JustMarkets Islamic Account

Overall, JustMarkets offers an Islamic account for Muslim traders. JustMarkets offers swap-free trading for Muslim traders on 7 trading account levels namely the MetaTrader 4 Standard Cent account, MetaTrader 4 Standard Account, MetaTrader 4 Pro account, MetaTrader 4 Raw Spread account, MetaTrader 5 Standard account, MetaTrader 5 Pro Account, and MetaTrader 5 Raw Spread Account.

- Louis Schoeman

Jump to:

Islamic Account Overview

What is an Islamic Account

How to open an JustMarkets Islamic Account

Pros and Cons

Final Verdict

FAQ

Min Deposit

USD 10

Regulators

FSA, CySec

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

240

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

JustMarkets at a Glance

| 🏛 Headquartered | Cyprus |

| 🌎 Global Offices | Cyprus, Seychelles |

| 🏛 Local Market Regulators in Botswana | • Ministry of Finance and Economic Development (MFED) • Bank of Botswana (BoB) • Non-Bank Financial Institutions Regulatory Authority (NBFIRA) |

| 💳 Foreign Direct Investment in Botswana | 115.89 BWP Million in 2021 |

| 💰 Foreign Exchange Reserves in Botswana | 5270 USD Million in 2021 |

| ✔️ Local office in Gaborone? | No |

| 👨⚖️ Governor of SEC in Botswana | None, Moses Dinekere Pelaelo is the Governor of the Bank of Botswana |

| ✔️ Accepts Botswana Traders? | Yes |

| 📊 Year Founded | 2012 |

| 📞 Botswana Office Contact Number | None |

| 📱 Social Media Platforms | • Facebook |

| ⚖️ Regulation | Seychelles Financial Services Authority (FSA), Cyprus Securities and Exchange Commission (CySec) |

| 1️⃣ Tier-1 Licenses | None |

| 2️⃣ Tier-2 Licenses | None |

| 3️⃣ Tier-3 Licenses | • Financial Services Authority (FSA) |

| 🪪 License Number | SD088 |

| ⚖️ MFED, BoB, or NBFIRA Regulation | No |

| ✔️ Regional Restrictions | The United States, Japan, United Kingdom, EU, EEA, Belgium, and Spain |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 7 |

| ✔️ PAMM Accounts | MAM Accounts |

| 💻 Liquidity Providers | 18 |

| ✔️ Affiliate Program | Yes |

| 📱 Order Execution | Market |

| 📊 Starting spread | From 0.0 pips |

| 📉 Minimum Commission per Trade | $3 per lot, per side |

| 💰 Decimal Pricing | 5th decimal pricing after the comma |

| 📞 Margin Call | 40% |

| 🛑 Stop-Out | 20% |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | 100 lots |

| ✅ Crypto trading offered? | Yes |

| ✔️ Offers a BWP Account? | No |

| 📉 Dedicated Botswana Account Manager? | No |

| 📈 Maximum Leverage | 1:3000 |

| 📊 Leverage Restrictions for Botswana? | No |

| 💳 Minimum Deposit (BWP) | 137 Botswanan Pula equivalent to $10 |

| ✔️ Botswana Pula Deposits Allowed? | Yes |

| 📊 Active Botswana Trader Stats | 250,000+ |

| 👥 Active Botswana-based JustMarkets customers | Unknown |

| 🔁 Botswana Daily Forex Turnover | Unknown, Forex overall is $6.6 Trillion |

| 💰 Deposit and Withdrawal Options | • Debit Card • Credit Card • China UnionPay • Skrill • Neteller • Perfect Money • Sticpay • AirTM • Bitcoin • Bitcoin Cash • Ethereum • Tether • USD Coin • Local Bank Transfers, • Cards, Mobile Money • Local Wallets |

| 💻 Minimum Withdrawal Time | Instant |

| ⏰ Maximum Estimated Withdrawal Time | 10 bank days |

| 💳 Instant Deposits and Instant Withdrawals? | Yes |

| 🏛 Segregated Accounts with Botswana Banks? | No |

| 📱 Trading Platforms | MT4, MT5, MT4/5 WebTrader, mobile (iOS & Android) |

| 💻 Tradable Assets | • Indices • Energies • Forex • Metals • Cryptocurrencies • Shares • Futures |

| ✔️ Offers USD/BWP currency pair? | No |

| 💰 Deposit Fee | None |

| 📊 USD/BWP Average Spread | N/A |

| ✅ Offers Botswana Stocks and CFDs | No |

| 💻 Languages supported on the Website | English, Spanish, Portuguese, French, Russian, Indonesian, Malaysian, Chinese (Simplified and Traditional), Lao, Vietnamese, Thai, Turkish, and more. |

| ☎️ Customer Support Languages | Multilingual |

| 👥 Copy Trading Support | Yes |

| ⏰ Customer Service Hours | 24/5 |

| 📞 Botswana-based customer support? | No |

| 💵 Holding company | Just Global Markets Ltd. |

| 💸 Bonuses and Promotions for Botswanans? | Yes |

| 📚 Education for Botswanan beginner traders | Yes |

| 📱 Proprietary trading software | No |

| 🤝 Most Successful Trader in Botswana | Unknown |

| ✔️ Is JustMarkets a safe broker for Botswana Traders? | Yes |

| 🎖 Rating for JustMarkets Botswana | 8/10 |

| 🥇 Trust score for JustMarkets Botswana | 49% |

| 👉 Open Account | 👉 Open Account |

JustMarkets Islamic Account Overview

JustMarkets is a trading name of Just Global Markets Ltd, a Seychelles limited liability company established in 2012. JustMarkets provides 7 distinct trading accounts, including commission-free, commission-based, and Islamic swap-free options.

Though the broker provides access to over 150 markets in which to trade across Forex ECN, stocks, indices, commodities, and bonds, trading privileges are restricted to specific accounts.

At JustMarkets, you can trade on the go using the MetaTrader 4 and 5 trading platforms for PC and the MetaTrader mobile trading app for Android and iOS.

Various market analysis articles and educational pieces are also available to users. In addition, the broker advertises not only its own Copytrading services but also a variety of bonuses and exclusive offers.

JustMarkets also provides traders with a narrow spread, market news, an economic calendar, and leverage of up to 1:1500.

JustMarkets appeals to newbie traders familiar with the MT4 and MT5 platforms because of its wide selection of low-deposit accounts and inexpensive trading fees. In addition, JustMarkets is committed to ensuring the safety of all trades for their clients.

Therefore, JustMarkets uses SSL, which encodes all data sent between their servers and their customers. This method is perfect for deterring hackers and stopping criminality before it happens. In addition, records are kept for auditing purposes, and customer behaviour is monitored.

Social trading on MetaTrader platforms is made easier with JustMarkets. With social trading, investors may copy the trades of successful investors and learn from their strategies.

The experts are the signal senders, and these experts’ records of success determine their worth. Botswanans can choose which signal providers to follow depending on how successful those providers have been in the past.

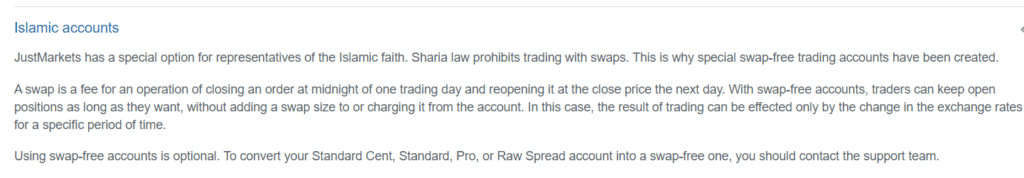

What exactly is an Islamic Account For Botswana Traders?

An Islamic, or swap-free, trading account is allowed by Islamic Sharia law. These accounts are based on the Islamic principle where interest is not applied to positions that are held open for longer than a trading day after the trading day has concluded.

Islamic Accounts are provided by brokers who serve Middle Eastern clients along with clients from other jurisdictions and offers certain features that are in line with the Sharia law, which prohibits the accrual of interest on funds deposited into the account.

The other important feature of an Islamic Account is that transactions must be settled immediately, requiring that currencies be transferred from one account to the other right after the transaction has been completed and therefore paid for in full.

Two key elements of the Islamic law relate specifically to trading accounts, these elements are:

➡️ Riba, and

➡️ Gharar

Riba is the prohibition of generating money from money, which in this case specifically refers to an interest, which is not allowed according to Sharia law. This type of interest is seen as both unjust and exploitive gains on trade or business.

What is an Islamic account offered by JustMarkets for Botswana traders, and how does it differ from regular trading accounts?

An Islamic account, also known as a swap-free account, is a specialized trading account offered by JustMarkets that is compliant with Islamic finance principles. It is designed for Botswana traders who adhere to Sharia law, which prohibits the payment or receipt of interest (riba).

Are there any eligibility requirements for Botswana traders to open an Islamic account with JustMarkets, and do traders need to provide proof of their religious beliefs to qualify for this account type?

Islamic accounts are typically available to all traders who wish to trade in accordance with Islamic finance principles, regardless of their religious beliefs. JustMarkets does not typically require traders to provide proof of their religious affiliation to open an Islamic account.

Why is interest discouraged or prohibited by Sharia law?

Due to the restrictions and certain prohibitions placed on Muslim traders when considering the intricate details involved with trading activities, the following is affected greatly:

➡️ Overnight rollovers – which involve the incurrence or receiving of swap points on positions that are held open for longer after the trading day has concluded at the New York close at 5 PM EST which is prohibited by the Sharia law.

➡️ Margin deposits and interest – which involves the accrual of interest on funds that are deposited into the trading account, which is prohibited.

➡️ Loans – when followers of the Sharia law have funds transferred by either a bank or other financial institution and it involves interest terms, this is prohibited by the Sharia law as per the key element, Riba.

➡️ Margin trading – stocks that are traded on margin result in the trader being liable for paying interest, which amounts to Riba, as money is borrowed from the broker to buy or sell such equities, and which is prohibited by the Sharia law.

➡️ Short sales – which affects mostly shares and involves borrowing and subsequent sale of an asset, which is prohibited.

➡️ Forward sales – which affects forward contracts as well as the trading of futures contracts which involves the buying and selling of contracts at a future date according to a price agreed upon on the day of entering such a contract.

Why does Sharia law discourage or prohibit interest (riba) in financial transactions, and how does this principle impact Islamic finance and banking practices?

Sharia law prohibits interest primarily because it is considered exploitative and unfair. The Islamic financial system is designed to promote economic justice and ethical conduct. Interest-bearing transactions are seen as a form of unjust enrichment, where the lender benefits at the expense of the borrower.

How does the prohibition of interest (riba) under Sharia law impact everyday financial practices and banking for individuals and businesses following Islamic principles?

The prohibition of interest under Sharia law fundamentally transforms various aspects of financial practices for individuals and businesses.

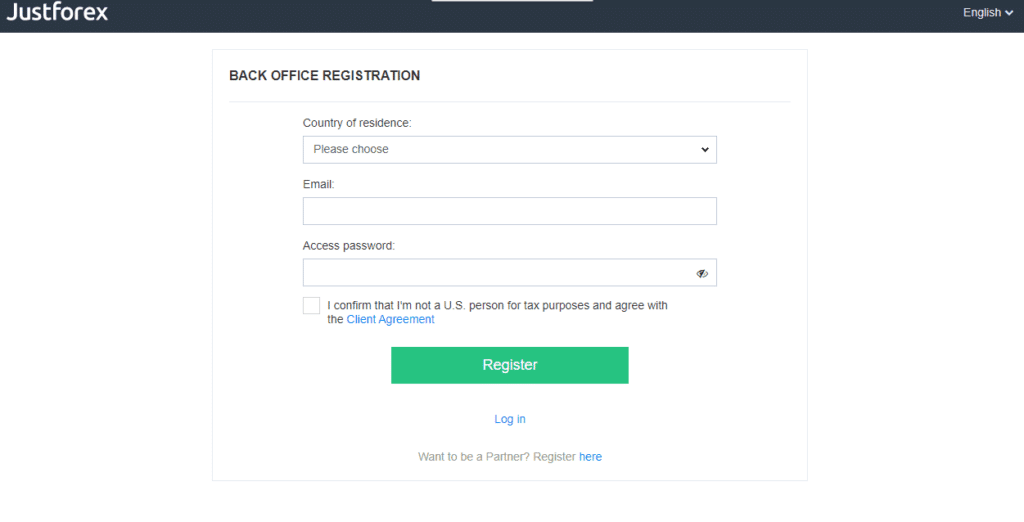

What are the steps involved in opening a JustMarkets Islamic Account?

Step 1: Register

Firstly, the applicant will need to register in order to gain access to the “Back Office”.

After the registration process has been completed, the applicant will be automatically redirected to the Back Office, where they can open their first account.

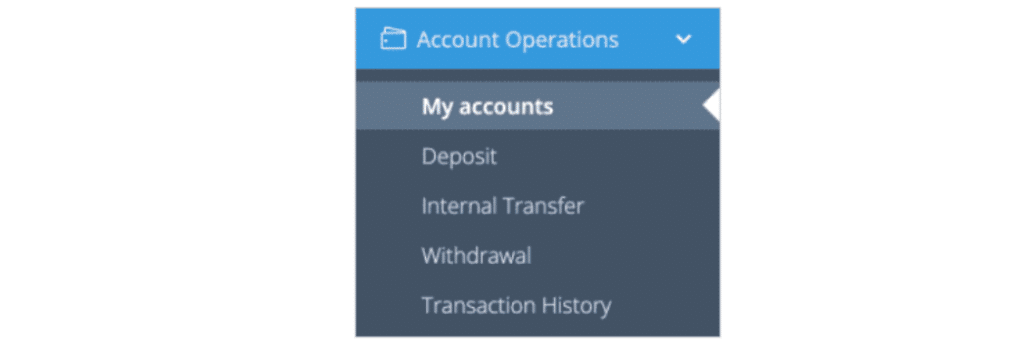

Step 2: My Accounts

In the “Account Operations” menu, click “My accounts.”

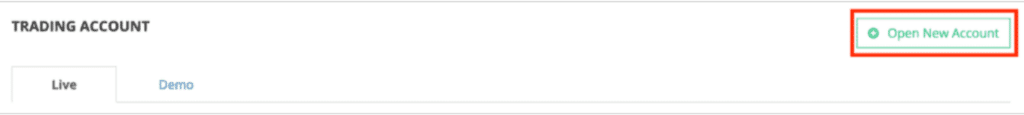

Step 3: Open New Account

On the “Live” page in the “Trading account” section, click “Open New Account.”

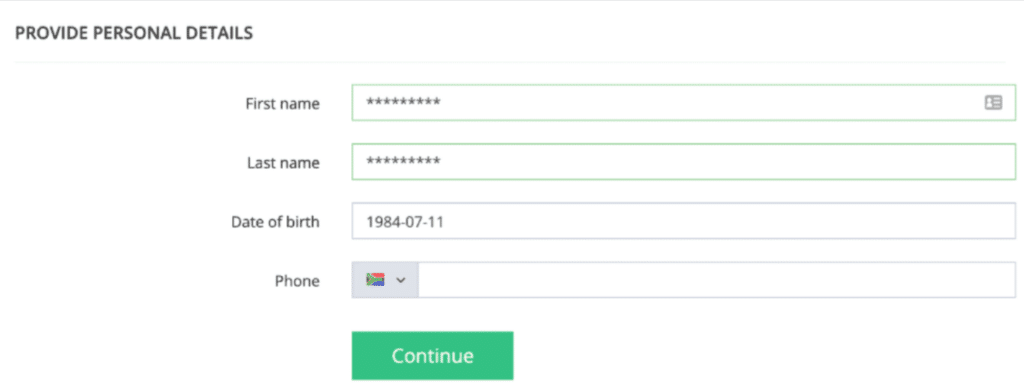

Step 4: Personal Details

The applicant will be required to fill in all the fields in the “Provide personal details” section. Note – This step is only for the clients who have not filled out this information before. If the applicant has already provided the required personal details, go to the next step.

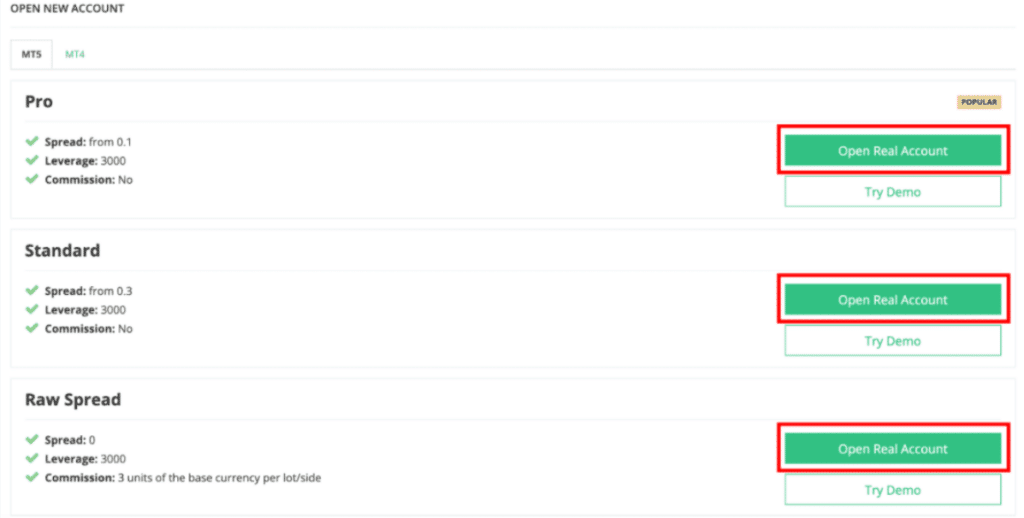

Step 5: Account Selection

Here, the applicant will be able to select the desired account type on the preferred platform page in the “Open New Account” section and click “Open Real Account.

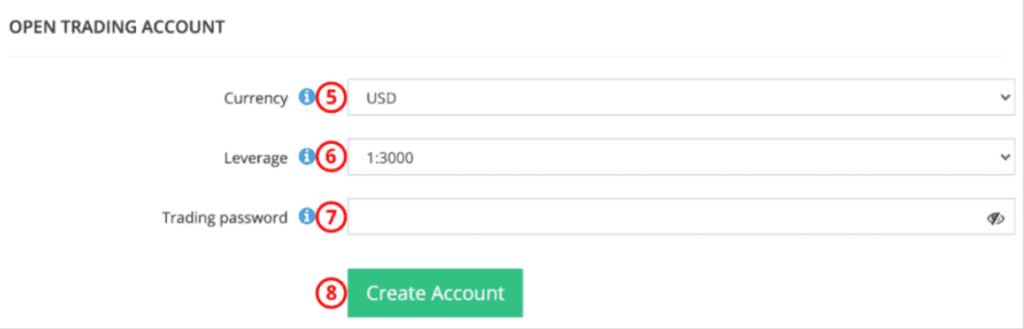

Step 6: Finalize

Once this step has been completed, the applicant will be able to set the base currency, define the leverage and set a main password. The next and final step is simply to click on Create account.

What are JustMarkets’s spread costs on an Islamic Account?

Market circumstances, trading volume, and the financial item being traded all have an impact on the spreads that traders might anticipate from their Islamic accounts.

The typical minimum spreads according to the account types are as follows:

➡️ MetaTrader 4 Standard Cent Account – 0.3 pips

➡️ MetaTrader 4 Standard Account – 0.3 pips

➡️ MetaTrader 4 Pro Account – 0.1 pips

➡️ MetaTrader 4 Raw Spread Account – 0.0 pips

➡️ MetaTrader 5 Standard Account – 0.3 pips

➡️ MetaTrader 5 Pro Account – 0.1 pips

➡️ MetaTrader 5 Raw Spread Account – 0.0 pips

What are the spread costs associated with JustMarkets’ Islamic Account, and how do they compare to other account types offered by the broker?

The spread costs on JustMarkets’ Islamic Account, like other account types, can vary depending on the trading instrument and market conditions. However, Islamic Accounts are typically designed to be swap-free, meaning they do not incur overnight financing charges (swap fees).

Are there any specific considerations or factors that Botswana traders should be aware of regarding spread costs on JustMarkets’ Islamic Account?

Botswana traders using JustMarkets’ Islamic Account should be aware that while the account is designed to be swap-free, there may still be spread costs associated with their trades.

What other features does JustMarkets’s Islamic Account offer Botswana traders?

Each account type has its own set of trading conditions and features, so what a trader can anticipate from their account in terms of basic functionality will vary. The typical account features that Botswana traders can expect from their Islamic account include some of the following:

➡️ Minimum deposits between $10 and $100

➡️ Leverage ratios between 1:1000 up to a maximum of 1:3000

➡️ A choice between several currencies as the base currency of the trading account including USD, EUR, GBP, JPY, MYR, IDR, THB, VND, KWD, CNY, and ZAR

➡️ Margin calls of 40% along with stop-out of 20%

➡️ 5th Decimal pricing

➡️ Market Execution on trades

➡️ Access to powerful trading platforms across several devices

➡️ Competitive trading and non-trading fees

➡️ Access to a wide range of funding options

➡️ Flexible position sizing according to the account type

➡️ Commission-free trading on some accounts

In addition to being swap-free, what other features and benefits does JustMarkets offer to Botswana traders with Islamic Accounts?

JustMarkets’ Islamic Accounts typically come with several features tailored to cater to traders who adhere to Islamic finance principles. These features may include access to a wide range of trading instruments, competitive spreads, leverage options, and a user-friendly trading platform.

Are there any limitations or restrictions on the trading activities of Botswana traders using JustMarkets’ Islamic Account, and do they have access to the same trading opportunities as traders with regular accounts?

JustMarkets’ Islamic Accounts are designed to provide traders with the same trading opportunities as those with regular accounts while adhering to Islamic finance principles. In most cases, there are no significant limitations or restrictions on trading activities.

JustMarkets Botswana Pros and Cons

| ✔️ Pros | ❌ Cons |

| With JustMarkets, Botswanans can make free deposits and withdrawals using several flexible non-crypto payment methods | There is a limited range of tradable instruments offered |

| Botswanans have access to an unlimited demo account on MT4 and MT5 | JustMarkets charges inactivity fees |

| Botswana provides an Islamic Account option for its Muslim traders who follow Sharia law | There is no top-tier regulation, and JustMarkets has a low trust score |

| Botswanans can access a range of educational materials and advanced tools | There is no BWP-denominated account |

| Mobile trading is enabled through a feature rich JustMarkets app for iOS and Android | Deposit fees are charged when Botswanans use cryptocurrencies |

| MT4 and MT5 are available to Botswanan traders, each with a dedicated account type | |

| Botswanans can expect affordable trading fees and a transparent schedule | |

| Client funds are kept secure in separate accounts | |

| JustMarkets offers expert market analysis | |

| JustMarkets provides a choice between several currencies that can be set as the base currency |

JustMarkets Final Verdict

Overall, JustMarkets can be summarised as a trustworthy broker that offers 0% deposit and withdrawal fees, low spreads, and a sign-up bonus of $30 / 414 Pula offered to first-time traders. An account can be opened with a minimum deposit amount of $10USD / 137 Pula.

You might also like: JustMarkets Review

You might also like: JustMarkets Account Types

You might also like: JustMarkets Demo Account

You might also like: JustMarkets Fees And Spreads

You might also like: JustMarkets Minimum Deposit

Conclusion

Now it is your turn to participate:

Regardless, please share your thoughts in the comments below.

Frequently Asked Questions

How can Botswanans register an Islamic Account with JustMarkets?

Botswanans can register for a Standard Cent, Standard, Pro, or Raw Spread Account on MT4 or MT5. Once they have verified their details and active live account, they can contact JustMarkets to request an account conversion to a Swap-Free account.

Will I prove my religion to qualify for a JustMarkets Islamic Account?

JustMarkets might require proof of your religion before approving your Islamic Account. This is to prevent misuse and abuse of the account.

What are the holding fees charged on the JustMarkets Islamic Account?

There are no holding fees applied to the JustMarkets Islamic Account.

Which accounts can I convert to a Swap-Free account with JustMarkets?

You can convert any of the following JustMarkets live accounts:

- Standard Cent Account

- Standard Account

- Pro Account

- Raw Spread Account

What are the average spreads I can expect on the JustMarkets Islamic Account?

The average spreads range from 0.0 to 0.9 pips depending on the account type, financial instrument you trade, and the overall market conditions when you decide to trade.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review