10 Best Low Minimum Deposit Brokers in Botswana

The 10 Best Low Minimum Deposit Forex Brokers in Botswana revealed. We tested and verified the best Low Minimum Deposit forex brokers for Botswanan Traders.

This is a complete list of Low Minimum deposits in Botswana.

In this in-depth guide you’ll learn:

- What is a Low Minimum Deposit?

- Who are the best low minimum deposit forex brokers for Botswanans?

- Which NASDAQ Forex brokers offer a low minimum deposit?

- How to Choose the Right Forex Broker in Botswana

- Which brokers offer no minimum deposit?

- Which brokers offer a signup bonus on their low minimum deposit.

And lots more…

So if you’re ready to go “all in” with the best-tested low minimum deposit forex brokers for Botswanans…

Let’s dive right in

- Lesche Duvenage

Best Low Minimum Deposit Brokers in Botswana

| 🏛️ Broker | 💰 Min Deposit | 👉 Open Account | 💵 Botswana Pula Deposits Allowed? | ✔️ Offers a Botswana Pula Account? |

| 1. Exness | USD 10 / 134 BWP | 👉 Open Account | Yes | No |

| 2. JustMarkets | USD 10 / 134 BWP | 👉 Open Account | No | Yes |

| 3. TD Ameritrade | $0 / 0 BWP | 👉 Open Account | Yes | Yes |

| 4. RoboForex | USD 10 / 134 BWP | 👉 Open Account | Yes | Yes |

| 5. FXOpen | USD 1 / 13 BWP | 👉 Open Account | No | Yes |

| 6. Fidelity Investments | USD 0 / 0 BWP | 👉 Open Account | No | No |

| 7. FBS | USD 5 / 96 BWP | 👉 Open Account | Yes | Yes |

| 8. SuperForex | USD 1 / 13 BWP | 👉 Open Account | No | No |

| 9. InstaForex | USD 1 / 13 BWP | 👉 Open Account | No | No |

| 10. HFM | $0 / 0 BWP | 👉 Open Account | Yes | Yes |

10 Best Forex Brokers in Botswana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

What is a Low Minimum Deposit?

A minimum deposit or initial deposit is the minimum amount of money required to open an account with a financial institution, such as a bank or brokerage firm.

Higher minimum deposits are generally associated with accounts offering premium services, whereas products oriented toward a mainstream audience generally offer lower minimum deposits to attract new customers.

10 Best Low Minimum Deposit Brokers in Botswana

- ✔️ Exness – Overall, Best Low Minimum Deposit Broker

- ✔️ JustMarkets – Top STP Forex Broker in Botswana

- ✔️ TD Ameritrade – Best MetaTrader 4/MT4 Broker

- RoboForex – Top Sign-Up Bonus Forex Broker

- FXOpen – Best NDD Forex Broker in Botswana

- Fidelity Investments – Top Volatility 75/VIX75 Broker

- FBS – Best Nasdaq100 Forex Broker in Botswana

- SuperForex – Top Lowest Spread Forex Broker in Botswana

- InstaForex – Best Mobile Trading App

- HFM – Top ECN Forex Broker in Botswana

1. Exness

Overview

Exness is a well-known worldwide broker that provides 5 distinct trading accounts, including one of the most cost-effective Cent Accounts on the market today.

Exness is a dependable broker to use for trading and has been granted permission to operate by a variety of authorities all over the world.

In addition, Exness offers protection against negative balances to all its customers, which means that traders cannot incur losses greater than the amount they initially deposited.

Min Deposit

$10 / 134 BWP

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Moreover, Exness undergoes routine inspections by Deloitte, which is widely regarded as one of the best auditing companies in the world.

The Cent Account is excellent for beginner Forex traders who want to learn without taking on too much risk since the minimum deposit is merely 10 USD / 134 BWP. Furthermore, micro-lots are unlocked, and spreads can be as low as 0.3 pips.

Market execution is available for all accounts, apart from the Pro Account, which has access to quick execution for all CFDs other than crypto. Furthermore, Botswanan Muslim traders can establish swap-free Islamic accounts for any trading account they want.

Features

| Feature | Information |

| ⚖️ Regulation | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Standard Account, Standard Cent Account, Raw Spread Account, Zero Account, Pro Account |

| 📊 Trading Platform | MetaTrader 4, MetaTrader 5, Exness Terminal, Exness Trader app |

| 💰 Minimum Deposit | $10 / 134 BWP |

| 💰 Trading Assets | Forex minor pairs, forex major pairs, forex exotic currency pairs, Metals, Crypto, Energies, Indices, Stocks |

| 🔎 Botswanan Pula-based Account? | No |

| 💳 BWP Deposits Allowed? | Yes |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 0.0 pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | No |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Exness is a reputable international broker authorized by several reputable market regulators | There is a limited selection of tradable instruments in only a few financial markets |

| The broker offers some of the tightest spreads across all types of accounts | There is a limited selection of funding options offered |

| There are several account types to choose from, each accommodating different types of traders | |

| There are various market metrics available including exchange rates, overall trading activities available, current market conditions, and more. | |

| Exness is ideal for any Botswanan beginner traders and institutional investors | |

| There are solutions offered for any type of professional trader who needs advanced options | |

| There is a powerful proprietary mobile app offered | |

| Client fund safety and investor protection is guaranteed | |

| Multilingual 24/7 customer support is offered | |

| Instant withdrawal methods are available |

2. JustMarkets

Overview

JustMarkets, with headquarters in Limassol, Cyprus, was founded in 2012 as a multi-asset CFD broker operating online, using STP and ECN technology. With JustMarkets, you can easily trade foreign currency pairs, stocks, commodities, indices, and cryptocurrencies all in one spot.

Except for BWP accounts, many offer several base currencies and a range of deposit and withdrawal options. Therefore, traders on JustMarkets can select from seven main account options to find a suitable one.

Min Deposit

USD 10

Regulators

FSA, CySec

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

240

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Beginner traders can open a spread account to simplify trading costs as they need not worry about commission fees. In contrast, the commission account might be advantageous for seasoned traders who execute bigger transactions.

In addition, novice traders benefit from low initial investments, which suit most budgets and ensure a lower risk of loss. For example, just $10 is needed to create an account with three different financial institutions, but $100 is advised for the remaining four.

Regardless of your inactive state, your JustMarkets account will always be available. However, if a trading account is inactive for 90 days or more, JustMarkets might archive it.

Features

| Account Feature | Value |

| 📉 Minimum Deposit Requirement | 34 Botswanan Pula equivalent to $10 |

| 💻 Account Base Currency | USC |

| 📊 Maximum leverage up to | 1:1000 |

| 💳 Commission charges | None |

| 📊 Swap-free option? | Yes |

| 📈 Average spreads from | 0.9 pips |

| 📉 Minimum order size | 0.01 cent lot |

| ➡️ Maximum order size | 1,000 cent lots |

| ⬆️ Maximum orders | 100 |

| 📞 Margin Call | 40% |

| 🛑 Stop-Out (%) | 20% |

| 📱 Trade Execution Method | Market Execution |

| ✔️ Pricing Format | Fifth Decimal Pricing |

| 💻 Contract Size | 1 lot = 1,000 base currency units |

| ✅ Trading Instruments Available | • 37 Forex pairs • 4 Metals • 9 Indices • 5 Cryptocurrency Pairs |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| JustMarkets offers a huge range of deposit methods and withdrawal options including bank wire transfers, bank transfers, Skrill, Neteller, and more | There is a limited choice of trading instruments |

| Demo trading and Islamic Swap-Free Accounts are offered | Inactivity Fees may apply after following several days of dormancy |

| JustMarkets offers mobile trading through powerful mobile trading apps | The broker does not have regulation through a reputable and trusted regulatory body |

| JustMarkets offers competitive cryptocurrency spreads across crypto pairs including Bitcoin, Ethereum, and others | |

| JustMarkets’s non-trading fees are reasonable | |

| The broker offers a risk warning, training webinars, an array of articles and education for inexperienced traders | |

| There is a wide choice between different types of accounts and excellent trading conditions | |

| One-click trading is offered in addition to insights to help Botswanan traders make better trading decisions | |

| Real-time market analysis is offered alongside analysis tools and several other additional tools | |

| Client funds are kept in segregated bank accounts | |

| There are several research and resources that can help traders make improved independent investment decisions | |

| JustMarkets’s account-opening process is quick and easy | |

| JustMarkets offers several innovative features including a range of services | |

| There are several trading account currencies to choose from | |

| There is no fee for withdrawals |

3. TD Ameritrade

Overview

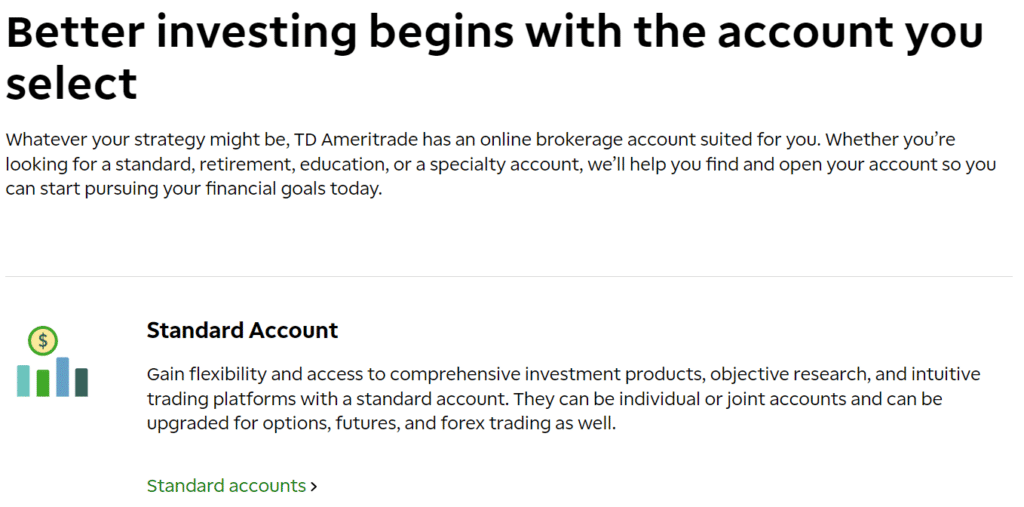

TD Ameritrade is a leading online broker due to its impressive features. Despite its reputation as an online broker, TD Ameritrade’s history extends back to the 1970s. Furthermore, the broker has been a pioneer in the brokerage industry for decades.

TD Ameritrade meets the demands of both beginner and seasoned investors, particularly those seeking a full-featured online broker with excellent education and research.

Overall Rating

- 4.7/5

Min Deposit

$0

Regulators

SEC, FINRA, CFTC, MAS

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

–

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

The thinkorswim trading platform is almost unrivalled. Available on mobile and desktop platforms, thinkorswim offers customization, graphing, and analytical tools.

TD Ameritrade provides access to trade expertise and superior customer support to assist you quickly and properly answer any queries you might have. Overall, TD Ameritrade is a renowned one-stop shop for investors and cash managers.

Furthermore, TD Ameritrade provides a variety of education and managed account choices in addition to regular taxable accounts, IRAs, and Roth IRAs.

Features

| Feature | Information |

| ⚖️ Regulation | FINRA, CFTC, SEC, SFC |

| 💳 Minimum deposit (BWP) | $0 / 0 BWP |

| 💵 Fees | $2.25 |

| 📈 Promotions | None |

| 🥇 Overall Score | 5/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| There are many different investment options available | A limited number of countries accepted |

| Strong systems that have a wide range of useful features and capabilities | CFDs are not offered |

| TD Ameritrade offers Internet-based and mobile platforms for trading and investing | There are only a few funding and withdrawal options offered |

| Zero-dollar minimum trade commissions and cheap trading costs | USD is the only accepted base currency |

| Wide variety of innovative resources for in-depth market research | The account-opening process is tedious and time-consuming |

| Tools for analysing and comparing various funds | |

| The availability of a wealth of learning materials |

4. RoboForex

Overview

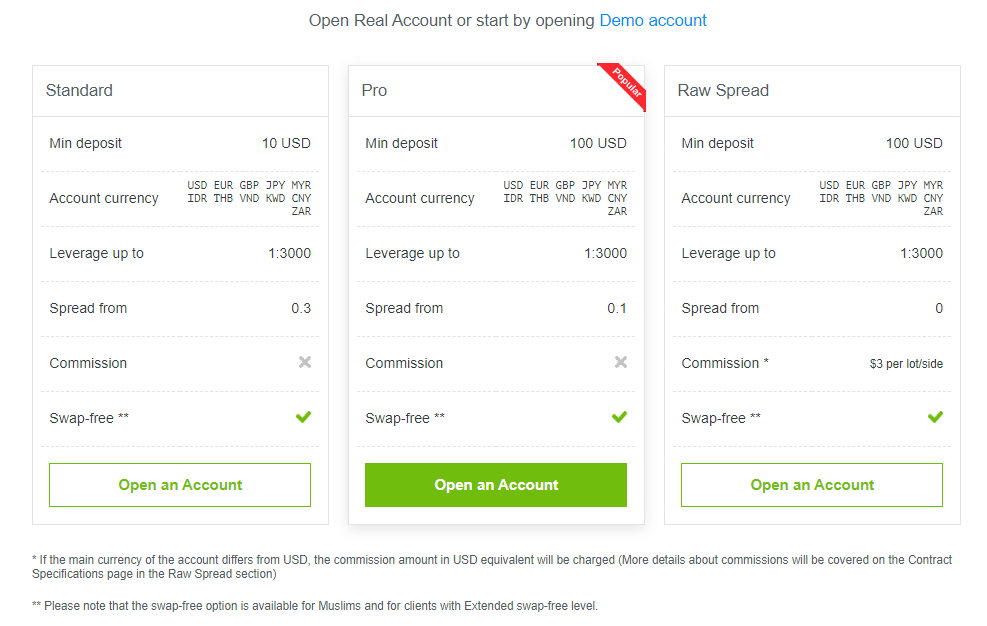

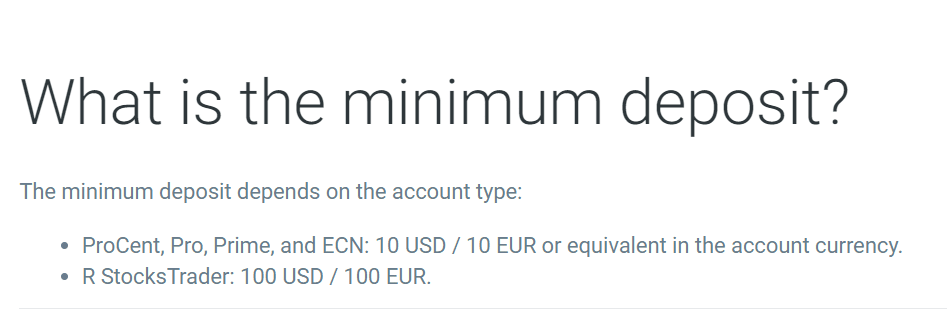

RoboForex provides 5 different live trading account types – the Prime Account, The ECN Account, The R StockTrader Account, The ProCent Account, and the Islamic Swap-Free Account Option. Additionally, a selection of Demo Accounts is also on offer. RoboForex offers accounts in USD, EUR at a minimum deposit of $10 USD / 34 BWP.

Min Deposit

USD 10

Regulators

IFSC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

36

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

The minimum deposit amount required to register a live RoboForex trading account is $10 USD. This minimum deposit is equivalent to 34 BWP at the current exchange rate between the US Dollar and Botswana at the time of writing. RoboForex offers a wide variety of deposit methods and applicants can simply select the option that is most comfortable to them.

Features

| Feature | Information |

| ⚖️ Regulation | IFSC |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | Botswanan Pula $10/134 BWP |

| Average spread from | Floating from 1.3 pips |

| 📈 Maximum Leverage | 1:2000 |

| 👥 Customer Support | 24/7 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The broker offers more than 12,000 markets that can be traded | US clients are not accepted |

| There are several flexible account types offered | There are no fixed spread accounts |

| Trading education is offered to all traders | |

| There are several powerful trading tools | |

| The broker applies negative balance protection to all retail trading accounts |

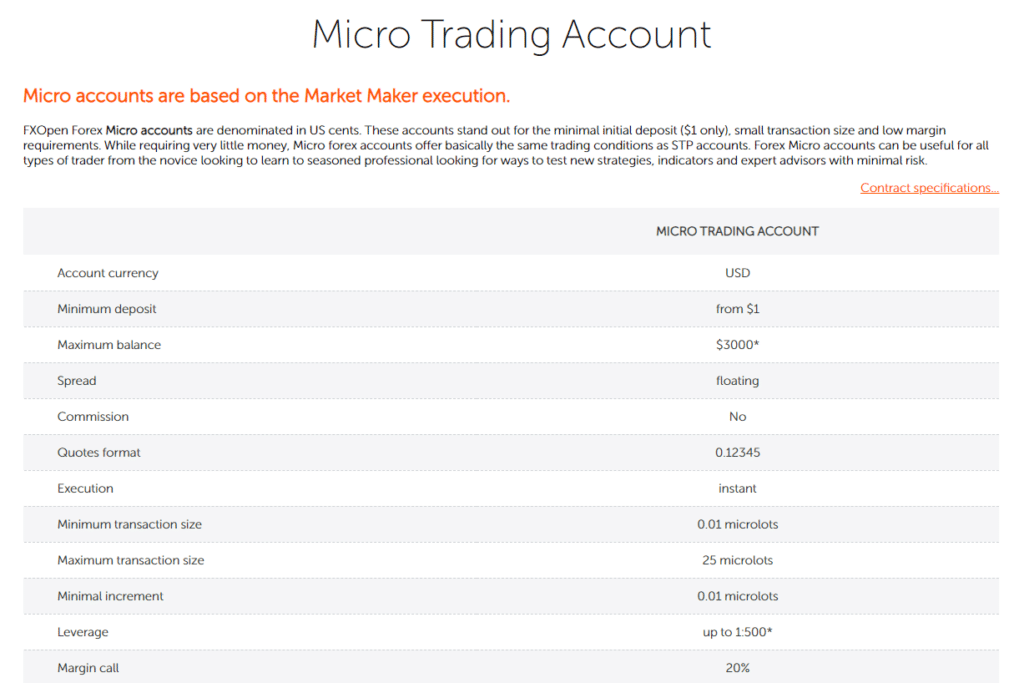

5. FXOpen

Overview

Trading currencies, stocks, commodities, indices, cryptocurrencies, and more are all available on the FXOpen platform. The FXOpen trading platform is user-friendly and safe, and practice accounts and live ECN accounts are available.

Traders of all experience levels, from novices to veterans, are universal in their praise for FXOpen’s brokerage services. Expert advisers help new traders through the complex financial markets and daily swings.

Overall Rating

- 4.8/5

Min Deposit

USD 1 / 13 BWP

Regulators

ASIC

Trading Desk

No Trading Desk

Crypto

Yes

Total Pairs

4

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Auto-trading, mobile trading, crypto trading, social trading, copy-trading, and other options are available with FXOpen.

In addition, risk disclosure, foreign currency pairings, financial guidance, easy and secure payment methods, and a payment system are all provided to both new and established traders.

Features

| Feature | Information |

| 📈 Range of Markets | Forex, ETFs, Crypto, Indices, Commodities, Shares |

| ⚖️ Regulation | FCA, ASIC |

| 💻 Account Types | • ECN Account • STP Account • Micro Account • Crypto Account |

| 💵 Minimum Spread | 0.0 pips |

| 💸 Minimum Deposit | 13 BWP ($1) |

| 📱 Platforms Supported | MetaTrader 4 MetaTrader 5 TickTrader Myfxbook AutoTrade |

| 📉 Minimum Trade Volume | 0.01 lots |

| 📈 Maximum Leverage | 1:500 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| FXOpen is known for its true ECN model | Withdrawal fees might apply |

| FXOpen is well-regulated and offers an unlimited demo account | Not all accounts have the same access to financial instruments |

| Negative balance protection is applied to trading accounts |

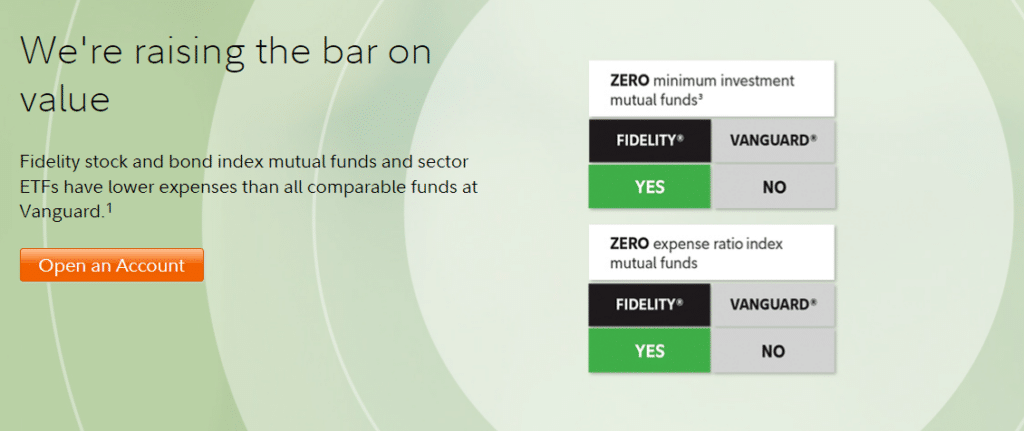

6. Fidelity Investments

Overview

Regarding online brokerage platforms, Fidelity Investments is among the best because of the extensive resources it provides for investors. In addition, Fidelity is a fantastic option for seasoned traders and novice investors because of its extensive library of educational materials.

Fidelity Investments is among the greatest online brokers because of its unique features. Downloadable Active Trader Pro provides stock and options traders with access to Fidelity’s extensive screeners, third-party research resources, and portfolio analysis tools.

Min Deposit

$o

Regulators

IFSC, CySEC

Trading Desk

Fidelity.com

Active Trader Pro

Crypto

Yes

Total Pairs

–

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Furthermore, Fidelity is a fantastic option for casual traders because of its substantial cost savings on order execution.

Fidelity’s Stocks by the Slice service enables you to acquire partial shares for as little as $0. In addition, you can invest in over 7,000 stocks and ETFs with the same low, flat fee. You could also reinvest dividends into more, smaller shares to get the most out of your capital.

Features

| Feature | Information |

| 📈 Range of Markets | Forex, ETFs, Crypto, Indices, Commodities, Shares |

| ⚖️ Regulation | FCA, ASIC |

| 💻 Account Types | Brokerage Account, Cash Management Account, Brokerage and Cash Management, The Fidelity Account for Businesses, Fidelity Go, Fidelity Personalized Planning and Advice, Portfolio Advisory Services Accounts, Fidelity Tax-Managed US Equity Index Strategy, Fidelity Equity-Income Strategy, Fidelity International Equity Strategy, Fidelity Tax-Managed International Equity Index Strategy, Fidelity US Large-Cap Equity Strategy, Fidelity Core Bond Strategy, Fidelity Intermediate Municipal Strategy, Breckinridge Intermediate Municipal Strategy |

| 💵 Minimum Spread | 0.0 pips |

| 💸 Minimum Deposit | $0 or an equivalent in 0 BWP |

| 📱 Platforms Supported | MetaTrader 4 MetaTrader 5 TickTrader Myfxbook AutoTrade |

| 📉 Minimum Trade Volume | 0.01 lots |

| 📈 Maximum Leverage | 1:500 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Fidelity Investments is well-regulated and has a good trust score | MetaTrader platforms are not supported |

| Member of the FDIC and the Securities Investor Protection Corporation (SIPC) | There is no Forex, CFD, or crypto trading offered |

| There is a wide range of investment options offered across several financial markets | There are limited funding options |

| There are several account types to choose from, each suiting different investors and traders | The account opening process can be time-consuming |

| There are many advanced trading tools offered on the website, trading platform, and mobile app | To get the best account benefits, traders must make larger deposits |

| Powerful proprietary trading platform offered | Management fees and a contract fee applied |

| Competitive trading conditions for cost-effective trading and investing | |

| Offers advanced research options and some educational material |

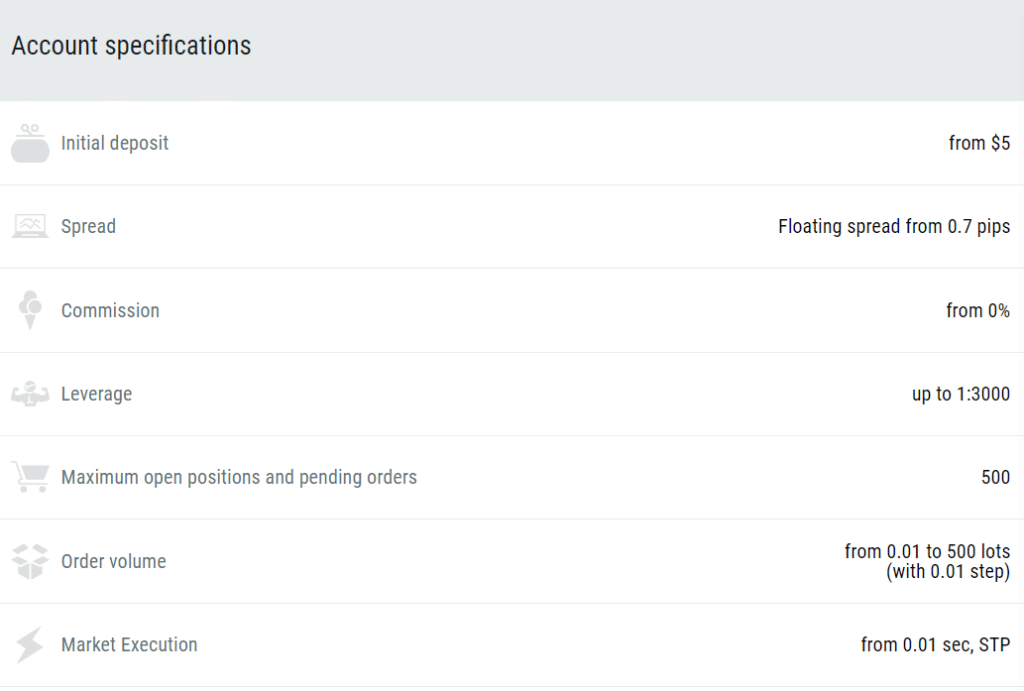

7. FBS

Overview

FBS is an online platform that facilitates trading in a vast array of assets. In addition, the FBS brokerage firm provides optimal leverage and margin call, so one does not need to have a large amount of cash to begin trading the finest forex pairs, commodities, and other assets.

More than 17 million traders from more than 150 countries are linked with the FBS transparent broker organization based in Cyprus.

Min Deposit

USD 5 / 67 BWP

Regulators

IFSC, FSCA (South Africa), ASIC, CySEC

Trading Desk

MetaTrader 4, MetaTrader 5, FBS Trader – all in one mobile trading platform.

Crypto

Yes

Total Pairs

250

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Botswanans who have registered an account on the FBS trading platform are currently eligible for a variety of enticing bonuses and special deals.

The Level Up bonus offer is by far the most well-liked promotion that FBS has to offer. Furthermore, Botswanans must register a trading account and verify their details to be eligible for the Level Up bonus of USD 70.

Features

| Account Feature | Value |

| 💳 Minimum Deposit | 67 Botswanan Pula equivalent to $5 |

| 📈 Average spread | Floating, from 1 pip |

| 🔎 Commission | None |

| 📈 Leverage | Up to 1:3000 |

| 📅 Maximum opening positions | 200 |

| 📊 Order volume | Between 0.01 to 1,000 cent lots |

| 📈 Market Execution | From 0.3 seconds, STP |

| 📱 Trading Platform | MetaTrader 4, MetaTrader 5, FBS Trader |

| 🚀 Tradable Instruments | Forex, precious metals, indices, energies, forex exotics, stocks |

| ☪️ Swap-Free Islamic Option | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| There is a very low minimum deposit required | Several regions are restricted from service |

| FBS is an online broker with regulation through IFSC and the Cyprus Securities and Exchange Commission | The spreads on some accounts are very high |

| There is a choice between investor accounts | Inactivity fees apply to dormant accounts |

| Traders have access to fast, flexible payment methods | The demo account expires after 40 days |

| The trading conditions are favourable and competitive | Withdrawal fees and deposit fees are charged |

| There are demo accounts and Islamic Accounts | There is a limited selection of funding options and there are only two base account currencies |

| Customer service is available 24/7 | Currency conversion fees are charged on deposits made in currencies other than USD and EUR |

| The broker is reputable and has a high trust score | |

| FBS is an official trading partner that offers a comprehensive affiliate program | |

| There are several bonuses and promotions offered |

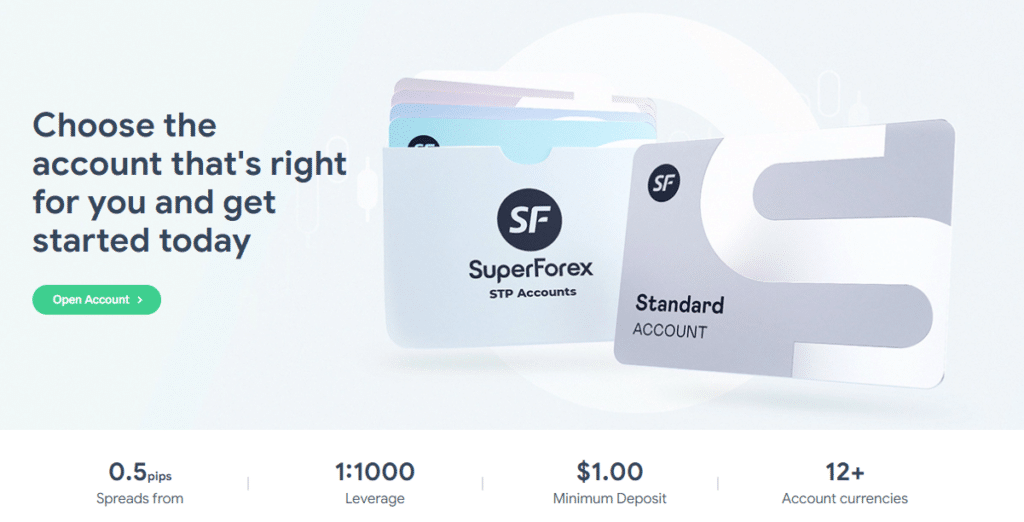

8. SuperForex

Overview

SuperForex was founded in 2013 to normalize the usage of foreign currency in daily life. The organization, which began in Belize but now has branches all over the globe, is a broker.

SuperForex offers its clients the MetaTrader 4 (MT4) trading platform, which may be utilized locally on desktop computers or online with any current web browser. Furthermore, useful video training is available to help you make the most of your time trading using MT4.

Min Deposit

USD 1 / 13 BWP

Regulators

IFSC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

300

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

The terminal can be used on both Windows and macOS systems. However, it should be noted that the MetaTrader 5 (MT5) platform is still unavailable on SuperForex.

Furthermore, the spreads offered by the broker vary depending on your account, and they are competitive compared to other brokers.

Botswanans should note that ECN accounts are more competitive because they provide direct market execution and variable spreads from 0.0 pips EUR/USD.

In contrast, spreads on the EUR/USD pair are typically 3 pips for a basic STP account, 3.5 pips on the USD/CAD pair, and 6.5 pips on the GBP/JPY pair.

Features

| Feature | Information |

| ⚖️ Regulation | IFSC |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | 13 Botswanan Pula equivalent to $1 |

| Average spread from | Variable spread |

| 📈 Maximum Leverage | 1:1000 |

| 👥 Customer Support | 24/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| At SuperForex, eleven retail accounts are offered, all of which are tailored to the unique needs of individual traders. | SuperForex is not regulated. |

| In addition to speedy, trustworthy transaction execution and cheap spreads, SuperForex has commission-free options. | There is no other platform other than SuperForex and MT4. |

| Muslims have access to Islamic trading accounts with no monthly maintenance fees. | SuperForex does not offer a BWP-denominated account. |

| Botswanans can quickly and easily deposit and withdraw monies from their accounts. |

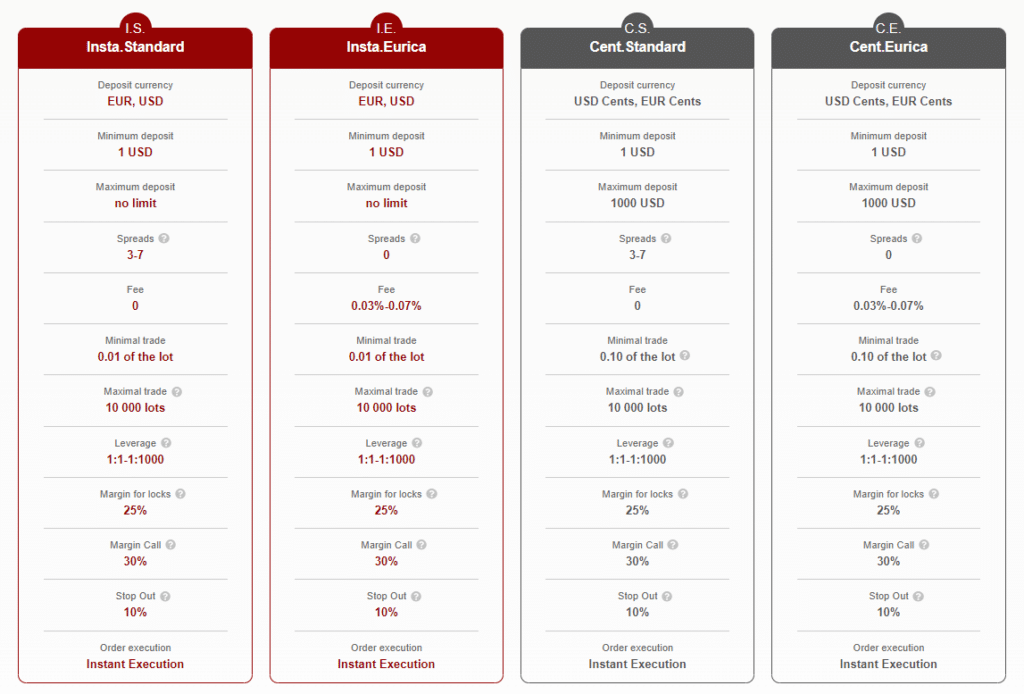

9. InstaForex

Overview

InstaForex gives you a solution from the world’s best developers, enabling you to execute trading assisted by the major counteragents offering direct market access.

InstaForex was founded in 2007, with its headquarters in Limassol, Cyprus. However, it now serves customers worldwide, and the number of traders using InstaForex surpasses 7 million, which is an astounding statistic.

Min Deposit

USD 1

Regulators

CySEC, FSC

Trading Desk

MetaTrader 4

MetaTrader 5

MultiTerminal

WebTrader

Crypto

Yes

Total Pairs

100

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

InstaForex is an excellent Forex broker with a wide selection of instruments and innovative technology. The platform is user-friendly, and InstaForex offers a variety of deposit options.

One advantage is that traders can begin with any amount since the broker does not need a minimum deposit. In addition, comprehensive education and market analysis are also available on the InstaForex platform.

InstaForex’s trading conditions, on the other hand, vary according to the regulatory entity with whom you will trade according to your region, and fees for specific products could be higher than those offered by other brokers.

Features

| Feature | Information |

| ⚖️ Regulation | FSC, BVI, SIBA |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | Botswanan Pula ($1 / 13 BWP ) |

| Average spread from | 0.0 pips EUR/USD |

| 📈 Maximum Leverage | 1:1000 |

| 👥 Customer Support | 24/7 |

Pros and Cons

| ✔️ Pros | ❌ Cons | |||

| The broker offers commission-free trading | There are restrictions on leverage for European Union clients | |||

| MetaTrader 4 and 5 are both offered, available across devices | US clients are not accepted | |||

| The broker is well-regulated and offers competitive trading conditions | ||||

| There is a choice between retail investor accounts, each suited to different types of traders | ||||

| There is a wide range of tradable assets offered |

10. HFM

Overview

HFM, formerly known as HotForex, is a multi-asset Forex broker that provides Forex and Commodities trading. In addition, HFM provides CFD trading services on five different account and platform options, with average spreads of only EUR USD 0.1 and unlimited liquidity.

Furthermore, automated trading platforms allow traders to choose their preferred spreads and liquidity providers, enabling them to use any trading technique (including News trading).

Min Deposit

USD 0

Regulators

CySEC, FCA, DFSA, FSCA, FSA, CMA

Trading Desk

MT4, MT5, HFM APP

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

0

Account Activation Time

24 Hours

With other industry accolades and sponsorships, HFM has over 500,000 active client accounts and renowned titles such as Best Client Funds Security Broker, Best Forex Provider, and many others.

Traders of any skill level, from novices just getting their feet wet to seasoned pros with decades of experience, will appreciate the many account types and the freedom HFM provides in tailoring their trading to their unique goals.

Features

| Features | Information |

| ⚖️ Regulation | FSCA, CySEC, DFSA, FSA, FCA, CMA, and FSC, with registration in ACPR, BaFin, MNB, CONSOB, CNMV, FI, FMA, FSC, and other regions |

| 💸 Minimum Withdrawal Time | – |

| 📈 Maximum Withdrawal Time | 2 to 4 working days |

| 💰 Instant Deposits/Withdrawals? | Yes, deposits |

| 💳 BWP-Denominated Account? | No |

| 📱 Minimum Deposit Amount | $0 / 0 BWP |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| HFM is well-regulated and features registrations from several countries worldwide, which adds to its reputation and trustworthiness | HFM’s spreads are wide on entry-level accounts |

| HFM’s overall reputation and reach are unparalleled | HFM does not support a large array of deposit and withdrawal options |

| The HFM brand has won over 60 accolades in its field throughout the years | Botswanans pay currency conversion fee as there is no BWP-denominated trading account |

| HFM’s demo accounts for MT4 and MT5 are unrestricted | |

| Botswanan Muslim traders who prefer Islamic accounts can make the switch at any time | |

| Botswanans can choose an account that suits their trading strategy and experience level the best | |

| Traders have access to a plethora of learning materials and innovative trading platforms | |

| The versatility of the trading platforms means that more people in Botswana can make use of them, even if they do not have previous trading experience | |

| Botswanans pay an extremely low minimum deposit of 65 BWP, and the market circumstances are favourable for trading |

How to Choose the Right Forex Broker in Botswana

Botswanan traders must evaluate the following components of a forex broker to decide whether the broker is suited to their unique trading objectives or needs.

Regulations and Licenses

This is the first vital component that Botswanan traders must thoroughly evaluate. Reputable brokers are regulated by market regulators such as FCA, ASIC, CySEC, FSCA, and others.

Botswanans must beware when dealing with brokers with only offshore regulations such as FSA, SVG BVI, FSC, and others.

Account Features

Account Features include leverage trading and margin requirement, commissions and spreads, initial deposit, additional features on retail investor accounts, and so on.

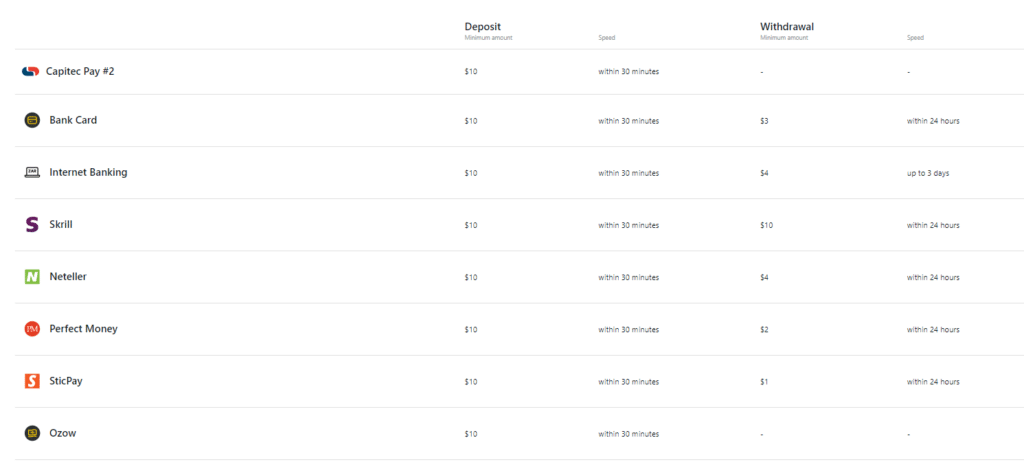

Deposits and Withdrawals

Botswanans must evaluate the payment options available, the processing times on withdrawal requests, deposit currencies offered, the withdrawal fee, deposit fees, and minimum withdrawal limits, among other trading and non-trading fees.

Range of Markets

The range of markets offered refers to the number and range of tradable instruments the broker offers. Therefore, Botswanans must consider what they wish to trade and what is available.

Customer Support

Customer Support is another crucial factor. Botswanans must check the availability of support (trading hours), the quality of support, and the promptness with which the customer support team responds to queries.

Trading Platform

A trading platform is the Botswanan trader’s portal to the financial markets. Therefore, traders must ensure that the trading platform has the necessary technical indicators, fundamental analysis, technical analysis, economic calendar, charting, newsfeed, and other tools they may need.

Education and Research

Education and Research come in handy to both novice traders and experienced investors. Education includes some of the following:

➡️ eBooks

➡️ Trading guides

➡️ Trading knowledge on leveraged products

➡️ A risk warning on complex instruments

➡️ Educational videos

Research can include some of the following:

➡️ Trading tools

➡️ Commentary

➡️ Status of International Markets

➡️ Price movements

➡️ Market sentiments

➡️ Whether there is a volatile market

➡️ Exchange Rates

➡️ Expert opinions and other resources can help experienced traders make informed trading decisions.

The Best Forex Brokers in Botswana

In this article, we have listed the best brokers that offer forex trading to traders in Botswana. In addition, we have further identified the brokers that offer additional services and solutions to Botswanan traders.

Best MetaTrader 4 / MT4 Forex Broker in Botswana

Min Deposit

USD 25

Regulators

FCA UK

Trading Platform

MT5, MT4, OctaTrader

Crypto

Yes

Total Pairs

28

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, OctaFX is the best MT4 forex broker in Botswana. OctaFX is an MT4 and MT5 broker that provides Botswanans with various markets. OctaFX offers a choice of accounts via MT4, including ECN and STP accounts, with superior trade execution.

Best MetaTrader 5 / MT5 Forex Broker in Botswana

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, AvaTrade is the best MetaTrader 5 forex broker in Botswana. In addition, AvaTrade is regarded as one of the most secure MT5 forex brokers.

No commission is charged for trading currency pairings, only leaving the spread to be paid. A demo account is also available for traders to sharpen their abilities via MT5 and several other platforms.

Best Forex Broker for beginners in Botswana

Min Deposit

$100

Regulators

CFT, NFA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FOREX.com is the best forex broker for beginners in Botswana. FOREX.com is a broker renowned for low trading fees and beginner-friendly solutions. In addition, FOREX.com offers several educational materials and a helpful demo account.

Best Low Minimum Deposit Forex Broker in Botswana

Min Deposit

$10 / 134 BWP

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Exness is the best Low Minimum Deposit Forex Broker in Botswana. Exness has a minimum deposit requirement of 10 USD / 130 BWP, making it easy for Botswanans to start trading 278 instruments.

Exness also offers MT4 and MT5 through which trades can be made. In addition, it offers some of the best trading tools, charting capabilities, technical indicators, expert advisors, and more.

Best ECN Forex Broker in Botswana

Min Deposit

USD 0

Regulators

CySEC, FCA, DFSA, FSCA, FSA, CMA

Trading Desk

MT4, MT5, HFM APP

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

0

Account Activation Time

24 Hours

Overall, HFM is the best ECN forex broker in Botswana. HFM is a hybrid forex and CFD broker that uses STP and ECN technology to ensure that Botswanans get the best pricing, minimal slippage, no requotes, and the fastest trade execution.

HFM uses the best liquidity providers who aggregate the pricing that Botswanans can see on MT4, MT5, and the HF App for Android and iOS.

Best Islamic / Swap-Free Forex Broker in Botswana

Min Deposit

USD 10 / 136 BWP

Regulators

CySec, FCA

Trading Desk

None

Crypto

Yes

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, eToro is the best Islamic / Swap-Free forex broker in Botswana. eToro is a renowned social trading platform that offers Muslim traders an Islamic Account.

eToro does not charge any interest on positions held for over 24 hours. However, registering an Islamic Account can be expensive initially, requiring a 1,000 USD / 13,400 BWP deposit.

Best Forex Trading App in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

ASIC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

300

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, CMC Markets is the best forex trading app in Botswana. In addition, CMC Markets offers a user-friendly mobile app with research tools, powerful charts, customizable watch lists, news reports, and a range of educational materials.

Best Lowest Spread Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

FCA, CySEC, IFSC, KNF

Trading Desk

No Trading Desk

Crypto

Yes

Total Pairs

48

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, XTB is the best lowest-spread forex broker in Botswana. XTB is a well-known forex and CFD broker with low and competitive forex spreads from 0.1 pips depending on the financial instrument and the market conditions.

XTB is also a good broker in terms of educational materials and research capabilities, providing traders with comprehensive market analysis across markets.

Best Nasdaq 100 Forex Broker in Botswana

Min Deposit

USD 10

Regulators

CySec, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

60

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXTM is the best Nasdaq 100 forex broker in Botswana. FXTM is a multi-regulated forex and CFD broker that accommodates Botswanan traders with a keen interest in Nasdaq. Traders can expect low and competitive spreads, a choice between accounts, and powerful trading platforms.

Best Volatility 75 / VIX 75 Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

IGRs

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, IG is Botswana’s best Volatility 75 / VIX 75 forex broker. IG is one of the best CFD brokers with powerful proprietary trading technology.

IG is well-regulated and offers Botswanans access to VIX75, with spreads from 0.04 pips / 0.13% and zero commission charges.

Best NDD Forex Broker in Botswana

Min Deposit

USD 50 / 672 BWP

Regulators

FCA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

–

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXCM is the best NDD forex broker in Botswana. FXCM is a No-Dealing Desk broker with STP and ECN execution across several markets.

In addition, FXCM offers a choice between third-party platforms in addition to technical indicators, charting tools, and competitive trading conditions.

Best STP Forex Broker in Botswana

Min Deposit

USD 10

Regulators

IFSC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

36

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, RoboForex is the best STP forex broker in Botswana. RoboForex is popular forex and CFD broker with competitive trading conditions. RoboForex offers STP execution with liquidity sourced from top providers.

Botswanans can expect access to over 12,000 instruments via powerful and innovative third-party platforms.

Best Sign-up Bonus Broker in Botswana

Min Deposit

50 USD / 682 BWP

Regulators

CYSEC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Windsor Brokers is the best sign-up bonus broker in Botswana. Windsor Brokers is a well-regulated broker that offers Botswanans a welcome account funded with 30 USD in trading credit. With this account, Botswanans can explore the platform or risk-free test their strategies.

You might like: Best Low Spread Forex Brokers in Botswana

You might like: Best Volatility 75 Forex Brokers in Botswana

You might like: Best NDD Forex Brokers in Botswana

You might like: Best Swap-Free Account Brokers in Botswana

You might like: Best Shares to Buy in Botswana

Conclusion

Online brokers typically require a minimum initial deposit to cover the costs of account opening and to ensure that traders have access to sufficient funds to initiate trades in their preferred market.

Brokers’ minimum required initial deposits range from thousands to as little as one dollar. However, while this is an attractive offer, Botswanans must remember that to start trading, they must cover margin requirements.

Furthermore, Botswanans must remember to use risk management strategies to minimize their losses and protect their capital, including using leverage carefully.

Frequently Asked Questions

Can I start trading with 1 USD / 13 BWP?

You can register an account with a minimum deposit of 1 USD. However, you might be unable to open trading positions with such a low investment amount. The reason is attributable to the fact that brokers have a margin requirement that must be paid.

Furthermore, even if you could start trading with 1 USD, it would mean that you apply large leverage amounts, which can be risky and lead to excessive loss.

Where can I start trading with 10 USD / 130 BWP?

Forex brokers such as Exness allow you to register a trading account for a minimum of 10 USD.

What is the minimum deposit for MetaTrader 4?

MetaTrader 4 does not have a set minimum deposit requirement. Instead, if the broker offers this platform, you pay your forex broker the minimum deposit to register an account that will give you access to MT4.

Is forex trading a get-rich-quick scheme?

Forex trading is legit and is not a scheme. However, fraudulent individuals, companies, and fake brokers run schemes to steal money from unsuspecting investors. Therefore, you should only deal with verified and well-regulated forex brokers.

Which forex broker in Botswana has the lowest minimum deposit?

Several forex brokers in Botswana have low minimum deposits from $1 and even 0 USD if the broker offers a no-deposit bonus. Brokers such as Exness, HFM, InstaForex, and others have extremely low minimum deposit requirements.

What is the minimum capital you need to start trading forex in Botswana?

The minimum capital needed to start trading forex in Botswana can vary based on several factors, including the chosen broker, trading strategy, and individual risk tolerance. Many brokers offer accounts with relatively low minimum deposits, ranging from around $50 to a few hundred dollars.

Who are the best low minimum deposit forex brokers for Botswanans?

- Exness

- HFM

- JustMarkets

- TD Ameritrade

- RoboForex

- FXOpen

- SuperForex

- InstaForex

Which NASDAQ Forex brokers offer a low minimum deposit?

- Exness

- JustMarkets

- RoboForex

- FXOpen

- FBS

Which brokers offer no minimum deposit?

- TD Ameritrade

- HFM

- Fidelity Investments

Which brokers offer a signup bonus on their low minimum deposit?

- JustMarkets

- RoboForex

- FXOpen

- Fidelity Investments

- SuperForex

- InstaForex

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review