6 Best Micro Currency Trading Platforms in Botswana

The 6 Best Micro Currency Trading Platforms in Botswana revealed. We tested and verified the best micro currency trading platforms with a minimum deposit for Botswana Traders.

This is a complete list of the best micro currency trading platform brokers in Botswana.

In this in-depth guide you’ll learn:

- What are micro currency platforms?

- Who are the best micro currency platform brokers?

- How to choose a forex broker – Compare them against each other.

- Which brokers are best for beginner traders?

- What is the difference between a micro account and a cent account?

- Which brokers offer a sign-up bonus to first-time traders?

- Which trading platforms offer IOS and ANDROID Apps for Botswana?

And lots more…

So if you’re ready to go “all in” with the best-tested micro currency brokers for Botswana…

Let’s dive right in…

- Lesche Duvenage

Best Micro Currency Trading Platforms in Botswana

| 🥇 Broker | 👉 Open Account | 💵 Minimum Deposit? | 📌 Micro Currency Forex Broker? | 💸 Allows Botswana Pula Account? |

| 1. FXTM | 👉 Open Account | $10 / 134 BWP | Yes | Yes |

| 2. FxPro | 👉 Open Account | $100 / 1321 BWP | Yes | Yes |

| 3. FxOpen | 👉 Open Account | $1 (13 BWP) | Yes | Yes |

| 4. RoboForex | 👉 Open Account | $10 / 134 BWP | Yes | No |

| 5. XM | 👉 Open Account | $5 / 67 BWP | Yes | Yes |

| 6.BDSwiss | 👉 Open Account | $10 / 134 BWP | Yes | No |

10 Best Forex Brokers in Botswana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

What is a micro currency trading platform?

Micro currency trading platforms provide the instantaneous buying and selling of currencies and other assets denominated in increments of 1,000. Therefore, rather than trading a full unit, the trader can make a price bet with a smaller opening balance and fewer resources, thereby reducing exposure to potential losses.

Micro currency trading platforms, which allow users to experience real trading without making a substantial commitment, are quite popular among beginner traders. An increasing number of people are turning to micro currency trading platforms to try out new strategies, bots, and other automated trading tools before committing any significant capital.

6 Best Micro Currency Trading Platforms in Botswana

1. FXTM

Overview

FXTM can be summarized as a trustworthy broker that provides Contracts for Difference (CFDs) and low spreads on 250+ trading instruments. FXTM is regulated by one tier-1 regulator (highest trust), two tier-2 regulators (medium trust), and one tier-3 regulator. FXTM has a trust score of 92 out of 100.

Min Deposit

USD 10

Regulators

CySec, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

60

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

The FXTM Micro Account is specifically designed for traders who want a real experience without making a big deposit.

Unique Features

| Feature | Information |

| ⚖️ Regulation | CySEC, FSCA, FCA, FSC Mauritius |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Micro Account, Advantage Account, Advantage Plus Account |

| 📊 Trading Platform | MetaTrader 4, MetaTrader 5, FXTM Trader |

| 💰 Minimum Deposit | 134 Botswanan Pula equivalent to $10 |

| 💰 Trading Assets | Precious Metals, Stock Trading, Stock CFDs, Indices, Forex Indices, Forex Currency Pairs (including minor, major, and exotic pairs), Commodities, Stock Baskets |

| 🔎 Botswanan Pula-based Account? | Yes |

| 💳 BWP Deposits Allowed? | Yes |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 0.0 pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| FXTM is a multi-regulated and a reputable broker that has gained a high level of trustworthiness | Inactivity fees apply when the retail investor account becomes dormant |

| Dedicated customer support offered for Botswanan traders Several deposit options and withdrawal methods offered | |

| There is a low minimum deposit requirement | |

| Commission-free trading is offered | |

| Deposit fees are not charged on any payment methods | |

| Withdrawal processing times are quick | |

| There are several educational tools offered | |

| There is an exclusive risk management tool offered |

2. FxPro

Overview

FxPro offers access to Contracts for Difference (CFDs) on 6 asset classes, top-tier liquidity, and advanced trade execution with no dealing desk intervention. Furthermore, FXPro offers access to a range of account types with excellent trading conditions and ultra-fast execution.

Min Deposit

USD 100 / 1321 BWP

Regulators

CySec, FSCA, FCA

Trading Desk

FxPro Trading Platfrom

Crypto

Yes

Total Pairs

70+

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

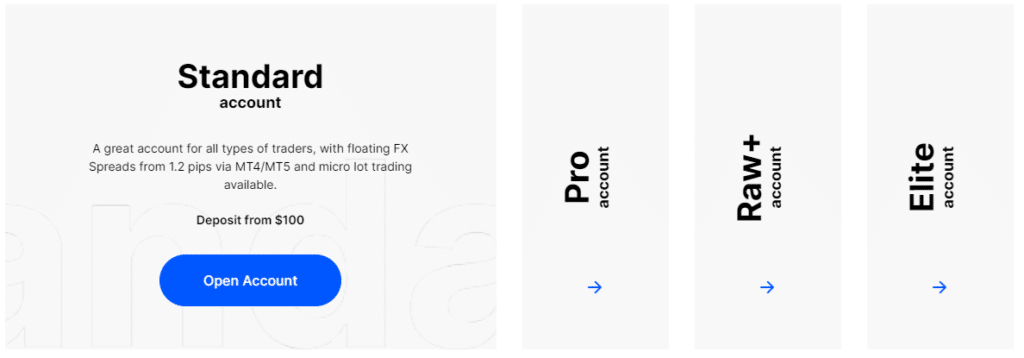

FxPro provides 4 different live trading accounts, Standard, Pro, Raw+, and Elite. The minimum deposit required to open a FxPro Account is $100 / 1321 BWP.

Unique Features

| Feature | Information |

| ⚖️ Regulation | FCA, CySEC, FSCA, SCB |

| ✅ Regulated in Botswana? | No |

| 💵 Minimum Deposit | 1 321 BWP ($100) |

| 📈 Account Types | • FxPro cTrader • FxPro MT4 • FxPro MT5 • Islamic Account • ProEdge |

| 📊 Trading Platforms | • FxPro • MetaTrader 4 • MetaTrader 5 • cTrader • FxPro Edge |

| 📚 Educational Material and Tools | • Educational Content • Demo Account |

| 📱 Research and Features | • Trading Centra • Economic Calendar • VPS • Trading Calculators |

| ✔️ Social and Copy Trading? | Yes |

| 💻 Demo Account? | Yes |

| 📉 Average Starting Spread EUR/USD | 0.4 pips |

| 💰 Commission Charges | $35 per million USD traded |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| FxPro offers 70 forex CFDs that can be traded across powerful trading software. | There is a limited number of share CFDs that can be traded. |

| Botswanans can expect low account fees, and several flexible payment options are offered. | There is limited education. |

| FxPro is well-regulated and guarantees client fund protection. | There is no BWP-denominated account. |

| FxPro integrated Trading Central and offers economic calendars, earnings, and calculators. |

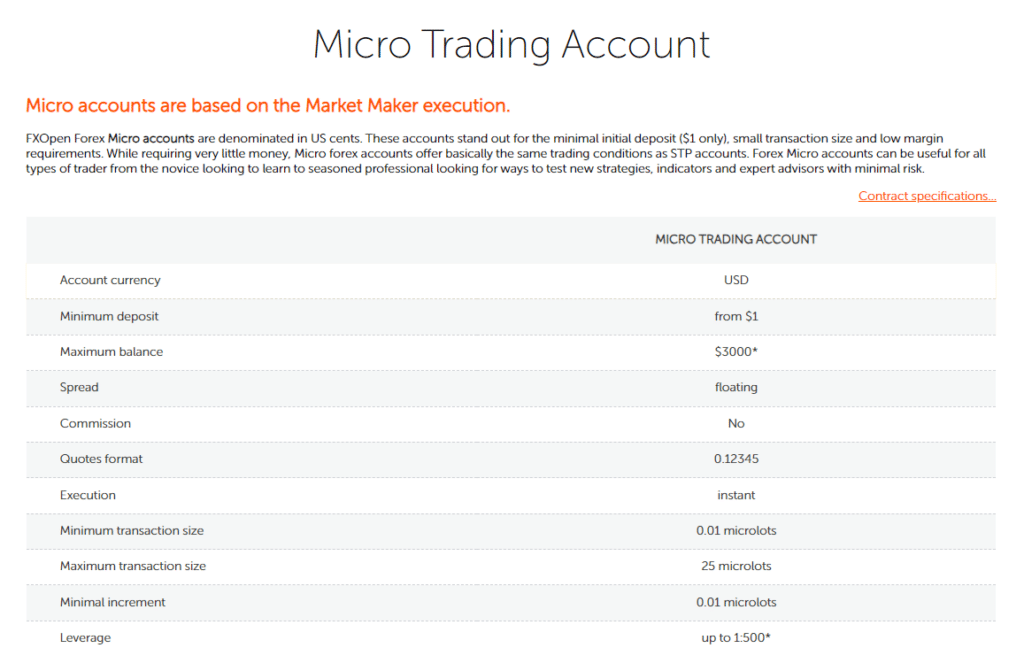

3. FxOpen

Overview

FXOpen is an ECN and STP broker with headquarters based in Australia, the UK, and Saint Kitts and Nevis, with respective regulations and authorization through ASIC and FCA.

Overall Rating

- 4.8/5

Min Deposit

USD 1 / 13 BWP

Regulators

ASIC

Trading Desk

No Trading Desk

Crypto

Yes

Total Pairs

4

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

FXOpen provides four different account types, namely the Micro Account, the STP Account, the ECN Account, and the Crypto Account. Each account type has its own set of conditions for commission, fees, margin calls, leverage, and minimum deposits.

Unique Features

| Feature | Information |

| 📈 Range of Markets | Forex, ETFs, Crypto, Indices, Commodities, Shares |

| ⚖️ Regulation | FCA, ASIC |

| 💻 Account Types | • ECN Account • STP Account • Micro Account • Crypto Account |

| 💵 Minimum Spread | 0.0 pips |

| 💸 Minimum Deposit | 13 BWP ($1) |

| 📱 Platforms Supported | MetaTrader 4 MetaTrader 5 TickTrader Myfxbook AutoTrade |

| 📉 Minimum Trade Volume | 0.01 lots |

| 📈 Maximum Leverage | 1:500 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| FXOpen is known for its true ECN model | Withdrawal fees might apply |

| FXOpen is well-regulated and offers an unlimited demo account | Not all accounts have the same access to financial instruments |

| Negative balance protection is applied to trading accounts |

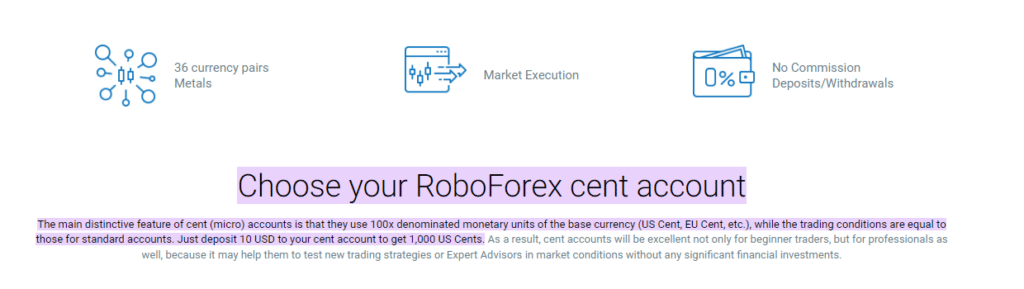

4. RoboForex

Overview

RoboForex provides 5 different live trading account types – the Prime Account, The ECN Account, The R StockTrader Account, The ProCent Account, and the Islamic Swap-Free Account Option. Additionally, a selection of Demo Accounts is also on offer.

Min Deposit

USD 10

Regulators

IFSC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

36

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

The minimum deposit amount required to register a live RoboForex trading account is $10 USD. This minimum deposit is equivalent to 134 BWP at the current exchange rate between the US Dollar and Botswana at the time of writing.

Unique Features

| Feature | Information |

| ⚖️ Regulation | IFSC |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | Botswanan Pula $10/134 BWP |

| Average spread from | Floating from 1.3 pips |

| 📈 Maximum Leverage | 1:2000 |

| 👥 Customer Support | 24/7 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The broker offers more than 12,000 markets that can be traded | US clients are not accepted |

| There are several flexible account types offered | There are no fixed spread accounts |

| Trading education is offered to all traders | |

| There are several powerful trading tools | |

| The broker applies negative balance protection to all retail trading accounts |

5. XM

Overview

XM is strictly regulated and supervised by ASIC, CySEC, IFSC, and FCA, respectively which facilitates the trade of several financial instruments spread across numerous assets, including, but not limited to Forex, commodities, cryptocurrency, and various others.

Min Deposit

USD 5 / 67 BWP

Regulators

IFSC, CySec, ASIC

Trading Desk

Desktop MT4 and MT5, Mobile MT4 and MT5, XM mobile app, Web platform

Total Pairs

57

Islamic Account

Yes

Trading Fees

No (Just spread)

Account Activation Time

24 Hours

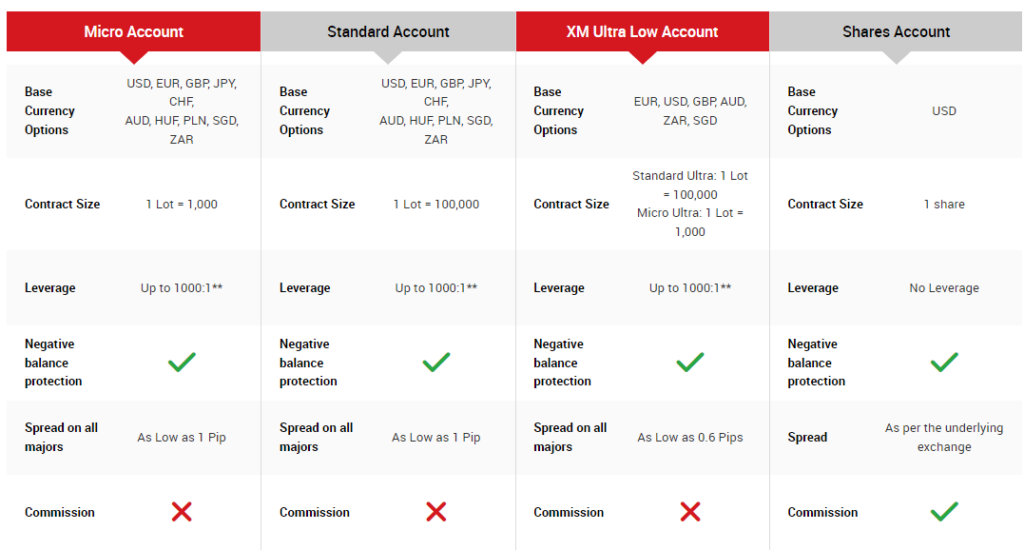

XM provides four different account types. Micro account, Standard account, Ultra-Low account, and Shares account with a Demo & Islamic account option available. The minimum deposit to open an account is $5 / 67 BWP

Unique features

| Feature | Information |

| ⚖️ Regulation | FSCA, IFSC |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | $5 / 67 BWP |

| Average spread from | 0.0 pips EUR/USD |

| 📈 Maximum Leverage | 1:1000 |

| 👥 Customer Support | 24/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Negative balance protection is applied to retail investor accounts | US clients are restricted from accessing XM’s trading services |

| There are several secure payment methods to choose from | There are no fixed spread accounts offered |

| The broker is known for low spreads, low commissions, and reliable trade execution speeds | There is an inactivity fee applied to dormant accounts |

| Traders can use hedging, scalping, and expert advisor trading strategies | |

| The broker offers personal customer service to its clients |

6. BDSwiss

Overview

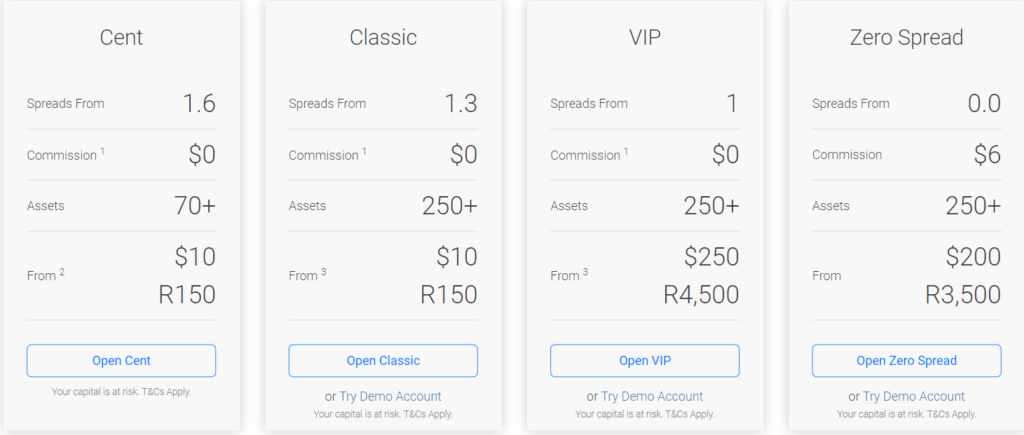

BDSwiss is a leading financial institution that offers Forex and CFD investment services worldwide. BDSwiss was established in 2012 and provides award-winning conditions, world-leading trading platforms, and competitive pricing.

Min Deposit

$10 / 136 BWP

Regulators

CySec, FSC, FSA, BaFin, NFA

Trading Desk

MetaTrader 4 , MetaTrader 5

Crypto

Yes

Total Pairs

50 Forex Pairs and 20 Crypto Pairs

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

BDSwiss has 6 different account types with minimum deposit amounts from $10 134 BWP. Spreads from 0.0 pips and leverage from 1:30 up to 1:1000 for the newly launched Premium Account.

Unique features

| Account Feature | Value |

| 💸 Minimum Deposit Required | 136 Botswanan Pula, 10 EUR, USD, GBP |

| 📊 Average Spreads | N/A |

| 🔧 Trading Instruments available | Forex Commodities Shares Indices Cryptocurrencies |

| 👍 Accepts Botswanan Traders? | Yes |

| 💻 Platforms Supported | MetaTrader 4, MetaTrader 5, BDSwiss Mobile, BDSwiss Web |

| ✴️Education for Botswanan beginners | Yes |

| 💳 Deposit and Withdrawal Options | Bank wire transfer Debit Cards Credit Cards Skrill Neteller |

| 📈 Maximum Leverage | 1:1000 |

| 💰 Botswana Daily Forex Turnover | $1.25 million+ |

| ☪️ Islamic Account Option | Yes |

| 👨💼 Languages supported on Website | English, Czech, German, Italian, Spanish, Korean, French, Norwegian, Polish, Danish, Arabic, Malaysian, Thai, Vietnamese, Filipino, Hindi, Indonesian, Chinese, Portuguese, Romanian, Turkish, Russian |

| 👥 Customer Service Hours | 24/5 |

| 💰 Bonuses and Promotions for Botswanans | None |

| ✔️Is BDSwiss a safe broker for Botswanans? | Yes |

| ✔️Rating for BDSwiss Botswana | 9/10 |

| ✔️Trust score for BDSwiss Botswana | 78% |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| BDSwiss is one of the trusted forex brokers with a high trust score that provides client protection | There are high minimum deposits on more premium accounts |

| There are commission-free options offered | Fixed spreads are not offered |

| There are competitive conditions with tight spreads and low commissions | There are some regional restrictions applied to some countries |

| BDSwiss has a large client base spread across the globe | The raw spreads are not the tightest |

| There are more than 250 CFDs to trade and several financial assets and classes | BDSwiss does not offer a deposit bonus or any other initiative |

| BDSwiss offers a high maximum leverage ratio up to 1:1000 | Does not offer a specific Botswanan client or terminal |

| Accepts electronic payments from Skrill, Neteller, and other trusted methods | Currency conversion fees are charged |

| Offers a powerful proprietary trading platform along with MetaTrader 4 and 5 | There is an inactivity fee charged on dormant accounts |

| There is a massive selection of educational material and trading tools, covering all aspects of trading | Withdrawal fee applied on the bank wire withdrawal option for certain amounts |

| Provides advanced charting tools and analytical material | There are no Botswanan Naira deposits allowed and there is no NGN account offered |

| Deposit fees are not charged on deposit methods | There is no desktop version of the proprietary trading platform |

| Offers a demo account and Islamic Account | |

| BDSwiss offers a decent range of payment methods | |

| There is a choice between dynamic retail investor accounts |

What is the difference between a micro account and a cent account?

The difference between a micro account and a cent account lies in the denomination of the trading units. Both account types are designed to cater to traders with smaller capital, providing a more accessible entry into the financial markets. In a micro account, the trading units are typically denominated in micro-lots, where one micro-lot is equivalent to 1,000 units of the base currency.

This allows traders to engage in transactions with relatively small amounts. On the other hand, a cent account utilizes a different approach, where the trading units are denominated in cents rather than the standard currency units. For example, one cent lot is equivalent to 100 units of the base currency. Cent accounts offer a way for traders to practice and familiarize themselves with real market conditions while using smaller, more manageable sums of money.

Both micro and cent accounts are popular among beginners or those with limited capital, providing a stepping stone for gaining experience in the complexities of trading without exposing traders to excessive risk.

How to choose a Micro Currency Trading Platform in Botswana

Botswanan traders must evaluate the following components of a forex broker to decide whether the broker is suited to their unique trading objectives or needs.

Regulations and Licenses

This is the first vital component that Botswanan traders must thoroughly evaluate. Reputable brokers are regulated by market regulators such as FCA, ASIC, CySEC, FSCA, and others.

Botswanans must beware when dealing with brokers with only offshore regulations such as FSA, SVG BVI, FSC, and others.

Account Features

Account Features include leverage trading and margin requirement, commissions and spreads, initial deposit, additional features on retail investor accounts, and so on.

Deposits and Withdrawals

Botswanans must evaluate the payment options available, the processing times on withdrawal requests, deposit currencies offered, the withdrawal fee, deposit fees, and minimum withdrawal limits, among other trading and non-trading fees.

Range of Markets

The range of markets offered refers to the number and range of tradable instruments the broker offers. Therefore, Botswanans must consider what they wish to trade and what is available.

Customer Support

Customer Support is another crucial factor. Botswanans must check the availability of support (trading hours), the quality of support, and the promptness with which the customer support team responds to queries.

Trading Platform

A trading platform is the Botswanan trader’s portal to the financial markets. Therefore, traders must ensure that the trading platform has the necessary technical indicators, fundamental analysis, technical analysis, economic calendar, charting, newsfeed, and other tools they may need.

Education and Research

Education and Research come in handy to both novice traders and experienced investors. Education includes some of the following:

➡️ eBooks

➡️ Trading guides

➡️ Trading knowledge on leveraged products

➡️ A risk warning on complex instruments

➡️ Educational videos

Research can include some of the following:

➡️ Trading tools

➡️ Commentary

➡️ Status of International Markets

➡️ Price movements

➡️ Market sentiments

➡️ Whether there is a volatile market

➡️ Exchange Rates

➡️ Expert opinions and other resources can help experienced traders make informed trading decisions.

The Best Micro Currency Trading Platform in Botswana

In this article, we have listed the best brokers that offer forex trading to traders in Botswana. In addition, we have further identified the brokers that offer additional services and solutions to Botswanan traders.

Best MetaTrader 4 / MT4 Forex Broker in Botswana

Min Deposit

USD 25

Regulators

FCA UK

Trading Platform

MT5, MT4, OctaTrader

Crypto

Yes

Total Pairs

28

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, OctaFX is the best MT4 forex broker in Botswana. OctaFX is an MT4 and MT5 broker that provides Botswanans with various markets. OctaFX offers a choice of accounts via MT4, including ECN and STP accounts, with superior trade execution.

Best MetaTrader 5 / MT5 Forex Broker in Botswana

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, AvaTrade is the best MetaTrader 5 forex broker in Botswana. In addition, AvaTrade is regarded as one of the most secure MT5 forex brokers.

No commission is charged for trading currency pairings, only leaving the spread to be paid. A demo account is also available for traders to sharpen their abilities via MT5 and several other platforms.

Best Forex Broker for beginners in Botswana

Min Deposit

$100

Regulators

CFT, NFA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FOREX.com is the best forex broker for beginners in Botswana. FOREX.com is a broker renowned for low trading fees and beginner-friendly solutions. In addition, FOREX.com offers several educational materials and a helpful demo account.

Best Low Minimum Deposit Forex Broker in Botswana

Min Deposit

$10 / 134 BWP

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Exness is the best Low Minimum Deposit Forex Broker in Botswana. Exness has a minimum deposit requirement of 10 USD / 130 BWP, making it easy for Botswanans to start trading 278 instruments.

Exness also offers MT4 and MT5 through which trades can be made. In addition, it offers some of the best trading tools, charting capabilities, technical indicators, expert advisors, and more.

Best ECN Forex Broker in Botswana

Min Deposit

USD 0

Regulators

CySEC, FCA, DFSA, FSCA, FSA, CMA

Trading Desk

MT4, MT5, HFM APP

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

0

Account Activation Time

24 Hours

Overall, HFM is the best ECN forex broker in Botswana. HFM is a hybrid forex and CFD broker that uses STP and ECN technology to ensure that Botswanans get the best pricing, minimal slippage, no requotes, and the fastest trade execution.

HFM uses the best liquidity providers who aggregate the pricing that Botswanans can see on MT4, MT5, and the HF App for Android and iOS.

Best Islamic / Swap-Free Forex Broker in Botswana

Min Deposit

USD 10 / 136 BWP

Regulators

CySec, FCA

Trading Desk

None

Crypto

Yes

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, eToro is the best Islamic / Swap-Free forex broker in Botswana. eToro is a renowned social trading platform that offers Muslim traders an Islamic Account.

eToro does not charge any interest on positions held for over 24 hours. However, registering an Islamic Account can be expensive initially, requiring a 1,000 USD / 13,400 BWP deposit.

Best Forex Trading App in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

ASIC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

300

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, CMC Markets is the best forex trading app in Botswana. In addition, CMC Markets offers a user-friendly mobile app with research tools, powerful charts, customizable watch lists, news reports, and a range of educational materials.

Best Lowest Spread Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

FCA, CySEC, IFSC, KNF

Trading Desk

No Trading Desk

Crypto

Yes

Total Pairs

48

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, XTB is the best lowest-spread forex broker in Botswana. XTB is a well-known forex and CFD broker with low and competitive forex spreads from 0.1 pips depending on the financial instrument and the market conditions.

XTB is also a good broker in terms of educational materials and research capabilities, providing traders with comprehensive market analysis across markets.

Best Nasdaq 100 Forex Broker in Botswana

Min Deposit

USD 10

Regulators

CySec, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

60

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXTM is the best Nasdaq 100 forex broker in Botswana. FXTM is a multi-regulated forex and CFD broker that accommodates Botswanan traders with a keen interest in Nasdaq. Traders can expect low and competitive spreads, a choice between accounts, and powerful trading platforms.

Best Volatility 75 / VIX 75 Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

IGRs

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, IG is Botswana’s best Volatility 75 / VIX 75 forex broker. IG is one of the best CFD brokers with powerful proprietary trading technology.

IG is well-regulated and offers Botswanans access to VIX75, with spreads from 0.04 pips / 0.13% and zero commission charges.

Best NDD Forex Broker in Botswana

Min Deposit

USD 50 / 672 BWP

Regulators

FCA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

–

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXCM is the best NDD forex broker in Botswana. FXCM is a No-Dealing Desk broker with STP and ECN execution across several markets.

In addition, FXCM offers a choice between third-party platforms in addition to technical indicators, charting tools, and competitive trading conditions.

Best STP Forex Broker in Botswana

Min Deposit

USD 10

Regulators

IFSC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

36

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, RoboForex is the best STP forex broker in Botswana. RoboForex is popular forex and CFD broker with competitive trading conditions. RoboForex offers STP execution with liquidity sourced from top providers.

Botswanans can expect access to over 12,000 instruments via powerful and innovative third-party platforms.

Best Sign-up Bonus Broker in Botswana

Min Deposit

50 USD / 682 BWP

Regulators

CYSEC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Windsor Brokers is the best sign-up bonus broker in Botswana. Windsor Brokers is a well-regulated broker that offers Botswanans a welcome account funded with 30 USD in trading credit. With this account, Botswanans can explore the platform or risk-free test their strategies.

You might also like: Best cTrader Brokers in Botswana

You might also like: Best Forex Trading Apps in Botswana

You might also like: Best Forex Trading Strategies in Botswana

You might also like: Best High Leverage Forex Brokers in Botswana

You might also like: Best Low Minimum Deposit Brokers in Botswana

Conclusion

Overall, when Botswanan traders perform the necessary research on a Micro Currency Trading Platforms, they have a better chance of maximizing their potential profits from trading using one of these platforms. A trader needs to have a solid trading plan and a risk management strategy in place before using a micro currency trading platform.

Frequently Asked Questions

What is a micro trading account?

A retail investor who wants exposure to foreign exchange (forex) trading but doesn’t want to risk a significant amount of money can use a micro account, which is designed specifically for them. A micro account’s smallest contract, also known as a micro lot, is a predetermined quantity equal to one tenth of a normal lot, which is equivalent to a total of one thousand units of currency.

What is a good lot size for a $10 Forex account?

Look for brokers who have a minimum trade size of at least 0.1 lot, with some offering even lower minimums of 0.01 lot. You will be able to conduct profitable trades with a low starting capital outlay by using these lot sizes. For instance, the initial investment for opening a trade with a 0.01 lot size would be $1,000, or $10 with leverage.

Can you make money with $100 in Forex?

If you want to trade on the foreign exchange market, all you need is one hundred dollars to get started, and it can even provide you a new way to earn money from the comfort of your own home. Many people are aware that one hundred dollars does not buy very much in today’s economy, but it can go far with Forex trading.

How much can a beginner make with Forex trading?

This is contingent on the amount of capital that you put at risk with each trade. If you are willing to take a risk of $1,000, you have the potential to earn $20,000 year on average. If you are willing to take a risk of $3000, you have the potential to earn an average of $60,000 every year. If you are willing to take a risk of $5000, you have the potential to earn an average of $100,000 every year.

Can I learn Forex on my own?

Even while it is feasible to teach yourself forex trading on your own, it is strongly recommended that you seek the guidance of an experienced trader.

There are a plethora of internet resources and discussion forums that you may participate in to gain knowledge from more seasoned traders. You should also think about getting a demo trading account so that you can get some experience under your belt before trading with real money.

Who are the best micro currency platform brokers?

- FXTM

- FxPro

- FXOpen

- RoboForex

- XM

- BDSwiss

Which brokers are best for beginner traders?

- AvaTrade

- Exness

Which brokers offer a sign-up bonus to first-time traders?

- FXOpen

- RoboForex

- XM

- BDSwiss

Which trading platforms offer IOS and ANDROID Apps for Botswana?

- FXTM

- FxPro

- FXOpen

- RoboForex

- XM

- BDSwiss

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review