9 Best Swap-Free Account Brokers in Botswana

The 9 Best Islamic Swap-Free Forex Brokers in Botswana revealed.

This is a complete list of the best licensed Islamic swap-free brokers in Botswana.

In this in-depth guide you’ll learn:

- What is a Swap-Free Trading Account?

- Who are the best Islamic Swap-Free brokers for Botswanans?

- How to choose the right broker for your trading style?

- How to begin trading with a shariah-compliant broker?

- Which halal brokers offer the lowest spreads and minimum deposits?

- What should I know about Swap-Free Accounts?

And lots more…

So, if you’re ready to go “all in” as a Muslim trader with the best-tested Islamic swap-free brokers for Botswanans…

Let’s dive right in…

- Louis Schoeman

Best Swap-Free Account Brokers in Botswana

| 🏛️ Broker | 👉 Open Account | 💰 Swap-Free Account Broker? | 💵 Minimum Deposit | ✔️ Offers a Botswana Pula Account? |

| 1. Exness | 👉 Open Account | Yes | USD 10 / 134 BWP | No |

| 2. XM | 👉 Open Account | Yes | USD 5 / 67 BWP | Yes |

| 3. eToro | 👉 Open Account | Yes | USD 10 / 136 BWP | Yes |

| 4. BDSwiss | 👉 Open Account | Yes | USD 10 / 136 BWP | Yes |

| 5. FXTM | 👉 Open Account | Yes | USD 10 / 136 BWP | Yes |

| 6. easyMarkets | 👉 Open Account | Yes | USD 25 /336 BWP | No |

| 7. Pepperstone | 👉 Open Account | Yes | USD 0 / 0 BWP | Yes |

| 8. AvaTrade | 👉 Open Account | Yes | USD 100 / 1 342 BWP | No |

| 9. IC Markets | 👉 Open Account | Yes | USD 200 / 2 685 BWP | No |

What is a Swap-Free Trading Account?

A Swap-Free Trading Account is a trading account that does not create swaps, as the name suggests. A swap is a rollover interest or charge that brokers levy when traders retain an open position for longer than one day (overnight).

A swap-free trading account generates no interest, which makes it suitable for Muslim traders. These are the only forms of interest-free trading accounts that have gained much popularity among Muslim merchants.

Even though Muslim traders commonly use swap-free accounts, non-Muslim traders, especially those who suffer constraints in forex trading due to their religious views, could also utilize them.

According to Islamic law, charging or receiving interest (or Riba) in a commercial transaction or contract is prohibited. However, currency exchange is permitted, according to Mohammed’s teachings.

Swap-free trading accounts were introduced to enable traders of various faiths and beliefs to engage in the markets. Even though the question of whether swap-free trading accounts are halal is still being debated, the ultimate choice rests with the individual.

Most Muslim traders feel that swap-free trading accounts satisfy the interest prohibition, which is why swap-free accounts are often known as Islamic accounts.

9 Best Swap-Free Account Brokers in Botswana

- Exness – Overall, Best Swap-Free Account Brokers in Botswana

- XM – Top Sign-Up Bonus Forex Broker

- eToro – Best Social Trader in Botswana

- BDSwiss – Top STP Forex Broker

- FXTM – Best NDD Forex Broker

- easyMarkets – Top Volatility 75/VIX 75 Forex Broker

- Pepperstone – Best Nasdaq100 Broker in Botswana

- AvaTrade – Top Lowest Spread Forex Broker

- IC Markets – Best Mobile App Forex Broker

1. Exness

Overview

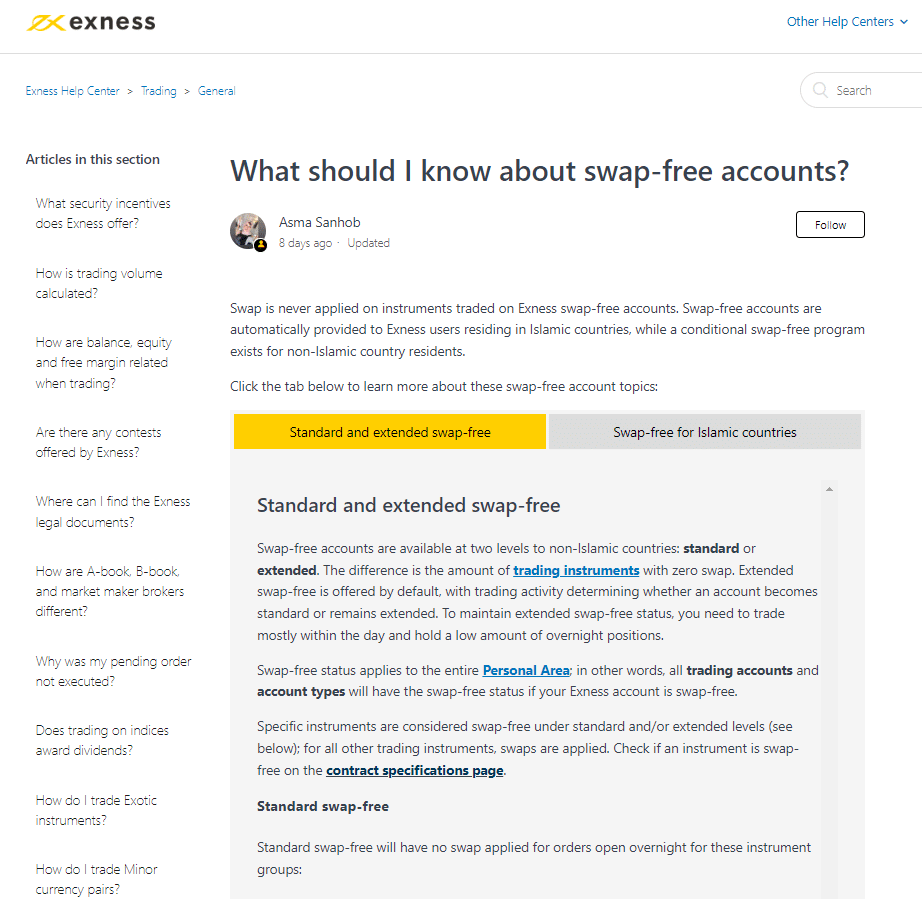

There are important distinctions to remember when comparing the swap-free accounts available to Islamic areas and those available to non-Islamic nations that Exness supplies. Furthermore, standard and Extended Swap-free are the two tiers of swap-free status.

By default, all trading accounts opened by customers residing in countries that are not Islamic are granted Extended Swap-free status. There will be no overnight swap charges for the following instruments held overnight by customers participating in the Standard Swap-free program:

➡️ XAU/USD

➡️ Crypto

➡️ Stocks

Swap-free instruments for Extended Swap-free clients include all the same instruments as Standard Swap-free, plus the following additional notations:

➡️ AUD/NZD

➡️ EUR/AUD

➡️ EUR/NZD

➡️ NZD/CAD

➡️ GBP/USD, and several others.

Min Deposit

$10 / 134 BWP

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Standard Swap-free traders who have engaged in eligible Extended Swap-free trading will have their accounts automatically upgraded, regardless of whether they want to do so.

Similarly, if a trader’s activity in an Extended Swap-free account goes below a certain threshold, the trader’s area swap-free status will automatically convert to Standard Swap-free.

Exness’ automated system automatically gives customers who live in countries where Islam is the prevalent religion swap-free trading accounts. However, this policy does not apply to any nations; thus, `residents of such countries cannot become swap-free.

Furthermore, Botswanan Muslim traders must note that cryptocurrencies, indices, and stocks are exempt from swaps. Moreover, the XAUUSD (Gold-USD) instrument pair has a swap rate of 0, regardless of whether it is considered swap-free.

Features

| Feature | Information |

| ⚖️ Regulation | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Standard Account, Standard Cent Account, Raw Spread Account, Zero Account, Pro Account |

| 📊 Trading Platform | MetaTrader 4, MetaTrader 5, Exness Terminal, Exness Trader app |

| 💰 Minimum Deposit | $10 / 134 BWP |

| 💰 Trading Assets | Forex minor pairs, forex major pairs, forex exotic currency pairs, Metals, Crypto, Energies, Indices, Stocks |

| 🔎 Botswanan Pula-based Account? | No |

| 💳 BWP Deposits Allowed? | Yes |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 0.0 pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | No |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Exness is a reputable international broker authorized by several reputable market regulators | There is a limited selection of tradable instruments in only a few financial markets |

| The broker offers some of the tightest spreads across all types of accounts | There is a limited selection of funding options offered |

| There are several account types to choose from, each accommodating different types of traders | |

| There are various market metrics available including exchange rates, overall trading activities available, current market conditions, and more. | |

| Exness is ideal for any Botswanan beginner traders and institutional investors | |

| There are solutions offered for any type of professional trader who needs advanced options | |

| There is a powerful proprietary mobile app offered | |

| Client fund safety and investor protection is guaranteed | |

| Multilingual 24/7 customer support is offered | |

| Instant withdrawal methods are available |

2. XM

Overview

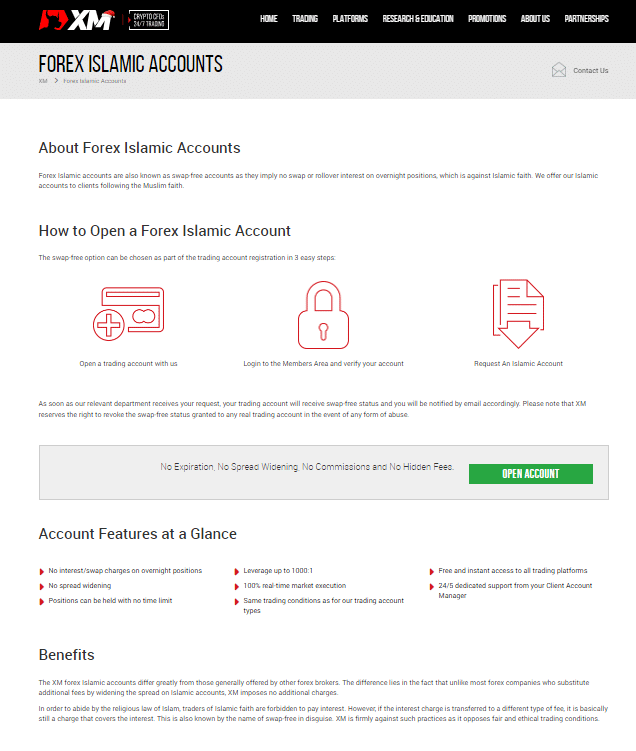

XM is unique among forex brokers because it does not impose additional fees on Islamic accounts. However, most brokers either add a commission to the trade or increase the spread to compensate for the absence of swap costs.

The Islamic account at XM offers the same trading conditions as the standard account, except for the swap charge.

Min Deposit

USD 5 / 67 BWP

Regulators

IFSC, CySec, ASIC

Trading Desk

Desktop MT4 and MT5, Mobile MT4 and MT5, XM mobile app, Web platform

Total Pairs

57

Islamic Account

Yes

Trading Fees

No (Just spread)

Account Activation Time

24 Hours

Furthermore, XM makes it easy to create an Islamic account by requiring traders to open and authenticate a normal account before submitting a request for an Islamic account to the company’s back office.

Trading conditions, account variety, execution speed, and the breadth of CFD assets on offer across MT4 and MT5 make XM one of the most regulated market makers in the foreign exchange market.

Traders willing to put down at least 5 USD / 65 BWP can create an XM Ultra Low Account, which offers spreads as low as 0.6 pips and no commission fees.

Features

| Feature | Information |

| ⚖️ Regulation | FSCA, IFSC |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | $5 / 67 BWP |

| Average spread from | 0.0 pips EUR/USD |

| 📈 Maximum Leverage | 1:1000 |

| 👥 Customer Support | 24/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Negative balance protection is applied to retail investor accounts | US clients are restricted from accessing XM’s trading services |

| There are several secure payment methods to choose from | There are no fixed spread accounts offered |

| The broker is known for low spreads, low commissions, and reliable trade execution speeds | There is an inactivity fee applied to dormant accounts |

| Traders can use hedging, scalping, and expert advisor trading strategies | |

| The broker offers personal customer service to its clients |

3. eToro

Overview

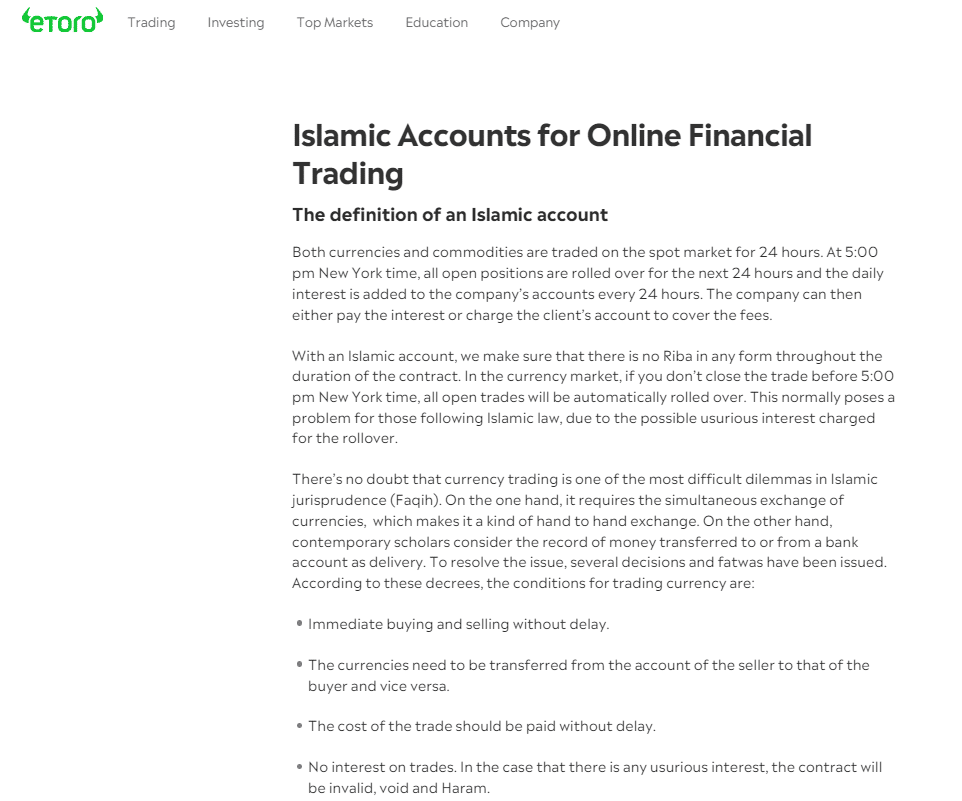

No interest is charged on any settlements made in an eToro Islamic account for 24 hours. This implies that your account will never get interest on rollovers. Furthermore, there are no extra fees for holding a deal for more than 24 hours.

This is a significant broker, especially compared to the other top broker accounts discussed on this website. Muslim forex traders using an eToro Islamic account can copy trade risk-free without worrying about commissions, fees, or other hidden costs.

Min Deposit

USD 10 / 136 BWP

Regulators

CySec, FCA

Trading Desk

None

Crypto

Yes

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Therefore, the spreads are the only source of income for the broker from Islamic accounts. Botswanans must remember that this applies to all other costs or debts incurred. Leveraged trading depends on borrowing money from your broker, so it is technically forbidden in Islam.

Therefore, interest leverage is not available on eToro’s Islamic trading accounts to ensure full compliance with Sharia law.

Customers must sign up for a real eToro account and deposit at least $1,000 / 13,000 BWP before opening an Islamic account. Then, after discussing your eligibility with support, you can apply to engage in swap-free trading from your client account.

Features

| Feature | Information |

| ⚖️ Regulation | CySEC, FCA, ASIC, FinCEN, FINRA, SIPC, DNB, FSA |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Retail, Professional |

| 📊 Trading Platform | eToro trading app and web-based platform |

| 💰 Minimum Deposit | 136 BWP equivalent to $10 |

| 💰 Trading Assets | Forex pairs, Commodities, Exchange-Traded Funds (ETFs), Indices, Stocks, Crypto trading, Stocks |

| 🔎 Botswanan Pula-based Account? | No |

| 💳 BWP Deposits Allowed? | No |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 1 pip EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| eToro has a strict and solid regulatory framework | There are limitations on leverage for retail traders |

| Client fund safety is guaranteed and there is consumer protection offered | There is a limited selection of retail investor accounts |

| eToro offers commission-free trading | Fixed spreads are not offered |

| There are over 2,000 complex instruments that can be traded | The spreads are not the tightest |

| The broker offers several trading opportunities and a social trading feature | There is a high minimum deposit on the Islamic Account |

| There is an award-winning proprietary platform offered | There is an inactivity fee charged on dormant accounts |

| eToro offers 24/6 dedicated customer services | |

| eToro offers a demo account and an Islamic Account | |

| Algorithmic trading and margin trading supported | |

| Real time quotes are offered alongside a wide range of benefits | |

| The mobile app is secure and features robust security such as two-factor authentication | |

| The app can be used as a wallet app for digital currencies | |

| Offers several resources that help traders make improved financial decisions with confidence | |

| Offers several helpful tools and services as a solid basis for investment decision along with investment advice | |

| Provides access to several popular cryptocurrencies that can be traded and crypto staking services | |

| There is a comprehensive portfolio management service and popular investor program offered |

4. BDSwiss

Overview

BDSwiss, known worldwide for its insightful financial commentary, provides Islamic trading accounts on MetaTrader 4, MetaTrader 5, and BDSwiss’ WebTrader.

BDSwiss’ customers get access to superior market analysis thanks to the firm’s devoted research staff, which comprises specialists in the field and experienced traders.

Min Deposit

$10 / 136 BWP

Regulators

CySec, FSC, FSA, BaFin, NFA

Trading Desk

MetaTrader 4 , MetaTrader 5

Crypto

Yes

Total Pairs

50 Forex Pairs and 20 Crypto Pairs

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

In addition to providing traders of all skill levels with access to free webinars and a library of all of BDSwiss’ training films, the company also provides a well-organized and extensive Forex education program.

BDSwiss’ administrative staff requests that new customers who want to create Islamic accounts contact them through email and may request proof of religious affiliation.

The Islamic account with BDSwiss has a few drawdowns, including a 10-day swap-free trading limit. Since swaps will be reapplied after 10 days, positional trading is impossible.

Features

| Account Feature | Value |

| ⬆️ Average Spread on EUR/USD | 1.1 pips |

| 📊 Maximum Leverage | 1:1000 |

| 📉 Tradable Instruments | Over 70 |

| 📈 Available Assets | • Forex CFDs • Commodities CFDs |

| 💸 Commissions per round lot | None |

| 📞 Margin Call | 50% |

| 🛑 Stop-out level | 20% |

| 💵 Instant Withdrawals offered? | Yes, only Credit Cards up to 2,000 €/$/£ |

| 💰 0% fees on Deposits and CC Withdrawal? | Yes |

| 📱 Platforms available | BDSwiss Web, BDSwiss Mobile, MetaTrader 4 |

| 🚨 Are trading alerts offered? | Limited Access granted |

| ✔️ AutoChartist Performance Stats offered? | Yes, with a 6,000 BWP minimum deposit |

| 📞 Personal Account Manager | Yes, with a 12,000 BWP minimum deposit |

| 📊 Priority Service | Yes |

| 🔨 AutoChartist Standard Tools | Yes |

| ✔️ Access to Trading Central? | Yes |

| 💻 Trading Academy and Live Webinars | No |

| ✔️ Trade Companion offered? | Yes |

| ☪️ Islamic Account option? | Yes |

| ✅ VIP Webinars | No |

| 📞 24/5 Customer Service and Support? | Yes |

| ✔️ Minimum deposit requirement | 136 BWP or an equivalent to $10 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| BDSwiss is a reputable MT4 and MT5 broker that offers STP and ECN execution on trades | Botswanans are subject to fees on withdrawals |

| Botswanans can expect competitive trading conditions across all asset classes | Local deposits and withdrawals are not available to Botswanan traders |

| There is an impressive range of instruments that can be traded | BWP is not a supported deposit currency or base currency for a retail trading account |

| BDSwiss is well-regulated and experiences high trading volumes and liquidity | |

| There is a superb customer support team available to assist with queries | |

| BDSwiss offers experienced traders several useful tools, and educational materials are offered to beginner traders | |

| The minimum deposit requirement on entry-level accounts makes it possible for any trader to sign up and start trading with BDSwiss |

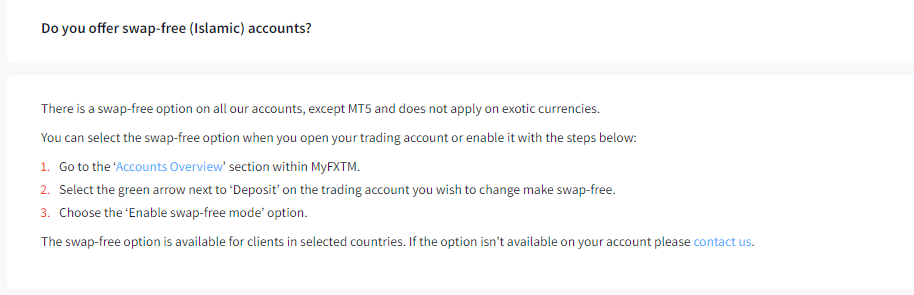

5. FXTM

Overview

FXTM offers a swap-free option across all trading accounts. However, MT5 users are unable to access these accounts. In addition, Muslim traders interested in FXTM’s swap-free accounts should also be aware that only certain currency pairings are eligible for trading without incurring swaps.

Furthermore, swap fees do not apply to Islamic accounts; instead, a commission beginning at USD 12.90 per lot is levied on the EUR/USD.

Min Deposit

USD 10

Regulators

CySec, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

60

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Besides Foreign Exchange (Forex), commodities, equities, and indices, FXTM also provides trading in a secure environment. Spreads start at 1.5 pips on the Micro Account and go as low as 0 pips on the Advantage Account (plus a 4 USD fee), while the minimum deposit is just 10 USD.

In addition, FXTM Invest, a copy-trading tool, is available to traders with Islamic accounts, allowing them to imitate the trades of successful traders for a charge.

Features

| Feature | Information |

| ⚖️ Regulation | CySEC, FSCA, FCA, FSC Mauritius |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Micro Account, Advantage Account, Advantage Plus Account |

| 📊 Trading Platform | MetaTrader 4, MetaTrader 5, FXTM Trader |

| 💰 Minimum Deposit | 134 Botswanan Pula equivalent to $10 |

| 💰 Trading Assets | Precious Metals, Stock Trading, Stock CFDs, Indices, Forex Indices, Forex Currency Pairs (including minor, major, and exotic pairs), Commodities, Stock Baskets |

| 🔎 Botswanan Pula-based Account? | Yes |

| 💳 BWP Deposits Allowed? | Yes |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 0.0 pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| FXTM is a multi-regulated and a reputable broker that has gained a high level of trustworthiness | Inactivity fees apply when the retail investor account becomes dormant |

| Dedicated customer support offered for Botswanan traders Several deposit options and withdrawal methods offered | |

| There is a low minimum deposit requirement | |

| Commission-free trading is offered | |

| Deposit fees are not charged on any payment methods | |

| Withdrawal processing times are quick | |

| There are several educational tools offered | |

| There is an exclusive risk management tool offered |

6. easyMarkets

Overview

easyMarkets is another broker renowned as professionals in trading CFDs but gives a guaranteed stop loss and take profit to all customers.

easyMarkets is a popular option among traders interested in opening a swap-free or Islamic forex broker account due to the company’s straightforward and trustworthy reputation.

Min Deposit

25 USD /336 BWP

Regulators

CySEC, ASIC, BVI, FSA

Trading Desk

MetaTrader 4, TradingView

Crypto

Yes

Total Pairs

275+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Furthermore, the account options comply with Islamic law. Traders who use an overnight approach on easyMarkets Islamic trading accounts will not be charged rollover fees.

This guarantees that Islamic traders never accumulate interest on their investments, keeping them in perfect compliance with Sharia law.

Consequently, the longest you may keep a trade open on an easyMarkets Islamic account is two weeks (or 14 days). When this time runs out, all open positions will close.

Features

| Account Feature | Value |

| 📱 Platform Offered | MetaTrader 4 |

| 📉 Minimum Transaction Size (USD) | 0.01 |

| 💻 Maximum Transaction Size (lots) | 50 lots |

| 📊 Average Fixed Spreads (from) | • EUR/USD – 1.7 pips • GBP/USD – 2.3 pips • USD/JPY – 2 pips • WTI (OIL) – 0.05 USD • XAU/USD – 0.45 USD |

| 📉 Minimum Deposit | 336 Pula (Equivalent to $25) |

| 📈 Maximum Leverage | 1:400 |

| 💵 Commission Fees | None |

| 💸 Account Fees | None |

| 💰 Deposit and Withdrawal Fees | None |

| 👥 Customer Telephonic Support | Yes |

| 🗣 Personal Account Manager | Yes |

| 📞 24/5 Customer Support Through Live Chat | Yes |

| 💵 Guaranteed Zero Slippage | Yes |

| 🛑 Guaranteed Stop-Loss | No |

| ❌ Negative Balance Protection | No |

| 📊 Daily Email on Fundamental Analysis | Yes |

| ✔️ Daily Email on Technical Analysis | Yes |

| 📱 Trading Central Indicator | Yes |

| 💰 Account Base Currency Options | EUR, CAD, CZK, JPY, NZD, AUD, PLN, TRY, CNY, HKD, USD, SGD, CHF, GBP, MXN, NOK, SEK, ZAR, BTC |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| easyMarkets is well-regulated and has an extremely high trust score | There are no variable spread accounts available to Botswanan traders |

| Botswanan traders can choose between MetaTrader and easyMarkets’ proprietary trading software | Botswanan traders cannot set Botswanan Pula as their base account currency |

| Botswanan traders have access to TradingView when they register a trading account | There is an inactivity fee applied to all dormant accounts |

| The broker is known for unique trading solutions such as Freeze-Rate, Inside Viewer, easyTrade, and several other innovative technologies | |

| Botswanan traders are given unlimited access to a demo account which is funded with virtual capital | |

| There are competitive fixed spreads offered | |

| There is a choice between different easyMarkets retail account types and trading options | |

| Commission-free trading is guaranteed on all trading accounts |

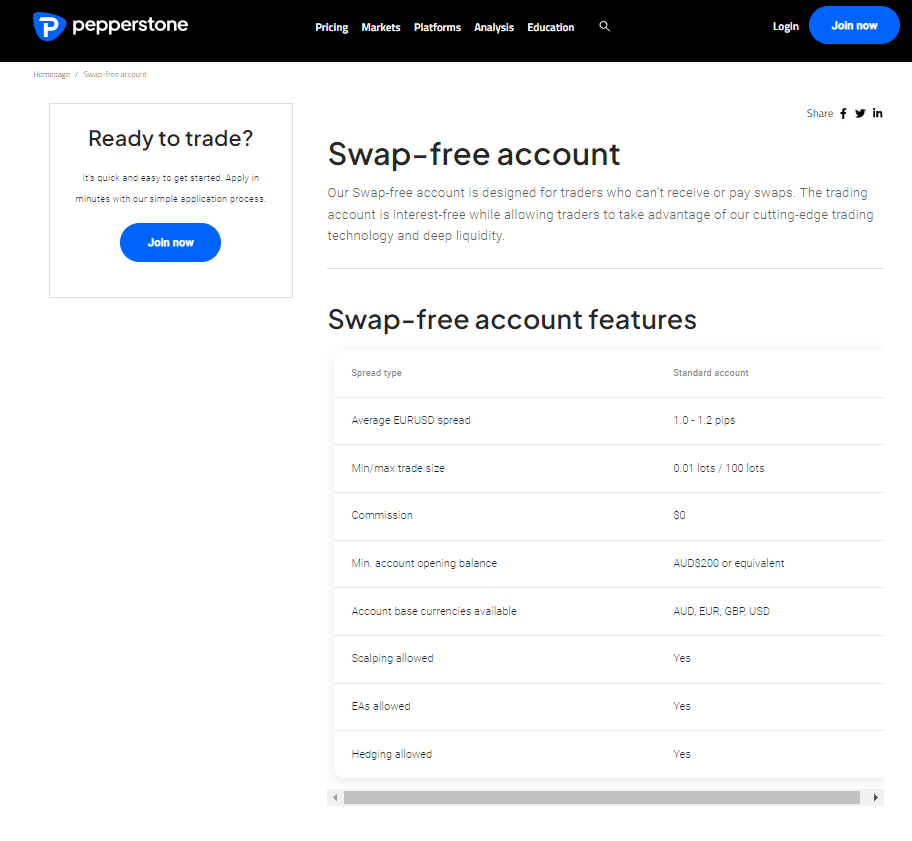

7. Pepperstone

Overview

Pepperstone is an Australian forex broker specializing in currencies, commodities, and indices.

The Pepperstone Islamic account is solely offered to customers who follow Islam, not to everyone interested in swap-free trading. Therefore, Pepperstone does not promote its swap-free Islamic trading options publicly.

As this account is swap-free, there are no overnight rolling fees. Instead, an administrative fee is levied, but it does not begin accruing until you have held your position for 11 days. After this, your position is charged every 11 days following.

Min Deposit

0 USD / 0 BWP

Regulators

ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB

Trading Desk

MetaTrader 4, MetaTrader 5, cTrader and TradeView

Crypto

Yes (Not available in Africa)

Total Pairs

60+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

In other words, you will only be charged an administrative fee once if you retain your positions for 16 days.

Pepperstone exclusively offers the swap-free account to traders in Islamic nations. To qualify for a swap-free trading account, you must present documentation from your mosque proving your Islamic beliefs.

Spreads on the Pepperstone standard account are competitively low. Given that there are no commission fees, the minimum spread for the EUR/USD currency pair is a highly competitive 0.60 pips.

Features

| Account Feature | Value |

| 💰 Minimum Deposit | $0 / 0 BWP |

| 💻 Minimum Trading Size | 0.01 lots |

| 📈 Maximum Trading Size | 100 lots in a single trade |

| 💵 Base Account Currency | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, and HKD |

| ✅ Trading Strategies Supported | All including scalping, hedging, and Expert Advisors (EAs) |

| 🗞 News Trading Offered? | Yes |

| ➡️ Trade Execution | No-Dealing Desk (NDD) |

| 📊 Average EUR/USD Spread | From 0.6 pips |

| 💸 Commissions | None |

| 🔃 Rollover Swaps | Yes, according to the market rates |

| ⬆️ Maximum Leverage per region | • Australia – 1:30 • Bahamas – 1:200 • Cyprus – 1:30 • Dubai – 1:30 • Germany – 1:30 • Botswana – 1:400 • United Kingdom – 1:30 |

| ❌ Negative Balance Protection Offered | Yes, only for retail clients |

| ✅ Margin Close-Out (%) | 50% |

| 🔨 Trading Instruments offered | 1,200+ |

| 💻 Trading Platforms offered | MetaTrader 4, MetaTrader 5, cTrader, TradingView, Myfxbook, DupliTrade |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Pepperstone offers competitive spreads that start from 0.0 pips on EUR/USD | There are restrictions on the countries that may use Pepperstone’s Islamic account |

| Pepperstone is well-regulated and offers an extremely secure trading environment with transparent trading fees | There is no BWP-denominated account offered, subjecting Botswanans to currency conversion fees |

| Investor protection is offered to EU clients through the FSCS | There are additional administrative fees applied to the Islamic account |

| Pepperstone offers a choice between some of the best trading platforms | |

| Negative balance protection is offered for clients in certain regions | |

| There is an Islamic account offered to Muslim traders | |

| There is a demo account offered by Pepperstone | |

| There are several trading tools offered |

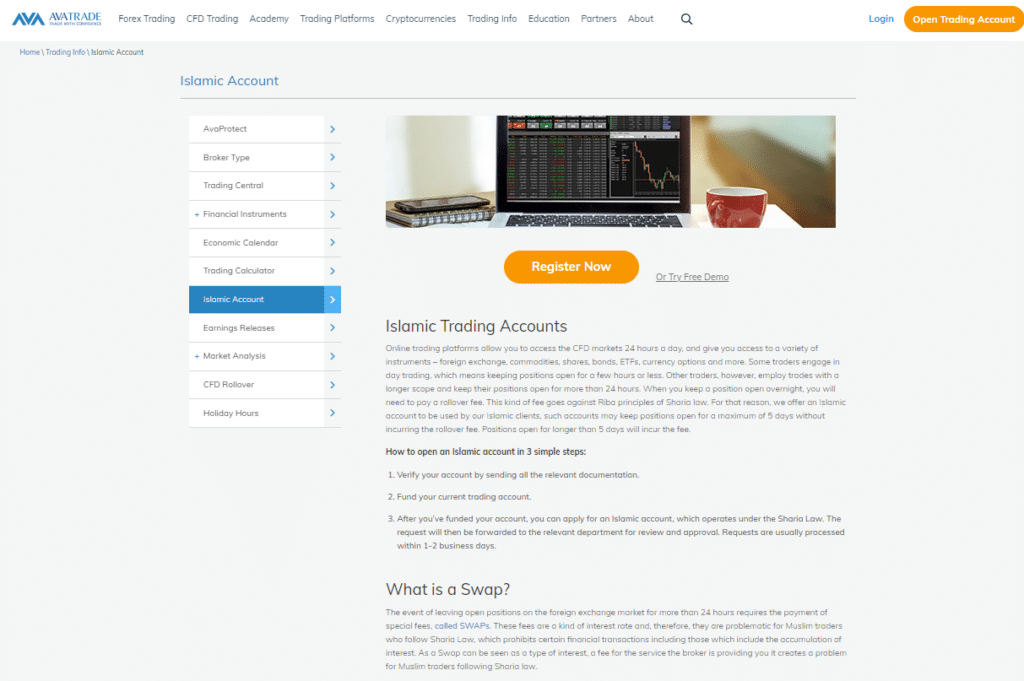

8. AvaTrade

Overview

AvaTrade was established in 2006 and is licensed and regulated on six continents. Retail and professional accounts have access to more than 1,260 financial products.

Furthermore, AvaTrade’s Islamic accounts can be used with MetaTrader 4, MetaTrader 5, WebTrader, and the fantastic and newly developed AvaTradeGo mobile app.

Spreads on the EUR/USD for Islamic accounts start at only 0.9 pips. In addition, the AvaTradeGo app provides South African forex traders with a streamlined and professional trading environment.

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

The sophisticated interface of AvaTradeGo includes sophisticated management tools, clear charts with the ability to zoom in for finer information, and a feature called Market Trends for tracking the latest trading fads among the AvaTrade community.

The AvaProtect feature lets traders buy temporary loss protection and are accessible through the mobile app.

AvaTrade’s Islamic accounts demand more work than those at other brokers. Furthermore, to register an Islamic account, Botswanans must first create and fund a Standard account.

Typically, applications are reviewed and approved within one to two working days. Islamic accounts at AvaTrade are not charged swap fees or a commission, as is common with other Islamic accounts. However, the spread will be marked up to cover overnight fees.

Features

| Feature | Information |

| ⚖️ Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, FRSA, CySEC, ISA |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Retail Investor Account, Professional Account Option |

| 📊 Trading Platform | AvaTradeGO, AvaOptions, AvaSocial, MetaTrader 4, MetaTrader 5, DupliTrade, ZuluTrade |

| 💰 Minimum Deposit (BWP) | $100 / 1343 BWP |

| 💰 Trading Assets | Foreign currencies, Cryptocurrencies, Commodities, Treasuries, Bonds, Indices, Stocks, ETFs, Options, CFDs, Precious Metals |

| 🔎 Botswanan Pula-based Account? | No |

| 💳 BWP Deposits Allowed? | No |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 0.9 pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| AvaTrade is multi-regulated and one of the most trusted online trading brokers in the world | Variable spreads are not offered |

| There is a wide range of financial instruments that can be traded across financial markets | There is a limited choice between account types |

| There are several technical indicators, economic indicators, and other solutions for advanced traders | Inactivity fees are applied |

| There are several trading platforms to choose from | Currency conversion fees may be applied |

| There is a decent selection of educational material that helps beginner traders navigate complex instruments and lower the degree of risk they are often exposed to | There is a limited number of base currency options offered on accounts |

| There is a multitude of social trading opportunities offered | |

| The broker accepts any trading strategy including automated trading, expert advisors, scalping, hedging, and others. |

9. IC Markets

Overview

In contrast to a significant number of other brokers, IC Markets does not levy any additional fees or commissions on Islamic accounts.

In addition, IC Markets is one of the very few brokers that provide Islamic accounts on the Raw Spread account type and the commission-free account type on the MT4, MT5, and cTrader trading platforms.

Clients trading via Islamic accounts will access leverage of 1:500, various tradeable instruments, and spreads as low as 0 pips on the EUR/USD currency pair. Furthermore, commissions on trades made using the Raw Spread account begin at $5 per lot.

Min Deposit

USD 200 / 2 685 BWP

Regulators

ASIC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

65

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Opening an Islamic account is straightforward and may be done directly from IC Market’s website. However, customer service will request confirmation of Islamic religion before registering the trading account.

Furthermore, registering an Islamic account can be done directly and quickly from IC Market’s website. IC Markets’ customers can rest easy knowing that their transactions are being performed using the broker’s innovative trading infrastructure, which is among the best in the industry.

Botswanan traders of the Islamic religion can rest assured that they enjoy the same advantages as the rest of the broker’s customer book thanks to the network of strategically located servers used by IC Markets

Features

| Account Feature | Value |

| 💻 Trading Platform | MetaTrader 4 and 5 |

| 💳 Commissions | $3.5 per side and $7 per round turn |

| 📊 Average Spreads | 0.0 pips |

| 📉 Minimum Deposit Requirement | 2,400 Botswanan Pula equivalent to $200 |

| 📊 Leverage | 1:500 |

| 📈 Maximum positions per account | 200 lots |

| 📍 Server Location | New York |

| ➡️ Micro trading allowed? | Yes |

| 📈 Currency Pairs | 64 |

| 📉 Index CFD Trading | Yes |

| 🛑 Stop-Out (%) | 50% |

| 📱 One-Click Trading offered? | Yes |

| ☪️ Islamic Accounts | Yes |

| ✔️ Trading Styles accepted | Scalping, hedging, expert advisors, algorithmic strategies, etc. |

| 💻 Programming Language | MQL4 |

| ✅ Suitable for | Expert advisers, scalpers |

| ✔️ Demo Account offered? | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| IC Markets is a multi-regulated forex and CFD broker with a decent trust score and a low-risk reputation | There is a higher minimum deposit requirement charged than other brokers |

| There is real raw spread trading offered across several asset classes | Botswanan traders could face currency conversion fees |

| IC Markets offers some of the best spreads in the industry | There is no BWP-denominated account offered |

| Botswanans can choose between MetaTrader 4, MetaTrader 5, and cTrader as their preferred platform | There are no fixed spreads offered by IC Markets |

| There is a choice between three different account types that suit different types of traders | There is no proprietary trading platform, or an app offered by IC Markets |

| There are no hidden fees and IC Markets is one of the best options for high volume trading because it has a long list of liquidity providers | |

| There is a free demo account offered | |

| There is an Islamic account option offered to Muslim traders |

How to begin trading with a shariah-compliant broker?

Embarking on trading with a Shariah-compliant broker involves several key steps to ensure adherence to Islamic principles. First and foremost, prospective traders should diligently research and select a broker with a clear commitment to Islamic finance principles, avoiding interest (Riba) and any involvement in prohibited activities such as gambling or speculation.

Shariah-compliant brokers offer accounts that operate in accordance with Islamic finance principles, ensuring that trades adhere to ethical and legal standards. Traders should opt for an Islamic trading account, which typically means that there are no swap or interest charges. Additionally, engaging in businesses deemed haram, or forbidden, such as those related to alcohol or gambling, should be avoided.

It’s crucial for traders to educate themselves on Shariah guidelines, consult with Islamic scholars if needed, and carefully review the terms and conditions of the broker to ensure a fully Shariah-compliant trading experience.

What to Consider when comparing Swap-Free Brokers

Many brokers will provide Islamic accounts to Muslim clients. Even though these account types are only adaptations of the live account, trading circumstances at the broker and unique alterations to the Islamic account’s trading requirements may affect trading expenses.

Botswanan traders must evaluate the following components of a forex broker to decide whether the broker is suited to their unique trading objectives and needs.

Restrictions on Financial Instruments

Brokers often limit the trading instruments available to Islamic clients. For example, with some forex brokers, Islamic accounts are subject to a wider spread on all currency pairings, and most Islamic accounts cannot trade cryptocurrencies.

Regulation and Security

For traders, regulation is the security of their money. Without regulation, the broker has discretion over your trading money. A mix of well-respected international authorities and your local regulator should oversee your broker.

Free Swap Fees

Swap costs are assessed every 24 hours when a position is kept open. The broker must never impose a swap fee for a trading account to be termed swap-free or Shari’ah-compliant.

Certain brokers limit swap-free trading to a period – typically 14 days after the deal is opened – and make the account swap-free during this time. Therefore, always ask the broker whether there is a time-limited swap-free period for transactions when comparing Islamic accounts.

Availability of features on Islamic Accounts

Many brokers provide a choice between flexible account types. However, swap costs cannot be withdrawn from all these accounts.

Always inquire with your broker whether live accounts provide a swap-free alternative, and evaluate whether the broker restricts certain features on accounts, including leverage, bonuses, etc.

Minimum Deposit

A live account will always require a minimum deposit, but brokers may occasionally increase this requirement for Islamic accounts.

Always verify the minimum deposit requirement before opening an account. For example, brokers might charge a much higher minimum deposit for an Islamic account than a normal live account to offset the absence of swaps.

Trading Fees

Brokers sometimes earn a profit via swaps, and to make up for lost revenue, and they may boost spreads or impose extra charges. The following are instances of extra fees:

➡️ Admin fees or commissions when Botswanans trade certain instruments.

➡️ Holding charges that apply after a few days if your position remains open.

➡️ Wider spreads, especially when the Islamic Account is a standalone live trading account instead of an option.

The Best Forex Brokers in Botswana

In this article, we have listed the best brokers that offer forex trading to traders in Botswana. In addition, we have further identified the brokers that offer additional services and solutions to Botswanan traders.

Best MetaTrader 4 / MT4 Forex Broker in Botswana

Min Deposit

USD 25

Regulators

FCA UK

Trading Platform

MT5, MT4, OctaTrader

Crypto

Yes

Total Pairs

28

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, OctaFX is the best MT4 forex broker in Botswana. OctaFX is an MT4 and MT5 broker that provides Botswanans with various markets. OctaFX offers a choice of accounts via MT4, including ECN and STP accounts, with superior trade execution.

Best MetaTrader 5 / MT5 Forex Broker in Botswana

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, AvaTrade is the best MetaTrader 5 forex broker in Botswana. In addition, AvaTrade is regarded as one of the most secure MT5 forex brokers.

No commission is charged for trading currency pairings, only leaving the spread to be paid. A demo account is also available for traders to sharpen their abilities via MT5 and several other platforms.

Best Forex Broker for beginners in Botswana

Min Deposit

$100

Regulators

CFT, NFA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FOREX.com is the best forex broker for beginners in Botswana. FOREX.com is a broker renowned for low trading fees and beginner-friendly solutions. In addition, FOREX.com offers several educational materials and a helpful demo account.

Best Low Minimum Deposit Forex Broker in Botswana

Min Deposit

$10 / 134 BWP

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Exness is the best Low Minimum Deposit Forex Broker in Botswana. Exness has a minimum deposit requirement of 10 USD / 130 BWP, making it easy for Botswanans to start trading 278 instruments.

Exness also offers MT4 and MT5 through which trades can be made. In addition, it offers some of the best trading tools, charting capabilities, technical indicators, expert advisors, and more.

Best ECN Forex Broker in Botswana

Min Deposit

USD 0

Regulators

CySEC, FCA, DFSA, FSCA, FSA, CMA

Trading Desk

MT4, MT5, HFM APP

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

0

Account Activation Time

24 Hours

Overall, HFM is the best ECN forex broker in Botswana. HFM is a hybrid forex and CFD broker that uses STP and ECN technology to ensure that Botswanans get the best pricing, minimal slippage, no requotes, and the fastest trade execution.

HFM uses the best liquidity providers who aggregate the pricing that Botswanans can see on MT4, MT5, and the HF App for Android and iOS.

Best Islamic / Swap-Free Forex Broker in Botswana

Min Deposit

USD 10 / 136 BWP

Regulators

CySec, FCA

Trading Desk

None

Crypto

Yes

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, eToro is the best Islamic / Swap-Free forex broker in Botswana. eToro is a renowned social trading platform that offers Muslim traders an Islamic Account.

eToro does not charge any interest on positions held for over 24 hours. However, registering an Islamic Account can be expensive initially, requiring a 1,000 USD / 13,400 BWP deposit.

Best Forex Trading App in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

ASIC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

300

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, CMC Markets is the best forex trading app in Botswana. In addition, CMC Markets offers a user-friendly mobile app with research tools, powerful charts, customizable watch lists, news reports, and a range of educational materials.

Best Lowest Spread Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

FCA, CySEC, IFSC, KNF

Trading Desk

No Trading Desk

Crypto

Yes

Total Pairs

48

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, XTB is the best lowest-spread forex broker in Botswana. XTB is a well-known forex and CFD broker with low and competitive forex spreads from 0.1 pips depending on the financial instrument and the market conditions.

XTB is also a good broker in terms of educational materials and research capabilities, providing traders with comprehensive market analysis across markets.

Best Nasdaq 100 Forex Broker in Botswana

Min Deposit

USD 10

Regulators

CySec, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

60

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXTM is the best Nasdaq 100 forex broker in Botswana. FXTM is a multi-regulated forex and CFD broker that accommodates Botswanan traders with a keen interest in Nasdaq. Traders can expect low and competitive spreads, a choice between accounts, and powerful trading platforms.

Best Volatility 75 / VIX 75 Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

IGRs

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, IG is Botswana’s best Volatility 75 / VIX 75 forex broker. IG is one of the best CFD brokers with powerful proprietary trading technology.

IG is well-regulated and offers Botswanans access to VIX75, with spreads from 0.04 pips / 0.13% and zero commission charges.

Best NDD Forex Broker in Botswana

Min Deposit

USD 50 / 672 BWP

Regulators

FCA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

–

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXCM is the best NDD forex broker in Botswana. FXCM is a No-Dealing Desk broker with STP and ECN execution across several markets.

In addition, FXCM offers a choice between third-party platforms in addition to technical indicators, charting tools, and competitive trading conditions.

Best STP Forex Broker in Botswana

Min Deposit

USD 10

Regulators

IFSC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

36

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, RoboForex is the best STP forex broker in Botswana. RoboForex is popular forex and CFD broker with competitive trading conditions. RoboForex offers STP execution with liquidity sourced from top providers.

Botswanans can expect access to over 12,000 instruments via powerful and innovative third-party platforms.

Best Sign-up Bonus Broker in Botswana

Min Deposit

50 USD / 682 BWP

Regulators

CYSEC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Windsor Brokers is the best sign-up bonus broker in Botswana. Windsor Brokers is a well-regulated broker that offers Botswanans a welcome account funded with 30 USD in trading credit. With this account, Botswanans can explore the platform or risk-free test their strategies.

You might also like: Best Futures Trading Platforms in Botswana

You might also like: Best Social Trading Platforms in Botswana

You might also like: Best Volatility 75 Forex Brokers in Botswana

You might also like: Best NDD Forex Brokers in Botswana

You might also like: Best Low Spread Forex Brokers in Botswana

Conclusion

An Islamic Forex account, also known as a swap-free account, is a special account that can be opened with certain brokers. They were designed for businesspeople who adhere to Islam, which forbids earning money via interest.

Most foreign exchange (Forex) companies make it possible for Muslims to trade according to their beliefs by providing swap-free trading accounts that adhere to Shari’ah law.

Botswanans must, however, remember that they must still carry out thorough research in searching for a suitable Swap-Free Account broker.

Frequently Asked Questions

Are Swap-Free Accounts better for Botswanans?

Trading with a swap-free account is permissible in Islam because swap interest is not charged. Therefore, Islamic forex accounts (which do not involve swaps) exist. These accounts are the only ones that do not involve swapping currencies.

Is forex halal in Islam?

Although conventional foreign exchange trading is forbidden by sharia law, the Islamic swap-free version of Forex trading is permissible and halal for Muslims.

Is crypto halal or haram?

If a Muslim uses the currency to buy anything, it is considered halal. However, using a cryptocurrency broker as a speculative investment vehicle is forbidden.

Is eToro swap-free?

eToro offers an Islamic account to Muslim traders, ensuring that traders are exempt from overnight fees.

How can Botswanans avoid Swap fees?

Botswanans can register an Islamic Account, trade in the direction of positive interest, and only trade using intraday, day, or scalping strategies.

Who are the best Islamic Swap-Free brokers for Botswanans?

- Exness

- eToro

- XM

- BDSwiss

- FXTM

- easyMarkets

- Pepperstone

- AvaTrade

- IC Markets

Which halal brokers offer the lowest spreads and minimum deposits?

- Exness

- XM

- eToro

- BDSwiss

- FXTM

- Pepperstone

What should I know about Swap-Free Accounts?

Swap-free accounts, also known as Islamic accounts, cater to traders adhering to Shariah principles, which prohibit the earning or paying of interest (Riba).

These accounts are designed to accommodate individuals who cannot participate in standard interest-bearing transactions due to religious beliefs. In a swap-free account, overnight interest or swap charges are waived, ensuring that positions can be held for an extended period without incurring interest, a practice considered non-compliant with Islamic finance principles.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review