OctaFX Account Types

Overall, OctaFX Account Types is very competitive in terms of its trading Fees and Spreads. OctaFX offers two retail investor accounts as well as a demo and Islamic Account for Botswanan traders. OctaFX has a trust score of 67% out of 100. OctaFX is currently not regulated by the MFED, BoB, or NBFIRA of Botswana

- Louis Schoeman

Jump to:

Account Types Overview

Account Types

Account Features

Pros and Cons

Final Verdict

FAQ

Min Deposit

USD 25

Regulators

FCA UK

Trading Platform

MT5, MT4, OctaTrader

Crypto

Yes

Total Pairs

28

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

OctaFX at a Glance

| 🏛 Headquartered | Saint Vincent and the Grenadines |

| 🌎 Global Offices | United Kingdom, Hong Kong, Indonesia, Cyprus, Malaysia, Thailand |

| 🏛 Local Market Regulators in Botswana | • Ministry of Finance and Economic Development (MFED) • Bank of Botswana (BoB) • Non-Bank Financial Institutions Regulatory Authority (NBFIRA) |

| 💳 Foreign Direct Investment in Botswana | 115.89 BWP Million in 2021 |

| 💰 Foreign Exchange Reserves in Botswana | 5270 USD Million in 2021 |

| ✔️ Local office in Gaborone? | No |

| 👨⚖️ Governor of SEC in Botswana | None, Moses Dinekere Pelaelo is the Governor of the Bank of Botswana |

| ✔️ Accepts Botswana Traders? | Yes |

| 📊 Year Founded | 2011 |

| 📞 Botswana Office Contact Number | None |

| 📱 Social Media Platforms | • Facebook • YouTube • Telegram |

| ⚖️ Regulation | CySEC, SVG FSA |

| 1️⃣ Tier-1 Licenses | None |

| 2️⃣ Tier-2 Licenses | • Cyprus Securities and Exchange Commission (CySEC) |

| 3️⃣ Tier-3 Licenses | • Financial Services Authority of Saint Vincent and the Grenadines |

| 🪪 License Number | • Cyprus – 372/18 • Saint Vincent and the Grenadines – 19776 |

| ⚖️ MFED, BoB, or NBFIRA Regulation | No |

| ✔️ Regional Restrictions | The United States |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 2 |

| ✔️ PAMM Accounts | No |

| 💻 Liquidity Providers | Unknown |

| ✔️ Affiliate Program | Yes |

| 📱 Order Execution | Market |

| 📊 Starting spread | From 0.6 pips |

| 📉 Minimum Commission per Trade | None |

| 💰 Decimal Pricing | 5th decimal pricing after the comma |

| 📞 Margin Call | 25% |

| 🛑 Stop-Out | 15% |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | 500 lots |

| ✅ Crypto trading offered? | Yes |

| ✔️ Offers a BWP Account? | No |

| 📉 Dedicated Botswana Account Manager? | No |

| 📈 Maximum Leverage | 1:500 |

| 📊 Leverage Restrictions for Botswana? | No |

| 💳 Minimum Deposit (BWP) | 481 Botswanan Pula or an equivalent to $25 |

| ✔️ Botswana Pula Deposits Allowed? | No |

| 📊 Active Botswana Trader Stats | 250,000+ |

| 👥 Active Botswana-based OctaFX customers | Unknown |

| 🔁 Botswana Daily Forex Turnover | Unknown, Forex overall is $6.6 Trillion |

| 💰 Deposit and Withdrawal Options | • Debit Card • Credit Card • Bitcoin (BTC) • Ethereum (ETH) • Dogecoin (DOGE) • Litecoin (LTC) • Tether TRC-20 (USDTT) • Tether ERC-20 (USDTE) • Skrill • Neteller |

| 💻 Minimum Withdrawal Time | 30 minutes |

| ⏰ Maximum Estimated Withdrawal Time | 3 hours |

| 💳 Instant Deposits and Instant Withdrawals? | No |

| 🏛 Segregated Accounts with Botswana Banks? | No |

| 📱 Trading Platforms | • MetaTrader 4 • MetaTrader 5 • OctaFX App • CopyTrade App |

| 💻 Tradable Assets | • Forex • Index CFDs • Commodities • Cryptocurrencies • Energies • Precious Metals |

| ✔️ Offers USD/BWP currency pair? | No |

| 📊 USD/BWP Average Spread | N/A |

| ✅ Offers Botswana Stocks and CFDs | No |

| 💻 Languages supported on the Website | English, Malaysian, Hindi, Bangla, Thai, Spanish, German, Vietnamese, Portuguese, Arabic, Chinese (Simplified) |

| ☎️ Customer Support Languages | Multilingual |

| 👥 Copy Trading Support | Yes |

| ⏰ Customer Service Hours | 24/7 |

| 📞 Botswana-based customer support? | Yes |

| 💸 Bonuses and Promotions for Botswanans? | Yes |

| 📚 Education for Botswanan beginner traders | Yes |

| 📱 Proprietary trading software | Yes |

| 🤝 Most Successful Trader in Botswana | Unknown |

| ✔️ Is OctaFX a safe broker for Botswana Traders? | Yes |

| 🎖 Rating for OctaFX Botswana | 7/10 |

| 🥇 Trust score for OctaFX Botswana | 67% |

| 👉 Open Account | 👉 Open Account |

OctaFX Overview

Overall, OctaFX is considered high-risk, with an overall Trust Score of 67 out of 100. OctaFX is licensed by zero Tier-1 Regulators (high trust), one Tier-2 Regulator (average trust), and one Tier-3 Regulator (low trust).

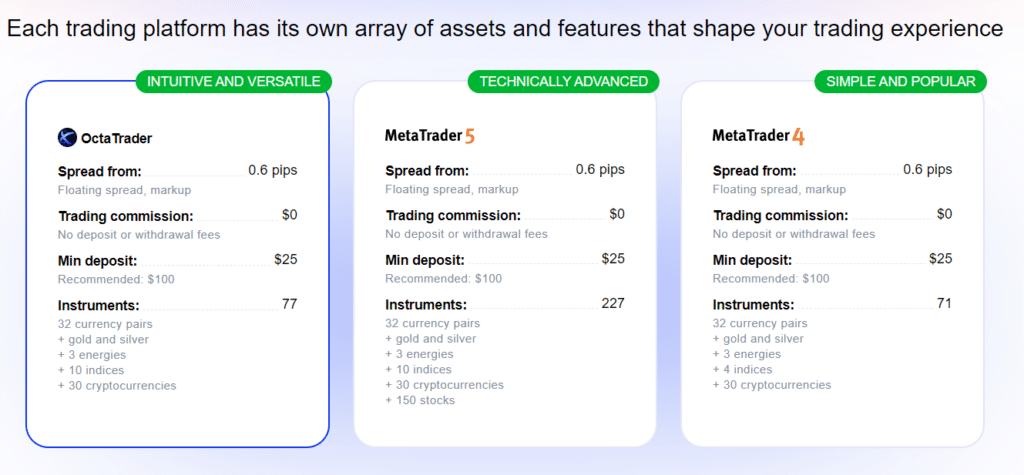

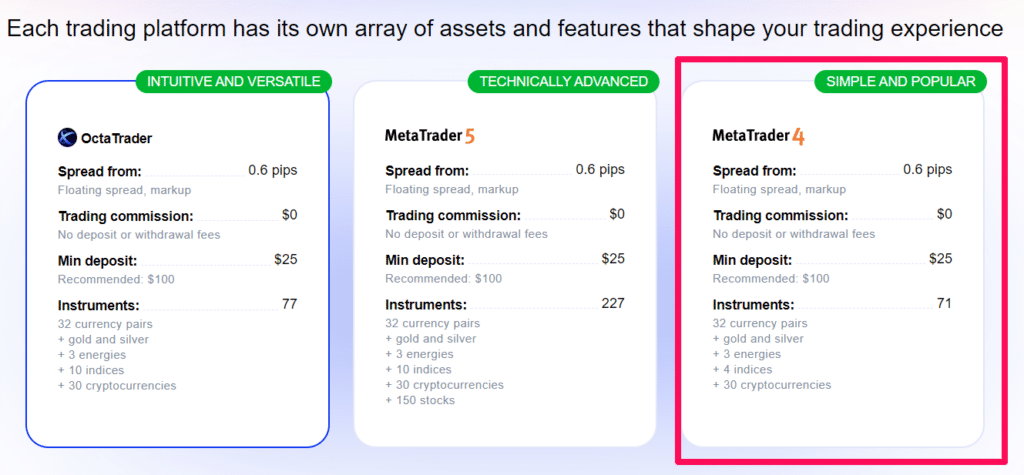

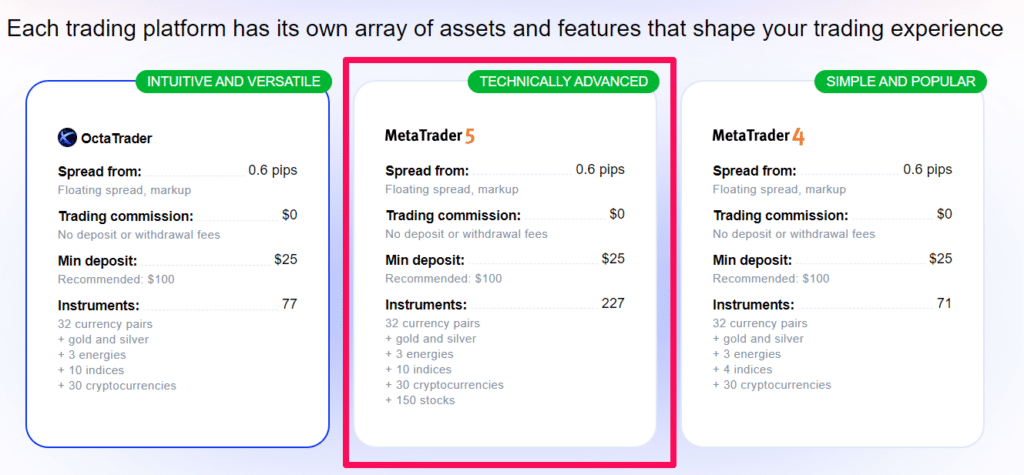

Additionally, OctaFX offers two different retail trading accounts: a MetaTrader 4 Account and a MetaTrader 5 Account.

OctaFX was founded in 2011 and offers a wide variety of user-friendly but sophisticated platforms for trading forex and CFD products at extremely affordable prices. OctaFX is a well-established forex and CFD broker with significant worldwide expansion in recent years.

Combining low prices, excellent customer service, and innovative technology, OctaFX has effectively extended its market share. Today, the company serves clients in 100 countries and has created an amazing 300,000 accounts with a daily turnover of $4 billion.

CFDs on currency, commodities, indices, and cryptocurrencies may be traded using MetaTrader 4, MetaTrader 5, and the OctaFX Trading app. In addition, two primary account kinds, Habitual Trading and Smart Trader, are designed to accommodate various trader profiles.

OctaFX consists of two legal entities. Located in an offshore area, Octa Markets Inc. is a company registered with St. Vincent and the Grenadines Financial Services Authority (FSA). The top-tier Cyprus Securities and Exchange Commission regulates Octa Markets Cyprus Ltd.

According to their website, customer monies are kept separate from corporate funds, and client accounts are protected against negative balances. As a result, OctaFX is one of the lowest-cost brokers in the business, with trading charges for EUR/USD averaging 9 USD per lot at rival brokers.

The MT4 account needs a minimum deposit of USD 25, and transactions incur no fee. Spreads average 0.7 pips, which is narrower than comparable firms. For Forex trading, the maximum leverage is 1:500, and the margin call/stop out is 25%/15%.

Additionally, metals, indexes, and cryptocurrencies are accessible for trading. Swaps are charged each night an open position is maintained.

The minimum deposit for an MT5 account is similarly 25 USD. Spreads on the EUR/USD average 0.7 pips, and no charges are paid. The MT5 trading platform has additional features such as market depth, an integrated economic calendar, and large tick charts.

The second distinction is that swaps are not applicable until the third night a position is maintained open. OctaFX has clients from around the world, and these areas have the largest distributions:

➡️ India – 43.2%

➡️ Pakistan – 18.1%

➡️ Malaysia – 12%

➡️ Philippines – 7%

➡️ Indonesia – 3.7%

OctaFX Account Types

OctaFX is unique among brokers in that it only provides two account types: market-execution accounts with varying minimum deposits based on the payment method used (the minimum deposit to open an account is 481 BWP, or around $25).

Furthermore, each trading account is linked to its own separate trading platform (either MT4 or MT5). Both account types provide traders access to the same markets, but the benefits vary based on the trading platform used.

For real-time trading, OctaFX provides the following types of accounts:

➡️ MetaTrader 4

➡️ MetaTrader 5

| 💻 Live Account | 📉 Minimum Dep. | 📊 Average Spread | 💰 Commissions | 💸 Average Trading Cost |

| ➡️ MetaTrader 4 | 481 BWP/ 25 USD | 0.6 pips | None | 6 USD |

| ➡️ MetaTrader 5 | 481 BWP/ 25 USD | 0.6 pips | None | 6 USD |

What are the different account types offered by OctaFX, and how do they differ in terms of features and benefits?

OctaFX typically offers a range of account types designed to cater to various trading preferences and experience levels.

Can I switch between OctaFX account types, and are there any requirements or fees associated with such changes?

OctaFX typically allows traders to switch between account types based on their preferences and trading needs. The process for switching accounts may involve contacting OctaFX’s customer support or using the broker’s online account management portal.

OctaFX Account Features

MetaTrader 4

For novice traders or those seeking more standard market conditions and features, the Habitual Account is an excellent choice. This kind of trading account, which is recommended for novice traders, has the following features:

| Account Feature | Value |

| ✔️ Minimum Deposit Requirement | 481 BWP or an equivalent to 25 USD |

| 📊 Average Spreads | Floating, from 0.6 pips |

| 💸 Commissions charged | None, mark-up is added to the spread |

| 🔨 Instruments offered on account | • 35 Forex Pairs • Gold and Silver • 3 Energies • 10 Indices • 30 Cryptocurrencies |

| 📈 Leverage Ratios | • Forex – up to 1:500 (1:100 for ZAR/JPY) • Precious Metals – up to 1:200 • Energies – up to 1:100 • Indices – up to 1:50 • Crypto – up to 1:25 |

| 📉 Minimum lot size | 0.01 lots |

| 💻 Maximum Trading Volume | 200 lots |

| 📞 Margin Call | 25% |

| 🛑 Stop-Out (%) | 15% |

| 📱 Trade Execution Type | Market |

| ✅ Trade Execution Average Speed | Under 0.1 seconds |

| 💰 Base Account Currency | USD or EUR |

| ✔️ Trading Strategies Allowed | Hedging, Scalping, Expert Advisors |

| ☪️ Islamic Account Offered? | Yes |

MetaTrader 5 Smart Trader Account

Accounts on MetaTrader 5 are ideal for experienced traders who often deal in various financial instruments. This account makes all the following innovative trading tools and sophisticated capabilities accessible to these traders.

| Account Feature | Value |

| ✔️ Minimum Deposit Requirement | 481 BWP or an equivalent to 25 USD |

| 📊 Average Spreads | Floating, from 0.6 pips |

| 💸 Commissions charged | None, mark-up is added to the spread |

| 🔨 Instruments offered on account | • 35 Forex Pairs • Gold and Silver • 3 Energies • 10 Indices • 30 Cryptocurrencies |

| 📈 Leverage Ratios | • Forex – up to 1:500 (1:100 for ZAR/JPY) • Precious Metals – up to 1:200 • Energies – up to 1:100 • Indices – up to 1:50 |

| 📉 Minimum lot size | 0.01 lots |

| 💻 Maximum Trading Volume | 500 lots |

| 📞 Margin Call | 25% |

| 🛑 Stop-Out (%) | 15% |

| 📱 Trade Execution Type | Market |

| ✅ Trade Execution Average Speed | Under 0.1 seconds |

| 💰 Base Account Currency | USD or EUR |

| ✔️ Trading Strategies Allowed | Hedging, Scalping, Expert Advisors |

| ☪️ Islamic Account Offered? | Yes |

What are some of the key features and benefits that OctaFX trading accounts offer to traders?

OctaFX trading accounts come with several key features designed to enhance the trading experience. These typically include access to a wide range of trading instruments, including forex currency pairs, commodities, indices, and cryptocurrencies.

Are there any additional account features or tools available to OctaFX traders beyond the standard offerings?

Yes, OctaFX often provides additional features and tools to enhance the trading experience for its clients. These may include educational resources such as trading webinars, video tutorials, and market analysis reports to help traders improve their skills and stay informed about market developments.

OctaFX Demo Account

The purpose of a demo account is to give prospective traders a taste of the real trading environment without the danger of losing any real money.

Even though all financial market trading has some degree of uncertainty, OctaFX provides its customers with a risk-free trading platform where they can try out new trading techniques, get a feel for the broker’s services, and familiarize themselves with genuine market circumstances.

OctaFX’s demo account is an exact representation of the real thing, down to the market conditions and the feel of trading forex. As a result, traders can add more virtual cash to their accounts at any moment and utilize the demo account for whatever purpose they see fit.

Traders of all experience levels could take advantage of demo accounts, which can be used for everything from learning the ropes to testing out complex trading strategies before they’re put into action on the real market.

OctaFX also offers a demo account, which Botswanan traders may use to participate in the Champion Demo Contest, with the chance to win real money.

Advanced and professional traders may utilize the demo account to polish their skills utilizing fictitious cash and various trading tools, market research, and other resources made available by OctaFX.

Traders have unrestricted access to this valuable tool, which they may use to develop a greater knowledge of forex and CFD trading and to quantify their risk exposure.

Botswanan traders may also:

➡️ Conduct unlimited risk-free trades to validate scalping trading strategies and algorithms.

➡️ Examine the trading platform and get acquainted with its features.

➡️ Acquire chart interpretation fundamentals, including the ability to spot levels and Fibonacci retracements

➡️ Experiment with different order types available on OctaFX.

How can I open a demo account with OctaFX, and is there a time limit on its usage?

Opening a demo account with OctaFX is typically a straightforward process and usually free of charge. Traders can visit OctaFX’s official website and follow the instructions to register for a demo account.

What are the differences between OctaFX’s demo accounts and live trading accounts?

OctaFX’s demo accounts are designed to simulate live trading conditions while using virtual funds. The primary difference between demo and live accounts is that demo accounts do not involve real money.

OctaFX Islamic Account

OctaFX welcomes traders of all backgrounds, including those who follow the Islamic legal code of Sharia. Taking or giving interest is forbidden in Islamic economics because it is seen as a kind of exploitation and waste of capital.

Since not all forex brokers allow positions to be held open overnight without risking overnight fees, this might restrict the trading possibilities accessible to Muslim investors.

OctaFX’s Islamic Account is a multi-award-winning service that facilitates the use of the medium- to long-term trading strategies by Muslims without compromising their religious beliefs.

OctaFX stands apart from the competition in many ways, including that its Islamic Account users, who are Muslim, incur no additional fees despite the absence of overnight financing charges.

What is an OctaFX Islamic Account, and how does it comply with Islamic finance principles?

An OctaFX Islamic Account, also known as a swap-free account, is designed to cater to traders who follow Islamic finance principles, which prohibit earning or paying interest (riba).

Are there any restrictions or limitations associated with OctaFX’s Islamic Account, and who is eligible to apply for it?

OctaFX’s Islamic Account is typically available to traders who follow Islamic finance principles and wish to trade in accordance with Sharia law. There are generally no specific restrictions or limitations on the types of instruments or markets that can be traded with Islamic Accounts.

Min Deposit

USD 25

Regulators

FCA UK

Trading Platform

MT5, MT4, OctaTrader

Crypto

Yes

Total Pairs

28

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

OctaFX Pros and Cons

| ✔️ Pros | ❌ Cons |

| Account set-up is easy and quick | OctaFX is an offshore broker that only has Tier-2 and Tier-3 regulation |

| There is an industry-standard minimum deposit requirement on both accounts that are offered | There is an extremely limited portfolio of tradable assets |

| There are Sharia-compliant trading options offered to Muslim Botswanan traders | There are limited base account currency options |

| There is an unlimited demo account offered, with virtual funds that can be topped up at any time | BWP is not an accepted deposit currency or an account base currency |

| Botswanans have access to maximum leverage up to 1:500 on major instruments | There are only two live trading accounts offered by OctaFX |

| There are no commission charges on any trades | |

| Botswanans have access to two powerful trading platforms and four innovative trading apps | |

| OctaFX supports copy trading and provides a designated app |

Verdict on OctaFX

Overall, OctaFX is very competitive in terms of its trading fees and spreads.

You might also like: OctaFX Review

You might also like: OctaFX Account Types

You might also like: OctaFX Demo Account

You might also like: OctaFX Minimum Deposit

You might also like: OctaFX Fees and Spreads

Conclusion

Now it is your turn to participate:

Regardless, please share your thoughts in the comments below.

Frequently Asked Questions

How can I register for an OctaFX account?

When you go to the OctaFX website, you may access the simple account signup procedure. After making the required minimum deposit, you can click the banner to establish an account and complete the application.

Before starting, you can choose your trading platform, present identification, and residency documentation, and begin trading.

What is the average spread that I can expect from my OctaFX account?

OctaFX is an ECN and STP broker charging spreads from 0.6 pips on EUR/USD and other major instruments. Because OctaFX does not charge commissions, the broker fees are included in the spread, which is why there is a mark-up.

Is there a free demo account with OctaFX?

OctaFX offers Botswanan traders an unlimited demo account that they can use via MT4 or MT5.

Can I convert my trading account into an Islamic Account?

Yes, OctaFX offers the opportunity for Muslim traders to convert the live account into an Islamic Account that exempts them from overnight fees.

Can I register a BWP-denominated account with OctaFX?

You can only register a USD or EUR-denominated account with OctaFX.

Exness Review

Exness Review