InstaForex Review

Overall, InstaForex is considered low-risk, with an overall Trust Score of 84% out of 100. InstaForex is licensed by one Tier-1 Regulator (high trust), one Tier-2 Regulator (average trust), and two Tier-3 Regulators (low trust). InstaForex offers four different retail trading accounts and a minimum deposit of $1 (13 BWP). InstaForex is currently not regulated by the Central Bank of Botswana.

- Louis Schoeman

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

USD 1

Regulators

CySEC, FSC

Trading Desk

MetaTrader 4

MetaTrader 5

MultiTerminal

WebTrader

Crypto

Yes

Total Pairs

100

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overview

Overall, InstaForex is considered average risk, with an overall Trust Score of 84 out of 100. InstaForex is licensed by one Tier-1 Regulator (high trust), one Tier-2 Regulator (average trust), and two Tier-3 Regulators (low trust).

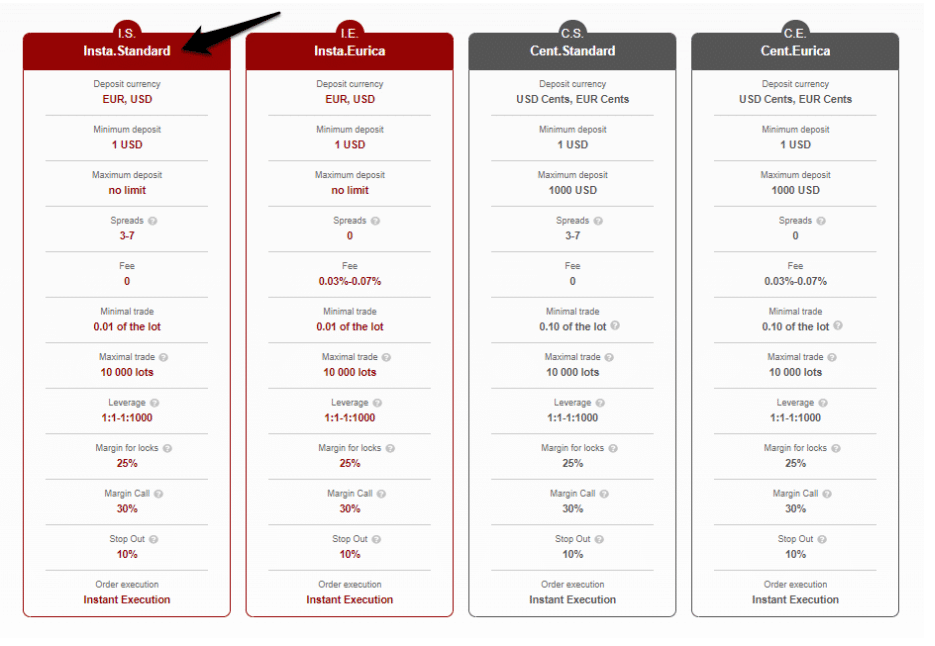

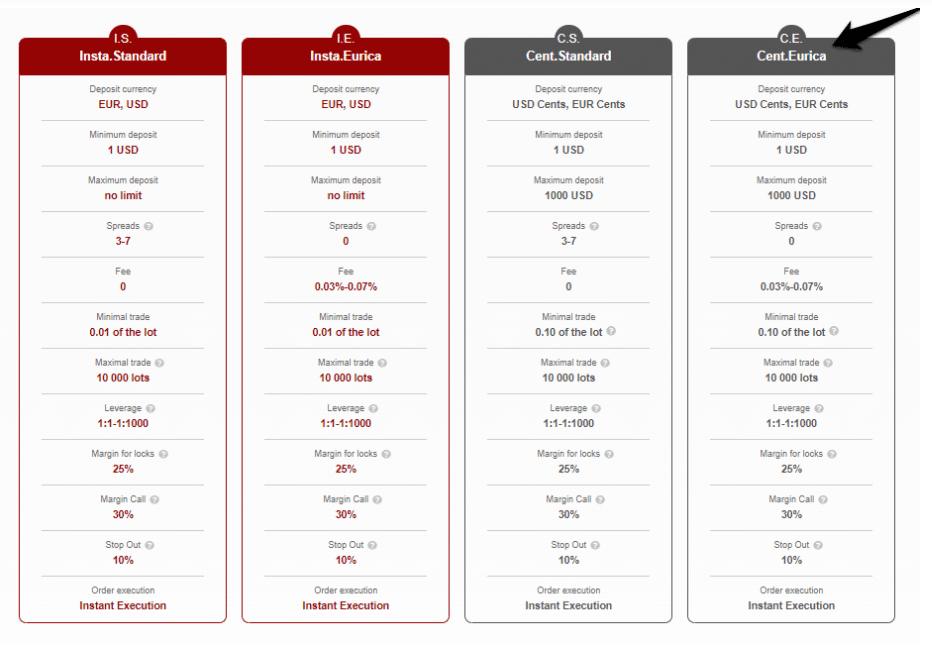

InstaForex offers four different retail trading accounts, namely an Insta.Standard Trading Account, Insta.Eurica Trading Account, Cent.Standard Trading Account, and a Cent.Eurica Trading Account.

Foreign exchange (FX), contract for difference (CFD) trading, and first-rate support are only two of the many services offered by InstaForex, a global brokerage brand serving seven million customers.

With various prominent endorsements, InstaForex has become one of the most recognizably prominent brands in the world. InstaForex was established in 2007 and has provided millions of traders worldwide with innovative online brokerage services.

InstaForex accepts Botswanan clients and has an average spread of 0.0 pips with commissions from 0.3%. InstaForex has a maximum leverage ratio up to 1:1000, and a demo and Islamic account are available.

MT4, MT5, WebIFX, InstaForex, and InstaTick Trader platforms are supported. InstaForex is headquartered in the British Virgin Islands and is regulated by BVI FSC, CySEC, and FSA SVG.

Distribution of Traders

Currently has the largest market share in these countries:

➡️ Germany – 19.43%

➡️ Russian Federation – 12.68%

➡️ Ukraine – 7.1%

➡️ Finland – 6.3%

➡️ Nigeria – 5.09%

Popularity among traders

Although the broker does not dominate the Botswanan CFD and FX markets, it is among the Top 45 brokers for novice and experienced traders.

InstaForex At a Glance

| 🏛 Headquartered | The British Virgin Islands |

| 🌎 Global Offices | Bangladesh, Ghana, Guatemala, Hong Kong, India, Indonesia, Kazakhstan, Malaysia, Moldovia, Nigeria, Pakistan, Peru, Tunisia, Ukraine |

| 🏛 Local Market Regulators in Botswana | • Ministry of Finance and Economic Development (MFED) • Bank of Botswana (BoB) • Non-Bank Financial Institutions Regulatory Authority (NBFIRA) |

| 💳 Foreign Direct Investment in Botswana | 115.89 BWP Million in 2021 |

| 💰 Foreign Exchange Reserves in Botswana | 5270 USD Million in 2021 |

| ✔️ Local office in Gaborone? | No |

| 👨⚖️ Governor of SEC in Botswana | None, Moses Dinekere Pelaelo is the Governor of the Bank of Botswana |

| ✔️ Accepts Botswana Traders? | Yes |

| 📊 Year Founded | 2007 |

| 📞 Botswana Office Contact Number | None |

| 📱 Social Media Platforms | • Facebook • YouTube • Telegram |

| ⚖️ Regulation | BVI FSC, CySEC, FSA SVG, FCA |

| 1️⃣ Tier-1 Licenses | • Financial Conduct Authority (FCA) |

| 2️⃣ Tier-2 Licenses | • Cyprus Securities and Exchange Commission (CySEC) |

| 3️⃣ Tier-3 Licenses | • Financial Services Commission (FSC) of the British Virgin Islands (BVI) • The Financial Services Authority (FSA) in St Vincent and the Grenadines |

| 🪪 License Number | • United Kingdom – 728735 • Cyprus – 266/15 • British Virgin Islands – SIBA/L/14/1082 • Saint Vincent and the Grenadines – 22945 and 24321 |

| ⚖️ MFED, BoB, or NBFIRA Regulation | No |

| ✔️ Regional Restrictions | The United States |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 4 |

| ✔️ PAMM Accounts | Yes, MAM through MT4 |

| 💻 Liquidity Providers | J.P. Morgan, UBS, Barclays, HSBC, Morgan Stanley & Citibank |

| ✔️ Affiliate Program | Yes |

| 📱 Order Execution | Instant |

| 📊 Starting spread | 0.0 pips, variable |

| 📉 Minimum Commission per Trade | $0.40 to $2 depending on trading volume |

| 💰 Decimal Pricing | • Forex – 5 decimals (3 on JPY pairs) • Metals – 2 decimals for XAU/USD and 3 decimals for XAG/USD |

| 📞 Margin Call | 30% |

| 🛑 Stop-Out | 10% |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | 100 lots |

| ✅ Crypto trading offered? | No |

| ✔️ Offers a BWP Account? | No |

| 📉 Dedicated Botswana Account Manager? | No |

| 📈 Maximum Leverage | Up to 1:1000 |

| 📊 Leverage Restrictions for Botswana? | No |

| 💳 Minimum Deposit (BWP) | 13 BWP or an equivalent to $1 |

| ✔️ Botswana Pula Deposits Allowed? | No, only USD, GBP, EUR |

| 📊 Active Botswana Trader Stats | 250,000+ |

| 👥 Active Botswana-based InstaForex customers | Unknown |

| 🔁 Botswana Daily Forex Turnover | Unknown, Forex overall is $6.6 Trillion |

| 💰 Deposit and Withdrawal Options | • SAR Online Banking • Debit Card • Credit Card • Skrill • International Bank Transfers • Neteller • PayCo • Cryptocurrencies • Bank wire Transfer • Local Transfers |

| 💻 Minimum Withdrawal Time | Instant |

| ⏰ Maximum Estimated Withdrawal Time | Up to 6 working days |

| 💳 Instant Deposits and Instant Withdrawals? | Yes, instant deposits |

| 🏛 Segregated Accounts with Botswana Banks? | No |

| 📱 Trading Platforms | • MetaTrader 4 • MetaTrader 5 • WebIFX • InstaForex Multi-Terminal • InstaForex WebTrader • InstaTick Trader • InstaForex MobileTrader |

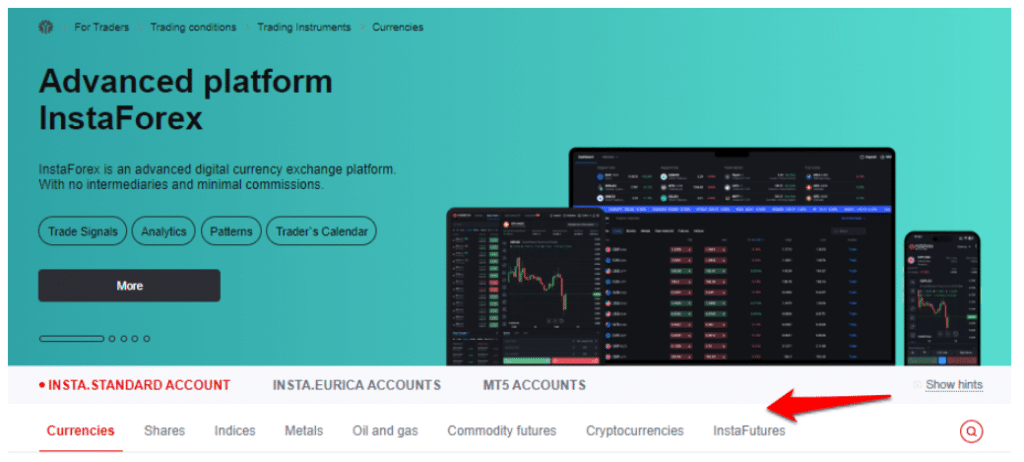

| 💻 Tradable Assets | • Forex • Shares • Indices • Precious Metals • Energies • Commodity Futures • Cryptocurrencies • InstaFutures |

| ✔️ Offers USD/BWP currency pair? | No |

| 📊 USD/BWP Average Spread | No |

| ✅ Offers Botswana Stocks and CFDs | No |

| 💻 Languages supported on the Website | English, French, Malay, Dutch, Italian, German, Simplified Chinese, Slovakian, Polish, Vietnamese, Portuguese, Spanish, Romanian, and more. |

| ☎️ Customer Support Languages | Multilingual |

| 👥 Copy Trading Support | Yes |

| ⏰ Customer Service Hours | 24/5 |

| 📞 Botswana-based customer support? | Yes |

| 💸 Bonuses and Promotions for Botswanans? | Yes |

| 📚 Education for Botswana beginner traders | Yes |

| 📱 Proprietary trading software | No |

| 🤝 Most Successful Trader in Botswana | Currently unknown |

| ✔️ Is InstaForex a safe broker for Botswana Traders? | Yes |

| 🎖 Rating for InstaForex Botswana | 8/10 |

| 🥇 Trust score for InstaForex Botswana | 84% |

| 👉 Open Account | 👉 Open Account |

Regulation and Safety of Funds

Regulation in Botswana

The local market regulators in Botswana are as follows:

➡️ Ministry of Finance and Economic Development (MFED)

➡️ Bank of Botswana (BoB)

➡️ Non-Bank Financial Institutions Regulatory Authority (NBFIRA)

The broker is regulated globally, the broker does not yet have local regulations or licenses in Botswana. However, they are a popular and trustworthy broker that accommodates Botswanan traders.

Global Regulations

The broker is well-regulated by the following regulatory entities:

➡️ Under reference number 728735, the Financial Operate Authority (FCA) in the United Kingdom has granted Instant Trading EU Ltd a temporary license to conduct services in the European Economic Area (EEA).

➡️ Insta Trading EU Ltd, established in Cyprus, provides investment, ancillary, and cross-border services to select EU member states. The broker also conducts business with several non-European Union countries. Per Regulation 266/15, the Cyprus Securities and Exchange Commission (CySEC) controls Insta Trading EU Ltd.

➡️ Instant Trading Ltd. has been approved, regulated, and overseen by the British Virgin Islands Financial Services Commission (FSC).

➡️ In the British Virgin Islands, SIBA/L/14/1082, the Investment Business Act, governs the broker In Saint Vincent and the Grenadines, InstaForex is registered as Insta Global Ltd and Insta Service Ltd.

Client Fund Security and Safety Features

SIBA oversees making sure the BVI’s licensing structure is in line with international standards for the financial sector established by organizations like the International Monetary Fund (IMF) and the International Organization for Standardization (IOSCO).

Suppose you want to trade on the EU brand. In that case, you must abide by certain conditions, such as maximum leverage of 1:30.

To add insult to injury, the European Securities and Markets Authority (ESMA), a European Supervisory Authority and financial regulatory organization, is also to blame.

Increased transparency in European Union financial markets can be attributed to the Markets in Financial Instruments Directive (MiFID), which seeks to standardize market regulatory disclosures.

InstaForex does not accept the United States and many developing countries due to their respective governments’ regulations.

Is InstaForex a regulated broker, and which regulatory authorities oversee its operations?

The broker operates under the regulatory framework to ensure transparency and the safety of client funds. The regulatory status of InstaForex may vary depending on the region and entity. In some jurisdictions, InstaForex is regulated by financial authorities such as the Cyprus Securities and Exchange Commission (CySEC)

How does InstaForex ensure the safety of client funds?

The broker prioritizes the safety of client funds through various protective measures. Client funds are typically held in segregated accounts, ensuring a clear separation between clients’ trading capital and the broker’s operational funds. This segregation provides an additional layer of protection, preventing the use of client funds for the broker’s business activities.

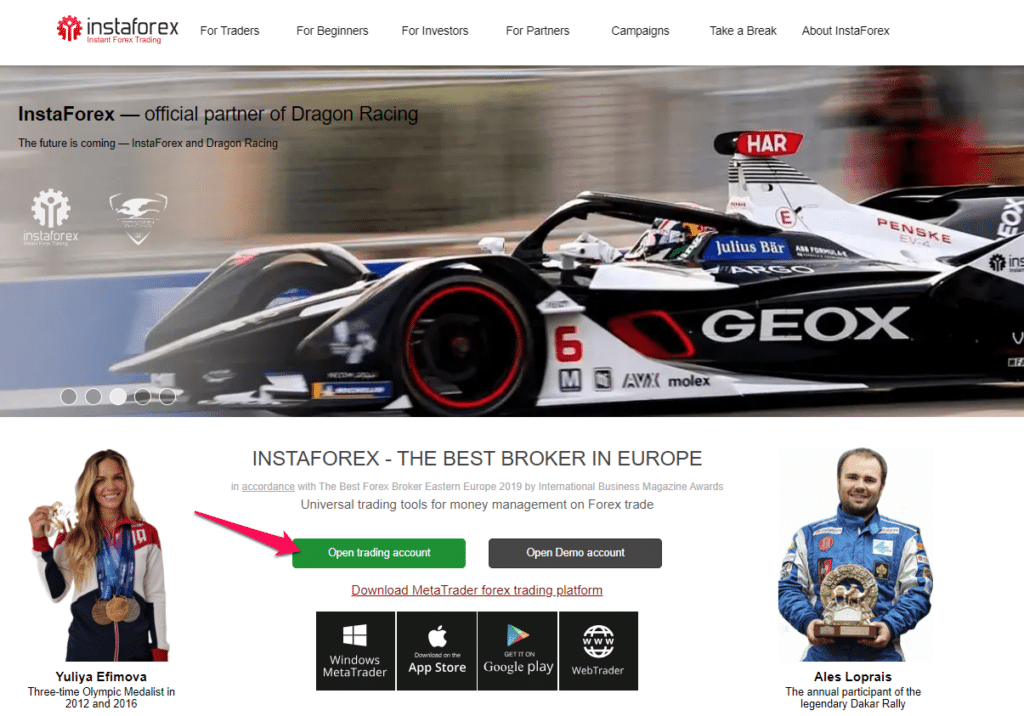

Awards and Recognition

The broker is a globally recognized forex brand. The organizations behind the InstaForex brand have a solid competitive position in all important sectors.

The group of businesses has received a few prestigious awards from business publications and specialized exhibitions for its impeccable quality, security, innovative approach, and vast services and offers.

➡️ In 2020, the International Business Magazine gave InstaForex the title of Best Forex Broker in Central and Eastern Europe.

➡️ Awarded Most Active Broker in Asia at the AtoZ Markets Forex Awards in 2020.

➡️ Global Brands Magazine’s Best Affiliate Program Award in 2020

In addition to a lengthy list of accolades the broker regularly engages in a few global sponsorships and social events. Among InstaForex’s partners are:

➡️ Borussia Dortmund Liverpool FC

➡️ Dragon Racing

➡️ Dakar Rally

➡️ Ole Einar Bjorndalen (Olympic biathlete)

➡️ Daria Kasatkina (Tennis emerging star) and other notable athletes and sports teams

Has InstaForex received any notable awards for its services in the financial industry?

Yes, the broker has garnered recognition and awards in the financial industry, attesting to its commitment to excellence and innovation. The platform has been honored in various categories, which may include Best Forex Broker, Best Customer Service, or recognition for technological advancements.

How is InstaForex regarded in the financial industry, and what do awards suggest about its reputation?

The broker enjoys recognition in the financial industry, and the awards it has received contribute to its positive reputation. Awards often reflect the acknowledgment of InstaForex’s efforts in delivering quality services, innovation, and customer satisfaction.

InstaForex Account Types and Features

The four basic account types offered appeal to a wide range of traders, regardless of their trading aims, aspirations, trading styles, or degrees of expertise. Each account type offers its own distinctive features and competitive trading conditions.

The live account options that are offered to Botswanans are:

➡️ Standard Trading Account

➡️ Eurica Trading Account

➡️ Standard Trading Account

➡️ Eurica Trading Account

| 💻 Live Account | 💳 Minimum Dep. | 📊 Average Spread | 💸 Commissions | 💰 Average Trading Cost |

| Insta.Standard | 13 BWP/1 USD | 0.0 pips | From 0.03% | 30 USD – 70 USD |

| Insta.Eurica | 13 BWP/1 USD | 3 pips | None | 30 USD |

| Cent.Standard | 13 BWP/1 USD | 0.0 pips | From 0.03% | 30 USD – 70 USD |

| Cent.Eurica | 13 BWP/1 USD | 3 pips | None | 30 USD |

Live Trading Account Details

Insta.Standard Trading Account

This account type allows Botswanan traders to trade all tradable financial goods under standard trading conditions.

This account adheres to the regulations of the Forex market. After gaining access to all trading instruments, a trader pays a specified spread. Regular accounts are free to use and can be used to settle standard spread transactions.

The account’s flexibility is its most valuable attribute since it allows traders to tailor their trading approach to their unique needs at any moment by modifying the trading leverage and deposit amount.

| Account Feature | Value |

| 💸 Account Base Currencies | EUR and USD |

| 📊 Minimum Deposit | 13 Botswanan Pula, equivalent to $1 |

| 🔧 Maximum Deposit Amount | None |

| 💵 Average spreads | Between 3 to 7 pips |

| 💻 Commissions | None |

| 📈 Minimum Trade Size | 0.01 lots |

| 📉 Maximum Trade Volume | 10,000 lots |

| 🔄 Leverage Ratios | Between 1:1 and up to 1:1000 |

| 📞 Margin for Locks | 25% |

| 📱 Margin Call | 30% |

| 🛑 Stop-out | 10% |

| 📈 Order Execution | Instant |

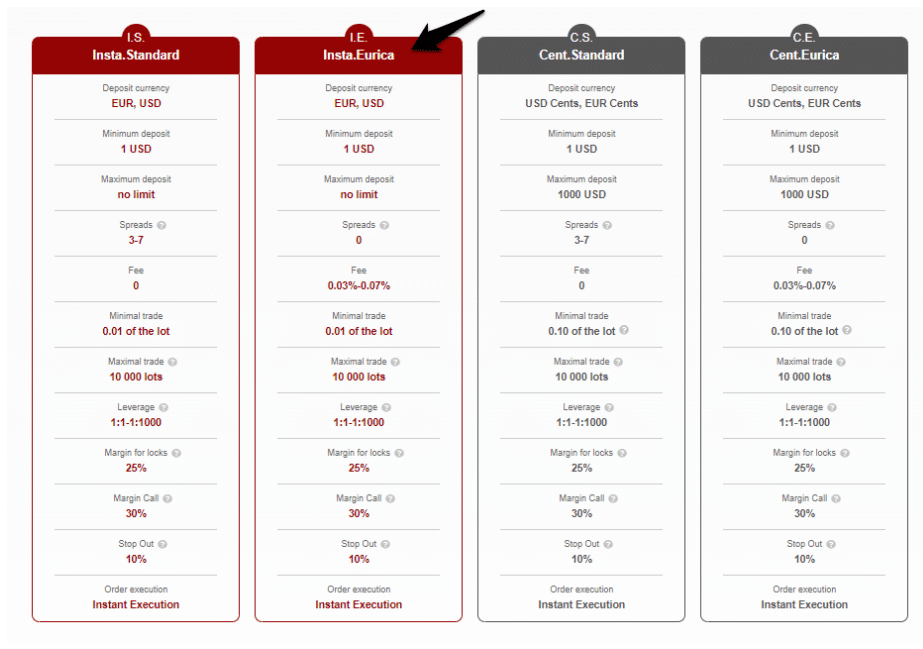

Insta.Eurica Trading Account

The spread is not charged to the account holder while using this sort of account. Due to the lack of margins on the Eurica account type, the BID and ASK prices are always identical.

Botswanan traders should know that the offered price is higher than the BID price due to a few technical peculiarities with the MetaTrader 4 platform. Traders in Botswana can use pending orders without worrying about the spread.

Since Botswanans do not have to think about how the spread will affect the outcome of their positions before placing GTC orders or joining the market, they can devote more time to conducting thorough technical analysis.

Aside from introducing inexperienced traders to the market via a more straightforward trading technique, seasoned investors can also benefit from opening an Insta.Eurica account because it offers the same trading features as a standard Insta.Standard account.

| Account Feature | Value |

| 💸 Account Base Currencies | EUR and USD |

| 📊 Minimum Deposit | 13 Botswanan Pula, equivalent to $1 |

| 🔧 Maximum Deposit Amount | None |

| 💵 Average spreads | Between 3 to 7 pips |

| 💻 Commissions | From 0.03% to 0.07% |

| 📈 Minimum Trade Size | 0.01 lots |

| 📉 Maximum Trade Volume | 10,000 lots |

| 🔄 Leverage Ratios | Between 1:1 and up to 1:1000 |

| 📞 Margin for Locks | 25% |

| 📱 Margin Call | 30% |

| 🛑 Stop-out | 10% |

| 📈 Order Execution | Instant |

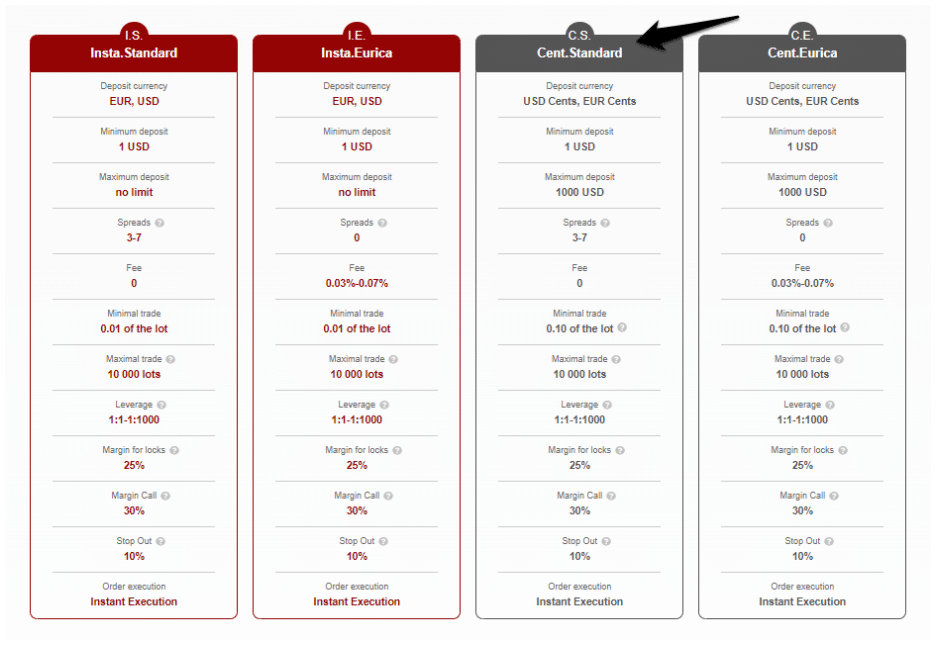

Cent.Standard Trading Account

Beginning traders in Botswana can use this account once they have tried out the trial account and seen how it works. For as little as one Cent every trade, traders in the Cent.Standard Trading accounts can experience the real market.

| Account Feature | Value |

| 💸 Account Base Currencies | EUR cents and USD cents |

| 📊 Minimum Deposit | 13 Botswanan Pula, equivalent to $1 |

| 🔧 Maximum Deposit Amount | None |

| 💵 Average spreads | Between 3 to 7 pips |

| 💻 Commissions | From 0.03% to 0.07% |

| 📈 Minimum Trade Size | 0.01 lots |

| 📉 Maximum Trade Volume | 10,000 lots |

| 🔄 Leverage Ratios | Between 1:1 and up to 1:1000 |

| 📞 Margin for Locks | 25% |

| 📱 Margin Call | 30% |

| 🛑 Stop-out | 10% |

| 📈 Order Execution | Instant |

Cent.Eurica Trading Account

The Cent.Eurica is like the Standard Account that InstaForex offers traders, except that the account is denominated in EUR or US cents.

| Account Feature | Value |

| 💸 Account Base Currencies | EUR cents and USD cents |

| 📊 Minimum Deposit | 13 Botswanan Pula, equivalent to $1 |

| 🔧 Maximum Deposit Amount | None |

| 💵 Average spreads | Between 3 to 7 pips |

| 💻 Commissions | From 0.03% to 0.07% |

| 📈 Minimum Trade Size | 0.01 lots |

| 📉 Maximum Trade Volume | 10,000 lots |

| 🔄 Leverage Ratios | Between 1:1 and up to 1:1000 |

| 📞 Margin for Locks | 25% |

| 📱 Margin Call | 30% |

| 🛑 Stop-out | 10% |

| 📈 Order Execution | Instant |

Base Account Currencies

Traders using InstaForex can only select the US dollar or the Euro as their base currency. This means additional costs could be associated with making deposits or withdrawals in a currency other than the base currency.

Demo Account

You can practice trading with unlimited virtual funds in a demo account. In addition, traders can learn the ropes of the InstaForex platforms and hone their skills with the help of a demo account.

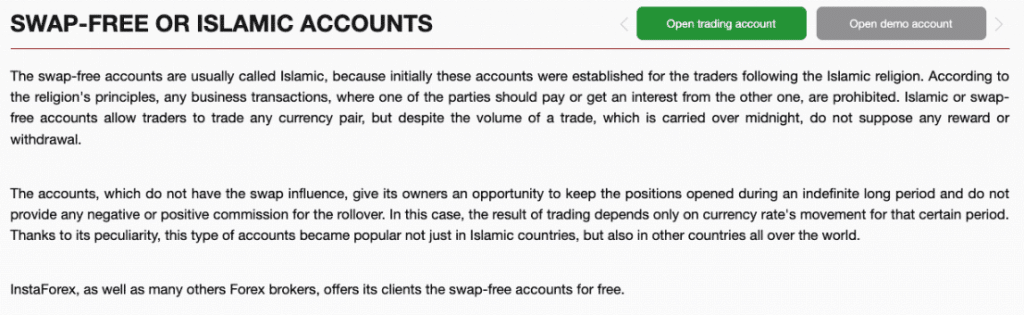

Islamic Account

Traders and believers of the Islamic faith who wish to open an Islamic trading account with InstaForex can select from four types of live trading accounts.

There is no swap fee or overnight commission with the InstaForex Islamic Account, allowing Muslims to trade across several marketplaces easily.

Each account’s trading requirements remain the same after being converted to an Islamic account, making InstaForex’s swap-free or Islamic trading option attractive.

Benefits include avoiding having to compensate for the absence of overnight costs by increasing fees or spreads for traders transferring accounts, as is commonly done by other brokers.

What types of trading accounts does InstaForex offer, and how do they differ?

The broker provides a variety of trading accounts to cater to the diverse needs of traders. The primary account types often include Standard Accounts and ECN (Electronic Communication Network) Accounts.

What features are included with InstaForex trading accounts?

The broker trading accounts come with a range of features designed to enhance the trading experience. Features may include access to the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, which are renowned for their user-friendly interfaces and advanced charting tools.

How to open an InstaForex Account – A Step-by-Step Guide

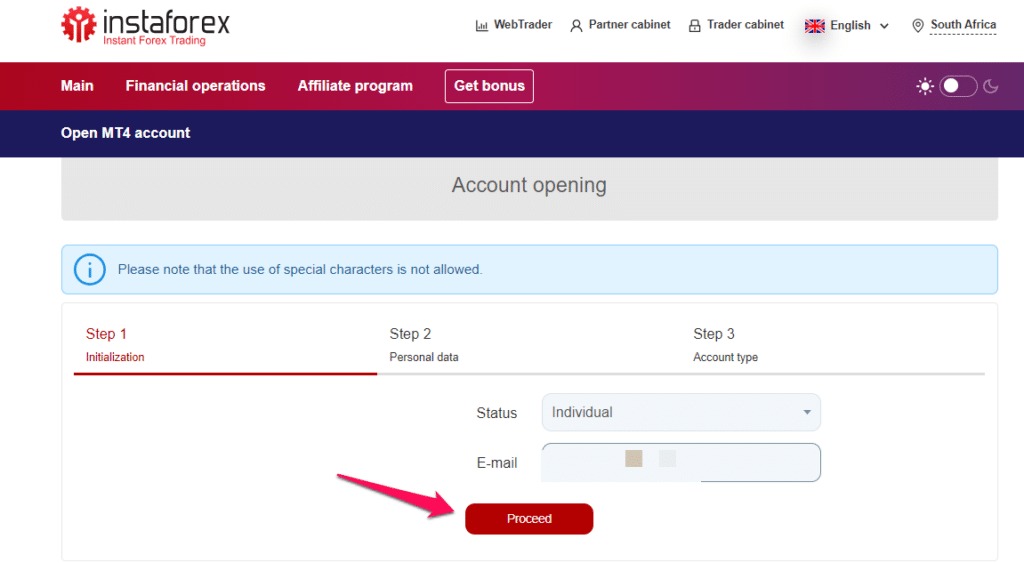

Step 1: Start the Registration Process.

In order to start the account registration process, the applicant can simply click on “Open Trading Account” located at the bottom left of the webpage. Once this has been done, a drop-down menu will appear that makes a registration option available.

Step 2: Complete the Registration Process.

The applicant will be required to complete a simple registration form in order for the registration proceed to be completed. Press Proceed to step 2.

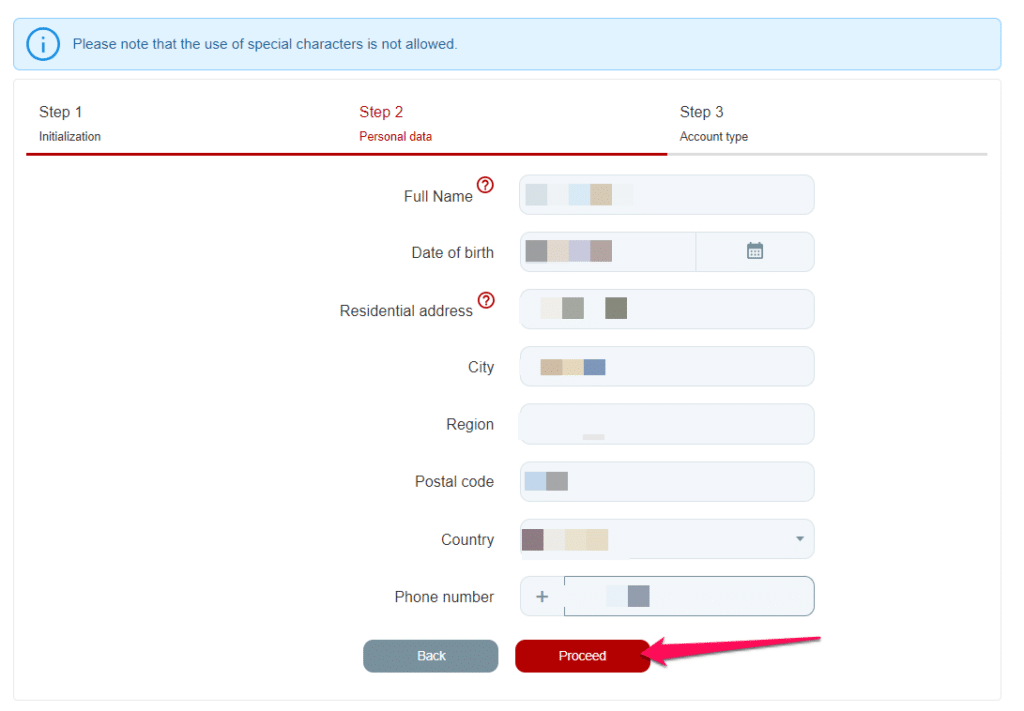

Step 3: Fill in your information

Fill in all your personal detials and press Preceed tp step 3.

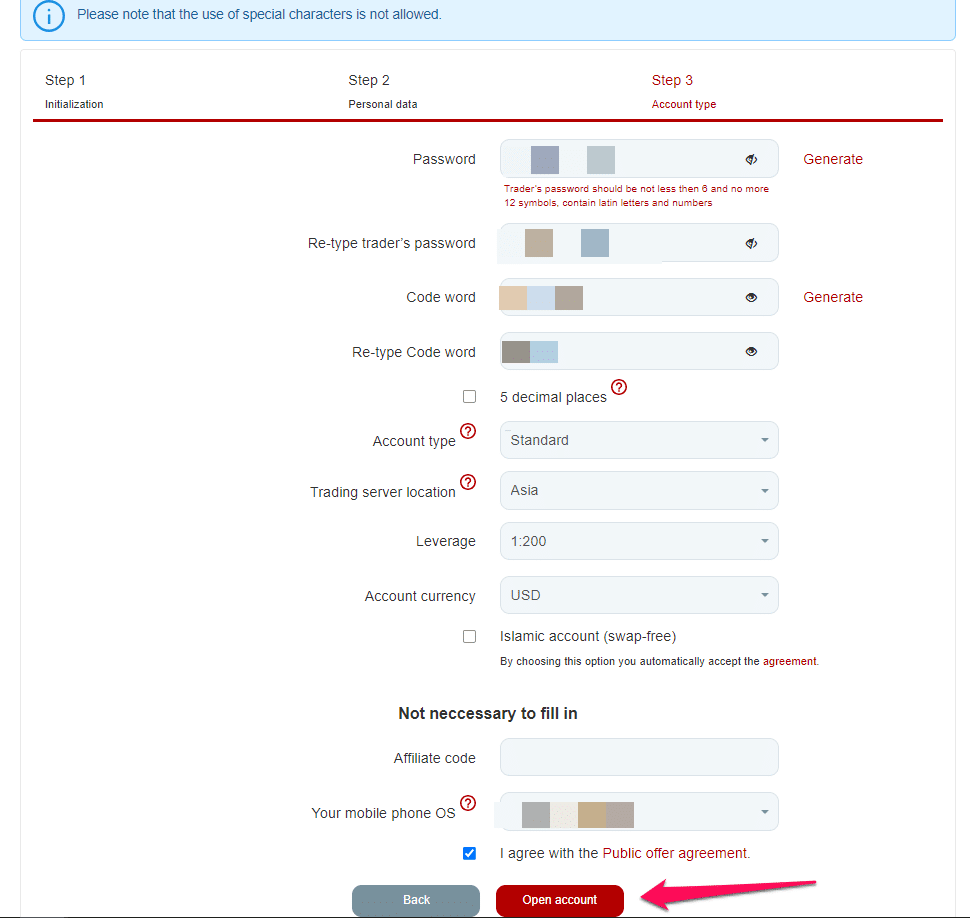

Step 4: Fill in final details

Fill in final details on step 3 to Open a account.

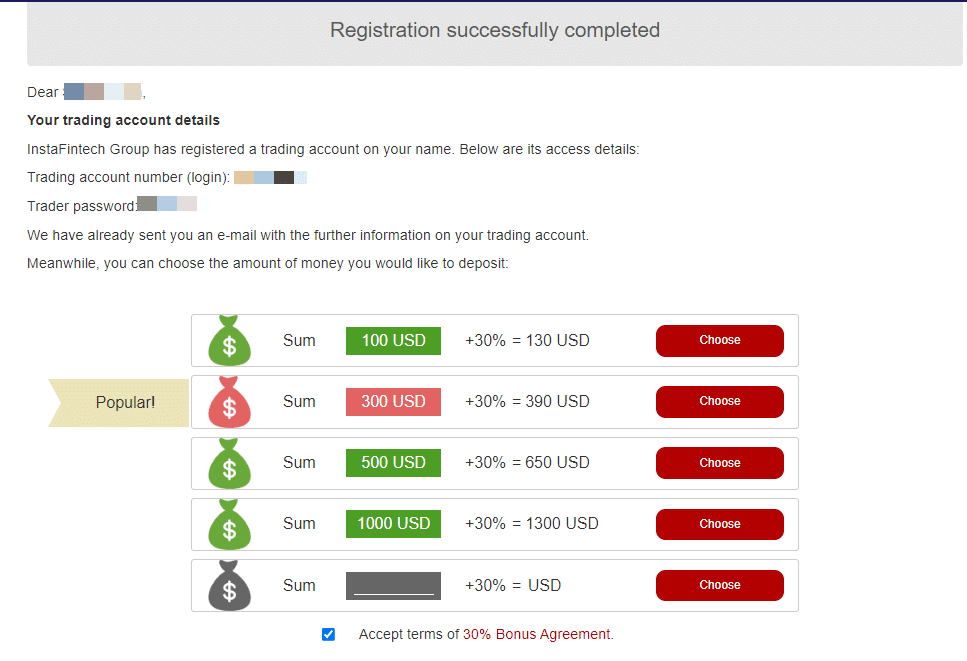

Step 5: Created

You will receive a email link to your new registered trading account.

InstaForex Vs GO Markets Vs JustMarkets – Broker Comparison

| 🥇 InstaForex | 🥈 GO Markets | 🥉 JustMarkets | |

| ⚖️ Regulation | FCA, BVI FSC, CySEC, FSA SVG | ASIC, FSA Seychelles, FSC Mauritius, CySEC | FSA |

| 📱 Trading Platform | • MetaTrader 4 • MetaTrader 5 • WebIFX • InstaForex Multi-Terminal • InstaForex WebTrader • InstaTick Trader • InstaForex MobileTrader | • MetaTrader 4 • MetaTrader 5 | • MetaTrader 5 • MetaTrader 4 • JustMarkets App |

| 💰 Withdrawal Fee | Yes | No | No |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 13 BWP | 1,700 BWP | 13 BWP |

| 📊 Leverage | 1:1000 | Up to 1:500 | Up to 1:3000 |

| 📊 Spread | 0.0 pips | 0.0 pips | 0.0 pips |

| 💰 Commissions | 0.03% to 0.07% | From US$2.50 | $3 units per lot/side |

| ✴️ Margin Call/Stop-Out | 30%/10% | 80%/50% | 40%/20% |

| 💻 Order Execution | Instant | Instant | Instant |

| 💳 No-Deposit Bonus | Yes | No | Yes |

| 📊 Cent Accounts | Yes | No | Yes |

| 📈 Account Types | • Insta.Standard Trading Account • Insta.Eurica Trading Account • Cent.Standard Trading Account • Cent.Eurica Trading Account | • Standard Account • GO+ Account | • MT4 Standard Cent Account • MT4 Standard Account • MT4 Pro Account • MetaTrader 4 Raw Spread Account • MT5 Standard Account • MT5 Pro Account • MT5 Raw Spread Account |

| ⚖️ CBN Regulation | No | No | No |

| 💳 BWP Deposits | Yes | No | Yes |

| 📊 Botswana Pula Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/5 | 24/5 |

| 📊 Retail Investor Accounts | 4 | 2 | 7 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 📉 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | 100 lots | 250 lots | 100 lots |

| 💰 Minimum Withdrawal Time | Instant | Instant | Instant |

| 📊 Maximum Estimated Withdrawal Time | Up to 6 working days | 1 to 3 business days | 10 bank days |

| 💸 Instant Deposits and Instant Withdrawals? | Yes | Yes | Yes |

InstaForex Trading Platforms

The broker offers Botswana traders a choice between these trading platforms:

- MetaTrader 4

- MetaTrader 5

- WebIFX

- InstaForex Multi-Terminal

- InstaForex WebTrader

- InstaTick Trader

- InstaForex MobileTrader

MetaTrader 4

A robust charting suite is among the many tools available to InstaForex MetaTrader4 users for tracking financial instruments and analysing the markets.

Professional-grade trading resources include free VPS hosting, the option to trade with expert advisors (EAs), the capacity to engage in scalping or hedging, and access to Money Manager solutions and APIs for PAMM accounts.

InstaForex makes all sorts of MT4 extensions, including “magic buttons” and “one-click trading,” available. Furthermore, one-click trading is highly effective because it enables you to trade with the same settings every time with a click.

MetaTrader 5

When Botswanans use MT5, an upgraded version of MT4, they may look forward to a wider range of features and capabilities than what was available to them in MT4.

Additional order types, expert advisors, market signals, and “one-click” trading are also featured, and several built-in indicators are offered.

InstaForex has taken advantage of MetaTrader’s established platform, user-friendliness, and design to serve its traders better. In addition, you can find even more customization choices in the Client Cabinet.

WebIFX

InstaForex’s WebIFX platform is the only one of its kind. As a result, Botswanans can benefit from its web interface that can be used without downloading any extra software.

In most cases, you only need a computer with a browser installed to do business from anywhere in the world. For example, trading charts can be opened, managed, closed, and analysed as they would on a conventional desktop trading platform, thanks to WebIFX.

Multi-Terminal

The MultiTerminal allows InstaForex Multi-Terminal Traders to manage multiple accounts at once. If you manage the financial assets of other people, this is a particularly useful tool for you.

The system is intended for investors who want to deposit any amount of money into a managed account and money managers who need to manage the funds of several clients.

Investors benefit if the account is profitable, while the money manager is compensated with a success fee. In addition, the monitoring tool provided by InstaForex enables you to view data over time and apply various filters to see only the accounts that are significant to you.

WebTrader

WebTrader is a trading platform developed by InstaForex and made available exclusively to the broker’s customers. Traders can do business without installing additional software by conducting transactions in the browser.

To participate in trading, you only need access to the Internet and a computer or mobile device. WebTrader’s sophisticated user base can benefit from the platform’s many trading features an extensive toolbox.

InstaTick Trader

To facilitate transactions, InstaForex created its own trading platform called InstaTick Trader. In the world of tick trading, this is a must-have. Six-digit quote precision is a major selling point.

Since even little swings significantly impact profit estimations, traders may use this feature to their advantage. With InstaTick Trader, investors may trade on the web without installing additional software.

MobileTrader

The trading platform, MT4 desktop apps, and online versions are fully compatible with MobileTrader, the company’s proprietary trading software. As a result, you will find it simpler to manage your trading account and engage in foreign exchange trading while using this software.

What trading platforms does InstaForex offer, and how do they differ?

The broker provides access to the widely acclaimed MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. Both platforms offer user-friendly interfaces, advanced charting tools, and a variety of technical indicators to assist traders in their analysis.

Can I trade on InstaForex using my mobile device, and what features are available on the mobile platforms?

Absolutely. InstaForex recognizes the importance of mobile trading and offers mobile versions of both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) for both iOS and Android devices.

Range of Markets

Botswanan traders can expect the following range of markets:

➡️ Forex

➡️ Shares

➡️ Indices

➡️ Precious Metals

➡️ Energies

➡️ Commodity Futures

➡️ Cryptocurrencies

➡️ InstaFutures

Financial Instruments and Leverage offered

| 🔨 Instrument | 💰 Number of Assets Offered | 📈 Max Leverage Offered |

| ➡️ Forex | 110 | 1:1000 |

| ➡️ Shares | 83 | – |

| ➡️ Indices | 15 | 1:100 |

| ➡️ Precious Metals | 4 | 1:100 |

| ➡️ Energies | 17 | 1:100 |

| ➡️ Commodity Futures | 53 | 1:100 |

| ➡️ Cryptocurrencies | 12 | Variable |

| ➡️ InstaFutures | 2 | – |

What financial instruments are available for trading on InstaForex?

The broker offers a diverse range of tradable instruments across various asset classes, providing traders with numerous opportunities for investment. The primary asset classes include forex, commodities, indices, and cryptocurrencies.

Does InstaForex offer cryptocurrency trading, and what cryptocurrencies are available on the platform?

Yes, InstaForex recognizes the growing popularity of cryptocurrencies and allows traders to engage in cryptocurrency trading. The platform typically offers a selection of popular digital assets, including but not limited to Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP).

Broker Comparison for Range of Markets

| 🥇 InstaForex | 🥈 GO Markets | 🥇 JustMarkets | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | No | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | No | Yes |

| ➡️️ Options | Yes | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | No | No |

Trading and Non-Trading Fees

Spreads

According to the account being used, the financial instrument being traded, and the general trading environment on the trading day, InstaForex assesses a spread. Following are some typical spreads on EUR/USD that Botswanans can anticipate based on their account type:

➡️ Standard Trading Account – Spreads between 3 to 7 pips.

➡️ Eurica Trading Account – Spreads from 0.0 pips.

➡️ Standard Trading Account – Spreads between 3 to 7 pips.

➡️ Eurica Trading Account – Spreads from 0.0 pips.

Spreads on a few other instruments are as follows:

➡️ Shares – from 2 pips

➡️ Indices – from $0.01

➡️ Metals – from 40 pips

➡️ Energies – $10

➡️ Commodity Futures – $10

➡️ Cryptocurrencies – from 25 pip

➡️ InstaFutures – $0.01

Commissions

Accounts with zero-pip spreads are subject to commission fees to meet InstaForex’s transaction execution costs. However, only on the Eurica accounts are commissions between 0.03% and 0.07% levied.

Additionally, with some financial products, Botswanans can anticipate the following commission costs:

➡️ Energies – $30 per round turn

➡️ Commodity Futures – $30 per round turn

➡️ Cryptocurrency – 0.1%

➡️ InstaFutures – 0.5%

Overnight Fees, Rollovers, or Swaps

Depending on the trader’s position when the transaction was initiated, fees are either subtracted from or added to the trader’s account (long or short).

The computation of overnight costs considers the size of the position, the type of financial instrument being traded, the interbank rate, and the amount of time the position has been open. Examples of regular overnight fees include the following:

➡️ EUR/USD – with a long swap of -0.61 pips and a short swap of -0.08 pips.

➡️ Shares – with a long swap of -7% and a short swap of -2%.

➡️ Spot Silver – with a long swap of -2.71 pips and a short swap of -1.54 pips.

➡️ Spot Gold – with a long swap of -21.81 pips and a short swap of -7.01.

➡️ Cryptocurrencies – with a long swap of -0.05% and a short swap of -0.05%.

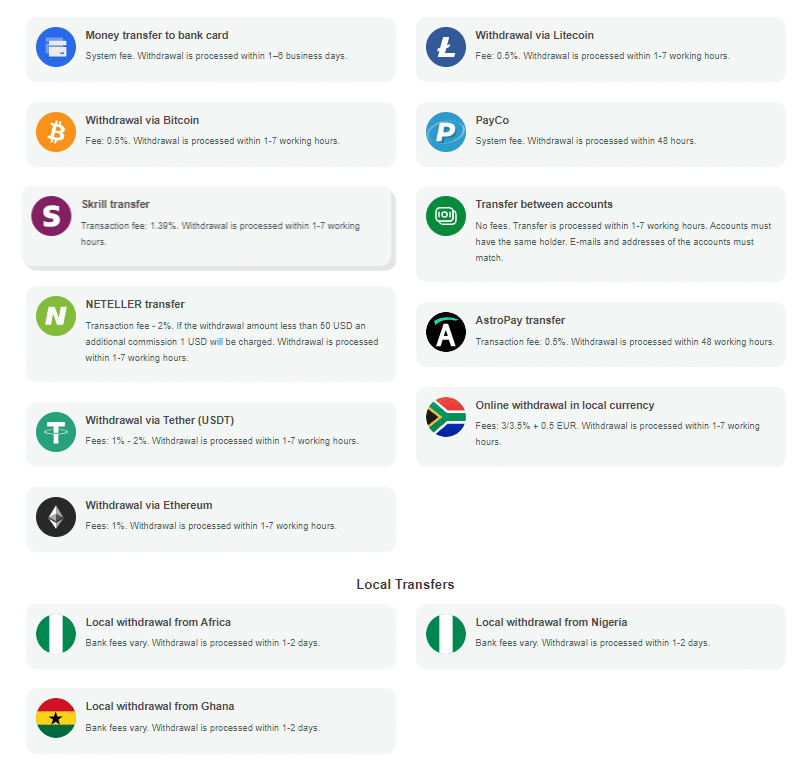

Deposit and Withdrawal Fees

While InstaForex does not charge any fees for deposits, it does charge the following fees for withdrawals:

➡️ Credit Card – System Fees

➡️ Debit Card – System Fees

➡️ Cryptocurrency (Bitcoin and Litecoin) – 0.5%

➡️ PayCo – System Fees

➡️ Skrill – Transaction fee of 1.39%

➡️ Southeast Asia Bank Transfers – Fees of 2% plus 0.3 EUR

➡️ Neteller – Transaction fee of 2%

➡️ AstroPay – Transaction fee of 0.5%

➡️ Philippines Online Banking – Fees of 1.75%

➡️ Africa Online Transfers – 3/3.5% plus 0.5 EUR

➡️ Other Crypto Payments – 1% fee

➡️ NEO – 1.6% Fees

➡️ Online Transfers of 6.5% along with a $0.5 Fee

Inactivity Fees

After a specific amount of inactivity, the broker does not impose any fees when a live trading account becomes dormant.

Currency Conversion Fees

Currency conversion fees will be charged if traders deposit money in a currency other than the base account currency. The currency conversion price is determined by the current market rate, displayed in the Client Cabinet and on InstaForex’s official website.

What are the trading fees associated with InstaForex, and how are they structured?

The broker employs a transparent fee structure primarily based on spreads for various financial instruments, including forex, commodities, indices, and cryptocurrencies. The spread is the difference between the buying (ask) and selling (bid) prices of an asset. Traders should be aware that the specific spread may vary depending on the asset being traded and market conditions.

Does InstaForex offer cryptocurrency trading, and what cryptocurrencies are available on the platform?

Yes, the broker recognizes the growing popularity of cryptocurrencies and allows traders to engage in cryptocurrency trading. The platform typically offers a selection of popular digital assets, including but not limited to Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP).

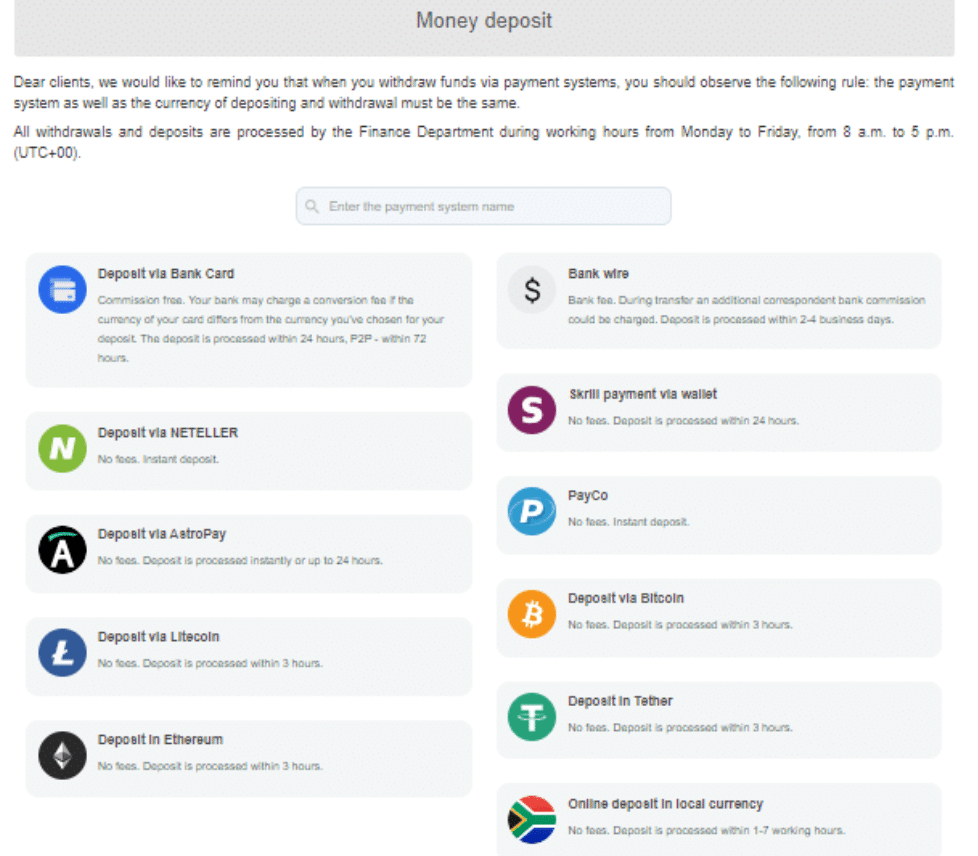

InstaForex Deposits and Withdrawals

Offers the following deposit and withdrawal methods:

➡️ SAR Online Banking

➡️ Debit Card

➡️ Credit Card

➡️ Skrill

➡️ Southeast Asia Bank Transfers

➡️ Asia United Bank

➡️ Banco de Oro

➡️ Bank of the Philippine Islands

➡️ Chinabank

➡️ ph

➡️ EastWest

➡️ EON by Unionbank

➡️ ePSBank Online

➡️ Landbank

➡️ Maybank

➡️ Metrobank

➡️ Philippine National Bank

➡️ RCBC

➡️ Robinsons Bank

➡️ Security Bank

➡️ UCPB

➡️ Unionbank

➡️ Neteller

➡️ PayCo

➡️ Payment Asia

➡️ Africa Online Transfers

➡️ Thai QR Payment

➡️ AstroPay

➡️ Cryptocurrencies

➡️ Local Indonesian Bank Transfer

➡️ Local China Bank Transfer

➡️ Local Indica Bank Transfer

➡️ Local Malaysian Bank Transfer

➡️ Local Nigerian Bank Transfer

➡️ Local Ghana Bank Transfer

➡️ Local Singapore Bank Transfer

➡️ Local Pakistan Bank Transfer

➡️ Local Korean Bank Transfer

➡️ Local Thailand Bank Transfer

➡️ Local Bangladesh Bank Transfer

➡️ Local UAE Bank Transfer

➡️ Local Bahrain Bank Transfer

➡️ Local Qatar Bank Transfer

➡️ Local Saudi Arabia Bank Transfer

➡️ Local Oman Bank Transfer

➡️ Local Philippines Bank Transfer

➡️ Local Kuwait Bank Transfer

Broker Comparison: Deposit and Withdrawals

| 🥇 InstaForex | 🥈 GO Markets | 🥉 JustMarkets | |

| Minimum Withdrawal Time | Instant | Instant | Instant |

| Maximum Estimated Withdrawal Time | Up to 6 working days | 1 to 3 business days | 10 bank days |

| Instant Deposits and Instant Withdrawals? | Yes | Yes | Yes |

Payment Methods, Deposit and Withdrawal Processing, and Withdrawal Fees

| 💳 Payment Method | 💵 Deposit Processing Time | 💳 Withdrawal Fee | 💸 Withdrawal Processing Time |

| SAR Online Banking | 24 hours | – | 1 – 6 Days |

| Debit Card | 24 hours | System Fee | 1 – 6 Days |

| Credit Card | 24 hours | System Fee | 1 – 7 hours |

| Skrill | 24 hours | 1.39% | 1 – 7 hours |

| Southeast Asia Bank Transfers | Between 1 – 7 hours | 2% + 0.3 EUR | 1 – 7 hours |

| Asia United Bank | Between 1 – 7 hours | 1.75% (5 EUR min) | 1 – 7 hours |

| Banco de Oro | Between 1 – 7 hours | 1.75% (5 EUR min) | 1 – 7 hours |

| Bank of the Philippine Islands | Between 1 – 7 hours | 1.75% (5 EUR min) | 1 – 7 hours |

| Chinabank | Between 1 – 7 hours | 1.75% (5 EUR min) | 1 – 7 hours |

| Coins.ph | Between 1 – 7 hours | 1.75% (5 EUR min) | 1 – 7 hours |

| EastWest | Between 1 – 7 hours | 1.75% (5 EUR min) | 1 – 7 hours |

| EON by Unionbank | Between 1 – 7 hours | 1.75% (5 EUR min) | 1 – 7 hours |

| ePSBank Online | Between 1 – 7 hours | 1.75% (5 EUR min) | 1 – 7 hours |

| Landbank | Between 1 – 7 hours | 1.75% (5 EUR min) | 1 – 7 hours |

| Maybank | Between 1 – 7 hours | 1.75% (5 EUR min) | 1 – 7 hours |

| Metrobank | Between 1 – 7 hours | 1.75% (5 EUR min) | 1 – 7 hours |

| Philippine National Bank | Between 1 – 7 hours | 1.75% (5 EUR min) | 1 – 7 hours |

| RCBC | Between 1 – 7 hours | 1.75% (5 EUR min) | 1 – 7 hours |

| Robinsons Bank | Between 1 – 7 hours | 1.75% (5 EUR min) | 1 – 7 hours |

| Security Bank | Between 1 – 7 hours | 1.75% (5 EUR min) | 1 – 7 hours |

| UCPB | Between 1 – 7 hours | 1.75% (5 EUR min) | 1 – 7 hours |

| Unionbank | Between 1 – 7 hours | 1.75% (5 EUR min) | 1 – 7 hours |

| Neteller | Between 1 – 7 hours | 2% | 1 – 7 hours |

| PayCo | Between 1 – 7 hours | System fee | 1 – 7 hours |

| Payment Asia | Instant | – | 48 hours |

| Africa Online Transfers | Instant | 3%/3.5% + 0.5 EUR | – |

| Thai QR Payment | 3 hours | – | 1 – 7 hours |

| AstroPay | 24 hours | 0.5% | – |

| Cryptocurrencies | 3 hours | 0.5% to 1.6% | 48 hours |

| Local Indonesian Bank Transfer | 1 – 2 Days | Bank Fees | 1 – 7 hours |

| Local China Bank Transfer | 1 – 2 Days | Bank Fees | 1 to 2 days |

| Local Indica Bank Transfer | 1 – 2 Days | Bank Fees | 1 to 2 days |

| Local Malaysian Bank Transfer | 1 – 2 Days | Bank Fees | 1 to 2 days |

| Local Nigerian Bank Transfer | 1 – 2 Days | Bank Fees | 1 to 2 days |

| Local Ghana Bank Transfer | 1 – 2 Days | Bank Fees | 1 to 2 days |

| Local Singapore Bank Transfer | 1 – 2 Days | Bank Fees | 1 to 2 days |

| Local Pakistan Bank Transfer | 1 – 2 Days | Bank Fees | 1 to 2 days |

| Local Korean Bank Transfer | 1 – 2 Days | Bank Fees | 1 to 2 days |

| Local Thailand Bank Transfer | 1 – 2 Days | Bank Fees | 1 to 2 days |

| Local Bangladesh Bank Transfer | 1 – 2 Days | Bank Fees | 1 to 2 days |

| Local UAE Bank Transfer | 1 – 2 Days | Bank Fees | 1 to 2 days |

| Local Bahrain Bank Transfer | 1 – 2 Days | Bank Fees | 1 to 2 days |

| Local Qatar Bank Transfer | 1 – 2 Days | Bank Fees | 1 to 2 days |

| Local Saudi Arabia Bank Transfer | 1 – 2 Days | Bank Fees | 1 to 2 days |

| Local Oman Bank Transfer | 1 – 2 Days | Bank Fees | 1 to 2 days |

| Local Philippines Bank Transfer | 1 – 2 Days | 1.75% (5 EUR min) | 1 – 7 hours |

| Local Kuwait Bank Transfer | 1 – 2 Days | Bank Fees | 1 to 2 days |

How can I make a deposit into my InstaForex trading account, and what payment methods are supported?

Making a deposit into your trading account is a straightforward process. The broker typically supports various payment methods, including bank wire transfers, credit/debit cards, and popular e-wallet options such as Skrill and Neteller. To make a deposit, log in to your InstaForex account, navigate to the deposit section, and choose your preferred payment method.

How can I initiate a withdrawal from my InstaForex trading account, and what withdrawal options are available?

Initiating a withdrawal from your trading account is simple. Log in to your account, go to the withdrawal section, and select your preferred withdrawal method. InstaForex typically processes withdrawals using the same method that was used for the initial deposit. Withdrawal options may include bank transfers, credit/debit cards, and e-wallets.

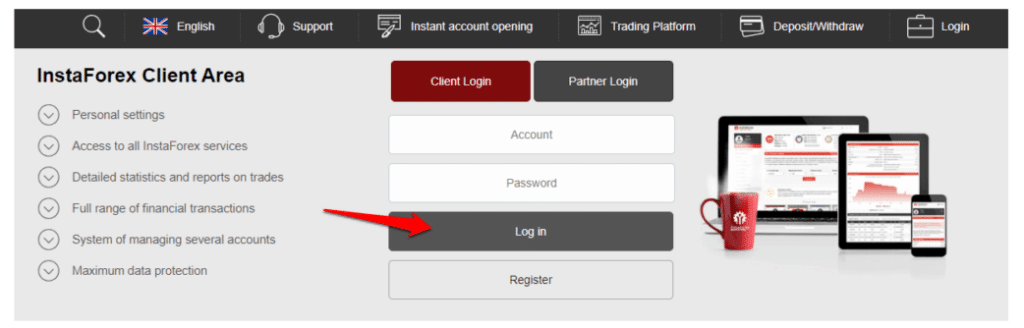

How to Deposit Funds with InstaForex

Step 1 – Log into your account

Step 1 – Log into your account

Traders can log into their personal area on their trading account.

Step 2 – Go to section for deposits and withdrawals

Step 2 – Go to section for deposits and withdrawals

Traders can navigate to the section dedicated to deposits and withdrawals.

Step 3 – Choose preferred payment method

Step 3 – Choose preferred payment method

Traders can select their preferred payment method, currency, and the amount they wish to deposit.

Step 4 – Confirm your deposit

Step 4 – Confirm your deposit

Lastly, traders can finalize and confirm their deposits.

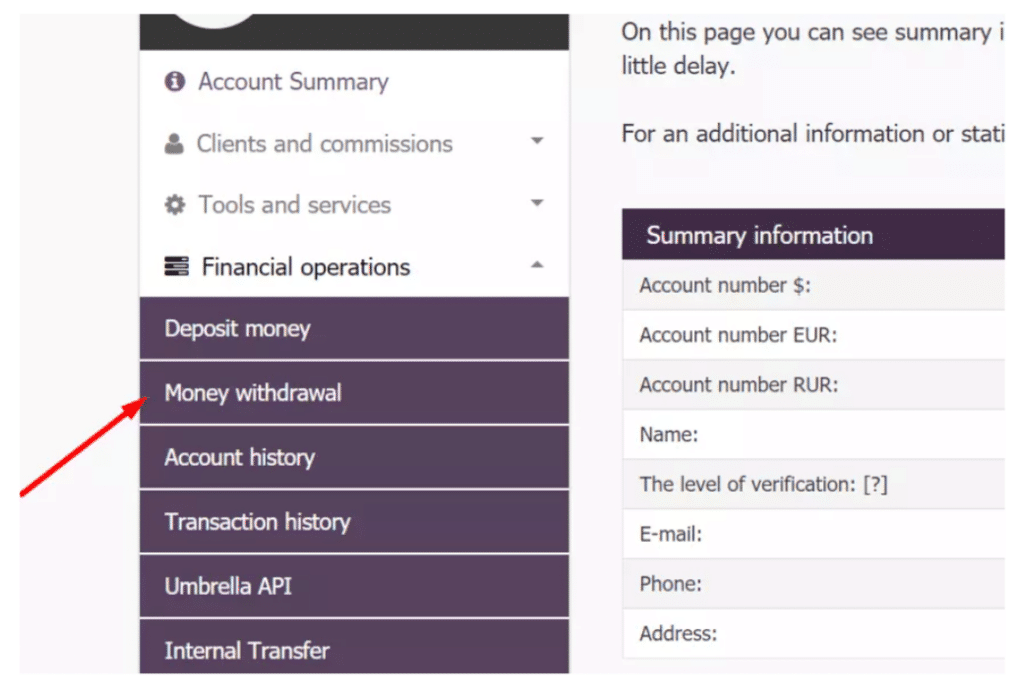

InstaForex Fund Withdrawal Process

To withdraw funds from an account with InstaForex, Botswanan traders can follow these steps:

- Log in to your trading account linked to your Demat account by providing a username and password. Navigate to the ‘Funds’ or ‘Accounts’ section and click on it.

- You will get two options: “Add Funds” or “Withdraw Funds.”

- Click on ‘Withdraw Funds’ to transfer money from the Demat account to your bank account.

- You will quickly see the total balance on your Demat account after the funds’ transfer. However, one can only transfer the funds once it is earned after selling the securities in the Demat account.

- When it comes to withdrawing funds, brokerage houses can put a particular fund cap depending on the trading leverage it offers. Remember that the amount one can pass is not equivalent to the trader’s fund cap. It is also based on the amount of money available in the trading account and the person’s shares in their Demat account.

- When transferring funds, type in the amount of money and the bank account to which the funds will be transferred. The sum is credited to the bank account based on the kind of account selected. Once you enter the password and press ‘enter’, the fund transfer will begin.

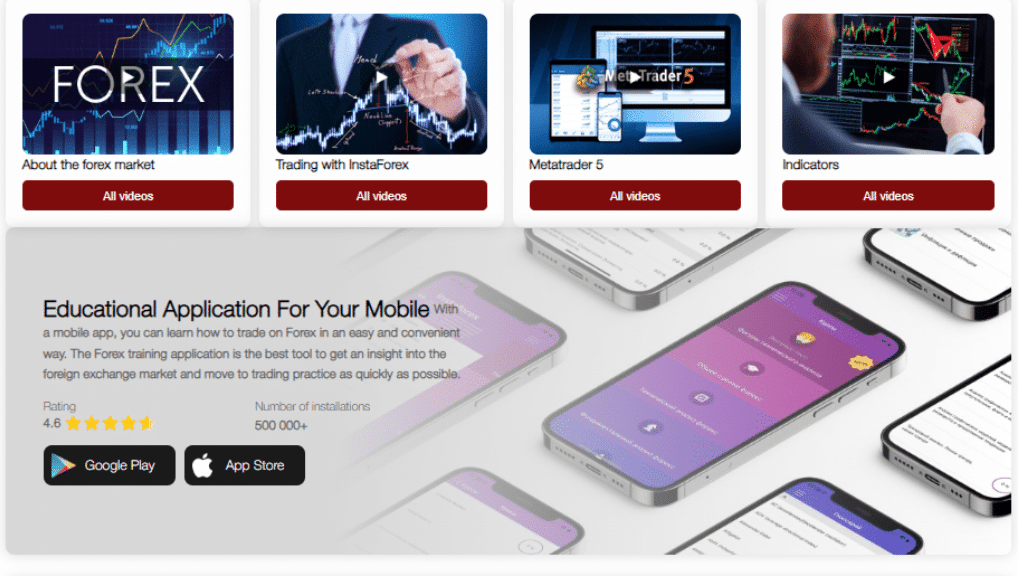

Education and Research

Education

Offers the following Educational Materials:

➡️ Demo Account

➡️ Training

➡️ Trading Platform Guidelines

➡️ FAQ Section

➡️ How to Start Trading

➡️ Video Tutorials

➡️ Forex Glossary

➡️ Knowledge Base

Research and Trading Tool Comparison

| 🥇 InstaForex | 🥈 GO Markets | 🥉 JustMarkets | |

| ➡️ Economic Calendar | Yes | Yes | Yes |

| ➡️ VPS | No | Yes | Yes |

| ➡️ AutoChartist | No | Yes | No |

| ➡️ Trading View | No | Yes | No |

| ➡️ Trading Central | No | Yes | Yes |

| ➡️ Market Analysis | Yes | Yes | No |

| ➡️ News Feed | Yes | Yes | Yes |

| ➡️ Blog | Yes | Yes | Yes |

InstaForex also offers Botswanan traders the following additional Research and Trading Tools:

➡️ Chief Strategies

➡️ Analytical Reviews

➡️ Economic Calendar

➡️ Video Analytics

➡️ InstaForex TV

➡️ Trading Sessions

➡️ News in Pictures

➡️ ForexCopy System

➡️ PAMM System

What educational resources does InstaForex offer to help traders enhance their skills and knowledge?

The broker is committed to empowering traders with a variety of educational resources. Traders can access webinars, video tutorials, and written guides covering a wide range of topics, from basic concepts to advanced trading strategies.

What research tools are available on InstaForex to assist traders in making well-informed decisions?

The broker equips traders with a variety of research tools designed to facilitate informed decision-making. The platform typically provides daily market analysis, economic calendars, and expert commentary to keep traders updated on significant market events and trends. Traders also have access to advanced charting tools and technical analysis resources, allowing for in-depth analysis of various financial instruments.

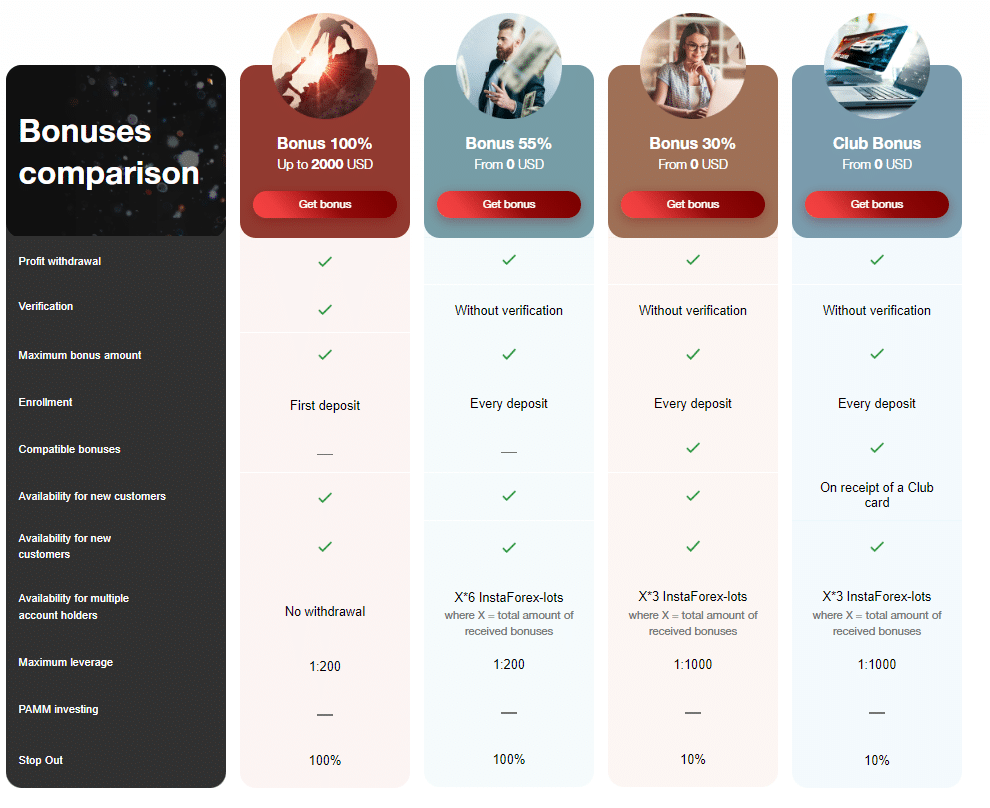

Bonuses and Promotions

InstaForex offers Botswanan traders the following bonuses and promotions:

➡️ 100% Deposit Bonus

➡️ 55% Deposit Bonus

➡️ 30% Deposit Bonus for recurring deposits

➡️ $1,000 Start-up No-deposit bonus

➡️ Ferrari from InstaForex

➡️ Lucky Trader

➡️ Chancy Deposit

➡️ Real Scalping

➡️ Great Race

➡️ FX-1 Rally

➡️ Ms InstaForex 2024

➡️ Free Devices

➡️ One Million Option

Does InstaForex offer bonuses to traders, and how do these bonus programs work?

Yes, the broker frequently runs bonus programs and promotions to enhance the trading experience for its clients. Bonus programs may include welcome bonuses, deposit bonuses, and other special promotions. The mechanics of these bonuses typically involve providing traders with additional funds based on their deposits or meeting certain trading volume requirements.

Does InstaForex organize trading contests or promotions, and how can traders participate?

Absolutely, the broker often organizes trading contests and promotions to engage traders and add excitement to the trading environment. These contests may include demo trading contests, live trading contests, or promotions with various incentives. Traders can participate by registering for the contests or promotions through the official InstaForex website. Contestants may compete for prizes such as cash rewards, trading credits, or other valuable gifts.

10 Best Forex Brokers in Botswana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

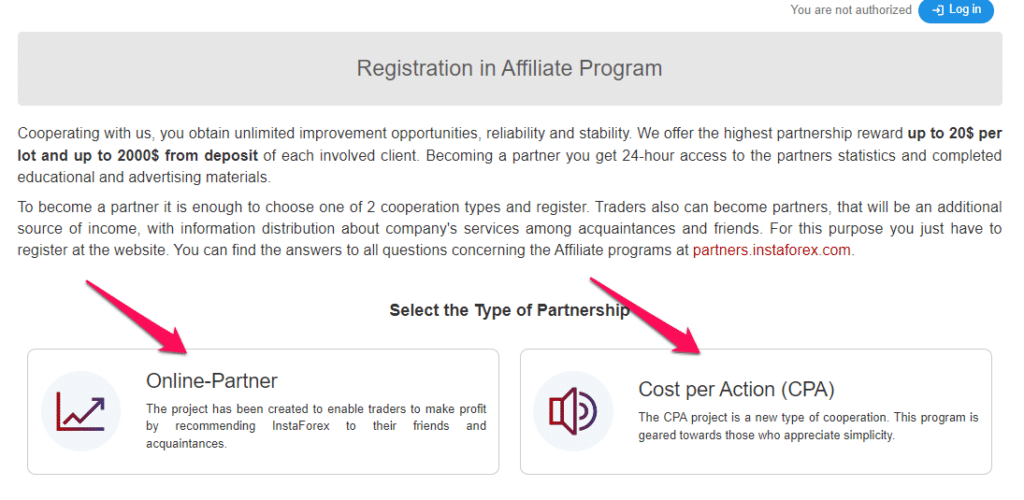

How to open an Affiliate Account

To register an Affiliate Account, Botswanan traders can follow these steps:

- Visit the website of InstaForex.

- Go to the Affiliate Programs page.

- Select the type of collaboration that best suits your preferences and goals. InstaForex has two types of partnerships available: Introducing Broker (IB) and Webmaster.

- Fill in your personal information on the registration form, such as your name, email address, and phone number.

- Fill out the “Comments” field with a detailed description of your proposed work and any additional information to help the InstaForex team understand your goals and expectations.

- After completing the form, click the “Register” or a similar button to submit your application for an Affiliate Account.

- Examine your email. When your Affiliate Account is activated, you will receive an email with your account information and a password. This email will also contain a link to the Partner Cabinet, where you can log in to your account.

InstaForex Affiliate Program Features

Botswanans could become Online Partners or Cost Per Action (CPA) Partners. When Botswanans choose to work with InstaForex, they might expect the following characteristics of the affiliate program: Attractive commissions of $10 to $13.3 every market lot transacted by customers

➡️ Multi-level affiliate program

➡️ Brand development

➡️ Private Manager

➡️ Multilingual support

How does the InstaForex affiliate program operate, and what are its key features?

The affiliate program operates on a commission-based structure, allowing individuals or entities (affiliates) to earn commissions by referring new clients to the platform. Affiliates receive unique tracking links or codes to identify their referred clients. Commissions are typically based on the trading activity of the referred clients, such as a percentage of the spreads or a share of the trading volume.

What support and tools does the InstaForex affiliate program provide to its partners?

The affiliate program is equipped with a range of support and tools to empower partners for success. Affiliates typically have access to a dedicated affiliate dashboard, where they can generate tracking links, monitor referral activity, and track commissions in real-time.

Customer Support

Customer assistance is available in 18 languages, including English, Arabic, Portuguese, Chinese, Indonesian, Malay, and others, through email, live chat, Skype, and rapid call-back service.

In addition, multiple chat programs, including WhatsApp, Telegram, and Viber, are available for technical support. Client services are available from 8 am to 5 pm (UTC +00), and technical support is offered 24 hours a day, five days a week.

| Customer Support | InstaForex’s Customer Support |

| ⏰ Operating Hours | 24/5 |

| 🗣 Support Languages | 18 languages |

| 🗯 Live Chat | Yes |

| 📧 Email Address | Yes |

| ☎️ Telephonic Support | Yes |

| 📞 Local Support in Botswana? | No |

| 🥇 Overall quality of InstaForex Support | 4.8/5 |

Corporate Social Responsibility

The core value of the InstaForex Company is compassion in business. Accordingly, InstaForex pursues a vision encompassing corporate ethics and universal moral norms and values.

Social responsibility exemplifies how InstaForex’s staff considers the role of a genuinely contemporary company that preserves core human values amid extreme competitiveness and strong market rivalry.

According to these views, major businesses run by empathic individuals must include social responsibility in their operations. As a result, InstaForex Company has collaborated with many non-profit organizations and private people for many years.

InstaForex’s website is often updated with new initiatives representing the broker’s social responsibility philosophy. In addition, InstaForex supports the following organizations and activities.

Our Verdict

InstaForex, a multiple-award-winning online trading broker, serves a massive clientele from all corners of the world. InstaForex is the greatest online resource for financial brokers and makers who are interested in learning more about online trading.

Furthermore, you will better understand the current initiatives in the Forex and financial markets. InstaForex is one of the best places to enter the world of foreign exchange trading.

In addition, several trading and expert strategies tutorial videos are also accessible online. The registration process takes just a few minutes, and the first investment is merely a dollar (13 BWP). They provide a free sample account to help you evaluate them before committing any money.

You might also like: Global GT Review

You might also like: GO Markets Review

You might also like: HF Market Review

You might also like: IC Markets Review

You might also like: FOREX.com Review

Pros and Cons

| ✔️ Pros | ❌ Cons |

| InstaForex offers a range of instruments that can be traded over powerful platforms | There is a limited selection of individual stocks |

| InstaForex is a beginner-friendly broker with several educational materials and tools | Withdrawal fees apply |

| There is a comprehensive ForexCopy system for Botswanans who want trading signals | There is no BWP-denominated account offered |

| Commission-free trading accounts are available | |

| There is free VPS offered to eligible traders | |

| Botswanans can register practice accounts | |

| There is an ultra-low minimum deposit of 1 USD / 13 BWP | |

| InstaForex is praised for its excellent customer support |

Conclusion

Now it is your turn to participate:

➡️ Do you have any prior experience with InstaForex?

➡️ What was the determining factor in your decision to engage with InstaForex?

➡️ Was it because of the minimum deposit, regulation, retail trading accounts, or other factors?

➡️ Have you experienced issues with InstaForex, such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

Regardless, please share your thoughts in the comments below.

Frequently Asked Questions

Does InstaForex have limits on withdrawals?

There are no minimum or maximum withdrawals, and Botswanans can withdraw their free margin anytime.

Does InstaForex have Nasdaq?

InstaForex provides commission-free trading of Nasdaq using the “#NDX” symbol.

Is InstaForex good for beginners?

InstaForex is a wonderful platform for first-time traders. InstaForex has created a forex trading solution for beginners that facilitates education, connection, and financial gain by fusing a realistic Forex training course with social networking features.

You may also gain from InstaForex ForexCopy, a service that mirrors the transactions of successful traders in real-time.

Does InstaForex have Volatility 75?

While InstaForex offers various CFDs on Indices, Volatility 75 is not one of them.

Does InstaForex give a No-Deposit Bonus?

An InstaForex account may be opened with $1,000 in bonus funds with no initial deposit required. In addition, new clients will get a fixed amount called the No-Deposit Bonus added to their accounts upon signing up with InstaForex.

What is the minimum deposit for InstaForex?

The minimum deposit for InstaForex is 1 USD / 13 BWP when traders register an account.

What is the withdrawal time with InstaForex?

With InstaForex, the time it takes to receive funds might be anything from instantly to up to 6 business days.

Is InstaForex regulated?

The Financial Conduct Authority (FCA) in the United Kingdom, the Cyprus Securities Exchange Commission (CySEC), the British Virgin Islands Financial Services Commission (BVI FSC), and Saint Vincent and the Grenadines Financial Services Authority (FSA SVG) all regulate InstaForex to a high standard.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review