AvaTrade Demo Account

Yes, AvaTrade does offer a Demo account. Traders can navigate to the AvaTrade website and select the “Demo Account” option to open a demo account. Trading in a safe environment is great for beginner traders that are new to trading

- Louis Schoeman

Jump to:

Account Types Overview

Account Types

Account Features

Pros and Cons

Final Verdict

FAQ

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

AvaTrade at a Glance

| 🏛 Headquartered | Dublin, Ireland |

| 🌎 Global Offices | Australia, Ireland, South Africa, Japan, British Virgin Islands, UAE |

| 🏛 Local Market Regulators in Botswana | • Ministry of Finance and Economic Development (MFED) • Bank of Botswana (BoB) • Non-Bank Financial Institutions Regulatory Authority (NBFIRA) |

| 💳 Foreign Direct Investment in Botswana | 115.89 BWP Million in 2021 |

| 💰 Foreign Exchange Reserves in Botswana | 5270 USD Million in 2021 |

| ✔️ Local office in Gaborone? | No |

| 👨⚖️ Governor of SEC in Botswana | None, Moses Dinekere Pelaelo is the Governor of the Bank of Botswana |

| ✔️ Accepts Botswana Traders? | Yes |

| 📊 Year Founded | 2006 |

| 📞 Botswana Office Contact Number | None |

| 📱 Social Media Platforms | • Twitter • YouTube |

| ⚖️ Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC |

| 1️⃣ Tier-1 Licenses | • Central Bank of Ireland (CBI) • Australian Securities and Investment • Commission (ASIC) • Japanese Financial Services Authority (JFSA) • Financial Futures Association of Japan (FFAJ) • Investment Industry Regulatory Organization of Canada (IIROC) through Friedberg Mercantile |

| 2️⃣ Tier-2 Licenses | • Cyprus Securities and Exchange • Commission (CySEC) Financial Sector • Conduct Authority (FSCA) Israel Securities • Authority (ISA) • Abu Dhabi Global Market Financial Services Regulatory Authority (ADGM FRSA) • Polish Financial Supervision Authority (KNF) |

| 3️⃣ Tier-3 Licenses | • British Virgin Islands Financial Service Commission (BVI FSC) |

| 🪪 License Number | • Ireland (C53877) • Australia (406684) • South Africa (45984) • British Virgin Islands (SIBA/L/13/1049) • Japan (JFSA 1662, FFAJ 1574) • Abu Dhabi (190018) • Cyprus (247/17) • Israel (514666577) • Poland (693023) • Canada (Friedberg Mercantile) |

| ⚖️ MFED, BoB, or NBFIRA Regulation | No |

| ✔️ Regional Restrictions | Iran, Belgium, and the United States |

| ☪️ Islamic Account | No |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 1 (Retail and Professional Option) |

| ✔️ PAMM Accounts | No, MAM |

| 💻 Liquidity Providers | Currenex, and other bank and non-bank entities |

| ✔️ Affiliate Program | Yes |

| 📱 Order Execution | Instant |

| 📊 Starting spread | From 0.9 pips |

| 📉 Minimum Commission per Trade | No Commission Charges |

| 💰 Decimal Pricing | 5 points after the comma |

| 📞 Margin Call | 50% on Retail, 25% on AvaOptions Accounts |

| 🛑 Stop-Out | 10% |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | Unlimited |

| ✅ Crypto trading offered? | Yes |

| ✔️ Offers a BWP Account? | No |

| 📉 Dedicated Botswana Account Manager? | No |

| 📈 Maximum Leverage | • 1:30 (Retail) • 1:400 (Pro) |

| 📊 Leverage Restrictions for Botswana? | No |

| 💳 Minimum Deposit (BWP) | 1370 Botswanan Pula or an equivalent to $100 |

| ✔️ Botswana Pula Deposits Allowed? | No |

| 📊 Active Botswana Trader Stats | 250,000+ |

| 👥 Active Botswana-based AvaTrade customers | Unknown |

| 🔁 Botswana Daily Forex Turnover | Unknown, Forex overall is $6.6 Trillion |

| 💰 Deposit and Withdrawal Options | • Wire Transfer • Electronic Payment • Gateways • Credit Cards • Debit Cards |

| 💻 Minimum Withdrawal Time | 24 to 48 Hours |

| ⏰ Maximum Estimated Withdrawal Time | Up to 10 days |

| 💳 Instant Deposits and Instant Withdrawals? | No |

| 🏛 Segregated Accounts with Botswana Banks? | No |

| 📱 Trading Platforms | • AvaTradeGO • AvaOptions • AvaSocial • MetaTrader 4 • MetaTrader 5 • DupliTrade • ZuluTrade |

| 💻 Tradable Assets | • Forex • Stocks • Commodities • Cryptocurrencies • Treasuries • Bonds • Indices • Exchange-Traded • Funds (ETFs) • Options • Contracts for • Difference (CFDs) • Precious Metals |

| ✔️ Offers USD/BWP currency pair? | No |

| 🚀Service description | financial instruments and multiple trading platforms, operating since 2006. |

| 💰 Bonus 20% | welcome bonus accordengly to regulation |

| 📊 USD/BWP Average Spread | N/A |

| ✅ Offers Botswana Stocks and CFDs | No |

| 📊 Average deposit/withdraw processing time | Depends on the method used. – CC and e-payments is immediate. Bank wire can take up to 7 business days depending on the banking institution |

| 🔎 Banned countries | US, North Korea, New Zealand, Iran, Belgium |

| 💻 Languages supported on the Website | English, Chinese (Simplified), Chinese (Traditional), Turkish, Thai, Slovakian, Russian, Portuguese, Polish, German, Hungarian, French, and several others |

| 📈 Related lot sizes | Standard, Mini and Micro lots size |

| 👥 Sponsorship | Currently with Bolt |

| ✴️ Instruments offered | 800+ |

| ✴️ Instruments | Metals, Commodities, Stocks, FX Options, Oil, ETFs, Options, Crypto currencies, CFDs, Indexes, Shares, Spread Betting, Indices, Forex, Bonds |

| ✴️ Total offered per instrument | CFD – Agricultural =7 CFD – Crypto = 20 CFD – EFTs = 60 CFD – Energies = 5 CFD – Indices = 32 CFD – Metals = 7 CFD – Shares = 623 Forex = 55 GRAND Total = 809 |

| ☎️ Customer Support Languages | Multilingual |

| 📈 Account Types | Real Account, Demo Account, Islamic Account. Options Account |

| 📈 Demo Account Description | Free Demo Accounts with $100,000. No limitations on the number of demo accounts. 21 days limitation |

| 👥 Copy Trading Support | Yes |

| ⏰ Customer Service Hours | 24/5 |

| 📞 Botswana-based customer support? | No |

| 💸 Bonuses and Promotions for Botswanans? | Yes |

| 📚 Education for Botswanan beginner traders | Yes |

| 📱 Proprietary trading software | Yes |

| 🤝 Most Successful Trader in Botswana | Unknown |

| ✔️ Is AvaTrade a safe broker for Botswana Traders? | Yes |

| 🎖 Rating for AvaTrade Botswana | 9/10 |

| 🥇 Trust score for AvaTrade Botswana | 93% |

| 👉 Open Account | 👉 Open Account |

How to set up a Demo Account – Step by Step for Botswanans

To register a demo account with AvaTrade, Botswanan traders can follow these steps:

Step 1 – Open up the Avatrade Website.

Navigate to the AvaTrade website and select the “Demo Account” option

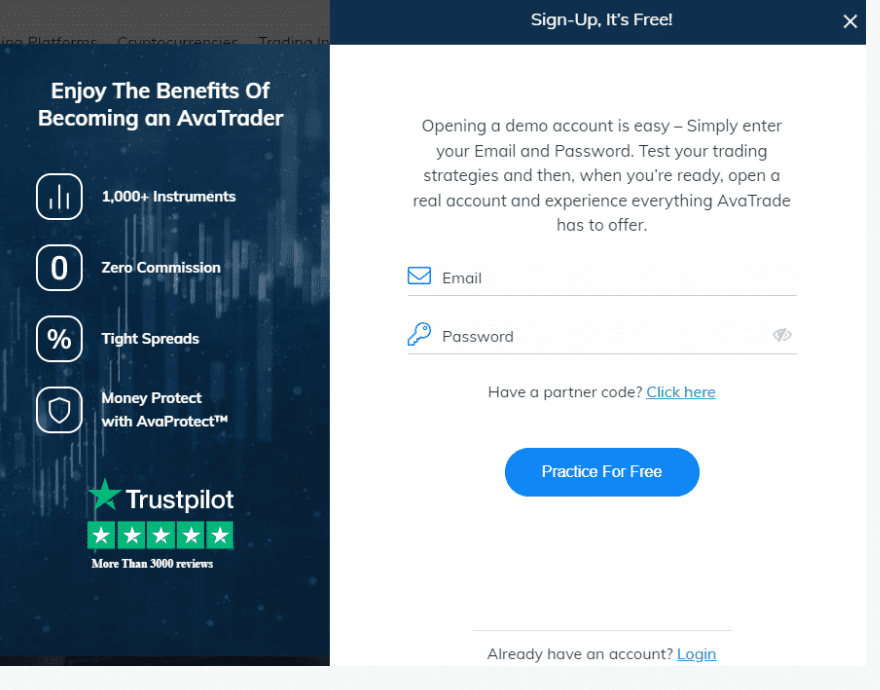

Step 2 – Insert your Credentials.

This will redirect the trader to a registration page where the trader can register using their Facebook or Google credentials, or they can register by providing their First and Last name, email address, and mobile number.

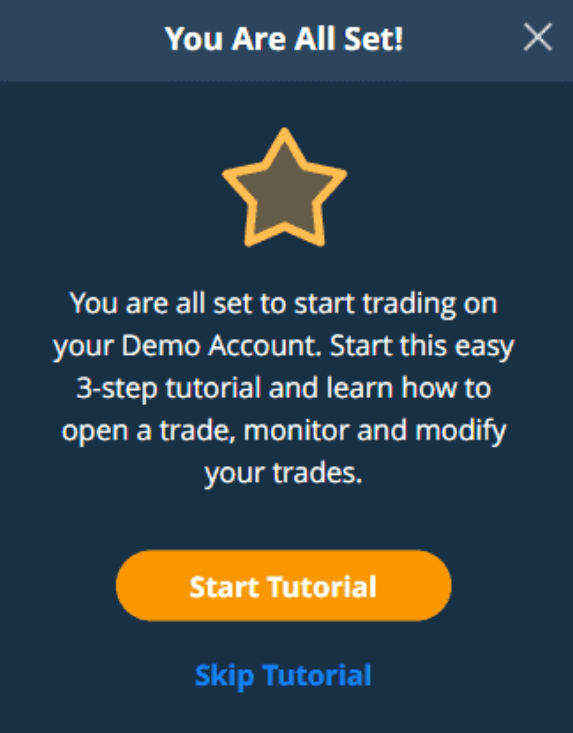

Step 3 – Click on one of the options to proceed.

Once this has been completed, the trader can select to proceed, and registration on the AvaTrade website will have been successful.

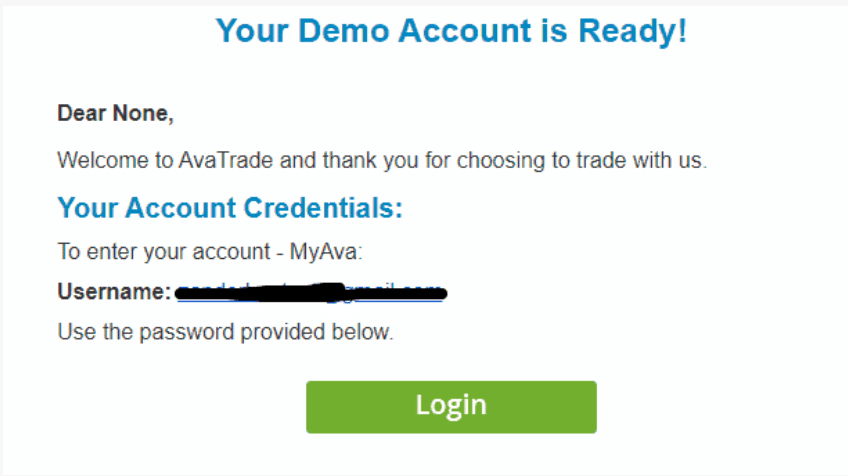

Step 4 – Verify and login into your account.

Traders will receive an email to the address that they provided with confirmation that their demo account registration has been successful. The email address will also contain the trader’s login details and relevant links to the AvaTrade website where they can start using their demo account.

Demo Account Features

AvaTrade offers a demo account for beginners and more advanced traders who are interested in testing the platform. The demo account is accessible regardless of the account type you choose, and it contains $100,000 in virtual currency.

It is accessible for 21 days after account creation. Educative resources are this broker’s greatest strength. AvaTrade provides articles and seminars on a vast array of FX and investing-related subjects.

There are instructional videos on the trading platform, and AvaTrade’s YouTube channel is loaded with high-quality, professionally produced videos.

The lessons are effectively divided into three sections namely beginner, intermediate, and advanced. In conjunction with the sample account, AvaTrade’s instructional material is a fantastic benefit for both novice and expert forex traders, and it is highly recommended that Botswanans evaluate this.

What is a demo account, and how can I benefit from using AvaTrade’s demo account?

A demo account, offered by AvaTrade, is a simulated trading environment that allows you to practice trading with virtual funds.

What are the key features of AvaTrade’s demo account, and is it different from a live trading account?

AvaTrade’s demo account typically offers many of the same features as a live trading account. Traders using the demo account can access real-time market data, execute trades, use technical analysis tools, and monitor their trading performance.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| AvaTrade is the best broker for beginners in Botswana | The demo account is only offered for 21 days |

| Advanced traders can access several trading tools to refine their trading | |

| There are a few robust trading platforms that Botswanans can use | |

| The practice account offers access to a range of financial instruments and markets |

Verdict on AvaTrade

Overall, AvaTrade is very competitive in terms of its trading fees and spreads.

You might also like: AvaTrade Review

You might also like: AvaTrade Account Types

You might also like: AvaTrade Fees and Spreads

You might also like: AvaTrade Sign Up Bonus

You might also like: AvaTrade Minimum Deposit

Frequently Asked Questions

Who can use AvaTrade’s demo account?

Anyone can use the AvaTrade demo account, from beginners to professional traders.

Can anyone register an AvaTrade practice account?

Anyone can register a demo account with AvaTrade, regardless of country, trading style, or unique trading strategies.

Which trading platforms does AvaTrade offer?

AvaTrade provides Botswanans access to these platforms:

- AvaTradeGO

- AvaOptions

- AvaSocial

- MetaTrader 4

- MetaTrader 5

- DupliTrade

- ZuluTrade

For how long can I use the AvaTrade demo account?

You can use the AvaTrade practice account for 3 weeks / 21 days. Once it expires, you must add another demo account.

Is AvaTrade a good option for beginner traders?

AvaTrade is an excellent option based on the range of educational materials, tools, and resources offered to beginners.

Conclusion

Now it is your turn to participate:

Do you have any prior experience?

What was the determining factor in your decision to engage?

Was it because of the minimum deposit, regulation, retail trading accounts, or any other factors?

Have you experienced any issues such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

Regardless, please share your thoughts in the comments below

Exness Review

Exness Review