TD Ameritrade Review

Overall, TD Ameritrade is considered low-risk, with an overall Trust Score of 84% out of 100. TD Ameritrade is licensed by three Tier-1 Regulators (high trust), one Tier-2 Regulator (average trust), and one Tier-3 Regulator (low trust). TD Ameritrade offers three different retail trading accounts as well as Demo and Islamic accounts. TD Ameritrade is currently not regulated by the Central Bank of Botswana.

- Louis Schoeman

Jump to:

Regulation and Safety of Funds

Account Types and Features

Account Registration

Trading Platforms

Range of Markets

Fees

Deposits and Withdrawals

Education and Research

Affiliate Program

Final Verdict

Pros and Cons

FAQ

Overall Rating

- 4.7/5

Min Deposit

$0

Regulators

SEC, FINRA, CFTC, MAS

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

–

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

TD Ameritrade Review – 23 key points quick overview:

TD Ameritrade Overview

👉 Overall, TD Ameritrade is considered low-risk, with an overall Trust Score of 98 out of 100. TD Ameritrade is licensed by four Tier-1 Regulators (high trust), zero Tier-2 Regulators (average trust), and zero Tier-3 Regulators (low trust).

👉 TD Ameritrade offers 2 retail investor accounts, including a Standard Account and a Margin Trading Account, with several other account options, including Retirement Accounts, Education Accounts, Speciality Accounts, and Managed Profiles.

👉 TD Ameritrade, which has been around since 1971, is an online marketplace where investors may buy and sell stocks, exchange-traded funds, mutual funds, cryptocurrencies, futures contracts, and more. TD Ameritrade has over 11 million customers and over a trillion dollars in assets.

👉 This broker is great since it caters to traders of varying skill levels. No matter how much or how little experience you have with investing, TD Ameritrade can provide you with the research, data, and advice you need to develop a successful portfolio.

👉 The fact that no money is required to open an account is another reason this broker is an excellent choice. Options and stock transactions, as well as trading in exchange-traded funds, incur no commission costs.

👉 In addition, there are more than 300 locations to choose from if you prefer in-person service. When compared to other trading platforms, thinkorswim is unrivalled. Mobile and desktop users alike may use the extensive charting and analytical toolset.

👉 Whenever you have a trade-related query, you may swiftly and correctly consult with a team of trading experts, and the service is second to none. However, the huge world might be overwhelming when searching for stocks, bonds, and mutual funds.

👉 TD Ameritrade offers various educational opportunities, such as seminars on technical analysis, income investing, options, trading methods, financial fundamentals, and more.

👉 Like its main rivals, TD Ameritrade does not impose transaction fees on customers who buy stocks or ETFs via its website. As a result, the brokerage’s prices and charges are competitive with those of similar providers.

👉 Among TD Ameritrade’s 13,000 mutual funds, approximately 4,000 are available with no load and transaction fees. Therefore, your fund selection is superior compared to similar online brokers.

👉 TD Ameritrade does not charge spreads but levies commissions from 0 USD. TD Ameritrade has a maximum leverage ratio up to 1:2, and there is a demo account but no Islamic Account.

👉 The TD Ameritrade and thinkorswim platforms are supported. TD Ameritrade is headquartered in the United States and regulated by FINRA, CFTC, SEC, and SFC.

👉 TD Ameritrade might not accept Botswanan traders. Therefore, this review might only serve informational purposes to Botswanan traders.

TD Ameritrade Distribution of Traders

👉 TD Ameritrade currently has the largest market share in these countries:

➡️ United States – 96.07%

➡️ Taiwan – 0.41%

➡️ Canada – 0.3%

➡️ India – 0.3%

➡️ Argentina – 0.1%

Popularity among traders who choose TD Ameritrade

👉 TD Ameritrade is rated 22nd in Finance and Investment and has offices all around the globe.

👉 Although TD Ameritrade does not have a noticeable market share in Africa overall, there is no question that it is one of the top foreign exchange (FX) and CFD brokers for beginner and professional traders.

TD Ameritrade At a Glance

| 🏛 Headquartered | United States |

| 🌎 Global Offices | United States, Europe, Asia |

| 🏛 Local Market Regulators in Botswana | • Ministry of Finance and Economic Development (MFED) • Bank of Botswana (BoB) • Non-Bank Financial Institutions Regulatory Authority (NBFIRA) |

| 💳 Foreign Direct Investment in Botswana | 115.89 BWP Million in 2021 |

| 💰 Foreign Exchange Reserves in Botswana | 5270 USD Million in 2021 |

| ✔️ Local office in Gaborone? | No |

| 👨⚖️ Governor of SEC in Botswana | None, Moses Dinekere Pelaelo is the Governor of the Bank of Botswana |

| ✔️ Accepts Botswana Traders? | Yes |

| 📊 Year Founded | 1975 |

| 📞 Botswana Office Contact Number | None |

| 📱 Social Media Platforms | • Twitter • YouTube |

| ⚖️ Regulation | FINRA, CFTC, SEC, SFC |

| 1️⃣ Tier-1 Licenses | • Financial Industry Regulatory Authority (FINRA) • Commodity Futures Trading Commission (CFTC) • Securities and Exchange Commission (SEC) • Securities Futures Commission (SFC) |

| 2️⃣ Tier-2 Licenses | None |

| 3️⃣ Tier-3 Licenses | None |

| 🪪 License Number | • CRD – 7870 • SEC – 801-60469 and 8-23395, CIK 0000277841 • SIPC • NFA ID – 0506639 (Not a member) • SFC – BJO462 |

| ⚖️ MFED, BoB, or NBFIRA Regulation | No |

| ✔️ Regional Restrictions | Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, United Kingdom, European Union |

| ☪️ Islamic Account | No |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 2 |

| ✔️ PAMM Accounts | Yes |

| 💻 Liquidity Providers | JP Morgan, Citadel Securities, XTX Markets, HC Technologies, Virtu Financial |

| ✔️ Affiliate Program | None |

| 📱 Order Execution | None |

| 📊 Starting spread | None |

| 📉 Minimum Commission per Trade | From $0 |

| 💰 Decimal Pricing | Up to 5 digits after the comma |

| 📞 Margin Call | None |

| 🛑 Stop-Out | None |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | None indicated; it depends on the account balance |

| ✅ Crypto trading offered? | Yes |

| ✔️ Offers a BWP Account? | No |

| 📉 Dedicated Botswana Account Manager? | No |

| 📈 Maximum Leverage | 1:2 |

| 📊 Leverage Restrictions for Botswana? | No |

| 💳 Minimum Deposit (BWP) | 1 USD |

| ✔️ Botswana Pula Deposits Allowed? | No |

| 📊 Active Botswana Trader Stats | 250,000+ |

| 👥 Active Botswana-based TD Ameritrade customers | Unknown |

| 🔁 Botswana Daily Forex Turnover | Unknown, Forex overall is $6.6 Trillion |

| 💰 Deposit and Withdrawal Options | • Electronic Bank Deposit (ACH) • Wire Transfer • Cheque • Broker Transfer • Stock Certificates |

| 💻 Minimum Withdrawal Time | 5 minutes |

| ⏰ Maximum Estimated Withdrawal Time | 7 working days |

| 💳 Instant Deposits and Instant Withdrawals? | No |

| 🏛 Segregated Accounts with Botswana Banks? | No |

| 📱 Trading Platforms | • TD Ameritrade • thinkorswim |

| 💻 Tradable Assets | • Stocks • Options • ETFs • Mutual Funds • Futures • Forex • Bonds • Fixed Income • Annuities • IPOs • CDs • Cryptocurrency Trading |

| ✔️ Offers USD/BWP currency pair? | No |

| 📊 USD/BWP Average Spread | No |

| ✅ Offers Botswana Stocks and CFDs | No |

| 💻 Languages supported on the Website | English |

| ☎️ Customer Support Languages | Multilingual |

| 👥 Copy Trading Support | Yes |

| ⏰ Customer Service Hours | 24/7 |

| 📞 Botswana-based customer support? | No |

| 💸 Bonuses and Promotions for Botswanans? | No |

| 📚 Education for Botswana beginner traders | Yes |

| 📱 Proprietary trading software | Yes |

| 🤝 Most Successful Trader in Botswana | Currently unknown |

| ✔️ Is TD Ameritrade a safe broker for Botswana Traders? | Yes |

| 🎖 Rating for TD Ameritrade Botswana | 8/10 |

| 🥇 Trust score for TD Ameritrade Botswana | 98% |

| 👉 Open Account | 👉 Open Account |

TD Ameritrade Regulation and Safety of Funds

TD Ameritrade Regulation in Botswana

👉 The local market regulators in Botswana are as follows:

➡️ Ministry of Finance and Economic Development (MFED)

➡️ Bank of Botswana (BoB)

➡️ Non-Bank Financial Institutions Regulatory Authority (NBFIRA)

👉 While TD Ameritrade is regulated globally, the broker does not yet have local regulations or licenses in Botswana. However, TD Ameritrade is a popular and trustworthy broker that accommodates Botswanan traders.

TD Ameritrade Global Regulations

👉 TD Ameritrade is well-regulated by:

➡️ Securities and Exchange Commission (SEC).

➡️ The Financial Industry Regulatory Authority (FINRA).

➡️ The Commodity Futures Trading Commission (CFTC).

➡️ Hong Kong’s Securities & Futures Commission (SFC).

TD Ameritrade Client Fund Security and Safety Features

👉 The Securities Investor Protection Corporation (SIPC) is in place to protect investors in the United States. Securities Investor Protection Corporation (SIPC) was established to protect investors’ money and property in case of a broker’s insolvency.

👉 Cash investments are limited to $250,000 and are not eligible for SIPC protection, which has a $500,000 cap. The broker also has a second insurance policy that covers losses up to $152 million ($2 million cash limit) per client and $500 million in total.

👉 It is important to note that the investor protection program does not cover all consumers and that certain investment products, like futures, are specifically excluded. In addition, no safeguards are in place to prevent account balances from falling below zero.

👉 To make an informed decision on which brokerage to create an account with, it is essential to read and fully comprehend all the terms and conditions provided by that broker.

TD Ameritrade Awards and Recognition

👉 TD Ameritrade was voted first in six areas in the StockBrokers.com 2024 Online Broker Review, including:

➡️ Phone Support

➡️ Customer Service

➡️ Options Trading

➡️ Platforms and Tools

➡️ Desktop Platform (thinkorswim)

➡️ Active Trading

👉 In addition, the broker ranked among the “Best in Class” in the following categories:

➡️ Education

➡️ Trading

➡️ Research

➡️ Futures Trading

➡️ Commissions and Fees

➡️ Overall Broker Class

➡️ IRA Accounts

➡️ Mobile Trading Apps

➡️ Ease of Use

➡️ Regarding stock trading platforms and research, TD Ameritrade was named a co-winner in NerdWallet’s Best-Of Awards for 2024.

➡️ TD Ameritrade was selected the Best Broker for Beginners at the 2024 Best Online Brokers Awards by Investopedia.

➡️ In addition, TD Ameritrade was also recognized as the Best Broker for Customer Service and Mobile Apps.

TD Ameritrade Account Types and Features

👉 TD Ameritrade is an online broker that offers a selection of accounts to satisfy various objectives and needs, regardless of the trader or investor. The following are all the accounts offered by TD Ameritrade:

➡️ The Standard Account offers thorough investing options, unbiased analysis, and reliable trading platforms.

➡️ Individual Retirement Accounts, Roth Individual Retirement Accounts, and Rollover Individual Retirement Accounts are all types of retirement accounts (IRAs). These accounts could help investors reach their retirement objectives.

➡️ Education Accounts are the best option for those who want to save money and invest in their kids’ future. These accounts provide a few possibilities for college savings.

➡️ Special accounts include individual trusts, pension plans, partnerships, and sole proprietorships.

➡️ Managed Profiles provide long-term investment options through the expertly managed portfolios of TD Ameritrade Investment Management, LLC.

➡️ With the use of margin trading, traders with various experience levels may borrow money from TD Ameritrade. This results in a leverage ratio of 1:2, allowing traders to start transactions worth 50% more than their initial deposit.

👉 TD Ameritrade offers several different account types. For example, its retail investor accounts include the Standard and Margin Trading accounts.

TD Ameritrade Live Trading Account Details

Standard Account

👉 A Joint Trader or an Individual Trader can open a Standard Account. This account type is related to the following client profiles:

➡️ Cash

➡️ Cash and Margin

➡️ Cash and Option

➡️ Cash, Margin, and Option

👉 The following list includes the charges involved and the minimum amount needed to start an account:

➡️ When establishing an account, no minimum deposit is necessary. However, additional requirements can be necessary if Botswanan traders wish to benefit from certain promotional offers.

➡️ A minimum of $50 must be sent electronically.

➡️ To use the Margin or Options rights on the Standard Account, you must make a minimum deposit of $2,000.

Margin Trading Account

👉 The purchasing power of investors who establish a margin trading account is double that of investors who create a conventional cash account. You might invest in this account or spend the money for personal reasons. The following qualities are advantageous to traders who create a margin account:

➡️ A wide range of products since margin trading is accessible on all platforms. Additionally, professionals may utilize this account to trade with unpaid funds and margin IRAs.

➡️ Availability of a thorough educational program with training materials, educational videos, and a classroom-like simulation.

➡️ Availability of round-the-clock customer service.

➡️ Simple and transparent trading fees.

TD Ameritrade Base Account Currencies

👉 TD Ameritrade only allows USD to be set as the base currency for trading accounts. This means that when traders deposit in any currency other than this, they will face currency conversion fees.

TD Ameritrade Demo Account

👉 A demo account is a practice trading account that gives traders a certain number of virtual dollars to practice trading before putting any of their own money at risk.

👉 When trading financial markets, there is some risk involved. TD Ameritrade provides its customers a risk-free platform to evaluate strategies, practice trading, and explore what the broker offers in a safe trading environment with genuine market circumstances.

👉 TD Ameritrade offers paper trading alternatives to investors and traders by offering the following:

➡️ A paperMoney practice trading account Is a tool that allows traders to evaluate their trading tactics and practice trading in simulated real market conditions without risking their actual money.

➡️ Access to the Virtual Stock Simulator – Using a virtual stock simulator, novice traders may hone their trading abilities before entering the market.

TD Ameritrade Islamic Account

👉 Forex traders may leave their positions open for more than one trading day if it fits within their trading strategy.

👉 The broker can impose an overnight or rollover fee on the trader. In addition, since the Riba laws of Sharia law prohibit interest, Muslim traders face restrictions in the foreign exchange market.

👉 TD Ameritrade does not provide an Islamic Account or a Swap-Free Account.

How to open an Account with TD Ameritrade in Botswana

👉 When compared to the procedures required by other brokers, opening an account with TD Ameritrade might be a time-consuming process.

👉 Because applicants must present various documents, including certified copies of their identification, which must be validated, the process could take longer than expected.

👉 When traders establish an account, they must input personal information such as their name, residential address, date of birth, and any other information that may be used to identify them.

👉 For this information to be validated, traders must present valid picture identification and evidence of domicile.

👉 Once an account has been verified and authorized, traders can deposit money into their accounts and begin trading as soon as the account has been approved.

TD Ameritrade Vs AvaTrade Vs InstaForex – Broker Comparison

| 🥇 TD Ameritrade | 🥈 AvaTrade | 🥉 InstaForex | |

| ⚖️ Regulation | FINRA, CFTC, SEC, SFC | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC | FCA, BVI FSC, CySEC, FSA SVG |

| 📱 Trading Platform | • TD Ameritrade • thinkorswim | • AvaTradeGO • AvaOptions • AvaSocial • MetaTrader 4 • MetaTrader 5 • DupliTrade • ZuluTrade | • MetaTrader 4 • MetaTrader 5 • WebIFX • InstaForex Multi-Terminal • InstaForex WebTrader • InstaTick Trader • InstaForex MobileTrader |

| 💰 Withdrawal Fee | No | Yes | No |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 1 USD | 1,300 BWP | 13 BWP |

| 📊 Leverage | 1:2 | • 1:30 (Retail) • 1:400 (Pro) | 1:1000 |

| 📊 Spread | None | Fixed, from 0.9 pips | 0.0 pips |

| 💰 Commissions | From $0 | None | 0.03% to 0.07% |

| ✴️ Margin Call/Stop-Out | None | • 25% – 50% (M) • 10% (S/O) | 30%/10% |

| 💻 Order Execution | None | Instant | Instant |

| 💳 No-Deposit Bonus | No | No | Yes |

| 📊 Cent Accounts | No | No | Yes |

| 📈 Account Types | • Standard Accounts • Retirement Accounts • Education Accounts • Specialty Accounts • Managed Profiles • Margin Trading Account | • Standard Live Account • Professional Account Option | • Insta.Standard Trading Account • Insta.Eurica Trading Account • Cent.Standard Trading Account • Cent.Eurica Trading Account |

| ⚖️ CBN Regulation | No | No | No |

| 💳 BWP Deposits | No | No | Yes |

| 📊 Botswana Pula Account | No | No | No |

| 👥 Customer Service Hours | 24/7 | 24/5 | 24/5 |

| 📊 Retail Investor Accounts | 2 | 1 | 4 |

| ☪️ Islamic Account | No | Yes | Yes |

| 📉 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | None indicated; it depends on the account balance | Unlimited | 100 lots |

| 💰 Minimum Withdrawal Time | 5 minutes | 24 to 48 Hours | Instant |

| 📊 Maximum Estimated Withdrawal Time | 7 working days | Up to 10 days | Up to 6 working days |

| 💸 Instant Deposits and Instant Withdrawals? | No | No | Yes |

TD Ameritrade Trading Platforms

👉 TD Ameritrade provides an array of sophisticated, user-friendly, and flexible trading platforms. These are free to consumers and available on the Web, desktop, and mobile devices.

👉 The platforms include various tools and features that appeal to investors with different skill levels and requirements.

👉 The platforms include all the tools necessary to research different firms, execute trades, view real-time quotes, read live-streaming news, manage your portfolio, and converse with financial experts. TD Ameritrade provides the following trading platforms to traders:

➡️ TD Ameritrade

➡️ thinkorswim

Desktop Platforms

➡️ thinkorswim Desktop

👉 Thinkorswim desktop provides access to elite-level trading tools and a platform backed by analytics, education, and a specialized trade desk.

👉 Discover the unrivalled power of a customizable trading experience designed to help you master even the most advanced strategies and techniques.

WebTrader Platforms

➡️ TD Ameritrade Web

➡️ thinkorswim Web

TD Ameritrade Web

👉 The web platform is self-sufficient and requires no additional software downloads or installations. It has all the tools that many investors will need. Typical characteristics include:

➡️ There are no essential downloads.

➡️ Executes directly inside a web browser.

➡️ User-friendly with a fully configurable dock.

➡️ Third-party studies are conducted independently.

➡️ Various sources of funding for education.

➡️ Daily economic reports are available.

➡️ Economic sentiment and social indicators.

thinkorswim Web

👉 Thinkorswim is a professional trading platform aimed at more experienced traders. The thinkorswim platform has the following features:

➡️ The most sophisticated and effective tools for conducting analysis and reviewing methods.

➡️ Market monitoring and scanning to discover trading opportunities with favourable risk-to-reward ratios.

➡️ thinkManual and several tutorials to help people get familiar with the platform.

Trading App

➡️ TD Ameritrade Mobile

➡️ thinkorswim mobile

TD Ameritrade Mobile

👉 Those who want access to and administration of their trading account while on the go can use the mobile trading platform. It may be accessed from anywhere in the world with an internet connection and is compatible with Android and iOS devices.

thinkorswim mobile

👉 The thinkorswim mobile application puts the power of thinkorswim in the palm of your hand. Our top-rated trading application, built for your smartphone, tablet, and Apple Watch, allows you to place trades easily and safely.

👉 Traders can trade confidently because of their access to powerful and innovative technologies, knowledge, and guidance from actual traders.

TD Ameritrade Range of Markets

👉 Traders can expect the following range of markets from TD Ameritrade:

➡️ Stocks

➡️ Options

➡️ ETFs

➡️ Mutual Funds

➡️ Futures

➡️ Forex

➡️ Bonds

➡️ Fixed Income

➡️ Annuities

➡️ IPOs

➡️ CDs

➡️ Cryptocurrency Trading

Broker Comparison for Range of Markets

| TD Ameritrade | AvaTrade | InstaForex | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | No | Yes | Yes |

| ➡️️ ETFs | No | Yes | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | No | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | Yes | Yes |

| ➡️️ Options | Yes | Yes | No |

| ➡️️ Energies | No | Yes | Yes |

| ➡️️ Bonds | Yes | Yes | No |

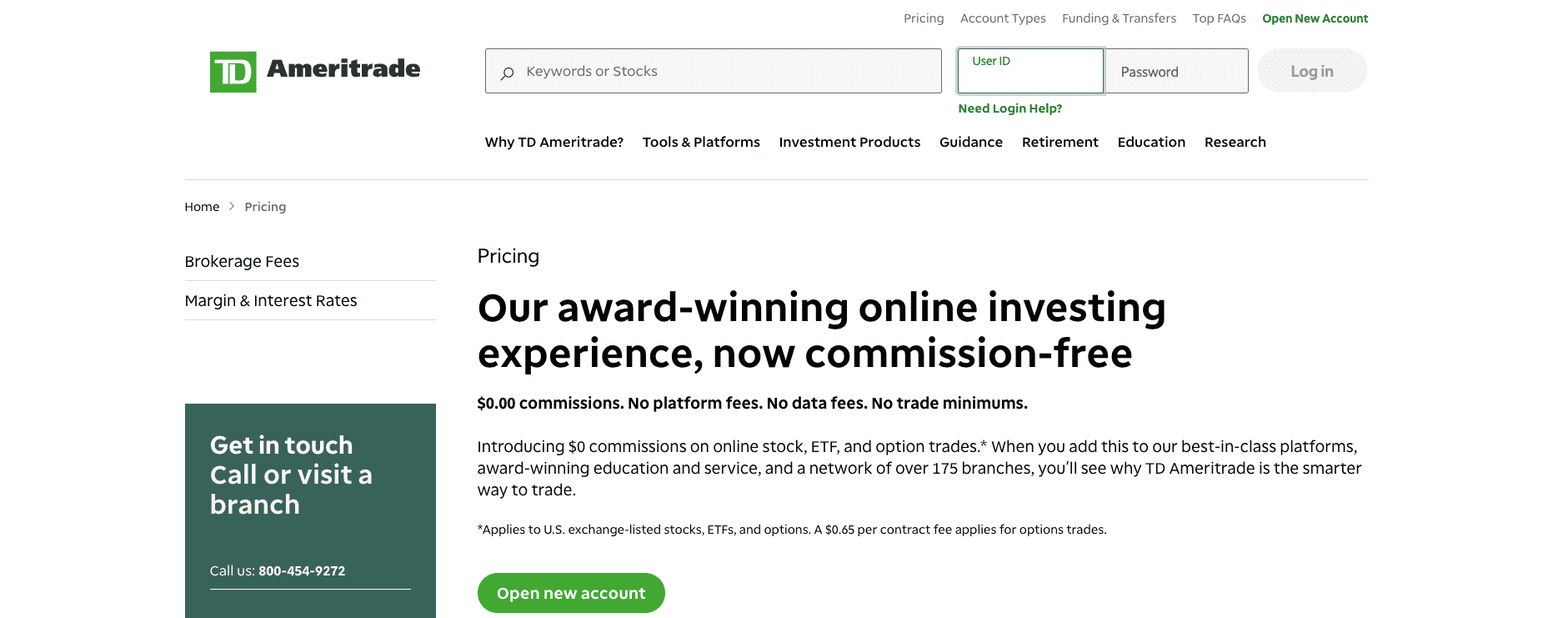

TD Ameritrade Trading and Non-Trading Fees

Spreads

👉 TD Ameritrade does not apply any spread charges on trades.

Commissions

👉 TD Ameritrade does not charge commissions for trading exchange-listed U.S. stocks, domestic and Canadian ETFs, and options. However, the following commissions are evaluated:

➡️ Equities – There is a $6.95 charge for online trading of OTC stocks that are not listed on a US exchange. In addition, there is a $5 cost for the phone system and a $25 fee for broker-assisted transactions.

➡️ Options – A $0.65 commission is added to the $5 + $0.65 cost for phone system trading and the $25 + $0.65 charge for broker-assisted trading.

➡️ Futures – Futures and futures on options trades incur a $2.25 fee.

Overnight Fees, Rollovers, or Swaps

👉 TD Ameritrade does not apply overnight fees, rollovers, or swaps on overnight positions.

Deposit and Withdrawal Fees

👉 TD Ameritrade does not charge deposit or withdrawal fees.

Inactivity Fees

👉 TD Ameritrade charges no platform, maintenance, or inactivity fees.

Currency Conversion Fees

👉 Currency conversion fees might apply when traders deposit or withdraw in currencies other than USD.

TD Ameritrade Deposits and Withdrawals

👉 TD Ameritrade offers the following deposit and withdrawal methods:

➡️ Electronic Bank Deposit (ACH)

➡️ Wire Transfer

➡️ Cheque

➡️ Broker Transfer

➡️ Stock Certificates

Broker Comparison: Deposit and Withdrawals

| 🥇 TD Ameritrade | 🥈 AvaTrade | 🥉 InstaForex | |

| Minimum Withdrawal Time | 5 minutes | 24 to 48 Hours | Instant |

| Maximum Estimated Withdrawal Time | 7 working days | Up to 10 days | Up to 6 working days |

| Instant Deposits and Instant Withdrawals? | No | No | Yes |

Payment Methods, Processing Times, Deposit Limits

| 💳 Payment Method | 💵 Processing Time | 💳 Deposit Limit |

| Electronic Bank Deposit (ACH) | 5 Minutes | $50 up to $250,000 |

| Wire Transfer | 1 Working Day | None |

| Cheque | 1 to 3 Working Days | None |

| Broker Transfer | Up to 7 Working Days | None |

| Stock Certificates | 1 Working Day | None |

How to Deposit Funds with TD Ameritrade

👉 To deposit funds to an account with TD Ameritrade, traders can follow these steps:

➡️ Link your bank account to your TD Ameritrade account.

➡️ Transfer cash from your bank account to your TD Ameritrade account.

TD Ameritrade Fund Withdrawal Process

👉 To withdraw funds from an account with TD Ameritrade, traders can follow these steps:

➡️ After logging in, go to “Deposits/Transfers” in your TD Ameritrade account.

➡️ You could do this by going to “Withdraw” and “Transfer from your Bank.”

➡️ Ensure to include the withdrawal amount and complete any other required procedures before submitting your withdrawal request.

TD Ameritrade Education and Research

Education

👉 TD Ameritrade offers the following Educational Materials:

➡️ Immersive Curriculum

➡️ Educational Articles

➡️ Webcasts

➡️ In-Person Events

➡️ Talking Green Podcast

Research and Trading Tool Comparison

| 🥇 TD Ameritrade | 🥈 AvaTrade | 🥉 InstaForex | |

| ➡️ Economic Calendar | Yes | Yes | Yes |

| ➡️ VPS | No | No | No |

| ➡️ AutoChartist | No | No | No |

| ➡️ Trading View | No | No | No |

| ➡️ Trading Central | No | Yes | No |

| ➡️ Market Analysis | Yes | Yes | Yes |

| ➡️ News Feed | Yes | Yes | Yes |

| ➡️ Blog | Yes | Yes | Yes |

👉 TD Ameritrade also offers traders the following additional Research and Trading Tools:

➡️ News Feeds

➡️ News Reports

➡️ Sectors and Industries

➡️ Economic Calendar

➡️ Analyst Reports

➡️ Investor Movement Index (IMX)

➡️ Market Screeners

➡️ Trading Ideas

➡️ Investment Ideas

➡️ Options Research

TD Ameritrade Bonuses and Promotions

👉 TD Ameritrade currently does not offer any bonuses or promotions to traders.

How to open an Affiliate Account with TD Ameritrade

👉 TD Ameritrade currently does not offer an Affiliate Program.

TD Ameritrade Affiliate Program Features

👉 TD Ameritrade currently does not offer an Affiliate Program.

TD Ameritrade Customer Support

👉 If traders have any questions or concerns, they could call TD Ameritrade’s toll-free number anytime. In addition, customers can reach out to TD Ameritrade by phone, email, our website, and the trading platform itself.

👉 TD Ameritrade also maintains an active presence on Twitter and Meta to answer any questions they might have about their accounts or trades.

👉 Thinkorswim mobile, TD Ameritrade’s in-app chat service, allows customers to have real-time conversations with support agents. For an additional cost, TD Ameritrade customers can speak with a real human broker instead of a bot.

👉 It is safe to assume that many of the TD representatives on the trading desk and fielding customer inquiries have either been professional floor traders and market makers in the past or have been taught by those who have.

👉 TD Ameritrade provides access to financial consultants who talk with clients. Chatbox feature is enabled utilizing Apple Business Chat, Meta Messenger, Twitter Direct Messages, and, in Asia, WeChat

| Customer Support | TD Ameritrade’s Customer Support |

| ⏰ Operating Hours | 24/5 |

| 🗣 Support Languages | English |

| 🗯 Live Chat | Yes |

| 📧 Email Address | Yes |

| ☎️ Telephonic Support | Yes |

| 📞 Local Support in Botswana? | No |

| 🥇 Overall quality of TD Ameritrade Support | 4/5 |

TD Ameritrade Corporate Social Responsibility

👉 The primary goal of TD Ameritrade is to help people live better lives via investing. To achieve this objective, the broker must engage with the people who live and work in the area around the company’s headquarters.

👉 According to TD Ameritrade, good corporate citizenship is making a positive difference in the lives of employees, customers, shareholders, and the local community by applying knowledge and resources.

👉 TD Ameritrade is proud to serve as a responsible corporate citizen, actively working to better local communities and respond to the needs of those in need.

👉 TD Ameritrade facilitates employee engagement in philanthropic endeavours by providing opportunities to volunteer with the American Red Cross, Habitat for Humanity, the Special Olympics, and the United Way.

👉 TD Ameritrade is more than willing to provide a helping hand; the firm is also willing to donate its employees’ time. Volunteer time at TD Ameritrade is eight hours per calendar year, with pay.

👉 In addition, TD Ameritrade has set up a matching scheme wherein it would double the amount of any employee’s donation to the United Way or the American Red Cross via the company’s corporate giving initiatives.

Our Verdict on TD Ameritrade

👉 Overall, TD Ameritrade has shown itself to be a platform that is receptive to consumer feedback and committed to fixing issues as they are brought to light. More than five decades have passed since the launch of this enduring platform.

👉 The fees and pricing structure of TD Ameritrade are easy to understand. Fees, prices, and other fees may be found in their own section of the site. For example, establishing margin rates might be subject to more frequent revisions than transfer-out fees.

👉 This broker has several benefits, including inexpensive costs and physical locations. In addition, newer traders will appreciate the high-quality research and data tools, which will allow them to grow not just their portfolios but also their expertise.

👉 Although some of TD Ameritrade’s trading products are pricier, and the desktop trader has some bugs, the benefits of using the service far outweigh the drawbacks.

TD Ameritrade Pros and Cons

| ✔️ Pros | ❌ Cons |

| There are many different investment options available | A limited number of countries accepted |

| Strong systems that have a wide range of useful features and capabilities | CFDs are not offered |

| TD Ameritrade offers Internet-based and mobile platforms for trading and investing | There are only a few funding and withdrawal options offered |

| Zero-dollar minimum trade commissions and cheap trading costs | USD is the only accepted base currency |

| Wide variety of innovative resources for in-depth market research | The account-opening process is tedious and time-consuming |

| Tools for analysing and comparing various funds | |

| The availability of a wealth of learning materials |

FAQ

Does TD Ameritrade have Volatility 75?

TD Ameritrade does not offer VIX 75 CFD instruments.

Does TD Ameritrade have Nasdaq?

TD Ameritrade offers stocks that are listed on the Nasdaq.

Is TD Ameritrade safe or a scam?

TD Ameritrade is a safe broker with a high trust score of 98%, regulated by top American market regulators.

Is TD Ameritrade regulated?

TD Ameritrade is well-regulated by FINRA, CFTC, SEC, and the SFC.

How long does it take to withdraw funds from TD Ameritrade?

It can take 1 to 7 business days to withdraw and receive your funds from TD Ameritrade.

Is TD Ameritrade suitable for beginners?

TD Ameritrade is ideal for all types of traders and offers a range of educational materials and research options.

Does TD Ameritrade apply non-trading fees?

Trading stocks, options, and ETFs with TD Ameritrade is completely commission-free. There is no charge for making a partial withdrawal, and no yearly or inactivity penalties are incurred. However, there is a $75 fee if you wish to withdraw your whole sum at once.

Conclusion

👉 Now it is your turn to participate:

➡️ Do you have any prior experience with TD Ameritrade?

➡️ What was the determining factor in your decision to engage with TD Ameritrade?

➡️ Was it because of the minimum deposit, regulation, retail trading accounts, or other factors?

➡️ Have you experienced any issues with TD Ameritrade, such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

👉 Regardless, please share your thoughts in the comments below.

Addendum/Disclosure:

👉 No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review