Admiral Markets Review

Overall, Admirals is considered average risk, with an overall Trust Score of 84 out of 100. Admirals is licensed by two Tier-1 Regulators (high trust), two Tier-2 Regulators (average trust), and two Tier-3 Regulators (low trust).

- Louis Schoeman

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

339 BWP or an equivalent of $25

Regulators

FCA, ASIC, CySEC, EFSA, JSC

Trading Desk

MT4, MT5, Admirals Mobile App

Crypto

Yes

Total Pairs

35 Forex Currency Pairs

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Overview

Admirals offers 4 different retail trading accounts, namely Trade.MT5, Zero.MT5, Trade.MT4, and Zero.MT4.

Admirals, formerly Admiral Markets, is a forex and CFD brokerage established in early 2001. Due to its international presence, Admiral Markets is subject to oversight from a wide range of financial regulators worldwide.

This includes the Financial Conduct Authority (FCA) in the United Kingdom, the Australian Securities and Exchange Commission (ASIC), and others.

Not only can you use Admirals’ innovative, user-friendly mobile app, but you can also use the popular MT4 and MT5 trading platforms. In addition, with six active accounts, Admirals offers exceptional market conditions for trading.

Admirals accepts Botswanan clients and has an average spread from 0.0 pips with a $0.02 commission. Admirals has a maximum leverage ratio up to 1:500, and a demo and Islamic account are available.

MT4, MT5, and Admirals’ mobile platforms are supported. Admirals is headquartered in the United Kingdom and regulated by FCA, ASIC, CySEC, EFSA, JSC, and FSCA.

Distribution of Traders

Currently has the largest market share in these countries:

Popularity among traders

Admirals may not command a substantial portion of the Botswanan market. However, it is still one of the best forex brokers in the country.

Admirals Review At a Glance

| 🏛️ Headquartered | London, United Kingdom |

| 🏛️ Global Offices | Jordan, Australia, Cyprus, the United Kingdom, South Africa |

| 👍 Accepts Botswanan Traders? | Yes |

| 📅 Year Founded | 2001 |

| 📱 Botswanan Office Contact Number | None |

| ⚖️ Regulation | FCA, ASIC, CySEC, EFSA, JSC |

| 🔎 License Number | • Jordan – 57026 • United Kingdom – FRN 595459 • Estonia – 4.1-1/46 • Cyprus – 201/13 • Australia – ABN 63151613839, AFSL 410681 |

| ⚖️ CBN Regulation | None |

| ✴️ Regional Restrictions | Canada, United States, Japan, Malaysia, Singapore, and some other countries |

| ☪️ Islamic Account | Yes |

| 📈 Demo Account | Yes |

| 📈 Retail Investor Accounts | 4 |

| 📊 PAMM Accounts | No |

| 📊 Liquidity Providers | Admiral Markets A.S. |

| 💵 Affiliate Program | Yes |

| 📊 Crypto trading offered? | Yes |

| 🚀 Offers a BWP Account? | No |

| 💻 Dedicated Botswanan Account Manager? | No |

| 📈 Maximum Leverage | 1:500 |

| 📈 Leverage Restrictions for Botswana? | No |

| 💳 Minimum Deposit | 339 BWP or an equivalent to $25 |

| 💳 Botswanan Pula Deposits Allowed? | Yes, but currency conversion fees may apply |

| 💰 Active Botswanan Trader Stats | 250,000+ |

| 💰 Active Botswanan-based Admirals customers | Unknown |

| 💳 Deposit and Withdrawal Options | • Bank Transfers • Klarna • Debit Card • Credit Card • PayPal • Neteller • Skrill • SafetyPay • iBank & BankLink • iDEAL • POLi |

| 💰 Segregated Accounts with Botswanan Banks? | No |

| 💻 Trading Platforms | • MetaTrader 4 • MetaTrader 5 • Admirals Mobile App |

| 💰 Tradable Assets | • ESG Trading Instruments • Forex • Cryptocurrency CFDs • Commodities • Indices • Stocks • ETFs • Bonds • Spread Betting |

| 🌐 Offers USD/BWP currency pair? | No |

| 🌐 USD/BWP Average Spread | N/A |

| 📈 Offers Botswanan Stocks and CFDs | None |

| 👨💼 Languages supported on Website | English, German, Frenchs, Italian, Romanian, Spanish, Portuguese, Russian, Polish, and several more. |

| 👥 Customer Support Languages | Multilingual |

| 👥 Customer Service Hours | 24/5 |

| 👥 Botswanan-based customer support? | No |

| 💰 Bonuses and Promotions for Botswanans | No |

| ✴️ Education for Botswanan beginners | Yes |

| 📊 Proprietary trading software | Yes |

| 💰 Most Successful Botswanan Trader | Currently unknown |

| ✔️ Is Admirals a safe broker for Botswanans? | Yes |

| ✔️ Rating for Admirals Botswanans | 9/10 |

| ✔️ Trust score for Admirals Botswanans | 83% |

| 👉 Open Account | 👉 Open Account |

Regulation and Safety of Funds

In several countries, Admirals has been approved and regulated by recognized authorities. Strong security and customer service procedures ensure the safety of traders when they use their services.

In addition, Admirals offers transparent reports regarding its financial reports that Botswana traders can view at any given time. The regulations and authorization that Admirals has include:

➡️️ Admiral Markets AS Jordan Ltd is an entity that is regulated by the Jordan Securities Commission (JSC) under registration number 57026.

➡️️ Admiral Markets UK Ltd is a trading provider that is regulated and authorized by the Financial Conduct Authority (FCA) under FRN 595450. In addition, this entity is authorized to hold client funds under the rules of FCA CASS and the firm is also a sister company of Admiral Markets AS in Estonia.

➡️️ Admiral Markets AS is both licensed and authorized to provide services in Estonia by the Estonian Financial Supervision Authority (EFSA) under license number 4.1-1/46.

➡️️ In Cyprus, Admiral Markets Cyprus Ltd is registered and authorized to provide financial services and financial products, with regulations through the Cyprus Securities and Exchange Commission (CySEC) under license number 201/13.

➡️️ Admiral Markets PTY Ltd is registered in Australia under ABN 63151613839 and is regulated by the Australian Securities and Investment Commission, with an Australian Financial Services License (AFSL) under AFSL number 410681.

In addition, Admiral Markets UK Ltd, Admiral Markets AS and Admiral Markets Cyprus Ltd are all fully compliant with the Directive on Markets in Financial Instruments 2014/65/EU, commonly known as MiFID II.

To comply with FCA regulations, all client funds are maintained in a credit institution authorized by the European Economic Area separate from Admirals’ own holdings. Clients’ money is always accessible and cannot be utilized by Admirals for any reason thanks to this system.

Furthermore, in the event of a firm’s bankruptcy, customer funds are shielded from ordinary creditors under UK insolvency legislation. Admirals adheres to FCA standards by doing daily customer money reconciliations. Segregated bank accounts show customer assets properly because of this procedure.

Subsequently, the total amount of a customer’s trading account is recognized as client money. The FCA oversees Admirals and requires it to provide monthly Client Money Asset Returns (CMARs) to the agency.

Admirals’ auditors, who report to the FCA, conduct an annual audit of Admirals’ money controls and systems. This body was created to safeguard clients of financial services organizations that have gone under.

If a broker goes out of business because of a shortfall in segregated client funds, the FSCS will compensate eligible clients up to £85,000 in compensation. If a PRA-regulated bank used to retain segregated customer money falls into liquidation, it pays up to £85,000 in compensation.

If there is a failure with the bank that holds funds, depositors are compensated via deposit guarantee systems (DGS). Deposit guarantee programs, which are mandated by EU law, guarantee deposits up to a maximum of €100,000.

However, minimum requirements have been agreed upon at the EU level in Europe for national organizations. Per EU regulations, each depositor is protected to the tune of €100,000. Savings banks, cooperative banks, public sector banks, and private banks are only a few of the types of financial institutions that exist in certain states.

Is Admirals a regulated broker, and which regulatory authorities oversee its operations?

Yes, Admirals is a regulated broker and operates under the oversight of reputable regulatory authorities. The specific regulatory status may vary based on the region and entity through which clients access Admirals’ services. Admirals entities are typically regulated by authorities such as the Financial Conduct Authority (FCA) in the United Kingdom, the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, the Australian Securities and Investments Commission (ASIC), and others.

How does Admirals ensure the safety of client funds?

The broker prioritizes the safety of client funds through several protective measures. Client funds are typically held in segregated bank accounts, ensuring a clear separation between clients’ trading capital and the broker’s operational funds.

Awards and Recognition

The broker has 2021 brought new awards and recognition to the Company, proving our continuous ambition to lead the market in terms of quality, outstanding customer service, and the best technological tools. Also in 2022, Admirals won a prestigious industry award as the Best Forex & CFD Broker in Germany.

Has Admirals received any notable awards for its services in the financial industry?

Yes, the broker has received numerous awards and recognitions for its outstanding services in the financial industry. Awards may cover various categories, including Best Broker, Best Trading Platform, and Excellence in Customer Service.

How is Admirals regarded in the financial industry, and what do awards suggest about its reputation?

The broker enjoys a positive reputation in the financial industry, and the awards and recognitions it has received contribute to its credibility. Awards often reflect the acknowledgment of Admirals’ efforts in delivering quality services, technological advancements, and customer satisfaction.

Admirals’ Account Types and Features

Offers Botswana traders a choice between six retail investor accounts that suit different trading needs and objectives. This flexible account structure ensures that all types of traders will find a solution when they choose to trade through Admirals.

➡️️ Trade.MT5

➡️️ Zero.MT5

➡️️ Trade.MT4

➡️️ Zero.MT4

Live Trading Accounts

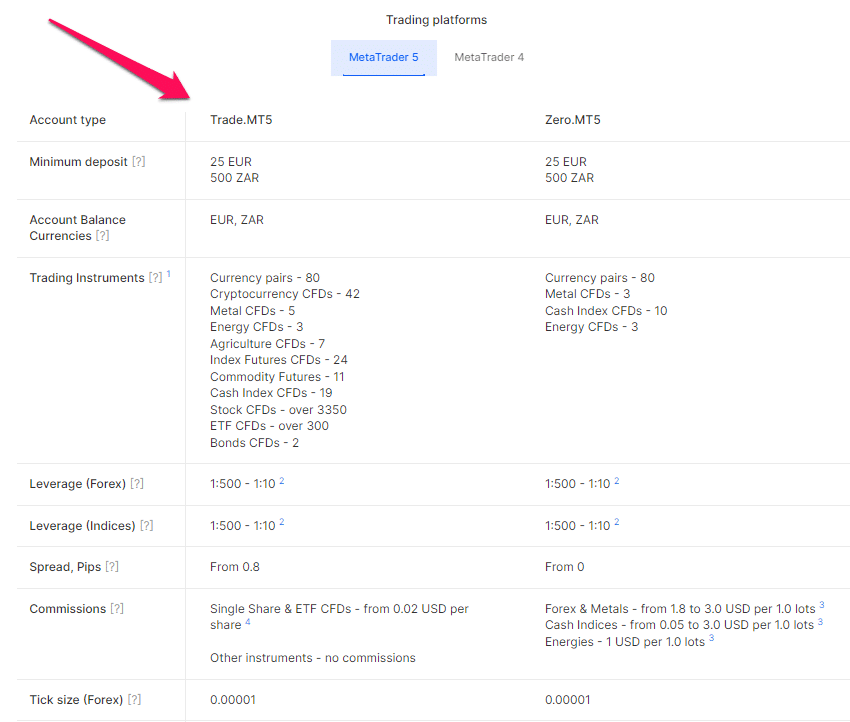

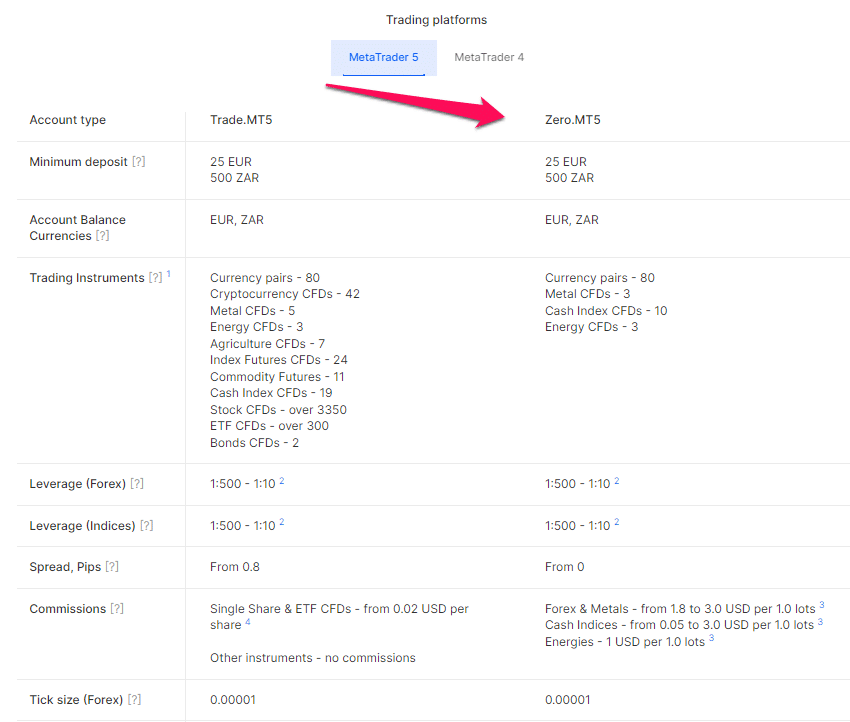

Trade.MT5

This is a basic live trading account that Botswana traders can use through MetaTrader 5.

| Account Feature | Value |

| 💰 Minimum Deposit | 339 BWP or an equivalent to $25 |

| 💵 Account Base Currency | EUR, USD, GBP, CHF, BGN, CZK, HRK, HUF, PLN, RON |

| 📊 Range of Markets Offered | • Currencies – 40 • Metal CFDs – 5 • Energy CFDs – 3 • Agriculture CFDs – 7 • Index Futures CFDs – 24 • Commodity Futures – 11 • Cash Index CFDs – 19 • Stock CFDs – over 3,350 • ETF CFDs – over 300 Bonds CFDs – 2 |

| 📈 Leverage on Forex | up to 1:500 |

| 📈 Leverage on Indices | up to 1:500 |

| 💻 Average Spread | From 0.8 pips on major pairs |

| 💸 Commissions charged on trades | • $0.02 per share on individual shares and ETF CFDs • Zero commissions on other tradable instrument |

| ✔️ Tick Size on Forex | 0.00001 |

| 📊 Trade Execution Type | Market |

| 📉 Minimum Position Size | 0.01 lots |

| 📈 Maximum Position Size | 100 standard lots |

| 📊 Maximum Open and Pending Orders | 500 standard lots |

| 🛑 Stop-Out Level | 50% |

| 📊 Negative Balance Protection offered? | Yes |

| ☪️ Islamic Account offered? | Yes |

| ✔️ One-Click Trading | Yes |

| 💰 Volatility Protection | Yes |

| 📊 Market Depth | Yes |

| 🗞 Market News | Yes |

| 📊 Market Analysis | Yes |

| 🗓 Economic Calendar | Yes |

| ✔️ Access to Trading Central? | Yes |

Zero.MT5

The Zero MetaTrader 5 account is for experienced traders and even professional traders who need the best trading conditions, features, and a competitive edge.

| Account Feature | Value |

| 💰 Minimum Deposit | 339 BWP or an equivalent to $25 |

| 💵 Account Base Currency | EUR, USD, GBP, CHF, BGN, CZK, HRK, HUF, PLN, RON |

| 📊 Range of Markets Offered | • Currencies – 45 • Metal CFDs – 3 • Energy CFDs – 3 • Cash Index CFDs – 10 |

| 📈 Leverage on Forex | up to 1:500 |

| 📉 Leverage on Indices | up to 1:500 |

| 📈 Average Spread | From 0.0 pips on major pairs |

| 💳 Commissions charged on trades | • From $1.8 to $3 per standard lot on Forex and Metals • From $0.05 to $3 per standard lot on Cash Indices • $1 per standard lot on Energies |

| ✔️ Tick Size on Forex | 0.00001 |

| 💻 Trade Execution Type | Market |

| 💰 Minimum Position Size | 0.01 lots |

| 💰 Maximum Position Size | 200 standard lots |

| 💵 Maximum Open and Pending Orders | 500 standard lots |

| 🛑 Stop-Out Level | 50% |

| 📉 Negative Balance Protection offered? | Yes |

| ☪️ Islamic Account offered? | No |

| 📲 One-Click Trading | Yes |

| 🛡 Volatility Protection | Yes |

| 📊 Market Depth | Yes |

| 🗞 Market News | Yes |

| 📊 Market Analysis | Yes |

| 🗓 Economic Calendar | Yes |

| 📍 Access to Trading Central? | Yes |

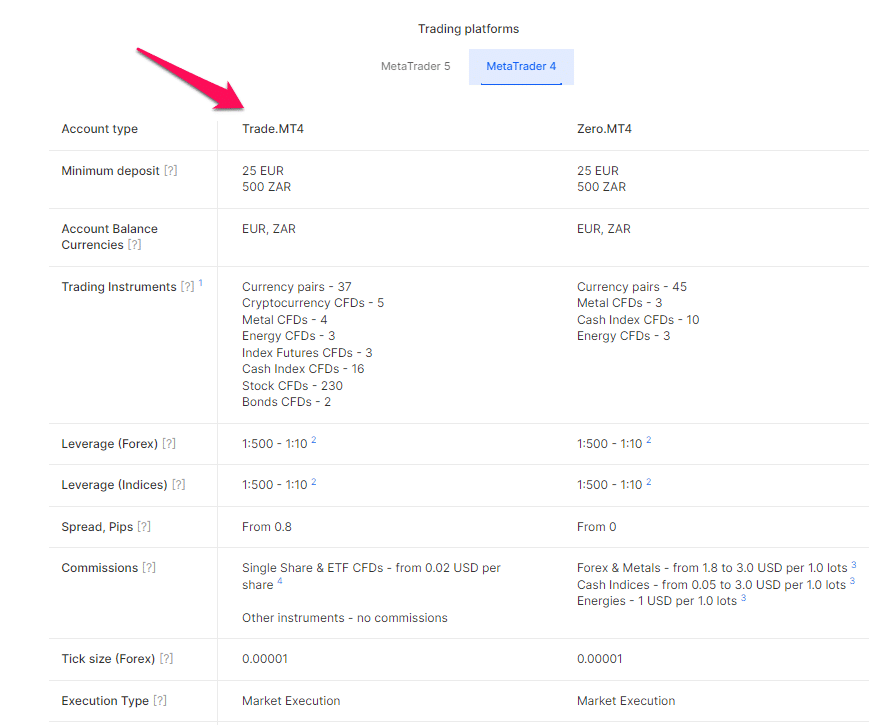

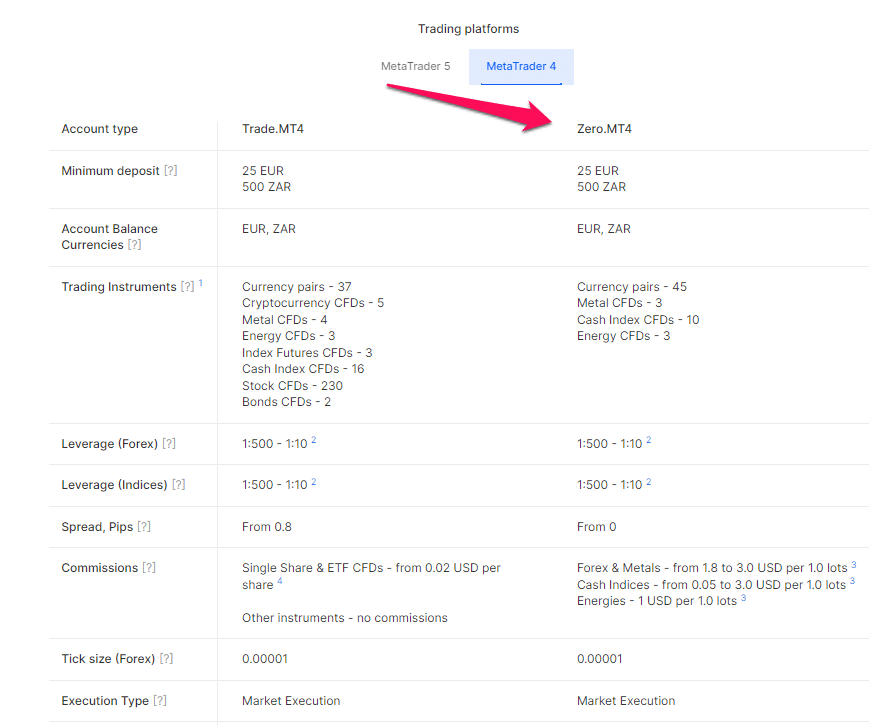

Trade.MT4

This is a basic trading account that is provided along with the use of MetaTrader 4, providing Botswana traders with competitive trading conditions and a range of features.

| Account Feature | Value |

| 💰 Minimum Deposit | 339 BWP or an equivalent to $25 |

| 💵 Account Base Currency | EUR, USD, GBP, CHF, BGN, CZK, HRK, HUF, PLN, RON |

| 📊 Range of Markets Offered | • Currencies – 37 • Metal CFDs – 4 • Energy CFDs – 3 • Index Futures CFDs – 3 • Cash Index CFDs – 16 • Stock CFDs – 230 • Bonds CFDs – 2 |

| 📈 Leverage on Forex | up to 1:500 |

| 📉 Leverage on Indices | up to 1:500 |

| 📈 Average Spread | From 0.8 pips on major pairs |

| 💳 Commissions charged on trades | • $0.02 per share on individual shares and ETF CFDs • Zero commissions on other tradable instruments |

| ✔️ Tick Size on Forex | 0.00001 |

| 💻 Trade Execution Type | Market |

| 💰 Minimum Position Size | 0.01 lots |

| 💰 Maximum Position Size | 100 standard lots |

| 💵 Maximum Open and Pending Orders | 500 standard lots |

| 🛑 Stop-Out Level | 50% |

| 📉 Negative Balance Protection offered? | Yes |

| ☪️ Islamic Account offered? | No |

| 📲 One-Click Trading | Yes |

| 🛡 Volatility Protection | Yes |

| 📊 Market Depth | No |

| 🗞 Market News | Yes |

| 📊 Market Analysis | Yes |

| 🗓 Economic Calendar | Yes |

| 📍 Access to Trading Central? | Yes |

Zero.MT4

The MetaTrader 4 Zero Account offers experienced and advanced traders a range of features and competitive trading conditions, allowing them to use a range of trading strategies including high-frequency trading, algorithmic trading, scalping, hedging, and day trading strategies.

| Account Feature | Value |

| 💰 Minimum Deposit | 339 BWP or an equivalent to $25 |

| 💵 Account Base Currency | EUR, USD, GBP, CHF, BGN, CZK, HRK, HUF, PLN, RON |

| 📊 Range of Markets Offered | • Currencies – 45 • Metal CFDs – 3 • Cash Index CFDs – 10 • Energy CFDs – 3 |

| 📈 Leverage on Forex | up to 1:500 |

| 📉 Leverage on Indices | up to 1:500 |

| 📈 Average Spread | From 0.0 pips on major pairs |

| 💳 Commissions charged on trades | • From $1.8 to $3 per standard lot on Forex and Metals • From $0.05 to $3 per standard lot on Cash Indices • $1 per standard lot on Energies |

| ✔️ Tick Size on Forex | 0.00001 |

| 💻 Trade Execution Type | Market |

| 💰 Minimum Position Size | 0.01 lots |

| 💰 Maximum Position Size | 200 standard lots |

| 💵 Maximum Open and Pending Orders | 200 standard lots |

| 🛑 Stop-Out Level | 50% |

| 📉 Negative Balance Protection offered? | Yes |

| ☪️ Islamic Account offered? | No |

| 📲 One-Click Trading | Yes |

| 🛡 Volatility Protection | Yes |

| 📊 Market Depth | No |

| 🗞 Market News | Yes |

| 📊 Market Analysis | Yes |

| 🗓 Economic Calendar | Yes |

| 📍 Access to Trading Central? | Yes |

Demo Account

A demo account is a practice account that offers traders a certain amount of virtual funds that they can use, allowing them to enter the live market without risking their capital.

There is a certain degree of risk involved when trading financial markets and Admirals offers its clients a risk-free platform where they can test strategies, practice trading, and explore what the broker offers in a safe trading environment with real market conditions.

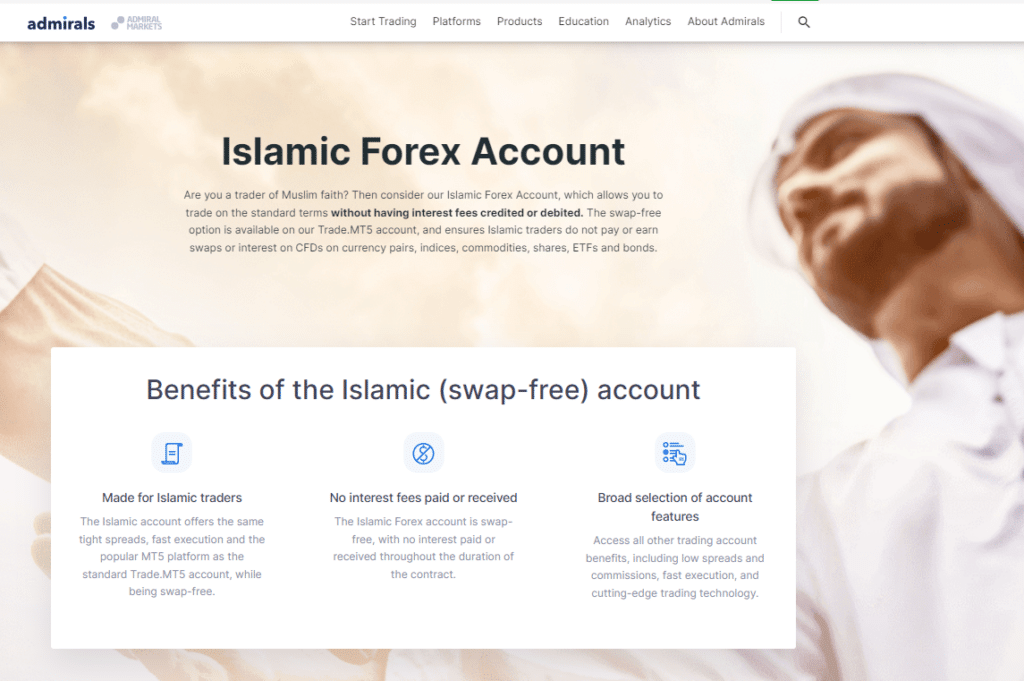

Islamic Account

Depending on the trading style and the trading strategy of the forex trader, they may keep their trading positions open for longer than 24 hours on a trading day.

This means that the trader could incur an overnight or rollover fee. This is a type of interest that is prohibited by Riba principles of Sharia law, which means that Muslim traders are often restricted in forex trading.

Muslim Botswana traders can convert their Trade.MT5 account to that of an Islamic account, providing them access to these features:

Botswana Muslim traders are subject to an Islamic Account Administration fee which is charged after a certain holding period per instrument. The holding period and average charges per instrument are as follows, with the full list available on the official website of Admirals:

What features are included with Admirals trading accounts?

The broker trading accounts come with a comprehensive set of features designed to enhance the trading experience. Features may include access to a user-friendly trading platform, advanced charting tools, technical analysis resources, and risk management tools.

What types of trading accounts does Admirals offer, and how do they differ?

The broker offers multiple types of trading accounts to cater to the diverse needs of traders. The specific account types may vary depending on the region and entity through which clients access Admirals’ services. Common account types include Standard Accounts and Premium Accounts.

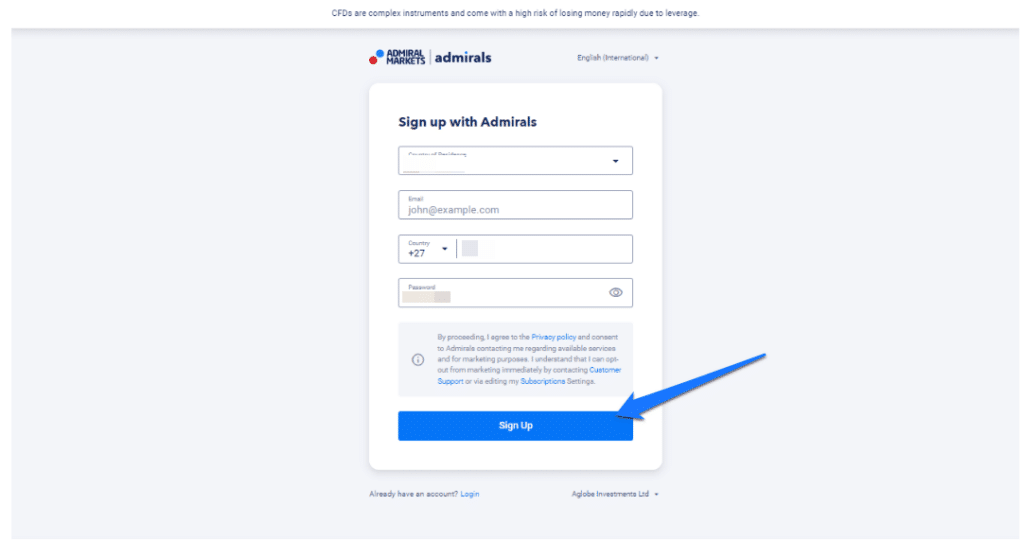

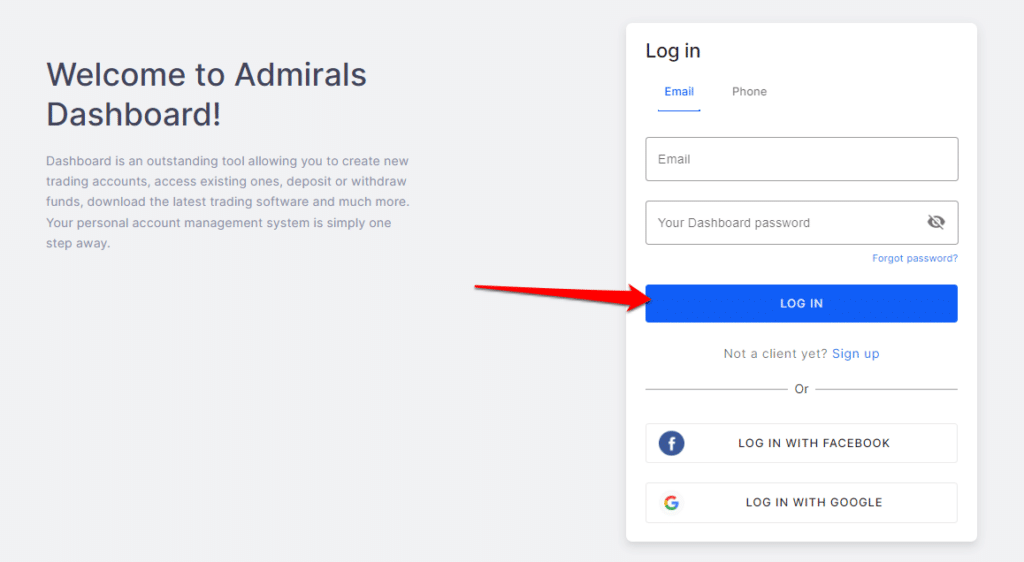

How to Open an Admiral Markets Account – Step by Step Guide.

Step 1: Green “Register”

New applicants will need to open an Admiral Markets online trading account in order to trade Forex & CFDs on indices, precious metals, energies, ETFs, and stocks on excellent terms with MetaTrader 4 and MetaTrader 5 trading platforms, or trade directly in your web browser with MetaTrader WebTrader. To start the process, the applicant can simply click on the green “Register” button located at the top right corner of the Brokers website.

Once this has been done, the applicant will be met with a registration form.

Step 2: Complete Registration

The applicant will be required to complete a short registration form and set up a password for their newly created account.

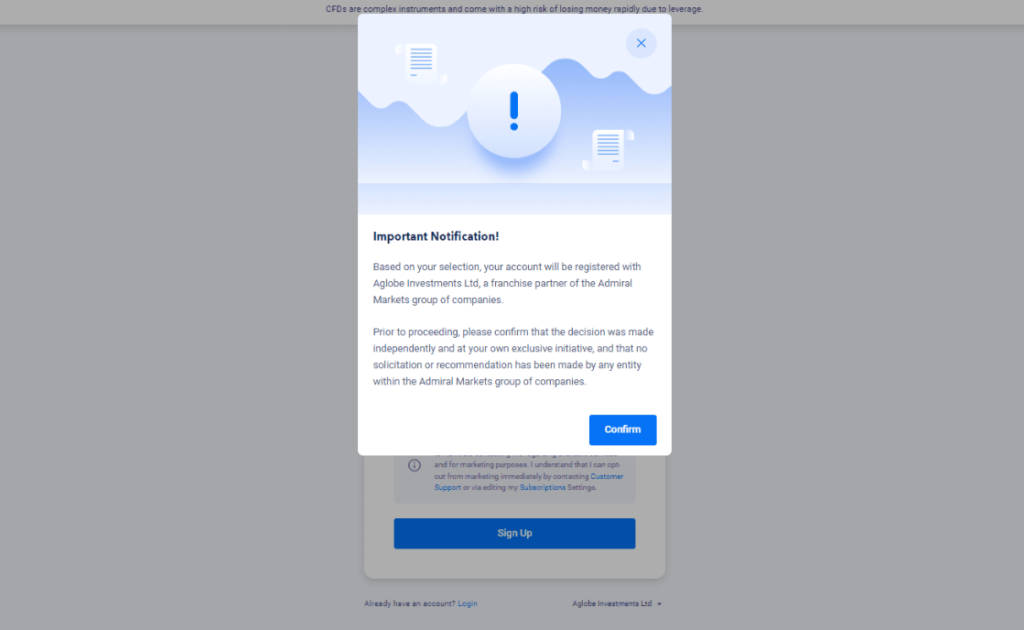

Step 3: Confirmation

Once the registration form has been completed an Important Notification will appear. The applicant must carefully read the notification before clicking on confirm.

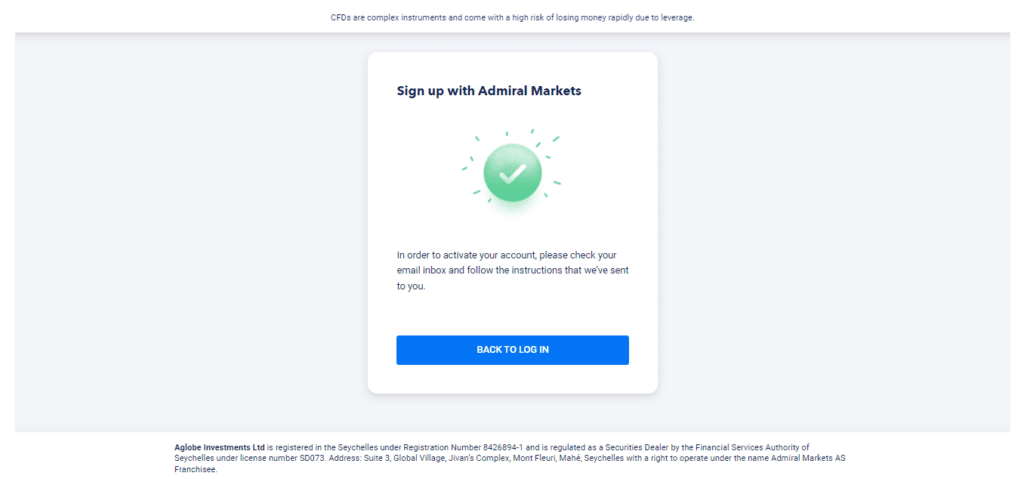

Step 4: Activation

The applicant will now be prompted to check their email account in order to complete the process.

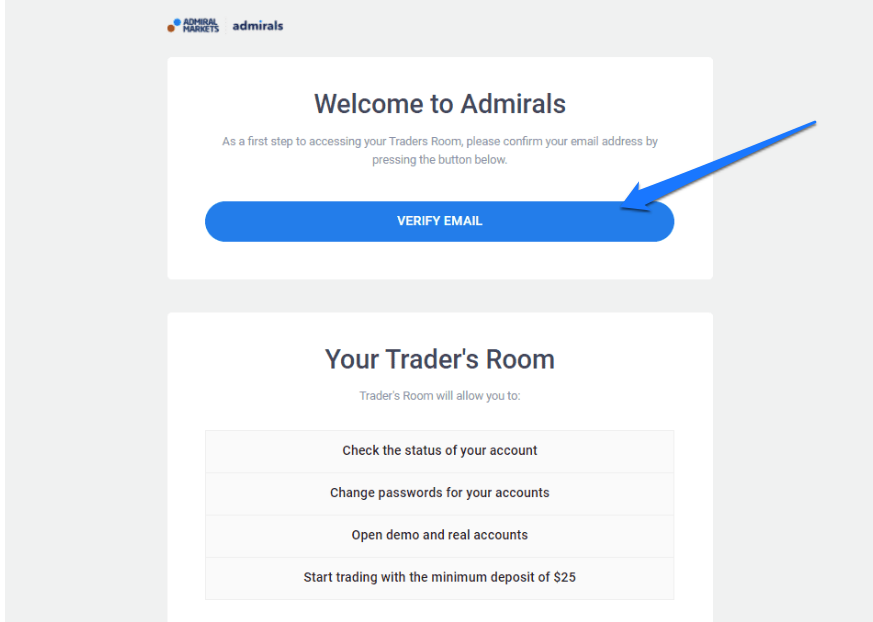

Step 5: Confirmation email

The Confirmation email received will look at follows

Admirals Vs FBS Vs TD Ameritrade – Broker Comparison

| 🥇Admirals | 🥈FBS | 🥉TD Ameritrade | |

| ⚖️ Regulation | FCA, ASIC, CySEC, EFSA, JSC | IFSC, CySEC | SEC, SFC, FINRA |

| 📱 Trading Platform | • MetaTrader 4 • MetaTrader 5 • Admirals Mobile Ap | • MetaTrader 4 • MetaTrader 5 • FBS Trader • CopyTrade | • TD Ameritrade Web • TD Ameritrade Mobile • thinkorswim mobile • thinkorswim web |

| 💰 Withdrawal Fee | Yes | Yes | No |

| 📈 Demo Account | Yes | Yes | Yes |

| 📊 Min Deposit | USD 25 / 339 BWP | USD 5 / 67 BWP | USD 0 / 0 BWP |

| 💰 Leverage | 1:500 | Up to 1:3000 | 1:2 |

| 💳 Spread | From 0.0 pips | From 0.0 pips | None |

| ✴️ Commissions | From $0.02 | From $6 | From $0 |

| 💳 Margin Call/Stop-Out | Stop-out from 50% | 40% and 20% | None |

| 📊 Order Execution | Market/Exchange | STP, ECN | None |

| 💰 No-Deposit Bonus | No | Yes | No |

| 💰 Cent Accounts | No | Yes | No |

| 📊 Account Types | • Trade.MT5 • Zero.MT5 • Trade.MT4 • Zero.MT4 | • FBS Cent Account • FBS Micro Account • FBS Standard Account • FBS Zero Account • FBS ECN Account • FBS Crypto Account | • Standard Accounts • Retirement Accounts • Education Accounts • Speciality Accounts • Managed Profiles • Margin Trading Account |

| ⚖️ CBN Regulation | No | No | No |

| 💵 BWP Deposits | Yes | Yes | No |

| 💳 Botswana Pula Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/7 | 24/7 |

| 🛍 Retail Investor Accounts | 6 | 6 | 2 |

| ☪️ Islamic Account | Yes | Yes | No |

Admirals’ Trading Platforms

MetaTrader 5

In addition, the Admirals mobile application is both secure and user-friendly. It provides Botswana traders instant access to a range of markets and several advanced features.

MetaTrader 5 is the #1 multi-asset platform chosen by traders and investors from around the globe for trading Forex, CFDs, exchange-traded instruments and futures. The platform offers advanced charting and trading tools, as well as options for automated trading.

All traders, no matter their skill level, may benefit from this free tool’s user-friendly design and customisability. An improved version of MetaTrader 4, featuring a few new features, is MetaTrader 5. Level II pricing, comprehensive charting, and trading tools, as well as free market data/news, are all included.

MetaTrader 4

MetaTrader is a well-known and dependable trading platform, and Admirals has a big range of it. To view and trade financial products in numerous marketplaces, traders utilize the MetaTrader 4 (MT4) trading platform, which provides real-time charting and real-time analysis.

MetaTrader 4 is a Forex and CFD trading platform used for trading and analysing the financial markets. MetaTrader 4 offers traders access to advanced trading operations in a fast, secure and reliable environment.

What trading platforms does Admirals offer, and how do they differ?

The broker offers a variety of trading platforms to suit different trading styles and preferences. The primary platform is the MetaTrader 4 (MT4) platform, a widely popular and versatile platform known for its advanced charting tools, technical analysis capabilities, and automated trading features.

Can I trade on Admirals using my mobile device, and what features are available on the mobile platforms?

Yes, Admirals offers mobile trading solutions to allow traders to stay connected to the markets on the go. The Admirals mobile app is available for both iOS and Android devices, providing access to trading features such as real-time price quotes, interactive charts, and the ability to execute trades from anywhere.

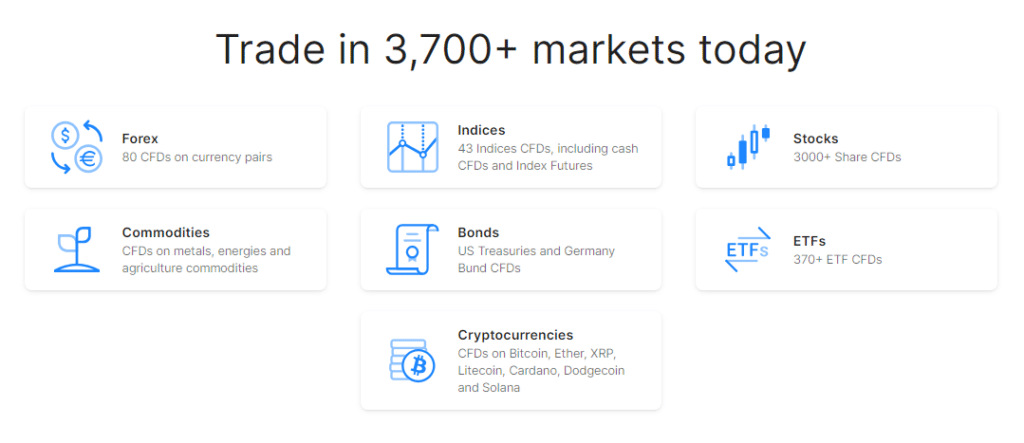

Range of Markets

Offer the following wide range of markets:

➡️️ ESG Trading Instruments

➡️️ Forex

➡️️ Cryptocurrency CFDs

➡️️ Commodities

➡️️ Indices

➡️️ Stocks

➡️️ ETFs

➡️️ Bonds

➡️️ Spread Betting

What financial instruments can I trade on Admirals, and which markets are available?

The broker provides access to a diverse range of tradable instruments across multiple markets. Traders can access forex pairs, including major, minor, and exotic currency pairs, allowing for extensive forex trading opportunities. Additionally, Admirals offers trading in indices, commodities, stocks, and cryptocurrencies.

Does Admirals offer cryptocurrency trading, and what cryptocurrencies are available on the platform?

Yes, Admirals recognizes the growing interest in cryptocurrencies and provides traders with the opportunity to trade a range of digital assets. The platform typically includes popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC), and more.

Broker Comparison for Range of Markets

| 🥇Admirals | 🥈FBS | 🥉TD Ameritrade | |

| 💰Forex | Yes | Yes | Yes |

| 🔨 Precious Metals | Yes | Yes | No |

| 💰 ETFs | Yes | No | Yes |

| 📊 CFDs | Yes | Yes | No |

| 📈 Indices | Yes | Yes | No |

| 💵 Stocks | Yes | Yes | Yes |

| 💳 Cryptocurrency | Yes | Yes | Yes |

| 💰 Options | No | No | Yes |

| 💸 Bonds | Yes | No | Yes |

| 🔋 Energies | Yes | No | Yes |

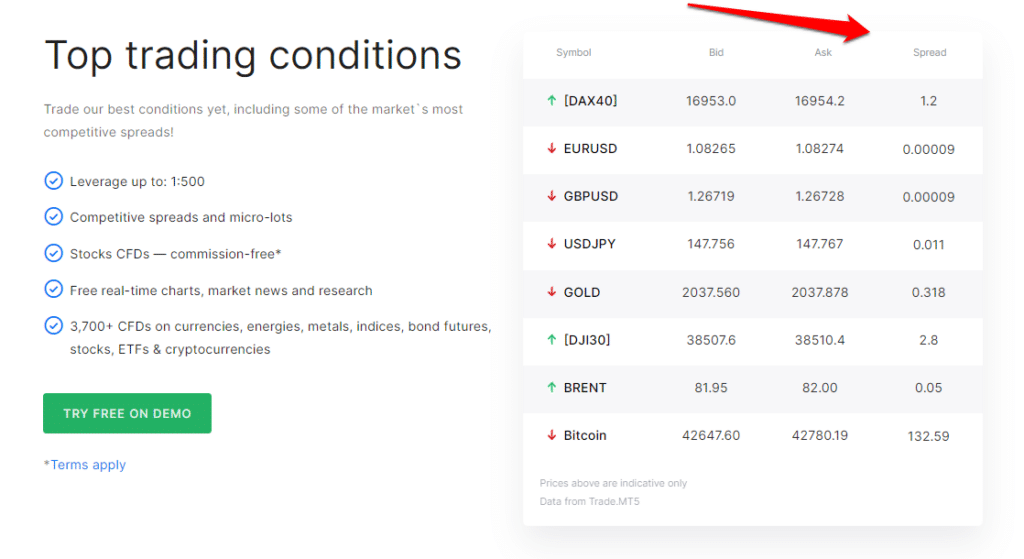

Trading and Non-Trading Fees

Spreads

The variable spreads that traders can expect from Admirals will depend on their account as follows:

➡️️ Trade.MT5 – from 0.5 pips on major currency pairs

➡️️ Zero.MT5 – from 0.0 pips on major pairs

➡️️ Trade.MT4 – from 0.5 pips on major currency pairs

➡️️ Zero.MT4 – from 0.0 pips on major pairs

Commissions

Admirals charges the following commissions on trading accounts:

| Account | Commissions charged on trades |

| Trade.MT5 | $0.02 per share on individual shares and ETF CFDs |

| Invest.MT5 | $0.02 per share on individual shares and ETF CFDs |

| Zero.MT5 | • From $1.8 to $3 per standard lot on Forex and Metals • From $0.05 to $3 per standard lot on Cash Indices • $1 per standard lot on Energies |

| Trade.MT4 | $0.02 per share on individual shares and ETF CFDs |

| Zero.MT4 | • From $1.8 to $3 per standard lot on Forex and Metals • From $0.05 to $3 per standard lot on Cash Indices • $1 per standard lot on Energies |

Overnight Fees, Rollovers, or Swaps

Overnight fees are charged when traders keep their positions open for longer than 24 hours. Admirals charges overnight fees according to the position size, the instrument, and other factors. Typical swap fees on EUR/USD, for instance, translate to -0.622 on a long swap and -0.041 on a short swap.

Muslim Botswana traders can convert their Trade.MT5 account to an Islamic Account, which exempts them from overnight fees.

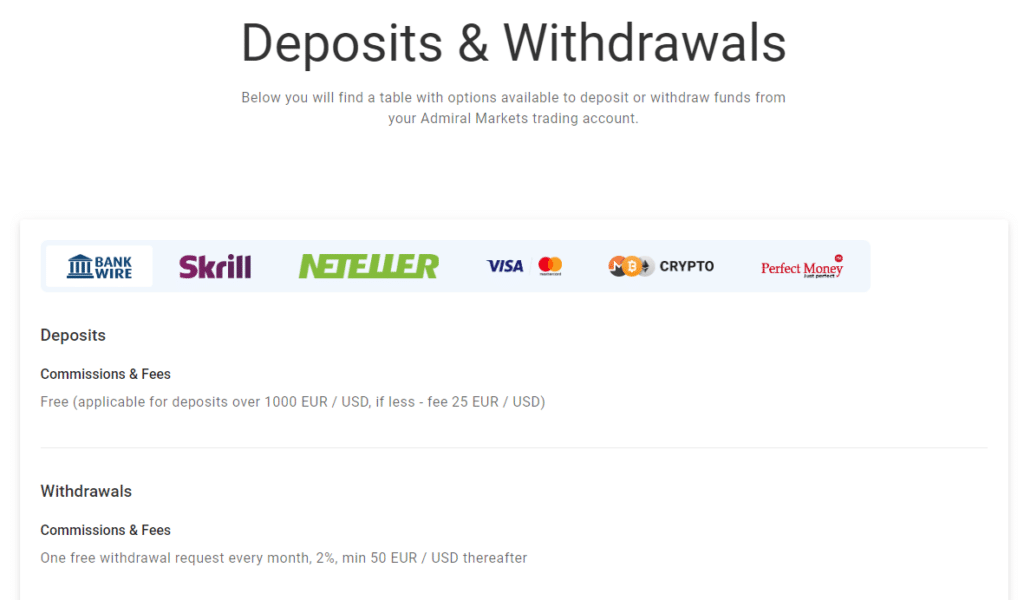

Deposit and Withdrawal Fees

Admirals charges deposit fees on the following payment methods:

➡️️ Skrill – 0.9% along with a minimum of 1 currency unit in EUR, USD, GBP, CHF, BGN, CZK, HRK, HUF, PLN, RON.

➡️️ Neteller – 0.9% along with a minimum of 1 currency unit in EUR or GBP.

With Admirals, Botswana receive one free withdrawal per month. If traders withdraw more than this, Admirals charges withdrawal fees as follows:

➡️️ Bank Transfers – if traders withdraw more than once, they are subjected to a fee of 10 USD, or an equivalent in EUR, GBP, CHF, BGN, CZK, HRK, HUF, PLN, RON.

➡️️ PayPal – 1% with a minimum of 1 currency unit in EUR, USD, GBP, CHF, BGN, CZK, HRK, HUF, PLN, RON.

➡️️ Skrill – 1% with a minimum of 1 currency unit in EUR, USD, GBP, CHF, BGN, CZK, HRK, HUF, PLN, RON.

➡️️ Neteller – 1% with a minimum of 1 currency unit in EUR, USD, GBP, CHF, BGN, CZK, HRK, HUF, PLN, RON.

➡️️ iBank and BankLink – 0.5% with a minimum of 1 currency unit in CNY, IDR, MYR, THB, VND.

Other Fees

Admirals charges administration fees on the Islamic Account as follows:

➡️️ Agricultural CFDs – 3 Days, from $0.1 up to $2.

➡️️ Cash Indices CFDs – between 3 to 10 days, ranging from $0.1 up to $3.

➡️️ Cryptocurrencies – after 1 day, from $0.01 up to $22.

➡️️ Energies – after 3 days, from $3 to $10.

➡️️ ETF CFDs – after 3 days, from $0.01 to $0.1.

➡️️ Forex, between 1 day and 10 days, from $3 to $113.

➡️️ Precious Metals – between 3 to 10 days, from $0.5 to $15.

➡️️ Stock CFDs – from 3 days, between $0.01 to $0.6

In addition, Botswana traders must note that an inactivity fee of 10 EUR is charged per month if the trading account goes dormant after two years of inactivity. There is also a currency conversion fee of 0.3% charged when Botswana fund their account in BWP , or any other currency other than EUR, USD, GBP, CHF, BGN, CZK, HRK, HUF, PLN, RON.

What are the trading fees associated with Admirals, and how are they structured?

The broker typically charges trading fees in the form of spreads, which are the differences between the buy (ask) and sell (bid) prices of tradable instruments. The specific spreads may vary depending on the asset being traded and market conditions.

Are there any non-trading fees associated with Admirals, and what should traders be aware of?

In addition to trading fees, Admirals may charge non-trading fees that traders should consider. Non-trading fees may include overnight financing fees (swap rates) for positions held overnight, withdrawal fees, and inactivity fees for dormant accounts.

Admirals Deposits and Withdrawals

Offers the following deposit methods:

➡️️ Bank Transfers

➡️️ Klarna

➡️️ Debit Card

➡️️ Credit Card

➡️️ PayPal

➡️️ Neteller

➡️️ Skrill

➡️️ SafetyPay

➡️️ iBank & BankLink

➡️️ iDEAL

➡️️ POLi

Broker Comparison: Deposit and Withdrawals

| 🥇Admirals | 🥉 FBS | 🥉TD Ameritrade | |

| Minimum Withdrawal Time | Same business day | 15 to 20 minutes (maximum 48 hours) | 1 business day |

| Maximum Estimated Withdrawal Time | up to three business days | Up to 7 days | 2 to 7 Business Days |

| Instant Deposits and Instant Withdrawals? | Yes, Instant payments | Instant Deposits | Instant Deposits |

Botswana traders can withdraw funds using these methods:

➡️️ Bank Transfers

➡️️ PayPal

➡️️ Neteller

➡️️ Skrill

➡️️ iBank & BankLink

How can I deposit funds into my Admirals trading account, and what payment methods are accepted?

Depositing funds into your Admirals trading account is a straightforward process. The platform typically accepts various payment methods, including bank transfers, credit/debit cards, and electronic wallets such as Skrill and Neteller. To make a deposit, log in to your Admirals account, navigate to the deposit section, and choose your preferred payment method. Follow the provided instructions to complete the transaction.

How can I withdraw funds from my Admirals trading account, and what withdrawal options are available?

Withdrawing funds from your Admirals trading account is simple and convenient. The platform typically offers multiple withdrawal options, including bank transfers, credit/debit cards, and electronic wallets.

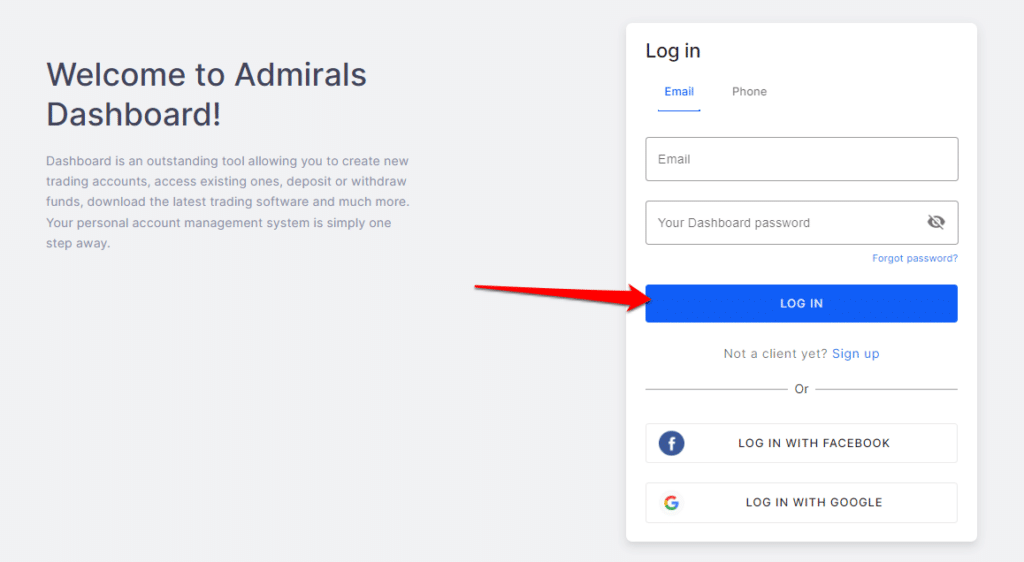

How to Deposit Funds with Admirals

Step 1: Log in to your Dashboard

To manage your accounts and set new payment orders, please log in to your Dashboard either via a Web browser or by logging into your Admirals mobile app.

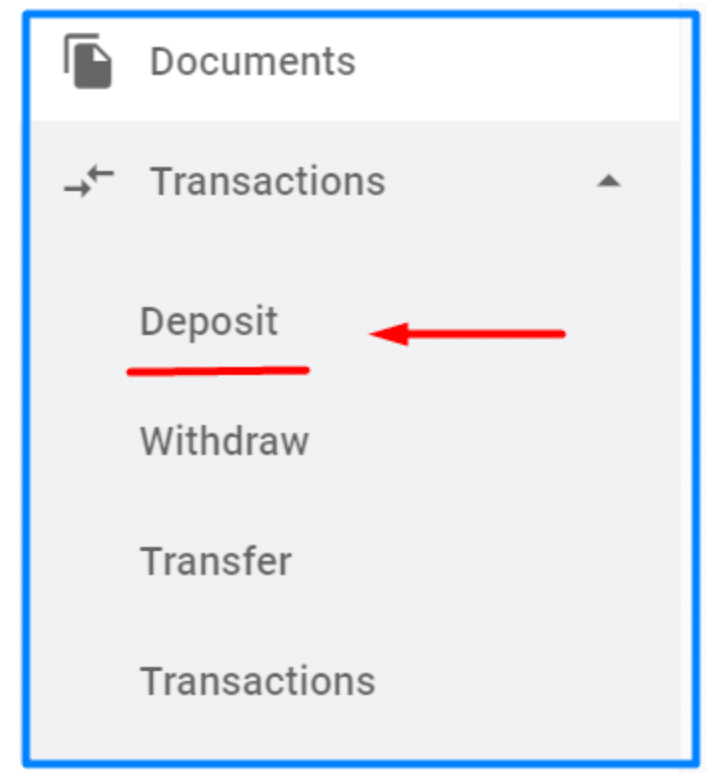

Step 2: To deposit in the Dashboard

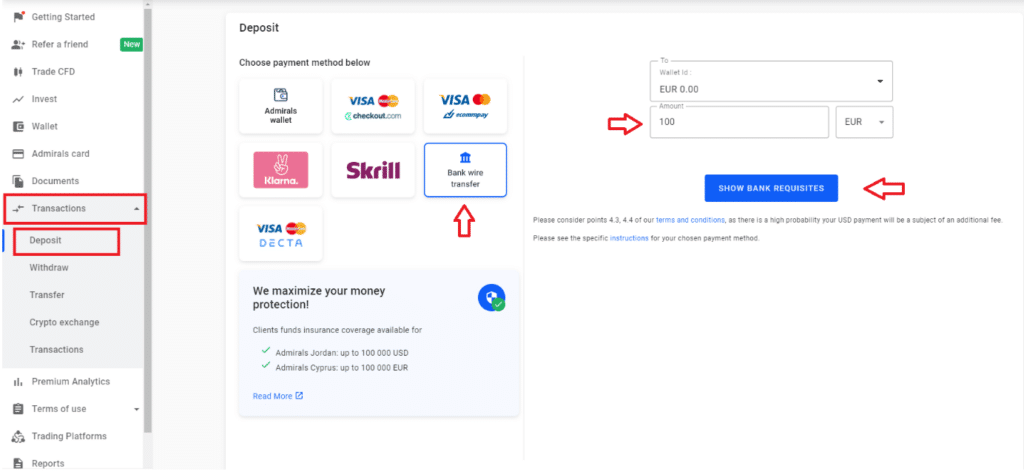

Select from the main menu the following option: “Transactions” and then “Deposit”.

In the main window, the site of the payment is shown now. For a bank deposit select the „Wire Transfer“ method. The Wire Transfer option shows you now a detailed list of bank accounts to which you can deposit your funds to.

Step 3: Deposit your Funds

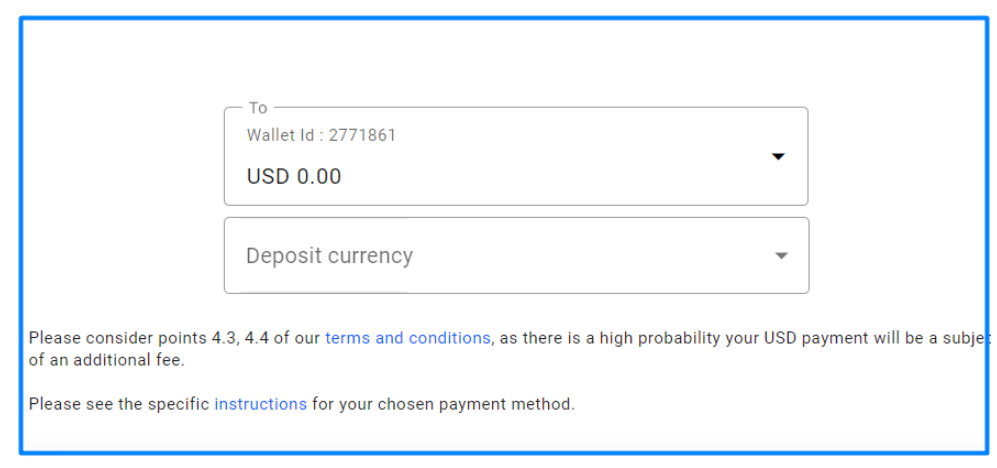

Select a trading account/wallet you wish to deposit your funds. We recommend you select the currency of the account based on your chosen bank deposit currency to avoid unnecessary currency conversions, whether it be direct to your trading account or to your wallet.

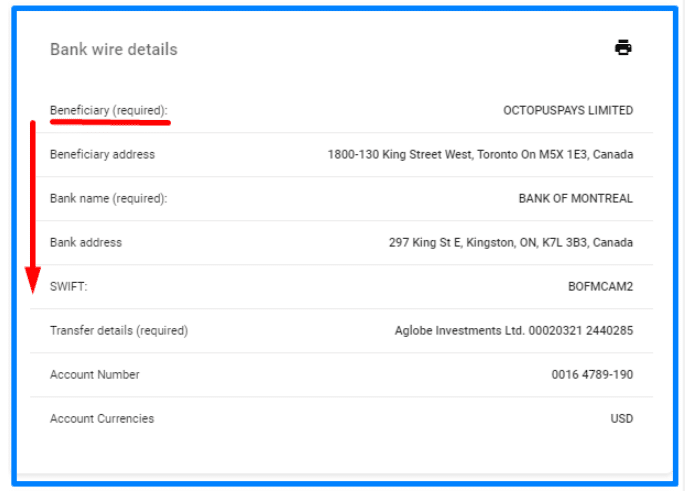

Step 4: Bank wire details

Scroll through the list of Bank wire details to show bank details you can use for your payment orders through your mobile banking application or for your physical payment slip. You can even print out this list by clicking on the right-hand „print icon“ for your convenience.

Admirals Fund Withdrawal Process

Step 1: Log in to your Dashboard

To manage your accounts and set new payment orders, please log in to your Dashboard either via a Web browser or by logging into your Admirals mobile app.

Open the “Transactions” drop-down icon and select “Transfer”,

Transfer the funds that you wish to withdraw from the trading account to the wallet,

Open the “Transactions” menu again, select “Withdraw” and then “Bank transfer”,

Withdraw the money from the wallet to your bank account,

Upload a bank statement issued within the past three months,

Your withdrawal request will then be processed.

10 Best Forex Brokers in Botswana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

Education and Research

Offers beginner traders the following educational resources:

➡️️ Forex and CFD webinars

➡️️ Frequently Asked Questions

➡️️ Trader’s Glossary

➡️️ Risk Management Guide

➡️️ Articles and Tutorials

➡️️ Zero To Hero

➡️️ Forex 1010

➡️️ Trading Videos

➡️️ eBooks

Offers the following trading tools and research:

➡️️ Global Market Updates

➡️️ Premium Analytics

➡️️ Fundamental Analysis

➡️️ Technical Analysis

➡️️ Forex Calendar

➡️️ Trading Central

➡️️ Trading News

➡️️ Market Heat Map

➡️️ Market Sentiment

➡️️ Weekly Trading Podcast

What educational resources does Admirals provide to help traders improve their skills and knowledge?

The broker is committed to empowering traders with educational resources to enhance their trading skills and knowledge. The platform typically offers a range of educational materials, including webinars, video tutorials, written guides, and articles covering various topics related to trading.

What research tools are available on Admirals to assist traders in making informed decisions?

The broker provides a comprehensive set of research tools designed to help traders make informed trading decisions. The platform typically offers daily market analysis, economic calendars, and expert commentary to keep traders updated on market trends and events.

Bonuses and Promotions

Cashback

Get rewarded as you trade, every month:

Admirals Cashback rewards you as you trade! Every month, your account will be automatically rewarded with an amount based on your trading volume. Simply trade and enjoy.

Pro.Cashback

Pro.Cashback loyalty programme rewards you as you trade. As a professional client, your account will be automatically credited with an amount based on your trading volume, every month. No need to claim your reward or perform any specific action: just trade and enjoy your reward.

The more funds are added to your account, the more opportunities you have to trade and potentially profit from the biggest and most liquid financial market in the world.

This loyalty programme is only available for professional clients. If you wish to check your eligibility for professional status, please first become familiar with the difference between retail and professional trading terms and then visit our Admirals Pro page for further details.

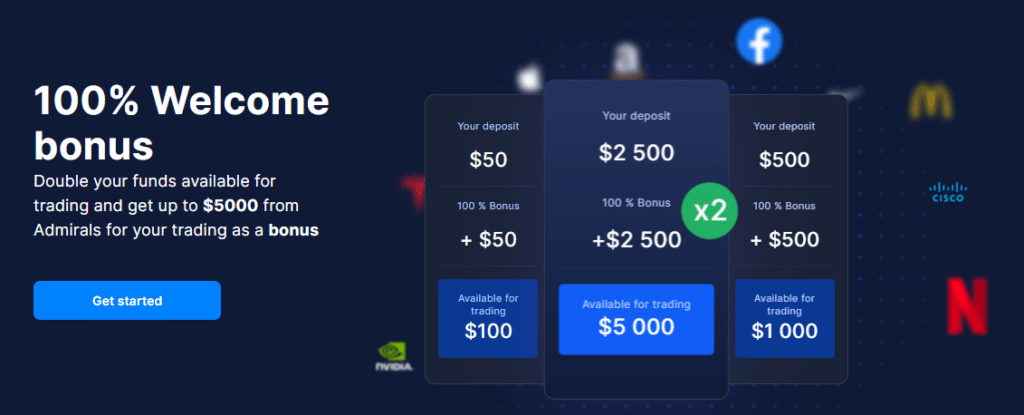

100% Welcome bonus

Double your funds available for trading and get up to $5000 from Admirals for your trading as a bonus.

$100 No Deposit Bonus

Choose from Trade.MT5, Trade.MT4, Zero.MT5, and Zero.MT4 accounts to activate the bonus.

- Trade CFDs on currencies, commodities and more.

- Use up to $100 in credit without risking your own funds.

- Experience live CFDs trading and make your first live trades

Terms and conditions apply, read about our bonus and trading profit withdrawals policy.

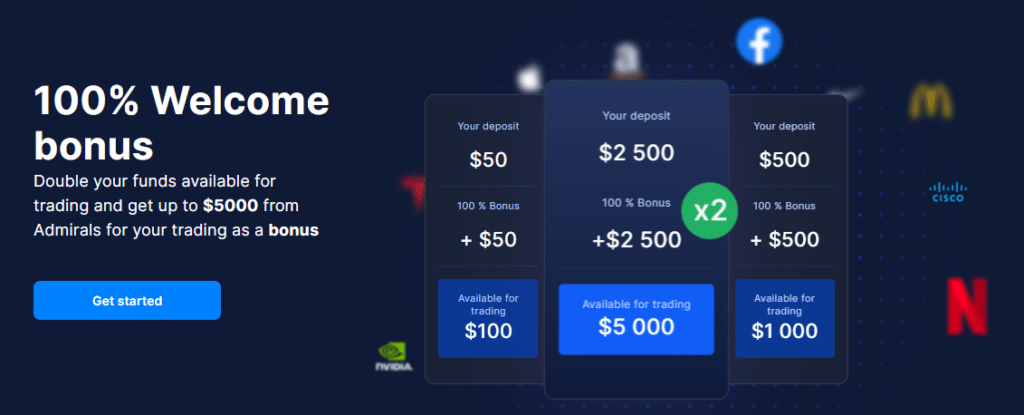

Affiliate Program

Admiral Markets Refer a Friend

For each friend, a trader invites to join Admiral Markets, both the trader and their friend will receive startup capital for investing in stocks as a reward.

How it works:

A referrer will need to have an Invest.MT5 account in order to participate.

After activating an Invest.MT5 account, the referrer gets access to the special menu in Traders Room where a personal referral link can be generated.

After getting the referral link the referrer can share it with their contact list, social media, and friends.

After the “friend” has completed their registration process and they will need to activate their Invest.MT5 account and make at least 1 trade.

After the process is completed the referrer and referral will receive 15 USD / EUR / GBP each.

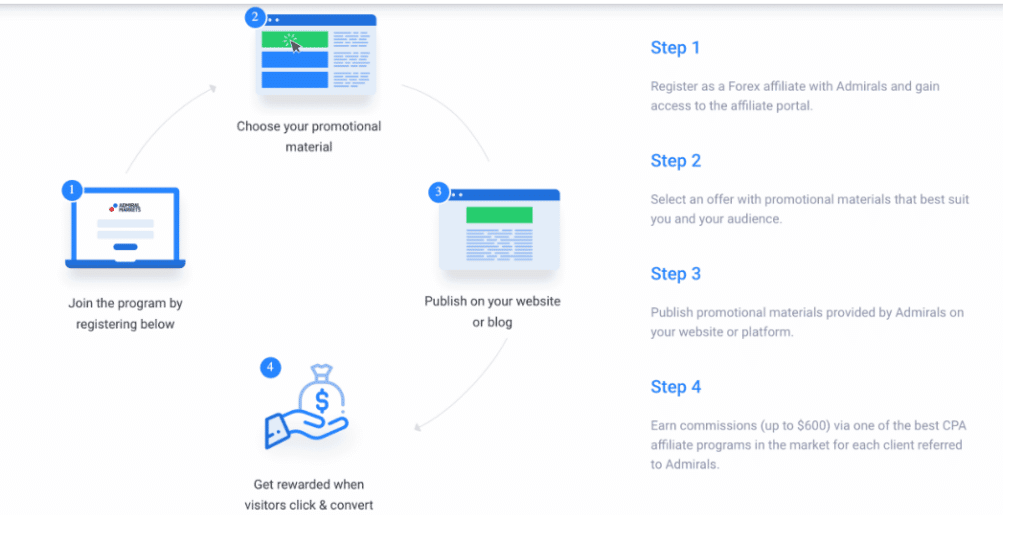

The benefits attributable to becoming an affiliate:

What is the Admirals Affiliate Program, and how does it work?

The Admirals Affiliate Program is a partnership opportunity for individuals or entities to earn commissions by referring new clients to the Admirals trading platform. Affiliates are provided with unique tracking links or codes, which they can use to promote Admirals’ services through various channels such as websites, social media, or email marketing.

How can I become an affiliate with Admirals, and what are the requirements?

Becoming an affiliate with Admirals is a straightforward process. Interested individuals or entities can usually apply to join the Admirals Affiliate Program through the official Admirals website. After submitting an application, Admirals’ affiliate management team reviews the application and may approve qualified applicants to become affiliates.

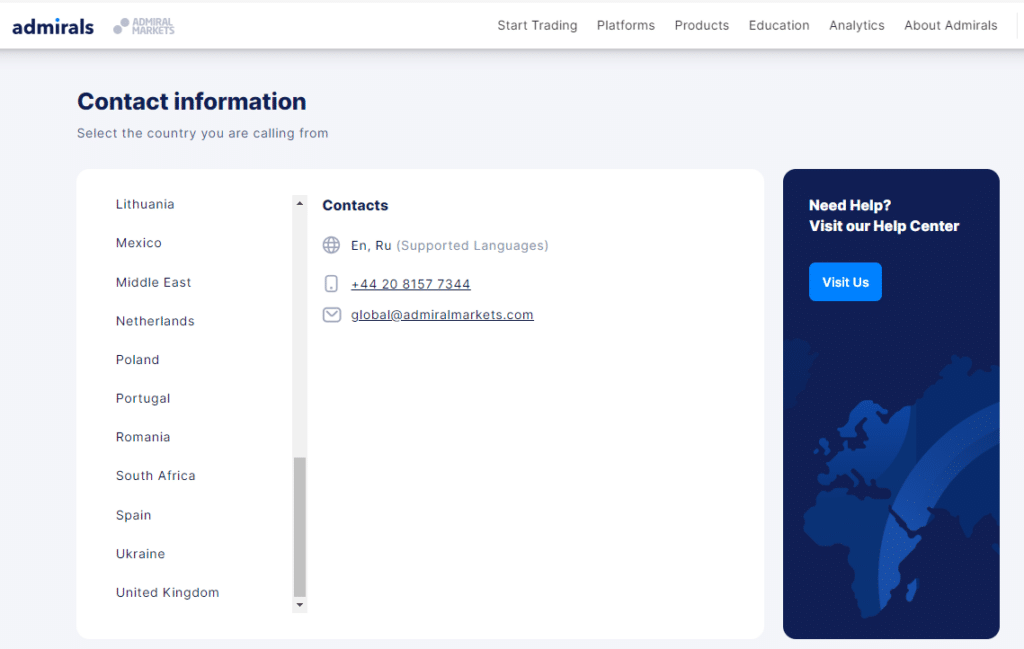

Customer Support

| Customer Support | Admiral ‘s Customer Support |

| ⏰ Operating Hours | call us between 5:30 am and 6 pm EET |

| 🗣 Support Languages | English, Chinese, French, German, Italian, Arabic, Japanese, Spanish, Swedish, Norwegian, Portuguese, Dutch, Danish |

| 🗯 Live Chat | Yes |

| 📧 Email Address | [email protected] |

| ☎️ Telephonic Support | +44 20 8157 7344 |

| 📞 Local Support in Botswana? | No |

| 🥇 Overall quality of Admiral Support | 4.8/5 |

Verdict on Admirals

Admiral Markets is an award-winning and licensed broker that provides a broad range of trading instruments on innovative trading platforms with customizable accounts, competitive spreads, rapid execution, and a variety of account funding alternatives.

Admiral is a highly regulated corporation and a well-known supplier of internet trading services. Admirals enable traders to trade with deep liquidity conditions from top-tier providers with its lightning-fast order executions, cheap initial deposit, and competitive pricing approach.

Technical solutions and improvements are carried out with utmost care while using the industry-proven MetaTrader 4 and 5 platforms along with the Admirals trading app.

You might also like: Best Forex Trading Apps in Botswana

You might also like: Best Forex Trading Strategies in Botswana

You might also like: Best Low Minimum Deposit Brokers in Botswana

You might also like: Best MT4 Brokers in Botswana

You might also like: Best MT5 Brokers in Botswana

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Admirals has an enormous range of tradable instruments spread across markets | The instruments that can be traded will depend on the trading account used |

| Admirals offers both MetaTrader platforms | There are high trading fees charged |

| Admirals offers real stocks and CFDs | Deposit and withdrawal fees apply |

| There is an ultra-low minimum deposit from 13 BWP / 1 USD | Admirals charges additional fees on the Islamic Account |

| There are several educational materials and trading tools available | |

| The rebate program is excellent | |

| Admirals has competitive spreads across accounts | |

| Admirals is extremely well-regulated and provides a safe trading environment |

Conclusion

Now it is your turn to participate:

Do you have any prior experience with Admirals ?

What was the determining factor in your decision to engage with Admirals ?

Was it because of the minimum deposit, regulation, retail trading accounts, or any other factors?

Have you experienced any issues with Admirals such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

Regardless, please share your thoughts in the comments below.

Frequently Asked Questions

Does Admirals have Volatility 75?

Admirals does not have Volatility 75.

Does Admirals have Nasdaq?

Admirals offers NASDAQ as an Index CFD and Cash Index under NQ100, with minimum spreads from 0.8 pips and zero commissions.

How long do withdrawals with Admirals take?

Depending on your payment method, withdrawal can take one to several business days.

Does Admirals accept PayPal?

Admirals supports the use of PayPal for deposits and withdrawals.

Is Admirals regulated and by whom?

Yes, Admirals is a well-regulated broker that holds licenses through FCA, ASIC, CySEC, EFSA, JSC, and FSCA.

Is Admirals a fake or a scam broker?

Admirals is not a fake or a scam broker. Instead, Admirals is a medium-trust forex and CFD broker with Tier-1, 2, and 3 regulations.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review