10 Best Forex Trading Strategies in Botswana

The 10 Best Forex Trading Strategies in Botswana revealed. We tested the best forex trading strategies for Botswana Traders.

This is a complete guide to forex trading strategies in Botswana.

In this in-depth guide you’ll learn:

- What is a Forex Trading Strategies?

- What are some recommended forex trading strategies for beginners in Botswana?

- How to compare the best trading strategies against each other.

- Which brokers offer a sign-up bonus for first-time traders in Botswana?

- What is a forex trading plan?

- What strategy should you follow for consistent profits?

And lots more…

So if you’re ready to go “all in” with the best-tested forex trading strategies…

Let’s dive right in…

- Louis Schoeman

10 Best Forex Brokers in Botswana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

What is a Forex Trading Strategy, and Why is it Important to have one?

A careful market study can determine the optimal entry and exit locations, position size, and trade timing in forex trading. To this, employing technical indicators, which a trader consults to foretell the market’s behaviour, is not out of the question.

Depending on their needs and preferences, experienced traders can combine aspects of many different approaches to analysis and trading.

However, we recommend that Botswanans consider beginner-friendly day trading techniques if you are starting in the trading world.

Your success in the markets depends on your ability to enter and exit trades according to a well-thought-out trading strategy that maximizes profits and minimizes losses. You can use technical or fundamental analysis for your trading strategy.

10 Best Forex Trading Strategies in Botswana

- ✔️ Breakout Strategy – Overall, Best Forex Trading Strategy in Botswana

- ✔️ Moving Average Crossover – Best Price Volatility Strategy

- ✔️ Scalping – Top Strategy for Experienced Traders

- Relative Strength Index – Best Foreign Currency Strategy for Botswana Traders

- Bladerunner – Top Analytical Technical Trading Strategy

- Day Trading – Most Trading Opportunities for Daily Trading

- Parabolic SAR – Possibility for Largest Gains

- MACD Strategy – Best Strategy to Spot Trends

- Position Trading – Best Strategy for Stop-Loss Order

- Trend Trading – Best Strategy to Utilize Systems

1. Breakout Strategy

Overview

Individuals that use a breakout approach are known as breakout traders. The idea behind this approach is to wait for a security to break through a level or region it has been stuck at (as it could keep moving in that direction).

A price “breaks out” when it passes through one of these points. Many breakout traders rely on technical analysis to locate potential breakout zones, namely, trendlines and price patterns.

A breakout trader is looking for trends, such as when the price of a security has been unable to break through a resistance level. The trader then tries to profit by initiating a trade in the breakout direction, betting that the price will continue to move in that direction.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Botswanans can profit from quick moves in the forex market | Traders must think on their feet |

| Traders can easily define their market entry and exit points | There is a risk that traders could receive false signals |

| The strategy is simple, and traders can use it using only price action | Additional confirmation signals might decrease the odds of identifying a profitable move |

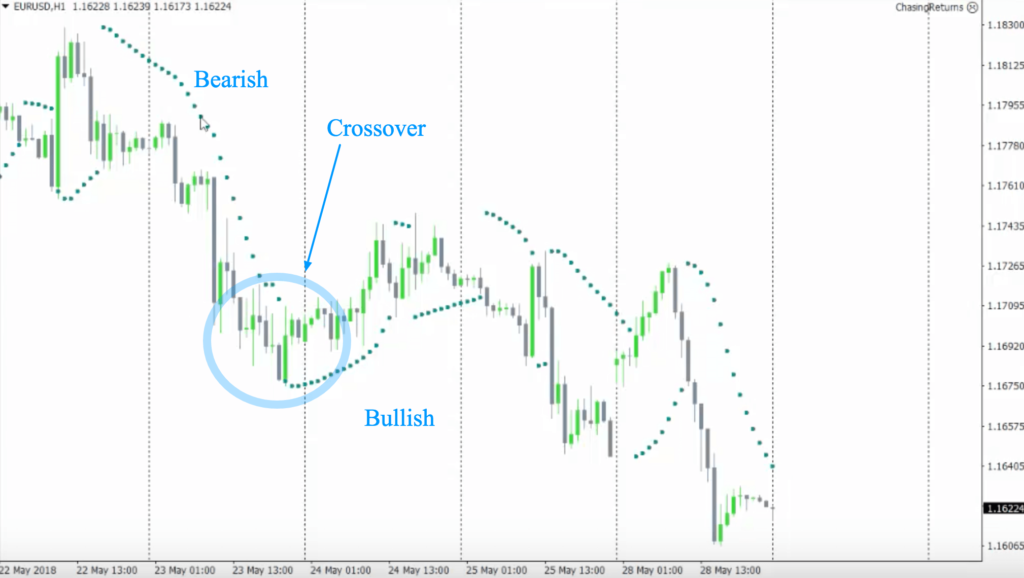

2. Moving Average Crossover

Overview

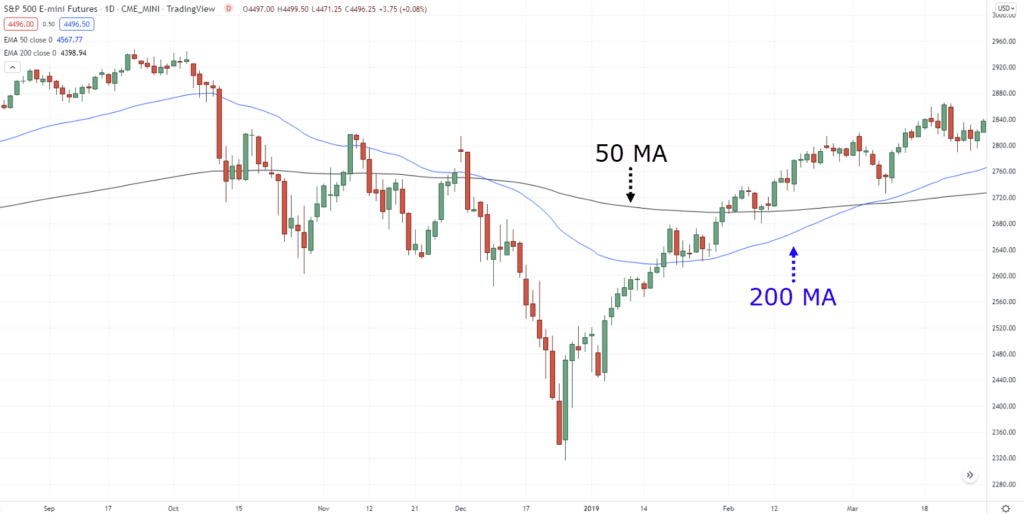

Moving average (MA) is a common tool in technical analysis that offsets price volatility. The timeframe over which this average is calculated is entirely up to the trader; examples range from 20 minutes to 3 days to 30 weeks.

The widespread use of moving average tactics may be attributed to their flexibility; these methods can be adapted to meet the needs of both long-term investors and day traders.

Indicating trend direction and finding support and resistance levels are two frequent uses for moving averages.

When the value of an asset rises above or falls below its moving average, it may be interpreted as a trading signal by technical traders.

For example, a trader may decide to sell when a price retraces above the MA or crosses above the MA with the intention of closing below the MA.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| For novice traders, the ease of use of most moving average trading methods is a major selling point | Although moving average tactics may be effective, many investors over-invest in them |

| Algorithmic traders, who often buy and sell according to predetermined algorithms, find moving average systems to be particularly alluring | Sustaining interest in this approach over the long run requires a great deal of mental strength |

| With the help of moving averages and the right approach, you can always trade in line with the market’s general trend | |

| Trading is simplified by the mechanistic nature of moving average tactics |

3. Scalping

Overview

The goal of scalping is to profit from tiny price fluctuations often occurring during the trading day. Some traders aim for as little as 5 pips every transaction, and their holding period for open positions may be from a few seconds to several minutes.

Scalpers must be analytical and fast on the draw to make calculated bets under intense time constraints. Consequently, they devote more time to the computer and often specialize in one or two marketplaces.

Being a scalper may have perks since it frees you from having to hold positions overnight or understand long-term fundamentals, allowing you to concentrate on the market for a limited period.

However, you must be under great stress if you want to succeed in scalping because you must always pay close attention to your trade.

In addition, while your transactions are live for just minutes, it is simpler to make errors and react impulsively. Therefore, it might not be the best trading strategy for novices.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The basic analysis on which scalping is based is less tedious and more engaging than the technical analysis | Problems such as slippage, slow order processing, platform failure, and others |

| You can have a higher success rate with scalping | Unpredictable price fluctuations that are negligible over the long run might trigger a stop order in the near term |

| When the market is stable, scalping can be extremely profitable | Forex scalping is best suited for trading highly liquid currency pairs that exhibit only low to moderate volatility |

| You avoid being trapped by reversals in the market | Because of the enormous stakes and the necessity for laser-like concentration under pressure, scalping necessitates the use of quite large leverage, which raises the associated dangers |

| Scalping uses a negligible amount of starting capital |

4. Relative Strength Index

Overview

The RSI gauges the velocity and magnitude of recent price fluctuations. One of the most straightforward methods for evaluating market momentum while trading foreign currency.

The relative strength index (RSI) is shown as an oscillator in the form of a line graph on a typical price chart, and its range is anywhere from 0 to 100.

The Relative Strength Index (RSI) may indicate more than whether a security is overbought or oversold. It may be used as an indicator of when to buy or sell.

Additionally, the RSI may be used to identify currencies whose values are likely to correct or reverse the trend.

A relative strength index (RSI) score of 70 or above indicates an overbought market condition. Less than or equal to 30 indicates an oversold position. Tracking current price swings may benefit from EMAs with a quicker response time.

Short-term indicators, such as the 5-day exponential moving average (EMA) crossing the 10-day EMA, function well with the relative strength index (RSI).

Pros and Cons

| ✔️ Pros | ❌ Cons |

| It relies on a basic formula in mathematics. As opposed to other technical indicators, RSI’s calculations are easy enough that traders may compute them by hand | As a confirmation or entry tool, RSI falls short |

| With RSI’s clearly defined overbought and oversold zones, even novice traders can quickly and effectively spot market turning points | Price reversals can have a murky timeline |

| Simple alerts let you spot potential trading opportunities | When forex trends are strong, RSI’s accuracy might decrease |

5. Bladerunner

Overview

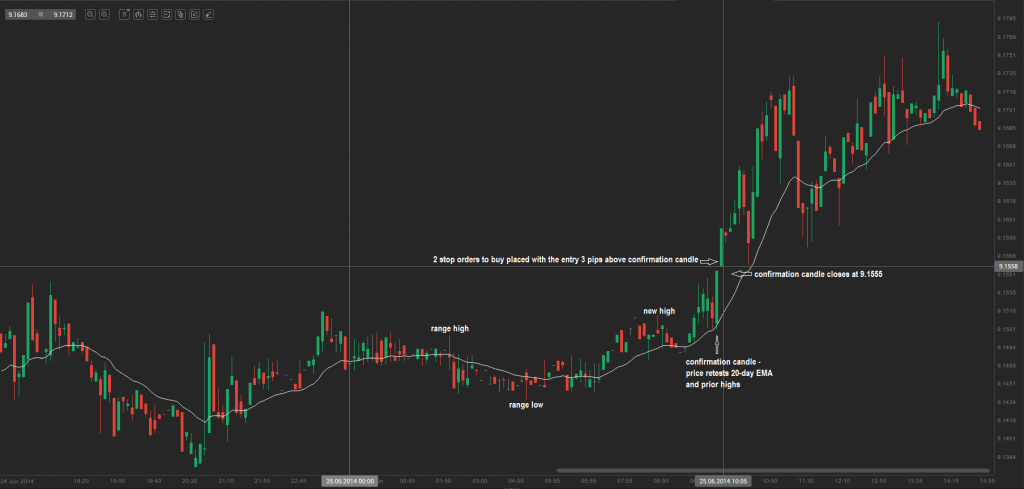

In addition to tracking price action, the Bladerunner method employs technical analysis tools, including support and resistance levels and candlestick charts. Finding profitable forex strategies relies heavily on learning when and how to use the appropriate indicators and charts.

Before using the Bladerunner strategy, traders should ensure that the market is trending.

The approach relies on the convergence of the middle line of the Bollinger Band indicator and the exponential moving average (EMA) with a 20-period timeframe.

If a price is above the EMA, it will fall soon. However, an upward trend is anticipated when it falls below the EMA. Botswanan traders must note the following:

➡️ A ‘signal candle’ occurs when a candlestick first touches an EMA.

➡️ A ‘confirmatory candle’ forms when the second candle breaks away from the EMA.

➡️ Considering these two metrics, traders can place their orders here to take advantage of the increasing price.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The strategy can be used on different financial instruments | Fundamental factors can lead to this strategy’s failure |

| The Bladerunner strategy can be applied to different timeframes | The strategy can generate false signals |

| The strategy allows Botswanans to make trades in current trend directions | The strategy is only suitable during trending price movements |

6. Day Trading

Overview

Trading foreign exchange (Forex) daily entails opening and closing a trade in one trading session. Forex day traders are investors who trade many times in a single trading day to capitalize on minute price fluctuations.

Day trading, also known as intra-day trading, is not for the casual investor since it requires constant attention, discipline, and a special frame of mind. It requires quick decision-making and a high volume of deals with modest gains.

Most investing methods aim to profit from price changes over the long term. Therefore, this approach is often seen as the opposite.

Depending on your preference, you could trade as little as once every session or as often as you see fit. But whichever you select, forex day trading demands attention and discipline in fast-changing markets.

Day traders often employ charts with time frames between 15 minutes and one hour, whereas scalpers focus on shorter time frames (M1 or below).

In contrast to day traders, who typically take things gradually and aim to locate 2-3 solid daily trading opportunities, scalpers prefer to initiate more than 10 transactions daily (some active traders can wind up with even more than 100 daily).

Pros and Cons

| ✔️ Pros | ❌ Cons |

| It avoids the risks and costs associated with keeping a transaction open after the market closes | Extremely time-consuming and requires continuous and diligent market analysis |

| Investment returns compound more quickly | Commissions and fees will increase because of increased trading frequency |

| It can take less time overall to generate substantial income | |

| Provides the option of using an automated trading system for the repetitive aspects of day trading | |

| The capacity to trade from anywhere in the world and concurrently hold many positions |

7. Parabolic SAR

Overview

Traders use the parabolic SAR, also known as the parabolic stop and reverse, to anticipate the short-term momentum of an asset.

The indicator, developed by the famous expert J. Welles Wilder, Jr., may be easily included in a trading strategy and utilized to determine where stop orders should be placed. Interestingly, this indicator assumes that the trader’s entire investment is at stake.

This will be of particular interest to people who create trading systems and those who trade to keep their money actively invested. Depending on the asset’s velocity, the Parabolic SAR indicator shows as a series of dots above or below the price on a price chart.

A dot will be put below the price of the asset when the trend of the asset is upward, and a dot will be placed above the price of the asset when the asset trend is downward.

Since a break above the SAR value would indicate a reversal and prompt the trader to expect a move in the other direction, many investors opt to set their trailing stop-loss orders there.

Since the parabolic SAR is often quite some distance from price during a continuous trend, traders may ride the trend for an extended period and make big gains without worrying about getting stopped out of a position on short-term retracements.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The capacity to recognize the trend and quantify its intensity or change in direction by examining the distance between the dot and the candle | During periods of market consolidation, it may provide mixed messages |

| Signals indicating a shift in trend, whether a reversal or a pause, could be identified | Even when the market is moving, it may be difficult for novice investors to tell a downturn from a reversal |

| It is a safety indicator that may be used as a stop loss in case trading activity suddenly slows down | Lacking data on market size, it provides no definitive entry point and relies on price movement for entry cues |

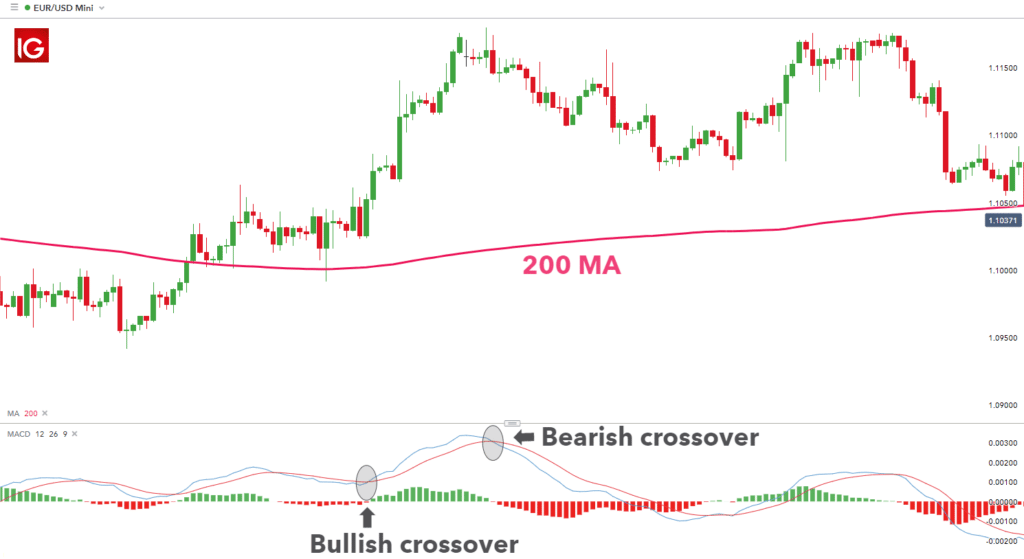

8. MACD Strategy

Overview

The MACD is a lagging indicator that can be classified as a sign of momentum. The forex pair chart is supplemented by a signal line comprised of a 9-day exponential moving average to verify momentum shifts.

Typically, a purchase order is considered when the MACD line rises over the signal line. Conversely, sellers could have the upper hand if the MACD line falls below the signal line. The 12, 26, and 9-day moving averages are three of the most popular employed by intraday traders.

Swing traders, on the other hand, are more likely to employ moving averages such the 5, 13, and 1. In contrast, scalpers often use shorter time frames, such as hourly or 4-hour charts.

The timeframe used depends on the specific tactic being employed. However, many investors use this method with the EMA to pinpoint entry possibilities.

A simple moving average (EMA) and a moving average convergence/divergence (MACD) indicator are used by traders to gauge market volatility and spot trends. Forex traders may benefit from this strategy, as it helps them to recognize the direction of price movement in both directions.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| MACD is a useful tool for both identifying trends and tracking the speed of such trends | Some erroneous reversals may be provided. MACD divergence reversal signals do not always portend a substantial reversal |

| MACD may be combined with other technical approaches for greater precision | In many cases, MACD fails to assess a trend accurately |

| This strategy can be used for both identifying trends and tracking the speed of such trends |

9. Position Trading

Overview

Position trading is the sort of trading characterized by the longest holding periods. Consequently, both the profit potential and the risk are increased. The past is replete with illustrious traders who amassed fortunes using position trading tactics.

A position trader is an investor who maintains investments for an extended time. However, on average, roles might be kept for months or even years.

Trend followers and position traders are less concerned with short-term changes unless they may affect the long-term outlook of their position. Overall, many position traders do not actively trade and are outpaced by long-term buy-and-hold investors regarding the time they hold positions.

When making judgments, position traders often utilize a mix of technical analysis and fundamental research. However, they also examine market trends and historical patterns.

Position traders who can correctly identify the entry, exit points, and know when to set a stop-loss order are proficient.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| It is a long-term technique that may result in substantial profits | A substantial amount of cash is required to maintain long-term holdings since transactions might last many months, resulting in the capital being locked up |

| There is less stress for the trader compared to some short-term techniques since positions do not need daily monitoring | It is impossible to open trading positions with a small amount of capital |

| There is more time available for other transactions or professional pursuits | If the position is open for an extended length of time, exchange costs may build to astronomical levels |

| Using this approach might immediately deplete a trader’s entire account if errors are made |

10. Trend Trading

Overview

When a market falls below support or over resistance, it is frequently an indication that a trend is about to begin. This happens when a market hits a new bottom after breaking support, forcing purchasers to become reluctant.

This is because purchasers are always aware of new lows being set and prefer to wait until a bottom is achieved before making any purchases.

There will also be traders developing short positions assuming that the price will fall further and are selling out of panic or because they are compelled to do so.

When it becomes clear that prices will no longer fall, the trend stops. However, after the selling has stopped, buyers’ faith in the market begins to restore. Traders who use trend-following methods often purchase when prices surpass resistance and sell when prices drop below support.

Even more so, trends may be both quite noticeable and persistent. The potentially massive price swings associated with this method make it a formidable contender for the most effective Forex trading technique title.

There is no fool-proof method for determining when a new trend has started. However, trend-following systems utilize indications to help traders guess.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Among the many benefits of trading trends is the high potential pay-off with negligible risk | The success rate of trend trading tactics is usually lower |

| Market participants may trade trends over a variety of timeframes | There is an inherent risk with false breakouts |

| Traders can be the first present when a trend starts, allowing them to benefit | Trend trading can be lagging, and it can be a difficult strategy to follow, especially for beginners |

| Entry and exits need not be precise | |

| The strategy is not time-consuming, and there are fewer costs involved |

How to Choose the Right Forex Broker in Botswana

Botswanan traders must evaluate the following components of a forex broker to decide whether the broker is suited to their unique trading objectives or needs.

Regulations and Licenses

This is the first vital component that Botswanan traders must thoroughly evaluate. Reputable brokers are regulated by market regulators such as FCA, ASIC, CySEC, FSCA, and others.

Botswanans must beware when dealing with brokers with only offshore regulations such as FSA, SVG BVI, FSC, and others.

Account Features

Account Features include leverage trading and margin requirement, commissions and spreads, initial deposit, additional features on retail investor accounts, and so on.

Deposits and Withdrawals

Botswanans must evaluate the payment options available, the processing times on withdrawal requests, deposit currencies offered, the withdrawal fee, deposit fees, and minimum withdrawal limits, among other trading and non-trading fees.

Range of Markets

The range of markets offered refers to the number and range of tradable instruments the broker offers. Therefore, Botswanans must consider what they wish to trade and what is available.

Customer Support

Customer Support is another crucial factor. Botswanans must check the availability of support (trading hours), the quality of support, and the promptness with which the customer support team responds to queries.

Trading Platform

A trading platform is the Botswanan trader’s portal to the financial markets. Therefore, traders must ensure that the trading platform has the necessary technical indicators, fundamental analysis, technical analysis, economic calendar, charting, newsfeed, and other tools they may need.

Education and Research

Education and Research come in handy to both novice traders and experienced investors. Education includes some of the following:

➡️ eBooks

➡️ Trading guides

➡️ Trading knowledge on leveraged products

➡️ A risk warning on complex instruments

➡️ Educational videos

Research can include some of the following:

➡️ Trading tools

➡️ Commentary

➡️ Status of International Markets

➡️ Price movements

➡️ Market sentiments

➡️ Whether there is a volatile market

➡️ Exchange Rates

➡️ Expert opinions and other resources can help experienced traders make informed trading decisions.

The Best Forex Brokers in Botswana

In this article, we have listed the best brokers that offer forex trading to traders in Botswana. In addition, we have further identified the brokers that offer additional services and solutions to Botswanan traders.

Best MetaTrader 4 / MT4 Forex Broker in Botswana

Min Deposit

USD 25

Regulators

FCA UK

Trading Platform

MT5, MT4, OctaTrader

Crypto

Yes

Total Pairs

28

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, OctaFX is the best MT4 forex broker in Botswana. OctaFX is an MT4 and MT5 broker that provides Botswanans with various markets. OctaFX offers a choice of accounts via MT4, including ECN and STP accounts, with superior trade execution.

Best MetaTrader 5 / MT5 Forex Broker in Botswana

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, AvaTrade is the best MetaTrader 5 forex broker in Botswana. In addition, AvaTrade is regarded as one of the most secure MT5 forex brokers.

No commission is charged for trading currency pairings, only leaving the spread to be paid. A demo account is also available for traders to sharpen their abilities via MT5 and several other platforms.

Best Forex Broker for beginners in Botswana

Min Deposit

$100

Regulators

CFT, NFA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FOREX.com is the best forex broker for beginners in Botswana. FOREX.com is a broker renowned for low trading fees and beginner-friendly solutions. In addition, FOREX.com offers several educational materials and a helpful demo account.

Best Low Minimum Deposit Forex Broker in Botswana

Min Deposit

$10 / 134 BWP

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Exness is the best Low Minimum Deposit Forex Broker in Botswana. Exness has a minimum deposit requirement of 10 USD / 130 BWP, making it easy for Botswanans to start trading 278 instruments.

Exness also offers MT4 and MT5 through which trades can be made. In addition, it offers some of the best trading tools, charting capabilities, technical indicators, expert advisors, and more.

Best ECN Forex Broker in Botswana

Min Deposit

USD 0

Regulators

CySEC, FCA, DFSA, FSCA, FSA, CMA

Trading Desk

MT4, MT5, HFM APP

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

0

Account Activation Time

24 Hours

Overall, HFM is the best ECN forex broker in Botswana. HFM is a hybrid forex and CFD broker that uses STP and ECN technology to ensure that Botswanans get the best pricing, minimal slippage, no requotes, and the fastest trade execution.

HFM uses the best liquidity providers who aggregate the pricing that Botswanans can see on MT4, MT5, and the HF App for Android and iOS.

Best Islamic / Swap-Free Forex Broker in Botswana

Min Deposit

USD 10 / 136 BWP

Regulators

CySec, FCA

Trading Desk

None

Crypto

Yes

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, eToro is the best Islamic / Swap-Free forex broker in Botswana. eToro is a renowned social trading platform that offers Muslim traders an Islamic Account.

eToro does not charge any interest on positions held for over 24 hours. However, registering an Islamic Account can be expensive initially, requiring a 1,000 USD / 13,400 BWP deposit.

Best Forex Trading App in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

ASIC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

300

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, CMC Markets is the best forex trading app in Botswana. In addition, CMC Markets offers a user-friendly mobile app with research tools, powerful charts, customizable watch lists, news reports, and a range of educational materials.

Best Lowest Spread Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

FCA, CySEC, IFSC, KNF

Trading Desk

No Trading Desk

Crypto

Yes

Total Pairs

48

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, XTB is the best lowest-spread forex broker in Botswana. XTB is a well-known forex and CFD broker with low and competitive forex spreads from 0.1 pips depending on the financial instrument and the market conditions.

XTB is also a good broker in terms of educational materials and research capabilities, providing traders with comprehensive market analysis across markets.

Best Nasdaq 100 Forex Broker in Botswana

Min Deposit

USD 10

Regulators

CySec, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

60

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXTM is the best Nasdaq 100 forex broker in Botswana. FXTM is a multi-regulated forex and CFD broker that accommodates Botswanan traders with a keen interest in Nasdaq. Traders can expect low and competitive spreads, a choice between accounts, and powerful trading platforms.

Best Volatility 75 / VIX 75 Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

IGRs

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, IG is Botswana’s best Volatility 75 / VIX 75 forex broker. IG is one of the best CFD brokers with powerful proprietary trading technology.

IG is well-regulated and offers Botswanans access to VIX75, with spreads from 0.04 pips / 0.13% and zero commission charges.

Best NDD Forex Broker in Botswana

Min Deposit

USD 50 / 672 BWP

Regulators

FCA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

–

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXCM is the best NDD forex broker in Botswana. FXCM is a No-Dealing Desk broker with STP and ECN execution across several markets.

In addition, FXCM offers a choice between third-party platforms in addition to technical indicators, charting tools, and competitive trading conditions.

Best STP Forex Broker in Botswana

Min Deposit

USD 10

Regulators

IFSC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

36

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, RoboForex is the best STP forex broker in Botswana. RoboForex is popular forex and CFD broker with competitive trading conditions. RoboForex offers STP execution with liquidity sourced from top providers.

Botswanans can expect access to over 12,000 instruments via powerful and innovative third-party platforms.

Best Sign-up Bonus Broker in Botswana

Min Deposit

50 USD / 682 BWP

Regulators

CYSEC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Windsor Brokers is the best sign-up bonus broker in Botswana. Windsor Brokers is a well-regulated broker that offers Botswanans a welcome account funded with 30 USD in trading credit. With this account, Botswanans can explore the platform or risk-free test their strategies.

You might also like: Best FTSE 250 Brokers in Botswana

You might also like: Best FTSE 100 Brokers in Botswana

You might also like: Best Low Spread Forex Brokers in Botswana

You might also like: Best Algorithmic Trading Platforms in Botswana

You might also like: Best Micro Currency Trading Platforms in Botswana

Conclusion

A healthy dose of reality is vital while selecting a forex trading strategy. However, you should not feel rushed.

Instead, consider your financial goals, the amount of time you have available to trade, your level of experience as a trader, and the current state of the market before making any hasty decisions.

It is crucial to be prepared for any eventuality in the market. It is important to have a plan ready for both rising and flat markets. In addition, you need to have multiple backup marketing strategies ready to go in case one of them fails to provide results.

Keep in mind that it will take some time for the true success of any plan to become apparent in the current market conditions, so hold off on making any hasty judgments.

Frequently Asked Questions

What is the most profitable forex pair to trade in Botswana?

EUR/USD. The Euro/US Dollar currency combination is recognized as the most successful pair in foreign exchange because it is extremely liquid. In addition, the United States economy is the greatest in the world, while Europe ranks second.

What is the most profitable trading strategy in Botswana?

Trend trading technique is one of the most profitable strategies. Using technical analysis to identify a trend and then placing trades exclusively in the direction of the trend is an example of this trading strategy.

Which currency pairs have the most predictable price movements in Botswana?

More predictable currencies often adhere to technical rulebooks and operate rationally. For example, AUD/USD, USD/JPY, and USD/CAD stand out in fundamental and technical textbooks and are thus more predictable than other pairs.

What is the best time to trade forex in Botswana?

Many investors regard the overlap of the New York and London markets from 8 am to noon to be the optimal trading period. In Botswana, this is from 2 pm to 6 pm.

What is the safest currency for Botswanans to trade?

The Swiss franc (CHF) is often regarded as the world’s safest currency, and many investors see it as a safe-haven asset. This is owing to Switzerland’s neutrality, as well as its robust monetary policy and low debt levels.

What are some recommended forex trading strategies for beginners in Botswana?

For beginner traders in Botswana, it’s advisable to start with simple and effective strategies. Trend Following, Swing Trading, and Breakout Trading are commonly recommended. Trend Following involves identifying and following prevailing market trends, Swing Trading focuses on short to medium-term price movements, and Breakout Trading aims to capitalize on significant price movements when key support or resistance levels are breached.

What is a Forex Trading Plan?

A forex trading plan is a comprehensive and structured document outlining a trader’s approach to the foreign exchange (forex) market. It serves as a blueprint that details the trader’s financial goals, risk tolerance, market analysis methodology, and specific trading strategies.

What strategy should you follow for consistent profits?

Achieving consistent profits in trading requires a disciplined and well-defined approach. One widely recommended strategy is to employ a risk management plan that limits the potential loss on any single trade to a small percentage of the trading capital. This ensures that a series of losing trades doesn’t significantly deplete the account. Additionally, focusing on high-probability trades and using a trading strategy with a positive risk-reward ratio can contribute to consistent profitability.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.