8 Best Volatility 75 Forex Brokers in Botswana

The 8 Best Volatility 75 Index Forex Brokers in Botswana. We tested the best VIX 75 index forex brokers for Botswana Traders.

This is a complete guide to brokers that offers traders in Botswana the chance to trade on the Volatility 75 Index.

In this in-depth guide you’ll learn:

- What is the Volatility 75 Index?

- What is the difference between the Volatility 75 Index vs NASDAQ 100 Index?

- How to choose the best VOL 75 broker for your trading style?

- The Best Metatrader 4 (MT4) and Metatrader 5 (MT5) on the VIX 75 platforms revealed.

- Who is our #1 recommended 75 Index Volatility Broker in Botswana?

- Which Volatility 75 Index broker accepts M-PESA?

And lots more…

So if you’re ready to go “all-in” with VIX 75 Index Forex Brokers, this guide is for you.

Let’s dive right in…

- Louis Schoeman

Best Volatility 75 Forex Brokers in Botswana

| 🏅 Forex Broker | 👉 Open Account | ✔️ Volatility 75 Broker? | 💰 Minimum Deposit? | 💸 Botswana Pula (BWP) Deposits Allowed? |

| 1. XTB | 👉 Open Account | Yes | $0 / 0 BWP | No |

| 2. HFM | 👉 Open Account | Yes | $0 / 0 BWP | No |

| 3. FXCM | 👉 Open Account | Yes | $50 / 933 BWP | No |

| 4. IG | 👉 Open Account | Yes | $250 / 4667 BWP | No |

| 5. AvaTrade | 👉 Open Account | Yes | USD 100 / 1866 BWP | No |

| 6. easyMarkets | 👉 Open Account | Yes | $25 / 467 BWP | No |

| 7. Pepperstone | 👉 Open Account | Yes | $0 / 0 BWP | No |

| 8. IC Markets | 👉 Open Account | Yes | $200 / 3742 BWP | No |

10 Best Forex Brokers in Botswana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

What is the Volatility 75 Index?

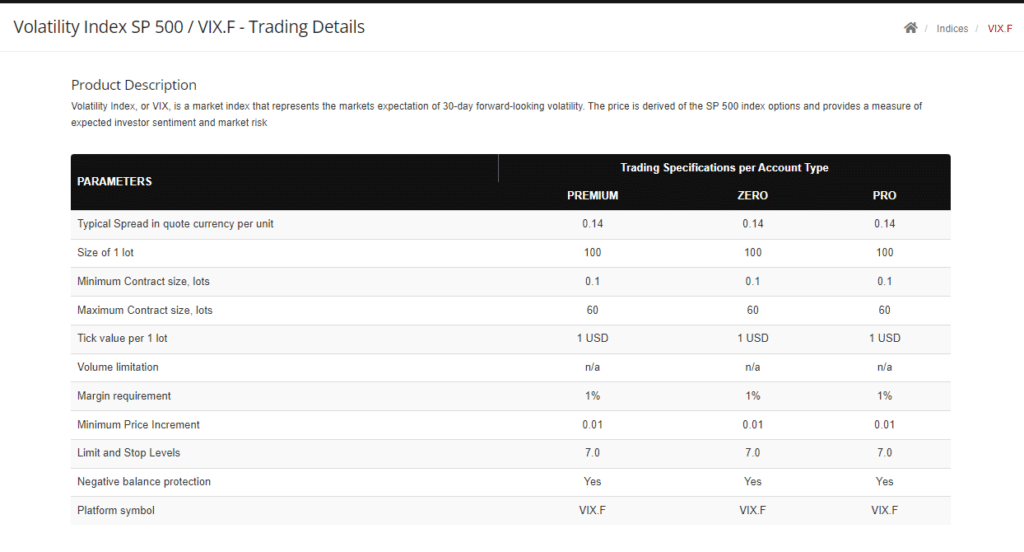

The volatility index, or VIX, is one of the most popular market sentiment indicators. Traders may use the VIX not just as a gauge of risk but also as a chance to profit from price fluctuations in the market.

Chicago Board Options Exchange (CBOE) created the VIX, the first of its kind. In addition, VIX provided a numerical value for the volatility investors were anticipating in the market.

However, the index reflects the expected volatility of the S&P 500 (SPX) over the subsequent 30 days because of its forward-looking nature.

While historical volatility measures how much asset prices have fluctuated in the past, implied volatility shows how the market anticipates those prices will vary in the future. The volatility of assets over a certain timeframe is referred to as “historical volatility.”

However, implied volatility is determined by the Black-Scholes formula. In contrast, historical volatility is determined by the standard deviation of the natural log ratio of successive closing prices over time.

The volatility that is anticipated is referred to as implied volatility. It is a vital indicator for traders. It gives them the chance to think about the long-term trajectory of market volatility.

If you want to figure out the odds in the market, this is a good method. It is a wonderful way to anticipate the market’s next move precisely. Traders and sellers, as suggested, cannot rely on previous results.

8 Best Volatility 75 Forex Brokers in Botswana

- ✔️ XTB – Overall, Best Volatility 75 Forex Broker in Botswana

- ✔️ HFM – Best Low Spread Broker

- ✔️ FXCM – Top CFD Forex Broker in Botswana

- IG – Best Broker for Beginner Traders

- AvaTrade – Top Broker that Accepts M-PESA

- easyMarkets– Highest Rated Brokers on TrustPilot

- Pepperstone – Top NASDAQ100 Broker

- IC Markets – Top Regulated Broker in Botswana

1. XTB

XTB is a popular option for investors seeking a broker with a solid reputation, a diverse selection of trading products, and insightful market research. Traders should be aware, however, that only XTB’s proprietary platform, xStation5, is supported.

XTB’s selection of over 2,100 financial assets for trading is extensive compared to other brokers. Foreign exchange, indices, commodities, contracts for difference (CFDs), exchange-traded funds (ETFs), and cryptocurrencies are all examples of tradable assets.

Min Deposit

USD 0 / 0 BWP

Regulators

FCA, CySEC, IFSC, KNF

Trading Desk

No Trading Desk

Crypto

Yes

Total Pairs

48

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

TB’s mission is to give its traders the best possible service and education. To this end, the company has developed a robust Trading Academy and a personal mentoring program.

Traders can easily get answers to their technical or account-related questions from XTB’s attentive customer support team. In addition, the company’s Market News section is often updated with analysis and trading suggestions.

There are just two active accounts to choose from at XTB. Both have above-average trading expenses but no minimum deposit restrictions.

XTB Overview

| Features | Information |

| ⚖️ Regulation | FCA, CySEC, KNF, CNMV, FSC, DFSA |

| 💸 Minimum Withdrawal Time | – |

| 📈 Maximum Withdrawal Time | 2 to 4 working days |

| 💰 Instant Deposits/Withdrawals? | Yes, deposits |

| 💳 BWP-Denominated Account? | No |

| 📱 Minimum Deposit Amount | 0 BWP ($0) |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| XTB is well-regulated and guarantees client fund security | MetaTrader is not supported |

| There are competitive trading conditions charged | Mark-up is added to spreads |

| There is a dedicated Swap-Free Account offered to Muslim Traders | Deposit and withdrawal fees are charged on several payment methods |

| There is no minimum deposit | There is no BWP account |

| XTB is suitable for beginners and professional traders |

2. HFM

HFM is a popular and renowned broker globally. In addition, various kinds of traders can easily use HFM’s trading services and solutions wherever they are in the globe since the company has a genuinely worldwide presence.

HFM is a multi-asset broker that was formerly known as HotForex. They provide extensive trading services, a choice of four account types, and strong trading platforms with low spreads.

The MT4 and MT5 trading platforms are both supported by HFM, in addition to the broker’s own mobile HF App, which enables customers to trade directly from charts and make deposits and withdrawals.

Min Deposit

USD 0

Regulators

CySEC, FCA, DFSA, FSCA, FSA, CMA

Trading Desk

MT4, MT5, HFM APP

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

0

Account Activation Time

24 Hours

In addition, it provides traders with various high-quality trading tools that could help them in many ways. For example, spot and futures contracts on various foreign indices via HFM.

These indexes include the Nikkei, NASDAQ, S&P500, and FTSE100, as well as the VIX and DAX30. Compared to other brokers, this one offers a wide variety of indexes.

Four different account types are available via HFM, which is more than most other brokers provide. The Micro Account is appropriate for novice traders because of the minimal minimum deposit required. At the same time, the Zero Spread Account is geared toward traders with more expertise.

HFM Overview

| Features | Information |

| ⚖️ Regulation | FSCA, CySEC, DFSA, FSA, FCA, CMA, and FSC, with registration in ACPR, BaFin, MNB, CONSOB, CNMV, FI, FMA, FSC, and other regions |

| 💸 Minimum Withdrawal Time | – |

| 📈 Maximum Withdrawal Time | 2 to 4 working days |

| 💰 Instant Deposits/Withdrawals? | Yes, deposits |

| 💳 BWP-Denominated Account? | No |

| 📱 Minimum Deposit Amount | $0 / 0 BWP |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| HFM does not charge any deposit fees when Botswanans transfer funds to a trading account | HFM does not support BWP as a deposit currency or an account base currency, which could result in currency conversion fees |

| There are competitive spreads charged | HFM’s spreads are wider on entry-level accounts |

| HFM is a transparent broker that does not have any hidden broker fees | |

| Botswanans need not worry about withdrawal fees when they transfer funds from the trading account |

3. FXCM

High-volume traders who value flexibility in platform selection and an abundance of specialized trading tools may find FXCM appealing.

FXCM provides traders with a few account options, a wide range of forex and CFD products, leverage, and an incredible selection of plugins and additional programs.

In addition, FXCM is distinguished by the wide variety of trading platforms it provides to its customers. These include the company’s own Trading Station, MetaTrader 4, the copy-trading platform ZuluTrade, NinjaTrader, and other add-on plugins.

FXCM has a long history of receiving accolades from industry leaders, including:

➡️ Best Customer Support from FX Empire in 2017.

➡️ Best Technical Tools from BrokerChooser in 2019.

➡️ Best Trading Tools in 2020 during the Online Personal Wealth Awards.

➡️ Best Forex Trading Platform of the Year at the Global Forex Awards in 2020.

Min Deposit

USD 50 / 672 BWP

Regulators

FCA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

–

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

FXCM can be recommended as a trustworthy broker because of the company’s long history of responsible behavior. Customer money is kept in a separate account, and the firm complies with international regulations.

FXCM has a smaller selection of financial instruments than other brokerages, with just 15 indices and CFDs on indices accessible for trading.

However, most investors like indexes that track the performance of a basket of stocks from some of the world’s biggest and most well-known corporations.

FXCM Overview

| Features | Information |

| ⚖️ Regulation | FCA, ASIC, CySEC, FSCA |

| 💸 Minimum Withdrawal Time | – |

| 📈 Maximum Withdrawal Time | 2 to 4 working days |

| 💰 Instant Deposits/Withdrawals? | Yes, deposits |

| 💳 BWP-Denominated Account? | No |

| 📱 Minimum Deposit Amount | USD 50 / 672 BWP |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| FXCM supports both CFD and forex trading and offers several trading options | There are high commission charges |

| Botswanans can access leverage up to 1:400 | An inactivity fee and currency conversion fee are charged |

| Several asset classes can be traded | There is a limited choice between retail accounts |

| FXCM offers several trading platforms and trading tools that Botswanans can use to their advantage | Does not support MT5 |

| There are competitive spreads on the CFD account | There is no option to register an account denominated in BWP |

| There is a demo and Islamic account | Withdrawal fees apply |

| FXCM is well-regulated by four reputable entities | The Islamic Account faces additional fees |

| Client fund security and investor protection are guaranteed |

4. IG

IG Group plc (LON: IGG) was established in 1974 and is a leading foreign exchange (FX) and contracts for difference (CFD) broker on the London Stock Exchange. With more than 19,000 products available for trading and 80 worldwide indices, IG Groups is one of the biggest online brokers in the world.

Compared to the other online brokers that Investopedia looked at, IG stands out as having the best educational resources and being the most dedicated to providing its customers with timely and useful research.

Min Deposit

USD 0 / 0 BWP

Regulators

IGRs

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

“Negative balance protection” is a service offered by IG and is now standard at most online brokers. In addition, trading on more indices is available via IG than it is through competitors. These indexes include the NASDAQ, FTSE100, VIX, DAX30, and Hang Seng.

Custom indices, such as the Cannabis Index and the Emerging Markets Index, are among IG’s offerings. A further perk is that trading on the main indexes may continue over the weekend.

Starting with a proprietary, user-friendly web-based service, IG provides its global clientele with a wide range of platform options and API interfaces. IG advises using Google Chrome; however, the platform is accessible from any browser.

IG Overview

| Features | Information |

| ⚖️ Regulation | FCA, BaFin, CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, CFTC, FINRA, NFA, BMA |

| 💸 Minimum Withdrawal Time | Instant |

| 📈 Maximum Withdrawal Time | Between 1 to 3 Business Days |

| 💰 Instant Deposits/Withdrawals? | Yes |

| 💳 BWP-Denominated Account? | No |

| 📱 Minimum Deposit Amount | 3 363 Botswanan Pula, equivalent to $250 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| IG offers an extensive range of financial instruments, one of the largest in the industry | There is no account protection given to several countries |

| IG has a long history of providing superior trading services at affordable prices | There is an extremely high minimum deposit requirement |

| IG is well-regulated | BWP is not an accepted base currency |

| IG places emphasis on education and research | There are several non-trading fees charged |

| Botswanans can choose from several trading accounts according to their unique needs |

5. AvaTrade

AvaTrade, which began operations in 2006, is a low-risk broker for trading CFDs and FX thanks to its regulation in five tier-1 countries, five tier-2 jurisdictions, and one tier-3 jurisdiction.

AvaTrade is a well-known international brand popular among foreign exchange (FX) and contracts for difference (CFD) traders for its extensive selection of top-notch trading platforms and comprehensive educational resources.

AvaTrade provides access to 1,260 symbols (through MT5), and WebTrader provides access to about the same number of symbols (albeit a few hundred are sometimes unavailable).

The VIX 75 is one of the 33 Index CFDs available via AvaTrade, ensuring that Botswanan traders gain exposure to global markets. In addition, most traders will be pleased with the mobile experience provided by AvaTrade’s bespoke applications (beginners included).

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

AvaTrade is making strides in this area and now provides a wide variety of useful apps suitable to different traders and trading strategies.

Trading Central is the main emphasis of AvaTrade’s research offering, along with AvaSocial, ZuluTrade, and DupliTrade for copy trading. In addition, a few services powered by Trading Central are integrated into AvaTrade’s online platform directly.

AvaTrade updates its blog with new market analyses every day. In addition, AvaTrade’s Vimeo and YouTube channels do the same for market videos.

In addition, there is a wide variety of instructional materials available on AvaTrade, from that created in-house to those created by third-party suppliers like Trading Central.

AvaTrade Overview

| Feature | Information |

| ⚖️ Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, FRSA, CySEC, ISA |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Retail Investor Account, Professional Account Option |

| 📊 Trading Platform | AvaTradeGO, AvaOptions, AvaSocial, MetaTrader 4, MetaTrader 5, DupliTrade, ZuluTrade |

| 💰 Minimum Deposit (BWP) | $100 / 1343 BWP |

| 💰 Trading Assets | Foreign currencies, Cryptocurrencies, Commodities, Treasuries, Bonds, Indices, Stocks, ETFs, Options, CFDs, Precious Metals |

| 🔎 Botswanan Pula-based Account? | No |

| 💳 BWP Deposits Allowed? | No |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 0.9 pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| AvaTrade is multi-regulated and one of the most trusted online trading brokers in the world | Variable spreads are not offered |

| There is a wide range of financial instruments that can be traded across financial markets | There is a limited choice between account types |

| There are several technical indicators, economic indicators, and other solutions for advanced traders | Inactivity fees are applied |

| There are several trading platforms to choose from | Currency conversion fees may be applied |

| There is a decent selection of educational material that helps beginner traders navigate complex instruments and lower the degree of risk they are often exposed to | There is a limited number of base currency options offered on accounts |

| There is a multitude of social trading opportunities offered | |

| The broker accepts any trading strategy including automated trading, expert advisors, scalping, hedging, and others. |

6. easyMarkets

easyMarkets was founded on the idea of democratizing trading. Back in 2001 when easyMarkets was founded, the only way to trade was through a physical trading room as a wealthy individual or an institutional client. If you didn’t have an initial investment of tens of thousands of dollars or more it was impossible to trade. There purpose was to give market access to anyone that wanted it.

Volatility is a central feature of the global financial markets and as a trader, you may either fear it or aim to capitalize on it. By offering a CFD on the CBOE Volatility Index, easyMarkets is making it easier than ever before to trade volatility-as-an-asset.

Min Deposit

25 USD /336 BWP

Regulators

CySEC, ASIC, BVI, FSA

Trading Desk

MetaTrader 4, TradingView

Crypto

Yes

Total Pairs

275+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

The Chicago Board Options Exchange (CBOE) Volatility Index, also known as the VIX or S&P 500 fear index, captures the market’s expectations of near-term volatility conveyed through S&P 500 Index option prices. As a mean-reverting indicator, the VIX trades on a scale of 1-100, where 20 is considered the historical average. VIX readings below that level generally point to below-normal volatility in the market, whereas readings above 20 signal higher volatility.

The VIX is commonly referred to as the “fear index” for its ability to capture market uncertainty. Through easyMarkets, traders may now trade volatility as a Contract for Difference (CFD), which provides direct exposure to the fast-moving index. CFDs on the CBOE Volatility Index are offered under the ticker symbol Fear (VXX) on our state of the art trading platform.

easyMarkets Overview

| Features | Information |

| ⚖️ Regulation | CySEC, FCA, ASIC, FinCEN, FINRA, SIPC, DNB, FSA |

| 💸 Minimum Withdrawal Time | 3 Hours |

| 📈 Maximum Withdrawal Time | 5 Working Days |

| 💰 Instant Deposits/Withdrawals? | Yes, deposits |

| 💳 BWP-Denominated Account? | No |

| 📱 Minimum Deposit Amount | 940 BWP equivalent to $50 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| eToro has a strict and solid regulatory framework | There are limitations on leverage for retail traders |

| Client fund safety is guaranteed and there is consumer protection offered | There is a limited selection of retail investor accounts |

| eToro offers commission-free trading | Fixed spreads are not offered |

| There are over 2,000 complex instruments that can be traded | The spreads are not the tightest |

| The broker offers several trading opportunities and a social trading feature | There is a high minimum deposit on the Islamic Account |

| There is an award-winning proprietary platform offered | There is an inactivity fee charged on dormant accounts |

| eToro offers 24/6 dedicated customer services | |

| eToro offers a demo account and an Islamic Account | |

| Algorithmic trading and margin trading supported | |

| Real time quotes are offered alongside a wide range of benefits | |

| The mobile app is secure and features robust security such as two-factor authentication | |

| The app can be used as a wallet app for digital currencies | |

| Offers several resources that help traders make improved financial decisions with confidence | |

| Offers several helpful tools and services as a solid basis for investment decision along with investment advice | |

| Provides access to several popular cryptocurrencies that can be traded and crypto staking services | |

| There is a comprehensive portfolio management service and popular investor program offered |

7. Pepperstone

Pepperstone Group is currently one of the most prominent internet brokers. Pepperstone was established in 2010, and with its regulation in three tier-1 countries, FX and CFD traders can feel confident and safe using the platform.

Pepperstone provides access to several social copy trading platforms, a wide variety of tradable marketplaces, and high-quality research. In addition to more than 70 Forex pairings, Pepperstone now offers currency indexes.

A total of 28 indices are available for trading on Pepperstone, including those of the NASDAQ, FTSE100, S&P500, VIX, and even the Johannesburg Stock Exchange. Separating customer cash from business finances is an extra precaution in a volatile sector.

Min Deposit

0 USD / 0 BWP

Regulators

ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB

Trading Desk

MetaTrader 4, MetaTrader 5, cTrader and TradeView

Crypto

Yes (Not available in Africa)

Total Pairs

60+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

There are a few ways to contact customer service, including round-the-clock chat, phone assistance, and a helpful Frequently Asked Questions section with information on handling depositing, withdrawing, and dispute resolution in trades.

Traders of all skill levels may enjoy the same high-quality experience thanks to a wide variety of desktop, mobile, and web-based platforms, a product portfolio that is standard in the industry, above-average instructional materials, low spreads, and a choice of account types.

All new customers can open a Standard account, where minimum FX spreads begin at 0.6 pips. However, no commission is charged, or a Razor account, where minimum FX spreads begin at 0 pips, but a commission fee is charged.

In addition, Botswanans should note that Pepperstone’s other available instruments are all priced using either a straight spread or a spread-and-commission structure.

Pepperstone Overview

| Account Feature | Value |

| 💰 Minimum Deposit | $0 / 0 BWP |

| 💻 Minimum Trading Size | 0.01 lots |

| 📈 Maximum Trading Size | 100 lots in a single trade |

| 💵 Base Account Currency | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, and HKD |

| ✅ Trading Strategies Supported | All including scalping, hedging, and Expert Advisors (EAs) |

| 🗞 News Trading Offered? | Yes |

| ➡️ Trade Execution | No-Dealing Desk (NDD) |

| 📊 Average EUR/USD Spread | From 0.6 pips |

| 💸 Commissions | None |

| 🔃 Rollover Swaps | Yes, according to the market rates |

| ⬆️ Maximum Leverage per region | • Australia – 1:30 • Bahamas – 1:200 • Cyprus – 1:30 • Dubai – 1:30 • Germany – 1:30 • Botswana – 1:400 • United Kingdom – 1:30 |

| ❌ Negative Balance Protection Offered | Yes, only for retail clients |

| ✅ Margin Close-Out (%) | 50% |

| 🔨 Trading Instruments offered | 1,200+ |

| 💻 Trading Platforms offered | MetaTrader 4, MetaTrader 5, cTrader, TradingView, Myfxbook, DupliTrade |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Pepperstone offers competitive spreads that start from 0.0 pips on EUR/USD | There are restrictions on the countries that may use Pepperstone’s Islamic account |

| Pepperstone is well-regulated and offers an extremely secure trading environment with transparent trading fees | There is no BWP-denominated account offered, subjecting Botswanans to currency conversion fees |

| Investor protection is offered to EU clients through the FSCS | There are additional administrative fees applied to the Islamic account |

| Pepperstone offers a choice between some of the best trading platforms | |

| Negative balance protection is offered for clients in certain regions | |

| There is an Islamic account offered to Muslim traders | |

| There is a demo account offered by Pepperstone | |

| There are several trading tools offered |

8. IC Markets

Since its inception in 2007, Australia has been home to IC Markets, which has licenses from some of the world’s most stringent regulatory bodies.

With over $15 billion in foreign currency transactions and over 500,000 orders completed daily, IC Markets is one of the major FX CFD providers in the world.

Traders of all types and experience levels can easily benefit from IC Markets’ state-of-the-art trading platforms, which are the company’s claim to fame. Botswanan traders can also engage in futures, stock indices, and commodity trading in addition to foreign exchange.

Min Deposit

USD 200 / 2 685 BWP

Regulators

ASIC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

65

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Because of its leverage, low spreads, and minimal commission costs, IC Markets is popular among traders. Everyone from experienced traders to novices, and even those using automated tactics, should consider IC Markets.

Experts in the financial markets and institutional investors want premium services like instantaneous order execution.

The NASDAQ, S&P 500, FTSE 100, VIX 75, and the Nikkei are just a few of the 25 worldwide indexes on which IC Markets provides cash and futures contracts. When compared to other brokers, this selection of indices is around par.

IC Markets Overview

| Account Feature | Value |

| 💻 Trading Platform | cTrader |

| 💰 Commission | $3 per side and $6 per round turn |

| 📈 Typical Average Spreads | 0.0 |

| 💳 Minimum Deposit Requirement | 2 685 Botswanan Pula equivalent to $200 |

| 📈 Leverage | 1:500 |

| 📈 Maximum positions per account | 2,000 |

| 🏛️ Server Location | London |

| ✴️ Micro trading allowed? | Yes |

| 📊 Currency Pairs | 64 |

| 📊 Index CFD Trading | Yes |

| 📊 Stop-out | 50% |

| 📈 One-Click Trading offered? | Yes |

| ☪️ Islamic Accounts | Yes |

| 📊 Trading Styles accepted | Scalping, hedging, expert advisors, algorithmic strategies, etc. |

| 💻 Programming Language | C# |

| 👍 Suitable for | Day traders, scalpers, active traders |

| 📊 Demo Account offered? | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| IC Markets is a multi-regulated forex and CFD broker with a decent trust score and a low-risk reputation | There is a higher minimum deposit requirement charged than other brokers |

| There is real raw spread trading offered across several asset classes | Botswanan traders could face currency conversion fees |

| IC Markets offers some of the best spreads in the industry | There is no BWP-denominated account offered |

| Botswanans can choose between MetaTrader 4, MetaTrader 5, and cTrader as their preferred platform | There are no fixed spreads offered by IC Markets |

| There is a choice between three different account types that suit different types of traders | There is no proprietary trading platform, or an app offered by IC Markets |

| There are no hidden fees and IC Markets is one of the best options for high volume trading because it has a long list of liquidity providers | |

| There is a free demo account offered | |

| There is an Islamic account option offered to Muslim traders |

How to choose the best VOL 75 broker for your trading style?

First and foremost, assess the broker’s regulatory status and reputation. Ensure they are properly regulated by a recognized authority in the financial industry, as this provides a level of security for your investments. Next, evaluate the broker’s trading conditions, including spreads, commissions, and leverage. These factors can affect your trading costs and risk management.

Additionally, consider the trading platform they offer, as it should be user-friendly and suit your preferences. Access to analytical tools, research, and educational resources can also be important for traders looking to enhance their skills. Furthermore, examine the available deposit and withdrawal methods to ensure they align with your financial requirements.

Customer support is another crucial aspect. A reliable broker should provide responsive and helpful customer service to address any issues or inquiries promptly. Finally, assess the broker’s track record, client reviews, and any history of operational problems.

Ultimately, the best VOL 75 broker for your trading style will align with your goals, risk tolerance, and preferences. It’s advisable to conduct thorough research, test their platform through a demo account if possible, and consider seeking advice from experienced traders or financial experts to make an informed decision.

How to Choose the Right Forex Broker in Botswana

Botswanan traders must evaluate the following components of a forex broker to decide whether the broker is suited to their unique trading objectives or needs.

Regulations and Licenses

This is the first vital component that Botswanan traders must thoroughly evaluate. Reputable brokers are regulated by market regulators such as FCA, ASIC, CySEC, FSCA, and others.

Botswanans must beware when dealing with brokers with only offshore regulations such as FSA, SVG BVI, FSC, and others.

Account Features

Account Features include leverage trading and margin requirement, commissions and spreads, initial deposit, additional features on retail investor accounts, and so on.

Deposits and Withdrawals

Botswanans must evaluate the payment options available, the processing times on withdrawal requests, deposit currencies offered, the withdrawal fee, deposit fees, and minimum withdrawal limits, among other trading and non-trading fees.

Range of Markets

The range of markets offered refers to the number and range of tradable instruments the broker offers. Therefore, Botswanans must consider what they wish to trade and what is available.

Customer Support

Customer Support is another crucial factor. Botswanans must check the availability of support (trading hours), the quality of support, and the promptness with which the customer support team responds to queries.

Trading Platform

A trading platform is the Botswanan trader’s portal to the financial markets. Therefore, traders must ensure that the trading platform has the necessary technical indicators, fundamental analysis, technical analysis, economic calendar, charting, newsfeed, and other tools they may need.

Education and Research

Education and Research come in handy to both novice traders and experienced investors. Education includes some of the following:

➡️ eBooks

➡️ Trading guides

➡️ Trading knowledge on leveraged products

➡️ A risk warning on complex instruments

➡️ Educational videos

Research can include some of the following:

➡️ Trading tools

➡️ Commentary

➡️ Status of International Markets

➡️ Price movements

➡️ Market sentiments

➡️ Whether there is a volatile market

➡️ Exchange Rates

➡️ Expert opinions and other resources can help experienced traders make informed trading decisions.

The Best Forex Brokers in Botswana

In this article, we have listed the best brokers that offer forex trading to traders in Botswana. In addition, we have further identified the brokers that offer additional services and solutions to Botswanan traders.

Best MetaTrader 4 / MT4 Forex Broker in Botswana

Min Deposit

USD 25

Regulators

FCA UK

Trading Platform

MT5, MT4, OctaTrader

Crypto

Yes

Total Pairs

28

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, OctaFX is the best MT4 forex broker in Botswana. OctaFX is an MT4 and MT5 broker that provides Botswanans with various markets. OctaFX offers a choice of accounts via MT4, including ECN and STP accounts, with superior trade execution.

Best MetaTrader 5 / MT5 Forex Broker in Botswana

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, AvaTrade is the best MetaTrader 5 forex broker in Botswana. In addition, AvaTrade is regarded as one of the most secure MT5 forex brokers.

No commission is charged for trading currency pairings, only leaving the spread to be paid. A demo account is also available for traders to sharpen their abilities via MT5 and several other platforms.

Best Forex Broker for beginners in Botswana

Min Deposit

$100

Regulators

CFT, NFA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FOREX.com is the best forex broker for beginners in Botswana. FOREX.com is a broker renowned for low trading fees and beginner-friendly solutions. In addition, FOREX.com offers several educational materials and a helpful demo account.

Best Low Minimum Deposit Forex Broker in Botswana

Min Deposit

$10 / 134 BWP

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Exness is the best Low Minimum Deposit Forex Broker in Botswana. Exness has a minimum deposit requirement of 10 USD / 130 BWP, making it easy for Botswanans to start trading 278 instruments.

Exness also offers MT4 and MT5 through which trades can be made. In addition, it offers some of the best trading tools, charting capabilities, technical indicators, expert advisors, and more.

Best ECN Forex Broker in Botswana

Min Deposit

USD 0

Regulators

CySEC, FCA, DFSA, FSCA, FSA, CMA

Trading Desk

MT4, MT5, HFM APP

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

0

Account Activation Time

24 Hours

Overall, HFM is the best ECN forex broker in Botswana. HFM is a hybrid forex and CFD broker that uses STP and ECN technology to ensure that Botswanans get the best pricing, minimal slippage, no requotes, and the fastest trade execution.

HFM uses the best liquidity providers who aggregate the pricing that Botswanans can see on MT4, MT5, and the HF App for Android and iOS.

Best Islamic / Swap-Free Forex Broker in Botswana

Min Deposit

USD 10 / 136 BWP

Regulators

CySec, FCA

Trading Desk

None

Crypto

Yes

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, eToro is the best Islamic / Swap-Free forex broker in Botswana. eToro is a renowned social trading platform that offers Muslim traders an Islamic Account.

eToro does not charge any interest on positions held for over 24 hours. However, registering an Islamic Account can be expensive initially, requiring a 1,000 USD / 18,714 BWP deposit.

Best Forex Trading App in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

ASIC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

300

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, CMC Markets is the best forex trading app in Botswana. In addition, CMC Markets offers a user-friendly mobile app with research tools, powerful charts, customizable watch lists, news reports, and a range of educational materials.

Best Lowest Spread Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

FCA, CySEC, IFSC, KNF

Trading Desk

No Trading Desk

Crypto

Yes

Total Pairs

48

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, XTB is the best lowest-spread forex broker in Botswana. XTB is a well-known forex and CFD broker with low and competitive forex spreads from 0.1 pips depending on the financial instrument and the market conditions.

XTB is also a good broker in terms of educational materials and research capabilities, providing traders with comprehensive market analysis across markets.

Best Nasdaq 100 Forex Broker in Botswana

Min Deposit

USD 10

Regulators

CySec, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

60

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXTM is the best Nasdaq 100 forex broker in Botswana. FXTM is a multi-regulated forex and CFD broker that accommodates Botswanan traders with a keen interest in Nasdaq. Traders can expect low and competitive spreads, a choice between accounts, and powerful trading platforms.

Best Volatility 75 / VIX 75 Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

IGRs

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, IG is Botswana’s best Volatility 75 / VIX 75 forex broker. IG is one of the best CFD brokers with powerful proprietary trading technology.

IG is well-regulated and offers Botswanans access to VIX75, with spreads from 0.04 pips / 0.13% and zero commission charges.

Best NDD Forex Broker in Botswana

Min Deposit

USD 50 / 672 BWP

Regulators

FCA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

–

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXCM is the best NDD forex broker in Botswana. FXCM is a No-Dealing Desk broker with STP and ECN execution across several markets.

In addition, FXCM offers a choice between third-party platforms in addition to technical indicators, charting tools, and competitive trading conditions.

Best STP Forex Broker in Botswana

Min Deposit

USD 10

Regulators

IFSC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

36

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, RoboForex is the best STP forex broker in Botswana. RoboForex is popular forex and CFD broker with competitive trading conditions. RoboForex offers STP execution with liquidity sourced from top providers.

Botswanans can expect access to over 12,000 instruments via powerful and innovative third-party platforms.

Best Sign-up Bonus Broker in Botswana

Min Deposit

50 USD / 682 BWP

Regulators

CYSEC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Windsor Brokers is the best sign-up bonus broker in Botswana. Windsor Brokers is a well-regulated broker that offers Botswanans a welcome account funded with 30 USD in trading credit. With this account, Botswanans can explore the platform or risk-free test their strategies.

Conclusion

Many traders and investors like VIX-linked securities for diversification, hedging, and even pure speculation due to their low correlation with the stock market. One option is to hedge your portfolio against the market’s volatility by holding a stake on the VIX.

Several trading techniques include the VIX, but the simplest one is to keep an eye on it and short it when it gets to extremely high levels.

Although taking advantage of market volatility is a sound trading tactic during times of uncertainty, investors should keep in mind that volatility will only last for a limited time.

You might also like: Best cTrader Brokers in Botswana

You might also like: Scam Forex Brokers in Botswana

You might also like: Best FTSE 250 Brokers in Botswana

You might also like: Best Low Spread Forex Brokers in Botswana

You might also like: Best NASDAQ 100 Brokers in Botswana

Frequently Asked Questions

Which broker in Botswanan is the best for Volatility 75?

Of the Forex and CFD brokers available, HFM, AvaTrade, IG, eToro, Pepperstone, and others are the best for trading VIX 75.

Can I trade VIX 75 on MT4 in Botswana?

You can easily trade VIX 75 via MetaTrader 4 if your broker supports the platform and offers this financial instrument.

How much will it cost to trade the Volatility 75 index in Botswana?

Depending on your broker’s fee schedule, you can easily start trading VIX 75 with spreads from 0.04 pips commission-free.

How can Botswanans trade VIX 75 successfully?

To trade VIX 75 successfully, you must have a solid trading plan and the correct position size. In addition, you must avoid using excessive leverage and ensure that you place your stop-loss orders according to your tested trading strategy.

Finally, you must ensure that you have realistic profit expectations and keep updated with the news.

What is the best time to trade VIX 75 in Botswana?

The best time to trade VIX 75 in Botswana is between 2 to 4 pm (noon to 2 pm GMT).

What is the difference between the Volatility 75 Index vs NASDAQ 100 Index?

The Volatility 75 Index and the NASDAQ 100 Index are two distinct financial instruments that represent different aspects of the financial markets.

The key distinction lies in their underlying assets and purpose.

What is the best Metatrader 4 (MT4) and Metatrader 5 (MT5) on the VIX 75 platforms revealed?

- AvaTrade

- HFM

- Pepperstone

- FXCM

- IG

- XTB

- IC Markets

Who is our #1 recommended 75 Index Volatility Broker in Botswana?

Exness is our 1 recommended Volatility Broker.

Which Volatility 75 Index broker accepts M-PESA?

- HFM

- Exness

- Pepperstone

- XM

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review