AvaTrade Review

Overall, AvaTrade is considered secure and can be summarised as dependable and trustworthy. AvaTrade is regulated by the elite FSCA and the FSA. AvaTrade is among the most prestigious platforms and ranked with an overall trust score of 96% out of 100. AvaTrade is currently not regulated by the MFED BoB or NBFIRA of Botswana

- Louis Schoeman

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

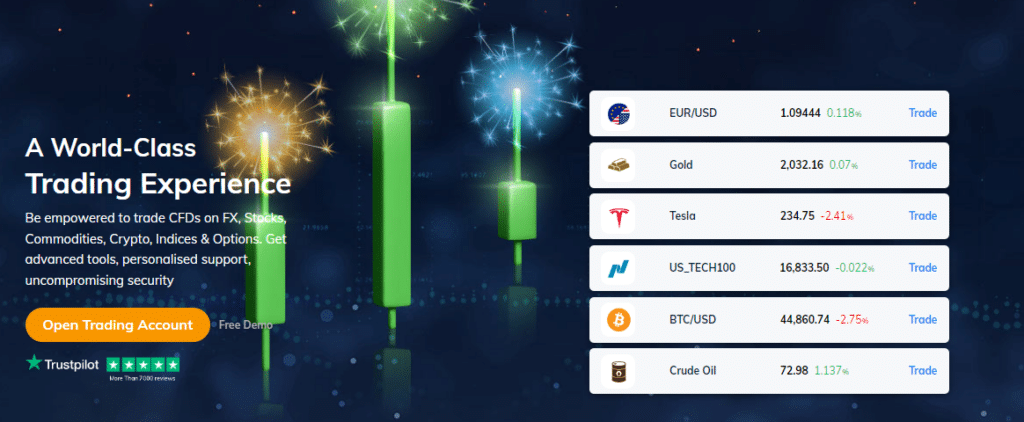

Overview

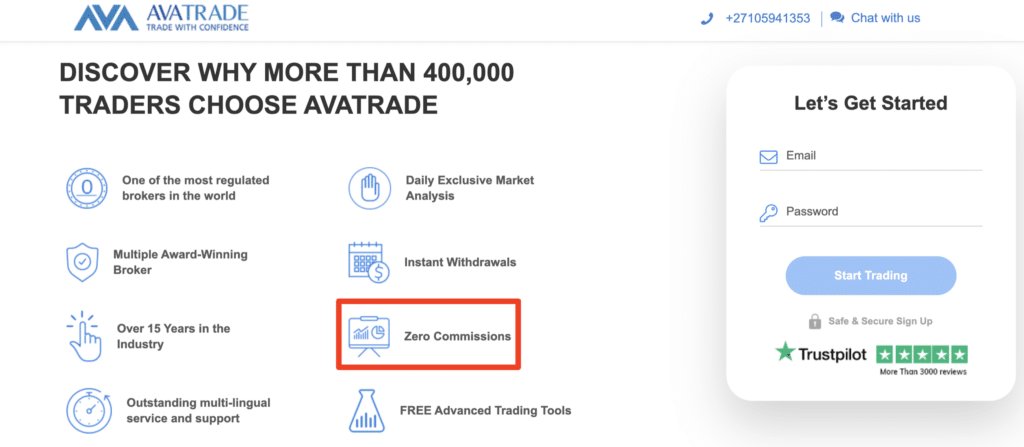

Overall, AvaTrade is considered low-risk, with an overall Trust Score of 93 out of 100. They are licensed by five Tier-1 Regulators (high trust), five Tier-2 Regulators (average trust), and one Tier-3 Regulator (low trust). And offers a single live trading account with the option between Retail and Professional.

The Broker Accepts Botswanan Clients and has an average spread from 0.9 pips EUR/USD with no commission charges. A maximum leverage ratio of up to 1:30 on Retail Accounts and 1:400 on Pro Accounts, and there is a demo and Islamic account available.

AvaTradeGO, MetaTrader 4, MetaTrader 5, and several other platforms are supported. AvaTrade is headquartered in Dublin, Ireland, and is regulated by the Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC

The broker is concerned with the trader’s experience, which is complemented by the broker’s solid financial backing and award-winning customer service, which is accessible 24 hours a day in 14 languages.

A diverse choice of trading instruments to traders of all experience levels, including Forex, Commodities, Cryptocurrency, Stocks, Shares, Indices, Metals, Energies, Options, Bonds, CFDs, and ETFs. Traders may access over 1250 products through a variety of trading platforms for PC and mobile trading applications.

Botswana will provide local retail traders with the details that they need to consider whether they are suited to their unique trading objectives and needs.

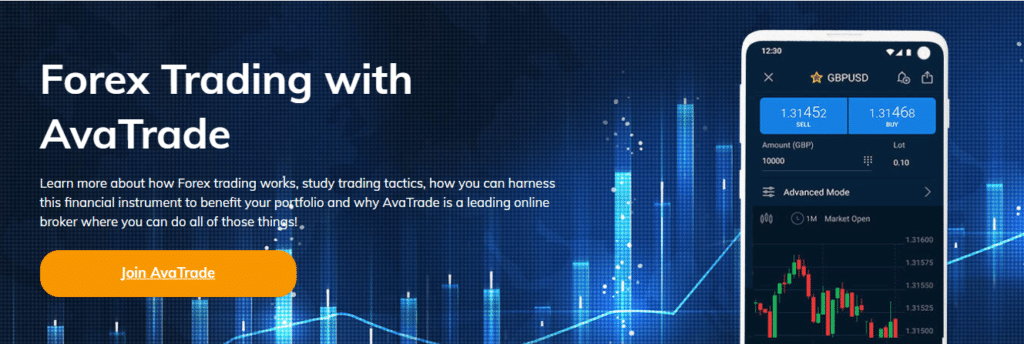

Distribution of Traders

Currently has the largest market share in these countries:

- South Africa – 9.9%

- Italy – 9.7%

- India – 6.7%

- United Kingdom – 6.5%

- Ireland – 5.04%

Popularity among traders

AvaTrade does not grab a substantial market share in Botswana, yet the broker not only welcomes Botswanan traders but accommodates all traders whatever their trading styles and aims, putting this broker in the Top 20 forex and CFD brokers for Botswanan traders.

What trading platforms does AvaTrade offer?

They provide a range of user-friendly and powerful trading platforms to suit the needs of different traders. Some of the popular platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), AvaTradeGO mobile app, and their own proprietary platform, AvaTrade WebTrader. These platforms offer advanced charting tools, technical indicators, and various order execution options for efficient trading.

Does AvaTrade offer educational resources for traders?

Yes, they do offer educational resources for traders.

AvaTrade at a Glance

| 🏛 Headquartered | Dublin, Ireland |

| 🌎 Global Offices | Australia, Ireland, South Africa, Japan, British Virgin Islands, UAE |

| 🏛 Local Market Regulators in Botswana | • Ministry of Finance and Economic Development (MFED) • Bank of Botswana (BoB) • Non-Bank Financial Institutions Regulatory Authority (NBFIRA) |

| 💳 Foreign Direct Investment in Botswana | 115.89 BWP Million in 2021 |

| 💰 Foreign Exchange Reserves in Botswana | 5270 USD Million in 2021 |

| ✔️ Local office in Gaborone? | No |

| 👨⚖️ Governor of SEC in Botswana | None, Moses Dinekere Pelaelo is the Governor of the Bank of Botswana |

| ✔️ Accepts Botswana Traders? | Yes |

| 📊 Year Founded | 2006 |

| 📞 Botswana Office Contact Number | None |

| 📱 Social Media Platforms | • Twitter • YouTube |

| ⚖️ Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC |

| 1️⃣ Tier-1 Licenses | • Central Bank of Ireland (CBI) • Australian Securities and Investment • Commission (ASIC) • Japanese Financial Services Authority (JFSA) • Financial Futures Association of Japan (FFAJ) • Investment Industry Regulatory Organization of Canada (IIROC) through Friedberg Mercantile |

| 2️⃣ Tier-2 Licenses | • Cyprus Securities and Exchange • Commission (CySEC) Financial Sector • Conduct Authority (FSCA) Israel Securities • Authority (ISA) • Abu Dhabi Global Market Financial Services Regulatory Authority (ADGM FRSA) • Polish Financial Supervision Authority (KNF) |

| 3️⃣ Tier-3 Licenses | • British Virgin Islands Financial Service Commission (BVI FSC) |

| 🪪 License Number | • Ireland (C53877) • Australia (406684) • South Africa (45984) • British Virgin Islands (SIBA/L/13/1049) • Japan (JFSA 1662, FFAJ 1574) • Abu Dhabi (190018) • Cyprus (247/17) • Israel (514666577) • Poland (693023) • Canada (Friedberg Mercantile) |

| ⚖️ MFED, BoB, or NBFIRA Regulation | No |

| ✔️ Regional Restrictions | Iran, Belgium, and the United States |

| ☪️ Islamic Account | No |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 1 (Retail and Professional Option) |

| ✔️ PAMM Accounts | No, MAM |

| 💻 Liquidity Providers | Currenex, and other bank and non-bank entities |

| ✔️ Affiliate Program | Yes |

| 📱 Order Execution | Instant |

| 📊 Starting spread | From 0.9 pips |

| 📉 Minimum Commission per Trade | No Commission Charges |

| 💰 Decimal Pricing | 5 points after the comma |

| 📞 Margin Call | 50% on Retail, 25% on AvaOptions Accounts |

| 🛑 Stop-Out | 10% |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | Unlimited |

| ✅ Crypto trading offered? | Yes |

| ✔️ Offers a BWP Account? | No |

| 📉 Dedicated Botswana Account Manager? | No |

| 📈 Maximum Leverage | • 1:30 (Retail) • 1:400 (Pro) |

| 📊 Leverage Restrictions for Botswana? | No |

| 💳 Minimum Deposit (BWP) | 1370 Botswanan Pula or an equivalent to $100 |

| ✔️ Botswana Pula Deposits Allowed? | No |

| 📊 Active Botswana Trader Stats | 250,000+ |

| 👥 Active Botswana-based AvaTrade customers | Unknown |

| 🔁 Botswana Daily Forex Turnover | Unknown, Forex overall is $6.6 Trillion |

| 💰 Deposit and Withdrawal Options | • Wire Transfer • Electronic Payment • Gateways • Credit Cards • Debit Cards |

| 💻 Minimum Withdrawal Time | 24 to 48 Hours |

| ⏰ Maximum Estimated Withdrawal Time | Up to 10 days |

| 💳 Instant Deposits and Instant Withdrawals? | No |

| 🏛 Segregated Accounts with Botswana Banks? | No |

| 📱 Trading Platforms | • AvaTradeGO • AvaOptions • AvaSocial • MetaTrader 4 • MetaTrader 5 • DupliTrade • ZuluTrade |

| 💻 Tradable Assets | • Forex • Stocks • Commodities • Cryptocurrencies • Treasuries • Bonds • Indices • Exchange-Traded • Funds (ETFs) • Options • Contracts for • Difference (CFDs) • Precious Metals |

| ✔️ Offers USD/BWP currency pair? | No |

| 🚀Service description | financial instruments and multiple trading platforms, operating since 2006. |

| 💰 Bonus 20% | welcome bonus accordengly to regulation |

| 📊 USD/BWP Average Spread | N/A |

| ✅ Offers Botswana Stocks and CFDs | No |

| 📊 Average deposit/withdraw processing time | Depends on the method used. – CC and e-payments is immediate. Bank wire can take up to 7 business days depending on the banking institution |

| 🔎 Banned countries | US, North Korea, New Zealand, Iran, Belgium |

| 💻 Languages supported on the Website | English, Chinese (Simplified), Chinese (Traditional), Turkish, Thai, Slovakian, Russian, Portuguese, Polish, German, Hungarian, French, and several others |

| 📈 Related lot sizes | Standard, Mini and Micro lots size |

| 👥 Sponsorship | Currently with Bolt |

| ✴️ Instruments offered | 800+ |

| ✴️ Instruments | Metals, Commodities, Stocks, FX Options, Oil, ETFs, Options, Crypto currencies, CFDs, Indexes, Shares, Spread Betting, Indices, Forex, Bonds |

| ✴️ Total offered per instrument | CFD – Agricultural =7 CFD – Crypto = 20 CFD – EFTs = 60 CFD – Energies = 5 CFD – Indices = 32 CFD – Metals = 7 CFD – Shares = 623 Forex = 55 GRAND Total = 809 |

| ☎️ Customer Support Languages | Multilingual |

| 📈 Account Types | Real Account, Demo Account, Islamic Account. Options Account |

| 📈 Demo Account Description | Free Demo Accounts with $100,000. No limitations on the number of demo accounts. 21 days limitation |

| 👥 Copy Trading Support | Yes |

| ⏰ Customer Service Hours | 24/5 |

| 📞 Botswana-based customer support? | No |

| 💸 Bonuses and Promotions for Botswanans? | Yes |

| 📚 Education for Botswanan beginner traders | Yes |

| 📱 Proprietary trading software | Yes |

| 🤝 Most Successful Trader in Botswana | Unknown |

| ✔️ Is AvaTrade a safe broker for Botswana Traders? | Yes |

| 🎖 Rating for AvaTrade Botswana | 9/10 |

| 🥇 Trust score for AvaTrade Botswana | 93% |

| 👉 Open Account | 👉 Open Account |

Regulation and Safety of Funds

Regulation in Botswana

While AvaTrade does not have local offices or regulations in Botswana, the broker is one of the best options for Botswanan traders.

Global Regulations

AvaTrade is a licensed foreign exchange broker operating in the European Union, Japan, Australia, South Africa, and the British Virgin Islands. This implies they must adhere to stringent regulatory compliance requirements.

This includes the way they manage client money (segregated accounts), as well as the security and reporting of financial information. Trading with a broker licensed in many countries assures customers that they are dealing with a respectable and reliable trading broker.

Following regulations and authorizations:

- The Central Bank of Ireland (CBI) regulates AVA Trade EU Ltd.

- Cyprus Securities and Exchange Commission (CySEC) controls DT Direct Investment Hub Ltd., one of the group’s subsidiaries. Investment Hub Ltd. is a regulated investment business operating according to the Markets in Financial Instruments Directive (MiFID). MiFID governs financial services in the European Union. It contributes to enhanced consumer investment protection while maintaining efficiency and openness.

- AVA Trade EU Ltd operates a branch in Poland according to an AvaTrade EU license issued by the Polish Financial Supervision Authority (KNF).

- AVA Trade Ltd is regulated by the Financial Services Commission of the British Virgin Islands (BVI). The BVI issues licenses to firms that conduct financial services operations inside the territory.

- The Australian Securities and Investments Commission (ASIC) regulates Ava Capital Markets Australia Pty Ltd. This is an Australian regulator that regulates clients in Australia. It contributes to the fair and transparent operation of financial services.

- The South African Financial Sector Conduct Authority (FSCA) regulates Ava Capital Markets Pty.

- Ava Trade Japan K.K. is regulated in Japan by the Financial Services Agency (FSA) and the Japan Association of Financial Futures Brokers (FFAJ).

- Ava Trade Middle East Ltd is supervised by the Financial Regulatory Services Authority (FRSA) of Abu Dhabi Global Markets (ADGM).

- AvaTrade operates under the name ATrade Ltd, a company that is well-regulated and overseen in Israel by the Israel Securities Authority (ISA).

- Accounts in Canada are established and maintained by Friedberg Direct, which executes transactions through a subsidiary of the AvaTrade group of enterprises. Friedberg Direct is a division of Friedberg Mercantile Group Ltd., which is a member of the Investment Industry Regulatory Organization of Canada (IIROC), the Canadian Investor Protection Fund (CIPF), and most Canadian exchanges.

Client Fund Security and Safety Features

The broker is one of the world’s most recognized CFD and FX brokers due to its tight regulation and authorization, with Botswanan client funds held in segregated accounts at top-tier institutions in each nation.

AvaTrade is an Investor Compensation Company Limited member in Europe, which provides additional money protection to European investors.

Not only is AvaTrade registered and regulated, but the broker is also committed to providing a safe, fair, and transparent trading environment, ensuring that all clients are treated fairly and have access to the best possible trading conditions.

Is AvaTrade a regulated broker?

Yes, they are regulated brokers.

How does AvaTrade ensure the safety of funds?

AvaTrade places a high priority on the safety of its client’s funds. To achieve this, the broker adopts several measures. First, client funds are kept in segregated bank accounts, separate from AvaTrade’s operational funds. This segregation ensures that the client’s money is not used for the company’s operational purposes and remains safe in case of any financial difficulties.

Awards and Recognition

The most recent awards are as follows:

- AvaTrade received the ForexBrokers.com No. 1 Innovation Award in 2021.

- In 2021, AvaTrade got The CEO Reviews’ Top Brand Award.

- In 2021, AvaTrade was named “Best Forex Broker Ireland” by The CEO Reviews.

- In 2021, Global Business Review Magazine named AvaTrade the “Best Retail Broker UAE.”

- In 2021, AvaTrade was named “Best Fixed Spread Broker” by Compare Forex Broker.

- In 2021, AvaTrade received the INVESTINGOAL award for “Best Mobile Trading Platform.”

Has AvaTrade received any awards for its services?

Yes, These awards often acknowledge AvaTrade’s excellence in areas such as customer service, trading platforms, educational resources, and overall broker performance.

Which awards has AvaTrade won recently?

AvaTrade’s dedication to excellence has been consistently recognized by industry peers.

Account Types and Features

Offers its Botswana retail traders a single basic account with several options and the option to register for a professional account if they qualify as professionals. The kind of account that traders may establish is regulated by their jurisdiction and the regulatory constraints applicable to that country.

Botswanan traders have the following retail investor account options, which vary according to the region where AvaTrade operates:

- Europe (Ava Trade EU Ltd) – Retail, Professional, Options, and Spread Betting account.

- Europe (DT Direct Investment Hub Ltd) – Retail, Professional, and Options account.

- British Virgin Islands – Standard, Options

- Australia – Standard, Options

- South Africa and Botswana – Standard, Options

- Japan – Retail, Options

- Abu Dhabi – Retail, Professional, Options

- Israel – Standard, Options

| 💻 Live Account | 📉 Minimum Dep. | 📊 Average Spread | 💰 Commissions | 💸 Average Trading Cost |

| ➡️ Standard Account | 1339 BWP/$100 | 0.9 pips | None | 9 USD |

| ➡️ Professional Account | 1339 BWP/$100 | 1.2 pips | None | 12 USD |

| ➡️ Islamic Account | 1339 BWP/$100 | 0.9 pips | None | 9 USD |

Live Trading Accounts

Retail Investor Account

AvaTrade offers a Standard Retail Account that is ideal for most Botswanan traders and intermediate investors seeking worldwide market exposure. This account is notable for the following characteristics:

| Account Feature | Value |

| 💰 Minimum Deposit Requirement | 1339 Botswanan Pula or an equivalent to 100 units in ZAR, USD, GBP, or AUD |

| 💳 Base Account Currency Options | ZAR, USD, GBP, or AUD |

| 📈 Maximum Leverage | 1:30 |

| 📉 Range of Markets offered | More than 1,250 tradable instruments |

| 💻 Trading Platforms | • AvaTradeGO • AvaOptions • AvaSocial • MetaTrader 4 • MetaTrader 5 • DupliTrade • ZuluTrade |

| 💵 Commissions on trades | None |

| 📈 Average spreads | From 0.9 pips EUR/USD |

| 📊 Margin Requirements | From 0.25% when using leverage of 1:400 |

| 📞 Customer Support Channels | Social Platforms, Email Request, Telephone, WhatsApp, Live Chat |

| 📚 Educational Materials offered | Trading Videos, Trading For Beginners, Trading Rules, Technical Analysis Indicators and Strategies, Economic Indicators, Market Terms, Order Types, Blog, Online Trading Strategies |

| 🔨 Trading tools offered | AvaProtect, Trading Central, CFD Rollover, Economic Calendar, Trading Calculator, Earnings Releases, Analysis |

| ✔️ Trading Strategies Allowed | All – scalping, swing trading, momentum trading, expert advisors, algorithmic trading, auto trading, etc. |

Professional Account

Before you register a Professional Account, you must have a verified and active AvaTrade retail account. To begin a profession in trading, traders must first create an account and have their application approved.

Professional Status and a subsequent Professional Account are available to traders who meet two of the following three criteria:

A minimum of twelve consecutive months of trading in a relevant financial market. During the previous four quarters, there have been an average of ten CFD, FX, or spread betting transactions every quarter.

Traders must have at least one year of experience in the financial services business.

The trader must have a minimum investment portfolio of €500,000 (or its equivalent in any other currency) that comprises both cash and financial instruments.

Options Trading

The Broker enables Botswana options traders to buy or sell a specific quantity of an asset at an agreed-upon price and time. This is referred to as options trading.

When retail Botswana traders trade options, they have total control over the product and the amount of money invested. Additionally, dealers in Botswana have the option of setting their own pricing and trading hour.

A single trading day, a week, a month, or even a year might be spent trading options, depending on the trader’s trading strategy and goals. AvaTrade offers both Call and Put options.

Call options provide the buyer with the possibility to purchase an instrument at a specified price. Investors who believe the market is heading in a good direction trade these options.

Spread Betting (UK Clients Only)

Spread betting on more than 200 financial instruments, including currency pairs, commodities, equities, bonds, and ETFs.

The British Pound Sterling (GBP) is the account currency for AvaTrade traders, with a minimum transaction size of 0.10 lots.

Even though AvaTrade’s spread betting customers have access to various trading platforms, they can only use MetaTrader 4 when trading on a retail or professional account. Additionally, AvaTrade provides tax-free spread betting, which is another reason why many UK traders choose AvaTrade to trade in global financial markets.

Base Account Currencies

When Botswanan traders register an account, they can choose between these base currencies:

- ZAR

- USD

- GBP

- AUD

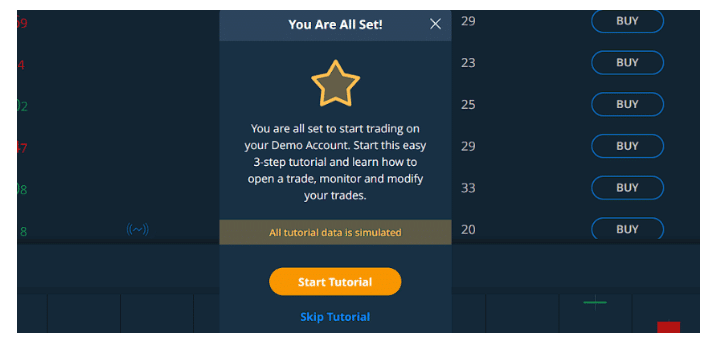

Demo Account

A demo account is a practice account that offers traders a certain amount of virtual funds that they can use, allowing them to enter the live market without risking their capital.

There is a certain degree of risk involved when trading financial markets and AvaTrade offers its clients a risk-free platform where they can test strategies, practice trading, and explore what the broker offers in a safe trading environment with actual market conditions.

To get a feel for the financial markets, AvaTrade’s free Demo account is a great place to start. How to achieve it is described in detail in the section below:

Creating a demo account is as simple as clicking a specific link and filling out a few fields. Providing contact information like a phone number and email address is all that is required throughout the registration process.

Alternatively, you can just piggyback on your Facebook or Google accounts to fill in all the necessary areas for you.

AvaTrade, like all authorized brokers, has a duty of care to anybody who registers, even if the Demo account offers risk-free trading. ‘Know Your Customer’ (KYC) requirements mandate that a company must have access to your personal information, including your name, address, and phone number.

Once you have checked those boxes, you will be brought to the Demo account interface, where you may begin trading.

Islamic Account

Depending on the trading style and the trading strategy of the forex trader, they may keep their trading positions open for longer than 24 hours on a trading day.

This means that the trader could incur an overnight or rollover fee. This is a type of interest that is prohibited by the Riba principles of Sharia law, which means that Muslim traders are often restricted in forex trading.

Botswanan Islamic accounts, which provide the same trading conditions without any extra fees or interest, are an alternative for Muslim traders. An Islamic account additionally gives users access to the following tools:

It is permissible to engage in the following financial activities while adhering to Islamic law:

- Halal Gold and Silver Trading

- Halal Oil Trading

- Halal Indices Trading

- Islamic Forex Trading

What types of trading accounts does AvaTrade offer?

Several types of trading accounts cater to the diverse needs of traders.

What features are included with AvaTrade trading accounts?

The broker trading accounts come with a range of features designed to enhance the trading experience. Across different account types, traders have access to the widely used MetaTrader 4 (MT4) platform and AvaTrade’s proprietary trading platform, AvaOptions.

How to open an Account with AvaTrade in Botswana

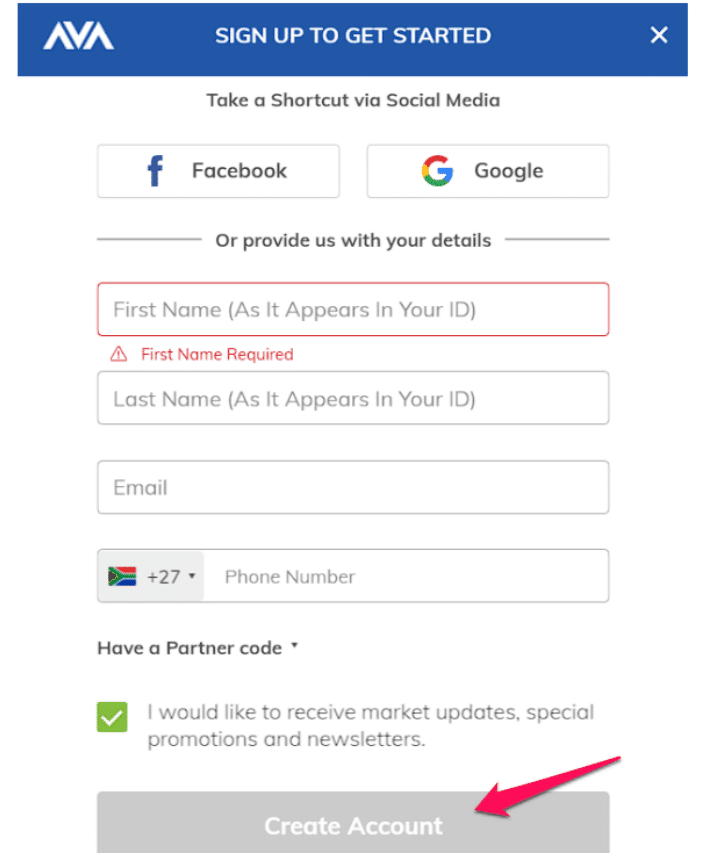

To register for a Demo Account with AvaTrade, traders can follow these few steps:

Step 1 – Open up the Avatrade Website.

navigate to the AvaTrade website and select the “Demo Account” option

Step 2 – Insert your credentials.

This will redirect the trader to a registration page where the trader can register using their Facebook or Google credentials, or they can register by providing their First and Last name, email address, and mobile number.

Step 3 – Click on one of the options to proceed.

Once this has been completed, the trader can select to proceed, and registration on the AvaTrade website will have been successful.

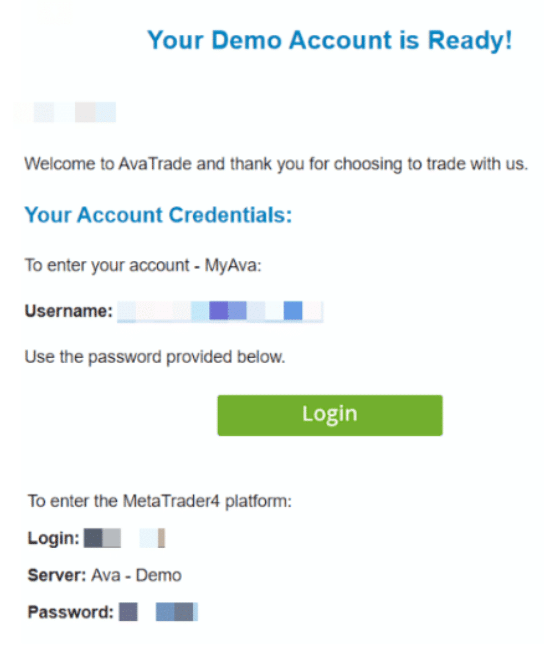

Step 4 – Verify and log into your account.

Traders will receive an email to the address that they provided with confirmation that their demo account registration has been successful. The email address will also contain the trader’s login details and relevant links to the AvaTrade website where they can start using their demo account.

When it comes to signing up, the procedure is simple. Traders may join by going to the website and selecting the appropriate option. Before their account can be validated, they must complete an online form, verify their email address, and submit supporting evidence.

With only a few clicks of the mouse, traders may fund their trading accounts and begin trading immediately. Traders may also count on AvaTrade’s helpful customer care for assistance.

AvaTrade Vs NAGA Vs Plus500 – Broker Comparison

| 🥇 AvaTrade | 🥈 NAGA | 🥉 Plus500 | |

| ⚖️ Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC | CySEC, BaFin | ASIC, FMA, FSCA, FCA, CySEC, FSA, MAS |

| 📱 Trading Platform | • AvaTradeGO • AvaOptions • AvaSocial • MetaTrader 4 • MetaTrader 5 • DupliTrade • ZuluTrade | • NAGA Trading Platform • MetaTrader 4 • MetaTrader 5 | Plus500 mobile and web-based trading platform |

| 💰 Withdrawal Fee | No | Yes | None |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 1339 BWP | 3,000 BWP | 1,200 BWP |

| 📊 Leverage | • 1:30 (Retail) • 1:400 (Pro) | 1:1000 | 1:30 |

| 📊 Spread | Fixed, from 0.9 pips | 0.7 pips | 0.8 pips |

| 💰 Commissions | None | None | None |

| ✴️ Margin Call/Stop-Out | • 25% – 50% (M) • 10% (S/O) | 100%/50% | None |

| 💻 Order Execution | Instant | Market | None |

| 💳 No-Deposit Bonus | No | No | No |

| 📊 Cent Accounts | No | No | No |

| 📈 Account Types | • Standard Live Account • Professional Account Option | • Iron Account • Bronze Account • Silver Account • Gold Account • Diamond Account • Crystal Account | • Standard Live Account |

| ⚖️ CBN Regulation | No | No | No |

| 💳 BWP Deposits | No | Yes | No |

| 📊 Botswana Pula Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/5 | 24/7 |

| 📊 Retail Investor Accounts | 1 | 6 | 1 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 📉 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | Unlimited | 10,000 | 100 lots |

| 💰 Minimum Withdrawal Time | 24 to 48 Hours | Instant | 1 working day |

| 📊 Maximum Estimated Withdrawal Time | Up to 10 days | Up to 5 working days | 5 working Up to 7 working days |

| 💸 Instant Deposits and Instant Withdrawals? | No | Yes | No |

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

AvaTrade Trading Platforms

Offers Botswana traders a choice between these trading platforms:

AvaTrade WebTrader

AvaTradeGO

AvaOptions

AvaSocial

MetaTrader 4

MetaTrader 5

DupliTrade

ZuluTrade

WebTrader

WebTrader is an excellent choice for Botswana traders looking for a user-friendly yet powerful trading experience. This proprietary platform includes novel features such as AvaProtect, which offers risk management solutions.

The platform is accessible through web browsers, removing the need for software downloads, and is suitable for both novice and experienced traders.

AvaTradeGO

AvaTradeGO is AvaTrade’s mobile trading platform, designed for traders on the go who want to manage their portfolios. The app includes various features, such as advanced charting tools and real-time market updates, making it a complete solution for mobile trading in Botswana.

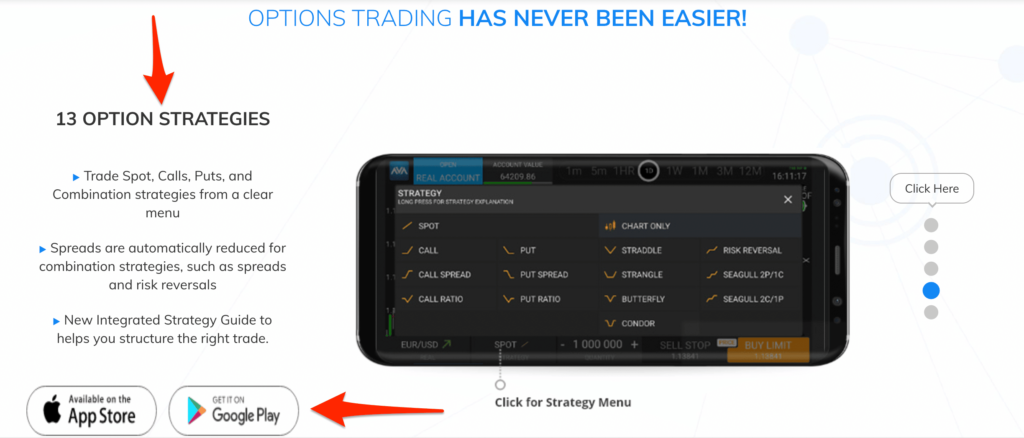

AvaOptions

Sentry Derivatives powers AvaOptions, a specialized platform for trading forex options. This platform is designed for professional traders and provides an excellent mobile trading experience. It offers a variety of forex trading options and is ideal for traders seeking more complex trading instruments.

AvaSocial

AvaSocial is a social trading app for mobile devices. It enables Botswanan traders to follow, interact with, and copy expert traders’ trades. The platform has an easy-to-use interface and is ideal for those seeking community wisdom.

MetaTrader 4

MetaTrader 4 (MT4) is a popular trading platform available to AvaTrade customers in Botswana. It provides advanced charting tools, multiple timeframes, and various indicators, making it appropriate for traders of all experience levels.

MetaTrader 5

MetaTrader 5 (MT5) is the successor to MT4 and includes new features such as more timeframes and chart types. It also supports trading in a wider range of markets, with 1,260 symbols available. This platform is ideal for traders who want to expand their trading capabilities.

DupliTrade

DupliTrade is a trading platform that allows you to copy expert traders’ trades directly into your AvaTrade account. It is MT4 compatible and especially useful for traders who prefer a hands-off approach while benefiting from expert strategies.

ZuluTrade

ZuluTrade is a well-known social trading platform that allows you to follow and copy the trades of experienced traders automatically.

Furthermore, ZuluTrade provides a commission-based model in which the trader you follow earns a commission on your transactions. This platform is ideal for those who want to tap into the expertise of a trading community.

What trading platforms does AvaTrade offer?

AvaTrade provides a range of advanced and user-friendly trading platforms to cater to the needs of different traders.

Can I use automated trading strategies on AvaTrade’s platforms?

Yes, Traders can create or download EAs that suit their trading strategies and risk tolerance. With automated trading, you can take advantage of trading opportunities even when you are not actively monitoring the markets, and it can help remove emotional biases from trading decisions.

Trading App

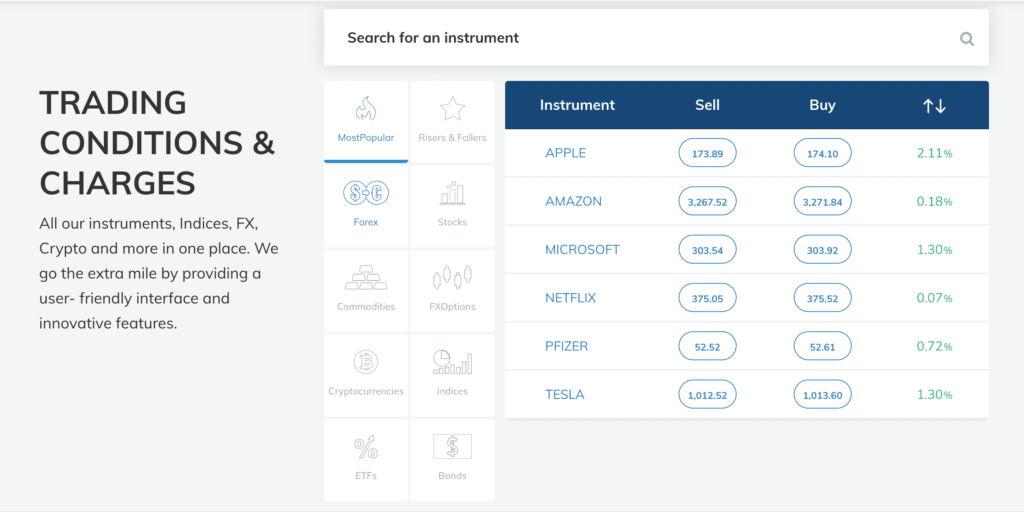

Botswana Traders can expect the following range of markets:

- Forex

- Stocks

- Commodities

- Cryptocurrencies

- Treasuries

- Bonds

- Indices

- Exchange-traded funds (ETFs)

- Options

- Contracts for Difference (CFDs)

- Precious Metals

Financial Instruments and Leverage offered

| 🔨 Instrument | 💰 Number of Assets Offered | 📈 Max Leverage Offered |

| ➡️ Forex | 55 | 1:400 |

| ➡️ Precious Metals | 5 | 1:200 |

| ➡️ ETFs | 59 | 1:20 |

| ➡️ Indices | 33 | 1:200 |

| ➡️ Stocks | 625 | 1:10 |

| ➡️ Cryptocurrency | 20 | 1:25 |

| ➡️ Options | 53 | 1:100 |

| ➡️ Energies | 5 | 1:200 |

| ➡️ Bonds | 2 | 1:20 |

| ➡️ FXOptions | 24 | 1:100 |

Is AvaTradeGO available for both Android and iOS devices?

Yes, AvaTradeGO is available for both Android and iOS devices.

Does AvaTrade offer trading in cryptocurrencies?

Yes, AvaTrade recognizes the growing popularity and importance of cryptocurrencies and offers trading in various digital currencies. Traders can access a selection of popular cryptocurrencies, including Bitcoin, Ethereum, Litecoin, Ripple, and more

Broker Comparison for a Range of Markets

| 🥇 AvaTrade | 🥈 NAGA | 🥉 Plus500 | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | Yes | Yes | Yes |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | No | Yes |

| ➡️️ Options | Yes | No | Yes |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | Yes | No | No |

Trading and Non-Trading Fees

Spreads

AvaTrade is one of the largest market maker brokers in the world, providing fixed spreads. This means that AvaTrade generates market liquidity for its retail traders, which enables them to complete their transactions.

AvaTrade works as a link between retail traders and the interbank market, acquiring large positions from several liquidity providers and reselling them to traders. AvaTrade executes orders in-house, guaranteeing that transactions are completed fast and without charge.

Additionally, offers single-price quotations and deducts its service fee from the spread paid. The average spread at AvaTrade is 0.9 pips on EUR/USD, the most frequently traded currency pair in the foreign exchange market.

Some other spreads that Botswanan traders can expect are as follows:

- Stocks – 0.13%

- Crude Oil – 0.029 pips

- FXOptions – 0.9 pips

- Cryptocurrency – From 0.02 pips on BTC/USD

- Indices – From 0.03 pips

- ETFs – 0.13%

- Bonds – From 0.03 pips Over the Market

Commissions

The Broker adds a markup to its fixed spreads which means that Botswanan traders need not worry about commission charges on their trades.

Overnight Fees, Rollovers, or Swaps

AvaTrade credits or debits these fees according to the size of the position, its length, the financial instrument traded, and other factors. Traders may compute these costs using the following formula:

The size of the position multiplied by the daily overnight interest rate equals the daily overnight interest charged/paid.

On the official website and trading interface, you can see the overnight interest rate for each asset. Some typical overnight fees that Botswanan traders can expect are as follows:

- EUR/USD – a short swap of -0.0015% and a long swap of -0.0060%

- Stocks (Apple) – a short swap of -0.0165% and a long swap of -0.0168%

- Gold – a short swap of -0.0082% and a long swap of -0.0085%

- Silver – a short swap of -0.0082% and a long swap of -0.0085%

- FXOptions (EUR/USD) – a short swap of -0.0015% and a long swap of -0.0060%

- Indices – a short swap of -0.0082% and a long swap of -0.0085%

- Cryptocurrency (BTC/USD) – a short swap of -0.0333% and a long swap of -0.0610%

- ETFs – a short swap of -0.0165% and a long swap of -0.0168%

Deposit and Withdrawal Fees

Deposit and withdrawal fees are not charged when Botswanan traders fund the trading account or withdraw funds from it.

Inactivity Fees

The levies are $50 / 675 BWP inactivity fee after three consecutive months of inactivity. This sum is withdrawn from the account monthly until the trade balance reaches zero.

However, if the trading account remains inactive/dormant for 12 consecutive months, a $100 / 1350 BWP administrative fee will be assessed. Additionally, currency translation fees may apply if Botswana traders deposit money in BWP and those monies are translated to one of the base account currencies accepted.

Currency Conversion Fees

Additionally, currency conversion fees may apply if Botswanan traders deposit funds in BWP and those funds are converted to one of the permitted base account currencies.

What are the trading fees charged?

The charges for trading fees are in the form of spreads and commissions. The spread is the difference between the buying (ask) and selling (bid) price of an asset.

Does AvaTrade impose non-trading fees on its clients?

Yes, apart from trading fees, they may impose non-trading fees, which are charges not directly related to executing trades.

AvaTrade Deposits and Withdrawals

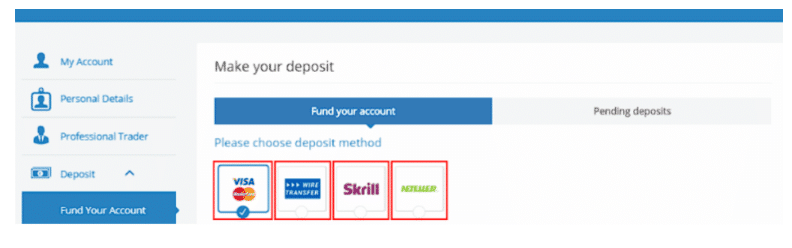

AvaTrade offers the following deposit and withdrawal methods:

- Bank Wire Transfer

- Credit/Debit Card

- PayPal

- WebMoney

- Neteller

- Skrill

Broker Comparison: Deposit and Withdrawals

| 🥇 AvaTrade | 🥈 NAGA | 🥉 Plus500 | |

| Minimum Withdrawal Time | 24 to 48 Hours | Instant | 1 business day |

| Maximum Estimated Withdrawal Time | Up to 10 days | Up to 5 working days | Up to 7 working days |

| Instant Deposits and Instant Withdrawals? | No | Yes | No |

Payment Method and Processing Times on Deposits and Withdrawals

| Method | Country | BG | Currency | Time | Comments |

| CC (MasterCard/Visa) (Deposit/WD) | Global | ALL | ALL | Instant | |

| Bank Wire (Deposit/WD) | Global | ALL | ALL | Up to 5 days | |

| PayPal (Deposit/WD) | Austria, Belgium, Cyprus, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, UK | Capital | EUR, USD,GBP, PLN | Instant | |

| Skrill (Deposit/WD) | Global | ALL | ALL | Instant | |

| Neteller (Deposit/WD) | Global | ALL | ALL | Instant | |

| P24 | Poland and Germany | Capital | USD, PLN | Up to 15 min | |

| Klarna/Sofort | Austria ,Belgium, Czech Republic, France, Germany, Hungary, Italy, Netherlands, Poland, Eslovakia, Spain, Switzerland, UK | Capital | EUR, USD | Up to 15 min | |

| Rapid Transfer | Austria, Belgium, Bulgaria, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Italy, Latvia, Netherlands, Norway, Poland, Portugal, Spain, Sweden, UK | Capital | EUR, USD, GBP | Up to 15 min | |

| Ideal | Netherlands | Capital | EUR | Up to 15 min | |

| Poli | Australia | BVI + AVA AU | AUD, USD | Up to 15 min | |

| Boleto | Brazil | BVI + AVA AU | USD, EUR | Up to 7 days | PSP process the transaction in clients local currency |

| Perfect M (Deposit/WD) | Argentina, Bangladesh, Benin, Bolivia, Brazil, Burkina faso, Cameroon, Chile, Colombia, Costa Rica, Cote d'ivoire, Dominican Republic, Ecuador, Egypt, El salvador, Gabon, Ghana, Guinea-Bissau, Honduras, India, Iran, Iraq, Mali, Mexico, Niger, Nigeria, Oman, Pakistan, Palestinian Territory, Panama, Paraguay, Peru, Russian, Saudi Arabia, Senegal, Togo, Turkey, Uruguay, Venezuela, Viet nam, Yemen | BVI + AVA AU | USD | Instant | |

| Giropay (Sofortüberweisung) | Germany | Capital | EUR, USD | Up to 5 min | |

| Multibanco-Portugal | Portugal | Capital | EUR | Up to 15 min | |

| NetbankingUPI – India | India | BVI | USD | Up to 15 min | PSP process the transaction in clients local |

| OnlineBankLatam | Brazil, Mexico, Chile, Peru, Colombia, Costa Rica | BVI | USD | Up to 15 min | PSP process the transaction in clients local currency |

| Qrpay | South Africa | BVI | USD, ZAR | Up to 15 min | PSP process the transaction in clients local currency + USD |

| Ozow | South Africa | BVI | USD, ZAR | Up to 5 days | PSP process the transaction in clients local currency + USD |

| UPI | India | BVI | USD | Up to 15 min | PSP process the transaction in clients local currency |

| M-PESA | Kenya | BVI | USD | Up to 15 min | PSP process the transaction in clients local currency |

| PayRetailers | Brazil, Mexico, Chile, Peru, Colombia, Costa Rica | BVI | USD | Up to 15 min | PSP process the transaction in clients local currency + USD |

What are the available deposit methods?

AvaTrade offers a variety of convenient and secure deposit methods to fund your trading account.

How long does it take for withdrawals to be processed by AvaTrade?

AvaTrade strives to provide prompt and efficient withdrawal processing to ensure a seamless experience for its traders. The time it takes for withdrawals to be processed may vary depending on several factors, including the withdrawal method chosen and the trader’s account verification status.

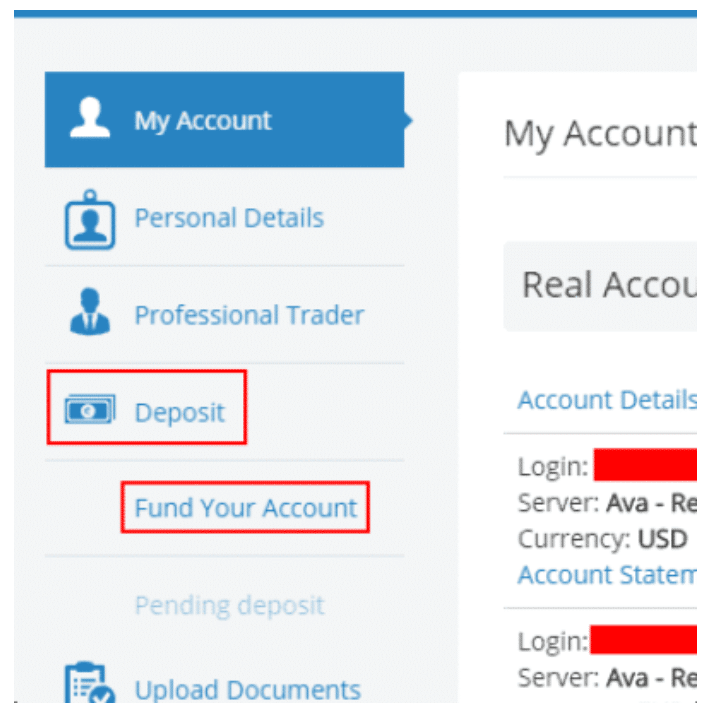

How to Deposit Funds

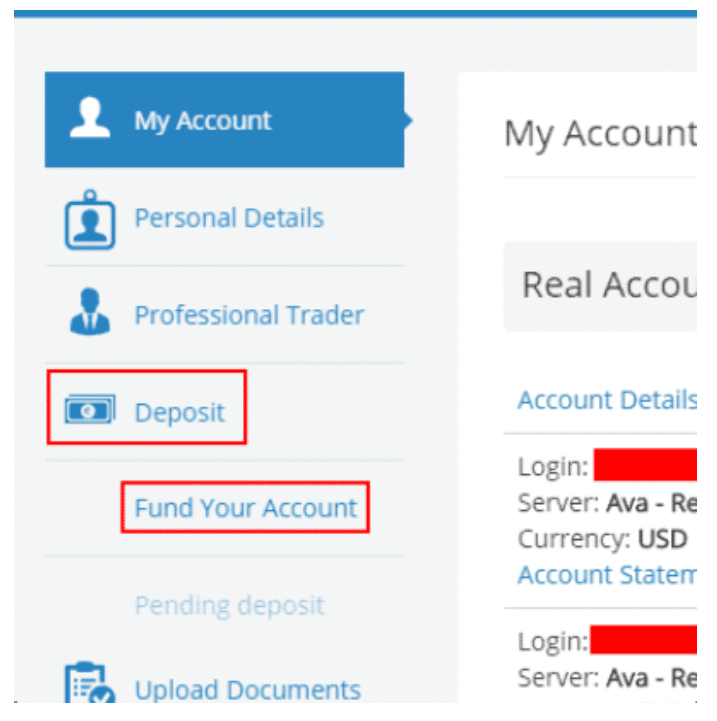

Step 1 -Locate the deposit option on your dashboard.

On the account, the trader can click on ‘Deposit’ and select their preferred deposit method.

Step 2 – Click on Fund your account option.

Once you have selected to fund your account you can now select your preferred method.

Step 3 – Enter the amount you wish to deposit.

Add the payment method details into the fields.

Step 4 – Click on ‘Deposit‘

Are there any fees associated with depositing funds into my account?

AvaTrade generally does not charge fees for depositing funds into your trading account. However, it’s important to note that some payment providers or banks may impose transaction fees on their end, especially for certain deposit methods like bank wire transfers or credit card transactions.

How long does it take for the deposited funds to appear in my trading account?

The time it takes for the deposited funds to appear in your AvaTrade trading account depends on the chosen deposit method.

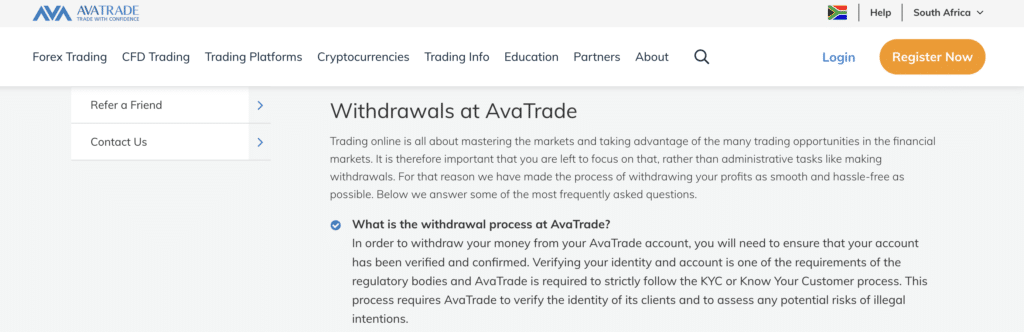

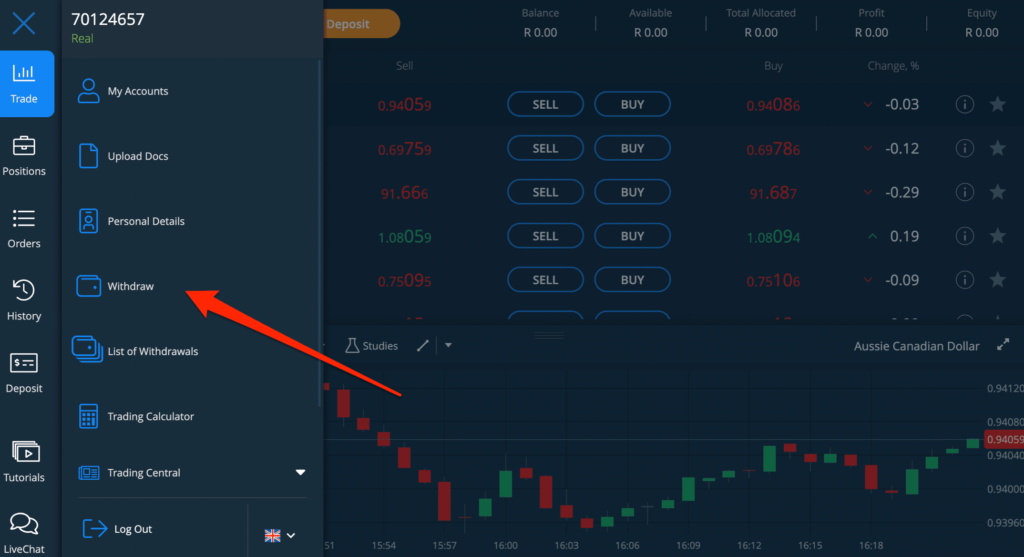

Fund Withdrawal Process

To withdraw funds from your account, you must first verify and validate your account. The regulatory organizations demand that you verify your identity and account, and AvaTrade is expected to adhere rigorously to the KYC or Know Your Customer procedure.

This procedure entails AvaTrade verifying its customers’ identities and assessing any dangers of criminal intent.

Are there any withdrawal fees imposed?

AvaTrade generally does not charge fees for withdrawals. However, some payment processors or banks may impose transaction fees on their end for processing the withdrawal. These fees are usually outside of AvaTrade’s control and are determined by the financial institution handling the transaction.

How long does it take for the withdrawn funds to reach my account?

The processing time for fund withdrawals from AvaTrade can vary depending on several factors. AvaTrade typically processes withdrawal requests within one to two business days.

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Education and Research

Education

- AvaTrade offers the following Educational Materials:

- Educational Videos

- Trading guides

- Trading Rules

- Market Terms

- Order Types

- Trading Strategies

- Trading Ideas

- Blog

- A demo account with virtual funds

- Articles

Research and Trading Tool Comparison

| 🥇 AvaTrade | 🥈 NAGA | 🥉 Plus500 | |

| ➡️ Economic Calendar | Yes | Yes | Yes |

| ➡️ VPS | No | No | No |

| ➡️ AutoChartist | No | No | No |

| ➡️ Trading View | No | Yes | No |

| ➡️ Trading Central | Yes | No | No |

| ➡️ Market Analysis | Yes | Yes | Yes |

| ➡️ News Feed | Yes | Yes | Yes |

| ➡️ Blog | Yes | Yes | Yes |

AvaTrade offers Botswana Traders the following Research and Trading Tools:

- Technical Analysis Indicators

- Economic Indicators

- Economic calendar

- Trading Strategies

- AvaProtect Risk Management

- Trading Central

- Trading Calculators

- Earnings Releases

- Fundamental Analysis

- Technical Analysis

What educational resources are offered to traders?

AvaTrade provides a comprehensive range of educational resources to empower traders with knowledge and skills.

How does AvaTrade support traders with research materials?

AvaTrade offers a wealth of research tools and resources to assist traders in making informed trading decisions.

10 Best Forex Brokers in Botswana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

Bonuses and Promotions

AvaTrade offers Botswana Traders the following bonuses and promotions:

New Accounts Pack – when Botswanan traders register a trading account for the first time, and deposit at least USD 100/ 1339 BWP they will be eligible for a sign-up bonus of $40 /535. The maximum deposit before traders must contact their account manager is $10,000 (135 BWP) which gives them a sign-up bonus of $2,000 (27 BWP).

The Refer a Friend bonus enables traders to earn between $50 and $250 when a referral opens a live account and deposits between $500 and $20,000 or more. The first investment placed on a trader’s suggestion will determine their earning potential.

Does AvaTrade offer any bonuses to new clients?

A welcome bonus to new clients on their initial deposit. The welcome bonus amount and terms may vary, so it is essential to check the current promotions on the official website or contact their customer support for the latest information regarding bonuses for new clients.

Are there any conditions or requirements for withdrawing bonus funds?

Yes, generally, bonus funds offered are subject to specific terms and conditions, including trading volume requirements. These terms are commonly known as “bonus terms” or “trading requirements.” Before you can withdraw bonus funds or any profits earned using the bonus, you may need to meet certain trading volume thresholds within a specified time frame

How to open an Affiliate Account with AvaTrade

To register an Affiliate Account, Botswana Traders can follow these steps:

Navigate to the AvaTrade website and navigate to the “Partners” tab on the main menu of the homepage.

Click on “Become a Partner” and select whether a Person or Company is registering for the Affiliate Account.

Next, complete the 4-step registration and application as per the website instructions.

AvaTrade Affiliate Program Features

AvaTrade’s global network of over 70,000 partners spans more than 150 countries. The AvaTrade affiliate program includes the following benefits:

- Lucrative commission payments, with $250,000,000 in commissions that have been paid thus far

- A secure, transparent trading environment

- Customizable deals

- Flexible commission structures

- Robust marketing strategies

- Reliable pay-outs

- Innovative technology

- Multilingual trading platforms

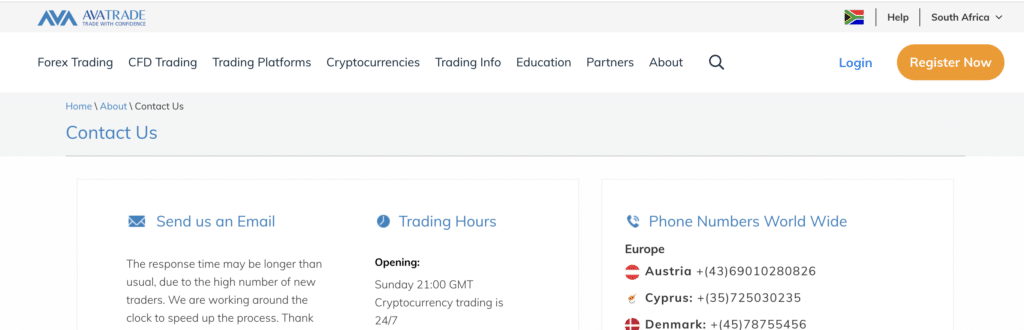

Customer Support

AvaTrade provides exceptional customer service, particularly when compared to other brokers. AvaTrade’s live chat representatives are timely, friendly, and helpful, offering relevant information to inquiries.

| ☎️ Telephone/WhatApp | https://www.avatrade.com/about-avatrade/contact-us |

| 🗺️ Website URL | https://www.avatrade.com/ |

| [email protected] | |

| 📙 FAQ’s | www.avatrade.com/?s=FAQ |

| 🎓 Customer Service | https://www.avatrade.com/about-avatrade/contact-us |

| 📍 GDPR compliant T&Cs | https://www.avatrade.com/about-avatrade/legal-documentation |

How can I contact AvaTrade’s customer support?

AvaTrade offers multiple channels through which you can contact their customer support team.

What are AvaTrade’s customer support hours?

AvaTrade’s customer support team operates during regular business hours, which typically correspond to the major financial markets operating hours. However, AvaTrade aims to provide support 24/5, meaning they are available from Sunday night until Friday evening (GMT), covering most of the trading week.

Our Verdict

AvaTrade distinguishes itself by a diverse array of trading platforms and instructional information for novices – areas in which it was named Best in Class. Its trading range has almost quadrupled year over year and spreads for customers classified as Professional Traders in the European Union are competitive

Overall, AvaTrade’s offering is strong, with a sophisticated in-house trading platform, a substantial quantity of highly valuable instructional information available at different levels, and multiple social and copy trading alternatives.

The minor disadvantages are that spreads are not extremely competitive (about average), and inactivity fines are a little excessive. Additionally, sketching capabilities are not accessible on AvaTrade WebTrader or on the AvaTradeGO app, which is another drawback that needs attention.

Three separate in-house applications are available for traders on the move, and AvaTrade’s solid regulatory background ensures that it is a broker worth trusting. We would suggest AvaTrade to novice and intermediate Botswanan traders alike.

You might also like: AvaTrade Account Types

You might also like: AvaTrade Fees and Spreads

You might also like: AvaTrade Demo Account

You might also like: AvaTrade Islamic Account

You might also like: AvaTrade Minimum Deposit

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Regulated by five Tier-1 regulators, which instils confidence and guarantees that traders are dealing with a legitimate broker | Fixed spreads that are marked-up |

| There are over 1,250 financial instruments that can be traded | There is a limited choice between account types |

| There are transparent trading and non-trading fees | There are limits on leverage for retail traders |

| AvaTrade guarantees trading fund protection | There is an inactivity fee charged |

| There are no commissions charged on any trades | There is no BWP-denominated account for Botswanan traders and there are no local deposit and withdrawal options or BWP deposit currencies |

| AvaTrade offers a selection of trading platforms that can be used | Currency conversion fees may apply for deposits/withdrawals made in BWP |

| Trading strategies are not limited | |

| There are no fees charged on deposits or withdrawals |

Frequently Asked Questions

Is AvaTrade regulated?

Yes, AvaTrade is a fully licensed and regulated broker in each country, as it has all relevant licenses and regulatory duties in several regions. AvaTrade is well-regulated by the Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, and IIROC.

How long does it take to withdraw money from AvaTrade?

If the account verification procedure has been completed and accepted by AvaTrade, it takes between 24 and 48 hours to execute a withdrawal request.

This is how credit cards, debit cards, and e-money are processed. Wire transfers might take up to ten business days to reflect in your account.

Does AvaTrade offer Nasdaq 100?

Yes, AvaTrade offers US_Tech100 (Nasdaq) to Botswanan traders. AvaTrade is devoted to giving Botswanan traders with the most up-to-date trading tips, tools, and expert coaching guidance to aid them in making NASDAQ 100 index trading selections.

Does AvaTrade offer Volatility 75?

AvaTrade does not yet provide the Volatility 75. However, you may diversify your portfolio by including different indexes such as the US 30 or the DAX 30.

Is AvaTrade good for Botswanan beginner traders?

AvaTrade is designed for the beginner investor seeking an introduction to FX and CFD trading. With a diverse product portfolio, competitive spreads, and a range of user interfaces, AvaTrade is great for inexperienced and undercapitalized traders looking to develop their skill sets.

Does AvaTrade have a no-deposit bonus for Botswanan traders?

No, AvaTrade does not offer a no-deposit bonus. When opposed to brokers that provide no-deposit bonuses, AvaTrade differentiates itself by periodically giving first-time sign-up bonuses, or welcome bonuses and a referral bonus, to traders who register a live account.

What is the overall rating for AvaTrade?

We score AvaTrade 9/10 in terms of regulatory status, the safety of funds, the range of markets, the range of trading software, and overall broker popularity and performance. AvaTrade is one of the best forex and CFD brokers in the world with many industry awards to back this statement.

While there are some things that the broker can work on, such as its choice of trading accounts and its fixed spreads, there are many features offered that will benefit different types of traders from Botswana.

Conclusion

Now it is your turn to participate:

Regardless, please share your thoughts in the comments below

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review

Corporate Social Responsibility

There is currently no information regarding AvaTrade’s Corporate Social Responsibility.