18 Best FSCA-Regulated Brokers in Botswana

The 18 Best FSCA-Regulated Forex Brokers for Botswanan revealed. We tested the best FSCA-Regulated brokers for Botswana Traders.

This is a complete guide to FSCA-Regulated brokers in Botswana.

In this in-depth guide you’ll learn:

- What is the purpose and responsibility of the FSCA?

- What is a South African Financial Sector Regulation Act (FSCA)?

- Which forex brokers offer the best trading platforms for Botswana traders?

- How to compare the best forex brokers against each other.

- Which FSCA-Regulated forex brokers are best for beginner Botswana Traders?

- Why is it important to trade with a licensed FSCA broker?

And lots more…

So if you’re ready to go “all in” with the best-tested SA FSCA-Regulated brokers…

Let’s dive right in…

- Louis Schoeman

10 Best Forex Brokers in Botswana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

Best FSCA-Regulated Brokers in Botswana

| 🏅 Broker | 👉 Open Account | 📌 FSCA Regulated | 💰 Minimum Deposit |

| 1. Velocity Trade | 👉 Open Account | Yes | No Minimum Deposit |

| 2. IG Markets | 👉 Open Account | Yes | USD 250 / 4702 BWP |

| 3. AvaTrade | 👉 Open Account | Yes | USD 100 / 1895 BWP |

| 4. Exness | 👉 Open Account | Yes | $10 / 188 BWP |

| 5. Quicktrade | 👉 Open Account | Yes | No Minimum Deposit |

| 6.FXCM | 👉 Open Account | Yes | $50 USD / 947 BWP |

| 7. Tickmill | 👉 Open Account | Yes | USD 100 / 1895 BWP |

| 8. FXTM | 👉 Open Account | Yes | 10 USD / 192 BWP |

| 9. GT247 | 👉 Open Account | Yes | No Minimum Deposit |

| 10. FXPro | 👉 Open Account | Yes | USD 100 / 1895 BWP |

| 11. ThinkMarkets | 👉 Open Account | Yes | No Minimum Deposit |

| 12. Globex360 | 👉 Open Account | Yes | USD 100 / 1895 BWP |

| 13. Khwezi Trade | 👉 Open Account | Yes | R500 / 360 BWP |

| 14. CM Trading | 👉 Open Account | Yes | USD 100 / 1895 BWP |

| 15. Trade Nation | 👉 Open Account | Yes | No Minimum Deposit |

| 16. Scope Markets | 👉 Open Account | Yes | USD 100 / 1895 BWP |

| 17. IFX Brokers | 👉 Open Account | Yes | USD 100 / 1895 BWP |

| 18. RCG Markets | 👉 Open Account | Yes | $50 USD / 947 BWP |

What is the purpose and responsibility of the FSCA?

In South Africa, the Financial Services Board (FSB) was succeeded by the Financial Sector Conduct Authority (FSCA), a market conduct regulator for financial institutions.

In April 2018, after a lengthy reorganization process, the Financial Services Board (FSB) was renamed the Financial Sector Conduct Authority (FSCA).

A very advanced and all-encompassing consumer protection framework is effectively created by the FSCA’s power over any firm or organization in South Africa that sells financial products or services.

The Financial Industry Conduct Authority (FSCA) has modelled its approach after the worldwide “Twin Peaks” model of financial regulation. However, it has tailored it to South Africa’s financial sector specifics.

The goal is to create and maintain a thriving and expanding financial services industry that is accessible to all citizens of South Africa and treats its clients fairly.

Furthermore, the FSCA has developed a comprehensive plan for educating consumers to protect their financial well-being better.

Supporting financial inclusion and expanding access to the financial sector for more South Africans in an ethical and empowering manner is another top FSCA strategic focus, and consumer empowerment is essential to this end.

The following long-term goals represent the FSCA’s commitment to its mission and fulfil its mandate:

➡️ Maintain a secure financial system.

➡️ Prompt changes in the banking system to broaden participation.

➡️ Foster a regulatory environment that ensures clients of financial institutions are treated fairly.

➡️ Give them the tools they need to understand their finances.

➡️ Encourage financial market innovation to preserve market efficiency and honesty.

18 Best FSCA-Regulated Brokers in Botswana

- ✔️ Velocity Trade – Overall, Best FXCA-Regulated Broker in Botswana

- ✔️ IG Markets – Top Volatility 75 / VIX 75 Broker

- ✔️ AvaTrade – Verified FSCA-Regulated Minimum Deposit Broke

- Exness – User-Friendly Forex Broker for Beginner Traders

- Quicktrade – Top FSCA-Regulated Islamic/Swap-Free Broker

- FXCM – Best Online Trading Experience

- Tickmill – Top Nasdaq100/NAS100 Broker

- FXTM – Top CFD Broker in Botswana

- GT247 – Most Products on the MetaTrader 5 Platform

- FXPro – FSCA Regulated NDD Broker

- ThinkMarkets – Largest Pairings Regulated by the FSCA

- Globex360 – Best Markets Analysis and Research Tools

- Khwezi Trade – Top Customer Support in Botswana

- CM Trading – Best Mobile Trading App

- Trade Nation – Most Variety of Currencies in Botswana

- Scope Markets – Top Trading Platforms

- IFX Brokers – Best Tier Two Broker in Botswana

- RCG Markets – Best Experienced Broker that is FSCA-Regulated

1. Velocity Trade

As a global electronic trading platform, Velocity Trade Limited serves traders from all over the globe. Its inception dates to 2007, and Velocity Trade Limited is an Australian company headquartered in Australia.

Velocity Trade’s offices are in four countries (Canada, New Zealand, South Africa, and the United Kingdom), making it a worldwide broker. For over 15 years, Velocity Trade has provided its clients with unrivalled foreign exchange market access.

In addition, Velocity trade facilitates trades in stock shares on its customers’ behalf. It aids its clients by providing various trading tools and strategies applicable across various marketplaces.

Features

| Feature | Information |

| ⚖️ Regulation | ASX, TMX, FCA, IIROC, AFM, FSCA, ASIC |

| ✅ Regulated in Botswana? | No |

| 💵 Minimum Deposit | No Minimum Deposit |

| 📈 Average spread from | Variable |

| 📊 Commissions from | Variable |

| 💸 Account Types | • Live Trading Account |

| 📱 Trading Platforms | • Velocity Trade Platform |

| ✔️ No-Deposit Bonus | No |

| 💻 Range of Markets | • Forex • Equities • Commodities • Futures • Options • CFDs |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Velocity Trade is extremely well-regulated and offers global trading solutions. | Velocity Trade caters specifically to institutional clients. |

| There is a vast range of tradable instruments. | There are no bonuses, and the trading conditions are unavailable on the website. |

| Traders can expect comprehensive solutions. | |

| Velocity Trade has high asset liquidity, which extends to margin trading and instruments. |

2. IG Markets

Founded in 1974, IG Group (IG) now serves a global clientele of more than 178,000. Traders of Contracts for Difference (CFDs) from all around the world are welcome at IG. IG generates revenue via the spread when its clients “cross” the spread while placing trades.

Every time you buy or sell a share through a contract for difference (CFD), you will be charged a commission on top of the market spread. Beginning with a proprietary, user-friendly web-based offering, IG provides access to a wide range of platform options and API interfaces.

Features

| Feature | Information |

| ⚖️ Regulation | FCA, BaFin, CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, CFTC, FINRA, NFA, BMA |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | IG Trading Account, IG Professional Account, IG Options Trading Account, IG Turbo24 Account, Limited Risk Account, Share Dealing Account, Exchange Account (NADEX) |

| 📊 Trading Platform | MetaTrader 4, IG Platform, ProRealTime (PRT), L2 Dealer, FIX API |

| 💰 Minimum Deposit | USD 250 / 3 363 BWP |

| 💰 Trading Assets | Forex, Shares, Indices, Commodities, Cryptocurrencies, Interest Rates, Bonds, ETFs, Futures, Options |

| 🔎 Botswanan Pula-based Account? | No |

| 💳 BWP Deposits Allowed? | Yes |

| 💰 Bonuses for Botswanan traders? | No |

| 📈 Minimum spread | 0.1 pips (DMA) on EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | No |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Offers a significant range of financial instruments, including Botswanan-specific trading instruments | High minimum deposit charged |

| There are several powerful trading platforms offered | Inactivity fees apply |

| There are competitive trading conditions that include low spreads, low commissions, and reliable trade execution | |

| Traders can get free trading signals | |

| There is a comprehensive IG Academy offered with dedicated educational resources | |

| Convenient funding options provided along with free deposits and withdrawals | |

| FIX API Direct Market Access trading is offered | |

| There are Swap-Free Accounts offered for Islamic traders |

3. AvaTrade

AvaTrade is a heavily licensed and regulated service provider that empowers investors to trade CFDs on FX, Stocks, Commodities, Crypto, Indices & Options.

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA, CBI, BVI, FSCA, FRSA, ISA

Trading Desk

MT4, MT5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

AvaTrade is a heavily licensed and regulated service provider. AvaTrade Regulations include:

- Australian Securities and Investments Commission (ASIC)

- South African Financial Sector Conduct Authority (FSCA)

- Polish Financial Supervision Authority

Features

| Feature | Information |

| ⚖️ Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, FRSA, CySEC, ISA |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Retail Investor Account, Professional Account Option |

| 📊 Trading Platform | AvaTradeGO, AvaOptions, AvaSocial, MetaTrader 4, MetaTrader 5, DupliTrade, ZuluTrade |

| 💰 Minimum Deposit (BWP) | $100 / 1343 BWP |

| 💰 Trading Assets | Foreign currencies, Cryptocurrencies, Commodities, Treasuries, Bonds, Indices, Stocks, ETFs, Options, CFDs, Precious Metals |

| 🔎 Botswanan Pula-based Account? | No |

| 💳 BWP Deposits Allowed? | No |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 0.9 pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| AvaTrade is multi-regulated and one of the most trusted online trading brokers in the world | Variable spreads are not offered |

| There is a wide range of financial instruments that can be traded across financial markets | There is a limited choice between account types |

| There are several technical indicators, economic indicators, and other solutions for advanced traders | Inactivity fees are applied |

| There are several trading platforms to choose from | Currency conversion fees may be applied |

| There is a decent selection of educational material that helps beginner traders navigate complex instruments and lower the degree of risk they are often exposed to | There is a limited number of base currency options offered on accounts |

| There is a multitude of social trading opportunities offered | |

| The broker accepts any trading strategy including automated trading, expert advisors, scalping, hedging, and others. |

4. Exness

Botswanans have another top-tier option in Exness, a broker licensed by the Financial Sector Conduct Authority (FSCA) as a Financial Services Provider (FSP).

Exness is a major foreign exchange (FX) broker in Botswana and throughout the world and allows traders to open accounts denominated in many currencies. In addition, Botswanans can easily make deposits and withdrawals using local online banking systems.

Exness’ forex trading spreads are comparable with those of other forex and CFD brokers, albeit they vary based on the products traded.

In addition to having no costs associated with deposits, withdrawals, or inactivity, this broker also provides one of the highest tradings leverages in the country.

Features

| Feature | Information |

| 📈 Account Base Currencies | AED, ARS, AUD, AZN, BDT, BHD, BND, BRL, CAD, CHF, CNY, EGP, EUR, GBP, GHS, HKD, HUF, IDR, INR, JOD, JPY, KES, KRW, KWD, KZT, MAD, MXN, MYR, NGN, NZD, OMR, PHP, PKR, QAR, SAR, SGD, THB, UAH, UGX, USD, UZS, VND, XOF, ZAR |

| 📊 Minimum Spread | 0.0 pips EUR/USD |

| 💳 Botswanan Deposits/Withdrawals | Yes |

| ⚖️ CBN Regulation | No |

| 📊 Account Types | Standard Account, Standard Cent Account, Raw Spread Account, Zero Account, Pro Account |

| ⚖️ Regulation | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA |

| 📈 Leverage | Unlimited |

| 📊 Micro Account Offered? | No |

| 📈 Trading Tools | Analytical tools, Trading calculators, currency converter, tick history, economic calendar |

| 💻 Educational Material | None |

| 👥 Botswanan-Based Customer Support | No |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The broker has a global presence and has authorization and regulation with market regulators around the globe | There is a limited selection of tradable instruments and only a few asset classes |

| Offers instant withdrawals and deposits | There are only a few funding options offered |

| Botswanan traders have a choice between several dynamic account types | |

| Client fund safety is guaranteed and there is investor protection offered | |

| Offers 24/7 customer support that is both prompt and helpful | |

| There are tight and variable spreads offered with competitive commissions |

5. Quicktrade

Since its inception in 2014, QuickTrade, a Market Maker broker in South Africa, has provided investors with access to the international financial markets through the robust and dependable MetaTrader 5 trading platform.

More than 30 currency pairings, ETFs, equities, and CFDs are available on QuickTrade. With QuickTrade’s single live trading account and its many useful features, traders may better navigate the dynamic and volatile markets and achieve their trading goals.

Features

| Feature | Information |

| ⚖️ Regulation | FSCA |

| ✅ Regulated in Botswana? | No |

| 💵 Minimum Deposit | 0 BWP / $0 |

| 📈 Average spread from | 1.2 pips |

| 📊 Commissions from | 0.03 USD per share |

| 💸 Account Types | • Standard Account |

| 📱 Trading Platforms | • MetaTrader 5 |

| ✔️ No-Deposit Bonus | No |

| 💻 Range of Markets | • Forex • Indices • Commodities • Stocks |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Quicktrade is a well-regulated broker that offers comprehensive trading solutions. | There is a limited choice between trading accounts. |

| Botswanans can access several markets using MetaTrader 5 on mobile, web, and desktop. | ZAR is the only accepted base currency. Therefore, BWP deposits and withdrawals will face currency conversion fees. |

| Traders can expect a fair, transparent, and safe trading environment with Quicktrade. | Negative balance protection is not applied to retail trading accounts. |

| There is a limited range of markets offered. |

6. FXCM

FXCM is a UK-based broker that is regulated by the UK’s Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), the Financial Sector Conduct Authority of South Africa (FSCA), and the Cyprus Securities and Exchange Commission (CySEC).

Min Deposit

USD 50 / 672 BWP

Regulators

FCA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

–

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

FXCM is well-regulated by the UK’s Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), the Financial Sector Conduct Authority of South Africa (FSCA), and the Cyprus Securities and Exchange Commission (CySEC).

Features

| Features | Information |

| ⚖️ Regulation | FCA, ASIC, CySEC, FSCA |

| 💸 Minimum Withdrawal Time | – |

| 📈 Maximum Withdrawal Time | 2 to 4 working days |

| 💰 Instant Deposits/Withdrawals? | Yes, deposits |

| 💳 BWP-Denominated Account? | No |

| 📱 Minimum Deposit Amount | USD 50 / 672 BWP |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| FXCM supports both CFD and forex trading and offers several trading options | There are high commission charges |

| Botswanans can access leverage up to 1:400 | An inactivity fee and currency conversion fee are charged |

| Several asset classes can be traded | There is a limited choice between retail accounts |

| FXCM offers several trading platforms and trading tools that Botswanans can use to their advantage | Does not support MT5 |

| There are competitive spreads on the CFD account | There is no option to register an account denominated in BWP |

| There is a demo and Islamic account | Withdrawal fees apply |

| FXCM is well-regulated by four reputable entities | The Islamic Account faces additional fees |

| Client fund security and investor protection are guaranteed |

7. Tickmill

Tickmill was established in 2015 and developed by a group of seasoned global market traders who deeply understand what it takes for traders to succeed. In addition, the liquidity of Tickmill comes from the world’s finest financial institutions.

Min Deposit

$100 / 1 343 BWP

Regulators

CySEC, FCA, FSA, FSCA, Labuan FSA

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

62

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

The liquidity pool comprises all this cash that has been amassed. Your order will be executed at the best available price from the liquidity pool.

Tickmill Group of Companies owns and operates Tickmill Ltd., which is regulated and authorized in South Africa by the FSCA.

Features

| Feature | Information |

| ⚖️ Regulation | FSA, FCA, CySEC, Labuan FSA, FSCA |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | $100 / 1 343 BWP |

| 📈 Average spread from | 0.0 pips EUR/USD |

| 📈 Maximum Leverage | 1:500 |

| 👥 Customer Support | 24/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The broker offers commission-free trading across financial instruments | The broker does not accept clients from the United States and some other regions |

| There are powerful trading platforms to choose from | Fixed spread accounts are not offered |

| The broker is well-regulated in several regions | |

| There is a selection of popular financial instruments that can be traded | |

| There are several advanced trading tools offered |

8. FXTM

Trading the markets, such as CFDs on forex, equities, cryptocurrencies, and commodities, have never been easier than with FXTM (Forex Time), which began in 2011. FXTM’s mission is to help traders become more proficient in the market to maximize the return on their capital.

ForexTime (FXTM) caters to a wide variety of traders by providing many account options and a range of leverage.

Min Deposit

USD 10

Regulators

CySec, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

60

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

In addition, FXTM has several reputable licenses worldwide, demonstrating the company’s dedication to regulation and transparency in the forex market.

Brokers must follow the law so that their business is conducted fairly and honestly for the benefit of all parties involved.

Features

| Feature | Information |

| ⚖️ Regulation | CySEC, FSCA, FCA, FSC Mauritius |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Micro Account, Advantage Account, Advantage Plus Account |

| 📊 Trading Platform | MetaTrader 4, MetaTrader 5, FXTM Trader |

| 💰 Minimum Deposit | 134 Botswanan Pula equivalent to $10 |

| 💰 Trading Assets | Precious Metals, Stock Trading, Stock CFDs, Indices, Forex Indices, Forex Currency Pairs (including minor, major, and exotic pairs), Commodities, Stock Baskets |

| 🔎 Botswanan Pula-based Account? | Yes |

| 💳 BWP Deposits Allowed? | Yes |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 0.0 pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| FXTM is a multi-regulated and a reputable broker that has gained a high level of trustworthiness | Inactivity fees apply when the retail investor account becomes dormant |

| Dedicated customer support offered for Botswanan traders Several deposit options and withdrawal methods offered | |

| There is a low minimum deposit requirement | |

| Commission-free trading is offered | |

| Deposit fees are not charged on any payment methods | |

| Withdrawal processing times are quick | |

| There are several educational tools offered | |

| There is an exclusive risk management tool offered |

9. GT247

The GT247 internet broker is based in Johannesburg, South Africa. As a forex and CFD broker, GT247 offers trading on more than 250 products using the robust and widely used MetaTrader 5 platform.

The main company, Purple Group, Ltd., is traded on the Johannesburg Stock Exchange (JSE) under the ticker code “JSE: PPE,” and GT247 has been in business since 1998 as one of its subsidiaries.

There is a combined 100+ years of expertise at the trading desk, allowing them to provide traders with some of the best prices and terms available.

Features

| Feature | Information |

| ⚖️ Regulation | FSCA |

| ✅ Regulated in Botswana? | No |

| 💵 Minimum Deposit | 0 BWP / $0 |

| 📈 Average spread from | 1 pip |

| 📊 Commissions from | None |

| 💸 Account Types | • ZAR Account • USD Account |

| 📱 Trading Platforms | • MetaTrader 5 |

| ✔️ No-Deposit Bonus | No |

| 💻 Range of Markets | • Equities • Commodities • Cryptocurrencies • Forex • Indices |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| GT247 offers MetaTrader 5 through which trades can be executed. | GT247 has limited account funding options. |

| Botswanans can trade more than 250 financial instruments. | There is a limited choice between account types. |

| GT247 is well-regulated by the FSCA. | There are restrictions on leverage. |

| There is no BWP-denominated account. |

10. FXPro

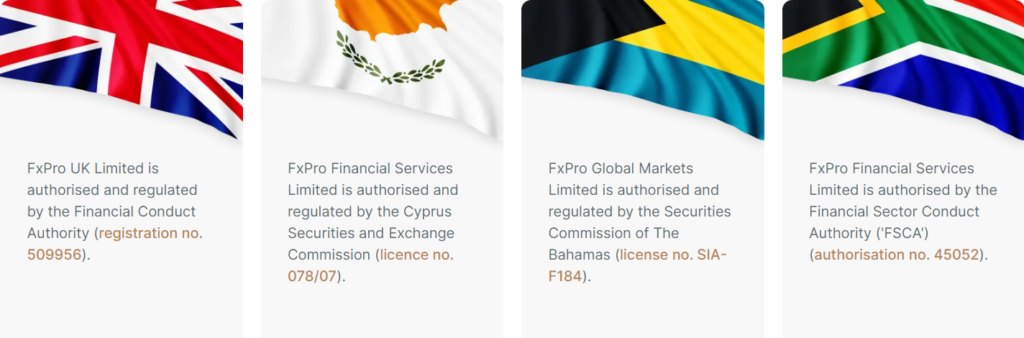

FxPro is authorized and regulated by the FCA, CySEC, and by the FSCA. (Pty) Ltd is a registered FSCA provider.

Min Deposit

USD 100 / 1321 BWP

Regulators

CySec, FSCA, FCA

Trading Desk

FxPro Trading Platfrom

Crypto

Yes

Total Pairs

70+

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

FxPro offers clients access to Contracts for Difference (CFDs) on 6 asset classes in more than 170 countries worldwide.

Features

| Feature | Information |

| ⚖️ Regulation | FCA, CySEC, FSCA, SCB |

| ✅ Regulated in Botswana? | No |

| 💵 Minimum Deposit | 1 321 BWP ($100) |

| 📈 Account Types | • FxPro cTrader • FxPro MT4 • FxPro MT5 • Islamic Account • ProEdge |

| 📊 Trading Platforms | • FxPro • MetaTrader 4 • MetaTrader 5 • cTrader • FxPro Edge |

| 📚 Educational Material and Tools | • Educational Content • Demo Account |

| 📱 Research and Features | • Trading Centra • Economic Calendar • VPS • Trading Calculators |

| ✔️ Social and Copy Trading? | Yes |

| 💻 Demo Account? | Yes |

| 📉 Average Starting Spread EUR/USD | 0.4 pips |

| 💰 Commission Charges | $35 per million USD traded |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| FxPro offers 70 forex CFDs that can be traded across powerful trading software. | There is a limited number of share CFDs that can be traded. |

| Botswanans can expect low account fees, and several flexible payment options are offered. | There is limited education. |

| FxPro is well-regulated and guarantees client fund protection. | There is no BWP-denominated account. |

| FxPro integrated Trading Central and offers economic calendars, earnings, and calculators. |

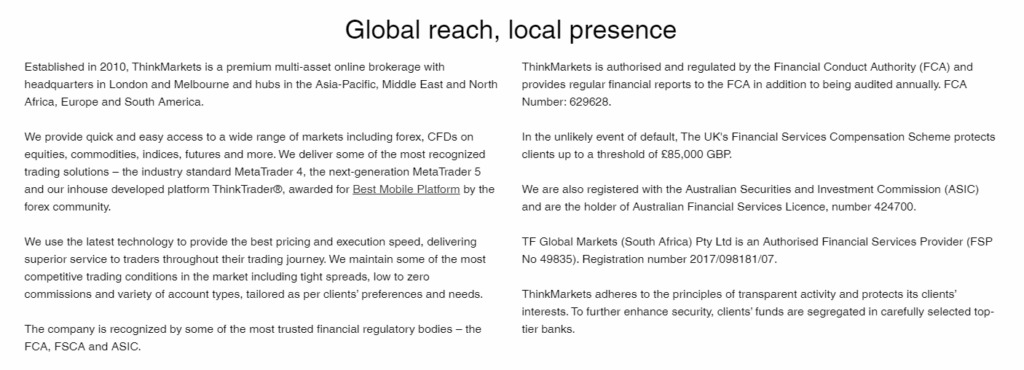

11. ThinkMarkets

Even though ThinkMarkets’ trading charges are higher than usual on its entry-level account, the broker is popular among experienced traders because of its wide selection of tradable assets and its comprehensive suite of trading tools.

Forex pairings, indices, commodities, 3500+ share CFDs, and 20+ cryptocurrency pairs are just some of the tradable assets offered by ThinkMarkets.

ThinkMarkets provides VPS hosting, along with support for MT4, MT5, and their proprietary platform, ThinkTrader, and some of the greatest trading tools in the business, such as Trading Central and Zulutrade.

Trading with ThinkMarkets is risk-free for Botswanans. Local oversight comes from the Financial Sector Conduct Authority.

Furthermore, ThinkMarkets is regulated by the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA) of the United Kingdom.

Features

| Feature | Information |

| ⚖️ Regulation | ASIC, FCA, FSCA |

| ✅ Regulated in Botswana? | No |

| 💵 Minimum Deposit | 0 BWP / $0 |

| 📈 Average spread from | 0.0 pips |

| 📊 Commissions from | 3.5 USD per side |

| 💸 Account Types | • Standard Account • ThinkZero Account |

| 📱 Trading Platforms | • MetaTrader 4 • Metatrader 5 • ThinkTrader • ZuluTrade |

| ✔️ No-Deposit Bonus | No |

| 💻 Range of Markets | • Forex • Share CFDs • CFDs • Indices • Precious Metals • Commodities • Cryptocurrencies |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| There is no set minimum deposit when Botswanans trade with ThinkMarkets. | There is limited market analysis on ThinkMarkets. |

| ThinkMarkets is well-regulated and offers robust trading platforms. | ThinkMarkets does not offer a BWP-denominated account. |

| There is a range of financial instruments that can be traded through ThinkMarkets. |

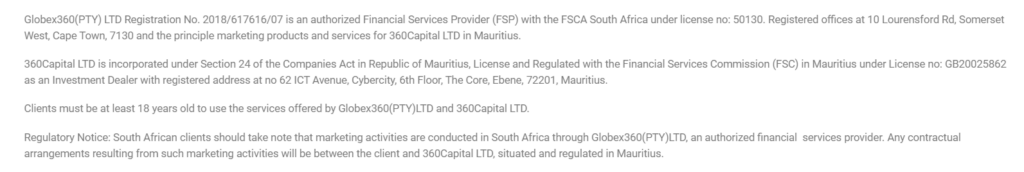

12. Globex360

Globex360, a broker based in South Africa and authorized by the Financial Sector Conduct Authority (FSCA), provides access to fewer assets than competing brokers.

Globex360 was established in 2017 and has been under regulation by the FSCA since 2019, which means that Globex360 is not as battle-tested as other brokers in the industry.

Furthermore, client funds are held in a segregated account, as required by the FSCA. However, there is no negative balance protection, so traders risk losing more than they initially invested.

There are three different trading accounts available on Globex360, each with its own set of trading costs. In addition, both the MT4 and MT5 versions of the MetaTrader trading platform are compatible with Globex360.

The ability to easily perform market research and analysis, place and close trades, and employ automated trading software from a third party is made possible by these platforms.

Features

| Feature | Information |

| ⚖️ Regulation | FSCA |

| ✅ Regulated in Botswana? | No |

| 💵 Minimum Deposit | 130 BWP / $100 |

| 📈 Average spread from | 1.2 pips |

| 📊 Commissions from | 8 USD per lot |

| 💸 Account Types | • Standard Account • Expert Account |

| 📱 Trading Platforms | • MetaTrader 4 |

| ✔️ No-Deposit Bonus | No |

| 💻 Range of Markets | • Forex • Commodities • Equities • Indices |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The account opening process is quick and effortless. | There is a limited demo account offered. |

| Globex360 is well-regulated and keeps all client funds in segregated accounts. | The trading and non-trading fees are not transparent. |

| Traders can use the MAM service, copy trading, and more. | Customer support is lacking. |

| Negative balance protection is not offered. |

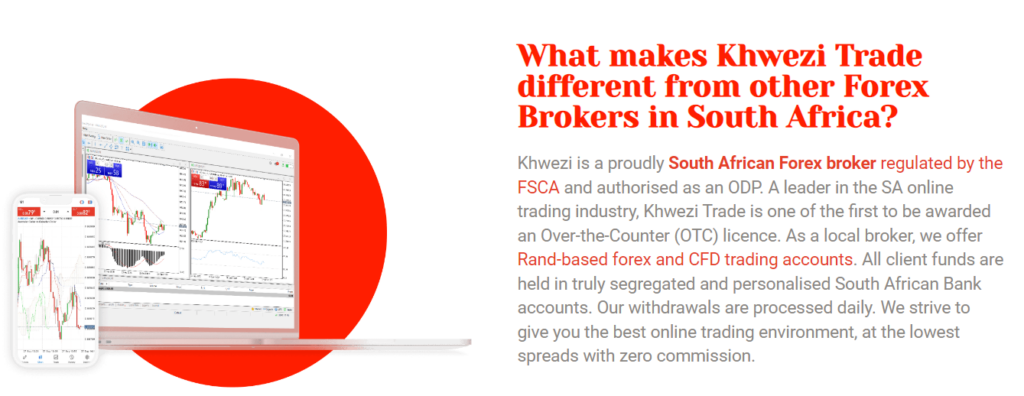

13. Khwezi Trade

Khwezi Trade was established in 2013 and is an FSCA-regulated local broker with low-deposit ZAR accounts and a reputation for putting its clients’ needs first. Botswanan traders needing an MT4 broker with dedicated service might choose Khwezi Trade.

Khwezi Trade is a reputable broker in Cape Town, South Africa. Khwezi Financial Services is a corporation’s subsidiary governed by the Financial Sector Conduct Authority of South Africa.

Moreover, Khwezi Trade was the second broker in South Africa to obtain its ODP license, which it did just recently.

Features

| Feature | Information |

| ⚖️ Regulation | FSCA |

| ✅ Regulated in Botswana? | No |

| 💵 Minimum Deposit | R500 / 360 BWP |

| 📈 Average spread from | 0.4 pips |

| 📊 Commissions from | None, only the spread is charged |

| 💸 Account Types | • ZAR One Account • USD One Account |

| 📱 Trading Platforms | • MetaTrader 5 |

| ✔️ No-Deposit Bonus | No |

| 💻 Range of Markets | • Forex • Commodities • Indices |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Khwezi Trade is well-regulated and offers fast and free withdrawals. | Khwezi Trade is only regulated by the Tier-2 FSCA and has no other Tier-1 regulation. |

| Khwezi Trade offers great customer support. | There is no Islamic Account offered to Muslim traders. |

| The spreads are wide, and there is a high minimum deposit requirement. |

14. CM Trading

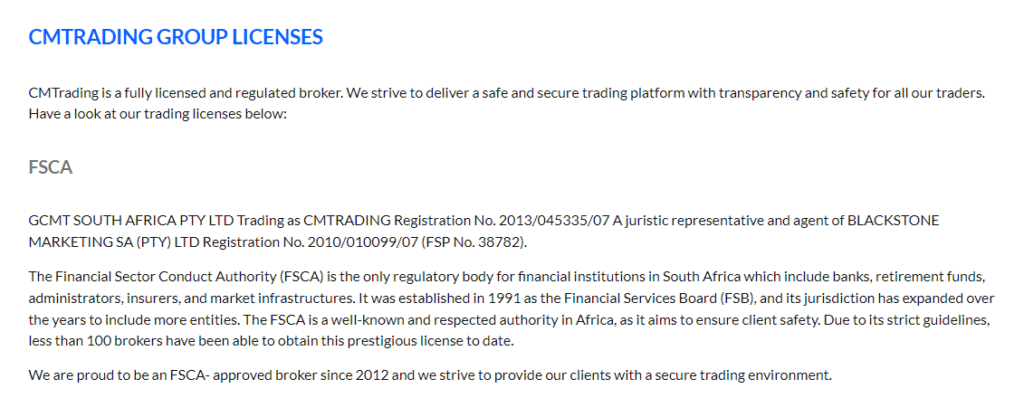

CM Trading is a well-established, award-winning Forex Broker that is well-regulated by The Financial Sector Conduct Authority (FSCA) and The Seychelles Financial Services Authority (FSA) respectively.

Min Deposit

USD100

Regulators

FSA

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

154

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

CM Trading is well-regulated by The Financial Sector Conduct Authority (FSCA) and The Seychelles Financial Services Authority (FSA) respectively.

Features

| Feature | Information |

| ⚖️ Regulation | FSA, FSCA |

| ✅ Regulated in Botswana? | Yes |

| 💵 Minimum Deposit | USD 100 / 1895 BWP |

| 📈 Average spread from | 1.2 pips |

| 📈 Maximum Leverage | 1:200 |

| 💸 Account Types | Bronze Account Silver Account Gold Account Premium Account |

| 📱 Trading Platforms | MetaTrader 4 CM Trading Web CopyKat Expert Advisors, Trading apps |

| ✔️ No-Deposit Bonus | No |

| 💻 Range of Markets | Currencies, Cryptocurrencies (Bitcoin, Litecoin Ethereum) CFDs (Gold, Silver, Other) Precious Metals Stocks Stock Indexes Oil, and Other Commodities |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Well-regulated broker with a wide variety of financial instruments offered | An inactivity fee may apply to dormant accounts |

| Client capital is kept in segregated accounts with top tier-1 banks. | Both deposit fees and withdrawal fees are charged |

| Offers a wide range of trading tools that can be used | Competitive spreads, but not the lowest in the industry when compared to competitors |

| Supports several trading strategies including algorithmic trading, scalping, hedging, and more. | |

| There is a comprehensive proprietary trader platform offered along with third-party apps and platforms | |

| CM Trading accommodates the Botswanan market | |

| Reasonable minimum deposit requirements for account tiers | |

| CM Trading has a good reputation and a long-standing history as a CFD and forex provider |

15. Trade Nation

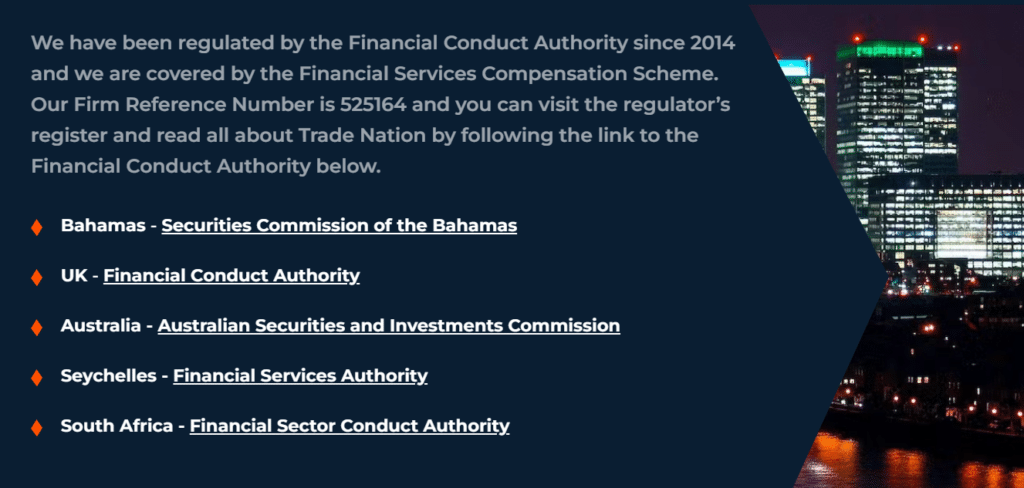

Regulated by the Financial Sector Conduct Authority (FSCA) in South Africa, FCA, ASIC, and SCB. Trade Nation, formerly Core Spreads, is now a trusted choice for many Botswanan investors.

Min Deposit

USD 0

Regulators

FSCA, SCB

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

33

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Trading accounts can be opened in several currencies, and traders can access MT4. Unlike its competitors, Trade Nation uses non-traditional sources of information to educate its customers and help them make trading decisions.

Trade Nation’s exclusive news aggregation platform makes it simple to zero in on the market developments most relevant to your trading strategies.

Features

| Feature | Information |

| ⚖️ Regulation | FSCA |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | USD 0 |

| 📈 Average spread from | Varies |

| 📈 Maximum Leverage | 1:200 |

| 👥 Customer Support | 24/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Trade Nation does not charge a minimum deposit, offering Botswanan traders with flexibility | There is a limited selection of funding options |

| The broker offers transparent fixed financial spread trading across several asset classes | The spread costs are not the lowest in the industry |

| There is a powerful desktop platform, innovative mobile trading app, and web-based trading platform | There are leverage restrictions on the UK and Australian clients |

| There is commission-free trading offered | United States clients are not accepted |

| There is a wide selection of educational content and beginner guides as part of an all-inclusive education material package | Inactivity account fees may apply |

| There is a dedicated customer service team offered | |

| There is an active business community offered along with a dedicated affiliate program | |

| Trade Nation offers international stability through a well-established regulatory framework | |

| There is no deposit fee or withdrawal fee charged on deposit or withdrawal methods | |

| There are several base currencies to choose from when registering a retail investor account |

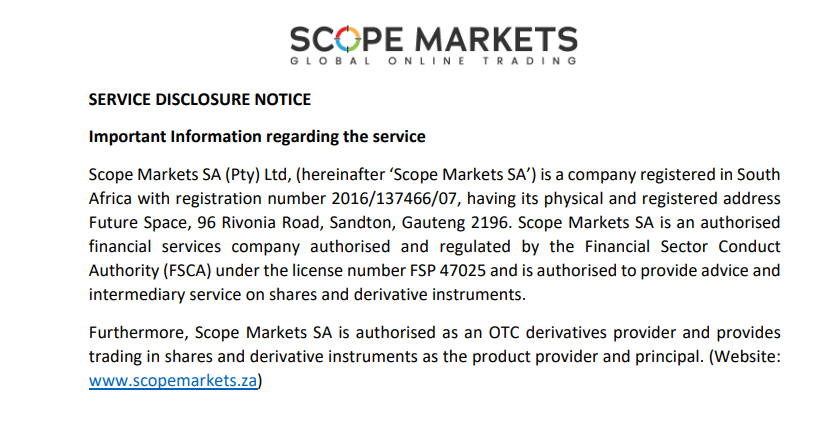

16. Scope Markets

When you open an account with Scope Markets EU, you will have access to online trading services through the robust and feature-rich MetaTrader 5 (MT5) platforms available on desktop, web, and mobile devices.

Min Deposit

1 328 BWP / $100

Regulators

IFSC, FSCA, CMA, CySEC

Trading Desk

MT4, MT5

Crypto

No

Total Pairs

70+

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Scope Markets is a well-known broker in the financial sector that aspires to provide all its customers access to state-of-the-art trading platforms.

Trading mostly in Forex and CFDs, their management team has been in the business for over 20 years, making connections and learning what it takes to be successful to provide traders of all skill levels with the best possible trading services.

Features

| Features | Information |

| ⚖️ Regulation | IFSC, FSCA, CMA, CySEC |

| 💸 Minimum Withdrawal Time | Up to 48 Hours |

| 📈 Maximum Withdrawal Time | Up to 8 working days |

| 💰 Instant Deposits/Withdrawals? | No |

| 💳 BWP-Denominated Account? | No, only USD, GBP, or EUR |

| 📱 Minimum Deposit Amount | 1,300 BWP ($100) |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| There is a decent range of tradable instruments offered across financial markets. | There are no managed accounts. |

| The trading conditions are favourable and involve low spreads. | There is a limited range of additional trading tools offered. |

| Scope Markets offers 24/5 customer support. | FIX API is not supported. |

| There are a few helpful calculators offered. | |

| There is an Islamic account option for Muslim traders. | |

| Commission-free trading is made available. |

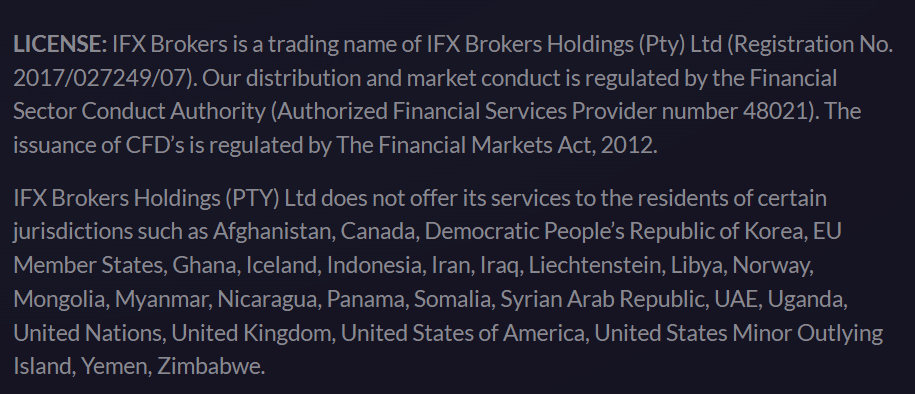

17. IFX Brokers

With a range of account options, support for MT4 and MT5 trading platforms, and a large selection of Forex pairings, IFX Brokers has quickly been a favorite among many traders since its 2018 founding.

Min Deposit

USD 10

Regulators

FSCA

Trading Desk

No Trading Desk

Crypto

Yes

Total Pairs

200

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

IFX Brokers is a tier 2 broker authorized by the South African Financial Sector Conduct Authority (FSCA), as opposed to brokers that several regulators regulate from around the globe.

South Africa’s Financial Sector Conduct Authority (FSCA) is not the most stringent regulator, but it is working to become such.

Features

| Feature | Information |

| ⚖️ Regulation | FSCA |

| ✅ Regulated in Botswana? | No |

| 💵 Minimum Deposit | 130 BWP / $10 |

| 📈 Average spread from | 0.5 pips |

| 📊 Commissions from | 6 USD per lot |

| 💸 Account Types | • Cent Account • Standard Account • Premium Account • VIP Account • Islamic Account |

| 📱 Trading Platforms | • MetaTrader 4 • MetaTrader 5 |

| ✔️ No-Deposit Bonus | No |

| 💻 Range of Markets | • Forex • Commodities • Cryptocurrencies • Indices |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| IFX Brokers is well-regulated by the FSCA. | IFX Brokers has limited market analysis. |

| There is a decent selection between trading accounts offered. | There are limited educational materials offered. |

| There is a low minimum deposit requirement. | The spreads charged are wider than that of other brokers. |

| Botswanans can register several commission-free accounts with IFX Brokers. |

18. RCG Markets

Established in 2018, RCG Markets (Pty) Ltd functions as a financial services intermediary. RCG Markets gives individuals, professional money managers, and corporations direct market access for executing transactions in various CFDs and FX.

The management team of RCG Markets comprises top professionals in their field with over 35 years of experience.

With RCG Markets, traders can adjust their leverage to suit their needs and take full command of all trading activities.

Features

| Feature | Information |

| ⚖️ Regulation | FSCA |

| ✅ Regulated in Botswana? | No |

| 💵 Minimum Deposit | $50 USD / 947 BWP |

| 📈 Average spread from | 0.0 pips |

| 📊 Commissions from | 7 USD |

| 💸 Account Types | • Classic Account • Raw Account • ECN Account |

| 📱 Trading Platforms | • MetaTrader 4 |

| ✔️ No-Deposit Bonus | No |

| 💻 Range of Markets | • Forex • Shares • Metals • Energies • Indices |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| RCG Markets is well-regulated and offers the popular MT4. | RCG Markets does not have any Tier-1 regulation. |

| Spreads with RCG Markets start from 0.0 pips, and commission-free options are offered. | There is only one trading platform offered. |

How to Choose the Right Forex Broker in Botswana

Botswanan traders must evaluate the following components of a forex broker to decide whether the broker is suited to their unique trading objectives or needs.

Regulations and Licenses

This is the first vital component that Botswanan traders must thoroughly evaluate. Reputable brokers are regulated by market regulators such as FCA, ASIC, CySEC, FSCA, and others.

Botswanans must beware when dealing with brokers with only offshore regulations such as FSA, SVG BVI, FSC, and others.

Account Features

Account Features include leverage trading and margin requirement, commissions and spreads, initial deposit, additional features on retail investor accounts, and so on.

Deposits and Withdrawals

Botswanans must evaluate the payment options available, the processing times on withdrawal requests, deposit currencies offered, the withdrawal fee, deposit fees, and minimum withdrawal limits, among other trading and non-trading fees.

Range of Markets

The range of markets offered refers to the number and range of tradable instruments the broker offers. Therefore, Botswanans must consider what they wish to trade and what is available.

Customer Support

Customer Support is another crucial factor. Botswanans must check the availability of support (trading hours), the quality of support, and the promptness with which the customer support team responds to queries.

Trading Platform

A trading platform is the Botswanan trader’s portal to the financial markets. Therefore, traders must ensure that the trading platform has the necessary technical indicators, fundamental analysis, technical analysis, economic calendar, charting, newsfeed, and other tools they may need.

Education and Research

Education and Research come in handy to both novice traders and experienced investors. Education includes some of the following:

➡️ eBooks

➡️ Trading guides

➡️ Trading knowledge on leveraged products

➡️ A risk warning on complex instruments

➡️ Educational videos

Research can include some of the following:

➡️ Trading tools

➡️ Commentary

➡️ Status of International Markets

➡️ Price movements

➡️ Market sentiments

➡️ Whether there is a volatile market

➡️ Exchange Rates

➡️ Expert opinions and other resources can help experienced traders make informed trading decisions.

The Best Forex Brokers in Botswana

In this article, we have listed the best brokers that offer forex trading to traders in Botswana. In addition, we have further identified the brokers that offer additional services and solutions to Botswanan traders.

Best MetaTrader 4 / MT4 Forex Broker in Botswana

Min Deposit

USD 25

Regulators

FCA UK

Trading Platform

MT5, MT4, OctaTrader

Crypto

Yes

Total Pairs

28

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, OctaFX is the best MT4 forex broker in Botswana. OctaFX is an MT4 and MT5 broker that provides Botswanans with various markets. OctaFX offers a choice of accounts via MT4, including ECN and STP accounts, with superior trade execution.

Best MetaTrader 5 / MT5 Forex Broker in Botswana

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, AvaTrade is the best MetaTrader 5 forex broker in Botswana. In addition, AvaTrade is regarded as one of the most secure MT5 forex brokers.

No commission is charged for trading currency pairings, only leaving the spread to be paid. A demo account is also available for traders to sharpen their abilities via MT5 and several other platforms.

Best Forex Broker for beginners in Botswana

Min Deposit

$100

Regulators

CFT, NFA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FOREX.com is the best forex broker for beginners in Botswana. FOREX.com is a broker renowned for low trading fees and beginner-friendly solutions. In addition, FOREX.com offers several educational materials and a helpful demo account.

Best Low Minimum Deposit Forex Broker in Botswana

Overall, Exness is the best Low Minimum Deposit Forex Broker in Botswana. Exness has a minimum deposit requirement of 10 USD / 130 BWP, making it easy for Botswanans to start trading 278 instruments.

Exness also offers MT4 and MT5 through which trades can be made. In addition, it offers some of the best trading tools, charting capabilities, technical indicators, expert advisors, and more.

Best ECN Forex Broker in Botswana

Min Deposit

USD 0

Regulators

CySEC, FCA, DFSA, FSCA, FSA, CMA

Trading Desk

MT4, MT5, HFM APP

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

0

Account Activation Time

24 Hours

Overall, HFM is the best ECN forex broker in Botswana. HFM is a hybrid forex and CFD broker that uses STP and ECN technology to ensure that Botswanans get the best pricing, minimal slippage, no requotes, and the fastest trade execution.

HFM uses the best liquidity providers who aggregate the pricing that Botswanans can see on MT4, MT5, and the HF App for Android and iOS.

Best Islamic / Swap-Free Forex Broker in Botswana

Overall, eToro is the best Islamic / Swap-Free forex broker in Botswana. eToro is a renowned social trading platform that offers Muslim traders an Islamic Account.

eToro does not charge any interest on positions held for over 24 hours. However, registering an Islamic Account can be expensive initially, requiring a 1,000 USD / 13,400 BWP deposit.

Best Forex Trading App in Botswana

Overall, CMC Markets is the best forex trading app in Botswana. In addition, CMC Markets offers a user-friendly mobile app with research tools, powerful charts, customizable watch lists, news reports, and a range of educational materials.

Best Lowest Spread Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

FCA, CySEC, IFSC, KNF

Trading Desk

No Trading Desk

Crypto

Yes

Total Pairs

48

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, XTB is the best lowest-spread forex broker in Botswana. XTB is a well-known forex and CFD broker with low and competitive forex spreads from 0.1 pips depending on the financial instrument and the market conditions.

XTB is also a good broker in terms of educational materials and research capabilities, providing traders with comprehensive market analysis across markets.

Best Nasdaq 100 Forex Broker in Botswana

Min Deposit

USD 10

Regulators

CySec, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

60

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXTM is the best Nasdaq 100 forex broker in Botswana. FXTM is a multi-regulated forex and CFD broker that accommodates Botswanan traders with a keen interest in Nasdaq. Traders can expect low and competitive spreads, a choice between accounts, and powerful trading platforms.

Best Volatility 75 / VIX 75 Forex Broker in Botswana

Overall, IG is Botswana’s best Volatility 75 / VIX 75 forex broker. IG is one of the best CFD brokers with powerful proprietary trading technology.

IG is well-regulated and offers Botswanans access to VIX75, with spreads from 0.04 pips / 0.13% and zero commission charges.

Best NDD Forex Broker in Botswana

Min Deposit

USD 50 / 672 BWP

Regulators

FCA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

–

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXCM is the best NDD forex broker in Botswana. FXCM is a No-Dealing Desk broker with STP and ECN execution across several markets.

In addition, FXCM offers a choice between third-party platforms in addition to technical indicators, charting tools, and competitive trading conditions.

Best STP Forex Broker in Botswana

Min Deposit

USD 10

Regulators

IFSC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

36

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, RoboForex is the best STP forex broker in Botswana. RoboForex is popular forex and CFD broker with competitive trading conditions. RoboForex offers STP execution with liquidity sourced from top providers.

Botswanans can expect access to over 12,000 instruments via powerful and innovative third-party platforms.

Best Sign-up Bonus Broker in Botswana

Overall, Windsor Brokers is the best sign-up bonus broker in Botswana. Windsor Brokers is a well-regulated broker that offers Botswanans a welcome account funded with 30 USD in trading credit. With this account, Botswanans can explore the platform or risk-free test their strategies.

You might also like: Best High Leverage Forex Brokers

You might also like: Best Low Minimum Deposit Brokers

You might also like: Best FTSE 100 Brokers

You might also like: Best Trading Robots

You might also like: Best Forex Brokers

Conclusion

Botswanan traders can expect access to global markets through hundreds of international brokers who offer CFD trading to local traders. However, there are no CFD brokers regulated in Botswana.

Regardless, some reputable FSCA-regulated brokers accept Botswanan traders, and these are the best ones.

Frequently Asked Questions

What is a South African Financial Sector Regulation Act (FSCA)?

FSCA aims to enhance and support the efficiency and integrity of financial markets and to protect financial customers by promoting their fair treatment by financial institutions, as well as providing financial customers with financial education. The FSCA will further assist in maintaining financial stability.

Is FSCA a trusted market regulator?

The FSCA is a reputable market regulator classified as a Tier-2 entity.

Who regulates the forex market in Botswana?

The Bank of Botswana regulates the foreign exchange of Botswanan Pula in the country.

How can I check a broker’s FSCA regulation?

You can search for the broker’s FSP number on the FSCA’s register of OTC Derivatives Providers.

What is an ODP license?

The license for an ODP, or OTC Derivative Product, is a new type of product authorization. Providers of CFDs, options, and other derivative financial instruments.

Furthermore, an ODP license authorizes FSPs to market derivative products to and enter contracts with citizens of South Africa.

Who needs to register with the FSCA?

Every company that offers financial services or products in South Africa must register as a Financial Services Provider (FSP).

Which forex brokers offer the best trading platforms for Botswana traders?

- HFM

- AvaTrade

- Exness

- Trade Nation

- Admirals

How to compare the best forex brokers against each other?

Comparing the best forex brokers against each other requires a systematic approach to ensure you select the one that best suits your trading needs. Start by evaluating the broker’s regulatory status, ensuring they are overseen by a reputable financial authority.

Which FSCA-Regulated forex brokers are best for beginner Botswana Traders?

- AvaTrade

- Exness

Why is it important to trade with a licensed FSCA broker?

- Your funds are kept safe

- You will have access to transparent trading conditions

- You will be protected from fraudulent actors

- You will benefit from sound legal compliance by the broker

- You will have due recourse

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review