FBS Fees and Spreads

Overall, FBS Fees and Spreads start from the average spread of 0.0 pips EUR/USD, and the commission depends on the trading account the trader is using. FBS is considered trustworthy, with an overall Trust Score of 75% out of 100.

- Lesche Duvenage

Jump to:

Fees and Spreads Overview

Additional Trading Fees

Broker Fees

Pros and Cons

Final Verdict

FAQ

FBS at a Glance

| 🏛 Headquartered | Belize |

| 🌎 Global Offices | Malaysia, Laos, Thailand, Dubai, Brazil, Turkey |

| 🏛 Local Market Regulators in Botswana | • Ministry of Finance and Economic Development (MFED) • Bank of Botswana (BoB) • Non-Bank Financial Institutions Regulatory Authority (NBFIRA) |

| 💳 Foreign Direct Investment in Botswana | 115.89 BWP Million in 2021 |

| 💰 Foreign Exchange Reserves in Botswana | 5270 USD Million in 2021 |

| ✔️ Local office in Gaborone? | No |

| 👨⚖️ Governor of SEC in Botswana | None, Moses Dinekere Pelaelo is the Governor of the Bank of Botswana |

| ✔️ Accepts Botswana Traders? | Yes |

| 📊 Year Founded | 2009 |

| 📞 Botswana Office Contact Number | None |

| 📱 Social Media Platforms | • Facebook • Telegram • YouTube |

| ⚖️ Regulation | IFSC, CySEC, ASIC, FSCA |

| 1️⃣ Tier-1 Licenses | • Australian Securities and Exchange Commission (ASIC) |

| 2️⃣ Tier-2 Licenses | • Cyprus Securities and Exchange Commission (CySEC) • Financial Sector Conduct Authority (FSCA) |

| 3️⃣ Tier-3 Licenses | • International Financial Service Commission (IFSC) in Belize |

| 🪪 License Number | • Belize – 000102/198 • Cyprus (Tradestone) – 331/17 • Australia (IFM) – 426359 • South Africa (Tradestone) – 50885 |

| ⚖️ MFED, BoB, or NBFIRA Regulation | None |

| ✔️ Regional Restrictions | Japan, United States, Canada, United Kingdom, Myanmar, Brazil, Malaysia, Israel, the Islamic Republic of Iran |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 3 |

| ✔️ PAMM Accounts | No |

| 💻 Liquidity Providers | Currenex |

| ✔️ Affiliate Program | Yes |

| 📱 Order Execution | Market |

| 📊 Starting spread | 0.0 pips |

| 📉 Minimum Commission per Trade | From $6 |

| 💰 Decimal Pricing | 5th decimal pricing after the comma |

| 📞 Margin Call | 40% |

| 🛑 Stop-Out | 20% |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | Unlimited |

| ✅ Crypto trading offered? | Yes |

| ✔️ Offers a BWP Account? | No |

| 📉 Dedicated Botswana Account Manager? | No |

| 📈 Maximum Leverage | 1:3000 |

| 📊 Leverage Restrictions for Botswana? | No |

| 💳 Minimum Deposit (BWP) | 96 Botswanan Pula or an equivalent to $5 |

| ✔️ Botswana Pula Deposits Allowed? | Yes |

| 📊 Active Botswana Trader Stats | 250,000+ |

| 👥 Active Botswana-based customers | Unknown |

| 🔁 Botswana Daily Forex Turnover | Unknown, Forex overall is $6.6 Trillion |

| 💰 Deposit and Withdrawal Options | • Credit Card • Debit Card • Neteller • Sticpay • Skrill • Perfect Money • Local Exchanges |

| 💻 Minimum Withdrawal Time | 15 to 20 minutes (maximum 48 hours) |

| ⏰ Maximum Estimated Withdrawal Time | Up to 7 days |

| 💳 Instant Deposits and Instant Withdrawals? | Instant Deposits |

| 🏛 Segregated Accounts with Botswana Banks? | No |

| 📱 Trading Platforms | • FBS Trader • MetaTrader 4 • MetaTrader 5 |

| 💻 Tradable Assets | • Forex • Precious Metals • Indices • Energies • Stocks • Exotic Forex • Cryptocurrencies |

| ✔️ Offers USD/BWP currency pair? | No |

| 📊 USD/BWP Average Spread | N/A |

| ✅ Offers Botswana Stocks and CFDs | No |

| 💻 Languages supported on the Website | English, German, Spanish, French, Italian, Portuguese, Indonesian, Malay, Vietnamese, Turkish, Korean, and others |

| ☎️ Customer Support Languages | Multilingual |

| ⏰ Customer Service Hours | 24/7 |

| 📞 Botswana-based customer support? | No |

| 💸 Bonuses and Promotions for Botswanans? | Yes |

| 📚 Education for Botswanan beginner traders | Yes |

| 📱 Proprietary trading software | Yes |

| 🤝 Most Successful Trader in Botswana | Unknown |

| ✔️ Is FBS a safe broker for Botswana Traders? | Yes |

| 🎖 Rating for FBS Botswana | 9/10 |

| 🥇 Trust score for FBS Botswana | 75% |

| 👉 Open Account | 👉 Open Account |

FBS Fees and Spreads

The spread list for FBS starts from 0.0 pips EUR/USD.

When Botswana traders register for a live trading account with FBS, they could choose from six retail investor accounts, each of which offers distinctive features and attractive trading terms.

Botswanans can subsequently anticipate a varying spread list based on their account type, the instrument they trade, and the day’s market circumstances. Typical spreads include the following:

Standard Account – Variable, from 0.5 pips

Cent Account – Variable, from 1 pip

Pro Account – Fixed, from 0.5 pips

What are the typical spreads offered by FBS, and do they vary across different account types?

FBS typically offers both fixed and variable spreads, and the exact spreads can vary depending on the currency pairs and account types chosen by traders.

Are there any hidden fees or commissions associated with trading on FBS, and what other non-trading fees should traders be aware of?

FBS typically operates on a no-commission basis for most standard accounts.

FBS Additional Trading Fees

Commissions

FBS’s trading commissions vary according to the account type and will be determined in terms of the trading volume. Botswanans can expect the following commission per trade:

Standard Account – $0

Cent Account – $0

Pro Account – $0

Overnight Fees, Rollovers, or Swaps

When registering an account with FBS, traders will have a clear idea of the costs involved according to FBS’s transparent charge schedules.

The following are some common overnight fees for Botswana traders:

| 🔧 Instrument | 📈 Long (Buy) Swap | 📉 Short (Sell) Swap |

| EUR/USD | -6.37 | -0.69 |

| XAG/USD | -1.77 | -1.24 |

| XAU/USD | -2.12 | -1.35 |

| US100 | -85.91 | -117.2 |

| XBR/USD | -7.74 | -6.28 |

| AAPL | -2.58 | -2.42 |

Muslim traders can convert the Cent, Standard to an Islamic Account, which will exempt them from swap fees.

FBS does not provide spread betting services to Botswana traders, only those in the United Kingdom. Therefore, Botswanans need not worry about being subject to spread betting fees.

Does FBS impose any additional trading fees beyond spreads and overnight financing costs?

FBS typically operates on a no-commission basis for most standard trading accounts, which means traders do not incur additional fees for executing trades.

Are there any withdrawal fees or charges for account inactivity that traders should be aware of with FBS?

FBS generally does not charge withdrawal fees for standard deposit and withdrawal methods.

FBS Broker Fees

Botswana traders must ensure that they verify any broker fees that might be charged, including currency conversion, deposit, withdrawal, and inactivity fees.

Deposit and Withdrawal Fees

FBS imposes transaction fees on a variety of accepted payment methods, both for making initial deposits and for making subsequent withdrawals from a trading account. Sticpay traders pay a 2.5% fee + 0.3 USD in commission when funding their trading accounts.

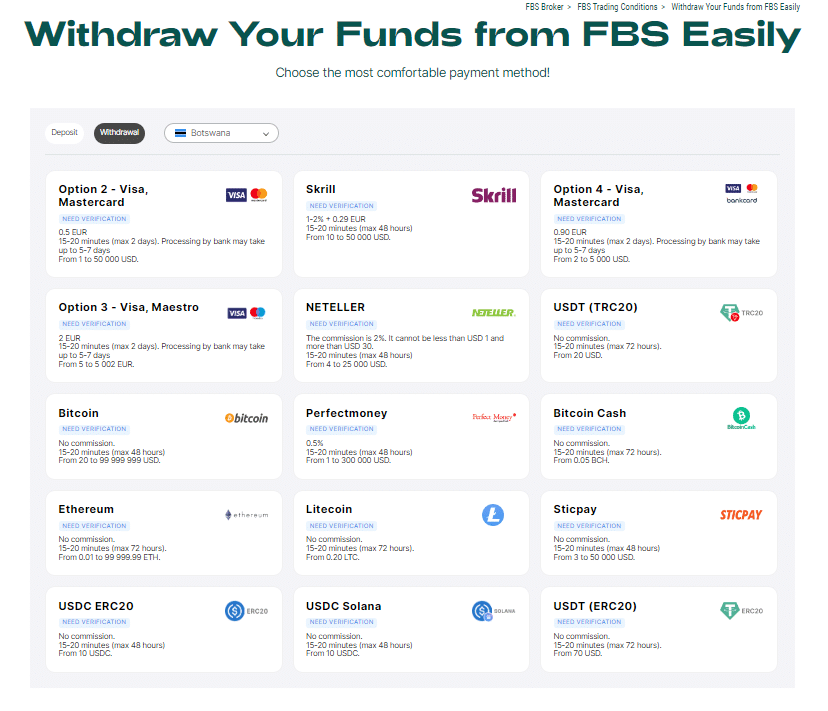

In addition, when withdrawing funds, Botswanans can expect the following withdrawal fees:

➡️ Credit Card – $1 commission

➡️ Debit Card – $1 commission

➡️ Neteller – 2% with a minimum of $1 and a maximum of $30

➡️ Sticpay – 2.5% + $0.3 commission

➡️ Skrill – 1% + $0.32 commission

➡️ Perfect Money – 0.50% commission

Inactivity Fees

A $5 inactivity fee will be charged to a live trading account if it has been inactive for more than 180 days.

Currency Conversion Fees

Only two base currencies are supported by FBS and may be utilized when creating a live trading account.

Therefore, depending on the currency Botswana traders pick as their account’s base currency, their BWP deposits and withdrawals will be translated to USD or EUR. This can cost Botswana traders in currency exchange charges.

Does FBS charge any broker fees or commissions for executing trades on standard trading accounts?

FBS typically operates on a no-commission basis for most standard trading accounts.

Are there any hidden or unexpected fees that traders should be aware of when trading with FBS?

FBS is generally transparent about its fee structure, and there are typically no hidden or unexpected fees associated with standard trading accounts.

FBS Botswana Pros and Cons

| ✔️ Pros | ❌ Cons |

| Botswanan traders have access to accounts according to their trading experience and skill | FBS applies deposit fees, and there are withdrawal fees charged on some payment methods |

| Demo accounts are available to beginners | The spreads on the Cent Account are wide |

| There is an Islamic account conversion offered to Muslim traders | |

| FBS often charges negative spreads on some financial instruments if the market conditions are ideal |

Verdict on FBS

Overall, FBS is very competitive in terms of its trading Fees and Spreads.

You might also like: FBS Review

You might also like: FBS Account Types

You might also like: FBS Demo Account

You might also like: FBS Minimum Deposit

You might also like: FBS Sign-Up Bonus

Conclusion

Now it is your turn to participate:

Regardless, please share your thoughts in the comments below.

Frequently Asked Questions

What spreads can I expect from FBS?

FBS charges spreads from 0.5 pips EUR/USD to 0.7 pips EUR/USD on more accounts.

Does FBS charge commissions?

No, FBS does not charge commissions accounts.

What happens if my FBS account becomes dormant?

Suppose your account is left unattended for 180 days. In that case, an inactivity fee of 5 USD will be deducted every month that the account remains inactive.

How much do I pay when I withdraw funds?

When you withdraw funds from FBS, you can expect these withdrawal fees:

- Credit Card – $1 commission

- Debit Card – $1 commission

- Neteller – 2% with a minimum of $1 and a maximum of $30

- Sticpay – 2.5% + $0.3 commission

- Skrill – 1% + $0.32 commission

- Perfect Money – 0.50% commission

How can I be exempted from overnight fees?

To prevent swap fees, you must close your position before the trading day ends. If you are of Muslim faith, you can apply for an Islamic Account with FBS.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review