10 Best High Leverage Forex Brokers in Botswana

The 10 Best High Leverage Forex Brokers in Botswana revealed. We tested and verified the best high-leverage brokers operating in Botswana.

This is a complete list of high-leverage brokers in Botswana.

In this in-depth guide you’ll learn:

- What are Margin and Leverage in Forex Trading?

- Is high leverage good in forex trading?

- Which Forex Brokers are best for beginner traders?

- Is 1: 100 leverage profitable?

- Which high-leverage broker offers the best BWP sign-up bonus?

- Which broker offers a mobile app to Botswana traders?

And lots more…

So if you’re ready to go “all in” with the best-tested high-leverage forex brokers for Botswanans…

Let’s dive right in…

- Louis Schoeman

Best High Leverage Forex Brokers in Botswana

| 🏅 Broker | 👉 Open Account | ✔️ High Leverage Broker? | 📈 Maximum Leverage | 💰 Minimum Deposit |

| 1. Exness | 👉 Open Account | Yes | Unlimited | 188 BWP / USD 10 |

| 2. FBS | 👉 Open Account | Yes | 1:3000 | 19 BWP / 1 USD |

| 3. AvaTrade | 👉 Open Account | Yes | 1:400 (Pro) | 1925 BWP / 100 USD |

| 4. SuperForex | 👉 Open Account | Yes | 1:2000 | 19 BWP / 1 USD |

| 5. FXTM | 👉 Open Account | Yes | 1:2000 | 192 BWP / 10 USD |

| 6. HFM | 👉 Open Account | Yes | 1:2000 | 0 BWP / 0 USD |

| 7. InstaForex | 👉 Open Account | Yes | 1:1000 | 13 BWP / 1 USD |

| 8. Alpari | 👉 Open Account | Yes | 1:1000 | 96 BWP / 5 USD |

| 9. RoboForex | 👉 Open Account | Yes | 1:2000 | 192 BWP / 10 USD |

| 10. JustMarkets | 👉 Open Account | Yes | 1:3000 | 192 BWP / 10 USD |

10 Best Forex Brokers in Botswana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

What are Margin and Leverage in Forex Trading?

The phrases “leverage” and “margin” are sometimes used interchangeably, but they mean different things. While leverage is the exposure a trader receives, the margin is the initial investment required to create a position.

Margin trading allows investors to make larger purchases with their available funds. Therefore, to start a lot bigger position, less initial investment is needed from the investor.

The term “initial margin” refers to the fraction of the position’s value that must be paid upfront rather than the entire amount.

Margin trading has a unique set of advantages and risks for Retail Clients. For example, extra collateral may be requested if a professional customer incurs losses more than their deposits.

Margin is the initial investment needed to initiate a trade, while leverage is the exposure multiplied by the account’s equity. The margin rate determines the margin amount. This varies from trading instrument to instrument based on the volatility and liquidity of the underlying market.

The volatility of a market is its propensity for sizeable percentage price swings. Liquidity and volatility are often intertwined. The foreign exchange (FX) market is an example of a highly liquid market since billions of dollars, pounds, euros, and yen change hands daily.

Margin requirements and leverage ratios may vary widely across brokers. However, 100:1, 200:1, and 50:1 are the most common ratios provided.

The proposed leverage will be proportional to the deal size. Leverage of 200:1 corresponds to a minimum margin requirement of 0.5%. If you have a leverage ratio of 100:1, your total leverage is 1%.

10 Best High Leverage Forex Brokers in Botswana

- ✔️ Exness – Overall, Best Forex Broker Accepting M-PESA in Botswana

- ✔️ FBS – Best Low Trading Prices

- ✔️ AvaTrade – Top Regulated Broker in Botswana

- SuperForex – Simple Trading Process for Beginner Traders

- FXTM – Best MetaTrader 5 Broker

- HFM – Best user friendly interface

- InstaForex – Top MetaTrader 4 Platform/MT4 in Botswana

- Alpari – Best Variety of Deposit Options

- RoboForex – Best award-winning market-maker broker

- JustMarkets – Offers the lowest spreads, high leverage

1. Exness

Exness allows for a limitless maximum leverage ratio and provides demo accounts and accounts that comply with Islamic law.

Platforms MT4 and MT5, in addition to an Exness trading app, are supported. The FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, and FCA are the regulatory bodies that oversee Exness, which has its headquarters in Cyprus.

Exness is a forex broker authorized by many authorities and has offices in several countries, including the United Kingdom, Seychelles, South Africa, the British Virgin Islands, and Curacao.

Min Deposit

$10 / 134 BWP

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Through partnerships with reputable businesses such as Nymstar Limited, Tortelo Limited, and Vlerizo (Pty) Limited, Exness can provide its services to customers.

When Botswanans decide to become traders with Exness, they will be introduced to a trading environment that is both secure and straightforward, and it will cover both the MT4 and MT5 platforms.

In addition, customers could anticipate favourable trading circumstances, such as low spreads and the availability of ECN accounts.

Features

| Feature | Information |

| 📈 Account Base Currencies | AED, ARS, AUD, AZN, BDT, BHD, BND, BRL, CAD, CHF, CNY, EGP, EUR, GBP, GHS, HKD, HUF, IDR, INR, JOD, JPY, KES, KRW, KWD, KZT, MAD, MXN, MYR, NGN, NZD, OMR, PHP, PKR, QAR, SAR, SGD, THB, UAH, UGX, USD, UZS, VND, XOF, ZAR |

| 📊 Minimum Spread | 0.0 pips EUR/USD |

| 💳 Botswanan Deposits/Withdrawals | Yes |

| ⚖️ CBN Regulation | No |

| 📊 Account Types | Standard Account, Standard Cent Account, Raw Spread Account, Zero Account, Pro Account |

| ⚖️ Regulation | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA |

| 📈 Leverage | Unlimited |

| 📊 Micro Account Offered? | No |

| 📈 Trading Tools | Analytical tools, Trading calculators, currency converter, tick history, economic calendar |

| 💻 Educational Material | None |

| 👥 Botswanan-Based Customer Support | No |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The broker has a global presence and has authorization and regulation with market regulators around the globe | There is a limited selection of tradable instruments and only a few asset classes |

| Offers instant withdrawals and deposits | There are only a few funding options offered |

| Botswanan traders have a choice between several dynamic account types | |

| Client fund safety is guaranteed and there is investor protection offered | |

| Offers 24/7 customer support that is both prompt and helpful | |

| There are tight and variable spreads offered with competitive commissions |

2. FBS

FBS originally operated as a broker out of Belize, but it has now grown to incorporate a Cyprus office. FBS also does business via subsidiaries in Australia and South Africa in addition to these locations.

This facilitates and promotes the service’s worldwide audience growth for inexperienced and seasoned traders.

FBS has been in business for a long time and offers a trustworthy trading environment. In addition, the firm provides practical trading terms, including copy trading on MetaTrader 4 and 5, and an extensive instructional section.

Min Deposit

USD 5 / 67 BWP

Regulators

IFSC, FSCA (South Africa), ASIC, CySEC

Trading Desk

MetaTrader 4, MetaTrader 5, FBS Trader – all in one mobile trading platform.

Crypto

Yes

Total Pairs

250

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

According to IFSC regulation, the maximum leverage used with FBS on major forex pairings such as EUR/USD through MetaTrader 4 is 1:3000.

Traders should note that while the maximum leverage that FBS makes accessible to its European customers is 1:30, the highest leverage that it makes available to its professional customers is 1:500.

With an FBS micro account, the minimum that must be deposited to access the 1:3000 leverage is $5 / 67 BWP. In addition, FBS allows clients to initiate positions in the foreign exchange market with a minimum of 0.01 lot.

Nano lots, equivalent to 0.0001 regular lots, are available. However, Botswanans should note that the leverage has been lowered to 1:1000. In addition, FBS allows customers to establish FX trades for as little as $0.33 with the highest available leverage.

Features

| Feature | Information |

| ⚖️ Regulation | IFSC, CySEC |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | USD 5 / 96 Pula |

| 📊 Average spread from | 0.0 pips EUR/USD |

| 📈 Maximum Leverage | 1:3000 |

| 👥 Customer Support | 24/7 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| FBS offers competitive trading conditions with some of the lowest spreads | There are wide spreads charges on some accounts |

| There are several account types to choose from | There is a limited number of tradable instruments |

| There are many social trading opportunities | There are several regional restrictions applied |

| There is an ultra-low minimum deposit requirement | |

| The broker is well-regulated and trusted |

3. AvaTrade

AvaTrade’s operations are overseen by CBI, BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, and IIROC.

The broker is concerned with the trader’s experience, complimented by the broker’s strong financial backing and award-winning customer service, both of which are available 24 hours a day in 14 different languages.

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

AvaTrade provides traders of all skill levels access to various trading products, such as foreign exchange (Forex), commodities, cryptocurrency, stocks, shares, indices, metals, energies, options, bonds, CFDs, and exchange-traded funds (ETFs).

In addition, traders get access to over 1,260 assorted products via a few trading platforms that are available for mobile trading apps and PC trading applications.

Features

| Feature | Information |

| ⚖️ Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, FRSA, CySEC, ISA |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Retail Investor Account, Professional Account Option |

| 📊 Trading Platform | AvaTradeGO, AvaOptions, AvaSocial, MetaTrader 4, MetaTrader 5, DupliTrade, ZuluTrade |

| 💰 Minimum Deposit (BWP) | $100 / 1343 BWP |

| 💰 Trading Assets | Foreign currencies, Cryptocurrencies, Commodities, Treasuries, Bonds, Indices, Stocks, ETFs, Options, CFDs, Precious Metals |

| 🔎 Botswanan Pula-based Account? | No |

| 💳 BWP Deposits Allowed? | No |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 0.9 pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| AvaTrade is multi-regulated and one of the most trusted online trading brokers in the world | Variable spreads are not offered |

| There is a wide range of financial instruments that can be traded across financial markets | There is a limited choice between account types |

| There are several technical indicators, economic indicators, and other solutions for advanced traders | Inactivity fees are applied |

| There are several trading platforms to choose from | Currency conversion fees may be applied |

| There is a decent selection of educational material that helps beginner traders navigate complex instruments and lower the degree of risk they are often exposed to | There is a limited number of base currency options offered on accounts |

| There is a multitude of social trading opportunities offered | |

| The broker accepts any trading strategy including automated trading, expert advisors, scalping, hedging, and others. |

4. SuperForex

SuperForex provides many currency pairings and a similarly substantial number of trading account types to attract as many consumers as possible. The company offers eleven distinct retail trading accounts.

Wide spreads characterized Market Maker STP accounts, while higher fees characterized ECN accounts. SuperForex is an online broker founded in 2013 to surpass customers’ expectations by providing high-quality, robust, and comprehensive online trading services.

Min Deposit

USD 1 / 13 BWP

Regulators

IFSC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

300

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

SuperForex offers customers access to more than 400 CFD products, which can be traded online using the intuitive MT4 trading platform.

Features

| Feature | Information |

| ⚖️ Regulation | IFSC |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | 13 Botswanan Pula equivalent to $1 |

| Average spread from | Variable spread |

| 📈 Maximum Leverage | 1:1000 |

| 👥 Customer Support | 24/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| At SuperForex, eleven retail accounts are offered, all of which are tailored to the unique needs of individual traders. | SuperForex is not regulated. |

| In addition to speedy, trustworthy transaction execution and cheap spreads, SuperForex has commission-free options. | There is no other platform other than SuperForex and MT4. |

| Muslims have access to Islamic trading accounts with no monthly maintenance fees. | SuperForex does not offer a BWP-denominated account. |

| Botswanans can quickly and easily deposit and withdraw monies from their accounts. |

5. FXTM

FXTM, also known as Forex Time, is a foreign exchange (FX) broker established in 2011, has its headquarters in Cyprus (Limassol), and is regulated by the Financial Conduct Authority and other agencies.

FXTM is widely regarded as one of the best forex brokers in the world and has the highest rate of growth. Within a few short years of its founding, FXTM had expanded across Europe and beyond, largely thanks to the company’s concentration on markets in Africa and Asia.

The spread offered on the FXTM Micro account is closer to the high end. But on their Advantage account, which is an ECN-style account with Raw spreads and a low cost for high-volume traders, the spread is tight and competitively priced.

Min Deposit

USD 10

Regulators

CySec, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

60

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

In addition, they provide a comprehensive selection of trading instruments, including currency pairs, CFDs on spot metals and indices, equities CFDs, and commodities, among many others.

In addition, FXTM’s website makes available a substantial selection of different CFD instruments from which to choose.

In addition to MT4, they provide the most up-to-date trading platform known as MT5. Another benefit of FXTM is that customer service representatives are always polite and quick to respond. In addition, the broker’s educational resources for traders are of the highest quality.

Features

| Feature | Information |

| ⚖️ Regulation | CySEC, FSCA, FCA, FSC Mauritius |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Micro Account, Advantage Account, Advantage Plus Account |

| 📊 Trading Platform | MetaTrader 4, MetaTrader 5, FXTM Trader |

| 💰 Minimum Deposit | 134 Botswanan Pula equivalent to $10 |

| 💰 Trading Assets | Precious Metals, Stock Trading, Stock CFDs, Indices, Forex Indices, Forex Currency Pairs (including minor, major, and exotic pairs), Commodities, Stock Baskets |

| 🔎 Botswanan Pula-based Account? | Yes |

| 💳 BWP Deposits Allowed? | Yes |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 0.0 pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| FXTM is a multi-regulated and a reputable broker that has gained a high level of trustworthiness | Inactivity fees apply when the retail investor account becomes dormant |

| Dedicated customer support offered for Botswanan traders Several deposit options and withdrawal methods offered | |

| There is a low minimum deposit requirement | |

| Commission-free trading is offered | |

| Deposit fees are not charged on any payment methods | |

| Withdrawal processing times are quick | |

| There are several educational tools offered | |

| There is an exclusive risk management tool offered |

6. HFM

HFM is a multi-asset broker that allows clients to trade in Forex and Commodities using Contracts for Difference (CFDs).

Through unrestricted liquidity, HFM makes it possible for traders of any size or profile to choose from a selection of spreads and liquidity providers using automated trading platforms and to carry out whatever trading strategy they wish.

The fact that HFM is particularly engaged in and influential in the regions of Africa, Asia, and the Middle East and North Africa (MENA) presents some of the most promising opportunities for people of the world.

Min Deposit

USD 0

Regulators

CySEC, FCA, DFSA, FSCA, FSA, CMA

Trading Desk

MT4, MT5, HFM APP

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

0

Account Activation Time

24 Hours

As a result of the fact that HFM complies with all the regulatory requirements necessitated by the Forex industry, the company can provide a reliable trading service. HFM was established in 2010, and its headquarters are in Cyprus.

However, the broker also offers services to locations in other countries worldwide. HFM is imbued with a profound sense of social duty and the conviction that they are obligated to aid others less fortunate.

HFM immediately jumps into action when the opportunity arises and helps with initiative-taking. As part of their employment, they must make charitable donations and participate in several community service initiatives.

Features

| Features | Information |

| ⚖️ Regulation | FSCA, CySEC, DFSA, FSA, FCA, CMA, and FSC, with registration in ACPR, BaFin, MNB, CONSOB, CNMV, FI, FMA, FSC, and other regions |

| 💸 Minimum Withdrawal Time | – |

| 📈 Maximum Withdrawal Time | 2 to 4 working days |

| 💰 Instant Deposits/Withdrawals? | Yes, deposits |

| 💳 BWP-Denominated Account? | No |

| 📱 Minimum Deposit Amount | $0 / 0 BWP |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Botswanans can sign up for a practice account within minutes | The HFM App is limited and cannot be used for trading activities |

| The demo account is unlimited | |

| HFM offers educational materials that are ideal for beginners | |

| The demo account can be used on MT4 and MT5 | |

| HFM customer support is available to help Botswanans |

7. InstaForex

InstaForex provides a solution from the world’s best developers that enables you to trade via the biggest counterparties with direct market access. InstaForex was founded in 2007 and has its headquarters in Limassol, Cyprus.

Min Deposit

USD 1

Regulators

CySEC, FSC

Trading Desk

MetaTrader 4

MetaTrader 5

MultiTerminal

WebTrader

Crypto

Yes

Total Pairs

100

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

It serves customers worldwide, and the current number of InstaForex traders surpasses 7 million, which is astounding. Overall, InstaForex’s goal is to offer a vast array of services while treating traders fairly at every level.

In addition to superb technical solutions, one of the finest trading conditions among the market’s offerings, and other benefits, the broker offers a personalized approach to each client by providing extensive educational and customer service resources.

Features

| Feature | Information |

| ⚖️ Regulation | FSC, BVI, SIBA |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | Botswanan Pula ($1 / 13 BWP ) |

| Average spread from | 0.0 pips EUR/USD |

| 📈 Maximum Leverage | 1:1000 |

| 👥 Customer Support | 24/7 |

Pros and Cons

| ✔️ Pros | ❌ Cons | |||

| The broker offers commission-free trading | There are restrictions on leverage for European Union clients | |||

| MetaTrader 4 and 5 are both offered, available across devices | US clients are not accepted | |||

| The broker is well-regulated and offers competitive trading conditions | ||||

| There is a choice between retail investor accounts, each suited to different types of traders | ||||

| There is a wide range of tradable assets offered |

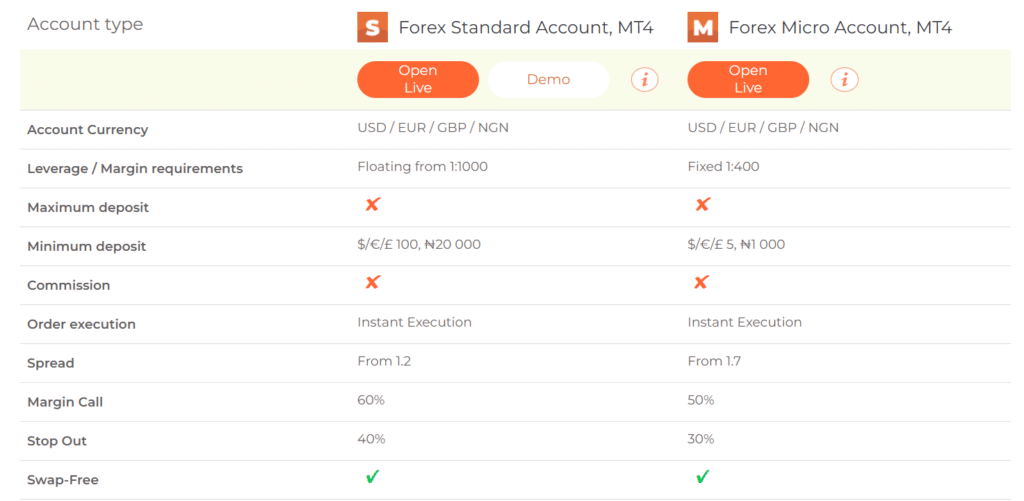

8. Alpari

Alpari provides professional traders willing to pay large minimum deposits in exchange for low continuing trading fees, with various accounts on the MT4 and MT5 platforms. Alpari caters effectively to these traders.

Min Deposit

5 USD / 67 BWP

Regulators

FSC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

48

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

According to the company’s website, Alpari Group has more than two million clients all over the globe. Since 1998, the company has been operating as a global FX and CFD broker. There are a total of four live accounts available through Alpari.

These include two commission-free instant execution accounts, a market execution ECN account that charges a commission per lot and a commission-free pro account that does not charge commissions and has extremely tight spreads but requires an exceptionally large initial deposit.

Features

| Account Feature | Value |

| 💰 Base Account Currency Options | USD, EUR, GBP, NGN |

| 💳 Minimum Deposit | 96 BWP / 5 USD |

| 💳 Maximum Deposit | None |

| 📈 Maximum Leverage | Floating from 1:1000 |

| 💰 Commission Charges | None |

| 📈 Average Spread | Floating from 1.2 pips |

| 🚀 Order Execution Type | Instant |

| 📊 Margin Call (%) | 60 |

| 📊 Stop-Out (%) | 40 |

| ✴️ Swap-Free Option | Yes |

| ✴️ Range of Markets | 61 pairs – Forex Major Pairs, Minors, Exotics, 5 Spot Metals, 14 Spot CFDs |

| 📊 Minimum Trade Volume | 0.01 lots |

| 📊 Maximum Trade Volume | 30 lots |

| 💰 Maximum Number of Orders | Unlimited |

| 📈 Maximum Order Volume | 100 Lots |

| 📊 Maximum Pending Orders | 100 Lots |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Well-regulated and award-winning CFD broker | Fixed spreads are not offered |

| Offers forex trading signals from AutoChartist and automatic trading | Not regulated by the Financial Conduct Authority, Cyprus Securities and Exchange Commission, or any other popular market regulators |

| MetaTrader 4 and MetaTrader 5 are supported across devices | There is a limited selection of trading instruments, educational tools, and research |

| News is streamed from FxWirePro | There are restrictions on several jurisdictions |

| A dedicated customer support team offers multilingual customer support | |

| Offers unique solutions to both beginner and experienced traders | |

| There are four retail investor accounts to choose from, demo accounts, and Islamic accounts | |

| There are several convenient funding options to choose from and deposit fees are not charged |

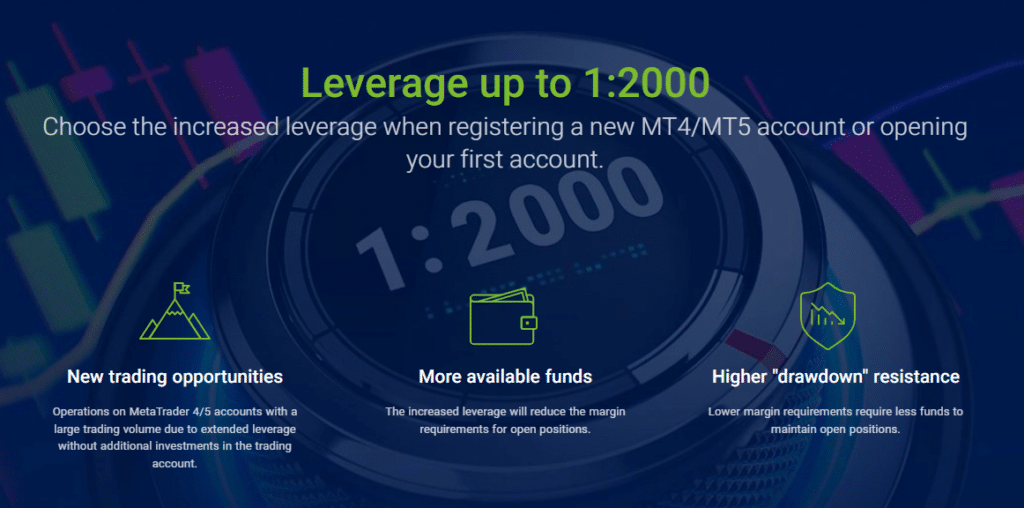

9. RoboForex

RoboForex has been recognized as the winner of several major accolades. In addition, the broker serves more than 4.56 million customers from approximately 169 countries.

RoboForex has no difficulty letting novice traders experiment before purchasing into the broker since demo accounts are offered for all accounts save the ECN account.

Min Deposit

USD 10

Regulators

IFSC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

36

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Regarding foreign exchange (Forex) trading, one of the most notable aspects of RoboForex is the brokerage’s trading conditions, which the company refers to as “unique.”

RoboForex has competitive spreads, starting at 0 pips and minimal non-trading fees. RoboForex also provides quick order execution because of its superior MetaTrader 4 and 5 platforms.

These platforms are the finest that a broker can provide to its customers. RoboForex’s ECN, Prime, and R StocksTrader accounts provide the finest possible trading circumstances and should be your first choice.

Features

| Feature | Information |

| ⚖️ Regulation | IFSC |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | Botswanan Pula $10/134 BWP |

| Average spread from | Floating from 1.3 pips |

| 📈 Maximum Leverage | 1:2000 |

| 👥 Customer Support | 24/7 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The broker offers more than 12,000 markets that can be traded | US clients are not accepted |

| There are several flexible account types offered | There are no fixed spread accounts |

| Trading education is offered to all traders | |

| There are several powerful trading tools | |

| The broker applies negative balance protection to all retail trading accounts |

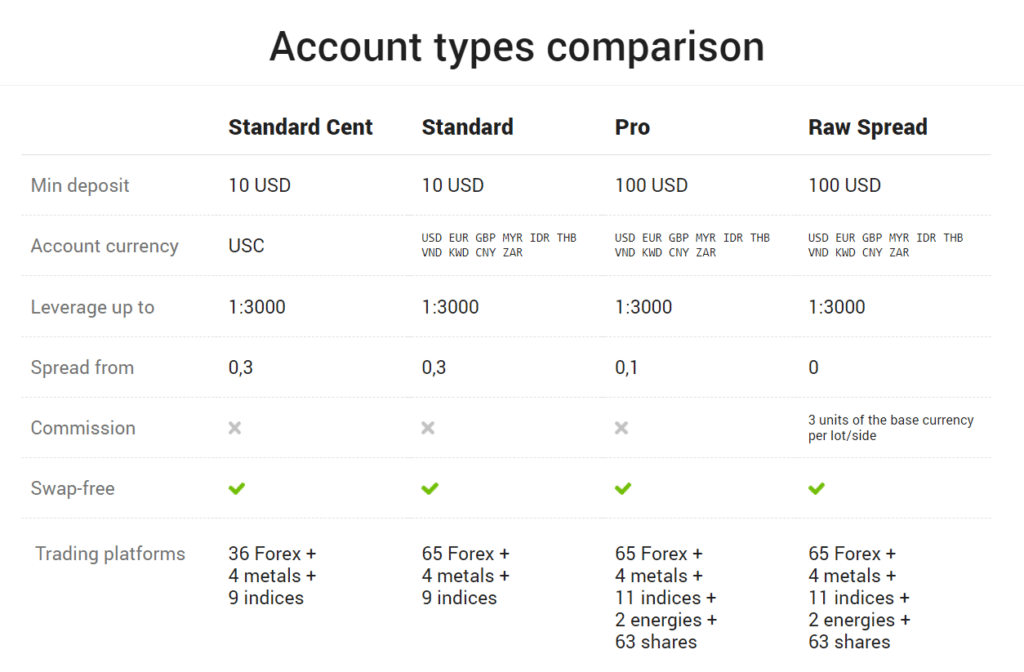

10. JustMarkets

JustMarkets welcomes customers from Botswana and offers an average spread starting from 0.0 pips and a $6 round turn commission rate. In addition, JustMarkets offers a maximum leverage ratio of up to 1:3000, a demo account, and an account compliant with Islamic law.

Platforms are supported, including MT4, MT5, and the JustMarkets App. JustMarkets is governed by the Financial Services Authority (FSA) and has its headquarters in Seychelles.

Min Deposit

USD 10

Regulators

FSA, CySec

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

240

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Just Global Markets Ltd., a brokerage business based in Seychelles and created in 2012, is the parent company of JustMarkets, founded the same year.

JustMarkets provides several flexible trading accounts, from Islamic swap-free to commission-based, commission-free to ECN trading accounts, each with its trading features and conditions suitable for diverse traders.

Features

| Feature | Information |

| ⚖️ Regulation | FSA in Seychelles, FSA in Saint Vincent and the Grenadines |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | MT4 Standard Cent, MT4 Standard Account, MT4 Pro Account, MT4 Raw Spread Account, MT5 Standard Account, MT5 Pro Account, MT5 Raw Spread Account |

| 📊 Trading Platform | MetaTrader 5, MetaTrader 4, ZuluTrade, JustMarkets App |

| 💰 Minimum Deposit | 192 Botswanan Pula equivalent to $10 |

| 💰 Trading Assets | Indices, Energies, Forex, Metals, Cryptocurrencies, Shares, Futures |

| 🔎 Botswanan Pula-based Account? | No |

| 💳 BWP Deposits Allowed? | Yes |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 0.0 pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| JustMarkets offers a huge range of deposit methods and withdrawal options including bank wire transfers, bank transfers, Skrill, Neteller, and more | There is a limited choice of trading instruments |

| Demo trading and Islamic Swap-Free Accounts are offered | Inactivity Fees may apply after following several days of dormancy |

| JustMarkets offers mobile trading through powerful mobile trading apps | The broker does not have regulation through a reputable and trusted regulatory body |

| JustMarkets offers competitive cryptocurrency spreads across crypto pairs including Bitcoin, Ethereum, and others | |

| JustMarkets’s non-trading fees are reasonable | |

| The broker offers a risk warning, training webinars, an array of articles and education for inexperienced traders | |

| There is a wide choice between different types of accounts and excellent trading conditions | |

| One-click trading is offered in addition to insights to help Botswanan traders make better trading decisions | |

| Real-time market analysis is offered alongside analysis tools and several other additional tools | |

| Client funds are kept in segregated bank accounts | |

| There are several research and resources that can help traders make improved independent investment decisions | |

| JustMarkets’s account-opening process is quick and easy | |

| JustMarkets offers several innovative features including a range of services | |

| There are several trading account currencies to choose from | |

| There is no fee for withdrawals |

How to Choose the Right Forex Broker in Botswana

Botswanan traders must evaluate the following components of a forex broker to decide whether the broker is suited to their unique trading objectives or needs.

Regulations and Licenses

This is the first vital component that Botswanan traders must thoroughly evaluate. Reputable brokers are regulated by market regulators such as FCA, ASIC, CySEC, FSCA, and others.

Botswanans must beware when dealing with brokers with only offshore regulations such as FSA, SVG BVI, FSC, and others.

Account Features

Account Features include leverage trading and margin requirement, commissions and spreads, initial deposit, additional features on retail investor accounts, and so on.

Deposits and Withdrawals

Botswanans must evaluate the payment options available, the processing times on withdrawal requests, deposit currencies offered, the withdrawal fee, deposit fees, and minimum withdrawal limits, among other trading and non-trading fees.

Range of Markets

The range of markets offered refers to the number and range of tradable instruments the broker offers. Therefore, Botswanans must consider what they wish to trade and what is available.

Customer Support

Customer Support is another crucial factor. Botswanans must check the availability of support (trading hours), the quality of support, and the promptness with which the customer support team responds to queries.

Trading Platform

A trading platform is the Botswanan trader’s portal to the financial markets. Therefore, traders must ensure that the trading platform has the necessary technical indicators, fundamental analysis, technical analysis, economic calendar, charting, newsfeed, and other tools they may need.

Education and Research

Education and Research come in handy to both novice traders and experienced investors. Education includes some of the following:

➡️ eBooks

➡️ Trading guides

➡️ Trading knowledge on leveraged products

➡️ A risk warning on complex instruments

➡️ Educational videos

Research can include some of the following:

➡️ Trading tools

➡️ Commentary

➡️ Status of International Markets

➡️ Price movements

➡️ Market sentiments

➡️ Whether there is a volatile market

➡️ Exchange Rates

➡️ Expert opinions and other resources can help experienced traders make informed trading decisions.

The Best Forex Brokers in Botswana

In this article, we have listed the best brokers that offer forex trading to traders in Botswana. In addition, we have further identified the brokers that offer additional services and solutions to Botswanan traders.

Best MetaTrader 4 / MT4 Forex Broker in Botswana

Min Deposit

USD 25

Regulators

FCA UK

Trading Platform

MT5, MT4, OctaTrader

Crypto

Yes

Total Pairs

28

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, OctaFX is the best MT4 forex broker in Botswana. OctaFX is an MT4 and MT5 broker that provides Botswanans with various markets. OctaFX offers a choice of accounts via MT4, including ECN and STP accounts, with superior trade execution.

Best MetaTrader 5 / MT5 Forex Broker in Botswana

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, AvaTrade is the best MetaTrader 5 forex broker in Botswana. In addition, AvaTrade is regarded as one of the most secure MT5 forex brokers.

No commission is charged for trading currency pairings, only leaving the spread to be paid. A demo account is also available for traders to sharpen their abilities via MT5 and several other platforms.

Best Forex Broker for beginners in Botswana

Min Deposit

$100

Regulators

CFT, NFA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FOREX.com is the best forex broker for beginners in Botswana. FOREX.com is a broker renowned for low trading fees and beginner-friendly solutions. In addition, FOREX.com offers several educational materials and a helpful demo account.

Best Low Minimum Deposit Forex Broker in Botswana

Min Deposit

$10 / 134 BWP

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Exness is the best Low Minimum Deposit Forex Broker in Botswana. Exness has a minimum deposit requirement of 10 USD / 130 BWP, making it easy for Botswanans to start trading 278 instruments.

Exness also offers MT4 and MT5 through which trades can be made. In addition, it offers some of the best trading tools, charting capabilities, technical indicators, expert advisors, and more.

Best ECN Forex Broker in Botswana

Min Deposit

USD 0

Regulators

CySEC, FCA, DFSA, FSCA, FSA, CMA

Trading Desk

MT4, MT5, HFM APP

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

0

Account Activation Time

24 Hours

Overall, HFM is the best ECN forex broker in Botswana. HFM is a hybrid forex and CFD broker that uses STP and ECN technology to ensure that Botswanans get the best pricing, minimal slippage, no requotes, and the fastest trade execution.

HFM uses the best liquidity providers who aggregate the pricing that Botswanans can see on MT4, MT5, and the HF App for Android and iOS.

Best Islamic / Swap-Free Forex Broker in Botswana

Min Deposit

USD 10 / 136 BWP

Regulators

CySec, FCA

Trading Desk

None

Crypto

Yes

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, eToro is the best Islamic / Swap-Free forex broker in Botswana. eToro is a renowned social trading platform that offers Muslim traders an Islamic Account.

eToro does not charge any interest on positions held for over 24 hours. However, registering an Islamic Account can be expensive initially, requiring a 1,000 USD / 19 252 BWP deposit.

Best Forex Trading App in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

ASIC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

300

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, CMC Markets is the best forex trading app in Botswana. In addition, CMC Markets offers a user-friendly mobile app with research tools, powerful charts, customizable watch lists, news reports, and a range of educational materials.

Best Lowest Spread Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

FCA, CySEC, IFSC, KNF

Trading Desk

No Trading Desk

Crypto

Yes

Total Pairs

48

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, XTB is the best lowest-spread forex broker in Botswana. XTB is a well-known forex and CFD broker with low and competitive forex spreads from 0.1 pips depending on the financial instrument and the market conditions.

XTB is also a good broker in terms of educational materials and research capabilities, providing traders with comprehensive market analysis across markets.

Best Nasdaq 100 Forex Broker in Botswana

Min Deposit

USD 10

Regulators

CySec, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

60

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXTM is the best Nasdaq 100 forex broker in Botswana. FXTM is a multi-regulated forex and CFD broker that accommodates Botswanan traders with a keen interest in Nasdaq. Traders can expect low and competitive spreads, a choice between accounts, and powerful trading platforms.

Best Volatility 75 / VIX 75 Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

IGRs

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, IG is Botswana’s best Volatility 75 / VIX 75 forex broker. IG is one of the best CFD brokers with powerful proprietary trading technology.

IG is well-regulated and offers Botswanans access to VIX75, with spreads from 0.04 pips / 0.13% and zero commission charges.

Best NDD Forex Broker in Botswana

Min Deposit

USD 50 / 672 BWP

Regulators

FCA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

–

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXCM is the best NDD forex broker in Botswana. FXCM is a No-Dealing Desk broker with STP and ECN execution across several markets.

In addition, FXCM offers a choice between third-party platforms in addition to technical indicators, charting tools, and competitive trading conditions.

Best STP Forex Broker in Botswana

Min Deposit

USD 10

Regulators

IFSC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

36

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, RoboForex is the best STP forex broker in Botswana. RoboForex is popular forex and CFD broker with competitive trading conditions. RoboForex offers STP execution with liquidity sourced from top providers.

Botswanans can expect access to over 12,000 instruments via powerful and innovative third-party platforms.

Best Sign-up Bonus Broker in Botswana

Min Deposit

50 USD / 682 BWP

Regulators

CYSEC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Windsor Brokers is the best sign-up bonus broker in Botswana. Windsor Brokers is a well-regulated broker that offers Botswanans a welcome account funded with 30 USD in trading credit. With this account, Botswanans can explore the platform or risk-free test their strategies.

You might also like: CFD Trading Platforms in Botswana

You might also like: Best Low Spread Forex Brokers in Botswana

You might also like: Best FTSE 100 Brokers in Botswana

You might also like: Best Cent Account Forex Brokers in Botswana

You might also like: Best Futures Trading Platforms in Botswana

Conclusion

Suppose you want to open an account with a high-leverage broker. In that case, you need to be a seasoned trader who is familiar with the market and has a solid comprehension of what you are getting yourself into.

When everything is said and done, there is a good reason why many forex brokers publish disclaimers in simple language.

You should not base your choice of broker just on which one has the biggest leverage; rather, you should consider the quality of service each broker provides and the level of liquidity they provide.

On top of everything else, a broker who deals in high leverage should nevertheless be able to give a service of a high standard.

The Forex brokers in Botswana that we have covered that provide high leverage rates are among the best in the industry since they offer superior customer care and are authorized and overseen by known and reputable market regulators.

Frequently Asked Questions

What is leveraged forex trading in Botswana?

Leverage is using borrowed money to expand a trader’s position beyond what would be possible with just their cash balance. Brokerage accounts provide leverage via margin trading, in which the broker delivers the borrowed money.

What is the safest leverage ratio for beginner Botswanan traders?

A safe ratio is one where you do not risk more than 1% to 2% of your investment. Alternatively, traders should consider leverage of 1:5 or 1:10.

How much leverage is considered too much?

Any leverage ratio that results in you risking more than 1% to 2% of your overall investment is considered too high.

Is leverage the same as debt in forex trading?

Leverage refers to the practice of financing an investment or undertaking through debt. The potential profits from a project are therefore multiplied. However, if the investment fails, the leveraged position will increase the losses.

What are some of the risks of using forex leverage in Botswana?

Leverage trading is risky since it magnifies the possibility of investment losses. You can sometimes lose more money than you have available for investment.

Is high leverage good in forex trading?

Forex traders should choose the level of leverage that makes them most comfortable. If you are conservative and don’t like taking many risks, or if you’re still learning how to trade currencies, a lower level of leverage like 5:1 or 10:1 might be more appropriate.

Which Forex Brokers are best for beginner traders?

- IG – Best for education, most trusted

- AvaTrade – Excellent educational resources

- Capital.com – Innovative educational app

- eToro – Best copy trading platform

- Plus500 – Overall winner for ease of use

- CMC Markets – Best web trading platform

- XTB – Great research and education

What is the best leverage for 1 100?

Many professional traders say that the best leverage for $100 is 1:100. This means that your broker will offer $100 for every $100, meaning you can trade up to $100,000. However, this does not mean that with a 1:100 leverage ratio, you will not be exposed to risk.

Which high leverage broker offers the best BWP sign-up bonus?

- SuperForex

- FBS

- JustMarkets

- AvaTrade

Which broker offers a mobile app to Botswana traders?

- RoboForex

- IC Markets

- easyMarkets

- Pepperstone

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review