10 Best MT5 Brokers in Botswana

The 10 Best MT5 Forex Brokers in Botswana revealed. We tested and verified the best MT5 platforms from top forex brokers with a secure, dependable trading environment for Botswana Traders.

This is a complete list of MT5 forex brokers in Botswana.

In this in-depth guide you’ll learn:

- How Does MT5 differ from MT4?

- What is the MT5 Trading Platform?

- How does MetaTrader5 work as a platform?

- How to open an MT5 account?

- Who are the best MT5 brokers in Botswana?

- How to choose a forex broker best suited for your trading style.

- How to download the MT5 platform on your phone (IOS and Android).

- Which MT5 broker offers a demo account?

- Which broker offers a sign-up bonus for first-time traders?

And lots more…

So if you’re ready to go “all in” with the best-tested MT5 forex brokers for Botswana Traders…

Let’s dive right in…

- Louis Schoeman

Best MT5 Brokers in Botswana

| 🏅 Forex Broker | 👉 Open Account | 💻 Trading Platform | 💰 Minimum Deposit? | 💸 Botswana Shilling (BWP) Deposits Allowed? |

| 5. XM | 👉 Open Account | Desktop MT4 and MT5, Mobile MT4 and MT5, XM mobile app, Web platform | USD 5 / 67 BWP | No |

| 2. FOREX.com | 👉 Open Account | MetaTrader 4, MetaTrader 5 | USD 100 / 1866 BWP | No |

| 1. Exness | 👉 Open Account | MetaTrader 4 and MetaTrader 5 | $10 / 188 BWP | No |

| 3. Admirals | 👉 Open Account | MetaTrader 4 MetaTrader 5 Admirals Mobile App | USD 25 / 466 BWP | No |

| 7. HFM | 👉 Open Account | MetaTrader 4 MetaTrader 5 | $0 / 0 BWP | No |

| 4. BDSwiss | 👉 Open Account | MetaTrader 4 , MetaTrader 5 | $100 / 1 229 BWP | No |

| 6. FP Markets | 👉 Open Account | MetaTrader 4, MetaTrader 5, cTrader and TradeView | 100 USD/1 229 BWP | No |

| 8. AvaTrade | 👉 Open Account | MetaTrader 4, MetaTrader 5, | 200 USD / 2622 BWP | No |

| 9.FBS | 👉 Open Account | MetaTrader 4, MetaTrader 5, FBS Trader – all in one mobile trading platform. | USD 1 / 13 Pula | No |

| 10.IC Markets | 👉 Open Account | MetaTrader 4 and 5 | USD 200 / 3733 BWP | No |

10 Best Forex Brokers in Botswana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

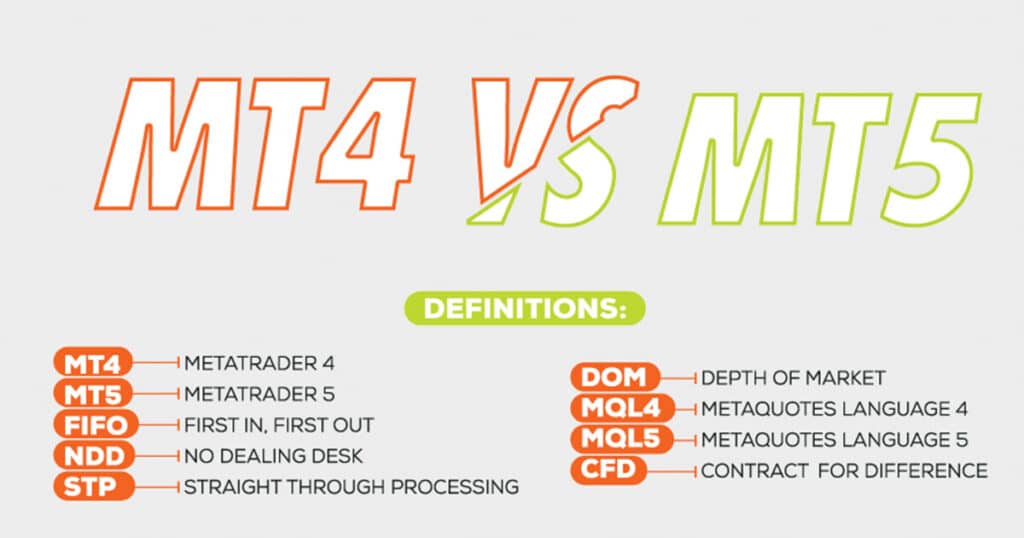

How Does MT5 differ from MT4?

Due in large part to the usefulness of its tools and resources for assessing positions and opening trades, MetaTrader 4 and MetaTrader 5 are among the most popular trading platforms for a broad spectrum of traders and advisers.

While the similarities between MT4 and MT5 in their titles may lead some to believe that MT5 is just an upgraded version of MT4, the fact is that the two systems cater to quite different types of traders.

The most notable difference between MT4 and MT5 is in the sorts of traders who use each platform. MT4’s features and capabilities are tailored to the needs of forex traders. Therefore, MT4 has become the go-to platform for serious foreign exchange traders.

The use of MT5 extends beyond contract-for-difference (CFD) trading to include stock and futures markets. Moreover, since it caters to traders interested in many asset classes, it offers more flexibility. As a result, it may be a better overall value for such traders.

It is important to remember that although MT5 may still be used for forex trading, the features and tools needed to examine forex charts are not as powerful, so you will see a drop in performance if you do. For ease of use, MT4 was designed.

Suppose you are just starting out in the trading world and do not need access to detailed information on different time frames. In that case, MT4 is the better choice since it gives you what you need without any of the extra fluff.

There are nine distinct timeframes available to MT4 traders. In comparison, MT5 greatly increases MT4’s possibilities with its 21 available timeframes. As a result, many investors do not need the tinkering possibilities these trading platforms provide.

Some traders, and some kinds of transactions, like CFDs, may profit tremendously from access to these less typical timeframes.

There is a possibility that more seasoned or culturally varied traders may find this data to be useful for making educated deals. For example, you can place four different orders in MT4: stop, limit, stop, and limit.

These order types should be sufficient for most traders, allowing you to put your trading strategy into action while limiting your exposure to risk and giving you more say over when and how you join and exit positions.

All these order types, including buy stop-limit and sell stop-limit, are available in MT5. As a result, investors have more leeway in determining when and why to purchase and sell based on price fluctuations.

These order types can be used often by seasoned traders but are less likely to be used by novice or occasional traders.

10 Best MT5 Brokers in Botswana

- ✔️ XM – Overall, Best MT5/Metatrader 5 Broker in Botswana

- ✔️ FOREX.com – Best Broker for Beginner Traders

- ✔️ Exness – Top Broker with Mobile App

- Admirals – Best Lowest Spread Forex Broker

- HFM – Top ECN Forex Broker

- BDSwiss – Top Nasdaq100 Forex Broker in Botswana

- FP Markets – Top Volatility75 Forex Broker

- AvaTrade – Best NDD Forex Broker in Botswana

- FBS – Top Sign-Up Broker

- IC Markets – Verifies STP Forex Broker in Botswana

1. XM

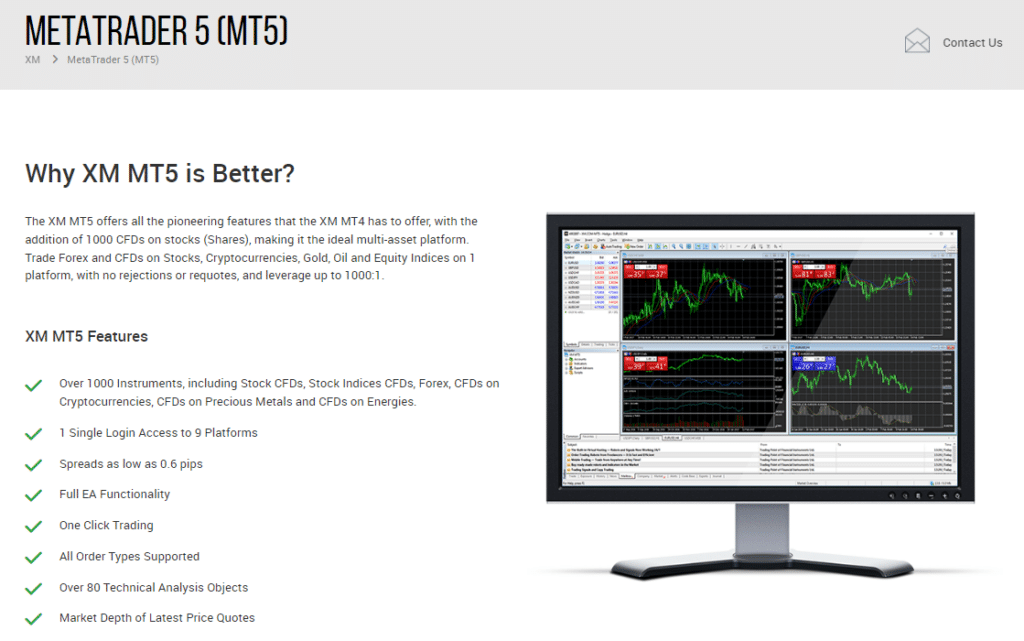

XM is a reputable market maker that supports MT4 and MT5 and has minimal minimum deposits, various account types, quick order execution, and a respectable selection of tradable assets.

XM’s Ultra-Low Account does not charge commission fees and spreads start from low as 0 pips. In addition, with an MT5 account, you can easily hedge, scalp, and use automated trading strategies.

Traders interested in more than simply Forex can test the waters with XM’s $100,000 virtual amount on an MT5 trial account. Stock CFDs, stock indices CFDs, precious metals CFDs, and energy CFDs are just some of the more than a thousand instruments traders will have at their disposal.

Min Deposit

USD 5 / 67 BWP

Regulators

IFSC, CySec, ASIC

Trading Desk

Desktop MT4 and MT5, Mobile MT4 and MT5, XM mobile app, Web platform

Total Pairs

57

Islamic Account

Yes

Trading Fees

No (Just spread)

Account Activation Time

24 Hours

The hedging tool, complete EA capabilities, and a market depth indicator are all accessible with the MT5 demo account. In addition, a minimum deposit of only 67 BWP / 5 USD is required when Botswanans register an account.

Multiple authorities oversee the platform’s operations, including ASIC, FSCA, IFSC, DFSA, FCA, and CySEC. If you are a trader considering joining XM, keep an eye out for special offers, as these are only available at certain times of the year or by special invitation.

XM Overview

| Feature | Information |

| ⚖️ Regulation | FSCA, IFSC |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | $5 / 67 BWP |

| Average spread from | 0.0 pips EUR/USD |

| 📈 Maximum Leverage | 1:1000 |

| 👥 Customer Support | 24/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Negative balance protection is applied to retail investor accounts | US clients are restricted from accessing XM’s trading services |

| There are several secure payment methods to choose from | There are no fixed spread accounts offered |

| The broker is known for low spreads, low commissions, and reliable trade execution speeds | There is an inactivity fee applied to dormant accounts |

| Traders can use hedging, scalping, and expert advisor trading strategies | |

| The broker offers personal customer service to its clients |

2. FOREX.com

Established in 2001 as a subsidiary of GAIN Capital Holdings, FOREX.com is a leading worldwide online broker for retail foreign exchange and contract for difference (CFD) traders.

Although not all of FOREX.com’s products are accessible in every country it serves, the company provides various CFDs, spread betting, and futures across various asset classes.

FOREX.com is a trading platform that allows users to engage in transactions involving a wide variety of financial instruments, including foreign exchange (the company’s namesake), commodities, indices, stocks, bonds, ETFs, gold, silver, cryptocurrencies, futures, and more (in the United States, these transactions are leveraged).

Min Deposit

$100

Regulators

CFT, NFA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

The FOREX.com trading platforms are flexible enough to serve expert day traders and those interested in longer-term investments.

Botswanans can trade using the powerful MetaTrader 5 (MT5) or MetaTrader 4 (MT4) trading platform that can be downloaded to a desktop computer, the web trader that can be used in a web browser, or the FOREX.com or MT4 mobile app that can be used on portable smart devices.

Charts, economic calendars, news, positions, trade/order histories, trade signals, research reports, and FOREX.com analysts’ market analyses are all available to traders inside the platforms.

The platforms are user-friendly enough to allow for quick transactions if necessary. In addition, the available indicators and drawing tools will please even the most dedicated technical analyst.

FOREX.com Overview

| Account Feature | Value |

| 📱 Minimum Deposit Required | 1343 BWP equivalent to $100 |

| 📉 Average Spreads | From 0.2 pips EUR/USD |

| 💻 Commissions Charged | None, only the spread is charged |

| 📊 Minimum Position Size | 0.01 lots (micro lots) |

| 📉 Rebates Added | 2 USD per side up to 100,000 USD |

| 📈 Maximum Leverage | Up to 1:200 |

| 💵 Margin Level for Hedged/Locked Positions | 50% |

| 💸 Execution | NDD and Market Execution |

| 💰 Margin Call | 25% |

| 👥 Stop-Out Levels | 15% |

| 🗣 Algorithmic trading offered? | Yes |

| 📞 Range of Markets Offered | • 36 Forex Pairs • Indices • Precious Metals • Energies • Cryptocurrencies • Shares |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| FOREX.com is one of the top-rated brokers with a high trust score of 99% | FOREX.com charges conversion fees of 0.5% if the trader’s deposit and withdrawal currency differ from the base currency of the account |

| FOREX.com offers over 4,500 financial instruments to traders from around the world | Inactivity fees will apply to all dormant accounts |

| Botswanan traders can choose from three dynamic retail accounts according to their unique trading needs and objectives | FOREX.com does not offer a BWP-denominated account to Botswanans |

| There are advanced trading tools offered to more experienced traders, including TradingView, Recognia, AutoChartist, and more | There are only a few deposit and withdrawal options |

| There is a demo account offered in addition to an Islamic account option | |

| FOREX.com offers commission-free options |

3. Exness

Exness is a licensed broker that provides inexpensive trading costs on its MT5 Standard Account, low spreads, and low minimum deposits on its three MT5 Professional Accounts.

Trading cryptocurrencies and indices are the beginning of what you can do with an Exness MT5 Standard Account, which only takes a deposit of 186 BWP / 10 USD to open. In addition, on the EUR/USD pair, spreads are variable but often start from 0.0 pips, depending on the trading account.

Min Deposit

$10 / 134 BWP

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

For a minimum deposit of 9334 BWP / 500 USD, two MT5 Professional Accounts provide raw spreads as low as 0.0 pips and commissions of $7 round trip.

In contrast to the Standard MT4 account, which has a spread of 0.3 pips at a minimum, the MT5 Pro Account’s spread starts at 0.1 pips without a commission fee, which means trading fees range between 6 USD to 10 USD.

Exness Overview

| Feature | Information |

| ⚖️ Regulation | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Standard Account, Standard Cent Account, Raw Spread Account, Zero Account, Pro Account |

| 📊 Trading Platform | MetaTrader 4, MetaTrader 5, Exness Terminal, Exness Trader app |

| 💰 Minimum Deposit | $10 / 134 BWP |

| 💰 Trading Assets | Forex minor pairs, forex major pairs, forex exotic currency pairs, Metals, Crypto, Energies, Indices, Stocks |

| 🔎 Botswanan Pula-based Account? | No |

| 💳 BWP Deposits Allowed? | Yes |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 0.0 pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | No |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The broker has a global presence and has authorization and regulation with market regulators around the globe | There is a limited selection of tradable instruments and only a few asset classes |

| Offers instant withdrawals and deposits | There are only a few funding options offered |

| Botswanan traders have a choice between several dynamic account types | |

| Client fund safety is guaranteed and there is investor protection offered | |

| Offers 24/7 customer support that is both prompt and helpful | |

| There are tight and variable spreads offered with competitive commissions |

4. Admirals

Admiral provides a honed version of MT5 known as MetaTrader Supreme Edition. Among the enhancements in this release are adding new indicators, such as Trading Central analysis and a market mood tool.

Spreads on the Admiral MT5 Zero account start at 0 pips, commissions start at 6 USD round trip, and leverage can go as high as 1:500, depending on your location.

Min Deposit

339 BWP or an equivalent of $25

Regulators

FCA, ASIC, CySEC, EFSA, JSC

Trading Desk

MT4, MT5, Admirals Mobile App

Crypto

Yes

Total Pairs

35 Forex Currency Pairs

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

This kind of account requires a minimum deposit of 466 BWP / $25 for international and 100 EUR for European traders. The MT5 platform is browser-based and available for usage on desktop computers. Regarding mobile devices, you may choose between Android and iOS.

MT5 supports the addition of expert advisors. As a result, it becomes an ideal platform for automated trading strategies when coupled with a virtual private server (VPS).

Admirals Overview

| Feature | Value |

| 💳 Minimum Deposit Requirement | 475 BWP equivalent to $25 |

| 📈 Platforms Available for Account Type | MetaTrader 4, cTrader |

| 📊 Average Spreads on Major Forex Pairs | 0.3 pips |

| 🚀 Maximum Leverage Ratio | • 1:30 (Retail) • 1:500 (Pro) |

| 🔎 Commission Charges on Trades | $6 per lot |

| 📈 Commissions on Stock CFDs | $0.04 per CFD with a minimum of $6 |

| 💰 Account Base Currency Options | EUR or USD |

| 🔨 Negative Balance Protection Offered | Yes |

| 📱 Is Hedging Allowed? | Yes |

| 💸 Minimum Forex Trading Volume | 0.01 lots |

| 💵 Islamic Account Conversion Offered? | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Admirals is well-regulated in several regions globally | There is an inactivity fee charged |

| Admirals offers commission-free options | Botswana traders are subject to currency conversion fees |

| The broker accepts Botswana traders despite their trading skills or trading strategies | There are deposit and withdrawal fees charged |

| There are user-friendly platforms available across devices | There are admin fees charged on the Islamic account |

| There is a wide range of tradable markets, complex instruments, and leveraged products | There is only one account type that can be converted to an Islamic Account |

| Admirals offers the MetaTrader Supreme Edition | |

| Traders are given access to premium analytics | |

| There are several educational materials, resources, and tools offered |

5. HFM

Three of HFM’s four account types are compatible with No-Dealing Desk STP execution, and MT5 is supported.

Micro Accounts with other brokers do not typically come close to the MT5 Micro Account’s narrow spreads of 1 pip on major Forex pairs, a minimum deposit of 67 BWP / 5 USD, and maximum leverage of up to 1:1000.

Min Deposit

USD 0

Regulators

CySEC, FCA, DFSA, FSCA, FSA, CMA

Trading Desk

MT4, MT5, HFM APP

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

0

Account Activation Time

24 Hours

In contrast, with a minimum deposit of 2,600 BWP / 200 USD, HFM’s MT5 Zero Spread Account provides traders access to spreads as low as 0 pips and a round turn cost of 7 USD per round turn.

Daily market news, trade analysis, and outlooks are just some features included on HFM’s website, which is also home to various trading tools.

Tools like trade calculators and economic calendars can be used independently of a trading platform. In addition, customers can reach out to customer support at any time through toll-free local phone lines that are active around the clock.

HFM Overview

| Features | Information |

| ⚖️ Regulation | FSCA, CySEC, DFSA, FSA, FCA, CMA, and FSC, with registration in ACPR, BaFin, MNB, CONSOB, CNMV, FI, FMA, FSC, and other regions |

| 💸 Minimum Withdrawal Time | – |

| 📈 Maximum Withdrawal Time | 2 to 4 working days |

| 💰 Instant Deposits/Withdrawals? | Yes, deposits |

| 💳 BWP-Denominated Account? | No |

| 📱 Minimum Deposit Amount | $0 / 0 BWP |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| HFM is a trusted broker that ensures client fund safety | There are only a few payment methods offered |

| Electronic payment gateways ensure quick deposits | HFM only accepts two deposit currencies |

| HFM does not keep client funds in its broker account | Conversion fees will apply to BWP deposits |

| The deposit is low and affordable, even for beginners | |

| There are flexible deposit methods offered |

6. BDSwiss

BDSwiss provides MT5 trading on a wide variety of asset classes, including Forex pairs, equities, commodities, shares, indices, exchange-traded funds (ETFs), and cryptocurrencies. In addition, there are no limits on the trading strategies that may be used.

The array of MT5 trading tools that BDSwiss offers and their industry-leading research and educational resources for traders of all experience levels will benefit MT5 traders.

Min Deposit

$10 / 136 BWP

Regulators

CySec, FSC, FSA, BaFin, NFA

Trading Desk

MetaTrader 4 , MetaTrader 5

Crypto

Yes

Total Pairs

50 Forex Pairs and 20 Crypto Pairs

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

The analysis consists of daily webinars, market insights, a weekly outlook, and daily briefings, all of which are provided by the team of industry specialists that BDSwiss has assembled.

BDSwiss has MT5 account types that are appropriate for novice traders and those with more extensive trading expertise. In addition, every account could take advantage of the lightning-fast execution rates, with 97.5% of transactions being completed in less than 0.2 seconds on average.

BDSwiss Overview

| Account Feature | Value |

| ⬆️ Average Spread on EUR/USD | 1.1 pips |

| 📊 Maximum Leverage | 1:1000 |

| 📉 Tradable Instruments | Over 70 |

| 📈 Available Assets | • Forex CFDs • Commodities CFDs |

| 💸 Commissions per round lot | None |

| 📞 Margin Call | 50% |

| 🛑 Stop-out level | 20% |

| 💵 Instant Withdrawals offered? | Yes, only Credit Cards up to 2,000 €/$/£ |

| 💰 0% fees on Deposits and CC Withdrawal? | Yes |

| 📱 Platforms available | BDSwiss Web, BDSwiss Mobile, MetaTrader 4 |

| 🚨 Are trading alerts offered? | Limited Access granted |

| ✔️ AutoChartist Performance Stats offered? | Yes, with a 6,000 BWP minimum deposit |

| 📞 Personal Account Manager | Yes, with a 12,000 BWP minimum deposit |

| 📊 Priority Service | Yes |

| 🔨 AutoChartist Standard Tools | Yes |

| ✔️ Access to Trading Central? | Yes |

| 💻 Trading Academy and Live Webinars | No |

| ✔️ Trade Companion offered? | Yes |

| ☪️ Islamic Account option? | Yes |

| ✅ VIP Webinars | No |

| 📞 24/5 Customer Service and Support? | Yes |

| ✔️ Minimum deposit requirement | 136 BWP or an equivalent to $10 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| BDSwiss is multi-regulated and offers high liquidity | Withdrawal fees are charged |

| There is a range of markets that can be traded | There are no local deposit or withdrawal methods offered to Botswanan traders |

| BDSwiss offers competitive trading conditions and a choice between account types | There is no desktop version of the BDSwiss trading platform |

| There is optimal service offered by prompt and dedicated customer support | |

| There are user-friendly and flexible trading platforms offered | |

| BDSwiss offers a large range of trading tools and research | |

| There are educational materials offered to beginner Botswanan traders | |

| There is an industry-standard deposit requirement when Botswanan traders register an account |

7. FP Markets

In terms of asset diversity, FP Markets is one of the best MT5 forex brokers. FP Markets provides over 10,000 CFD products using MT4 and MT5. In addition, standard and raw accounts are available through MT5 for Forex trading, and an Islamic Account is offered for Muslim traders.

The spread between currency pairings varies by account. For instance, the spreads on the Standard account begin at 1 pip, whereas those on the Raw Accounts begin at 0 pips.

Regardless of the account selected, traders get access to over sixty forex pairs. Retail customers are allowed leverage of up to 1:500, and the minimum transaction size is 0.01 lots. Botswanans must pay an 100 USD/1 229 BWP deposit to register an account.

Min Deposit

100 USD/1 343 BWP

Regulators

ASIC, CySEC, FSCA, CMA

Trading Desk

MetaTrader 4, MetaTrader 5

Crypto

Yes

Total Pairs

63

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Traders can choose from credit/debit cards, bank transfers, and E-wallets consisting of Neteller, Skrill, FasaPay, Sticpay, and more options when they deposit and withdraw funds.

The broker’s ECN pricing methodology and network of liquidity providers in Equinix NYC data centers provide instantaneous trade execution. At the same time, MT5 support enables hedging, scalping, and automated trading.

When comparing FP Markets to competing Forex brokers, the broker places a premium on attracting new traders by providing them with a wealth of resources.

The resources provided by FP Markets includes award-winning customer service, dedicated account managers, and a comprehensive education section that includes daily email updates on the latest financial news impacting currency markets.

FP Markets Overview

| Account Feature | Value |

| 💰 Minimum Deposit | 100 USD / 1 343 BWP |

| 📊 Average Spreads | Variable, from 1 pip |

| ✔️ Instruments Available | 60+ Forex pairs, metals, indices, commodities |

| 📈 Maximum Leverage Ratio | 1:500 |

| 📱 Execution Type | ECN |

| 💵 Commissions | None |

| 👥 Expert Advisors Offered? | Yes |

| 📲 Mobile App Offered? | Yes |

| ✔️ VPS Available? | Yes |

Pros and Cons

| ✔️ PROS | ❌ CONS |

| fpmarkets is a well-established Australian broker regulated by ASIC and CySEC | Fixed spreads are not available |

| Botswanan traders can choose from an impressive range of markets that can be traded through powerful platforms | There are withdrawal fees charged on most payment methods that are supported |

| fpmarkets offers comprehensive mobile trading opportunities | There are administration fees which apply to the Islamic accounts and trading |

| Botswanan traders can expect superior ECN pricing that includes raw and tight spreads and low commissions | |

| fpmarkets is known for its fast trade execution that is delivered through the Equinix servers | |

| There are commission-free accounts offered that still feature competitive spreads | |

| There are dedicated Islamic accounts for Muslim traders | |

| fpmarkets offers a range of educational materials and advanced trading tools |

8. AvaTrade

It is widely believed that AvaTrade is one of the most trustworthy MT5 forex brokers. However, stringent compliance laws must be adhered to regarding the management of client assets, the protection of cash, and the provision of regular financial reporting.

Several regulatory bodies are involved, including ASIC, FSCA, and FSA. As a result, clients who meet the requirements can trade with a leverage of up to 1:400.

Subsequently, Botswanans can potentially increase their profits by a factor of 400 if they are successful in speculating on the price variations of a pair of currencies. In addition, you will not be required to pay any commission when trading currency pairings.

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

After this, the only remaining expense will be the spread. For example, the spread on the EUR/USD currency pair is now 0.9 pips as of the time of this writing. Demo accounts are also available for traders to use to enhance their expertise.

Moreover, vanilla options are offered at AvaTrade. Electronic wallets, wire transfers, credit cards, and debit cards are valid deposit methods that can be used here.

In addition, traders will need to investigate the platform to determine whether payment methods are acceptable since this information depends on the trader’s country of residency.

There is a USD 100/ 1881 BWP minimum deposit requirement, an industry-standard minimum. Another benefit of AvaTrade is that eligible traders have access to VPS.

AvaTrade Overview

| Feature | Information |

| ⚖️ Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, FRSA, CySEC, ISA |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Retail Investor Account, Professional Account Option |

| 📊 Trading Platform | AvaTradeGO, AvaOptions, AvaSocial, MetaTrader 4, MetaTrader 5, DupliTrade, ZuluTrade |

| 💰 Minimum Deposit (BWP) | $100 / 1343 BWP |

| 💰 Trading Assets | Foreign currencies, Cryptocurrencies, Commodities, Treasuries, Bonds, Indices, Stocks, ETFs, Options, CFDs, Precious Metals |

| 🔎 Botswanan Pula-based Account? | No |

| 💳 BWP Deposits Allowed? | No |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 0.9 pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| AvaTrade is multi-regulated and one of the most trusted online trading brokers in the world | Variable spreads are not offered |

| There is a wide range of financial instruments that can be traded across financial markets | There is a limited choice between account types |

| There are several technical indicators, economic indicators, and other solutions for advanced traders | Inactivity fees are applied |

| There are several trading platforms to choose from | Currency conversion fees may be applied |

| There is a decent selection of educational material that helps beginner traders navigate complex instruments and lower the degree of risk they are often exposed to | There is a limited number of base currency options offered on accounts |

| There is a multitude of social trading opportunities offered | |

| The broker accepts any trading strategy including automated trading, expert advisors, scalping, hedging, and others. |

9. FBS

FBS is a global MT5 broker serving clients throughout Europe, Asia, the United Arab Emirates, and South Africa. Particularly noteworthy is that users may trade currencies with this MT5 broker with leverage of up to 1:3000.

FBS is an online forex broker established in 2009. In addition, FBS has swiftly upped its pace and retains a sterling image among its traders. As a result, FBS has achieved a continuous rate of new membership of 10,000 per day, even after 12 years have passed since its inception.

Min Deposit

USD 5 / 67 BWP

Regulators

IFSC, FSCA (South Africa), ASIC, CySEC

Trading Desk

MetaTrader 4, MetaTrader 5, FBS Trader – all in one mobile trading platform.

Crypto

Yes

Total Pairs

250

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

FBS and its services may be tailored to meet the needs of every trader, thanks to the wide variety of account types offered by the broker. Nevertheless, those who do not intend to make an initial investment of a significant sum are the best candidates for FBS.

FBS Overview

| Feature | Information |

| ⚖️ Regulation | IFSC, CySEC |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | USD 5 / 96 Pula |

| 📊 Average spread from | 0.0 pips EUR/USD |

| 📈 Maximum Leverage | 1:3000 |

| 👥 Customer Support | 24/7 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| There is an extremely low barrier of entry with a low minimum deposit | The spreads offered on some accounts are wide |

| Well-regulated broker with a high level of trust | The demo trading expires after 40 days have lapsed |

| There is a selection of retail investor accounts | There is a limited selection of funding options |

| There are fast and flexible payment methods offered for deposits and withdrawal requests | There are only two base account currency options |

| Competitive trading conditions are offered | Currency conversion fees apply |

| Customer service team is available 24/7, including English language customer support | |

| FBS prides itself as an official trading partner that offers a comprehensive affiliate program |

10. IC Markets

IC Markets is a CFD broker in Australia that provides MetaTrader 5 in addition to a variety of other trading platforms, some of which are MT4, cTrader, and ZuluTrade. It is one of the best forex brokers for traders who wish to automate their trades and monitor their success using Myfxbook.

Those traders should consider signing up with this broker. Copy trading and automated trading are two features that may be used on any of IC Markets’ supported trading platforms, which includes MT5.

Min Deposit

USD 200 / 2 685 BWP

Regulators

ASIC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

65

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Botswanans can easily access more than 2,200 worldwide markets with IC Markets, which includes 61 main and minor currency pairings in forex trading.

Using a Standard trading account, Botswanans can leverage up to 1:500 for trading key currency pairs, and spreads begin as low as 0.6 pips. In addition, IC Markets has ECN trading accounts, which include costs as low as $3 per transaction and spreads beginning at 0 pip.

IC Markets Overview

| Account Feature | Value |

| 💻 Trading Platform | MetaTrader 4 and 5 |

| 💳 Commissions | $3.5 per side and $7 per round turn |

| 📊 Average Spreads | 0.0 pips |

| 📉 Minimum Deposit Requirement | 2,400 Botswanan Pula equivalent to $200 |

| 📊 Leverage | 1:500 |

| 📈 Maximum positions per account | 200 lots |

| 📍 Server Location | New York |

| ➡️ Micro trading allowed? | Yes |

| 📈 Currency Pairs | 64 |

| 📉 Index CFD Trading | Yes |

| 🛑 Stop-Out (%) | 50% |

| 📱 One-Click Trading offered? | Yes |

| ☪️ Islamic Accounts | Yes |

| ✔️ Trading Styles accepted | Scalping, hedging, expert advisors, algorithmic strategies, etc. |

| 💻 Programming Language | MQL4 |

| ✅ Suitable for | Expert advisers, scalpers |

| ✔️ Demo Account offered? | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| IC Markets is a multi-regulated forex and CFD broker with a decent trust score and a low-risk reputation | There is a higher minimum deposit requirement charged than other brokers |

| There is real raw spread trading offered across several asset classes | Botswanan traders could face currency conversion fees |

| IC Markets offers some of the best spreads in the industry | There is no BWP-denominated account offered |

| Botswanans can choose between MetaTrader 4, MetaTrader 5, and cTrader as their preferred platform | There are no fixed spreads offered by IC Markets |

| There is a choice between three different account types that suit different types of traders | There is no proprietary trading platform, or an app offered by IC Markets |

| There are no hidden fees and IC Markets is one of the best options for high volume trading because it has a long list of liquidity providers | |

| There is a free demo account offered | |

| There is an Islamic account option offered to Muslim traders |

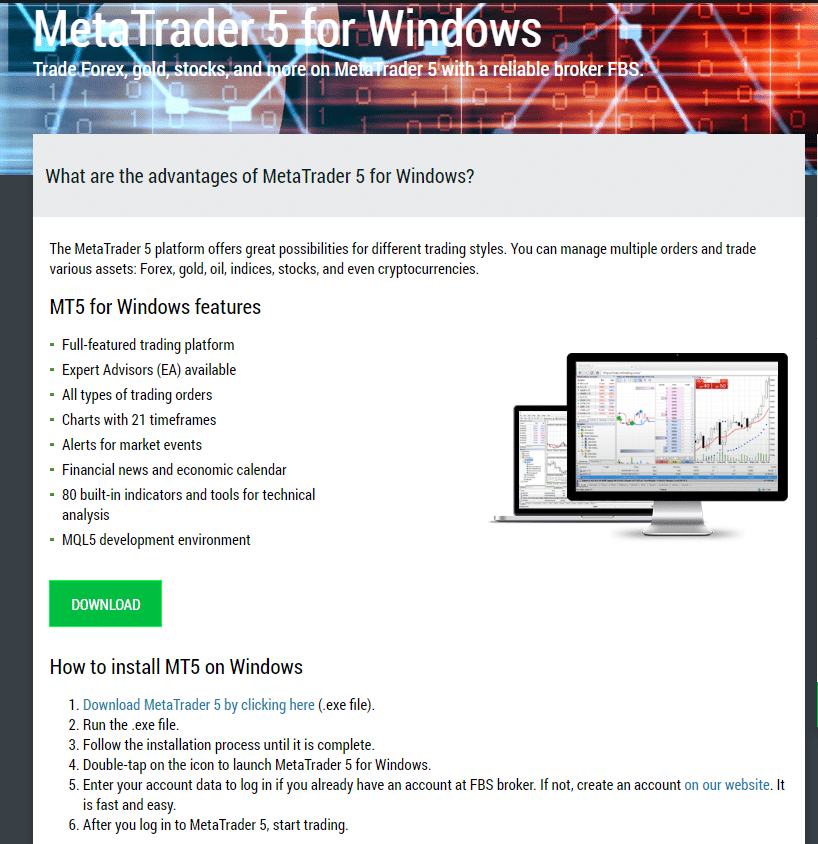

How to download the MT5 platform on your phone (IOS and Android)

Getting Started on the MT5 Mobile App:

Once you’ve downloaded and opened the MetaTrader 5 app on your mobile device:

Add an Account:

Tap on the menu or account icon and select “Login to an Existing Account” or “Open a Demo Account.”

Broker Selection:

Enter the name of your broker or choose the server manually if required.

Account Login:

Provide your account number and password, which are provided by your broker during account registration.

Server Selection:

Choose the appropriate trading server offered by your broker.

Trade:

Once logged in, you can access your account, view real-time market data, analyze charts, place trades, and manage your positions directly from your mobile device.

For Android:

Visit Google Play Store:

Open the Google Play Store on your Android device.

Search for MT5:

In the search bar, enter “MetaTrader 5” and search for the app.

Select the App:

Locate the official MetaTrader 5 app by MetaQuotes Software Corp. Tap on it to access the app’s page.

Select the App:

Look for the official MetaTrader 5 app by MetaQuotes Software Corp. Tap on it to access the app’s page.

Download and Install:

Tap the “Get” or download button.

How to Choose the Right Forex Broker in Botswana

Botswanan traders must evaluate the following components of a forex broker to decide whether the broker is suited to their unique trading objectives or needs.

Regulations and Licenses

This is the first vital component that Botswanan traders must thoroughly evaluate. Reputable brokers are regulated by market regulators such as FCA, ASIC, CySEC, FSCA, and others.

Botswanans must beware when dealing with brokers with only offshore regulations such as FSA, SVG BVI, FSC, and others.

Account Features

Account Features include leverage trading and margin requirement, commissions and spreads, initial deposit, additional features on retail investor accounts, and so on.

Deposits and Withdrawals

Botswanans must evaluate the payment options available, the processing times on withdrawal requests, deposit currencies offered, the withdrawal fee, deposit fees, and minimum withdrawal limits, among other trading and non-trading fees.

Range of Markets

The range of markets offered refers to the number and range of tradable instruments the broker offers. Therefore, Botswanans must consider what they wish to trade and what is available.

Customer Support

Customer Support is another crucial factor. Botswanans must check the availability of support (trading hours), the quality of support, and the promptness with which the customer support team responds to queries.

Trading Platform

A trading platform is the Botswanan trader’s portal to the financial markets. Therefore, traders must ensure that the trading platform has the necessary technical indicators, fundamental analysis, technical analysis, economic calendar, charting, newsfeed, and other tools they may need.

Education and Research

Education and Research come in handy to both novice traders and experienced investors. Education includes some of the following:

➡️ eBooks

➡️ Trading guides

➡️ Trading knowledge on leveraged products

➡️ A risk warning on complex instruments

➡️ Educational videos

Research can include some of the following:

➡️ Trading tools

➡️ Commentary

➡️ Status of International Markets

➡️ Price movements

➡️ Market sentiments

➡️ Whether there is a volatile market

➡️ Exchange Rates

➡️ Expert opinions and other resources can help experienced traders make informed trading decisions.

The Best Forex Brokers in Botswana

In this article, we have listed the best brokers that offer forex trading to traders in Botswana. In addition, we have further identified the brokers that offer additional services and solutions to Botswanan traders.

Best MetaTrader 4 / MT4 Forex Broker in Botswana

Min Deposit

USD 25

Regulators

FCA UK

Trading Platform

MT5, MT4, OctaTrader

Crypto

Yes

Total Pairs

28

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, OctaFX is the best MT4 forex broker in Botswana. OctaFX is an MT4 and MT5 broker that provides Botswanans with various markets. OctaFX offers a choice of accounts via MT4, including ECN and STP accounts, with superior trade execution.

Best MetaTrader 5 / MT5 Forex Broker in Botswana

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, AvaTrade is the best MetaTrader 5 forex broker in Botswana. In addition, AvaTrade is regarded as one of the most secure MT5 forex brokers.

No commission is charged for trading currency pairings, only leaving the spread to be paid. A demo account is also available for traders to sharpen their abilities via MT5 and several other platforms.

Best Forex Broker for beginners in Botswana

Min Deposit

$100

Regulators

CFT, NFA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FOREX.com is the best forex broker for beginners in Botswana. FOREX.com is a broker renowned for low trading fees and beginner-friendly solutions. In addition, FOREX.com offers several educational materials and a helpful demo account.

Best Low Minimum Deposit Forex Broker in Botswana

Min Deposit

$10 / 134 BWP

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Exness is the best Low Minimum Deposit Forex Broker in Botswana. Exness has a minimum deposit requirement of 10 USD / 130 BWP, making it easy for Botswanans to start trading 278 instruments.

Exness also offers MT4 and MT5 through which trades can be made. In addition, it offers some of the best trading tools, charting capabilities, technical indicators, expert advisors, and more.

Best ECN Forex Broker in Botswana

Min Deposit

USD 0

Regulators

CySEC, FCA, DFSA, FSCA, FSA, CMA

Trading Desk

MT4, MT5, HFM APP

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

0

Account Activation Time

24 Hours

Overall, HFM is the best ECN forex broker in Botswana. HFM is a hybrid forex and CFD broker that uses STP and ECN technology to ensure that Botswanans get the best pricing, minimal slippage, no requotes, and the fastest trade execution.

HFM uses the best liquidity providers who aggregate the pricing that Botswanans can see on MT4, MT5, and the HF App for Android and iOS.

Best Islamic / Swap-Free Forex Broker in Botswana

Min Deposit

USD 10 / 136 BWP

Regulators

CySec, FCA

Trading Desk

None

Crypto

Yes

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, eToro is the best Islamic / Swap-Free forex broker in Botswana. eToro is a renowned social trading platform that offers Muslim traders an Islamic Account.

eToro does not charge any interest on positions held for over 24 hours. However, registering an Islamic Account can be expensive initially, requiring a 1,000 USD / 13,400 BWP deposit.

Best Forex Trading App in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

ASIC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

300

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, CMC Markets is the best forex trading app in Botswana. In addition, CMC Markets offers a user-friendly mobile app with research tools, powerful charts, customizable watch lists, news reports, and a range of educational materials.

Best Lowest Spread Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

FCA, CySEC, IFSC, KNF

Trading Desk

No Trading Desk

Crypto

Yes

Total Pairs

48

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, XTB is the best lowest-spread forex broker in Botswana. XTB is a well-known forex and CFD broker with low and competitive forex spreads from 0.1 pips depending on the financial instrument and the market conditions.

XTB is also a good broker in terms of educational materials and research capabilities, providing traders with comprehensive market analysis across markets.

Best Nasdaq 100 Forex Broker in Botswana

Min Deposit

USD 10

Regulators

CySec, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

60

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXTM is the best Nasdaq 100 forex broker in Botswana. FXTM is a multi-regulated forex and CFD broker that accommodates Botswanan traders with a keen interest in Nasdaq. Traders can expect low and competitive spreads, a choice between accounts, and powerful trading platforms.

Best Volatility 75 / VIX 75 Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

IGRs

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, IG is Botswana’s best Volatility 75 / VIX 75 forex broker. IG is one of the best CFD brokers with powerful proprietary trading technology.

IG is well-regulated and offers Botswanans access to VIX75, with spreads from 0.04 pips / 0.13% and zero commission charges.

Best NDD Forex Broker in Botswana

Min Deposit

USD 50 / 672 BWP

Regulators

FCA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

–

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXCM is the best NDD forex broker in Botswana. FXCM is a No-Dealing Desk broker with STP and ECN execution across several markets.

In addition, FXCM offers a choice between third-party platforms in addition to technical indicators, charting tools, and competitive trading conditions.

Best STP Forex Broker in Botswana

Min Deposit

USD 10

Regulators

IFSC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

36

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, RoboForex is the best STP forex broker in Botswana. RoboForex is popular forex and CFD broker with competitive trading conditions. RoboForex offers STP execution with liquidity sourced from top providers.

Botswanans can expect access to over 12,000 instruments via powerful and innovative third-party platforms.

Best Sign-up Bonus Broker in Botswana

Min Deposit

50 USD / 682 BWP

Regulators

CYSEC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Windsor Brokers is the best sign-up bonus broker in Botswana. Windsor Brokers is a well-regulated broker that offers Botswanans a welcome account funded with 30 USD in trading credit. With this account, Botswanans can explore the platform or risk-free test their strategies.

You might also like: Best MT4 Brokers in Botswana

You might also like: Best FSCA-Regulated Brokers in Botswana

You might also like: Best Day Trading Strategies in Botswana

You might also like: Best Forex No-Deposit Bonus Brokers in Botswana

You might also like: Best Low Minimum Deposit Brokers in Botswana

Conclusion

Unless one of MetaQuotes’ rivals catches up first, MT5 will replace MT4 as the dominant platform.

Brokers and traders alike find MT5’s improved feature set, cross-market trading capability, and script testing enhancements extremely attractive. Traders in Botswana may tailor MT5 to their needs, goals, and preferences. Since this is a new platform, traders should try it out first.

Frequently Asked Questions

What minimum deposit can Botswanans expect with MT5?

There is no minimum deposit that is payable to MT5. The minimum deposit that traders must pay will depend on their forex broker.

How can Botswanans withdraw money from MT5?

To withdraw funds, you must send a withdrawal request to the broker with whom you have a trading account.

Can Botswanans use MT5 without a broker?

You can use MT5’s demo account facilities, but to place a real trade with real capital, you must use MT5 through a forex broker.

How can Botswanans check their profits on MT5?

Traders can use the “Trade” tab to display the account balance, free margin, margin on open positions, and equity.

Is MT5 a suitable option for Botswanan day traders?

MT5 is an excellent platform for day traders who want to add a competitive edge to their trading, providing them with additional tools and features that they can use to refine and improve their trading strategies.

What is the MT5 Trading Platform?

- AvaTrade

- FBS

- IC Markets

How does MetaTrader5 work as a platform?

MetaTrader 5 is a web-based trading platform designed to help Forex and stock traders automate trading using trading robots, signals and fundamental analysis. Key features include web trading, algorithmic trading, mobile trading and professional technical analysis.

How to open an MT5 account?

To open an MT5 account, follow these steps: Start by choosing a reputable forex broker that offers MetaTrader 5 accounts. Visit the broker’s official website and locate the “Open Account” or “Sign Up” option. Select the type of MT5 account that suits your trading preferences, considering factors like spreads, fees, and leverage. Download the MetaTrader 5 platform from the broker’s website or app store. Launch the platform, input your account credentials, select the appropriate trading server, and start trading by analyzing markets and executing trades on your newly opened MT5 account. Always ensure that you’re using secure and official channels throughout the account-opening process.

Who are the best MT5 brokers in Botswana?

- IC Markets – Best MetaTrader broker overall.

- FP Markets – Excellent pricing, great for MetaTrader.

Which MT5 broker offers a demo account?

- XM

- AvaTrade

Which broker offers a sign-up bonus for first-time traders?

InstaForex

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review