SuperForex Review

Overall, SuperForex is considered low-risk, with an overall Trust Score of 87% out of 100. SuperForex offers 11 different retail trading accounts as well as Demo and Islamic accounts. SuperForex offers a BWP account to Botswana traders. SuperForex is currently not regulated by the Central Bank of Botswana.

- Louis Schoeman

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

USD 1 / 13 BWP

Regulators

IFSC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

300

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overview

The broker is considered low-risk, with an overall Trust Score of 87 out of 100. SuperForex is licensed by zero Tier-1 Regulators (high trust), zero Tier-2 Regulators (average trust), and zero Tier-3 Regulators (low trust).

The broker offers eleven different retail trading accounts: a Standard Account, Swap-Free Account, a No Spread Account, Micro Cent Account, Profi STP Account, Crypto Account, ECN Standard Account, ECN Standard Mini Account, ECN Swap-Free Account, ECN Swap-Free Mini Account, and an ECN Crypto Account.

The broker attempts to attract as many customers as possible by providing a substantial number of foreign exchange pairings and a similarly substantial number of trading account types.

Market Maker STP accounts had very wide spreads, while the ECN accounts has higher commissions. They are an online broker established in 2013 with the mission of exceeding clients’ expectations by delivering high-quality and innovative online trading services.

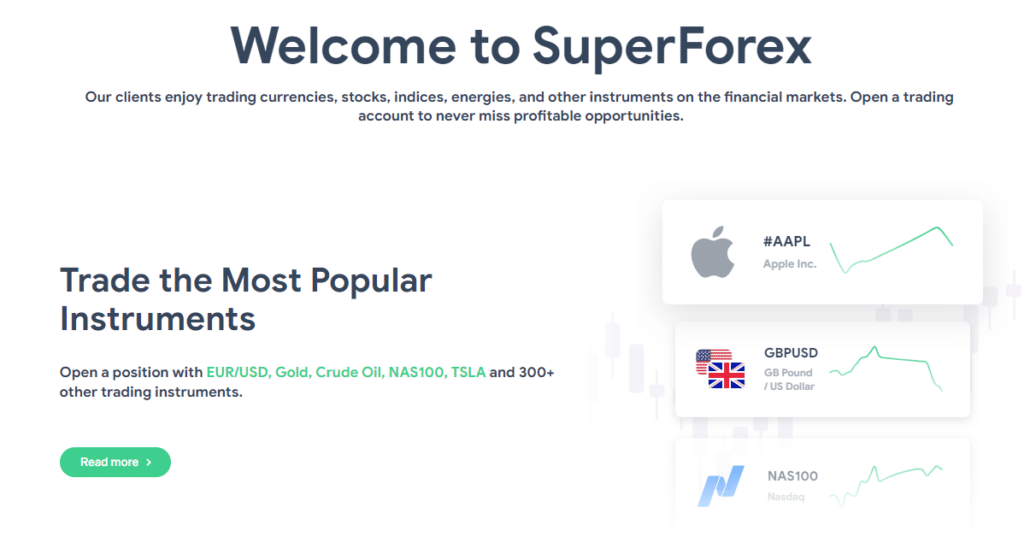

SuperForex is a worldwide brokerage that provides clients with an extensive selection of over 400 different CFD products that can be traded online using the user-friendly MT4 trading platform.

In addition to that, it operates several subsidiaries in other countries. Over 200,000 customers from more than 150 different nations use there services.

SuperForex accepts Botswanan clients and has an average spread from 0.0 pips with 0.013% commission. SuperForex has a maximum leverage ratio of up to 1:2000, and a demo and Islamic account are available.

MetaTrader 4 and SuperForex mobile platforms are supported. SuperForex is headquartered in Belize and is not currently regulated by any known regulatory entities.

Distribution of Traders

Currently has the largest market share in these countries:

➡️ Tanzania – 12.1%

➡️ Brazil – 8%

➡️ Kenya- 7.03%

➡️ Algeria – 6.69%

➡️ Zimbabwe – 5.98%

Popularity among traders

While SuperForex does not dominate Botswanan’s forex and CFD market, the broker still forms part of the top 35 brokers for the region.

SuperForex At a Glance

| 🏛 Headquartered | Belize |

| 🌎 Global Offices | Belize |

| 🏛 Local Market Regulators in Botswana | • Ministry of Finance and Economic Development (MFED) • Bank of Botswana (BoB) • Non-Bank Financial Institutions Regulatory Authority (NBFIRA) |

| 💳 Foreign Direct Investment in Botswana | 115.89 BWP Million in 2021 |

| 💰 Foreign Exchange Reserves in Botswana | 5270 USD Million in 2021 |

| ✔️ Local office in Gaborone? | No |

| 👨⚖️ Governor of SEC in Botswana | None, Moses Dinekere Pelaelo is the Governor of the Bank of Botswana |

| ✔️ Accepts Botswana Traders? | Yes |

| 📊 Year Founded | 2013 |

| 📞 Botswana Office Contact Number | None |

| 📱 Social Media Platforms | • Telegram • YouTube |

| ⚖️ Regulation | None |

| 1️⃣ Tier-1 Licenses | None |

| 2️⃣ Tier-2 Licenses | None |

| 3️⃣ Tier-3 Licenses | None |

| 🪪 License Number | None |

| ⚖️ MFED, BoB, or NBFIRA Regulation | None |

| ✔️ Regional Restrictions | United States, Ukraine, North Korea |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 11 |

| ✔️ PAMM Accounts | Yes, through SuperForex Bank |

| 💻 Liquidity Providers | BNP Paribas, Natixis, Citibank, UBS |

| ✔️ Affiliate Program | Yes |

| 📱 Order Execution | Market, Instant |

| 📊 Starting spread | No Spread |

| 📉 Minimum Commission per Trade | From 0.013% |

| 💰 Decimal Pricing | None |

| 📞 Margin Call | 80% |

| 🛑 Stop-Out | 40% |

| 📉 Minimum Trade Size | 1 lot or share |

| 📈 Maximum Trade Size | Unlimited |

| ✅ Crypto trading offered? | No |

| ✔️ Offers a BWP Account? | Yes, ECN Standard Mini |

| 📉 Dedicated Botswana Account Manager? | No |

| 📈 Maximum Leverage | 1:2000 |

| 📊 Leverage Restrictions for Botswana? | No |

| 💳 Minimum Deposit (BWP) | 13 BWP or an equivalent of $1 |

| ✔️ Botswana Pula Deposits Allowed? | No, only USD |

| 📊 Active Botswana Trader Stats | 250,000+ |

| 👥 Active Botswana-based SuperForex customers | Unknown |

| 🔁 Botswana Daily Forex Turnover | Unknown, Forex overall is $6.6 Trillion |

| 💰 Deposit and Withdrawal Options | • Bank Transfers • South African Bank Transfers • Southeast Asian Bank Transfers • Latin American Bank Transfers • Credit Card • Debit Card • UnionPay • Skrill • Sticpay • Neteller • Triv • Fasapay • Perfect Money • OnlineNaira • BitWallet • AstroPay • MPesa • Airtel • MTN • Vodacom • Zamtel • Crypto Wallets • Local Payments • SuperForex Money |

| 💻 Minimum Withdrawal Time | Instant |

| ⏰ Maximum Estimated Withdrawal Time | 2 to 4 working days |

| 💳 Instant Deposits and Instant Withdrawals? | Yes |

| 🏛 Segregated Accounts with Botswana Banks? | No |

| 📱 Trading Platforms | • MetaTrader 4 • SuperForex App |

| 💻 Tradable Assets | • Forex • Precious Metals • Stocks • Indices • Cryptocurrencies • Commodities • Energies • ETFs • Futures • Stock CFDs |

| ✔️ Offers USD/BWP currency pair? | No |

| 📊 USD/BWP Average Spread | No |

| ✅ Offers Botswana Stocks and CFDs | No |

| 💻 Languages supported on the Website | English, Russian, Arabic, Thai, French, Spanish, Chinese (Simplified), Chinese (Traditional), Italian, Polish, Indonesian, Vietnamese, Portuguese, German, and others. |

| ☎️ Customer Support Languages | Multilingual |

| 👥 Copy Trading Support | Yes, Standard and Swap-Free Accounts |

| ⏰ Customer Service Hours | 24/7 |

| 📞 Botswana-based customer support? | No |

| 💸 Bonuses and Promotions for Botswanans? | Yes |

| 📚 Education for Botswana beginner traders | Yes |

| 📱 Proprietary trading software | Yes |

| 🤝 Most Successful Trader in Botswana | Currently unknown |

| ✔️ Is SuperForex a safe broker for Botswana Traders? | Yes |

| 🎖 Rating for SuperForex Botswana | 8/10 |

| 🥇 Trust score for SuperForex Botswana | 87% |

| 👉 Open Account | 👉 Open Account |

Regulation and Safety of Funds

Regulation in Botswana

The local market regulators in Botswana are as follows:

➡️ Ministry of Finance and Economic Development (MFED)

➡️ Bank of Botswana (BoB)

➡️ Non-Bank Financial Institutions Regulatory Authority (NBFIRA)

Global Regulations

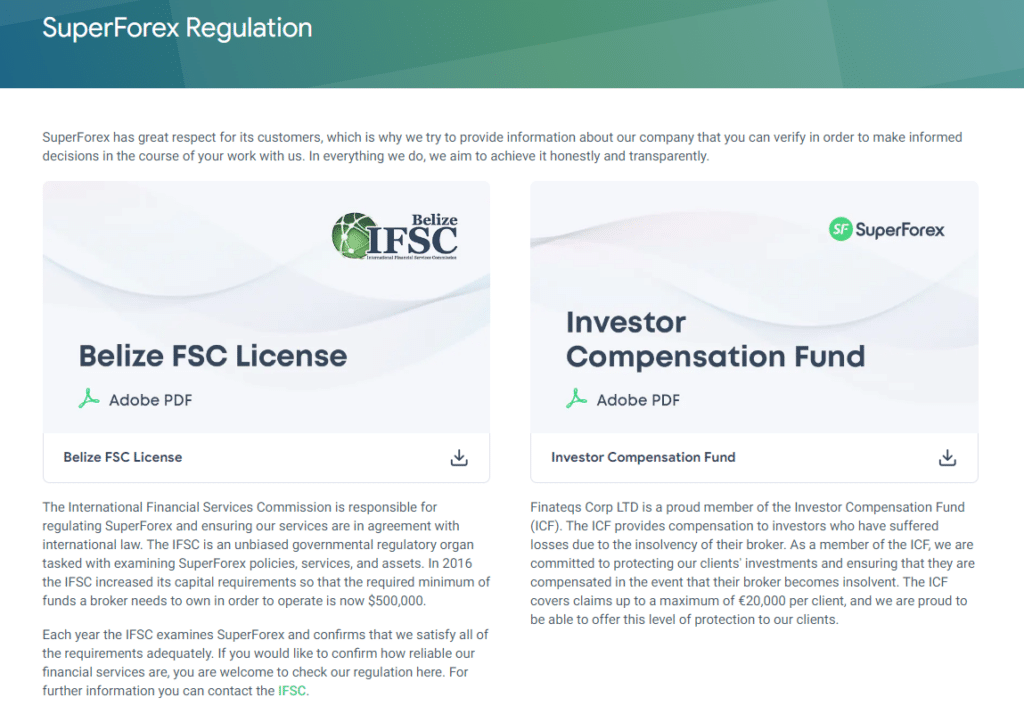

The broker is regulated by the International Financial Services Commission (IFSC) in Belize. However, SuperForex does not provide a license or reference number, and further investigation into the company’s regulatory standing has not provided any clear answers.

A clickable IFSC link on the SuperForex website is nowhere useful in learning about the company’s regulatory standing.

Client Fund Security and Safety Features

The broker claims to use “segregated funds” even though it is not regulated. They claim that it does not reinvest any customer funds into the business.

The broker is obligated to provide separate bank accounts for customer funds to be used only for trading purposes. In addition, SuperForex has implemented SSL authentication certificates for customer safety purposes. Client machines and SuperForex servers are both protected in this way.

They advise there clients to review their contact information and verify that they follow AML laws to keep their accounts secure.

In addition, SuperForex requires all clients to provide a government-issued ID card and a utility bill to verify their identity and residence, as detailed in an AML policy document. This verification process is mandatory for all new customers registering with Botswana’s traders.

SuperForex gives its Botswanan clients access to details on their account activity, such as the user’s IP address, the time and date of their most recent login, the platform and browser they used, and so on.

The brokers Client’s Cabinet may be used to keep track of all a client’s credentials. Customers of SuperForex will not be allowed to log in from any device that is not on this approved list.

To further prevent hackers from accessing customers’ accounts, they can construct a list of IP addresses from which they do not want their accounts to be accessed.

Is SuperForex regulated, and what measures are in place to ensure the safety of traders’ funds?

The broker is a globally operating broker with regulation by the International Financial Services Commission (IFSC).

What steps can traders take to enhance the safety of their funds when trading with SuperForex or any other broker?

These include conducting due diligence on the broker’s regulatory status, reading and understanding the broker’s terms and conditions, using strong and unique login credentials, enabling two-factor authentication, and keeping sensitive account information secure.

Awards and Recognition

Superforex provides customers with superior services. Several international Forex authorities evaluating the service supplied by brokerage firms such as the broker hase evaluated the organization.

The broker is pleased to report that the brokerage has received recognition for expertise in a few fields:

➡️ Best Crypto Broker (2024) – awarded by Global Business Magazine.

➡️ Best Withdrawal Options (2024) – awarded by the World Financial Award.

➡️ Best ECN broker in 2021, awarded by Global Business Magazine.

How can traders benefit from SuperForex’s awards and recognition in their trading decisions?

Awards and recognition in the forex industry can serve as a form of validation for a broker’s services and reputation.

Has SuperForex received any awards or recognition for its services in the forex industry?

Yes, the broker has announced that they have been awarded for there excellence in quite a few fields

Account Types and Features

The broker offers a diverse selection of account choices to its traders. Botswanan traders must choose the account type that corresponds most closely with their objectives, trading methods, and investment horizons.

It is essential to note that each account type has its own set of regulations, trading conditions, and limits. With direct access to the Forex market through ECN accounts, intermediate institutions are unnecessary to facilitate transactions.

Consequently, ECN accounts eliminate the need for intermediaries and requotes between market players. As a result, traders in Botswana may expect quick order execution because of this technology and its benefit.

Provides the following account types:

➡️ Standard Account

➡️ Swap-Free Account

➡️ No Spread Account

➡️ Micro Cent Account

➡️ Profi STP Account

➡️ Crypto Account

➡️ ECN Standard Account

➡️ ECN Standard Mini Account

➡️ ECN Swap-Free Account

➡️ ECN Swap-Free Mini Account

➡️ ECN Crypto Account

| 💻 Live Account | 💳 Minimum Dep. | 📊 Average Spread | 💸 Commissions | 💰 Average Trading Cost |

| Standard | 13 BWP / 1 USD | 2 pips | None | 20 USD |

| Swap-Free | 13 BWP / 1 USD | 2 pips | None | 20 USD |

| No-Spread | 1,300 BWP / 100 USD | 0.1 pips | 0.017% | 1 – 5 USD |

| Micro Cent | 13 BWP / 1 USD | 2 pips | None | 20 USD |

| Profi STP | 6,600 BWP / 500 USD | 2 pips | 0.013% | 1 – 5 USD |

| Crypto | 1,300 BWP / 100 USD | 2 pips | 0.75% | 9 USD |

| ECN Standard | 1,300 BWP / 100 USD | 0.0 pips | 8 to 10 USD | 8 – 10 USD |

| ECN Standard Mini | 13 BWP / 1 USD | 0.0 pips | 0 pips | 0 USD |

| ECN Swap-Free | 1,300 BWP / 100 USD | 0.0 pips | 10 – 40 USD | 10 – 40 USD |

| ECN Swap-Free Mini | 13 BWP / 1 USD | 0.0 pips | 10 – 40 USD | 10 – 40 USD |

| ECN Crypto | 1,300 BWP / 100 USD | 0.0 pips | 0.6% | 6 USD |

Live Trading Account Details

Standard Account

Regardless of their trading goals or preferences, many Botswanan traders may use this basic account.

| Account Features | Value |

| 💻 Account Base Currency Options | USD, EUR, GBP, RUB, ZAR, NGN, CNY, BDT, INR, THB |

| 💵 Minimum Deposit | 13 BWP or an equivalent of $1 |

| 💰 Maximum Deposit | Unlimited |

| 💳 Maximum Leverage offered | 1:1000 |

| 💸 Commissions charged | None |

| 🔧 Instruments available on this Account | All |

| ✅ Bonuses offered | All |

| 📈 Position Size for the Account | 10,000 USD |

| 🔄 Swaps | Included |

| 📊 Average Spreads | • EUR/USD – 2 pips • XAU/USD – 7 pips • XAG/USD – 7 pips • AAPL – 1 pip • Brent Crude Oil (BRT) – 2.5 pips • SPX – 13 pips • NAS100 – 13 pips • SVXY.US – 7 pips |

| ✔️ Forex Copy-trading offered | Included |

Swap-Free Account

If you are a Muslim and a trader in Botswana, you can open a Swap-Free account and avoid the fees associated with holding overnight positions. This standard STP Islamic Account has wider spreads but zero commission fees.

| Account Features | Value |

| 💻 Account Base Currency Options | USD, EUR, GBP, RUB, IDR, MYR, AED, ZAR, NGN, BDT |

| 💵 Minimum Deposit | 13 BWP or an equivalent of $1 |

| 💰 Maximum Deposit | Unlimited |

| 💳 Maximum Leverage offered | 1:1000 |

| 💸 Commissions charged | None |

| 🔧 Instruments available on this Account | All |

| ✅ Bonuses offered | All |

| 📈 Position Size for the Account | 10,000 USD |

| 🔄 Swaps | Included |

| 📊 Average Spreads | • EUR/USD – 2 pips • XAU/USD – 7 pips • XAG/USD – 7 pips • AAPL – 1 pip • Brent Crude Oil (BRT) – 2.5 pips • SPX – 13 pips • NAS100 – 13 pips • SVXY.US – 7 pips |

| ✔️ Forex Copy-trading offered | Included |

No Spread Account

This account has the tightest spreads and is ideal for algorithmic traders, scalpers, aggressive traders, and other strategies that need quick execution.

| Account Features | Value |

| 💻 Account Base Currency Options | USD, EUR, GBP |

| 💵 Minimum Deposit | 1,300 BWP or an equivalent to $100 |

| 💰 Maximum Deposit | Unlimited |

| 💳 Maximum Leverage offered | 1:1000 |

| 💸 Commissions charged | Yes, from 0.017% |

| 🔧 Instruments available on this Account | • Forex • Precious Metals • Stocks • Commodities • CFDs • Futures |

| ✅ Bonuses offered | Welcome, Energy, Hot, Dynamic |

| 📈 Position Size for the Account | 100,000 USD |

| 🔄 Swaps | Included |

| 📊 Average Spreads | • EUR/USD – 2 pips • XAU/USD – 7 pips • XAG/USD – 7 pips • AAPL – 1 pip • Brent Crude Oil (BRT) – 2.5 pips • SPX – 13 pips • NAS100 – 13 pips • SVXY.US – 7 pips |

| ✔️ Forex Copy-trading offered | None |

Micro Cent Account

This account is great for novice traders because of the lower risks associated with the smaller position sizes. In addition, this account is ideal for those who have stopped using a demo account and are now ready to transition to live trading slowly.

| Account Features | Value |

| 💻 Account Base Currency Options | USD, EUR |

| 💵 Minimum Deposit | 13 BWP or an equivalent of $1 |

| 💰 Maximum Deposit | 40,000 BWP or an Equivalent to $3,000 |

| 💳 Maximum Leverage offered | 1:1000 |

| 💸 Commissions charged | 10,000 USD or EUR Cents |

| 🔧 Instruments available on this Account | Forex |

| ✅ Bonuses offered | Welcome, Energy, Hot, Dynamic |

| 📈 Position Size for the Account | 100,000 USD |

| 🔄 Swaps | Included |

| 📊 Average Spreads | • EUR/USD – 2 pips • XAU/USD – 7 pips • XAG/USD – 7 pips • AAPL – 1 pip • Brent Crude Oil (BRT) – 2.5 pips • SPX – 13 pips • NAS100 – 13 pips • SVXY.US – 7 pips |

| ✔️ Forex Copy-trading offered | None |

Profi STP Account

This advanced account is tailored to the needs of traders who want to optimize their returns.

| Account Features | Value |

| 💻 Account Base Currency Options | USD, EUR, GBP, ZAR |

| 💵 Minimum Deposit | 6,600 BWP or an equivalent to $500 |

| 💰 Maximum Deposit | Unlimited |

| 💳 Maximum Leverage offered | 1:2000 |

| 💸 Commissions charged | Yes, from 0.013% |

| 🔧 Instruments available on this Account | All except ETFs |

| ✅ Bonuses offered | Welcome, Energy, Hot, Dynamic |

| 📈 Position Size for the Account | 100,000 USD |

| 🔄 Swaps | No |

| 📊 Average Spreads | • EUR/USD – 2 pips • XAU/USD – 7 pips • XAG/USD – 7 pips • AAPL – 1 pip • Brent Crude Oil (BRT) – 2.5 pips • SPX – 13 pips • NAS100 – 13 pips • SVXY.US – 7 pips |

| ✔️ Forex Copy-trading offered | None |

Crypto Account

The only objective of this account is to make transactions involving bitcoins easier to complete.

| Account Features | Value |

| 💻 Account Base Currency Options | USD |

| 💵 Minimum Deposit | 1,300 BWP or an equivalent to $100 |

| 💰 Maximum Deposit | Unlimited |

| 💳 Maximum Leverage offered | 1:10 |

| 💸 Commissions charged | Yes, from 0.75% |

| 🔧 Instruments available on this Account | • Forex Major Pairs • Cryptocurrencies |

| ✅ Bonuses offered | Welcome, Energy, Hot, Dynamic |

| 📈 Position Size for the Account | 10 BTC |

| 🔄 Swaps | No |

| 📊 Average Spreads | • EUR/USD – 2 pips • XAU/USD – 7 pips • XAG/USD – 7 pips • AAPL – 1 pip • Brent Crude Oil (BRT) – 2.5 pips • SPX – 13 pips • NAS100 – 13 pips • SVXY.US – 7 pips |

| ✔️ Forex Copy-trading offered | None |

ECN Standard Account

Traders could use the benefits of ECN trading since ECN execution is a standard feature of their accounts. In addition, this is a more advanced trading account, and while commissions are charged, traders can expect lower spreads.

| Account Features | Value |

| 💻 Account Base Currency Options | USD, EUR, GBP |

| 💵 Minimum Deposit | 1,300 BWP or an equivalent to $100 |

| 💰 Maximum Deposit | Unlimited |

| 💳 Maximum Leverage offered | 1:1000 |

| 💸 Commissions charged | Between $8 to $10 on Forex |

| 🔧 Instruments available on this Account | • Forex Major Pairs • Cryptocurrencies |

| ✅ Bonuses offered | Welcome, Energy, Hot, Dynamic |

| 📈 Position Size for the Account | 100,000 USD |

| 🔄 Swaps | Included |

| 📊 Average Spreads | • EUR/USD – 2 pips • XAU/USD – 7 pips • XAG/USD – 7 pips • AAPL – 1 pip • Brent Crude Oil (BRT) – 2.5 pips • SPX – 13 pips • NAS100 – 13 pips • SVXY.US – 7 pips |

| ✔️ Forex Copy-trading offered | None |

ECN Standard Mini Account

This is a wonderful account for traders who desire to evaluate their trading tactics in an environment with reduced risks while experiencing actual market circumstances.

| Account Features | Value |

| 💻 Account Base Currency Options | USD, EUR, GBP, NZD, TZS, UGX, GHS, BWP, MYR, BRL, NGN, ZAR |

| 💵 Minimum Deposit | 13 BWP or an equivalent of $1 |

| 💰 Maximum Deposit | Unlimited |

| 💳 Maximum Leverage offered | 1:1000 |

| 💸 Commissions charged | Between $8 to $10 on Forex |

| 🔧 Instruments available on this Account | • Forex • CFDs • Precious Metals • Indices • ETFs • Futures |

| ✅ Bonuses offered | Welcome, Energy, Hot, Dynamic |

| 📈 Position Size for the Account | 10,000 USD |

| 🔄 Swaps | Included |

| 📊 Average Spreads | • EUR/USD – 2 pips • XAU/USD – 7 pips • XAG/USD – 7 pips • AAPL – 1 pip • Brent Crude Oil (BRT) – 2.5 pips • SPX – 13 pips • NAS100 – 13 pips • SVXY.US – 7 pips |

| ✔️ Forex Copy-trading offered | None |

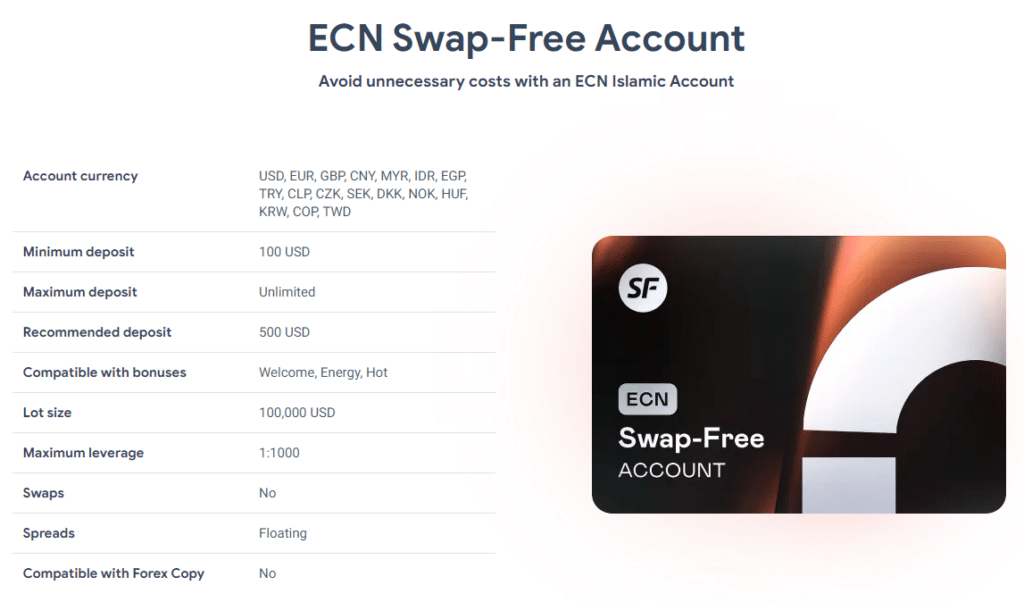

ECN Swap-Free Account

This is a standard ECN Islamic account that has been tailored specifically for traders who practice Islam. The ECN Swap-Free account provides Muslim traders who use fast-paced strategies with the benefit of zero-pip spreads.

| Account Features | Value |

| 💻 Account Base Currency Options | USD, EUR, GBP |

| 💵 Minimum Deposit | 1,300 BWP or an equivalent to $100 |

| 💰 Maximum Deposit | Unlimited |

| 💳 Maximum Leverage offered | 1:1000 |

| 💸 Commissions charged | • $10 on Forex Majors • $40 on Energies |

| 🔧 Instruments available on this Account | • Forex • CFDs • Precious Metals • Indices • ETFs • Futures |

| ✅ Bonuses offered | Welcome, Energy, Hot, Dynamic |

| 📈 Position Size for the Account | 100,000 USD |

| 🔄 Swaps | No |

| 📊 Average Spreads | • EUR/USD – 2 pips • XAU/USD – 7 pips • XAG/USD – 7 pips • AAPL – 1 pip • Brent Crude Oil (BRT) – 2.5 pips • SPX – 13 pips • NAS100 – 13 pips • SVXY.US – 7 pips |

| ✔️ Forex Copy-trading offered | None |

ECN Swap-Free Mini Account

This trading account caters to Muslim traders in Botswana who are just beginning their careers as investors by providing them with favorable trading conditions and ECN execution.

| Account Features | Value |

| 💻 Account Base Currency Options | USD, EUR, GBP |

| 💵 Minimum Deposit | 110 BWP or an equivalent of $1 |

| 💰 Maximum Deposit | Unlimited |

| 💳 Maximum Leverage offered | 1:1000 |

| 💸 Commissions charged | $10 on Forex Majors and $40 on Energies |

| 🔧 Instruments available on this Account | • Forex • CFDs • Precious Metals • Indices • ETFs • Futures |

| ✅ Bonuses offered | Welcome, Energy, Hot, Dynamic |

| 📈 Position Size for the Account | 10,000 USD |

| 🔄 Swaps | No |

| 📊 Average Spreads | • EUR/USD – 2 pips • XAU/USD – 7 pips • XAG/USD – 7 pips • AAPL – 1 pip • Brent Crude Oil (BRT) – 2.5 pips • SPX – 13 pips • NAS100 – 13 pips • SVXY.US – 7 pips |

| ✔️ Forex Copy-trading offered | None |

ECN Crypto Account

Only trading in cryptocurrencies with ECN execution is allowed on this account.

| Account Features | Value |

| 💻 Account Base Currency Options | USD |

| 💵 Minimum Deposit | 1,300 BWP or an equivalent to $100 |

| 💰 Maximum Deposit | Unlimited |

| 💳 Maximum Leverage offered | 1:10 |

| 💸 Commissions charged | Yes, from 0.6% |

| 🔧 Instruments available on this Account | • Forex Major Pairs • Cryptocurrencies |

| ✅ Bonuses offered | Welcome, Energy, Hot, Dynamic |

| 📈 Position Size for the Account | 10 BTC |

| 🔄 Swaps | No |

| 📊 Average Spreads | • EUR/USD – 2 pips • XAU/USD – 7 pips • XAG/USD – 7 pips • AAPL – 1 pip • Brent Crude Oil (BRT) – 2.5 pips • SPX – 13 pips • NAS100 – 13 pips • SVXY.US – 7 pips |

| ✔️ Forex Copy-trading offered | None |

Base Account Currencies

SuperForex offers one of the largest selections of base currencies according to the account type traders register. Botswanans can select from these currencies per account type:

| 💻 Account Type | 💵 Supported Base Currency |

| Standard Account | USD, EUR, GBP, RUB, ZAR, NGN, CNY, BDT, INR, THB |

| Swap-Free Account | USD, EUR, GBP, RUB, IDR, MYR, AED, ZAR, NGN, BDT |

| No Spread Account | USD, EUR, GBP |

| Micro Cent Account | USD, EUR |

| Profi STP Account | USD, EUR, GBP, ZAR |

| Crypto Account | USD |

| ECN Standard Account | USD, EUR, GBP |

| ECN Standard Mini Account | USD, EUR, GBP, NZD, TZS, UGX, GHS, KES, MYR, BRL, NGN, ZAR |

| ECN Swap-Free Account | USD, EUR, GBP |

| ECN Swap-Free Mini Account | USD, EUR, GBP |

| ECN Crypto Account | USD |

Botswanans must note that SuperForex does not offer BWP as a base currency, which could subject traders to currency conversion fees when they deposit or withdraw funds.

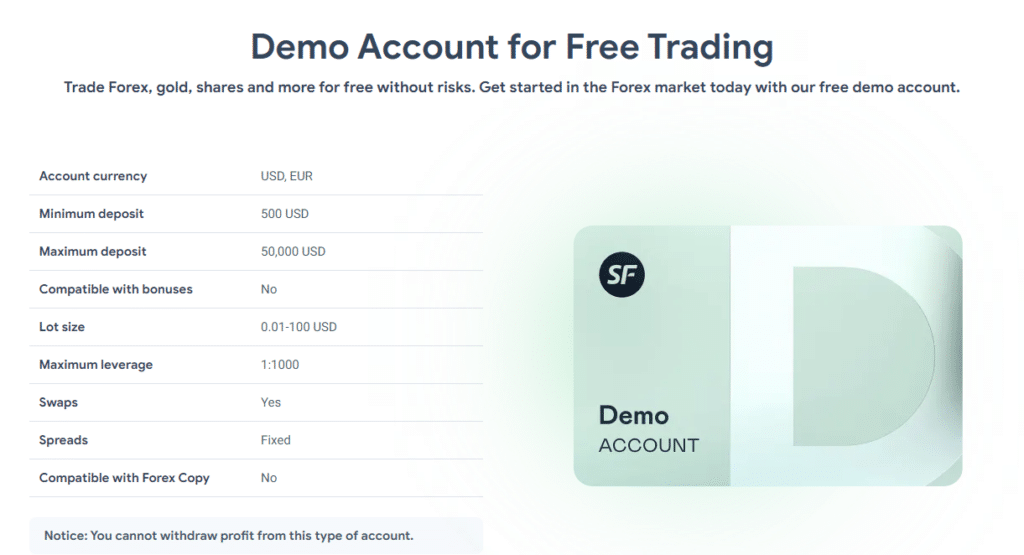

Demo Account

Any customer can sign up for a free demo account now. Using a trial trading account is a wonderful way to evaluate the various trading platforms and put your trading techniques to the test without putting any of your own money at risk.

The SuperForex Demo Account offers Botswanan traders the following features:

➡️ Change the account’s base currency from USD to EUR.

➡️ The virtual funding ranges from 500 to 50,000 USD.

➡️ You may trade as little as $0.01 or as much as $100.

➡️ Leverage of up to 1:1000.

➡️ Availability of Swaps.

➡️ The demo account has fixed spreads.

Islamic Account

The broker is a viable alternative for Muslim traders since it provides STP and ECN Islamic accounts per Sharia law by being swap-free. SuperForex offers the following Islamic Swap-Free Accounts to Botswanan Muslim traders:

➡️ STP Swap-Free Account

➡️ ECN Swap-Free Account

➡️ ECN Swap-Free Mini Account

What are the different types of trading accounts offered by SuperForex, and how do they differ in terms of features and trading conditions?

SuperForex typically offers a range of trading account types to cater to the diverse needs of traders. These accounts may include standard accounts, ECN accounts, and specific account types for different trading platforms.

Can traders switch between different account types with SuperForex, and what is the process for changing account types?

SuperForex generally allows traders to switch between different account types if they wish to do so. The process for changing account types typically involves contacting SuperForex’s customer support and requesting the account type change.

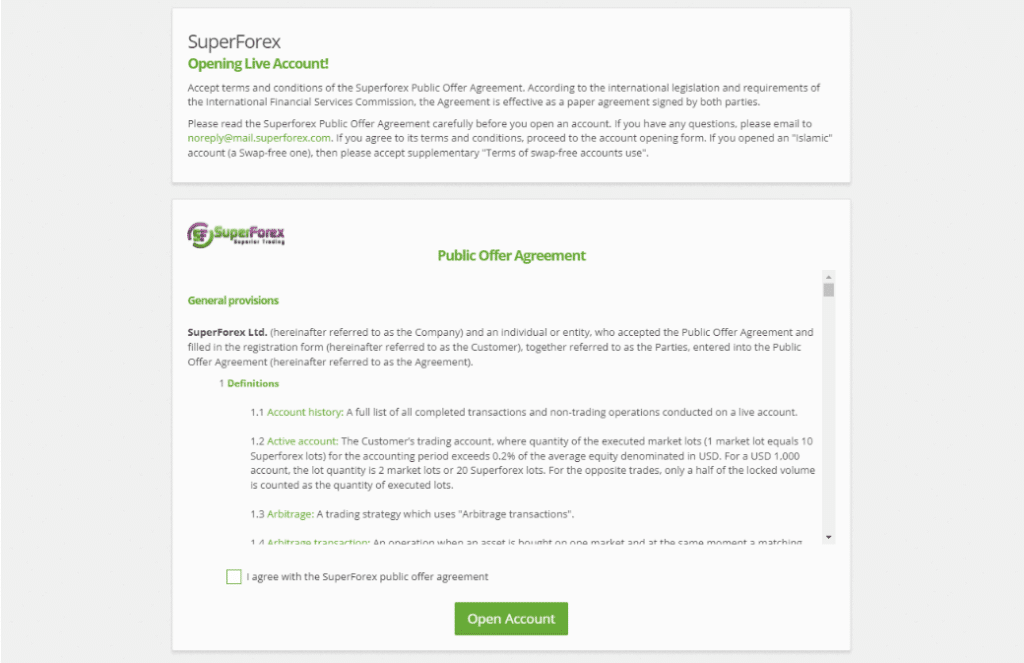

How to open an Account with SuperForex in Botswana

Step 1: Start-Process.

In order for the applicant to start the process, they can simply click on the “Open Account” button located at the top, right-hand side of the webpage.

Step 2: Accept Agreement

The next step is to accept the Public Offer Agreement. Applicants must make sure that they fully understand what they are agreeing to before they continue.

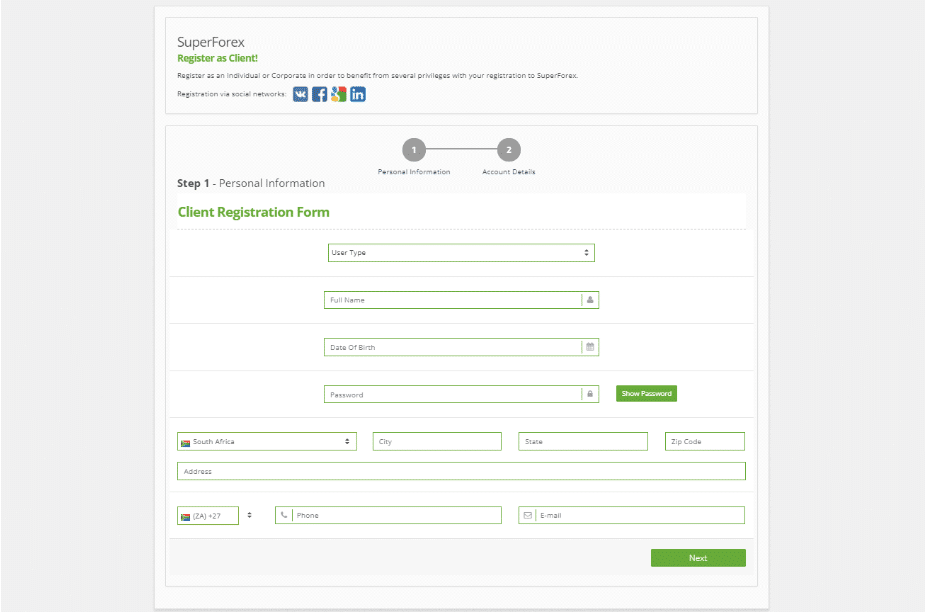

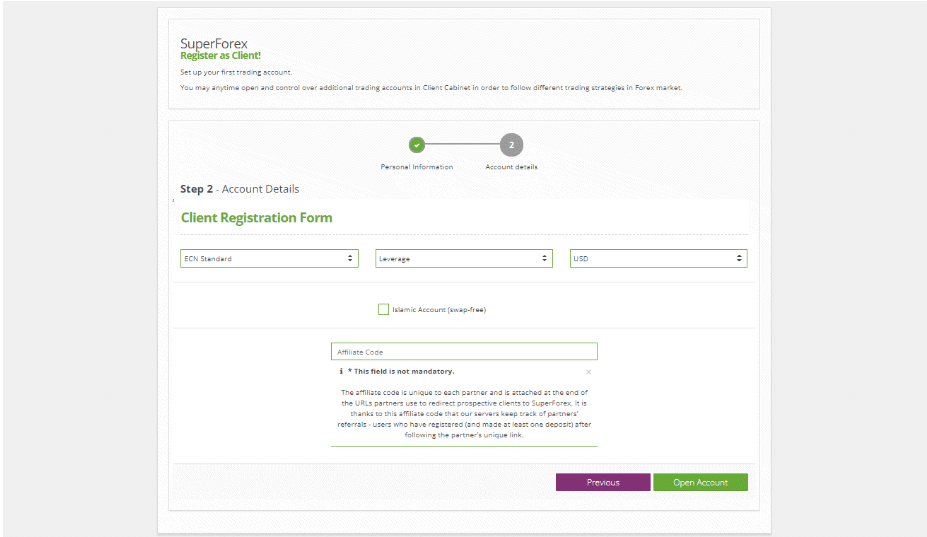

Step 3: Complete Registration

The third step in the account application process is to complete a short, simple registration form. Once the registration form has been completed, the applicant can simply click “Open Account” to complete it.

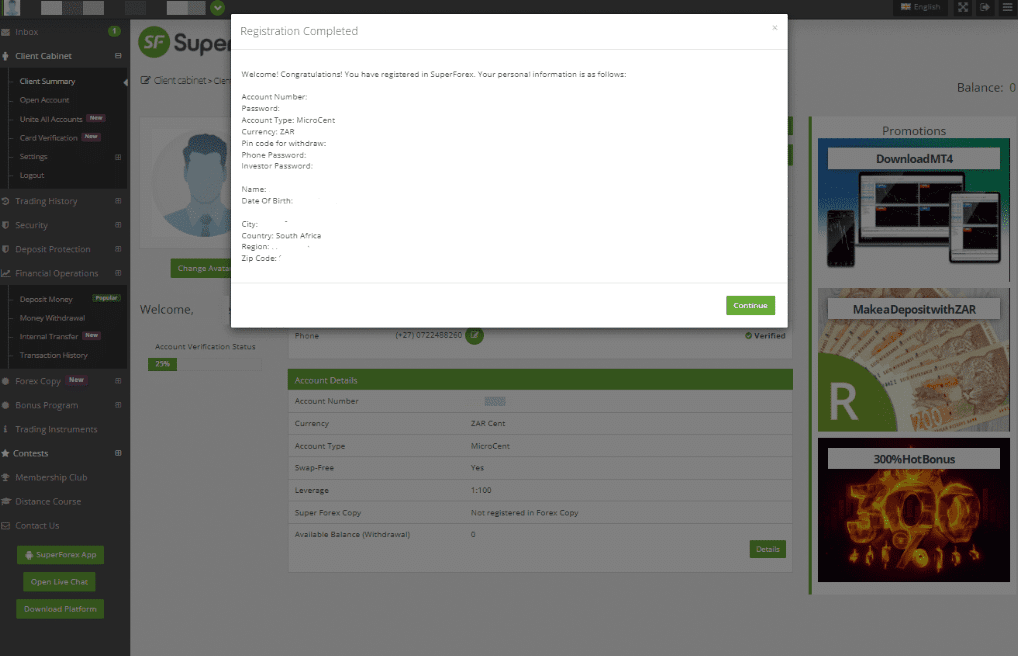

Step 4: Registration Completed

The Trader will now be met with a Welcome message, congratulating them on registering their brand new live trading account. The trader can now click on Continue to take a look around.

SuperForex Vs HFM Vs Alpari – Broker Comparison

| 🥇 SuperForex | 🥈 HFM | 🥉 Alpari | |

| ⚖️ Regulation | None | FSCA, CySEC, DFSA, FSA, FCA, FSC, and CMA with registration in ACPR, BaFin, MNB, CONSOB, CNMV, FI, FMA, FSC, and other regions | FSC |

| 📱 Trading Platform | • MetaTrader 4 • SuperForex App | • MetaTrader 4 • MetaTrader 5 • HF App | • MetaTrader 4 • MetaTrader 5 • Alpari Mobile App |

| 💰 Withdrawal Fee | Yes | No | Yes |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 13 BWP | 66 BWP | 66 BWP |

| 📊 Leverage | 1:2000 | 1:1000 | 1:1000 |

| 📊 Spread | From 0.0 pips | From 1 pip | From 0.4 pips |

| 💰 Commissions | From 0.013% | $3 to $4 | $1.5 |

| ✴️ Margin Call/Stop-Out | 80%/40% | • 40%/10% • 50%/20% | • 60% to 120% • 30% to 100% |

| 💻 Order Execution | Market, Instant | Market | Instant and Market |

| 💳 No-Deposit Bonus | Yes | No | No |

| 📊 Cent Accounts | Yes | No | No |

| 📈 Account Types | • Standard Account • Swap-Free Account • No Spread Account • Micro Cent Account • Profi STP Account • Crypto Account • ECN Standard Account • ECN Standard Mini Account • ECN Swap-Free Account • ECN Swap-Free Mini Account • ECN Crypto Account | • Micro Account • Premium Account • HFcopy Account • Zero Spread Account • Auto Account | • Standard Account • Micro Account • ECN Account • Pro Account |

| ⚖️ CBN Regulation | No | No | No |

| 💳 BWP Deposits | Yes | Yes | Yes |

| 📊 Botswana Pula Account | Yes | No | No |

| 👥 Customer Service Hours | 24/5 | 24/5 | 24/5 |

| 📊 Retail Investor Accounts | 11 | 5 | 4 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 📉 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | None | 60 lots | 250 lots |

| 💰 Minimum Withdrawal Time | Instant | 10 Minutes | Instant |

| 📊 Maximum Estimated Withdrawal Time | 2 to 4 working days | 10 business days | 3 to 5 Business Days |

| 💸 Instant Deposits and Instant Withdrawals? | Yes, deposits | No | Yes |

Trading Platforms

SuperForex offers Botswanan traders a choice between these trading platforms:

➡️ MetaTrader 4

➡️ SuperForex App

Desktop Platforms

Many brokers and traders across the globe use MetaTrader 4 (MT4) since it is a free and extensively utilized professional trading platform. Some key features of the MT4 trading platform include the following:

➡️ You can alter any design aspect, including the look and feel, the interface, the charts, and the windows.

➡️ All investable assets are shown in one of three chart types over nine timeframes.

➡️ It comes with 30 indicators and 24 analysis tools out of the box.

➡️ Traders may automate Forex and CFD trading by creating, evaluating, and using expert advisors (EAs).

➡️ To do historical data-based backtesting on EAs, a strategy tester is employed.

➡️ The ability to place several orders simultaneously, including pending and market orders, is provided.

➡️ Users could choose to get notifications through platform pop-ups, email, or text message.

WebTrader Platforms

MetaTrader 4 is a trading platform that provides users with abundant charting, indicator, and analytic tools accessible from any web browser. Additionally, MetaTrader 4 is accessible through any operating system and web browser.

The MetaTrader 4 web client has the same functionality as the native client since it is an integral part of the desktop platform.

Subsequently, the online platform’s dependability and compatibility with the MetaTrader 4 ecosystem are ensured. In addition, this software can send and receive encrypted data safely.

Trading App

➡️ MetaTrader 4

➡️ SuperForex App

MetaTrader 4

This MT4 mobile platform is available as an app for iOS and Android. You may get these apps from their respective app stores.

The MT4 mobile app’s features and integration with MT4 accounts are almost comparable to those of the MT4 desktop platform. As a result, traders who are always on the move may reap the benefits of mobile trading software.

SuperForex App

SuperForex has created a suite of mobile apps for Botswanan traders to keep them linked to their profession and enable them to make instantaneous trading choices to keep up with the fast-paced financial markets of today.

The SuperForex app development team has allowed traders to do all their trading from their mobile devices, including checking the status of open trades and opening or closing new ones.

What trading platforms are available for traders using SuperForex, and do they offer mobile trading options?

SuperForex typically offers a range of trading platforms to accommodate different trading styles and preferences. These platforms may include the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are known for their advanced charting tools and technical indicators.

Are there any platform-related fees or limitations when using SuperForex’s trading platforms, and do they provide access to a demo account for practice?

SuperForex’s trading platforms typically do not impose fees for accessing or using the platforms themselves.

Range of Markets

Botswanan traders can expect the following range of markets:

➡️ Forex

➡️ Precious Metals

➡️ Indices

➡️ Cryptocurrencies

➡️ Commodities

➡️ Energies

➡️ ETFs

➡️ Futures

➡️ Stock CFDs

Financial Instruments and Leverage offered

| 💻 Instrument | 💵 Number of Assets Offered | 💸 Max Leverage Offered |

| Forex | 84 | • 1:2000 (Profi-STP) • 1:1000 (all other accounts) |

| Precious Metals | 9 | 1:5 |

| Indices | 19 | 1:5 |

| Cryptocurrencies | 20 | 1:5 |

| Commodities | 6 | 1:5 |

| Energies | 3 | 1:5 |

| ETFs | 23 | 1:5 |

| Futures | 9 | 1:5 |

| CFDs | 90 | 1:5 |

Broker Comparison for a Range of Markets

| 🥇 SuperForex | 🥈 HFM | 🥉 Alpari | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | Yes | No | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | Yes | No |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | No | No |

What financial markets and instruments are available for trading with SuperForex?

SuperForex typically offers a range of financial instruments across various markets. These may include major and minor currency pairs in the forex market, commodities like gold and oil, indices representing global stock markets, cryptocurrencies, and CFDs (Contract for Difference) on stocks and other assets.

Do traders have access to leverage when trading with SuperForex, and are there any limitations or considerations regarding leverage in different markets?

SuperForex typically offers leverage options to traders, allowing them to amplify their trading positions. However, the leverage levels and specific conditions can vary depending on the chosen account type and the regulatory requirements of the trader’s location.

Trading and Non-Trading Fees

Spreads

Traders should expect spreads from SuperForex to change based on the financial instrument being dealt with, the current state of the market, and the specifics of the transaction being made. SuperForex gives traders a complete rundown of all the spreads they can use for their accounts.

Average EUR/USD spreads per account type are shown below:

➡️ Standard Account – Fixed, 2 pips

➡️ Swap-Free Account – Fixed, 2 pips

➡️ No Spread Account – Fixed, 0.1 pips

➡️ Micro Cent Account – Fixed, 2 pips

➡️ Profi STP Account – Fixed, 0.1 pips

➡️ Crypto Account – Fixed, 2 pips

➡️ ECN Standard Account – Variable, from 0.0 pips

➡️ ECN Standard Mini Account – Variable, from 0.0 pips

➡️ ECN Swap-Free Account – Variable, from 0.0 pips

➡️ ECN Swap-Free Mini Account – Variable, from 0.0 pips

➡️ ECN Crypto Account – Variable, from 0.0 pips

Commissions

In certain cases, commissions could be applied to SuperForex accounts and financial products. Only the following accounts incur fees, even though most do not:

➡️ No Spread Account – form 0.017%

➡️ Profi STP Account – from 0.013%

➡️ Crypto Account – from 0.75%

➡️ ECN Standard Account – Between $8 to $10 on Forex

➡️ ECN Swap-Free Account – Between $10 on Forex Majors and $40 on Energies

➡️ ECN Swap-Free Mini Account – Between $10 on Forex Majors and $40 on Energies

➡️ ECN Crypto Account – From 0.6%

Overnight Fees, Rollovers, or Swaps

For a select few accounts and only on certain currency pairs, SuperForex charges overnight costs. For a couple of the available currency pairings, Botswanans should expect the following average overnight fees:

➡️ EUR/USD – a long swap of -0.018 and a short swap of 0.006

➡️ USD/CAD – a long swap of -0.29 and a short swap of 0.18

➡️ AUD/CHF – a long swap of 0.52 and a short swap of -0.63

➡️ CHF/JPY – a long swap of -0.06 and a short swap of -0.06

➡️ USD/ZAR – a long swap of -1.115 and a short swap of 0.545

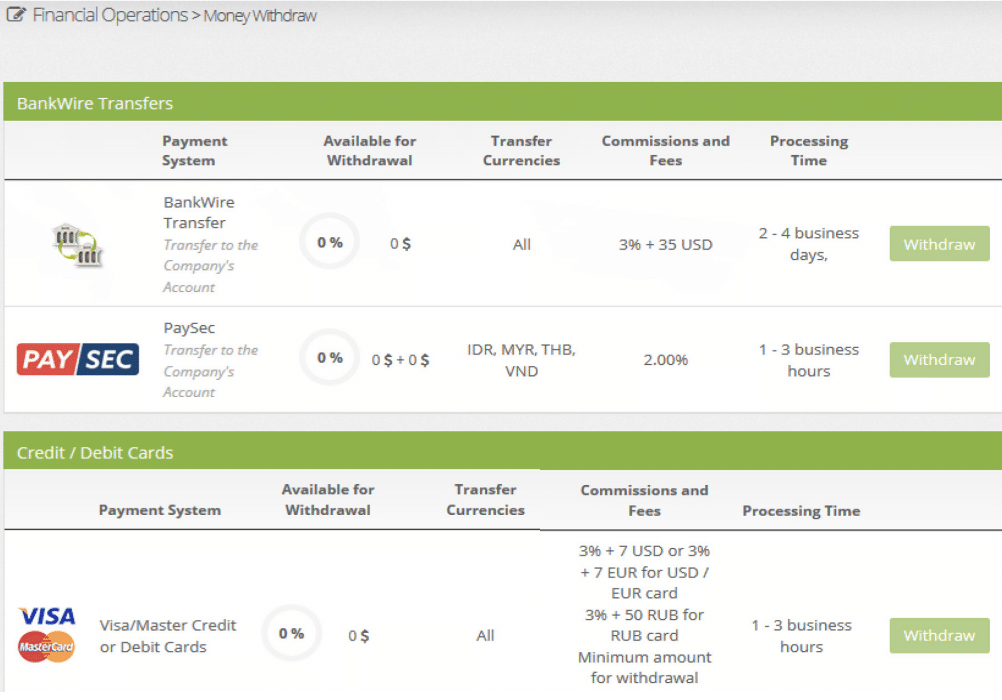

Deposit and Withdrawal Fees

The broker does not have any costs associated with making a deposit. However, the following fees apply when making a withdrawal:

➡️ Bank Transfers (All) – 3% along with 35 USD

➡️ South African Bank Transfers – from 1.4% to 3.8%

➡️ Southeast Asian Bank Transfers – 3%

➡️ Latin American Bank Transfers – $5

➡️ Credit and Debit Card – 3% + 10 USD

➡️ UnionPay – 3%

➡️ Skrill – 1 USD if the withdrawal amount is less than 50 USD, 1.5% if the withdrawal amount is more than 50 USD

➡️ Neteller – 2%

➡️ Sticpay – 2.5% + $0.3

➡️ Triv, Fasapay, and Perfect Money – 0.5%

➡️ OnlineNaira – 2%

➡️ BitWallet – 4%

➡️ AstroPay – 5%

➡️ MPesa, Airtel, MTN – 3%

➡️ Crypto Wallets – 5%

➡️ Local Payments – Local Bank Wire Fees

Inactivity Fees

does not charge any fees when the trading account goes dormant.

Currency Conversion Fees

Because SuperForex does not accept BWP as a base currency for a retail account, Botswanan traders who deposit or withdraw in their local currency could face currency conversion fees.

What are the typical trading fees associated with SuperForex, such as spreads and commissions, and do they vary across different account types or trading platforms?

The broker typically charges trading fees in the form of spreads and, in some cases, commissions. Spreads can vary depending on the currency pair or financial instrument being traded and may differ between account types and trading platforms.

Are there any non-trading fees that traders should be aware of when using SuperForex’s services, such as deposit or withdrawal fees, account inactivity fees, or conversion fees for different currencies?

The broker may impose non-trading fees that traders should consider. These fees can include deposit and withdrawal fees, although they often vary depending on the payment method chosen.

Deposits and Withdrawals

SuperForex offers the following deposit and withdrawal methods:

➡️ Bank Transfers

➡️ South African Bank Transfers

➡️ Southeast Asian Bank Transfers

➡️ Latin American Bank Transfers

➡️ Credit Card

➡️ Debit Card

➡️ UnionPay

➡️ Skrill

➡️ Sticpay

➡️ Neteller

➡️ Triv

➡️ Fasapay

➡️ Perfect Money

➡️ OnlineNaira

➡️ BitWallet

➡️ AstroPay

➡️ MPesa

➡️ Airtel

➡️ MTN

➡️ Vodacom

➡️ Zamtel

➡️ Crypto Wallets

➡️ Local Payments

➡️ SuperForex Money

Broker Comparison: Deposit and Withdrawals

| 🥇 SuperForex | 🥈 HFM | 🥉 Alpari | |

| Minimum Withdrawal Time | Instant | 10 Minutes | Instant |

| Maximum Estimated Withdrawal Time | 2 to 4 working days | 10 business days | 3 to 5 Business Days |

| Instant Deposits and Instant Withdrawals? | Yes, deposits | No | Yes |

Payment Method, Accepted Currencies, Fees, Processing Times

| 💳 Payment Method | 💵 Accepted Currencies | 💳 Withdrawal Processing | 💰 Deposit Processing Time | 💸 Withdrawal Processing Time |

| Bank Transfers | All | 3% + 35 USD | 2 – 4 days | 2 – 4 days |

| South African Bank Transfers | ZAR | 1.4% – 3.8% | Instant | 2 – 4 days |

| Southeast Asian Bank Transfers | IDR, MYR, THB, VND | 3% | Instant | 1 – 3 days |

| Latin American Bank Transfers | BRL, MXN | 5% | Instant | 1 – 3 days |

| Credit Card | All | 3% + 10 USD | Instant | 2 – 4 days |

| Debit Card | All | 3% + 10 USD | Instant | 2 – 4 days |

| UnionPay | CNY | 3% | Instant | 1 – 4 hours |

| Skrill | USD, EUR | <50USD - $1 >50 USD – 1.5% | Instant | 1 – 3 hours |

| Sticpay | USD | 2.5% + 0.3 USD | Instant | 1 – 3 hours |

| Neteller | USD, EUR | 2% | Instant | 1 – 3 hours |

| Triv | IDR | 0.5% | Instant | 1 – 3 hours |

| Fasapay | USD, IDR | 0.5% | Instant | 1 – 3 hours |

| Perfect Money | USD, EUR | 0.5% | Instant | 1 – 3 hours |

| OnlineNaira | NGN | 2% | Instant | 1 – 3 hours |

| BitWallet | JPY, USD, EUR | 4% | Instant | 2 – 4 hours |

| AstroPay | USD | 5% | Instant | 2 – 4 days |

| MPesa | BWP | 3% | Instant | 1 – 4 hours |

| Airtel | TZS | 3% | Instant | 1 – 4 hours |

| MTN | UGX, GHS, RWF | 3% | Instant | 1 – 4 hours |

| Vodacom | ZMW | – | Instant | 1 – 4 hours |

| Zamtel | ZMW | – | Instant | 1 – 4 hours |

| Crypto Wallets | BTC, LTC, DOGE, PPC, DASH, RDD, ZEC, BLK, USDT | 5% | Instant | 1 – 3 hours |

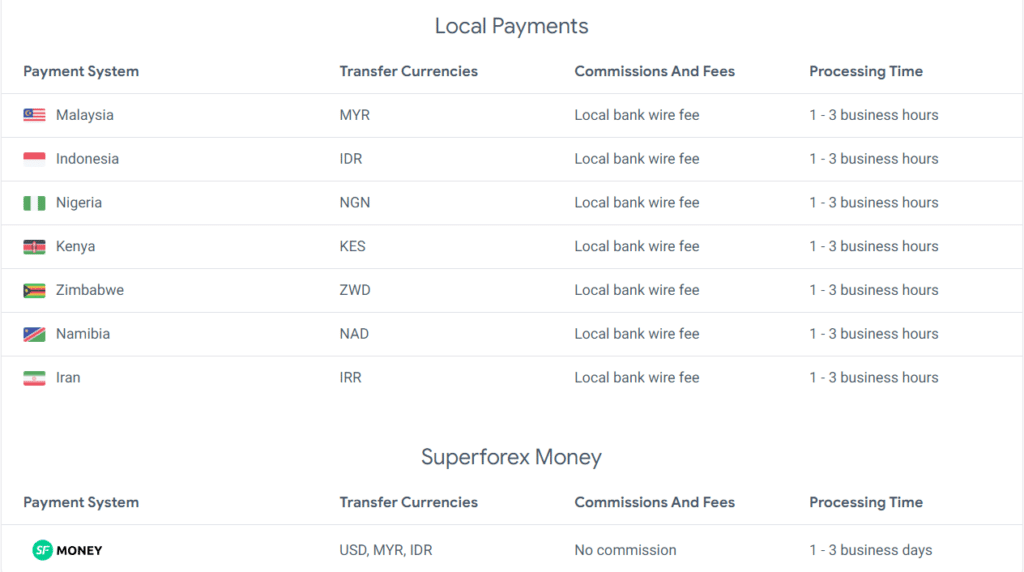

| Local Payments | MYR, IDR, NGN, BWP, ZWD, NAD, IRR | Local wire fee | Instant | 1 – 3 hours |

| SuperForex Money | USD, MYR, IDR | (+7% Discount) | Instant | 1 – 3 days |

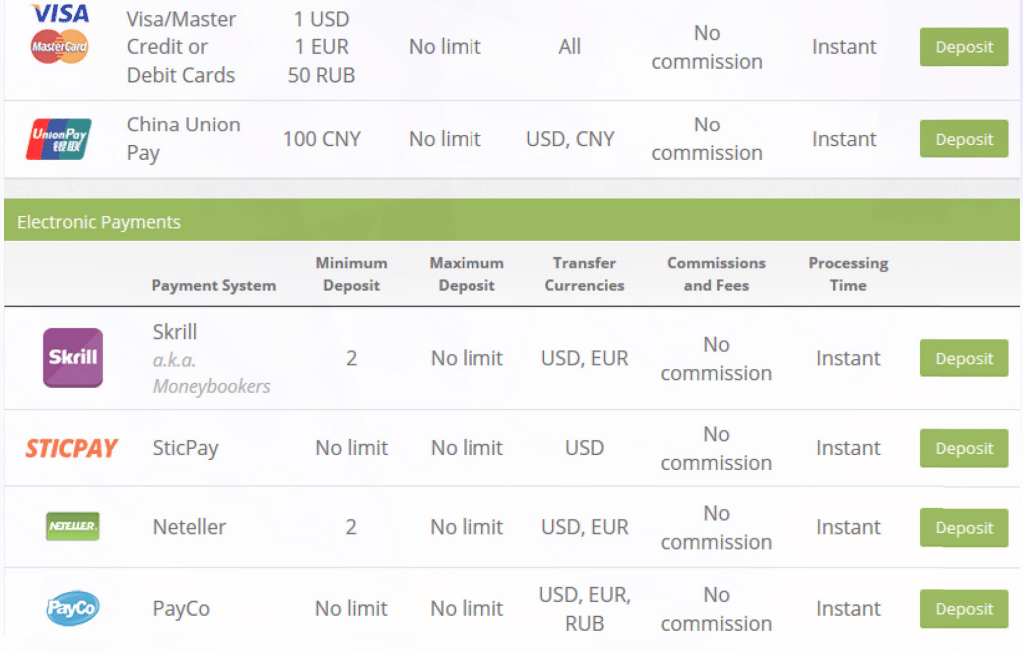

What deposit methods are available for funding a SuperForex trading account, and are there any associated fees or processing times?

The broker typically offers a variety of deposit methods to accommodate traders from different regions. These methods may include bank wire transfers, credit/debit card payments, electronic wallets like Skrill and Neteller, and cryptocurrency deposits.

What is the process for withdrawing funds from a SuperForex trading account, and are there any withdrawal limits or fees to be aware of?

The withdrawal process from the trading account typically involves a straightforward procedure. Traders can log in to their account, navigate to the withdrawal section, and select their preferred withdrawal method.

How to Deposit Funds with SuperForex

In this step-by-step guide you will learn how to make deposits to and withdrawals from your

SuperForex account.

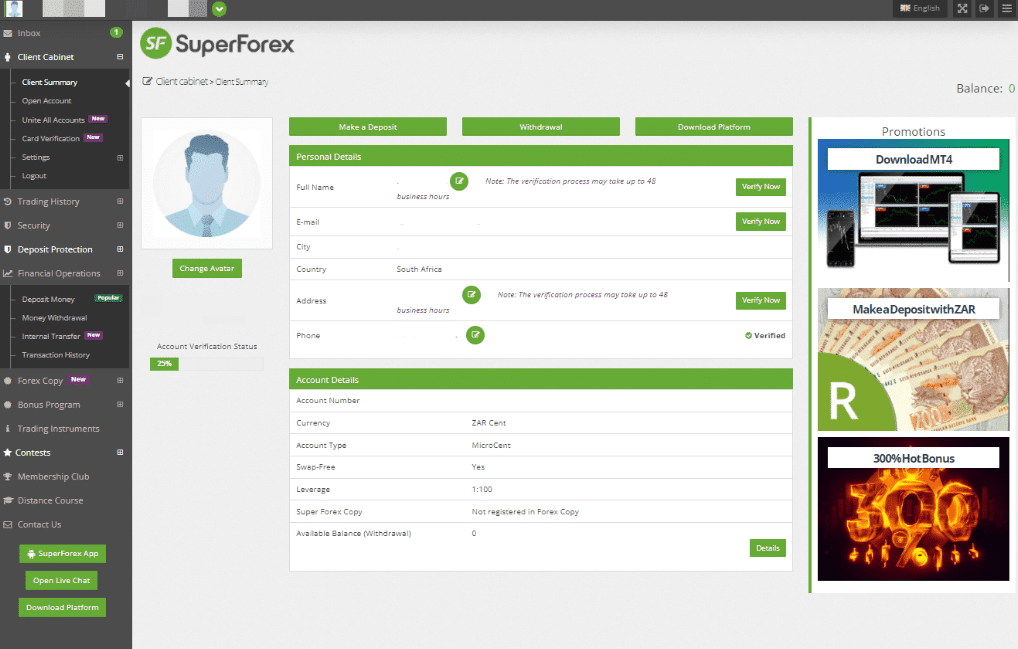

Step 1: Log In

First you need to head over to the Client’s Cabinet and log into the account you would like to

charge with money or withdraw funds from. Once inside the Cabinet, navigate to the Financial Operations menu on the left where you can see

the options Deposit Money and Money Withdrawal.

Step 2. Make a Deposit

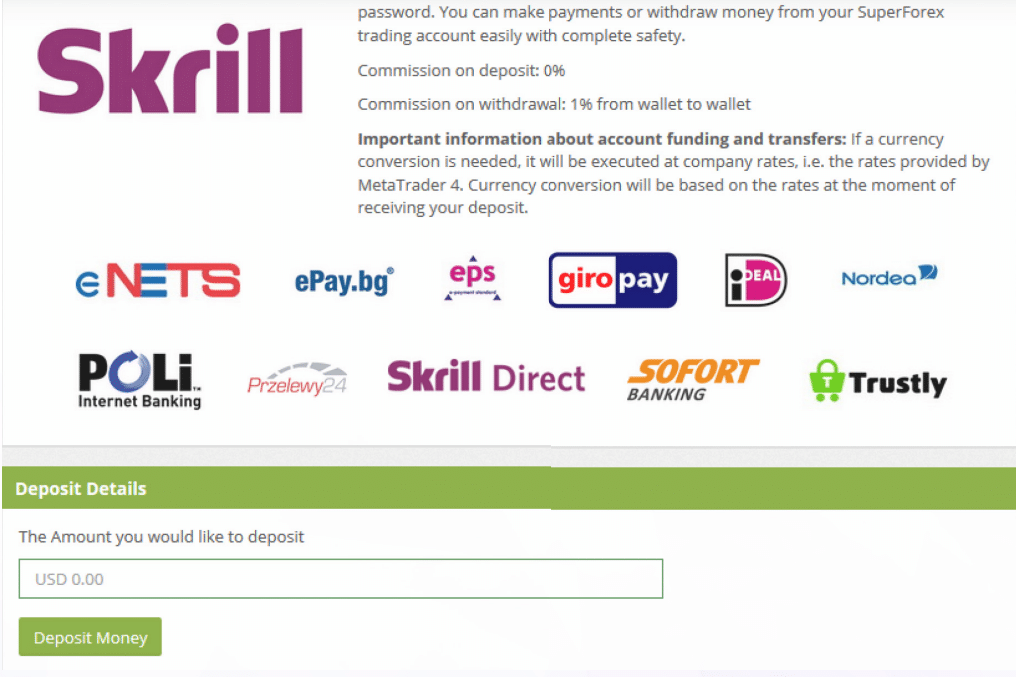

To make a deposit, click on Deposit Money. This will take you to a page that contains all of our supported payment systems. It is up to you to decide what deposit method you would like to choose. When you select a method, click on the green Deposit button.

Step 3. Deposit Money

This will take you to a more detailed overview of the selected payment system where you can learn more about it. Specify the amount you would like to deposit in the Deposit Details field below, then press Deposit Money.

This will take you to the relevant webpage for that payment system where you can complete the

transaction.

Fund Withdrawal Process

To withdraw funds from an account with SuperForex, Botswanan traders can follow these steps:

Step 1. Withdraw Button

To make a withdrawal, go to Money Withdrawal. This will take you to a page that contains all of our supported payment systems. It is up to you to decide what withdrawal method you would like to use. When you select a method, click on the green Withdraw button.

Step 2. Withdraw Money

Similar to the deposits page, pressing Withdraw will offer more information for the payment system and ask you to specify the withdrawal amount. Once you fill in the withdrawal amount and

press Withdraw Money, you will be redirected to the relevant webpage to complete the transaction. Please note that you need to complete each transaction via the relevant webpage of the payment system you are using, so make sure to always follow the steps to the end.

Education and Research

Education

Offers the following Educational Materials:

➡️ Training Centre

➡️ Seminars

➡️ Educational Videos

➡️ Glossary

➡️ Pattern Graphix

Research and Trading Tool Comparison

| 🥇 SuperForex | 🥈 HFM | 🥉 Alpari | |

| ➡️ Economic Calendar | Yes | Yes | Yes |

| ➡️ VPS | No | Yes | No |

| ➡️ AutoChartist | No | Yes | No |

| ➡️ Trading View | No | No | No |

| ➡️ Trading Central | No | No | No |

| ➡️ Market Analysis | Yes | Yes | Yes |

| ➡️ News Feed | Yes | Yes | Yes |

| ➡️ Blog | Yes | Yes | Yes |

Also offers Botswanan traders the following additional Research and Trading Tools:

➡️ Technical Analysis

➡️ Economic News

➡️ Fundamental Analysis

➡️ Video Analysis

➡️ Weekly Review

What educational resources does SuperForex provide to help traders improve their skills and knowledge in forex trading?

The broker typically offers a range of educational materials and resources to assist traders in enhancing their trading skills. These resources may include educational articles, video tutorials, webinars, trading courses, and a dedicated learning center.

Does SuperForex provide market research and analysis tools to help traders make informed trading decisions?

The broker often offers market research and analysis tools to help traders stay informed about market trends and make well-informed trading decisions. These tools may include daily market analysis, economic calendars, technical analysis reports, and forex news updates.

Bonuses and Promotions

Offers Botswanan traders the following bonuses and promotions:

➡️ Welcome Bonus of 50% with every deposit

➡️ 300% hot Bonus when traders deposit $100 or more

➡️ An Easy Deposit Bonus of up to 3,000% on all deposits up to $750

➡️ A no-deposit bonus of $88

➡️ 60% Energy Bonus on each deposit made

➡️ Gold Rush Contest

➡️ Bitcoin Mania Contest

➡️ Auto Reset Balance offer

➡️ Interest Rate on Equity Offer

➡️ Membership Club Promotion

➡️ Account Packages Promotion

What types of bonuses and promotions does SuperForex offer to traders, and how can traders participate in them?

The broker often provides a variety of bonuses and promotions to enhance the trading experience for its clients. These promotions may include deposit bonuses, no-deposit bonuses, and special trading contests.

Are there any conditions or requirements associated with SuperForex’s bonuses, such as trading volume targets or time limitations?

Yes, the broker typically imposes certain conditions and requirements on its bonuses and promotions. These conditions may include trading volume targets that traders must meet before they can withdraw bonus funds.

How to open an Affiliate Account with SuperForex

To register an Affiliate Account, Botswanan traders can follow these steps:

➡️ If you are interested in being an affiliate for SuperForex, visit the official website and click on the “Partners” tab.

➡️ By clicking “Partnership Program” and “Become a Partner,” prospective affiliates could learn more about the affiliate program and sign up.

➡️ Botswanans interested in becoming affiliates must first register on the website by filling out a brief registration form that requests personal information such as name, email, address, and cellphone number.

➡️ After application completion, Botswanans may use affiliate links, banners, products, presentations, and live websites to begin promoting their business immediately.

Affiliate Program Features

Customers could expand their companies by referring the broker’s complete trading services to their networks via the Affiliate and Partnership Program. For example, SuperForex offers generous commissions to its affiliates who bring in new customers.

SuperForex provides its Botswanan clients with several useful resources, such as a custom-designed website, various engaging promotional materials, and an affiliate connection that gives affiliates access to detailed information on their Botswanan partners.

Furthermore, the Golden Challenge is always open to new business partners. The following are some of the benefits of participating in the SuperForex Affiliate Program:

➡️ Payment of commissions equals 75% of the spread.

➡️ A plethora of advertising options.

➡️ Private Affiliate Managers are Available.

➡️ Ease of getting refunds in your account automatically.

➡️ New customers may take advantage of a fully transferable 100% incentive.

➡️ Multi-Level Partnerships, Introducing Brokers and Regional Representatives are just some of the affiliate options you can access.

➡️ Availability of in-depth data and pre-built, compatible partner sites.

Customer Support

During market hours, the client service desk of the broker is open 24 hours per day, seven days per week.

In addition, they have included a Frequently Asked Questions (FAQs) area for website users to search for solutions to potential questions before contacting them.

Fill out the website’s ‘call back’ form if you would like to be contacted by the support desk. A support person will contact you at your leisure.

The quickest method to get assistance is via the website’s immediate chat feature. Yahoo messenger, WhatsApp, Skype, Telegram, and WeChat are additional chat choices.

You may also access assistance by email or phoning the international support helpline. In addition, SuperForex is present on Meta, YouTube, Twitter, LinkedIn, and Instagram.

| Customer Support | SuperForex’s Customer Support |

| ⏰ Operating Hours | 24/5 |

| 🗣 Support Languages | Multilingual |

| 🗯 Live Chat | Yes |

| 📧 Email Address | Yes |

| ☎️ Telephonic Support | Yes |

| 📞 Local Support in Botswana? | No |

| 🥇 Overall quality of SuperForex Support | 4/5 |

Corporate Social Responsibility

The broker hopes to demonstrate to its Botswanan clientele an aspect of its business not often emphasized in the broker’s marketing efforts: the significance of its social responsibility program.

SuperForex is a global leader in the financial brokerage industry due to its innovative and ever-evolving services. However, the company would rather put its success to effective use.

The broker is not oblivious to the hardships endured by individuals everywhere. For this reason, the broker tries to work with other organizations and provide time, energy, and money to charitable causes that aid the underprivileged worldwide.

In the past, SuperForex has been involved in a variety of projects, including but not limited to the following:

➡️ Christmas Giving in 2021 in Lagos, Nigeria

➡️ Helping orphanages in Sumatera Utara, Indonesia

➡️ Helping orphans in Songea, Tanzania

➡️ Charity events in Nairobi, Botswana

➡️ Charity initiatives in Bangladesh

➡️ Charity events in Malang and several other areas around the globe

Our Verdict

SuperForex is an excellent choice for anyone who wants easy access to a wide range of currency pairs under favourable trading conditions.

In addition, SuperForex offers a few account types, allowing each trader to choose the best one for their background, investment amount, and trading experience.

You can access a range of easy, quick, and simple payment options to meet consumers from diverse countries with varied needs. In addition, the broker’s provision of market information and educational materials demonstrates its commitment to aiding traders.

Managed portfolios offered by SuperForex bank and Forex Replicate are designed for traders and investors looking to duplicate or give trading signals.

However, while SuperForex has a unique and attractive offer, Botswanans must practice due diligence because SuperForex’s IFSC regulation cannot be confirmed.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| SuperForex offers several trading tools and managed accounts via SuperForex Bank | SuperForex’s IFSC regulation cannot be verified on the market regulator’s website |

| Social trading is available through Forex Copy | BWP is not a supported base currency for any of the trading accounts |

| There are eleven trading accounts to choose from and dedicated Islamic Accounts | Withdrawal fees are charged across several payment options |

| There are free demo accounts offered for practice trading | FIX API solutions are not offered |

| Commission-free options are offered across several account types | MetaTrader 5 is not provided |

| There is an ultra-low minimum deposit of 1 USD with leverage up to 1:2000 (on the Profi-STP Account) | |

| There are tight spreads from 0.0 pips on major instruments such as EUR/USD | |

| There are several markets to choose from, including cryptocurrencies |

You might also like: FBS Review

You might also like: FOREX.com Review

You might also like: FP Markets Review

You might also like: FXChoice Review

You might also like: IG Review

Conclusion

Now it is your turn to participate:

➡️ Do you have any prior experience with SuperForex?

➡️ What was the determining factor in your decision to engage with SuperForex?

➡️ Was it because of the minimum deposit, regulation, retail trading accounts, or other factors?

➡️ Have you experienced any issues with SuperForex, such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

Regardless, please share your thoughts in the comments below.

Frequently Asked Questions

Is SuperForex regulated?

SuperForex claims to be regulated by the IFSC in Belize. However, this cannot be verified from the official website of the market regulator.

How long will it take to withdraw funds from SuperForex?

Several withdrawal options, including Skrill, Neteller, Triv, Fasapay, Perfect Money, MPesa Botswana, Airtel, MTN, Vodacom, Zamtel, Crypto Wallets, and local payments, have an hour-to-three-hour minimum withdrawal period.

Does SuperForex have Volatility 75?

SuperForex does not offer VIX as part of its comprehensive trading portfolio.

Does SuperForex have Nasdaq?

NASDAQ, SPX, Dow Jones, and many more are just a few of the tradable instruments found in SuperForex’s extensive trading portfolio, including more than 300 currency pairs, futures, shares, stock indices, and numerous others.

SuperForex gives you the ability to trade a wide variety of products, as well as to hedge your bets and diversify your portfolio.

Does SuperForex have a no-deposit bonus?

SuperForex offers an array of bonuses, including an 88 USD no-deposit bonus when traders register a real trading account for the first time.

Can I trust SuperForex?

SuperForex has a high trust score and is considered minimal risk. However, traders must conduct extensive research on any broker before they choose to invest real money with any broker, including SuperForex.

What is the minimum deposit for a SuperForex account?

The minimum deposit for a SuperForex account is 1 USD or 13 BWP.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review