ACY Securities Review

Overall, ACY Securities is considered average risk, with an overall Trust Score of 74 out of 100. ACY Securities is licensed by one tier-1 regulator (high trust), zero tier-2 regulators (average trust), and one tier-3 regulator (low trust). ACY Securities offers three different retail trading accounts: a Standard Account, ProZero Account, and Bespoke Account. ACY Securities is currently not regulated by the Central Bank of Botswana.

- Louis Schoeman

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

USD 50 / 666 BWP

Regulators

ASIC AFSL

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

60+ ECN pairs

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

ACY Securities Overview

Overall, ACY Securities is considered average risk, with an overall Trust Score of 74 out of 100. ACY Securities is licensed by one tier-1 regulator (high trust), zero tier-2 regulators (average trust), and one tier-3 regulator (low trust).

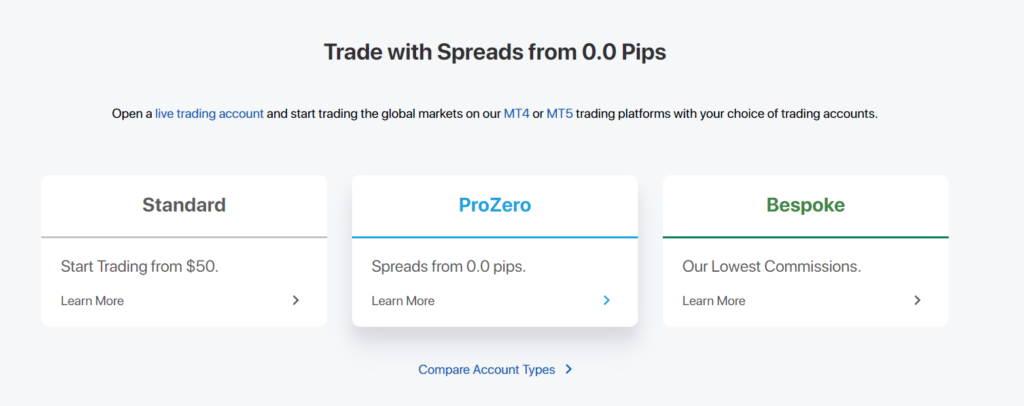

ACY Securities offers three different retail trading accounts namely a Standard Account, ProZero Account, and Bespoke Account.

ACY Securities’ VFSC-regulated firm will onboard Botswanan traders, meaning they will have limited redress in the case of a disagreement with the broker.

However, ACY Securities’ Australian subsidiary is licensed by ASIC and offers negative balance protection to all traders. ACY Securities was founded in 2011 in Sydney, Australia, as a multi-asset online CFD trading company.

Two companies supply the company’s services: ACY Securities Pty Ltd (ASIC) and ACY Capital Australia Limited (VFSC). ACY Securities provides a wide variety of equities, ETFs, commodities, and indexes.

There are also a decent number of deposit and withdrawal alternatives. There are several base currencies available for accounts, which is quite useful.

ACY Securities accepts Botswanan clients and has an average spread from 0.0 pips with 5 USD commission. ACY Securities has a maximum leverage ratio up to 1:500 and there is a demo and Islamic account available.

MT4 and MT5 platforms are supported. ACY Securities is headquartered in Sydney, Australia and regulated by ASIC and VFSC.

ACY Securities Distribution of Traders

ACY Securities currently has the largest market share in these countries:

➡️ Australia – 37%

➡️ Columbia – 13.3%

➡️ Egypt – 6.6%

➡️ Philippines – 5.6%

➡️ Russian Federation 4.4%

Popularity among traders who choose ACY Securities

While focusing on the Australian market, ACY Securities admits Botswanan clients, putting it among the top 100 forex brokers for Botswanan traders.

ACY Securities At a Glance

| 🏛 Headquartered | Sydney, Australia |

| 🌎 Global Offices | Australia, Egypt, Saudi Arabia, China, Philippines, Vietnam, Malaysia |

| 🏛 Local Market Regulators in Botswana | • Ministry of Finance and Economic Development (MFED) • Bank of Botswana (BoB) • Non-Bank Financial Institutions Regulatory Authority (NBFIRA) |

| 💳 Foreign Direct Investment in Botswana | 115.89 BWP Million in 2021 |

| 💰 Foreign Exchange Reserves in Botswana | 5270 USD Million in 2021 |

| ✔️ Local office in Gaborone? | No |

| 👨⚖️ Governor of SEC in Botswana | None, Moses Dinekere Pelaelo is the Governor of the Bank of Botswana |

| ✔️ Accepts Botswana Traders? | Yes |

| 📊 Year Founded | 2011 |

| 📞 Botswana Office Contact Number | None |

| 📱 Social Media Platforms | • Facebook • YouTube |

| ⚖️ Regulation | ASIC, VFSC |

| 1️⃣ Tier-1 Licenses | • Australian Securities and Investments Commission (ASIC) |

| 2️⃣ Tier-2 Licenses | None |

| 3️⃣ Tier-3 Licenses | • Vanuatu Financial Services Commission (VFSC) |

| 🪪 License Number | • Australia – AFSL 403863 and ABN 80150565781 • Vanuatu – VFSC 012868 |

| ⚖️ MFED, BoB, or NBFIRA Regulation | No |

| ✔️ Regional Restrictions | United States |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 3 |

| ✔️ PAMM Accounts | Yes |

| 💻 Liquidity Providers | 16 global banks |

| ✔️ Affiliate Program | Yes |

| 📱 Order Execution | STP |

| 📊 Starting spread | 0.0 pips, variable |

| 📉 Minimum Commission per Trade | $0.40 to $2 depending on trading volume |

| 💰 Decimal Pricing | • Forex – 5 decimals (3 on JPY pairs) • Metals – 2 decimals for XAU/USD and 3 decimals for XAG/USD |

| 📞 Margin Call | 100% |

| 🛑 Stop-Out | 50% |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | Depends on region and trading instrument |

| ✅ Crypto trading offered? | Yes |

| ✔️ Offers a BWP Account? | No |

| 📉 Dedicated Botswana Account Manager? | No |

| 📈 Maximum Leverage | 1:500 |

| 📊 Leverage Restrictions for Botswana? | No |

| 💳 Minimum Deposit (BWP) | 660 Botswanan Pula equivalent to $50 |

| ✔️ Botswana Pula Deposits Allowed? | Yes, it will be converted to USD, AUD, EUR, GBP, NZD, CAD, or JPY |

| 📊 Active Botswana Trader Stats | 250,000+ |

| 👥 Active Botswana-based ACY Securities customers | Unknown |

| 🔁 Botswana Daily Forex Turnover | Unknown, Forex overall is $6.6 Trillion |

| 💰 Deposit and Withdrawal Options | • Credit Card • Debit Card • Wire Transfer • Skrill • Neteller • China Union Pay • Doku Wallet |

| 💻 Minimum Withdrawal Time | 24 to 48 hours |

| ⏰ Maximum Estimated Withdrawal Time | 5 to 7 working days |

| 💳 Instant Deposits and Instant Withdrawals? | Yes |

| 🏛 Segregated Accounts with Botswana Banks? | No |

| 📱 Trading Platforms | • MetaTrader 4 • MetaTrader 5 |

| 💻 Tradable Assets | • Forex • Precious Metals • Indices • Energies • Shares • ETFs • Cryptocurrency |

| ✔️ Offers USD/BWP currency pair? | No |

| 📊 USD/BWP Average Spread | No |

| ✅ Offers Botswana Stocks and CFDs | No |

| 💻 Languages supported on the Website | English, Chinese, Vietnamese, Arabic, Thai, Japanese, Romanian, French, Portuguese, Spanish, Russian, Italian, and several others. |

| ☎️ Customer Support Languages | Multilingual |

| 👥 Copy Trading Support | Yes |

| ⏰ Customer Service Hours | 24/5 |

| 📞 Botswana-based customer support? | Yes |

| 💸 Bonuses and Promotions for Botswanans? | Yes |

| 📚 Education for Botswana beginner traders | Yes |

| 📱 Proprietary trading software | No |

| 🤝 Most Successful Trader in Botswana | Currently unknown |

| ✔️ Is ACY Securities a safe broker for Botswana Traders? | Yes |

| 🎖 Rating for ACY Securities Botswana | 8/10 |

| 🥇 Trust score for ACY Securities Botswana | 74% |

| 👉 Open Account | Open Account |

ACY Securities Regulation and Safety of Funds

ACY Securities Regulation in Botswana

The local market regulators in Botswana are as follows:

➡️ Ministry of Finance and Economic Development (MFED)

➡️ Bank of Botswana (BoB)

➡️ Non-Bank Financial Institutions Regulatory Authority (NBFIRA)

While ACY Securities is regulated globally, the broker does not yet have local regulations or licenses in Botswana. However, despite this, ACY Securities is a popular and trustworthy broker that accommodates Botswanan traders.

ACY Securities Global Regulations

ACY Securities is well-regulated by the following entities:

➡️ ACY Securities Pty Ltd, also known as ACY AU, is well-regulated by the Australian Securities and Investments Commission and has had this license, AFSL 403863, since July 2011.

➡️ ACY Capital Australia Limited, also known as ACY LTD, is registered in Vanuatu, and the broker is licensed by the Vanuatu Financial Services Commission under license number 012880.

ACY Securities Client Fund Security and Safety Features

ACY AU and ACY LTD both use the trade name ACY Securities, and all Australian customers are onboarded via ACY AU, but all other clients, including Botswanans, are onboarded through ACY LTD, subject to local laws or any other requirements in the area as specified by the CMA.

The Commonwealth Bank maintains all customer funds in fully segregated client trust accounts. Client funds are kept separate from ACY’s company funds and will not be utilized to repay creditors if ACY declares bankruptcy.

ACY Securities allows a few deposit and withdrawal options, including credit cards, bank transfers, and foreign transfers, to ensure the proper use and safety of customer funds.

Both ACY AU and ACY LTD carry Professional Indemnity Insurance on behalf of their respective clients as per the guidelines set out by the Regulatory Guide 126 of the Australian Securities and Investments Commission (ASIC) and the requirements of the VFSC.

ACY Securities participates in many alternative dispute resolution systems. Internally, professional support and the compliance team evaluate complaints to ensure that the ACY Securities trading experience is unparalleled.

Clients could escalate to an impartial external dispute resolution mechanism, which for ACY AU is AFCA and for ACY LTD is VFSC. When opening a live trading account, ACY Securities requires all clients to provide complete and accurate proof of identity and address.

Traders from Botswana must guarantee that deposits and withdrawals are made from/to the same name as the registered trading account.

In addition to prohibiting third-party payments, ACY Securities is committed to respecting its privacy obligations as outlined in the Privacy Policy Statement.

This privacy policy describes how the broker collects, uses, discloses, and protects the personal information of applicants and users of its services. On the official website of the broker, Botswanans may obtain further material on the Privacy Policy of ACY Security.

Is ACY Securities regulated?

Yes, ACY Securities is regulated by several financial authorities depending on the region they operate in. Key examples include:

➡️Australia: Australian Securities and Investments Commission (ASIC) AFSL: 403863

➡️Cyprus: Cyprus Securities and Exchange Commission (CySEC) License: 357/18

➡️Seychelles: Financial Services Authority (FSA) License: SD057

These regulations help ensure client protection and adherence to financial standards.

How are my funds secured at ACY Securities?

ACY Securities implements several measures to protect your funds:

➡️Client Money Segregation: Your funds are held in separate accounts from the company’s operational funds, reducing commingling risk.

➡️Negative Balance Protection: This feature prevents your account balance from going below zero, safeguarding you from unexpected losses.

➡️Tier-1 Capitalization: ACY maintains strong capital reserves to ensure financial stability and withstand potential losses.

➡️Regular Audits: Independent auditors regularly review ACY’s finances, providing transparency and accountability.

ACY Securities Awards and Recognition

Over the years, ACY Securities has received several awards and titles recognizing the broker’s contribution to the forex industry. The most recent accolades include:

➡️ ACY earned the title for Premium Multi-Asset Broker in Asia at the FX168 2020 Brokers Billboard Annual Awards, highlighting its extensive choice of CFDs across MT4 and MT5.

➡️ As the broker established their new ACYPartners.com website and proceeded to spend more resources to worldwide partners, ACY was awarded the World Finance Forex Award for the Best Partnership Program in 2020.

➡️ The prominent technology publication Technology Era recognized ACY the “Best Multi-Asset Broker in Australia in 2020.” The choice was based on the variety of goods, platforms, education, and market research.

ACY Securities Account Types and Features

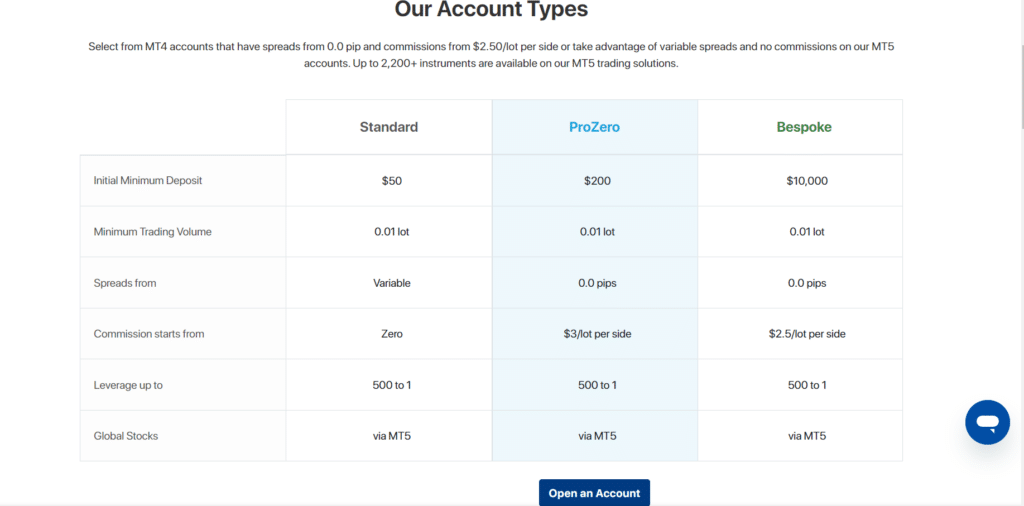

The broker offers three distinct account tiers: Standard, ProZero, and Bespoke. Opening an account with ACY Securities Pty Ltd, a worldwide company, gives traders access to leverage of up to 1:30. In contrast, ACY Capital Australia Limited offers its traders a maximum leverage of 1:500.

Botswanan traders can note that in the table below, the expenses of trading on the Standard Account are greater than those on the ProZero and Bespoke Accounts, which have a minimal charge per lot moved.

The Standard Account’s minimum deposit requirement is far lower than that of the ProZero and Bespoke accounts, nevertheless.

| 💻 Live Account | 💳 Minimum Dep. | 📊 Average Spread | 💸 Commissions | 💰 Average Trading Cost |

| Standard | 660 BWP / 50 USD | 1 pip | No | 10 USD |

| ProZero | 2,600 BWP / 200 USD | 0.0 pips | 6 USD per lot | 6 USD |

| Bespoke | 130,000 BWP / 10,000 USD | 0.0 pips | 5 USD per lot | 5 USD |

ACY Securities Live Trading Account Details

Standard Account

The Standard account is supported by infrastructure housed on Equinix trading servers in New York, which are geographically adjacent to the price engine servers used by ACY’s liquidity suppliers.

Sixteen different foreign banks have contributed to the vast liquidity. You may join the marketplaces at any moment and get the greatest matching and price thanks to this.

| Account Feature | Value |

| 💸 Initial Minimum Deposit | 660 Botswanan Pula equivalent to $50 |

| 📊 Minimum Deposit after the initial | 660 Botswanan Pula equivalent to $50 |

| 🔧 Minimum Trading Volume | 0.01 lot |

| 💵 Swap-Free Account Option | Yes |

| 💻 Average Spreads on Major Forex Pairs | • AUD/USD – 1.3 Pips • GBP/USD – 1.6 Pips • EUR/USD – 1 Pip • USD/JPY – 1.2 Pips • XAU/USD – $0.2 • WTI/USD – $0.04 |

| 📈 Forex Commissions per round turn | None |

| 📉 Precious Metals Commissions per round turn | None |

| 🔄 Commissions on Indices per round turn | None |

| 📞 Maximum Leverage Ratio | From 1:30 to 1:500 depending on region and experience |

| 📱 Account Base Currency | USD, AUD, EUR, GBP, NZD, CAD, JPY |

| 1️⃣ One-on-one Service | Yes |

| 📈 Access to Market Analysis | Yes |

| 💰 Deposit Fees | None |

| 📉 Share CFDs offered on MT5 | • ASX – 290+ • NYSE – 820+ • NASDAQ – 450+ • ARC – 110+ |

| 📈 Margin Requirement on MT5 | 20% |

| 📱 DMA share CFD Exchanges on MT5 | ASX, NYSE, NASDAQ, ARC |

ProZero Account

In the ProZero trading account, you may buy and sell assets at spreads that are among the lowest in the industry, as low as 0 basis points (pips). To cut down on trading expenses, this brokerage account type allows for trades with no spread and set charges.

The $3 lot per side is ideal for high-volume, aggressive traders who are looking to maximize profits while keeping expenses low.

| Account Feature | Value |

| 💸 Initial Minimum Deposit | 2,600 BWP equivalent to $200 |

| 📊 Minimum Deposit after the initial | 660 Botswanan Pula equivalent to $50 |

| 🔧 Minimum Trading Volume | 0.01 lot |

| 💵 Swap-Free Account Option | Yes |

| 💻 Average Spreads on Major Forex Pairs | • AUD/USD – 0.0 Pips • GBP/USD – 0.0 Pips • EUR/USD – 0.0 Pip • USD/JPY – 0.0 Pips • XAU/USD – $0.06 • WTI/USD – $0.034 |

| 📈 Forex Commissions per round turn | • USD – US$6 • AUD – AU$8.5 • EUR – €5.5 • GBP – £5 • NZD – NZ$9 • CAD – CA$8 • JPY – ¥700 |

| 📉 Precious Metals Commissions per round turn | • USD – US$6 • AUD – AU$8.5 • EUR – €5.5 • GBP – £5 • NZD – NZ$9 • CAD – CA$8 • JPY – ¥700 |

| 🔄 Commissions on Indices per round turn | None |

| 📞 Maximum Leverage Ratio | From 1:30 to 1:500 depending on region and experience |

| 📱 Account Base Currency | USD, AUD, EUR, GBP, NZD, CAD, JPY |

| 1️⃣ One-on-one Service | Yes |

| 📈 Access to Market Analysis | Yes |

| 💰 Deposit Fees | None |

| 📉 Share CFDs offered on MT5 | • ASX – 290+ • NYSE – 820+ • NASDAQ – 450+ • ARC – 110+ |

| 📈 Margin Requirement on MT5 | 20% |

| 📱 DMA share CFD Exchanges on MT5 | ASX, NYSE, NASDAQ, ARC |

Bespoke Account

This is a professional account created for Botswanan traders who are aware of the risks involved in trading and can manage their exposure to risk. Trades may be made in an endless number of international traders using this account.

| Account Feature | Value |

| 💸 Initial Minimum Deposit | 130,000 BWP equivalent to $10,000 |

| 📊 Minimum Deposit after the initial | 660 Botswanan Pula equivalent to $50 |

| 🔧 Minimum Trading Volume | 0.01 lot |

| 💵 Swap-Free Account Option | Yes |

| 💻 Average Spreads on Major Forex Pairs | • AUD/USD – 0.0 Pips • GBP/USD – 0.0 Pips • EUR/USD – 0.0 Pip • USD/JPY – 0.0 Pips • XAU/USD – $0.06 • WTI/USD – $0.034 |

| 📈 Forex Commissions per round turn | • USD – US$6 • AUD – AU$8.5 • EUR – €5.5 • GBP – £5 • NZD – NZ$9 • CAD – CA$8 • JPY – ¥700 |

| 📉 Precious Metals Commissions per round turn | • USD – US$6 • AUD – AU$8.5 • EUR – €5.5 • GBP – £5 • NZD – NZ$9 • CAD – CA$8 • JPY – ¥700 |

| 🔄 Commissions on Indices per round turn | None |

| 📞 Maximum Leverage Ratio | From 1:30 to 1:500 depending on region and experience |

| 📱 Account Base Currency | USD, AUD, EUR, GBP, NZD, CAD, JPY |

| 1️⃣ One-on-one Service | Yes |

| 📈 Access to Market Analysis | Yes |

| 💰 Deposit Fees | None |

| 📉 Share CFDs offered on MT5 | • ASX – 290+ • NYSE – 820+ • NASDAQ – 450+ • ARC – 110+ |

| 📈 Margin Requirement on MT5 | 20% |

| 📱 DMA share CFD Exchanges on MT5 | ASX, NYSE, NASDAQ, ARC |

ACY Securities Base Account Currencies

When registering either of the three live accounts, Botswanan traders can choose from USD, AUD, EUR, GBP, NZD, CAD, or JPY as the base currency.

This means that any deposits and withdrawals in BWP will automatically be converted to the base currency, and traders are subject to a currency conversion fee.

ACY Securities Demo Account

The virtual money in ACY Securities’ demo accounts may reach $100,000. All the account types are mirrored in the demo versions of the MT4 and MT5 software. The trial period is six months, and extensions are available upon request.

ACY Securities Islamic Account

If you are interested in the swap-free (Islamic) account, you may open one alongside the Standard Account. While ProZero Account and Bespoke Account both provide more account types, none of them are an Islamic Account.

Botswanans should be aware of the following additional administrative expenses, even if they do not charge for sleeping space:

➡️ Major Currency Pairs – forex, metals, indices, and cryptocurrency – a flat fee of US$2.50 per day, per lot.

➡️ Minor Forex Pairs – forex, metals, indices, cryptocurrencies – a flat fee of US$5 per day, per lot.

➡️ Exotic Pairs – forex, metals, indices, and cryptocurrencies – a flat fee of US$10 per day, per lot.

How to open an Account with ACY Securities in Botswana

Step 1 – Start Process

To start the process, the applicant can click on the blue “Open an Account” button located at the top, right of the ACY Securities landing page.

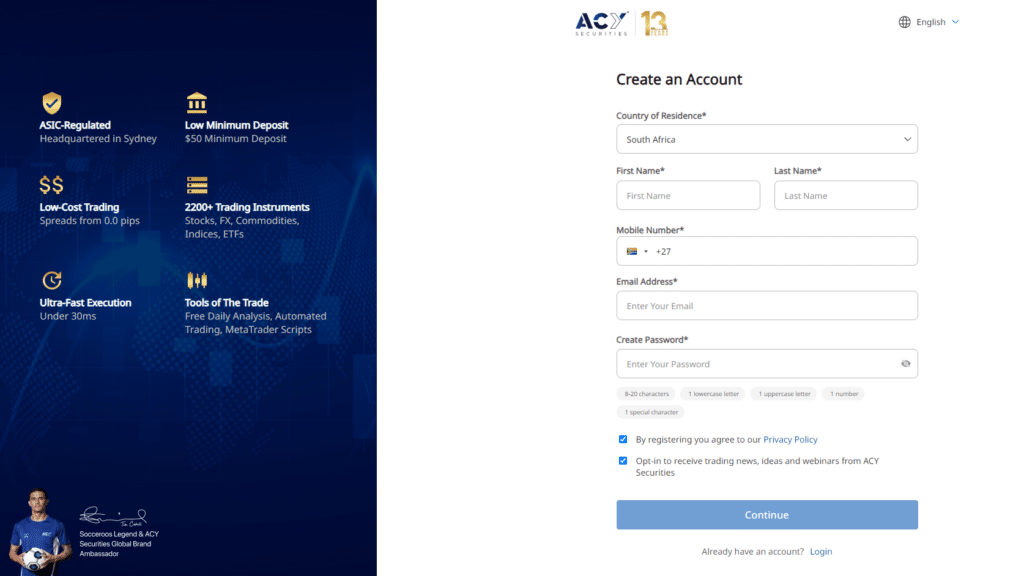

Step 2 – Personal Details

The applicant will need to complete a simple registration form in order to continue. Information required includes the preferred account type, country of residence

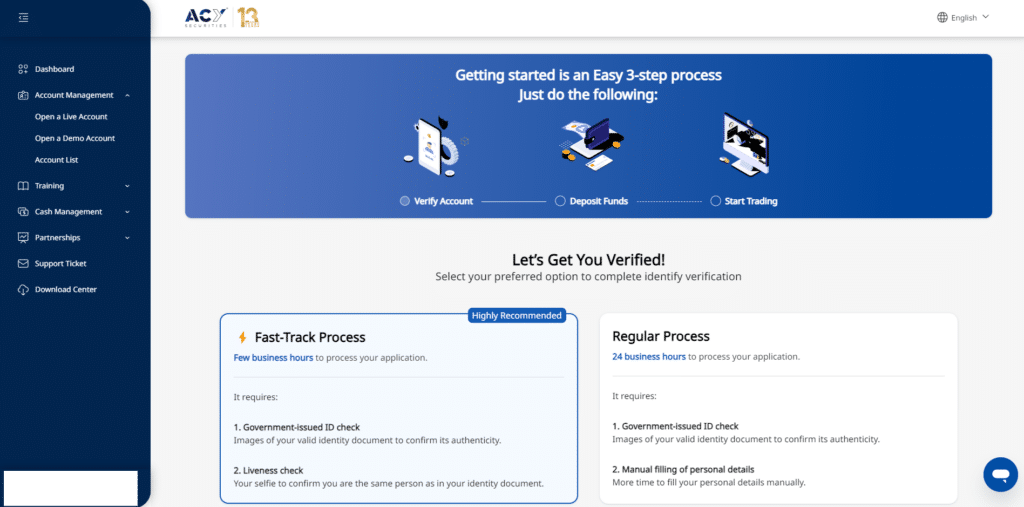

Step 3 – Government ID

Information required includes Government ID

Step 4 – Verification process

Ensure that you have the necessary ID documents available and a QR code scanner app.

Step 5 – Terms and Conditions

Step 5 – Terms and Conditions

In order to complete the registration process, the applicant will need to read and apply to set terms and conditions.

ACY Securities Vs XM Vs Pepperstone – Broker Comparison

| 🥇 ACY Securities | 🥈 XM | 🥉 Pepperstone | |

| ⚖️ Regulation | ASIC, VFSC | FSCA, IFSC, ASIC, CySEC, DFSA | ASIC, BaFin, CMA, CySEC, DFSA, FCA and SCB |

| 📱 Trading Platform | • MetaTrader 4 • MetaTrader 5 | • MetaTrader 4 • MetaTrader 5 • XM Mobile App | • MetaTrader 4 • MetaTrader 5 • cTrader • TradingView • Myfxbook • DupliTrade |

| 💰 Withdrawal Fee | Yes | Yes | No |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 660 BWP | 66 BWP | 1,700 BWP |

| 📊 Leverage | 1:500 | 1:888 | 1:400 |

| 📊 Spread | Variable, 0.0 pips | 0.0 pips | Variable, 0.0 pips |

| 💰 Commissions | From $5 | $1 to $9 | From AU$7 |

| ✴️ Margin Call/Stop-Out | 100%/50% | • 50%/20%, • 100%/50% (EU) | 90%/20% |

| 💻 Order Execution | STP | Market, Instant | Instant |

| 💳 No-Deposit Bonus | No | No | No |

| 📊 Cent Accounts | No | No | No |

| 📈 Account Types | • Standard Account • ProZero Account • Bespoke Account | • Micro Account • Standard Account • XM Ultra-Low Account • Shares Account | • Standard Account • Razor Account |

| ⚖️ CBN Regulation | No | No | No |

| 💳 BWP Deposits | No | No | Yes |

| 📊 Botswana Pula Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/5 | 24/5 |

| 📊 Retail Investor Accounts | 3 | 4 | 2 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 📉 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | Depends on region and trading instrument | 100 lots | 100 lots |

| 💰 Minimum Withdrawal Time | 24 to 48 hours | 1 working day | 1 business day |

| 📊 Maximum Estimated Withdrawal Time | 5 to 7 working days | 5 working days | Up to 7 business days |

| 💸 Instant Deposits and Instant Withdrawals? | Yes | Yes | No |

ACY Securities Trading Platforms

ACY Securities offers Botswanan traders a choice between these trading platforms:

➡️ MetaTrader 4

➡️ MetaTrader 5

Desktop Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4

MT4 has been around for a long time, making it a reliable and popular choice for forex and CFD traders. Traders of all skill levels may take use of MT4’s many helpful features and tools, which contributes to the platform’s widespread appeal.

ACY Securities clients may use the MT4 WebTrader, desktop, and mobile apps on their iOS and Android smart devices.

MT4 is compatible with a wide variety of charting, analytical, trading, and plugin applications. Traders may design their own plugins for the MetaTrader 4 platform using a C++-based programming language called MQL4.

In addition, EAs, or software robots, can be used to automate certain trading strategies. Furthermore, expert advisors can be developed and evaluated with the Strategy Tester for MT4 and the MQL4 programming language before being uploaded to the MT4 trading platform.

MetaTrader 5

The forefront and powerful MetaTrader 5 (MT5) trading platform are available from ACY Securities as well. The MT5 platform is an improvement over its predecessor, MT4, in terms of both functionality and potential.

Plus, MT5 provides:

➡️ Charts with more additional timeframes and six order types.

➡️ Extra indications for technical analysis.

➡️ Level II DOM (Depth of Market) pricing access.

➡️ Features an integrated economic calendar.

➡️ Experts in testing cross-currency strategies.

➡️ The availability of stocks for trading alongside foreign exchange, commodities, and indices.

WebTrader Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4

MT4 provides its Web-based users with a plethora of options and features. The platform and traders’ accounts are protected by innovative safety measures, and traders may use any operating system they like (Windows, Mac, or Linux).

With ACY’s MT4 for Web technology, investors may get on the world’s financial markets whenever and wherever they choose. Trades made on MT4 can be conducted fast and reliably due of the platform’s ease of use and functionality.

MetaTrader 5

Traders in Botswana may use MetaTrader 5 thanks to ACY Securities. The MT5 platform provides users with everything they want in a unified web browser. Level II pricing, deep liquidity feeds, and spreads as low as 0 pips may all be available via your browser.

Trading App

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4

You can download the MT4 app for your mobile device from the relevant app store for your operating system of choice.

Traders all around the world use the mobile app to track the markets, enter positions, perform analysis, check account balances, initiate trades, and get the latest market data.

Botswanan traders on the move will appreciate the app’s user-friendliness, portability, dependability, and speed.

In addition to a simulated trading environment, users get access to real-time prices, charts, and trading. Mobile traders can easily do market research and place orders using the MT4 mobile app.

MetaTrader 5

With the meteoric rise of mobile trading in Botswana, investors may take advantage of ACY Securities’ MT5 trading software without being physically present in the country.

Anywhere you have access to a solid internet connection, you may review, modify, and update your orders with the aid of MT5’s mobile solutions.

What trading platforms does ACY offer?

ACY provides two popular platforms:

➡️MetaTrader 4 (MT4): This industry-standard platform is known for its user-friendly interface, advanced charting tools, and extensive community resources.

➡️MetaTrader 5 (MT5): The next-generation platform, MT5 offers additional features like market depth, hedging options, and built-in Expert Advisors (EAs).

Both platforms are available as desktop, web, and mobile versions, allowing you to trade from your preferred device.

What assets can I trade on ACY’s platforms?

ACY offers a wide range of tradable assets, including:

➡️Forex: Major, minor, and exotic currency pairs.

➡️Share CFDs: Trade shares of global companies without owning the underlying asset.

➡️Indices: Gain exposure to entire stock markets through index CFDs.

➡️Precious Metals: Trade gold, silver, and other precious metals.

➡️Commodities: Speculate on the price movements of oil, gas, and other commodities.

ACY Securities Range of Markets

Botswanan traders can expect the following range of markets from ACY Securities:

➡️ Forex

➡️ Precious Metals

➡️ Indices

➡️ Energies

➡️ Shares

➡️ ETFs

Financial Instruments and Leverage offered by ACY Securities

| 🔨 Instrument | 💰 Number of Assets Offered | 📈 Max Leverage Offered |

| ➡️ Forex | 138 | 1:100 |

| ➡️ Indices | 23 | 1:100 |

| ➡️ Shares | 5,455 | 1:20 |

| ➡️ Commodities | 37 | 1:100 |

| ➡️ Cryptocurrencies | 476 | 1:100 |

What major market categories does ACY offer?

ACY caters to diverse trading interests by offering a broad spectrum of markets across five main categories:

➡️Forex: Dive into the world’s largest financial market, trading major, minor, and exotic currency pairs with competitive spreads and leverage options.

➡️Share CFDs: Trade CFDs on shares of leading global companies listed on major exchanges like NYSE, Nasdaq, and ASX. This allows you to speculate on share prices without physically owning the underlying asset.

➡️Indices: Gain exposure to entire stock markets through index CFDs. Track and trade major indices like the S&P 500, NASDAQ 100, and FTSE 100.

➡️Commodities: Trade popular commodities like gold, silver, oil, and gas, speculating on their price movements and diversifying your portfolio.

➡️Cryptocurrencies: For those interested in digital assets, ACY offers CFDs on major cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

How many instruments can I trade within each category?

ACY boasts a vast selection of instruments within each category, exceeding 2,200 in total. Here’s a glimpse into the variety:

➡️Forex: Choose from over 80 currency pairs, including popular majors like EUR/USD and GBP/USD, as well as niche minors and exotics.

➡️Share CFDs: Access over 2,000 CFDs on shares of renowned companies across various sectors and regions.

➡️Indices: Trade CFDs on 20+ major global indices spanning diverse economies and industries.

➡️Commodities: Explore over 20 CFDs on commodities like precious metals, energy sources, and agricultural products.

➡️Cryptocurrencies: Trade CFDs on the top 8 cryptocurrencies, offering exposure to this dynamic and innovative asset class.

Broker Comparison for Range of Markets

| ACY Securities | XM | Pepperstone | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | Yes | No | Yes |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | Yes | Yes |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | No | No |

ACY Securities Trading and Non-Trading Fees

Spreads

The spread that Botswanan traders at ACY Securities pay varies depending on their trading account type and the financial instrument they are buying or selling. These spreads may alter during the trading day; thus, they are also impacted by day-of-trade market conditions.

Typical spreads for traders are listed below:

| Standard Account | • AUD/USD – 1.3 Pips • GBP/USD – 1.6 Pips • EUR/USD – 1 Pip • USD/JPY – 1.2 Pips • XAU/USD – $0.2 • WTI/USD – $0.04 |

| ProZero Account | • AUD/USD – 0.0 Pips • GBP/USD – 0.0 Pips • EUR/USD – 0.0 Pips • USD/JPY – 0.0 Pips • XAU/USD – $0.06 • WTI/USD – $0.034 |

| Bespoke Account | • AUD/USD – 0.0 Pips • GBP/USD – 0.0 Pips • EUR/USD – 0.0 Pips • USD/JPY – 0.0 Pips • XAU/USD – $0.05 • WTI/USD – $0.034 |

Commissions

Botswanan traders pay different amounts for brokerage services depending on their account type and the financial instrument they choose. Botswanans might look forward to the following commissions:

| 🔧 Instruments | 💻 ProZero Account | 📱 Bespoke Account |

| Forex | • USD – US$6 • AUD – AU$8.5 • EUR – €5.5 • GBP – £5 • NZD – NZ$9 • CAD – CA$8 • JPY – ¥700 | • USD – US$5 • AUD – AU$7 • EUR – €4.5 • GBP – £4 • NZD – NZ$7.5 • CAD – CA$7 • JPY – ¥600 |

| Precious Metals | • USD – US$6 • AUD – AU$8.5 • EUR – €5.5 • GBP – £5 • NZD – NZ$9 • CAD – CA$8 • JPY – ¥700 | • USD – US$5 • AUD – AU$7 • EUR – €4.5 • GBP – £4 • NZD – NZ$7.5 • CAD – CA$7 • JPY – ¥600 |

Overnight Fees, Rollovers, or Swaps

Overnight fees are applied to open positions that have been neglected for more than 24 hours. Both regular and summertime U.S. times are reflected in ACY Securities’ market hours. MetaTrader gives Botswana traders access to the trading hours of all accessible instruments around the clock.

Some typical exchange rates are as follows:

➡️ EUR/USD – buy swap -3.75 pips and sell swap -0.34 pips.

➡️ GBP/USD – buy swap -2.33 pips and sell swap -1.28 pips.

➡️ USD/JPY – buy swap -0.78 pips and sell swap -2.76 pips.

➡️ AUD/USD – buy swap -1.44 pips and sell swap -1.21 pips.

Deposit and Withdrawal Fees

Funding your account with ACY Securities is free of charge. Funds withdrawals, however, are subject to the following charges:

➡️ Withdrawals from foreign accounts incur a $25 service fee.

➡️ Skrill has a per-withdrawal merchant charge of 3%.

➡️ Traders will be charged $25 for any withdrawal made more than three in a single calendar month.

Inactivity Fees

ACY Securities does not currently charge any inactivity fees on dormant accounts.

Currency Conversion Fees

Botswanans who deposit or withdraw funds in currencies other than those accepted as the base currency of a trading account will be subject to currency conversion fees.

ACY Securities Deposits and Withdrawals

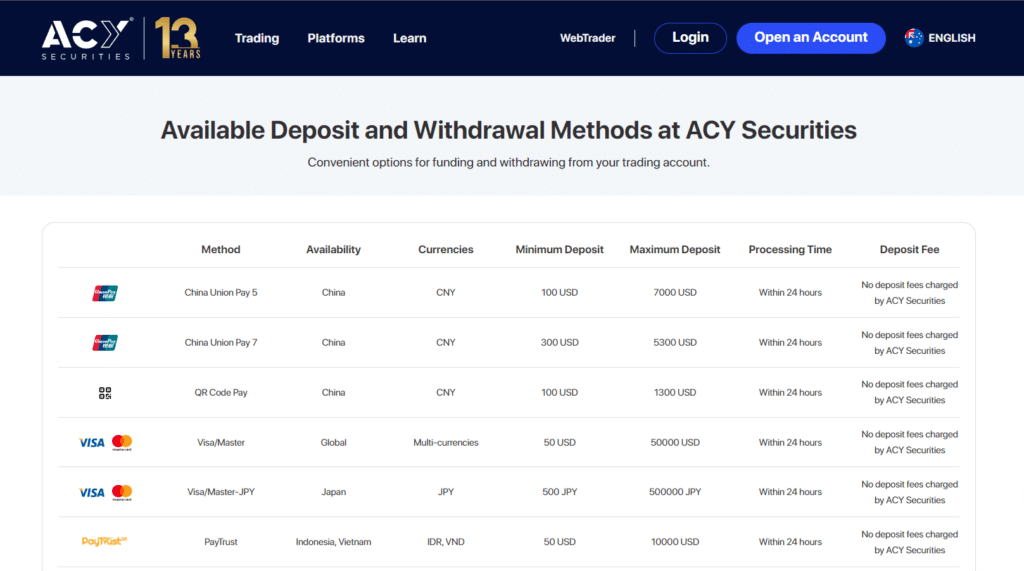

ACY Securities offers the following deposit and withdrawal methods:

➡️ Credit Card

➡️ Debit Card

➡️ Wire Transfer

➡️ Skrill

➡️ Neteller

➡️ China Union Pay

➡️ Doku Wallet

Broker Comparison: Deposit and Withdrawals

| 🥇 ACY Securities | 🥈 XM | 🥉 Pepperstone | |

| Minimum Withdrawal Time | 24 to 48 hours | 1 working day | 1 business day |

| Maximum Estimated Withdrawal Time | 5 to 7 working days | 5 working days | Up to 7 business days |

| Instant Deposits and Instant Withdrawals? | Yes | Yes, deposits | No |

ACY Securities Deposit Currencies, Deposit and Withdrawal Processing Times

| 💳 Payment Method | 💵 Deposit Currencies | 💳 Deposit Processing | 💸 Withdrawal Processing Time |

| Credit Card | Any | 2 to 3 days | 2 to 3 days |

| Debit Card | Any | 2 to 3 days | 2 to 3 days |

| Wire Transfer | Any | 3 to 5 days | 3 to 5 days |

| Skrill | Any | 1 to 3 days | 1 to 3 days |

| Neteller | Any | 1 to 3 days | 1 to 3 days |

| China Union Pay | Any | 1 to 3 days | 1 to 3 days |

| Doku Wallet | Any | 1 to 3 days | 1 to 3 days |

How to Deposit Funds with ACY Securities

Deposit Methods

We offer a variety of deposit methods to suit your preferences. Whether you prefer bank transfers, credit/debit cards, or electronic payment systems, we have a solution for you. Our user-friendly platform allows you to choose the deposit method that works best for you, making it quick and straightforward to fund your trading account.

To deposit funds to an account with ACY Securities, Botswanan traders can follow these steps:

Step – 1 To make a deposit

You can login to your ACY Client Portal > and select Cash Management > then click on Deposit.

Step 2 – Click the “Deposit” tab

Choose the “Deposit” button next to the currency you desire to use and the amount you wish to deposit.

Traders might need to take extra measures to verify their deposits depending on the payment type they choose.

ACY Securities Fund Withdrawal Process

To withdraw funds from an account with ACY Securities, Botswanan traders can follow these steps:

➡️ Use the Client Portal to put in a withdrawal request. Botswanans must note that withdrawal requests received after 2 pm AEST will be processed the next business day.

➡️ Withdraw funds to your credit card directly from the ACY.Cloud client interface. In addition, Australian banks allow consumers to make three fee-free ATM withdrawals every month.

Each subsequent withdrawal or transfer to a foreign bank will incur a $25 service charge. When withdrawing money from your Skrill account, a 3% charge is deducted from the total amount.

ACY Securities Education and Research

Education

👉 ACY Securities offers the following Educational Materials:

➡️ eBooks

➡️ Webinars

➡️ Trading Courses

➡️ How to Trade Forex

Research and Trading Tool Comparison

| 🥇 ACY Securities | 🥈 XM | 🥉 Pepperstone | |

| ➡️ Economic Calendar | Yes | Yes | Yes |

| ➡️ VPS | No | No | Yes |

| ➡️ AutoChartist | No | No | Yes |

| ➡️ Trading View | No | No | Yes |

| ➡️ Trading Central | No | No | Yes |

| ➡️ Market Analysis | Yes | No | No |

| ➡️ News Feed | Yes | Yes | Yes |

| ➡️ Blog | Yes | Yes | Yes |

👉 ACY Securities also offers Botswanan traders the following additional Research and Trading Tools:

➡️ Code-Free Trading Automation

➡️ Research and Analysis tools

➡️ Smart Notifications

➡️ Strategies Library

➡️ Technical Indicators

➡️ Market News

➡️ Market Analysis

ACY Securities Bonuses and Promotions

👉 ACY Securities does not currently offer any bonuses or promotions to Botswanans.

How to open an Affiliate Account with ACY Securities

👉 To register an Affiliate Account, Botswanan traders can follow these steps:

➡️ The first step is to visit the ACY Securities online platform.

➡️ Click “ACY Partners” at the top of the main page.

➡️ To access the online contact form, traders can scroll down the page to find the relevant section.

➡️ Your full name, an active email address, a phone number with an authentication code, and the country in which you now live are all required.

➡️ Residents of Botswana could also share the URL to the ACY Securities website and mention how they learned about the company.

➡️ Lastly, Botswanans have the option of adding a personal note before sending in their contact form. In addition, information given by Botswanans will be recorded, and thereafter ACY Securities will respond to their inquiries and help them apply to become affiliates.

ACY Securities Affiliate Program Features

👉 When visiting the main website of ACY Securities, if you scroll down to the “ACY Partners” section, you will be taken to a comprehensive affiliate network. By investing in ACY Securities, investors get principal advantages:

➡️ 24/5 resolute and multilingual customer support

➡️ Real-time reporting is done through ACY.Cloud

➡️ Finlogix widgets that have an affiliate tracking code

➡️ Access to a personal account manager

➡️ Bespoke tailored solutions

👉 ACY Securities has a dedicated group of liquidity providers that work together to provide our partners and clients the best possible execution. Therefore, depending about the market, traders may take advantage of EUR/USD spreads as low as 0.0 pips.

👉 Partners have access to a variety of financial widgets that can be easily integrated into a website’s HTML by dragging and dropping. Simply copying and pasting some pre-written code onto the partner’s website gives them access to a wide variety of innovative financial widgets.

ACY Securities Customer Support

👉 Multilingual, around-the-clock, five-days-a-week help in many different languages is just one of the many customer care features that set ACY Securities apart as a broker worth considering.

👉 After signing up, traders are given one-on-one assistance with account setup and any other technical issues they may have.

| Customer Support | ACY Securities’s Customer Support |

| ⏰ Operating Hours | 24/5 |

| 🗣 Support Languages | Multilingual |

| 🗯 Live Chat | Yes |

| 📧 Email Address | Yes |

| ☎️ Telephonic Support | Yes |

| 📞 Local Support in Botswana? | No |

| 🥇 Overall quality of ACY Securities Support | 4/5 |

ACY Securities Corporate Social Responsibility

👉 It has not yet been made clear what kind of CSR initiatives ACY Securities participates in on their website.

Our Verdict on ACY Securities

👉 ACY Securities provides three account types that are appropriate for both novice and experienced traders. Beginners may find the Standard Account’s modest minimum deposit and straightforward cost structure to be very handy.

👉 While sophisticated traders may get cheaper fees and tighter spreads via the Bespoke Account, which requires a $10,000 minimum opening deposit. ACY Securities may be of interest to traders interested in stocks and ETFs due to the breadth of the firm’s stock and ETF offerings.

👉 With spreads as low as 0.0 pips on two of its accounts and inexpensive costs, it provides outstanding trading conditions.

👉 Trading is available on the two most prominent platforms (MT4 and MT5), and all trading tactics are supported, plus there is a respectable library of instructional resources available via ACY.

👉 Although customer money is separated from ACY’s operational capital and traders are granted negative balance protection, the absence of regulatory control is a downside. Overall, ACY Securities is a solid, though unremarkable, CFD broker.

ACY Securities Pros and Cons

| ✔️ Pros | ❌ Cons |

| As a broker with top-tier regulation, ACY Securities has earned a solid reputation | ACY Securities does not provide a BWP-denominated account |

| Over 1,800 financial products are made available to Botswanan traders | The demo account expires after 30 days |

| There is a selection of educational material for beginner traders | There are additional administrative fees charged on the Islamic Account |

| The STP and NDD model used by ACY Securities facilitates trustworthy transaction execution | Withdrawal fees are applied |

| Traders in Botswana have the option of opening either a Managed Account or a Passively Managed Account |

Frequently Asked Questions

Does ACY Securities have Nasdaq?

The S&P500, Dow Jones, Nasdaq, Dax, FTSE, Euro Stoxx, Hong Kong 50, Nikkei, China A50, and S&P ASX 200 are all available to traders at ACY.

How long do withdrawals with ACY Securities take?

They can take 1 to 2 working days to be processed. However, it could take longer for funds to reach the trader’s bank account.

Does ACY Securities have Volatility 75?

ACY Securities does not include VIX 75 in its comprehensive financial instrument portfolio.

Is ACY Securities safe or a scam?

ACY Securities is a dependable broker with Tier-1 and Tier-3 regulation.

Is ACY Securities regulated?

ACY Securities is regulated in Australia by ASIC and Vanuatu by VFSC.

What is the minimal spread with ACY Securities?

ACY Securities charges zero-pip spreads on major instruments on the Bespoke and ProZero Accounts.

Does ACY Securities charge commissions?

ACY Securities charges commissions from 5 to 6 USD on the Bespoke and ProZero Accounts.

What order execution does ACY Securities have?

ACY Securities is an ECN and STP broker that offers STP execution, with liquidity sourced from 16 global banks.

Conclusion

Now it is your turn to participate:

➡️ Do you have any prior experience with ACY Securities?

➡️ What was the determining factor in your decision to engage with ACY Securities?

➡️ Was it because of the minimum deposit, regulation, retail trading accounts, or other factors?

➡️ Have you experienced any issues with ACY Securities, such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

Regardless, please share your thoughts in the comments below.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review