HFM Review

Overall, HFM is very competitive in terms of its trading fees and spreads. The Broker is a multi-regulated forex broker headquartered in Cyprus. They are regulated by FSCA, CySEC, DFSA, FSA, FCA, FSC, and CMA and have a Trust Score of 85% out of 100. HF Markets is currently not regulated by the MFED, BoB, or NBFIRA of Botswana

- Louis Schoeman

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

USD 0

Regulators

CySEC, FCA, DFSA, FSCA, FSA, CMA

Trading Desk

MT4, MT5, HFM APP

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

0

Account Activation Time

24 Hours

Overview

Overall, the Broker is considered low-risk, with an overall Trust Score of 85 out of 100. They are licensed by one Tier-1 Regulator (high trust), four Tier-2 Regulators (average trust), and two Tier-3 Regulators (low trust). The broker offers four different retail trading accounts namely a Cent Account, a Premium Account, a Zero Account, and Pro Account.

They accept Botswanan clients and have an average spread from 0.0 pips with a $6 to $8 commission round turn and have a maximum leverage ratio up to 1:2000 and there is a demo and Islamic account available. MT4, MT5, and HF App platforms are supported. The broker is headquartered in Cyprus and regulated by FSCA, CySEC, DFSA, FSA, FCA, FSC, and CMA.

The broker is a multi-asset broker that provides Forex and Commodities trading using CFDs. The Broker provides access to unfettered liquidity, enabling any size or profile trader to choose from a variety of spreads and liquidity providers through automated trading platforms and the execution of any strategy.

The fact that this Broker is primarily interested in and influential in the African, Asian, and MENA areas provides some of the greatest prospects for global citizens.

The broker provides its trading service in conjunction with the appropriate licenses that govern the Forex sector and hence provides trustworthy service and was founded in 2010 with its headquarters in Cyprus, but the broker also provides services to other international locations.

The Broker has a deeply ingrained sense of social responsibility and the belief that they must assist the less fortunate. When the chance presents itself and responds by aggressively providing aid. Contributing to local communities via charity contributions and other social projects is a part of their job.

Distribution of Traders

The broker currently has the largest market share in these countries:

➡️ South Africa – 94.8%

➡️ Nigeria – 2.54%

➡️ United States – 0.77%

➡️ Morocco – 0.74%

➡️ Netherlands – 0.27%

Popularity among traders

The Broker is popular in Africa overall and while it does not dominate the derivatives market in Botswana and is one of the Top 10 brokers for Botswanan traders regardless of their trading experience or unique trading styles.

At a Glance

| 🏛 Headquartered | Cyprus |

| 🌎 Global Offices | Seychelles, South Africa, Dubai, UK, Kenya |

| 🏛 Local Market Regulators in Botswana | • Ministry of Finance and Economic Development (MFED) • Bank of Botswana (BoB) • Non-Bank Financial Institutions Regulatory Authority (NBFIRA) |

| 💳 Foreign Direct Investment in Botswana | 115.89 BWP Million in 2021 |

| 💰 Foreign Exchange Reserves in Botswana | 5270 USD Million in 2021 |

| ✔️ Local office in Gaborone? | No |

| 👨⚖️ Governor of SEC in Botswana | None, Moses Dinekere Pelaelo is the Governor of the Bank of Botswana |

| ✔️ Accepts Botswana Traders? | Yes |

| 📊 Year Founded | 2010 |

| 📞 Botswana Office Contact Number | None |

| 📱 Social Media Platforms | • Facebook • YouTube • Telegram |

| ⚖️ Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA |

| 1️⃣ Tier-1 Licenses | • Financial Conduct Authority (FCA) |

| 2️⃣ Tier-2 Licenses | • Financial Sector Conduct Authority (FSCA) • Cyprus Securities and Exchange Commission (CySEC) • Capital Markets Authority (CMA) • Dubai Financial Services Authority (DFSA) |

| 3️⃣ Tier-3 Licenses | • Financial Services Authority (FSA) • Financial Services Commission (FSC) |

| 🪪 License Number | • South Africa – FSP 46632 • Cyprus – 183/12 • Dubai – F004885 • Seychelles – SD015 • United Kingdom – 801701 • Mauritius – 094286/GBL • Kenya – CMA license 155 |

| ⚖️ MFED, BoB, or NBFIRA Regulation | No |

| ✔️ Global Restrictions | • France ACPR – 53684 • Germany BaFin – 132342 • Hungary MNB – K8761153 • Italy CONSOB– 3673 • Norway – FT00080085 • Spain CNMV – 3427 • Sweden FI – 31987 • Austria FMA • Bulgaria FSC • Croatia HANFA • Czech Republic CNB • Denmark Finanstilsynet • Estonia FSA • Finland FSA • Greece HCMC • Iceland FME • Central Bank of Ireland • Latvia FKTK • Liechtenstein FMA • Lithuania Lietuvos Bankas • Luxembourg CSSF • Malta MFSA • Poland KNF • Portugal CMVM • Romania ASF • Slovakia NBS • Slovenia ATVP |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 5 |

| ✔️ PAMM Accounts | No |

| 💻 Liquidity Providers | Barclays UK, BNP Paribas, and others |

| ✔️ Affiliate Program | Yes |

| 📱 Order Execution | Market |

| 📊 Starting spread | 0.0 pips |

| 📉 Minimum Commission per Trade | $3 to $4 |

| 💰 Decimal Pricing | 5th decimal pricing after the comma |

| 📞 Margin Call | Between 40% to 50% |

| 🛑 Stop-Out | Between 10% and 20% |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | 60 lots |

| ✅ Crypto trading offered? | Yes |

| ✔️ Offers a BWP Account? | No |

| 📉 Dedicated Botswana Account Manager? | Yes |

| 📈 Maximum Leverage | 1:2000 |

| 📊 Leverage Restrictions for Botswana? | No |

| 💳 Minimum Deposit (BWP) | 0 BWP or an equivalent to $0 |

| ✔️ Botswana Pula Deposits Allowed? | Yes |

| 📊 Active Botswana Trader Stats | 250,000+ |

| 👥 Active Botswana-based HFM customers | Unknown |

| 🔁 Botswana Daily Forex Turnover | Unknown, Forex overall is $6.6 Trillion |

| 💰 Deposit and Withdrawal Options | • Bank Wire Transfer • Electronic Transfer • Credit Card • Debit Card • Skrill |

| 💻 Minimum Withdrawal Time | 10 Minutes |

| ⏰ Maximum Estimated Withdrawal Time | 10 business days |

| 💳 Instant Deposits and Instant Withdrawals? | No |

| 🏛 Segregated Accounts with Botswana Banks? | No |

| 📱 Trading Platforms | • MetaTrader 4 • MetaTrader 5 • HF App |

| 💻 Tradable Assets | • Forex • Precious Metals • Energies • Indices • Shares • Commodities • Cryptocurrencies • Bonds • Stocks DMA • ETFs |

| ✔️ Offers USD/BWP currency pair? | No |

| 📊 USD/BWP Average Spread | None |

| ✅ Offers Botswana Stocks and CFDs | No |

| 💻 Languages supported on the Website | 20 Languages |

| ☎️ Customer Support Languages | Multilingual |

| 👥 Copy Trading Support | Yes |

| ⏰ Customer Service Hours | 24/5 |

| 📞 Botswana-based customer support? | No |

| 💸 Bonuses and Promotions for Botswanans? | No |

| 📚 Education for Botswanan beginner traders | Yes |

| 📱 Proprietary trading software | Yes |

| 🤝 Most Successful Trader in Botswana | Unknown |

| ✔️ Is HFM a safe broker for Botswana Traders? | Yes |

| 🎖 Rating for HFM Botswana | 9/10 |

| 🥇 Trust score for HFM Botswana | 85% |

| 👉 Open Account | 👉 Open Account |

Regulation and Safety of Funds

Regulation in Botswana

They are globally regulated and while accepting Botswanan traders do not have any local regulations in Botswana.

Global Regulations

HFM businesses are comprised of the following firms, and are the trading brand of the HF Markets Group of companies:

➡️ HF Markets SA (PTY) Limited, is a company that is officially registered in South Africa (2015/341406/07).

➡️ HF Markets (Europe) Limited is an organization with its headquarters in Cyprus and its registration number listed as HE 277582.

➡️ HF Markets (DIFC) Ltd is regulated in Dubai under F004885 by the Dubai Financial Services Authority (DFSA).

➡️ HF Markets (Seychelles) Limited is a well-established entity that is licensed and registered in Seychelles under 8149176-1.

➡️ HF Markets (UK) Ltd is based in the United Kingdom and is regulated by the Financial Conduct Authority under reference number 801701.

➡️ HF Markets Limited has a Category 1 Global Business no. C110008214 and a Company registration number of 094286/GBL. Both these license and registration numbers can be found on the Mauritius government website.

➡️ HFM Investments Limited is a licensed dealer in Kenya under CMA 155.

HFM is regulated and permitted to do business in a variety of worldwide countries by the market regulators listed below, along with their respective license numbers:

➡️ South Africa: The Financial Sector Conduct Authority (FSCA), as a Financial Service Provider (FSP), with the license number 46632.

➡️ Cyprus: The Cyprus Securities and Exchange Commission (CySEC) has a cross-border license, holding license number 183/12. Additionally, the broker is a participant on the Committee of the European Securities and Markets Authority (commonly known as ESMA).

➡️ Dubai: HF Markets (DIFC) Ltd is authorized by the Dubai Financial Services Authority (DFSA), which also regulates the company under the number F004885.

➡️ The Republic of Seychelles: HF Markets (Seychelles) Ltd is licensed by the Seychelles Financial Services Authority (FSA) under license number SD015, and its registration number is 8419176-1.

➡️ The United Kingdom: HF Markets (UK) Ltd has license number 801701 from the Financial Conduct Authority (FCA), which ensures that the company adheres to all applicable regulations.

➡️ Mauritius: HF Markets Ltd. is authorized by the Financial Services Commission (FSC) of Mauritius to do business under the C11000814 (Global Business Number) and the 094286/GBL corporate registration.

➡️ Kenya: HFM Investments Limited is a Kenyan-based entity that is regulated and authorized by the Capital Markets Authority (CMA) under license number CMA 155.

Additional registrations that HFM owns on a worldwide scale include some of the following, with the complete comprehensive list being accessible on the official website:

➡️ France – Autorité de Contrôle Prudentiel et de Résolution (ACPR)

➡️ Germany – Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) – 132342

➡️ Hungary – Magyar Nemzeti Bank (MNB) – K8761153

➡️ Italy – Commissione Nazionale per le Società e la Borsa (CONSOB) – 3673

➡️ Norway – Finanstilsynet – FT00080085

➡️ Spain – Comisión Nacional del Mercado de Valores (CNMV) – 3427

➡️ Croatia – Hrvatska agencija za nadzor financijskih usluga (HANFA)

➡️ Greece – Ελληνική Επιτροπή Κεφαλαιαγοράς (HCMC)

➡️ Lithuania – Lietuvos Bankas

➡️ Malta – Malta Financial Services Authority (MFSA)

➡️ Poland – Komisji Nadzoru Finansowego (KNF)

➡️ Slovakia – Národná Banka Slovenska (NBS), and many more.

HFM Client Fund Security and Safety Features

HFM always maintains client money in separate accounts at the most reputable financial institutions. In addition to this, the broker additionally has a Civil Liability insurance policy with a maximum limit of five million Euros.

This program provides coverage against mistakes, carelessness, omissions, fraud, and other hazards that might expose traders to the risk of loss. Other risks that are covered include fraud.

Another risk management technique that is provided by them is known as negative balance protection, and this feature is included with all retail trading accounts.

The negative balance protection that is provided by this Broker is applicable regardless of the volatility of the market, particularly in situations where margin calls and stop-outs may fail. This protection ensures that clients are exempt from paying back their brokers if their accounts go into a negative.

Is HF Markets a regulated broker?

Yes, they are often regulated by multiple financial authorities in different regions. These regulatory bodies ensure that the broker operates within legal and ethical guidelines, providing traders with a level of protection and transparency.

Which regulatory authorities oversee HF Markets’ operations?

The broker is typically regulated by renowned financial authorities such as CySEC (Cyprus Securities and Exchange Commission) and the FCA (Financial Conduct Authority) in the UK. They might also be registered with other regulatory bodies in various jurisdictions.

Awards and Recognition

Over its years in operation, HFM has collected several highly prestigious titles from well-respected awarding bodies from around the globe, including some of the following:

➡️ 2021 – Best Forex Broker in Nigeria (International Finance Awards)

➡️ Top 100 Companies (World Finance Magazine)

➡️ Best Multi-Asset Broker Globally (Pan Finance) in 2021

➡️ Forex Trading Platform of the Year (Business Day)

➡️ Best Forex Broker Asia (Global Business Review Magazine) in 2021

Has the broker received any awards for its services and offerings?

Yes, they have received numerous awards and recognitions from industry organizations and publications for their exceptional services and offerings.

What are some of the industry recognitions that HF Markets has received for its services?

HFM has gained significant industry recognition for its services and contributions to the trading community. Some notable industry awards and accolades include:

Best Forex Broker in the Middle East: HotForex was awarded the “Best Forex Broker in the Middle East” by International Business Magazine, reflecting its popularity and quality services in the Middle Eastern region.

Best Client Fund Security 2021: HotForex was recognized with the “Best Client Fund Security 2021” award by Global Brands Magazine, highlighting the broker’s dedication to maintaining a secure trading environment.

Best Forex Education Provider Africa 2020: The International Business Magazine named HotForex the “Best Forex Education Provider Africa 2020,” acknowledging its efforts to educate and empower traders in the African continent.

Best Forex Trading Platform South East Asia: HotForex received the “Best Forex Trading Platform South East Asia” award from Global Banking & Finance Review, showcasing its user-friendly and innovative trading platforms.

HFM Account Types and Features

There is a selection of trading accounts available to choose from. These accounts are designed to accommodate various levels of trading expertise, levels of trading experience, and trading styles. The following types of retail investor accounts are provided:

➡️CENT Account

➡️ZERO Account

➡️PREMIUM Account

➡️PRO Account

Live Trading Accounts

CENT Account

A Cent account is a type of trading account that allows you to trade swaps free and with cent lots. A Cent lot equals 0,01 of a Standard lot or 1,000 units. The margin requirements are as low as 10 US cents making it a beginner-friendly option for traders transitioning from trading on a Demo account to real trading.

Cent accounts are an excellent choice for novice traders who want to put their trading skills to the test and learn the dynamics of the real market – all while not investing too much of their trading funds. Experienced traders can also trade on Cent accounts to test new trading instruments and develop their strategies with less capital and reduced exposure.

ZERO Account

The FX Revolution starts at Zero! With no minimum opening deposit and leverage up to 1:2000, the Zero account is an accessible, swap-free, low-cost trading solution that is suitable for all traders. Receive RAW, Super-Tight Spreads from leading liquidity providers with NO hidden markups and commissions starting from a low $0.03 per 1k lot!

PREMIUM Account

Premium account is for retail traders who are looking for swap-free trading with lower spreads, no minimum deposit, and no commission. Open a Premium account today and access the markets via MT4, MT5, Webtrader, or the HFM App!

PRO Account

With ultra-low spreads, leverage up to 1:2000, and no commissions, the swap-free Pro account is developed to suit the needs of a more experienced trader who wants to take their trading to the next level.

Demo Account

A demo account is a practice account that offers traders a certain amount of virtual funds that they can use, allowing them to enter the live market without risking their capital.

The demo account provided to its Botswanan traders may be used for one of two purposes: novice traders can use it to get experience trading without risking any real money, and more experienced traders can use it to evaluate the effectiveness of their trading methods.

Traders from Botswana can open a demo account on any of the following account types:

CENT Account, ZERO Account, PREMIUM Account, PRO Account.

Islamic Account

- Depending on the trading style and the trading strategy of the forex trader, they may keep their trading positions open for longer than 24 hours on a trading day.

- This means that the trader could incur an overnight or rollover fee. This is a type of interest that is prohibited by the Riba principles of Sharia law, which means that Muslim traders are often restricted in forex trading.

- When Muslim traders keep their positions open overnight in their Islamic Account, they will not be charged interest since this account is consistent with Sharia law and operates per Islamic principles.

- The broker gives its Muslim customers the option to convert any of the live trading accounts they have into an Islamic Account, which allows them to engage in halal trading without any constraints.

Can I switch between different account types?

Yes, traders can typically switch between different account types. However, the ability to switch accounts may be subject to certain conditions and requirements.

What are the different account types offered by the broker and how can I determine which account type is suitable for my trading style and goals?

They offer a range of account types, including Cent, Premium, Zero, and Pro accounts. Each account type has its features, such as minimum deposit requirements, spreads, leverage, and additional services. To choose the most suitable account type, consider factors such as your trading experience, risk tolerance, preferred trading strategies, and the level of services you require. You can find detailed information about each account type on the website or contact their customer support for personalized guidance based on your trading needs.

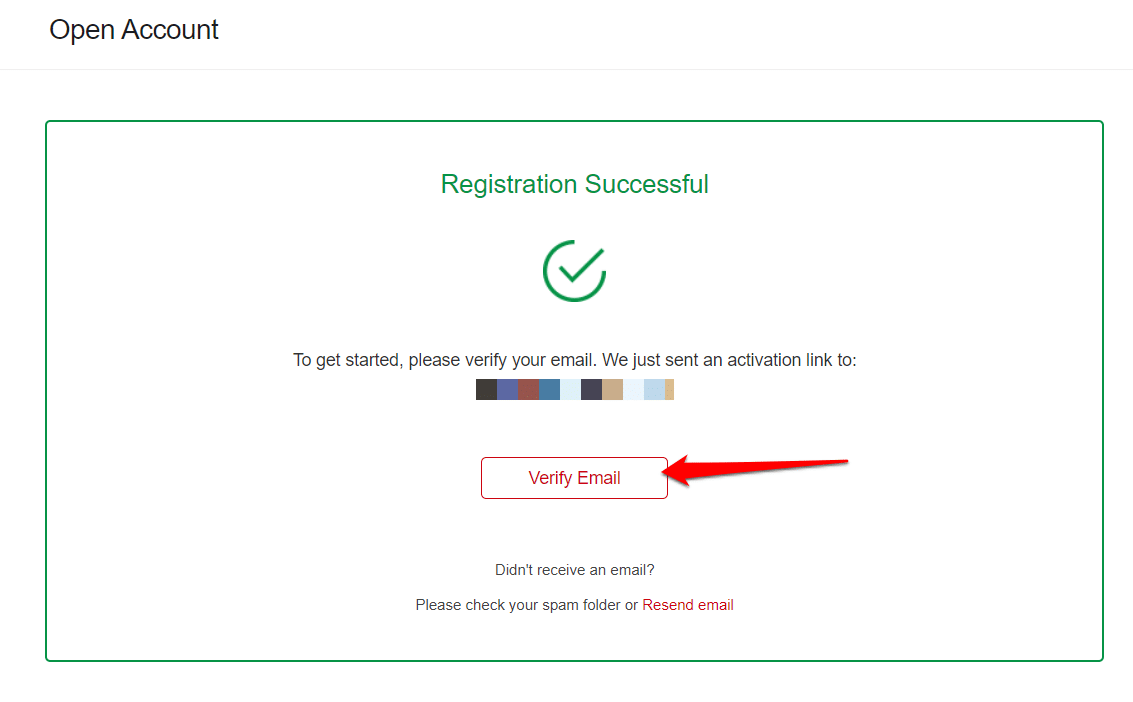

How to open an Account with HF Markets in Botswana

To register an account, Botswana Traders can follow these steps:

Step 1. Register

Navigate to the official website and select the option to register from the homepage.

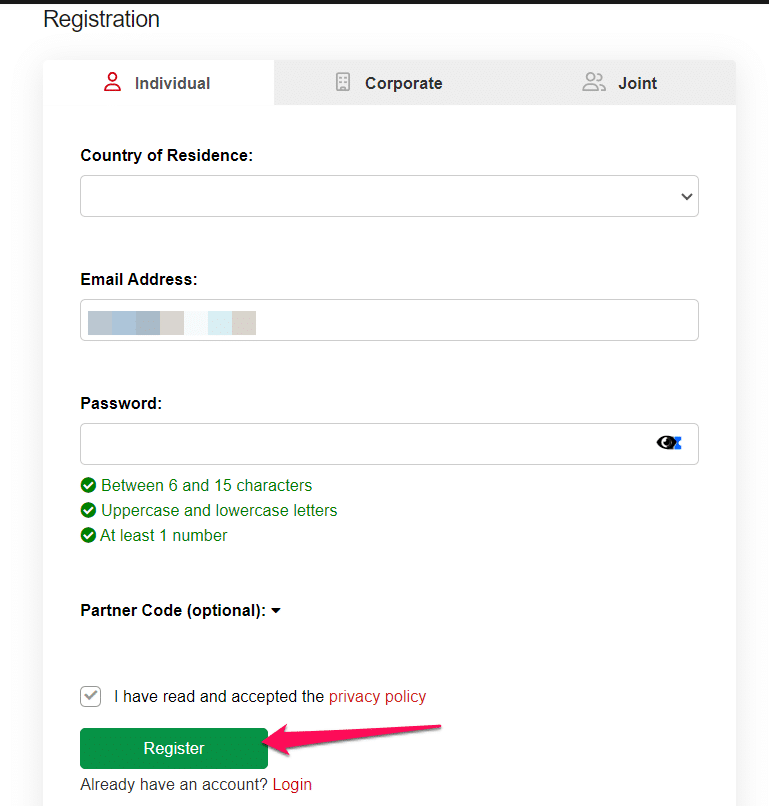

Step 2. Complete Application

Complete the online application and include your complete Country of residence, email address, and password.

Step 3. Receive Email

After registration, you will receive a link to your email.

➡️ After completing this process, you will gain access to the MyHF dashboard. This is the administrative center for a demo, live, and other accounts.

➡️ Select your account type from the available account options and upload all Know Your Customer (KYC) documents through the MyHF portal. To be accepted as a retail trader, required at least two documents namely proof of identity and proof of residence.

➡️ Proof of Identification can be a colored scanned copy (in PDF or JPG format) of your current (not expired) passport. If a legitimate passport is not available, a picture identification card or driver’s license with a comparable design can suffice.

HF Markets Vs GO Markets Vs easyMarkets – Broker Comparison

| 🥇 HFM Markets | 🥈 GO Markets | 🥉 easyMarkets | |

| ⚖️ Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, and CMA with registration in ACPR, BaFin, MNB, CONSOB, CNMV, FI, FMA, FSC, and other regions | ASIC, FSA Seychelles, FSC Mauritius, CySEC | BVI FSC, CySEC, ASIC, FSA |

| 📱 Trading Platform | • MetaTrader 4 • MetaTrader 5 • HF App | • MetaTrader 4 • MetaTrader 5 | • easyMarkets Platform • MetaTrader 4 • MetaTrader 5 • TradingView |

| 💰 Withdrawal Fee | No | No | No |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 0 BWP | 1,600 BWP | 334 BWP ($25) |

| 📊 Leverage | 1:2000 | Up to 1:500 | Up to 1:400 |

| 📊 Spread | 1.2 pip | From 0.0 pips | Fixed, 0.03 USD |

| 💰 Commissions | $3 to $4 | From US$2.50 | None |

| ✴️ Margin Call/Stop-Out | • 40%/10% • 50%/20% | 80%/50% | 70%/30% |

| 💻 Order Execution | Market | Instant | Market |

| 💳 No-Deposit Bonus | Yes | No | No |

| 📊 Cent Accounts | Yes | No | No |

| 📈 Account Types | • Cent Account • Premium Account • Pro Account • Zero Account | • Standard Account • GO+ Account | • Standard Account • Premium Account • VIP Account |

| ⚖️ CBN Regulation | No | No | No |

| 💳 BWP Deposits | Yes | No | Yes |

| 📊 Botswanan Pula Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/5 | 24/5 |

| 📊 Retail Investor Accounts | 5 | 2 | 3 |

| ☪️ Islamic Account | Yes | No | Yes |

| 📉 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | 60 lots | 250 lots | 50 lots |

| 💰 Minimum Withdrawal Time | 10 Minutes | Instant | Instant |

| 📊 Maximum Estimated Withdrawal Time | 10 business days | 1 to 3 business days | Up to 5 Days |

| 💸 Instant Deposits and Instant Withdrawals? | No | Yes | Yes |

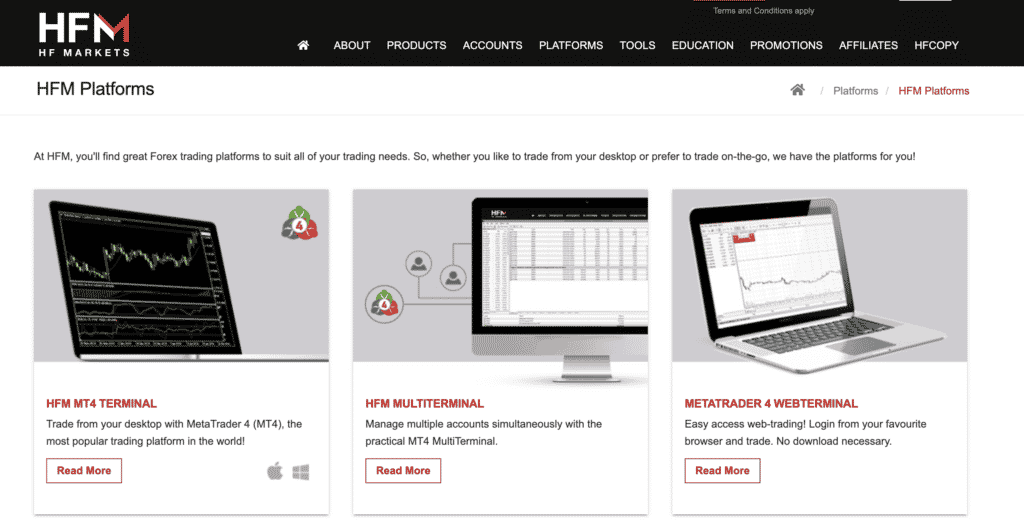

Trading Platforms

The broker offers Botswana Traders a choice between these trading platforms:

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ HF App

Desktop Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4

The most extensively used electronic trading platform nowadays is MT4. A good place to start for individuals new to internet trading, but with ample features for more seasoned investors as well.

In addition to its user-friendly interface, MT4 is noted for its wide range of trading tools and other resources. More than 50 built-in indicators and tools make it easy to do in-depth technical analysis on a wide variety of assets over several periods.

Custom indicators and automated trading systems (expert advisors) may be constructed using the built-in MetaEditor in the MQL4/5 programming language. An online community of traders and analysts is also a reliable source of information.

Live price quotations are shown on the market watch window, with news feeds incorporated directly into MT4, and real-time client account summaries include account balances and equity, margins, and floating profits/losses. In addition, MT4 allows one-click trading and different order types.

MetaTrader 5

MT5 provides you with all the advantages that MT4 did, in addition to several additional features. These features include the ability to examine 100+ charts concurrently, greater order management tools, 21 distinct timeframes, 100+ technical indicators, and more.

MT5 is a robust platform that is simple to use, and it gives you complete control over your transactions to improve your overall trading experience.

WebTrader Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4

Any web browser can be used to access the MT4 online terminal, which offers the same user-friendly interface and powerful trading tools as the MT4 desktop platform.

Because of this, you will not have to worry about downloading, setting up, or running any other supplementary software, and you will be able to trade from any location around the globe if you have access to the internet.

Other advantages include the ability to trade right from the charts, real-time quotations, and charts that may be customized.

MetaTrader 5

You will have access to all the same capabilities on the MT5 online terminal as you do on the MT5 desktop terminal, with the exception that you will not be required to download, install, or execute any software.

You only need to run the web terminal from any computer and browser to begin trading in a matter of seconds using all the same features that are available on the MT5 desktop platform.

Trading App

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4

Both Android and iOS-based mobile devices may use the MT4 mobile terminal successfully. It is tailored to facilitate trading while on the go while retaining all its capabilities.

If you have access to the internet, you can easily log into your account and carry out your trading activity regardless of where you are or when you do it. The MT4 mobile app may be downloaded for free from the app stores that are relevant to it.

MetaTrader 5

With the MT5 mobile terminal installed on your Android or iOS smartphone or tablet, you will have complete command over your trading account.

Traders that require quick and easy access to their accounts while they are on the go, no matter where they are in the globe, may benefit from using this platform. You can place trades, maintain positions, and do chart analysis. Additionally included are signals for push notifications.

HF App

The HF app gives users access to the client area as well as live-streaming market prices, news, and market analysis. Other trading tools are accessible from inside the app, as is a library of instructional content that may assist you in gaining knowledge even when you are not at your computer.

Another feature of the HF App is that Botswanan traders can access HFcopy seamlessly through the mobile trading app. Traders may use HFcopy to send signals to their followers, which the followers can then copy automatically to their trading accounts.

Signal providers can earn a performance fee, but followers have complete authority over their trading accounts and are free to choose and modify the traders they are following whenever they want.

However, Botswanan traders must note that the performance of a signal in the past is in no way a guarantee of its performance in the future.

What trading platforms are offered?

MetaTrader 4 (MT4):

A widely-used trading platform known for its user-friendly interface, advanced charting tools, technical indicators, and automated trading capabilities.

MetaTrader 5 (MT5):

Building on the features of MT4, MT5 offers additional assets, more timeframes, an economic calendar, more technical indicators, and an improved strategy tester.

HF App:

A mobile application that allows traders to access their accounts, trade, and monitor the markets on the go using their smartphones or tablets.

Are the trading platforms available for different devices?

Yes, trading platforms are available for various devices. The MetaTrader 4 and MetaTrader 5 platforms can be downloaded and installed on Windows computers. They are also available for macOS users through emulation software. The HF App is designed for iOS and Android devices, making it convenient for traders to access their accounts and trade from their smartphones and tablets.

Range of Markets

Botswana Traders can expect the following range of markets:

➡️ More than 50 currency pairings, including major, minor, and exotic currency pairs.

➡️ Access to precious metals and spot metals, including Palladium, Platinum, Silver, and Gold.

➡️ 2 Spot Energies and Future Energies, including Brent Oil from the United Kingdom and Crude Oil from the United States

➡️ 11 Spot Indices and Futures Indices, including the AUS200, GER40, UK 100, and US Tech 100, among others.

➡️ Over 71 Individual Stocks

➡️ 5 Commodities consisting of Sugar, Cocoa, Coffee, Copper, and Cotton.

➡️ 15 Cryptocurrencies, among them ZCash, Monero, XRP, Stellar, TRON, OmiseGo, Bitcoin, Ethereum, and Litecoin.

➡️ 3 bonds, including the Euro Bund, the United Kingdom Gilt, and the United States 10-year Treasury Note.

➡️ Over 900 DMA Stocks

➡️ 34 Exchange-Traded Funds

| 🔨 Instrument | 💰 Number of Assets Offered | 📈 Max Leverage Offered |

| ➡️ Forex | 53 | 1:500 |

| ➡️ Precious Metals | 6 | • Gold: 1:200 • Silver: 1:100 • Platinum: Floating • Palladium: 1:20 |

| ➡️ ETFs | 34 | 1:5 |

| ➡️ Stock DMA | 901 | 1:5 |

| ➡️ Indices | 24 | 1:200 |

| ➡️ Stocks | 23 | 1:14 |

| ➡️ Cryptocurrency | 19 | 1:50 |

| ➡️ Energies | 4 | 1:66 |

| ➡️ Bonds | 3 | 1:50 |

| ➡️ Agricultural Commodities | 5 | 1:66 |

How can I diversify my trading portfolio using a range of markets?

The broker offers a diverse selection of financial instruments that enable traders to diversify their portfolios and manage risk.

Are there any trading restrictions or limitations on the range of markets offered?

The broker provides access to a wide range of markets, it’s important to note that specific instruments may have trading restrictions or limitations.

Broker Comparison for Range of Markets

| 🏅 HotForex | 🥈 GO Markets | 🥉 easyMarkets | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | No | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | No | Yes |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | Yes | No | No |

Trading and Non-Trading Fees

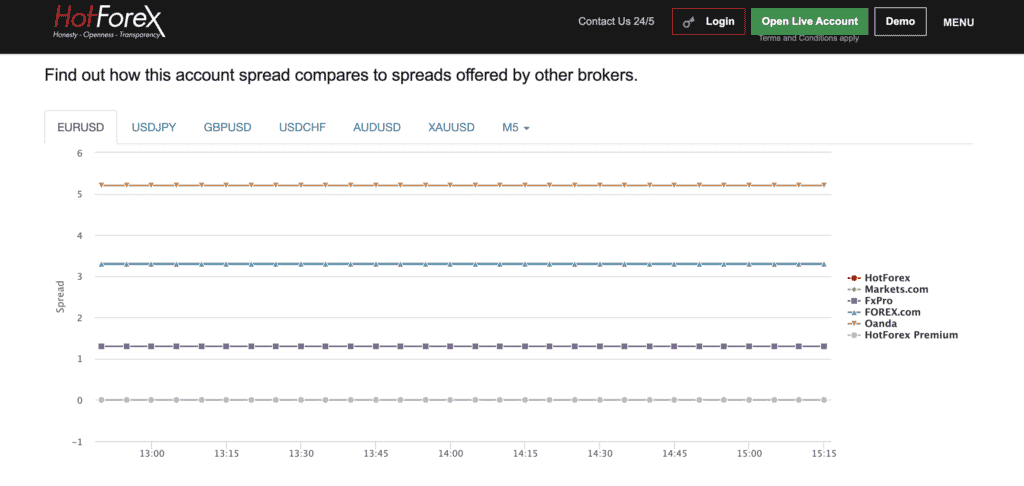

Spreads

A trader’s account type, the market circumstances, and the financial instrument they choose to trade all affect the spreads they may anticipate. These are the typical spreads by account type:

➡️ Cent Account – From 1.2 pip

➡️ Premium Account – From 1.2 pip

➡️ Zero Account – From 0 on Forex and Gold

➡️ Pro Account – From 0.5 pip

According to the financial instruments offered, traders can expect these average spreads:

| Instrument | Average Spread |

| ➡️ EUR/USD | 1.3 pips |

| ➡️ NZD/USD | 1.9 pips |

| ➡️ XAG/USD | 0.03 pips |

| ➡️ XAU/USD | 0.25 pips |

| ➡️ US OIL Spot | 0.09 pips |

| ➡️ US OIL Futures | 0.11 pips |

| ➡️ US Tech 100 Spot | 2.03 pips |

| ➡️ US Tech 100 Futures | 3.13 pips |

| ➡️ Volatility Index SP 500 (VIX.F) | 0.14 pips |

| ➡️ APPLE (NASDAQ – APPLE) | 0.5 pips |

| ➡️ Commodities | From 0.008 (Copper) |

| ➡️ BTC/USD | 26 pips |

| ➡️ Bonds | From 0.05 pips to 0.06 pips |

Commissions

Commissions are clear and competitively cheap when compared to those of other FX and CFD brokers. For major currency pairings, Botswanan traders should anticipate charges of $3 / 40 BWP; for other financial products, they can expect costs of $4 / 54 BWP.

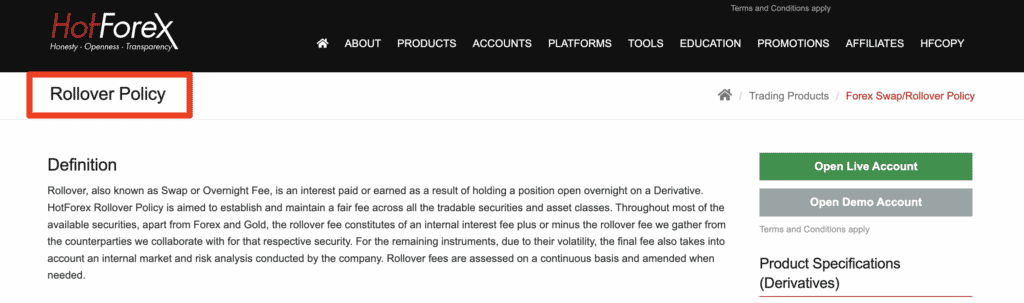

Overnight Fees, Rollovers, or Swaps

Botswanan traders should note the following conditions associated with overnight fees:

➡️ Individual stock swaps are updated daily based on market circumstances and the rates provided by price suppliers. All positions are subject to these swaps, and on Wednesdays, there are triple swaps.

➡️ Swaps for precious metals are updated every day in response to changes in the market and the rates received by price suppliers. Botswanan traders who keep positions open must note that triple swaps will be applied on Wednesdays. In addition, the swaps for both XAU and XAG are indicated as 1 pip per lot.

➡️ Market circumstances and prices provided by price providers are used to alter energy swaps daily. There are triple swaps on Wednesdays and USOil and UKOil swaps are in US Dollar values. Traders should be aware of this information.

➡️ All these instruments have their swap rates modified every day per market circumstances and the rates acquired by price providers, including indices, bonds, DMA stocks, ETFs, and cryptocurrencies. All positions are subject to these swaps, and there are quadruple swaps on Fridays.

Some typical overnight fees that Botswanan traders can expect are as follows:

| 🔨 Instrument | 🔁 Swap Short | 📊 Swap Long |

| EUR/USD | 0.1 pips | -5.8 pips |

| XAG/USD | -0.07 pips | -0.4 pips |

| XAU/USD | -0.55 pips | -4.15 pips |

| US OIL Spot | -4.35 pips | 0.23 pips |

| US OIL Futures | -0.53 pips | -2.0 pips |

| US Tech 100 Spot | -1.07 pips | -0.85 pips |

| US Tech 100 Futures | 0.0 pips | 0.0 pips |

| Volatility Index SP 500 (VIX.F) | 0.0 pips | 0.0 pips |

| APPLE (NASDAQ – APPLE) | -2.93 pips | -4.57 pips |

| Copper | -0.53 pips | -1.58 pips |

| BTC/USD | -6000.0 pips | -6000.0 pips |

| Bonds | -0.53 pips | 0.0 pips |

| DMA Stocks NASDAQ | -2.93 pips | -4.57 pips |

| DMA Stocks Netherlands | -4.33 pips | -3.17 pips |

| DMA Stocks France | -4.33 pips | -3.17 pips |

| DMA Stocks UK | -2.81 pips | -4.69 pips |

| DMA Stocks NYSE | -2.93 pips | -4.57 pips |

| DMA Stocks Germany | -4.33 pips | -3.17 pips |

| DMA Stocks Ireland | -4.33 pips | -3.17 pips |

| DMA Stocks Spain | -4.33 pips | -3.17 pips |

| ETFs | -2.93 pips | -4.57 pips |

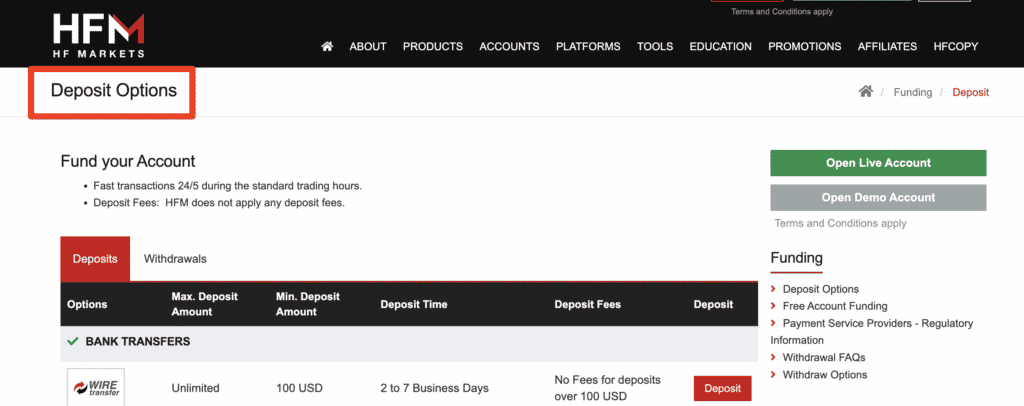

Deposit and Withdrawal Fees

All the deposit and withdrawal methods supported are free of charge. On the other hand, bank wire transfer fees do not apply to deposits of more than $100.

Deposits under 1353 BWP, or the equivalent of 100 USD at the current exchange rate between the USD and BWP, could be subject to fees if made by Botswanan traders by bank wire.

Inactivity Fees

There is an additional $5 / 67 BWP monthly fee that will be levied on a live trading account that has been inactive for six months or more until the account balance hits zero and the account is canceled.

Currency Conversion Fees

Because the broker only accepts deposits and withdrawals in USD and ZAR, Botswanan traders using Botswanan Pula could be charged currency conversion costs.

What non-trading fees can I expect when trading with HF Markets?

Non-trading fees at the broker might include fees for depositing and withdrawing funds, as well as potential fees for account inactivity or overnight financing (swap) charges.

How can I avoid or minimize non-trading fees?

To minimize non-trading fees, you can choose deposit and withdrawal methods with lower transaction costs. Additionally, maintaining an active trading account and keeping an eye on your positions to avoid unnecessary overnight financing charges can help reduce fees.

Deposits and Withdrawals

Offers the following deposit and withdrawal methods:

➡️ Bank Wire Transfer

➡️ Electronic Transfer

➡️ Credit Card

➡️ Debit Card

➡️ Skrill

Broker Comparison: Deposit and Withdrawals

| 🥇 HotForex | 🥈 GO Markets | 🥉 easyMarkets | |

| Minimum Withdrawal Time | 10 Minutes | Instant | Instant |

| Maximum Estimated Withdrawal Time | 10 business days | 1 to 3 business days | Up to 5 Days |

| Instant Deposits and Instant Withdrawals? | No | Yes | Yes |

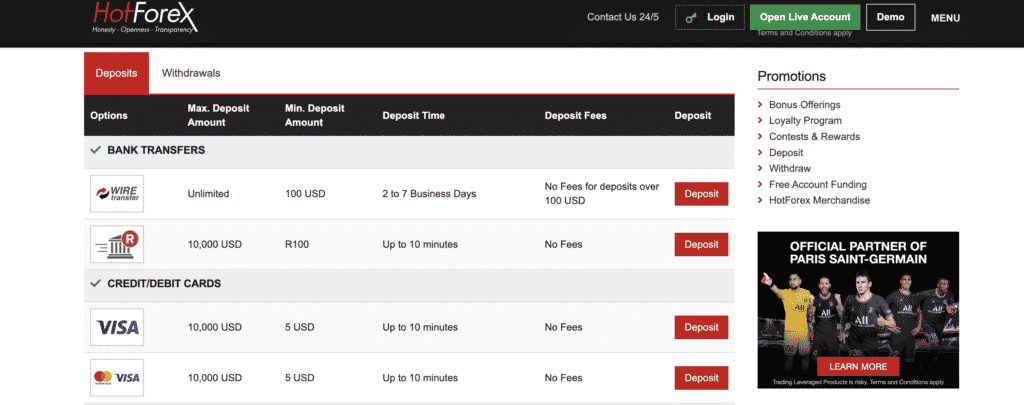

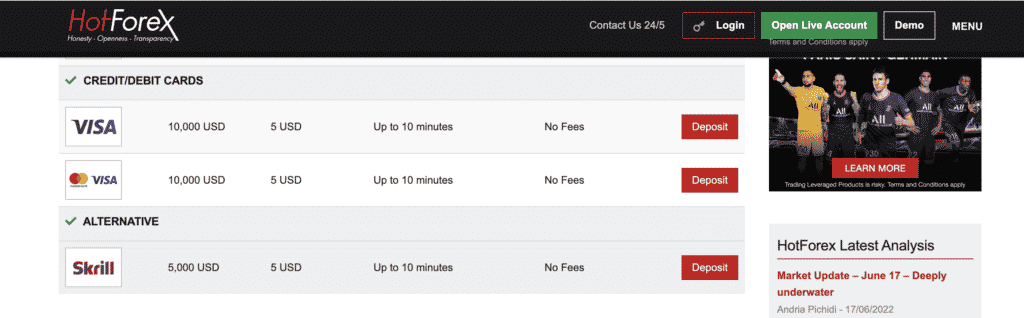

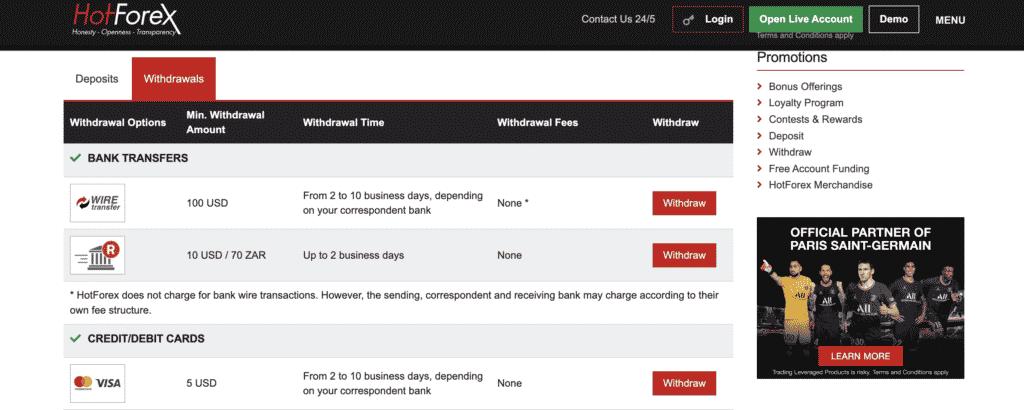

Deposit Currencies, Deposit and Withdrawal Processing Times, Minimum Withdrawal Amount, and Maximum Deposit Amounts

| 💳 Payment Method | 💰 Deposit Currencies | 🔁 Deposit Processing | 💳 Withdrawal Processing | 📈 Max Deposit | 📉 Min Withdrawal |

| Bank Wire Transfer | USD, ZAR | 2 to 7 working days | 2 to 10 working days | Unlimited | 100 USD |

| Electronic Transfer | USD, ZAR | Up to 10 min | Up to 2 working days | 10,000 USD | 10 USD or 70 ZAR |

| Credit Card | USD, ZAR | Up to 10 min | 2 to 10 working days | 10,000 USD | 5 USD |

| Debit Card | USD, ZAR | Up to 10 min | 2 to 10 working days | 10,000 USD | 5 USD |

| Skrill | USD, ZAR | Up to 10 min | Up to 10 Min | 10,000 USD | 5 USD |

What are the available methods for depositing funds into my HF Markets trading account?

The broker typically offers a variety of deposit methods, including bank wire transfers, credit/debit card payments, and online payment platforms such as Skrill and Neteller. The specific options might vary depending on your region and account type.

Are there any fees associated with depositing funds into my HF Markets account?

They might not charge fees for deposits, but certain payment methods could have associated transaction fees. It’s advisable to review their official website or contact their customer support to understand the potential fees for your chosen deposit method.

How to Deposit Funds

To deposit funds to an account with HFM, Botswana Traders can follow these steps:

➡️ Once a Botswanan trader has signed into their myHF account, they will have the ability to pick the option to deposit, after which they will be able to select the preferred payment method.

➡️ Traders are then able to specify the number of their deposits and the currency of their deposits.

➡️ Traders may, as the last step, provide their payment service providers with any extra information that may be required to confirm and complete the deposit.

Fund Withdrawal Process

To withdraw funds from an account, Traders can follow these steps:

➡️ Log onto your myHF portal.

➡️ From the list of available choices, choose “Fund Withdrawal.”

➡️ To initiate a withdrawal, choose a withdrawal method and then enter the desired withdrawal amount.

➡️ As the last step, ensure that you complete and send in the withdrawal request according to any further instructions provided by the payment provider of your choice.

Education and Research

Education

Offers the following Educational Materials:

➡️ Educational Videos

➡️ Training Course Videos

➡️ Forex Education

➡️ eCourses

➡️ Live Webinars

➡️ Events

➡️ Podcasts

Research and Trading Tools

| 🥈 HotForex | 🥈 GO Markets | 🥉 easyMarkets | |

| ➡️ Economic Calendar | Yes | Yes | Yes |

| ➡️ VPS | Yes | Yes | Yes |

| ➡️ AutoChartist | Yes | Yes | No |

| ➡️ Trading View | No | Yes | Yes |

| ➡️ Trading Central | No | Yes | Yes |

| ➡️ Market Analysis | Yes | Yes | Yes |

| ➡️ News Feed | Yes | Yes | Yes |

| ➡️ Blog | Yes | Yes | Yes |

Offers Botswana Traders the following Research and Trading Tools:

➡️ HF App

➡️ VPS Hosting Services

➡️ Premium Trader Tools

➡️ AutoChartist Tools

➡️ Trading Calculators

➡️myHF Client Area

➡️ Advanced Insights

➡️ Economic Calendar

➡️ Traders’ Board

➡️ Auto Trading through MQL5

➡️ Forex News presented by FXstreet

➡️ One-Click Trading

➡️ Events

➡️ Exclusive Analysis

Do HF Markets provide research materials to assist traders in making informed decisions?

Yes, they offer research materials to help traders stay informed about market trends. These materials include daily and weekly market analyses, economic calendars, technical analysis reports, and expert insights into various financial instruments.

How often are the research materials updated?

The broker updates its research materials regularly to ensure that traders have access to the latest market information. Daily and weekly market analysis reports are common, and the frequency of updates may vary depending on market events and conditions.

10 Best Forex Brokers in Botswana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

Bonuses and Promotions

Offers Botswana Traders the following bonuses and promotions:

➡️ Free Funding

➡️ Contests including Traders Awards, Gadget Giveaways, Demo Contests, Trading Contests, Currency Wars Contest

➡️ Loyalty Program

➡️ 50% Welcome Bonus for Micro Accounts

➡️ 100% Supercharged Bonus applied to a range of accounts

➡️ 30% Rescue Bonus

➡️ 100% Credit Bonus

Does HF Markets offer any bonuses or promotions to its traders?

Yes, they occasionally offer bonuses and promotions to their traders. These promotions can include deposit bonuses, cashback offers, and other incentives to enhance the trading experience.

How can I participate in HF Markets’ bonuses and promotions?

To participate, in bonuses and promotions, you usually need to have a trading account with them. Keep an eye on their official website or communication channels for announcements about ongoing or upcoming promotions, and follow the instructions provided to take advantage of these offers.

How to open an Affiliate Account with HF Markets

To register an Affiliate Account, Botswana Traders can follow these steps:

➡️ Go to the HF Markets website that is officially sanctioned.

➡️ To get further knowledge about the Affiliate Program, go to “Affiliates” on the main toolbar, and then click on the link labeled “About HF Affiliates.”

➡️ Learn more about the many kinds of Affiliates that are willing to work with, and then get started by clicking on the green banner that says, “Become an Affiliate.”

➡️ Select the kind of affiliate you want to be, whether it is an individual or a corporation.

➡️ Please provide your personal information by filling in the blanks in the necessary areas.

➡️ After that, finish filling out the part under “Business information” by giving information about your affiliate experience, the estimated number of current clients, the projected deposits from existing clients, and how you find your customers.

➡️ Finish the section on Program information by choosing “Yes” or “No” under the HFM Revenue Share heading.

➡️ Before you sign up for the affiliate program, make sure that you have familiarized yourself with the Affiliates Agreement, Terms and Conditions, and Privacy Policy. This should be done before you register for the program.

Affiliate Program Features

A broker that has won several awards, is well-known for its transparency, honesty, and provision of services that are at the forefront of its business to both its traders and its affiliates.

Individuals from all corners of the world are encouraged to sign up for our prestigious affiliate program, which goes by the name HF Affiliates. The broker offers generous reward programs as well as a multi-tier affiliate monitoring system to ensure that its associates stick around for the long term.

If an affiliate signs up for the HF Affiliate program, they will be eligible to receive comprehensive marketing support and promotional materials, along with prompt, on-demand help from a department that is specifically devoted to assisting affiliates.

Customer Support

The broker provides exceptional customer service that is centered on the needs of the customer and is accessible through a variety of contact methods around the clock, five days a week.

| Customer Support | HotForex’s Customer Support |

| ⏰ Operating Hours | 24/5 |

| 🗣 Support Languages | English, Japanese, Vietnamese, Chinese, Arabic, Hindi |

| 🗯 Live Chat | Yes |

| 📧 Email Address | Yes |

| ☎️ Telephonic Support | Yes |

| 📞 Local Support in Botswana? | No |

| 🥇 Overall quality of HotForex Support | 4.7/5 |

How can I reach HF Markets’ customer support?

HF Markets offers various channels to reach its customer support team. You can typically contact them through email, live chat on their website, and phone. The specific contact details are usually available on their official website.

What are the operating hours for HF Markets’ customer support?

The operating hours for customer support at HF Markets may vary depending on your region and the type of support you need. They often provide 24/5 support during the trading week, with customer service available in multiple languages.

Corporate Social Responsibility

The HFM Group was founded on the principle that it is their moral obligation to aid individuals who are struggling. The management and personnel of HFM Group of Companies have a long tradition of engaging in charitable giving over the long term.

The broker which is known as a corporation that places a strong emphasis on its social responsibility, contributed significant amounts of money in the past to the World Health Organization’s attempt to battle the Covid-19 epidemic.

In addition to working tirelessly across the globe, the team played a key role in limiting the pandemic’s effect on susceptible regions by leading and coordinating operations.

The Group made a philanthropic contribution to the worldwide non-profit organization known as The Rainforest Alliance to support the efforts of Indigenous people to put out the fires that have ravaged the Amazon rainforest, which is colloquially known as the “lungs of the Earth.”

This donation was made possible by the Rainforest Alliance’s efforts to aid in the mitigation of the fires that have ravaged the Amazon rainforest.

As a method of demonstrating its commitment to the community, HF Markets gave a sizeable gift to the Larnaca Lions Club, the regional chapter of the Lions Club International.

As part of the philanthropic work that HF Markets has done this year, the company has provided financial help to dozens of young people.

In 2017, the staff at HF Markets made it possible for a select group of young people to celebrate the holiday season by giving them cash aid and positive reinforcement. Larnaca, which is the company’s hometown and is in Cyprus, was inundated with gifts and toys.

What is HF Markets’ approach to Corporate Social Responsibility (CSR)?

The broker takes Corporate Social Responsibility seriously and strives to make a positive impact on society. They engage in various initiatives aimed at contributing to social, environmental, and ethical causes.

Can traders contribute to HF Markets’ CSR initiatives?

Some brokers, including HF Markets, encourage traders to participate in their CSR initiatives by donating a portion of their trading profits to charitable causes. Traders can often find information on how to get involved in these initiatives on the broker’s website.

Our Verdict

Because of its commitment to complete openness and the high standard of information, it maintains for both new and current customers, HF Markets distinguishes out from the competition.

In addition to a detailed analysis of the expenses, margin requirements, and minimum deposits connected with each account type, this section also offers extensive information on the richness of trading information accessible on the website.

Traders who value flexibility in terms of minimum account balances, fees, spreads, and enough liquidity will like the diversity of alternatives that this market-making provider has to offer. Traders may choose from several different possibilities.

Botswanan users who are already familiar with MT4 or MT5 and want the convenience and utility of enhanced trading tools and valuable investor resources should consider using the broker as their platform of choice because of the additional tools that can be used in conjunction with these industry-standard platforms.

What is the overall verdict on HF Markets as a trading broker?

HF Markets is generally regarded as a reputable and established broker in the trading industry. Their offering includes a wide range of financial instruments, advanced trading platforms, and various account types suitable for traders of different experience levels.

What factors contribute to the positive reputation of HF Markets?

HF Markets’ positive reputation is often attributed to its commitment to regulatory compliance, transparency, comprehensive educational resources, and reliable customer support. Their focus on technological innovation and a wide variety of tradable assets also adds to their appeal.

You might also like: HF Markets Account Types

You might also like: HF Markets Demo Account

You might also like: HF Markets Fees and Spreads

You might also like: HF Markets Islamic Account

You might also like: HF Markets Sign Up Bonus

Pros and Cons

| ✔️ Pros | ❌ Cons |

| HF Markets is globally recognized as a trusted brand and destination for trading solutions | USD and ZAR are the only accepted deposit currencies, which means that BWP deposits and withdrawals could face currency conversion fees |

| HF Markets offers tight, competitive spreads across all account types and financial instruments | BWP, ZAR, and USD are the only base currencies offered on trading accounts |

| Botswanan traders can choose from five dynamic account types to suit their unique needs and objectives | There are limited deposit and withdrawal options and no local payment methods for Botswanan traders |

| HF Markets is perfect for both beginner and professional traders | |

| There are a plethora of advanced trading tools offered to more experienced Botswanan traders | |

| There are demo accounts and Islamic account options offered | |

| There is a range of educational materials offered to inexperienced traders who are starting their trading journey | |

| There is a choice between MetaTrader 4 and 5 along with the proprietary HF App for iOS and Android |

Frequently Asked Questions

Is the broker regulated?

Yes, they are well regulated in South Africa (FSCA), Cyprus (CySEC), the United Kingdom (FCA), Dubai (DFSA), Seychelles (FSA), Mauritius (FSC), and Kenya (CMA).

Are HF Markets suitable for beginners?

Yes, they are good for beginners. There are four different account types available, which is more than most other brokers provide. The Cent Account is appropriate for novice traders because of the minimal minimum deposit required.

Is the broker an ECN broker?

Yes, the broker is both an ECN and STP broker, and as a hybrid broker, and offers full transparency and some of the tightest spreads in the industry.

What is the withdrawal time for them?

The withdrawal times range from 10 minutes on electronic and bank cards up to 10 days on bank wire transfers.

Is the broker safe or a scam?

They are safe and are a low-risk and high-trust broker with a trust score of 85 out of 100. The broker is regulated by one Tier-1 regulator (FCA), 4 Tier-2 regulators (FSCA, CySEC, CMA, DFSA), and 2 Tier-3 Regulators (FSA, FSC).

Can I trade indices on HF Markets?

Yes, you can trade derivatives featured on major indices that are spread across global equity markets.

Conclusion

Now it is your turn to participate:

➡️ Do you have any prior experience with HF Markets?

➡️ What was the determining factor in your decision to engage with HF Markets?

➡️ Was it because of the minimum deposit, regulation, retail trading accounts, or any other factors?

➡️ Have you experienced any issues with HF Markets such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc?

Regardless, please share your thoughts in the comments below.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review