FBS Minimum Deposit

Overall, FBS Minimum Deposit amount required to register a live trading account is $5, this minimum deposit is equivalent to 96 BWP. FBS is considered trustworthy and credible, with an overall Trust Score of 75% out of 100.

- Louis Schoeman

Jump to:

Minimum Deposit Overview

Deposit Fees and Methods

Step By Step guide to depositing the Minimum Deposit

Pros and Cons

Final Verdict

FAQ

FBS at a Glance

| 🏛 Headquartered | Belize |

| 🌎 Global Offices | Malaysia, Laos, Thailand, Dubai, Brazil, Turkey |

| 🏛 Local Market Regulators in Botswana | • Ministry of Finance and Economic Development (MFED) • Bank of Botswana (BoB) • Non-Bank Financial Institutions Regulatory Authority (NBFIRA) |

| 💳 Foreign Direct Investment in Botswana | 115.89 BWP Million in 2021 |

| 💰 Foreign Exchange Reserves in Botswana | 5270 USD Million in 2021 |

| ✔️ Local office in Gaborone? | No |

| 👨⚖️ Governor of SEC in Botswana | None, Moses Dinekere Pelaelo is the Governor of the Bank of Botswana |

| ✔️ Accepts Botswana Traders? | Yes |

| 📊 Year Founded | 2009 |

| 📞 Botswana Office Contact Number | None |

| 📱 Social Media Platforms | • Facebook • Telegram • YouTube |

| ⚖️ Regulation | IFSC, CySEC, ASIC, FSCA |

| 1️⃣ Tier-1 Licenses | • Australian Securities and Exchange Commission (ASIC) |

| 2️⃣ Tier-2 Licenses | • Cyprus Securities and Exchange Commission (CySEC) • Financial Sector Conduct Authority (FSCA) |

| 3️⃣ Tier-3 Licenses | • International Financial Service Commission (IFSC) in Belize |

| 🪪 License Number | • Belize – 000102/198 • Cyprus (Tradestone) – 331/17 • Australia (IFM) – 426359 • South Africa (Tradestone) – 50885 |

| ⚖️ MFED, BoB, or NBFIRA Regulation | None |

| ✔️ Regional Restrictions | Japan, United States, Canada, United Kingdom, Myanmar, Brazil, Malaysia, Israel, the Islamic Republic of Iran |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 3 |

| ✔️ PAMM Accounts | No |

| 💻 Liquidity Providers | Currenex |

| ✔️ Affiliate Program | Yes |

| 📱 Order Execution | Market |

| 📊 Starting spread | 0.0 pips |

| 📉 Minimum Commission per Trade | From $6 |

| 💰 Decimal Pricing | 5th decimal pricing after the comma |

| 📞 Margin Call | 40% |

| 🛑 Stop-Out | 20% |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | Unlimited |

| ✅ Crypto trading offered? | Yes |

| ✔️ Offers a BWP Account? | No |

| 📉 Dedicated Botswana Account Manager? | No |

| 📈 Maximum Leverage | 1:3000 |

| 📊 Leverage Restrictions for Botswana? | No |

| 💳 Minimum Deposit (BWP) | 96 Botswanan Pula or an equivalent to $5 |

| ✔️ Botswana Pula Deposits Allowed? | Yes |

| 📊 Active Botswana Trader Stats | 250,000+ |

| 👥 Active Botswana-based customers | Unknown |

| 🔁 Botswana Daily Forex Turnover | Unknown, Forex overall is $6.6 Trillion |

| 💰 Deposit and Withdrawal Options | • Credit Card • Debit Card • Neteller • Sticpay • Skrill • Perfect Money • Local Exchanges |

| 💻 Minimum Withdrawal Time | 15 to 20 minutes (maximum 48 hours) |

| ⏰ Maximum Estimated Withdrawal Time | Up to 7 days |

| 💳 Instant Deposits and Instant Withdrawals? | Instant Deposits |

| 🏛 Segregated Accounts with Botswana Banks? | No |

| 📱 Trading Platforms | • FBS Trader • MetaTrader 4 • MetaTrader 5 |

| 💻 Tradable Assets | • Forex • Precious Metals • Indices • Energies • Stocks • Exotic Forex • Cryptocurrencies |

| ✔️ Offers USD/BWP currency pair? | No |

| 📊 USD/BWP Average Spread | N/A |

| ✅ Offers Botswana Stocks and CFDs | No |

| 💻 Languages supported on the Website | English, German, Spanish, French, Italian, Portuguese, Indonesian, Malay, Vietnamese, Turkish, Korean, and others |

| ☎️ Customer Support Languages | Multilingual |

| ⏰ Customer Service Hours | 24/7 |

| 📞 Botswana-based customer support? | No |

| 💸 Bonuses and Promotions for Botswanans? | Yes |

| 📚 Education for Botswanan beginner traders | Yes |

| 📱 Proprietary trading software | Yes |

| 🤝 Most Successful Trader in Botswana | Unknown |

| ✔️ Is FBS a safe broker for Botswana Traders? | Yes |

| 🎖 Rating for FBS Botswana | 9/10 |

| 🥇 Trust score for FBS Botswana | 75% |

| 👉 Open Account | 👉 Open Account |

FBS Minimum Deposit

FBS charges a minimum deposit amount of 5 USD.

Botswana traders can deposit a minimum of $5 to open a live account with FBS, which, at the current conversion rate between the US dollar and the Botswanan Pula, is equivalent to 96 BWP.

Although the Capital Markets Authority (CMA) in Botswana does oversee FBS, the ASIC, FSCA, CySEC, and IFSC control FBS and its activities.

FBS is a well-known, multi-regulated broker that keeps client deposits in segregated accounts with top-tier brokers, offering some of the highest levels of client money protection in the business.

These assets, which are exclusively utilized for trading, are held separate from the broker account.

All traders who establish an account with FBS are subject to the Know Your Client policy. To create an account, Botswana traders must verify their identity and provide evidence of residence.

FBS follows anti-money laundering standards, which are reflected in the requirements of traders for deposits and withdrawals from/to unidentified accounts. Traders should be aware of this.

Applying negative balance protection to a retail investor account will prevent a trader from losing their whole account balance if they suffer a big loss. This is typically what happens when traders use a lot of leverage to increase the size of their bets and the market moves against them.

FBS Deposit fees and deposit methods

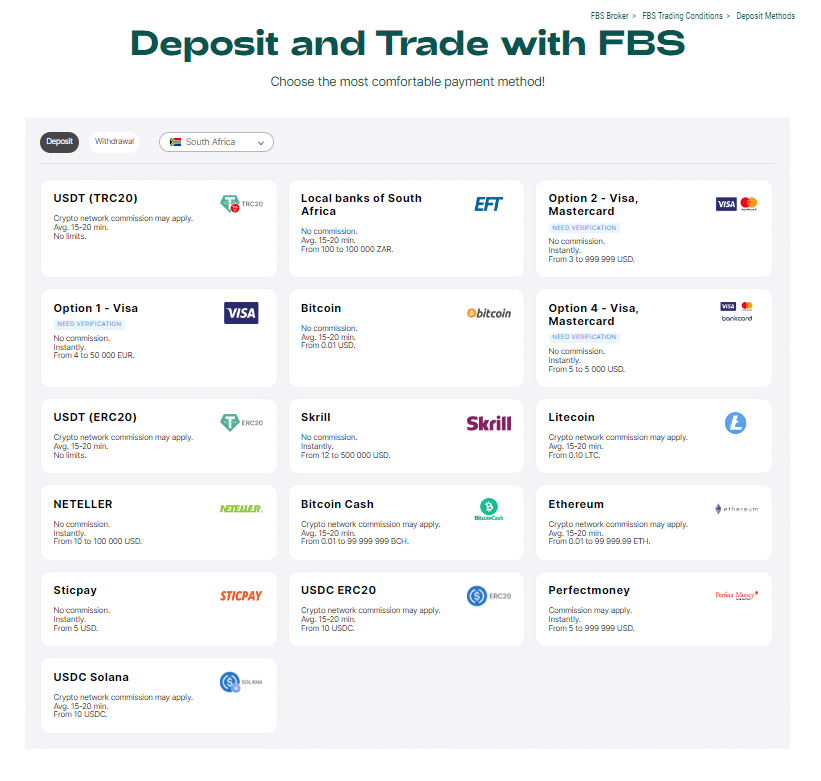

When Botswana traders utilize Sticpay to deposit the minimum deposit amount, FBS levies deposit fees. This cost amounts to fees of 2.5% plus $0.3 per transaction. When making the minimum deposit, traders may select between the following options:

➡️ Credit Card

➡️ Debit Card

➡️ Neteller

➡️ Sticpay

➡️ Skrill

➡️ Perfect Money

➡️ Local Exchanges

When making the Minimum Deposit in either one of the retail accounts that FBS offers, Botswanans can choose between these deposit currencies:

➡️ EUR

➡️ USD

What deposit methods are available with FBS, and are there any deposit fees?

FBS typically offers a range of deposit methods to cater to traders’ preferences. These methods often include bank wire transfers, credit/debit card payments, electronic payment systems like Skrill, Neteller, and various other e-wallets, as well as cryptocurrency deposits.

Are there any restrictions on the minimum or maximum deposit amounts when funding an FBS trading account?

FBS typically has minimum and maximum deposit amounts that can vary based on the chosen deposit method and account type.

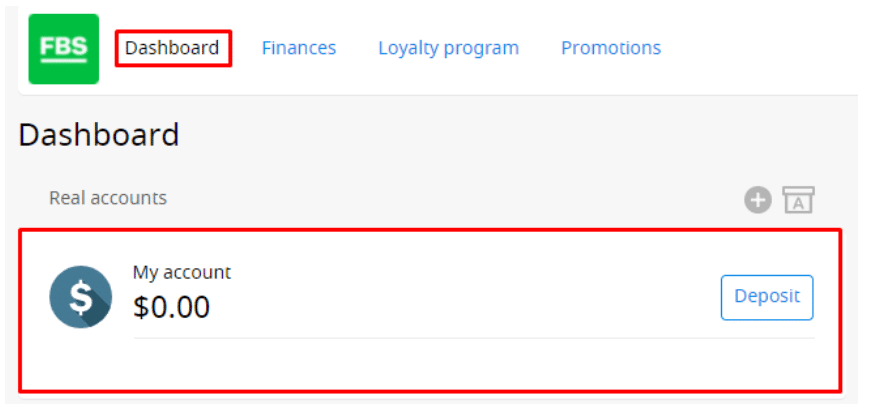

A step-by-step guide to depositing the minimum amount

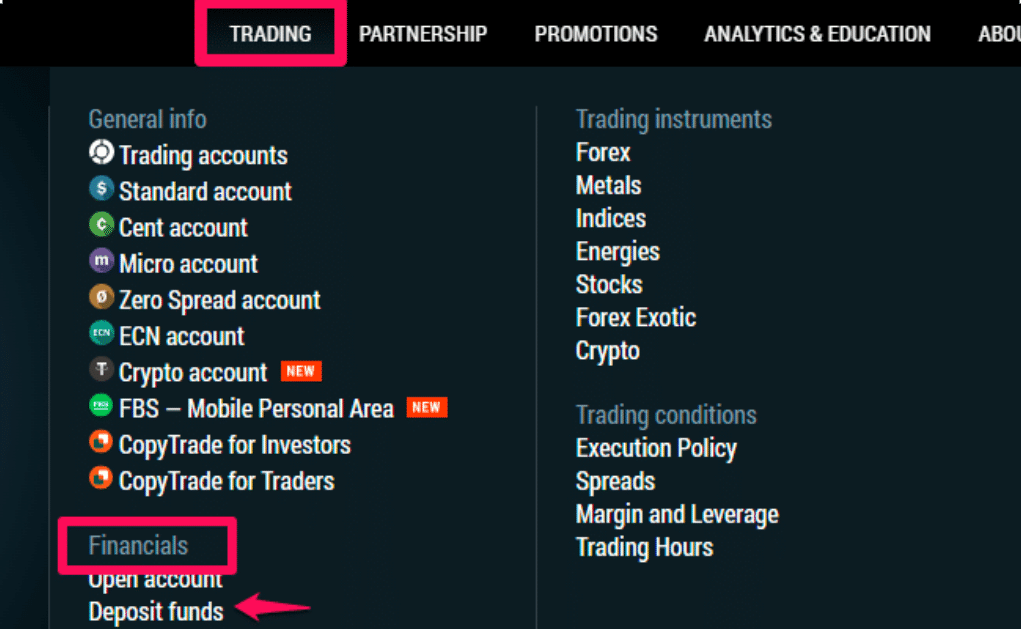

Step 1 – Web selection

Select ‘deposit funds’ from the ‘Financials’ section under Trading on the website.

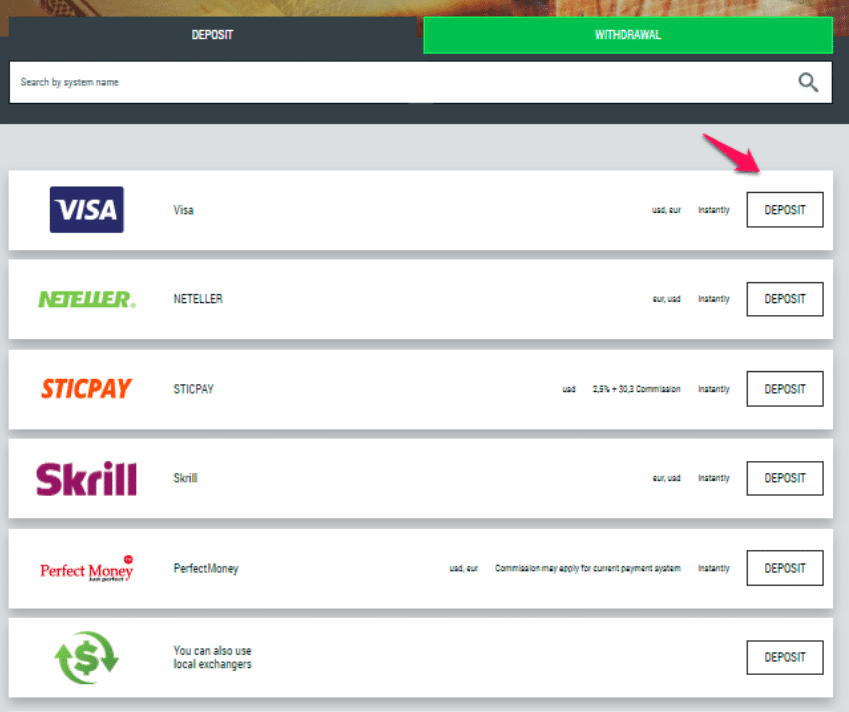

Step 2 – Choose payment method

Choose your preferred method of payment, whether online or offline, and select the ‘deposit’ tab.

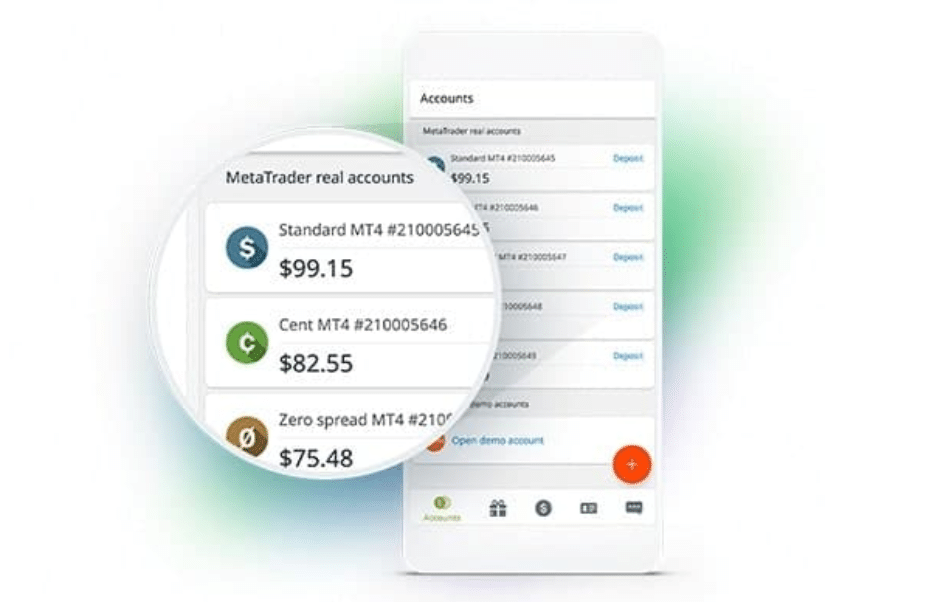

Step 3 – Select the trading account

Select the trading account that traders wish to fund, should they have more than one, and enter the amount they wish to deposit.

Step 4 – Confirm the deposit

Confirm the deposits on the next page to finalize the deposit.

FBS Botswana Pros and Cons

| ✔️ Pros | ❌ Cons |

| FBS is one of few brokers with an ultra-low minimum deposit of 1 USD / 12 BWP | FBS applies deposit fees on Sticpay |

| FBS is trusted and used by millions of traders from around the world | Currency conversion fees can apply on all deposits in currencies other than EUR or USD |

| FBS does not keep funds in its broker account but separates client money from its operational funds | |

| Traders deemed eligible receive investor protection |

Verdict on FBS

Overall, FBS is very competitive in terms of its trading fees and spreads.

You might also like: FBS Review

You might also like: FBS Account Types

You might also like: FBS Demo Account

You might also like: FBS Fees and Spreads

You might also like: FBS Sign Up Bonus

Conclusion

Now it is your turn to participate:

Regardless, please share your thoughts in the comments below.

Frequently Asked Questions

How much will it cost to register an account with FBS?

The minimum deposit to register a live account with FBS is 5 USD / 96 BWP.

How can I deposit funds into my FBS account?

You can deposit funds into your FBS account by using these payment methods:

Can my friend make my FBS deposit on my behalf?

FBS prohibits all third-party payments. You must deposit funds from a bank account that reflects your name when registering an FBS account.

How long will my deposit to my FBS account take?

Most payment methods supported by FBS are instant.

Where does FBS store my money?

FBS holds client funds in bank accounts with top-tier financial institutions.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review