Capital.com Review

Overall, Capital.com is considered low-risk, with an overall Trust Score of 9 out of 10. Capital.com allows Botswana deposits to offer four different trading platforms. Capital.com offers one retail trading account and one Professional Account. Capital.com is currently not regulated by the Central Bank of Botswana.

- Louis Schoeman

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

$20 / 269 BWP

Regulators

CYSEC, ASIC, FCA and NBRB licence Seychelles coming soon

Trading Desk

Market maker

Crypto

Yes

Total Pairs

–

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overview

Overall, Capital.com is considered average risk forex and CFD broker, with an overall Trust Score of 77 out of 100. Capital.com is licensed by two Tier-1 Regulators (high trust), one Tier-2 Regulator (average trust), and two Tier-3 Regulators (low trust). In addition, Capital.com offers one trading account with a Retail or Professional Account option.

Capital.com welcomes novice and experienced traders in search of a new MT4 broker with one of the lowest trading costs in the business and a wide variety of tradable assets. Capital.com, owned and run by Capital Com SV Investments Limited, launched in 2016 as a worldwide CFD broker.

Capital.com offers clients from over 183 countries, with headquarters in Cyprus. The ability to trade with as little as a $20 card deposit is a major perk of Capital.com. The global CFD broker holds money from retail customers in separate, uninsured accounts. The broker also provides clients with trading manuals, learning resources, and up-to-date news. New traders may benefit from these services, which were created to help and instruct them.

Traders in need of an elite trading experience can sign up with Capital.com. This broker provides a mobile app that uses a unique artificial intelligence detection algorithm to enhance the trading experience.

It is rare to find a broker that uses this innovation to aid its traders, but they do. For example, Capital.com provides its users with various resources for learning how to utilize the site and any problems they may have. The broker has even designed a special “Learning Mode” for its clients.

In this setting, traders can access various learning resources, including webinars, courses, guidelines, and tutorials, all at no cost to them. All these characteristics suggest that the broker places a premium on educating their clients.

Capital.com accepts Botswanan clients and has an average spread of 0.6 pips with no commission charges. Capital.com has a maximum leverage ratio up to 1:100, and there is a demo account available, but no Islamic Account

Capital.com, MetaTrader 4, and TradingView platforms are supported. Capital.com is headquartered in the United Kingdom and regulated by FCA, ASIC, CySEC, NBRB, and FSA.

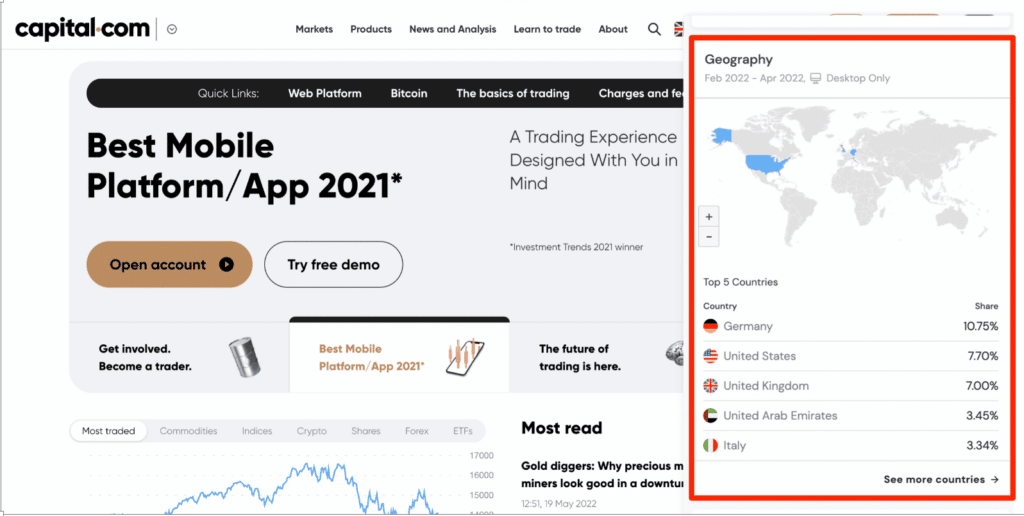

Capital.com Distribution of Traders

Capital.com currently has the largest market share in these countries:

➡️ Germany – 10.7%

➡️ United States – 7.7%

➡️ United Kingdom – 7%

➡️ United Arab Emirates – 3.4%

➡️ Italy – 3.3%

Popularity among traders who choose Capital.com

Capital.com is one of the top 75 international brokers among Botswanan traders, even though it does not yet have the same long-standing reputation as other brokers.

Capital.com At a Glance

| 🏛️ Headquartered | United Kingdom |

| 🏛️ Botswanan Based Office | No |

| 👍 Accepts Botswanan Traders? | Yes |

| 📅 Year Founded | 2016 |

| 📱 Botswanan Office Contact Number | None |

| ⚖️ Regulation | ASIC, FCA, NBRB, and CySEC |

| 🔎License Number | United Kingdom – FRB 793714 Cyprus – 319/17 Belarus – 193225654 Australia – AFSL 513393 |

| ⚖️ CBN Regulation | None |

| ✴️ Regional Restrictions | The United States and Canada |

| ☪️ Islamic Account | No |

| 📈 Demo Account | Yes |

| 📈 Retail Investor Accounts | 1 Retail, 1 Professional |

| 📊 PAMM Accounts | None |

| 📊 Liquidity Providers | None indicated |

| Affiliate Program | Yes |

| 📊 Crypto trading offered? | Yes |

| 🚀 Offers a Botswanan Account? | No |

| 💻 Dedicated Botswanan Account Manager? | No |

| 📈 Maximum Leverage | NBRB Registration – 1:100 FCA Registration – 1:30 ASIC/CySEC Registration – 1:30 |

| 📈 Leverage Restrictions for Botswana? | No |

| 💳 Minimum Deposit | 273 Botswanan Pula equivalent to $20 |

| 💳 Botswanan Pula Deposits Allowed? | Yes |

| 💰 Active Botswanan Trader Stats | 1.3 million |

| Active Botswanan-based BDSwiss customers | 150,000+ |

| 💰 Botswana Daily Forex Turnover | $1.25 million+ |

| 💳 Deposit and Withdrawal Options | Global Bank Transfers Credit Card Debit Card Apple Pay PayPal Several Electronic Payment Processors |

| 💰 Segregated Accounts with Botswanan Banks? | No |

| 💻 Trading Platforms | Capital.com Web, Capital.com Mobile, MetaTrader 4, TradingView |

| 💰 Tradable Assets | Indices Forex Commodities Cryptocurrencies Shares |

| 🌐 Offers USD/BWP currency pair? | No |

| 🌐 USD/BWP Average Spread | N/A |

| 📈 Offers Botswanan Stocks and CFDs | No |

| 👨💼 Languages supported on Website | English, Indonesian, Malaysian, German, Spanish, French, Italian, Dutch, Polish, Portuguese, Romanian, Russian, Vietnamese, Bulgarian, Czech, Greek, Croatian, Latvian, Chinese (simplified), Thai, Finnish, and more. |

| 👥 Customer Support Languages | Multilingual |

| 👥 Customer Service Hours | 24/7 |

| 👥 Botswanan-based customer support? | No |

| 💰 Bonuses and Promotions for Botswanans | None |

| ✴️Education for Botswanan beginners | Yes |

| 📊 Proprietary trading software | Yes |

| 💰 Most Successful Botswanan Trader | Uche Paragon ($20 million net worth) |

| ✔️Is Capital.com a safe broker for Botswanans? | Yes |

| ✔️Rating for Capital.com Botswana | 9/10 |

| ✔️Trust score for Capital.com Botswana | 76% |

| 👉 Open Account | 👉 Open Account |

Regulation and Safety of Funds

Capital.com Regulation in Botswana

The local market regulators in Botswana are as follows:

➡️ Ministry of Finance and Economic Development (MFED)

➡️ Bank of Botswana (BoB)

➡️ Non-Bank Financial Institutions Regulatory Authority (NBFIRA)

While Capital.com is regulated globally, the broker does not yet have local regulations or licenses in Botswana. However, Capital.com is a popular and trustworthy broker that accommodates Botswanan traders.

Capital.com Global Regulations

Capital.com is a UK limited liability company with additional locations in Belarus, Gibraltar, Cyprus, Seychelles, and Australia (company number: 10506220).

Capital.com is licensed and registered to do business under the following names in each of these jurisdictions:

➡️ com operates in Seychelles as Capital Com Live Stock Investing Limited, a business with registration number 8429903-1, and is regulated by the Financial Services Authority of Seychelles (FSA) with license number SD101.

➡️ Capital Com Australia Limited (ABN 47 625 601 489) is a reputable Australian company that operates legally under the Australian Securities and Investments Commission (ASIC) and AFSL 513393.

➡️ Capital Com (UK) Limited is authorized to do business in the United Kingdom by the Financial Conduct Authority (FCA) with the firm reference number 793714.

➡️ The registration number for Capital Com SV Investments Limited with the Cyprus Securities and Exchange Commission (CySEC) is 354252. In addition, the firm has been issued licenses under license number 319/17.

➡️ Capital Com Bel is a closed joint-stock company with a valid registration number (193225654) with the National Bank of the Republic of Belarus (NBRB).

Capital.com Client Fund Security and Safety Features

Capital.com has partnered with some of the best money managers in Europe to store, protect, and manage their clients’ funds. The broker separates this fund from its general funds.

The Investor Compensation Fund ensures that customers may trade with the utmost trust per legal regulations. However, professional traders should know that the Investor Compensation Fund does not cover them.

Capital.com is a member of the Financial Services Compensation Scheme. The broker safeguards retail accounts against negative balances and margin close-outs, ensuring that traders do not lose more than they can afford.

Further, all client data is protected through Transport Layer Security (TLS), replicated in real-time, and safely backed up on Capital.com, per PCI Data Security standards.

Capital.com uses both pre-trade and post-trade fraud detection tools. In addition, Capital.com takes measures to prevent money laundering by using self-assessment instruments, expert internal audits, required training, training and development, and other strategies.

Capital.com is also compliant with the highest Know Your Customer (KYC), Source of Wealth (SOW), and Source of Funds (SOF) regulations. In addition, sophisticated identification technologies are being used to verify documents, which significantly helps fight against identity theft.

Is Capital.com regulated?

Yes, Capital.com operates under different regulatory licenses depending on its target audience. In Europe, it is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 319/17. For UK users, it is authorized and regulated by the Financial Conduct Authority (FCA) under license number 793714. Always check the relevant regulatory body for your region for more details.

Are my funds safe with Capital.com?

Capital.com implements measures to protect client funds. They:

➡️Segregate client funds: Client funds are held in separate accounts from the company’s own funds, reducing the risk of misuse.

➡️Offer negative balance protection: This protects users from losing more than their deposited funds in most circumstances.

➡️Utilize secure technology: They use state-of-the-art encryption and security measures to protect client data and transactions.

Remember, all trading involves risk, and Capital.com cannot guarantee the safety of your funds. It’s crucial to understand the risks before investing.

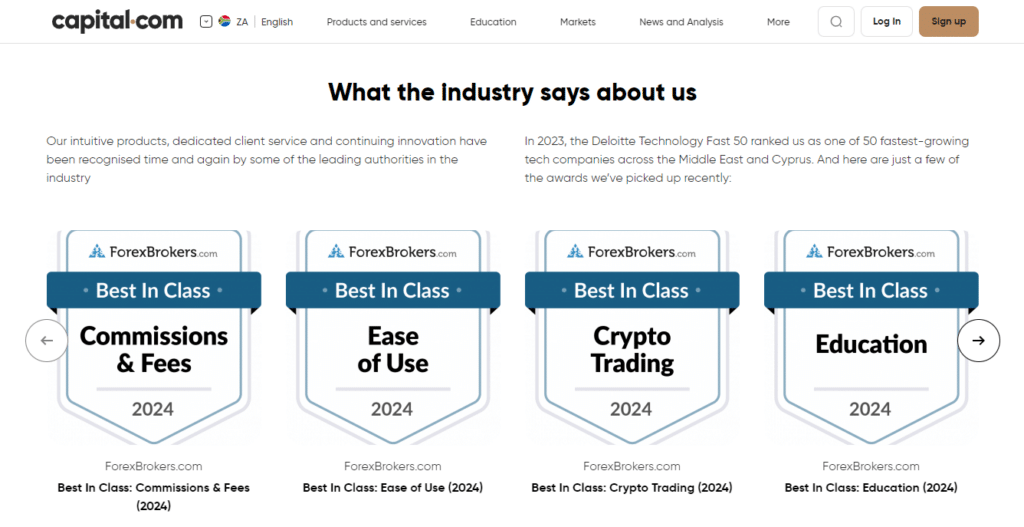

Awards and Recognition

Capital.com is a well-known and strictly regulated broker that has recently won the following awards:

➡️ Winner in terms of Platform Features during the 2024 France Leverage Trading Report.

➡️ Winner in terms of the best Mobile App/Platform during the 2024 France Leverage Trading Report.

➡️ Best Spread Betting Platform in 2024 – presented during the International Financial Awards.

➡️ Best Crypto and Forex Broker (2024) – awarded by Fxdailinfo.com.

➡️ Most Innovative Tech in 2021 (TradingView).

Capital.com Account Types and Features

Capital.com only provides a single account type, but it is suitable for novice and seasoned traders. This contrasts with the two or three account types provided by other CFD brokers.

Trading is available on Capital.com online trader platform and MT4, and customers must register once to create a real and demo account.

An account with Capital.com is useful for both novice and seasoned traders. Newcomers to the trading world, or those who have been doing so for less than a year, fall under the “beginning traders.”

In addition to not wanting to take the plunge with a huge amount of money, most beginners also lack time to devote to trading throughout the week. On the other hand, Capital.com account minimum is quite low at only USD 20, making it accessible to novice traders.

Capital.com appeals to more experienced traders because of its cheap trading costs and extensive asset selection, even if they often choose greater minimum deposits and narrower spreads in return for a fee per lot.

More advanced traders who satisfy specific requirements may also open a professional account on Capital.com. Regulations from NBRN limit Botswanans’ leverage to 100:1. However, professional traders may access leverage of up to 500:1.

Botswanans must remember that professional accounts have no negative balance protection if leverage ratios of 50:1 or more are used.

Spreads are Capital.com only source of revenue; the broker does not accept commissions. In addition, the starting spread of 0.6 pips on the EUR/USD is competitive and free of any hidden fees.

Although the platform lacks a copy trading feature, hedging, and scalping are acceptable strategies on Capital.com.

| 💻 Live Account | 💳 Minimum Dep. | 📊 Average Spread | 💸 Commissions | 💰 Average Trading Cost |

| Standard | 260 BWP / 20 USD | 0.6 pips | None | 6 USD |

Capital.com Live Trading Account Details

Retail Account

Most Botswanan traders, regardless of their trading needs, goals, or trading style, may benefit from opening a Retail account.

The following functionalities are available on this account for traders:

➡️ When opening a real account with Capital.com, a deposit of 2,300 Botswanan Pula (about $20) is needed.

➡️ Trades incur no commission fees since the broker’s cut is included in the spread.

➡️ Inclusion of 6,500 financial instruments covering a wide range of asset classes.

➡️ There are low and fair overnight costs when positions are held for more than 24 hours.

➡️ Base account currency may be set to EUR, USD, GBP, RUB, or PLN.

➡️ Spreads on the EUR/USD may be as low as 0.6 pips.

➡️ Instantaneous updates on current prices.

➡️ Effective graphing tools.

➡️ Leverage can be adjusted based on the trader’s location and the rules of the area in which the account is opened. Up to 1:100 in leverage is permissible by NBRB rules, 1:30 by FCA rules, and 1:30 by ASIC/CySEC rules.

➡️ Access to both proprietary and the popular MetaTrader 4 trading platform.

➡️ The ability to trade both long and short.

➡️ Safeguarding against negative account balances.

Professional Account

Traders in Botswana should consider several factors, such as leverage limits, negative balance protection, and presumptive knowledge when deciding whether their accounts meet the criteria for professional status.

Because of their expertise, professional traders can acquire higher amounts of leverage. Therefore, professional trading accounts are ineligible for negative balance protection.

Moreover, as professional traders are assumed to be seasoned traders who can reliably manage their risk, they are unlikely to access the same risk management tools as regular traders.

Base Account Currencies

Capital.com’s selection of base (trading account) currencies is around par compared to other brokers in its industry.

In comparison to other brokers, IQ Option’s support for five base currencies (EUR, USD, GBP, RUB, and PLN) for trading accounts is standard.

Botswanans, who are more likely to hold bank accounts denominated in BWP, will be at a disadvantage since Capital.com does not provide BWP trading accounts and would thus charge them for currency conversion on deposits and withdrawals.

Opening a USD-denominated trading account with a digital currency bank is preferable for high-volume traders (10+ lots per month), particularly when dealing with assets like the EUR/USD.

This is because a minor conversion charge will be incurred whenever a deal between a currency pair listed in US dollars and an account denominated in a different currency. As a result, traders may sidestep transaction costs by opening numerous accounts in various base currencies.

Demo Account

Capital.com allows users to practice trading with virtual money in an unlimited free demo account. Account setup and technical issues? The helpful staff is on call around-the-clock

Although Capital.com only provides a single live account option, its competitive trading fees, minimal minimum deposit, and extensive asset selection make it an excellent choice for traders of all skill levels.

What is a Capital.com demo account and how does it work?

A Capital.com demo account is a free practice platform that lets you simulate trading with virtual funds. It comes preloaded with $1,000 (or equivalent in your local currency) and mirrors the live trading platform with real-time market data. This allows you to test strategies, explore the platform, and practice trading without risking real money.

What are the benefits of using a Capital.com demo account?

➡️ Risk-free practice: Gain experience trading different markets like forex, stocks, and indices without risking your own capital.

➡️ Learn the platform: Familiarize yourself with the Capital.com trading interface, features, and tools before going live.

➡️ Develop trading strategies: Experiment with different strategies and techniques in a safe environment.

➡️ Boost your confidence: Practice trading and build your confidence before transitioning to real money.

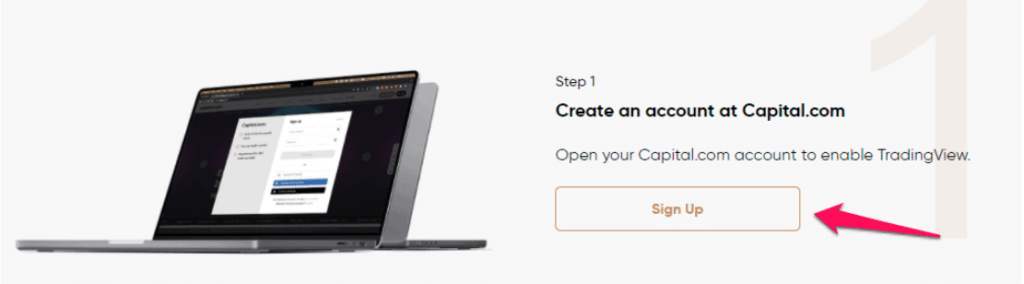

How to open an Account with Capital.com in Botswana

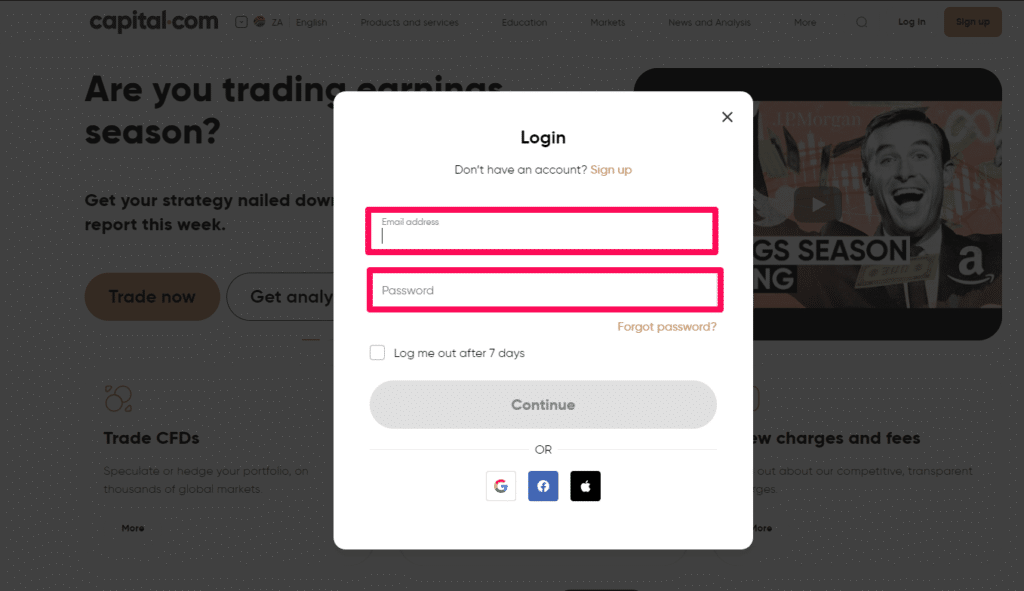

Step 1 – Create an account

To register a forex trading account with Capital.com for the first time, you will be required to go through a basic “know your customer” process.

Create an account with Capital.com via the website.

Step 2 – Create an account

Complete the requested information. Or sign-up using your Facebook, Google or apple accounts.

With Capital.com, the process entails logging onto their website and filling in some basic information. You will be asked to provide proof of your bank account, residence, and a copy of your legal ID.

You may also be required to answer a few questions regarding your level of trading experience.

Step 3 – Start trading

Once this is completed you wait for your account approval, make your minimum deposit requirement, and start trading.

Capital.com Vs FP Markets Vs IG – Broker Comparison

| 🥇 Capital.com | 🥈 FP Markets | 🥉 IG | |

| ⚖️ Regulation | FCA, ASIC, CySEC, NBRB, FSA | ASIC, CySEC | FCA, BaFin CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, FMA, CFTC, NFA, BMA |

| 📱 Trading Platform | • Capital.com • MetaTrader 4 • TradingView | • MetaTrader 4 • MetaTrader 5 • Myfxbook AutoTrade • FP Markets App | • MetaTrader 4 • IG Platform • ProRealTime (PRT) • L2 Dealer • FIX API |

| 💰 Withdrawal Fee | No | Yes | No |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 273 BWP | 850 BWP | 3,300 BWP |

| 📊 Leverage | • BRB – 1:100 • FCA – 1:30 • ASIC/CySEC – 1:30 | 1:500 | • 1:30 (Retail, EU, UK) • 1:222 (Professional) |

| 📊 Spread | Variable, from 0.6 pips | 0.0 pips | From 0.1 pips DMA |

| 💰 Commissions | None | From US$3 | From 0.10% |

| ✴️ Margin Call/Stop-Out | 100%/50% | 100%/50% | 100%/50% |

| 💻 Order Execution | Market | Market | Market |

| 💳 No-Deposit Bonus | No | No | No |

| 📊 Cent Accounts | No | No | No |

| 📈 Account Types | Live Account (Retail or Professional) | • MT4/5 Standard Account • MT4/5 Raw Account • MT4/5 Islamic Standard Account • MT4/5 Islamic Raw Account | • CFD/DMA Trading Account • Limited Risk Trading Account • Options Trading Account • Turbo24 Trading Account • Share Dealing Account • Spread Betting Account • Swap-Free Trading Account |

| ⚖️ CBN Regulation | No | No | No |

| 💳 BWP Deposits | Yes | Yes | No |

| 📊 Botswana Pula Account | No | No | No |

| 👥 Customer Service Hours | 24/7 | 24/7 | 24/7 |

| 📊 Retail Investor Accounts | 1 | 4 | 7 |

| ☪️ Islamic Account | No | Yes | Yes, Dubai |

| 📉 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | Depends on the account balance | 50 lots | Unknown |

| 💰 Minimum Withdrawal Time | Instant | Instant | 1 business day |

| 📊 Maximum Estimated Withdrawal Time | Up to 3 Days | Up to 5 working days | Up to five business days |

| 💸 Instant Deposits and Instant Withdrawals? | Yes | Yes, Sticpay wallet withdrawals | Yes, Deposits on PayPal |

Capital.com Trading Platforms

Capital.com offers Botswanan traders a choice between these trading platforms:

➡️ com

➡️ MetaTrader 4

➡️ Trading View

Desktop Platforms

MetaTrader 4

MetaTrader4 has become the de facto standard among traders of all experience levels for its user-friendly interface and comprehensive set of trading capabilities.

Traders in Botswana may get started on Capital.com by downloading MT4 to any desktop computer running Linux, Windows, or macOS.

WebTrader Platforms

➡️ com

➡️ MetaTrader 4

Capital.com

More than seventy-five technical indicators, multiple chart styles, and sophisticated drawing tools are available on Capital.com’s one-of-a-kind web-based trading platform.

Stop loss, take profit, and negative balance protection are just a few advanced risk management capabilities available via the Capital.com unique interface and online terminal.

MetaTrader 4

MetaTrader 4 is an advanced trading platform with many useful features. Even though seasoned traders will have an easier time with the platform’s capabilities, newcomers should have no trouble utilizing the platform’s architecture.

Trading App

➡️ com

➡️ MetaTrader 4

➡️ TradingView

Capital.com

Capital.com provides a CFD trading app that allows Botswanan traders to trade from their mobile devices wherever they have internet access.

Because of as many as 70 technical analysis indicators and other technical tools, trades may be placed fast and easily. In addition, the app store provides easy access to various useful applications for Android and iOS devices.

MetaTrader 4

The MetaTrader 4 app is available for download on iOS and Android devices, allowing you to utilize MT4 on the go. However, be warned that you will need an iOS device running iOS 9.0 or later to use the app.

At least 4.5 out of 5 ratings have been given to both the Apple and Android versions of the software.

The easy-to-use MetaTrader 4 trading platform is available in both mobile and desktop versions, giving Botswanan traders the freedom to carry out trading from wherever they have access to the internet.

TradingView

TradingView mobile is also available on Capital.com for both iOS and Android smartphones. TradingView’s technical analysis features are useful for investors and traders of all experience levels.

TradingView is presently among the greatest solutions out there for day-to-day trading requirements.

What platforms does Capital.com offer?

Capital.com provides users with multiple platforms to suit their trading style:

➡️Web platform: Accessible from any browser, it’s user-friendly and perfect for beginners.

➡️Mobile app: Trade on the go with access to all major features and real-time market updates.

➡️TradingView integration: Utilize advanced charting tools and analysis directly within the platform.

➡️MetaTrader 4: Popular platform for experienced traders seeking more customization and automation.

➡️API: Connect to the platform programmatically for algorithmic trading strategies.

Which platform is right for me?

Here’s a quick breakdown:

➡️Beginners: Start with the web platform or mobile app for their simplicity and educational resources.

➡️Mobile traders: The dedicated app offers convenience and seamless experience.

➡️Advanced traders: Explore TradingView integration or MetaTrader 4 for in-depth analysis and automation.

➡️Programmatic traders: Utilize the API for building custom trading strategies.

Ultimately, the best platform depends on your individual needs and experience level. Capital.com encourages trying their demo accounts to explore each platform risk-free before committing.

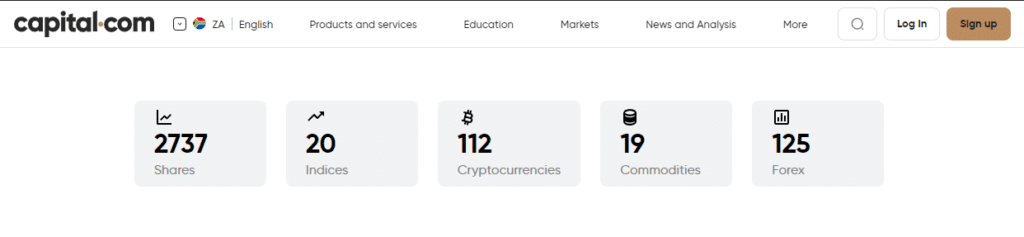

Capital.com Range of Markets

Botswanan traders can expect the following range of markets from Capital.com:

➡️ Forex Pairs (Majors, Minors, Exotics)

➡️ Commodities

➡️ Cryptocurrencies

➡️ Indices

➡️ Shares

Financial Instruments and Leverage offered by Capital.com

| 🔨 Instrument | 💰 Number of Assets Offered | 📈 Max Leverage Offered |

| ➡️ Forex | 138 | 1:100 |

| ➡️ Indices | 23 | 1:100 |

| ➡️ Shares | 5,455 | 1:20 |

| ➡️ Commodities | 37 | 1:100 |

| ➡️ Cryptocurrencies | 476 | 1:100 |

Capital.com offers a wide range of markets, including:

➡️ Shares: Trade CFDs on thousands of popular companies from various countries and sectors.

➡️ Indices: Gain exposure to entire markets through major global indices like the S&P 500 and FTSE 100.

➡️ Commodities: Trade CFDs on precious metals, energy resources, and agricultural products.

➡️ Forex: Speculate on currency pairs like EUR/USD and GBP/JPY with competitive spreads.

➡️Cryptocurrencies: Invest in popular digital currencies like Bitcoin, Ethereum, and Litecoin.

How many markets does Capital.com offer?

Capital.com boasts access to over 3,000+ markets, providing diverse trading opportunities across various asset classes. This vast selection allows you to tailor your portfolio and adapt to different market conditions.

Broker Comparison for a Range of Markets

| Capital.com | FP Markets | IG | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | Yes | No | Yes |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | No | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | Yes | Yes |

| ➡️️ Options | No | No | Yes |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | No | Yes |

Capital.com Trading and Non-Trading Fees

Spreads

The spreads offered by Capital.com are not fixed but fluctuate with the underlying asset being traded; overnight fees apply to indices, commodities, and currency pairs. It may also change because of the day’s market conditions.

Traders in Botswana should expect the following spreads when using Capital.com:

➡️ EUR/USD – from 0.00006 pips

➡️ BTC/USD – 110 pips

➡️ Spot Crude Oil – 0.2 pips

➡️ ETH/USD – 7.7 pips

➡️ Spot Gold – 0.18 pips

➡️ GBP/USD – 0.13 pips

➡️ US Tech 100 – 1.1 pips

➡️ Germany 40 – from 1 pip

Commissions

Since the broker makes money off the spread on financial instruments, Capital.com does not add commission fees to transactions.

Overnight Fees, Rollovers, or Swaps

The overnight fee applies to all available slots. After 10 pm, Capital.com implements a nightly fee (UTC).

Traders should expect the following overnight costs, albeit they may vary depending on the instrument, market conditions, position size, and type of position opened (long or short):

| 🔧 Instrument | 📈 Long (Buy) Swap | 📉 Short (Sell) Swap |

| EUR/USD | -0.00046% | -0.0009% |

| Spot Gold (CFD) | -0.0044% | -0.0002% |

| Spot Silver (CFD) | -0.0052% | -0.0004% |

| Brent | 0.0201% | -0.0392% |

| Shares (Apple, Inc.) | -0.0064% | -0.0059% |

| Indices (US100) | -0.0052% | -0.0027% |

| Cryptocurrency (BTC/USD) | -0.0500% | 0.0140% |

Deposit and Withdrawal Fees

No matter the payment method you choose to fund or withdraw from your Capital.com account, you will never incur any fees. If a Botswanan trader deposits or withdraws money, their bank may assess a fee.

Inactivity Fees

Inactivity fees are not charged on dormant accounts.

Currency Conversion Fees

If traders deposit or withdraw in currencies other than the account base currency, they will face currency conversion fees.

Capital.com Deposits and Withdrawals

Capital.com offers the following deposit and withdrawal methods:

➡️ Global Bank Transfers

➡️ Credit Card

➡️ Debit Card

➡️ Apple Pay

➡️ PayPal

➡️ Sofort

➡️ Payments_2C2P

➡️ Ideal

➡️ Giropay

➡️ Multibanko

➡️ Przelewy

➡️ Qiwi

➡️ Trustly

➡️ Bank of Indonesia

➡️ Bank of Malaysia

➡️ Bank of Philippines

➡️ Nganluong

➡️ UPI

➡️ Netbanking

➡️ Boleto

➡️ Transferencia Bancaria

➡️ Efecty

➡️ Baloto

➡️ BCI

➡️ Banorte

➡️ Spei

➡️ BBVA Bancomer

➡️ Thai QR

➡️ GCash

➡️ GlobePay

➡️ PayMaya

➡️ Pay Retailers

➡️ POLi

➡️ XPAY

Broker Comparison: Deposit and Withdrawals

| 🥇 Capital.com | 🥈 FP Markets | 🥉 IG | |

| Minimum Withdrawal Time | Instant | Instant | 1 business day |

| Maximum Estimated Withdrawal Time | Up to 3 Days | Up to 5 working days | Up to five business days |

| Instant Deposits and Instant Withdrawals? | Yes | Yes, Sticpay wallet withdrawals | Yes, Deposits on PayPal |

How can I deposit funds to my Capital.com account?

Capital.com offers a variety of convenient deposit methods, including:

➡️ Credit/Debit Cards: Visa, Mastercard, Maestro (instant processing, no fees)

➡️ Bank Transfers: Secure and reliable, processing time varies depending on your bank

➡️ E-wallets: Skrill, Neteller, PayPal (instant processing, fees may apply)

➡️ Open Banking: Available in specific countries, instant processing

Are there any fees associated with deposits and withdrawals?

Capital.com does not charge any fees for depositing funds into your account. However, some payment methods like e-wallets might have their own processing fees. Additionally, withdrawals are also fee-free.

How to Deposit Funds with Capital.com

To deposit funds to an account with Capital.com, Botswanan traders can follow these steps:

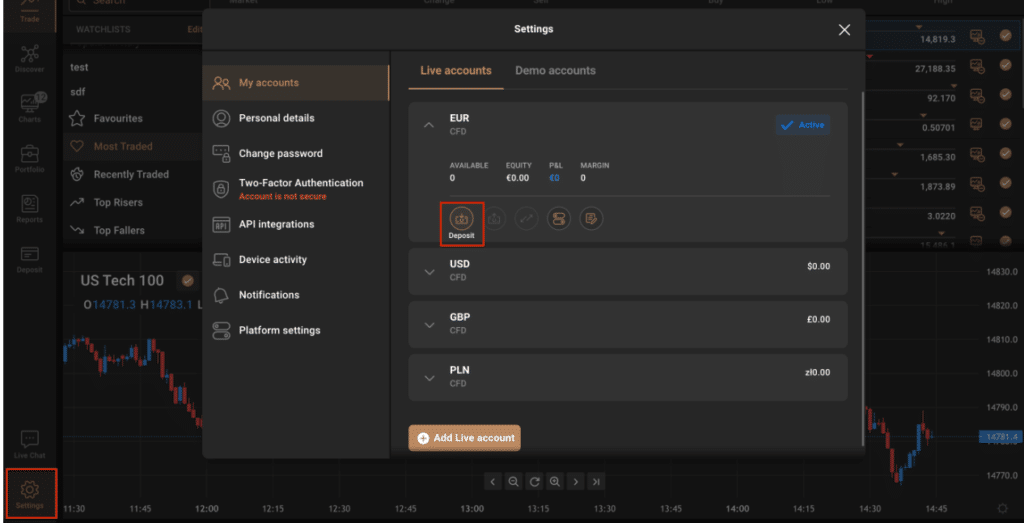

Step 1 – Log in

Login to open your personal dashboard.

Step 2 – Log in Details

After entering your login details select continue.

Step 3 – Make a deposit

Go to Settings -> My accounts, select the account and click on “Deposit”

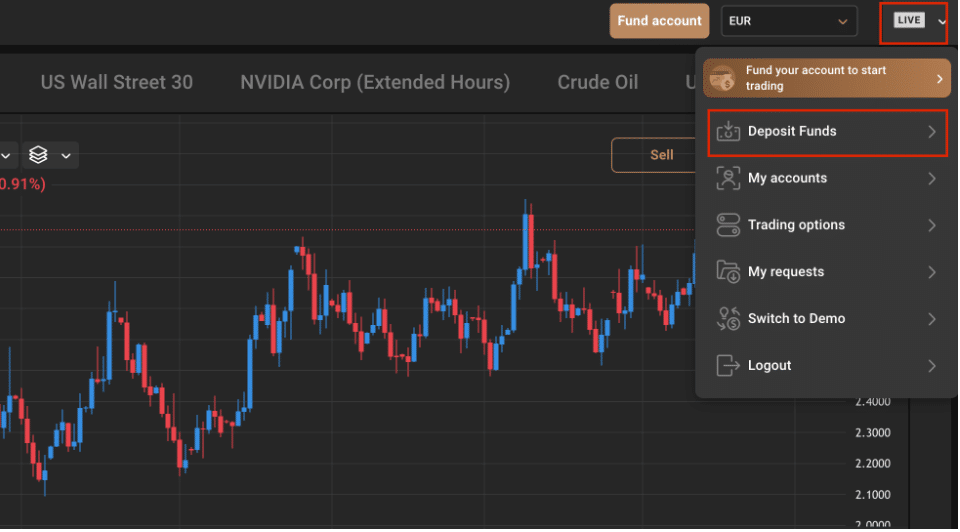

Step 4 – LIVE -> Deposit Funds.

To make a live deposit follow the steps below:

Capital.com Fund Withdrawal Process

To withdraw funds from an account with Capital.com, Botswanan traders can follow these steps:

➡️ To access the “Account” area of the app or trading platform, log in.

➡️ To withdraw money, go to “Payments” and “Withdraw.”

➡️ To make a withdrawal, choose the same payment option you used to deposit money, input the amount you want to withdraw, and confirm.

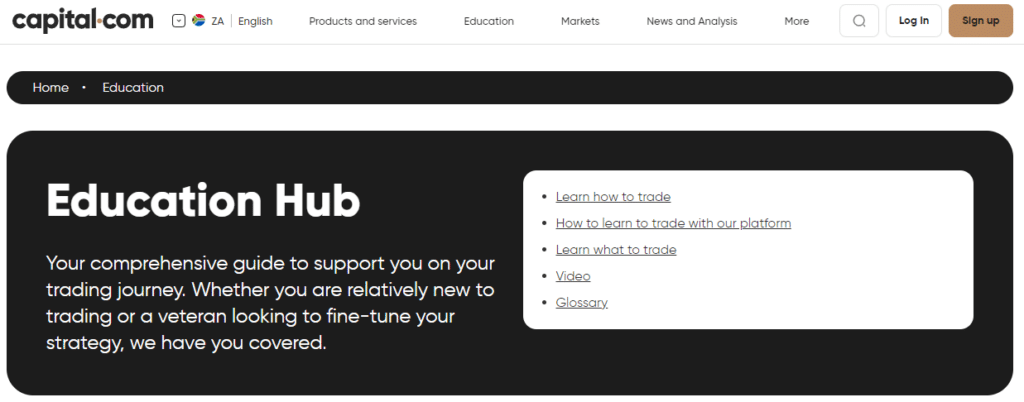

Capital.com Education and Research

Education

Capital.com offers the following Educational Materials:

➡️ The Basics of Trading

➡️ Popular Market Guides

➡️ Trading Guides

Research and Trading Tool Comparison

| 🥇 Capital.com | 🥈 FP Markets | 🥉 IG | |

| ➡️ Economic Calendar | Yes | Yes | Yes |

| ➡️ VPS | No | Yes | Yes |

| ➡️ AutoChartist | No | Yes | Yes |

| ➡️ Trading View | Yes | No | Yes |

| ➡️ Trading Central | No | No | No |

| ➡️ Market Analysis | Yes | Yes | No |

| ➡️ News Feed | Yes | Yes | Yes |

| ➡️ Blog | Yes | Yes | Yes |

Capital.com also offers Botswanan traders the following additional Research and Trading Tools:

➡️ Webinars

➡️ Economic Calendar

➡️ com TV

➡️ Market News Feeds

➡️ Technical Analysis

➡️ Fundamental Analysis

➡️ Market Insights

What type of educational resources does Capital.com offer?

Capital.com provides a comprehensive range of educational resources for traders of all levels, including:

➡️Online courses: Bite-sized, jargon-free courses covering essential trading concepts like CFDs, margin, risk management, and technical analysis.

➡️Trading Guides: Detailed guides on various asset classes like shares, indices, forex, and cryptocurrencies.

➡️Investmate App: A dedicated mobile app offering educational content, quizzes, and goal-setting tools to learn on the go.

➡️Webinars and Videos: Regular webinars hosted by experts and a library of insightful videos on current market trends and trading strategies.

Are these resources free and accessible to anyone?

Yes, all of Capital.com’s educational resources are completely free and accessible to everyone, regardless of whether you have an account or not. This commitment to education reflects their goal of fostering financial literacy and responsible trading practices.

10 Best Forex Brokers in Botswana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

Bonuses and Promotions

Traders who recommend their friends to download the Capital.com app could each earn a $250 “Refer a Friend” prize. The referred customer must sign up for an account, verify their information, and deposit at least 200 EUR or GBP.

Additionally, the referred client must make at least three transactions before the trader and their referral are eligible for the bonus.

Does Capital.com offer any welcome bonuses or promotions?

As of February 5, 2024, Capital.com does not have any sign-up bonuses, deposit bonuses, or other promotional offers in place. They have chosen to focus on providing a transparent and competitive trading platform with educational resources for users of all levels.

Are there any alternative benefits to using Capital.com?

Despite not offering traditional bonuses, Capital.com provides several advantages to users:

➡️Commission-free trading: You won’t pay any commissions on trades, making it potentially more cost-effective than platforms with commission fees.

➡️Competitive spreads: Capital.com offers competitive spreads on various markets, helping you keep trading costs manageable.

➡️Leverage trading: Leverage allows you to amplify potential gains (and losses) with a smaller investment. However, use leverage cautiously due to the associated risks.

➡️Fractional shares: Invest in popular companies with smaller amounts by purchasing fractional shares instead of whole shares.

➡️Advanced charting tools: Analyze market trends and make informed decisions with powerful charting tools and technical indicators.

How to open an Affiliate Account with Capital.com

Suppose you are a resident of Botswana and are interested in becoming a broker with Capital.com. In that case, you can learn more about the services provided by visiting their website.

Likewise, Botswanans interested in applying and finding out whether they are eligible may do so by contacting Capital.com.

Capital.com Affiliate Program Features

With Capital.com’s CPA-style Affiliate program, partners may earn up to $800 for each recommended customer on the Capital.com platform.

Subsequently, for the affiliate to get a commission, the referred client must sign up for a real account, validate the account, and fund the trading account.

Capital.com provides the following for its affiliates:

➡️ A resolute personal manager

➡️ Weekly market updates

➡️ Customized marketing and promo materials

➡️ World-class trading education for clients who join

➡️ Dedicated customer support

➡️ Innovative trading technology

Customer Support

Capital.com offers comprehensive assistance to its customers. For example, its support staff can communicate in 24 different tongues, ensuring that customers from all over the globe get their questions answered quickly.

English, Russian, German, Spanish, Arabic, French, Italian, and Turkish speakers can reach out to Capital.com by phone, Meta message, Viber, WhatsApp, Telegram, online Live Chat, and email.

| Customer Support | Capital.com’s Customer Support |

| ⏰ Operating Hours | 24/5 |

| 🗣 Support Languages | Multilingual |

| 🗯 Live Chat | Yes |

| 📧 Email Address | Yes |

| ☎️ Telephonic Support | Yes |

| 📞 Local Support in Botswana? | No |

| 🥇 Overall quality of Capital.com Support | 4/5 |

Corporate Social Responsibility

Capital.com does not currently indicate any Corporate Social Responsibility initiatives or projects.

Our Verdict

Capital.com is great for newbie traders because of its huge and well-organized library of learning and research resources. In addition, the proprietary platform is both simple to use and feature-rich.

When seeking a low-cost trading environment with a wide variety of tradable assets, Capital.com is a great option.

There are many excellent brokers to choose from, and Capital.com may be one of the finest. The broker uses innovative technologies to provide excellent service for its customers.

The in-house trading platform has been recognized for its excellence. It is one of a kind and tailor-made for investors seeking a simple trading environment.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Capital.com offers over 6,000 financial instruments that can be traded | Spreads are marked-up, and there is no BWP-denominated account |

| There are no commissions charged on trades and no hidden fees | |

| The order execution is dependable and fast | |

| There is an unlimited demo account offered | |

| Capital.com is well-regulated and can guarantee customer fund protection | |

| There is an extremely low minimum deposit when Botswanans fund an account via a card | |

| There is the excellent training material | |

| The broker offers an AI technology-driven platform |

You might also like: Admirals Markets Review

You might also like: ACY Securities Review

You might also like: Axiory Fees and Spreads

You might also like: AvaTrade Minimum Deposit

You might also like: BDSwiss Account Types

Conclusion

Now it is your turn to participate:

➡️ Do you have any prior experience with Capital.com?

➡️ What was the determining factor in your decision to engage with Capital.com?

➡️ Was it because of the minimum deposit, regulation, retail trading accounts, or other factors?

➡️ Have you experienced any issues with Capital.com, such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

Regardless, please share your thoughts in the comments below.

Frequently Asked Questions

Is Capital.com regulated?

Capital.com is regulated in many locations by FCA, ASIC, CySEC, NBRB, and FSA, giving the broker a worldwide presence.

Is Capital.com safe or a scam?

Capital.com is a reliable and trustworthy broker. Capital has existed since 2016 and is governed by some of the world’s strictest financial regulations.

Does Capital.com have Volatility 75?

Capital.com offers traders access to the VIX Volatility Index, with spreads that start from 0.18 pips.

Does Capital.com have Nasdaq?

Capital.com enables you to trade CFDs on the NASDAQ 100 and other highly traded indices, even if you have little cash in your account.

How long do withdrawals with Capital.com take?

Unlike some deposit methods, withdrawals are seldom instantaneous. Typically, it takes at least one business day, but sometimes many.

What is the minimum deposit for Capital.com?

Capital.com’s account has a low minimum deposit requirement of 20 USD, making it accessible to novice traders.

How can I withdraw funds from Capital.com?

Traders can sign into their account and choose “Withdrawal” or “Withdraw money” from the corresponding option.

Next, traders can select the withdrawal method and destination account (if more than one option is available).

Lastly, traders can indicate the withdrawal amount and, if requested, a brief explanation or description.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review