10 Best PAMM Account Forex Brokers in Botswana

The 10 Best Botswana Forex Brokers with a PAMM Account in Botswana revealed. We tested and verified the best PAMM Account forex brokers for Botswanan Traders.

This is a complete list of forex brokers that offer a PAMM Account in Botswana.

In this in-depth guide you’ll learn:

- What is Percent Allocation Money Management (PAMM)?

- Who are the best PAMM account forex brokers for Botswanans?

- Which PAMM Account forex brokers are the most profitable?

- Which PAMM Account forex brokers offer the best account management?

- Do PAMM Accounts have regulations?

- How safe are PAMM Accounts?

- Which PAMM Account brokers offer a low minimum deposit of $5 (64 BWP)?

And lots more…

So if you’re ready to go “all in” with the best-tested PAMM Accounts forex brokers for Botswanans…

Let’s dive right in…

- Louis Schoeman

Best PAMM Account Forex Brokers in Botswana

| 🏛️ Broker | 👉 Open Account | 💵 Minimum Deposit | 💰 PAMM Account Broker? | ✔️ Offers a Botswana Pula Account? |

| 1. Just2Trade | 👉 Open Account | USD 100 / 1 365 BWP | Yes | No |

| 2. Alpari | 👉 Open Account | USD 5 / 67 BWP | Yes | Yes |

| 3. FXTM | 👉 Open Account | USD 10 / 136 BWP | Yes | Yes |

| 4. FP Markets | 👉 Open Account | USD 100 / 1 365 BWP | Yes | Yes |

| 5. Moneta Markets | 👉 Open Account | USD 50 / 672 BWP | Yes | Yes |

| 6. Vantage Markets | 👉 Open Account | USD 50 /672 BWP | Yes | No |

| 7. Skilling | 👉 Open Account | USD 100 / 1 365 BWP | Yes | No |

| 8. FusionMarkets | 👉 Open Account | USD 0 / 0 BWP | Yes | No |

| 9. Dukascopy | 👉 Open Account | USD 100 / 1 365 BWP | Yes | No |

| 10. FXOpen | 👉 Open Account | USD 1 / 13 BWP | Yes | No |

10 Best Forex Brokers in Botswana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

What is Percent Allocation Money Management (PAMM)?

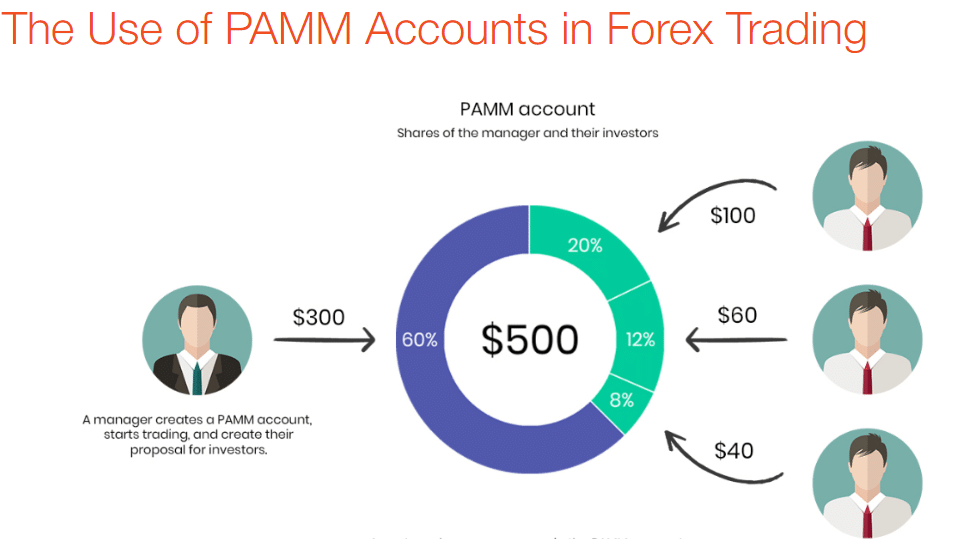

PAMM accounts function comparable to mutual funds, and you commit your funds to a third party who will trade on your behalf.

Consequently, you can obtain exposure to the financial markets without prior trading knowledge. Moreover, unlike a major organization, your money will be put with an experienced trader with a proven record of buying and selling online assets.

In addition, the trader you choose will engage in day trading rather than purchasing and keeping assets for months or years.

Importantly, PAMM account traders will always contribute their funds to the investment portfolio since doing so assures that they are financially motivated to trade cautiously.

PAMM traders get a fee on the income they generate for you and other clients in exchange for their efforts. Furthermore, this commission is deducted before realizing your gains.

10 Best PAMM Account Forex Brokers in Botswana

- ✔️ Just2Trade – Overall, Best PAMM Account Forex Broker in Botswana

- ✔️ Alpari – Best Forex Broker for Beginner Traders

- ✔️ FXTM – Top Low Deposit Broker in Botswana

- FP Markets – Best Volatility 75/VIX 75 Broker

- Moneta Markets – Top NDD Broker in Botswana

- Vantage Markets – Best STP Forex Broker in Botswana

- Skilling – Verified Sign Up Bonus Broker

- Fusion Markets – Best Lowest Spread Forex Broker in Botswana

- Dukascopy – Top ECN Forex Broker

- FXOpen – Top MetaTrader 5/MT5 Broker in Botswana

1. Just2Trade

Overview

Just2Trade is a Cyprus-based ECN and STP broker that has been in business since 2006 and is tightly regulated by CySEC in supplying online trading solutions and services to many traders.

Min Deposit

USD 100 / 1 365 BWP

Regulators

CySEC, FINRA, SIPC, NFA

Trading Desk

MT4, MT5

Crypto

Yes

Total Pairs

0

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Just2Trade provides a range of tradable financial products and other trading services as a global broker. When trading using Just2Trade, traders can access various instruments across asset classes.

Direct market access is offered to traders with cheap fees, maximum liquidity from several liquidity providers aggregated from large banks, and narrow spreads beginning at 0 pips.

Features

| Feature | Information |

| 📈 Range of Markets | Forex, Stocks, Futures, CFDs, Bonds |

| ⚖️ Regulation | CySEC |

| 💻 Account Types | • MT5 Global • Multifunctional Account • Forex Account |

| 💵 Minimum Spread | From 0.5 pips |

| 💸 Minimum Deposit | 1,365 BWP ($100) |

| 📱 Platforms Supported | • MetaTrader 4 • MetaTrader 5 • CQG • Sterling Trader Pro |

| 📉 Minimum Trade Volume | 0.01 lots |

| 📈 Maximum Leverage | 1:500 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Just2Trade offers sophisticated platforms where traders can access equities, bonds, and other instruments | The fee structure is not transparent |

| Just2Trade offers dedicated customer support 24/5 | Only Tier-2 regulation |

| Traders can benefit from commission-free trading on the forex account | |

| There is instant execution and some of the best liquidity | |

| Comprehensive PAMM services are available | |

| Bonuses are offered to new and existing traders |

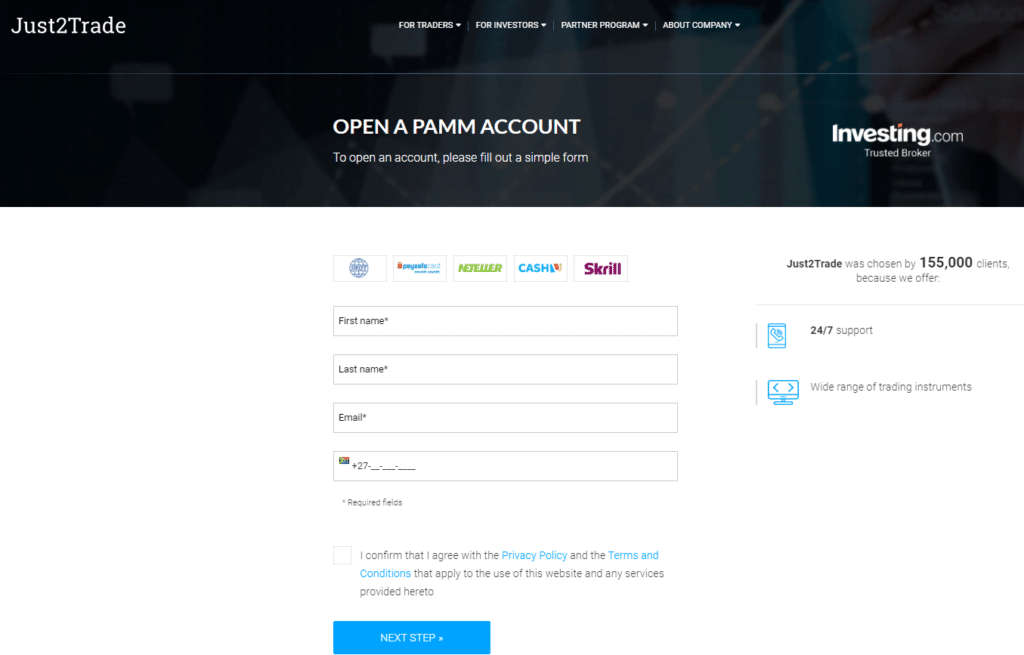

2. Alpari

Overview

Alpari has been operating since 1998 and provides Botswanan traders direct access to managed PAMM accounts.

Numerous PAMM traders on the Alpari site have a decade of expertise, hence improving traders’ chances of success. In addition, once you have identified a trader you want to invest in, you can easily negotiate commission rates and trading techniques.

Min Deposit

5 USD / 67 BWP

Regulators

FSC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

48

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Every PAMM account manager must fund their account in advance. This should give you confidence that the account trader is motivated to execute low-risk transactions to maximize your (and their) profit.

Features

| Feature | Information |

| ⚖️ Regulation | Financial Services Commission Mauritius (FSC) |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Forex Standard Account, Forex Micro Account, Forex ECN Account, Forex Pro Account |

| 📊 Trading Platform | MetaTrader 4, MetaTrader 5, Alpari Trading App |

| 💰 Minimum Deposit | 67 Botswanan Pula or 5 EUR, USD, or GBP |

| 💰 Trading Assets | Forex Majors, Forex Minors, Forex Exotics, Forex RUB, Spot Metals, Spot Commodities, Stock Trading, Spot Indices |

| 🔎 Botswanan Pula-based Account? | Yes |

| 💳 BWP Deposits Allowed? | Yes |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 0.4 pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | No |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Well-regulated and award-winning CFD broker | Fixed spreads are not offered |

| Offers forex trading signals from AutoChartist and automatic trading | Not regulated by the Financial Conduct Authority, Cyprus Securities and Exchange Commission, or any other popular market regulators |

| MetaTrader 4 and MetaTrader 5 are supported across devices | There is a limited selection of trading instruments, educational tools, and research |

| News is streamed from FxWirePro | There are restrictions on several jurisdictions |

| A dedicated customer support team offers multilingual customer support | |

| Offers unique solutions to both beginner and experienced traders | |

| There are four retail investor accounts to choose from, demo accounts, and Islamic accounts | |

| There are several convenient funding options to choose from and deposit fees are not charged |

3. FXTM

Overview

Cyprus-based FXTM, short for ForexTime Limited, is a major player in the foreign exchange and contracts for difference (CFD) markets.

FXTM is authorized to offer trading services in several countries and is compatible with the MetaTrader 4 and 5 trading platforms and their mobile applications.

Min Deposit

USD 10

Regulators

CySec, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

60

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Tight trading spreads and the availability of an ECN account, which grants direct market access, are features that high-volume traders and market veterans highly value. For an ECN account, a tiny fee is added to the tight market trading spreads.

FXTM’s PAMM and managed accounts are another reason why it stands out from the competition. For example, suppose you are interested in making money on the foreign exchange market but do not want to trade the market yourself. In that case, a managed account might be a good option.

Features

| Feature | Information |

| ⚖️ Regulation | CySEC, FSCA, FCA, FSC Mauritius |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Micro Account, Advantage Account, Advantage Plus Account |

| 📊 Trading Platform | MetaTrader 4, MetaTrader 5, FXTM Trader |

| 💰 Minimum Deposit | 134 Botswanan Pula equivalent to $10 |

| 💰 Trading Assets | Precious Metals, Stock Trading, Stock CFDs, Indices, Forex Indices, Forex Currency Pairs (including minor, major, and exotic pairs), Commodities, Stock Baskets |

| 🔎 Botswanan Pula-based Account? | Yes |

| 💳 BWP Deposits Allowed? | Yes |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 0.0 pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| FXTM is a multi-regulated and a reputable broker that has gained a high level of trustworthiness | Inactivity fees apply when the retail investor account becomes dormant |

| Dedicated customer support offered for Botswanan traders Several deposit options and withdrawal methods offered | |

| There is a low minimum deposit requirement | |

| Commission-free trading is offered | |

| Deposit fees are not charged on any payment methods | |

| Withdrawal processing times are quick | |

| There are several educational tools offered | |

| There is an exclusive risk management tool offered |

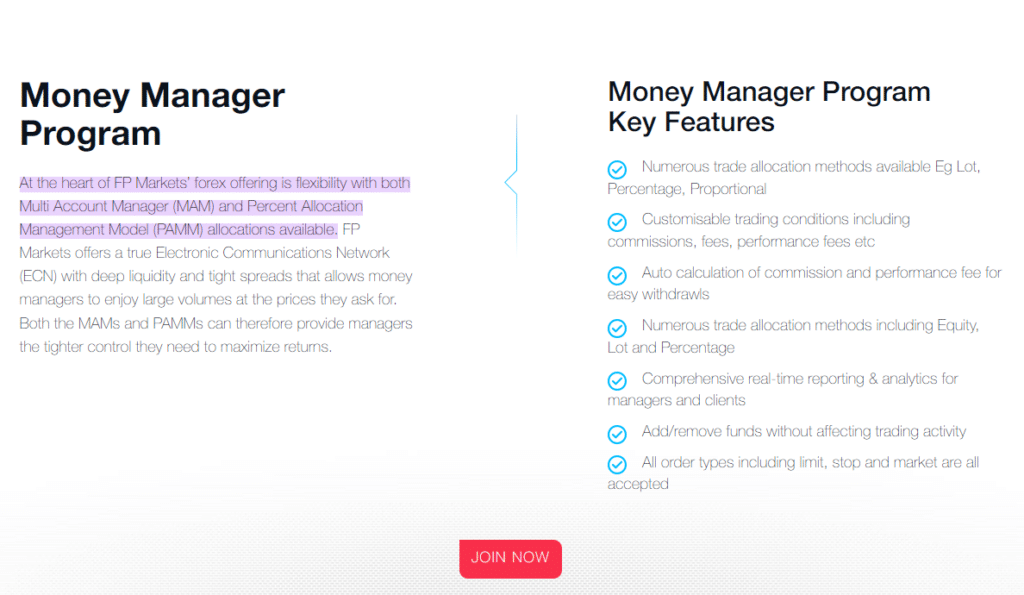

4. FP Markets

Overview

FP Markets provides customers with PAMM and MAM accounts that allow a portfolio manager to access their funds. This procedure is helped by MT4 and MT5, which provide deep liquidity through ECN trading. This guarantees that traders avoid slippage on many occasions.

Min Deposit

100 USD/1 343 BWP

Regulators

ASIC, CySEC, FSCA, CMA

Trading Desk

MetaTrader 4, MetaTrader 5

Crypto

Yes

Total Pairs

63

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

The amazing part about FP Markets is that customers have a variety of alternatives to pick from since money managers can tailor their commissions, currencies, and performance fees, among other things.

Moreover, customers can easily withdraw their cash at any moment and see real-time performance data.

Features

| Account Feature | Value |

| 💰 Minimum Deposit | 100 USD / 1 343 BWP |

| 📊 Average Spreads | Variable, from 1 pip |

| ✔️ Instruments Available | 60+ Forex pairs, metals, indices, commodities |

| 📈 Maximum Leverage Ratio | 1:500 |

| 📱 Execution Type | ECN |

| 💵 Commissions | None |

| 👥 Expert Advisors Offered? | Yes |

| 📲 Mobile App Offered? | Yes |

| ✔️ VPS Available? | Yes |

Pros and Cons

| ✔️ PROS | ❌ CONS |

| fpmarkets is a well-established Australian broker regulated by ASIC and CySEC | Fixed spreads are not available |

| Botswanan traders can choose from an impressive range of markets that can be traded through powerful platforms | There are withdrawal fees charged on most payment methods that are supported |

| fpmarkets offers comprehensive mobile trading opportunities | There are administration fees which apply to the Islamic accounts and trading |

| Botswanan traders can expect superior ECN pricing that includes raw and tight spreads and low commissions | |

| fpmarkets is known for its fast trade execution that is delivered through the Equinix servers | |

| There are commission-free accounts offered that still feature competitive spreads | |

| There are dedicated Islamic accounts for Muslim traders | |

| fpmarkets offers a range of educational materials and advanced trading tools |

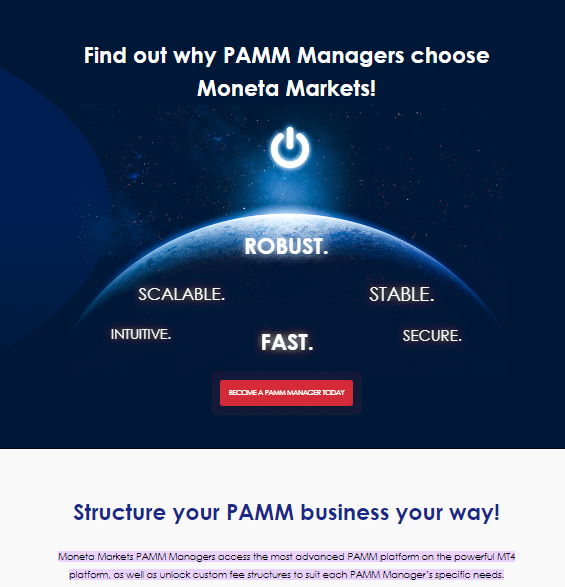

5. Moneta Markets

Overview

Moneta Markets was established in 2020 as a foreign exchange broker under Vantage International Group Limited.

Min Deposit

USD 50 / 672 BWP

Regulators

CIMA

Trading Desk

MT4, MT5, WebTrader

Crypto

No

Total Pairs

49

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

PAMM Managers at Moneta Markets have access to the industry’s most sophisticated PAMM platform, built on the robust MT4 platform. They can also use flexible pricing tiers to meet their individual requirements.

In addition, Moneta’s innovative IB Portal automatically computes bespoke rebates based on the specifics of your PAMM firm, giving you complete authority over investor money and providing a comprehensive, omnidirectional approach to managing them.

Features

| Feature | Information |

| 📈 Range of Markets | Bonds, ETFs, Share CFDs, Forex, Indices, Commodities |

| ⚖️ Regulation | FSCA, CySEC, SVG FSA |

| 💻 Account Types | Direct STP Account Prime ECN Account |

| 💵 Minimum Spread | 0.0 pips |

| 💸 Minimum Deposit | 672 BWP ($50) |

| 📱 Platforms Supported | • Pro Trader • MetaTrader 4 |

| 📉 Minimum Trade Volume | 0.01 lots |

| 📈 Maximum Leverage | 1:500 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Moneta Markets offers excellent research for traders | There are limited options in terms of withdrawals |

| There are no deposit or inactivity fees charged | There is no BWP-denominated account offered to Botswanans |

| Moneta Markets has streamlined onboarding | |

| There is a range of markets that can be traded | |

| Botswanans pay a low minimum deposit to register an account | |

| A demo account is available | |

| There are advanced trading platforms |

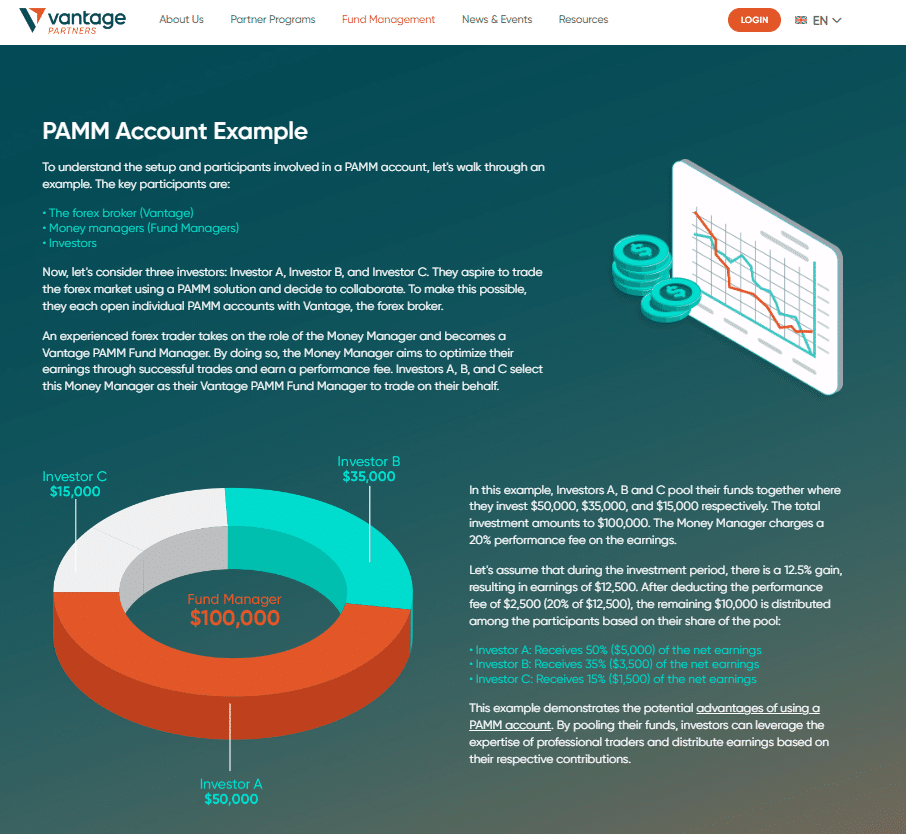

6. Vantage Markets

Overview

Award-winning Vantage Markets is a multi-asset broker focused on making it easy for traders to take advantage of market openings. Vantage Markets has served as a broker and trading environment for over a decade, and the platform provides a wealth of features and benefits.

Min Deposit

USD 50 /672 BWP

Regulators

VFSC

Trading Desk

MetaTrader 4, MetaTrader 5

Crypto

Yes

Total Pairs

–

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Vantage Markets, formerly known as Vantage Markets, changed its name and logo over a year ago to better position itself as a multi-asset broker and trading platform. With its improved accessibility and simplicity, the platform is a more viable option for novice traders.

Furthermore, Vantage Markets’ wide variety of tradable assets mimics the multi-trade support the leading trading platforms provide, allowing investors to spread their bets over a wider range of markets.

Features

| Feature | Information |

| 📈 Range of Markets | Forex, Soft Commodities, Precious Metals, Bonds, Share CFDs, Indices, Energies, ETFs |

| ⚖️ Regulation | CIMA, VFSC, ASIC, CySEC |

| 💻 Account Types | • Raw ECN Account • Standard STP Account • PRO ECN Account • Cent Account • Swap-Free Account |

| 💵 Minimum Spread | 0.0 pips |

| 💸 Minimum Deposit | USD 50 /672 BWP |

| 📱 Platforms Supported | • Vantage App • ProTrader • MetaTrader 4 • MetaTrader 5 • V Social |

| 📉 Minimum Trade Volume | 0.01 lots |

| 📈 Maximum Leverage | 1:1000 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| There is a large range of trading instruments offered | There is no BWP-denominated account |

| There are sophisticated trading platforms | Trading is mostly limited to CFD instruments and not underlying instruments |

| Vantage Markets offers flexible trading accounts suited to different traders | |

| There are spreads from 0.0 pips on major instruments according to the account type | |

| PAMM Solutions are provided | |

| There are several educational materials offered | |

| Botswanans pay a low minimum deposit when they register a Cent Account |

7. Skilling

Overview

Skilling, an innovative broker founded in 2016, offers three trading platforms to its clients: MT4, cTrader, and a proprietary platform that integrates with cTrader in a way that has never been seen before in the industry.

Skilling’s clients can hire account managers to act as proxy traders through the service’s account management offering. Custom-built hardware or software, also known as MAM/PAMM, is required to carry out this service.

Min Deposit

USD 100 / 1 365 BWP

Regulators

CySEC, FSA

Trading Desk

MT4, cTrader, Skilling Trader

Crypto

Yes

Total Pairs

73

Islamic Account

No

Trading Fees

Low

Account Activation Time

24/5

In addition, the MAM program relays all allocation preferences to the Skilling MetaTrader 4 server in a single, streamlined transaction.

Moreover, Money managers who want to manage funds for multiple clients from a single Master Account and user interface will find Skilling’s PAMM and MAM solutions ideal.

Features

| Feature | Information |

| 📈 Range of Markets | Forex, Shares, Indices, Cryptocurrencies, Commodities |

| ⚖️ Regulation | CySEC, FSA |

| 💻 Account Types | • Standard Account • Premium Account • MT4 Account • MT4 Premium Account |

| 💵 Minimum Spread | 0.1 pips |

| 💸 Minimum Deposit | 1,365 BWP ($100) |

| 📱 Platforms Supported | • Skilling Trader • MetaTrader 4 • Skilling Copy • cTrader • TradingView |

| 📉 Minimum Trade Volume | 0.01 lots |

| 📈 Maximum Leverage | 1:500 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Skilling has a user-friendly website and interface, with solutions ideal for beginners | There are limited payment options offered for deposits and withdrawals |

| All commissions and fees are transparent | |

| Skilling has market-leading trading technology that sets it apart from other brokers | |

| There is a decent range of tradable instruments offered | |

| User accounts are protected | |

| Traders have access to the Skilling trading academy when they start out | |

| Skilling is trusted and well-regulated |

8. Fusion Markets

Overview

Fusion Markets is a popular CFD No Dealing Desk broker because of its cheap spreads, lightning-fast execution, and no set minimum deposits.

Money managers who oversee numerous accounts will appreciate the MAM/PAMM account type, which is exclusive to the MetaTrader trading platform. Furthermore, there are prerequisites to meet before opening this type of account.

Min Deposit

USD 0 / 0 BWP

Regulators

ASIC and VFSC

Trading Desk

MT4

Crypto

Yes

Total Pairs

90+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

With a maximum of three financed sub-accounts, you must deposit at least $5,000 into each one you want to use. Furthermore, you must present proof of at least three months’ worth of profitable business operations.

Additionally, this account manager must have been trading successfully with Fusion Markets for at least a month and must meet all local requirements to manage and trade with this sort of account.

Features

| Feature | Information |

| ⚖️ Regulation | ASIC, VFSC, FSA |

| ⚖️ Regulated in Botswana? | No |

| 📊 Trading Accounts | • Zero Account • Classic Account |

| 📊 Trading Platform | • MetaTrader 4 • MetaTrader 5 • Fusion+ Copy Trading |

| 💰 Minimum Deposit (BWP) | 0 BWP ($0) |

| 💰 FTSE 100 Average Spread | 0.7 pips |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Fusion Markets has reliable trade execution | Negative balance protection is not currently available |

| Spreads with Fusion Markets start from 0.0 pips, and FTSE 100 spreads are competitive | There is a limited range of markets |

| There is no minimum deposit requirement | A trading account left dormant for 90 days will be terminated |

| Botswanans can choose from MT4 and MT5 |

9. Dukascopy

Overview

Dukascopy Bank was established in 2004 and is headquartered in Switzerland. Dukascopy is a financial services firm that helps its customers with banking, online brokerage, and trading.

Moreover, Dukascopy is a licensed Swiss bank subject to oversight by the Swiss Financial Market Supervisory Authority (FINMA).

Min Deposit

USD 100 / 1 365 BWP

Regulators

FINMA, JFSA, FCMC

Trading Desk

MT4, JForex Desktop, JForex Web

Crypto

Yes

Total Pairs

60

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Regarding the trading environment, Dukascopy offers a few special touches that set them apart from the competition.

Clients of Dukascopy have access to the most up-to-date proprietary trading platform, JForex and Metatrader 4, which are both compatible with the IOS and Android mobile operating systems.

Features

| Feature | Information |

| 📈 Range of Markets | Forex, Commodities, Indices, Bonds, Cryptocurrencies, Stocks, ETFs |

| ⚖️ Regulation | FINMA |

| 💻 Account Types | • Forex Account (MT4) • CFD Accounts • Gold Accounts |

| 💵 Minimum Spread | 0.1 pips |

| 💸 Minimum Deposit | 1,365 BWP ($100) |

| 📱 Platforms Supported | • MetaTrader 4 • JForex |

| 📉 Minimum Trade Volume | 0.01 lots |

| 📈 Maximum Leverage | 1:30 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Dukascopy is a well-regulated entity | There are inactivity fees charged |

| Client fund safety is guaranteed, and investor protection is available | There are several non-trading fees charged |

| There is a range of tradable instruments | There are limitations to leverage |

| Dukascopy offers a powerful proprietary trading platform alongside MT4 | |

| Comprehensive PAMM solutions are available |

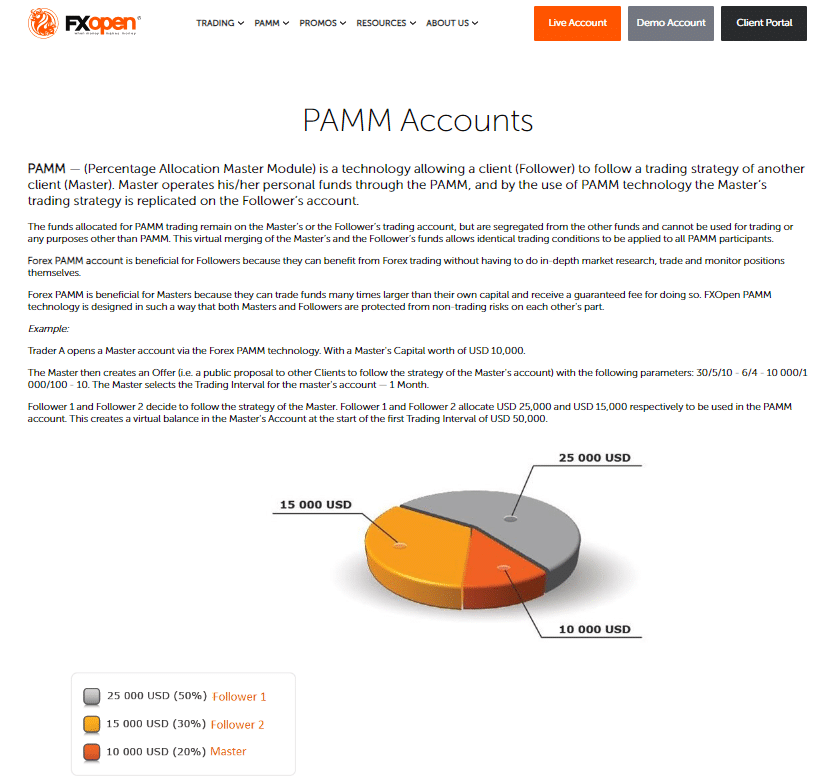

10. FXOpen

Overview

In 2005, FXOpen started as a broker to meet the need for more honest and open exchanges. With the industry’s lowest trading costs and the tightest spreads, you can make the most of your investments with FXOpen.

Overall Rating

- 4.8/5

Min Deposit

USD 1 / 13 BWP

Regulators

ASIC

Trading Desk

No Trading Desk

Crypto

Yes

Total Pairs

4

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

In addition to its own PAMM technology, FXOpen provides access to the tactics of professional traders. With FXOpen’s PAMM service, seasoned traders may pool their resources to become a Master and profit from Forex followers to the mutual advantage of both parties.

Features

| Feature | Information |

| 📈 Range of Markets | Forex, ETFs, Crypto, Indices, Commodities, Shares |

| ⚖️ Regulation | FCA, ASIC |

| 💻 Account Types | • ECN Account • STP Account • Micro Account • Crypto Account |

| 💵 Minimum Spread | 0.0 pips |

| 💸 Minimum Deposit | 13 BWP ($1) |

| 📱 Platforms Supported | MetaTrader 4 MetaTrader 5 TickTrader Myfxbook AutoTrade |

| 📉 Minimum Trade Volume | 0.01 lots |

| 📈 Maximum Leverage | 1:500 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| FXOpen is known for its true ECN model | Withdrawal fees might apply |

| FXOpen is well-regulated and offers an unlimited demo account | Not all accounts have the same access to financial instruments |

| Negative balance protection is applied to trading accounts |

What must you look for in a PAMM Broker?

For the average investor, PAMM accounts are a panacea. You may engage in full-time trading with zero prior familiarity or preparation required for any financial instrument.

Despite this, it is essential that you conduct your own research since the market is dominated by scam platforms that lack the proper regulatory license. Therefore, when evaluating various PAMM accounts, it is important to keep the following criteria in mind.

Regulation

When selecting a PAMM broker, regulation is one of the most important factors. Since clients will provide access to their trading capital, partnering with a broker strictly regulated by top-tier entities is essential.

Minimum Deposit

PAMM companies often need a far bigger initial deposit than you would make with a conventional broker. In addition, the PAMM trader will make money from the investment since they will be using a commission structure.

Analysis and Trading Tools

The greatest PAMM brokers will include MT4/MT5 compatibility since these platforms are the industry standard. Using these systems, traders may connect their accounts to third-party traders through their preferred broker or another organization.

It is also advisable to utilize a broker that provides technical indicators, real-time price charts, and portfolio reports since they may give context to the money manager’s actions.

Commission Structure

You must thoroughly understand the commission structure, which might vary across PAMMs. In addition, if you work directly with a registered broker, you may have to produce your own commission arrangement.

Availability of a Demo Account

Although practicing PAMM trading without giving real funds is impossible, several brokers provide a free demo account function. This tool replicates the real trading environment and allows novices to practice placing trades.

Mobile Trading

Numerous brokers provide mobile applications that enable traders to track their holdings on the fly. Numerous brokers link with MT4, cTrader, and MT5, allowing traders to keep track of the markets using smartphone or tablet applications.

Overall Liquidity

Botswanans should avoid a PAMM account if they often anticipate a need to withdraw funds from their investment account. Instead, it would help if you looked at it as a long-term investment that will help your money grow over time.

But there may come the point when you need to withdraw money from your PAMM account. Again, it will help if you read the fine print of your investment’s redemption policy to see how long you will have to wait to get your money back.

Payment Methods for Deposits and Withdrawals

The best low-spread forex brokers that provide PAMM accounts will allow a variety of payment ways to facilitate account funding, including credit/debit cards, PayPal, Skrill, and Neteller.

Customer Support

Since it might be difficult to entrust another individual with trading funds, it is prudent to work with a broker that has a specialized customer support staff. In addition, look for brokers offering telephone and live chat support since these methods provide prompt and individualized assistance.

Range of Instruments

The PAMM trader you support should specialize in the asset class in which you invest. If you want to diversify your portfolio and obtain exposure to the foreign exchange market, for instance, it will not make sense to invest with a crypto trader.

Therefore, before deciding to invest with a PAMM trader, you should be able to see what kinds of investments they are managing.

Drawdown

Getting a handle on the drawdown is crucial. This is the largest percentage drop in the trader’s portfolio from its highest point. In addition, if a PAMM trader’s drawdown is in the double digits, it is a red flag that they are making riskier trades with poor results.

Type of PAMM Account Platform

The first step in opening a PAMM account is deciding what kind of account you want. Consider whether you want to use a third-party all-in service or sign up with a broker who offers PAMM accounts directly.

The type of platform is important info to have, as you will want to know how your money is being safeguarded.

The Best Forex Brokers in Botswana

In this article, we have listed the best brokers that offer forex trading to traders in Botswana. In addition, we have further identified the brokers that offer additional services and solutions to Botswanan traders.

Best MetaTrader 4 / MT4 Forex Broker in Botswana

Min Deposit

USD 25

Regulators

FCA UK

Trading Platform

MT5, MT4, OctaTrader

Crypto

Yes

Total Pairs

28

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, OctaFX is the best MT4 forex broker in Botswana. OctaFX is an MT4 and MT5 broker that provides Botswanans with various markets. OctaFX offers a choice of accounts via MT4, including ECN and STP accounts, with superior trade execution.

Best MetaTrader 5 / MT5 Forex Broker in Botswana

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, AvaTrade is the best MetaTrader 5 forex broker in Botswana. In addition, AvaTrade is regarded as one of the most secure MT5 forex brokers.

No commission is charged for trading currency pairings, only leaving the spread to be paid. A demo account is also available for traders to sharpen their abilities via MT5 and several other platforms.

Best Forex Broker for beginners in Botswana

Min Deposit

$100

Regulators

CFT, NFA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FOREX.com is the best forex broker for beginners in Botswana. FOREX.com is a broker renowned for low trading fees and beginner-friendly solutions. In addition, FOREX.com offers several educational materials and a helpful demo account.

Best Low Minimum Deposit Forex Broker in Botswana

Min Deposit

$10 / 134 BWP

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Exness is the best Low Minimum Deposit Forex Broker in Botswana. Exness has a minimum deposit requirement of 10 USD / 130 BWP, making it easy for Botswanans to start trading 278 instruments.

Exness also offers MT4 and MT5 through which trades can be made. In addition, it offers some of the best trading tools, charting capabilities, technical indicators, expert advisors, and more.

Best ECN Forex Broker in Botswana

Min Deposit

USD 0

Regulators

CySEC, FCA, DFSA, FSCA, FSA, CMA

Trading Desk

MT4, MT5, HFM APP

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

0

Account Activation Time

24 Hours

Overall, HFM is the best ECN forex broker in Botswana. HFM is a hybrid forex and CFD broker that uses STP and ECN technology to ensure that Botswanans get the best pricing, minimal slippage, no requotes, and the fastest trade execution.

HFM uses the best liquidity providers who aggregate the pricing that Botswanans can see on MT4, MT5, and the HF App for Android and iOS.

Best Islamic / Swap-Free Forex Broker in Botswana

Min Deposit

USD 10 / 136 BWP

Regulators

CySec, FCA

Trading Desk

None

Crypto

Yes

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, eToro is the best Islamic / Swap-Free forex broker in Botswana. eToro is a renowned social trading platform that offers Muslim traders an Islamic Account.

eToro does not charge any interest on positions held for over 24 hours. However, registering an Islamic Account can be expensive initially, requiring a 1,000 USD / 13,400 BWP deposit.

Best Forex Trading App in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

ASIC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

300

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, CMC Markets is the best forex trading app in Botswana. In addition, CMC Markets offers a user-friendly mobile app with research tools, powerful charts, customizable watch lists, news reports, and a range of educational materials.

Best Lowest Spread Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

FCA, CySEC, IFSC, KNF

Trading Desk

No Trading Desk

Crypto

Yes

Total Pairs

48

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, XTB is the best lowest-spread forex broker in Botswana. XTB is a well-known forex and CFD broker with low and competitive forex spreads from 0.1 pips depending on the financial instrument and the market conditions.

XTB is also a good broker in terms of educational materials and research capabilities, providing traders with comprehensive market analysis across markets.

Best Nasdaq 100 Forex Broker in Botswana

Min Deposit

USD 10

Regulators

CySec, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

60

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXTM is the best Nasdaq 100 forex broker in Botswana. FXTM is a multi-regulated forex and CFD broker that accommodates Botswanan traders with a keen interest in Nasdaq. Traders can expect low and competitive spreads, a choice between accounts, and powerful trading platforms.

Best Volatility 75 / VIX 75 Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

IGRs

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, IG is Botswana’s best Volatility 75 / VIX 75 forex broker. IG is one of the best CFD brokers with powerful proprietary trading technology.

IG is well-regulated and offers Botswanans access to VIX75, with spreads from 0.04 pips / 0.13% and zero commission charges.

Best NDD Forex Broker in Botswana

Min Deposit

USD 50 / 672 BWP

Regulators

FCA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

–

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXCM is the best NDD forex broker in Botswana. FXCM is a No-Dealing Desk broker with STP and ECN execution across several markets.

In addition, FXCM offers a choice between third-party platforms in addition to technical indicators, charting tools, and competitive trading conditions.

Best STP Forex Broker in Botswana

Min Deposit

USD 10

Regulators

IFSC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

36

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, RoboForex is the best STP forex broker in Botswana. RoboForex is popular forex and CFD broker with competitive trading conditions. RoboForex offers STP execution with liquidity sourced from top providers.

Botswanans can expect access to over 12,000 instruments via powerful and innovative third-party platforms.

Best Sign-up Bonus Broker in Botswana

Min Deposit

50 USD / 682 BWP

Regulators

CYSEC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Windsor Brokers is the best sign-up bonus broker in Botswana. Windsor Brokers is a well-regulated broker that offers Botswanans a welcome account funded with 30 USD in trading credit. With this account, Botswanans can explore the platform or risk-free test their strategies.

You might also like: Best Algorithmic Trading Platforms in Botswana

You might also like: CFD Trading Platforms in Botswana

You might also like: Best Cent Account Forex Brokers in Botswana

You might also like: Best NASDAQ 100 Brokers in Botswana

You might also like: Best STP Forex Brokers in Botswana

Conclusion

PAMM accounts facilitate the execution of transactions with funds from numerous accounts, allowing money managers to trade forex on behalf of several investors.

This has a few benefits, including allowing investors to profit without watching markets or doing technical analysis. However, PAMM accounts are subject to the same dangers as individual trading, making risk management crucial.

However, employing a PAMM account provider does not ensure financial success. Since there are so many different PAMM traders, it is in your best interest to spread your money around and learn about each one.

Frequently Asked Questions

What is a PAMM broker in Botswana?

PAMM is a service that enables investors to deposit monies into traders’ accounts. These traders are typically referred to as managers or masters and are compensated for investment gains.

Is PAMM forex legitimate in Botswana, or a scam?

If they are controlled, then your PAMM account is secure. Regarding the software powering the account, earnings and losses are automatically dispersed, so there is nothing to worry about. However, all forms of trading include risk, and there is no assurance of success.

Is PAMM trading in Botswana profitable?

PAMM accounts, like any trading services, include risk, but they are undeniably lucrative. One of the benefits is that investors will not have to worry about their trading strategy since a professional will manage it.

How do I withdraw funds from my PAMM Account?

You can withdraw funds from your PAMM Account by logging into your trading account with a PAMM broker, selecting the option to withdraw, and completing the necessary steps to confirm the withdrawal request.

What is the difference between PAMM and MAM?

MAM and PAMM are abbreviations for Multi-Account Manager and Percentage Allocation Management Module, respectively.

Both systems enable fund managers to handle several accounts from their accounts. As a result, they do not need to establish a separate investment fund to handle other people’s accounts.

Who are the best PAMM account forex brokers for Botswanans?

Best PAMM account is fpmarkets, AvaTrade, IC Markets,

Which PAMM Account forex brokers are the most profitable?

- Just2Trade

- Alpari

- FXTM

Which PAMM Account forex brokers offer the best account management?

- Just2Trade

- FXOpen

- fpmarkets

Do PAMM Accounts have regulations?

Yes, there are many well-regulated brokers available who provide PAMM accounts.

How safe are PAMM Accounts?

Yes, it is safe to use a PAMM (Percentage Allocation Management Module) account in general.

Which PAMM Account brokers offer a low minimum deposit of $5 (64 BWP)?

Low Minimum Deposit PAMM Account is Alpari.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review