OctaFX Review

Overall, OctaFX is very competitive in terms of its trading fees and spreads. OctaFX offers two retail investor accounts as well as a demo and Islamic Account for Botswanan traders. OctaFX has a trust score of 67% out of 100. OctaFX is currently not regulated by the MFED, BoB, or NBFIRA of Botswana

- Lesche Duvenage

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

USD 25

Regulators

FCA UK

Trading Platform

MT5, MT4, OctaTrader

Crypto

Yes

Total Pairs

28

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overview

Overall, OctaFX is considered high-risk, with an overall Trust Score of 67 out of 100. OctaFX is licensed by zero Tier-1 Regulators (high trust), one Tier-2 Regulator (average trust), and one Tier-3 Regulator (low trust). The broker offers two different retail trading accounts namely a MetaTrader 4 Habitual Trader Account and a MetaTrader 5 Smart Trader Account.

They accepts Botswanan clients and has an average spread from 0.6 pips with zero commission charges. The broker has a maximum leverage ratio up to 1:500 and there is a demo and Islamic account available.

MT4, MT5, OctaFX, and CopyTrade platforms are supported. OctaFX is headquartered in Saint Vincent and the Grenadines and regulated by CySEC and SVG FSA.

The broker has been offering customers a broad selection of trading alternatives while also requiring modest initial deposits ever since the company’s start in 2011.

OctaFX has been the winner of multiple industry awards for its outstanding online trading services and platforms. OctaFX is an umbrella name that is utilized by two different broker firms in their business.

Customers of OctaFX can take advantage of greater leverage and bonus incentives since the OctaFX website is registered under Octa Markets Incorporated, which was created in St. Vincent and the Grenadines.

OctaFX, which has its headquarters in St. Vincent and the Grenadines, serves customers from 185 different nations. OctaFX stands out above other forex trading platforms because of its user-friendliness and great spreads.

OctaFX is an excellent choice for investors who are looking for a cost-effective means to get started trading a diverse range of assets. The platform’s primary focus is on foreign exchange, but it also supports trading in a variety of other asset types.

this broker review for Botswana will provide local retail traders with the details that they need to consider whether the broker is suited to their unique trading objectives and needs.

Distribution of Traders

Currently has the largest market share in these countries:

➡️ India – 43.2%

➡️ Pakistan – 18.1%

➡️ Malaysia – 12%

➡️ Philippines – 7%

➡️ Indonesia – 3.7%

Popularity among traders

The broker is an international broker that has a large market share in the Asian market. While the broker has a <5% market share in Botswana, the broker caters for both beginner and professional Botswanan traders regardless of their trading objectives, making OctaFX one of the Top 50 brokers for the region.

OctaFX At a Glance

| 🏛 Headquartered | Saint Vincent and the Grenadines |

| 🌎 Global Offices | United Kingdom, Hong Kong, Indonesia, Cyprus, Malaysia, Thailand |

| 🏛 Local Market Regulators in Botswana | • Ministry of Finance and Economic Development (MFED) • Bank of Botswana (BoB) • Non-Bank Financial Institutions Regulatory Authority (NBFIRA) |

| 💳 Foreign Direct Investment in Botswana | 115.89 BWP Million in 2021 |

| 💰 Foreign Exchange Reserves in Botswana | 5270 USD Million in 2021 |

| ✔️ Local office in Gaborone? | No |

| 👨⚖️ Governor of SEC in Botswana | None, Moses Dinekere Pelaelo is the Governor of the Bank of Botswana |

| ✔️ Accepts Botswana Traders? | Yes |

| 📊 Year Founded | 2011 |

| 📞 Botswana Office Contact Number | None |

| 📱 Social Media Platforms | • Facebook • YouTube • Telegram |

| ⚖️ Regulation | CySEC, SVG FSA |

| 1️⃣ Tier-1 Licenses | None |

| 2️⃣ Tier-2 Licenses | • Cyprus Securities and Exchange Commission (CySEC) |

| 3️⃣ Tier-3 Licenses | • Financial Services Authority of Saint Vincent and the Grenadines |

| 🪪 License Number | • Cyprus – 372/18 • Saint Vincent and the Grenadines – 19776 |

| ⚖️ MFED, BoB, or NBFIRA Regulation | No |

| ✔️ Regional Restrictions | The United States |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 2 |

| ✔️ PAMM Accounts | No |

| 💻 Liquidity Providers | Unknown |

| ✔️ Affiliate Program | Yes |

| 📱 Order Execution | Market |

| 📊 Starting spread | From 0.6 pips |

| 📉 Minimum Commission per Trade | None |

| 💰 Decimal Pricing | 5th decimal pricing after the comma |

| 📞 Margin Call | 25% |

| 🛑 Stop-Out | 15% |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | 500 lots |

| ✅ Crypto trading offered? | Yes |

| ✔️ Offers a BWP Account? | No |

| 📉 Dedicated Botswana Account Manager? | No |

| 📈 Maximum Leverage | 1:500 |

| 📊 Leverage Restrictions for Botswana? | No |

| 💳 Minimum Deposit (BWP) | 481 Botswanan Pula or an equivalent to $25 |

| ✔️ Botswana Pula Deposits Allowed? | No |

| 📊 Active Botswana Trader Stats | 250,000+ |

| 👥 Active Botswana-based OctaFX customers | Unknown |

| 🔁 Botswana Daily Forex Turnover | Unknown, Forex overall is $6.6 Trillion |

| 💰 Deposit and Withdrawal Options | • Debit Card • Credit Card • Bitcoin (BTC) • Ethereum (ETH) • Dogecoin (DOGE) • Litecoin (LTC) • Tether TRC-20 (USDTT) • Tether ERC-20 (USDTE) • Skrill • Neteller |

| 💻 Minimum Withdrawal Time | 30 minutes |

| ⏰ Maximum Estimated Withdrawal Time | 3 hours |

| 💳 Instant Deposits and Instant Withdrawals? | No |

| 🏛 Segregated Accounts with Botswana Banks? | No |

| 📱 Trading Platforms | • MetaTrader 4 • MetaTrader 5 • OctaFX App • CopyTrade App |

| 💻 Tradable Assets | • Forex • Index CFDs • Commodities • Cryptocurrencies • Energies • Precious Metals |

| ✔️ Offers USD/BWP currency pair? | No |

| 📊 USD/BWP Average Spread | N/A |

| ✅ Offers Botswana Stocks and CFDs | No |

| 💻 Languages supported on the Website | English, Malaysian, Hindi, Bangla, Thai, Spanish, German, Vietnamese, Portuguese, Arabic, Chinese (Simplified) |

| ☎️ Customer Support Languages | Multilingual |

| 👥 Copy Trading Support | Yes |

| ⏰ Customer Service Hours | 24/7 |

| 📞 Botswana-based customer support? | Yes |

| 💸 Bonuses and Promotions for Botswanans? | Yes |

| 📚 Education for Botswanan beginner traders | Yes |

| 📱 Proprietary trading software | Yes |

| 🤝 Most Successful Trader in Botswana | Unknown |

| ✔️ Is OctaFX a safe broker for Botswana Traders? | Yes |

| 🎖 Rating for OctaFX Botswana | 7/10 |

| 🥇 Trust score for OctaFX Botswana | 67% |

| 👉 Open Account | 👉 Open Account |

Regulation and Safety of Funds

Regulation in Botswana

The broker is not locally regulated in Botswana but is regulated in Cyprus and Saint Vincent and the Grenadines to offer services to global clients.

Global Regulations

OctaFX has a license to do business in St. Vincent and the Grenadines that was granted to it by the Financial Services Authority of St. Vincent and the Grenadines (FSA SVG). Octa Markets Cyprus Ltd., which has its headquarters in Cyprus, is subject to regulation by the Cyprus Securities and Exchange Commission (CySEC), a Tier-2 Market Regulator.

Because of Brexit, OctaFX was compelled to close its headquarters in the United Kingdom and get a license from the Cyprus Securities and Exchange Commission to replace its Financial Conduct Authority (FCA) regulation.

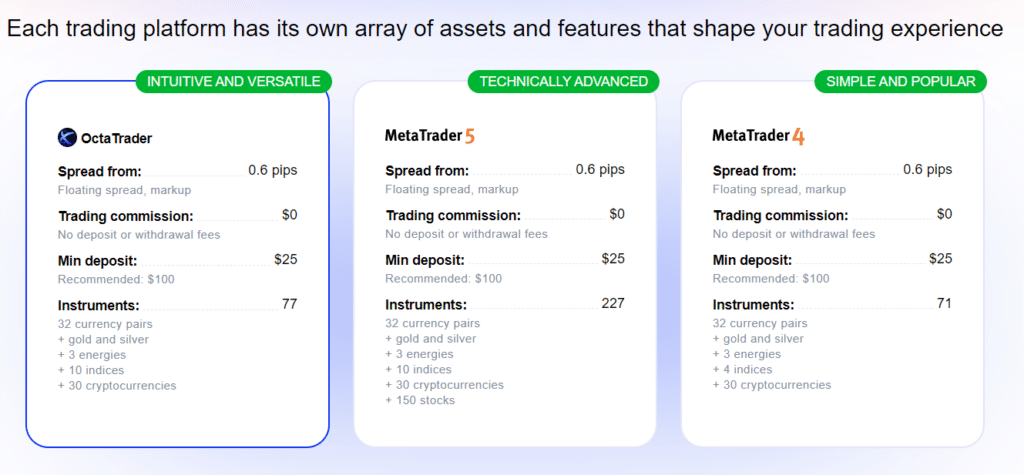

Client Fund Security and Safety Features

According to the official website of OctaFX, the broker takes several precautions to guarantee the security of all customer deposits received from Botswanan traders.

All customer monies are held in separate accounts at reputable financial institutions, as required by the international regulatory norms that are in place. This is done so that the broker’s balance sheets are kept separate from the cash belonging to the customer.

OctaFX employs some of the most secure technologies available to guarantee the privacy and safety of its customers’ financial and personal information as well as their financial transactions. This is accomplished by offering a Personal Area that is encrypted using 128 bits and is protected using SSL.

OctaFX employs stringent “Know Your Customer” (KYC) processes, in which the identity and address evidence of all new traders is validated. This helps to guarantee that all financial dealings are allowed and safe.

In addition, OctaFX has secure withdrawal procedures, which require the trader to confirm all withdrawals by email confirmation. The processing of credit and debit cards also makes use of the 3D secure technology, which guarantees the safety and openness of all Visa and Mastercard transactions.

Is OctaFX a regulated forex broker, and how does it ensure the safety of funds?

Yes, OctaFX is a regulated forex broker. It operates under the oversight of several financial regulatory authorities, including CySEC (Cyprus Securities and Exchange Commission) and VFSC (Vanuatu Financial Services Commission).

What additional measures does OctaFX take to enhance the safety of funds for its clients?

OctaFX prioritizes the safety of clients’ funds by implementing multiple security measures. One significant aspect is the Investor Compensation Fund (ICF), which is available to clients under CySEC regulation.

Awards and Recognition

OctaFX has won several rewards in recent years, including but not limited to some of the following:

➡️ Decade of Excellence in Forex Asia 2021 (Global Banking and Finance Review)

➡️ Best Forex Broker Asia 2021 (Global Banking and Finance Review)

➡️ Best ECN broker 2021 (World Finance)

➡️ Best Forex Broker Asia 2021 (Global Banking and Finance Review, and more.

Has OctaFX received any awards for its services in the forex industry?

Yes, OctaFX has received numerous awards and recognition for its services in the forex industry. The broker has been consistently acknowledged for its commitment to providing a high-quality trading experience, competitive spreads, and innovative trading tools.

How can I verify OctaFX’s awards and recognition?

Traders interested in verifying OctaFX’s awards and recognition can visit the broker’s official website.

Account Types and Features

OctaFX is not like other brokers in that it only offers two types of accounts, both of which are market-execution accounts, and the minimum deposits required for each account differ depending on the payment method chosen, with the initial deposit to register an account being 481 BWP or an equivalent to $25.

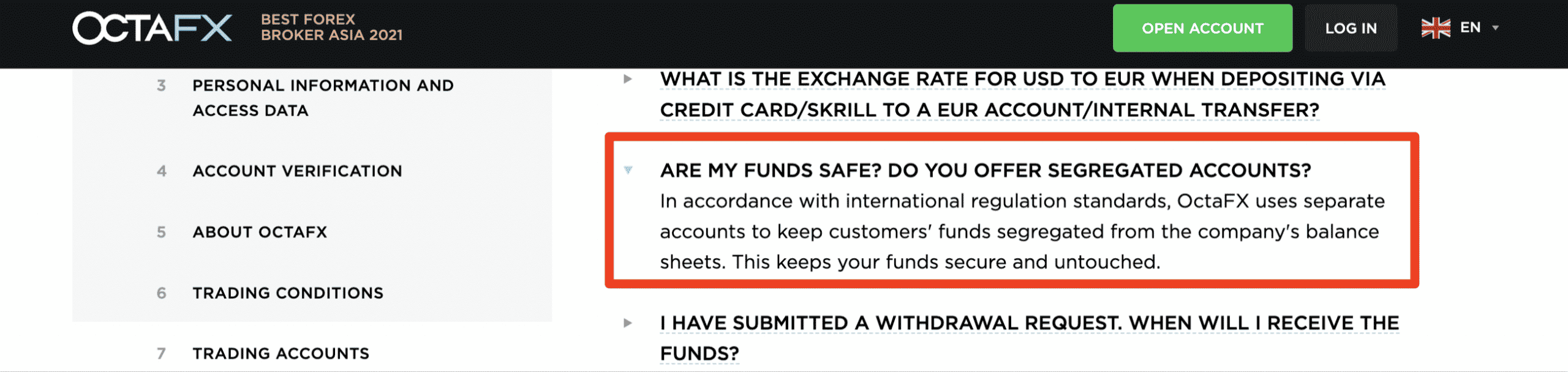

In addition, each account is connected to a distinct trading platform (either MT4 or MT5). The market conditions for trading are the same for both account choices, but the advantages change depending on which trading platform is used.

The live trading accounts offered:

➡️ MetaTrader 4

➡️ MetaTrader 5

| 💻 Live Account | 📉 Minimum Dep. | 📊 Average Spread | 💰 Commissions | 💸 Average Trading Cost |

| ➡️ MetaTrader 4 | 481 BWP/ 25 USD | 0.6 pips | None | 6 USD |

| ➡️ MetaTrader 5 | 481 BWP/ 25 USD | 0.6 pips | None | 6 USD |

Live Trading Accounts

MetaTrader 4

This retail investor account is ideal for those who are just starting in the FX market and those looking for more conventional trading conditions and features. The following characteristics are included with this sort of trading account, which is considered an ideal account for beginning traders:

| Account Feature | Value |

| ✔️ Minimum Deposit Requirement | 481 BWP or an equivalent to 25 USD |

| 📊 Average Spreads | Floating, from 0.6 pips |

| 💸 Commissions charged | None, mark-up is added to the spread |

| 🔨 Instruments offered on account | • 35 Forex Pairs • Gold and Silver • 3 Energies • 10 Indices • 30 Cryptocurrencies |

| 📈 Leverage Ratios | • Forex – up to 1:500 (1:100 for ZAR/JPY) • Precious Metals – up to 1:200 • Energies – up to 1:100 • Indices – up to 1:50 • Crypto – up to 1:25 |

| 📉 Minimum lot size | 0.01 lots |

| 💻 Maximum Trading Volume | 200 lots |

| 📞 Margin Call | 25% |

| 🛑 Stop-Out (%) | 15% |

| 📱 Trade Execution Type | Market |

| ✅ Trade Execution Average Speed | Under 0.1 seconds |

| 💰 Base Account Currency | USD or EUR |

| ✔️ Trading Strategies Allowed | Hedging, Scalping, Expert Advisors |

| ☪️ Islamic Account Offered? | Yes |

MetaTrader 5 Smart Trader Account

The MetaTrader 5 account is perfect for sophisticated traders who are active participants in a variety of financial markets and assets. This account gives these advanced traders access to the greatest trading conditions and trading technology available, including the following advanced features:

| Account Feature | Value |

| ✔️ Minimum Deposit Requirement | 481 BWP or an equivalent to 25 USD |

| 📊 Average Spreads | Floating, from 0.6 pips |

| 💸 Commissions charged | None, mark-up is added to the spread |

| 🔨 Instruments offered on account | • 35 Forex Pairs • Gold and Silver • 3 Energies • 10 Indices • 30 Cryptocurrencies |

| 📈 Leverage Ratios | • Forex – up to 1:500 (1:100 for ZAR/JPY) • Precious Metals – up to 1:200 • Energies – up to 1:100 • Indices – up to 1:50 |

| 📉 Minimum lot size | 0.01 lots |

| 💻 Maximum Trading Volume | 500 lots |

| 📞 Margin Call | 25% |

| 🛑 Stop-Out (%) | 15% |

| 📱 Trade Execution Type | Market |

| ✅ Trade Execution Average Speed | Under 0.1 seconds |

| 💰 Base Account Currency | USD or EUR |

| ✔️ Trading Strategies Allowed | Hedging, Scalping, Expert Advisors |

| ☪️ Islamic Account Offered? | Yes |

Base Account Currencies

The broker is highly limiting for traders since it only allows trading accounts to be denominated in EUR and USD. This is especially problematic for Botswanans who would have bank accounts denominated in BWP.

OctaFX Demo Account

A demo account is a practice account that offers traders a certain amount of virtual funds that they can use, allowing them to enter the live market without risking their capital.

There is a certain degree of risk involved when trading financial markets and OctaFX offers its clients a risk-free platform where they can test strategies, practice trading, and explore what the broker offers in a safe trading environment with real market conditions.

The demo account provided by OctaFX replicates the genuine trading accounts’ environments, including market circumstances and the experience of trading forex. Traders have unlimited access to virtual funds that can be topped up at any time, and they have unrestricted access to the demo account no matter how they put it to use.

Demo accounts are available to traders of all skill levels and may be used for a variety of purposes, including the practice of trading by novices and the evaluation of sophisticated trading methods before their implementation in live markets.

Another benefit of OctaFX’s demo account is that Botswanan traders can enter the Champion Demo Contest where traders could win real money.

OctaFX Islamic Account

Depending on the trading style and the trading strategy of the forex trader, they may keep their trading positions open for longer than 24 hours on a trading day.

This means that the trader could incur an overnight or rollover fee. This is a type of interest that is prohibited by Riba principles of Sharia law, which means that Muslim traders are often restricted in forex trading.

OctaFX accommodates all sorts of traders, including Muslim traders who adhere to the principles of Sharia Law. According to the teachings of Islam, traders who engage in monetary transactions cannot take or provide interest because they believe it promotes exploitation and is a waste of resources.

This often places limitations on the trading options available to Muslim investors since not all forex brokers allow positions to be kept open overnight without the danger of incurring overnight fees.

OctaFX’s Islamic Account is a solution that has won several awards and was designed to make it possible for Muslim traders to profit from medium- to long-term trading techniques without encountering any complications.

One of the things that set OctaFX unique from its rivals is the fact that Muslim Traders who use the Islamic Account do not have to pay any extra costs to offset the lack of overnight fees.

What are some of the key features available with OctaFX trading accounts?

OctaFX trading accounts come with several key features, including access to a wide range of trading instruments, including forex pairs, commodities, indices, and cryptocurrencies. The broker offers advanced trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), known for their user-friendly interfaces and powerful trading tools.

What are the different account types offered by OctaFX?

- MetaTrader 4

- MetaTrader 5

- OctaTrader

- Demo

- Islamic Account

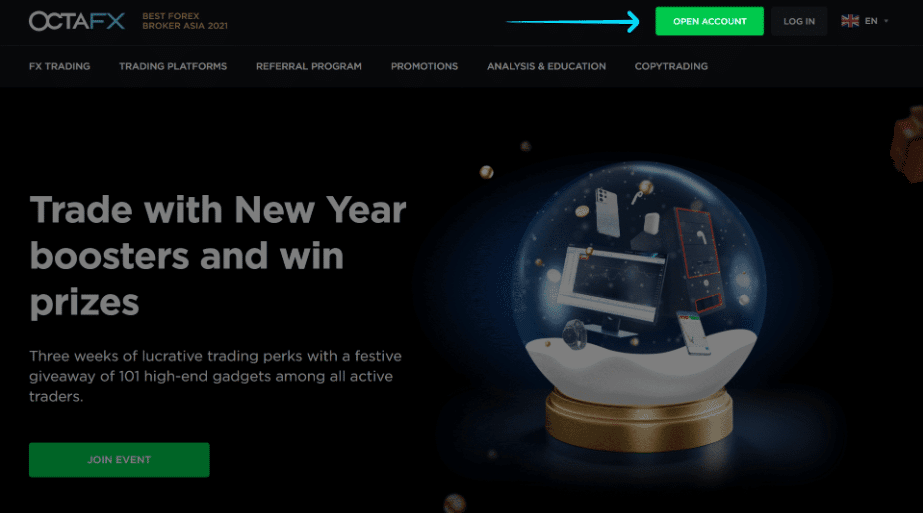

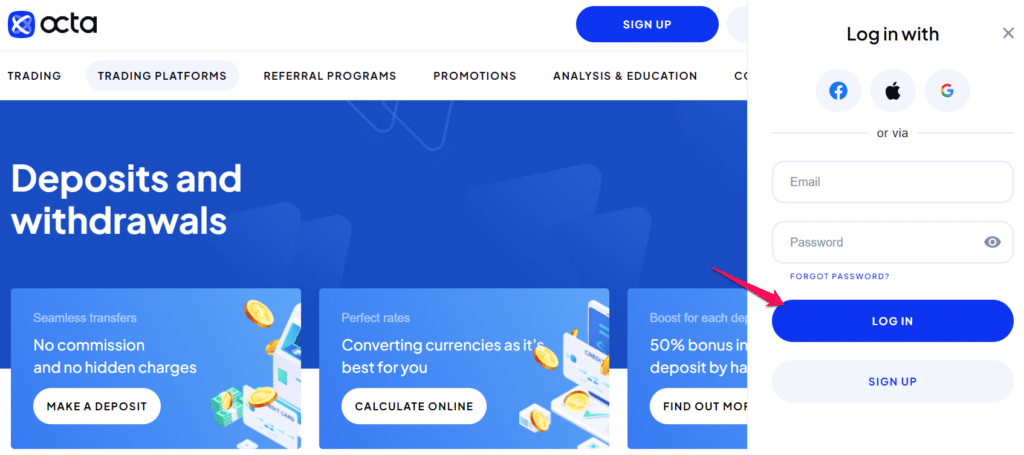

How to open an Account with OctaFX in Botswana

Opening an account is a straightforward process that only involves a few steps. To open a trading account, please, follow the step-by-step instruction:

Step 1: Press the Open Account Button.

The Open Account button is located at the top right of the OctaFX webpage. A registration form can also be found via the signup page link.

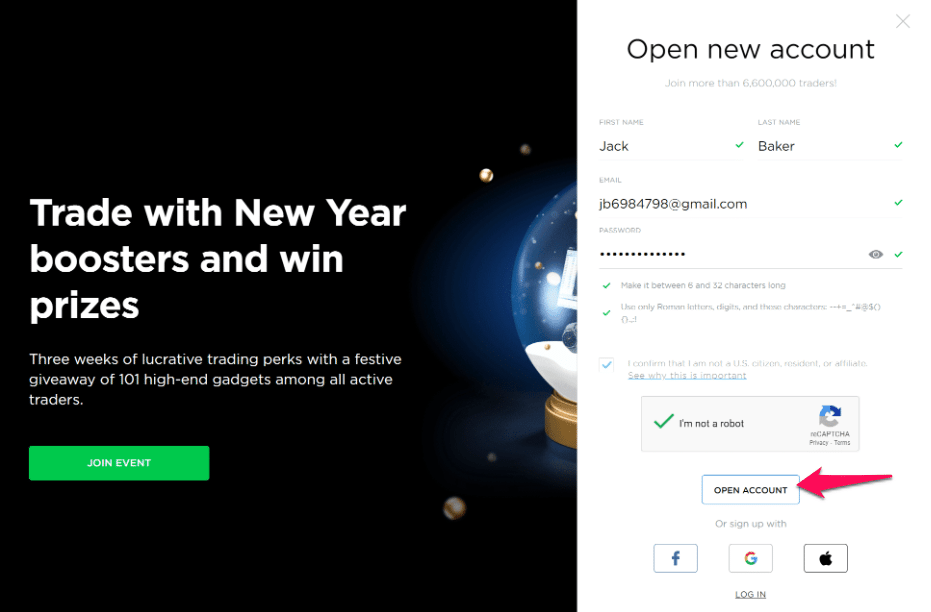

Step 2: Complete Details.

After pressing the Open Account button, a registration form will appear. Complete the required information and press the Open Account button located below the form.

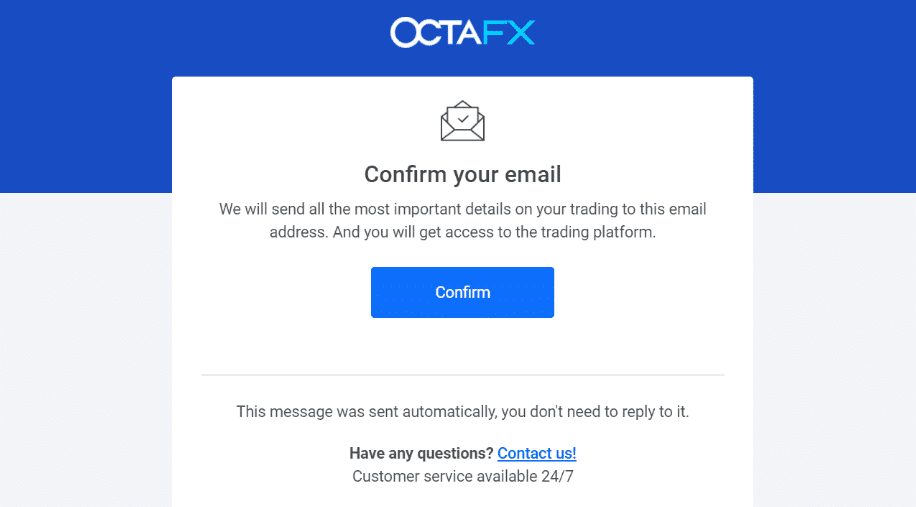

Step 3: Email Account Verification.

After all the required details have been completed and submitted, a confirmation email will be sent to the applicant’s account. After locating and opening the email – press Confirm.

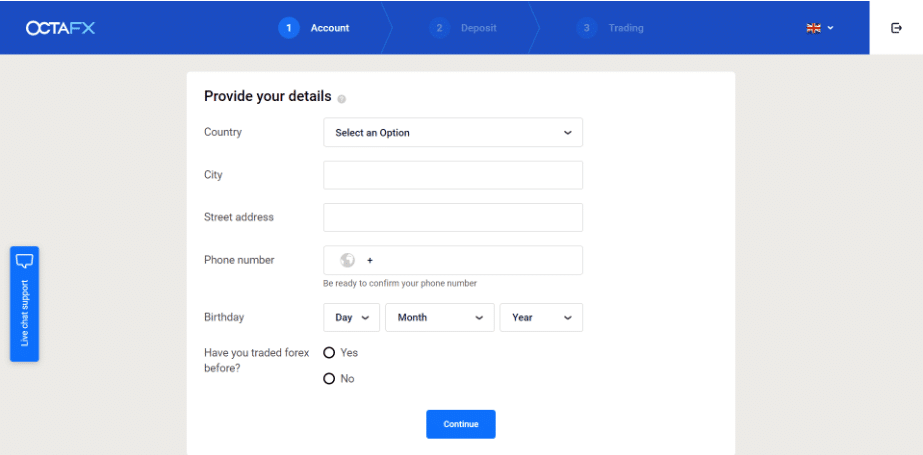

Step 4: Complete Personal Details.

Once the applicant’s email has been confirmed, they will be directed to the OctaFX website to fill in their personal details. The information provided by the applicant must be accurate, relevant, and up-to-date.

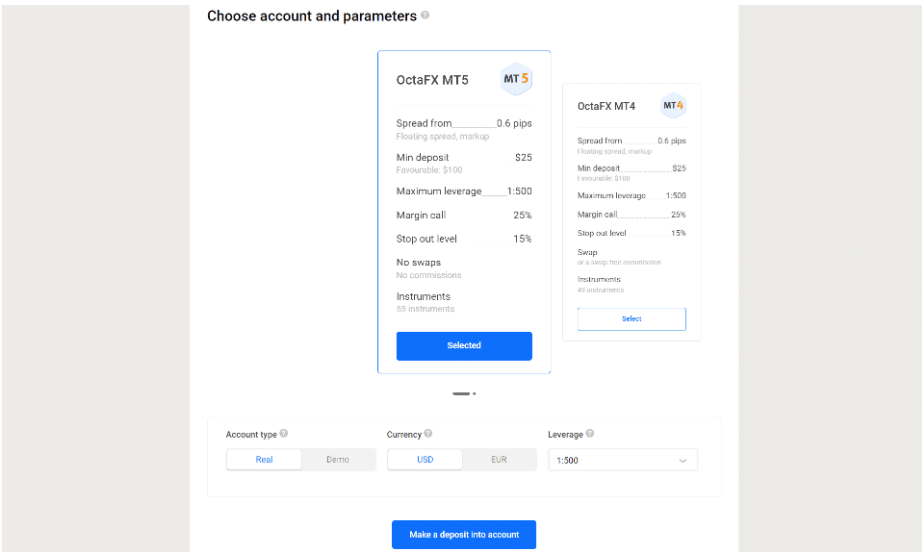

Step 5: Select a Trading Platform.

The applicant must select between a real or demo account.

Step 6: Complete Account Selection.

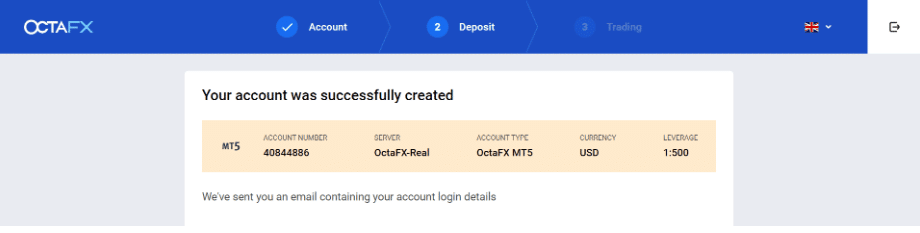

After choosing a platform, the applicant will press continue in order to finalize account creation.

Step 7: Make a Deposit.

The account holder can now make their first deposit and the account has been successfully

OctaFx Vs FBS Vs JustMarkets – Broker Comparison

| 🥇 OctaFX | 🥈 FBS | 🥉 JustMarkets | |

| ⚖️ Regulation | CySEC, SVG FSA | IFSC, CySEC, FSCA, ASIC | FSA |

| 📱 Trading Platform | • MetaTrader 4 • MetaTrader 5 • OctaFX App • CopyTrade App | • MetaTrader 4 • MetaTrader 5 • FBS Trader • CopyTrade | • MetaTrader 5 • MetaTrader 4 • JustMarkets App |

| 💰 Withdrawal Fee | No | Yes | None |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 481 BWP / $ 25 | 12 BWP | 12 BWP |

| 📊 Leverage | 1:500 | Up to 1:3000 | Up to 1:3000 |

| 📊 Spread | 0.6 pips | From 0.0 pips | From 0.0 pips |

| 💰 Commissions | None | From $6 | $3 units per lot/side |

| ✴️ Margin Call/Stop-Out | 25%/15% | 40%/ 20% | 40%/20% |

| 💻 Order Execution | Market | Market | Market |

| 💳 No-Deposit Bonus | Yes | Yes | Yes |

| 📊 Cent Accounts | No | Yes | Yes |

| 📈 Account Types | • MetaTrader 4 • MetaTrader 5 | • FBS Cent Account • FBS Micro Account • FBS Standard Account • FBS Zero Account • FBS ECN Account • FBS Crypto Account | • MetaTrader 4 Standard Cent Account • MetaTrader 4 Standard Account • MetaTrader 4 Pro Account • MetaTrader 4 Raw Spread Account • MetaTrader 5 Standard Account • MetaTrader 5 Pro Account • MetaTrader 5 Raw Spread Account |

| ⚖️ CBN Regulation | No | No | No |

| 💳 BWP Deposits | No | Yes | Yes |

| 📊 Botswana Pula Account | No | No | No |

| 👥 Customer Service Hours | 24/7 | 24/7 | 24/5 |

| 📊 Retail Investor Accounts | 2 | 6 | 7 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 📉 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | 500 lots | 500 lots | 100 lots |

| 💰 Minimum Withdrawal Time | 30 minutes | 15 to 20 minutes (maximum 48 hours) | Instant |

| 📊 Maximum Estimated Withdrawal Time | 3 hours | Up to 7 days | 10 bank days |

| 💸 Instant Deposits and Instant Withdrawals? | No | Instant Deposits | Yes |

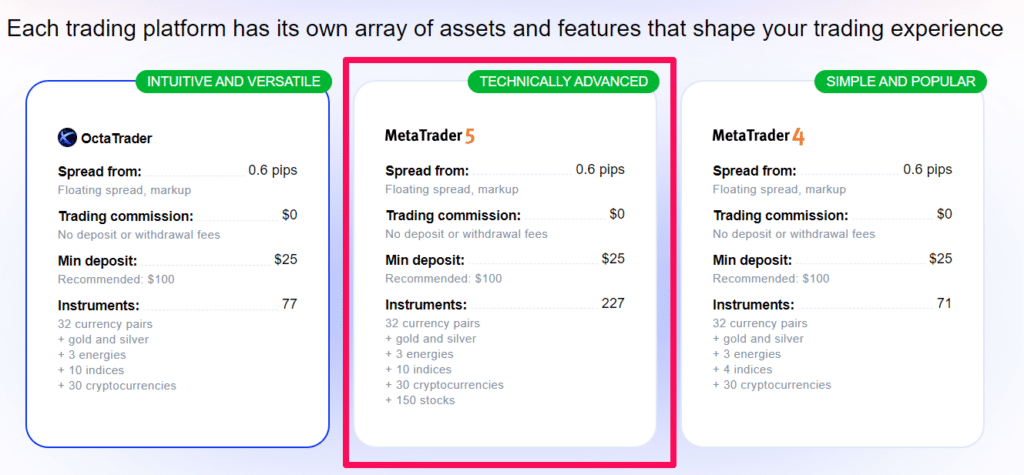

Trading Platforms

OctaFX offers Botswana Traders a choice between these trading platforms:

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ OctaFX App

➡️ CopyTrading App

Desktop Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4 and 5

Beginner Botswanan traders along with those with more experience who are looking for a platform that is easy to use but still sophisticated can consider MT4. It offers a user interface that is pleasant to both novice and experienced users, making it simple to browse while yet being completely modifiable.

MT5 maintains the straightforward nature of its predecessor’s user interface while adding a few useful new features that enhance the experience. Additional technical and fundamental indicators may be found for chart analysis, along with 21 different periods, graphical objects, support for more order kinds, an economic calendar, and other features.

WebTrader Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4 and 5

MT4 is pre-loaded with a wide variety of indicators for doing technical analysis and can execute automated trading strategies known as expert advisors (EAs). There are nine different timeframes available for selection.

There is support for many order types, along with real-time market execution and comprehensive risk management, in addition to a substantial number of other helpful features.

The MT5 trading platform is gaining popularity among Forex brokers, and this trend is expected to continue. It possesses a more up-to-date user interface, enables the creation of an unlimited number of charts, demonstrates the Depth of the Market, and comes equipped with an Economic Calendar.

Not only do the back-testing aspects of this software run more quickly than those of MT4, but it also enables simultaneous testing of many different currency pairings.

In addition to this, it supports a greater variety of pending order types than MT4, comes equipped with an integrated chat system, and offers more sophisticated charting capabilities.

Trading App

➡️ MetaTrader 4

➡️ MetaTrader 5

➡️ OctaFX App

➡️ CopyTrading App

MetaTrader 4 and 5

Both the MT4 and MT5 trading platforms are accessible on mobile devices and tablets running Android and iOS. Beginner traders should be aware that when compared to desktop trading platforms, there is some feature loss, such as limited timeframes and fewer charting tools.

The MT4 and MT5 applications allow Botswanan traders to operate from anywhere, with the ability to cancel and alter current orders as well as compute profit/loss in real-time.

OctaFX App

OctaFX has its own OctaFX Trading App that provides you access to all your OctaFX accounts (including your Demo Account) and is completely connected with Market Insights.

The software also enables Botswanan traders to manage all their accounts in one location, including the option to change leverage, make and cancel trades, deposit, and withdraw cash, and monitor bonuses and promotions.

The trading app is well-designed and easy to use, making it enticing to new traders who rely on mobile technology to connect to the financial markets.

When compared to other brokers, OctaFX’s mobile trading support is above average, with MT4 and MT5 mobile versions accessible in addition to the OctaFX trading app. While MT4 and MT5 are accessible on both iOS and Android smartphones, OctaFX’s trading app is only available on Android.

CopyTrading App

The OctaFX Copytrading software provides a straightforward way for you to duplicate trading signals from many other traders. The layout of the application is quite appealing to users, making it simple to locate signal sources to follow depending on the customized criteria you have applied.

At any moment, you may construct and monitor the progress of your portfolio. There are master accounts available for traders who want to give their trading techniques as signals to followers, as well as master accounts available for followers who want to imitate signals.

Which trading platforms are available for traders using OctaFX?

OctaFX offers a choice of advanced trading platforms to suit different preferences. Traders can access the globally popular MetaTrader 4 (MT4) platform, known for its user-friendly interface, extensive charting tools, and automated trading capabilities through Expert Advisors (EAs). OctaFX also provides the MetaTrader 5 (MT5) platform, offering additional features like more timeframes, technical indicators, and an economic calendar.

Does OctaFX support algorithmic trading and automated strategies on its trading platforms?

Yes, OctaFX supports algorithmic trading and automated strategies on its trading platforms, particularly through the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms.

Range of Markets

Botswana Traders can expect the following range of markets:

➡️ Forex

➡️ Index CFDs

➡️ Commodities

➡️ Cryptocurrencies

➡️ Energies

➡️ Precious Metals

Financial Instruments and Leverage offered

| 🔨 Instrument | 💰 Number of Assets Offered | 📈 Max Leverage Offered |

| ➡️ Forex | 32 | 1:500 |

| ➡️ Commodities | 5 | 1:50 |

| ➡️ Indices | 10 | 1:50 |

| ➡️ Cryptocurrency | 30 | 1:25 |

| ➡️ Precious Metals | 2 | 1:50 |

Forex

OctaFX offers up to 32 forex pairs that can be traded with a maximum leverage ratio of up to 1:500. This means that OctaFX will leverage your original investment and you start trading with a small investment amount.

OctaFX does not charge any hidden commissions and provides highly secure services, with the focus remaining on the convenience of traders. Botswanan traders can change their trading preferences at any given time and OctaFX does not limit traders on these.

When trading forex with OctaFX, Botswanans can use any given trading strategy including auto trading, allowing traders to apply Expert Advisors, cBots, and any other automated systems.

Index CFDs

With OctaFX, Botswanans can trade up to 10 Indices as CFDs with a maximum leverage of up to 1:50. With Index CFDs, traders have access to both MetaTrader 4 and 5, low spreads, and the opportunity for larger investments and larger profits using leverage.

In addition, there are no swaps or commissions charged when trading Index CFDs with OctaFX. With OctaFX, you can benefit from the ten most popular indices, including Dow Jones, NASDAQ, Nikkei, and Eurostoxx 50, using OctaFX’s CFDs and other products.

Commodities

Metals like gold, silver, platinum, and copper, as well as crude oil, natural gas, and other resources, are examples of physical assets that may be exchanged, most referred to as soft and hard commodities depending on the type of commodity.

Commodities are valuable to traders because they are unaffected by currency and stock market fluctuations, allowing them to build a wide and steady investment portfolio.

Modern investing provides several simple methods to participate in commodity trading, the most prevalent of which is trading CFDs (contracts for difference). These allow you to speculate on the price of a commodity without really owning the item.

OctaFX offers Precious Metals along with Energies under commodities. While trading gold and silver, Botswanans can use leverage up to 1:200 while energies have a cap at 1:50. The advantages of trading commodities with OctaFX are:

➡️ There are no round-turn commissions charged. While other brokers charge any fees for facilitating the trade when they open and close a position, OctaFX does not charge any commissions.

➡️ You can expect tight spreads, attributable to OctaFX having minimized the commodity trading costs.

➡️ Flexible leverage that provides Botswanans with additional market exposure while also providing risk management tools such as Negative Balance Protection, stop-loss orders, and others.

➡️ Free market insights are sourced from OctaFX’s analysts, allowing Botswanans to stay on top of market movements.

Cryptocurrencies

With OctaFX, Botswanans can trade more than 30 digital assets through MetaTrader 4 and MetaTrader 5. The maximum leverage that Botswanans can expect with OctaFX is up to 1:25 and traders can start trading from as little as 1,200 BWP.

OctaFX offers live quotes on the website, allowing traders to keep track of the broker’s competitive pricing. Botswanan traders also have the benefit that they can trade crypto from anywhere in the world using the MT4, MT5, and OctaFX apps.

Energies

OctaFX offers Botswanan traders access to Brent Crude Oil, WTI Crude Oil, and US Natural Gas that can be traded, with competitive spreads and reasonable margin requirements.

Precious Metals

OctaFX offers both Silver and Gold that can be traded on Spot Markets with competitive spreads, zero commissions, decent leverage, and reasonable margin requirements.

What financial markets and instruments can I trade with OctaFX?

OctaFX provides access to a diverse range of financial markets and instruments. Traders can trade a wide variety of forex currency pairs, including major, minor, and exotic pairs. Additionally, OctaFX offers commodities like gold, silver, and oil, as well as indices representing major global stock markets.

Does OctaFX offer trading on global stocks or individual company shares?

OctaFX primarily focuses on forex, commodities, indices, and cryptocurrencies.

Broker Comparison for Range of Markets

| 🥇 OctaFX | 🥈 FBS | 🥉 JustMarkets | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | No | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | No | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | Yes | Yes |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | No | No |

Trading and Non-Trading Fees

Spreads

OctaFX’s variable spreads are increased to account for the broker’s service charge, which is incurred during the transaction’s execution. OctaFX will compute the spreads for each transaction depending on the type of financial instrument being traded as well as the market circumstances on that trading day.

Botswanan traders should anticipate some of the following typical spreads:

➡️ EUR/USD – from 0.6 pips

➡️ USD/JPY – from 1 pip

➡️ NAS100 – from 1.2 pips

➡️ BTC/USD – from 2.8 pips

➡️ XBR/USD – from 0.7 pips

➡️ XTI/USD – from 0.7 pips

Commissions

OctaFX does not impose transaction fees since the broker’s cost for facilitating the transaction is included in the spread, which is why spreads are marked up.

Overnight Fees, Rollovers, or Swaps

The swap rate that is levied on positions that are held overnight is the last trading cost that should be taken into consideration at OctaFX. OctaFX does not impose any swap fees on positions that are maintained open on MT5 for the first two nights of trading. However, after the third night, a fixed cost will be applied.

Swap fees are accrued and deducted from the MT4 Account each night that an open position is maintained. OctaFX’s swaps are calculated as follows: the pip price x swap (short/long) x volume / 10.

Some typical overnight fees that Botswanan traders can expect are as follows:

➡️ EUR/USD – a short swap of -0.64 points and a long swap of -1.03 points

➡️ USD/JPY – a short swap of -0.77 points and a long swap of -0.69 points

➡️ NAS100 – a short swap of -8.00 points and a long swap of -8.00 points

➡️ BTC/USD – a short swap of -2.00 points and a long swap of -2.00 points

➡️ XBR/USD – a short swap of -1.00 points and a long swap of -1.00 points

➡️ XTI/USD – a short swap of -1.00 points and a long swap of -1.00 points

Deposit and Withdrawal Fees

OctaFX does not impose any fees on its users for making deposits or taking money out of their accounts. Traders in Botswana may, on the other hand, be subject to processing costs levied by their payment provider or financial institution.

Inactivity Fees

There are no inactivity fees applied by OctaFX on the inactive accounts of Botswanan traders regardless of how long they remain dormant.

Currency Conversion Fees

When Botswanan traders make deposits or withdrawals in BWP, they run the risk of being charged currency conversion costs due to the restricted number of base account currencies available.

What are the trading fees associated with OctaFX accounts?

OctaFX primarily charges trading fees in the form of spreads and, in some cases, overnight financing fees (swap rates) for positions held overnight.

Are there any non-trading fees that traders should be aware of when using OctaFX?

OctaFX typically does not charge non-trading fees such as deposit fees or withdrawal fees for standard payment methods.

Deposits and Withdrawals

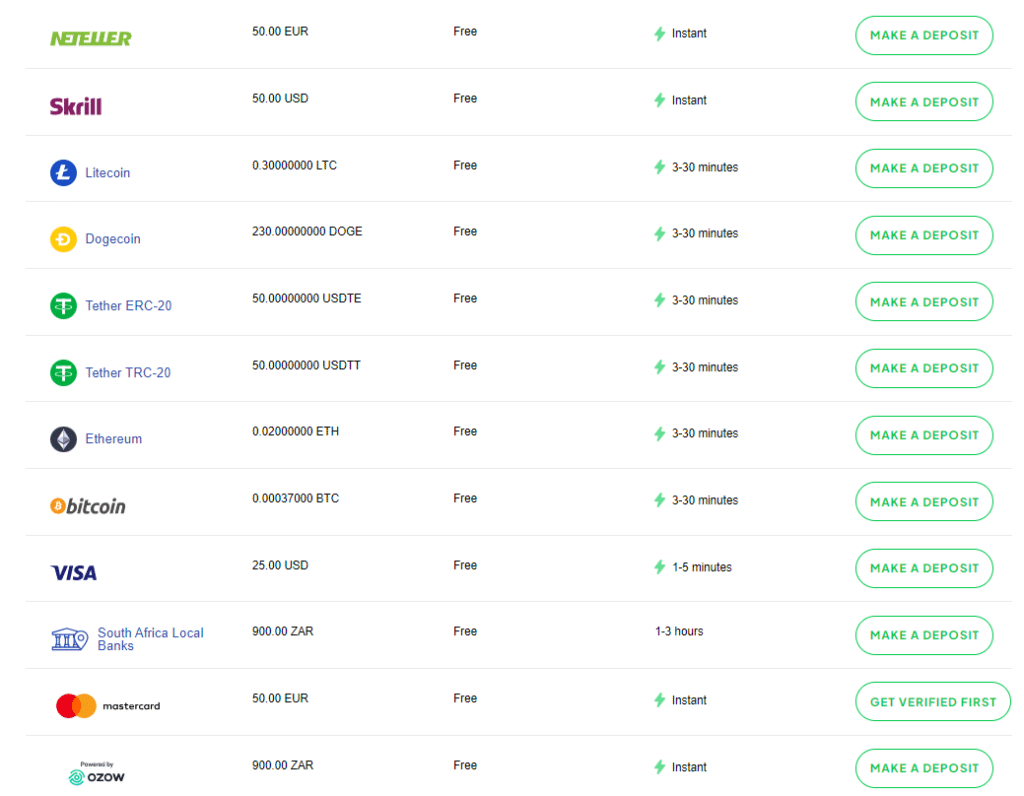

OctaFX offers the following deposit and withdrawal methods:

➡️ Credit Card

➡️ Debit Cards

➡️ Bitcoin (BTC)

➡️ Litecoin (LTC)

➡️ Dogecoin (DOGE)

➡️ Tether ERC-20 (USDTE)

➡️ Tether TRC-20 (USDTT)

➡️ Ethereum (ETH)

➡️ Skrill

➡️ Neteller

Broker Comparison: Deposit and Withdrawals

| 🥇 OctaFX | 🥈 FBS | 🥉 JustMarkets | |

| Minimum Withdrawal Time | 30 minutes | 15 to 20 minutes (maximum 48 hours) | Instant |

| Maximum Estimated Withdrawal Time | 3 hours | Up to 7 days | 10 bank days |

| Instant Deposits and Instant Withdrawals? | No | Instant Deposits | Yes |

Deposit Currencies, Deposit and Withdrawal Processing, Min Deposit and Withdrawal Amount

| 💳 Payment Method | ✔️ Accepted Currencies | 💳 Withdrawal Processing | 💸 Withdrawal Processing | 💵 Min Deposit | 💰 Min Withdrawal |

| Credit Card | USD, EUR | 1 to 5 minutes | Min: 30 Max: 1 – 3 hours | 25 USD | 20 USD |

| Debit Card | USD, EUR | 1 to 5 minutes | Min: 30 Max: 1 – 3 hours | 25 USD | 20 USD |

| Bitcoin (BTC) | BTC | 3 to 30 minutes | Min: 30 Max: 1 – 3 hours | 0.00037 BTC | 0.00009 BTC |

| Litecoin (LTC) | LTC | 3 to 30 minutes | Min: 30 Max: 1 – 3 hours | 0.3 LTC | 0.11 LTC |

| Dogecoin (DOGE) | DOGE | 3 to 30 minutes | Min: 30 Max: 1 – 3 hours | 230 DOGE | 75 DOGE |

| Tether ERC-20 (USDTE) | USDTE | 3 to 30 minutes | Min: 30 Max: 1 – 3 hours | 50 USDTE | 20 USDTT |

| Tether TRC-20 (USDTT) | USDTT | 3 to 30 minutes | Min: 30 Max: 1 – 3 hours | 50 USDTE | 20 USDTT |

| Ethereum (ETH) | ETH | 3 to 30 minutes | Min: 30 Max: 1 – 3 hours | 0.02 ETH | 0.005 ETH |

| Skrill | USD, EUR | Instant | Min: 30 Max: 1 – 3 hours | 50 USD | 5 USD |

| Neteller | USD, EUR | Instant | Min: 30 Max: 1 – 3 hours | 50 USD | 5 USD |

What deposit methods are available when funding an OctaFX trading account?

OctaFX offers a variety of deposit methods to cater to the diverse needs of its clients. These methods typically include bank wire transfers, credit/debit card payments, and a range of popular electronic payment systems and e-wallets.

Are there any fees associated with deposits and withdrawals at OctaFX?

OctaFX typically does not charge fees for deposits and withdrawals made using standard payment methods.

How to Deposit Funds with OctaFX

Opening an OctaFX account is a straightforward process that only involves a few steps. To open a trading account, please, follow the step-by-step instruction:

Step 1: Press the Open Account Button.

To make a deposit, log in to your profile.

Step 2: New Deposit.

Press the New Deposit button.

Step 3: Transfer Money

Select the account you want to top up.

Step 4: Transfer Method

Choose your preferred transfer method. You can deposit money using several payment methods.

We have prepared step-by-step guides for the most popular of them:

- bank transfer

- credit card, debit card, or e-wallet

- Bitcoin (BTC)

- Tether (USDT).

The actual list of available payment methods depends on the country you specified during the registration.

Fund Withdrawal Process

To withdraw funds from an account with OctaFX, Botswana Traders can follow these steps:

➡️ Traders from Botswana can access their personal area on OctaFX by logging into their personal area on the website.

➡️ Traders can then go to the main menu and choose the option to Withdraw funds.

➡️ Traders can indicate a withdrawal amount and a payment method from this section of the platform.

➡️ Lastly, Botswanan traders are required to confirm their information before submitting the request.

Traders need to note that withdrawals can only be processed from trading accounts that have been validated and authorized. Even though OctaFX normally handles withdrawal requests within one to three hours, the length of time it takes for funds to be deposited into a trading account is determined by the payment system.

Education and Research

Education

OctaFX offers the following Educational Materials:

➡️ Webinars

➡️ Forex basics articles

➡️ Forex basics video course

➡️ Platform video tutorials

➡️ Platform article tutorials

➡️ Glossary

➡️ Comprehensive Frequently Asked Question section

Research and Trading Tool Comparison

| 🥇 OctaFX | 🥈 FBS | 🥉 JustMarkets | |

| ➡️ Economic Calendar | Yes | Yes | Yes |

| ➡️ VPS | No | Yes | Yes |

| ➡️ AutoChartist | Yes | No | No |

| ➡️ Trading View | No | No | No |

| ➡️ Trading Central | No | No | No |

| ➡️ Market Analysis | Yes | Yes | Yes |

| ➡️ News Feed | Yes | Yes | Yes |

| ➡️ Blog | Yes | Yes | Yes |

OctaFX offers Botswana Traders the following Research and Trading Tools:

➡️ Trading calculators

➡️ Profit calculators

➡️ Live quotes

➡️ Account monitoring

➡️ AutoChartist Pro

➡️ Market information

➡️ Proprietary economic calendar

➡️ Forex market news

➡️ Interest rate information

➡️ Holiday calendar

➡️ Technical analysis tools

➡️ Fundamental analysis tools

What educational resources does OctaFX provide to traders looking to improve their skills?

OctaFX offers a range of educational resources designed to help traders enhance their knowledge and skills in forex and CFD trading. These resources often include educational articles, video tutorials, webinars, and trading guides covering topics like technical analysis, fundamental analysis, risk management, and trading strategies.

Does OctaFX provide any research tools or market analysis for traders?

Yes, OctaFX typically provides traders with access to a variety of research tools and market analysis. This can include daily market insights, economic calendars, technical analysis reports, and news updates.

Bonuses and Promotions

Offers Botswana Traders the following bonuses and promotions:

➡️ A demo contest

➡️ Trade and win giveaway

➡️ 50% deposit bonus

➡️ Status program

What types of bonuses and promotions are available to OctaFX traders?

The broker offers a range of bonuses and promotions to its traders, which may include deposit bonuses, rebate programs, and various seasonal or thematic promotions.

Are there any specific terms and conditions associated with OctaFX bonuses and promotions?

Yes, OctaFX bonuses and promotions usually come with specific terms and conditions that traders should be aware of. These conditions can include minimum deposit requirements, trading volume targets, and time limitations during which the bonus or promotion is valid.

How to open an Affiliate Account with OctaFX

To register an Affiliate Account, Botswana Traders can follow these steps:

➡️ When you are on the OctaFX website, go to the homepage and look for the “Referral Program” option.

➡️ Afterwards, potential affiliates may get started by selecting the “IB Program” from the drop-down menu.

➡️ Potential affiliates can learn more about the services that OctaFX provides, and when they are ready to sign up, they may go to the partner website and click the “Become IB” button.

➡️ The application for an IB Account will load, and potential affiliates will be able to fill out the necessary details.

➡️ Potential candidates are required to read the Customer Agreement and demonstrate that they have a solid grasp of its contents before submitting their application.

➡️ Once an affiliate has enrolled with OctaFX’s extensive affiliate program, they will have access to all the promotional materials and other services that are made available to them by OctaFX.

Affiliate Program Features

The broker provides its partners with a diverse set of benefits via its extensive affiliate network, which are as follows:

➡️ A straightforward method for potential partners to start on the program

➡️ Trading conditions that are competitive for customers

➡️ Generous compensation offered to affiliates

➡️ Tailored solutions for partners and affiliates

➡️ Unlimited pay-outs to affiliates

➡️ Hassle-free and frequent pay-outs

➡️ A completely open and accessible program with no hidden conditions or fees

➡️ Commissions with no upper limit

In addition to offering some of the most competitive pay on the market, OctaFX also provides unique partnerships that may be tailored to the preferences of each affiliate. In addition, the International Baccalaureate (IB) offers a prestigious master’s program that allows for extra growth, as well as several IB competitions.

Partners have the potential to earn up to $12 per lot traded on accounts with 60 or more recommended customers. In addition, customers who have reached this level are eligible to get the greatest trading conditions and fully customisable programs, both of which will assist them in growing their total earnings.

Customer Support

OctaFX’s customer service is accessible 24 hours a day, 7 days a week to assist traders in every manner possible. OctaFX’s financial department is open from 6 pm to 10 pm (EET) Monday through Friday, while the Account Verification department is open from 8 am to 5 pm. Monday through Friday.

| Customer Support | OctaFX’s Customer Support |

| ⏰ Operating Hours | 24/7 |

| 🗣 Support Languages | English, Malay, Portuguese, Indonesian, Thai, Chinese, Vietnamese |

| 🗯 Live Chat | Yes |

| 📧 Email Address | Yes |

| ☎️ Telephonic Support | Yes |

| 📞 Local Support in Botswana? | No |

| 🥇 Overall quality of OctaFX Support | 4.2/5 |

Corporate Social Responsibility

The fact that OctaFX is a socially responsible and ethical company is a source of tremendous pride for the company. OctaFX is heavily engaged in a wide range of philanthropic organizations and causes, and the company makes every effort to help those who need help and support.

OctaFX considers it both a part of its mission and its responsibility to strive toward increasing the quality of life experienced by disabled people all around the globe. This is something that they see as being important on both levels.

Our Verdict

Overall, OctaFX is a great trading platform with cheap starting deposits and a diverse selection of asset classes and trading instruments. The 50% deposit bonus for non-EU customers, as well as leverage and copy trading capabilities, are all outstanding features of OctaFX’s service, which offers high-quality functionality at a low cost.

This is great for traders who are new to forex trading and want to learn the ropes on a safe, dependable, and economical platform.

OctaFX’s customer support staff can be contacted through a range of communication channels 24 hours a day, 7 days a week, with helpful and friendly agents to answer any questions or queries that Botswanan traders may have.

Furthermore, experienced investors with more complex strategies will appreciate the incredibly narrow spreads, absence of costs, and invitation to all trading techniques like as hedging, scalping, and automated trading strategies.

OctaFX is an ideal platform to start trading or implement an existing strategy, attributable to its superb support, range of trading tools and functions, and extensive trader education materials.

You might also like: OctaFX Account Types

You might also like: OctaFX Demo Account

You might also like: OctaFX Fees and Spreads

You might also like: OctaFX Islamic Account

You might also like: OctaFX Minimum Deposit

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Account set-up is easy and quick | OctaFX is an offshore broker that only has Tier-2 and Tier-3 regulation |

| There is an industry-standard minimum deposit requirement on both accounts that are offered | There is an extremely limited portfolio of tradable assets |

| There are Sharia-compliant trading options offered to Muslim Botswanan traders | There are limited base account currency options |

| There is an unlimited demo account offered, with virtual funds that can be topped up at any time | BWP is not an accepted deposit currency or an account base currency |

| Botswanans have access to maximum leverage up to 1:500 on major instruments | There are only two live trading accounts offered by OctaFX |

| There are no commission charges on any trades | |

| Botswanans have access to two powerful trading platforms and four innovative trading apps | |

| OctaFX supports copy trading and provides a designated app |

Conclusion

Now it is your turn to participate:

➡️ Do you have any prior experience with OctaFX?

➡️ What was the determining factor in your decision to engage with OctaFX?

➡️ Was it because of the minimum deposit, regulation, retail trading accounts, or any other factors?

➡️ Have you experienced any issues with OctaFX such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

Regardless, please share your thoughts in the comments below.

Frequently Asked Questions

How do I deposit money into OctaFX?

You can log into your Personal Area and select the option to deposit. You can then choose the account that you want to fund, choose a preferred deposit method and currency, and indicate the amount to deposit. Lastly, you can follow any additional steps to finalize and confirm your deposit.

Is OctaFX regulated?

Yes, OctaFX is well-regulated in Cyprus by the Cyprus Securities and Exchange Commission (CySEC), and in Saint Vincent and the Grenadines by the Financial Services Authority (FSA).

What type of broker is OctaFX?

OctaFX is an STP and ECN broker that offers commission-free trading, market execution, a range of tradable instruments, and the use of several trading platforms through which trading activities can be carried out.

What is the withdrawal time with OctaFX?

Withdrawals with OctaFX can take between 5 minutes when you use either Skrill or Neteller, up to at least 3 hours on all other payment methods offered.

Is OctaFX safe or a scam?

OctaFX is not a scam broker. However, OctaFX is a high risk because it only has Tier-2 and 3 regulations, which gives it a low trust score.

Is OctaFX halal?

Yes, OctaFX is 100% Shariah-compliant and has an Islamic account option available on both retail trading accounts that are offered.

Does OctaFX have Nasdaq?

Yes, NAS100 is available as a contract for difference (CFD) on indices.

Does OctaFX have Volatility 75?

No, OctaFX does not currently have VIX as a part of its Index CFDs.

Is OctaFX’s copy trading real or fake?

OctaFX is a real broker that offers copy trading through the CopyTrade mobile application.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review