7 Best Low Spread Forex Brokers in Botswana

The 7 Best Low Spread Forex Brokers in Botswana revealed. We tested and verified the best low-spread forex brokers for Botswana Traders.

This is a complete list of low-spread forex brokers operating in Botswana.

In this in-depth guide you’ll learn:

- What are spreads in trading?

- Why traders should consider spreads before choosing a trading broker?

- Which brokers offer zero-spread accounts?

- Which local brokers have the lowest commissions in Botswana?

- How to choose a forex broker – Compare them against each other.

- Which broker offers a sign-up BONUS for first-time traders.

And lots more…

So if you’re ready to go “all in” with the best-tested low spread forex brokers for Botswana traders…

Let’s dive right in…

- Louis Schoeman

Best Low Spread Forex Brokers in Botswana

| 🥇 Broker | 💰 Minimum Deposit? | 👉 Open Account | ✔️ Low-Spread Broker? | 💸 Minimum Spread? |

| 1. easyMarkets | $ 25 / 336 BWP | 👉 Open Account | Yes | 0.03 USD |

| 2. FP Markets | $100 /1 343 BWP | 👉 Open Account | Yes | 0.0 Pip |

| 3. Alpari | $5 / 67 BWP | 👉 Open Account | Yes | 0.4 Pip |

| 4. IG | $ 250 / 3 363 BWP | 👉 Open Account | Yes | 0.0 Pip |

| 5. AvaTrade | $100 (1 315 BWP) | 👉 Open Account | Yes | 0.6 Pip |

| 6. FXTM | $10 / 135 BWP | 👉 Open Account | Yes | 0.8 Pip |

| 7. GO Markets | $200 / 2 690 BWP | 👉 Open Account | Yes | 0.0 Pip |

10 Best Forex Brokers in Botswana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

What are spreads in trading?

Spreads in trading refer to the difference between the buying (ask) and selling (bid) prices of a financial instrument, such as a currency pair, stock, or commodity. Essentially, it represents the cost of executing a trade and serves as compensation for the broker facilitating the transaction. The spread is measured in pips in the context of forex trading and points in other markets.

A tight or narrow spread indicates a minimal difference between buying and selling prices, which is favorable for traders, as it reduces the overall cost of entering and exiting positions. On the other hand, a wider spread can increase the cost of trading. Spreads can vary based on market conditions, liquidity, and the broker’s fee structure.

Understanding and monitoring spreads is crucial for traders, as it directly influences transaction costs and, consequently, profitability. Tight spreads are often sought after by traders aiming to optimize cost efficiency in their trading activities.

7 Best Low-Spread Forex Brokers in Botswana

- ✔️ easyMarkets – Overall, Lowest Spread Broker in Botswana

- ✔️ FP Markets – Top MetaTrader 4/MT4 Broker

- ✔️ Alpari – Verified ECN Broker in Botswana

- IG – Best Mobile App for Botswana Traders

- AvaTrade – Top Broker for Beginner Traders

- FXTM – Best Social Trading Broker

- GO Markets – Top MetaTrader 5/MT5 Broker in Botswana

1. easyMarkets

Overview

EasyMarkets serves Botswanan customers and offers WTI (Fixed) with an average spread starting at 0.03 USD and no commission fees. EasyMarkets offers a demo account and an Islamic account, and its maximum leverage ratio is 1:400. Platforms such as MT4, MT5, easyMarkets, and TradingView are supported. With its headquarters in the British Virgin Islands, easyMarkets is subject to BVI FSC, CySEC, ASIC, and FSA regulation.

One of the first companies to offer online trading through an easy-to-use interface was easyMarkets, which started operations in 2001. With a fixed spread and no slippage, easyMarkets seeks to give traders dependable trading conditions in response to market volatility, so they are always informed of their costs.

Min Deposit

25 USD /336 BWP

Regulators

CySEC, ASIC, BVI, FSA

Trading Desk

MetaTrader 4, TradingView

Crypto

Yes

Total Pairs

275+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Since the broker’s beginning, their mission has been to democratise trading by accepting an initial deposit of merely 336 Pula ($25), while also growing their clientele and receiving numerous positive evaluations for their trading platform.

easyMarkets’ Contracts for Difference (CFDs) offering has grown considerably over the years to include cryptocurrency trading in addition to Forex instruments, international indices, energy, metals, and stocks. Additionally, easyMarkets also offers CFDs for commodities such as energy and metals.

In general, easyMarkets has a good reputation, particularly among those who are just beginning their trading careers. In addition, easyMarkets is well-known for the user-friendliness of its features, which include a low freeze rate and the ability to cancel transactions.

Unique Features

| Account Feature | Value |

| 📱 Platform Offered | MetaTrader 4 |

| 📉 Minimum Transaction Size (USD) | 0.01 |

| 💻 Maximum Transaction Size (lots) | 50 lots |

| 📊 Average Fixed Spreads (from) | • EUR/USD – 1.7 pips • GBP/USD – 2.3 pips • USD/JPY – 2 pips • WTI (OIL) – 0.05 USD • XAU/USD – 0.45 USD |

| 📉 Minimum Deposit | 336 Pula (Equivalent to $25) |

| 📈 Maximum Leverage | 1:400 |

| 💵 Commission Fees | None |

| 💸 Account Fees | None |

| 💰 Deposit and Withdrawal Fees | None |

| 👥 Customer Telephonic Support | Yes |

| 🗣 Personal Account Manager | Yes |

| 📞 24/5 Customer Support Through Live Chat | Yes |

| 💵 Guaranteed Zero Slippage | Yes |

| 🛑 Guaranteed Stop-Loss | No |

| ❌ Negative Balance Protection | No |

| 📊 Daily Email on Fundamental Analysis | Yes |

| ✔️ Daily Email on Technical Analysis | Yes |

| 📱 Trading Central Indicator | Yes |

| 💰 Account Base Currency Options | EUR, CAD, CZK, JPY, NZD, AUD, PLN, TRY, CNY, HKD, USD, SGD, CHF, GBP, MXN, NOK, SEK, ZAR, BTC |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| easyMarkets is well-regulated and has an extremely high trust score | There are no variable spread accounts available to Botswanan traders |

| Botswanan traders can choose between MetaTrader and easyMarkets’ proprietary trading software | Botswanan traders cannot set Botswanan Pula as their base account currency |

| Botswanan traders have access to TradingView when they register a trading account | There is an inactivity fee applied to all dormant accounts |

| The broker is known for unique trading solutions such as Freeze-Rate, Inside Viewer, easyTrade, and several other innovative technologies | |

| Botswanan traders are given unlimited access to a demo account which is funded with virtual capital | |

| There are competitive fixed spreads offered | |

| There is a choice between different easyMarkets retail account types and trading options | |

| Commission-free trading is guaranteed on all trading accounts |

2. FP Markets

Overview

Botswana residents are welcome to use FP Markets, which has a round-turn commission cost of US$6 ($3 per side) and an average spread starting at 0.0 pip.

FP Markets offers demo and Islamic accounts, and its highest leverage ratio is 1:500. Supported platforms include MT4, MT5, Myfxbook, and FP Markets. FP Markets, which is based in Australia, is governed by ASIC and CySEC.

Min Deposit

100 USD/1 343 BWP

Regulators

ASIC, CySEC, FSCA, CMA

Trading Desk

MetaTrader 4, MetaTrader 5

Crypto

Yes

Total Pairs

63

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Since its foundation in 2005, FP Markets has served clients from all around the world, giving it a comprehensive understanding of the industry. FP Markets has a big advantage in that it strengthens its service and funds its innovation by utilising cutting-edge trading technology and electronic bridges.

FP Markets has garnered a stella reputation in the industry during its operational history, making it a highly trustworthy broker despite its lack of regulation in Botswana.

Unique Features

| Account Feature | Value |

| 💰 Minimum Deposit | 100 USD / 1 343 BWP |

| 📊 Average Spreads | Variable, from 1 pip |

| ✔️ Instruments Available | 60+ Forex pairs, metals, indices, commodities |

| 📈 Maximum Leverage Ratio | 1:500 |

| 📱 Execution Type | ECN |

| 💵 Commissions | None |

| 👥 Expert Advisors Offered? | Yes |

| 📲 Mobile App Offered? | Yes |

| ✔️ VPS Available? | Yes |

Pros and Cons

| ✔️ PROS | ❌ CONS |

| fpmarkets is a well-established Australian broker regulated by ASIC and CySEC | Fixed spreads are not available |

| Botswanan traders can choose from an impressive range of markets that can be traded through powerful platforms | There are withdrawal fees charged on most payment methods that are supported |

| fpmarkets offers comprehensive mobile trading opportunities | There are administration fees which apply to the Islamic accounts and trading |

| Botswanan traders can expect superior ECN pricing that includes raw and tight spreads and low commissions | |

| fpmarkets is known for its fast trade execution that is delivered through the Equinix servers | |

| There are commission-free accounts offered that still feature competitive spreads | |

| There are dedicated Islamic accounts for Muslim traders | |

| fpmarkets offers a range of educational materials and advanced trading tools |

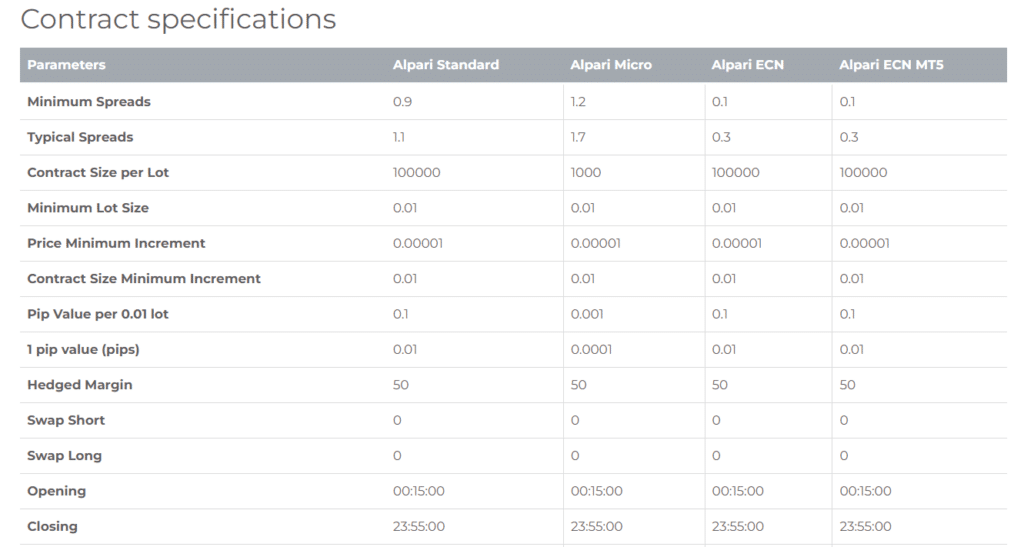

3. Alpari

Overview

Alpari was founded in 1998 by three Russian partners from scratch, and over the years it has developed into one of the top Forex brokers.

Alpari currently provides a wide range of premium services for cutting-edge internet trading on the foreign exchange currency market to more than a million customers from 150 different countries through offices in Russia, Ukraine, Belarus, Belize, Moldova, Mauritius, Saint Vincent and the Grenadines, Uzbekistan, Kazakhstan, and Georgia.

Min Deposit

5 USD / 67 BWP

Regulators

FSC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

48

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Alpari allows Botswanan customers and charges a $1.5 commission per side with an average spread of 0.4 pip. The maximum leverage ratio of Alpari is 1:1000, and the brokerage offers both a sample account and an Islamic account.

Alpari is a great option for beginner traders in Botswana, due to its user-friendly interface, high level of comprehensive educational resources, and excellent customer support. That said, advanced traders will also find a lot to like at Alpari with its proprietary mobile trading app.

Unique Features

| Feature | Information |

| ⚖️ Regulation | Financial Services Commission Mauritius (FSC) |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Forex Standard Account, Forex Micro Account, Forex ECN Account, Forex Pro Account |

| 📊 Trading Platform | MetaTrader 4, MetaTrader 5, Alpari Trading App |

| 💰 Minimum Deposit | 67 Botswanan Pula or 5 EUR, USD, or GBP |

| 💰 Trading Assets | Forex Majors, Forex Minors, Forex Exotics, Forex RUB, Spot Metals, Spot Commodities, Stock Trading, Spot Indices |

| 🔎 Botswanan Pula-based Account? | Yes |

| 💳 BWP Deposits Allowed? | Yes |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 0.4 pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | No |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Well-regulated and award-winning CFD broker | Fixed spreads are not offered |

| Offers forex trading signals from AutoChartist and automatic trading | Not regulated by the Financial Conduct Authority, Cyprus Securities and Exchange Commission, or any other popular market regulators |

| MetaTrader 4 and MetaTrader 5 are supported across devices | There is a limited selection of trading instruments, educational tools, and research |

| News is streamed from FxWirePro | There are restrictions on several jurisdictions |

| A dedicated customer support team offers multilingual customer support | |

| Offers unique solutions to both beginner and experienced traders | |

| There are four retail investor accounts to choose from, demo accounts, and Islamic accounts | |

| There are several convenient funding options to choose from and deposit fees are not charged |

4. IG

Overview

IG, which started operations in the UK in 1974, is one of the biggest CFD brokers in the world.

The Financial Conduct Authority (FCA) in the United Kingdom and the Federal Financial Supervisory Authority in Germany are among the primary regulators that oversee IG in various parts of the world (BaFin).

Min Deposit

USD 0 / 0 BWP

Regulators

IGRs

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

The IG Group also trades on the London Stock Exchange and has public shares. IG is reconised as a trustworthy business since it is publicly traded, its financials are open to public inspection, and it is held to the strictest regulatory standards.

The variety of currency combinations that traders can choose from gives them access to a wide range of trading opportunities, commission-free alternatives, a highly competitive trading environment, and highly sophisticated trading algorithms.

IG is one of the longest standing Forex brokers in the industry, further boosting its reliability and trustworthiness.

Unique Features

| Features | Information |

| ⚖️ Regulation | FCA, BaFin, CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, CFTC, FINRA, NFA, BMA |

| 💸 Minimum Withdrawal Time | Instant |

| 📈 Maximum Withdrawal Time | Between 1 to 3 Business Days |

| 💰 Instant Deposits/Withdrawals? | Yes |

| 💳 BWP-Denominated Account? | No |

| 📱 Minimum Deposit Amount | 3 363 Botswanan Pula, equivalent to $250 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| IG offers an extensive range of financial instruments, one of the largest in the industry | There is no account protection given to several countries |

| IG has a long history of providing superior trading services at affordable prices | There is an extremely high minimum deposit requirement |

| IG is well-regulated | BWP is not an accepted base currency |

| IG places emphasis on education and research | There are several non-trading fees charged |

| Botswanans can choose from several trading accounts according to their unique needs |

5. AvaTrade

Overview

More than 400 000 users use AvaTrade on a global scale. It is one of the most strictly regulated brokers globally and the recipient of numerous industry awards.

AvaTrade provides service and support in numerous languages when trading in more than 1250 FX pairs. It includes Smart Charts, Webinars, and a variety of forex trading education in addition to its advanced trading tools, all of which are offered without charge.

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

A dedicated account manager from AvaTrade is available to the trader for support and guidance as well as one-on-one training sessions with a $1,000 investment.

Customers’ money is stored in segregated accounts, and the business is subject to tight regulations. Botswanan investors have a comprehensive selection of investor accounts with a variety of account types offered in different jurisdictions through AvaTrade.

The spread at AvaTrade is typically between 0.6 and 0.92 pip.

Unique Features

| Feature | Information |

| ⚖️ Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, FRSA, CySEC, ISA |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Retail Investor Account, Professional Account Option |

| 📊 Trading Platform | AvaTradeGO, AvaOptions, AvaSocial, MetaTrader 4, MetaTrader 5, DupliTrade, ZuluTrade |

| 💰 Minimum Deposit (BWP) | $100 / 1343 BWP |

| 💰 Trading Assets | Foreign currencies, Cryptocurrencies, Commodities, Treasuries, Bonds, Indices, Stocks, ETFs, Options, CFDs, Precious Metals |

| 🔎 Botswanan Pula-based Account? | No |

| 💳 BWP Deposits Allowed? | No |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 0.9 pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| AvaTrade is multi-regulated and one of the most trusted online trading brokers in the world | Variable spreads are not offered |

| There is a wide range of financial instruments that can be traded across financial markets | There is a limited choice between account types |

| There are several technical indicators, economic indicators, and other solutions for advanced traders | Inactivity fees are applied |

| There are several trading platforms to choose from | Currency conversion fees may be applied |

| There is a decent selection of educational material that helps beginner traders navigate complex instruments and lower the degree of risk they are often exposed to | There is a limited number of base currency options offered on accounts |

| There is a multitude of social trading opportunities offered | |

| The broker accepts any trading strategy including automated trading, expert advisors, scalping, hedging, and others. |

6. FXTM

Overview

In Botswana, FXTM is a reputable, competitive, and low-risk forex broker. It was established in 2011 and is headquartered in Cyprus. The business has won over 25 honours throughout its more than ten years in business, including Best Investment Broker.

The Financial Conduct Authority in the UK has registered it as a multi-regulated FX broker. Money from retail clients is kept in securely separated accounts with reputable banks.

Min Deposit

USD 10

Regulators

CySec, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

60

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Five days a week, 24 hours a day, FXTM provides access to the forex market. It offers average to affordable forex trading fees and trades in all significant, minor, and exotic currency pairs.

It features a robust and concentrated customer care system that is reachable by phone, live chat, or email. Analysis of trading errors and remedies to trading issues as they arise are all parts of trading and technical assistance.

For all varieties of trading techniques, trading solutions are offered, and FXTM’s standard spread ranges from 0.8 to 1.0 pip.

Unique Features

| Feature | Information |

| ⚖️ Regulation | CySEC, FSCA, FCA, FSC Mauritius |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Micro Account, Advantage Account, Advantage Plus Account |

| 📊 Trading Platform | MetaTrader 4, MetaTrader 5, FXTM Trader |

| 💰 Minimum Deposit | 134 Botswanan Pula equivalent to $10 |

| 💰 Trading Assets | Precious Metals, Stock Trading, Stock CFDs, Indices, Forex Indices, Forex Currency Pairs (including minor, major, and exotic pairs), Commodities, Stock Baskets |

| 🔎 Botswanan Pula-based Account? | Yes |

| 💳 BWP Deposits Allowed? | Yes |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 0.0 pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| FXTM is a multi-regulated and a reputable broker that has gained a high level of trustworthiness | Inactivity fees apply when the retail investor account becomes dormant |

| Dedicated customer support offered for Botswanan traders Several deposit options and withdrawal methods offered | |

| There is a low minimum deposit requirement | |

| Commission-free trading is offered | |

| Deposit fees are not charged on any payment methods | |

| Withdrawal processing times are quick | |

| There are several educational tools offered | |

| There is an exclusive risk management tool offered |

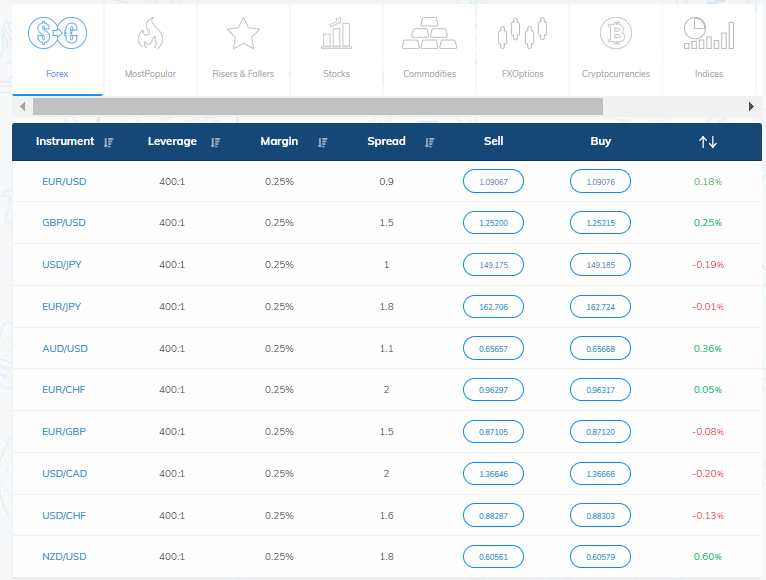

7. GO Markets

Overview

In Botswana, GO Markets is a multi-regulated forex broker that abides by strict guidelines set forth by a compliance management system. Money from clients is kept in segregated accounts at reputable banks.

Two retail investor accounts are available from the company, each suited for traders with varying degrees of knowledge and expertise.

Min Deposit

USD 200 / 2 690 BWP

Regulators

ASIC, CySec, FSC, FSA, SCA

Trading Desk

Hybrid

Crypto

Yes

Total Pairs

600+

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

GO Markets, one of the top 50 forex brokers in Botswana priority on meeting client demands and providing excellent customer service. It offers an average spread of 1.1–1.2 pips against major currencies and has very competitive trading fees.

Unique Features

| Account Feature | Value |

| 📉 Minimum Deposit Requirement | 2 690 BWP or an equivalent to AU$200 |

| 📊 Spreads | Variable, from 1 pip |

| 🔨 Instruments Available | • 60+ Forex pairs • Precious Metals • Indices • Commodities |

| 💳 Commission Charges | None |

| ✔️ Markets Offered | • 50+ FX Pairs including major, minor, and exotic pairs • Shares • Indices • Commodities • Cryptocurrencies |

| 📈 Maximum Leverage offered | 1:500 |

| 📈 Access to Trading Tools | Yes |

| 💻 Base Account Currencies | AUD, USD, EUR, GBP, NZD, CAD, SGD, CHF, HKD |

| ✔️ Expert Advisors Offered? | Yes |

| 📱 Scalping Allowed? | Yes |

| ✅ VPS Available? | Yes |

Pros and Cons

| ✔️ PROS | ❌ CONS |

| GO Markets is a multi-regulated and multi-asset CFD and Forex broker that has a high trust score | There is a high minimum deposit requirement on both accounts |

| Both MetaTrader 4 and 5 are offered to Botswanan traders | There are only two trading accounts offered and no Islamic account option |

| There are tight spreads offered on the GO+ Account, making it ideal for scalpers and other high-frequency traders | There are no BWP-denominated trading accounts offered |

| Advanced traders are given access to a range of useful tools such as Trading Central, Myfxbook, AutoChartist, a-Quant, and more | |

| There is a demo account provided | |

| There is a choice between deposit and withdrawal options, with no fees charged on either | |

| Beginner Botswanan traders are given access to a range of educational materials |

How to choose a low spread Forex broker in Botswana

Botswanan traders must evaluate the following components of a forex broker to decide whether the broker is suited to their unique trading objectives or needs.

Regulations and Licenses

This is the first vital component that Botswanan traders must thoroughly evaluate. Reputable brokers are regulated by market regulators such as FCA, ASIC, CySEC, FSCA, and others.

Botswanans must beware when dealing with brokers with only offshore regulations such as FSA, SVG BVI, FSC, and others.

Account Features

Account Features include leverage trading and margin requirement, commissions and spreads, initial deposit, additional features on retail investor accounts, and so on.

Deposits and Withdrawals

Botswanans must evaluate the payment options available, the processing times on withdrawal requests, deposit currencies offered, the withdrawal fee, deposit fees, and minimum withdrawal limits, among other trading and non-trading fees.

Range of Markets

The range of markets offered refers to the number and range of tradable instruments the broker offers. Therefore, Botswanans must consider what they wish to trade and what is available.

Customer Support

Customer Support is another crucial factor. Botswanans must check the availability of support (trading hours), the quality of support, and the promptness with which the customer support team responds to queries.

Trading Platform

A trading platform is the Botswanan trader’s portal to the financial markets. Therefore, traders must ensure that the trading platform has the necessary technical indicators, fundamental analysis, technical analysis, economic calendar, charting, newsfeed, and other tools they may need.

Education and Research

Education and Research come in handy to both novice traders and experienced investors. Education includes some of the following:

➡️ eBooks

➡️ Trading guides

➡️ Trading knowledge on leveraged products

➡️ A risk warning on complex instruments

➡️ Educational videos

Research can include some of the following:

➡️ Trading tools

➡️ Commentary

➡️ Status of International Markets

➡️ Price movements

➡️ Market sentiments

➡️ Whether there is a volatile market

➡️ Exchange Rates

➡️ Expert opinions and other resources can help experienced traders make informed trading decisions.

The Best Low Spread Forex Brokers in Botswana

In this article, we have listed the best brokers that offer forex trading to traders in Botswana. In addition, we have further identified the brokers that offer additional services and solutions to Botswanan traders.

Best MetaTrader 4 / MT4 Forex Broker in Botswana

Min Deposit

USD 25

Regulators

FCA UK

Trading Platform

MT5, MT4, OctaTrader

Crypto

Yes

Total Pairs

28

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, OctaFX is the best MT4 forex broker in Botswana. OctaFX is an MT4 and MT5 broker that provides Botswanans with various markets. OctaFX offers a choice of accounts via MT4, including ECN and STP accounts, with superior trade execution.

Best MetaTrader 5 / MT5 Forex Broker in Botswana

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, AvaTrade is the best MetaTrader 5 forex broker in Botswana. In addition, AvaTrade is regarded as one of the most secure MT5 forex brokers.

No commission is charged for trading currency pairings, only leaving the spread to be paid. A demo account is also available for traders to sharpen their abilities via MT5 and several other platforms.

Best Forex Broker for beginners in Botswana

Min Deposit

$100

Regulators

CFT, NFA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FOREX.com is the best forex broker for beginners in Botswana. FOREX.com is a broker renowned for low trading fees and beginner-friendly solutions. In addition, FOREX.com offers several educational materials and a helpful demo account.

Best Low Minimum Deposit Forex Broker in Botswana

Min Deposit

$10 / 134 BWP

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Exness is the best Low Minimum Deposit Forex Broker in Botswana. Exness has a minimum deposit requirement of 10 USD / 130 BWP, making it easy for Botswanans to start trading 278 instruments.

Exness also offers MT4 and MT5 through which trades can be made. In addition, it offers some of the best trading tools, charting capabilities, technical indicators, expert advisors, and more.

Best ECN Forex Broker in Botswana

Min Deposit

USD 0

Regulators

CySEC, FCA, DFSA, FSCA, FSA, CMA

Trading Desk

MT4, MT5, HFM APP

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

0

Account Activation Time

24 Hours

Overall, HFM is the best ECN forex broker in Botswana. HFM is a hybrid forex and CFD broker that uses STP and ECN technology to ensure that Botswanans get the best pricing, minimal slippage, no requotes, and the fastest trade execution.

HFM uses the best liquidity providers who aggregate the pricing that Botswanans can see on MT4, MT5, and the HF App for Android and iOS.

Best Islamic / Swap-Free Forex Broker in Botswana

Min Deposit

USD 10 / 136 BWP

Regulators

CySec, FCA

Trading Desk

None

Crypto

Yes

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, eToro is the best Islamic / Swap-Free forex broker in Botswana. eToro is a renowned social trading platform that offers Muslim traders an Islamic Account.

eToro does not charge any interest on positions held for over 24 hours. However, registering an Islamic Account can be expensive initially, requiring a 1,000 USD /13, 452 BWP deposit.

Best Forex Trading App in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

ASIC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

300

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, CMC Markets is the best forex trading app in Botswana. In addition, CMC Markets offers a user-friendly mobile app with research tools, powerful charts, customizable watch lists, news reports, and a range of educational materials.

Best Lowest Spread Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

FCA, CySEC, IFSC, KNF

Trading Desk

No Trading Desk

Crypto

Yes

Total Pairs

48

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, XTB is the best lowest-spread forex broker in Botswana. XTB is a well-known forex and CFD broker with low and competitive forex spreads from 0.1 pips depending on the financial instrument and the market conditions.

XTB is also a good broker in terms of educational materials and research capabilities, providing traders with comprehensive market analysis across markets.

Best Nasdaq 100 Forex Broker in Botswana

Min Deposit

USD 10

Regulators

CySec, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

60

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXTM is the best Nasdaq 100 forex broker in Botswana. FXTM is a multi-regulated forex and CFD broker that accommodates Botswanan traders with a keen interest in Nasdaq. Traders can expect low and competitive spreads, a choice between accounts, and powerful trading platforms.

Best Volatility 75 / VIX 75 Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

IGRs

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, IG is Botswana’s best Volatility 75 / VIX 75 forex broker. IG is one of the best CFD brokers with powerful proprietary trading technology.

IG is well-regulated and offers Botswanans access to VIX75, with spreads from 0.04 pips / 0.13% and zero commission charges.

Best NDD Forex Broker in Botswana

Min Deposit

USD 50 / 672 BWP

Regulators

FCA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

–

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXCM is the best NDD forex broker in Botswana. FXCM is a No-Dealing Desk broker with STP and ECN execution across several markets.

In addition, FXCM offers a choice between third-party platforms in addition to technical indicators, charting tools, and competitive trading conditions.

Best STP Forex Broker in Botswana

Min Deposit

USD 10

Regulators

IFSC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

36

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, RoboForex is the best STP forex broker in Botswana. RoboForex is popular forex and CFD broker with competitive trading conditions. RoboForex offers STP execution with liquidity sourced from top providers.

Botswanans can expect access to over 12,000 instruments via powerful and innovative third-party platforms.

Best Sign-up Bonus Broker in Botswana

Min Deposit

50 USD / 682 BWP

Regulators

CYSEC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Windsor Brokers is the best sign-up bonus broker in Botswana. Windsor Brokers is a well-regulated broker that offers Botswanans a welcome account funded with 30 USD in trading credit. With this account, Botswanans can explore the platform or risk-free test their strategies.

You might also like: Best Trading Robots in Botswana

You might also like: CFD Trading Platforms in Botswana

You might also like: Best Futures Trading Platforms in Botswana

You might also like: Best Forex Brokers that Accept M-Pesa Botswana

You might also like: Best Cent Account Forex Brokers in Botswana

Conclusion

Overall, to trade with peace of mind in a transparent and low-cost trading environment, go no further than the top Botswanan forex brokers. Many also allow demo trading and offer Islamic accounts that are suitable for Botswanan investors. They provide numerous trading options and platforms, as well as low spreads and safe account storage.

Frequently Ask Questions

Are low spreads good in Forex trading?

When referring to the difference in price between the bid and the ask, a low spread indicates that the gap is narrow. Trading during times when spreads are narrow, such as during the major forex sessions, is highly recommended. When the spread is low, volatility is typically low as well, and it often suggests that liquidity is strong.

Why is a load spread important?

A currency pair is said to have a modest spread when the price difference between the bid price and the ask price is relatively small. If the spread is smaller, the amount of money that is “creamed off the top” for the broker is also smaller, which means that the price that you pay for a currency pair is closer to the price that is actually being traded on the market.

Which Forex pair moves the most?

Those forex pairs that move the most pips are USD/RUB, USD/TRY, and USD/ZAR. On the other hand, the least volatile currency pairs (major) are AUD/NZD, EURCHF, EURUSD, AUDCHF, USDCHF, EURCAD, and so on.

Which Forex session is most volatile?

The London trading session is typically the most volatile of the day’s sessions because of the high volume of transactions that take place during that session. The majority of trends get their start during the London session, and they will normally remain in place until the start of the New York session.

Who are scalpers in Forex?

The goal of a forex scalper is to make a high number of trades in order to profit from the frequent and minute fluctuations in currency prices that occur during the trading day. Scalping is a method of trading that focuses on pursuing very modest profits, typically between 5 and 20 basis points (pips) every trade. The profit that may be made from these trades can be augmented by raising the size of the position.

Why traders should consider spreads before choosing a trading broker?

The spread is the difference between the bid (buy) and the ask (sell) price. In general, the lower the spread, the better it is for the trader.

Which brokers offer zero-spread accounts?

- FP Markets

- IG

- GO Markets

Which local brokers have the lowest commissions in Botswana?

- easyMarkets

- FP Markets

- AvaTrade

- GO MARKETS

Which broker offers a sign-up BONUS for first-time traders?

- easyMarkets

- AvaTrade

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review