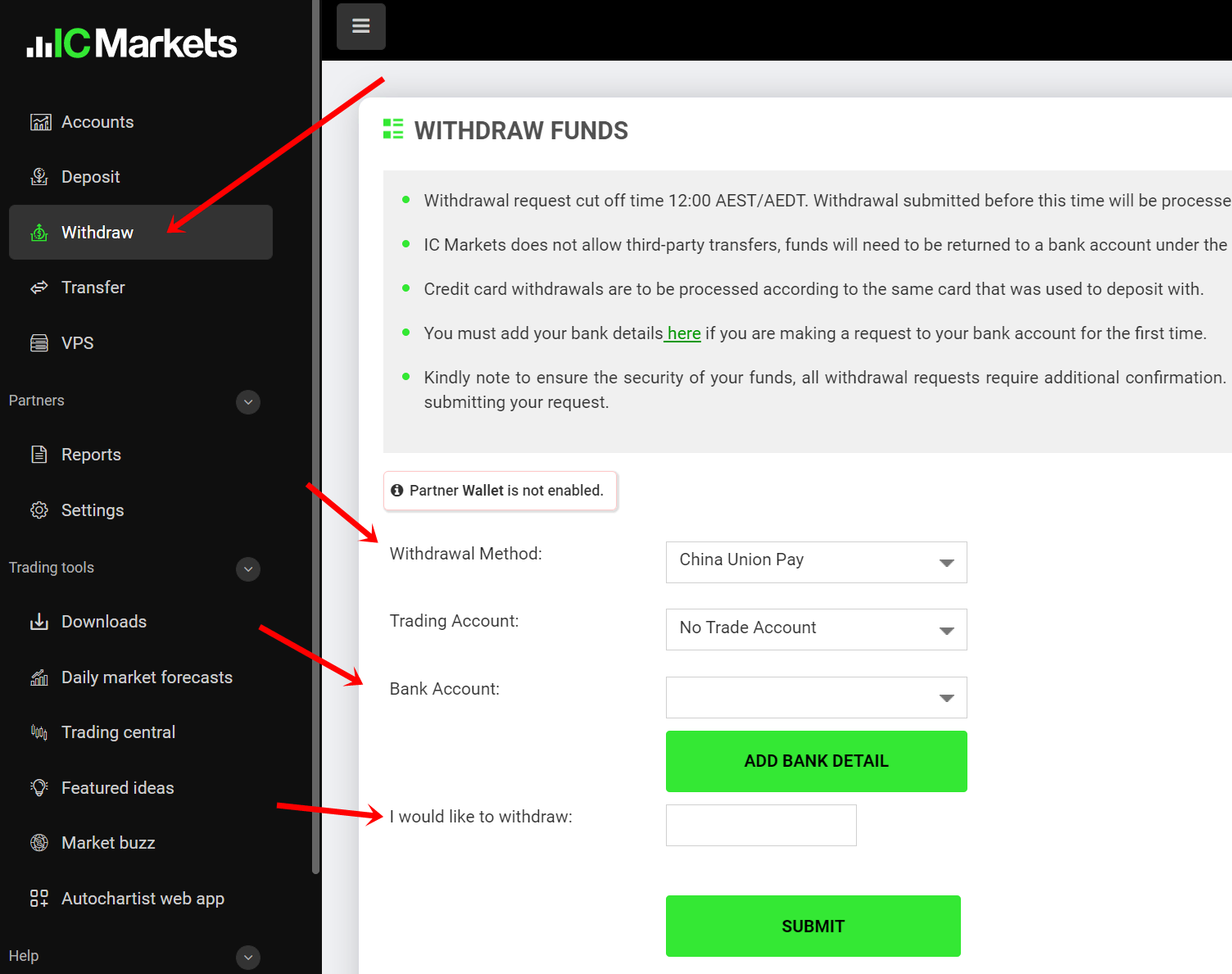

Fund Withdrawal Process

Traders must file a withdrawal request to remove funds from their IC Markets account. This request may be in the trader’s Client Area and consists of a completed online form. Once finished, traders can submit a withdrawal request before noon AEST/AEDT, which means the withdrawal can be handled the same business day.

To make an IC Markets withdrawal from your online trading account, you can follow these steps.

- Log in to your IC Markets trading account by entering your login credentials.

- Check the availability of funds in your account before submitting an IC Markets withdrawal request.

- Submit a withdrawal request from the client area by clicking on the ‘Withdraw Funds’ option.

- Enter the withdrawal amount from your IC Markets trading account. The broker does not specify any minimum withdrawal amount, which means you can take out any amount from your IC Markets online trading account.

- Select the mode of payment that you used to deposit funds into your trading account and submit your withdrawal request.

Following these steps, you can withdraw funds from your IC Markets trading account without any trouble. You can select any payment method to deposit or withdraw funds from your online trading account.

However, you should note that you can withdraw funds only into that payment method that you used to make the deposit. It means that if you used your credit card to deposit funds into your IC Markets trading account, you could request to withdraw funds through the same credit card.

The same holds for all the other payment options. If you use wire transfers to deposit funds, you can request IC Markets withdrawal through the same payment method.

Education and Research

Education

IC Markets offers the following Educational Materials:

➡️ Trading Knowledge

➡️ Advantages of Forex

➡️ Advantages of CFDs

➡️ Video Tutorials

➡️ Web TV

➡️ Webinars

➡️ Podcasts

➡️ Getting Started (includes 10 lessons)

Research and Trading Tool Comparison

| 🥇 IC Markets | 🥈 HotForex | 🥉 FP Markets | |

| ➡️ Economic Calendar | Yes | Yes | Yes |

| ➡️ VPS | Yes | Yes | Yes |

| ➡️ AutoChartist | Yes | Yes | No |

| ➡️ Trading View | No | No | No |

| ➡️ Trading Central | Yes | No | No |

| ➡️ Market Analysis | Yes | Yes | Yes |

| ➡️ News Feed | Yes | Yes | Yes |

| ➡️ Blog | Yes | Yes | Yes |

IC Markets offers Botswana Traders the following Research and Trading Tools:

➡️ Economic Calendar

➡️ Market Analysis Blog

➡️ Forex Calculators

➡️ Forex Glossary

What educational resources does IC Markets provide to traders?

IC Markets offers a comprehensive range of educational resources to help traders of all experience levels enhance their trading skills and knowledge. These resources include articles, video tutorials, webinars, and trading guides covering a wide array of topics such as fundamental and technical analysis, risk management, and trading strategies.

Does IC Markets offer any research tools or market analysis for traders?

Yes, IC Markets provides traders with a variety of research tools and market analysis resources. These include daily market analysis reports, technical analysis insights, and market commentary from financial experts.

Bonuses and Promotions

IC Markets does not currently offer any bonuses or promotions to Botswanan traders.

How to open an Affiliate Account

To register an Affiliate Account, Botswana Traders can follow these steps:

➡️ At the top of the IC Markets homepage is a “Partners” link that Botswanans can access.

➡️ Affiliates can peruse IC Markets’ offerings on a new page that loads.

➡️ Prospective affiliates can begin the application process by clicking on the green “Join Now” banner.

➡️ Interested affiliates can apply to IC Markets for consideration by filling out the form and providing the necessary information.

➡️ Once an affiliate’s application has been approved, an IC Markets representative will contact them with instructions on how to begin referring customers.

Affiliate Program Features

Referrals are paid based on the volume of trades they make. IC Markets’ affiliate program necessitates that partners recommend the firm to other active traders.

Botswanans who become affiliates of IC Markets get access to several tools and services as well as personalized customer service.

For affiliates who join forces with IC Markets, there are numerous opportunities to take advantage of market-leading trading performance, expand their businesses while guiding customers, and stay one step ahead of the competition thanks to expert financial advice and guidance from a dedicated team.

Customer Support

IC Markets provides customers with a dedicated support team that is available through live chat, email, and phone around the clock. Support through live chat and the phone is available to assist with all frequent questions and problems.

Email is the sole method that may be used to communicate with inquiries that are aimed at departments, such as the department of accounts. In addition, the frequently asked questions (FAQ) part of IC Markets is comprehensive and provides answers that are related to the most common concerns.

| Customer Support | IC Market’s Customer Support |

| ⏰ Operating Hours | 24/7 |

| 🗣 Support Languages | Portuguese, English, Vietnamese, Chinese |

| 🗯 Live Chat | Yes |

| 📧 Email Address | Yes |

| ☎️ Telephonic Support | Yes |

| 📞 Local Support in Botswana? | No |

| 🥇 Overall quality of IC Markets Support | 4.3/5 |

How can I contact IC Markets’ customer support, and what are their response times?

IC Markets offers multiple channels for customer support. You can reach their support team through email, phone, or live chat, which is available 24/5 during market hours. The response times may vary depending on the complexity of your inquiry and the method of contact.

Is IC Markets’ customer support available in multiple languages?

Yes, IC Markets provides customer support in multiple languages to accommodate its global clientele. Their multilingual support team can assist traders in various languages, making it convenient for traders from different regions and language backgrounds to communicate their needs and receive assistance.

Corporate Social Responsibility

IC Markets takes its corporate social responsibility seriously and is committed to giving back to the community and fostering a positive impact. Some of the initiatives IC Markets has been involved in include charitable donations to various causes, supporting educational programs, and contributing to environmental sustainability efforts.

The company aims to promote social welfare and environmental awareness through its CSR activities, aligning its corporate values with a broader commitment to making a positive difference in society.

Our Verdict

When it comes to traders searching for a broker with cheap fees, IC Markets is the finest option. IC Markets is one of the finest forex brokers for intermediate or experienced forex traders since they provide the choice of trading platforms, including MT4, MT5, and the cTrader platform.

IC Markets, in contrast to most other providers, has genuine direct market access. Therefore, there is the potential for endless gains depending on the trading strategy, risk management and tolerance, and the overall trading plan of Botswanan traders.

IC Markets continues to be a fantastic choice for algorithmic techniques, high-frequency traders, and scalpers since the execution speed is excellent. Traders may acquire maximum leverage of 1:500 in one of the safest trading settings with a deposit of only 2,400 BWP or an equivalent to $200.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| IC Markets is a multi-regulated forex and CFD broker with a decent trust score and a low-risk reputation | There is a higher minimum deposit requirement charged than other brokers |

| There is real raw spread trading offered across several asset classes | Botswanan traders could face currency conversion fees |

| IC Markets offers some of the best spreads in the industry | There is no BWP-denominated account offered |

| Botswanans can choose between MetaTrader 4, MetaTrader 5, and cTrader as their preferred platform | There are no fixed spreads offered by IC Markets |

| There is a choice between three different account types that suit different types of traders | There is no proprietary trading platform, or an app offered by IC Markets |

| There are no hidden fees and IC Markets is one of the best options for high volume trading because it has a long list of liquidity providers | |

| There is a free demo account offered | |

| There is an Islamic account option offered to Muslim traders |

You might also like: IC Markets Account Types

You might also like: IC Markets Demo Account

You might also like: IC Markets Fees And Spreads

You might also like: IC Markets Sign-Up Bonus

You might also like: IC Markets Minimum Deposit

Frequently Asked Questions

Is IC Markets regulated?

Yes, IC Markets is well-regulated by the ASIC, CySEC, FSA, and SCB under these verified license numbers:

- Seychelles – SD018

- Australia – AFSL 335692

- Cyprus – 362/18

- Bahamas – SIA-F214

What is the withdrawal time with IC Markets?

IC Markets’ withdrawal time ranges from instant withdrawals on PayPal, Neteller, Neteller VIP, Skrill, and Union pay and up to a maximum of 14 days on Bank Wire Transfer. All other payments have a withdrawal time that ranges from 2 to 5 working days depending on when the withdrawal request is received.

What leverage does IC Markets have?

The leverage that you can expect from IC Markets ranges from 1:1 up to 1:500 depending on the financial instrument that you trade.

Is IC Markets an offshore broker?

Yes, for Botswanans IC Markets is an offshore broker based in Australia, but with regulations and authorization through ASIC, CySEC, FSA, and SCB which makes it a trusted broker.

Is IC Markets safe or a scam?

IC Markets is a safe broker that has a high trust score of 85 out of 100. In addition, IC Markets is well-regulated by Tier-1, Tier-2, and Tier-3 regulators that have stringent demands and procedures to keep brokers like IC Markets in check.

Does IC Markets have Nasdaq?

Yes, IC Markets offers Nasdaq along with several other Index CFDs that can be traded across accounts and trading platforms.

Does IC Markets have Volatility 75?

Yes, IC Markets has Volatility 75 (CBOE Volatility Index, or VIX) that Botswanans can trade as a Futures CFD.

How can I change IC Markets’ leverage?

You can log into your IC Markets account and navigate to your “Client Area.” From here you can select the account number and you can request a new leverage level by submitting the request.

Is IC Markets a CFD broker?

Yes, IC Markets is a forex and CFD broker that offers a wide range of contracts for difference on Indices, Energies, Metals, Forex, and several other financial markets.

Conclusion

Now it is your turn to participate:

➡️ Do you have any prior experience with IC Markets?

➡️ What was the determining factor in your decision to engage with IC Markets?

➡️ Was it because of the minimum deposit, regulation, retail trading accounts, or any other factors?

➡️ Have you experienced any issues with IC Markets such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

Regardless, please share your thoughts in the comments below.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review