8 Best NASDAQ 100 Brokers in Botswana

The 8 Best Nasdaq 100 index Forex Brokers in Botswana revealed. We tested and verified the best Nas100 Brokers for Botswana Traders.

This is a complete list of Nasdaq 100 forex brokers in Botswana.

In this in-depth guide you’ll learn:

- What is Nasdaq 100?

- Why you should invest with a broker on the Nasdaq 100?

- Our recommended Nas100 brokers for Botswana Beginner Traders.

- How to compare INDEXNASDAQ: NDX forex trading brokers against each other.

- How and can I trade on the Nas100?

- Which brokers offer a sign-up bonus on the NDX100 index in Botswana?

- Which Nas100 brokers offer low minimum deposits in Botswana?

And lots more…

So if you’re ready to go “all in” with the best-tested Nasdaq 100 forex brokers for Botswanans…

Let’s dive right in…

- Louis Schoeman

Best NASDAQ 100 Brokers in Botswana

| 🏅 Forex Broker | 👉 Open Account | ✔️ Accepting M-PESA? | 💰 Minimum Deposit? | 💸 Botswana Shilling (BWP) Deposits Allowed? |

| 1. Exness | 👉 Open Account | Yes | USD 10 / 188 BWP | No |

| 2. AvaTrade | 👉 Open Account | Yes | USD 100 / 1866 BWP | No |

| 3. HFM | 👉 Open Account | Yes | $0 / 0 BWP | No |

| 4. CMC Markets | 👉 Open Account | Yes | $ 0 / 0 BWP | No |

| 5. IG | 👉 Open Account | Yes | $250 / 4667 BWP | No |

| 6. XM | 👉 Open Account | Yes | $5 / 94 BWP | No |

| 7. easyMarkets | 👉 Open Account | Yes | $25 / 467 BWP | No |

| 8. OANDA | 👉 Open Account | Yes | $0 / 0 BWP | No |

10 Best Forex Brokers in Botswana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

What is NASDAQ 100?

Stocks of the 100 biggest and most frequently traded non-financial firms listed on the NASDAQ Stock Market are included in the NASDAQ-100 Index. To gauge the market’s performance overall, investors could use an index to track the movement of stocks’ prices over time.

A wide variety of sectors, including IT, retail, industrial, telecommunications, healthcare, transportation, and media, are represented in the NASDAQ-100 Index.

Companies like Microsoft, Apple, and Amazon.com are all represented here because they are leaders in their respective technology fields. Because of this, the NASDAQ-100 Index has earned a reputation as a measure of technology stocks.

Traders could speculate on daily price variations since NASDAQ trading volumes are greater and more volatile than other major indexes. However, remember that there is a correlation between volatility and the potential for financial loss.

All investing and trading include risk, but because of US regulation, monitoring, and federal exchange laws, NASDAQ traders have a secure haven to operate.

8 Best NASDAQ 100 Brokers in Botswana

- ✔️ Exness – Overall, Best NASDQ100 Broker in Botswana

- ✔️ AvaTrade – Top Broker for Beginner Traders

- ✔️ HFM – Best Mobile Trading App

- CMC Markets – Top MetaTrader 4/MT4 Broker in Botswana

- IG – Best CFD Broker

- XM – Top MetaTrader 5/MT5 Broker in Botswana

- easyMarkets – Highest Rated Brokers on TrustPilot

- OANDA – Best ECN Broker in Botswana

1. Exness

As of April 2024, the trade volume on Exness was in the billions, and the company boasted hundreds of thousands of active customers. The broker provides access to a diverse selection of assets for its traders.

Every sort of trader may find an account at the award-winning broker. For example, you can trade with an ECN account from Exness with a spread from 0 pips.

Min Deposit

$10 / 134 BWP

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

As well as the highly regarded Tier-1 FCA in the United Kingdom, Exness is regulated by two Tier-2 and four Tier-3 agencies worldwide. In addition, Exness offers free virtual private server hosting, ideal for those that want speedy and trustworthy trade execution.

This ensures that you will not experience any disruptions in your trade due to technical difficulties. In addition, traders in Botswana may use Exness to trade the NASDAQ 100, despite the broker’s restricted offering of tradable products and financial markets.

Overview

| Feature | Information |

| ⚖️ Regulation | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Standard Account, Standard Cent Account, Raw Spread Account, Zero Account, Pro Account |

| 📊 Trading Platform | MetaTrader 4, MetaTrader 5, Exness Terminal, Exness Trader app |

| 💰 Minimum Deposit | $10 / 134 BWP |

| 💰 Trading Assets | Forex minor pairs, forex major pairs, forex exotic currency pairs, Metals, Crypto, Energies, Indices, Stocks |

| 🔎 Botswanan Pula-based Account? | No |

| 💳 BWP Deposits Allowed? | Yes |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 0.0 pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | No |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Exness is a reputable international broker authorized by several reputable market regulators | There is a limited selection of tradable instruments in only a few financial markets |

| The broker offers some of the tightest spreads across all types of accounts | There is a limited selection of funding options offered |

| There are several account types to choose from, each accommodating different types of traders | |

| There are various market metrics available including exchange rates, overall trading activities available, current market conditions, and more. | |

| Exness is ideal for any Botswanan beginner traders and institutional investors | |

| There are solutions offered for any type of professional trader who needs advanced options | |

| There is a powerful proprietary mobile app offered | |

| Client fund safety and investor protection is guaranteed | |

| Multilingual 24/7 customer support is offered | |

| Instant withdrawal methods are available |

2. AvaTrade

Regarding internet brokerage organizations, AvaTrade is one of the oldest, having been around since 2006. It is now among the most prominent Forex and CFD Share Brokers worldwide.

There are four of its locations across the world. These are in Australia, Japan, Ireland, and the British Virgin Islands. AvaTrade is a financial services provider based in Dublin, Ireland.

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

AvaTrade offers a wide variety of financial products and trading platforms, both manual and automated. By default, the AvaTradeGo app syncs a comprehensive collection of watchlists and includes a volatility protection feature called AvaProtect.

Through AvaProtect, a trader may partly hedge an open position with a CFD Share option for an extra charge, reducing the overall transaction risk. Whether you are a first-time trader or a seasoned pro, AvaTrade is a fantastic platform.

The broker provides a wealth of resources for new traders to learn the ropes. However, even seasoned traders will find something of value in AvaTrade, thanks to the platform’s comprehensiveness and innovative features.

Overview

| Feature | Information |

| ⚖️ Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, FRSA, CySEC, ISA |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Retail Investor Account, Professional Account Option |

| 📊 Trading Platform | AvaTradeGO, AvaOptions, AvaSocial, MetaTrader 4, MetaTrader 5, DupliTrade, ZuluTrade |

| 💰 Minimum Deposit (BWP) | $100 / 1343 BWP |

| 💰 Trading Assets | Foreign currencies, Cryptocurrencies, Commodities, Treasuries, Bonds, Indices, Stocks, ETFs, Options, CFDs, Precious Metals |

| 🔎 Botswanan Pula-based Account? | No |

| 💳 BWP Deposits Allowed? | No |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 0.9 pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| AvaTrade is multi-regulated and one of the most trusted online trading brokers in the world | Variable spreads are not offered |

| There is a wide range of financial instruments that can be traded across financial markets | There is a limited choice between account types |

| There are several technical indicators, economic indicators, and other solutions for advanced traders | Inactivity fees are applied |

| There are several trading platforms to choose from | Currency conversion fees may be applied |

| There is a decent selection of educational material that helps beginner traders navigate complex instruments and lower the degree of risk they are often exposed to | There is a limited number of base currency options offered on accounts |

| There is a multitude of social trading opportunities offered | |

| The broker accepts any trading strategy including automated trading, expert advisors, scalping, hedging, and others. |

3. HFM

HF Markets (HFM) was established in 2010 under the HotForex brand. Recently, HFM has started offering investment in commission-free individual stocks and ETFs in addition to its extensive portfolio of over 1,000 CFDs.

HFM is a market-executing ECN/STP broker offering a top-notch, low-cost trading platform. One of the greatest in the business, the comprehensive education department is only one of many outstanding features.

Min Deposit

USD 0

Regulators

CySEC, FCA, DFSA, FSCA, FSA, CMA

Trading Desk

MT4, MT5, HFM APP

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

0

Account Activation Time

24 Hours

This 45-time award-winning broker, with a physical presence on every continent and strong regulation in place, has a complicated corporate structure, which means the offering might vary based on region. A CFD Share Broker is HFM.

Over a hundred assets are available to trade, including currency pairings, commodities, indices, stocks, and bonds as CFDs. In addition, spreads can be as low as 0 pips (depending on the account type), and Botswanans can expect competitively low commission fees.

For example, a VIP or Zero account trader can take advantage of a discounted fee rate of $6 for every round-turn lot traded.

Overview

| Features | Information |

| ⚖️ Regulation | FSCA, CySEC, DFSA, FSA, FCA, CMA, and FSC, with registration in ACPR, BaFin, MNB, CONSOB, CNMV, FI, FMA, FSC, and other regions |

| 💸 Minimum Withdrawal Time | – |

| 📈 Maximum Withdrawal Time | 2 to 4 working days |

| 💰 Instant Deposits/Withdrawals? | Yes, deposits |

| 💳 BWP-Denominated Account? | No |

| 📱 Minimum Deposit Amount | $0 / 0 BWP |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| HFM is well-regulated and features registrations from several countries worldwide, which adds to its reputation and trustworthiness | HFM’s spreads are wide on entry-level accounts |

| HFM’s overall reputation and reach are unparalleled | HFM does not support a large array of deposit and withdrawal options |

| The HFM brand has won over 60 accolades in its field throughout the years | Botswanans pay currency conversion fee as there is no BWP-denominated trading account |

| HFM’s demo accounts for MT4 and MT5 are unrestricted | |

| Botswanan Muslim traders who prefer Islamic accounts can make the switch at any time | |

| Botswanans can choose an account that suits their trading strategy and experience level the best | |

| Traders have access to a plethora of learning materials and innovative trading platforms | |

| The versatility of the trading platforms means that more people in Botswana can make use of them, even if they do not have previous trading experience | |

| Botswanans pay an extremely low minimum deposit of 65 BWP, and the market circumstances are favourable for trading |

4. CMC Markets

Founded in 1989, CMC Markets (CMC) is a reputable United Kingdom-based CFD Share broker that has thrived despite the industry’s constant evolution thanks to its public listing.

Specialized sites for professionals and institutions highlight CMC’s increased focus on expert traders. However, premium benefits, like rebates and a free API interface for “professional” traders, are unavailable to the average investor.

CMC Markets has a strong focus on client service, as seen in their availability of live brokers and chat service 24 hours a day, five days a week. The combination of this and their instructional materials helped them rise in the rankings.

Min Deposit

USD 0 / 0 BWP

Regulators

ASIC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

300

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

CMC also generates revenue via the spread when customers “cross” the bid/ask spread while placing transactions. Next Generation is the only platform where you must pay a premium for guaranteed stop losses (GSLO).

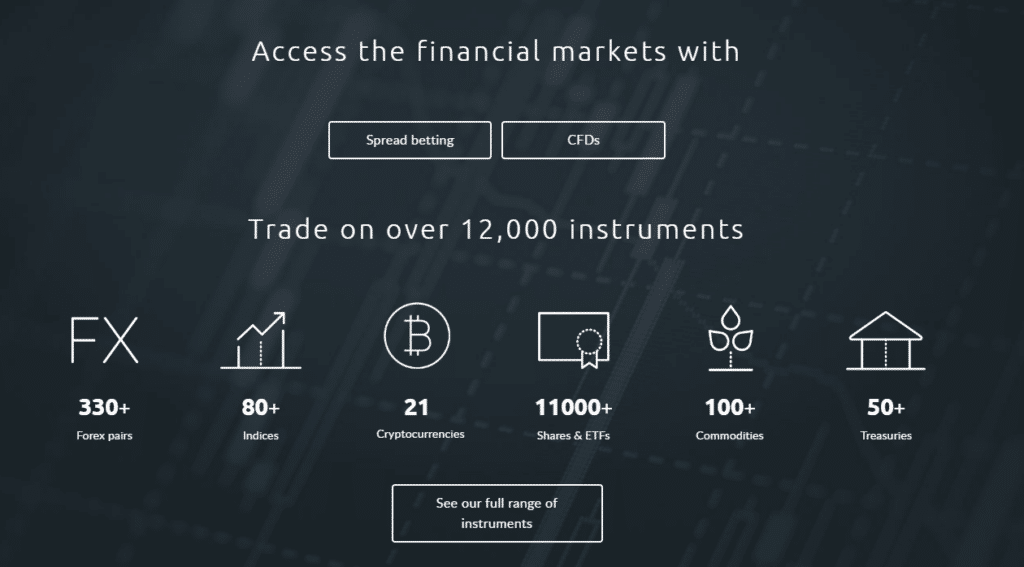

Regarding online CFD Share brokers, CMC Markets has one of the widest product selections accessible to its customers.

CMC Markets’ website boasts that customers may trade up to 10,000 products, which presents a wealth of new possibilities, particularly for those managing portfolios over the long term.

Overview

| Features | Information |

| ⚖️ Regulation | BaFin, FCA, IIROC, ASIC, MAS, FMA |

| 💸 Minimum Withdrawal Time | 0 BWP / 0 USD |

| 📈 Trading Assets | • Forex • Indices • Cryptocurrencies • Shares • Share Baskets • Treasuries |

| 💰 FTSE 250 Average Spread | 2 pips |

| 💳 Demo Account | Yes |

| ☪️ Islamic Account | No |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| There are revolutionary trading tools available for in-depth market analysis. | CMC Markets does not offer MetaTrader 5. |

| All customer accounts are safeguarded. | There is no option for Muslim traders to convert their accounts into Islamic accounts. |

| CMC Markets provides a demo account as well as several tools. | There is no BWP-denominated account. |

| CMC Markets provides exceptional customer service across the world. | Traders are subject to currency conversion, inactivity, and withdrawal fees. |

| There is no need for a minimum deposit. | |

| Beginner traders will benefit from educational materials such as manuals and videos. | |

| CMC Markets offers a wide range of financial instruments across powerful software. | |

| There is a major emphasis on customer education and assistance through various channels 24 hours a day, 5 days a week. |

5. IG

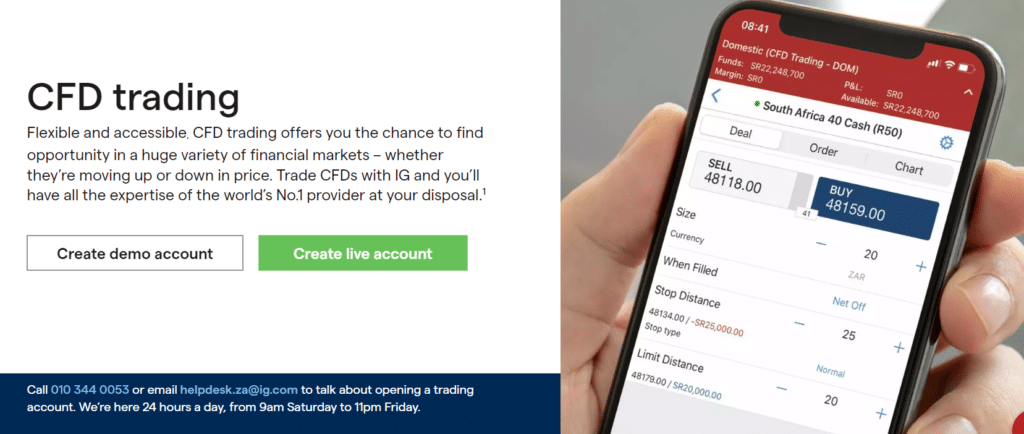

IG was established in 1974 and is regulated by the Financial Services and Conduct Authority (FSCA) as of 2021. They are known for their inexpensive trading costs, extensive instrument selection, and high rate of happy customers.

In addition, IG operates a legitimate stock brokerage. New traders may use IG’s extensive library of instructional and market analysis resources and its wide variety of trading instruments. IG’s selection of tradable instruments is enormous.

There are three ways to trade shares on IG, and they have one of the widest choices available. It also provides unique CFDs like Sectors, the Crypto Index, and more.

Min Deposit

USD 0 / 0 BWP

Regulators

IGRs

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Currency pairs that include the British pound, the Japanese yen, and the Euro are all available for weekend trading with IG. As a result, weekends often have wider and more stable spreads (6 pips on the EUR/USD).

Among the many indices available for trading with IG are the South African 40, NASDAQ, FTSE100, DAX30, and Hang Seng, making it the broker of choice compared to other comparable options.

IG also provides unique indexes like the Cannabis Index and the Emerging Markets Index. Most major indexes are open for trading on weekends as well.

Overview

| Feature | Information |

| ⚖️ Regulation | FCA, BaFin, CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, CFTC, FINRA, NFA, BMA |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | IG Trading Account, IG Professional Account, IG Options Trading Account, IG Turbo24 Account, Limited Risk Account, Share Dealing Account, Exchange Account (NADEX) |

| 📊 Trading Platform | MetaTrader 4, IG Platform, ProRealTime (PRT), L2 Dealer, FIX API |

| 💰 Minimum Deposit | USD 250 / 3 363 BWP |

| 💰 Trading Assets | Forex, Shares, Indices, Commodities, Cryptocurrencies, Interest Rates, Bonds, ETFs, Futures, Options |

| 🔎 Botswanan Pula-based Account? | No |

| 💳 BWP Deposits Allowed? | Yes |

| 💰 Bonuses for Botswanan traders? | No |

| 📈 Minimum spread | 0.1 pips (DMA) on EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | No |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Offers a significant range of financial instruments, including Botswanan-specific trading instruments | High minimum deposit charged |

| There are several powerful trading platforms offered | Inactivity fees apply |

| There are competitive trading conditions that include low spreads, low commissions, and reliable trade execution | |

| Traders can get free trading signals | |

| There is a comprehensive IG Academy offered with dedicated educational resources | |

| Convenient funding options provided along with free deposits and withdrawals | |

| FIX API Direct Market Access trading is offered | |

| There are Swap-Free Accounts offered for Islamic traders |

6. XM

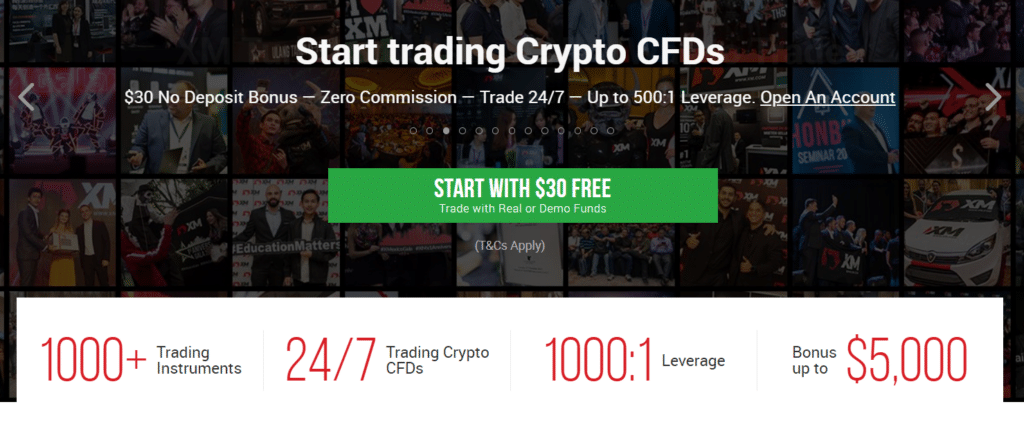

More than a thousand financial products are available on the MT4 and MT5 platforms the XM Group provides.

Foreign Exchange (Forex), Contracts for Difference (CFDs) on Crypto, Stocks, Commodities, Equity Indices, Precious Metals and Energies, and more are all accessible, as are some of the most dependable and quickest order execution times available to regular traders.

Serving over 5 million customers in over 25 languages throughout 190 countries, the Group is especially proud that 99.9% of its deals are done in less than 1 second.

Min Deposit

USD 5 / 67 BWP

Regulators

IFSC, CySec, ASIC

Trading Desk

Desktop MT4 and MT5, Mobile MT4 and MT5, XM mobile app, Web platform

Total Pairs

57

Islamic Account

Yes

Trading Fees

No (Just spread)

Account Activation Time

24 Hours

Margin trading allows traders with a higher risk appetite and more trading ability to take on larger positions with a smaller initial investment.

Consequently, both gains and losses from a transaction are amplified, albeit XM’s negative balance protection and margin calls are available to cushion the blow. In addition, XM’s pedagogical offerings are unparalleled.

Because of its dedication to user training, it offers free weekly webinars on hot subjects. In addition, its Live Education service allows customers of all experience levels to ask questions of native-speaking teachers to talk about trading methods, market trends, and industry news.

Overview

| Feature | Information |

| ⚖️ Regulation | FSCA, IFSC |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | $5 / 67 BWP |

| Average spread from | 0.0 pips EUR/USD |

| 📈 Maximum Leverage | 1:1000 |

| 👥 Customer Support | 24/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Negative balance protection is applied to retail investor accounts | US clients are restricted from accessing XM’s trading services |

| There are several secure payment methods to choose from | There are no fixed spread accounts offered |

| The broker is known for low spreads, low commissions, and reliable trade execution speeds | There is an inactivity fee applied to dormant accounts |

| Traders can use hedging, scalping, and expert advisor trading strategies | |

| The broker offers personal customer service to its clients |

7. easyMarkets

According to research in South Africa, easyMarkets was founded as a Forex broker in 2001 as Easy-Forex. In 2016, the brokerage introduced CFD trading and re-branded it to easyMarkets.easyMarkets appears to be a solid brokerage and a dominant player in the industry.

Min Deposit

25 USD /336 BWP

Regulators

CySEC, ASIC, BVI, FSA

Trading Desk

MetaTrader 4, TradingView

Crypto

Yes

Total Pairs

275+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Its overall asset selection for pure Forex traders is exceptional, and commodities and metals are presented thoroughly, but equity and index CFDs are fairly limited, with only three cryptocurrencies available.

Overview

| Features | Information |

| ⚖️ Regulation | ASIC / CySEC |

| 📈 Maximum Leverage | 1:200 |

| 💳 Deposit Options | Bank Wire, VISA, MasterCard, American Express, AstroPay, BPAY, FasaPay, Giropay, iDEAL, JCB, Local Bank Transfers, Maestro, Neteller, Skrill, SOFORT, UnionPay, WebMoney, WeChatPay. |

| 💳 Withdrawal Options | Bank Wire, VISA, MasterCard, American Express, AstroPay, BPAY, FasaPay, Giropay, iDEAL, JCB, Local Bank Transfers, Maestro, Neteller, Skrill, SOFORT, UnionPay, WebMoney, WeChatPay. |

| 💳 BWP-Denominated Account? | No |

| 📱 Minimum Deposit Amount | 467 BWP equivalent to $25 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| easyMarkets is well-regulated and has an extremely high trust score | There are no variable spread accounts available to Botswanan traders |

| Botswanan traders can choose between MetaTrader and easyMarkets’ proprietary trading software | Botswanan traders cannot set Botswanan Pula as their base account currency |

| Botswanan traders have access to TradingView when they register a trading account | There is an inactivity fee applied to all dormant accounts |

| The broker is known for unique trading solutions such as Freeze-Rate, Inside Viewer, easyTrade, and several other innovative technologies | |

| Botswanan traders are given unlimited access to a demo account which is funded with virtual capital | |

| There are competitive fixed spreads offered | |

| There is a choice between different easyMarkets retail account types and trading options | |

| Commission-free trading is guaranteed on all trading accounts |

8. OANDA

OANDA has been around since 1996 and provides access to various financial markets, including foreign exchange, indexes, metals, commodities, and bonds.

OANDA gives its traders access to a wide range of financial products but excels at providing a top-notch desktop trading experience for seasoned professionals. However, traders should be aware that product availability varies by area.

Min Deposit

USD 0

Regulators

ASIC, BVI, CFTC, FCA, FFAJ, FSC, IIROC, MAS, NFA

Trading Desk

Metatrader 4 and Metatrader 5

Crypto

Yes

Total Pairs

45

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Spreads are nevertheless vulnerable to market volatility and liquidity, despite OANDA’s claims that they utilize an automated engine to try to monitor worldwide prices closely.

OANDA is committed to being as open as possible. Thus, OANDA’s website provides historical spread data across all asset classes.

Customers who want to create a “regular” account with OANDA are not required to make a minimum deposit. However, this amount will be subject to the margin requirements of the smallest transaction size the user desires to place.

Overview

| Account Feature | Value |

| ✔️ Full Account Verification Needed? | No, not for account deposits under 100,000 BWP or an equivalent to $9,000 |

| 📊 Average Spreads | Variable, from 1 pip |

| 💸 Commissions (Per 1 mil traded) | None |

| 📈 Maximum Leverage | 1:200 |

| 📉 Minimum lot size | 0.01 lots |

| 🔨 Instruments | 81 |

| 🛑 Stop-Out (%) | 50% |

| 📱 One-Click Trading offered? | Yes |

| ✅ Strategies allowed | All |

| 💰 Base Account Currency | USD, EUR, HKD, SGD |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| There is an enormous range of currency pairs that can be traded along with several other asset classes | There are several ancillary fees charged |

| OANDA is multi-regulated, multi-asset, and multi-award-winning, giving it a high trust score and a good reputation | There is no dedicated BWP-denominated account for Botswanans |

| There is a comprehensive yet user-friendly proprietary trading platform offered alongside MT4 and MT5 | There is an inactivity fee charged |

| OANDA has an incredibly competitive pricing environment and is suited to both beginner and expert traders alike | There are withdrawal fees applied |

| OANDA is one of a few brokers that accept US clients in addition to global traders through various entities based around the world | |

| There are superior research offerings and robust trading tools offered | |

| There is no set minimum deposit requirement, giving Botswanans flexibility with how much they wish to invest | |

| There is complete transparency in the trading and non-trading fees charged, with no hidden charges |

How to Choose the Right Forex Broker in Botswana

Botswanan traders must evaluate the following components of a forex broker to decide whether the broker is suited to their unique trading objectives or needs.

Regulations and Licenses

This is the first vital component that Botswanan traders must thoroughly evaluate. Reputable brokers are regulated by market regulators such as FCA, ASIC, CySEC, FSCA, and others.

Botswanans must beware when dealing with brokers with only offshore regulations such as FSA, SVG BVI, FSC, and others.

Account Features

Account Features include leverage trading and margin requirement, commissions and spreads, initial deposit, additional features on retail investor accounts, and so on.

Deposits and Withdrawals

Botswanans must evaluate the payment options available, the processing times on withdrawal requests, deposit currencies offered, the withdrawal fee, deposit fees, and minimum withdrawal limits, among other trading and non-trading fees.

Range of Markets

The range of markets offered refers to the number and range of tradable instruments the broker offers. Therefore, Botswanans must consider what they wish to trade and what is available.

Customer Support

Customer Support is another crucial factor. Botswanans must check the availability of support (trading hours), the quality of support, and the promptness with which the customer support team responds to queries.

Trading Platform

A trading platform is the Botswanan trader’s portal to the financial markets. Therefore, traders must ensure that the trading platform has the necessary technical indicators, fundamental analysis, technical analysis, economic calendar, charting, newsfeed, and other tools they may need.

Education and Research

Education and Research come in handy to both novice traders and experienced investors. Education includes some of the following:

➡️ eBooks

➡️ Trading guides

➡️ Trading knowledge on leveraged products

➡️ A risk warning on complex instruments

➡️ Educational videos

Research can include some of the following:

➡️ Trading tools

➡️ Commentary

➡️ Status of International Markets

➡️ Price movements

➡️ Market sentiments

➡️ Whether there is a volatile market

➡️ Exchange Rates

➡️ Expert opinions and other resources can help experienced traders make informed trading decisions.

How to compare INDEXNASDAQ: NDX forex trading brokers against each other.

Comparing INDEXNASDAQ: NDX forex trading brokers involves a comprehensive assessment of key factors to ensure a well-informed choice. First, verify the broker’s regulatory status and reputation to ensure trustworthiness. Next, evaluate their trading platform for user-friendliness and essential features like real-time charts and order types.

Confirm the availability of Nasdaq 100 index trading alongside other instruments for diversification. Leverage and margin options should match your risk appetite. Consider the cost of trading, including spreads, commissions, and potential fees, as these impact profitability. Reliable execution speed and risk management tools are crucial for effective trading strategies.

Adequate customer support and educational resources contribute to a seamless trading experience. Furthermore, assess deposit and withdrawal methods, mobile trading options, and the availability of demo accounts for practice. Comparing these factors empowers traders to choose the most suitable INDEXNASDAQ: NDX forex broker tailored to their trading objectives and preferences.

10 Best Forex Brokers in Botswana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

How and can I trade on the Nas100?

Trading on the Nasdaq 100 (Nas100) index involves several steps and options. To trade on the Nas100, you’ll typically need to follow these steps:

Choose a Broker:

Select a reputable online broker that offers access to trading the Nasdaq 100 index. Ensure the broker provides a trading platform that suits your needs and preferences.

Account Setup:

Open a trading account with the chosen broker. This usually involves providing personal information and verifying your identity. You may also need to deposit funds into your trading account.

Research and Analysis:

Before trading, perform thorough research and analysis on the Nasdaq 100 index. Understand its components, historical price movements, and factors influencing its performance.

Select a Trading Strategy:

Decide on a trading strategy that aligns with your goals and risk tolerance. Strategies can range from day trading to long-term investing.

Trade Execution:

Use your broker’s trading platform to place trades on the Nas100 index. You can choose to buy (go long) if you believe the index will rise or sell (go short) if you expect it to fall.

Risk Management:

Implement risk management techniques, such as setting stop-loss and take-profit orders, to protect your capital from significant losses.

Monitor and Manage Trades:

Keep a close eye on your trades and monitor the market conditions. You can adjust your trades as needed based on new information or changing market dynamics.

Profit and Loss:

Your profit or loss will be determined by the difference between your entry price and exit price, considering the size of your position.

Exit Strategy:

Decide on an exit strategy before you enter a trade. This can involve setting a specific profit target or adhering to a predetermined time frame.

Continuous Learning:

Trading on the Nasdaq 100 requires ongoing learning and adaptation. Stay updated on market news, economic indicators, and trading techniques to improve your skills.

The Best Forex Brokers in Botswana

In this article, we have listed the best brokers that offer forex trading to traders in Botswana. In addition, we have further identified the brokers that offer additional services and solutions to Botswanan traders.

Best MetaTrader 4 / MT4 Forex Broker in Botswana

Min Deposit

USD 25

Regulators

FCA UK

Trading Platform

MT5, MT4, OctaTrader

Crypto

Yes

Total Pairs

28

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, OctaFX is the best MT4 forex broker in Botswana. OctaFX is an MT4 and MT5 broker that provides Botswanans with various markets. OctaFX offers a choice of accounts via MT4, including ECN and STP accounts, with superior trade execution.

Best MetaTrader 5 / MT5 Forex Broker in Botswana

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, AvaTrade is the best MetaTrader 5 forex broker in Botswana. In addition, AvaTrade is regarded as one of the most secure MT5 forex brokers.

No commission is charged for trading currency pairings, only leaving the spread to be paid. A demo account is also available for traders to sharpen their abilities via MT5 and several other platforms.

Best Forex Broker for beginners in Botswana

Min Deposit

$100

Regulators

CFT, NFA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FOREX.com is the best forex broker for beginners in Botswana. FOREX.com is a broker renowned for low trading fees and beginner-friendly solutions. In addition, FOREX.com offers several educational materials and a helpful demo account.

Best Low Minimum Deposit Forex Broker in Botswana

Min Deposit

$10 / 134 BWP

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Exness is the best Low Minimum Deposit Forex Broker in Botswana. Exness has a minimum deposit requirement of 10 USD / 130 BWP, making it easy for Botswanans to start trading 278 instruments.

Exness also offers MT4 and MT5 through which trades can be made. In addition, it offers some of the best trading tools, charting capabilities, technical indicators, expert advisors, and more.

Best ECN Forex Broker in Botswana

Min Deposit

USD 0

Regulators

CySEC, FCA, DFSA, FSCA, FSA, CMA

Trading Desk

MT4, MT5, HFM APP

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

0

Account Activation Time

24 Hours

Overall, HFM is the best ECN forex broker in Botswana. HFM is a hybrid forex and CFD broker that uses STP and ECN technology to ensure that Botswanans get the best pricing, minimal slippage, no requotes, and the fastest trade execution.

HFM uses the best liquidity providers who aggregate the pricing that Botswanans can see on MT4, MT5, and the HF App for Android and iOS.

Best Islamic / Swap-Free Forex Broker in Botswana

Min Deposit

USD 10 / 136 BWP

Regulators

CySec, FCA

Trading Desk

None

Crypto

Yes

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, eToro is the best Islamic / Swap-Free forex broker in Botswana. eToro is a renowned social trading platform that offers Muslim traders an Islamic Account.

eToro does not charge any interest on positions held for over 24 hours. However, registering an Islamic Account can be expensive initially, requiring a 1,000 USD / 13,400 BWP deposit.

Best Forex Trading App in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

ASIC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

300

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, CMC Markets is the best forex trading app in Botswana. In addition, CMC Markets offers a user-friendly mobile app with research tools, powerful charts, customizable watch lists, news reports, and a range of educational materials.

Best Lowest Spread Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

FCA, CySEC, IFSC, KNF

Trading Desk

No Trading Desk

Crypto

Yes

Total Pairs

48

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, XTB is the best lowest-spread forex broker in Botswana. XTB is a well-known forex and CFD broker with low and competitive forex spreads from 0.1 pips depending on the financial instrument and the market conditions.

XTB is also a good broker in terms of educational materials and research capabilities, providing traders with comprehensive market analysis across markets.

Best Nasdaq 100 Forex Broker in Botswana

Min Deposit

USD 10

Regulators

CySec, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

60

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXTM is the best Nasdaq 100 forex broker in Botswana. FXTM is a multi-regulated forex and CFD broker that accommodates Botswanan traders with a keen interest in Nasdaq. Traders can expect low and competitive spreads, a choice between accounts, and powerful trading platforms.

Best Volatility 75 / VIX 75 Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

IGRs

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, IG is Botswana’s best Volatility 75 / VIX 75 forex broker. IG is one of the best CFD brokers with powerful proprietary trading technology.

IG is well-regulated and offers Botswanans access to VIX75, with spreads from 0.04 pips / 0.13% and zero commission charges.

Best NDD Forex Broker in Botswana

Min Deposit

USD 50 / 672 BWP

Regulators

FCA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

–

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXCM is the best NDD forex broker in Botswana. FXCM is a No-Dealing Desk broker with STP and ECN execution across several markets.

In addition, FXCM offers a choice between third-party platforms in addition to technical indicators, charting tools, and competitive trading conditions.

Best STP Forex Broker in Botswana

Min Deposit

USD 10

Regulators

IFSC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

36

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, RoboForex is the best STP forex broker in Botswana. RoboForex is popular forex and CFD broker with competitive trading conditions. RoboForex offers STP execution with liquidity sourced from top providers.

Botswanans can expect access to over 12,000 instruments via powerful and innovative third-party platforms.

Best Sign-up Bonus Broker in Botswana

Min Deposit

50 USD / 682 BWP

Regulators

CYSEC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Windsor Brokers is the best sign-up bonus broker in Botswana. Windsor Brokers is a well-regulated broker that offers Botswanans a welcome account funded with 30 USD in trading credit. With this account, Botswanans can explore the platform or risk-free test their strategies.

Conclusion

The NASDAQ 100 is an underlying asset for many financial instruments. It is thus traded on financial exchanges via intermediaries such as share CFD brokers. In addition, derivatives such as futures, options, and contracts for difference are included as exchange-traded funds (ETFs).

However, Botswanans should remember that CFDs are highly leveraged products with a significant potential for investment loss. Therefore, the only traders who should be trading these products are seasoned professionals willing to take on a high level of risk.

You might also like: Best Forex Brokers in Botswana

You might also like: Best Trading Robots in Botswana

You might also like: Best FSCA-Regulated Brokers in Botswana

You might also like: Best FTSE 250 Brokers in Botswana

You might also like: Best MT5 Brokers in Botswana

Frequently Asked Questions

How can Botswanans start trading NASDAQ 100?

Traders can look for a suitable share CFD broker, test their platform using a demo account, and deposit funds once they know the broker suits their trading needs and objectives. Traders can trade NASDAQ as a CFD on indices or trade NASDAQ shares individually or as CFDs.

How much will it cost Botswanans to start trading NASDAQ 100?

It can cost anywhere from 13 BWP to 1,300 BWP depending on the minimum deposit of your broker and the margin requirements on CFDs.

What is the minimum trade that Botswanans can expect on NASDAQ 100?

NASDAQ can be traded with spreads from 0.0 pips depending on your broker and the prices it aggregates from liquidity providers, or (in the case of market makers), the pricing it provides you.

Is it worth it for Botswanans to invest in NASDAQ 100?

NASDAQ is known for its high growth rates and is a popular index containing top companies. Therefore, investing in NASDAQ 100 could be profitable for Botswanan traders.

What factors influence the prices of the NASDAQ 100?

The NASDAQ 100 and the firms included are subject to various influences. Therefore, this modified market capitalization-weighted index might be affected by profit, trading attitude, economic strength, and other things.

Why you should invest with a broker on the Nasdaq 100?

The companies included in this index are often technology or biotechnology firms. The Nasdaq 100 is a useful tool for investors who wish to trade technology stocks because it provides a good overview of how all tech sector stocks are performing at any given time.

Our recommended Nas100 brokers for Botswana Beginner Traders?

IG is best Nas100 broker for beginners.

Which brokers offer a sign-up bonus on the NDX100 index in Botswana?

Windsor Brokers is the best sign-up bonus broker in Botswana.

Which Nas100 brokers offer low minimum deposits in Botswana?

Exness is the best Low Minimum Deposit Forex Broker in Botswana.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review