Overview, CMTRADING provides access to a broad selection of Forex and CFD products on popular trading platforms to traders around the world. CMTRADING is regulated by the Financial Services Authority (FSA) in Seychelles and Financial Sector Conduct Authority (FSCA) in South Africa

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

USD100

Regulators

FSA

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

154

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overview

Overall, CM Trading is considered low-risk, with an overall Trust Score of 91 out of 100. CM Trading is licensed by zero Tier-1 Regulators (high trust), one Tier-2 Regulator (average trust), and one Tier-3 Regulator (low trust). CM Trading offers four retail trading accounts: a Bronze Account, Silver Account, Gold Account, and Premium Account.

CM Trading is a South African company that opened in 2012 under Blackstone Marketing SA (PTY) LTD. However, it is still subject to regulation by the FSCA, the governing body in its home city of Johannesburg, and the FSA in Seychelles.

Compared to European Union and United Kingdom authorities, it has less stringent regulations. For example, the FSCA requires all brokers to keep customer cash in separate accounts. However, it does not require them to provide negative balance protection or adhere to leverage limits.

CM Trading operates openly and honestly, placing a premium on the safety and protection of its customers. CM Trading also offers access to various robust trading platforms that may meet the demands of traders of all experience levels.

You can boost your trading efficiency and produce new trade ideas using the broker’s wide variety of trading tools. CM Trading succeeds in this area and differentiates itself from the competition. They stress the importance of traders receiving enough training and making calculated judgments based on thorough research.

CM Trading accepts Botswanan clients and has an average spread from 0.9 pips with zero commission charges. In addition, CM Trading has a maximum leverage ratio of up to 1:200, and a demo and Islamic account are available.

MT4, CM Trading (Web), CopyKat, Expert Advisors, and Trading App platforms are supported. CM Trading is headquartered in South Africa and is regulated by the FSCA and FSA.

Distribution of Traders

CM Trading currently has the largest market share in these countries:

Popularity among traders who choose CM Trading

CM Trading has a decent market share in Botswana, making it one of the Top 20 brokers for the region.

CMTrading at a Glance

| 🏛️ Headquartered | South Africa |

| 🏛️ Local office in Gaborone? | No |

| 👍 Accepts Botswanan Traders? | Yes |

| 📅 Year Founded | 2012 |

| 📱 Botswanan Office Contact Number | None |

| ⚖️ Regulation | FSA, FSCA |

| 🔎 License Number | Seychelles – SD070 South Africa – 2013/045335/07 and FSP 38782 |

| ⚖️ MFED, BoB, or NBFIRA Regulation | None |

| ✴️ Regional Restrictions | The United States, Hong Kong, Israel, EU regions |

| ☪️ Islamic Account | Yes |

| 📈 Demo Account | Yes |

| 📈 Retail Investor Accounts | 4 |

| 📊 PAMM Accounts | No |

| 📊 Liquidity Providers | Anonymous |

| 💰 Affiliate Program | Yes |

| 📊 Crypto trading offered? | Yes |

| 🚀 Offers a BWP Account? | No |

| 💻 Dedicated Botswanan Account Manager? | No |

| 📈 Maximum Leverage | 1:200 |

| 📈 Leverage Restrictions for Botswana? | No |

| 💳 Minimum Deposit | 1,200 BWP or equivalent to 100 USD |

| 💳 Botswanan Pula Deposits Allowed? | No |

| 💰 Active Botswanan Trader Stats | 250,000+ |

| 📈 Active Botswanan-based CM Trading customers | Unknown |

| 💰 Botswana Daily Forex Turnover | Unknown, Forex overall is $6.6 Trillion |

| 💳 Deposit and Withdrawal Options | Bank Wire Transfer Bank Transfer OZOW Electronic Fund Transfer (EFT) Skrill Neteller Credit Card Debit Card MPesa Local Mobile Money Cryptocurrencies |

| 💰 Segregated Accounts with Botswanan Banks? | No |

| 💻 Trading Platforms | MetaTrader 4, CM Trading Web, CopyKat, Expert Advisors, Trading apps |

| 💰 Tradable Assets | • Currency trading • Stocks • Indices • Cryptocurrencies • Commodities • CFDs |

| 🌐 Offers USD/BWP currency pair? | No |

| 🌐 USD/BWP Average Spread | N/A |

| 📈 Offers Botswanan Stocks and CFDs | None |

| 👨💼 Languages supported on Website | English, Arabic |

| 👥 Customer Support Languages | Multilingual |

| 👥 Customer Service Hours | 24/5 |

| 👥 Botswanan-based customer support? | No |

| 💰 Bonuses and Promotions for Botswanans | None |

| ✴️ Education for Botswanan beginners | Yes |

| 📊 Proprietary trading software | Yes |

| 💰 Most Successful Botswanan Trader | Currently unknown |

| ✔️ Is CM Trading a safe broker for Botswanans? | Yes |

| ✔️ Rating for CM Trading Botswana | 8/10 |

| ✔️ Trust score for CM Trading Botswana | 91% |

| 👉 Open an account | 👉 Open Account |

Regulation and Safety of Funds

CMTrading is a fully licensed broker that aims to ensure that its trading platforms are secure, safe and that there are transparent conditions offered to all traders. CMTrading operates through the following entities:

➡️️ GCMT South Africa Pty Ltd, which is trading as CM Trading, is registered under 2013/045335/07. In addition, this entity is a representative and an agent of Blackstone Marketing Pty Ltd, which is registered under 2010/010099/07 with Financial Service Provider (FSP) number 38782.

➡️️ GCMT Limited trades as CM Trading and is a licensed Securities Dealer that is registered in Seychelles. CM Trading is registered under 8425982-1 and is regulated by the Financial Services Authority (FSA) in Seychelles, under license number SD070.

The Financial Sector Conduct Authority (FSCA) is a respected and well-established market regulatory and regulatory authority in Africa. It is the only regulatory body for financial institutions in South Africa that covers banks, retirement funds, administrators, insurers, and all market infrastructures, ensuring that consumers are protected.

The broker has been regulated by the FSCA since 2012 and this license and regulation can be verified by Botswana traders when they visit the official FSCA website.

In addition to the FSCA regulation, CM Trading obtained FSA regulation in 2021, striving to provide quality trading services in this region to beginner traders and professional investors.

Is CMTrading a regulated broker, and what regulatory standards does it adhere to?

Yes, the broker is a regulated online broker committed to ensuring the safety and security of its clients. The company operates under the regulatory framework of the Financial Sector Conduct Authority (FSCA) in South Africa.

How does CMTrading ensure the safety of client funds?

They prioritizes the safety of client funds through various protective measures. Firstly, as a regulated broker under the FSCA, CMTrading follows strict guidelines and operational standards to secure client assets.

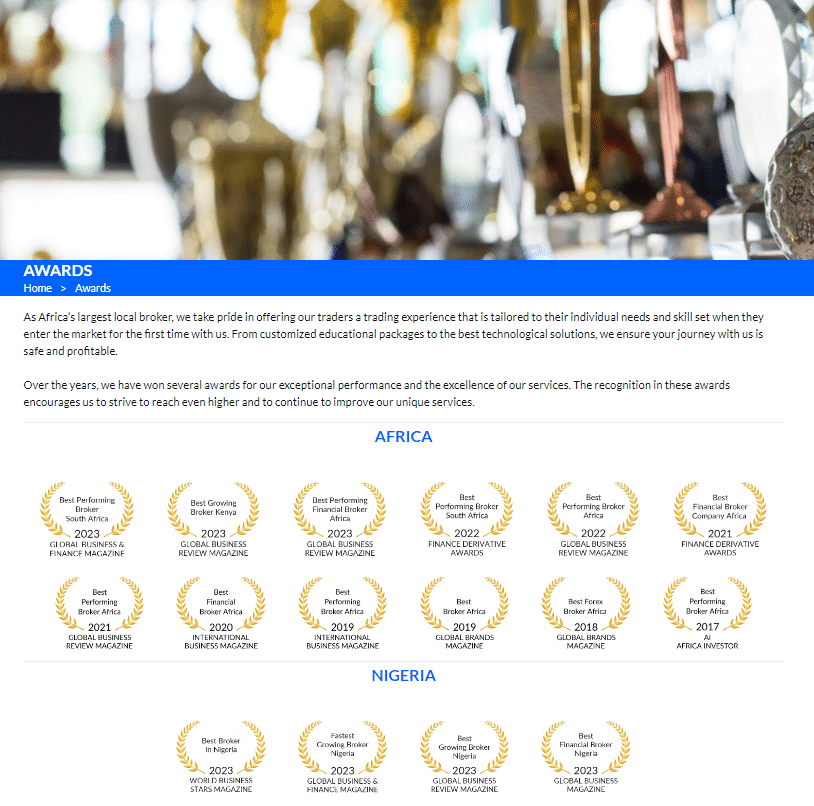

Awards and Recognition

CMTrading received the following recent awards and recognition:

Fastest Growing Broker in Nigeria in 2022 – Global Business Review Magazine

Has CMTrading received any notable awards for its services in the financial industry?

Yes, they have been recognized and awarded for its excellence in the financial industry. The platform has received accolades in various categories, including its trading services, customer support, and educational resources.

How is CMTrading regarded in the financial industry, and what does its reputation suggest about the platform?

The broker enjoys a positive reputation within the financial industry, reflecting its dedication to providing a reliable and user-friendly trading environment. The platform’s recognition through awards and positive reviews from traders underscores its success in delivering quality services.

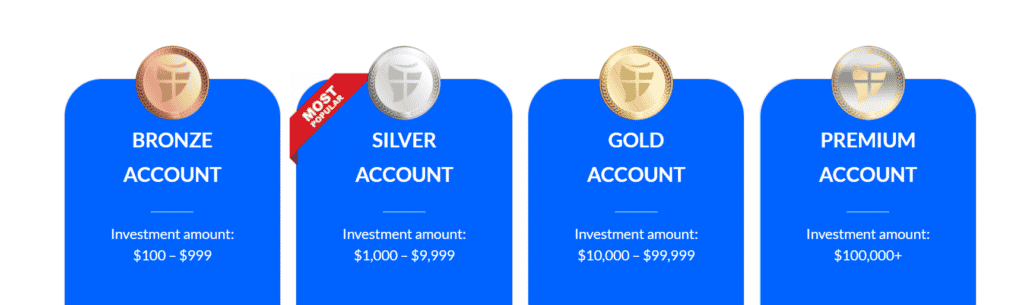

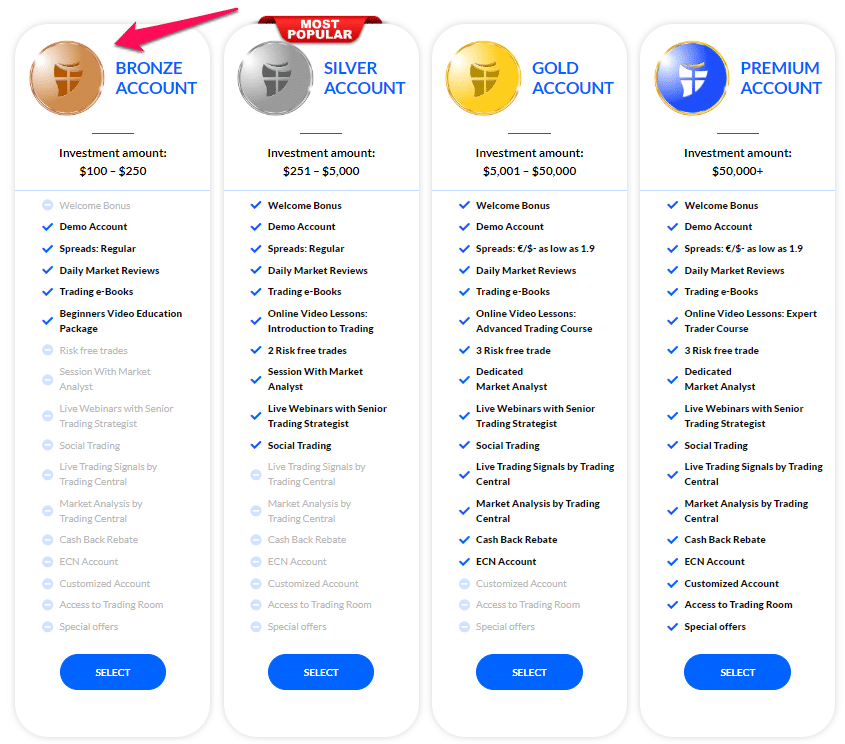

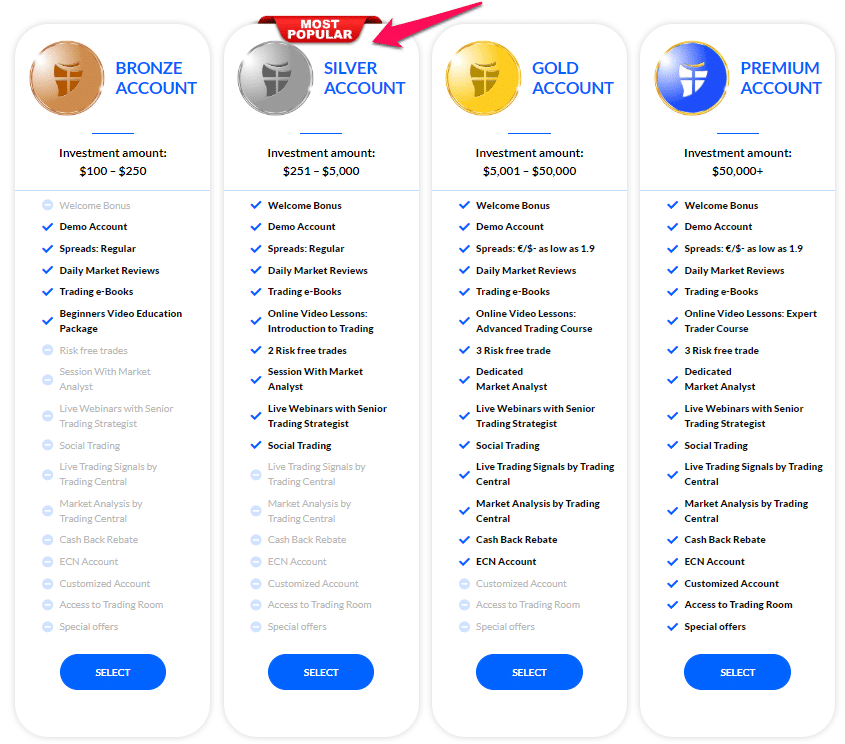

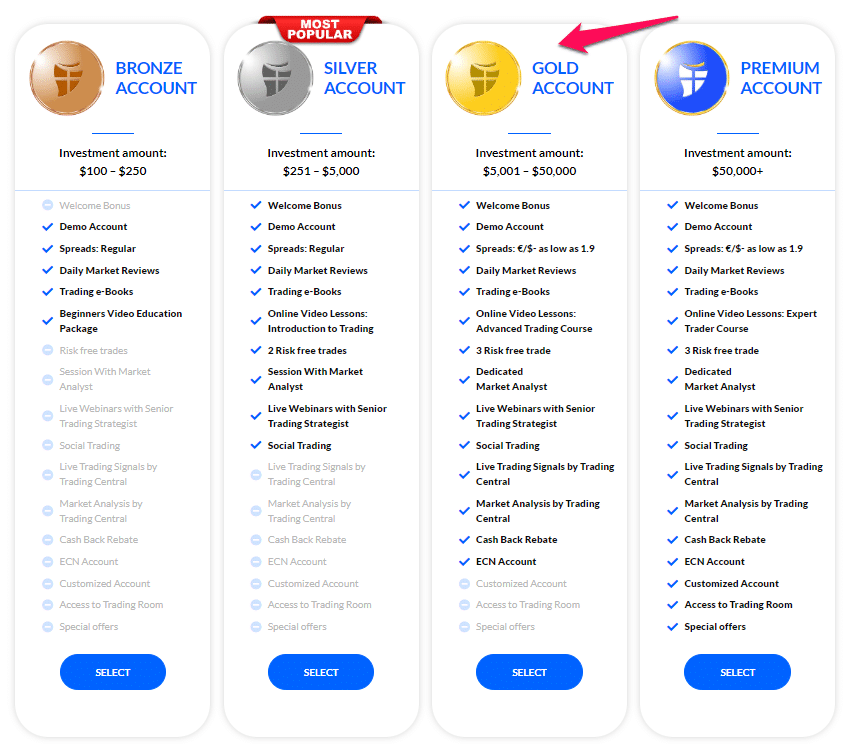

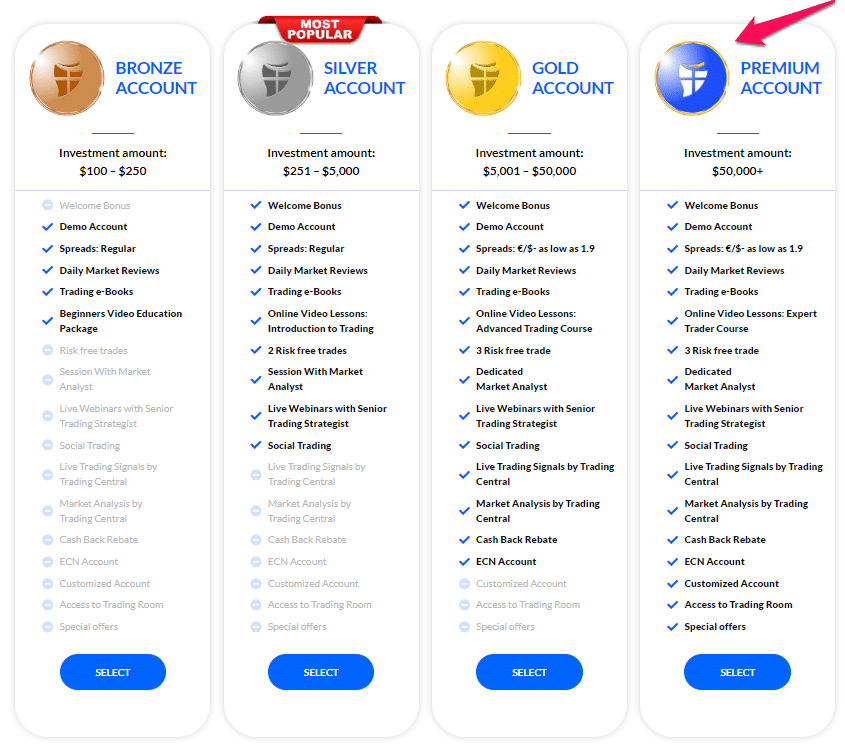

CMTrading Account Types and Features

CMTrading offers some of the best trading conditions in the industry, distributed across four unique retail investor accounts. Each of these accounts serves to provide different traders with unique trading conditions and features that will suit their trading needs and objectives.

The account types offered are:

➡️️ Bronze Account

➡️️ Silver Account

➡️️ Gold Account

➡️️ Premium Account

Live Trading Accounts

✅ Bronze Account

The Bronze Account offered by CM Trading is an entry-level account that has the following unique features.

| Account Feature | Value |

| 💳 Minimum Deposit | 1,200 Botswanan Pula, equivalent to $100 |

| 💳 Maximum Deposit | 12,900 Botswanan Pula, equivalent to $999 |

| 📊 Demo Account | Yes |

| 📈 Educational materials | Yes, Trading eBook, Webinars |

| ✴️ Market Reviews | Yes |

| 📈 Spreads from | Regular spreads |

| 🔎 Live Trading Signals | No |

| 📊 Risk-Free Trades offered | No |

| 🎓 Personal Assistant offered? | No |

| 📈 Trading Central Trading Signals | No |

| 👨💼 Trading Central Live Trading Signals | No |

| 🚀 Cashback Rebates | No |

| 🔎 Access to ECN? | No |

| 📊 Market News and Analysis For Fundamental Analysis | No |

| 📈 Special Offers | No |

| ✅ Dedicated Trading Room | No |

| 📊 Trading specialist offering investment advice | No |

✅ Silver Account

The Silver Account is one of CM Trading’s most popular options because it is suited to most types of traders.

| Account Feature | Value |

| 💳 Minimum Deposit | 3355 Botswanan Pula equivalent to $251 |

| 💳 Maximum Deposit | 129,000 Botswanan Pula, equivalent to $9,999 |

| 📊 Demo Account | Yes |

| 📈 Educational materials | Yes, Trading eBook, Webinars |

| ✴️ Market Reviews | Yes |

| 📈 Spreads from | 1.2 pips EUR/USD |

| 🔎 Live Trading Signals | Yes |

| 📊 Risk-Free Trades offered | 1 Risk-Free Trade |

| 🎓 Personal Assistant offered? | Yes |

| 📈 Trading Central Trading Signals | Yes |

| 👨💼 Trading Central Live Trading Signals | Yes |

| 🚀 Cashback Rebates | No |

| 🔎 Access to ECN? | No |

| 📊 Market News and Analysis For Fundamental Analysis | No |

| 📈 Special Offers | No |

| ✅ Dedicated Trading Room | No |

| 📊 Trading specialist offering investment advice | No |

✅ Gold Account

The Gold Account offers some of the best trading conditions to active traders, high-frequency traders, expert advisors, algorithmic traders, and other short-term, competitive traders.

| Account Feature | Value |

| 💳 Minimum Deposit | 66 Botswanan Pula, equivalent to $5,001 |

| 💳 Maximum Deposit | 1,290,000 Botswanan Pula equivalent to $99,999 |

| 📊 Demo Account | Yes |

| 📈 Educational materials | Yes, Trading eBook, Webinars |

| ✴️ Market Reviews | Yes |

| 📈 Spreads from | 0.9 pips |

| 🔎 Live Trading Signals | Yes |

| 📊 Risk-Free Trades offered | 3 Risk-Free Trades |

| 🎓 Personal Assistant offered? | Yes |

| 📈 Trading Central Trading Signals | Yes |

| 👨💼 Trading Central Live Trading Signals | Yes |

| 🚀 Cashback Rebates | Yes |

| 🔎 Access to ECN? | Yes |

| 📊 Market News and Analysis For Fundamental Analysis | No |

| 📈 Special Offers | No |

| ✅ Dedicated Trading Room | No |

| 📊 Trading specialist offering investment advice | No |

✅ Premium Account

The Premium Account is dedicated to professional traders who want the most from their trading account. This account has the best features and options available.

| Account Feature | Value |

| 💳 Minimum Deposit | 668 Botswanan Pula and more equivalent to $50,000 |

| 💳 Maximum Deposit | None |

| 📊 Demo Account | Yes |

| 📈 Educational materials | Yes, Trading eBook, Webinars |

| ✴️ Market Reviews | Yes |

| 📈 Spreads from | 0.9 pips |

| 🔎 Live Trading Signals | Yes |

| 📊 Risk-Free Trades offered | 3 Risk-Free Trades |

| 🎓 Personal Assistant offered? | Yes |

| 📈 Trading Central Trading Signals | Yes |

| 👨💼 Trading Central Live Trading Signals | Yes |

| 🚀 Cashback Rebates | Yes |

| 🔎 Access to ECN? | Yes |

| 📊 Market News and Analysis For Fundamental Analysis | Yes |

| 📈 Special Offers | Yes |

| ✔️ Dedicated Trading Room | Yes |

| 📊 Trading specialist offering investment advice | Yes |

✅ Demo Account

A demo account is a practice account that offers traders a certain amount of virtual funds that they can use, allowing them to enter the live market without risking their capital.

There is a certain degree of risk involved when trading financial markets and CM Trading offers its clients a risk-free platform where they can test strategies, practice trading, and explore what the broker offers in a safe trading environment with real market conditions.

✅ Islamic Account

Depending on the trading style and the trading strategy of the forex trader, they may keep their trading positions open for longer than 24 hours on a trading day.

This means that the trader could incur an overnight or rollover fee. This is a type of interest that is prohibited by Riba principles of Sharia law, which means that Muslim traders are often restricted in forex trading.

The broker is a forex broker that is compliant with all requirements surrounding Sharia law as well as the principles of Islamic Finance. CM Trading offers swap-free trading accounts that are exempted from swap charges and rollover interest when Muslim traders hold positions overnight.

In addition, Muslim traders are only given access to financial instruments that are Shariah-compliant, which means that cryptocurrencies and stocks are not available for trading when using an Islamic swap-free account.

What types of trading accounts does CMTrading offer to its clients?

The broker provides traders with a range of account types to suit different trading preferences. The main account types offered include the Bronze Account, Silver Account, Gold Account, Premium Account.

What features are included with CMTrading trading accounts?

The broker offers a range of features across its various trading accounts to enhance the trading experience. Common features include access to a variety of financial instruments, including forex, commodities, indices, and cryptocurrencies.

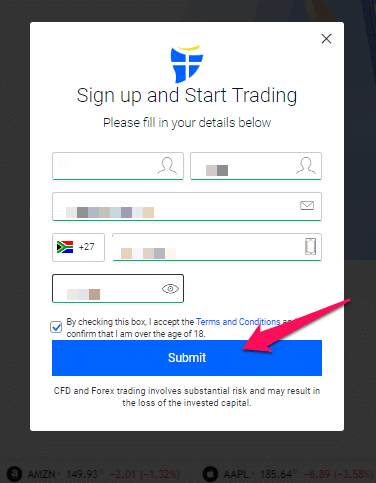

How to open a CMTRADING Account – Step by Step

Follow these 3 steps to open a CMTrading demo account:

Step 1 – Register a new account

click here, this will open up a new screen where you will get access to register your new account.

Step 2 – Fill out the form

Fill out the form with all your necessary details. This info will include details such as your first name, last name, email address, and mobile number. Remember to accept the T&C’s.

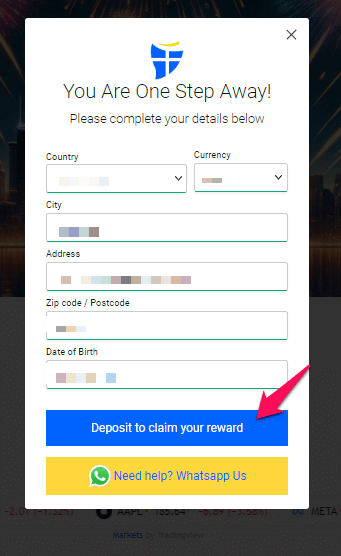

Step 3 – Choose your account Payment

Once your deposit has been made your account will be activated, and you can start.

CMTrading VS AvaTrade VS Exness – Broker Comparison

| 🥇 CMTrading | 🥈 AvaTrade | 🥉 Exness | |

| ⚖️ Regulation | FSA, FSCA | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA |

| 📱 Trading Platform | MetaTrader 4 CMTrading Web CopyKat | • AvaTradeGO • AvaOptions • AvaSocial • MetaTrader 4 • MetaTrader 5 • DupliTrade • ZuluTrade | • MetaTrader 4 • MetaTrader 5 • Exness App • Exness Terminal |

| 💰 Withdrawal Fee | Yes | No | No |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 1 342 BWP ($100) | 1,200 BWP | 120 BWP |

| 📊 Leverage | 1:200 | • 1:30 (Retail) • 1:400 (Pro) | Unlimited |

| 📊 Spread | From 0.9 pips | Fixed, from 0.9 pips | Variable, from 0.0 pips |

| 💰 Commissions | None | None | From $0.1 per side, per lot |

| ✴️ Margin Call/Stop-Out | From 20% | • 25% – 50% (M) • 10% (S/O) | 60%/0% |

| 💻 Order Execution | Market | Instant | Instant |

| 💳 No-Deposit Bonus | None | No | No |

| 📊 Cent Accounts | None | No | Yes |

| 📈 Account Types | Bronze Account Silver Account Gold Account Premium Account | • Standard Live Account • Professional Account Option | • Standard Account • Standard Cent Account • Raw Spread Account • Zero Account • Pro Account |

| ⚖️ CBN Regulation | No | No | No |

| 💳 BWP Deposits | Yes | No | Yes |

| 📊 Botswana Pula Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/5 | 24/7 |

| 📊 Retail Investor Accounts | 4 | 1 | 5 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 📉 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | Unknown | Unlimited | Unlimited |

| 💰 Minimum Withdrawal Time | Instant | 24 to 48 Hours | Instant |

| 📊 Maximum Estimated Withdrawal Time | Up to 3 working days | Up to 10 days | Up to 72 hours |

| 💸 Instant Deposits and Instant Withdrawals? | Yes, deposits and withdrawals | No | Yes |

CMTRADING Trading Platforms

offers the following trading platforms:

➡️️ MetaTrader 4

➡️️ CM Trading Web

➡️️ CopyKat

➡️️ Expert Advisors

➡️️ Trading apps

✅ MetaTrader 4

CMTrading’s MetaTrader 4 platform has been completely integrated into the broker’s service portfolio, enabling customers to experience trading as it should be, including tight spreads, no requotes, and market execution. MetaTrader 4 is the appropriate platform for all trading strategies despite the account type that traders use.

It gives assistance and all the tools necessary to properly trade utilizing expert advisors and permits trading methods such as hedging, algorithmic trading, auto trading, or scalping. These are crucial aspects in completing effective trade execution utilizing Technical Analysis without delay.

Traders who have developed their own expert advisors can easily integrate them into CM Trading’s MetaTrader 4. Alternatively, advanced traders can develop expert advisors using MetaTrader 4’s programming language.

MetaTrader 4’s programming language also permits the development and modification of custom-made indicators and a wide range of advanced charting tools.

✅ CMTrading Web

For currency traders, CMTrading WebTrader is a significant change because it enables them to trade from their mobile devices such as smartphones and tablets without having to download or install any software.

✅ CopyKat

CM Trading’s proprietary CopyKat trading platform is suited to beginner and professional traders who want to copy the trading strategies of successful traders. With CopyKat, traders can follow expert traders and copy their trades to their own trading accounts.

Every time these successful traders trade, the trades will take place on the account of the trader and when these traders make a profit, so will the trader.

✅ Expert Advisors

MetaTrader 4’s expert advisors (EA) facilitate automated trading. The MQL programming language, developed specifically for automated trading, is used to generate EAs.

There are numerous pre-existing classes and methods in the robust computer language that traders may use to swiftly build and implement new trading techniques. Meta Editor is also supplied with each MT4 platform. The Meta Editor is a compiler that has been designed expressly to be used by this MQL programming language.

✅ Trading Apps

CM Trading offers iOS mobile device users the opportunity to access the proprietary WebTrader when they download and install it to their devices. The CM Trading app helps traders analyse currencies, access real-time data, and place orders.

Any economic news release that occurs throughout a normal 24-hour trading day may have a significant impact on the main currency pairs in the forex trading sectors. Having access to conversations, quotations, market news, and their retail investor accounts from anywhere and at any time is a big plus for skilled and active currency traders.

This is the primary reason why forex trading software has grown so popular. All the well-known forex brokers provide their customers with mobile apps, and CM Trading is no exception.

What trading platforms does CMTrading offer to its clients?

The broker provides a choice of advanced trading platforms to cater to diverse trading preferences. The primary trading platform is the popular MetaTrader 4 (MT4), known for its user-friendly interface, advanced charting tools, and automated trading capabilities.

Can I trade on CMTrading using my mobile device, and what features are available on the mobile platforms?

Absolutely. CMTrading understands the importance of mobile trading in today’s dynamic markets. Traders can access their accounts and trade on the go using the mobile trading applications. CMTrading supports mobile trading on both iOS and Android devices.

Range of Markets

offers the following range of tradable instruments:

➡️️ Currency trading

➡️️ Stocks

➡️️ Indices

➡️️ Cryptocurrencies

➡️️ Commodities

➡️️ CFDs

Financial Instruments and Leverage

| 🔨 Instrument | 💰 Number of Assets Offered | 📈 Max Leverage Offered |

| ➡️ Forex | 50 | 1:200 |

| ➡️ Commodities | 16 | 1:50 |

| ➡️ Indices | 17 | 1:50 |

| ➡️ Stocks | 109 | 1:10 |

| ➡️ Cryptocurrency | 21 | 1:2 |

What financial instruments can I trade on CMTrading?

CMTrading offers a diverse range of financial instruments across different asset classes. Traders can participate in the dynamic foreign exchange market (forex) with major and minor currency pairs, including EUR/USD, GBP/USD, and USD/JPY.

What cryptocurrencies are available for trading on CMTrading?

CMTrading recognizes the growing interest in cryptocurrencies and provides traders with the opportunity to trade a selection of digital assets. Cryptocurrencies available on the platform include popular options such as Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and Litecoin (LTC).

Broker Comparison for a Range of Markets

| 🥇 CMTRADING | 🥈 AvaTrade | 🥉 Exness | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | Yes | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | Yes | No |

| ➡️️ Options | No | Yes | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | Yes | No |

Trading and Non-Trading Fees

Spreads

The spreads that traders can expect from CMTrading will depend on what they trade, the retail investor account they use, and what the market conditions are on the day of trading. The typical minimum spreads that traders can expect include:

➡️️ Bronze Account – Regular spreads

➡️️ Silver Account – 1.2 pips EUR/USD

➡️️ Gold Account – from 0.9 pips EUR/USD

➡️️ Premium Account – from 0.9 pips EUR/USD

Overnight Fees, Rollovers, or Swaps

When Botswana traders keep their positions open for longer after the trading day has passed, they may incur overnight fees. These rates are determined by the position that traders hold, the financial instrument they trade, and their position size.

To determine the overnight fees on positions, traders can use the following formula:

➡️️ The overnight fees = Duration of the position/number of nights x Swap (buy or sell) x No of Lots x Point value

Deposit and Withdrawal Fees

CMTrading charges deposit fees when traders use cryptocurrencies to fund their accounts. Withdrawal fees are applied to the following withdrawal methods:

➡️️ Bank Wire Transfer – 2%

➡️️ Bank Transfer – 2%

➡️️ OZOW – 2%

➡️️ Electronic Fund Transfer (EFT) – 2%

➡️️ Skrill – 2%

➡️️ Neteller – 2%

➡️️ Credit Card – 2%

➡️️ Debit Card – 2%

➡️️ MPesa – 2%

➡️️ Local Mobile Money – 2%

➡️️ Cryptocurrencies – 4%

What are the trading fees associated with CMTrading?

The broker employs a transparent fee structure, primarily based on spreads for forex trading. The spread is the difference between the buying (ask) and selling (bid) prices of a financial instrument.

Are there any non-trading fees on CMTrading, and if so, what should I be aware of?

In addition to trading fees, CMTrading may charge non-trading fees that traders should be aware of. These may include overnight financing fees for positions held overnight (swap rates), withdrawal fees, and inactivity fees for dormant accounts.

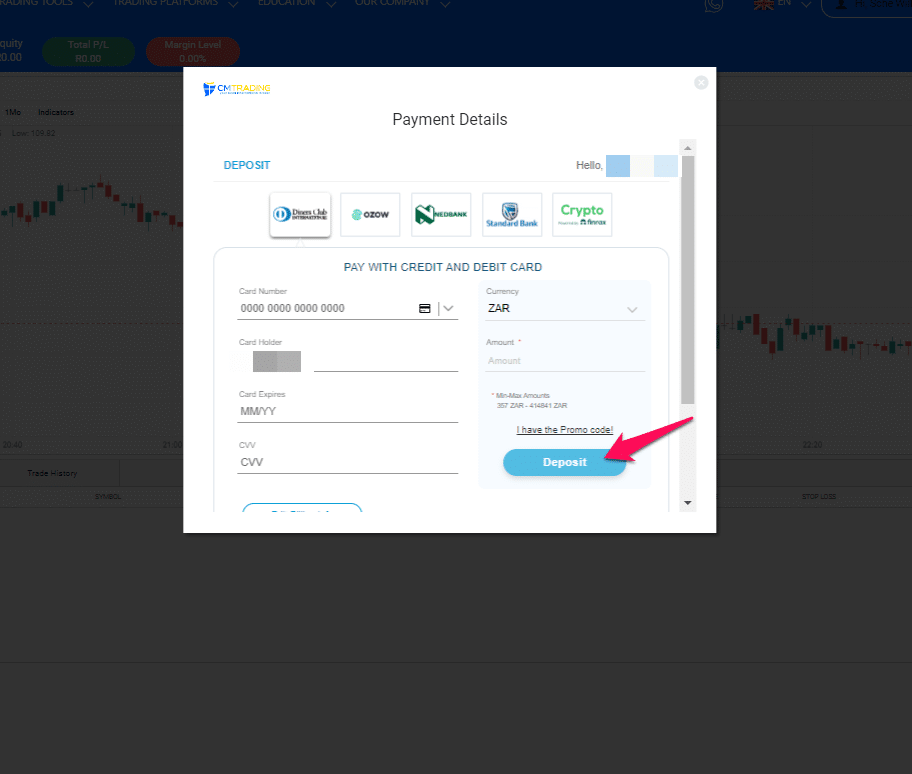

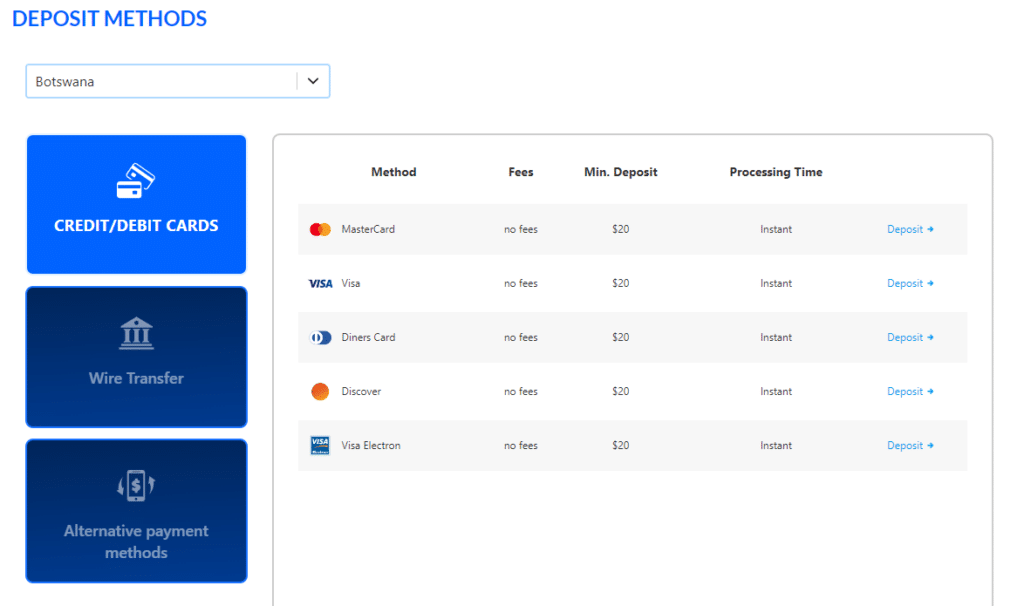

CMTRADING Deposits and Withdrawals

Offers the following deposit and withdrawal methods:

➡️️ Bank Wire Transfer

➡️️ Bank Transfer

➡️️ OZOW

➡️️ Electronic Fund Transfer (EFT)

➡️️ Skrill

➡️️ Neteller

➡️️ Credit Card

➡️️ Debit Card

➡️️ MPesa

➡️️ Local Mobile Money

➡️️ Cryptocurrencies

Broker Comparison: Deposit and Withdrawals

| 🥇 CMTRADING | 🥈 AvaTrade | 🥉 Exness | |

| Minimum Withdrawal Time | Instant | 24 to 48 Hours | Instant |

| Maximum Estimated Withdrawal Time | Up to 3 working days | Up to 10 days | Up to 72 hours |

| Instant Deposits and Instant Withdrawals? | Yes, deposits and withdrawals | No | Yes |

Deposit and Withdrawal Processing time, Minimum Withdrawal Amount

| 💳 Payment Method | 📌 Deposit Currencies | ⏰ Deposit Processing | ⏱️ Withdrawal Processing |

| 💰 MasterCard | USD, EUR, GBP, ZAR | Instant | Instant |

| 🪙 Visa | USD, EUR, GBP, ZAR | Instant | Instant |

| 💷 Standard Bank ZAR | USD, EUR, GBP, ZAR | 1 – 3 days | 1 – 3 days |

| 💸 Cryptocurrency Payments | BTC, ETH, etc | Instant | Instant |

| 💴 Neteller | USD | Instant | Instant |

How can I make a deposit into my CMTrading trading account, and what payment methods are supported?

Depositing funds into your CMTrading trading account is a straightforward process. The platform supports various payment methods, including bank wire transfers, credit/debit cards, and popular e-wallet options such as Neteller and Skrill.

How can I initiate a withdrawal from my CMTrading trading account, and what withdrawal options are available?

Withdrawing funds from your CMTrading trading account is a user-friendly process. Simply log in to your account, go to the withdrawal section, and select your preferred withdrawal method.

How to Deposit Funds

- Access your CMTrading account.

- Navigate to the deposit section, commonly found under “Funding” or “Deposit.”

- Choose your desired deposit method, such as bank wire transfers or e-wallets.

- Follow the instructions for your preferred deposit method.

- Enter the desired deposit amount and click the Confirm button.

Wait for the deposit to be completed, which can take anywhere from a few minutes to several business days, depending on the method you use and your bank’s policies.

Fund Withdrawal Process

To withdraw funds from an account with CMTrading, traders can follow these steps:

- Go to the CMTrading website and sign in to your account.

- Select “Withdraw” after clicking on your name in the top right corner.

- Select the funded account from which you wish to withdraw funds and enter the withdrawal amount.

- Select your preferred payment method and click “Withdraw Funds.”

- Enter the required payment and account information.

Finally, click “Submit” to begin processing your withdrawal request.

Education and Research

Offers the following educational materials:

➡️️ eBooks

➡️️ Training Videos

➡️️ Webinars

➡️️ Live Seminars

For those who want to learn about the fundamentals of trading, CM Trading’s eBooks are an excellent source of information. Financial markets, strategy, psychology, money management, technical analysis, and more are all discussed.

There are two different areas for introductory courses and in-depth courses provided by CM Trading in addition to eBooks. These well-illustrated videos provide a wealth of information about trading. Trading platforms, trading tools, and social trading are some of the topics covered in this course.

CM Trading sometimes offers free webinars that traders can sign up for, but they are infrequent. Participating in online trader chats is a great way to broaden your trading horizons. Traders can also view previous webinars on the official CM Trading website.

In terms of research tools, CM Trading offers the following options to advanced traders:

➡️️ Daily Market Reviews

➡️️ Trading Signals

➡️️ Economic Calendar

➡️️ Calculators

➡️️ Fundamental Analysis

➡️️ Technical Analysis

What educational resources does CMTrading offer to traders?

The broker is committed to empowering traders with knowledge, and to achieve this, the platform provides a range of educational resources. Traders can access video tutorials, webinars, and articles covering various aspects of trading, from fundamental concepts to advanced strategies.

What research tools are available on CMTrading to assist traders in making informed decisions?

The broker equips traders with a variety of research tools designed to enhance their decision-making process. These tools may include daily market analysis, economic calendars, and insights from experienced analysts.

10 Best Forex Brokers in Botswana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

Bonuses and Promotions

CMTRADING does not currently offer a sign-up bonus, no-deposit bonus, deposit bonus, or any other promotions or initiatives. But a Refer a Friend BONUS of $ 100 is offered.

Affiliate Program

Offers a comprehensive partnership program that offers the following:

➡️️ Quick pay-outs and complete transparency

➡️️ Dedicated customer service and support

➡️️ A personal manager

➡️️ An FSCA-regulated environment

➡️️ Attractive and flexible commission schemes

➡️️ Fresh, localized marketing material

➡️️ A high conversion rate

In addition, CM Trading also offers a loyalty program that can be divided into the following tiers:

➡️️ Bronze – with competitive plans, certificate of achievement, online marketing tools, IB starter pack, and free webinar hosting.

➡️️ Silver offers access to all the benefits in the Bronze Tier along with a personal business developer, marketing budgets, and promotional material.

➡️️ Gold offers access to the same benefits as Bronze and Silver in addition to extra targets commissions, customized marketing material, exclusive business cards, custom-built websites, and the attendance of CM Trading at events.

➡️️ The Platinum tier is the highest and offers unrestricted access to exclusive tools as well as promotions, professional guidance, financial advice, and assistance.

Customer Support

| Customer Support | CMTRADING’s Customer Support |

| ⏰ Operating Hours | 24/5 |

| 🗣 Support Languages | English, Arabic |

| 🗯 Live Chat | Yes |

| 📧 Email Address | [email protected] |

| ☎️ Telephonic Support | Yes |

| 📞 Local Support in Botswana? | No |

| 🥇 Overall quality of CMTRADING Support | 4/5 |

Corporate Social Responsibility

CMTrading’s commitment to corporate social responsibility is obvious in its numerous community-driven projects emphasizing youth development, teamwork, and sportsmanship. Notably, from December 12th to 14th, 2022, CMTrading funded a three-day coaching workshop in Langa, Cape Town, in collaboration with Sporting Chance.

This program allowed local South African youngsters to participate in football and netball games, boosting peer connection and providing quality equipment. It was held at Langa Stadium and demonstrated CMTrading’s commitment to community outreach and developing young talent.

CMTrading enabled the participation of brilliant youths in the Legends 5v5 Tournament held in Camps Bay, Cape Town, on November 27th and 28th, 2021, as part of Accelerate Futbol.

The U10 and U12 boys’ teams demonstrated outstanding sportsmanship, with the U10 squad willingly donating their tournament prizes to a less fortunate team. Despite the difficulties, the U12 team showed tenacity and determination, leaving an indelible impact.

Dricus du Plessis, a well-known South African UFC fighter and CMTrading brand ambassador surprised the young athletes with an inspiring pep talk. In addition, his encouragement fuelled their passion and desire even more, emphasizing the importance of perseverance and dedication in their journey.

These projects demonstrate CMTrading’s dedication to making a positive difference in the community and developing the future generation’s potential.

Our Verdict

CM Trading is a South-African online trading broker that offers a wide range of trading instruments spread across several financial markets. CM Trading offers online trading that caters for traders despite their trading experience, skill, or unique trading style, making it ideal for Botswana traders.

CM Trading offers MetaTrader 4, which is a popular trading platform, WebTrading, and mobile trading apps that can be used to keep traders updated while they are on the move. In addition, the proprietary mobile app has the same functions as the CM Trading web-based platform.

CM Trading offers commission-free trading despite the type of trading account traders use and there are a plethora of trading tools offered including daily market review, market trends, market volatility indicators, and other powerful features.

CM Trading has a dedicated customer support team that offers professional guidance in all matters relating to the trading industry. CM Trading also offers several payment methods and deposit currencies, allowing traders to deposit in their local currency.

While deposit fees are only charged on crypto payments, CM Trading applies withdrawal fees to all withdrawal options, which is a drawback.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| CM Trading is a good option for Botswanan beginners | CM Trading does not have Tier-1 regulations |

| The customer support offered by CM Trading is outstanding | Withdrawals can be expensive |

| There are copy trading opportunities offered to traders | Traders must register for a live account to opt for a demo account |

| CM Trading has user-friendly trading platforms for mobile, desktop, and web browsers | |

| CM Trading does not charge any commissions | |

| Hedging, scalping, and EAs are allowed | |

| There is an Islamic account offered to Muslim traders | |

| CM Trading offers daily market analysis |

You might also like: Admirals Markets Review

You might also like: Alpari Review

You might also like: FP Markets Review

You might also like: FXChoice Review

You might also like: FXCM Review

Conclusion

Now it is your turn to participate:

Regardless, please share your thoughts in the comments below.

Frequently Asked Questions

How can I withdraw my funds from CMTRADING?

To withdraw funds from your account, you can log into the website, navigate to the “Withdrawal” section, complete the form, and send it through to CMTRADING.

What is the withdrawal time with CMTRADING?

Withdrawal times vary from immediate to up to ten business days for certain withdrawal methods.

Does CMTRADING offer any bonuses or promotions to Botswanans?

No, the broker does not currently offer any bonuses or promotions.

Does CMTRADING have Volatility 75?

Yes, they provide Volatility 75 as a CFD on Indices under the symbol “VIX.”

Is CMTRADING regulated?

Yes, the Financial Sector Conduct Authority (FSCA) and the Financial Services Authority (FSA) in Seychelles and South Africa supervise CMTrading.

Does CMTRADING have Nasdaq?

Nasdaq can be traded with a leverage of up to 1:50 and is offered by CMTrading under the ticker symbol “NSDQ” or “USTECH.”

Exness Review

Exness Review