Pepperstone Review

Overall, Pepperstone is very competitive in terms of its trading fees and spreads. Pepperstone is regulated by one Tier-1 (High Trust), one Tier-2 (Medium Trust), and one Tier-3 (Low Trust) regulator. Pepperstone has a trust score of 92% out of 100. Pepperstone is currently not regulated by the MFED, BoB, or NBFIRA of Botswana

- Louis Schoeman

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

0 USD / 0 BWP

Regulators

ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB

Trading Desk

MetaTrader 4, MetaTrader 5, cTrader and TradeView

Crypto

Yes (Not available in Africa)

Total Pairs

60+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overview

Overall, Pepperstone is considered low-risk, with an overall Trust Score of 92 out of 100. The broker is licensed by three Tier-1 Regulators (high trust), three Tier-2 Regulators (average trust), and one Tier-3 Regulator (low trust). They offer two different retail trading accounts namely a Standard Account and a Razor Account.

Since opening its doors in 2010, Pepperstone Group has risen to the forefront of the online brokerage industry, constructing a highly competitive and feature-rich trading site that concentrates on forex, shares, indices, metals, commodities, and even cryptocurrencies.

A modest initial deposit of 200 units in the base currency enables novice traders to enter the market, while leverage ratios of up to 500:1 facilitate their participation.

Pepperstone provides an extra degree of protection for customers in volatile industries like financial services by separating customer accounts from the company’s cash.

There are several ways to get assistance, including round-the-clock chat and phone support and a comprehensive FAQ with information on depositing, withdrawing, and resolving trade disputes.

This Pepperstone review for Botswana will provide local retail traders with the details that they need to consider whether Pepperstone is suited to their unique trading objectives and needs.

Pepperstone accepts Botswanan clients and charges an average spread of 0.0 pips with an AU$7 commission round turn. Pepperstone has a maximum leverage ratio up to 1:200 (Retail) and 1:500 (Pro), and there is a demo and Islamic account available.

MT4, MT5, cTrader, TradingView, Myfxbook, and DupliTrade platforms are supported. Pepperstone is headquartered in Australia and regulated by ASIC, BaFin, CMA, CySEC, DFSA, FCA and SCB.

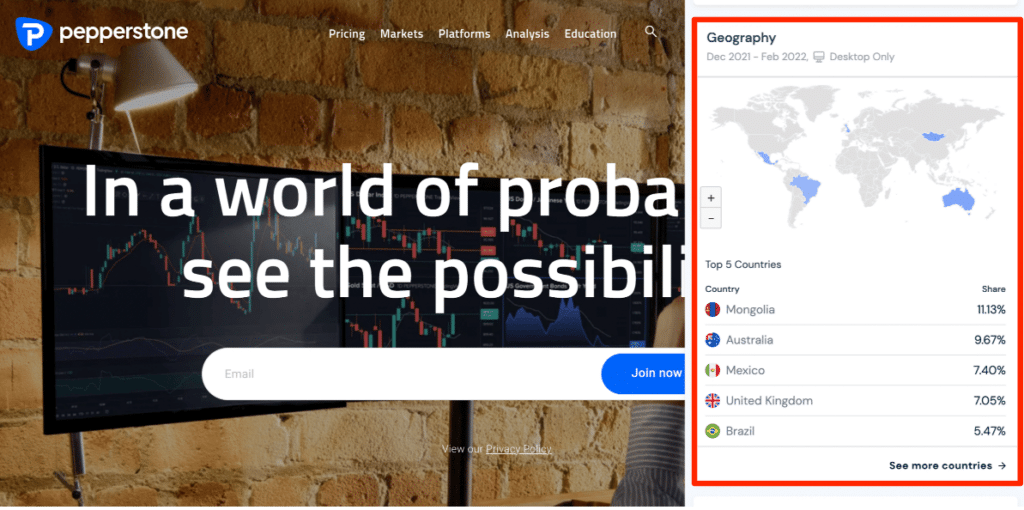

Distribution of Traders

Currently has the largest market share in these countries

➡️ Australia – 9%

➡️ Hong Kong – 8%

➡️ Brazil – 7.7%

➡️ United Kingdom – 6.2%

➡️ Mongolia – 5.9%

Popularity among traders who choose

🥇 Even though Pepperstone has a limited market share in Botswana, the broker is classified among the top 50 FX and CFD brokers that cater to Botswanan traders regardless of their trading experience or specific goals.

Pepperstone At a Glance

| 🏛 Headquartered | Melbourne, Australia with offices globally |

| 🌎 Global Offices | Australia, UK, Germany, Bahamas, Dubai, Kenya, Cyprus |

| 🏛 Local Market Regulators in Botswana | • Ministry of Finance and Economic Development (MFED) • Bank of Botswana (BoB) • Non-Bank Financial Institutions Regulatory Authority (NBFIRA) |

| 💳 Foreign Direct Investment in Botswana | 115.89 BWP Million in 2021 |

| 💰 Foreign Exchange Reserves in Botswana | 5270 USD Million in 2021 |

| ✔️ Local office in Gaborone? | No |

| 👨⚖️ Governor of SEC in Botswana | None, Moses Dinekere Pelaelo is the Governor of the Bank of Botswana |

| ✔️ Accepts Botswana Traders? | Yes |

| 📊 Year Founded | 2010 |

| 📞 Botswana Office Contact Number | None |

| 📱 Social Media Platforms | • Facebook • YouTube |

| ⚖️ Regulation | ASIC, BaFin, CMA, CySEC, DFSA, FCA and SCB |

| 1️⃣ Tier-1 Licenses | • Australian Securities and Investment • Commission (ASIC) Financial Conduct • Authority (FCA) Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) |

| 2️⃣ Tier-2 Licenses | • Cyprus Securities and Exchange • Commission (CySEC) Dubai Financial Services Authority (DFSA) • Capital Markets Authority (CMA) |

| 3️⃣ Tier-3 Licenses | • Securities Commission of the Bahamas (SCB) |

| 🪪 License Number | • Bahamas – 177174 B • Australia – ACN 147055703, AFSL 414530 • United Kingdom – 684312 • Cyprus – HE 398429 • Nigeria – CMA Licence Number 128 • Dubai – DFSA F004356, DIFC 3460 • Germany – 151148 |

| ⚖️ MFED, BoB, or NBFIRA Regulation | No |

| ✔️ Regional Restrictions | United States, Canada, Iran, Japan, Iraq, Zimbabwe, Yemen, and others |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 2 |

| ✔️ PAMM Accounts | No, only MAM for fund managers |

| 💻 Liquidity Providers | Barclays, HSBC |

| ✔️ Affiliate Program | Yes |

| 📱 Order Execution | Market |

| 📊 Starting spread | Variable, from 0.0 pips EUR/USD |

| 📉 Minimum Commission per Trade | From AU$7 |

| 💰 Decimal Pricing | 5th decimal pricing after the comma |

| 📞 Margin Call | 90% |

| 🛑 Stop-Out | 20% |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | 100 lots |

| ✅ Crypto trading offered? | Yes |

| ✔️ Offers a BWP Account? | No |

| 📉 Dedicated Botswana Account Manager? | No |

| 📈 Maximum Leverage | • 1:500 (Professional) • 1:200 (Retail) – Depending on the jurisdiction |

| 📊 Leverage Restrictions for Botswana? | No |

| 💳 Minimum Deposit (BWP) | 0 BWP or an equivalent to $0 |

| ✔️ Botswana Pula Deposits Allowed? | No |

| 📊 Active Botswana Trader Stats | 250,000+ |

| 👥 Active Botswana-based Pepperstone customers | Unknown |

| 🔁 Botswana Daily Forex Turnover | Unknown, Forex overall is $6.6 Trillion |

| 💰 Deposit and Withdrawal Options | • Visa • Mastercard • Bank transfer • MPESA • Paypal • Bpay • Neteller • POLi • Skrill • China UnionPay |

| 💻 Minimum Withdrawal Time | 1 business day |

| ⏰ Maximum Estimated Withdrawal Time | Up to 7 business days |

| 💳 Instant Deposits and Instant Withdrawals? | No |

| 🏛 Segregated Accounts with Botswana Banks? | No |

| 📱 Trading Platforms | • MetaTrader 4 • MetaTrader 5 • cTrader • TradingView • Myfxbook • DupliTrade |

| 💻 Tradable Assets | • Forex • Cryptocurrencies • Shares • ETFs • Indices • Commodities • Currency Indices |

| ✔️ Offers USD/BWP currency pair? | No |

| 📊 USD/BWP Average Spread | N/A |

| ✅ Offers Botswana Stocks and CFDs | No |

| 💻 Languages supported on the Website | English, Spanish, Russian, Chinese, Vietnamese, Arabic, Indonesian, Italian, French, German, Hungarian, Turkish |

| ☎️ Customer Support Languages | Multilingual |

| 👥 Copy Trading Support | Yes |

| ⏰ Customer Service Hours | 24/5 |

| 📞 Botswana-based customer support? | Yes |

| 💸 Bonuses and Promotions for Botswanans? | None |

| 📚 Education for Botswanan beginner traders | Yes |

| 📱 Proprietary trading software | No |

| 🤝 Most Successful Trader in Botswana | Unknown |

| ✔️ Is Pepperstone a safe broker for Botswana Traders? | Yes |

| 🎖 Rating for Pepperstone Botswana | 9/10 |

| 🥇 Trust score for Pepperstone Botswana | 92% |

| 👉 Open Account | 👉 Open Account |

Regulation and Safety of Funds

Regulation in Botswana

Even though the broker is not regulated by the Bank of Botswana or other local regulators, the broker is authorized and regulated by several other renowned market regulators throughout the world.

Global Regulations

Pepperstone is an Australian-based broker that is regulated by the Australian Securities and Investment Commission (ASIC) under the ACN 147055703 and the AFSL 414530, as well as the Financial Conduct Authority (FCA) in the United Kingdom under the Company Number 08965105 and the FRN 684312.

In addition to this, the broker also holds the following licenses and authorization:

➡️ The DFSA regulates Pepperstone Financial Services (DIFC) Limited in Dubai under the license number DFSA F004356 and DIFC 3460

➡️ SCB is a Tier-3 regulator that oversees Pepperstone Markets Limited under license number 177174B.

➡️ CySEC is the Tier-2 market regulator in Cyprus that oversees Pepperstone EU, Ltd. under license number HE398429.

➡️ In Germany, Pepperstone GmbH is well-regulated and overseen by Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) under license number 151148.

➡️ Lastly, Pepperstone Markets Kenya Limited is overseen and well-regulated by the Tier-2 CMA under license number 128.

Client Fund Security and Safety Features

A policy from Lloyd’s of London provides Pepperstone with professional indemnity insurance. Traders in the United Kingdom are safeguarded against losses of up to £85,000 according to the Financial Services Compensation Scheme Protection (FSCS).

To prevent unauthorized use of customer money, National Australia Bank keeps it in a separate account from its general finances. In addition, Ernst & Young oversees conducting impartial audits for Pepperstone Group.

In turbulent market situations, the trading platforms feature automated stop-out procedures to minimize negative balances; nonetheless, the website does state that “losses may surpass your deposit amount” in some circumstances.

For its customers in the United Kingdom and the European Union, Pepperstone has implemented negative balance protection, as required by the ESMA regulations that were employed in 2018.

However, customers who are not located in the United Kingdom or the European Union are not eligible for negative balance protection, and there is no assurance of a stop loss.

The broker does provide support for two-factor authentication (2FA), but the mobile application does not support biometric authentication currently.

Is Pepperstone a regulated broker, and what regulatory standards does it adhere to?

Yes, the broker is a regulated broker. The company operates under stringent regulatory frameworks to ensure the safety and security of its clients.

How does Pepperstone ensure the safety of client funds?

The broker prioritizes the safety of client funds through several measures. Firstly, being regulated by reputable authorities such as ASIC and the FCA ensures that the company operates under strict guidelines to protect client assets.

Awards and Recognition

In 2024 and 2021, Pepperstone was awarded the following:

➡️ Best Forex Broker Overall, Best MetaTrader 4 (MT4) Forex Broker, and Best No-Commission Trading Account, issued by Compareforexbrokers.com in 2024.

➡️ #1 for Overall Client Satisfaction, and #1 for Customer Service, awarded by the Investments Trends report.

➡️ International Business Magazine Awards issued Pepperstone awards for the Best Forex Broker Middle East in 2021.

➡️ Pepperstone won the INVESTINGOAL’s Best Broker in the World, Best Broker in Australia, Best cTrader Broker, and Best Scalping Broker awards.

Has Pepperstone received any notable awards for its services in the financial industry?

Indeed, Pepperstone has earned widespread recognition and several awards for its outstanding performance in the financial industry. The platform has been acknowledged for excellence in various categories, including its trading services, customer support, and technological innovations.

How is Pepperstone regarded in the financial industry, and what does its reputation suggest about the platform?

Pepperstone enjoys a positive and esteemed reputation within the financial industry, reflecting its commitment to providing a cutting-edge and reliable trading platform.

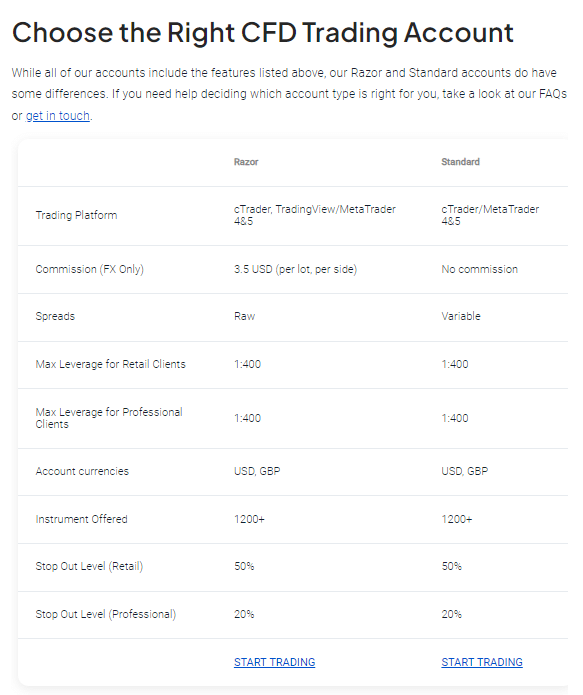

Pepperstone Account Types and Features

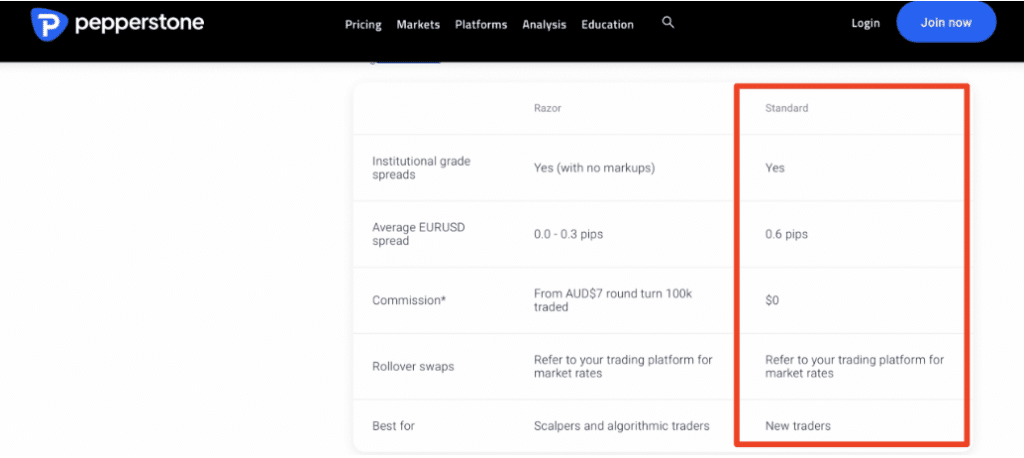

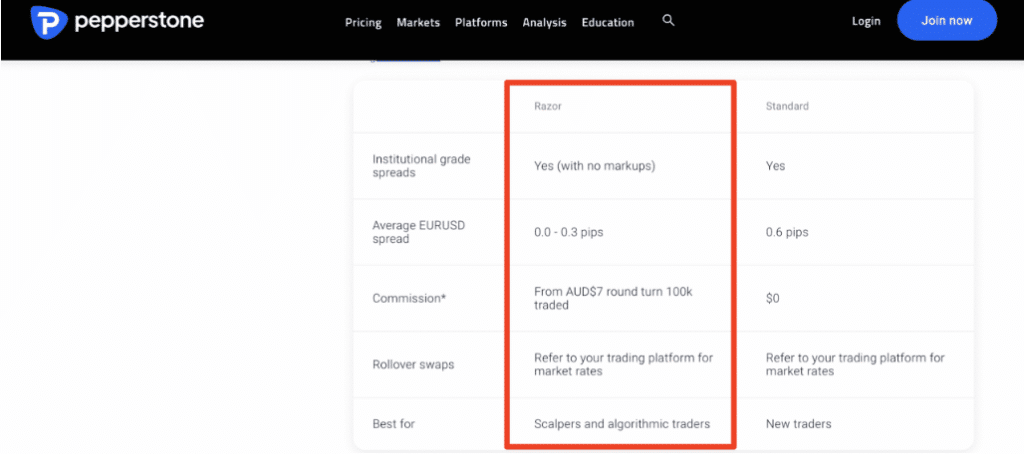

Standard Accounts and Razor Accounts are the two distinct kinds of dynamic retail accounts that Pepperstone offers to clients that are in Botswana.

Beginning traders or non-professionals can sign up for a Standard Account, which is a traditional type that has zero commission charges while still offering institutional-grade STP spreads.

In addition, despite the account type, Pepperstone accounts offer the same quality performance, support, and comprehensive platform features.

A choice for professional traders who would rather pay commission than spread consistently in the Razor Account – commission starting at 3.5 USD per side and spreads starting at 0.0 pips, while leverage can be adjusted to suit your needs and there are sophisticated algorithms to ensure fast trade execution.

| 💻 Live Account | 📉 Minimum Dep. | 📊 Average Spread | 💰 Commissions | 💸 Average Trading Cost |

| ➡️ Standard | 0 BWP/ 0 $ | 0.6 pips | None | 7.7 USD |

| ➡️ Razor | 0 BWP/ 0 $ | 0.0 pips | 7 AUD per lot | • cTrader: 8.17 USD • MT4: 8.17 USD • MT5: 9.2 USD |

Live Trading Account Details

Standard Account

The Standard account is the one that is typically chosen by most Botswanan traders, particularly novices and those who engage in an average amount of daily trading activity.

| Account Feature | Value |

| 💰 Minimum Deposit | $0 / 0 BWP |

| 💻 Minimum Trading Size | 0.01 lots |

| 📈 Maximum Trading Size | 100 lots in a single trade |

| 💵 Base Account Currency | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, and HKD |

| ✅ Trading Strategies Supported | All including scalping, hedging, and Expert Advisors (EAs) |

| 🗞 News Trading Offered? | Yes |

| ➡️ Trade Execution | No-Dealing Desk (NDD) |

| 📊 Average EUR/USD Spread | From 0.6 pips |

| 💸 Commissions | None |

| 🔃 Rollover Swaps | Yes, according to the market rates |

| ⬆️ Maximum Leverage per region | • Australia – 1:30 • Bahamas – 1:200 • Cyprus – 1:30 • Dubai – 1:30 • Germany – 1:30 • Botswana – 1:400 • United Kingdom – 1:30 |

| ❌ Negative Balance Protection Offered | Yes, only for retail clients |

| ✅ Margin Close-Out (%) | 50% |

| 🔨 Trading Instruments offered | 1,200+ |

| 💻 Trading Platforms offered | MetaTrader 4, MetaTrader 5, cTrader, TradingView, Myfxbook, DupliTrade |

Razor Account

This professional account is ideal for traders in Botswana that use algorithmic trading strategies or scalping. These fast-paced traders will subsequently discover that the Razor account has the narrowest spreads of any other trading platform in the business.

| Account Feature | Value |

| 💰 Minimum Deposit | 0 BWP or an equivalent to $0 |

| 💻 Minimum Trading Size | 0.01 lots |

| 📈 Maximum Trading Size | 100 lots in a single trade |

| 💵 Base Account Currency | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, and HKD |

| ✅ Trading Strategies Supported | All including scalping, hedging, and Expert Advisors (EAs) |

| 🗞 News Trading Offered? | Yes |

| ➡️ Trade Execution | No-Dealing Desk (NDD) |

| 📊 Average EUR/USD Spread | Between 0.0 pips and 0.3 pips |

| 💸 Commissions | From AU$7 round turn on 100,000 traded |

| 🔃 Rollover Swaps | Yes, according to the market rates |

| ⬆️ Maximum Leverage per region | • Australia – 1:30 • Bahamas – 1:200 • Cyprus – 1:30 • Dubai – 1:30 • Germany – 1:30 • Botswana – 1:400 • United Kingdom – 1:30 |

| ❌ Negative Balance Protection Offered | Yes, only for retail clients |

| ✅ Margin Close-Out (%) | 50% |

| 🔨 Trading Instruments offered | 1,200+ |

| 💻 Trading Platforms offered | MetaTrader 4, MetaTrader 5, cTrader, TradingView, Myfxbook, DupliTrade |

Pepperstone Base Account Currencies

BWP is not an accepted base account currency option when registering a Standard or Razor Account with Pepperstone. Instead, Botswanan traders can choose from the following currency options:

➡️ AUD

➡️ USD

➡️ JPY

➡️ GBP

➡️ EUR

➡️ CAD

➡️ CHF

➡️ NZD

➡️ SGD

➡️ HKD

Demo Account

Pepperstone gives prospective traders full access to a demo trading account, which may be utilized to practice trading in real-time.

New traders can practice and make use of the MT4, MT5, and cTrader trading platforms, which each give a wide variety of completely configurable trading tools and features. This can help new traders achieve greater success in their trading endeavors.

Pepperstone Islamic Account

Pepperstone’s Islamic Account is best suited for practicing Muslims who engage in commercial transactions while still adhering to the principles of Sharia law.

Since collecting or paying interest of any kind is seen as both exploitative and wasteful, the law outlaws charging interest of any kind, including overnight costs.

Originating from the following locations, Muslim traders may open an Islamic Account with Pepperstone if they meet the requirements:

➡️ Albania

➡️ Azerbaijan

➡️ Bangladesh

➡️ Burkina Faso

➡️ Bahrain

➡️ Brunei

➡️ Nigeria

➡️ Brunei Darussalam

➡️ Algeria

➡️ Egypt

➡️ Guinea

➡️ Indonesia

➡️ Jordan

➡️ Kyrgyzstan

➡️ Kuwait

➡️ Morocco

➡️ Mauritania, and several other Islamic regions.

What types of trading accounts does Pepperstone offer?

The broker provides traders with a selection of account types to cater to various trading preferences. The two primary account types are the Standard Account and the Razor Account. The Standard Account is suitable for most traders and features competitive spreads without any commission charges.

What features are available with Pepperstone trading accounts?

The brokers trading accounts come with a range of features to enhance the trading experience. These features include advanced trading platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, providing traders with powerful tools for analysis and execution.

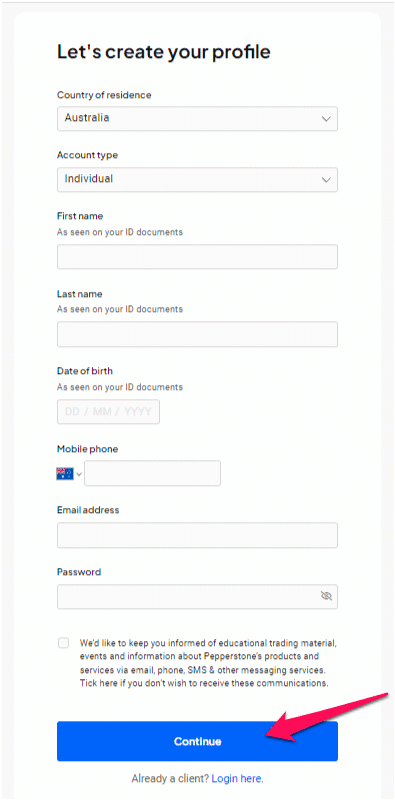

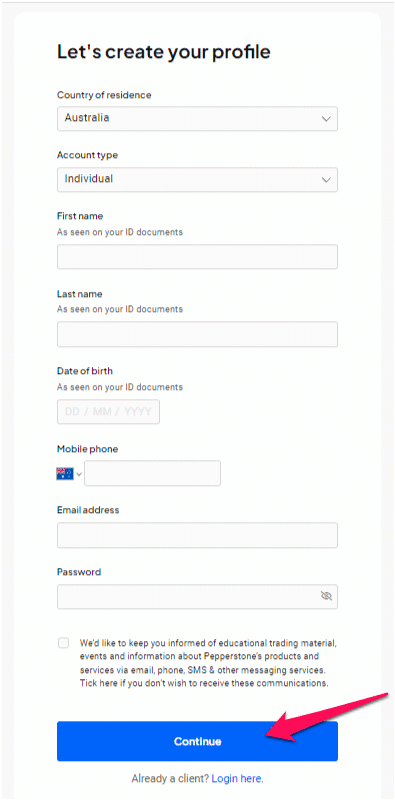

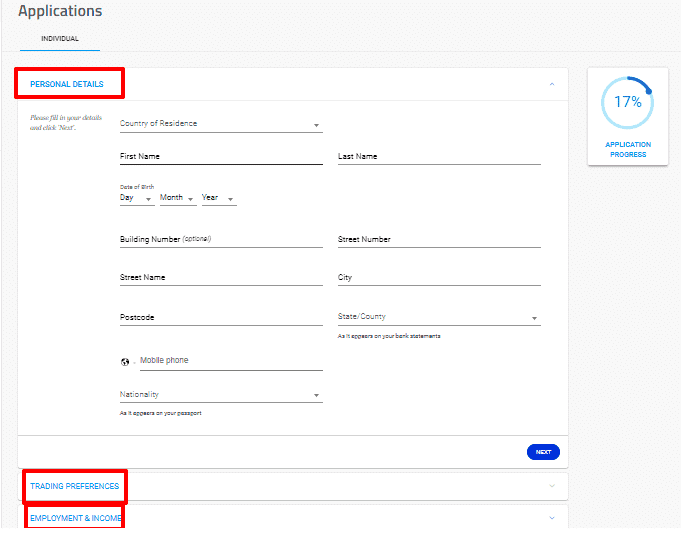

How to set up a Pepperstone Demo Account – Step by Step

To register for, and set up a demo account with Pepperstone, traders can visit the website and follow 3 steps.

1. Step 1 – Open an account

On the official website, you can click the “Join now” or “Try demo” tabs to quick and easy open an account.

2. Step 2 – Register an account

New accounts are applied online and processed according to established industry standards.

You can open a live account or demo account (also called a practice account) from start to finish on the website and choose to open a demo account first. Brokers usually require an e-mail and password to complete the initial step and if more than one currency can be used, traders must select their preferred account currency.

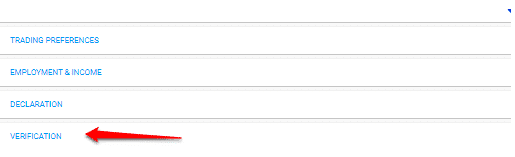

3. Step 3 – Account verification

An account verification process is usually mandatory due to regulatory requirements, so keep a copy of your ID and a proof of residency document ready for the last step.

Note that this ‘Know Your Client (KYC) process, may only be necessary once you decide to move forward and work with real money.

Pepperstone Vs OANDA Vs FBS – Broker Comparison

| 🥇 Pepperstone | 🥈 OANDA | 🥉 FBS | |

| ⚖️ Regulation | ASIC, BaFin, CMA, CySEC, DFSA, FCA and SCB | IIROC, ASIC, CFTC, NFA, FCA, FFAJ, JFSA, MAS, MFSA, BVI FSC | IFSC, CySEC, ASIC, FSCA |

| 📱 Trading Platform | • MetaTrader 4 • MetaTrader 5 • cTrader • TradingView • Myfxbook • DupliTrade | • MetaTrader 4 • MetaTrader 5 • OANDA Platform • TradingView | • MetaTrader 4 • MetaTrader 5 • FBS Trader • CopyTrade |

| 💰 Withdrawal Fee | No | Yes, bank wire | Yes |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 0 BWP | 0 BWP | 12 BWP |

| 📊 Leverage | 1:400 | 1:200 | Up to 1:3000 |

| 📊 Spread | Variable, from 0.0 pips | Variable, from 0.1 pips | From 0.0 pips |

| 💰 Commissions | From AU$7 | $40 | From $6 |

| ✴️ Margin Call/Stop-Out | 90%/20% | 100%/ 50% | 40%/ 20% |

| 💻 Order Execution | Market | Market | Market |

| 💳 No-Deposit Bonus | No | No | Yes |

| 📊 Cent Accounts | No | No | Yes |

| 📈 Account Types | • Standard Account • Razor Account | • Standard Account • Core Account • Swap-Free Account | • FBS Cent Account • FBS Micro Account • FBS Standard Account • FBS Zero Account • FBS ECN Account • FBS Crypto Account |

| ⚖️ CBN Regulation | No | No | No |

| 💳 BWP Deposits | No | Yes | Yes |

| 📊 Botswana Pula Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/5 | 24/7 |

| 📊 Retail Investor Accounts | 2 | 3 | 6 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 📉 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | 100 lots | 1,000 lots | 500 lots |

| 💰 Minimum Withdrawal Time | 1 business day | 1 business day | 15 to 20 minutes (maximum 48 hours) |

| 📊 Maximum Estimated Withdrawal Time | Up to 7 business days | Up to 7 business days | Up to 7 days |

| 💸 Instant Deposits and Instant Withdrawals? | No | No | Instant Deposits |

Min Deposit

0 USD / 0 BWP

Regulators

ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB

Trading Desk

MetaTrader 4, MetaTrader 5, cTrader and TradeView

Crypto

Yes (Not available in Africa)

Total Pairs

60+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Pepperstone Trading Platforms

Pepperstone’s trading technology and software highlight the significance of performance and then an extra added metrics.

With several Pepperstone trading platforms including MT4 or its latest version MT5, TradingView, and cTrader, you can refine your trading while perfecting your trading strategy since all trading styles are covered.

Pepperstone offers Botswanan Traders a choice between these trading platforms:

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ cTrader

➡️ TradingView

➡️ Myfxbook

➡️ DupliTrade

Desktop Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ cTrader

MetaTrader 4

MT4 is a trading platform that is focused on foreign exchange, whereas MT5 is a multi-asset platform that provides access to a wider range of markets.

Pepperstone allows its users to trade over 700 different CFD products, including dozens of different cryptocurrencies and hundreds of different equities. The commissions for MT5 are the same as they were for MT4, except for a reduced fee of AU$3.50 per lot for traders.

MetaTrader 5

The most recent version, MetaTrader 5, is an improvement over its predecessor, MT4. MetaTrader 5 already includes all the features from MT4 but offers more extensive capabilities and functions, and it is the most powerful edition of the platform.

In addition, another benefit of MetaTrader 5 is that you will not have any trouble with the coding, and the processing speed and personalization options will also improve.

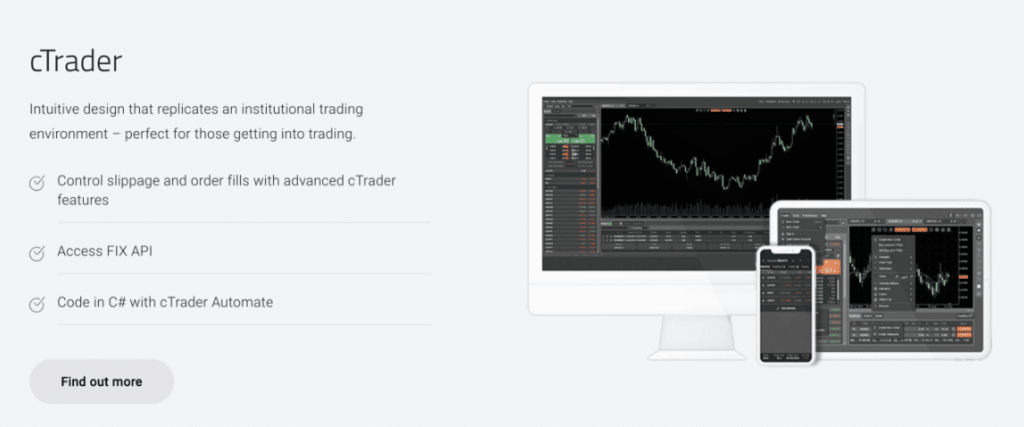

cTrader

The supporters of the cTrader Platform are welcomed since this program is widely regarded as being among the most innovative and forward-thinking trading platforms that are accessible through the Desktop version.

Because it is built on algorithmic logic, the platform demonstrates excellent performance and enables effective position management in markets that are constantly shifting.

In any case, the elevated level of productivity provided by Pepperstone’s mix of liquid assets and solid infrastructure is unmatched.

WebTrader Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ cTrader

➡️ TradingView

➡️ Myfxbook

➡️ DupliTrade

MetaTrader 4 and 5

The widely used option of MetaTrader 4 and 5 offers compatibility for a variety of platforms, including mobile apps, desktop applications, and web-based applications.

In addition, the platforms have a comprehensive and straightforward user interface and offer order management tools, indications, expert advisors, DDE protocols, and many other applications.

In addition, the Pepperstone platform has been improved with Smart Trader Tools, which is a collection of over ten different intelligent tools that make trading more effective.

cTrader

Professional online trading is available via cTrader, which has an easy trading platform design that simulates the atmosphere of an institutional trading environment. cTrader is the platform of choice for seasoned CFD traders with some of the following features:

➡️ Direct access to the inter-bank market depth to employ sophisticated algorithmic trading systems for foreign exchange.

➡️ An interface that allows for customization, including pre-set charts that may be removed.

➡️ Back-testing facilities that are comprehensive and extensive

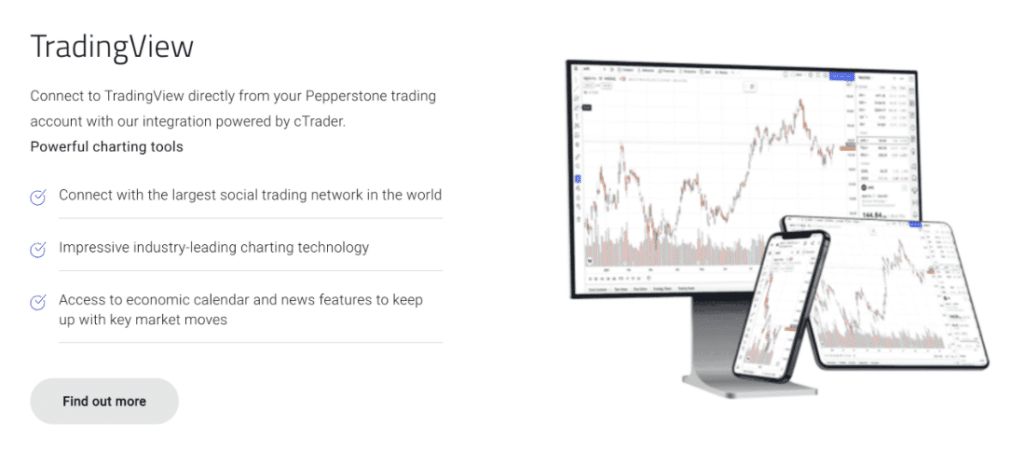

TradingView

TradingView was only recently introduced to the collection of trading tools offered by Pepperstone. TradingView is offered at no cost to traders who register for a real account with the platform. It is an especially useful device for investigating, charting, and screening any financial instrument.

Myfxbook

Myfxbook AutoTrade is a service that mirrors your trading account and lets you mimic the trades of the most successful forex trading systems out there.

By establishing your own portfolio with the help of this tool, you will not have to pay any performance or management fees when you make your own investments, and you will not have to pay any additional costs either.

DupliTrade

Although Pepperstone does not provide its own social trading platform, it does provide support for the MetaTrader Signals marketplace and Duplitrade.

Duplitrade is a well-known third-party trading strategy marketplace that enables you to automate your trading by following the strategies of other traders who have proven themselves to be successful.

The MetaTrader Signals copy trading system may be followed by anybody who uses the MetaTrader platform; however, the Duplitrade copy trading system can only be accessed via Pepperstone with a minimum deposit of 5000 USD (or an equal amount in another currency).

Trading App

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ cTrader

MetaTrader 4 and 5

There is no better alternative than MT4 if you are seeking a forex trading application that will aid you in growing your trading abilities than MT4.

This platform does not just feature the best analytical tools now available on the market; in addition to that, it works with hundreds of brokers and offers outstanding tools for first-time traders, such as copy trading and demo accounts.

Mobile trading with MetaTrader 5 for Android gives you the ability to access the Foreign Exchange (Forex) and Stock Exchange (Exchange) markets easily and effortlessly from your smartphone or tablet.

You may simply access your Pepperstone account from any location in the globe, which allows you to carry out activities such as analysing the quotes of various exchange instruments, including currencies, stocks, and other financial instruments, and conducting trading operations.

cTrader

Both the mobile application and the web version of the platform may be accessed using a mobile device. cAlgo, which was created to be a strong tool with robots and indicators based on C# for straightforward functioning, is one of the most important components of cTrader.

What trading platforms are available on Pepperstone, and which one is right for me?

The broker offers a variety of advanced trading platforms to cater to different preferences and skill levels. The popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms are available, known for their user-friendly interfaces, comprehensive charting tools, and automated trading capabilities.

Can I trade on Pepperstone using my mobile device, and what features are available on the mobile platforms?

Yes, Pepperstone recognizes the importance of mobile trading and provides mobile versions of the MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader platforms.

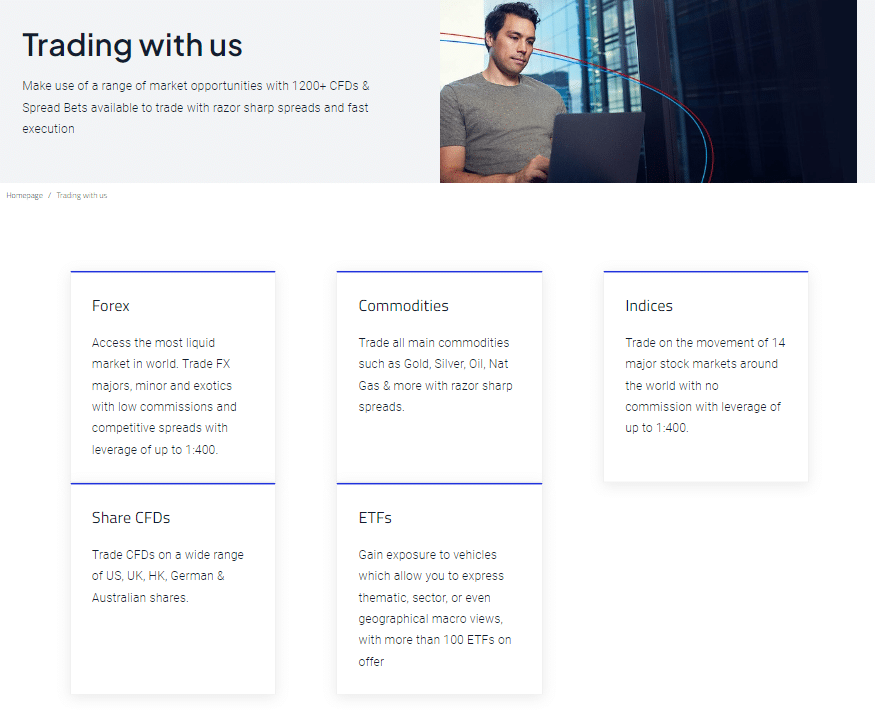

Range of Markets

Botswanan Traders can expect the following range of markets from:

➡️ Forex

➡️ Cryptocurrencies

➡️ Shares

➡️ ETFs

➡️ Indices

➡️ Commodities

➡️ Currency Indices

Financial Instruments and Leverage offered

| 🔨 Instrument | 💰 Number of Assets Offered | 📈 Max Leverage Offered |

| ➡️ Forex | 70 | • 1:200 (retail) • 1:500 (Pro) |

| ➡️ Precious Metals | 5 | 1:200 |

| ➡️ ETFs | 5 | 1:20 |

| ➡️ Indices | 16 | 1:200 |

| ➡️ Stocks | 5 | 1:10 |

| ➡️ Cryptocurrency | 5 | 1:10 |

| ➡️ Commodities | 17 | 1:200 |

Broker Comparison for Range of Markets

| 🥇 Pepperstone | 🥈 OANDA | 🥉 FBS | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | Yes | No | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | No | Yes |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | Yes | No |

What financial instruments can I trade on Pepperstone?

The broker provides access to a diverse range of financial instruments, allowing traders to build diversified portfolios. The platform covers major and minor currency pairs in the forex market, including EUR/USD, GBP/USD, and USD/JPY.

What financial instruments can I trade on Pepperstone?

The broker provides access to a diverse range of financial instruments, allowing traders to build diversified portfolios. The platform covers major and minor currency pairs in the forex market, including EUR/USD, GBP/USD, and USD/JPY.

10 Best Forex Brokers in Botswana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

Trading and Non-Trading Fees

The broker pricing is either integrated into a spread or a commission basis, and it is offered by numerous liquidity providers. As a result, you are guaranteed to get highly competitive pricing, and Pepperstone’s spread is regarded to be among the lowest spreads in the industry.

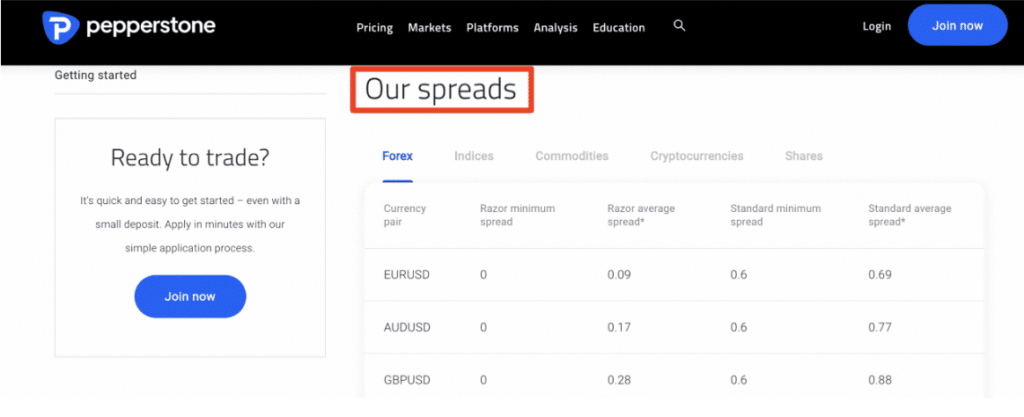

Spreads

The account type that a trader selects at Pepperstone will determine the spreads that the trader may anticipate receiving from Pepperstone.

Pepperstone’s Standard Account offers a variable spread with a mark-up, which ensures that there are no commission costs associated with this account. The Razor Account, however, offers zero-pip spreads and thus has a commission fee tied to it. The Islamic account offered by Pepperstone has marked-up spreads to offset the absence of overnight fees.

These are the typical spreads that Botswanans can expect from:

➡️ Standard Account – from 0.6 pips EUR/USD

➡️ Razor Account – between 0.0 pips and 0.3 pips EUR/USD

➡️ Islamic Account Option – from between 1 pip and 1.2 pips EUR/USD

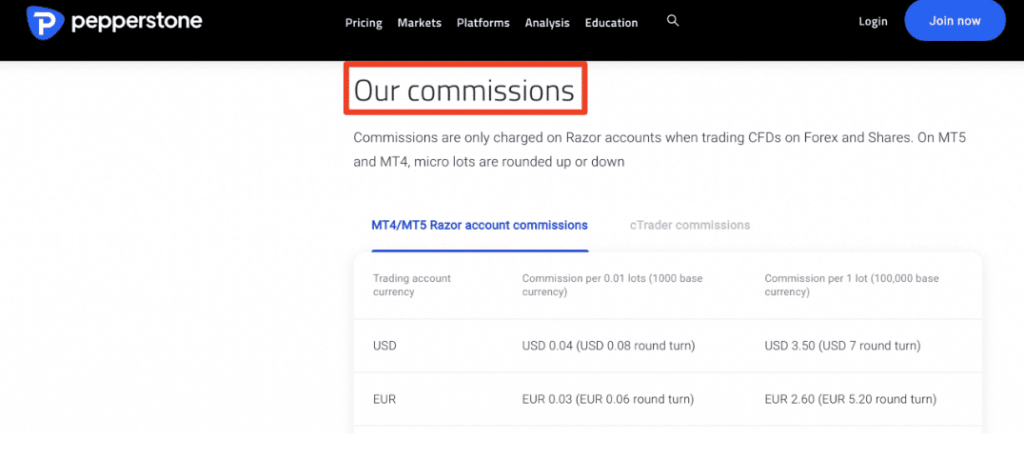

Commissions

Since you will be trading with interbank spread quotes beginning from 0 pips and commission charges will be charged as a trading cost, Razor Accounts are the only ones that have the commission fee added and this fee is AU$3.5 per side or AU$7 per round for every 100,000 in the base currency that is traded.

Overnight Fees, Rollovers, or Swaps

Overnight financing is a cost for keeping a stake in stocks, commodities, cryptocurrencies, metals, or index markets, as well as a swap for foreign exchange holdings that are kept beyond rollover.

Traders should be aware that every Friday, a triple swap is applied to CFD Equities and Indices, which accounts for holdings maintained over the weekend.

Muslim traders who utilize Pepperstone’s Islamic Account should be aware that they will be charged administrative costs every 10 days that they keep a position open.

Deposit and Withdrawal Fees

Regardless of their place of residence, Pepperstone does not impose any deposit or withdrawal fees on most traders. However, traders who utilize International Telegraphic Transfer (TT) would be charged an AU$20 fee.

Inactivity Fees

When the trading account is no longer in use or it becomes dormant after an extended period, Botswanan traders are not charged an inactivity fee.

Currency Conversion Fees

Because BWP is not an accepted base account currency, Botswanans who deposit or withdraw their funds in Botswanan Pula could face currency conversion fees.

Other Fees

When Muslim traders want to convert their trading account to an Islamic Account, Pepperstone requires proof of residence to approve the application.

In addition, there is an administrative fee applied to the Islamic account when traders hold their positions past a certain time. These admin fees are as follows:

➡️ Cryptocurrencies (Professional Account Only), commodities, equities – 1.5 USD

➡️ Index Markets – 10 USD

➡️ SpotCrude and SpotBrent – 20 USD

➡️ Forex, precious metals on the retail account – 50 USD

➡️ Only on the professional account – Crypto10, Crypto20, and Crypto30 – 50 USD

➡️ BTC/USD (Professional Account Only) – 125 USD

➡️ GER40, FRA40, JPN225, CN50, ETH/USD (Professional Account Only) – 12 USD

➡️ US30 – 30 USD

What are the trading fees associated with Pepperstone?

The broker employs a transparent fee structure that is competitive in the industry. The primary trading fees include spreads, which are the differences between the buying and selling prices of a financial instrument.

Are there any non-trading fees on Pepperstone, and what should I be aware of?

In addition to trading fees, Pepperstone may charge certain non-trading fees. These can include overnight financing fees for positions held overnight, withdrawal fees, and inactivity fees for dormant accounts.

Deposits and Withdrawals

offers the following deposit and withdrawal methods:

➡️ Visa

➡️ Mastercard

➡️ Bank transfer

➡️ MPESA

➡️ Paypal

➡️ Bpay

➡️ Neteller

➡️ POLi

➡️ Skrill

➡️ China UnionPay

Broker Comparison: Deposit and Withdrawals

| 🥇 Pepperstone | 🥈 OANDA | 🥉 FBS | |

| Minimum Withdrawal Time | 1 business day | 1 business day | 15 to 20 minutes (maximum 48 hours) |

| Maximum Estimated Withdrawal Time | Up to 7 business days | 7 to 10 business days | Up to 7 days |

| Instant Deposits and Instant Withdrawals? | No | No | Instant Deposits |

Deposit Currencies, Deposit and Withdrawal Processing Times

| 💳 Payment Method | 💰 Deposit Currencies | 🔁 Deposit Processing | 💳 Withdrawal Processing |

| Visa | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD | 3 to 5 days | 3 to 5 days |

| Mastercard | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD | 3 to 5 days | 3 to 5 days |

| Bank transfer | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD | 3 to 7 days | 3 to 7 days |

| MPESA | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD | Instant | 3 to 5 days |

| Paypal | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD | Instant | 3 to 5 days |

| Bpay | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD | 3 to 5 days | 3 to 5 days |

| Neteller | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD | Instant | 3 to 5 days |

| POLi | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD | 1 to 3 days | 1 to 3 days |

| Skrill | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD | Instant | 3 to 5 days |

| China UnionPay | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD | 3 to 5 days | 3 to 5 days |

How can I initiate a withdrawal from my Pepperstone trading account, and what withdrawal options are available?

Withdrawing funds from your trading account is a user-friendly process. Simply log in to your account, go to the withdrawal section, and select your preferred withdrawal method.

How can I make a deposit into my Pepperstone trading account, and what are the available payment methods?

Making a deposit into your trading account is a straightforward process. The platform supports various payment methods, including bank wire transfers, credit/debit cards, and popular e-wallet options such as PayPal, Neteller, and Skrill. To make a deposit, log in to your account, navigate to the deposit section, and choose your preferred payment method.

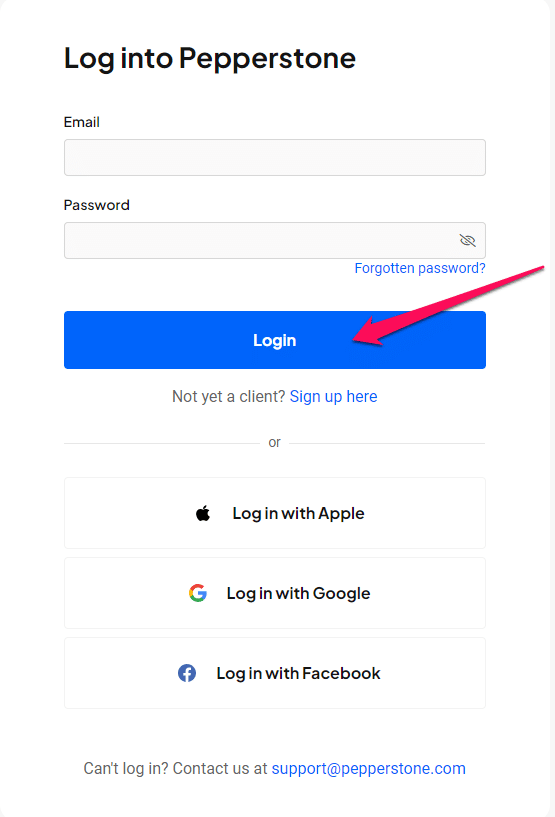

How to Deposit Funds with Pepperstone

1. Step 1 – Registration

Register your email and password; confirm your email; then proceed to the Secure Client Area.

2. Step 2 – Fill in Information

Fill in your personal information and set the base currency of your account.

3. Step 3 – Complete information

Complete a trading application with all personal and relevant info.

4. Step 4 – Upload personal document.

Upload a copy of your passport or ID, and a utility bill or some other proof of address.

Traders can fund their accounts by sending the funds to one of the Pepperstone segregated client accounts from their own bank account or execute the option to deposit the minimum amount from their personal area after a live trading account was registered and had been approved.

Traders then log into their personal area, select the option for deposits, and follow the instructions to make a deposit into their trading account. Traders must make sure that they select the correct deposit currency if there is a choice available.

Funds must be transferred in the same currency as the bank account to which they are sending it, to prevent currency conversion fees from being charged.

Pepperstone Fund Withdrawal Process

To withdraw funds from an account with Pepperstone, Botswanan Traders can follow these steps:

Step 1: Log In

Simply log in to your secure client area

Step 2: “Funds”

Navigate to the “Funds” section on their trader’s dashboard.

From here, they can click on “Withdraw Funds” and select from the withdrawal methods available.

Step 3: “Accept Withdrawal”

Traders can then confirm their withdrawal request details by clicking the “Accept Withdrawal” link on the email that is sent.

If Botswanan traders have set up and activated their 2-Factor Authentication (2FA), they may need to approve using the app before the withdrawal request can be finalized and submitted for processing.

Min Deposit

0 USD / 0 BWP

Regulators

ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB

Trading Desk

MetaTrader 4, MetaTrader 5, cTrader and TradeView

Crypto

Yes (Not available in Africa)

Total Pairs

60+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Education and Research

Education

Pepperstone offers the following Educational Materials:

➡️ Learn to Trade CFDs

➡️ Learn to Trade Forex

➡️ Learn to Trade Crypto

➡️ Learn to Trade Shares

➡️ Trading Guides

➡️ Webinars

Research and Trading Tool Comparison

| 🥇 Pepperstone | 🥈 OANDA | 🥉 FBS | |

| ➡️ Economic Calendar | Yes | Yes | Yes |

| ➡️ VPS | Yes | Yes | Yes |

| ➡️ AutoChartist | Yes | Yes | No |

| ➡️ Trading View | Yes | Yes | No |

| ➡️ Trading Central | No | No | No |

| ➡️ Market Analysis | Yes | Yes | Yes |

| ➡️ News Feed | Yes | Yes | Yes |

| ➡️ Blog | Yes | Yes | Yes |

The broker also offers Botswanan traders the following additional Research and Trading Tools:

➡️ Market Analysis

➡️ Smart Trader Tools for MetaTrader

➡️ cTrader Automate

➡️ AutoChartist

➡️ API Trading

➡️ Economic Calendar

➡️ Meet the Pepperstone analysts

What educational resources does Pepperstone provide for traders?

The broker is dedicated to empowering traders with the knowledge and skills needed to navigate financial markets successfully. The platform offers a comprehensive range of educational resources, including webinars, video tutorials, articles, and market analysis.

What research tools are available on Pepperstone to assist traders in their decision-making process?

The broker provides traders with a suite of research tools to stay informed about market trends and make well-informed decisions. The platform offers daily market analysis, economic calendars, and insights from expert analysts. Traders can access real-time market data, technical analysis, and the latest news to stay abreast of market developments.

Bonuses and Promotions

offers Botswanan Traders the following bonuses and promotions:

➡️ Referral bonus for Professional clients

➡️ Referral bonus for Retail traders

How to open an Affiliate Account

To register an Affiliate Account, Botswanan Traders can follow these steps:

➡️ Navigate to the official website.

➡️ From the homepage, prospective affiliates can navigate to the affiliate section and click on “Find out more.”

➡️ A new page will load, and prospective affiliates can read the information provided by Pepperstone to decide whether this partnership is suited to their objectives.

➡️ Once complete, prospective affiliates can click on “Start Earning Today” to start the application.

➡️ The application form must be completed by filling in all the required fields, after which it can be submitted for review.

➡️ Once approved, Botswanan affiliates can navigate to the affiliate area where they can access their comprehensive affiliate package.

➡️ Botswanan affiliates can now start referring customers and they can also expect payment within 30 days for each successful referral that signs up on the Pepperstone website.

Affiliate Program Features

Pepperstone offers a comprehensive affiliate program that allows Botswanans to expand their business. Pepperstone offers an enormous collection of resources and tools that can help affiliates draw in more customers.

With the broker, affiliates can easily earn up to $1,300 in CPA per customer that is referred to the Pepperstone site. In addition, with Pepperstone, affiliates will find that they have access to 24/7 real-time reporting, a multi-tiered CPA framework, extensive support, and more.

The affiliate program that Pepperstone offers is ideal for those who have a large social media following and who can reach a large audience or anyone else that experiences frequent website traffic and who can benefit from a partnership with a reliable and prominent broker.

Customer Support

The broker offers dedicated customer support that can be reached during market hours. They offer multi-lingual support presented over several communication channels.

| Customer Support | Pepperstone’s Customer Support |

| ⏰ Operating Hours | 24/5 |

| 🗣 Support Languages | English, Vietnamese, Thai, Chinese, Polish, Arabic |

| 🗯 Live Chat | Yes |

| 📧 Email Address | Yes |

| ☎️ Telephonic Support | Yes |

| 📞 Local Support in Botswana? | No |

| 🥇 Overall quality of Pepperstone Support | 4.8/5 |

Corporate Social Responsibility

To demonstrate its dedication to the environment and corporate social responsibility, Pepperstone has pledged to become a Carbon Neutral firm by the end of 2024 and to encourage other FX and CFD brokers in the industry to follow suit.

Workers, the board of directors, shareholders, and the communities in which they live and operate all contribute to Pepperstone’s commitment.

Our Verdict

Botswanan traders can concentrate on the challenging endeavor of attempting to effectively trade the markets since Pepperstone provides access to the markets that are free of any complications.

Traders who desire a reasonable selection of low-cost options, several choices of user interfaces and account kinds, and rapid customer assistance will find Pepperstone to be a perfect alternative.

In determining that Pepperstone is the best forex broker for trading experience in 2020, the ranking system used by Investopedia considered each of these characteristics.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Pepperstone offers competitive spreads that start from 0.0 pips on EUR/USD | There are restrictions on the countries that may use Pepperstone’s Islamic account |

| Pepperstone is well-regulated and offers an extremely secure trading environment with transparent trading fees | There is no BWP-denominated account offered, subjecting Botswanans to currency conversion fees |

| Investor protection is offered to EU clients through the FSCS | There are additional administrative fees applied to the Islamic account |

| Pepperstone offers a choice between some of the best trading platforms | |

| Negative balance protection is offered for clients in certain regions | |

| There is an Islamic account offered to Muslim traders | |

| There is a demo account offered by Pepperstone | |

| There are several trading tools offered |

You might also like: FBS Review

You might also like: FOREX.com Review

You might also like: FP Markets Review

You might also like: FXChoice Review

You might also like: FXCM Review

Frequently Asked Questions

Is Pepperstone regulated?

Yes, Pepperstone is regulated in Australia by the ASIC, Germany by BaFin, Kenya by the CMA, Cyprus by CySEC, Dubai by the DFSA, United Kingdom by the FCA, and the Bahamas by SCB.

Can I change leverage on Pepperstone?

Yes, you can change your leverage on Pepperstone. To change leverage, you can go to the Account section of your secure client area to modify your leverage.

Change Leverage by clicking on the pen symbol above the appropriate account. Be aware that any open transactions on your account will be affected if your leverage is changed.

Does Pepperstone have cryptocurrency?

Yes, Pepperstone offers 19 cryptocurrencies that can be traded including Bitcoin, Ethereum, Litecoin, and many others. When trading cryptocurrencies through Pepperstone, you can use leverage up to 1:10.

What is the withdrawal time with Pepperstone?

The withdrawal time that you can expect from Pepperstone is between a minimum of 1 day and a maximum of up to 7 business days, depending on the withdrawal method that you have chosen.

What is Pepperstone’s leverage?

Pepperstone limits UK retail clients to 1:30 because of FCA and ESMA requirements. However, other regions have access to leverage up to 1:200 while only professional traders can get leverage up to 1:500.

Is Pepperstone safe or a scam?

Pepperstone is a safe broker with a trust score of 92 out of 100 and an overall rating of 9/10. Pepperstone is one of the largest brokers and is a prominent name in the forex and CFD trading industry.

Does Pepperstone have Nasdaq?

Yes, Pepperstone has Nasdaq. Nasdaq forms a part of the Index CFDs that Pepperstone offers under the symbol “NAS100”.

How much can you withdraw from Pepperstone?

You may only withdraw up to 90% of your free margin while you have open transactions on your account. Your current free margin can be accessed on your MT4/5 Terminal under the ‘Trade’ tab.

Does Pepperstone have Volatility 75?

Yes, Pepperstone has Volatility 75. Pepperstone is one of the few brokers that make VIX part of its comprehensive financial instrument portfolio.

Conclusion

Now it is your turn to participate:

➡️ Do you have any prior experience with Pepperstone?

➡️ What was the determining factor in your decision to engage with Pepperstone?

➡️ Was it because of the minimum deposit, regulation, retail trading accounts, or any other factors?

➡️ Have you experienced any issues with Pepperstone such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

Regardless, please share your thoughts in the comments below.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review