8 Best Futures Trading Platforms in Botswana

The 8 Best Futures Trading Platforms in Botswana revealed. We tested and verified the best futures trading platforms for Botswanan Traders.

This is a complete list of futures trading platforms in Botswana.

In this in-depth guide you’ll learn:

- What is a Futures Trading Platform?

- Which futures trading platforms are best for Botswana Beginners?

- Which futures trading platforms are available on mobile (IOS and Android) devices?

- Which brokers have interactive futures trading platforms?

- Which broker offers a low $5 (64 BWP) minimum deposit?

- Which brokers offer a sign-up bonus for first-time traders?

And lots more…

So if you’re ready to go “all in” with the best futures trading platforms for Botswanans…

Let’s dive right in…

- Louis Schoeman

10 Best Forex Brokers in Botswana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

What is Futures Trading, and how does it work?

Contracts for purchasing or selling a commodity or securities at a predetermined future date and price are known as futures.

Futures contracts, or “futures” for short, are exchanged on futures exchanges like the CME Group by brokers with a special account that allows them to trade futures. Like an options contract, a futures contract requires the participation of a buyer and a seller.

When a futures contract expires, the buyer must purchase and receive the underlying asset, and the seller must furnish and deliver the underlying item. At the same time, options could become worthless upon expiry.

Individual investors and traders use futures contracts to hedge their bets against the risk of a decline in the underlying asset’s value. Moreover, they anticipate financial gain by speculating on the future price movement of a commodity, index, or other financial instruments.

Some investors use futures as a hedging strategy to protect their portfolios or businesses from the potential adverse effects of price fluctuations in a specific commodity.

8 Best Futures Trading Platforms in Botswana

- ✔️ TD Ameritrade – Overall, Best Futures Trading Platform Broker

- ✔️ Lightspeed – Top Diversified Products Broker

- ✔️ Interactive Brokers – Most Affordable Commission Plan

- TradeStation – Best Platform for Experienced Traders

- E*TRADE – Top Platform for Beginner Traders

- tastyworks – Best Desktop Futures Trading Platform in Botswana

- NinjaTrader – Top Innovative Trading Tools

- Charles Schwab – Best Commission-Free Stock Trading Platform

1. TD Ameritrade

TD Ameritrade’s research and education sections are particularly useful for novice investors because of their extensive market and stock/fund coverage. In addition, you may trade as many securities with this broker as you can with any of its competitors.

In terms of stock trading and retirement planning, TD Ameritrade has you covered in every way a full-service brokerage should. Forex and futures trading is accessible to traders with any account.

Overall Rating

- 4.7/5

Min Deposit

$0

Regulators

SEC, FINRA, CFTC, MAS

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

–

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

There are two mobile applications available from TD Ameritrade: TD Ameritrade Mobile, which is geared toward infrequent traders, and thinkorswim Mobile, which is geared toward frequent traders who need a wide range of tools.

Both programs have several features and could be useful for trading. However, before you can fully use those features, there is a learning curve. The ability to personalize charts and choice chains is fantastic. However, it adds a degree of complexity to the usage of these tools.

Features

| Feature | Information |

| ⚖️ Regulation | FINRA, CFTC, SEC, SFC |

| 💳 Minimum deposit (BWP) | $0 / 0 BWP |

| 💵 Fees | $2.25 |

| 📈 Promotions | None |

| 🥇 Overall Score | 5/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| There are many different investment options available | A limited number of countries accepted |

| Strong systems that have a wide range of useful features and capabilities | CFDs are not offered |

| TD Ameritrade offers Internet-based and mobile platforms for trading and investing | There are only a few funding and withdrawal options offered |

| Zero-dollar minimum trade commissions and cheap trading costs | USD is the only accepted base currency |

| Wide variety of innovative resources for in-depth market research | The account-opening process is tedious and time-consuming |

| Tools for analysing and comparing various funds | |

| The availability of a wealth of learning materials |

2. Lightspeed

To attract ordinary investors, several online brokers have diversified their products. In contrast, Lightspeed and a select few others have focused on a certain market.

Lightspeed’s limited number of asset types makes it instantly less applicable to a wider range of users. If you are not a high-volume, active trader and cannot afford the $10,000 to $25,000 buy-in, Lightspeed is not for you.

Regarding the stock, options, and futures markets, Lightspeed is the broker of choice for professional day traders, institutional investors, and hedge funds.

Lightspeed Trader is the broker’s principal trading platform. However, they also offer Lightspeed Web & Mobile and Sterling Trader Pro, a fully-featured Level II trading platform with comprehensive charting.

Lightspeed’s website is simple and easy to use, and it takes only a few minutes to sign up for an account. Lightspeed is a trading platform specializing in stocks, options, and futures. It is designed for aggressive traders (you need a separate account to trade futures).

Features

| Feature | Information |

| ⚖️ Regulation | SIPC, FINRA, NFA |

| 💳 Minimum deposit (BWP) | $10,000 / 130,000 BWP |

| 💵 Fees | $1.29 |

| 📈 Promotions | None |

| 🥇 Overall Score | 3/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Lightspeed offers traders access to some of the best trading platforms. | Lightspeed only caters to professional and institutional traders. |

| There are low trading costs involved with trading futures. | There are high commission fees and high minimum deposits. |

3. Interactive Brokers

Investors who often buy and sell stocks, options, and futures, will benefit from using Interactive Brokers. Interactive Brokers has one of the most affordable commission plans out there. In addition, it offers lower commissions on futures and other financial products for high-volume traders.

Futures trading has a large $100,000 / 1.3 million BWP minimum, which is plainly out of reach for many first-time investors.

However, Interactive Brokers is perfect for professional and serious futures traders seeking a low-cost trading platform. Information is the lifeblood of Interactive Brokers.

This service is remarkable because of its wealth of information, the precision of its technical indications, and the extent to which it can be personalized. This is immensely helpful, given the importance of technical analysis to successful futures trading.

Fundamental research benefits similarly from Interactive Brokers’ wealth of high-quality news and other real-world data sources. In addition, Interactive Brokers provides one of the most advanced trading toolkits available.

More than eighty tools, including condition settings, algorithmic and automated triggers, multi-step order construction, and other complicated trading mechanisms, are available on this platform. As a result, Interactive Brokers is a good option if you want a flexible, feature-rich platform.

Features

| Feature | Information |

| ⚖️ Regulation | FINRA, IIROC, FCA, CSSF, CBI, MNB, ASIC, SFC, MAS |

| ⚖️ Regulated in Botswana? | No |

| 📊 Trading Accounts | • IBKR Lite • IBKR Pro |

| 📊 Trading Platform | • IB Client Portal • TWS Desktop • IBKR Mobile • Ibot • IBKR WebTrader (Pro Accounts Only) • IBKR APIs (Pro Accounts Only) |

| 💰 Minimum Deposit (BWP) | 0 BWP ($0) |

| 💰 Bonuses for Botswanan traders? | No |

| 📈 FTSE 100 Average Spread | 0.005% |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | No |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Interactive Brokers provides its IB SmartRouting, which allows Botswanans to see significant price improvements versus the overall industry | Interactive Brokers is not suitable for beginners |

| Traders can expect some of the lowest margin rates in the industry | |

| Traders can earn more when they lend their fully-paid shares | |

| Botswanans can participate in fractional trading | |

| IBKR is one of the most powerful algorithmic platforms that is user-friendly |

4. TradeStation

Even while TradeStation used to cater mostly to wealthy, seasoned, and frequent traders, which has since changed.

TradeStation saw a younger demographic of customers when it eliminated platform fees and lowered minimum deposits, began accepting cryptocurrency, released YouCanTrade, and partnered with TradingView.

More traders across all experience levels are looking for trustworthy platforms. As a result, TradeStation has experienced an increase in consumers who have converted to the service from other providers.

Everything about TradeStation is designed with active traders in mind. So, for example, it has various features, including minimal costs, futures trading, a top-notch trading interface, a plethora of technical tools, and more.

The broker’s fees for trading stocks and ETFs are zero dollars, making it competitive with other large brokers. In addition, TradeStation’s two desktop and online platforms put the broker’s strength in the spotlight.

The flagship desktop platform is highly customizable and designed with serious traders in mind. For example, traders can use custom chart indicators or the broker’s pre-built ones.

In addition, more than 180 technical and fundamental indicators are already included, and you can make your own. Traders can easily backtest any new indicators against decades worth of data.

Features

| Feature | Information |

| ⚖️ Regulation | FINRA |

| 💳 Minimum deposit (BWP) | $0 / 0 BWP |

| 💵 Fees | $1.50 |

| 📈 Promotions | New customers can receive a 50% discount |

| 🥇 Overall Score | 3/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| TradeStation offers some of the best trading platforms packed with features and tools. | Traders must have TS Select to qualify for free trading. |

| Botswanans can expect some of the best research and an active trader community. | The plans offered and their pricing can be confusing to beginners. |

| There are commission-free ETFs, options, and stock trading. | There are high-margin interest rates. |

| There is a plethora of futures products that Botswanans could choose from. | |

| It is cheaper to start trading futures (from 500 USD / 6,500 BWP) compared to other brokers and platforms. |

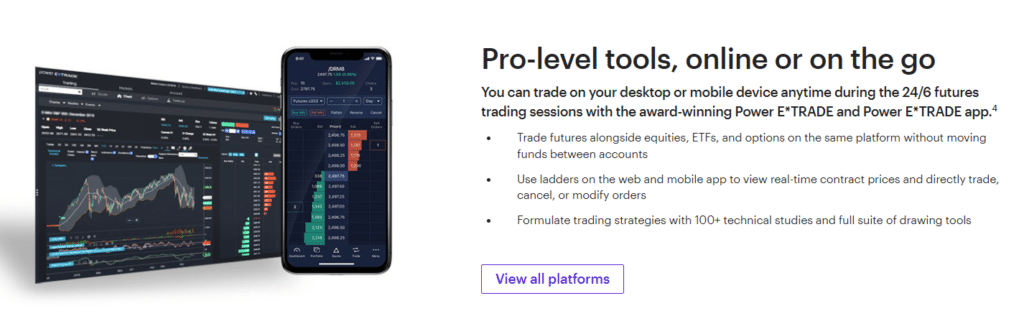

5. E*TRADE

E*TRADE is widely recognized as one of the most forward-thinking brokerage houses around. With Morgan Stanley’s backing, the firm is expanding its offerings.

It offers a wide variety of investment opportunities, retirement accounts, and banking services like checking and high-interest savings, all at low costs and with a significant sign-up bonus. In addition, E*TRADE has several attractive features for novice investors.

It is not a fluke that their user-friendly interface is the most popular. Meanwhile, seasoned investors will value E*TRADE’s superior analytical tools.

E*TRADE’s tools include the Power E*TRADE platform’s commendable advanced charting, technical pattern identification technologies, and live-streaming Bloomberg TV’s coverage of global markets.

As its name implies, Power E*TRADE is aimed at more experienced traders. The live-streaming Bloomberg TV feed is only one of the many features of this user-friendly trading platform.

With over 145 charting tools, E*TRADE is competitive with the finest trading platforms since it caters to technical traders who want in-depth research. In addition, learning about and implementing options strategies and associated risk probabilities is simple.

Paper trading allows inexperienced traders to hone their craft without endangering real funds. Watchlists, notifications, screeners, Level II quotations, and trading beyond normal business hours are all offered.

Features

| Feature | Information |

| ⚖️ Regulation | NFA, FINRA |

| 💳 Minimum deposit (BWP) | $0 / 0 BWP |

| 💵 Fees | $1.50 |

| 📈 Promotions | None |

| 🥇 Overall Score | 4.5/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The Power E*TRADE platform provides a wide range of robust trading tools. | Customer support is lacking. |

| Botswanans have access to financial consultants and specialists. | Fractional shares cannot be traded, and there is no crypto trading facility. |

| There are several educational resources for beginners and a paper trading feature. | Botswanans cannot trade forex, and there is no journal integration feature. |

| The platform is intuitive and ideal for both beginner and professional Botswanan traders. | To stream data, traders must pay a 1,000 USD / 13,000 BWP deposit. |

6. tastyworks

Options and futures trading are tailor-made for tastyworks. TD Ameritrade’s flagship options and futures trading platform, thinkorswim, whose creators and executives worked on this product, was the inspiration behind this market-leading platform.

The brokerage’s desktop trading program is robust and user-friendly, providing a full suite of trading tools. It also provides advanced trading solutions that a web browser or mobile app can access.

The live trading activity of other users can be tracked, making tastyworks an attractive option. In addition, Botswanans can use one-click trading, allowing them to mimic the strategies of seasoned traders.

The site provides a wealth of materials, including original video lessons for those interested in learning how to trade futures. When it comes to futures trading, tastyworks offers some of the most competitive prices around.

➡️ Trades in ordinary futures contracts incur a $1.25 commission fee.

➡️ Trades in micro-futures contracts cost $0.85.

➡️ Trades in tiny futures contracts cost $0.25.

➡️ Standard futures options cost $2.50 per contract to open.

➡️ Micro-futures options cost $1.50 per contract to open.

Features

| Feature | Information |

| ⚖️ Regulation | NFA, SIPC, FINRA |

| 💳 Minimum deposit (BWP) | $0 / 0 BWP |

| 💵 Fees | $0.25 – $2.50 |

| 📈 Promotions | None |

| 🥇 Overall Score | 4/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The team behind tastyworks’ trading platform was among the first to build and construct a platform for retail options trading. | There are limited resources for long-term investors. |

| tastyworks provides various investment options, including standard, Roth, and SEP IRAs, business accounts, and trusts. | Tastyworks does not offer mutual funds. |

| When you create a brokerage account with tastyworks, you are not subject to any account minimums. | The margin rates are subpar when compared to competitors. |

| tastyworks is not suitable for beginners. |

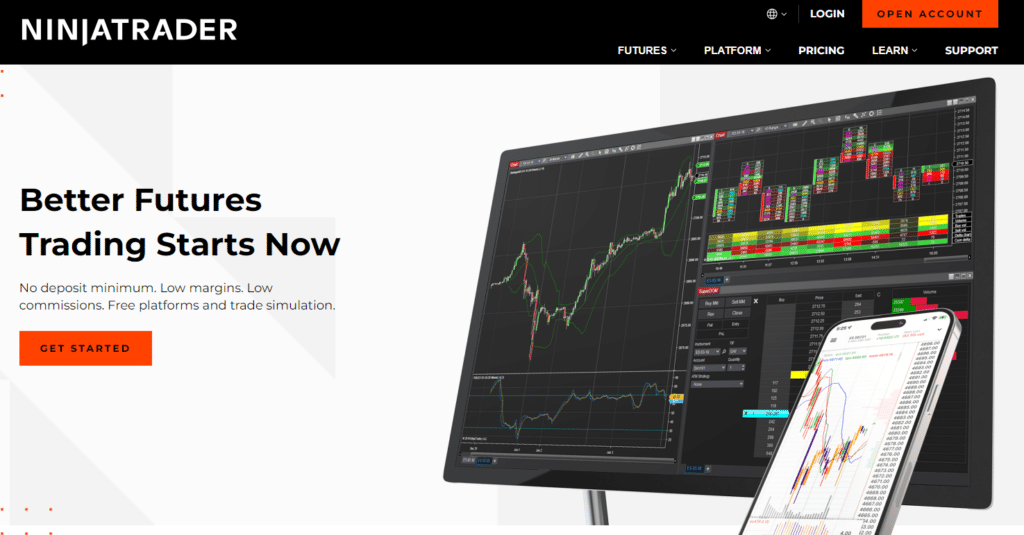

7. NinjaTrader

Since 2003, online brokerage company NinjaTrader has provided traders access to the world’s futures, currency, stock, and options markets. They provide innovative tools, low fees, and top-notch service to traders worldwide.

NinjaTrader includes everything a trader might want, including useful tools for both beginners and pros. Advanced research tools include a robust trading platform, sophisticated charting, expert market analysis, virtual trading, and more.

Min Deposit

USD 0

Regulators

CFTC

Trading Desk

No Trading Desk

Crypto

Yes

Total Pairs

9

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

NinjaTrader’s commission rates and required initial deposits are platform- and security-specific. As a trusted online broker, NinjaTrader equips you to trade various assets and financial instruments.

The National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC) provide strict oversight for NinjaTrader in the United States (CFTC). NinjaTrader is a popular trading platform that has helped traders worldwide.

NinjaTrader provides a wide variety of day trading indicators (over 100) and top-notch brokerage services, along with access to the futures exchanges of CME, CBOT, NYMEX, NYBOT, and Eurex.

Features

| Feature | Information |

| ⚖️ Regulation | NFA |

| 💳 Minimum deposit (BWP) | 50 USD / 650 BWP |

| 💵 Fees | $0.25 – $2.50 |

| 📈 Promotions | None |

| 🥇 Overall Score | 4/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| NinjaTrader offers discounts on commissions as well as lower margins on futures | There are only a few payment methods for deposits and withdrawals |

| Botswanans can customize their platform with signals, strategies, and indicators | The overall fee structure is expensive |

| There is unlimited support and daily training offered | There is no Islamic account offered to Muslim traders |

| Traders can expect access to professional market data and unlimited simulated trading | There is no BWP-denominated account, and this subjects traders to currency conversion fees |

| There is a comprehensive and helpful community forum where traders can connect with others | |

| There are over 100 indicators offered on the platform | |

| NinjaTrader offers thousands of third-party apps that can be integrated into the platform | |

| There is award-winning charting and analysis offered to all traders |

8. Charles Schwab

Charles Schwab is a perennial all-star who is always an outstanding selection. This broker excels at everything and prioritizes the needs of individual investors.

In April 1971, Chuck Schwab and other partners established First Commander Corporation, which in 1973 became known as Charles Schwab & Co., Inc. The “Through Clients’ Eyes” approach was developed to make the client the company’s top priority.

Schwab acquired TD Ameritrade in October 2020, and the two companies will fully integrate by the end of 2024.

Botswanan traders will value top-notch research, commission-free stock and ETF trading, suitable platforms for novice and seasoned investors, helpful and approachable customer care, and one of the greatest sign-up incentives available.

In addition, Charles Schwab provides you with innovative trading platforms, including:

➡️ com WebTrader – An inexperienced trader will not lack features with this broker’s basic trading interface. The software has all the standard functions plus the ability to monitor important indexes and watchlists, get financials and trade data for a firm, see options chains, and do trend analysis.

➡️ StreetSmart Edge – There is no mistaking that this is Schwab’s premier trading platform. With the platform’s flexible interface, you can tailor it to your trading needs. For example, while scrolling through news feeds or watching live CNBC coverage, you can search screeners for potential trade ideas.

Schwab provides a wide variety of investing options since it is a full-service broker. As the market for alternative investments, such as those focused on environmental, social, and governance (ESG) factors expands, Schwab responds by expanding its current selection.

Customers of both firms have gained access to more investment options after Schwab acquired TD Ameritrade. In addition, traders actively engaged in the markets will be able to use thinkorswim’s newly integrated futures and currency trading functionality.

Features

| Feature | Information |

| ⚖️ Regulation | CFTC, FINRA, SEC |

| 💳 Minimum deposit (BWP) | 50 USD / 650 BWP |

| 💵 Fees | $2.25 |

| 📈 Promotions | None |

| 🥇 Overall Score | 5/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Charles Schwab offers powerful trading platforms, and there are no account minimums. | There is an extremely limited default cash sweep rate. |

| The mobile trading app is critically acclaimed and highly rated. | Botswanans can expect high margin rates. |

| The broker offers its clients extensive research and several financial markets. | There is no opportunity to invest in crypto directly. |

| Charles Schwab offers Robo-advisors and AI features. | There are no fractional shares offered. |

How to Choose the Right Futures Trading Platform in Botswana

Botswanan traders must evaluate the following components of a forex broker to decide whether the broker is suited to their unique trading objectives or needs.

Regulations and Licenses

This is the first vital component that Botswanan traders must thoroughly evaluate. Reputable brokers are regulated by market regulators such as FCA, ASIC, CySEC, FSCA, and others.

Botswanans must beware when dealing with brokers with only offshore regulations such as FSA, SVG BVI, FSC, and others.

Account Features

Account Features include leverage trading and margin requirement, commissions and spreads, initial deposit, additional features on retail investor accounts, and so on.

Deposits and Withdrawals

Botswanans must evaluate the payment options available, the processing times on withdrawal requests, deposit currencies offered, the withdrawal fee, deposit fees, and minimum withdrawal limits, among other trading and non-trading fees.

Range of Markets

The range of markets offered refers to the number and range of tradable instruments the broker offers. Therefore, Botswanans must consider what they wish to trade and what is available.

Customer Support

Customer Support is another crucial factor. Botswanans must check the availability of support (trading hours), the quality of support, and the promptness with which the customer support team responds to queries.

Trading Platform

A trading platform is the Botswanan trader’s portal to the financial markets. Therefore, traders must ensure that the trading platform has the necessary technical indicators, fundamental analysis, technical analysis, economic calendar, charting, newsfeed, and other tools they may need.

Education and Research

Education and Research come in handy to both novice traders and experienced investors. Education includes some of the following:

➡️ eBooks

➡️ Trading guides

➡️ Trading knowledge on leveraged products

➡️ A risk warning on complex instruments

➡️ Educational videos

Research can include some of the following:

➡️ Trading tools

➡️ Commentary

➡️ Status of International Markets

➡️ Price movements

➡️ Market sentiments

➡️ Whether there is a volatile market

➡️ Exchange Rates

➡️ Expert opinions and other resources can help experienced traders make informed trading decisions.

The Best Forex Brokers in Botswana

In this article, we have listed the best brokers that offer forex trading to traders in Botswana. In addition, we have further identified the brokers that offer additional services and solutions to Botswanan traders.

Best MetaTrader 4 / MT4 Forex Broker in Botswana

Min Deposit

USD 25

Regulators

FCA UK

Trading Platform

MT5, MT4, OctaTrader

Crypto

Yes

Total Pairs

28

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, OctaFX is the best MT4 forex broker in Botswana. OctaFX is an MT4 and MT5 broker that provides Botswanans with various markets. OctaFX offers a choice of accounts via MT4, including ECN and STP accounts, with superior trade execution.

Best MetaTrader 5 / MT5 Forex Broker in Botswana

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, AvaTrade is the best MetaTrader 5 forex broker in Botswana. In addition, AvaTrade is regarded as one of the most secure MT5 forex brokers.

No commission is charged for trading currency pairings, only leaving the spread to be paid. A demo account is also available for traders to sharpen their abilities via MT5 and several other platforms.

Best Forex Broker for beginners in Botswana

Min Deposit

$100

Regulators

CFT, NFA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FOREX.com is the best forex broker for beginners in Botswana. FOREX.com is a broker renowned for low trading fees and beginner-friendly solutions. In addition, FOREX.com offers several educational materials and a helpful demo account.

Best Low Minimum Deposit Forex Broker in Botswana

Min Deposit

$10 / 134 BWP

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Exness is the best Low Minimum Deposit Forex Broker in Botswana. Exness has a minimum deposit requirement of 10 USD / 130 BWP, making it easy for Botswanans to start trading 278 instruments.

Exness also offers MT4 and MT5 through which trades can be made. In addition, it offers some of the best trading tools, charting capabilities, technical indicators, expert advisors, and more.

Best ECN Forex Broker in Botswana

Min Deposit

USD 0

Regulators

CySEC, FCA, DFSA, FSCA, FSA, CMA

Trading Desk

MT4, MT5, HFM APP

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

0

Account Activation Time

24 Hours

Overall, HFM is the best ECN forex broker in Botswana. HFM is a hybrid forex and CFD broker that uses STP and ECN technology to ensure that Botswanans get the best pricing, minimal slippage, no requotes, and the fastest trade execution.

HFM uses the best liquidity providers who aggregate the pricing that Botswanans can see on MT4, MT5, and the HF App for Android and iOS.

Best Islamic / Swap-Free Forex Broker in Botswana

Min Deposit

USD 10 / 136 BWP

Regulators

CySec, FCA

Trading Desk

None

Crypto

Yes

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, eToro is the best Islamic / Swap-Free forex broker in Botswana. eToro is a renowned social trading platform that offers Muslim traders an Islamic Account.

eToro does not charge any interest on positions held for over 24 hours. However, registering an Islamic Account can be expensive initially, requiring a 1,000 USD / 13,400 BWP deposit.

Best Forex Trading App in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

ASIC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

300

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, CMC Markets is the best forex trading app in Botswana. In addition, CMC Markets offers a user-friendly mobile app with research tools, powerful charts, customizable watch lists, news reports, and a range of educational materials.

Best Lowest Spread Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

FCA, CySEC, IFSC, KNF

Trading Desk

No Trading Desk

Crypto

Yes

Total Pairs

48

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, XTB is the best lowest-spread forex broker in Botswana. XTB is a well-known forex and CFD broker with low and competitive forex spreads from 0.1 pips depending on the financial instrument and the market conditions.

XTB is also a good broker in terms of educational materials and research capabilities, providing traders with comprehensive market analysis across markets.

Best Nasdaq 100 Forex Broker in Botswana

Min Deposit

USD 10

Regulators

CySec, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

60

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXTM is the best Nasdaq 100 forex broker in Botswana. FXTM is a multi-regulated forex and CFD broker that accommodates Botswanan traders with a keen interest in Nasdaq. Traders can expect low and competitive spreads, a choice between accounts, and powerful trading platforms.

Best Volatility 75 / VIX 75 Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

IGRs

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, IG is Botswana’s best Volatility 75 / VIX 75 forex broker. IG is one of the best CFD brokers with powerful proprietary trading technology.

IG is well-regulated and offers Botswanans access to VIX75, with spreads from 0.04 pips / 0.13% and zero commission charges.

Best NDD Forex Broker in Botswana

Min Deposit

USD 50 / 672 BWP

Regulators

FCA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

–

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXCM is the best NDD forex broker in Botswana. FXCM is a No-Dealing Desk broker with STP and ECN execution across several markets.

In addition, FXCM offers a choice between third-party platforms in addition to technical indicators, charting tools, and competitive trading conditions.

Best STP Forex Broker in Botswana

Min Deposit

USD 10

Regulators

IFSC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

36

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, RoboForex is the best STP forex broker in Botswana. RoboForex is popular forex and CFD broker with competitive trading conditions. RoboForex offers STP execution with liquidity sourced from top providers.

Botswanans can expect access to over 12,000 instruments via powerful and innovative third-party platforms.

Best Sign-up Bonus Broker in Botswana

Min Deposit

50 USD / 682 BWP

Regulators

CYSEC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Windsor Brokers is the best sign-up bonus broker in Botswana. Windsor Brokers is a well-regulated broker that offers Botswanans a welcome account funded with 30 USD in trading credit. With this account, Botswanans can explore the platform or risk-free test their strategies.

Conclusion

Futures trading, like any other form of trading, is ideal for individuals who thoroughly understand the market. However, futures trading is a dangerous endeavor.

Novices need to acquire as much knowledge as possible before beginning. If you are thinking about beginning to trade futures, it might be a wise idea to find a broker with loads of instructional materials.

Frequently Asked Questions

What is the fastest futures trading platform for Botswanans?

The fastest futures trading platform for Botswanans is tastyworks, followed by TD Ameritrade, Interactive Brokers, Charles Schwab, and others.

Can Botswanans trade futures with $100 / 1379 BWP?

You could fund an account with 1379 BWP / $100, but you may not be able to cover margin requirements and trading fees with this deposit. To determine how much you need to start trading futures, you must consult your futures broker to evaluate their minimums and fees.

Can Botswanans get rich trading futures?

Futures trading could result in affluence. Futures are among the most versatile and valuable instruments available due to their high liquidity, ease of access, excellent short-selling possibilities, and high leverage.

Can Botswanans trade futures without a broker?

Futures trading needs a margined online broker account with futures trading permission. First, research and decide on the contract you want to trade, complete the order ticket, and execute the transaction.

In addition, Botswanans must consider that each futures contract has a unique margin requirement.

How difficult is futures trading for Botswanans?

Futures trading is difficult and demands a significant time and energy commitment. Even for a seasoned trader, analyzing charts, reading market comments, and keeping up with the news could be a significant undertaking.

Which futures trading platforms are best for Botswana Beginners?

E*TRADE

Which futures trading platforms are available on mobile (IOS and Android) devices?

- TD Ameritrade

- Interactive Brokers

- TradeStation

- E*TRADE

- tastyworks

- NinjaTrader

- Charles Schwab

Which brokers have interactive futures trading platforms?

- Interactive Brokers

Which broker offers a low $5 (68 BWP) minimum deposit?

- XM

Which brokers offer a sign-up bonus for first-time traders?

- SuperForex

- Tickmill

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review