JustMarkets Review

Overall, JustMarkets is very competitive in terms of its trading fees and spreads. JustMarkets is a multi-regulated forex broker and is trustworthy for Botswanan traders with a Trust Score of 9 out of 10. JustMarkets is currently not regulated by the MFED, BoB, or NBFIRA of Botswana

- Louis Schoeman

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

USD 10

Regulators

FSA, CySec

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

240

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Overview

Overall, JustMarkets is considered high-risk, with an overall Trust Score of 49 out of 100. The broker is licensed by zero Tier-1 Regulators (high trust), zero Tier-2 Regulators (average trust), and one Tier-3 Regulator (low trust). They offers seven different retail trading accounts namely a Standard Cent Account (MT4), Standard Account (MT4), Pro Account (MT4), Raw Spread Account (MT4), Standard Account (MT5), Pro Account (MT5), Raw Spread Account (MT5).

The broker accepts Botswanan clients and has an average spread from 0.0 pips with $6 commission round turn. They have a maximum leverage ratio up to 1:3000 and there is a demo and Islamic account available. MT4, MT5, and JustMarkets App platforms are supported. There headquartered are in Seychelles and regulated by the FSA.

The broker was established in 2012 and forms a part of Just Global Markets Ltd., a brokerage firm that is registered in Seychelles.

JustMarkets offers seven distinct types of trading accounts, ranging from commission-free to commission-based, Islamic swap-free to ECN trading accounts, all with unique trading conditions and features that suit several types of traders.

Overall, the broker is a well-rounded broker since it maintains a competitive price environment, high leverage, superior research, and education. This JustMarkets review for Botswana will provide local retail traders with the details that they need to consider whether JustMarkets is suited to their unique trading objectives and needs.

Distribution of Traders

currently has the largest market share in these countries:

➡️ Malaysia – 37.5%

➡️ Togo – 7.7%

➡️ Indonesia – 6.2%

➡️ Colombia – 4.6%

➡️ Bahamas – 3.5%

Popularity among traders who

The broker has found that consumers from Africa and Asia make up a significant share of its most engaged clientele. JustMarkets is one of the top fifty popular brokers in Botswana, even though there are many more well-known brokers operating in the industry.

What is the minimum deposit required to open an account with JustMarkets?

JustMarkets offers different trading accounts, and the minimum deposit requirement can vary depending on the account type you choose. Typically, the minimum deposit for a standard account is quite low and can start from as little as $1.

What trading platforms does JustForex offer?

JustForex provides traders with access to the widely popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms.

JustMarkets At a Glance

| 🏛 Headquartered | Cyprus |

| 🌎 Global Offices | Cyprus, Seychelles |

| 🏛 Local Market Regulators in Botswana | • Ministry of Finance and Economic Development (MFED) • Bank of Botswana (BoB) • Non-Bank Financial Institutions Regulatory Authority (NBFIRA) |

| 💳 Foreign Direct Investment in Botswana | 115.89 BWP Million in 2021 |

| 💰 Foreign Exchange Reserves in Botswana | 5270 USD Million in 2021 |

| ✔️ Local office in Gaborone? | No |

| 👨⚖️ Governor of SEC in Botswana | None, Moses Dinekere Pelaelo is the Governor of the Bank of Botswana |

| ✔️ Accepts Botswana Traders? | Yes |

| 📊 Year Founded | 2012 |

| 📞 Botswana Office Contact Number | None |

| 📱 Social Media Platforms | • Facebook |

| ⚖️ Regulation | Seychelles Financial Services Authority (FSA), Cyprus Securities and Exchange Commission (CySec) |

| 1️⃣ Tier-1 Licenses | None |

| 2️⃣ Tier-2 Licenses | None |

| 3️⃣ Tier-3 Licenses | • Financial Services Authority (FSA) |

| 🪪 License Number | SD088 |

| ⚖️ MFED, BoB, or NBFIRA Regulation | No |

| ✔️ Regional Restrictions | The United States, Japan, United Kingdom, EU, EEA, Belgium, and Spain |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 7 |

| ✔️ PAMM Accounts | MAM Accounts |

| 💻 Liquidity Providers | 18 |

| ✔️ Affiliate Program | Yes |

| 📱 Order Execution | Market |

| 📊 Starting spread | From 0.0 pips |

| 📉 Minimum Commission per Trade | $3 per lot, per side |

| 💰 Decimal Pricing | 5th decimal pricing after the comma |

| 📞 Margin Call | 40% |

| 🛑 Stop-Out | 20% |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | 100 lots |

| ✅ Crypto trading offered? | Yes |

| ✔️ Offers a BWP Account? | No |

| 📉 Dedicated Botswana Account Manager? | No |

| 📈 Maximum Leverage | 1:3000 |

| 📊 Leverage Restrictions for Botswana? | No |

| 💳 Minimum Deposit (BWP) | 137 Botswanan Pula equivalent to $10 |

| ✔️ Botswana Pula Deposits Allowed? | Yes |

| 📊 Active Botswana Trader Stats | 250,000+ |

| 👥 Active Botswana-based JustMarkets customers | Unknown |

| 🔁 Botswana Daily Forex Turnover | Unknown, Forex overall is $6.6 Trillion |

| 💰 Deposit and Withdrawal Options | • Debit Card • Credit Card • China UnionPay • Skrill • Neteller • Perfect Money • Sticpay • AirTM • Bitcoin • Bitcoin Cash • Ethereum • Tether • USD Coin • Local Bank Transfers, • Cards, Mobile Money • Local Wallets |

| 💻 Minimum Withdrawal Time | Instant |

| ⏰ Maximum Estimated Withdrawal Time | 10 bank days |

| 💳 Instant Deposits and Instant Withdrawals? | Yes |

| 🏛 Segregated Accounts with Botswana Banks? | No |

| 📱 Trading Platforms | MT4, MT5, MT4/5 WebTrader, mobile (iOS & Android) |

| 💻 Tradable Assets | • Indices • Energies • Forex • Metals • Cryptocurrencies • Shares • Futures |

| ✔️ Offers USD/BWP currency pair? | No |

| 💰 Deposit Fee | None |

| 📊 USD/BWP Average Spread | N/A |

| ✅ Offers Botswana Stocks and CFDs | No |

| 💻 Languages supported on the Website | English, Spanish, Portuguese, French, Russian, Indonesian, Malaysian, Chinese (Simplified and Traditional), Lao, Vietnamese, Thai, Turkish, and more. |

| ☎️ Customer Support Languages | Multilingual |

| 👥 Copy Trading Support | Yes |

| ⏰ Customer Service Hours | 24/5 |

| 📞 Botswana-based customer support? | No |

| 💵 Holding company | Just Global Markets Ltd. |

| 💸 Bonuses and Promotions for Botswanans? | Yes |

| 📚 Education for Botswanan beginner traders | Yes |

| 📱 Proprietary trading software | No |

| 🤝 Most Successful Trader in Botswana | Unknown |

| ✔️ Is JustMarkets a safe broker for Botswana Traders? | Yes |

| 🎖 Rating for JustMarkets Botswana | 8/10 |

| 🥇 Trust score for JustMarkets Botswana | 49% |

| 👉 Open Account | 👉 Open Account |

Regulation and Safety of Funds

Regulation in Botswana

The broker is not governed by any local legislation in Botswana, but the broker accommodates Botswanan traders.

Global Regulations

The broker is registered as a business with the Financial Services Authority (FSA) in Seychelles, which does not apply any supervision of trading-related activities; consequently, any claims it makes regarding the security of funds cannot be proven.

Even though they have a history of responsible behavior, the FSA, as a Tier-3 (high risk, low trust regulator) does not apply any supervision of trading-related activities.

Other entities that are associated include:

➡️ The Financial Services Authority (FSA) in the area acts as the supervisor for GM Group Limited, which has its headquarters in Saint Vincent and the Grenadines and is registered there with the number 23993.

➡️ GM Group Limited is a company that is incorporated in Limassol, Cyprus. GMFT Services Ltd. is the payment agent that operates on behalf of GM Group Limited.

Client Fund Security and Safety Features

The broker ensures its customers’ financial security by placing their cash in separate bank accounts and providing negative balance protection. This implies that customers may lose all their money, but the amount they lose cannot be higher than the current balance in their trading account.

The website is protected by SSL secure connections, which encrypt the information and data of customers while it is being sent between the website and the trading platform.

JustMarkets has ensured that all its internal operations adhere to the PCI Data Security Standards. The broker protects its customers’ data by maintaining several servers and a convoluted data-backup system, both of which assist ensure that customer data is never lost.

Is the broker a regulated broker, and where are they licensed?

The broker is a regulated Forex broker.It operates under the regulations of the Financial Services Authority (FSA) of St. Vincent and the Grenadines, where the company is registered.

How do they ensure the safety of client funds?

They place a strong emphasis on the safety of client funds. They use segregated accounts to keep client funds separate from the company’s operational funds. This means that your deposited funds are held in reputable banks, separate from JustMarkets own accounts, providing an additional layer of security.

Awards and Recognition

There are currently no indications of any awards or recognition on the official JustMarkets website.

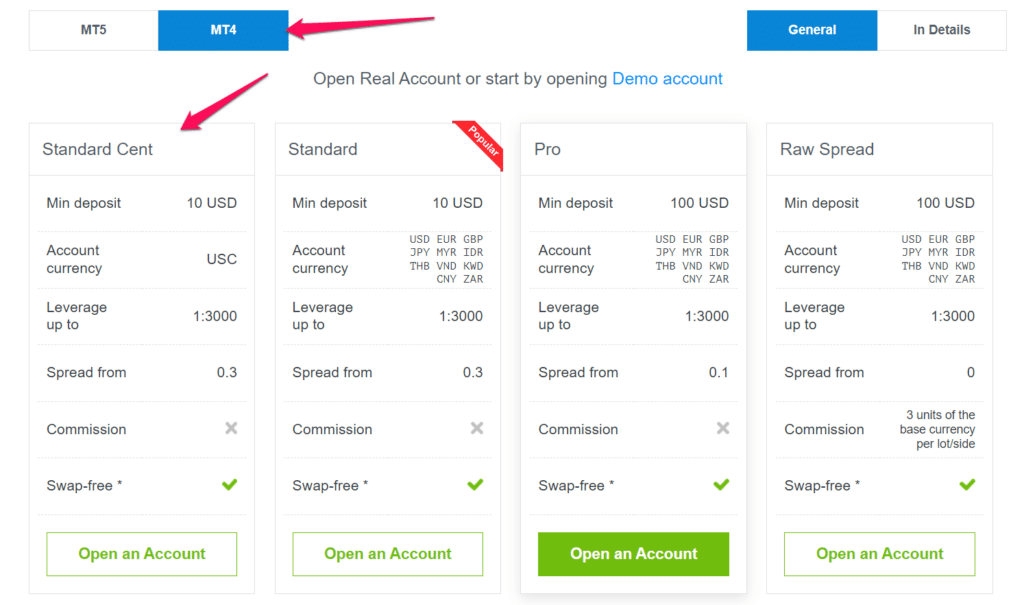

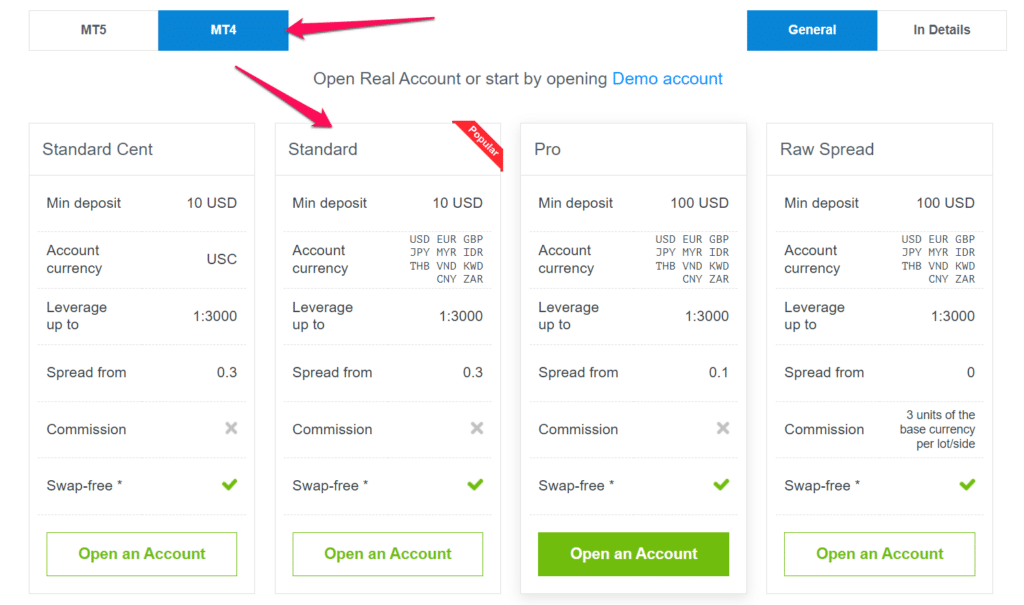

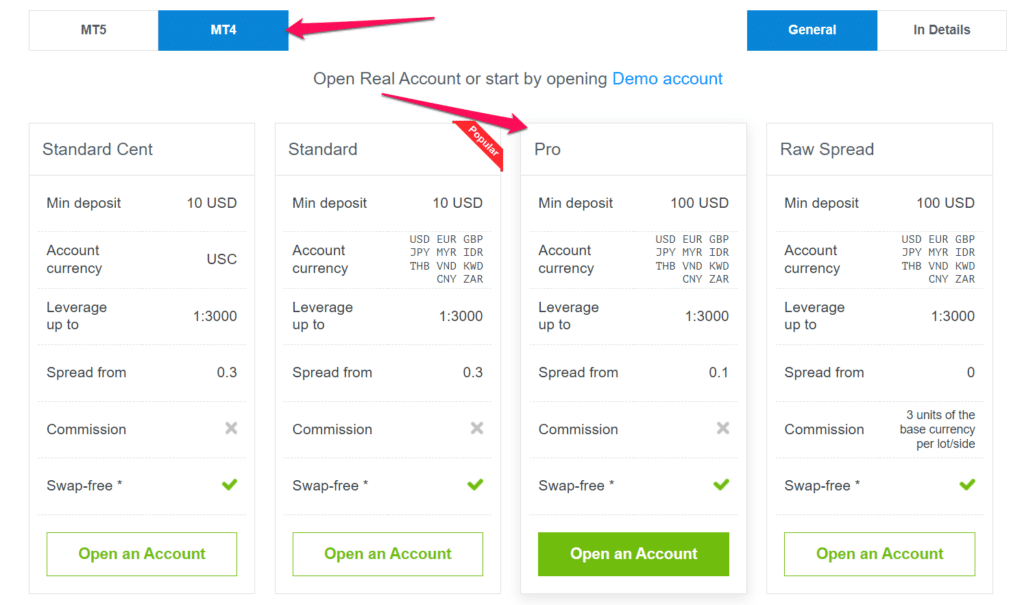

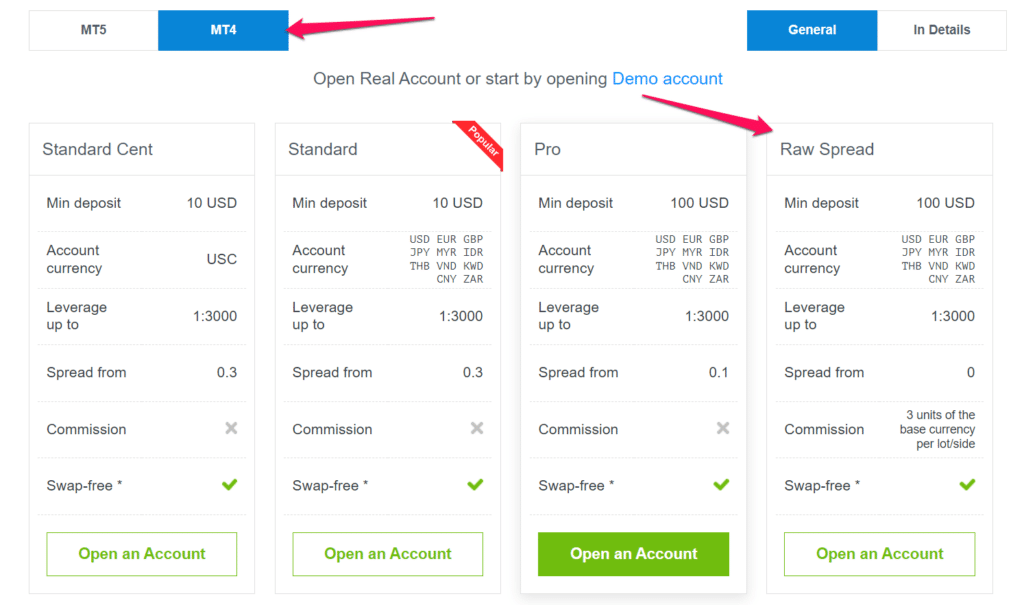

Account Types and Features

MT4 and MT5 trading platforms are supported, which provides seven real accounts with varied minimum deposits. With five commission-free accounts, trading expenses are incorporated in the variable spreads, while the other two accounts feature a narrower spread in exchange for a fee per lot moved.

The Standard Accounts have higher trading expenses than usual, whilst the Pro Accounts have lower trading charges but higher initial deposit requirements. Three Standard Accounts are better suited for those who are just starting in the forex market while the Raw Spread and Pro accounts cater for more advanced traders.

Botswanan traders should note that they have more leeway with trading strategies than with other brokers and hedging, scalping, netting, and copy trading are all permitted on all accounts, and Islamic Swap-free accounts are offered.

Botswanans must note that there are 11 base currencies namely USD, EUR, GBP, JPY, MYR, IDR, THB, VND, KWD, CNY, and ZAR. However, the MT4 Standard Cent Account is denominated in US cents.

MetaTrader 4 retail investor accounts are:

➡️ Standard Cent Account

➡️ Standard Account

➡️ Pro Account

➡️ Raw Spread Account

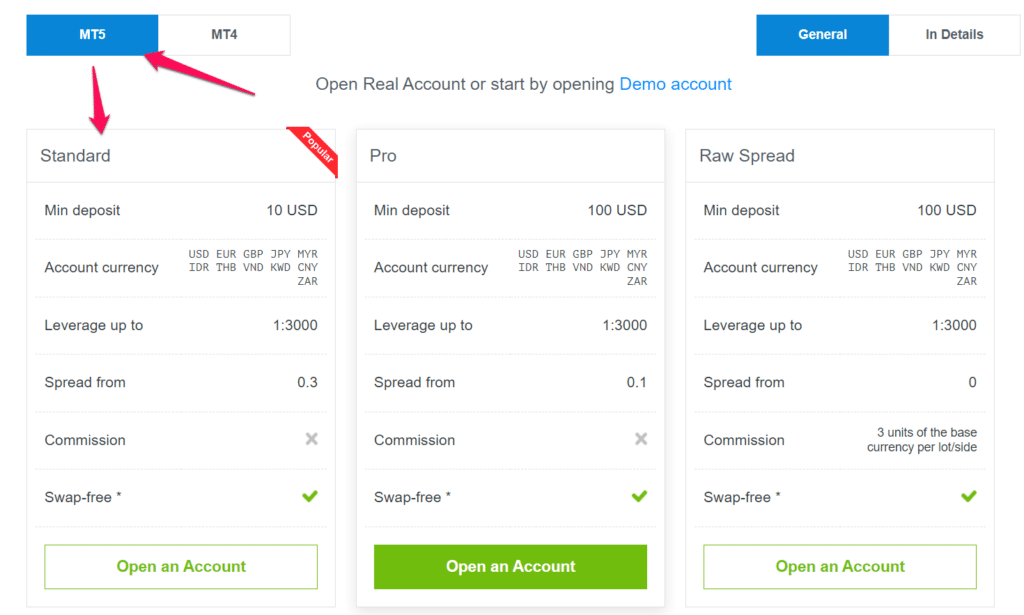

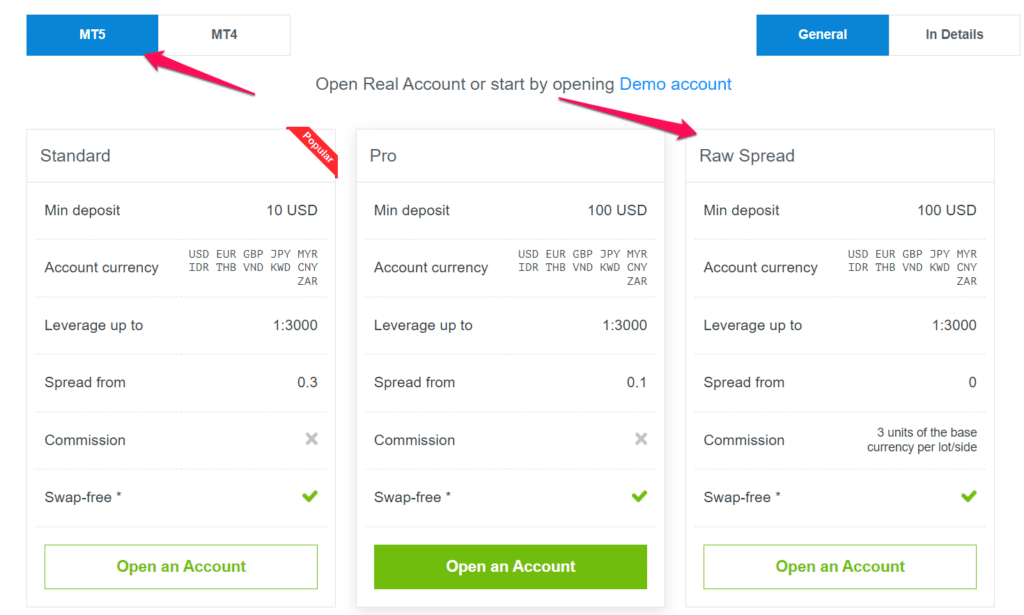

The MetaTrader 5 retail accounts are:

➡️ Standard Account

➡️ Pro Account

➡️ Raw Spread Account

| 💻 Live Account | 📉 Minimum Dep. | 📊 Average Spread | 💰 Commissions | 💸 Average Trading Cost |

| ➡️ MT4 Standard Cent | 137 BWP/10 USD | 0.9 pips | None | 9 USD |

| ➡️ MT4 Standard | 137 BWP /10 USD | 1 pip | None | 10 USD |

| ➡️ MT4 Pro | 1,380 BWP /100 USD | 0.6 pips | None | 6 USD |

| ➡️ MT4 Raw Spread | 1,380 BWP /100 USD | 0.1 pips | $6 per turn | 6 USD |

| ➡️ MT5 Standard | 137 BWP /10 USD | 1 pip | None | 14 USD |

| ➡️ MT5 Pro | 1,380 BWP /100 USD | 0.6 pips | None | 6 USD |

| ➡️ MT5 Raw Spread | 1,380 BWP /100 USD | 0.0 pips | $6 per turn | 6 USD |

Live Trading Accounts

MetaTrader 4 Standard Cent Account

With this account, novices and more experienced traders alike may test their methods in a safe setting before risking their money in a real-world trading environment. The following are the specifics of this account.

| Account Features | Value |

| 💳 Minimum Deposit | 137 Botswanan Pula, equivalent to $10 |

| 📈 Account Base Currency | USC |

| 💰 Maximum leverage up to | 1:3000 |

| 💰 Commission Charges | None |

| 📊 Swap-free option? | Yes |

| 📈 Average spreads from | 0.3 pips |

| 📊 Minimum order size | 0.01 lot |

| 📊 Maximum order size | 100 Lots |

| 📊 Maximum orders | Unlimited |

| 💰 Margin Call | 40% |

| 🛑 Stop-Out | 20% |

| 🔀 Trade Execution Method | Market Execution |

| 💰 Pricing Format | Fifth Decimal Pricing |

| 📑 Contract Size | 1 lot = 100,000 base currency units |

| 💰 Trading Instruments Available | • 65 Forex pairs • 8 Metals • 9 Indices • 5 Cryptocurrency Pairs |

MetaTrader 4 Standard Account

Trading on a Standard Account is a convenient and cost-effective way to get started in the market. Here are the account’s features.

| Account Features | Value |

| 💳 Minimum Deposit | 137 Botswanan Pula, equivalent to $10 |

| 📈 Account Base Currency | USC |

| 💰 Maximum leverage up to | 1:3000 |

| 💰 Commission Charges | None |

| 📊 Swap-free option? | Yes |

| 📈 Average spreads from | 0.3 pips |

| 📊 Minimum order size | 0.01 lot |

| 📊 Maximum order size | 100 Lots |

| 📊 Maximum orders | Unlimited |

| 💰 Margin Call | 40% |

| 🛑 Stop-Out | 20% |

| 🔀 Trade Execution Method | Market Execution |

| 💰 Pricing Format | Fifth Decimal Pricing |

| 📑 Contract Size | 1 lot = 100,000 base currency units |

| 💰 Trading Instruments Available | • 65 Forex pairs • 8 Metals • 9 Indices • 5 Cryptocurrency Pairs |

MetaTrader 4 Pro Account

For experienced and professional traders who are familiar with the financial markets, this account type is ideal. The razor-thin spreads, huge leverage, commission-free trading, and the option to trade an infinite number of positions of any volume make this account stand out from the crowd. The following are the account’s specifics.

| Account Features | Value |

| 💰 Minimum Deposit | 1380 Botswanan Pula, equivalent to $100 |

| 💸 Account Base Currency | USD, EUR, GBP, JPY, MYR, IDR, THB, VND, KWD, CNY, ZAR |

| 💰 Maximum leverage up to | 1:3000 |

| 💰 Commission Charges | None |

| 🔀 Swap-free option? | Yes |

| 📈 Average spreads from | 0.1 pips |

| 📊 Minimum order size | 0.01 lot |

| 📊 Maximum order size | 100 Lots |

| 📊 Maximum orders | Unlimited |

| 📈 Margin Call | 40% |

| 🛑 Stop-Out | 20% |

| 📈 Trade Execution Method | Market Execution |

| 💰 Pricing Format | Fifth Decimal Pricing |

| 📑 Contract Size | 1 lot = 100,000 base currency units |

| 📈 Trading Instruments Available | • 65 Forex pairs • 8 Metals • 11 Indices • 2 Energies • 7 Cryptocurrency Pairs • 64 Shares • 21 Futures |

MetaTrader 4 Raw Spread Account

To individuals who employ day trading or intraday trading tactics, frequent inputs, outputs, and short periods, this account provides the greatest potential spread. The following are the characteristics specifically tailored to the needs of scalpers.

| Account Feature | Value |

| 💳 Minimum Deposit | 1380 Botswanan Pula, equivalent to $100 |

| 💰 Account Base Currency | USD, EUR, GBP, JPY, MYR, IDR, THB, VND, KWD, CNY, ZAR |

| 💳 Maximum leverage up to | 1:3000 |

| 💸 Commission Charges | 3 units of the base currency per lot/per side |

| 🔀 Swap-free option? | Yes |

| 📈 Average spreads from | 0.1 pips |

| 📊 Minimum order size | 0.01 lot |

| 📊 Maximum order size | 100 Lots |

| 📊 Maximum orders | Unlimited |

| 📈 Margin Call | 40% |

| 🛑 Stop-Out | 20% |

| 📈 Trade Execution Method | Market Execution |

| 💰 Pricing Format | Fifth Decimal Pricing |

| 📑 Contract Size | 1 lot = 100,000 base currency units |

| 📊 Trading Instruments Available | • 65 Forex pairs • 8 Metals • 11 Indices • 2 Energies • 7 Cryptocurrency Pairs • 64 Shares • 21 Futures |

MetaTrader 5 Standard Account

JustMarkets’s MetaTrader 5 Standard Account is a popular choice for most traders who seek access to a wide range of financial markets and competitive trading conditions. Traders might anticipate the following features.

| Account Feature | Value |

| 💳 Minimum Deposit | 137 Botswanan Pula, equivalent to $10 |

| 💰 Account Base Currency | USD, EUR, GBP, JPY, MYR, IDR, THB, VND, KWD, CNY, ZAR |

| Swap-free option? | Yes |

| 📈 Average spreads from | 0.3 pips |

| 📊 Maximum orders | 100 lots |

| 📊 Maximum order size | 100 Lots |

| 📊 Minimum order | Unlimited |

| 📈 Margin Call | 40% |

| 🛑 Stop-Out | 20% |

| 💸 Commission Charges | Yes |

| 🔀 Swap-free option? | 0.3 pips |

| 📈 Trade Execution Method | Market Execution |

| 💰 Pricing Format | Fifth Decimal Pricing |

| 📑 Contract Size | 1 lot = 100,000 base currency units |

| 📊 Trading Instruments Available | • 65 Forex pairs • 8 Metals • 11 Indices • 2 Energies • 7 Cryptocurrency Pairs • 64 Shares • 21 Futures |

MetaTrader 5 Pro Account

Some of the greatest trading conditions and the following specs are available with the MetaTrader 5 Pro Account, which is popular among more experienced traders.

| Account Feature | Value |

| 💳 Minimum Deposit | 1380 Botswanan Pula, equivalent to $100 |

| 💰 Account Base Currency | USD, EUR, GBP, JPY, MYR, IDR, THB, VND, KWD, CNY, ZAR |

| 🔁 Swap-free option? | Yes |

| 📈 Average spreads from | 0.1 pips |

| 📊 Maximum orders | 100 lots |

| 📊 Maximum order size | 0.01 lot |

| 📈 Margin Call | 40% |

| 🛑 Stop-Out | 20% |

| 💸 Commission Charges | Yes |

| 🔀 Swap-free option? | 0.3 pips |

| 📈 Trade Execution Method | Market Execution |

| 💰 Pricing Format | Fifth Decimal Pricing |

| 📑 Contract Size | 1 lot = 100,000 base currency units |

| 📊 Trading Instruments Available | • 65 Forex pairs • 8 Metals • 11 Indices • 2 Energies • 7 Cryptocurrency Pairs • 64 Shares • 21 Futures |

MetaTrader 5 Raw Spread Account

Scalpers and traders who focus on short time frames and precision will find the Raw Spread Account to be an excellent choice. The following are the account’s specifics.

| Account Feature | Value |

| 💳 Minimum Deposit | 1380 Botswanan Pula, equivalent to $100 |

| 💰 Account Base Currency | USD, EUR, GBP, JPY, MYR, IDR, THB, VND, KWD, CNY, ZAR |

| 🔁 Swap-free option? | Yes |

| 📈 Average spreads from | 0.1 pips |

| 📊 Maximum orders | 100 lots |

| 📊 Maximum order size | 0.01 lot |

| 📈 Margin Call | 40% |

| 🛑 Stop-Out | 20% |

| 💸 Commission Charges | 3 units of the base currency per lot/per side |

| 📈 Trade Execution Method | Market Execution |

| 💰 Pricing Format | Fifth Decimal Pricing |

| 📑 Contract Size | 1 lot = 100,000 base currency units |

| 📊 Trading Instruments Available | • 65 Forex pairs • 8 Metals • 11 Indices • 2 Energies • 7 Cryptocurrency Pairs • 64 Shares • 21 Futures |

Base Account Currencies

JustMarkets gives customers the ability to choose the base currency of their trading account from among several other currencies. On the other hand, this does not account for BWP. Traders are only permitted to open an account that is denominated in one of the following currencies:

➡️ USD

➡️ EUR

➡️ GBP

➡️ JPY

➡️ MYR

➡️ IDR

➡️ THB

➡️ VND

➡️ KWD

➡️ CNY

➡️ ZAR

Demo Account

A demo account is a practice account that offers traders a certain amount of virtual funds that they can use, allowing them to enter the live market without risking their capital.

There is a certain degree of risk involved when trading financial markets and the broker offers its clients a risk-free platform where they can test strategies, practice trading, and explore what the broker offers in a safe trading environment with real market conditions.

A risk-free practice trading account can be established with a wide range of live account types. Demo trading is a simulation of genuine trading on the Forex market that is designed for practice and education.

The demo account does not call for any investments and is completely free to use. Gaining expertise in online trading, practical skills in dealing with MetaTrader, and the ability to test your strategy without taking any risks is one of many advantages of the demo account.

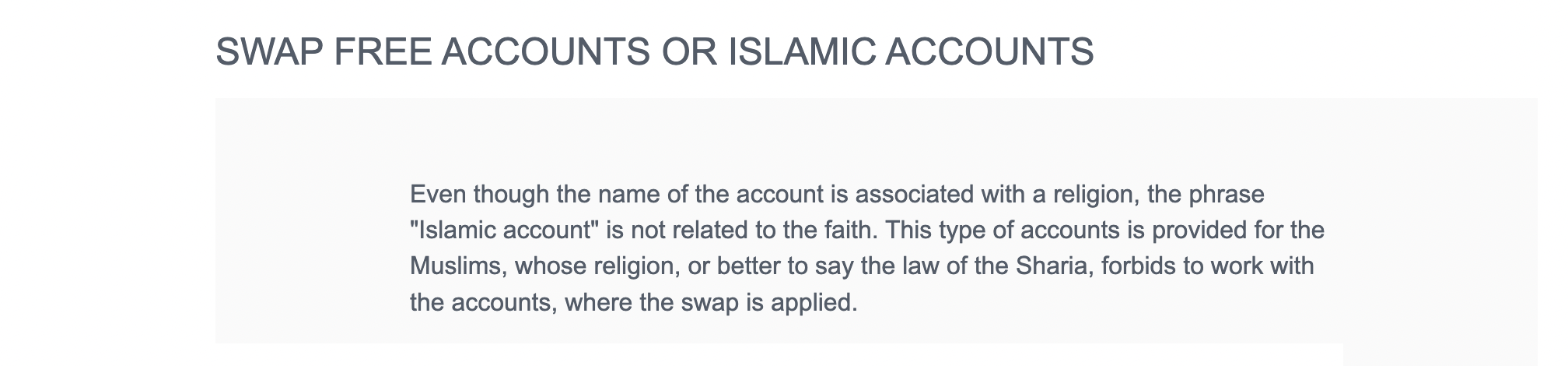

Islamic Account

Depending on the trading style and the trading strategy of the forex trader, they may keep their trading positions open for longer than 24 hours on a trading day.

This means that the trader could incur an overnight or rollover fee. This is a type of interest that is prohibited by Riba principles of Sharia law, which means that Muslim traders are often restricted in forex trading.

Because Islamic trading accounts do not charge swap or rollover interest on positions that are held overnight in the currency market, these accounts are also known as “no swap accounts.”

Clients who adhere to Islam can trade financial instruments online using Islamic trading accounts while still complying with Sharia law. After you have transferred funds into your live trading account, you are eligible to apply for an Islamic account.

After that, the request is going to be sent to the appropriate department so that they may look it over and provide their approval, with reserving the right to approve or deny an application without any further explanation. The processing of requests typically takes between one and two days of business.

What types of trading accounts does the broker offer, and how do they differ?

They offers a variety of trading account types to cater to different trading preferences and strategies. The main account types typically include Cent, Standard, Pro and RAW accounts.

What are the key features of trading accounts?

They provide a range of features with their trading accounts, including access to the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, competitive spreads, high leverage options, and a wide range of tradable instruments, including Forex, cryptocurrencies, and commodities.

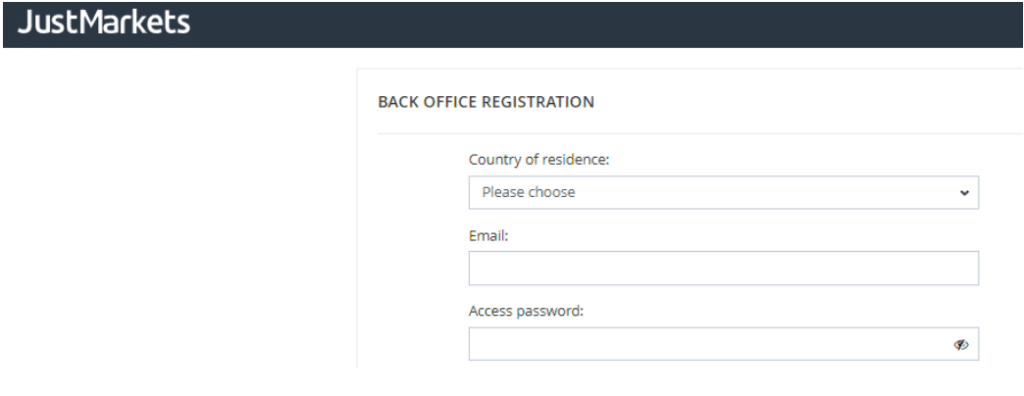

How to open an Account with JustMarkets in Botswana

To register an account with JustMarkets, Botswana Traders can follow these steps:

Step 1: Register

Firstly, the applicant will need to register in order to gain access to the “Back Office”.

After the registration process has been completed, the applicant will be automatically redirected to the Back Office, where they can open their first account.

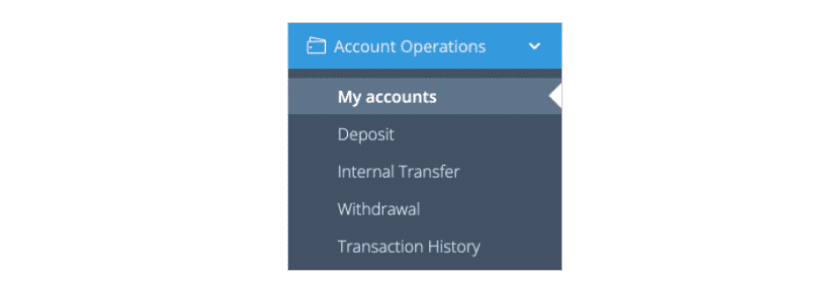

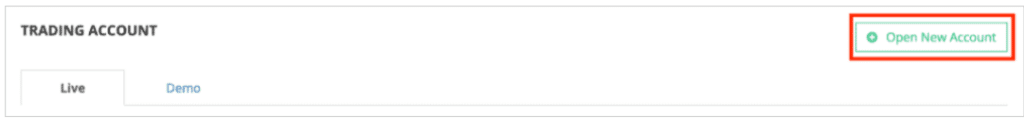

Step 2: My Accounts

In the “Account Operations” menu, click “My accounts.”

Step 3: Open New Account

On the “Live” page in the “Trading account” section, click “Open New Account.”

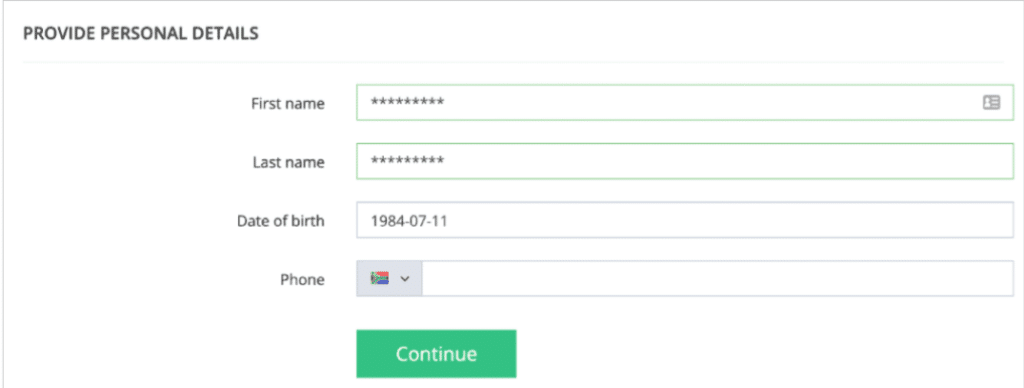

Step 4: Personal Details

The applicant will be required to fill in all the fields in the “Provide personal details” section. Note – This step is only for the clients who have not filled out this information before. If the applicant has already provided the required personal details, go to the next step.

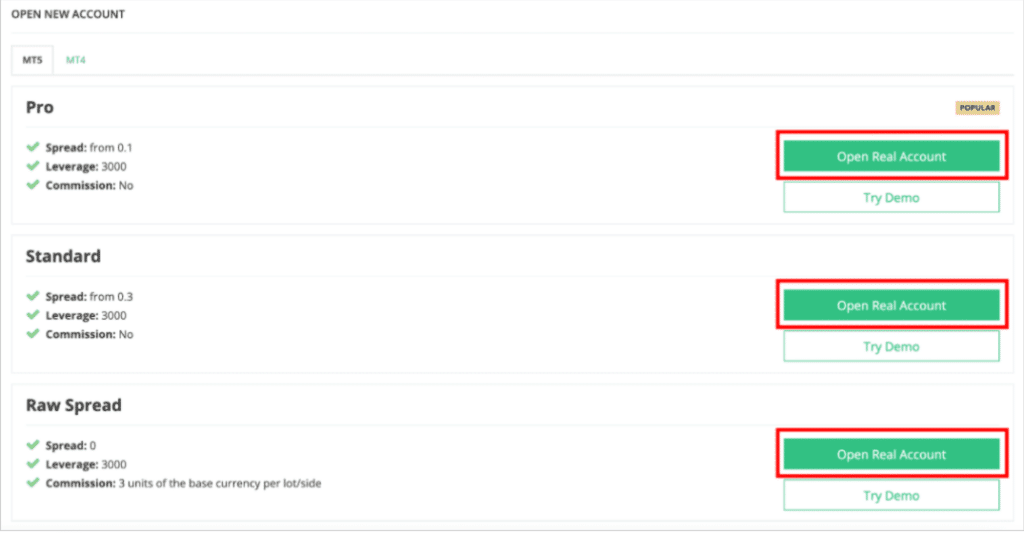

Step 5: Account Selection

Here, the applicant will be able to select the desired account type on the preferred platform page in the “Open New Account” section and click “Open Real Account.

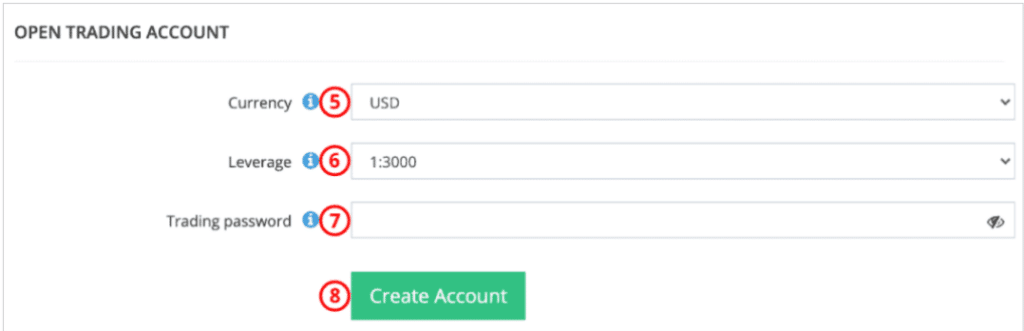

Step 6: Finalize

Once this step has been completed, the applicant will be able to set the base currency, define the leverage and set a main password. The next and final step is simply to click on Create account.

JustMarkets Vs AvaTrade Vs FBS – Broker Comparison

| 🥇 JustMarkets | 🥈 AvaTrade | 🥉 FBS | |

| ⚖️ Regulation | FSA | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC | IFSC, CySEC, ASIC, FSCA |

| 📱 Trading Platform | • MetaTrader 5 • MetaTrader 4 • JustMarkets App | • AvaTradeGO • AvaOptions • AvaSocial • MetaTrader 4 • MetaTrader 5 • DupliTrade • ZuluTrade | • MetaTrader 4 • MetaTrader 5 • FBS Trader • CopyTrade |

| 💰 Withdrawal Fee | No | No | Yes |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 12 BWP | 1,200 BWP | 12 BWP |

| 📊 Leverage | Up to 1:3000 | • 1:30 (Retail) • 1:400 (Pro) | Up to 1:3000 |

| 📊 Spread | From 0.0 pips | Fixed, from 0.9 pips | From 0.0 pips |

| 💰 Commissions | $3 units per lot/side | None | From $6 |

| ✴️ Margin Call/Stop-Out | 40%/20% | • 25% – 50% (M) • 10% (S/O) | 40%/ 20% |

| 💻 Order Execution | Market | Instant | Market |

| 💳 No-Deposit Bonus | Yes | No | Yes |

| 📊 Cent Accounts | Yes | No | Yes |

| 📈 Account Types | • MetaTrader 4 • Standard Cent Account • MetaTrader 4 Standard Account • MetaTrader 4 Pro Account • MetaTrader 4 Raw Spread Account • MetaTrader 5 Standard Account • MetaTrader 5 Pro Account • MetaTrader 5 Raw Spread Account | • Standard Live Account • Professional Account Option | • FBS Cent Account • FBS Micro Account • FBS Standard Account • FBS Zero Account • FBS ECN Account • FBS Crypto Account |

| ⚖️ CBN Regulation | No | No | No |

| 💳 BWP Deposits | Yes | No | No |

| 📊 Botswana Pula Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/5 | 24/7 |

| 📊 Retail Investor Accounts | 7 | 1 | 6 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 📉 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | 100 lots | Unlimited | 500 lots |

| 💰 Minimum Withdrawal Time | Instant | 24 to 48 Hours | 15 to 20 minutes (maximum 48 hours) |

| 📊 Maximum Estimated Withdrawal Time | 10 bank days | Up to 10 days | Up to 7 days |

| 💸 Instant Deposits and Instant Withdrawals? | Yes | No | Instant Deposits |

Trading Platforms

offers Botswana Traders a choice between these trading platforms:

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ JustMarkets App

Desktop Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4

The previous version of MetaTrader was developed by MetaQuotes and is known as MetaTrader 4. Even though MetaTrader 5 is an improved version of MetaTrader 4, the latter has continued to hold the title of the most widely used platform.

One of the primary reasons why MetaTrader 4 has grown so popular is that MetaTrader 5, which was released a few years later, is incompatible with the hundreds of trading systems that have been developed specifically for MetaTrader 4.

Among the many features offered by MT4 are the following:

➡️ A large variety of analytical tools and graphical tools

➡️ 9 timeframes

➡️ Algorithmic trading using EAs in addition to several other useful tools and components

MetaTrader 5

The professional trading platform known as MetaTrader 5 is renowned for its robust capabilities in the areas of trading, analysis, and charting. The trading platform known as MetaTrader 5 is incredibly quick, flexible, and adaptable, and it is compatible with a broad variety of trading strategies.

The following is a list of some of the most notable features that are included in MetaTrader 5:

➡️ Advanced charting across a wide range of markets

➡️ 21 distinct timeframes that can be selected on charts

➡️ A diverse selection of order types, such as pending orders, limit orders, and others

➡️ 38 graphical items and 44 technical indicators for use in chart analysis

➡️ Trading based on algorithms with the assistance of experienced advisors

➡️ Integrated market depth as well as a complete economic calendar

➡️ Comprehensive crypto analysis

➡️ Fundamental summaries

➡️ Hosting on a Virtual Private Server

➡️ Widgets that can be used with an analysis of the depth of market

➡️ An expanded selection of charting capabilities, in addition to other improvements.

WebTrader Platforms

➡️ MetaTrader 4 and 5

MetaTrader 4 and 5

Traders have the option of using either the MT4 or MT5 trading platform’s most fundamental version. It provides a concise tutorial on how to use MT4, which is a welcome addition, and places it just underneath the first explanation of the trading platform.

Unfortunately, the broker does not let any third-party add-ons be utilized in the process of upgrading the trading platforms. The MT4 and MT5 versions of MQL5 Signal Trading offer social trading.

While the MT4 trading platform is still the best option, the MT5 platform is also accessible, which is evidence that JustMarkets has invested further resources into improving its infrastructure.

Trading App

➡️ MetaTrader 4 and 5

➡️ JustMarkets App

MetaTrader 4 and 5

The MetaTrader mobile application gives the same access to the global financial markets as the standard desktop terminal, with a few exceptions. Mobile trading on MetaTrader 4 and 5 offers Botswanan traders the benefit that they can trade from anywhere, at any given time.

Another benefit, that will save bandwidth, is that offline trading is possible with the MetaTrader apps for Android and iOS. For many traders, MetaTrader’s mobile app is a handy supplement to the desktop version.

JustMarkets App

All the features that are available on the desktop version of the website are also available on the mobile application. The app provides Botswanan traders with a straightforward graphical user interface that can be utilized for reading analytics, verifying their accounts, and managing withdrawals.

What trading platforms do they offer?

They provides traders with access to the widely popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms.

Does the broker trading platforms support automated trading and algorithmic strategies?

Yes, both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) offered by JustMarkets support automated trading through Expert Advisors (EAs) and algorithmic strategies.

Range of Markets

Botswana Traders can expect the following range of markets:

➡️ 65 Forex pairs

➡️ 8 Metals

➡️ 11 Indices

➡️ 2 Energies

➡️ 7 Cryptocurrency Pairs

➡️ 64 Shares

➡️ 21 Futures

Financial Instruments and Leverage:

| 🔨 Instrument | 💰 Number of Assets Offered | 📈 Max Leverage Offered |

| ➡️ Forex | 65 | 1:3000 |

| ➡️ Precious Metals | 10 | 1:100 |

| ➡️ ETFs | 11 | 1:200 |

| ➡️ Stocks | 63 | 1:20 |

| ➡️ Cryptocurrency | 7 | 1:10 |

| ➡️ Futures | 23 | 1:50 |

Broker Comparison for Range of Markets

| 🥇 JustMarkets | 🥈 AvaTrade | 🥉 FBS | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | Yes | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | Yes | Yes |

| ➡️️ Options | No | Yes | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | Yes | No |

What financial markets can I trade on?

The broker provides access to a diverse range of financial markets. The primary market available for trading is the foreign exchange (Forex) market, where you can trade a wide variety of currency pairs, including major, minor, and exotic pairs.

Are there any restrictions on trading certain markets or instruments?

While JustMarkets offers a broad range of trading opportunities, it’s important to note that trading conditions and available instruments may vary based on your account type and location due to regulatory considerations.

Trading and Non-Trading Fees

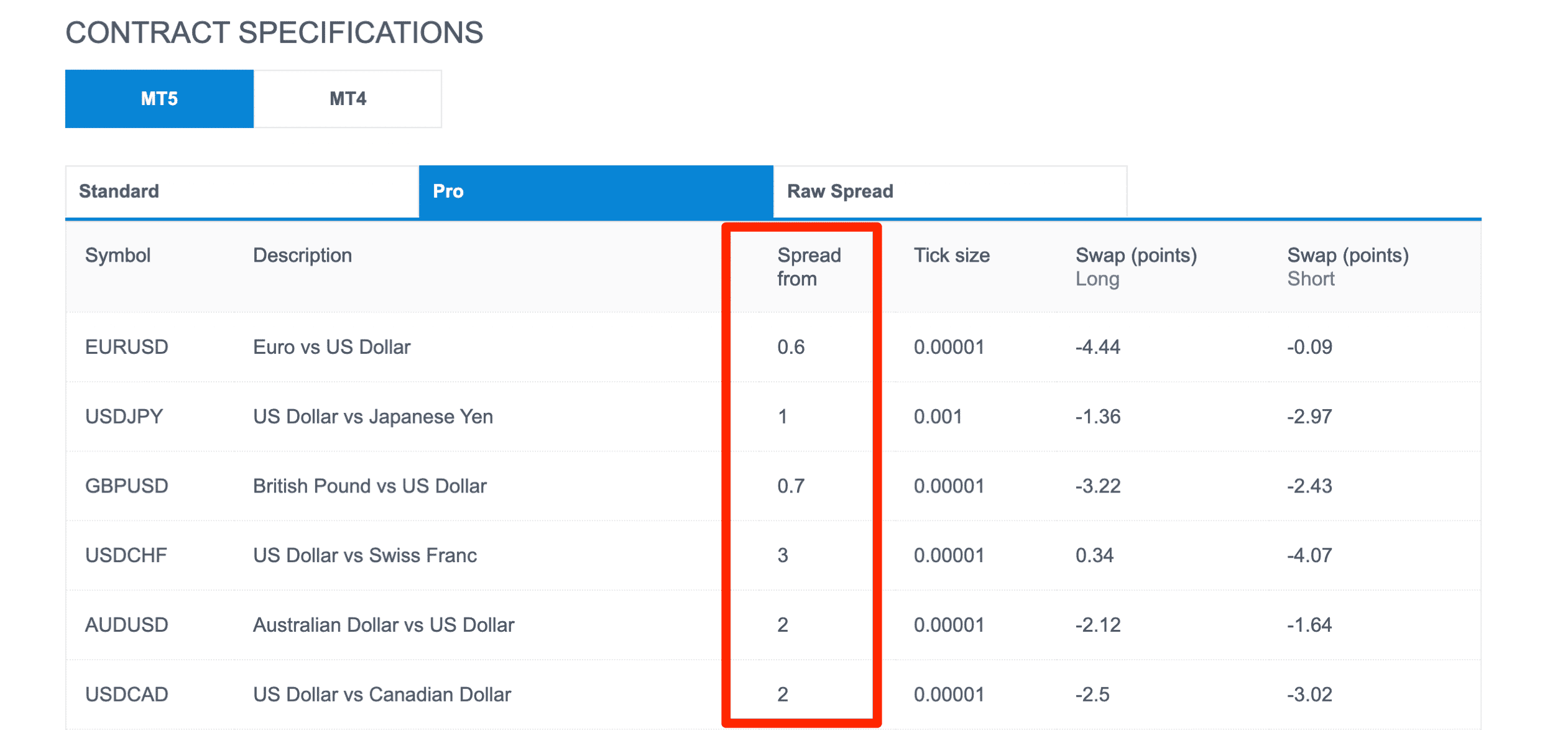

Spreads

The minimum spreads that traders can anticipate receiving, will be contingent on the type of account that they use, the financial instrument that is being traded, and the general market conditions on the day that they decide to trade.

Traders can anticipate these factors when they participate in financial instrument trading through the website. The competitive spreads offered by JustMarkets are lower than the norm offered by the industry, even though they are not the lowest in the market.

The following is a list of the common minimum spreads, organized according to the distinct types of accounts:

➡️ MetaTrader 4 Standard Cent Account – 0.9 pips

➡️ MetaTrader 4 Standard Account – 1 pips

➡️ MetaTrader 4 Pro Account – 0.6 pips

➡️ MetaTrader 4 Raw Spread Account – 0.0 pips

➡️ MetaTrader 5 Standard Account – 1 pip

➡️ MetaTrader 5 Pro Account – 0.6 pips

➡️ MetaTrader 5 Raw Spread Account – 0.0 pips

In addition to these spreads, Botswanan traders can expect some of the following averages spreads:

| 🔨 Instrument | 💻 Standard | 🥇 Pro | 📊 Raw Spread | 📈 Cent |

| Forex | 1 pip | 0.6 pips | 0.0 pips | 0.9 pips |

| Metals | 2.5 pips | 2.2 pips | 1 pip | 2.5 pips |

| Indices | 2.5 pips | 1 pip | 1 pip | 2.5 pips |

| Energies | – | 2 pips | 2 pips | – |

| Crypto | 20 pips | 0.0 pips | 0.0 pips | 11 pips |

| AAPL | – | 10 pips | 10 pips | – |

| Futures | – | 0.1 pips | 0.1 pips | – |

Commissions

Commissions are applied to the following types of accounts:

➡️ MetaTrader 4 Raw Spread Account – 3 units of the base currency per lot/per side

➡️ MetaTrader 5 Raw Spread Account – 3 units of the base currency per lot/per side

Overnight Fees, Rollovers, or Swaps

When Botswanan traders keep their positions open for more than 24 hours, they are subject to overnight costs.

These costs are established in a manner that is unique to each broker, but in general, they are related to the size of the trader’s position, the financial instrument involved, and whether the trader is long or short.

The following are some examples of the typical overnight fees for Botswanan traders:

| 🔨 Instrument | 🔁 Swap Long | 🔃 Swap Short |

| EUR/USD | -4.44 pips | -0.09 pips |

| USD/JPY | -1.36 pips | -2.97 pips |

| Cryptocurrencies | -20% | -20% |

| Energies | -6% | -3% |

| Indices | -1% | -1.50% |

| Shares | -6% | -3% |

| XAG/USD | -0.2 pips | -0.09 pips |

| XAU/USD | -4.18 pips | -0.77 pips |

| Futures | -6% | -3% |

Deposit and Withdrawal Fees

There are costs associated with each cryptocurrency deposit option; however, there are no fees associated with withdrawing cryptocurrency. When Botswanan traders withdraw funds from their trading accounts, they could be subject to processing fees applied by their payment provider.

The deposit fee of 2% applies to these cryptocurrencies:

➡️ Bitcoin (BTC)

➡️ Bitcoin Cash (BCH)

➡️ Ethereum (ETH)

➡️ Gemini (GUSD)

➡️ USD Coin (USDC)

Inactivity Fees

If a live trading account becomes dormant after 150 days, the account will be charged an inactivity fee of $5. This amount will be deducted from the account every month that it remains inactive until the account balance is zero, after which the account will be closed automatically.

Currency Conversion Fees

Botswanan traders should anticipate having to pay currency conversion costs if they make a deposit or withdrawal in a currency that is not one of the account’s allowed currencies.

What are the trading fees associated with the accounts?

They typically do not charge trading commissions on most of its account types. Instead, the broker earns revenue through spreads—the difference between the bid (selling) and ask (buying) prices of currency pairs and other financial instruments.

What non-trading fees should I be aware of when using there services?

JustMarkets may charge certain non-trading fees that can include withdrawal and deposit fees. These fees can vary based on the payment method you use and your account type.

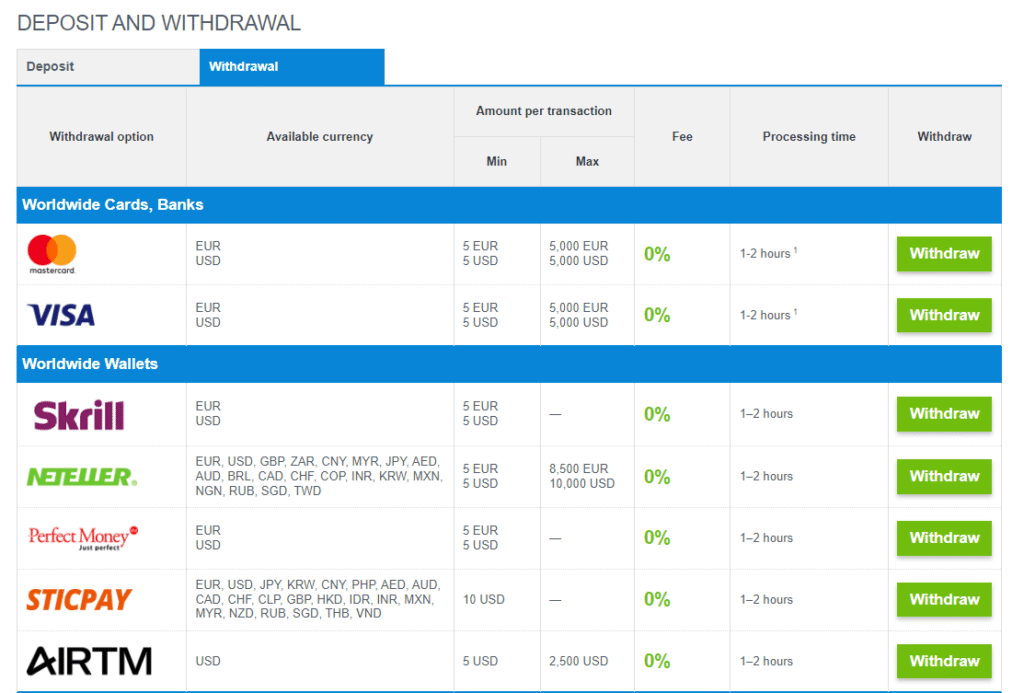

Deposits and Withdrawals

offers the following deposit and withdrawal methods:

➡️ Debit Card

➡️ Credit Card

➡️ China UnionPay

➡️ Skrill

➡️ Neteller

➡️ Perfect Money

➡️ Sticpay

➡️ AirTM

➡️ Bitcoin

➡️ Bitcoin Cash

➡️ Ethereum

➡️ Tether

➡️ USD Coin

➡️ Local Bank Transfers, Cards, Mobile Money

➡️ Local Wallets and worldwide wallets

Broker Comparison: Deposit and Withdrawals

| 🥇 JustMarkets | 🥈 AvaTrade | 🥉 FBS | |

| Minimum Withdrawal Time | Instant | 24 to 48 Hours | 15 to 20 minutes (maximum 48 hours) |

| Maximum Estimated Withdrawal Time | 10 bank days | 10 business days | Up to 7 days |

| Instant Deposits and Instant Withdrawals? | Yes | No | Instant Deposits |

Deposit Currencies, Minimum and Maximum Deposit and Withdrawal Amounts

| 💳 Payment Method | 💰 Deposit Currencies | 🔁 Deposit Processing | 💳 Withdrawal Processing | 💻 Max Deposit | 📉 Min Withdrawal | 💸 Max Withdrawal |

| Debit Card | EUR, USD | Instant | 4 to 10 days | 10,000 USD | 5 EUR, USD | 5,000 EUR, USD |

| Credit Card | EUR, USD | Instant | 4 to 10 days | 10,000 USD | 5 EUR, USD | 5,000 EUR, USD |

| China UnionPay | EUR, USD | Instant | – | 10,000 USD | – | – |

| Skrill | EUR, USD | Instant | Instant | – | 1 EUR, USD | None |

| Neteller | EUR, USD, GBP, ZAR, CNY, MYR, JPY, AED, AUD, BRL, CAD, CHF, COP, INR, KRW, MXN, NGN, RUB, SGD, TWD | Instant | Instant | – | 1 EUR, USD | 8,500 EUR 10,000 USD |

| Perfect Money | EUR, USD | Instant | Instant | – | 1 EUR, USD | None |

| Sticpay | EUR, USD, JPY, KRW, CNY, PHP, AED, AUD, CAD, CHF, CLP, GBP, HKD, IDR, INR, MXN, MYR, NZD, RUB, SGD, THB, VND | Instant | Instant | – | 5 USD | None |

| AirTM | USD | Instant | Instant | 2,500 USD | 1 USD | 2,500 USD |

| Bitcoin | BTC | 1 – 3 hours | 1 – 2 hours | – | 0.0015 BTC | None |

| Bitcoin Cash | BCH | 1 – 3 hours | 1 – 2 hours | – | 0.05 BCH | None |

| Ethereum | ETH | 1 – 3 hours | 1 – 2 hours | – | 0.06 ETH | None |

| Tether | – | – | – | – | 10 USDT | None |

| USD Coin | USD | 1 – 3 hours | 1 – 2 hours | – | 10 USDC | None |

| Local Bank Transfers, Cards, Mobile Money | MYR, IDR, THB, VND, PHP, NGN, ZAR, UGX, KES, RWF, GHS, XAF, TZS, EUR, USD, COP, BRL | Instant up to 1 day | Instant up to 3 days | 800 USD to 15,000 USD | • 50 MYR • 200,000 IDR • 500 THB • 300,000 VND • 2,500 PHP • 2,000 NGN • 50 ZAR • 5,000 UGX • 500 KES • 3,000 RWF • 10 GHS • 3,000 XAF • 2,000 MXN • 76,750 CLP • 530 BRL | • 50,000 MYR • 200,000,000 IDR • 500,000 THB • 300,000,000 VND • 140,000 PHP • 800,000 NGN • 250,000 ZAR • 500,000 UGX • 70,000 KES • 2,000,000 RWF • 2,000 GHS • 3,000,000 XAF |

What deposit methods are available for funding my trading account?

The broker offers a variety of deposit methods to accommodate traders from different regions. These methods may include bank wire transfers, credit/debit card payments, e-wallets like Skrill, Neteller, and various cryptocurrency options.

What is the process for withdrawing funds from my account, and are there any withdrawal fees?

To withdraw funds from your trading account, you typically need to log in to your client portal and initiate a withdrawal request.

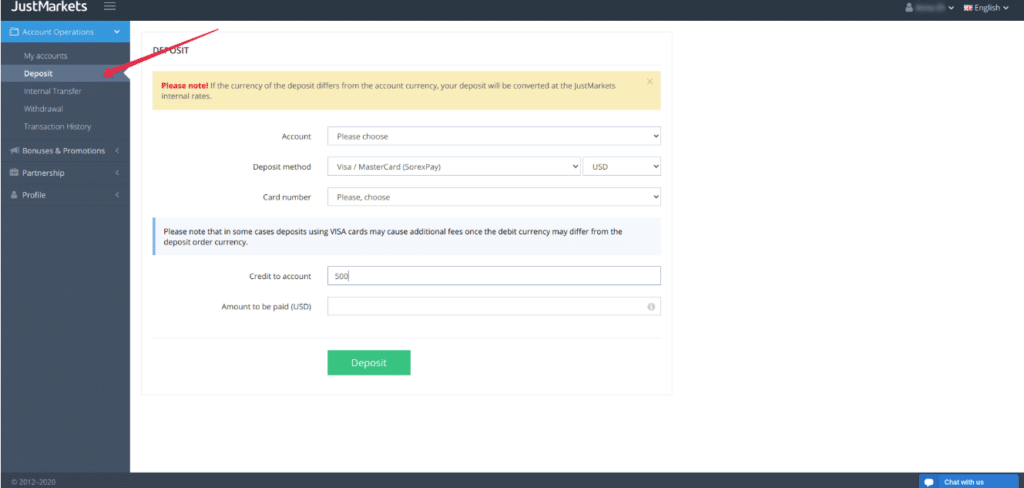

How to Deposit Funds

To deposit funds to an account with JustMarkets, Botswana Traders can follow these steps:

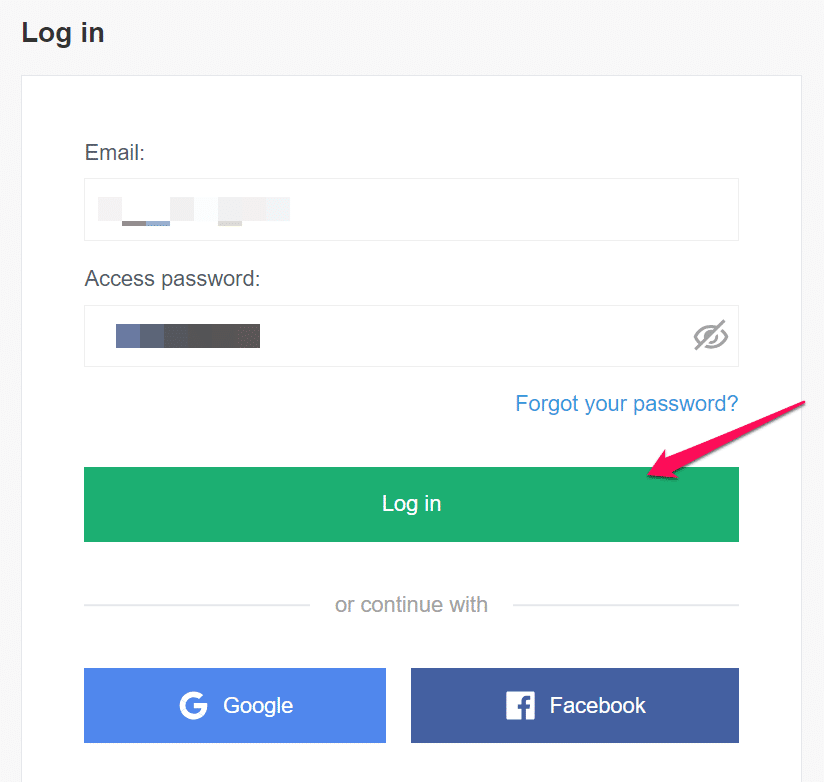

STEP 1: LOG IN

Traders in Botswana can log in to the Back Office by using their credentials.

STEP 2: DEPOSIT

You can deposit funds via credit/debit card, electronic payment systems, or payment agents. The whole list of available payment methods, conditions, and fees can be found here.

To make a deposit, open your Back Office → Account Operations → Deposit or just follow this link. Then proceed with the required steps.

Fund Withdrawal Process

Initiating a fund withdrawal from your trading account typically involves the following steps:

STEP 1: Log In

Traders in Botswana can log in to the Back Office by using their credentials.

Step. 2 Payment Method

Traders can choose their chosen payment method (which must be the same method that was used to deposit into the account), the amount that needs to be withdrawn, and any other relevant extra data from this page.

As soon as a trader submits a request to withdraw funds, such request will immediately be forwarded to the appropriate department to be handled.

Traders are required to make sure that the name on the trading account that they established with is the same as the name on the account to which they will send payments.

It’s important to note that withdrawal processes may vary based on your account type and location. Ensure you follow the specific instructions provided in your client portal and consider any applicable fees or processing times associated with your chosen withdrawal method.

How long does it take for a withdrawal request from my account to be processed?

Generally, withdrawals through e-wallets and cryptocurrencies tend to be processed more quickly, often within a few hours or less. Bank wire transfers, on the other hand, may take several business days to reach your bank account due to the banking system’s processing times.

Education and Research

Education

offers the following Educational Materials:

➡️ Quick Start

➡️ Online Training Webinars

➡️ Bookings for future webinars

➡️ Forex Articles

➡️ Forex Glossary

➡️ Educational Videos

➡️ Currencies

In terms of the Forex Articles offered, there website offers over 55 forex trading articles. The articles are designed for novices and introduce forex trading, vocabulary, proper trading methods, and money management tactics.

The broker also offers a comprehensive glossary that offers over 70 forex/CFD trading terminology and thorough descriptions. This might assist users in becoming acquainted with some of the more often used trading phrases.

In addition, they provides a total of 5 trading videos that educate traders on how to use some of the more advanced features of the MetaTrader platform, such as:

➡️ Selecting a trade signal on the MT4 or MT5 platform

➡️ Purchasing a robot or indication from the MetaTrader Market.

➡️ Creating a ‘Trading Robot’ on MetaTrader without having to write any code.

Research and Trading Tool Comparison

| 🥇 JustMarkets | 🥈 AvaTrade | 🥉 FBS | |

| ➡️ Economic Calendar | Yes | Yes | Yes |

| ➡️ VPS | Yes | No | Yes |

| ➡️ AutoChartist | No | No | No |

| ➡️ Trading View | No | Yes | No |

| ➡️ Trading Central | Yes | Yes | Yes |

| ➡️ Market Analysis | Yes | Yes | Yes |

| ➡️ News Feed | Yes | Yes | Yes |

| ➡️ Blog | Yes | Yes | Yes |

offers Botswana Traders the following Research and Trading Tools:

➡️ Market Overview

➡️ Daily Forecasts

➡️ Market News

In addition, they also offers the following tools:

➡️ MAM Accounts

➡️ Social/Copy Trading

➡️ VPS

➡️ Economic Calendar

MAM

MAM is a solution for the brokers money managers who wish to trade on behalf of investors and for investors who wish to authorize money managers to trade on their behalf. They provide Multi Account Manager (MAM) software, which enables money managers to concurrently manage and trade several accounts.

Social Trading

The broker offers social trading using its MT4 trading platform. Social trading allows traders to duplicate the trades of other experienced traders onto their trading accounts to replicate their tactics. The signal providers are the specialists, who are assessed based on their performance records.

VPS

A VPS is a powerful virtual computer that can be utilized to run your trading platforms around-the-clock, seven days a week. Traders that expect a constant connection to trade servers frequently require this.

VPS is frequently required by EA users, social trading investors, and traders who utilize other advanced trading systems. They are typically considered as easily available, dependable, and extremely rapid. In addition, various vendors are offering VPS subscriptions through the MetaTrader platforms.

Economic Calendar

This application displays hundreds of upcoming economic events from more than 50 different nations. The significance of these events is graded as low, medium, or high. The analyst consensus is shown as a percentage, as is the prior impact %.

When you click on an event, it will provide a thorough analysis and chart. A benefit of the economic calendar offered by them is that it can be tailored to the traders’ preferred events.

Does the broker provide educational resources for traders who are new to forex and financial markets?

Yes, JustMarkets offers a range of educational resources designed to assist traders, including beginners. These resources often include articles, video tutorials, webinars, and trading guides that cover topics such as forex basics, technical and fundamental analysis, risk management, and trading strategies.

What research tools and market analysis does the broker offer to traders?

JustMarkets typically provides a variety of research tools and market analysis to help traders make informed decisions. This may include daily market analysis reports, economic calendars, and technical analysis insights.

Bonuses and Promotions

offers Botswana Traders the following bonuses and promotions:

➡️ Welcome Bonus or No-Deposit Bonus

➡️ 120% Deposit Bonus up to $40,000

➡️ Referral bonus and program

➡️ 0% Fees on deposits and withdrawals

What types of bonuses and promotions does the broker offer to traders?

They often run various promotions and bonuses to enhance the trading experience for its clients. These promotions may include deposit bonuses, welcome bonuses for new clients, and occasional special offers during specific trading events or holidays.

Are there any conditions or requirements for withdrawing profits earned from the bonuses?

Yes, typically, there are specific conditions and requirements that traders must meet before they can withdraw profits generated the brokers bonuses. These conditions may include achieving a certain trading volume or meeting a minimum number of trades within a specified time frame.

How to open an Affiliate Account

To register an Affiliate Account, Botswana Traders can follow these steps:

➡️ Go to the the broker official website and hover over the “Partnerships” option at the top of the page.

➡️ Choose “Affiliates” from the drop-down menu.

➡️ Prospective affiliates can evaluate the information offered by the broker and select their desired affiliate program from “Revenue Share” or “CPA” by clicking “Become a partner” beneath the applicable choice.

➡️ Botswanans may register an affiliate account by filling out a simple registration form that includes their country of residence, email address, and password that they choose. Finally, before clicking “Become a partner,” Botswanans must certify that they are not a US resident and that they agree with the Client Agreement and the Introducing Broker Agreement. Current JustMarkets clients can utilize the “Log In” option throughout this phase to log in to their existing account, from which they can apply as an affiliate.

➡️ After registering, affiliates will receive notification that their IB Account has been created.

➡️ The new affiliate may access their advertising materials as well as all other elements of their affiliate program from this page.

Affiliate Program Features

The affiliate program allows partners to earn an unlimited commission, establish their own network, and select a personalized scheme that will provide the partner with more from their traffic.

The Affiliate Programs were designed by partners for partners, according to each affiliate’s specific requirements and aspirations. JustMarkets provides the following revenue share options:

➡️ Profits up to 65% according to the trading activity of referrals

➡️ Quick and easy withdrawals

➡️ Access to comprehensive loyalty programs

➡️ Access to a Personal Affiliate Manager

➡️ Automatic rebates

➡️ Extended revenue share

Where CPA is concerned, affiliates can expect the following:

➡️ Payments of up to $1,500 according to the trading activity of referrals

➡️ Access to a dedicated affiliate manager

➡️ High conversion rates and transparency in report statistics

➡️ Access to a wide range of promotional and marketing tools

➡️ Instant, frequent payments

Customer Support

As part of the broker comprehensive offering, the broker also offers dedicated and helpful customer support.

| Customer Support | JustMarkets’s Customer Support |

| ⏰ Operating Hours | 24/5 for all languages except English, which is offered 24/7 |

| 🗣 Support Languages | English, Malaysian, Russian, Chinese, Indonesian |

| 🗯 Live Chat | Yes |

| 📧 Email Address | Yes |

| ☎️ Telephonic Support | Yes |

| 📞 Local Support in Botswana? | No |

| 🥇 Overall quality of JustMarkets Support | 3.5/5 |

Corporate Social Responsibility

There is currently no information regarding the broker Corporate Social Responsibility initiatives or projects.

What is the broker approach to corporate social responsibility, and what initiatives do they support?

JustMarkets is committed to corporate social responsibility and places importance on contributing positively to the communities and environments in which it operates.

How can traders and clients of the broker participate in or support the company’s corporate social responsibility efforts?

Traders and clients of the broker can participate in CSR efforts by staying informed about the company’s initiatives and actively engaging with them.

Our Verdict

The broker has eye-catching data on its website and provides a trading environment and educational opportunities that are satisfactory. It continues to be ahead of many of its competitors in this area because of the work put in to give honest research along with hundreds of trade suggestions each day.

The emphasis will continue to be placed on developing markets, which have traditionally had more modest portfolios than developed economies. In addition, they try to stay ahead of the competition by offering substantial incentive promotions.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The broker offers a choice between several account types, each catering to diverse types of Botswanan traders | There is a limited range of tradable instruments |

| There is an impressive list of funding and withdrawal options | There is an inactivity fee charged on dormant accounts |

| The broker offers a proprietary trading app that can be used across mobile devices | The broker does not have regulation through Tier-1 or Tier-2 market regulators |

| Both MetaTrader 4 and MetaTrader 5 are offered to Botswanan traders | |

| There are both demo and Islamic accounts offered across live trading accounts | |

| JustMarkets supports the use of one-click trading | |

| There is a comprehensive real-time market analysis offered in addition to several other tools | |

| There is an Islamic account option offered to Muslim JustMarkets offers beginner traders a range of educational materials |

You might also like: JustMarkets Account Types

You might also like: JustMarkets Demo Account

You might also like: JustMarkets Minimum Deposit

You might also like: JustMarkets Islamic Account

You might also like: JustMarkets Fees And Spreads

Frequently Asked Questions

Is JustMarkets regulated?

Yes, they are regulated and registered in Seychelles through Just Global Markets Ltd under license number SD088.

How do you get the $30 bonus from the broker?

When you establish a Welcome Account, you will receive a $30 incentive. Next, you must give your phone number to open the account and within 30 days, you must trade at least 5 lots. In addition, the transactions that you carry out must have profit or loss must be at least 6 pips (60 points).

What is the withdrawal time with them?

The withdrawal time with JustMarkets ranges from instant withdrawals up to 10 working days when traders use debit/credit cards.

How do I deposit money on there website?

You can log into your Back Office, follow the page to select “Deposit,” and complete the required information to verify and complete the deposit prompt.

What is the brokers minimum deposit?

The minimum deposit is 12 BWP or an equivalent to 1 USD.

Is the broker safe or a scam?

No, they are not a scam. However, because the broker only has Tier-3 regulation the broker has an exceptionally low trust level of 49 out of 100.

Does JustMarkets have Nasdaq?

Yes, they offers Botswanan traders access to Nasdaq along with other indices such as AU200, JP225, US30, and more.

Is the broker an ECN broker?

Yes, JustMarkets is an STP and ECN broker that sends the orders of clients to liquidity providers.

Does JustMarkets have Volatility 75?

No, they do not currently offer VIX as a tradable financial instrument.

Conclusion

Now it is your turn to participate:

➡️ Do you have any prior experience with the broker?

➡️ What was the determining factor in your decision to engage with the broker?

➡️ Was it because of the minimum deposit, regulation, retail trading accounts, or any other factors?

➡️ Have you experienced any issues with JustMarkets such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

Regardless, please share your thoughts in the comments below.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review