IG Review

Overall, IG is very competitive in terms of its trading fees and spreads. IG is regulated by 8 Tier-1 (High-Trust), 3 Tier-2 (Medium-Trust) and 1 Tier-3 (Low-Trust) regulators. IG offer 7 retail investor accounts and has a Trust Score of 99% out of 100. IG is currently not regulated by the MFED, BoB, or NBFIRA of Botswana

- Louis Schoeman

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

USD 0 / 0 BWP

Regulators

IGRs

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

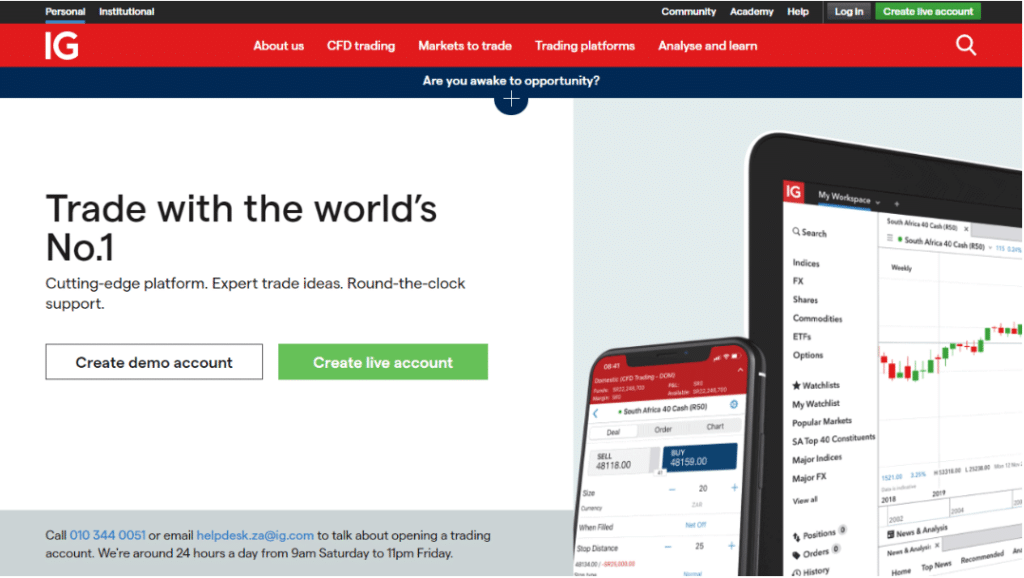

Overview

Overall, IG is considered low-risk, with an overall Trust Score of 99 out of 100. IG is licensed by eight Tier-1 Regulators (high trust), three Tier-2 Regulators (average trust), and one Tier-3 Regulator (low trust). IG offers seven retail trading accounts namely CFD/DMA Trading Account, Limited Risk Trading Account, Options Trading Account, Turbo24 Trading Account, Share Dealing Account, Spread Betting Account, and a Swap-Free Trading Account.

One of the largest CFD brokers in the world is IG, which began operations in 1974 in the United Kingdom.

Several different authorities govern IG in regions all over the world, including top-tier regulators such as the Financial Conduct Authority (FCA) in the United Kingdom and the Federal Financial Supervisory Authority in Germany (BaFin).

In addition, the IG Group has public shares and is traded on the London Stock Exchange. Because it is publicly traded, its financials are easily accessible, and it is subject to the scrutiny of the most stringent authorities, IG is regarded as a reliable company.

Traders have access to many currency pairings, which provides them with a range of trading opportunities, commission-free options, a highly competitive trading market, and access to very advanced trading systems.

This IG review for Botswana will provide local retail traders with the details that they need to consider whether IG is suited to their unique trading objectives and needs.

IG accepts Botswanan clients and has an average spread from 0.1 pips with 0.10% commission. IG has a maximum leverage ratio up to 1:200 and there is a demo and Islamic account available.

MT4, IG, ProRealTime (PRT), L2 Dealer, and FIX API platforms are supported. IG is headquartered in the United Kingdom and regulated by FCA, BaFin CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, FMA, CFTC, NFA, and BMA.

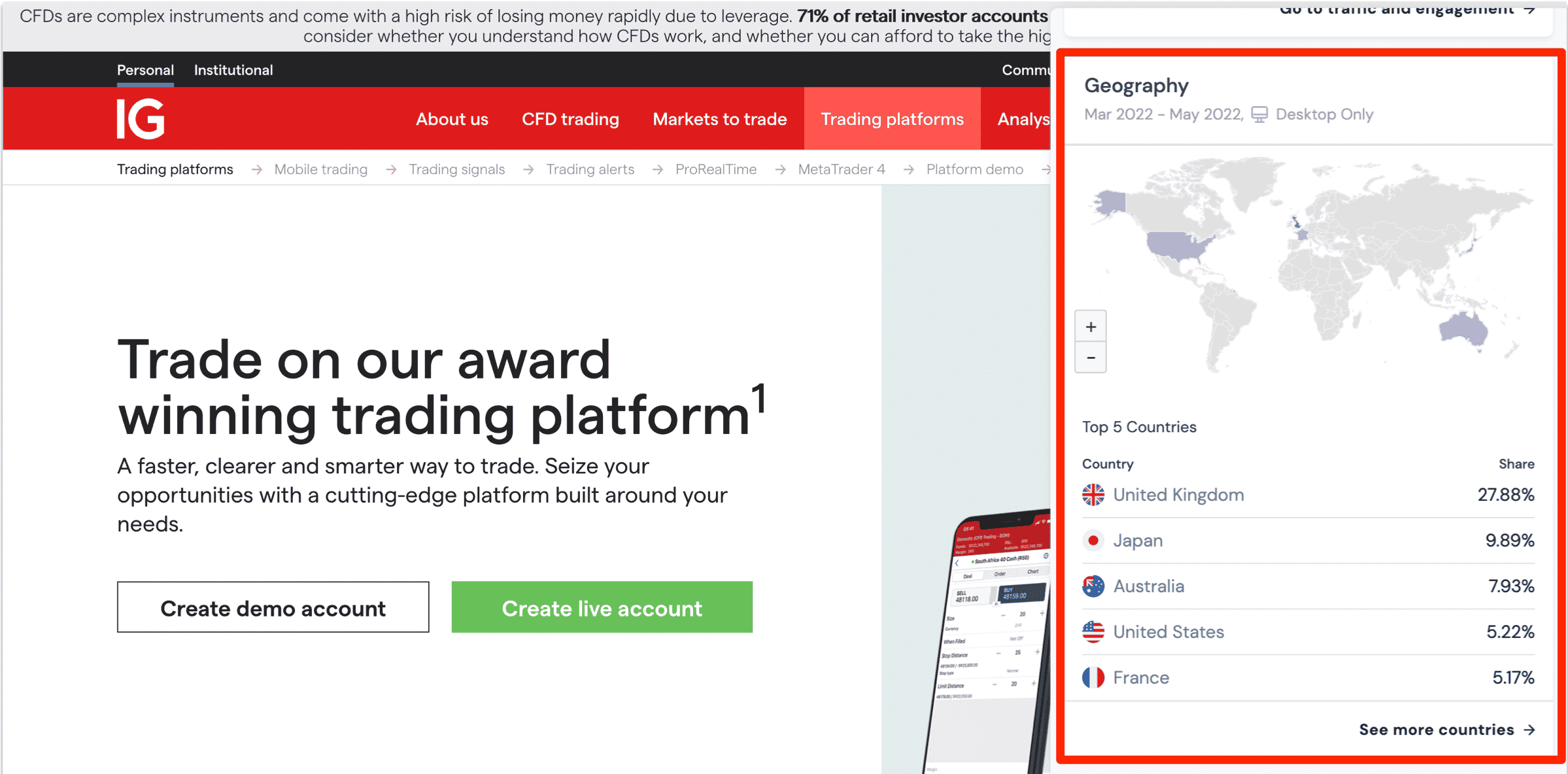

Distribution of Traders

Currently has the largest market share in these countries

➡️ United Kingdom – 27.7%

➡️ Japan – 10.7%

➡️ Australia – 8.2%

➡️ United States – 5.4%

➡️ Germany – 5.1%

Popularity among traders

🥇 Even though it does not have a dominant position in the FX and CFD markets in Botswana, IG is ranked among the Top 20 brokers for retail and professional traders and investors.

IG At a Glance

| 🏛 Headquartered | London, United Kingdom |

| 🌎 Global Offices | Germany, France, Italy, Norway, Portugal, Ireland, Netherlands, Switzerland, United Kingdom, Spain, Austria, Sweden, United States, Australia, Singapore, Japan, South Africa, United Arab Emirates |

| 🏛 Local Market Regulators in Botswana | • Ministry of Finance and Economic Development (MFED) • Bank of Botswana (BoB) • Non-Bank Financial Institutions Regulatory Authority (NBFIRA) |

| 💳 Foreign Direct Investment in Botswana | 115.89 BWP Million in 2021 |

| 💰 Foreign Exchange Reserves in Botswana | 5270 USD Million in 2021 |

| ✔️ Local office in Gaborone? | No |

| 👨⚖️ Governor of SEC in Botswana | None, Moses Dinekere Pelaelo is the Governor of the Bank of Botswana |

| ✔️ Accepts Botswana Traders? | Yes |

| 📊 Year Founded | 1974 |

| 📞 Botswana Office Contact Number | None |

| 📱 Social Media Platforms | • LinkedIn • YouTube |

| ⚖️ Regulation | FCA, BaFin CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, FMA, CFTC, NFA, BMA |

| 1️⃣ Tier-1 Licenses | • Financial Conduct Authority (FCA) • Monetary Authority of Singapore (MAS) • Japanese Financial Services Authority (JFSA) • Commodity Futures Trading Commission (CFTC) • Financial Markets Authority (FMA) • Australian Securities and Investments Commission (ASIC) • Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) • Swiss Financial Market Supervisory Authority (FINMA) |

| 2️⃣ Tier-2 Licenses | • Cyprus Securities and Exchange Commission (CySEC) • Dubai Financial Services Authority (DFSA) • Financial Sector Conduct Authority (FSCA) |

| 3️⃣ Tier-3 Licenses | • Bermuda Monetary Authority (BMA) |

| 🪪 License Number | • United Kingdom (IG Markets Ltd) – 195355 • United Kingdom (IG Index Ltd) – 114059 • Germany – 10148759 • Cyprus (BrightPool Ltd) – 378/19 • Switzerland – FINMA • Dubai – F001780 • Dubai DIFC – 1840 • South Africa – 41393 Singapore – 200510021K • Japan – FSA • Australia – ABN 84 099 019 851, AFSL 220440 • New Zealand – FSP18923 • United States – NFA ID 0509630 • Bermuda (IG • International Limited) – 54814 |

| ⚖️ MFED, BoB, or NBFIRA Regulation | No |

| ✔️ Regional Restrictions | None |

| ☪️ Islamic Account | Yes, Dubai traders only |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 7 |

| ✔️ PAMM Accounts | Yes |

| 💻 Liquidity Providers | Several Tier-1 partnerships, banks, and others |

| ✔️ Affiliate Program | Yes |

| 📱 Order Execution | Market |

| 📊 Starting spread | From 0.1 pips DMA |

| 📉 Minimum Commission per Trade | 0.10% |

| 💰 Decimal Pricing | 5th decimal pricing after the comma |

| 📞 Margin Call | 100% |

| 🛑 Stop-Out | 50% |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | Unknown |

| ✅ Crypto trading offered? | Yes |

| ✔️ Offers a BWP Account? | No |

| 📉 Dedicated Botswana Account Manager? | No |

| 📈 Maximum Leverage | • 1:30 (Retail, EU, UK) • 1:222 (Professional) |

| 📊 Leverage Restrictions for Botswana? | No |

| 💳 Minimum Deposit (BWP) | 0 BWP or an equivalent to $0 |

| ✔️ Botswana Pula Deposits Allowed? | No |

| 📊 Active Botswana Trader Stats | 250,000+ |

| 👥 Active Botswana-based IG customers | Unknown |

| 🔁 Botswana Daily Forex Turnover | Unknown, Forex overall is $6.6 Trillion |

| 💰 Deposit and Withdrawal Options | • Bank Wire Transfer • Debit Card • Credit Card • PayPal |

| 💻 Minimum Withdrawal Time | 1 business day |

| ⏰ Maximum Estimated Withdrawal Time | Up to five business days |

| 💳 Instant Deposits and Instant Withdrawals? | Yes, Deposits on PayPal |

| 🏛 Segregated Accounts with Botswana Banks? | No |

| 📱 Trading Platforms | • Forex • Indices • Share CFDs • Commodities • Cryptocurrencies • Futures • Options • Bonds • ETFs • Digital 100s • Interest Rates |

| 💻 Tradable Assets | • Forex • Commodities • Indices • Bonds • Cryptocurrencies • Stocks • Futures |

| ✔️ Offers USD/BWP currency pair? | No |

| 📊 USD/BWP Average Spread | N/A |

| ✅ Offers Botswana Stocks and CFDs | No |

| 💻 Languages supported on the Website | English |

| ☎️ Customer Support Languages | Multilingual |

| 👥 Copy Trading Support | Yes |

| ⏰ Customer Service Hours | 24/7 |

| 📞 Botswana-based customer support? | No |

| 💸 Bonuses and Promotions for Botswanans? | No |

| 📚 Education for Botswanan beginner traders | Yes |

| 📱 Proprietary trading software | Yes |

| 🤝 Most Successful Trader in Botswana | Unknown |

| ✔️ Is IG a safe broker for Botswana Traders? | Yes |

| 🎖 Rating for IG Botswana | 9/10 |

| 🥇 Trust score for IG Botswana | 99% |

| 👉 Open Account | 👉 Open Account |

Regulation and Safety of Funds

IG Regulation in Botswana

The local market regulators in Botswana are as follows:

➡️ Ministry of Finance and Economic Development (MFED)

➡️ Bank of Botswana (BoB)

➡️ Non-Bank Financial Institutions Regulatory Authority (NBFIRA)

While IG is regulated globally, the broker does not yet have local regulations or licenses in Botswana. However, despite this, IG is a popular and trustworthy broker that accommodates Botswanan traders.

Global Regulations

The broker is well-regulated by the FCA, BaFin, CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, FMA, CFTC, and NFA, and BMA operates through several worldwide organizations.

IG Markets Limited (IGM) and IG Index Limited (IGI), both founded in England and Wales, are separately regulated as investment enterprises by the Financial Conduct Authority (FCA) in the United Kingdom under license numbers 195355 and 114059, respectively.

Within the parameters of their separate licenses, IGM and IGI may operate as principals or agents and execute orders for a range of derivatives and securities. In addition to professional and retail clients, IGM’s discretionary management services may also be advantageous.

In Germany, the BaFin (10148759) and the Deutsche Bundesbank control IG Europe GmbH (IGE). This license enables IGE to offer a direct service to all European Union consumers.

BrightPool Limited is an investment enterprise approved and regulated by the Cyprus Securities and Exchange Commission (CySEC) under regulation 378/19. As such, it acts as a market maker for a variety of asset types and offers investment and related services.

IG Bank SA (IGB) is registered with the Swiss Financial Market Supervisory Authority as a broker-dealer (FINMA). If IG Bank SA keeps its license, trading will continue in the following instruments:

➡️ Bilateral non-tradable contracts for difference (CFDs)

➡️ A variety of custom derivatives on the underlying markets for currency exchange

➡️ Stocks

➡️ Indices

➡️ Precious metals

➡️ Commodities

Under F001780 and DIFC 1840, the Dubai Financial Services Authority (DFSA) has authorized IG Limited, domiciled in Dubai, to create investment agreements and directly deal in investments as a principal.

A branch of IG Markets South Africa Limited is headquartered in England and Wales. This specific entity is well-regulated by the Financial Sector Conduct Authority (FSCA) and licensed in South Africa as a Financial Service Provider with FSP41393.

This rule and authorisation allow IG Markets to offer non-automated advising along with execution-only services across a broad variety of derivatives contracts.

IG Asia Pte Ltd (IGA) is supervised, licensed, and controlled by the Monetary Authority of Singapore (MAS) under license number 200510021K. Under the Securities and Futures Act, as a registered capital markets service provider, it may trade over-the-counter derivatives contracts on a variety of platforms.

IG Securities Ltd is approved and regulated by the Japanese Financial Services Agency (JFSA) associated with the following:

➡️ Currencies

➡️ Securities

➡️ Ministry of Economy Trade and Industry (METI)

➡️ Hard Commodities

➡️ Ministry of Agriculture, Forestry and Fisheries (MAFF)

➡️ Soft Commodities

The Australian Securities and Investments Commission (ASIC) is a Tier-1 market regulator that oversees and regulates IGM in Australia under the ABN 84099019851. In addition, IGM runs under an Australian Financial Services Licence that has been validated (220440).

In addition, IGM is governed in New Zealand by the Tier-1 market regulator namely the Financial Markets Authority (FMA). IGM operates under a derivative issuers licence FSP18923, which covers a vast array of derivative contracts.

IG US LLC (IG US) is regulated by the Commodity Futures Trading Commission (CFTC) as a retail foreign currency dealer and introducing broker. Moreover, IG US LLC is a confirmed and active member of the National Futures Association with NFA ID 0509630.

On an execution-only basis, IG US can offer spot FX and options on a rolling basis. Arizona and Ohio residents may not be permitted to establish an account.

The Bermuda Monetary Authority authorizes IG International Limited (IG INT) to engage in investment and digital asset activities under license number 54814.

According to its licenses, IG INT is authorized to provide CFDs on a broad range of asset classes, including cryptocurrencies, to retail clients on an execution-only basis.

Client Fund Security and Safety Features

Because they are retail customers of IG, Botswanan traders may be certain that their client’s money is protected in a few separate ways.

Customers in Botswana who have an IG account do not have to worry about the safety of their money since it is kept in separate accounts at high-ranking financial institutions all around the globe that are governed by stringent trustee arrangements.

Because of this, IG will not be able to retrieve any of the monies that have been placed. Because it is acknowledged to be money belonging to customers, this also suggests that IG and the creditors with whom it is affiliated do not have any right to charge, claim, or right of set-off or retention over it.

Banks such as Barclays and Lloyds, among others, serve as custodians for the segregated bank accounts. To ensure that the money belonging to their clients is not kept in a single place, they have made it a priority to disperse it over several different financial institutions.

Is IG a regulated broker, and which regulatory authorities oversee its operations?

Yes, the broker is a regulated broker and operates under the oversight of reputable regulatory authorities. The specific regulatory status may vary based on the region and entity through which clients access IG’s services. In the United Kingdom, IG is authorized and regulated by the Financial Conduct Authority (FCA).

How does IG ensure the safety of client funds?

The broker prioritizes the safety of client funds through several protective measures. Client funds are typically held in segregated accounts, ensuring a clear separation between clients’ trading capital and the broker’s operational funds.

Awards and Recognition

Multiple awards for trading excellence have been bestowed upon IG because of the high quality of the company’s customer service as well as the innovative nature of the trading tools that it makes accessible to its clients. IG has been lauded in the brokerage industry for both factors.

The broker has been honored with several accolades, including some of the following:

➡️ The ADVFN International Finance Awards for Best Multi-Platform Provider

➡️ The Online Personal Wealth Awards for Best Trading Support

➡️ Best Overall Personal Wealth Provider

➡️ Professional Trader Awards for Best Overall Professional Trading Account

➡️ Best Trading App

➡️ ADVFN International Finance Awards for Best Multi-Platform Provider

Has IG received any notable awards for its services in the financial industry?

Yes, the broker has received numerous awards and recognitions for its outstanding services in the financial industry. Awards may cover various categories, including Best Broker, Best Trading Platform, and Excellence in Customer Service.

How is IG regarded in the financial industry, and what do awards suggest about its reputation?

The broker enjoys a positive reputation in the financial industry, and the awards and recognitions it has received contribute to its credibility. Awards often reflect the acknowledgment of IG’s efforts in delivering quality services, technological advancements, and customer satisfaction.

IG Account Types and Features

The comprehensive offering of IG may be observed according to the location in which traders are headquartered. IG now provides seven distinct retail accounts, which include the following:

➡️ CFD/DMA Trading Account

➡️ Limited Risk Trading Account

➡️ Options Trading Account

➡️ Turbo24 Trading Account

➡️ Share Dealing Account

➡️ Spread Betting Account

➡️ Swap-Free Trading Account

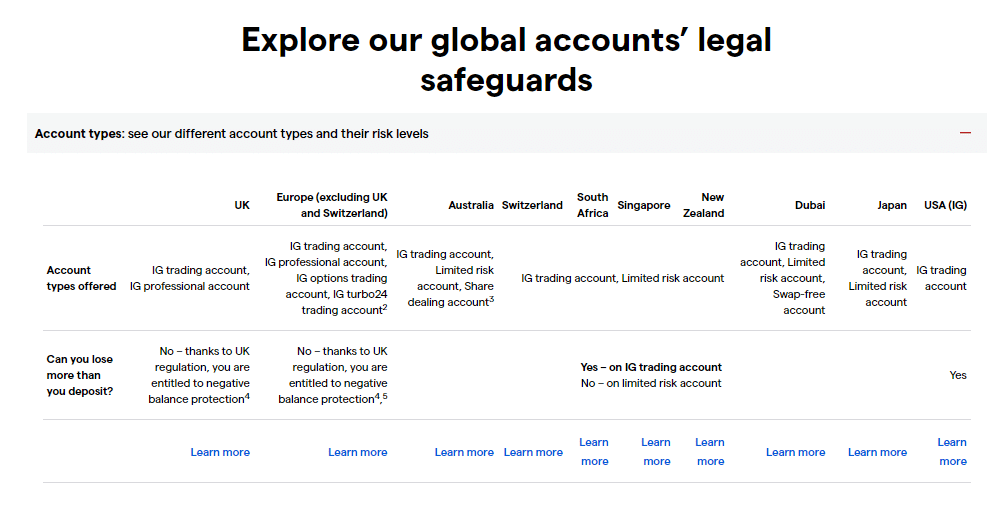

The accounts that traders have access to according to their region include the following:

➡️ United Kingdom Accounts

➡️ European Accounts (excluding UK and Switzerland)

➡️ Australian Accounts

➡️ Switzerland, South Africa, Singapore, and New Zealand Accounts

➡️ Dubai Accounts

➡️ Japan Accounts

➡️ US (IG) Accounts

➡️ USA (NADEX) Accounts

New traders are required to make a deposit of 2,900 Botswanan Pula, which is equivalent to $250, to open an account with IG. Traders have access to a variety of spreads, which they may choose according to the financial instrument being transacted.

Some typical spreads charged by IG are as follows:

➡️ Forex – 0.6 pips EUR/USD with an average spread of 0.75 pips

➡️ Forex – DMA spread of 0.1 pips

➡️ Indices – from 0.4 pips on the FTSE 100

➡️ Commodities – from 0.3 pips

➡️ Cryptocurrency – from 0.2 pips on Stellar

➡️ Futures – from 0.6 pips

➡️ Interest Rates – from 1 pip

➡️ Bonds – from 1 pip

Fees on shares in the EU and the UK begin at 0.10%, whereas commissions on shares in the US begin at $0.2. The following sections might serve as a reference for traders in Botswana who are interested in opening an account with IG.

A study of the individual account features accessible on the IG website does not contain a precise explanation of the many kinds of accounts that are currently offered.

IG Live Trading Account Details

United Kingdom Accounts

These accounts are especially geared at meeting the requirements and achieving the goals of traders living in the UK.

| Account Feature | Value |

| 📉 Minimum Deposit Requirement | £250 |

| 💻 Account Types Available | • IG Trading Account • IG Professional Account • IG Spread Betting Account |

| 💳 Deposit/Withdrawal Options | • Debit Card • Credit Card • PayPal |

| 📊 Account Opening Requirements | Electronic Verification with required documentation |

| ❌ Negative Balance Protection | Yes |

| 📈 Swap-Free Option | No |

| 💻 Trading Products offered | • CFDs • Share Dealing • 18,000 Markets including indices, commodities, shares, forex, and more |

European Accounts (excluding UK and Switzerland)

European traders, apart from those located in the United Kingdom and Switzerland, have the option of opening either an IG Trading, Professional, Options, or turbo24 account. In addition, traders should expect the following account features:

| Account Feature | Value |

| 📉 Minimum Deposit Requirement | £300 |

| 💻 Account Types Available | • IG Trading Account • IG Professional Account • IG Options Account • IG Turbo 24 Account |

| 💳 Deposit/Withdrawal Options | • Debit Card • Credit Card • PayPal |

| 📊 Account Opening Requirements | Electronic Verification with required documentation |

| ❌ Negative Balance Protection | Yes |

| 📈 Swap-Free Option | No |

| 💻 Trading Products offered | • CFDs • Barriers • Vanilla Options • Tubo24 Warrants • 18,000 Markets including indices, commodities, shares, forex, and more |

Australian Accounts

These accounts are made available to Australian traders by IG Markets Ltd., Australia, and provide them with trading conditions and features that are exclusive to the market as well as those that are competitive.

| Account Feature | Value |

| 📉 Minimum Deposit Requirement | £450 |

| 💻 Account Types Available | • IG Trading Account • Limited Risk Account • Share Dealing Account |

| 💳 Deposit/Withdrawal Options | Non-APAC Residents – Free Debit/Credit Card Deposits and Withdrawals, while APAC Residents can expect some charges: • Debit Cards – Free • Credit Cards – 1% • VISA – 0.5% • MasterCard – 1% • PayPal – 1% |

| 📊 Account Opening Requirements | Electronic Verification |

| ❌ Negative Balance Protection | Yes, IG Trading Account |

| 📈 Swap-Free Option | None |

| 💻 Trading Products offered | • CFDS • Options • Digital 100s • Share Dealing • 18,000 Markets including indices, commodities, shares, forex, and more |

Switzerland, South Africa, Singapore, and New Zealand Accounts

These territories are covered by IG Bank S.A., IG Markets South Africa Ltd., IG Asia Pte Ltd., and IG Markets Ltd, Australia, which provide worldwide customers with access to IG’s broad product offering and trading solutions.

There are no expenses associated with opening an IG account, apart from the required minimum deposit. Once Botswana customers have funded their trading account and begun trading, IG will only charge them the spread or a minor commission fee on equity trades.

To ensure that new clients get a low minimum contract price, a margin payment (starting at 0.5% on EUR/USD) is needed. There is a lot of opportunity for manoeuvre since traders only pay a fraction of what they would ordinarily.

| Account Feature | Value |

| 📉 Minimum Deposit Requirement | 2,500 CHF, 4,000 ZAR, 600 SGD, 680 NZD, 2,900 BWP, or any other accepted currency from these regions |

| 💻 Account Types Available | • IG Trading Account • Limited Risk Account |

| 💳 Switzerland Deposits/Withdrawals | • Debit Card – Free • Credit Card – Free |

| South Africa Deposits/Withdrawals | • Debit Card – Free • Credit Card Free |

| Singapore Deposits/Withdrawals | • Debit Card – 2.3% • Credit Card – 2.3% |

| New Zealand Deposits/Withdrawals | • Debit Card – Free • Credit Card – 1% • VISA – 0.5% |

| 📊 Account Opening Requirements | • Switzerland – Proof of Identity document • South Africa – Proof of Identity document • Singapore – Proof of Identity document • New Zealand – Electronic Verification |

| ❌ Negative Balance Protection | Yes, IG Trading Account |

| 📈 Swap-Free Option | No |

| Trading Products Switzerland, Singapore, New Zealand | • CFDS • Options • Digital 100s • 18,000 Markets including indices, commodities, shares, forex, and more |

| 💻 Trading Products offered | • CFDs • 18,000 Markets including indices, commodities, shares, forex, and more |

Dubai Accounts

Traders in this area may make use of IG Limited’s complete trading solutions and services. Traders can anticipate the following account features and choices while working with IG:

| Account Feature | Value |

| 📉 Minimum Deposit Requirement | 1,600 AED ($450) |

| 💻 Account Types Available | • IG Trading Account • Limited Risk Account • Swap-Free Account |

| 💳 Deposits/Withdrawals | Free deposits and withdrawals on Credit and Debit Cards |

| 📊 Account Opening Requirements | Proof of Identity Documents |

| ❌ Negative Balance Protection | Yes |

| 📈 Swap-Free Option | Yes |

| 💻 Trading Products offered | 10,000+ Markets spread across indices, commodities, cryptocurrencies, and more |

Japan Accounts

IG Securities Ltd. is based in Japan and is licensed by the JFSA. It offers the following trading services to Japanese clients:

| Account Feature | Value |

| 📉 Minimum Deposit Requirement | ¥35,000 |

| 💻 Account Types Available | • IG Trading Account • Limited Risk Account |

| 💳 Deposits/Withdrawals | Free deposits and withdrawals on Credit and Debit Cards |

| 📊 Account Opening Requirements | Proof of Identity Requirements |

| ❌ Negative Balance Protection | Yes, IG Trading Account |

| 📈 Swap-Free Option | None |

| 💻 Trading Products offered | 10,000+ Markets spread across indices, commodities, cryptocurrencies, and more |

US (IG) Accounts

Traders in the United States may open an IG Trading Account, which gives them access to the following features:

| Account Feature | Value |

| 📉 Minimum Deposit Requirement | $250 |

| 💳 Deposits/Withdrawals | • Debit Card – Free • Credit Card – Free • Bank Wire Withdrawal – $25 |

| 📊 Account Opening Requirements | Electronic Verification and required documents |

| ❌ Negative Balance Protection | Yes |

| 📈 Swap-Free Option | None |

| 💻 Trading Products offered | 80+ Forex Pairs |

USA (NADEX) Accounts

This is IG’s exchange account, which US traders may utilize to trade exchange-traded binaries. This account also includes the following features:

| Account Feature | Value |

| 📉 Minimum Deposit Requirement | $250 |

| 💳 Deposits/Withdrawals | US Residents: • Debit Card – Free • ACH – Free • Bank Wire Deposits – Free • Bank Wire Withdrawals – $25 Non-US Residents: • Debit Cards – Free • International Bank • Transfer Deposits – Free • International Bank • Transfer Withdrawals – $25 |

| 📊 Account Opening Requirements | Proof of Identity |

| ❌ Negative Balance Protection | None |

| 📈 Swap-Free Option | None |

| 💻 Trading Products offered | 10,000+ contracts, including indices, forex, and commodities |

IG Professional Account

Professional clients have access to account features that retail clients do not, albeit at the expense of certain investment safeguards.

As a professional IG client, you must avoid your account from entering negative territory. In such a case, you will be required to make further payments to bring the balance over zero.

Base Account Currencies

Because of IG’s global offering, there are several base currencies to choose from when you register an account. However, the default currency for all accounts is USD and traders must submit a written request to IG’s customer support to have this changed.

If IG does not support BWP as a base account currency, it would mean that traders could be subject to currency conversion fees.

Demo Account

IG provides several platforms and selecting between them is not an easy option. All customers have access to a free demo account that assists them in identifying the most feasible and successful trading platform options.

The demo account is the best place to begin if you want a risk-free account that replicates real trading with virtual cash and no commitment. Here, you can get a risk-free introduction to your broker, the overall industry, and trading platforms.

In addition, because the account uses virtual funds that can be reset at any given time, you are never required to deposit real funds.

This is an ideal starting place for beginner Botswanan traders, and the IG Markets sample account never expires.

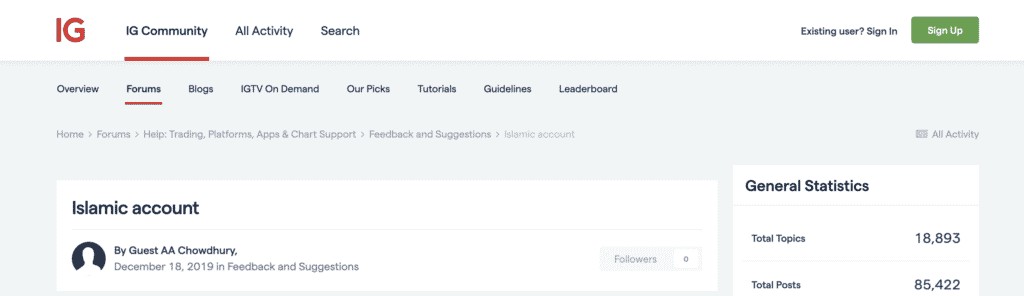

Islamic Account

Depending on the trading style and the trading strategy of the forex trader, they may keep their trading positions open for longer than 24 hours on a trading day.

This means that the trader could incur an overnight or rollover fee. This is a type of interest that is prohibited by Riba principles of Sharia law, which means that Muslim traders are often restricted in forex trading.

IG Markets has an Islamic account option. This swap-free account is nevertheless only accessible to traders who are registered with the Dubai-based broker’s UAE company. This account type is naturally Sharia-compliant since it does not levy a rollover fee.

However, IG may impose an extra fee of an additional fee to cover the swap, and some assets may not be accessible for trading with this account type.

What types of trading accounts does IG offer, and how do they differ?

The broker provides various types of trading accounts to cater to the diverse needs of traders. The primary account types typically include Standard Accounts and Professional Accounts. Standard Accounts are suitable for most retail traders and offer access to a wide range of financial instruments. Professional Accounts are designed for experienced traders who meet certain eligibility criteria, providing additional features such as higher leverage.

What features are included with IG trading accounts?

The brokers trading accounts come with a comprehensive set of features to enhance the trading experience. Features may include access to the IG trading platform, a user-friendly interface, advanced charting tools, and technical analysis resources.

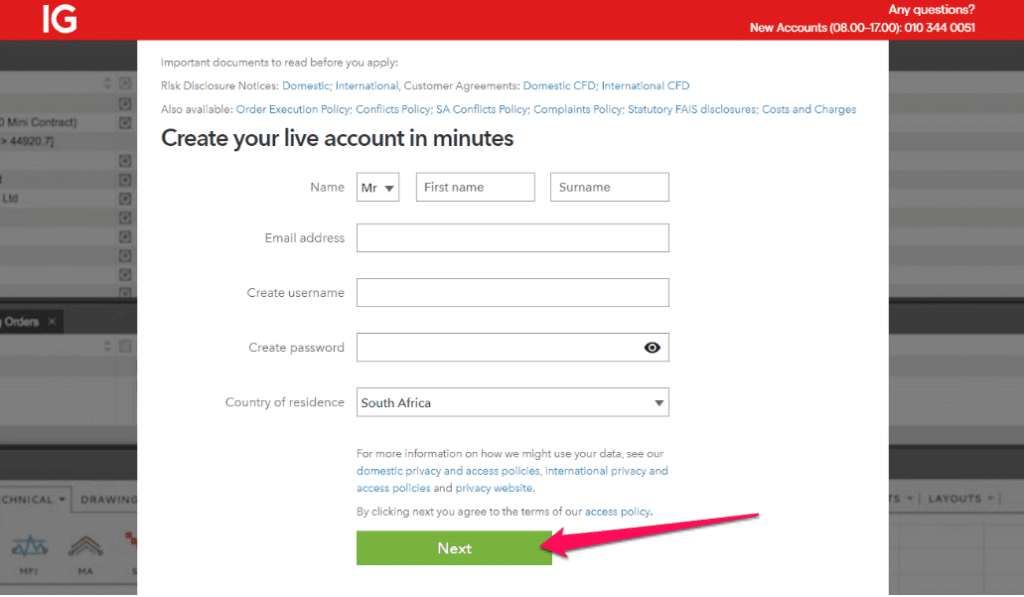

How to Open an IG Trading Account – A Step-by-Step Guide

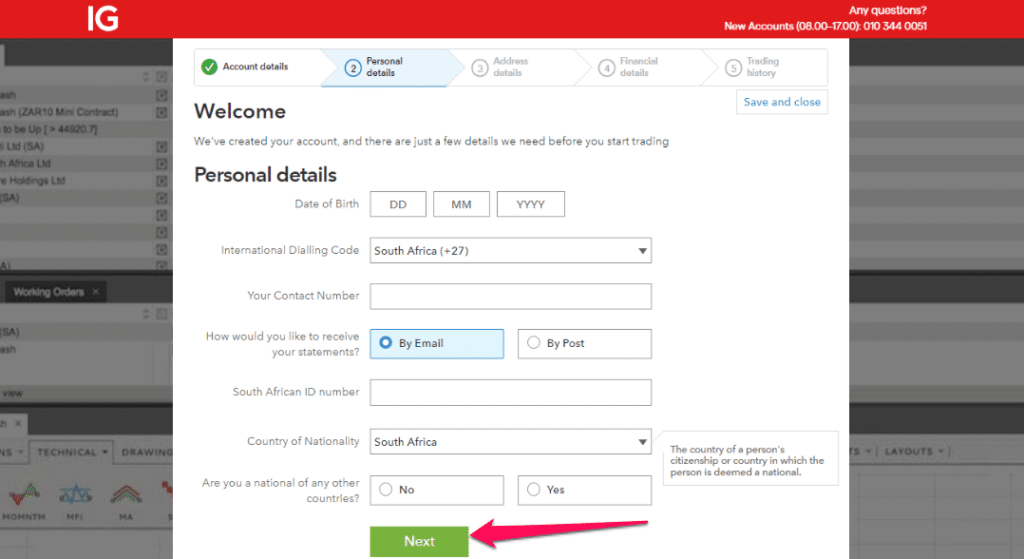

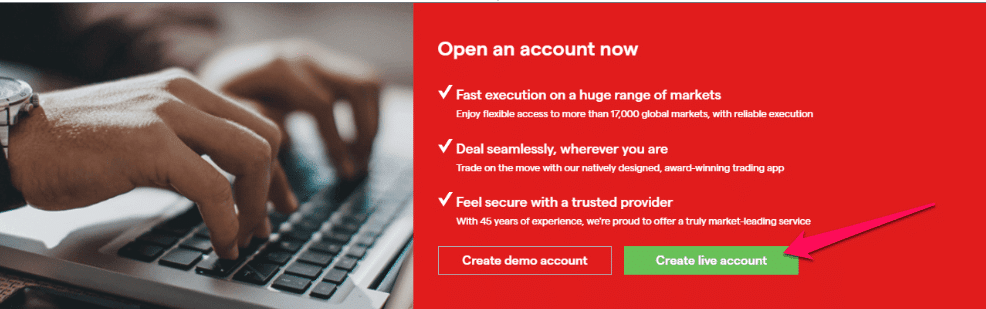

Step 1: Create Live Account

Start the application by clicking on the green “Create Live Account” button located on the landing page or throughout the website in the header of the page.

Step 2: Registration Form

The applicant must start setup by supplying general information including a valid email address and country of residence.

Step 3: Complete Personal Information

The next step will need more personal information to be added, including the applicant’s direct contact details and identification number.

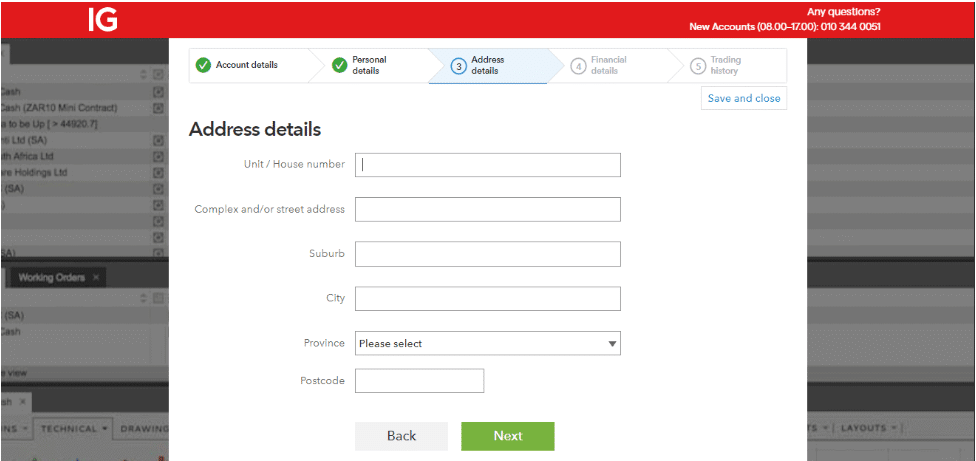

Step 4: Adress Details

The applicant must complete their address details to move on to the final steps of the registration process.

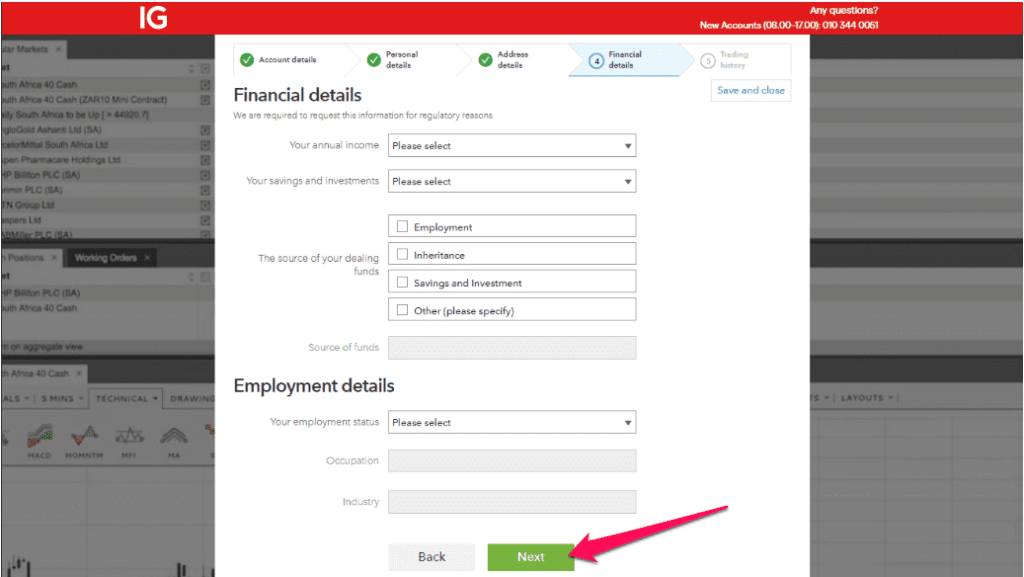

Step 5: Financial Information

The second last step is to complete Financial details, including the applicant’s annual income and employment history.

Step 6: Trading History

In the final step, Applicants must provide their trading history. Once this step has been completed, the application can be saved and closed.

IG Vs Tickmill Vs FBS – Broker Comparison

| 🥇 IG | 🥈 Tickmill | 🥉 FBS | |

| ⚖️ Regulation | FCA, BaFin CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, FMA, CFTC, NFA, BMA | Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA | IFSC, CySEC, ASIC, FSCA |

| 📱 Trading Platform | • MetaTrader 4 • IG Platform • ProRealTime (PRT) • L2 Dealer • FIX API | • MetaTrader 4 • MetaTrader 5 | • MetaTrader 4 • MetaTrader 5 • FBS Trader • CopyTrade |

| 💰 Withdrawal Fee | No | No | Yes |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 0 BWP | 1,200 BWP | 12 BWP |

| 📊 Leverage | • 1:30 (Retail, EU, UK) • 1:222 (Professional) | 1:500 | Up to 1:3000 |

| 📊 Spread | From 0.1 pips DMA | Variable, from 0.0 pips | From 0.0 pips |

| 💰 Commissions | From 0.10% | $1 per side per 100,000 traded | From $6 |

| ✴️ Margin Call/Stop-Out | 100%/50% | 100%/30% | 40%/ 20% |

| 💻 Order Execution | Market | Market | Market |

| 💳 No-Deposit Bonus | No | Yes | Yes |

| 📊 Cent Accounts | No | No | Yes |

| 📈 Account Types | • CFD/DMA Trading Account • Limited Risk • Trading Account • Options Trading Account • Turbo24 Trading Account • Share Dealing Account • Spread Betting Account • Swap-Free Trading Account | • Pro Account • Classic Account • VIP Account | • FBS Cent Account • FBS Micro Account • FBS Standard Account • FBS Zero Account • FBS ECN Account • FBS Crypto Account |

| ⚖️ CBN Regulation | No | No | No |

| 💳 BWP Deposits | No | No | Yes |

| 📊 Botswana Pula Account | No | No | No |

| 👥 Customer Service Hours | 24/7 | 24/5 | 24/7 |

| 📊 Retail Investor Accounts | 7 | 3 | 6 |

| ☪️ Islamic Account | Yes, Dubai | Yes | Yes |

| 📉 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | Unlimited | 100 lots | 500 lots |

| 💰 Minimum Withdrawal Time | 1 business day | 1 business day | 15 to 20 minutes (maximum 48 hours) |

| 📊 Maximum Estimated Withdrawal Time | Up to five business days | 2 to 7 Business Days | Up to 7 days |

| 💸 Instant Deposits and Instant Withdrawals? | Yes, Deposits on PayPal | Instant Deposits | Instant Deposits |

IG Trading Platforms

Offers Botswanan Traders a choice between these trading platforms:

➡️ MetaTrader 4

➡️ IG Platform

➡️ ProRealTime (PRT)

➡️ L2 Dealer

➡️ FIX API

Desktop Platforms

➡️ MetaTrader 4

➡️ IG Platform

➡️ L2 Dealer

MetaTrader 4

MetaTrader 4 is offered to IG Markets traders and is one of the industry’s most powerful and reliable trading platforms. It facilitates the trading of foreign exchange, indexes, and commodities in the most intuitive and customizable manner possible.

The MT4 trading platform is compatible with AutoChartist and Trading Central services and is compatible with both Windows and Mac operating systems.

IG Platform

The IG Markets trading program on the web is simply a blank canvas where you may insert different trading items and alter the size to your liking, enabling you to personalize your trading interface.

The platform brings together a variety of features, including a Reuters-aggregated news feed, IG’s in-house analysts, configurable price and indicator level alerts, and trading signals.

L2 Dealer

The L2 Dealer platform is intended for stockbroking, while it does support trading in all IG assets. Although algo trading is not allowed on this platform, it is a popular and user-friendly option for trading.

However, premium add-on services for this trading platform may be bought to help you improve your trading experience even further.

WebTrader Platforms

➡️ MetaTrader 4

➡️ IG Platform

➡️ ProRealTime

➡️ FIX API

MetaTrader 4

The vast majority of forex and CFD providers offer MetaTrader 4 Web as a trading platform. The consistency attributable to MetaTrader 4 is an advantage for traders, especially because they can change brokers without having to learn a new interface, change their trading technique, or re-develop their trading bots.

The IG MT4 platform is limited to FX and CFD trading and does not include the hundreds of instruments offered on other IG platforms.

IG Platform

The IG Markets WebTrader is a well-known trading platform that serves as the broker’s proprietary trading platform and offers exceptional trading capabilities and accessibility to all traders.

You can also do all the account administration operations you may need, as well as carry out fundamental or technical analysis if necessary.

IG’s trading interface is quite appealing and straightforward, and it is popular with all sorts of traders.

ProRealTime

ProRealTime is a powerful chart analysis program that can give you precise market data and charting analysis. It is only accessible as a WebTrader. It is free for the first month, but it will cost you $30 per month after that. This cost will be returned if you are an active trader at IG Markets.

FIX API

API stands for “Application Programming Interface.” The term “API” does not refer to a platform in and of itself; rather, it refers to software that links applications, such as connecting your platform to your IG trading account.

You can access the IG Group “ecosystem” when you trade using APIs, which is a fancy way of stating you will have more control and order execution will be quicker.

Trading App

➡️ MetaTrader 4

➡️ IG Platform

MetaTrader 4

MetaTrader 5, the improved version of MT4, is not available from IG Group. Fortunately, MT4 remains a good client, and this downloadable platform has been the industry standard since 2002.

When it comes to server uptime, MT4 is unrivalled in the market. Third-party bridges are not available. You can either trade short or long on hundreds of markets with modest spreads.

You can access, change, and monitor your positions no matter where you are with the app’s full-dealing capability. For risk control, you may use trailing and assured stops, amongst several other useful tools and components.

IG Platform

Another proprietary trading platform is the IG mobile app, which is accessible on iOS and Android for both your smartphone and other smart devices.

The platform itself is quite robust for a mobile app, and it offers many of the same features as the WebTrader. You will also get access to AutoChartist and a variety of tools to make trading on the move a seamless experience.

What trading platforms does IG offer, and how do they differ?

The broker offers a versatile selection of trading platforms to cater to the diverse needs of its clients. The primary platform is the IG Trading Platform, a web-based platform accessible through web browsers.

Can I trade on IG using my mobile device, and what features are available on the mobile platforms?

Absolutely. IG recognizes the importance of mobile trading and offers mobile versions of its trading platforms. Traders can access the markets and manage their positions on the go through the IG Trading App, available for both iOS and Android devices.

IG Range of Markets

Botswanan Traders can expect the following range of markets:

➡️ Forex

➡️ Indices

➡️ Share CFDs

➡️ Commodities

➡️ Cryptocurrencies

➡️ Futures

➡️ Options

➡️ Bonds

➡️ ETFs

➡️ Digital 100s

➡️ Interest Rates

Financial Instruments and Leverage offered by IG

| 🔨 Instrument | 💰 Number of Assets Offered | 📈 Max Leverage Offered |

| ➡️ Forex | 80 | • Retail, EU, UK – 1:30 • Professional – 1:222 |

| ➡️ Indices | 80 | • Retail – 1:20 • Professional – 1:222 |

| ➡️ Share CFDs | 13,000 | • Retail – 1:5 • Professional – 1:22 |

| ➡️ Commodities | 35 | • Retail – 1:10 • Professional – 1:222 |

| ➡️ Cryptocurrency | 10 | 1:20 |

| ➡️ Options | 20 | 1:20 |

| ➡️ Bonds | 12 | 1:20 |

| ➡️ ETFs | 6,000 | 1:10 |

| ➡️ Digital 100s | 28 | Not Leveraged |

| ➡️ Interest Rates | 6 | 1:50 |

What financial instruments can I trade on IG, and which markets are available?

The broker offers a comprehensive range of tradable instruments across various asset classes. Traders can access a diverse selection of markets, including forex, indices, commodities, cryptocurrencies, shares, and more. In the forex market, a wide range of currency pairs is available, covering major, minor, and exotic pairs. Indices represent global stock market performance, while commodities include popular assets like gold, silver, and oil.

Does IG offer cryptocurrency trading, and what cryptocurrencies are available on the platform?

Yes, IG recognizes the growing interest in cryptocurrencies and provides traders with the opportunity to trade a range of digital assets. The platform typically includes popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC), and more.

Broker Comparison for Range of Markets

| 🥇 IG | 🥈 Tickmill | 🥉 FBS | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | Yes | No | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | Yes | Yes |

| ➡️️ Options | Yes | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | Yes | Yes | No |

IG Trading and Non-Trading Fees

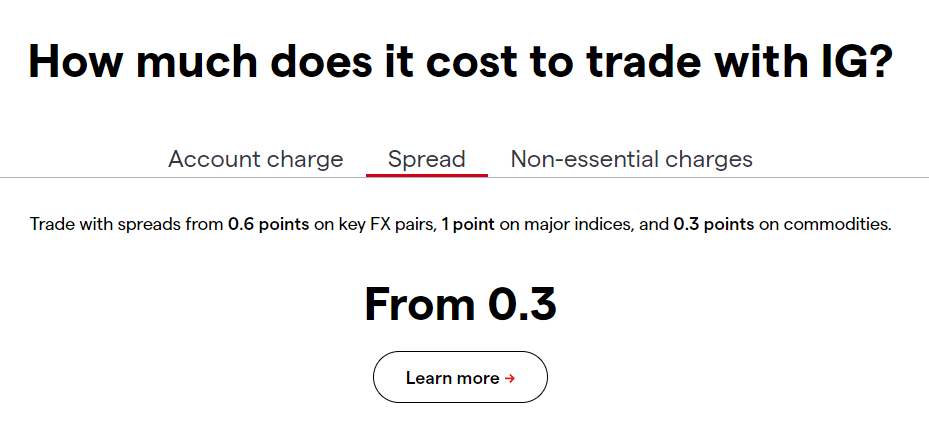

Spreads

The spread is the most important expense when trading CFDs. The broker gathers wholesale pricing, frequently from several sources, and aggregates the prices to get the optimum bid and ask prices. On both this bid and ask price, the broker will apply a mark-up, resulting in a profit for the brokerage.

Because the broker gets its pricing from outside sources, it does not necessarily execute transactions externally. Instead, it offsets customers’ orders internally. The risk of these orders can be mitigated since IG Markets has hundreds of thousands of customers trading in many ways.

If the broker does not use an external service to deliver the deal, they enhance their profit margin even more. The spread varies according to the product and liquidity. The narrower the spreads grow, the more active the market is.

IG Markets charges some of the following spreads on financial instruments:

➡️ Forex – 0.6 pips EUR/USD with an average spread of 0.75 pips

➡️ Forex – DMA spread of 0.1 pips

➡️ Indices – from 0.4 pips on the FTSE 100

➡️ Commodities – from 0.3 pips

➡️ Cryptocurrency – from 0.2 pips on Stellar

➡️ Futures – from 0.6 pips

➡️ Interest Rates – from 1 pip

➡️ Bonds – from 1 pip

Commissions

Unlike CFDs, there is no spread mark-up when you buy and sell shares with IG; they transmit your orders straight to the exchanges and offer you the best available price. Instead, they charge a commission depending on the transaction’s value and, in many circumstances, a minimum fee.

The charges paid by IG Markets for trading stocks are determined by the number of transactions you made in the preceding month and the underlying exchange where the product is traded.

Commissions are charged as follows:

➡️ EU and UK Shares – 0.10%

➡️ US Shares – $0.2

Overnight Fees, Rollovers, or Swaps

When you trade CFDs with leverage, particularly FX, you are effectively borrowing money to keep your position open.

If you borrow money from a broker to hold positions overnight, you are charged a fee at the end of each trading day. In addition, you could be charged triple fees before weekends or on Wednesdays for weekend positions.

Brokers utilize a variety of methods to determine the fees that are paid to or deducted from traders. The method IG determines overnight financing costs differs by asset class; therefore FX, indices, commodities, and shares are all calculated differently.

The following formula is used to calculate CFD overnight fees with IG:

➡️ The number of contracts is multiplied by the contract value and price x (SONIA% +/- the 2.5% admin fee) divided by 365.

If traders have a long position, the formula will be added while a short position will be subtracted, as follows:

➡️ Long Position – Number of contracts x contract value x price (SONIA% + 2.5% admin fee) / 365.

➡️ Short Position – Number of contracts x contract value x price (SONIA% – 2.5% admin fee) / 365.

Deposit and Withdrawal Fees

When traders fund their trading accounts using credit or debit cards via IG, they are subject to a transaction fee equal to 2.1% of the total deposit amount.

Inactivity Fees

If you have not used your trading account to conduct trades for more than two years, IG will begin charging an inactivity fee of 12 USD on the first day of every month until you begin using your account again to execute trades.

You will not fall behind on payments because of this fee since it is only deducted when there is available money in the account.

Currency Conversion Fees

When you trade items that are quoted in a currency that is different from the currency of your account, you are subject to a currency conversion charge equal to 0.5% of the total transaction value.

For instance, if the base currency of your trading account is BWP but you trade shares denominated in USD, you will be subject to a currency conversion fee, and the same will apply for deposits and withdrawals that are made in BWP to a USD-denominated account.

What are the trading fees associated with IG, and how are they structured?

The broker employs a transparent fee structure primarily based on spreads for various financial instruments. The spread is the difference between the buying (ask) and selling (bid) prices of an asset.

Are there any non-trading fees on IG, and what should traders be aware of?

In addition to trading fees, IG may charge non-trading fees that traders should consider. Non-trading fees may include overnight financing fees (swap rates) for positions held overnight, withdrawal fees, and inactivity fees for dormant accounts.

IG Deposits and Withdrawals

Offers the following deposit and withdrawal methods:

➡️ Bank Wire Transfer

➡️ International Transfers

➡️ Cheques

➡️ ACH

➡️ PayPal

➡️ Debit Cards

➡️ Credit Cards

Broker Comparison: Deposit and Withdrawals

| 🥇 IG | 🥈 Tickmill | 🥉 FBS | |

| Minimum Withdrawal Time | 1 business day | 1 business day | 15 to 20 minutes (maximum 48 hours) |

| Maximum Estimated Withdrawal Time | Up to five business days | 2 to 7 Business Days | Up to 7 days |

| Instant Deposits and Instant Withdrawals? | Yes, Deposits on PayPal | Instant Deposits | Instant Deposits |

Deposit Currencies, Deposit and Withdrawal Processing Times

| 💳 Payment Method | 💰 Deposit Currencies | 🔁 Deposit Processing | 💳 Withdrawal Processing |

| Bank Wire Transfer | Depends on Region | 1 business day | 1 to 5 days |

| International Transfers | Depends on Region | 1 business day | 1 to 5 days |

| Cheques | USD | 1 business day | 1 to 5 days |

| ACH | USD | 1 business day | 1 to 5 days |

| PayPal | USD | Instant | 1 to 5 days |

| Debit Cards | AUD, GBP, EUR, CAD, SGD, JPY | Instant | 1 to 5 days |

| Credit Cards | AUD, USD, JPY, EUR, SGD, GBP | Instant | 1 to 5 days |

How can I make a deposit into my IG trading account, and what payment methods are supported?

Making a deposit into your IG trading account is a straightforward process. IG typically supports various payment methods, including bank transfers, credit/debit cards, and e-wallet options such as PayPal. To make a deposit, log in to your IG account, navigate to the deposit section, and choose your preferred payment method.

How can I initiate a withdrawal from my IG trading account, and what withdrawal options are available?

Initiating a withdrawal from your IG trading account is simple. Log in to your account, go to the withdrawal section, and select your preferred withdrawal method. IG typically processes withdrawals using the same method that was used for the initial deposit. Withdrawal options may include bank transfers, credit/debit cards, and e-wallets.

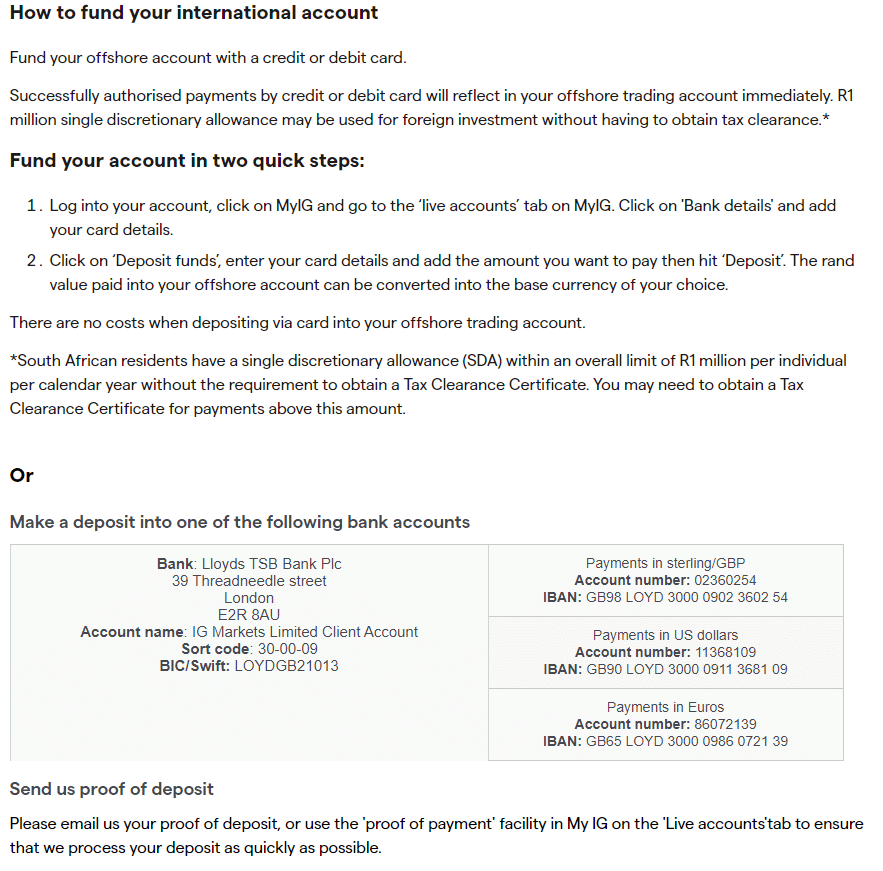

How to Deposit Funds with IG

To deposit funds to an account with IG, Botswanan Traders can follow these steps:

Traders can make deposits into their trading accounts by logging into their My IG portals and selecting the “Deposit” option from the menu.

Traders have the option of selecting the payment method they desire to use, selecting the deposit currency, and entering the amount they wish to deposit.

Traders may need to complete extra steps to successfully finish a deposit depending on the form of deposit used.

Traders who want to make an overseas payment to IG are required to ensure that they give the broker proof of payment once funds have been sent.

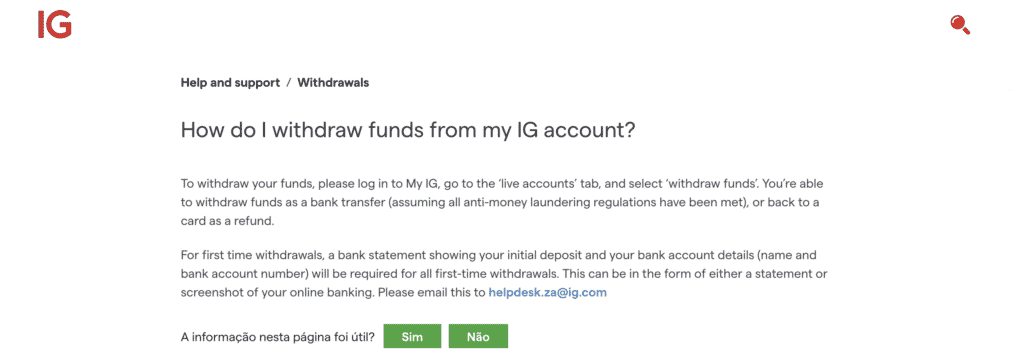

IG Fund Withdrawal Process

To withdraw funds from an account with IG, Botswanan Traders can follow these steps:

Traders from Botswana who want to withdraw money can do so by logging into their My IG portals, navigating to the “Live Accounts” section, and then clicking on the “Withdraw Funds” button.

Traders are only able to withdraw money through a bank transfer, and if they first deposited funds using a credit or debit card, they must use that card to withdraw their cash.

When making their first withdrawal of cash, traders are required to provide a bank statement that specifies their original deposit as well as any future deposits made to their bank account.

Traders are required to provide this information through email to the helpdesk email address listed on the official website’s Help and Support page.

After the information has been checked and validated, the request to withdraw funds may be processed and fulfilled.

Education and Research

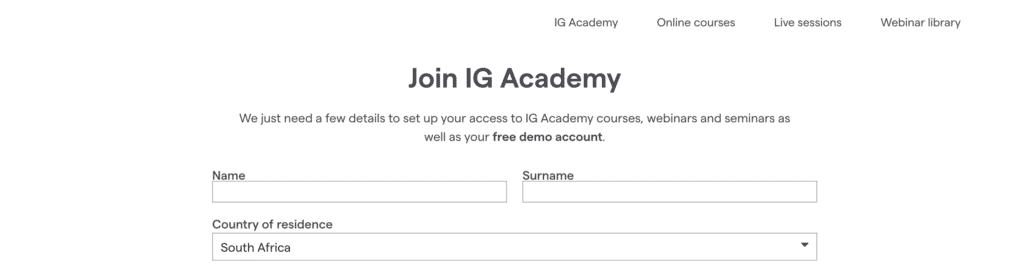

Education

Offers the following Educational Materials:

➡️ IG Academy

➡️ Risk Management Guidelines

➡️ Maximizing Trading Success

➡️ Developing a Trading Strategy

➡️ Webinars

➡️ Seminars

➡️ Glossary

Research and Trading Tool Comparison

| 🥇 IG | 🥈 Tickmill | 🥉 FBS | |

| ➡️ Economic Calendar | Yes | Yes | Yes |

| ➡️ VPS | Yes | Yes, not free | Yes |

| ➡️ AutoChartist | Yes | Yes | No |

| ➡️ Trading View | No | No | No |

| ➡️ Trading Central | No | No | No |

| ➡️ Market Analysis | Yes | Yes | Yes |

| ➡️ News Feed | Yes | Yes | Yes |

| ➡️ Blog | Yes | Yes | Yes |

The broker also offers Botswanan traders the following additional Research and Trading Tools:

➡️ News and Trade Ideas

➡️ Trading Strategies

➡️ Financial Events

➡️ Trade Analytics Tool

➡️ Subscriptions and Downloads

➡️ Special Reports

➡️ Podcasts

➡️ Economic Calendar

What educational resources does IG offer to help traders improve their skills and knowledge?

The broker is committed to providing a wealth of educational resources to empower traders. The platform typically offers webinars, video tutorials, and written guides covering a broad spectrum of topics, from basic trading concepts to advanced strategies.

What research tools are available on IG to assist traders in making informed decisions?

The broker provides a range of research tools designed to facilitate informed decision-making. Traders typically have access to daily market analysis, economic calendars, and expert commentary to stay updated on significant market events and trends.

10 Best Forex Brokers in Botswana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

Bonuses and Promotions

There is just one bonus program available currently, and it is a refer-a-friend program. If the person you suggest makes five eligible transactions, you could be rewarded up to $10,000 if you make multiple successful referrals who meet the trading volume criteria for this bonus.

Does IG run promotions or special offers for traders?

While IG may not offer traditional deposit bonuses, the platform occasionally runs promotions or special offers. These promotions can vary and may include reduced trading costs, cash rebates, or other incentives.

Does IG offer bonuses to traders, and how do these bonus programs work?

IG, in adherence to regulatory standards, typically does not offer traditional deposit bonuses or promotions. Instead, IG focuses on providing a transparent and competitive trading environment with tight spreads and a range of tradable instruments.

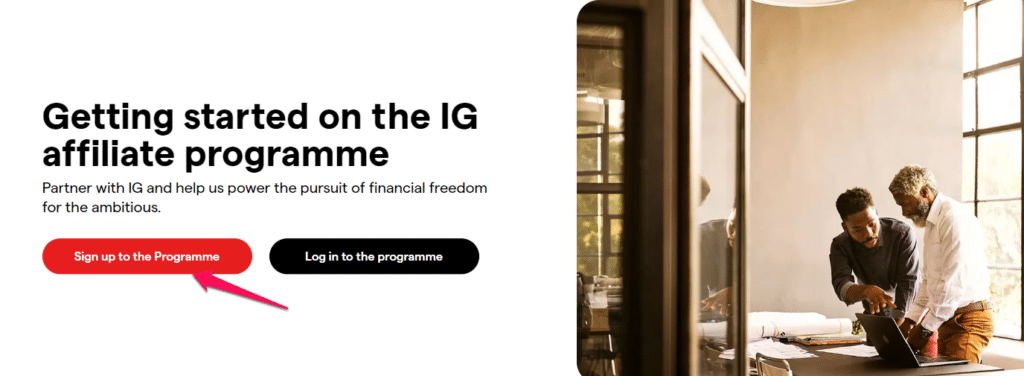

How to open an Affiliate Account

To register an Affiliate Account, Botswanan Traders can follow these steps:

Step 1: Sign Up to the Programme

Interested affiliates can go to the official IG website and choose “Sign Up to the Programme” on the homepage.

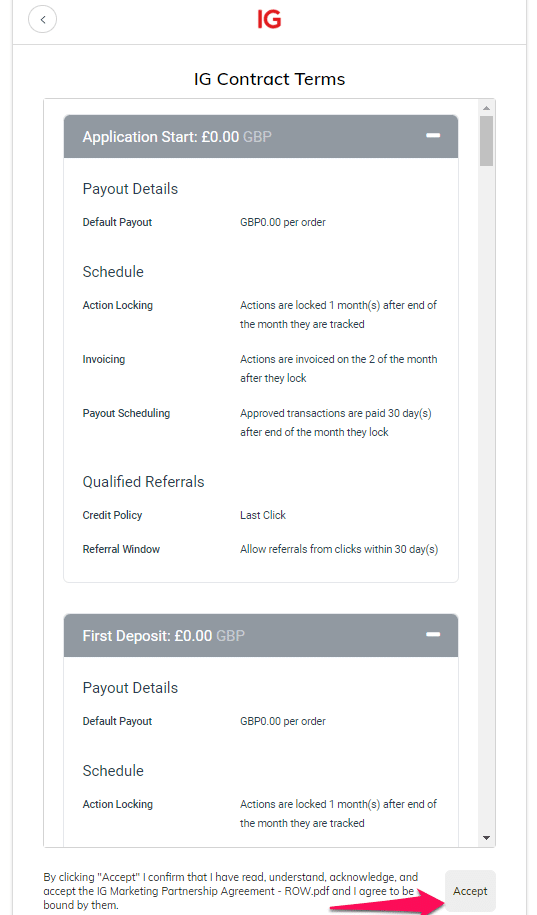

Step 2: Contract

Read the Affiliate Program details and then click the “Accept” link at the bottom of the page.

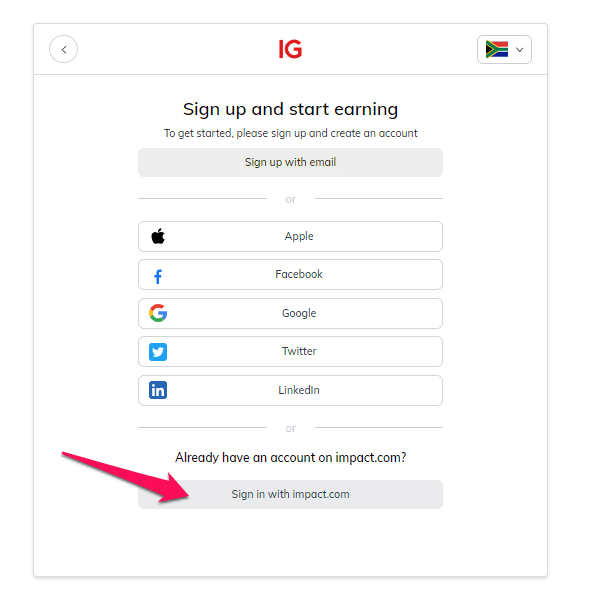

Step 3: Sign Up

Sign Up with preference account and start earning.

After the IG team confirms that you match the criteria, an IG agent will contact you to discuss the result of your application.

If your application is accepted, you may begin looking at the extensive program, marketing materials, tools, and other features that IG provides to its partners.

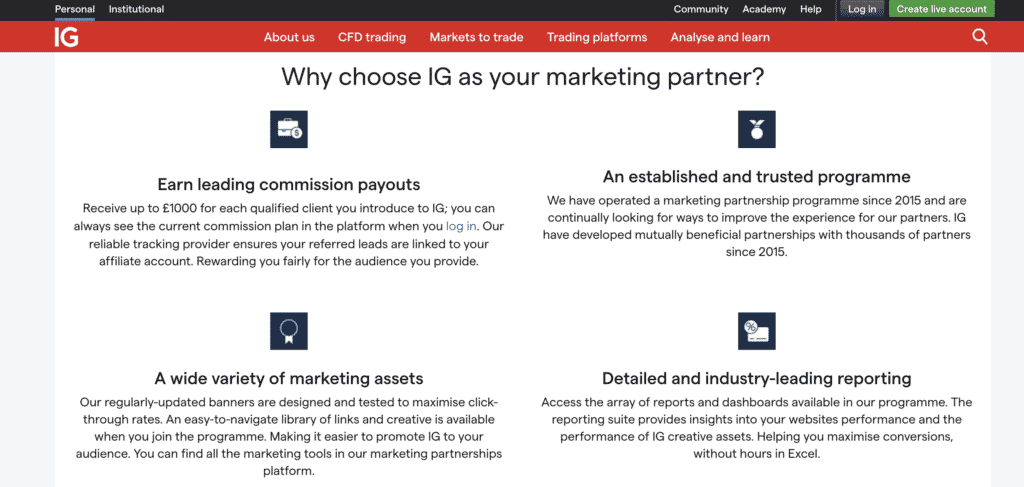

Affiliate Program Features

The broker is widely acknowledged as the industry standard broker in both online trading and investing. IG is a well-established, well-respected firm that is listed on the FTSE 250, and the broker has an exceptional balance sheet.

IG has over 40 years of expertise working in global financial markets, which is another reason why many are attracted to its affiliate program.

The following advantages and capabilities are made available to Botswanans via IG’s Affiliate Program:

➡️ Because of the sophisticated and all-encompassing monitoring system, affiliates could earn a bonus of up to $1,000 for each new client who meets the requirements and joins IG because of their efforts.

➡️ Tailored online and mobile banners are developed to boost the number of times a banner advertisement is selected to be seen.

➡️ Not only do partners get access to various reports and dashboards, but they also have access to a dedicated relationship manager as well as our multilingual support team.

➡️ Affiliates may instantly provide a convincing offer for their consumers by promoting IG and the broker’s world-class goods. This enables the affiliates to increase their sales.

The following are the minimal prerequisites for participation in an IG affiliate program:

➡️ Any potential partners must be above the age of 18 to be considered.

➡️ The potential affiliate must provide evidence of the operation of a website.

➡️ Either trading or financial services should be the primary emphasis of the website.

➡️ Information about business or finances must be presented on the website in a way that is fair and unbiased.

➡️ The website must be geared at users who are above the age of 18 as its target demographic.

How does the IG affiliate program work, and what are its key features?

The affiliate program operates on a commission-based structure, allowing individuals or entities (affiliates) to earn commissions by referring new clients to the platform. Affiliates receive unique tracking links or codes to identify their referred clients.

What support and tools does the IG affiliate program provide to its partners?

The affiliate program is equipped with a range of support and tools to empower partners for success. Affiliates typically have access to a dedicated affiliate dashboard, where they can generate tracking links, monitor referral activity, and track commissions in real-time.

You might also like: FBS Review

You might also like: JustMarkets Review

You might also like: LegacyFX Review

You might also like: LiteFinance Review

You might also like: Markets.com Review

Customer Support

IG offers 24/7 customer support that can be contracted in several ways including live chat, email, and telephonically. This ensures that traders have all the help that they need when they may need it.

| Customer Support | IG ‘s Customer Support |

| ⏰ Operating Hours | 24/7 |

| 🗣 Support Languages | English, Chinese, French, German, Italian, Arabic, Japanese, Spanish, Swedish, Norwegian, Portuguese, Dutch, Danish |

| 🗯 Live Chat | Yes |

| 📧 Email Address | Yes |

| ☎️ Telephonic Support | Yes |

| 📞 Local Support in Botswana? | No |

| 🥇 Overall quality of IG Support | 4.8/5 |

Corporate Social Responsibility

According to IG, its employees have a sense of responsibility in the operations of the business and the effect that operations have on people and the environment. The IG Group’s success is due to its devotion to ethics, which can be seen in the following:

An online broker’s regular activities produce fewer harmful pollutants than many businesses in other industries. IG is proud to be carbon neutral under PAS2060 and to minimize its environmental impact.

IG believes in protecting the environment and helping others. IG contributes 1% of its post-tax income to charity.

IG also requires its workers to volunteer time and money to Brighter Future Finance, which funds community outreach activities.

As a financial services firm, IG must maintain strong governance and regulatory requirements. IG has established a thorough risk management technique to keep the broker on track.

Key Risk Indicators and risk ratings assist IG to meet its own criteria.

Our Verdict

There is a great degree of confidence in IG, which is why it is fully regulated and listed on the London Stock Exchange. When it comes to online trading, IG is one of the finest brokers.

A complete library of training and guidance on how to day trade effectively is available on IG’s website, making it a great broker for newbies to get started. Charts, market news, customer mood, and data and analytical tools are all available to traders.

IG is an excellent choice for both novice and experienced traders, with low spreads, a wide range of trading instruments, and innovative news, research, and instructional website.

As their accounts grow in value, clients can choose from a choice of platforms and upgrade at any time. In addition, direct market access (DMA) bypassing the dealing desk is something that is an advantage for professional traders.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| IG offers competitive spreads that ensure that traders receive the best pricing in a competitive market | IG requires a high minimum deposit |

| There are several educational resources offered by IG | There are currency conversion fees and inactivity fees charged |

| IG offers flexible forex and CFD trading over several trading platforms | There is a limited range of funding and withdrawal options offered by IG |

| IG offers one of the largest portfolios of tradable instruments | There is a restriction on the leverage level that traders can expect from IG |

| IG’s customer support is available around the clock | |

| There are several account types to choose from according to the trader’s country of residence and market regulator | |

| There are several reliable funding options offered by IG | |

| IG offers an Islamic account and a demo account |

Conclusion

Now it is your turn to participate:

Do you have any prior experience with IG?

What was the determining factor in your decision to engage with IG?

Was it because of the minimum deposit, regulation, retail trading accounts, or any other factors?

Have you experienced any issues with IG such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

Regardless, please share your thoughts in the comments below.

Frequently Asked Questions

Is IG regulated?

Yes, the broker is well-regulated by eight Tier-1, three Tier-2, and one Tier-3 market regulators in the United Kingdom, Singapore, Japan, the United States, New Zealand, Australia, Germany, Switzerland, Cyprus, Dubai, and South Africa, and Bermuda.

How much leverage does IG offer?

They offer leverage up to 1:30 to UK and EU residents along with retail traders. Professional traders have access to leverage up to 1:222.

Is IG an ECN broker?

Yes, the broker is an ECN, STP, and DMA broker. IG employs Electronic Communications Network (ECN), Straight-Through Processing (STP), and Direct Market Access (DMA) technology.

What is the withdrawal time with IG?

Withdrawals can take from 1 working day up to five business days, depending on the payment method that you used.

How much does IG charge per trade on shares?

Between $5 to $8. If you had more than three trades in the previous month, you can expect commissions of $5 per trade while fewer trades will cost you $8 per trade.

Does IG use MT4?

Yes, the broker offers MT4 along with these trading platforms:

- IG Platform

- ProRealTime (PRT)

- L2 Dealer

- FIX API

Is IG safe or a scam?

The broker is one of the safest brokers in the world with a 99% trust score.

Does IG have Nasdaq?

Yes, the broker offers Nasdaq as part of its financial instrument portfolio.

Does IG have Volatility 75?

Yes, they are one of a few forex and CFD brokers that currently offer VIX as an Index CFD.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review