Markets.com Review

Overall, Markets.com is considered an average risk, with an overall Trust Score of 97% out of 100. Markets.com offers 5 excellent trading platforms. Markets.com is authorized by two tier-1 regulators (high trust), one tier-2 regulator (average trust), and zero tier-3 regulators (low trust). Markets.com is currently not regulated by the Central Bank of Botswana.

- Louis Schoeman

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

100 USD /1 349 BWP

Regulators

CySEC, FSCA, ASIC, FCA, FSC

Trading Desk

MetaTrader 4, MetaTrader 5 Markets.com, proprietary platform

Crypto

Yes

Total Pairs

67

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overview

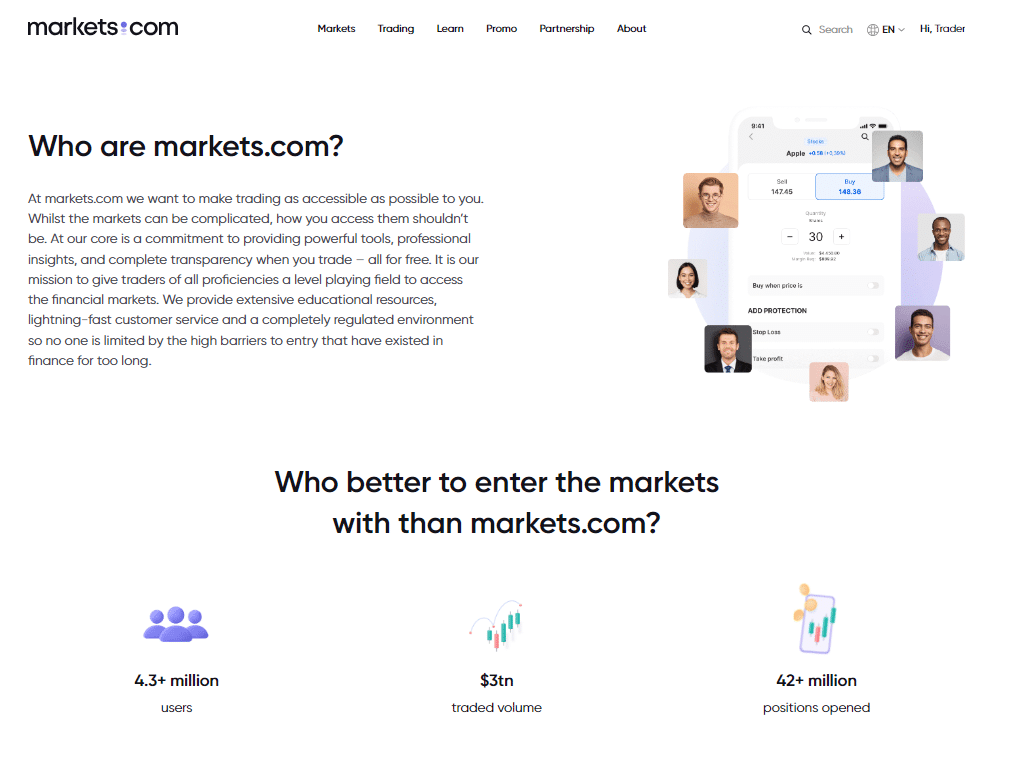

Overall, Markets.com is considered low-risk, with an overall Trust Score of 98 out of 100. Markets.com is licensed by two Tier-1 Regulators (high trust), two Tier-2 Regulators (average trust), and one Tier-3 Regulator (low trust). In addition, Markets.com offers one different retail trading account, namely a Standard MarketsX Account.

Markets.com was created in 2008 and is a subsidiary of Finalto, a subsidiary of Playtech PLC, a component of the FTSE 250 Index, and listed on the London Stock Exchange Main Market.

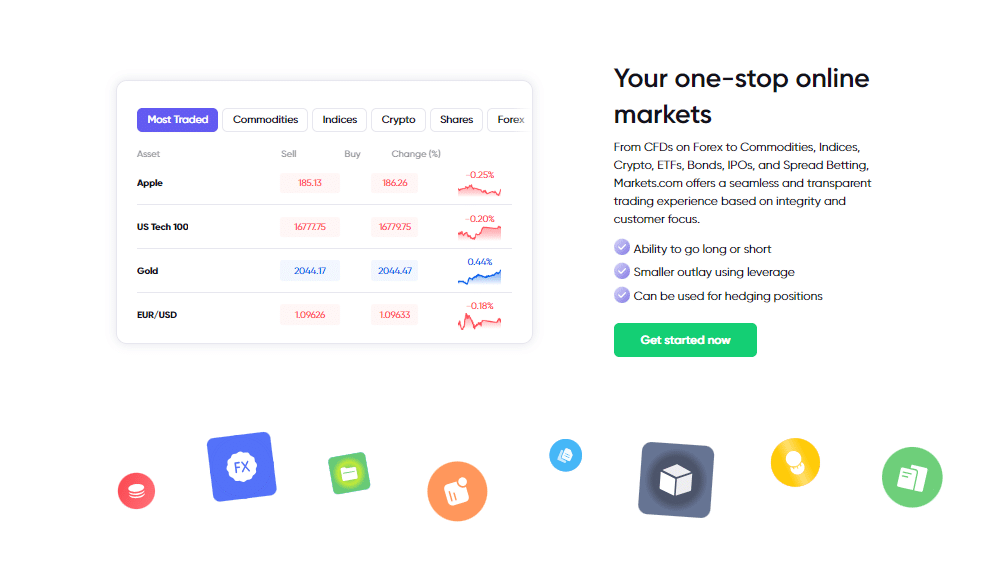

Markets.com provides traders with quick, low-cost trading on various financial products, including over 2,000 stock CFDs, Forex, commodities, cryptocurrencies, indices, ETFs, and bonds.

Markets.com accepts Botswanan clients and has an average spread from 0.6 pips with zero commission charges. In addition, Markets.com has a maximum leverage ratio of up to 1:300, and a demo and Islamic account are available.

MT4, MT5, and MarketsX platforms are supported. Markets.com is headquartered in South Africa and regulated by ASIC, CySEC, FSCA, FCA, and BVI FSC.

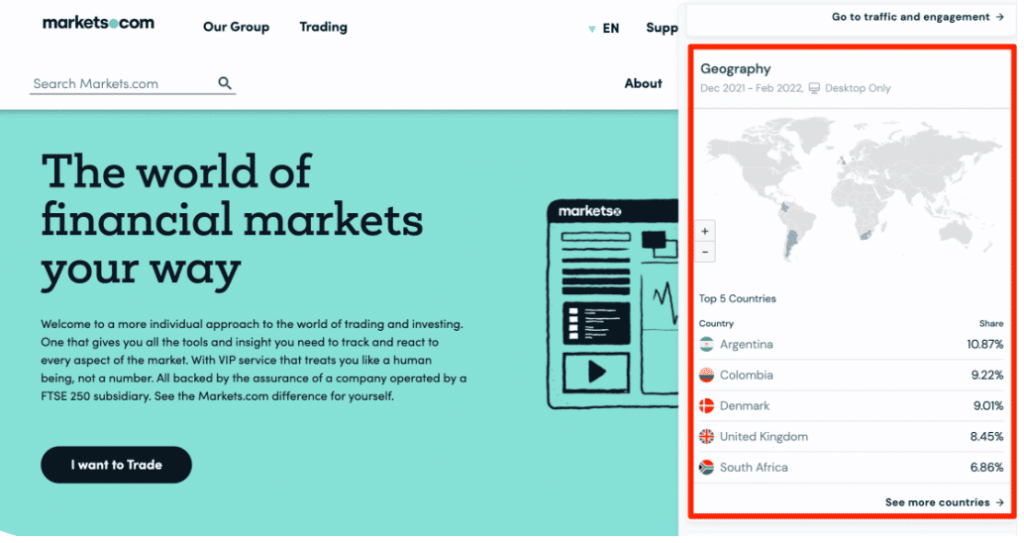

Distribution of Traders

Markets.com currently has the largest market share in these countries:

➡️ Argentina – 10.8%

➡️ Colombia – 9.2%

➡️ Denmark – 9.01%

➡️ United Kingdom – 8.45%

➡️ South Africa – 6.8%

Popularity among traders

Markets.com is a well-known South African broker. While it does not dominate the Botswanan forex market, it is a practical and trustworthy choice for Botswanan traders, ranking it among the country’s Top 15 forex and CFD brokers.

Markets.com At a Glance

| 🏛 Headquartered | The British Virgin Islands |

| 🌎 Global Offices | United Kingdom, South Africa, Cyprus, Australia, the British Virgin Islands |

| 🏛 Local Market Regulators in Botswana | • Ministry of Finance and Economic Development (MFED) • Bank of Botswana (BoB) • Non-Bank Financial Institutions Regulatory Authority (NBFIRA) |

| 💳 Foreign Direct Investment in Botswana | 115.89 BWP Million in 2021 |

| 💰 Foreign Exchange Reserves in Botswana | 5270 USD Million in 2021 |

| ✔️ Local office in Gaborone? | No |

| 👨⚖️ Governor of SEC in Botswana | None, Moses Dinekere Pelaelo is the Governor of the Bank of Botswana |

| ✔️ Accepts Botswana Traders? | Yes |

| 📊 Year Founded | 2008 |

| 📞 Botswana Office Contact Number | None |

| 📱 Social Media Platforms | • Facebook • YouTube |

| ⚖️ Regulation | ASIC, CySEC, FSCA, FCA, BVI FSC |

| 1️⃣ Tier-1 Licenses | • Financial Conduct Authority (FCA) • Australian Securities and Investments Commission (ASIC) |

| 2️⃣ Tier-2 Licenses | • Cyprus Securities and Exchange Commission (CySEC) • Financial Sector Conduct Authority (FSCA) |

| 3️⃣ Tier-3 Licenses | • British Virgin Islands Financial Services Commission (BVI FSC) |

| 🪪 License Number | • Cyprus (Safecap Investments) – 092/08 • British Virgin Islands (Finalto) – SIBA/L/14/1067 • South Africa (Finalto Pty Ltd) – 46860 • South Africa (Safecap Investments Limited) – 43906 • United Kingdom (Finalto Trading Ltd) – 607305 • Australia (Finalto) – ABN 82158641 |

| ⚖️ MFED, BoB, or NBFIRA Regulation | No |

| ✔️ Regional Restrictions | The United States, Japan, Canada, Belgium, Israel, New Zealand, Russia, Hong Kong, and several other regions |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 2 |

| ✔️ PAMM Accounts | Yes |

| 💻 Liquidity Providers | None indicated |

| ✔️ Affiliate Program | Yes |

| 📱 Order Execution | Market and Instant |

| 📊 Starting spread | 0.6 pips EUR/USD |

| 📉 Minimum Commission per Trade | Commission-free |

| 💰 Decimal Pricing | Up to 5 digits after the comma |

| 📞 Margin Call | 50% |

| 🛑 Stop-Out | 20% |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | 100 lots |

| ✅ Crypto trading offered? | No |

| ✔️ Offers a BWP Account? | No |

| 📉 Dedicated Botswana Account Manager? | No |

| 📈 Maximum Leverage | 1:300 |

| 📊 Leverage Restrictions for Botswana? | No |

| 💳 Minimum Deposit (BWP) | 1 349 Botswanan Pula or an equivalent to $100 |

| ✔️ Botswana Pula Deposits Allowed? | No, only USD, ZAR, GBP, and EUR |

| 📊 Active Botswana Trader Stats | 250,000+ |

| 👥 Active Botswana-based Markets.com customers | Unknown |

| 🔁 Botswana Daily Forex Turnover | Unknown, Forex overall is $6.6 Trillion |

| 💰 Deposit and Withdrawal Options | • Bank Wire Transfer • Credit Card • Debit Card • Skrill • Neteller • PayPal • Local Bank Transfer • Ideal • Sofort |

| 💻 Minimum Withdrawal Time | 24 Hours |

| ⏰ Maximum Estimated Withdrawal Time | 7 working days |

| 💳 Instant Deposits and Instant Withdrawals? | Yes |

| 🏛 Segregated Accounts with Botswana Banks? | No |

| 📱 Trading Platforms | • MarketsX • MetaTrader 4 • MetaTrader 5 |

| 💻 Tradable Assets | • Forex Pairs • Commodities • Exchange-traded funds (ETFs) • Indices • Crypto Assets • Stocks |

| ✔️ Offers USD/BWP currency pair? | No |

| 📊 USD/BWP Average Spread | No |

| ✅ Offers Botswana Stocks and CFDs | No |

| 💻 Languages supported on the Website | English, Spanish, Thai, Vietnamese |

| ☎️ Customer Support Languages | Multilingual |

| 👥 Copy Trading Support | Yes |

| ⏰ Customer Service Hours | 24/5 |

| 📞 Botswana-based customer support? | Yes |

| 💸 Bonuses and Promotions for Botswanans? | Yes |

| 📚 Education for Botswana beginner traders | Yes |

| 📱 Proprietary trading software | No |

| 🤝 Most Successful Trader in Botswana | Currently unknown |

| ✔️ Is Markets.com a safe broker for Botswana Traders? | Yes |

| 🎖 Rating for Markets.com Botswana | 7/10 |

| 🥇 Trust score for Markets.com Botswana | 98% |

| 👉 Open Account | 👉 Open Account |

Regulation and Safety of Funds

Regulation in Botswana

The local market regulators in Botswana are as follows:

➡️ Ministry of Finance and Economic Development (MFED)

➡️ Bank of Botswana (BoB)

➡️ Non-Bank Financial Institutions Regulatory Authority (NBFIRA)

While Markets.com is regulated globally, the broker does not yet have local regulations or licenses in Botswana. However, Markets.com is a popular and trustworthy broker that accommodates Botswanan traders.

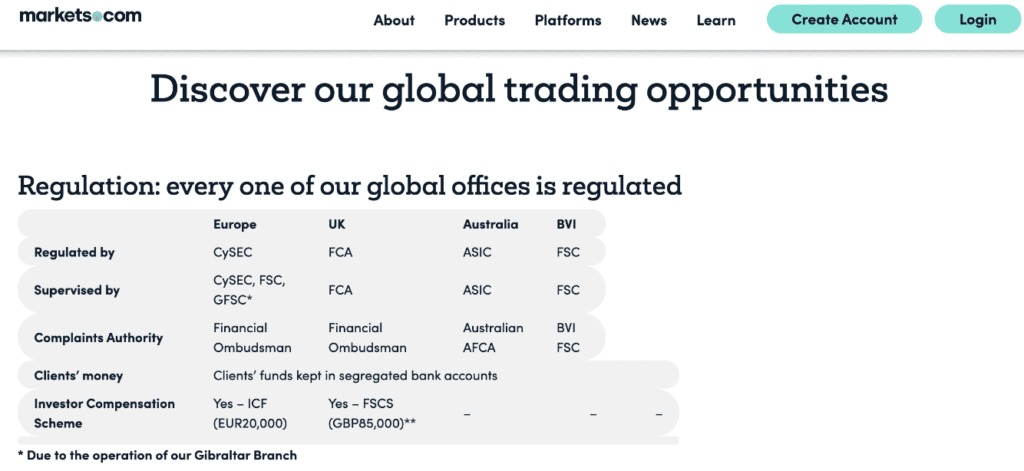

Global Regulations

The following entities regulate Markets.com:

➡️ The Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC) are responsible for regulating Markets.com AU and Markets.com CY, respectively.

➡️ com SA is governed by the reputable and stringent Financial Sector Conduct Authority (FSCA) in South Africa, where the firm maintains a local office.

➡️ com UK is overseen and regulated by the Financial Conduct Authority (FCA).

➡️ In addition to regulating Markets.com, the British Virgin Islands Financial Services Commission (BVI FSC) is responsible for its management.

Client Fund Security and Safety Features

Each region is responsible for ensuring that investors’ interests are protected. Markets.com’s size allows it to adapt its services to your area, including any local restrictions.

In several countries worldwide, strict financial reporting regulations require segregating client assets. As a result, customers’ funds are maintained in separate bank accounts from Markets.com’s own funds, and negative balance protection is advantageous for traders.

How does Markets.com ensure the safety of client funds?

The broker places a strong emphasis on the safety of client funds through various protective measures. As a regulated broker, Markets.com adheres to the regulatory guidelines set by the British Virgin Islands Financial Services Commission (BVIFSC).

Awards and Recognition

Other than the “Best Trading Platform” award from FxScouts in 2020, Markets.com does not presently provide any information on its awards and accolades.

Has Markets.com received any notable awards for its services in the financial industry?

Yes, has garnered recognition through several notable awards within the financial industry. The platform has been honored across various categories, including trading services, customer support, and technological innovations.

How is Markets.com regarded in the financial industry, and what does its reputation suggest about the platform?

The broker enjoys a positive reputation within the financial industry, reflecting its dedication to transparency, customer satisfaction, and technological innovation.

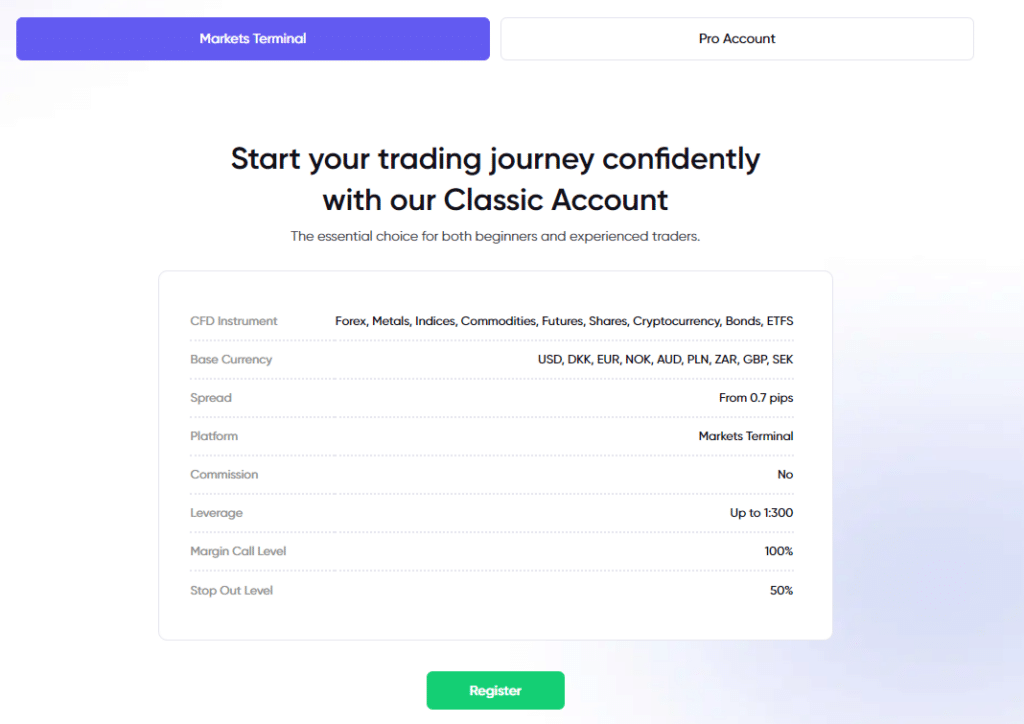

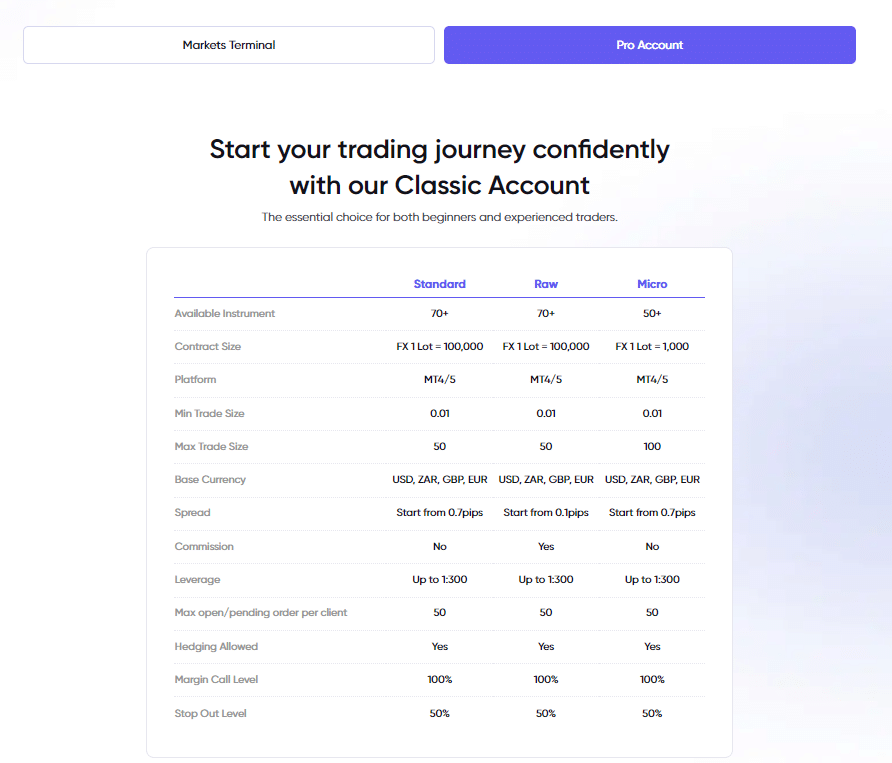

Markets.com Account Types and Features

Markets.com offers two types of trading accounts, namely the Retail Account and the Professional Account. The broker also offers a free demo account, as well as a swap-free account for Islamic traders. Traders can also open Joint and Corporate Accounts. You can only hold a Joint Account with a spouse or a first-degree family relative (mother, father, brother, sister).

Live Trading Account Details

Markets Account

| Account Feature | Value |

| 💵 Minimum Deposit | 1 349 BWP or an equivalent to $100 |

| 📊 Average Spreads | From 0.8 pips on major forex pairs |

| 📈 Average Spreads MetaTrader 4 | From 0.6 pips on major forex pairs |

| 📉 Average Spreads MetaTrader 5 | From 0.6 pips on major forex pairs |

| 💰 Commissions | None |

| 💵 Leverage | Up to 1:300 for non-EU traders |

| 💸 Trading Platforms | • MetaTrader 4 • MetaTrader 5 • MarketsX |

| 📱 Customer Support Offered | Yes |

| 💻 Trading Signals | Yes |

| 🔧 Trading Tools offered | Yes |

| 🚨 Trading Alerts and Notifications | Customizable alerts |

| 📉 Range of Markets | 8,000+ financial instruments |

Pro Account

Professional – This is for professionals investing over $500,000. Additional leverage is available with a professional account.

Base Account Currencies

Botswanans can choose their default account currency among USD, EUR, GBP, DKK, NOK, SEK, PLN, CZK, and AED when opening an account with Markets.com.

This implies that Botswanans making deposits or withdrawals in BWP can incur currency translation costs, which might harm their profitability.

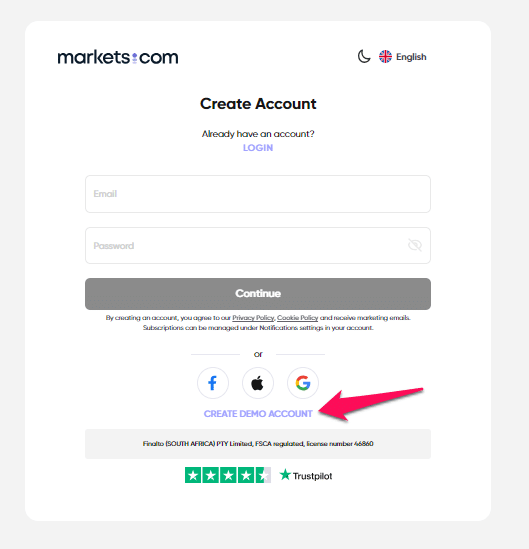

Demo Account

Traders can also open a Demo Account, which allows them to learn how the platform and markets function. Demo accounts come with a $10,000 virtual balance.

The 30-day duration of the sample account is extendable if required. Additionally, it is mobile-friendly, so you can study trading on your smartphone or tablet.

Islamic Account

Depending on their trading style and approach, a forex trader’s position may be open for longer than 24 hours throughout a trading day.

This might incur an overnight or rollover fee for the trader. Moreover, this kind of interest is prohibited under Sharia law’s Riba regulations, restricting Muslim forex traders.

Muslim traders who adhere to Sharia may create a live account with Markets.com and have it converted into an Interest-Free Islamic Account, exempting them from paying or earning overnight fees when positions are open for more than 24 hours.

What types of trading accounts does Markets.com offer, and how do they differ?

The broker caters to a diverse range of traders by offering multiple account types to suit different preferences and trading styles. The primary account types include the Retail Account and the Professional Account.

What features are included with Markets.com trading accounts?

The brokers trading accounts come with a range of features aimed at enhancing the overall trading experience. Across different account types, traders have access to a selection of cutting-edge trading platforms, including the popular MetaTrader 4 (MT4) and the proprietary Marketsx platform.

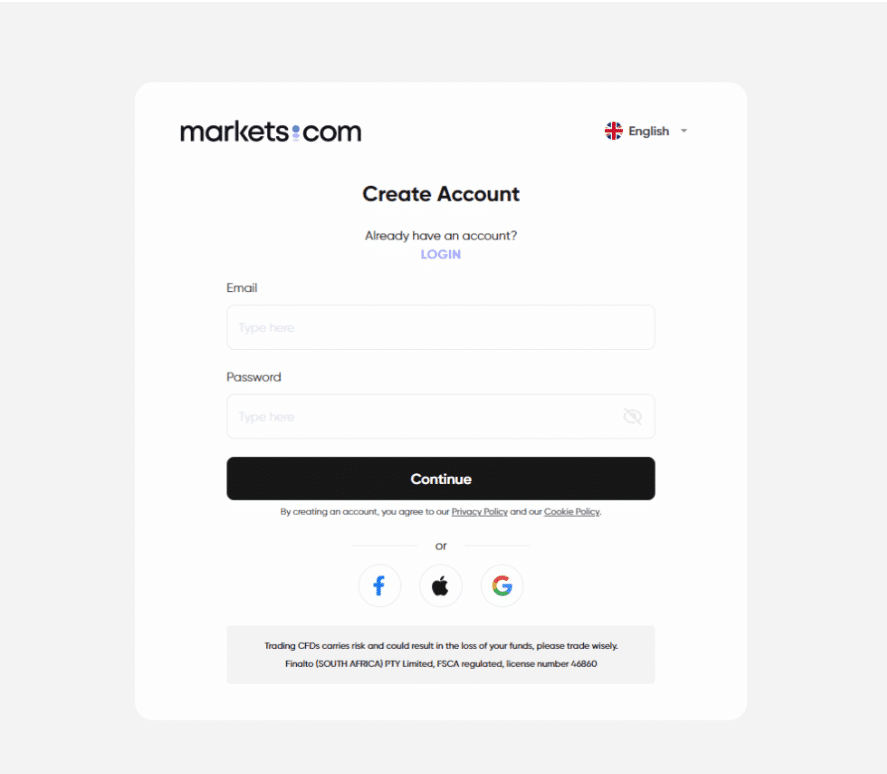

How to open an Account with Markets.com

Step 1: Start the Markets.com Account Registration.

In order for a Markets.com Account, the applicant can simply click on the black “Sign Up” button located at the top right corner of the Markets.com website.

Step 2: Complete the Markets.com Account Registration.

In order for the account registration to be completed, the applicant will be required to sign up or log in via Apple, Facebook, or Google. A selection of questions must be completed where after the created account can be funded and trading can commence.

Markets.com Vs HFM Vs Exness – Broker Comparison

| 🥇 Markets.com | 🥈 HFM | 🥉 Exness | |

| ⚖️ Regulation | ASIC, CySEC, FSCA, FCA, BVI FSC | FSCA, CySEC, DFSA, FSA, FCA, FSC, and CMA with registration in ACPR, BaFin, MNB, CONSOB, CNMV, FI, FMA, FSC, and other regions | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA |

| 📱 Trading Platform | • MarketsX • MetaTrader 4 • MetaTrader 5 | • MetaTrader 4 • MetaTrader 5 • HF App | • MetaTrader 4 • MetaTrader 5 • Exness App • Exness Terminal |

| 💰 Withdrawal Fee | None | No | No |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 1 349 BWP | 66 BWP | 130 BWP |

| 📊 Leverage | 1:300 | 1:1000 | Unlimited |

| 📊 Spread | From 0.6 pips | 0.0 pips | Variable, from 0.0 pips |

| 💰 Commissions | Spread only | $3 to $4 | From $0.1 per side per lot |

| ✴️ Margin Call/Stop-Out | 50%/20% | • 40%/10% • 50%/20% | 60%/0% |

| 💻 Order Execution | Instant, Market | Market | Market |

| 💳 No-Deposit Bonus | No | No | No |

| 📊 Cent Accounts | No | No | Yes |

| 📈 Account Types | MarketsX Account | • Micro Account • Premium Account • Nigeria HFcopy Account • Nigeria Zero Spread Account • Auto Account | • Standard Account • Standard Cent Account • Raw Spread Account • Zero Account • Pro Account |

| ⚖️ CBN Regulation | No | No | No |

| 💳 BWP Deposits | No | Yes | Yes |

| 📊 Botswana Pula Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/5 | 24/7 |

| 📊 Retail Investor Accounts | 2 | 5 | 3 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 📉 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | 100 lots | 60 lots | Unlimited |

| 💰 Minimum Withdrawal Time | 24 hours | 10 Minutes | Instant |

| 📊 Maximum Estimated Withdrawal Time | 7 working days | 10 business days | Up to 72 hours |

| 💸 Instant Deposits and Instant Withdrawals? | Yes, Deposits | No | Yes |

Markets.com Trading Platforms

Offers Botswanan traders a choice between these trading platforms:

➡️ MarketsX

➡️ MetaTrader 4

➡️ MetaTrader 5

Desktop Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4

The Forex-specific MetaTrader 4 (MT4) platform remains one of the most popular and user-friendly trading platforms.

MT4, used by millions of traders across the globe, offers an abundance of tools and functionality to provide a smooth and pleasant trading experience for traders of all experience levels.

MetaTrader 5

MetaTrader 5, abbreviated as MT5, is a multi-asset derivatives platform designed for trading on a wide range of currencies, futures, stocks, and CFDs. In contrast, MetaTrader 4, or MT4, was created particularly for currency trading.

It is a streamlined, faster version of MT4 that allows hedging and netting and provides more technical indicators, better market depth information, and a wider number of periods. In addition, it provides a greater variety of technical indications.

WebTrader Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4

MetaTrader 4’s user interface is not too frightening for those new to online trading. The number of accessible trading tools should be adequate to suit the requirements of even the most demanding traders.

More free trading tools are available to increase the platform’s usefulness. When Markets.com controls pricing and infrastructure, you can be guaranteed that your transactions will be performed at the best available rates and with the lowest possible spreads.

MetaTrader 5

Markets.com’s exclusive trading platform, with its support for MetaTrader 5, offers traders a vast array of investment analysis tools, indicators, and signals to assist them in making the most profitable trading decisions possible.

While novice and intermediate traders will find the customized platform most helpful, it is more probable that advanced traders will utilize MetaTrader 5.

Trading App

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ MarketsX Mobile

MetaTrader 4 and 5

MT4/5 mobile has many tools and features that make trading easy and enjoyable for traders of all experience levels. In addition, the user interface offers a variety of trading instruments to satisfy even the most discerning Botswanan investors.

MetaTrader 5, a multi-asset derivatives platform meant to compete with MetaTrader 4, enables Forex, futures, stock, and CFD trading. In addition, MetaTrader 5 enables hedging and netting and provides a wider selection of timeframes and different technical indicators.

MarketsX

The Markets.com mobile app is compatible with Android and iOS smartphones and tablets. This user-friendly mobile trading application allows you access to several dynamic trading tools and innovative trading technology while on the go.

You may trade online using Markets.com’s award-winning trading platform, which offers various customizable features.

Markets.com’s features include a shortlist of your preferred trading instruments, several chart views, and advanced trading tools, all developed by Markets.com’s algorithms.

The platform’s slick, the user-friendly layout makes trading enjoyable. Moreover, each platform feature may be accessible promptly with a few clicks.

In addition, you may choose a multi-chart view from inside the website, which offers extensive charting with innovative analytical tools and free real-time quotes.

In addition, the app may be downloaded from the App Store or Google Play by completing a simple form on Markets.com.

What trading platforms does Markets.com offer to its clients?

The broker provides its clients with access to a variety of cutting-edge trading platforms, catering to different preferences and trading styles. The platform offers the widely acclaimed MetaTrader 4 (MT4), a robust and user-friendly platform known for its advanced charting tools, technical analysis features, and support for automated trading through Expert Advisors (EAs).

Can I trade on Markets.com using my mobile device, and what features are available on the mobile platforms?

Absolutely. the broker recognizes the importance of mobile trading in today’s fast-paced markets. Traders can trade on the go using the mobile versions of MetaTrader 4 (MT4) and the Marketsx platform.

Range of Markets

Botswanan traders can expect the following range of markets from Markets.com:

➡️ Shares

➡️ Bonds

➡️ Cryptocurrencies

➡️ Forex

➡️ ETFs

➡️ Futures

➡️ Indices

➡️ Blends

➡️ Commodities

Financial Instruments and Leverage offered by Markets.com

| 🔨 Instrument | 💰 Number of Assets Offered | 📈 Max Leverage Offered |

| ➡️ Shares | 1,953 | 1:10 |

| ➡️ Bonds | 4 | 1:1000 |

| ➡️ Cryptocurrencies | 25 | 1:10 |

| ➡️ Forex | 67 | • MarketsX – 1:300 • MT4/MT5 – 1:200 |

| ➡️ ETFs | 60 | 1:33 |

| ➡️ Indices | 40 | 1:200 |

| ➡️ Blends | 10 | 1:10 |

| ➡️ Commodities | 28 | 1:200 |

| ➡️ Futures | 19 | 1:200 |

What financial instruments can I trade on Markets.com?

The broker offers a diverse range of financial instruments across various asset classes, providing traders with numerous opportunities for portfolio diversification. The platform covers the dynamic foreign exchange market (forex) with a wide array of currency pairs, including majors, minors, and exotic pairs.

Does Markets.com offer cryptocurrency trading, and what cryptocurrencies are available on the platform?

Yes, the broker recognizes the growing popularity of cryptocurrencies and provides traders with the opportunity to trade a selection of popular digital assets. Cryptocurrencies available on the platform may include Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and other notable digital currencies.

Broker Comparison for Range of Markets

| 🥇Markets.com | 🥈HFM | 🥉Exness | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | Yes | No | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | Yes | No |

| ➡️️ Options | Yes | No | No |

| ➡️️ Energies | No | Yes | Yes |

| ➡️️ Bonds | Yes | Yes | No |

Trading and Non-Trading Fees

Spreads

Markets.com provides a premium service with market-beating spreads that change based on market price, financial instrument, and time of day. Therefore, Botswanan traders engaged in leveraged trading with Markets.com should only concern themselves with the spread since the broker charge is already included.

The following are some common spreads that traders might anticipate:

➡️ EUR/USD – from 0.8 pips

➡️ USD/JPY – from 1.2 pips

➡️ AUD/USD – from 0.7 pips

➡️ USD/CHF – from 1.7 pips

➡️ USD/CAD – from 1.4 pips

➡️ GBP/USD – from 1.1 pips

Commissions

Markets.com does not charge commissions for MarketsX, MetaTrader 4, or MetaTrader 5; traders are only charged the spread, which includes Markets.com’s broker fee for completing the transaction.

Overnight Fees, Rollovers, or Swaps

Each open position close to a company’s trading day may incur overnight rollover fees. The rollover charge calculation method differs based on the appropriate instrument type.

In addition, since the fee is tied to current interbank interest rates, its amount will change. This charge may be assessed to your account at the end of the trading day, with or without prior notice.

To avoid the automatic termination of your account, any open positions will be automatically rolled over to the next trading day. As a result, Botswanan traders should anticipate some of the following overnight fees:

➡️ EUR/USD – a short swap of -12.0485 points and a long swap of -12.0489 points.

➡️ Cryptocurrency pairs – short swaps of -12 points and long swaps of -25 points.

➡️ BTCFutures – a short swap of -501.2 points and a long swap of -501.2 points.

➡️ Brent Toil – a short swap of -1.05 points and a long swap of -1.09 points.

➡️ XAU/USD – a short swap of -28.52 points and a long swap of -29.49 points.

➡️ AUS200 – a short swap of -63.835 points and a long swap of -67.59 points.

➡️ US100 – a short swap of -123.6 points and a long swap of -130.8 points.

➡️ VIXX – a short swap of -0.211 points and a long swap of -0.258 points.

➡️ APPL – a short swap of -0.592 points and a long swap of -0.62 points.

➡️ EUR-BUND-10Y – a short swap of -1.2 points and a long swap of -1.2 points.

During significant refinancing operations, the Central Bank of the country whose currency the asset is denominated in announces the Key Interest Rate (or an equivalent). The Financing Charge is a product-specific charge comprised of the following costs:

➡️ Forex – 3.75%

➡️ Indices – 3.75%

➡️ Oil – 6%

➡️ Shares – 11%

➡️ Commodities – 6%

➡️ Natural Gas – 10%

Deposit and Withdrawal Fees

Markets.com does not charge any fees on the deposit or withdrawal methods offered.

Inactivity Fees

After 90 consecutive days of inactivity, inactivity fines are applied to trading accounts. If an account becomes inactive, a $10 fee will be assessed until the account balance reaches zero. At that point, the account will be closed.

Currency Conversion Fees

Markets.com applies currency conversion fees equal to 0.6% multiplied by the conversion rate. These costs are collected when currencies are exchanged.

What are the trading fees associated with Markets.com, and how are they structured?

The broker employs a transparent fee structure primarily based on spreads for various financial instruments, including forex, stocks, indices, commodities, and cryptocurrencies. The spread is the difference between the buying (ask) and selling (bid) prices of an asset.

Are there any non-trading fees on Markets.com, and what should traders be aware of?

In addition to trading fees, Markets.com may charge non-trading fees that traders should consider. Non-trading fees may include overnight financing fees (swap rates) for positions held overnight, withdrawal fees, and inactivity fees for dormant accounts.

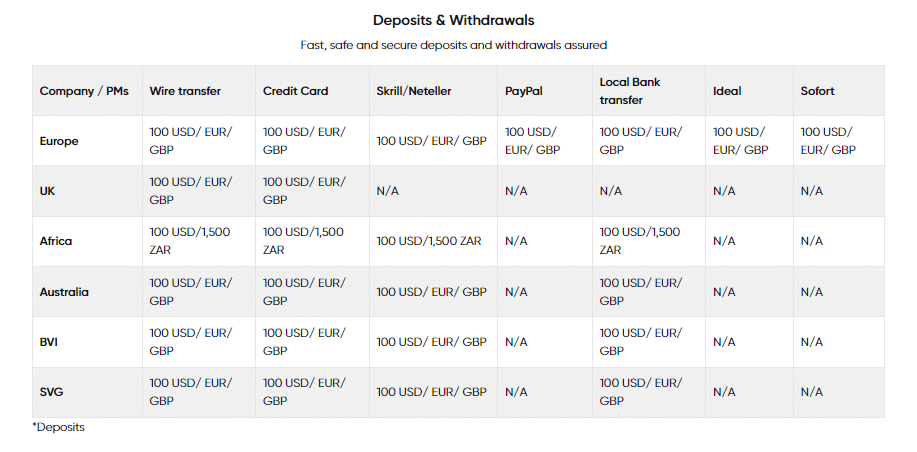

Markets.com Deposits and Withdrawals

Offers the following deposit and withdrawal methods:

➡️ Bank Wire Transfer

➡️ Credit Card

➡️ Debit Card

➡️ Skrill

➡️ Neteller

➡️ PayPal

➡️ Local Bank Transfer

➡️ Ideal

➡️ Sofort

Broker Comparison: Deposit and Withdrawals

| 🥇 Markets.com | 🥈 HFM | 🥉 Exness | |

| Minimum Withdrawal Time | 24 hours | 10 Minutes | Instant |

| Maximum Estimated Withdrawal Time | 7 working days | 10 business days | Up to 72 hours |

| Instant Deposits and Instant Withdrawals? | Yes, Deposits | No | Yes |

Deposit Currencies, Accepted Regulatory Regions for Method, Processing Time, Minimum Withdrawal Amount

| 💳 Payment Method | 💵 Deposit Currencies | 💳 Deposit Processing | 💰 Minimum Withdrawal |

| Bank Wire Transfer | Europe, Australia, UK, BVI | 1 to 2 days | • 100 USD, EUR, GBP • 20 EUR (EU) |

| Credit Card | Europe, Australia, UK, BVI | Up to 24 hours | 10 USD, EUR, GBP |

| Debit Card | Europe, Australia, UK, BVI | Up to 24 hours | 10 USD, EUR, GBP |

| Skrill | Europe, Australia, UK, BVI | – | 5 USD, EUR, GBP |

| Neteller | Europe, Australia, UK, BVI | – | 5 USD, EUR, GBP |

| PayPal | Europe | – | – |

| Local Bank Transfer | Europe, Australia, UK, BVI | – | – |

| Ideal | Europe | – | – |

| Sofort | Europe | – | – |

How can I make a deposit into my Markets.com trading account, and what payment methods are supported?

Making a deposit into your Markets.com trading account is a straightforward process. The platform supports a variety of payment methods for deposits, including bank wire transfers, credit/debit cards, and popular e-wallet options such as Skrill and Neteller.

How can I initiate a withdrawal from my Markets.com trading account, and what withdrawal options are available?

Initiating a withdrawal from your Markets.com trading account is a simple process. Log in to your account, go to the withdrawal section, and select your preferred withdrawal method. Markets.com typically processes withdrawals using the same method that was used for the initial deposit.

How to Deposit Funds with Markets.com

Step 1: Log in to your Markets.com account.

Once you have registered an account, visit the markets.com home page to access your trading account.

Step 2: Fill in your Log in details

Go to your personal client area on the account dashboard and select the option to make a deposit.

Step 3: locate Markets.com dashboard to deposit funds.

Select your payment method. This is the same method by which you will have to make withdrawals, Specify the amount you wish to deposit, confirm, and submit your deposit.

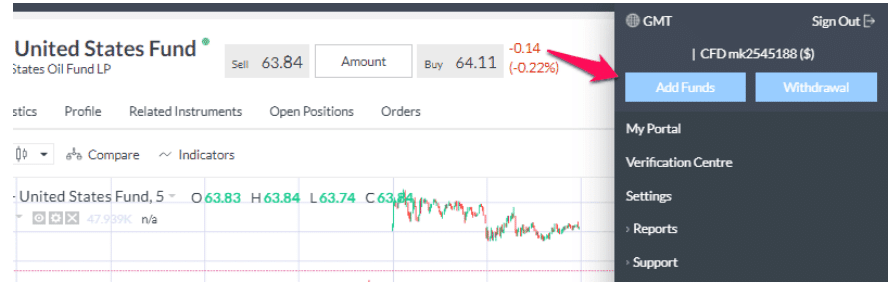

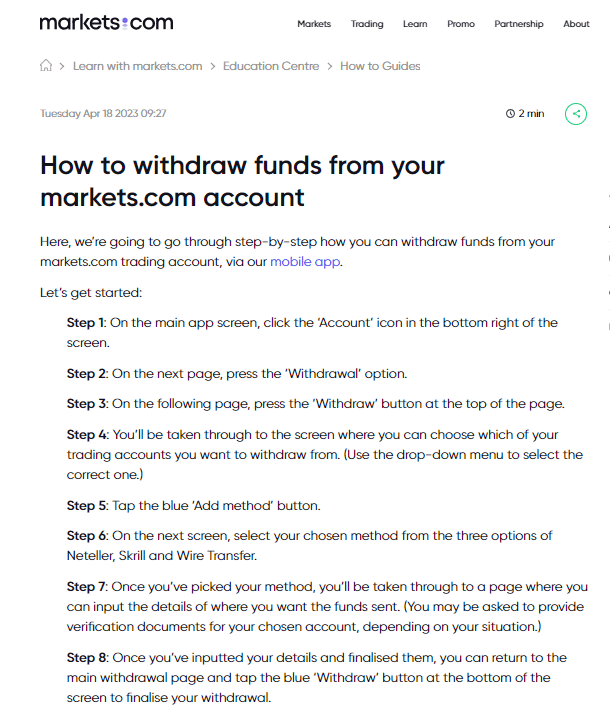

Markets.com Fund Withdrawal Process

To withdraw funds from an account with Markets.com, Botswanan traders can follow these steps:

➡️ To withdraw money from your Markets.com account, go to the Menu in the upper right corner of the site and choose withdrawal.

➡️ If withdrawing using the mobile app is more convenient, you may do so.

➡️ Complete and submit the withdrawal request to Markets.com for processing.

Up to the amount placed, clients will receive monies using the same payment method they used to deposit. For example, if a deposit is made using a credit card, the funds will be returned to the same credit card.

Preference is given to credit card deposits, which will be refunded first (with deposits made within the last year getting priority), followed by other withdrawal methods.

Education and Research

Education

Markets.com offers the following Educational Materials:

➡️ Xray

➡️ eBooks

➡️ Market News

➡️ FAQs

➡️ Webinars

Research and Trading Tool Comparison

| 🥇 Markets.com | 🥈 HFM | 🥉 Exness | |

| ➡️ Economic Calendar | No | Yes | Yes |

| ➡️ VPS | No | Yes | Yes |

| ➡️ AutoChartist | No | Yes | Yes |

| ➡️ Trading View | Yes | No | Yes |

| ➡️ Trading Central | No | No | Yes |

| ➡️ Market Analysis | Yes | Yes | Yes |

| ➡️ News Feed | Yes | Yes | Yes |

| ➡️ Blog | Yes | Yes | Yes |

Markets.com also offers Botswanan traders the following additional Research and Trading Tools:

➡️ Analysis

➡️ Market insight

➡️ Fundamental Analysis

➡️ Technical Tools

➡️ Sentimental tools

➡️ Blogger’s opinions

➡️ Hedge Funds Investment Confidence

➡️ Insider Trades

➡️ Trading Analysis Recommendations

➡️ Trends in Trading

➡️ Trading Signals

➡️ Advanced Charting

➡️ Financial Commentary

➡️ Advanced Trading Alerts

➡️ Thomson Reuters Stock Report

What educational resources does Markets.com offer to help traders enhance their skills and knowledge?

The broker is committed to supporting the educational needs of traders by providing a range of comprehensive resources. The platform offers educational materials such as webinars, video tutorials, and written guides that cover a wide range of topics.

What research tools are available on Markets.com to assist traders in making informed decisions?

The broker equips traders with a variety of research tools designed to facilitate informed decision-making. The platform provides daily market analysis, economic calendars, and expert commentary to keep traders updated on significant market events and trends.

10 Best Forex Brokers in Botswana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

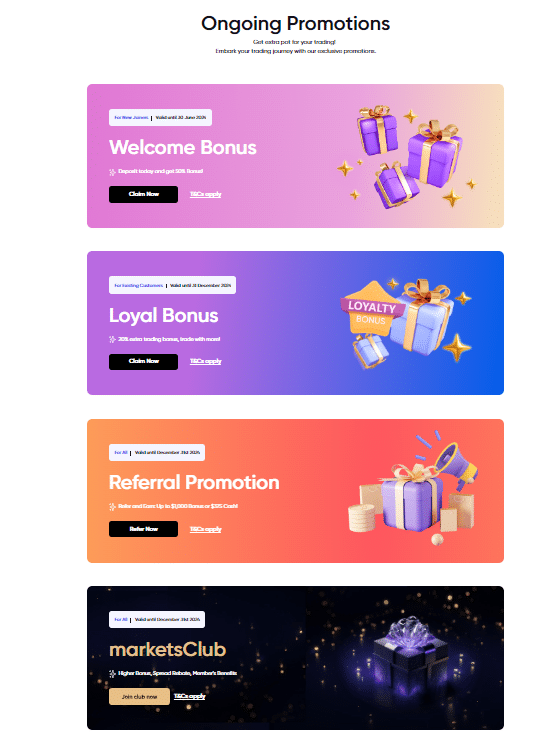

Bonuses and Promotions

The broker offers a variety of broker bonuses and promotions to new and existing loyal customers. These include trading bonuses and referral bonuses, though at the time of writing deposit bonuses and no deposit bonuses are not available to Botswanan traders.

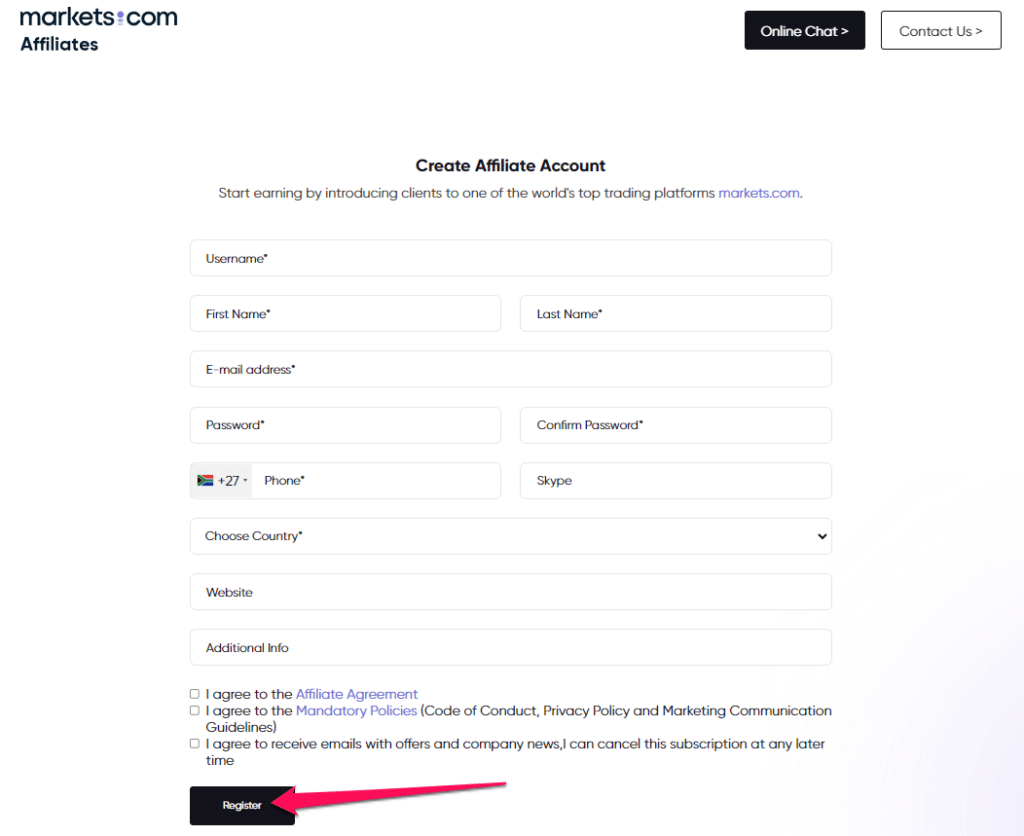

How to open an Affiliate Account with Markets.com

To register an Affiliate Account, Botswanan traders can follow these steps:

Step 1 : “Partnership”.

Navigate to Markets.com website by entering “Partnership”.

Step 2: Click on Join Us

Before joining, read Markets.com’s partnership offering, terms and conditions, Privacy Policy, and client agreement.

Step 3: “Register,”

Click the “Join Us” banner and fill out the Affiliate account application using your username, first and last name, email address, and mobile phone number. Next, pick a user-defined password, select your country from the drop-down menu, and input your firm information, such as its name and website address.

Apply by clicking “Register,” and then wait for a Markets.com affiliate customer representative to contact you about the status of your application.

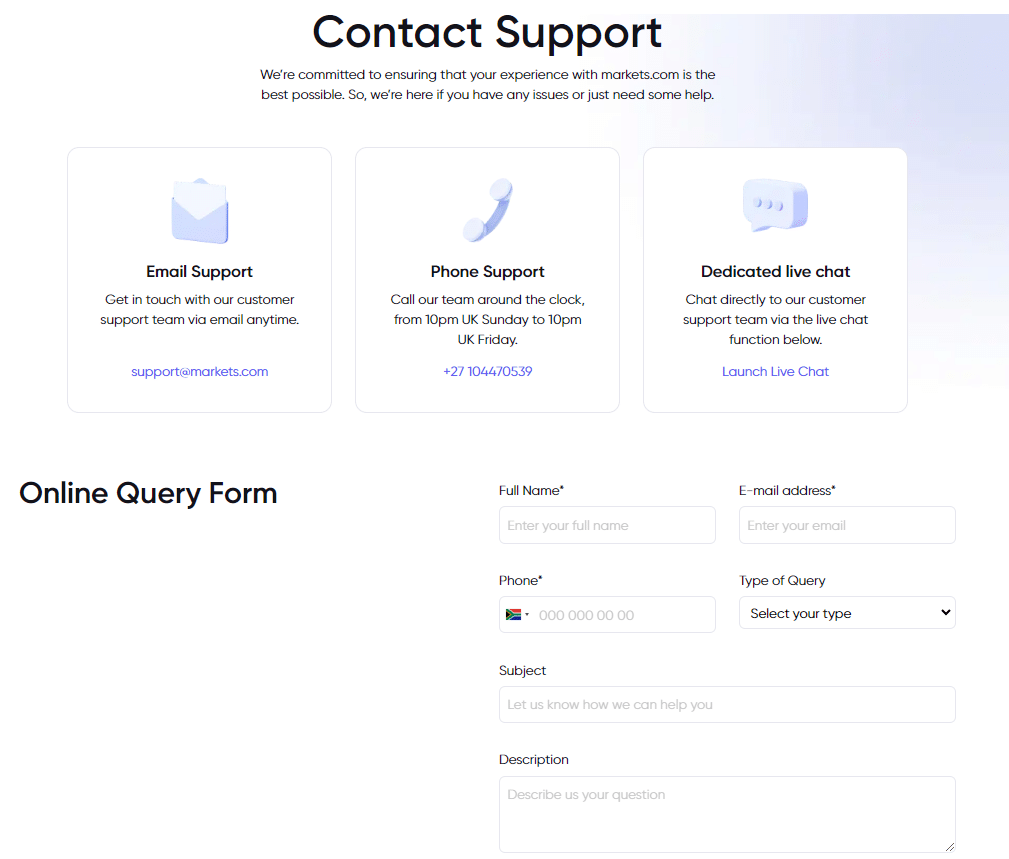

Customer Support

This award-winning trading platform has excellent customer support accessible through phone, email, and live chat throughout the trading week to assist you with any questions or technical issues. In addition, Markets.com has a thorough FAQ area that addresses a range of topics.

| Customer Support | Markets.com’s Customer Support |

| ⏰ Operating Hours | 24/5 |

| 🗣 Support Languages | Arabic, Afrikaans, Bulgarian, French, German, Greek, Italian, Spanish |

| 🗯 Live Chat | Yes |

| 📧 Email Address | Yes |

| ☎️ Telephonic Support | Yes |

| 📞 Local Support in Botswana? | No |

| 🥇 Overall quality of Markets.com Support | 4.7/5 |

Corporate Social Responsibility

Currently, Markets.com provides no information about CSR activities or projects.

Our Verdict

Markets.com is a well-regulated broker that offers to trade on a wide variety of assets that other brokers seldom offer. In addition, Markets.com provides traders with a free choice of trading platforms and a comprehensive selection of trading tools.

In addition, Markets.com excels in customer service, and all traders have access to a personal account manager, an industry rarity. As a result, Markets.com is an excellent option for traders of all levels of expertise.

A broad range of currency pairs, metals, stocks, bonds, ETFs, cryptocurrencies (Crypto CFDs are not available to retail customers via the broker’s UK business), and blends is one of the platform’s finest characteristics.

Blend funds from Markets.com, such as the Buffet, Soros, Cannabis, Brexit Winners and Losers, and Dogs of the Dow blends, provide investors with a varied mix of growth and value companies across a variety of sectors and geographies.

Markets.com provides several buy, sell, and hold signaling tools in addition to their fundamental investor education offerings. In addition, investors will benefit from Markets.com’s stock alerts, insider trade alerts, hedge fund confidence indices, and user-generated trading trends.

You might also like: OANDA Review

You might also like: OctaFX Review

You might also like: FOREX.com Review

You might also like: Axiory Review

You might also like: CMTRADING Review

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Markets.com is extremely well-regulated | There is an inactivity fee |

| There are commission-free options offered | |

| Markets.com provides advanced trading tools | |

| There is 24/5 dedicated customer support | |

| Botswanans can choose from flexible account types | |

| There is a demo and Islamic account | |

| There are flexible funding and withdrawal options offered |

Conclusion

Now it is your turn to participate:

➡️ Do you have any prior experience with Markets.com?

➡️ What was the determining factor in your decision to engage with Markets.com?

➡️ Was it because of the minimum deposit, regulation, retail trading accounts, or other factors?

➡️ Have you experienced any issues with Markets.com, such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

Regardless, please share your thoughts in the comments below.

Frequently Asked Questions

Is Markets.com regulated?

Markets.com is well-regulated by ASIC, CySEC, FSCA, FCA, and BVI FSC.

Does Markets.com have Nasdaq?

Markets.com allows Nasdaq to be traded as a Primary CFD, Futures CFD, or Cash instrument under the “US Tech 100” category of CFD on Indices.

How do I open a demo account on Markets.com?

You may access this feature directly from the homepage of the main website. Then, after filling out a brief registration form and confirming your contact information, you can begin trading by downloading the MT4, MT5, or MarketsX mobile platforms.

What is the minimum deposit for Markets.com?

Markets.com requires a minimum deposit of 1,300 BWP, or around USD 100.

Does Markets.com have Volatility 75?

Primary CFDs on Markets.com include Volatility 75.

What is the withdrawal time with Markets.com?

The Markets.com withdrawal time can range from a few hours to a few days.

Does Markets.com have a no-deposit bonus?

There is no no-deposit bonus available to new customers in Botswana on Markets.com.

Is Markets.com safe or a scam?

Markets.com is a legit broker that is well-regulated and guarantees the safety of all client funds.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review