10 Best MT4 Brokers in Botswana

The 10 Best MT4 Forex Brokers in Botswana revealed. We tested and verified the best MT4 platforms from top forex brokers with a secure, dependable trading environment for Botswana Traders.

This is a complete list of MT4 forex brokers in Botswana.

In this in-depth guide you’ll learn:

- What is the MT4 Trading Platform?

- How does MetaTrader4 work as a platform?

- How to open an MT4 account?

- Who are the best MetaTrader4 brokers in Botswana?

- How to choose a forex broker best suited for your trading style.

- How to download the MT4 platform on your phone (IOS and Android).

- Which MT4 broker offers a demo account?

- Which MetaTrader4 brokers offer a low minimum deposit of $5 (93 BWP)?

- Which broker offers a sign-up bonus for first-time traders?

And lots more…

So if you’re ready to go “all in” with the best-tested MT4 forex brokers for Botswana Traders…

Let’s dive right in…

- Louis Schoeman

Best MT4 Brokers in Botswana

| 🏅 Forex Broker | 👉 Open Account | 🎉 Trading Platform | 💰 Minimum Deposit? | 💸 Botswana Shilling (BWP) Deposits Allowed? |

| 1. Exness | 👉 Open Account | MetaTrader 4 and MetaTrader 5 | $10 / 188 BWP | No |

| 2. AvaTrade | 👉 Open Account | MetaTrader 4, MetaTrader 5 | USD 100 / 1866 BWP | No |

| 3. IG | 👉 Open Account | MetaTrader 4 | USD 250 / 4702 BWP | No |

| 4. JustMarkets | 👉 Open Account | Metatrader 4 | $1 / 13 BWP | No |

| 5. XM | 👉 Open Account | Desktop MT4 and MT5, Mobile MT4 and MT5, XM mobile app, Web platform | USD 5 / 67 BWP | No |

| 6. FXTM | 👉 Open Account | MetaTrader 4 MetaTrader 5 | $10/ 135 BWP | No |

| 7. HFM | 👉 Open Account | MetaTrader 4 MetaTrader 5 | $0 / 0 BWP | No |

| 8. Pepperstone | 👉 Open Account | MetaTrader 4, MetaTrader 5, cTrader and TradeView | 200 USD / 2622 BWP | No |

| 9. Tickmill | 👉 Open Account | MT4 & MT5 , MetaTrader WebTrader MetaTrader 4 for Mac Tickmill Mobile App | $100 / 1866 BWP | No |

| 10. CMC Markets | 👉 Open Account | Metatrader 4 | $ 0 / 0 BWP | No |

10 Best Forex Brokers in Botswana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

What is MetaTrader 4, and why is it so popular?

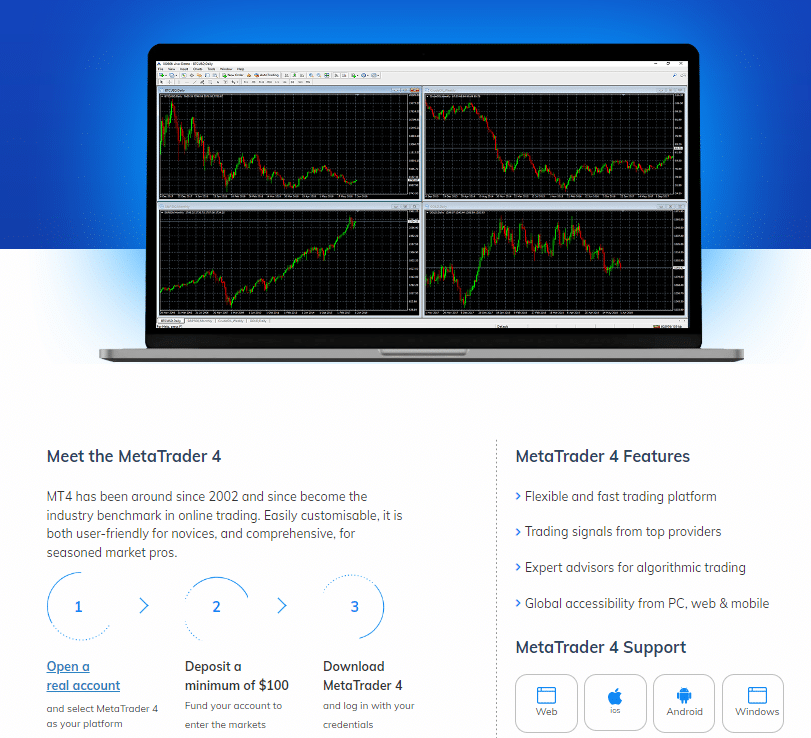

MetaQuotes’ 2005 release of MetaTrader 4 (MT4) makes trading on the web easier. MetaTrader 4, most typically used for forex trading, may also be used to trade other markets, such as indices, cryptocurrencies, and commodities, via contracts for difference (CFDs).

Traders use MT4 because it can be easily modified to suit their specific needs. It may also be programmed to initiate and cancel transactions automatically based on a user-specified set of criteria. When it comes to retail foreign exchange trading, MetaTrader4 (MT4) is king.

More than 700 online forex brokers support this platform. Among trading platforms, it is among the most feature-rich and comprehensive. Real-time trading requires a complete focus on beating the market and closing with a profit.

Daily success is already challenging; a complex trading platform will worsen matters. Therefore, it is essential to simplify the trading platform. MT4 contains all the tools and indications you want, as described above, but it is straightforward to navigate.

You can find the symbols and rates on the left side of the platform, the charts on the right, and the indicators and other features at the top.

Trading and customizing with a single click have made it simpler. MT4 provides it in several ways, but the most significant are as follows:

➡️ Regarding servers, MT4’s are much more innovative than their rivals and the previous edition. For example, it can handle thousands of transactions at once.

➡️ In addition to using little system resources, MT4 performs well even when connected through a slow internet connection. Therefore, it has a quicker response time to the subsequent point.

➡️ Brokers may use the client terminal’s mailbox feature to send time-sensitive messages to their customers in real-time, saving everyone involved a lot of time and effort.

➡️ Safeguards: The MT4’s safety measures are almost flawless. It significantly improved over earlier versions in that it protects against DoS attacks. It uses a single, symmetric 129-bit key to link both ends.

10 Best MT4 Brokers in Botswana

- ✔️ Exness – Overall, Best MT4/MetaTrader 4 Broker in Botswana

- ✔️ AvaTrade – Top Forex Broker for Beginner Traders

- ✔️ IG – Best STP Forex Broker

- Justmarkets – Top Sign-Up Bonus Forex Broker

- XM – Best Lowest Spread Forex Brokers in Botswana

- FXTM – Top Nasdaq100 Forex Broker

- HFM – Best ECN Forex Broker in Botswana

- Pepperstone – Top MetaTrader 5/MT5 Forex Broker

- Tickmill – Best Forex Broker for Beginner Traders

- CM Trading – Top Islamic/Swap-Free Forex Broker in Botswana

1. Exness

The Standard Account on MT4 from Exness needs a minimum deposit of 186 BWP / 10 USD and has an average EUR/USD spread of 0.3 pips. This account is an excellent low-risk way for novice traders to get expertise on live markets.

The Pro Account on MT4 offers commission-free trading with average spreads of 0.1 pips EUR/USD. However, a minimum deposit of 9334 BWP / 500 USD is required.

Exness also provides two commission-based accounts, namely the Raw Spread and Zero Account, with zero-pip spreads and commissions that range from $0.1 to $3.5, depending on the position size and financial instrument.

Min Deposit

$10 / 134 BWP

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Botswanans can also expect a Standard Cent Account that they can register through MetaTrader 4. The Standard Cent is the perfect account once traders start exploring live markets, the spreads start from 0.3 pips, and there are no commission fees.

All Exness MT4 customers receive access to financial news from the world’s main suppliers and the TC Technical Analysis indicator from the worldwide research firm Trading Central.

Exness supports the MT4 MultiTerminal platform, enabling customers to manage several accounts from a single application. Lastly, Exness provides complete MT4 compatibility and custom-built EAs for automatic trading on all account types.

Overview

| Feature | Information |

| ⚖️ Regulation | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Standard Account, Standard Cent Account, Raw Spread Account, Zero Account, Pro Account |

| 📊 Trading Platform | MetaTrader 4, MetaTrader 5, Exness Terminal, Exness Trader app |

| 💰 Minimum Deposit | $10 / 134 BWP |

| 💰 Trading Assets | Forex minor pairs, forex major pairs, forex exotic currency pairs, Metals, Crypto, Energies, Indices, Stocks |

| 🔎 Botswanan Pula-based Account? | No |

| 💳 BWP Deposits Allowed? | Yes |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 0.0 pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | No |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Exness is a reputable international broker authorized by several reputable market regulators | There is a limited selection of tradable instruments in only a few financial markets |

| The broker offers some of the tightest spreads across all types of accounts | There is a limited selection of funding options offered |

| There are several account types to choose from, each accommodating different types of traders | |

| There are various market metrics available including exchange rates, overall trading activities available, current market conditions, and more. | |

| Exness is ideal for any Botswanan beginner traders and institutional investors | |

| There are solutions offered for any type of professional trader who needs advanced options | |

| There is a powerful proprietary mobile app offered | |

| Client fund safety and investor protection is guaranteed | |

| Multilingual 24/7 customer support is offered | |

| Instant withdrawal methods are available |

2. AvaTrade

In addition to being regulated by the CySEC, ISA, KNF, IIROC, JFSA, BVI FSC, ASIC, CBI, FSCA, ADGM, and FFAJ, AvaTrade also boasts over 200 thousand satisfied consumers worldwide.

AvaTrade is the top MT4 broker because it offers the greatest assistance, tools, and trading conditions while providing MT5 and its own WebTrader, including the excellent AvaTradeGo mobile platform.

AvaTrade provides its Botswanan MT4 customers full support for all native features, including 9 timeframes, EA functionality, 30 built-in indicators, and the Guardian Angel system.

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

The Guardian Angel system is a personalized trading feedback tool that helps traders refine their decision-making. In addition, AvaTrade offers seamless integration with automated trading platforms like ZuluTrade and DupliTrade and access to Trading Central at no cost.

The AvaTrade MT4 platform has competitive spreads over 55 forex pairs, commodities, and cryptocurrencies (Bitcoin, Ethereum, and Litecoin) but, unfortunately, applies mark-up to spreads.

Botswanans can access 1:400 leverage, 0.9 pip spreads on the EUR/USD, and commission-free trading with an industry-standard 1866 BWP / 100 USD minimum deposit on MT4.

Overview

| Feature | Information |

| ⚖️ Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, FRSA, CySEC, ISA |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Retail Investor Account, Professional Account Option |

| 📊 Trading Platform | AvaTradeGO, AvaOptions, AvaSocial, MetaTrader 4, MetaTrader 5, DupliTrade, ZuluTrade |

| 💰 Minimum Deposit (BWP) | $100 / 1343 BWP |

| 💰 Trading Assets | Foreign currencies, Cryptocurrencies, Commodities, Treasuries, Bonds, Indices, Stocks, ETFs, Options, CFDs, Precious Metals |

| 🔎 Botswanan Pula-based Account? | No |

| 💳 BWP Deposits Allowed? | No |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 0.9 pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| AvaTrade is multi-regulated and one of the most trusted online trading brokers in the world | Variable spreads are not offered |

| There is a wide range of financial instruments that can be traded across financial markets | There is a limited choice between account types |

| There are several technical indicators, economic indicators, and other solutions for advanced traders | Inactivity fees are applied |

| There are several trading platforms to choose from | Currency conversion fees may be applied |

| There is a decent selection of educational material that helps beginner traders navigate complex instruments and lower the degree of risk they are often exposed to | There is a limited number of base currency options offered on accounts |

| There is a multitude of social trading opportunities offered | |

| The broker accepts any trading strategy including automated trading, expert advisors, scalping, hedging, and others. |

3. IG

IG may be the most trustworthy and best-regulated MT4 broker in the world. In addition to being publicly listed on the London Stock Exchange and holding a full banking license, IG is governed by twelve national authorities, including, but not limited to, the FSCA, FCA, ASIC, MAS, and FINMA.

IG provides outstanding education and market research in addition to low spreads, complete MT4 support, and tight spreads.

Min Deposit

USD 0 / 0 BWP

Regulators

IGRs

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

The IG version of MT4, which includes a set of free add-ons and indicators, brings the platform to a higher level than prior versions. A Trade Terminal, Stealth Orders, a Correlation Matrix, and a dozen other indicators are this platform’s highlights.

In addition, AutoChartist is made available to each customer of IG completely free of charge. This advanced software for automatic technical analysis searches the market for possibilities you may have overlooked.

All these capabilities are easily accessible by Botswanan traders, in addition to commission-free trading and narrow spreads, with the EUR/USD exchange rate from an average of 0.1 pips DMA.

Overview

| Feature | Information |

| ⚖️ Regulation | FCA, BaFin, CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, CFTC, FINRA, NFA, BMA |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | IG Trading Account, IG Professional Account, IG Options Trading Account, IG Turbo24 Account, Limited Risk Account, Share Dealing Account, Exchange Account (NADEX) |

| 📊 Trading Platform | MetaTrader 4, IG Platform, ProRealTime (PRT), L2 Dealer, FIX API |

| 💰 Minimum Deposit | USD 250 / 3 363 BWP |

| 💰 Trading Assets | Forex, Shares, Indices, Commodities, Cryptocurrencies, Interest Rates, Bonds, ETFs, Futures, Options |

| 🔎 Botswanan Pula-based Account? | No |

| 💳 BWP Deposits Allowed? | Yes |

| 💰 Bonuses for Botswanan traders? | No |

| 📈 Minimum spread | 0.1 pips (DMA) on EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | No |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Offers a significant range of financial instruments, including Botswanan-specific trading instruments | High minimum deposit charged |

| There are several powerful trading platforms offered | Inactivity fees apply |

| There are competitive trading conditions that include low spreads, low commissions, and reliable trade execution | |

| Traders can get free trading signals | |

| There is a comprehensive IG Academy offered with dedicated educational resources | |

| Convenient funding options provided along with free deposits and withdrawals | |

| FIX API Direct Market Access trading is offered | |

| There are Swap-Free Accounts offered for Islamic traders |

4. JustMarkets

JustMarkets began operations in 2012, and during the past decade, JustMarkets has expanded its operations worldwide. JustMarkets is registered in Seychelles and is regulated by the FSA through GM Group Limited.

Despite its lack of Tier-1 or 2 regulation, JustMarkets is a reliable and honest broker that supports two trading platforms, namely MetaTrader 4 and MetaTrader 5. There is also an innovative JustMarkets App available for iOS and Android users.

Min Deposit

USD 10

Regulators

FSA, CySec

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

240

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

JustMarkets provides access to seven distinct account types, consisting of four MT4 and three MT5 Accounts.

Botswanans can easily evaluate JustMarkets before diving in headfirst by opening a “demo” account. Once traders are ready, they can open an MT4 Standard Cent Account to explore live markets.

The minimum deposit on an MT4 account is 13 BWP / 1 USD and spreads start from 0.9 pips on the MT4 Standard Cent Account, while the MT5 Raw Spread Account offers zero-pip spreads on EUR/USD. Only the MT4 Raw and MT5 Raw Accounts incur commission fees of 6 USD per turn.

Overview

| Account Feature | Value |

| 📉 Minimum Deposit Requirement | 12 Botswanan Pula equivalent to $1 |

| 💻 Account Base Currency | USD, EUR, GBP, JPY, MYR, IDR, THB, VND, KWD, CNY, ZAR |

| 📊 Maximum leverage up to | 1:3000 |

| 💳 Commission charges | None |

| 📊 Swap-free option? | Yes |

| 📈 Average spreads from | 1 pip |

| 📉 Minimum order size | 0.01 lot |

| ➡️ Maximum order size | 100 lots |

| ⬆️ Maximum orders | Unlimited |

| 📞 Margin Call | 40% |

| 🛑 Stop-Out (%) | 20% |

| 📱 Trade Execution Method | Market Execution |

| ✔️ Pricing Format | Fifth Decimal Pricing |

| 💻 Contract Size | 1 lot = 100,000 base currency units |

| ✅ Trading Instruments Available | • 65 Forex pairs • 8 Metals • 9 Indices • 5 Cryptocurrency Pairs |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| JustMarkets offers a huge range of deposit methods and withdrawal options including bank wire transfers, bank transfers, Skrill, Neteller, and more | There is a limited choice of trading instruments |

| Demo trading and Islamic Swap-Free Accounts are offered | Inactivity Fees may apply after following several days of dormancy |

| JustMarkets offers mobile trading through powerful mobile trading apps | The broker does not have regulation through a reputable and trusted regulatory body |

| JustMarkets offers competitive cryptocurrency spreads across crypto pairs including Bitcoin, Ethereum, and others | |

| JustMarkets’s non-trading fees are reasonable | |

| The broker offers a risk warning, training webinars, an array of articles and education for inexperienced traders | |

| There is a wide choice between different types of accounts and excellent trading conditions | |

| One-click trading is offered in addition to insights to help Botswanan traders make better trading decisions | |

| Real-time market analysis is offered alongside analysis tools and several other additional tools | |

| Client funds are kept in segregated bank accounts | |

| There are several research and resources that can help traders make improved independent investment decisions | |

| JustMarkets’s account-opening process is quick and easy | |

| JustMarkets offers several innovative features including a range of services | |

| There are several trading account currencies to choose from | |

| There is no fee for withdrawals |

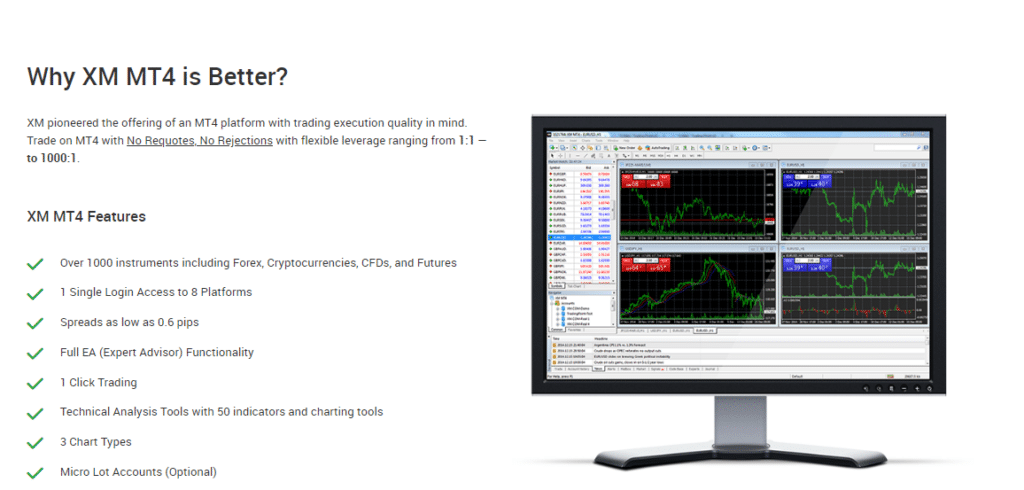

5. XM

XM distinguishes out from the mass of MT4 brokers thanks to its dedication to education and excellent customer service and its inexpensive trading costs spread among three easy account types.

Beginner traders can easily learn the ropes of using XM’s MT4 platform with the help of video guides. In addition, most aspects of trading, including signing up for an account, placing pending orders, and testing Expert Advisors, are covered in comprehensive tutorials on XM’s official website.

Min Deposit

USD 5 / 67 BWP

Regulators

IFSC, CySec, ASIC

Trading Desk

Desktop MT4 and MT5, Mobile MT4 and MT5, XM mobile app, Web platform

Total Pairs

57

Islamic Account

Yes

Trading Fees

No (Just spread)

Account Activation Time

24 Hours

Minimum deposits for MT4 accounts are from 93 BWP / 5 USD. The maximum leverage is 1000:1. Most transactions on XM MT4 are completed in about 1 second, and spreads start at only 0.0 pips EUR/USD on the Ultra-Low Account.

In addition, XM never re-quotes or rejects transactions, ensuring that your orders will always be executed at the price you anticipate. The Foreign Exchange market, stock indexes, precious metals, and energy markets are all accessible via MT4.

Overview

| Feature | Information |

| ⚖️ Regulation | FSCA, IFSC |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | $5 / 67 BWP |

| Average spread from | 0.0 pips EUR/USD |

| 📈 Maximum Leverage | 1:1000 |

| 👥 Customer Support | 24/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Negative balance protection is applied to retail investor accounts | US clients are restricted from accessing XM’s trading services |

| There are several secure payment methods to choose from | There are no fixed spread accounts offered |

| The broker is known for low spreads, low commissions, and reliable trade execution speeds | There is an inactivity fee applied to dormant accounts |

| Traders can use hedging, scalping, and expert advisor trading strategies | |

| The broker offers personal customer service to its clients |

6. FXTM

Botswanans can use MetaTrader 4 on the Micro, Advantage, and Advantage Plus Accounts provided by FXTM. The minimum deposit on the Micro Account is 190 BWP / 10 USD, and spreads on this account start from 1.5 pips EUR/USD.

The Advantage and Advantage Plus Accounts require much higher deposits of 9334 BWP / 500 USD. However, the spreads on major instruments like EUR/USD are much lower, often from 0.0 pips, with competitive commissions on the Advantage Account from $0.40.

Because new traders can learn how to utilize MT4’s sophisticated automation tools like scripts, EAs, and indicators, the Micro MT4 account is great for novice traders just starting on the platform.

Min Deposit

USD 10

Regulators

CySec, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

60

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Additionally accessible via the MT4 trading platform, the FXTM Invest Copy trading plan is widely regarded as one of the most effective in the industry.

Traders unfamiliar with MT4 could discover more experienced strategy managers whose risk profile is like theirs and imitate their trades.

FXTM provides weekend support, which is great for retail traders who wish to get their MT4 platform set up during the weekend but would otherwise not have expert assistance if they were dealing with another broker.

Overview

| Feature | Information |

| ⚖️ Regulation | CySEC, FSCA, FCA, FSC Mauritius |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Micro Account, Advantage Account, Advantage Plus Account |

| 📊 Trading Platform | MetaTrader 4, MetaTrader 5, FXTM Trader |

| 💰 Minimum Deposit | 134 Botswanan Pula equivalent to $10 |

| 💰 Trading Assets | Precious Metals, Stock Trading, Stock CFDs, Indices, Forex Indices, Forex Currency Pairs (including minor, major, and exotic pairs), Commodities, Stock Baskets |

| 🔎 Botswanan Pula-based Account? | Yes |

| 💳 BWP Deposits Allowed? | Yes |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 0.0 pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| FXTM is a multi-regulated and a reputable broker that has gained a high level of trustworthiness | Inactivity fees apply when the retail investor account becomes dormant |

| Dedicated customer support offered for Botswanan traders Several deposit options and withdrawal methods offered | |

| There is a low minimum deposit requirement | |

| Commission-free trading is offered | |

| Deposit fees are not charged on any payment methods | |

| Withdrawal processing times are quick | |

| There are several educational tools offered | |

| There is an exclusive risk management tool offered |

7. HFM

HFM is a licensed broker by one Tier-1, four Tier-2, and two Tier-3 regulators, and it offers five distinct accounts on the MT4 platform. HFM offers market execution on trades, and spreads typically start from 0.0 pips on the Zero Spread Account.

The Micro Account has a minimum deposit requirement of $0, and the spreads on the EUR/USD start at only 1 pip. In addition, Botswanan traders can note that demo versions of HFM’s various MT4 account types are available to new traders constantly.

Min Deposit

USD 0

Regulators

CySEC, FCA, DFSA, FSCA, FSA, CMA

Trading Desk

MT4, MT5, HFM APP

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

0

Account Activation Time

24 Hours

For MT4 traders who are more comfortable with Cent spreads and fees, the HFM Zero Spread Account provides trading conditions with spreads as low as 0 pips for a minimum deposit of $0 USD.

HFM supports MT4 in every conceivable manner, including the MT4 MultiTerminal, which enables traders to handle numerous MT4 accounts from a single platform and is one of how HFM supports MT4.

In addition to being accessible through the web and PC, MT4 can also be downloaded as an app for Android and iOS. Trading tools include a free version of AutoChartist, a Virtual Private Server (VPS), and copy trading services provided by HFCopy.

Overview

| Features | Information |

| ⚖️ Regulation | FSCA, CySEC, DFSA, FSA, FCA, CMA, and FSC, with registration in ACPR, BaFin, MNB, CONSOB, CNMV, FI, FMA, FSC, and other regions |

| 💸 Minimum Withdrawal Time | – |

| 📈 Maximum Withdrawal Time | 2 to 4 working days |

| 💰 Instant Deposits/Withdrawals? | Yes, deposits |

| 💳 BWP-Denominated Account? | No |

| 📱 Minimum Deposit Amount | $0 / 0 BWP |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| HFM does not charge any deposit fees when Botswanans transfer funds to a trading account | HFM does not support BWP as a deposit currency or an account base currency, which could result in currency conversion fees |

| There are competitive spreads charged | HFM’s spreads are wider on entry-level accounts |

| HFM is a transparent broker that does not have any hidden broker fees | |

| Botswanans need not worry about withdrawal fees when they transfer funds from the trading account |

8. Pepperstone

Pepperstone is an excellent option for traders needing a reputable MT4 broker that also offers an ECN account. The spread on the EUR/USD currency pair is 0.0 pips with the Pepperstone ‘Razor’ account.

Given that a commission is charged on every open position, Botswanans seeking the lowest possible cost could do well to open a “Standard” account, which rolls all costs into the spread.

Pepperstone is a broker that offers access to more than 70 different currency pairings via a MetaTrader 4. In addition, Pepperstone is one of the top automated trading platforms since it offers MT4, 28 forex indicators, and various Expert Advisors (EAs).

Min Deposit

0 USD / 0 BWP

Regulators

ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB

Trading Desk

MetaTrader 4, MetaTrader 5, cTrader and TradeView

Crypto

Yes (Not available in Africa)

Total Pairs

60+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Pepperstone is one of the safest choices since three major bodies regulate it: the Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), and the Federal Financial Supervisory Authority (BaFin).

In addition, Pepperstone is also regulated by CySEC in Cyprus, DFSA in Dubai, CMA in Kenya, and SCB in the Bahamas.

Overview

| Account Feature | Value |

| 💰 Minimum Deposit | $0 / 0 BWP |

| 💻 Minimum Trading Size | 0.01 lots |

| 📈 Maximum Trading Size | 100 lots in a single trade |

| 💵 Base Account Currency | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, and HKD |

| ✅ Trading Strategies Supported | All including scalping, hedging, and Expert Advisors (EAs) |

| 🗞 News Trading Offered? | Yes |

| ➡️ Trade Execution | No-Dealing Desk (NDD) |

| 📊 Average EUR/USD Spread | From 0.6 pips |

| 💸 Commissions | None |

| 🔃 Rollover Swaps | Yes, according to the market rates |

| ⬆️ Maximum Leverage per region | • Australia – 1:30 • Bahamas – 1:200 • Cyprus – 1:30 • Dubai – 1:30 • Germany – 1:30 • Botswana – 1:400 • United Kingdom – 1:30 |

| ❌ Negative Balance Protection Offered | Yes, only for retail clients |

| ✅ Margin Close-Out (%) | 50% |

| 🔨 Trading Instruments offered | 1,200+ |

| 💻 Trading Platforms offered | MetaTrader 4, MetaTrader 5, cTrader, TradingView, Myfxbook, DupliTrade |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Pepperstone offers competitive spreads that start from 0.0 pips on EUR/USD | There are restrictions on the countries that may use Pepperstone’s Islamic account |

| Pepperstone is well-regulated and offers an extremely secure trading environment with transparent trading fees | There is no BWP-denominated account offered, subjecting Botswanans to currency conversion fees |

| Investor protection is offered to EU clients through the FSCS | There are additional administrative fees applied to the Islamic account |

| Pepperstone offers a choice between some of the best trading platforms | |

| Negative balance protection is offered for clients in certain regions | |

| There is an Islamic account offered to Muslim traders | |

| There is a demo account offered by Pepperstone | |

| There are several trading tools offered |

9. Tickmill

Tickmill is a dependable broker that supports MT4 and MT5, offering three of the most competitively priced trading accounts in the business. In addition, Tickmill’s commission-based accounts have exceptionally low continuing trading charges, while the Classic Account’s fees are above average.

The minimum deposit for both the Classic and Pro accounts is 1866 BWP / 100 USD, which is within reach of most traders. In contrast, the VIP Account caters to more professional traders, requiring a 933424 BWP / 50,000 USD deposit.

Min Deposit

$100 / 1 343 BWP

Regulators

CySEC, FCA, FSA, FSCA, Labuan FSA

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

62

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

You can download MetaTrader4 (MT4) and MetaTrader5 (MT5) for your iPhone, iPad, Android, or Windows mobile device. The app will sync with the desktop program so you can trade on the go without missing a beat.

Metatrader 4 (MT4) is the most trusted and widely used platform, having long since established itself as the market standard. Its simple layout and welcoming atmosphere make it an ideal platform for online commerce.

In addition to its adaptability and swiftness, it is lauded for its extensive charting options, algorithmic trading, and rapid execution times. The Tickmill platform uses the MT4 standard version; this platform has several paid add-ons.

Overview

| Feature | Information |

| ⚖️ Regulation | FSA, FCA, CySEC, Labuan FSA, FSCA |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | $100 / 1 343 BWP |

| 📈 Average spread from | 0.0 pips EUR/USD |

| 📈 Maximum Leverage | 1:500 |

| 👥 Customer Support | 24/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The broker offers commission-free trading across financial instruments | The broker does not accept clients from the United States and some other regions |

| There are powerful trading platforms to choose from | Fixed spread accounts are not offered |

| The broker is well-regulated in several regions | |

| There is a selection of popular financial instruments that can be traded | |

| There are several advanced trading tools offered |

10. CM Trading

CM Trading was founded in 2009 in Johannesburg, South Africa. It is regulated by the FSCA and FSA, albeit it operates legally as Blackstone Marketing SA (PTY) Ltd.

Client monies are held in separate accounts from the company’s operational capital at major South African banks, and CM Trading’s books and records are audited regularly. In addition, CM Trading backs the Android and iOS versions of the MT4 mobile trading app.

Min Deposit

USD100

Regulators

FSA

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

154

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Guardian Angel and CopyKat are two of the most well-known trading methods offered by CM Trading. To aid traders in perfecting their methods and avoiding costly mistakes, Guardian Angel displays market tendencies and gives feedback on trading behaviour.

As a social trading platform, CopyKat is especially helpful for novice traders since it enables them to mimic the actions of seasoned pros.

Overview

| Account Feature | Value |

| 💳 Minimum Deposit | 668 Botswanan Pula and more equivalent to $50,000 |

| 💳 Maximum Deposit | None |

| 📊 Demo Account | Yes |

| 📈 Educational materials | Yes, Trading eBook, Webinars |

| ✴️ Market Reviews | Yes |

| 📈 Spreads from | 0.9 pips |

| 🔎 Live Trading Signals | Yes |

| 📊 Risk-Free Trades offered | 3 Risk-Free Trades |

| 🎓 Personal Assistant offered? | Yes |

| 📈 Trading Central Trading Signals | Yes |

| 👨💼 Trading Central Live Trading Signals | Yes |

| 🚀 Cashback Rebates | Yes |

| 🔎 Access to ECN? | Yes |

| 📊 Market News and Analysis For Fundamental Analysis | Yes |

| 📈 Special Offers | Yes |

| ✔️ Dedicated Trading Room | Yes |

| 📊 Trading specialist offering investment advice | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| CM Trading is a good option for Botswanan beginners | CM Trading does not have Tier-1 regulations |

| The customer support offered by CM Trading is outstanding | Withdrawals can be expensive |

| There are copy trading opportunities offered to traders | Traders must register for a live account to opt for a demo account |

| CM Trading has user-friendly trading platforms for mobile, desktop, and web browsers | |

| CM Trading does not charge any commissions | |

| Hedging, scalping, and EAs are allowed | |

| There is an Islamic account offered to Muslim traders | |

| CM Trading offers daily market analysis |

How does MetaTrader4 work as a platform?

MetaTrader 4 (MT4) functions as a comprehensive trading platform, providing traders with a seamless environment for analyzing financial markets and executing trades. Upon installation, users access a user-friendly interface featuring windows like Market Watch and Charts.

Through real-time price data in the Market Watch, traders can select trading instruments, while the Chart Window offers technical indicators and tools for in-depth market analysis. By placing various order types, including market and pending orders, traders execute trades with defined risk management using stop-loss and take-profit levels.

MT4’s distinctive feature is Expert Advisors (EAs), allowing automated trading strategies based on predefined criteria. The platform extends to mobile devices, enabling on-the-go trading, and offers a range of technical indicators, news feeds, and communication tools. Overall, MetaTrader 4 serves as a powerful hub for traders to make informed decisions and engage in the dynamic world of financial trading.

How to Choose the Right Forex Broker in Botswana

Botswanan traders must evaluate the following components of a forex broker to decide whether the broker is suited to their unique trading objectives or needs.

Regulations and Licenses

This is the first vital component that Botswanan traders must thoroughly evaluate. Reputable brokers are regulated by market regulators such as FCA, ASIC, CySEC, FSCA, and others.

Botswanans must beware when dealing with brokers with only offshore regulations such as FSA, SVG BVI, FSC, and others.

Account Features

Account Features include leverage trading and margin requirement, commissions and spreads, initial deposit, additional features on retail investor accounts, and so on.

Deposits and Withdrawals

Botswanans must evaluate the payment options available, the processing times on withdrawal requests, deposit currencies offered, the withdrawal fee, deposit fees, and minimum withdrawal limits, among other trading and non-trading fees.

Range of Markets

The range of markets offered refers to the number and range of tradable instruments the broker offers. Therefore, Botswanans must consider what they wish to trade and what is available.

Customer Support

Customer Support is another crucial factor. Botswanans must check the availability of support (trading hours), the quality of support, and the promptness with which the customer support team responds to queries.

Trading Platform

A trading platform is the Botswanan trader’s portal to the financial markets. Therefore, traders must ensure that the trading platform has the necessary technical indicators, fundamental analysis, technical analysis, economic calendar, charting, newsfeed, and other tools they may need.

Education and Research

Education and Research come in handy to both novice traders and experienced investors. Education includes some of the following:

➡️ eBooks

➡️ Trading guides

➡️ Trading knowledge on leveraged products

➡️ A risk warning on complex instruments

➡️ Educational videos

Research can include some of the following:

➡️ Trading tools

➡️ Commentary

➡️ Status of International Markets

➡️ Price movements

➡️ Market sentiments

➡️ Whether there is a volatile market

➡️ Exchange Rates

➡️ Expert opinions and other resources can help experienced traders make informed trading decisions.

The Best Forex Brokers in Botswana

In this article, we have listed the best brokers that offer forex trading to traders in Botswana. In addition, we have further identified the brokers that offer additional services and solutions to Botswanan traders.

Best MetaTrader 4 / MT4 Forex Broker in Botswana

Min Deposit

USD 25

Regulators

FCA UK

Trading Platform

MT5, MT4, OctaTrader

Crypto

Yes

Total Pairs

28

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, OctaFX is the best MT4 forex broker in Botswana. OctaFX is an MT4 and MT5 broker that provides Botswanans with various markets. OctaFX offers a choice of accounts via MT4, including ECN and STP accounts, with superior trade execution.

Best MetaTrader 5 / MT5 Forex Broker in Botswana

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, AvaTrade is the best MetaTrader 5 forex broker in Botswana. In addition, AvaTrade is regarded as one of the most secure MT5 forex brokers.

No commission is charged for trading currency pairings, only leaving the spread to be paid. A demo account is also available for traders to sharpen their abilities via MT5 and several other platforms.

Best Forex Broker for beginners in Botswana

Min Deposit

$100

Regulators

CFT, NFA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FOREX.com is the best forex broker for beginners in Botswana. FOREX.com is a broker renowned for low trading fees and beginner-friendly solutions. In addition, FOREX.com offers several educational materials and a helpful demo account.

Best Low Minimum Deposit Forex Broker in Botswana

Min Deposit

$10 / 134 BWP

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Exness is the best Low Minimum Deposit Forex Broker in Botswana. Exness has a minimum deposit requirement of 10 USD / 130 BWP, making it easy for Botswanans to start trading 278 instruments.

Exness also offers MT4 and MT5 through which trades can be made. In addition, it offers some of the best trading tools, charting capabilities, technical indicators, expert advisors, and more.

Best ECN Forex Broker in Botswana

Min Deposit

USD 0

Regulators

CySEC, FCA, DFSA, FSCA, FSA, CMA

Trading Desk

MT4, MT5, HFM APP

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

0

Account Activation Time

24 Hours

Overall, HFM is the best ECN forex broker in Botswana. HFM is a hybrid forex and CFD broker that uses STP and ECN technology to ensure that Botswanans get the best pricing, minimal slippage, no requotes, and the fastest trade execution.

HFM uses the best liquidity providers who aggregate the pricing that Botswanans can see on MT4, MT5, and the HF App for Android and iOS.

Best Islamic / Swap-Free Forex Broker in Botswana

Min Deposit

USD 10 / 136 BWP

Regulators

CySec, FCA

Trading Desk

None

Crypto

Yes

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, eToro is the best Islamic / Swap-Free forex broker in Botswana. eToro is a renowned social trading platform that offers Muslim traders an Islamic Account.

eToro does not charge any interest on positions held for over 24 hours. However, registering an Islamic Account can be expensive initially, requiring a 1,000 USD / 18 668 BWP deposit.

Best Forex Trading App in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

ASIC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

300

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, CMC Markets is the best forex trading app in Botswana. In addition, CMC Markets offers a user-friendly mobile app with research tools, powerful charts, customizable watch lists, news reports, and a range of educational materials.

Best Lowest Spread Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

FCA, CySEC, IFSC, KNF

Trading Desk

No Trading Desk

Crypto

Yes

Total Pairs

48

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, XTB is the best lowest-spread forex broker in Botswana. XTB is a well-known forex and CFD broker with low and competitive forex spreads from 0.1 pips depending on the financial instrument and the market conditions.

XTB is also a good broker in terms of educational materials and research capabilities, providing traders with comprehensive market analysis across markets.

Best Nasdaq 100 Forex Broker in Botswana

Min Deposit

USD 10

Regulators

CySec, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

60

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXTM is the best Nasdaq 100 forex broker in Botswana. FXTM is a multi-regulated forex and CFD broker that accommodates Botswanan traders with a keen interest in Nasdaq. Traders can expect low and competitive spreads, a choice between accounts, and powerful trading platforms.

Best Volatility 75 / VIX 75 Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

IGRs

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, IG is Botswana’s best Volatility 75 / VIX 75 forex broker. IG is one of the best CFD brokers with powerful proprietary trading technology.

IG is well-regulated and offers Botswanans access to VIX75, with spreads from 0.04 pips / 0.13% and zero commission charges.

Best NDD Forex Broker in Botswana

Min Deposit

USD 50 / 672 BWP

Regulators

FCA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

–

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXCM is the best NDD forex broker in Botswana. FXCM is a No-Dealing Desk broker with STP and ECN execution across several markets.

In addition, FXCM offers a choice between third-party platforms in addition to technical indicators, charting tools, and competitive trading conditions.

Best STP Forex Broker in Botswana

Min Deposit

USD 10

Regulators

IFSC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

36

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, RoboForex is the best STP forex broker in Botswana. RoboForex is popular forex and CFD broker with competitive trading conditions. RoboForex offers STP execution with liquidity sourced from top providers.

Botswanans can expect access to over 12,000 instruments via powerful and innovative third-party platforms.

Best Sign-up Bonus Broker in Botswana

Min Deposit

50 USD / 682 BWP

Regulators

CYSEC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Windsor Brokers is the best sign-up bonus broker in Botswana. Windsor Brokers is a well-regulated broker that offers Botswanans a welcome account funded with 30 USD in trading credit. With this account, Botswanans can explore the platform or risk-free test their strategies.

You might also like: Best cTrader Brokers in Botswana

You might also like: Best Forex Trading Apps in Botswana

You might also like: Best Forex Trading Strategies in Botswana

You might also like: Best High Leverage Forex Brokers in Botswana

You might also like: Best Low Minimum Deposit Brokers in Botswana

Conclusion

MetaTrader 4 has been the go-to platform for foreign exchange trading for the previous seventeen years. It links investors with brokers so they may trade CFDs and foreign exchange. In addition, many aspiring professional traders owe much of their success to MetaTrader 4.

It could still be here for many years, serving as a resource for aspiring traders. Still, it is a strong contender for meeting 90% of your trading demands, especially if you seek to maximize your charting efficiency without resorting to gimmicky add-ons.

Frequently Asked Questions

Is MT4 a broker?

The MetaTrader 4 platform does not function as a broker. However, brokers can get licenses to use this automated trading platform, which is then available to the broker’s clients.

How much will it cost Botswanans to start trading using MT4?

MetaTrader 4 does not have a minimum deposit and will depend on your broker’s minimum deposit.

Is it free for Botswanans to use MT4?

MetaTrader 4 is free of charge to use. However, there are some paid products and services, such as indicators developed by other users.

Can Botswanans withdraw their money from MT4?

Although MT4 does not have a built-in deposit/withdrawal feature, you can fund your account by signing into your broker’s client portal and signing in.

Next, you can locate the option to deposit, choose your deposit method and currency, and follow any additional steps required.

Can Botswanans directly trade on MT4?

You cannot enter the foreign exchange market only with Metatrader 4 since it is only a trading platform and the link between you, your broker, and the financial market.

Therefore, after downloading and installing MT4, the next step is to create a trading account.

How to open an MT4 account?

To open an MT4 account, follow these steps:

Begin by selecting a reputable broker that offers MetaTrader 4. Visit the broker’s website and navigate to the account opening section. Choose the account type that suits your trading preferences and financial goals, whether it’s a demo account for practice or a live account for real trading. Fill in the required personal information, contact details, and financial information as requested. Submit any necessary verification documents, such as identification and proof of address, to meet regulatory requirements. Once your information is verified and approved, you’ll receive your MT4 account login credentials, including a username and password. Download the MetaTrader 4 platform from the broker’s website or app store, install it on your device, and log in using the provided credentials. You’re now ready to explore the platform, analyze markets, and start trading with your newly opened MT4 account.

How to download the MT4 platform on your phone (IOS and Android).

Select the App:

Find the official MetaTrader 4 app by MetaQuotes Software Corp. Tap on it to access the app’s page.

Download and Install:

Tap the “Get” or download button.

Which MT4 broker offers a demo account?

FP Markets

Which MetaTrader4 brokers offer a low minimum deposit of $5 (93 BWP)?

- HFM

- XM

- Exness

- FXTM

- OctaFX

- Alpari

Which broker offers a sign-up bonus for first-time traders?

- XM

- Tickmill

- SuperForex

- FBS

- JustMarkets

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review