5 Best FTSE 250 Brokers in Botswana

The 5 Best FTSE 250 Index Forex Brokers in Botswana revealed. We tested and verified the best FTSE 250 Index forex brokers for Botswana Stock Traders.

This is a complete list of the Best FTSE two hundred and fifty index forex brokers in Botswana.

In this in-depth guide you’ll learn:

- What is the FTSE 250 Index?

- How to choose a forex broker for your trading style.

- How can I invest in the FTSE 250 Index?

- What is the process of trading FTSE 250 Index futures?

- Can I invest in the FTSE 250 from outside the UK?

And lots more…

So if you’re ready to go “all in” with the best United Kingdom FTSE 250 brokerages for Botswanans…

Let’s dive right in…

- Louis Schoeman

Best FTSE 250 Brokers in Botswana

| 🏛️ Broker | 👉 Open Account | 💵 Minimum Deposit | ✔️ FTSE250 Broker? | ✔️ Offers a Botswana Pula Account? |

| 1. XTB | 👉 Open Account | USD 250 / 3 320 BWP | Yes | No |

| 2. CMC Markets | 👉 Open Account | USD 0 / 0 BWP | Yes | No |

| 3. eToro | 👉 Open Account | USD 10 / 136 BWP | Yes | No |

| 4. IG | 👉 Open Account | USD 250 / 3 363 BWP | Yes | No |

| 5. Admirals | 👉 Open Account | USD 25 / 339 BWP | Yes | No |

10 Best Forex Brokers in Botswana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

What is the FTSE 250?

The FTSE 250 Index is a market-capitalization-weighted index representing the performance of the 250 mid-cap companies listed on the London Stock Exchange (LSE). These companies are the next tier below the FTSE 100 in terms of size and market capitalization.

5 Best FTSE 250 Brokers in Botswana

- ✔️ XTB – Overall, Best FTSE250 Broker in Botswana

- ✔️ CMC Markets – Top Mobile App Broker

- ✔️ eToro – Best Social Broker in Botswana

- IG – Best Broker for Beginner Traders

- Admirals – Verified MT4/MetaTrader 4 Broker

1. XTB

Overview

To trade in stocks, commodities, cryptocurrencies, indices, and more, you may sign up with XTB Online Trading, one of the industry’s most well-known and reputable forex brokers.

Furthermore, the broker’s services are provided at a moderate cost, making it a great choice for frequent traders. XTB Online Trading is a European Union-focused Forex broker with over two decades of experience in the industry.

This broker has remained one of the greatest options for traders of all stripes despite the intense competition in the sector. One of the best options available because of the inexpensive price and wide selection of markets available.

Min Deposit

USD 0 / 0 BWP

Regulators

FCA, CySEC, IFSC, KNF

Trading Desk

No Trading Desk

Crypto

Yes

Total Pairs

48

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

The broker’s flagship product is an intuitive trading platform called “xStation 5” that caters to novice and seasoned traders with a suite of useful features.

It seems that XTB places sufficient importance on the security of your funds. Therefore, your funds will be kept in completely independent accounts from the broker’s operating accounts.

The broker also places a high priority on protecting their clients’ financial information. Biometrics (fingerprint/voice verification) are used to maintain account security.

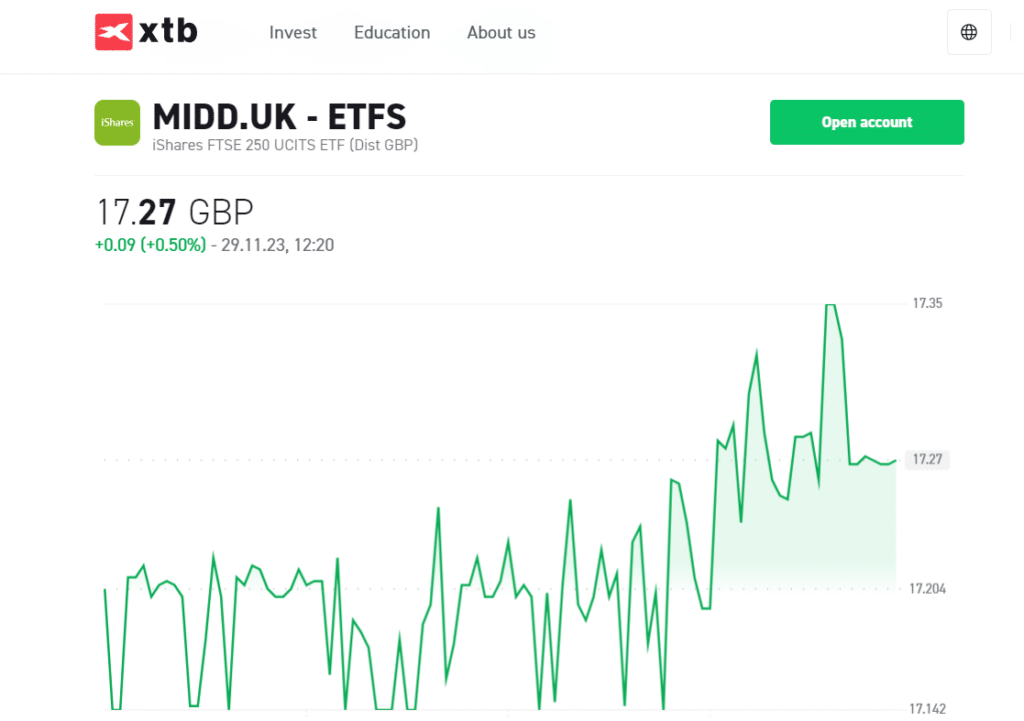

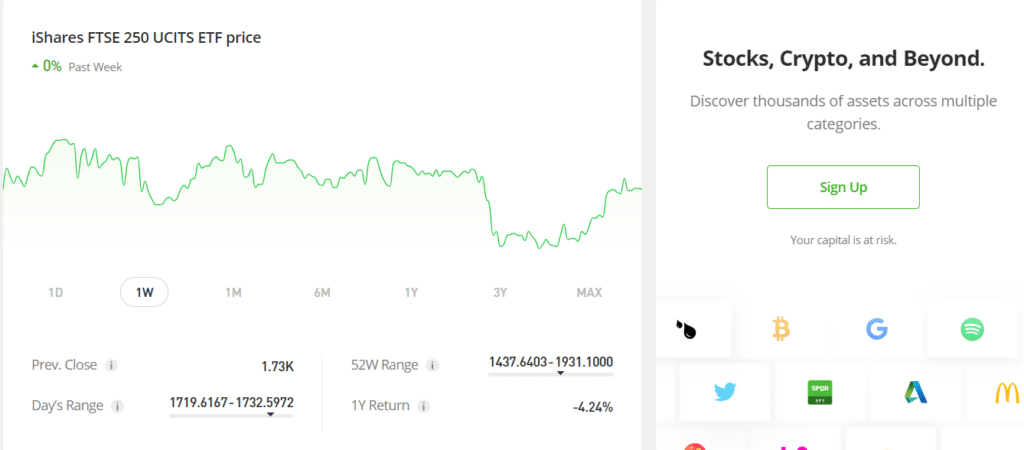

In addition, Botswanan traders can gain access to the FTSE 250 as an ETF on XTB under the symbol “MIDD.UK.” Traders should note that the typical spread is 0.2 pips, with a minimum order of 10 USD or 10 EUR.

Features

| Features | Information |

| ⚖️ Regulation | FCA, CySEC, KNF, CNMV, FSC, DFSA |

| 💸 Minimum Withdrawal Time | – |

| 📈 Maximum Withdrawal Time | 2 to 4 working days |

| 💰 Instant Deposits/Withdrawals? | Yes, deposits |

| 💳 BWP-Denominated Account? | No |

| 📱 Minimum Deposit Amount | 0 BWP ($0) |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| XTB is well-regulated and guarantees client fund security | MetaTrader is not supported |

| There are competitive trading conditions charged | Mark-up is added to spreads |

| There is a dedicated Swap-Free Account offered to Muslim Traders | Deposit and withdrawal fees are charged on several payment methods |

| There is no minimum deposit | There is no BWP account |

| XTB is suitable for beginners and professional traders |

2. CMC Markets

Overview

CMC Markets, established in 1989, is one of the most well-known and popular UK-based brokers. CMC Markets provides its unique trading platform and the next-generation Metatrader 4 trading platform, demonstrating its dedication to traders, and allowing them to take full benefit of its services.

CMC Markets offers tier-1 liquidity, and brokers supervise its trading techniques and market volatility in a similar position. CMC Markets was founded to offer Forex and CFD services through an online trading platform.

Min Deposit

USD 0 / 0 BWP

Regulators

ASIC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

300

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

In 1989, CMC Markets was formed, and its asset portfolio contains more than 10,000 CFD trading products. It encompasses various trading instruments, including indexes, bonds, stocks, trade stocks, and commodities.

CMC Markets stockbroking is a well-known and well-established broker with a reputation for competitive CFD trading and spread betting solutions. This broker is licensed in the United Kingdom and listed on the London stock market as one of the most prominent stock exchanges.

Features

| Features | Information |

| ⚖️ Regulation | BaFin, FCA, IIROC, ASIC, MAS, FMA |

| 💸 Minimum Withdrawal Time | 0 BWP / 0 USD |

| 📈 Trading Assets | • Forex • Indices • Cryptocurrencies • Shares • Share Baskets • Treasuries |

| 💰 FTSE 250 Average Spread | 2 pips |

| 💳 Demo Account | Yes |

| ☪️ Islamic Account | No |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| There are revolutionary trading tools available for in-depth market analysis. | CMC Markets does not offer MetaTrader 5. |

| All customer accounts are safeguarded. | There is no option for Muslim traders to convert their accounts into Islamic accounts. |

| CMC Markets provides a demo account as well as several tools. | There is no BWP-denominated account. |

| CMC Markets provides exceptional customer service across the world. | Traders are subject to currency conversion, inactivity, and withdrawal fees. |

| There is no need for a minimum deposit. | |

| Beginner traders will benefit from educational materials such as manuals and videos. | |

| CMC Markets offers a wide range of financial instruments across powerful software. | |

| There is a major emphasis on customer education and assistance through various channels 24 hours a day, 5 days a week. |

3. eToro

Overview

eToro was launched in Israel in 2007 and has grown in several other countries over the last few years. eToro provides a crypto exchange with 30+ cryptocurrencies for trading and an online brokerage platform with a limited range of equities and exchange-traded funds (ETFs).

Because of its social features and active community, this platform is an excellent choice for consumers who seek a more communal trading experience.

The eToro platform has an active user community and social elements such as a newsfeed for individual currencies that are accessible for trading.

Min Deposit

USD 10 / 136 BWP

Regulators

CySec, FCA

Trading Desk

None

Crypto

Yes

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

eToro launched one of the first social trading experiences, OpenBook, in 2010, allowing users to learn from and mimic other experienced traders.

The platform expanded its offerings to include stock trading, ETFs, automated portfolios, cryptocurrency, and cash management capabilities, demonstrating its creative character. eToro is available in over 100 countries and has over 20 million users.

Botswanan traders can trade FTSE 250 via eToro under “MIDD.L” as an ETF, with spreads from 6 pips depending on market conditions.

Features

| Feature | Information |

| ⚖️ Regulation | CySEC, FCA, ASIC, FinCEN, FINRA, SIPC, DNB, FSA |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Retail, Professional |

| 📊 Trading Platform | eToro trading app and web-based platform |

| 💰 Minimum Deposit | 136 BWP equivalent to $10 |

| 💰 Trading Assets | Forex pairs, Commodities, Exchange-Traded Funds (ETFs), Indices, Stocks, Crypto trading, Stocks |

| 🔎 Botswanan Pula-based Account? | No |

| 💳 BWP Deposits Allowed? | No |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 1 pip EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| eToro has a strict and solid regulatory framework | There are limitations on leverage for retail traders |

| Client fund safety is guaranteed and there is consumer protection offered | There is a limited selection of retail investor accounts |

| eToro offers commission-free trading | Fixed spreads are not offered |

| There are over 2,000 complex instruments that can be traded | The spreads are not the tightest |

| The broker offers several trading opportunities and a social trading feature | There is a high minimum deposit on the Islamic Account |

| There is an award-winning proprietary platform offered | There is an inactivity fee charged on dormant accounts |

| eToro offers 24/6 dedicated customer services | |

| eToro offers a demo account and an Islamic Account | |

| Algorithmic trading and margin trading supported | |

| Real time quotes are offered alongside a wide range of benefits | |

| The mobile app is secure and features robust security such as two-factor authentication | |

| The app can be used as a wallet app for digital currencies | |

| Offers several resources that help traders make improved financial decisions with confidence | |

| Offers several helpful tools and services as a solid basis for investment decision along with investment advice | |

| Provides access to several popular cryptocurrencies that can be traded and crypto staking services | |

| There is a comprehensive portfolio management service and popular investor program offered |

4. IG

Overview

IG (formerly IG Markets ltd) was founded in 1974 as a forerunner in the business and developed the notion of financial spread betting, which heralded the advent of internet trading as early as 1998.

IG can easily serve customers all over the globe because of its 13 international offices, all of which are situated in major financial hubs.

It is no surprise that IG is the world’s leading CFD supplier. IG serves over 178,000 customers in 190 countries across five continents and offers various products at reasonable prices.

Min Deposit

USD 0 / 0 BWP

Regulators

IGRs

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

IG’s web-based solution is the first of several available platform options and API interfaces worldwide. Even though IG advises using Google Chrome, this simplified trading interface is compatible with any web browser.

In addition, the IG Community website features several trading recommendations from forum discussions and blog postings.

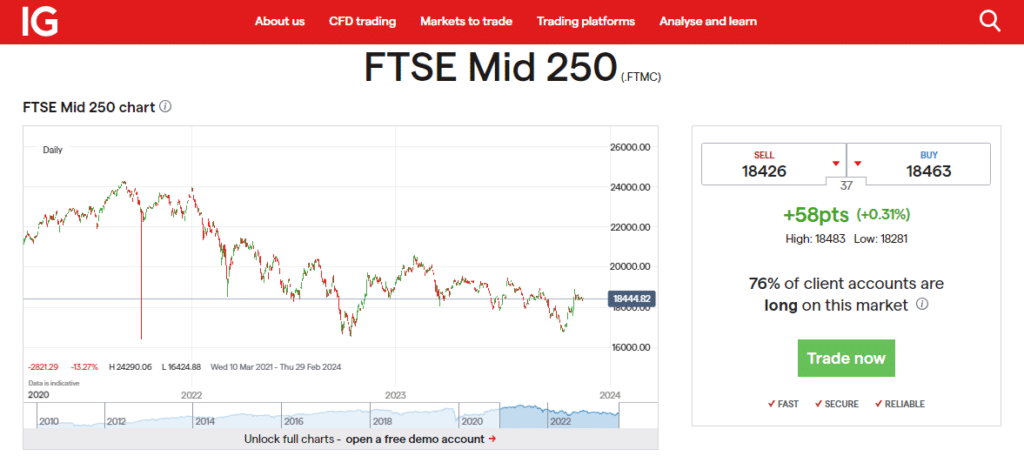

Botswanan traders can start trading FTSE 250 with IG as a CFD on indices under “FTSE Mid 250,” with typical spreads from 30 pips. The minimum position size is 0.10 lots, and there is a contract size of 10 GBP, with a 10% margin requirement.

Features

| Feature | Information |

| ⚖️ Regulation | FCA, BaFin, CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, CFTC, FINRA, NFA, BMA |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | IG Trading Account, IG Professional Account, IG Options Trading Account, IG Turbo24 Account, Limited Risk Account, Share Dealing Account, Exchange Account (NADEX) |

| 📊 Trading Platform | MetaTrader 4, IG Platform, ProRealTime (PRT), L2 Dealer, FIX API |

| 💰 Minimum Deposit | USD 250 / 3 363 BWP |

| 💰 Trading Assets | Forex, Shares, Indices, Commodities, Cryptocurrencies, Interest Rates, Bonds, ETFs, Futures, Options |

| 🔎 Botswanan Pula-based Account? | No |

| 💳 BWP Deposits Allowed? | Yes |

| 💰 Bonuses for Botswanan traders? | No |

| 📈 Minimum spread | 0.1 pips (DMA) on EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | No |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Offers a significant range of financial instruments, including Botswanan-specific trading instruments | High minimum deposit charged |

| There are several powerful trading platforms offered | Inactivity fees apply |

| There are competitive trading conditions that include low spreads, low commissions, and reliable trade execution | |

| Traders can get free trading signals | |

| There is a comprehensive IG Academy offered with dedicated educational resources | |

| Convenient funding options provided along with free deposits and withdrawals | |

| FIX API Direct Market Access trading is offered | |

| There are Swap-Free Accounts offered for Islamic traders |

5. Admirals

Overview

Almost twenty years have passed since Admirals first premiered. This broker provides innovative trading software, including MetaTrader 4 and 5, and a custom add-on dubbed MetaTrader Supreme Edition.

Admirals’ spreads and commissions are among the best in the industry. Different types of accounts are available depending on the program you use. When compared to other brokers, Admirals offers more options for how you may manage your account.

MT4 and MT5 are available via Admirals and have become de facto standards in the industry. Admirals’ MetaTrader Supreme Edition is the most powerful trading platform available today. Admirals built this extension for MetaTrader 4 and 5.

Min Deposit

339 BWP or an equivalent of $25

Regulators

FCA, ASIC, CySEC, EFSA, JSC

Trading Desk

MT4, MT5, Admirals Mobile App

Crypto

Yes

Total Pairs

35 Forex Currency Pairs

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

More than fifty functions are included that are not available on the 4 or 5 systems. In addition, Admirals is upfront about the costs associated with depositing and withdrawing funds in various ways by devoting an entire page to the topic.

The commissions that this broker charges are outlined in terms of the contract and might change depending on the state of the market.

Botswanan traders can access FTSE 250 using Admirals’ Trade.MT5 Account under “#MIDDL” as an iShares CFD on ETFs. The minimum margin on this instrument is 50%, with commission charges from 0.1%, with average spreads from 4 pips.

Features

| Feature | Value |

| 💳 Minimum Deposit Requirement | 475 BWP equivalent to $25 |

| 📈 Platforms Available for Account Type | MetaTrader 4, cTrader |

| 📊 Average Spreads on Major Forex Pairs | 0.3 pips |

| 🚀 Maximum Leverage Ratio | • 1:30 (Retail) • 1:500 (Pro) |

| 🔎 Commission Charges on Trades | $6 per lot |

| 📈 Commissions on Stock CFDs | $0.04 per CFD with a minimum of $6 |

| 💰 Account Base Currency Options | EUR or USD |

| 🔨 Negative Balance Protection Offered | Yes |

| 📱 Is Hedging Allowed? | Yes |

| 💸 Minimum Forex Trading Volume | 0.01 lots |

| 💵 Islamic Account Conversion Offered? | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Admirals is well-regulated in several regions globally | There is an inactivity fee charged |

| Admirals offers commission-free options | Botswana traders are subject to currency conversion fees |

| The broker accepts Botswana traders despite their trading skills or trading strategies | There are deposit and withdrawal fees charged |

| There are user-friendly platforms available across devices | There are admin fees charged on the Islamic account |

| There is a wide range of tradable markets, complex instruments, and leveraged products | There is only one account type that can be converted to an Islamic Account |

| Admirals offers the MetaTrader Supreme Edition | |

| Traders are given access to premium analytics | |

| There are several educational materials, resources, and tools offered |

How to Choose the Right Forex Broker in Botswana

Botswanan traders must evaluate the following components of a forex broker to decide whether the broker is suited to their unique trading objectives or needs.

Regulations and Licenses

This is the first vital component that Botswanan traders must thoroughly evaluate. Reputable brokers are regulated by market regulators such as FCA, ASIC, CySEC, FSCA, and others.

Botswanans must beware when dealing with brokers with only offshore regulations such as FSA, SVG BVI, FSC, and others.

Account Features

Account Features include leverage trading and margin requirement, commissions and spreads, initial deposit, additional features on retail investor accounts, and so on.

Deposits and Withdrawals

Botswanans must evaluate the payment options available, the processing times on withdrawal requests, deposit currencies offered, the withdrawal fee, deposit fees, and minimum withdrawal limits, among other trading and non-trading fees.

Range of Markets

The range of markets offered refers to the number and range of tradable instruments the broker offers. Therefore, Botswanans must consider what they wish to trade and what is available.

Customer Support

Customer Support is another crucial factor. Botswanans must check the availability of support (trading hours), the quality of support, and the promptness with which the customer support team responds to queries.

Trading Platform

A trading platform is the Botswanan trader’s portal to the financial markets. Therefore, traders must ensure that the trading platform has the necessary technical indicators, fundamental analysis, technical analysis, economic calendar, charting, newsfeed, and other tools they may need.

Education and Research

Education and Research come in handy to both novice traders and experienced investors. Education includes some of the following:

➡️ eBooks

➡️ Trading guides

➡️ Trading knowledge on leveraged products

➡️ A risk warning on complex instruments

➡️ Educational videos

Research can include some of the following:

➡️ Trading tools

➡️ Commentary

➡️ Status of International Markets

➡️ Price movements

➡️ Market sentiments

➡️ Whether there is a volatile market

➡️ Exchange Rates

➡️ Expert opinions and other resources can help experienced traders make informed trading decisions.

The Best Forex Brokers in Botswana

In this article, we have listed the best brokers that offer forex trading to traders in Botswana. In addition, we have further identified the brokers that offer additional services and solutions to Botswanan traders.

Best MetaTrader 4 / MT4 Forex Broker in Botswana

Min Deposit

USD 25

Regulators

FCA UK

Trading Platform

MT5, MT4, OctaTrader

Crypto

Yes

Total Pairs

28

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, OctaFX is the best MT4 forex broker in Botswana. OctaFX is an MT4 and MT5 broker that provides Botswanans with various markets. OctaFX offers a choice of accounts via MT4, including ECN and STP accounts, with superior trade execution.

Best MetaTrader 5 / MT5 Forex Broker in Botswana

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, AvaTrade is the best MetaTrader 5 forex broker in Botswana. In addition, AvaTrade is regarded as one of the most secure MT5 forex brokers.

No commission is charged for trading currency pairings, only leaving the spread to be paid. A demo account is also available for traders to sharpen their abilities via MT5 and several other platforms.

Best Forex Broker for beginners in Botswana

Min Deposit

$100

Regulators

CFT, NFA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FOREX.com is the best forex broker for beginners in Botswana. FOREX.com is a broker renowned for low trading fees and beginner-friendly solutions. In addition, FOREX.com offers several educational materials and a helpful demo account.

Best Low Minimum Deposit Forex Broker in Botswana

Min Deposit

$10 / 134 BWP

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Exness is the best Low Minimum Deposit Forex Broker in Botswana. Exness has a minimum deposit requirement of 10 USD / 130 BWP, making it easy for Botswanans to start trading 278 instruments.

Exness also offers MT4 and MT5 through which trades can be made. In addition, it offers some of the best trading tools, charting capabilities, technical indicators, expert advisors, and more.

Best ECN Forex Broker in Botswana

Min Deposit

USD 0

Regulators

CySEC, FCA, DFSA, FSCA, FSA, CMA

Trading Desk

MT4, MT5, HFM APP

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

0

Account Activation Time

24 Hours

Overall, HFM is the best ECN forex broker in Botswana. HFM is a hybrid forex and CFD broker that uses STP and ECN technology to ensure that Botswanans get the best pricing, minimal slippage, no requotes, and the fastest trade execution.

HFM uses the best liquidity providers who aggregate the pricing that Botswanans can see on MT4, MT5, and the HF App for Android and iOS.

Best Islamic / Swap-Free Forex Broker in Botswana

Min Deposit

USD 10 / 136 BWP

Regulators

CySec, FCA

Trading Desk

None

Crypto

Yes

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, eToro is the best Islamic / Swap-Free forex broker in Botswana. eToro is a renowned social trading platform that offers Muslim traders an Islamic Account.

eToro does not charge any interest on positions held for over 24 hours. However, registering an Islamic Account can be expensive initially, requiring a 1,000 USD / 13,400 BWP deposit.

Best Forex Trading App in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

ASIC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

300

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, CMC Markets is the best forex trading app in Botswana. In addition, CMC Markets offers a user-friendly mobile app with research tools, powerful charts, customizable watch lists, news reports, and a range of educational materials.

Best Lowest Spread Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

FCA, CySEC, IFSC, KNF

Trading Desk

No Trading Desk

Crypto

Yes

Total Pairs

48

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, XTB is the best lowest-spread forex broker in Botswana. XTB is a well-known forex and CFD broker with low and competitive forex spreads from 0.1 pips depending on the financial instrument and the market conditions.

XTB is also a good broker in terms of educational materials and research capabilities, providing traders with comprehensive market analysis across markets.

Best Nasdaq 100 Forex Broker in Botswana

Min Deposit

USD 10

Regulators

CySec, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

60

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXTM is the best Nasdaq 100 forex broker in Botswana. FXTM is a multi-regulated forex and CFD broker that accommodates Botswanan traders with a keen interest in Nasdaq. Traders can expect low and competitive spreads, a choice between accounts, and powerful trading platforms.

Best Volatility 75 / VIX 75 Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

IGRs

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, IG is Botswana’s best Volatility 75 / VIX 75 forex broker. IG is one of the best CFD brokers with powerful proprietary trading technology.

IG is well-regulated and offers Botswanans access to VIX75, with spreads from 0.04 pips / 0.13% and zero commission charges.

Best NDD Forex Broker in Botswana

Min Deposit

USD 50 / 672 BWP

Regulators

FCA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

–

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXCM is the best NDD forex broker in Botswana. FXCM is a No-Dealing Desk broker with STP and ECN execution across several markets.

In addition, FXCM offers a choice between third-party platforms in addition to technical indicators, charting tools, and competitive trading conditions.

Best STP Forex Broker in Botswana

Min Deposit

USD 10

Regulators

IFSC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

36

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, RoboForex is the best STP forex broker in Botswana. RoboForex is popular forex and CFD broker with competitive trading conditions. RoboForex offers STP execution with liquidity sourced from top providers.

Botswanans can expect access to over 12,000 instruments via powerful and innovative third-party platforms.

Best Sign-up Bonus Broker in Botswana

Min Deposit

50 USD / 682 BWP

Regulators

CYSEC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Windsor Brokers is the best sign-up bonus broker in Botswana. Windsor Brokers is a well-regulated broker that offers Botswanans a welcome account funded with 30 USD in trading credit. With this account, Botswanans can explore the platform or risk-free test their strategies.

You might also like: Best FTSE 100 Brokers in Botswana

You might also like: Best Day Trading Strategies in Botswana

You might also like: Best PAMM Account Forex Brokers in Botswana

You might also like: Best Micro Currency Trading Platforms in Botswana

You might also like: Best Algorithmic Trading Platforms in Botswana

Conclusion

The FTSE 250 is comprised of 250 firms that are at the forefront of their industries and show great potential for development and expansion, providing investors with a high return on investment.

Choosing a dependable broker is the first step in trading and investing in the FTSE 250 index. Traders in Botswana should do their homework before signing up with any broker to ensure they are dealing in a regulated, secure environment that meets their needs.

Frequently Asked Questions

Can Botswanans invest in the FTSE 250?

You cannot invest directly in the FTSE 250, but you may acquire shares of its components or ETFs that follow the index’s price.

When you invest, you get direct ownership of the underlying asset, and you can only benefit if the asset’s price increases.

Is the FTSE 250 an ETF?

FTSE 250 is typically offered as a CFD ETF by most brokers.

How can Botswanans buy FTSE shares or invest in the FTSE 250 index?

Traders can invest in FTSE shares or FTSE 250 by registering an account with a broker that offers this instrument, choosing a trading platform, paying the minimum amount required, and covering the margin requirement to start trading.

Are FTSE 250 index funds or ETFs better for Botswanans?

Both index funds and ETFs could give investors a wide, diversified stock market exposure, making them excellent long-term investments suited for many investors.

What are the disadvantages of Botswanans trading FTSE 250 as an ETF?

There are low trading volumes which translate to higher trading fees. There can also be tracking errors, less diversification, and several inherent hidden risks.

How can I invest in the FTSE 250 Index?

There are several ways to invest in the FTSE 250. One common approach is through exchange-traded funds (ETFs) that track the performance of the index. Alternatively, investors can consider index-tracking mutual funds or invest directly in individual stocks of companies listed in the FTSE 250.

What is the process of trading FTSE 250 Index futures?

Trading FTSE 250 Index futures involves speculating on the future price movements of the index. To trade futures, you need to open an account with a futures broker, deposit margin funds, and then enter buy or sell orders based on your market outlook. It’s important to monitor market conditions and be aware of the risks associated with futures trading.

Can I invest in the FTSE 250 from outside the UK?

Yes, international investors can invest in the FTSE 250. This can be done through global brokerage platforms that offer access to UK markets. Investors should be aware of currency exchange rates and any tax implications associated with investing in foreign markets.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review