7 Best FTSE 100 Brokers in Botswana

The 7 Best FTSE 100 Index Forex Brokers in Botswana revealed. We tested and verified the best FTSE Index forex brokers for Botswana Stock Traders.

This is a complete list of the Best FTSE one hundred index forex brokers in Botswana.

In this in-depth guide you’ll learn:

- What is the FTSE 100 Index?

- How to choose a forex broker for your trading style.

- How can I invest in the FTSE Index?

- Can international investors trade the FTSE Index?

- How are dividends distributed to investors in the FTSE 100?

- What risks should I be aware of when investing in the FTSE Index?

And lots more…

So if you’re ready to go “all in” with the best UK FTSE 100 brokerages for Botswanans…

Let’s dive right in…

- Louis Schoeman

Best FTSE 100 Brokers in Botswana

| 🏛️ Broker | 👉 Open Account | 💵 Minimum Deposit | ✔️ FTSE100 Broker? | ✔️ Offers a Botswana Pula Account? |

| 1. Exness | 👉 Open Account | $10 / 134 BWP | Yes | Yes |

| 2. AvaTrade | 👉 Open Account | $100 / 1 342 BWP | Yes | Yes |

| 3. IG | 👉 Open Account | USD 250 / 3 363 BWP | Yes | No |

| 4. eToro | 👉 Open Account | USD 10 / 136 BWP | Yes | No |

| 5. Plus500 | 👉 Open Account | $100 / 1 342 BWP | Yes | No |

| 6. XM | 👉 Open Account | USD 5 / 67 BWP | Yes | No |

| 7. HFM | 👉 Open Account | USD 0 / 0 BWP | Yes | Yes |

10 Best Forex Brokers in Botswana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

What is the FTSE 100?

When it comes to the market capitalization of firms listed on the London Stock Exchange (LSE), the Footsie is the index that shows the 100 biggest. The FTSE 100 accounts for almost 80% of the LSE’s total market valuation.

The Financial Times and the London Stock Exchange (LSE) are its founding institutions, thus the name “FTSE.” The London Stock Exchange Group controls and maintains the FTSE, a prominent indication of market success.

It is as important in London as the Dow Jones Industrial Average, or the S&P 500 are in the United States. In Europe, the FTSE 100 is extensively followed.

The index began at 1000 in January 1984, when it was first created. Since then, it has risen to over 7,000, an all-time high. The FTSE 100 is determined by adding the index value to the combined market capitalization of its component firms.

Since the value of an index is based on the total market capitalization, it fluctuates during the trading day as the prices of the underlying stocks do.

The FTSE 100’s daily gains and losses are compared to the previous day’s market closing when being quoted. Every day, it is computed continually at 8 AM with the market opening and ending at 4h30 PM with the closing of trade on the LSE.

7 Best FTSE 100 Brokers in Botswana

1. Exness

Overview

Exness is a well-known international online forex brokerage firm that focuses on delivering retail foreign exchange services, partnership opportunities, and corporate solutions to customers located all over the globe.

Exness makes a comprehensive selection of products available to its customers, including Forex, Crypto, Metals, Energies, and many more.

Min Deposit

$10 / 134 BWP

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Traders have been given new chances, the ability to experience various financial services, and continuous prospects for development thanks to Exness.

The trading process is carried out on the intuitive MT4/5 platforms, which enable the investor to trade, test strategies, carry out in-depth analysis on the FTSE 100, and more.

Features

| Feature | Information |

| ⚖️ Regulation | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Standard Account, Standard Cent Account, Raw Spread Account, Zero Account, Pro Account |

| 📊 Trading Platform | MetaTrader 4, MetaTrader 5, Exness Terminal, Exness Trader app |

| 💰 Minimum Deposit | $10 / 134 BWP |

| 💰 Trading Assets | Forex minor pairs, forex major pairs, forex exotic currency pairs, Metals, Crypto, Energies, Indices, Stocks |

| 🔎 Botswanan Pula-based Account? | No |

| 💳 BWP Deposits Allowed? | Yes |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 0.0 pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | No |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Exness is a reputable international broker authorized by several reputable market regulators | There is a limited selection of tradable instruments in only a few financial markets |

| The broker offers some of the tightest spreads across all types of accounts | There is a limited selection of funding options offered |

| There are several account types to choose from, each accommodating different types of traders | |

| There are various market metrics available including exchange rates, overall trading activities available, current market conditions, and more. | |

| Exness is ideal for any Botswanan beginner traders and institutional investors | |

| There are solutions offered for any type of professional trader who needs advanced options | |

| There is a powerful proprietary mobile app offered | |

| Client fund safety and investor protection is guaranteed | |

| Multilingual 24/7 customer support is offered | |

| Instant withdrawal methods are available |

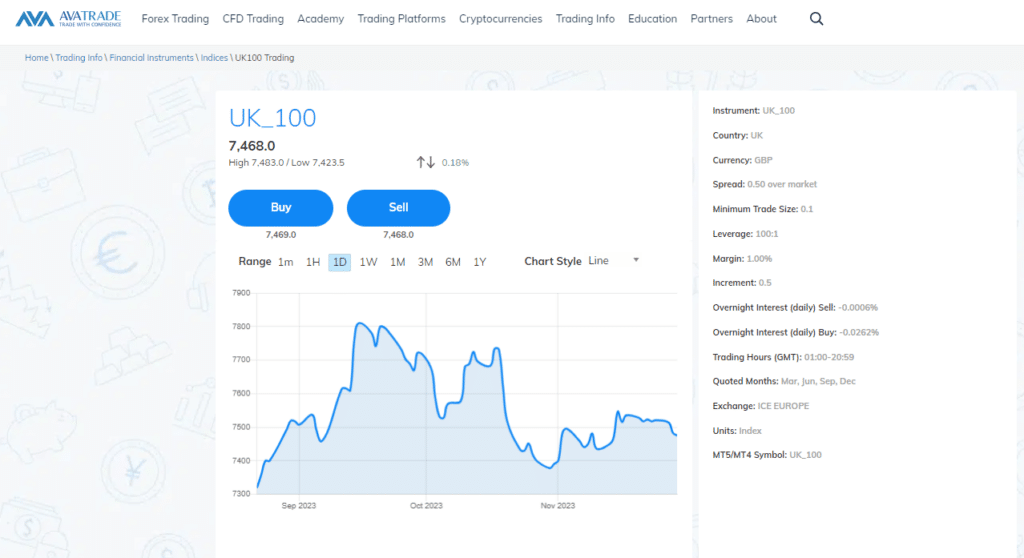

2. AvaTrade

Overview

AvaTrade is an international forex and CFD broker that has been operating since 2006. AvaTrade is regulated by many top-tier financial regulators, including the ASIC, the FSA, and the Central Bank of Ireland, to mention a few.

AvaTrade provides 33 distinct stock index CFDs, 625 Stock CFDs, and 59 ETF CFDs as traded products. Contract for difference trading might be a difficult issue for novice traders. However, AvaTrade provides AvaSocial, a smartphone application for social trading.

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

AvaSocial is a terrific tool for novice investors since it enables them to communicate with other investors and imitate their transactions with a single click.

Regarding costs, suppose you want to trade the FTSE 100 CFD. Then, during peak trading hours and with costs included in the spread, this broker’s average spread is 0.5 points. In addition to its industry-leading spread structure, AvaTrade allows its customers to trade CFDs with zero fees.

Furthermore, AvaTrade offers a vast array of other financial assets, ranging from forex to commodities trading. Therefore, you will likely reach most of your financial objectives using AvaTrade.

Features

| Feature | Information |

| ⚖️ Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, FRSA, CySEC, ISA |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Retail Investor Account, Professional Account Option |

| 📊 Trading Platform | AvaTradeGO, AvaOptions, AvaSocial, MetaTrader 4, MetaTrader 5, DupliTrade, ZuluTrade |

| 💰 Minimum Deposit (BWP) | $100 / 1343 BWP |

| 💰 Trading Assets | Foreign currencies, Cryptocurrencies, Commodities, Treasuries, Bonds, Indices, Stocks, ETFs, Options, CFDs, Precious Metals |

| 🔎 Botswanan Pula-based Account? | No |

| 💳 BWP Deposits Allowed? | No |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 0.9 pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| AvaTrade is multi-regulated and one of the most trusted online trading brokers in the world | Variable spreads are not offered |

| There is a wide range of financial instruments that can be traded across financial markets | There is a limited choice between account types |

| There are several technical indicators, economic indicators, and other solutions for advanced traders | Inactivity fees are applied |

| There are several trading platforms to choose from | Currency conversion fees may be applied |

| There is a decent selection of educational material that helps beginner traders navigate complex instruments and lower the degree of risk they are often exposed to | There is a limited number of base currency options offered on accounts |

| There is a multitude of social trading opportunities offered | |

| The broker accepts any trading strategy including automated trading, expert advisors, scalping, hedging, and others. |

3. IG

Overview

Trading with IG is the best option if you want to begin with a large CFD trading firm with years of expertise and various licenses provided by recognized regulating agencies.

Since its introduction to traders in 1974, this label has amassed an impressive number of industry accolades, including the most recent Best Multi-Platform Provider at the 2024 ADVFN International Financial Awards.

Min Deposit

USD 0 / 0 BWP

Regulators

IGRs

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

IG’s spreads, commissions, and fees are exceptionally low compared to other key participants in the online trading market. Moreover, everything you need to know is meticulously organized and readily available without logging in.

Affordability is not a problem except for the minimum deposit of 3,300 BWP / $250 when Botswanans register a live trading account.

Features

| Feature | Information |

| ⚖️ Regulation | FCA, BaFin, CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, CFTC, FINRA, NFA, BMA |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | IG Trading Account, IG Professional Account, IG Options Trading Account, IG Turbo24 Account, Limited Risk Account, Share Dealing Account, Exchange Account (NADEX) |

| 📊 Trading Platform | MetaTrader 4, IG Platform, ProRealTime (PRT), L2 Dealer, FIX API |

| 💰 Minimum Deposit | USD 250 / 3 363 BWP |

| 💰 Trading Assets | Forex, Shares, Indices, Commodities, Cryptocurrencies, Interest Rates, Bonds, ETFs, Futures, Options |

| 🔎 Botswanan Pula-based Account? | No |

| 💳 BWP Deposits Allowed? | Yes |

| 💰 Bonuses for Botswanan traders? | No |

| 📈 Minimum spread | 0.1 pips (DMA) on EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | No |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Offers a significant range of financial instruments, including Botswanan-specific trading instruments | High minimum deposit charged |

| There are several powerful trading platforms offered | Inactivity fees apply |

| There are competitive trading conditions that include low spreads, low commissions, and reliable trade execution | |

| Traders can get free trading signals | |

| There is a comprehensive IG Academy offered with dedicated educational resources | |

| Convenient funding options provided along with free deposits and withdrawals | |

| FIX API Direct Market Access trading is offered | |

| There are Swap-Free Accounts offered for Islamic traders |

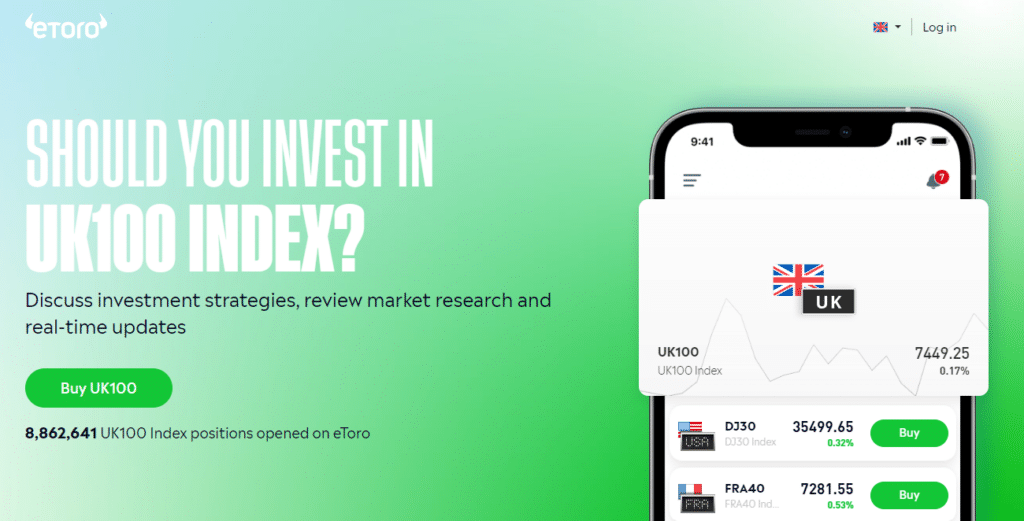

4. eToro

Overview

After more than a decade in business, eToro has earned a solid reputation as one of the best trading platforms in the world. The indexes, stocks, cryptocurrencies, commodities, and exchange-traded funds (ETFs) are all covered by the brokerage’s extensive activities.

In addition, eToro has opted to forego integration with third-party trading systems to develop intuitive online and mobile-based proprietary solutions. More than 3,000 financial items can be traded on this custom-built platform without a hitch.

Min Deposit

USD 10 / 136 BWP

Regulators

CySec, FCA

Trading Desk

None

Crypto

Yes

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Most notably, eToro has a tool called “copy trading” that lets less-experienced traders mimic the actions of the platform’s most successful users. In addition, Botswanans can access valuable data on a trader’s equity growth and other key metrics by clicking on the statistics page.

Trading opportunities on eToro now extend to several regional and global market indexes. The UK100, the NSDQ100, the SPX500, the GER40, and the DJ30 are among the most followed. In addition, opening leveraged long or short bets is possible while trading with CFDs.

Features

| Feature | Information |

| ⚖️ Regulation | CySEC, FCA, ASIC, FinCEN, FINRA, SIPC, DNB, FSA |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Retail, Professional |

| 📊 Trading Platform | eToro trading app and web-based platform |

| 💰 Minimum Deposit | 136 BWP equivalent to $10 |

| 💰 Trading Assets | Forex pairs, Commodities, Exchange-Traded Funds (ETFs), Indices, Stocks, Crypto trading, Stocks |

| 🔎 Botswanan Pula-based Account? | No |

| 💳 BWP Deposits Allowed? | No |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 1 pip EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| eToro has a strict and solid regulatory framework | There are limitations on leverage for retail traders |

| Client fund safety is guaranteed and there is consumer protection offered | There is a limited selection of retail investor accounts |

| eToro offers commission-free trading | Fixed spreads are not offered |

| There are over 2,000 complex instruments that can be traded | The spreads are not the tightest |

| The broker offers several trading opportunities and a social trading feature | There is a high minimum deposit on the Islamic Account |

| There is an award-winning proprietary platform offered | There is an inactivity fee charged on dormant accounts |

| eToro offers 24/6 dedicated customer services | |

| eToro offers a demo account and an Islamic Account | |

| Algorithmic trading and margin trading supported | |

| Real time quotes are offered alongside a wide range of benefits | |

| The mobile app is secure and features robust security such as two-factor authentication | |

| The app can be used as a wallet app for digital currencies | |

| Offers several resources that help traders make improved financial decisions with confidence | |

| Offers several helpful tools and services as a solid basis for investment decision along with investment advice | |

| Provides access to several popular cryptocurrencies that can be traded and crypto staking services | |

| There is a comprehensive portfolio management service and popular investor program offered |

5. Plus500

Overview

Plus500 has been in operation since 2008 and it is a multi-regulated and trusted CFD provider that has offices in Singapore, Australia, Cyprus, and the United Kingdom, with respective regulations and authorization in each region.

Min Deposit

USD100

Regulators

CySEC, FCA, MAS, FSA, ASIC, FMA, FSCA

Trading Desk

WebTrader

Total Pairs

70

Crypto

Yes (Availability subject to regulations)

Trading Fees

Low

Account Activation Time

24 Hours

Plus500 is well-known as a leading CFD provider that offers traders a wide range of tradable instruments, competitive trading conditions, commission-free trading, and a powerful proprietary trading platform through which trades can be executed seamlessly on mobile and desktop.

Features

| Feature | Information |

| ⚖️ Regulation | ASIC, FMA, FSCA, FCA, CySEC, FSA, MAS |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Standard trading account |

| 📊 Trading Platform | Proprietary mobile trading app mobile devices and web-based trading |

| 💰 Minimum Deposit | 1 343 Botswanan Pula equivalent to $100 |

| 💰 Trading Assets | Forex, Indices, Commodities, Cryptocurrencies, Shares, Options, Exchange-Traded Funds (ETFs) |

| 🔎 Botswanan Pula-based Account? | No |

| 💳 BWP Deposits Allowed? | No |

| 💰 Bonuses for Botswanan traders? | No |

| 📈 Minimum spread | 0.8 pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | No |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Plus500 is well-regulated and has a high trust score | There is an inactivity fee charged on dormant accounts after a few months of inactivity |

| There is multilingual customer service offered 24/7 across communication channels | Guaranteed stops come at an additional charge |

| All client funds are held in segregated accounts | Plus500 restricts retail traders in certain regions |

| There is a wide range of markets to choose from | Restricted maximum leverage |

| The trading costs are low and can suit any financial restrictions that traders may have, especially novice traders | Trading strategies such as expert advisors, automated trading, hedging, scalping, and others, are prohibited |

| There are no commissions charged on trades | There is no desktop platform offered |

| There are no deposit fees charged | |

| The proprietary platform is robust |

6. XM

Overview

XM is one of the largest brokers in the world with a client base of more than 2.5 million registered forex traders. Established in 2009, XM has grown to become a world-renowned CFD and forex broker that offers comprehensive trading solutions and some of the best trading conditions.

Min Deposit

USD 5 / 67 BWP

Regulators

IFSC, CySec, ASIC

Trading Desk

Desktop MT4 and MT5, Mobile MT4 and MT5, XM mobile app, Web platform

Total Pairs

57

Islamic Account

Yes

Trading Fees

No (Just spread)

Account Activation Time

24 Hours

XM caters to both beginner and professional traders, offering a large and impressive selection of financial instruments which are spread across several financial markets including forex, commodities, indices such as the FTSE 100, and several more.

Features

| Feature | Information |

| ⚖️ Regulation | FSCA, IFSC |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | $5 / 67 BWP |

| Average spread from | 0.0 pips EUR/USD |

| 📈 Maximum Leverage | 1:1000 |

| 👥 Customer Support | 24/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Negative balance protection is applied to retail investor accounts | US clients are restricted from accessing XM’s trading services |

| There are several secure payment methods to choose from | There are no fixed spread accounts offered |

| The broker is known for low spreads, low commissions, and reliable trade execution speeds | There is an inactivity fee applied to dormant accounts |

| Traders can use hedging, scalping, and expert advisor trading strategies | |

| The broker offers personal customer service to its clients |

7. HFM

Overview

There seems to be enough justification for the HFM Group to claim that it is an award-winning conglomerate.

HFM has received several major accolades recently, including “Best Multi-Asset Broker Global” at the 2021 Pan Finance Awards and “Best CFD Trading Conditions 2021” by the World Economic Magazine.

HFM’s component firms are governed by the CySEC, FSA, FCA, FSC, CMA, FSCA, and DFSA. The brokerage is also authorized to do business in 28 European countries.

Over a thousand different trading products (indices, foreign exchange, metals, energy, contracts for difference (CFD) stocks, bonds, commodities, physical stocks, and exchange-traded funds (ETFs) are available to HFM users.

Min Deposit

USD 0

Regulators

CySEC, FCA, DFSA, FSCA, FSA, CMA

Trading Desk

MT4, MT5, HFM APP

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

0

Account Activation Time

24 Hours

Spot and futures contracts can trade the UK 100 and other indexes. As a result, Botswanans can get protection against a negative balance no matter what kind of asset they are trading.

HFM’s goal is to appeal to a wide range of traders. Hence, the company offers four distinct accounts, each with its own minimum deposit requirements and general focus. Because the terms and conditions may vary from country to country, we urge you to read them carefully.

In addition, Botswanans must consider their account’s currency, margin call, and stop-out level. HFM’s demo account is useful since it simulates real-world trading conditions as precisely as possible, allows unlimited use, and offers a virtual balance of up to $100,000.

Features

| Features | Information |

| ⚖️ Regulation | FSCA, CySEC, DFSA, FSA, FCA, CMA, and FSC, with registration in ACPR, BaFin, MNB, CONSOB, CNMV, FI, FMA, FSC, and other regions |

| 💸 Minimum Withdrawal Time | – |

| 📈 Maximum Withdrawal Time | 2 to 4 working days |

| 💰 Instant Deposits/Withdrawals? | Yes, deposits |

| 💳 BWP-Denominated Account? | No |

| 📱 Minimum Deposit Amount | $0 / 0 BWP |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| HFM does not charge any deposit fees when Botswanans transfer funds to a trading account | HFM does not support BWP as a deposit currency or an account base currency, which could result in currency conversion fees |

| There are competitive spreads charged | HFM’s spreads are wider on entry-level accounts |

| HFM is a transparent broker that does not have any hidden broker fees | |

| Botswanans need not worry about withdrawal fees when they transfer funds from the trading account |

How to Choose the Right CFD Broker in Botswana

Botswanan traders must evaluate the following components of a forex broker to decide whether the broker is suited to their unique trading objectives or needs.

Regulations and Licenses

This is the first vital component that Botswanan traders must thoroughly evaluate. Reputable brokers are regulated by market regulators such as FCA, ASIC, CySEC, FSCA, and others.

Botswanans must beware when dealing with brokers with only offshore regulations such as FSA, SVG BVI, FSC, and others.

Account Features

Account Features include leverage trading and margin requirement, commissions and spreads, initial deposit, additional features on retail investor accounts, and so on.

Deposits and Withdrawals

Botswanans must evaluate the payment options available, the processing times on withdrawal requests, deposit currencies offered, the withdrawal fee, deposit fees, and minimum withdrawal limits, among other trading and non-trading fees.

Range of Markets

The range of markets offered refers to the number and range of tradable instruments the broker offers. Therefore, Botswanans must consider what they wish to trade and what is available.

Customer Support

Customer Support is another crucial factor. Botswanans must check the availability of support (trading hours), the quality of support, and the promptness with which the customer support team responds to queries.

Trading Platform

A trading platform is the Botswanan trader’s portal to the financial markets. Therefore, traders must ensure that the trading platform has the necessary technical indicators, fundamental analysis, technical analysis, economic calendar, charting, newsfeed, and other tools they may need.

Education and Research

Education and Research come in handy to both novice traders and experienced investors. Education includes some of the following:

➡️ eBooks

➡️ Trading guides

➡️ Trading knowledge on leveraged products

➡️ A risk warning on complex instruments

➡️ Educational videos

Research can include some of the following:

➡️ Trading tools

➡️ Commentary

➡️ Status of International Markets

➡️ Price movements

➡️ Market sentiments

➡️ Whether there is a volatile market

➡️ Exchange Rates

➡️ Expert opinions and other resources can help experienced traders make informed trading decisions.

The Best Forex Brokers in Botswana

In this article, we have listed the best brokers that offer forex trading to traders in Botswana. In addition, we have further identified the brokers that offer additional services and solutions to Botswanan traders.

Best MetaTrader 4 / MT4 Forex Broker in Botswana

Min Deposit

USD 25

Regulators

FCA UK

Trading Platform

MT5, MT4, OctaTrader

Crypto

Yes

Total Pairs

28

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, OctaFX is the best MT4 forex broker in Botswana. OctaFX is an MT4 and MT5 broker that provides Botswanans with various markets. OctaFX offers a choice of accounts via MT4, including ECN and STP accounts, with superior trade execution.

Best MetaTrader 5 / MT5 Forex Broker in Botswana

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, AvaTrade is the best MetaTrader 5 forex broker in Botswana. In addition, AvaTrade is regarded as one of the most secure MT5 forex brokers.

No commission is charged for trading currency pairings, only leaving the spread to be paid. A demo account is also available for traders to sharpen their abilities via MT5 and several other platforms.

Best Forex Broker for beginners in Botswana

Min Deposit

$100

Regulators

CFT, NFA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FOREX.com is the best forex broker for beginners in Botswana. FOREX.com is a broker renowned for low trading fees and beginner-friendly solutions. In addition, FOREX.com offers several educational materials and a helpful demo account.

Best Low Minimum Deposit Forex Broker in Botswana

Min Deposit

$10 / 134 BWP

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Exness is the best Low Minimum Deposit Forex Broker in Botswana. Exness has a minimum deposit requirement of 10 USD / 130 BWP, making it easy for Botswanans to start trading 278 instruments.

Exness also offers MT4 and MT5 through which trades can be made. In addition, it offers some of the best trading tools, charting capabilities, technical indicators, expert advisors, and more.

Best ECN Forex Broker in Botswana

Min Deposit

USD 0

Regulators

CySEC, FCA, DFSA, FSCA, FSA, CMA

Trading Desk

MT4, MT5, HFM APP

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

0

Account Activation Time

24 Hours

Overall, HFM is the best ECN forex broker in Botswana. HFM is a hybrid forex and CFD broker that uses STP and ECN technology to ensure that Botswanans get the best pricing, minimal slippage, no requotes, and the fastest trade execution.

HFM uses the best liquidity providers who aggregate the pricing that Botswanans can see on MT4, MT5, and the HF App for Android and iOS.

Best Islamic / Swap-Free Forex Broker in Botswana

Min Deposit

USD 10 / 136 BWP

Regulators

CySec, FCA

Trading Desk

None

Crypto

Yes

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, eToro is the best Islamic / Swap-Free forex broker in Botswana. eToro is a renowned social trading platform that offers Muslim traders an Islamic Account.

eToro does not charge any interest on positions held for over 24 hours. However, registering an Islamic Account can be expensive initially, requiring a 1,000 USD / 13,400 BWP deposit.

Best Forex Trading App in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

ASIC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

300

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, CMC Markets is the best forex trading app in Botswana. In addition, CMC Markets offers a user-friendly mobile app with research tools, powerful charts, customizable watch lists, news reports, and a range of educational materials.

Best Lowest Spread Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

FCA, CySEC, IFSC, KNF

Trading Desk

No Trading Desk

Crypto

Yes

Total Pairs

48

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, XTB is the best lowest-spread forex broker in Botswana. XTB is a well-known forex and CFD broker with low and competitive forex spreads from 0.1 pips depending on the financial instrument and the market conditions.

XTB is also a good broker in terms of educational materials and research capabilities, providing traders with comprehensive market analysis across markets.

Best Nasdaq 100 Forex Broker in Botswana

Min Deposit

USD 10

Regulators

CySec, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

60

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXTM is the best Nasdaq 100 forex broker in Botswana. FXTM is a multi-regulated forex and CFD broker that accommodates Botswanan traders with a keen interest in Nasdaq. Traders can expect low and competitive spreads, a choice between accounts, and powerful trading platforms.

Best Volatility 75 / VIX 75 Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

IGRs

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, IG is Botswana’s best Volatility 75 / VIX 75 forex broker. IG is one of the best CFD brokers with powerful proprietary trading technology.

IG is well-regulated and offers Botswanans access to VIX75, with spreads from 0.04 pips / 0.13% and zero commission charges.

Best NDD Forex Broker in Botswana

Min Deposit

USD 50 / 672 BWP

Regulators

FCA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

–

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXCM is the best NDD forex broker in Botswana. FXCM is a No-Dealing Desk broker with STP and ECN execution across several markets.

In addition, FXCM offers a choice between third-party platforms in addition to technical indicators, charting tools, and competitive trading conditions.

Best STP Forex Broker in Botswana

Min Deposit

USD 10

Regulators

IFSC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

36

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, RoboForex is the best STP forex broker in Botswana. RoboForex is popular forex and CFD broker with competitive trading conditions. RoboForex offers STP execution with liquidity sourced from top providers.

Botswanans can expect access to over 12,000 instruments via powerful and innovative third-party platforms.

Best Sign-up Bonus Broker in Botswana

Min Deposit

50 USD / 682 BWP

Regulators

CYSEC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Windsor Brokers is the best sign-up bonus broker in Botswana. Windsor Brokers is a well-regulated broker that offers Botswanans a welcome account funded with 30 USD in trading credit. With this account, Botswanans can explore the platform or risk-free test their strategies.

You might also like: Best MT4 Brokers in Botswana

You might also like: Best MT5 Brokers in Botswana

You might also like: Best cTrader Brokers in Botswana

You might also like: Best FTSE 250 Brokers in Botswana

You might also like: Best PAMM Account Forex Brokers in Botswana

Conclusion

Traders and investors often look to the FTSE 100 to gauge the state of the UK stock market and economy. Derivatives like contracts for difference (CFDs) allow Botswanans to trade the FTSE 100 and speculate on price changes (both up and down) without holding any of the underlying assets.

As a result of the leverage inherent in both products, a very modest initial outlay of capital (the “margin”) is needed to get substantial exposure.

However, keep in mind that when using leverage, your losses or gains might far exceed your initial margin deposit since they are based on the total size of your investment. In addition, Botswanans must ensure that they choose a dependable broker through which to trade FTSE 100.

Frequently Asked Questions

How can Botswanans trade the FTSE 100?

Botswanans can decide on the type of trader they want to be and their investment horizon. Next, they can create a trading plan according to that information, implement a solid risk management plan, and start studying charts.

Botswanans can also use technical analysis to find signals and indicators and set trading alerts to ensure that they remain updated on market movements and trading opportunities. Once Botswanans have selected a suitable CFD broker, they can start trading.

Can Botswanans buy shares in the FTSE 100?

Botswanans cannot invest directly in the FTSE 100, but they can invest in ETFs or index funds. This is an extremely promising option for traders who want exposure to all the companies in FTSE 100.

Is it worth it for Botswanans to invest in the FTSE 100?

The FTSE 100 can be smart if you want a promising long-term investment. Since many stocks are cheap now, investing in them might provide a healthy profit in the next five to ten years.

What is the best time for Botswanans to trade the FTSE 100?

The FTSE 100 is the most profitable to trade when the volume is high. Typically, this occurs when the London Stock Exchange opens for the day (8 AM UK time or 10 AM in Botswana). As traders start talking to one another, volatility and liquidity should increase.

Can Botswanans make money investing in FTSE 100?

As the leading index and experts’ dividend projections fail to make significant headway, the FTSE 100 yield is anticipated to settle around 4.1% in 2024.

How can I invest in the FTSE Index?

Investors can gain exposure to the FTSE Index through various financial instruments. One common method is investing in exchange-traded funds (ETFs) that track the FTSE 100. These ETFs are traded on stock exchanges, providing a convenient way to invest in the overall performance of the index.

Can international investors trade the FTSE Index?

Yes, international investors can trade the FTSE Index through online brokerage platforms that provide access to global markets. Investors should be mindful of currency exchange rates, trading hours, and any regulatory considerations associated with cross-border trading.

How are dividends distributed to investors in the FTSE 100?

Dividends are typically distributed to investors in the FTSE 100 through cash payments. Shareholders receive a portion of the company’s profits for each share they own. These payments are usually made on a regular basis, often quarterly or annually, depending on the company’s dividend policy.

What risks should I be aware of when investing in the FTSE Index?

Investing in the FTSE Index carries inherent risks, including market volatility, economic uncertainties, and geopolitical factors. Diversification, understanding risk tolerance, and staying informed about market conditions are crucial for managing these risks effectively.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review