10 Best Forex Trading Apps in Botswana.

The 10 Best Forex Trading Apps in Botswana revealed. We tested the best forex trading apps for Botswana Traders.

This is a complete guide to forex trading apps in Botswana.

In this in-depth guide you’ll learn:

- What is a Trading Platform?

- What are the benefits of Forex Trading Apps?

- What is the difference between forex and stock trading apps?

- How to compare the best trading apps against each other.

- Which Trading Apps are best for beginner Botswana Traders?

- Which trading app offers a mobile app on IOS and Android for Botswana Traders?

And lots more…

So if you’re ready to go “all in” with the best-tested forex trading apps…

Let’s dive right in…

- Louis Schoeman

Best Forex Trading Apps in Botswana

| 🏅 Broker or Provider | 👉 Open Account | 💻 Trading Platform | ✔️ BWP Account | ✅ BWP Deposits | ☪️ Islamic Account |

| 1. XM | 👉 Open Account | MetaTrader 4 MetaTrader 5 XM App | No | Yes | Yes |

| 2. IC Markets | 👉 Open Account | MetaTrader 4 MetaTrader 5 cTrader | No | No | Yes |

| 3. InstaForex | 👉 Open Account | MetaTrader 4 MetaTrader 5 MultiTerminal WebTrader | No | Yes | Yes |

| 4. FBS | 👉 Open Account | FBS Trader MetaTrader 4 MetaTrader 5 CopyTrade Platform | No | Yes | Yes |

| 5. Admirals Market | 👉 Open Account | MetaTrader 4 MetaTrader 5 Admirals Mobile App | No | Yes | No |

| 6. eToro | 👉 Open Account | eToro App eToro Web | No | No | Yes |

| 7. AvaTrade | 👉 Open Account | AvaTradeGO AvaOptions AvaSocial MetaTrader 4 MetaTrader 5 DupliTrade ZuluTrade | No | Yes | Yes |

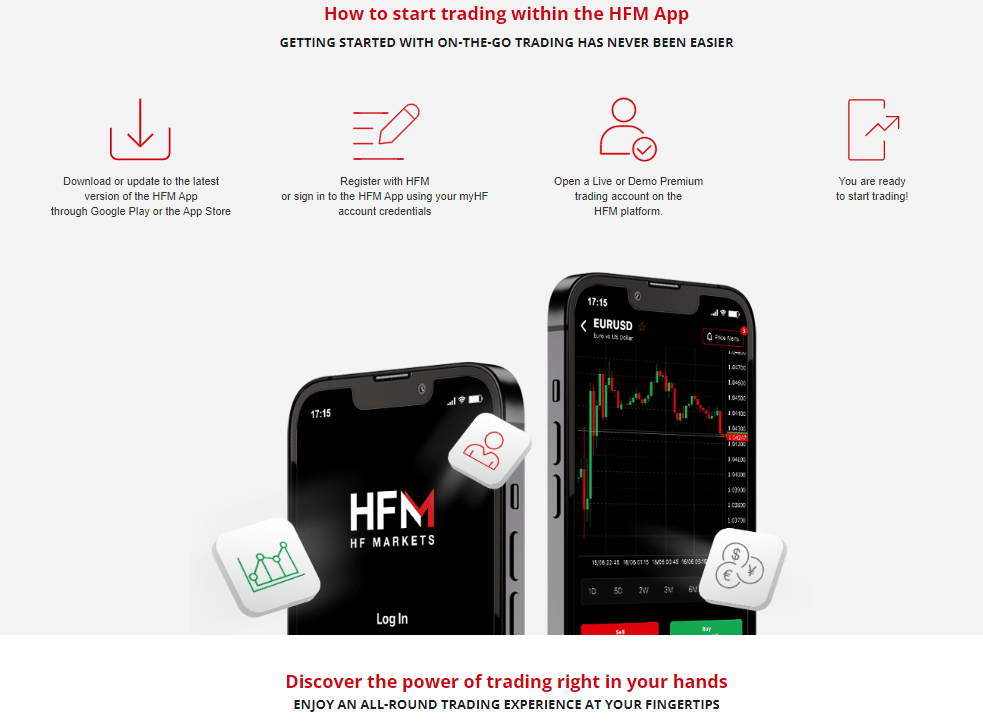

| 8. HFM | 👉 Open Account | MetaTrader 4 MetaTrader 5 HF App | No | No | Yes |

| 9. Exness | 👉 Open Account | MetaTrader 4 MetaTrader 5 Exness App | No | No | Yes |

| 10.Pepperstone | 👉 Open Account | MetaTrader 4, MetaTrader 5, cTrader TradeView | No | Yes | Yes |

10 Best Forex Brokers in Botswana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

What Is a Trading Platform?

A trading platform is a software system used to trade securities. It allows investors to open, close, and manage market positions online through a financial intermediary, such as an online broker.

Online trading platforms are frequently offered by brokers either for free or at a discount in exchange for maintaining a funded account and/or making a specified number of trades per month. The best trading platforms offer a mix of robust features and low fees.

10 Best Forex Trading Apps in Botswana

- ✔️ XM – Overall, Best Lowest Spread Forex Brokers in Botswana

- ✔️ IC Markets– Verifies STP Forex Broker in Botswana

- ✔️ InstaForex– Best STP Forex Broker in Botswana

- FBS– Best Cent Accounts are best for beginner

- Admirals – Top MetaTrader 5/MT5 Forex Broker

- eToro– offers Best social and copy trading options

- AvaTrade– Top Forex Broker for Beginner Traders

- HFM– Best ECN Forex Broker in Botswana

- Exness – Top Regulated Broker in Botswana

- Pepperstone – Top MetaTrader 5/MT5 Forex Broker

1. XM

XM is unique among brokers because it provides more than one mobile trading platform. The whole suite is accessible on both iOS and Android. However, XM’s Trading Point app is only offered on MT5 accounts and allows for direct trading on mobile.

Setup and use are straightforward, and Botswanans will find that the search function on the app is superior, allowing traders to search for products according to name or by using the category options.

Min Deposit

USD 5 / 67 BWP

Regulators

IFSC, CySec, ASIC

Trading Desk

Desktop MT4 and MT5, Mobile MT4 and MT5, XM mobile app, Web platform

Total Pairs

57

Islamic Account

Yes

Trading Fees

No (Just spread)

Account Activation Time

24 Hours

XM’s mobile trading applications for MT4 and MT5 are feature-parallel to their desktop and web-based counterparts. Except for share CFD trading, which is exclusive to MT5, all other instruments and charts offered by XM are accessible to traders.

In addition, all order types in the trading system are open to you. Finally, both MT4 and MT5 have mobile apps, with the sole difference being a reduction in the number of indicators.

XM Overview

| Feature | Information |

| ⚖️ Regulation | FSCA, IFSC |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | $5 / 67 BWP |

| Average spread from | 0.0 pips EUR/USD |

| 📈 Maximum Leverage | 1:1000 |

| 👥 Customer Support | 24/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Negative balance protection is applied to retail investor accounts | US clients are restricted from accessing XM’s trading services |

| There are several secure payment methods to choose from | There are no fixed spread accounts offered |

| The broker is known for low spreads, low commissions, and reliable trade execution speeds | There is an inactivity fee applied to dormant accounts |

| Traders can use hedging, scalping, and expert advisor trading strategies | |

| The broker offers personal customer service to its clients |

2. IC Markets

Botswana’s seasoned traders may use IC Markets’ extensive selection of technical indicators, trading ideas, and other trading services. Automated trading techniques, scalping, hedging, expert advisers, and many other methods are just some of the trading methods available to sophisticated traders.

Thanks to IC Markets’ three mobile trading platforms, you can easily trade on the go with your Android or iOS smartphone or tablet. However, compared to traditional desktop trading platforms, mobile trading apps have fewer features, such as fewer periods and charting choices.

With its sleek user interface, built-in teaching materials, and innovative risk management tools, cTrader is one of the best third-party trading platforms for newcomers.

Min Deposit

USD 200 / 2 685 BWP

Regulators

ASIC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

65

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

All the order types, trade analysis tools, and watchlists included in the desktop version are also accessible in the mobile app version of cTrader.

Among foreign exchange (FX) traders, MetaTrader 4 (MT4) is still by far the most widely used trading platform because of its user-friendliness, robust environment, and automated trading capabilities.

However, more traders are switching to MT5, the latest iteration of the popular MetaTrader trading platform. All MT4’s essential features are there in MT5, plus an EA trading environment that has been fine-tuned.

Traders can access nine timeframes, thirty indicators, and dynamic currency charts through the MT4 and MT5 mobile applications from IC Markets. In addition, traders on the go could benefit from tick charts, the flexibility to cancel or modify existing orders, and accurate tracking of gains and losses.

IC Markets Overview

| Account Feature | Value |

| 💻 Trading Platform | cTrader |

| 💰 Commission | $3 per side and $6 per round turn |

| 📈 Typical Average Spreads | 0.0 |

| 💳 Minimum Deposit Requirement | 2 685 Botswanan Pula equivalent to $200 |

| 📈 Leverage | 1:500 |

| 📈 Maximum positions per account | 2,000 |

| 🏛️ Server Location | London |

| ✴️ Micro trading allowed? | Yes |

| 📊 Currency Pairs | 64 |

| 📊 Index CFD Trading | Yes |

| 📊 Stop-out | 50% |

| 📈 One-Click Trading offered? | Yes |

| ☪️ Islamic Accounts | Yes |

| 📊 Trading Styles accepted | Scalping, hedging, expert advisors, algorithmic strategies, etc. |

| 💻 Programming Language | C# |

| 👍 Suitable for | Day traders, scalpers, active traders |

| 📊 Demo Account offered? | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| IC Markets is a multi-regulated forex and CFD broker with a decent trust score and a low-risk reputation | There is a higher minimum deposit requirement charged than other brokers |

| There is real raw spread trading offered across several asset classes | Botswanan traders could face currency conversion fees |

| IC Markets offers some of the best spreads in the industry | There is no BWP-denominated account offered |

| Botswanans can choose between MetaTrader 4, MetaTrader 5, and cTrader as their preferred platform | There are no fixed spreads offered by IC Markets |

| There is a choice between three different account types that suit different types of traders | There is no proprietary trading platform, or an app offered by IC Markets |

| There are no hidden fees and IC Markets is one of the best options for high volume trading because it has a long list of liquidity providers | |

| There is a free demo account offered | |

| There is an Islamic account option offered to Muslim traders |

3. InstaForex

Established in 2007, InstaForex has grown to become a top provider of online brokerage services for millions of traders across the globe. In addition, the broker has partnered with software developers to provide investors with innovative trading applications and platforms.

InstaForex also supports MetaTrader 4 and MetaTrader 5, the two most widely used platforms in the foreign exchange market, in addition to its own two web-based platforms. Furthermore, for those who want to trade with InstaForex, the broker offers an intuitive WebTrader interface.

There is no need to install any software to use WebTrader, since trading may be done immediately in a web browser. In addition, this platform syncs with all other InstaForex platforms, enabling cross-platform trading, and providing access to the latest Forex news and analysis.

Min Deposit

USD 1

Regulators

CySEC, FSC

Trading Desk

MetaTrader 4

MetaTrader 5

MultiTerminal

WebTrader

Crypto

Yes

Total Pairs

100

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Its proprietary trading platform, InstaTick Trader, is named after the company that created it, InstaForex. In addition, six-digit quotations are its main selling point.

The InstaTick platform offers traders an even more comprehensive perspective of the minute swings in the Forex market than the standard 5-digit quotations offered by other platforms. Moreover, you can use InstaTick right in your browser, and no additional software is needed.

Because InstaForex supports MT4 and MT5, traders who decide to switch brokers will still have access to their customized versions of these platforms. In addition, MetaTrader platforms also have access to tens of thousands of other add-ons and resources.

InstaForex Overview

| Feature | Information |

| ⚖️ Regulation | FSC, BVI, SIBA |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | Botswanan Pula ($1 / 13 BWP ) |

| Average spread from | 0.0 pips EUR/USD |

| 📈 Maximum Leverage | 1:1000 |

| 👥 Customer Support | 24/7 |

Pros and Cons

| ✔️ Pros | ❌ Cons | |||

| The broker offers commission-free trading | There are restrictions on leverage for European Union clients | |||

| MetaTrader 4 and 5 are both offered, available across devices | US clients are not accepted | |||

| The broker is well-regulated and offers competitive trading conditions | ||||

| There is a choice between retail investor accounts, each suited to different types of traders | ||||

| There is a wide range of tradable assets offered |

4. FBS

FBS is one of the few top trading apps for Botswanan traders on the list that provides high leverage of up to 1:3000, allowing users to establish greater position sizes. However, traders should use care and adhere to established risk management procedures.

In contrast to its name, the FBS Trader app is not a trading platform in and of itself but a gateway via which users of the MT4 and MT5 platforms could access and manage their accounts from a mobile device or tablet. The FBS Trader app has a simple interface.

After signing up, you will be guided through a brief tutorial that explains the basics of using the site. The app’s sleek interface makes switching between a live and a demo account as simple as tapping a button.

Min Deposit

USD 5 / 67 BWP

Regulators

IFSC, FSCA (South Africa), ASIC, CySEC

Trading Desk

MetaTrader 4, MetaTrader 5, FBS Trader – all in one mobile trading platform.

Crypto

Yes

Total Pairs

250

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

The software includes a video library for learning purposes, a handy economic calendar, and a help system for submitting questions.

Additionally, traders may see real-time statistics, open, shut, update, and remove positions and orders. In addition to proprietary software, FBS backs the mobile trading applications MT4 and MT5 for Android and iOS.

However, functionality is reduced compared to desktop trading systems (such as fewer time frames and charting choices). Nevertheless, traders can still cancel and alter orders, calculate profit and loss, and trade directly from the charts.

FBS Overview

| Feature | Information |

| ⚖️ Regulation | IFSC, CySEC |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | USD 5 / 96 Pula |

| 📊 Average spread from | 0.0 pips EUR/USD |

| 📈 Maximum Leverage | 1:3000 |

| 👥 Customer Support | 24/7 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| FBS offers competitive trading conditions with some of the lowest spreads | There are wide spreads charges on some accounts |

| There are several account types to choose from | There is a limited number of tradable instruments |

| There are many social trading opportunities | There are several regional restrictions applied |

| There is an ultra-low minimum deposit requirement | |

| The broker is well-regulated and trusted |

5. Admiral

Admiral provides a honed version of MT5 known as MetaTrader Supreme Edition. Among the enhancements in this release are adding new indicators, such as Trading Central analysis and a market mood tool.

Spreads on the Admiral MT5 Zero account start at 0 pips, commissions start at 6 USD round trip, and leverage can go as high as 1:500, depending on your location.

Min Deposit

339 BWP or an equivalent of $25

Regulators

FCA, ASIC, CySEC, EFSA, JSC

Trading Desk

MT4, MT5, Admirals Mobile App

Crypto

Yes

Total Pairs

35 Forex Currency Pairs

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

This kind of account requires a minimum deposit of 466 BWP / $25 for international and 100 EUR for European traders. The MT5 platform is browser-based and available for usage on desktop computers. Regarding mobile devices, you may choose between Android and iOS.

MT5 supports the addition of expert advisors. As a result, it becomes an ideal platform for automated trading strategies when coupled with a virtual private server (VPS).

Admirals Overview

| Feature | Value |

| 💳 Minimum Deposit Requirement | 475 BWP equivalent to $25 |

| 📈 Platforms Available for Account Type | MetaTrader 4, cTrader |

| 📊 Average Spreads on Major Forex Pairs | 0.3 pips |

| 🚀 Maximum Leverage Ratio | • 1:30 (Retail) • 1:500 (Pro) |

| 🔎 Commission Charges on Trades | $6 per lot |

| 📈 Commissions on Stock CFDs | $0.04 per CFD with a minimum of $6 |

| 💰 Account Base Currency Options | EUR or USD |

| 🔨 Negative Balance Protection Offered | Yes |

| 📱 Is Hedging Allowed? | Yes |

| 💸 Minimum Forex Trading Volume | 0.01 lots |

| 💵 Islamic Account Conversion Offered? | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Admirals is well-regulated in several regions globally | There is an inactivity fee charged |

| Admirals offers commission-free options | Botswana traders are subject to currency conversion fees |

| The broker accepts Botswana traders despite their trading skills or trading strategies | There are deposit and withdrawal fees charged |

| There are user-friendly platforms available across devices | There are admin fees charged on the Islamic account |

| There is a wide range of tradable markets, complex instruments, and leveraged products | There is only one account type that can be converted to an Islamic Account |

| Admirals offers the MetaTrader Supreme Edition | |

| Traders are given access to premium analytics | |

| There are several educational materials, resources, and tools offered |

6. eToro

eToro features a critically acclaimed mobile app and trading platform. Android and iOS users can download the mobile app from their respective app stores for free. eToro pioneered the concept of social trading and is now the industry’s leading social online trading broker.

CopyPortfolios, which group all tradable assets under one specified market strategy to minimize long-term risk and produce diversified investments, are supported on its mobile app.

Min Deposit

USD 10 / 136 BWP

Regulators

CySec, FCA

Trading Desk

None

Crypto

Yes

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Making the eToro mobile app work exactly as you want it to is easy. Trading directly from the charts, making deposits and withdrawals, searching for instruments, and making watchlists are all simple tasks for Botswanans.

Furthermore, Botswanans will be thrilled with the accessibility of the most recent market information and the flexibility to customize their watchlists and chart layouts.

eToro Overview

| Features | Information |

| ⚖️ Regulation | CySEC, FCA, ASIC, FinCEN, FINRA, SIPC, DNB, FSA |

| 💸 Minimum Withdrawal Time | 3 Hours |

| 📈 Maximum Withdrawal Time | 5 Working Days |

| 💰 Instant Deposits/Withdrawals? | Yes, deposits |

| 💳 BWP-Denominated Account? | No |

| 📱 Minimum Deposit Amount | 940 BWP equivalent to $50 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The eToro platform provides Botswanan traders with an engaging and communal experience | There is limited customer support |

| eToro offers real crypto along with CFDs on crypto | The Islamic Account requires a 1,000 USD minimum deposit |

| There is a comprehensive selection of educational material offered | MetaTrader is not supported |

| Botswanan traders can easily transfer their crypto from the eToro platform to another | eToro applies high currency conversion fees and does not provide a BWP trading account |

| There is a demo, and an Islamic account offered | There are inactivity fees charged |

| eToro offers a powerful and innovative trading platform for traders | |

| There is a range of instruments offered that can be traded | |

| eToro offers some of the best social and copy trading options in the industry |

7. AvaTrade

Regarding Forex (FX) and CFD (Contracts for Difference) trading, AvaTrade is widely regarded as a leading industry player. The platform’s principal objective is to provide users with a highly reactive and fluid trading environment.

AvaTrade offers the best mobile trading experience thanks to its compatibility with four different trading applications, including the highly regarded AvaTradeGo.

The AvaTradeGo app is more of a gateway enabling traders to control their desktop installations of Metatrader 4 from their mobile devices. It works with AvaTrade’s social trading platform and can be downloaded for free on iOS and Android.

The user-friendly interface and advanced features of AvaTradeGO’s home page make it easy to access the app’s many features, such as market analysis tools and tutorial videos.

In addition, it is exceedingly easy to place trading orders, establish watchlists, check live prices and charts, and use powerful search features. AvaTrade’s risk management system, AvaProtect, is also included in the mobile app.

When using this innovative trading instrument, customers may buy protection against losing trades for a certain time. If the deal is cancelled during that time, the client will get a full refund of any losses incurred.

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

The AvaTradeGO mobile app generally offers a streamlined trading experience with a clean interface. Both MetaTrader 4 and MetaTrader 5 are available for download on the Android and iOS platforms from AvaTrade.

Traders will have access to analytics with technical indicators, graphical objects, and the complete complement of trading orders, but with a restricted set of features compared to the desktop versions of the platforms due to fewer periods and charting choices.

In addition to its standard forex trading services, AvaTrade now provides its customers with AvaOptions. This platform allows for the purchase and sale of vanilla options. Additionally, it has developed its own options trading app for mobile devices.

In addition, more than 40 currency pairings plus precious metals like gold and silver are available for trading. You can also easily tailor your portfolio’s risk and return to your market outlook with the platform’s help.

Compared to other brokers, AvaTrade’s support for mobile trading is among the best thanks to the availability of the MT4 and MT5 mobile versions and the AvaTradeGo and AvaOptions trading applications.

AvaTrade Overview

| Account Features | Value |

| 💰 Minimum Deposit Requirement | 1370 BWP or equivalent to 100 units in ZAR, USD, GBP, or AUD |

| ℹ️ Base Account Currency Options | ZAR, USD, GBP, or AUD |

| 📈 Maximum Leverage | • 1:30 (Retail) • 1:400 (Professional) |

| 📱 The range of Markets offered | More than 1,260 tradable instruments |

| 💻 Trading Platforms | • AvaTradeGO • AvaOptions • AvaSocial • MetaTrader 4 • MetaTrader 5 • DupliTrade • ZuluTrade |

| 💵 Commissions on trades | None |

| 📊 Average spreads | From 0.9 pips EUR/USD |

| 💰 Margin Requirements | From 0.25% when using leverage of 1:400 |

| 🗣 Customer Support Channels | Social Platforms, Email Request, Telephone, WhatsApp, Live Chat |

| 📚 Educational Materials offered | Trading Videos, Trading for Beginners, Trading Rules, Technical Analysis Indicators and Strategies, Economic Indicators, Market Terms, Order Types, Blog, Online Trading Strategies |

| ✅ Trading tools offered | AvaProtect, Trading Central, CFD Rollover, Economic Calendar, Trading Calculator, Earnings Releases, Analysis |

| ✔️ Trading Strategies Allowed | All – scalping, swing trading, momentum trading, expert advisors, algorithmic trading, auto trading, etc. |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| AvaTrade is the best broker for beginners in Botswana | The demo account is only offered for 21 days |

| Advanced traders can access several trading tools to refine their trading | |

| There are a few robust trading platforms that Botswanans can use | |

| The practice account offers access to a range of financial instruments and markets |

8. HFM

The mobile applications provided by HFM, a reputable and well-regulated hybrid STP and ECN broker, are also quite popular among Botswanan traders. Traders in Botswana may access a comprehensive selection of products across many asset classes through the app’s mobile platform.

The HF App is a gateway for MT4 and MT5 with a modern design and an easy-to-use interface, and it is very customizable.

This is one of the top mobile trading applications on the market. Traders in Botswana will be delighted by the flexibility it affords them in terms of chart kinds and views, trading and appearance settings, and order placement (in terms of money, lots, or units).

The HF App offers a built-in economic calendar and facilitates traders’ easy deposits, withdrawals, and cash transfers.

Min Deposit

USD 0

Regulators

CySEC, FCA, DFSA, FSCA, FSA, CMA

Trading Desk

MT4, MT5, HFM APP

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

0

Account Activation Time

24 Hours

Traders who use HFM have access to a wealth of resources, including instructional materials (such as the ability to sign up for webinars geared at novices, intermediates, and experts) and news revolving around their preferred instruments.

HFM’s MT4 and MT5 applications allow traders to carry out trades from almost any location with nine different timeframes, thirty different indicators, and interactive currency charts.

In addition, Botswanans can quickly and simply close orders, make changes, and determine their gains or losses. Furthermore, searching for instruments will be much simpler for Botswanans on these platforms than on the online trader versions.

HFM Overview

| Features | Information |

| ⚖️ Regulation | FSCA, CySEC, DFSA, FSA, FCA, CMA, and FSC, with registration in ACPR, BaFin, MNB, CONSOB, CNMV, FI, FMA, FSC, and other regions |

| 💸 Minimum Withdrawal Time | – |

| 📈 Maximum Withdrawal Time | 2 to 4 working days |

| 💰 Instant Deposits/Withdrawals? | Yes, deposits |

| 💳 BWP-Denominated Account? | No |

| 📱 Minimum Deposit Amount | $0 / 0 BWP |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| HFM does not charge any deposit fees when Botswanans transfer funds to a trading account | HFM does not support BWP as a deposit currency or an account base currency, which could result in currency conversion fees |

| There are competitive spreads charged | HFM’s spreads are wider on entry-level accounts |

| HFM is a transparent broker that does not have any hidden broker fees | |

| Botswanans need not worry about withdrawal fees when they transfer funds from the trading account |

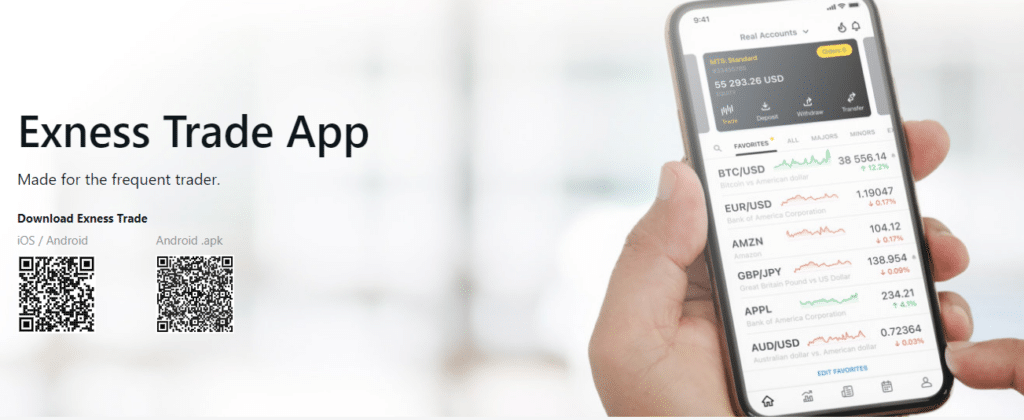

9. Exness

Exness, like many other brokers, supports the Android and iOS versions of the MetaTrader 4 and 5 trading applications. Also, for MT5 users alone, Exness provides its app for account management, money transfers, and trading across all of Exness’ financial instruments.

The Exness app’s home page and dashboard are functional and easy to use. In addition, TradingView’s selected trade signals for each instrument are displayed for your viewing pleasure.

Min Deposit

$10 / 134 BWP

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

It is easy to use this app to monitor market trends, execute orders, get notifications, build watchlists, and check live prices and charts.

The Exness MT4 and MT5 applications allow traders to operate from almost any location with nine timeframes, thirty indicators and live, interactive currency charts.

In addition, tick chart trading, the ability to cancel and alter open orders, and live profit/loss calculations give mobile traders a significant leg up.

Exness Overview

| Feature | Information |

| 📈 Account Base Currencies | AED, ARS, AUD, AZN, BDT, BHD, BND, BRL, CAD, CHF, CNY, EGP, EUR, GBP, GHS, HKD, HUF, IDR, INR, JOD, JPY, KES, KRW, KWD, KZT, MAD, MXN, MYR, NGN, NZD, OMR, PHP, PKR, QAR, SAR, SGD, THB, UAH, UGX, USD, UZS, VND, XOF, ZAR |

| 📊 Minimum Spread | 0.0 pips EUR/USD |

| 💳 Botswanan Deposits/Withdrawals | Yes |

| ⚖️ CBN Regulation | No |

| 📊 Account Types | Standard Account, Standard Cent Account, Raw Spread Account, Zero Account, Pro Account |

| ⚖️ Regulation | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA |

| 📈 Leverage | Unlimited |

| 📊 Micro Account Offered? | No |

| 📈 Trading Tools | Analytical tools, Trading calculators, currency converter, tick history, economic calendar |

| 💻 Educational Material | None |

| 👥 Botswanan-Based Customer Support | No |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The broker has a global presence and has authorization and regulation with market regulators around the globe | There is a limited selection of tradable instruments and only a few asset classes |

| Offers instant withdrawals and deposits | There are only a few funding options offered |

| Botswanan traders have a choice between several dynamic account types | |

| Client fund safety is guaranteed and there is investor protection offered | |

| Offers 24/7 customer support that is both prompt and helpful | |

| There are tight and variable spreads offered with competitive commissions |

10. Pepperstone

Pepperstone is an excellent option for traders needing a reputable MT4 broker that also offers an ECN account. The spread on the EUR/USD currency pair is 0.0 pips with the Pepperstone ‘Razor’ account.

Given that a commission is charged on every open position, Botswanans seeking the lowest possible cost could do well to open a “Standard” account, which rolls all costs into the spread.

Pepperstone is a broker that offers access to more than 70 different currency pairings via a MetaTrader 4. In addition, Pepperstone is one of the top automated trading platforms since it offers MT4, 28 forex indicators, and various Expert Advisors (EAs).

Min Deposit

0 USD / 0 BWP

Regulators

ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB

Trading Desk

MetaTrader 4, MetaTrader 5, cTrader and TradeView

Crypto

Yes (Not available in Africa)

Total Pairs

60+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Pepperstone is one of the safest choices since three major bodies regulate it: the Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), and the Federal Financial Supervisory Authority (BaFin).

In addition, Pepperstone is also regulated by CySEC in Cyprus, DFSA in Dubai, CMA in Kenya, and SCB in the Bahamas.

Pepperstone Overview

| Account Feature | Value |

| 💰 Minimum Deposit | $0 / 0 BWP |

| 💻 Minimum Trading Size | 0.01 lots |

| 📈 Maximum Trading Size | 100 lots in a single trade |

| 💵 Base Account Currency | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, and HKD |

| ✅ Trading Strategies Supported | All including scalping, hedging, and Expert Advisors (EAs) |

| 🗞 News Trading Offered? | Yes |

| ➡️ Trade Execution | No-Dealing Desk (NDD) |

| 📊 Average EUR/USD Spread | From 0.6 pips |

| 💸 Commissions | None |

| 🔃 Rollover Swaps | Yes, according to the market rates |

| ⬆️ Maximum Leverage per region | • Australia – 1:30 • Bahamas – 1:200 • Cyprus – 1:30 • Dubai – 1:30 • Germany – 1:30 • Botswana – 1:400 • United Kingdom – 1:30 |

| ❌ Negative Balance Protection Offered | Yes, only for retail clients |

| ✅ Margin Close-Out (%) | 50% |

| 🔨 Trading Instruments offered | 1,200+ |

| 💻 Trading Platforms offered | MetaTrader 4, MetaTrader 5, cTrader, TradingView, Myfxbook, DupliTrade |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Pepperstone offers competitive spreads that start from 0.0 pips on EUR/USD | There are restrictions on the countries that may use Pepperstone’s Islamic account |

| Pepperstone is well-regulated and offers an extremely secure trading environment with transparent trading fees | There is no BWP-denominated account offered, subjecting Botswanans to currency conversion fees |

| Investor protection is offered to EU clients through the FSCS | There are additional administrative fees applied to the Islamic account |

| Pepperstone offers a choice between some of the best trading platforms | |

| Negative balance protection is offered for clients in certain regions | |

| There is an Islamic account offered to Muslim traders | |

| There is a demo account offered by Pepperstone | |

| There are several trading tools offered |

What are the benefits of Forex Trading Apps?

The foreign exchange market can be much more manageable with a little help from technology. For example, a foreign exchange (Forex) trading app might be useful for certain traders.

Technologies like 3G and 4G allow you to utilize mobile applications regardless of your connection speed to the internet. In this manner, all you need is a mobile device and access to the internet to engage in trades on the road.

You can easily improve your trading experience with the help of the mobile trading platform. These applications are meant to aid you in making wise choices at crucial junctures. Botswanan traders could expand their market potential by using an online forex trading platform.

This is because the app allows you to participate in the market constantly and continuously. In addition, the foreign exchange market is open for trading five days a week, so investors may make transactions whenever they choose.

How to Choose the Right Forex Broker in Botswana

Botswanan traders must evaluate the following components of a forex broker to decide whether the broker is suited to their unique trading objectives or needs.

Regulations and Licenses

This is the first vital component that Botswanan traders must thoroughly evaluate. Reputable brokers are regulated by market regulators such as FCA, ASIC, CySEC, FSCA, and others.

Botswanans must beware when dealing with brokers with only offshore regulations such as FSA, SVG BVI, FSC, and others.

Account Features

Account Features include leverage trading and margin requirement, commissions and spreads, initial deposit, additional features on retail investor accounts, and so on.

Deposits and Withdrawals

Botswanans must evaluate the payment options available, the processing times on withdrawal requests, deposit currencies offered, the withdrawal fee, deposit fees, and minimum withdrawal limits, among other trading and non-trading fees.

Range of Markets

The range of markets offered refers to the number and range of tradable instruments the broker offers. Therefore, Botswanans must consider what they wish to trade and what is available.

Customer Support

Customer Support is another crucial factor. Botswanans must check the availability of support (trading hours), the quality of support, and the promptness with which the customer support team responds to queries.

Trading Platform

A trading platform is the Botswanan trader’s portal to the financial markets. Therefore, traders must ensure that the trading platform has the necessary technical indicators, fundamental analysis, technical analysis, economic calendar, charting, newsfeed, and other tools they may need.

Education and Research

Education and Research come in handy to both novice traders and experienced investors. Education includes some of the following:

➡️ eBooks

➡️ Trading guides

➡️ Trading knowledge on leveraged products

➡️ A risk warning on complex instruments

➡️ Educational videos

Research can include some of the following:

➡️ Trading tools

➡️ Commentary

➡️ Status of International Markets

➡️ Price movements

➡️ Market sentiments

➡️ Whether there is a volatile market

➡️ Exchange Rates

➡️ Expert opinions and other resources can help experienced traders make informed trading decisions.

The Best Forex Brokers in Botswana

In this article, we have listed the best brokers that offer forex trading to traders in Botswana. In addition, we have further identified the brokers that offer additional services and solutions to Botswanan traders.

Best MetaTrader 4 / MT4 Forex Broker in Botswana

Min Deposit

USD 25

Regulators

FCA UK

Trading Platform

MT5, MT4, OctaTrader

Crypto

Yes

Total Pairs

28

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, OctaFX is the best MT4 forex broker in Botswana. OctaFX is an MT4 and MT5 broker that provides Botswanans with various markets. OctaFX offers a choice of accounts via MT4, including ECN and STP accounts, with superior trade execution.

Best MetaTrader 5 / MT5 Forex Broker in Botswana

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, AvaTrade is the best MetaTrader 5 forex broker in Botswana. In addition, AvaTrade is regarded as one of the most secure MT5 forex brokers.

No commission is charged for trading currency pairings, only leaving the spread to be paid. A demo account is also available for traders to sharpen their abilities via MT5 and several other platforms.

Best Forex Broker for beginners in Botswana

Min Deposit

$100

Regulators

CFT, NFA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FOREX.com is the best forex broker for beginners in Botswana. FOREX.com is a broker renowned for low trading fees and beginner-friendly solutions. In addition, FOREX.com offers several educational materials and a helpful demo account.

Best Low Minimum Deposit Forex Broker in Botswana

Min Deposit

$10 / 134 BWP

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Exness is the best Low Minimum Deposit Forex Broker in Botswana. Exness has a minimum deposit requirement of 10 USD / 130 BWP, making it easy for Botswanans to start trading 278 instruments.

Exness also offers MT4 and MT5 through which trades can be made. In addition, it offers some of the best trading tools, charting capabilities, technical indicators, expert advisors, and more.

Best ECN Forex Broker in Botswana

Min Deposit

USD 0

Regulators

CySEC, FCA, DFSA, FSCA, FSA, CMA

Trading Desk

MT4, MT5, HFM APP

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

0

Account Activation Time

24 Hours

Overall, HFM is the best ECN forex broker in Botswana. HFM is a hybrid forex and CFD broker that uses STP and ECN technology to ensure that Botswanans get the best pricing, minimal slippage, no requotes, and the fastest trade execution.

HFM uses the best liquidity providers who aggregate the pricing that Botswanans can see on MT4, MT5, and the HF App for Android and iOS.

Best Islamic / Swap-Free Forex Broker in Botswana

Min Deposit

USD 10 / 136 BWP

Regulators

CySec, FCA

Trading Desk

None

Crypto

Yes

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, eToro is the best Islamic / Swap-Free forex broker in Botswana. eToro is a renowned social trading platform that offers Muslim traders an Islamic Account.

eToro does not charge any interest on positions held for over 24 hours. However, registering an Islamic Account can be expensive initially, requiring a 1,000 USD / 18,668 BWP deposit.

Best Forex Trading App in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

ASIC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

300

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, CMC Markets is the best forex trading app in Botswana. In addition, CMC Markets offers a user-friendly mobile app with research tools, powerful charts, customizable watch lists, news reports, and a range of educational materials.

Best Lowest Spread Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

FCA, CySEC, IFSC, KNF

Trading Desk

No Trading Desk

Crypto

Yes

Total Pairs

48

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, XTB is the best lowest-spread forex broker in Botswana. XTB is a well-known forex and CFD broker with low and competitive forex spreads from 0.1 pips depending on the financial instrument and the market conditions.

XTB is also a good broker in terms of educational materials and research capabilities, providing traders with comprehensive market analysis across markets.

Best Nasdaq 100 Forex Broker in Botswana

Min Deposit

USD 10

Regulators

CySec, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

60

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXTM is the best Nasdaq 100 forex broker in Botswana. FXTM is a multi-regulated forex and CFD broker that accommodates Botswanan traders with a keen interest in Nasdaq. Traders can expect low and competitive spreads, a choice between accounts, and powerful trading platforms.

Best Volatility 75 / VIX 75 Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

IGRs

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, IG is Botswana’s best Volatility 75 / VIX 75 forex broker. IG is one of the best CFD brokers with powerful proprietary trading technology.

IG is well-regulated and offers Botswanans access to VIX75, with spreads from 0.04 pips / 0.13% and zero commission charges.

Best NDD Forex Broker in Botswana

Min Deposit

USD 50 / 672 BWP

Regulators

FCA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

–

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXCM is the best NDD forex broker in Botswana. FXCM is a No-Dealing Desk broker with STP and ECN execution across several markets.

In addition, FXCM offers a choice between third-party platforms in addition to technical indicators, charting tools, and competitive trading conditions.

Best STP Forex Broker in Botswana

Min Deposit

USD 10

Regulators

IFSC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

36

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, RoboForex is the best STP forex broker in Botswana. RoboForex is popular forex and CFD broker with competitive trading conditions. RoboForex offers STP execution with liquidity sourced from top providers.

Botswanans can expect access to over 12,000 instruments via powerful and innovative third-party platforms.

Best Sign-up Bonus Broker in Botswana

Min Deposit

50 USD / 682 BWP

Regulators

CYSEC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Windsor Brokers is the best sign-up bonus broker in Botswana. Windsor Brokers is a well-regulated broker that offers Botswanans a welcome account funded with 30 USD in trading credit. With this account, Botswanans can explore the platform or risk-free test their strategies.

You might also like: Best MT5 Brokers in Botswana

You might also like: Best MT4 Brokers in Botswana

You might also like: CFD Trading Platforms in Botswana

You might also like: Best Algorithmic Trading Platforms in Botswana

You might also like: Best Micro Currency Trading Platforms in Botswana

Conclusion

M-Pesa is a Kenya-based worldwide mobile banking service that enables users to store and transfer funds through the network. However, because M-Pesa does not cover a substantial fraction of Forex traders, few Forex brokers are interested in forming relationships with the firm.

However, despite this, there are a few options for Botswanan traders who want to use this affordable, trusted payment method.

Frequently Asked Questions

Can I trade forex on my phone in Botswana?

You can trade currency pairs if you have a smartphone and a forex trading app. However, these applications provide a wider range of services than only mobile trading.

Markets, worldwide financial and business news, and technical analysis of existing and future assets may all be tracked in real-time with their assistance.

Are forex trading apps safe?

Forex trading apps by reputable brokers and third-party providers are safe. This is because apps use the same tried-and-true security measures as web-based portals.

Is forex trading via an app legal in Botswana?

Traders in Botswana may legally do business in the foreign exchange market, which the central bank governs per the Bank of Botswana Regulations of 2004.

What is the most popular trading app in Botswana?

Trading stocks, currencies, futures, options, and other financial products from your mobile device is made possible by MetaTrader, one of the most popular trading platform applications for individual investors utilizing Android smartphones.

How much will I need to start trading forex on my phone?

You can start trading with capital of 100 USD / 1866 BWP. However, it is recommended that you deposit enough funds to meet the margin requirement.

What is the difference between forex and stock trading apps?

The forex market is far more volatile than the stock market.

How to compare the best trading apps against each other?

Comparing the best trading apps against each other involves evaluating a range of critical factors to determine which aligns most closely with your trading needs.

Which Trading Apps are best for beginner Botswana Traders?

FOREX.com is the best Trading APP for beginners.

Which trading app offers a mobile app on IOS and Android for Botswana Traders?

CMC Markets is the best mobile app.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review