Tickmill Review

Overall, Tickmill is very competitive in terms of its trading fees and spreads. Tickmill offers three retail investor accounts as well as demo and Islamic accounts. Tickmill has a trust score of 82% out of 100. Tickmill is currently not regulated by the MFED, BoB, or NBFIRA of Botswana

- Lesche Duvenage

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

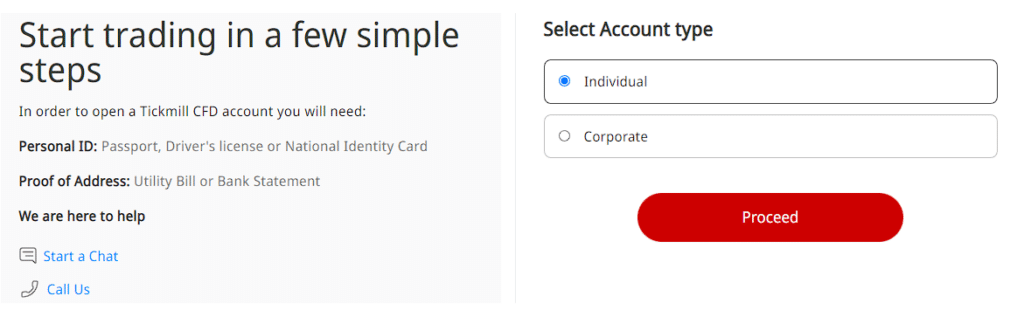

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

$100 / 1 343 BWP

Regulators

CySEC, FCA, FSA, FSCA, Labuan FSA

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

62

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overview

Overall, Tickmill is considered low-risk, with an overall Trust Score of 82 out of 100. The broker is licensed by one Tier-1 regulator (high trust), two Tier-2 Regulators (average trust), and two Tier-3 Regulators (low trust). They offer three different retail trading accounts namely a Pro Account, Classic Account, and a VIP Account.

Tickmill is a global provider of financial CFD trading services, with a primary concentration on contracts for difference (CFDs) on foreign currency exchange (Forex), stock indices, commodities, and other asset classes.

The broker was launched in 2015 and holds licenses from reputable regulators in the foreign exchange market.

Tickmill offers first-rate products and services and caters to the requirements of the most discerning retail and professional customers all over the world.

The broker provides exceptional trading conditions, including spreads starting at 0 pip, incredibly rapid execution speeds, and superb customer service in more than 15 languages.

Tickmill’s development team is focused on meeting the trading expectations and ambitions of the brokerage’s existing clients while also ensuring that the brokerage continues to grow and expand.

The broker employs innovative trading technology in combination with superior trading conditions. Tickmill exclusively uses the best and most well-known liquidity providers, such as major banks and hedge funds, to offer liquidity.

Traders may access powerful and customizable trading platforms like MetaTrader 4 and MetaTrader 5 from a range of devices. Traders will also get access to a few client tools and promotions, as well as favorable trading conditions.

This Tickmill review for Botswana will provide local retail traders with the details that they need to consider whether Tickmill is suited to their unique trading objectives and needs.

They accepts Botswanan clients and has an average spread from 0.0 pips with commissions from $1 per standard lot traded. Tickmill has a maximum leverage ratio up to 1:500 and there is a demo and Islamic account available.

MetaTrader 4 and MetaTrader 5 platforms are supported. Tickmill is headquartered in London, United Kingdom and regulated by Seychelles FSA, FCA, CySEC, Labuan FSA, and FSCA.

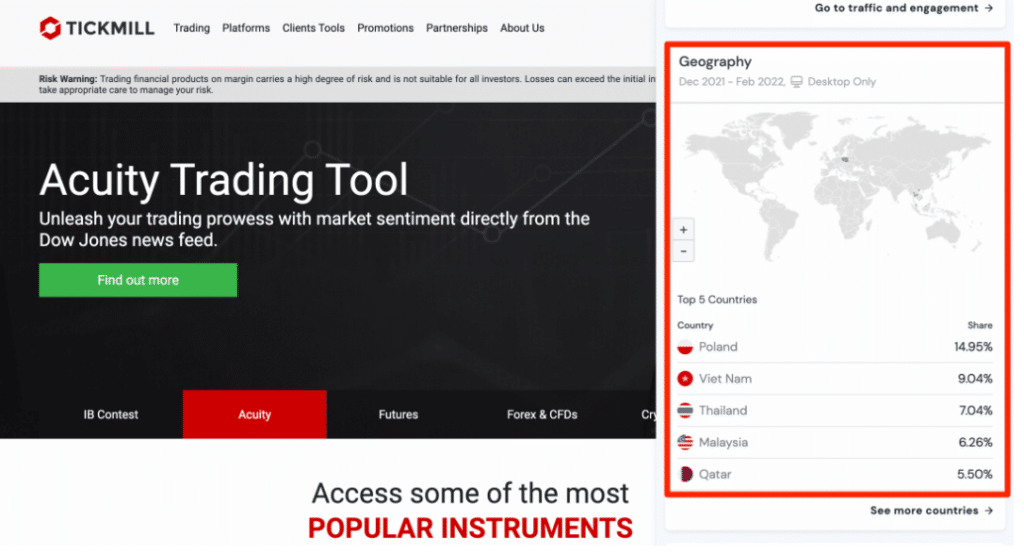

Distribution of Traders

currently has the largest market share in these countries

➡️ Poland – 14.9%

➡️ Vietnam – 9.04%

➡️ Thailand – 7.04%

➡️ Malaysia – 6.26%

➡️ Qatar – 5.50%

Popularity among traders

🥇 Despite having a market share of less than 5% in Botswana, The broker is a broker that accepts and welcomes Botswanan traders. Because of this, They are ranked among the Top 50 brokers for Botswanan traders.

Tickmill At a Glance

| 🏛 Headquartered | London, United Kingdom |

| 🌎 Global Offices | Cyprus, South Africa, Seychelles, Malaysia |

| 🏛 Local Market Regulators in Botswana | • Ministry of Finance and Economic Development (MFED) • Bank of Botswana (BoB) • Non-Bank Financial Institutions Regulatory Authority (NBFIRA) |

| 💳 Foreign Direct Investment in Botswana | 115.89 BWP Million in 2021 |

| 💰 Foreign Exchange Reserves in Botswana | 5270 USD Million in 2021 |

| ✔️ Local office in Gaborone? | No |

| 👨⚖️ Governor of SEC in Botswana | None, Moses Dinekere Pelaelo is the Governor of the Bank of Botswana |

| ✔️ Accepts Botswana Traders? | Yes |

| 📊 Year Founded | 2015 |

| 📞 Botswana Office Contact Number | None |

| 📱 Social Media Platforms | • Facebook • YouTube • Telegram |

| ⚖️ Regulation | Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA |

| 1️⃣ Tier-1 Licenses | • Financial Conduct Authority (FCA) |

| 2️⃣ Tier-2 Licenses | • Cyprus Securities and Exchange • Commission (CySEC) • Financial Sector Conduct Authority (FSCA) |

| 3️⃣ Tier-3 Licenses | • Financial Services Authority (FSA) • Financial Services Authority Labuan (LFSA) |

| 🪪 License Number | • Seychelles – SD008 • United Kingdom – 733772 • Cyprus – 278/15 • Labuan – MB/18/0028 • South Africa – FSP 49464 |

| ⚖️ MFED, BoB, or NBFIRA Regulation | No |

| ✔️ Regional Restrictions | The United States |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 3 |

| ✔️ PAMM Accounts | MAM Accounts |

| 💻 Liquidity Providers | Barclays and other top-tier banks as well as hedge funds |

| ✔️ Affiliate Program | Yes |

| 📱 Order Execution | Market |

| 📊 Starting spread | From 0.0 pips |

| 📉 Minimum Commission per Trade | $1 per side, per standard lot traded |

| 💰 Decimal Pricing | 5th decimal pricing after the comma |

| 📞 Margin Call | 100% |

| 🛑 Stop-Out | 30% |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | 100 lots |

| ✅ Crypto trading offered? | Yes |

| ✔️ Offers a BWP Account? | No |

| 📉 Dedicated Botswana Account Manager? | No |

| 📈 Maximum Leverage | 1:500 |

| 📊 Leverage Restrictions for Botswana? | No |

| 💳 Minimum Deposit (BWP) | 1 343 Botswanan Pula equivalent to $100 |

| ✔️ Botswana Pula Deposits Allowed? | No, only USD, GBP, EUR, IDR, CNY, VND, RUB |

| 📊 Active Botswana Trader Stats | 250,000+ |

| 👥 Active Botswana-based Tickmill customers | Unknown |

| 🔁 Botswana Daily Forex Turnover | Unknown, Forex overall is $6.6 Trillion |

| 💰 Deposit and Withdrawal Options | • Bank Transfer • Debit Card • Credit Card • Skrill • Neteller • Sticpay • Fasapay • UnionPay • Nganluong • QIWI • WebMoney |

| 💻 Minimum Withdrawal Time | 1 business day |

| ⏰ Maximum Estimated Withdrawal Time | 2 to 7 Business Days |

| 💳 Instant Deposits and Instant Withdrawals? | Instant Deposits |

| 🏛 Segregated Accounts with Botswana Banks? | No |

| 📱 Trading Platforms | • MetaTrader 4 • MetaTrader 5 |

| 💻 Tradable Assets | • Forex • Stock Indices • Energies • Precious Metals • Bonds • Cryptocurrencies |

| ✔️ Offers USD/BWP currency pair? | No |

| 📊 USD/BWP Average Spread | N/A |

| ✅ Offers Botswana Stocks and CFDs | No, but offers AFRICA40 FTSE/JSE |

| 💻 Languages supported on the Website | English, Indonesian, Russian, Arabic, Italian, Thai, Vietnamese, German, Chinese (Simplified), Spanish, Polish, Korean, Malay, Portuguese |

| ☎️ Customer Support Languages | Multilingual |

| 👥 Copy Trading Support | Yes, Myfxbook |

| ⏰ Customer Service Hours | 24/5 |

| 📞 Botswana-based customer support? | No |

| 💸 Bonuses and Promotions for Botswanans? | Yes |

| 📚 Education for Botswanan beginner traders | Yes |

| 📱 Proprietary trading software | No |

| 🤝 Most Successful Trader in Botswana | Unknown |

| ✔️ Is Tickmill a safe broker for Botswana Traders? | Yes |

| 🎖 Rating for Tickmill Botswana | 9/10 |

| 🥇 Trust score for Tickmill Botswana | 82% |

| 👉 Open Account | 👉 Open Account |

Regulation and Safety of Funds

Regulation in Botswana

Tickmill is not regulated by any of the following local market regulators in Botswana:

➡️ Ministry of Finance and Economic Development (MFED)

➡️ Bank of Botswana (BoB)

➡️ Non-Bank Financial Institutions Regulatory Authority (NBFIRA)

However, despite this, The broker is well-regulated in several other regions by Tier-1, Tier-2, and Tier-3 regulatory entities, which proves that this is a safe and reliable broker for Botswanans.

Global Regulations

The broker is a subsidiary of the Tickmill Group of Companies, which includes the following companies and organizations:

➡️ United Kingdom – Tickmill UK Ltd is a financial services company that is based in the United Kingdom and is authorized and regulated by the Financial Conduct Authority (FCA).

➡️ Cyprus – The Cyprus Securities and Exchange Commission (CySEC) oversees the operations of Tickmill Europe Ltd.

➡️ South Africa – Tickmill South Africa (Pty) Ltd is a Financial Services Provider (FSP) that is registered with the number 49464 and regulated by the Financial Sector Conduct Authority (FSCA).

➡️ Seychelles – The Financial Services Authority (FSA) oversees Tickmill Ltd. In addition to this, Tickmill Ltd. owns Procard Global Ltd. and operates it as a subsidiary.

➡️ Malaysia – Tickmill Asia Ltd. is a company that is licensed by the Financial Services Authority of Labuan under license number MB/18/0028.

Apart from these strict regulations, they are also registered by the following entities:

➡️ United Kingdom – Financial Conduct Authority (FCA)

➡️ Germany – Federal Financial Supervisory Authority (BaFin)

➡️ Italy – Commissione Nazionale per le Società e la Borsa (CONSOB)

➡️ France – Autorité de Contrôle Prudential (ACPR)

➡️ Spain – Comisión Nacional del Mercado de Valores (CNMV)

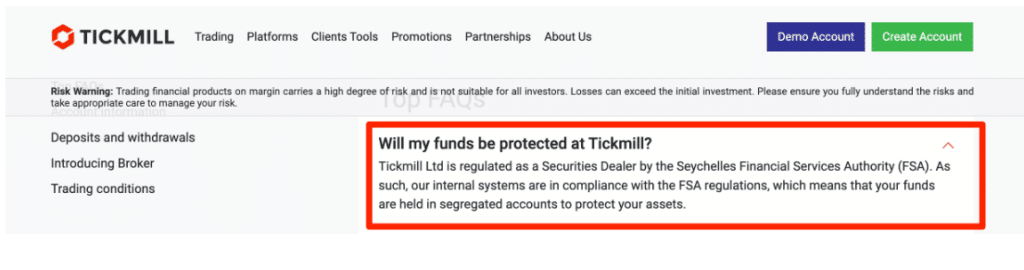

Client Fund Security and Safety Features

Tickmill conforms with MiFID II, the European Union’s Markets in Financial Instruments Directive. This guarantees that the broker is completely transparent in all its dealings and that consumers are protected.

They must keep all customer monies in separate bank accounts with top financial institutions in the regions where they do business. These funds are distinct from Tickmill’s own and can only be utilized for customer trading activity.

Investor protection is provided by Tickmill UK Ltd’s participation in the Financial Services Compensation Scheme (FSCS), which provides qualifying clients with compensation of up to £85,000 per customer.

If the broker fails to satisfy claims against it, the firm seizes operations or declares default, this compensation is provided to retail clients. Traders who have lost money due to trading decisions they made in live markets are not eligible for compensation.

Tickmill Europe Ltd is a member of the Investor Compensation Fund (ICF), which focuses on resolving claims made by clients protected by the plan against ICF members like Tickmill.

If a claim of loss arises because the broker fails to satisfy its financial commitments, ICF compensates qualified clients up to a specific sum.

Is Tickmill a regulated broker, and which regulatory authorities oversee its operations?

Yes, the broker is a regulated broker committed to maintaining the highest standards of integrity and client protection. The company is authorized and regulated by multiple financial regulatory authorities. Tickmill UK Ltd is authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom, while Tickmill Europe Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC).

How does Tickmill ensure the safety of client funds?

The broker places a strong emphasis on the safety of client funds through various protective measures. Firstly, as a regulated broker, they are required to adhere to strict regulatory standards set by the FCA and CySEC. Client funds are held in segregated accounts with reputable banks, ensuring that they are kept separate from the broker’s operational funds.

Awards and Recognition

The broker has garnered quite a few prestigious accolades for the quality of its offerings, including the fact that its prices are consistently among the most affordable in the industry. Some of these include:

➡️ Best Trading Conditions (2021) – FxScouts

➡️ #1 Broker for Commissions and Fees (2021) – ForexBrokers.com

➡️ Best MENA Forex Broker (2021) – Cairo Virtual Expo

➡️ Best Customer Service (2021) – Cairo Virtual Expo

➡️ Best Commodities Broker (2020) – Rankia Markets Experience Expo

➡️ Best CFD Broker Asia (2019) – International Business Magazine, and many more.

Has Tickmill received any notable awards for its services in the financial industry?

Yes, They have garnered recognition and prestigious awards for its outstanding services within the financial industry. The platform has been honored in various categories, including trading services, customer support, and technological innovations.

How is Tickmill regarded in the financial industry, and what does its reputation suggest about the platform?

The broker enjoys a positive reputation within the financial industry, reflecting its commitment to transparency, customer satisfaction, and innovation. The platform’s recognition through awards and positive reviews from traders underscores its success in delivering a reliable and user-friendly trading experience.

Tickmill Account Types and Features

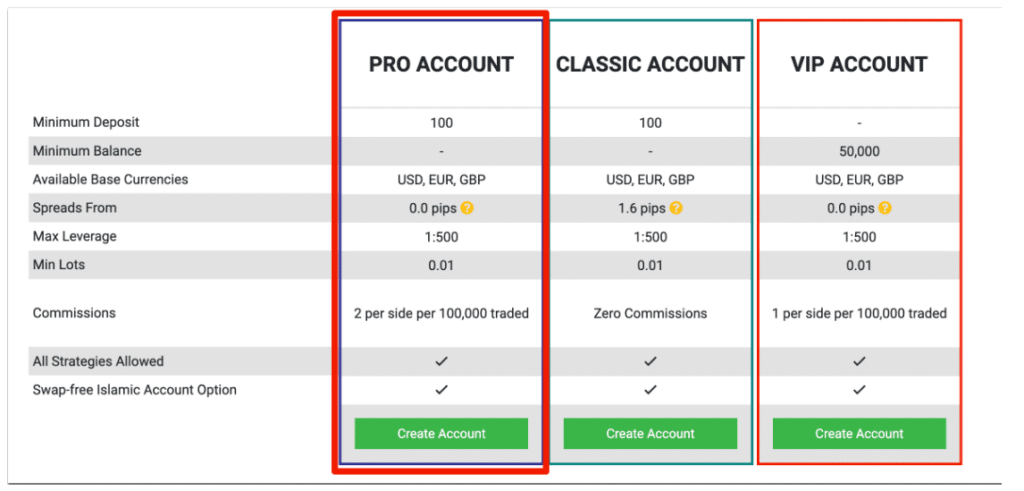

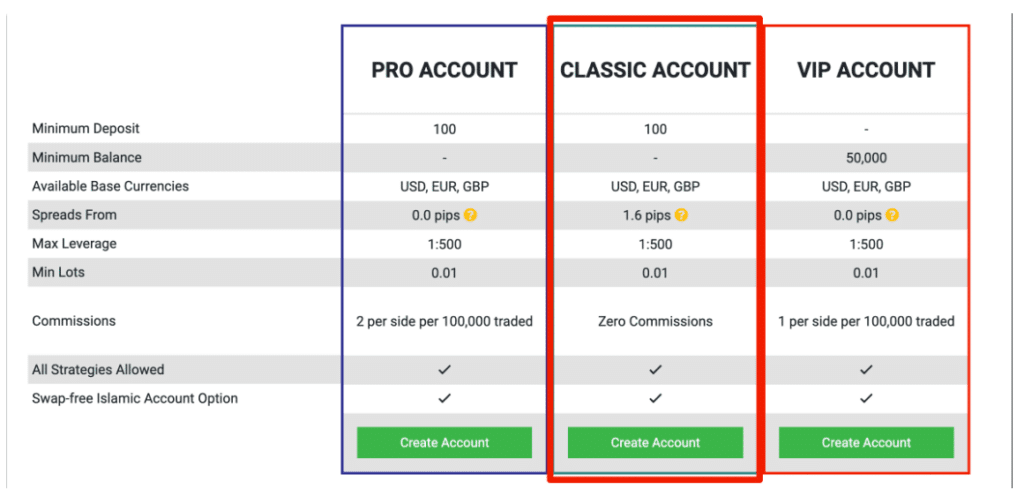

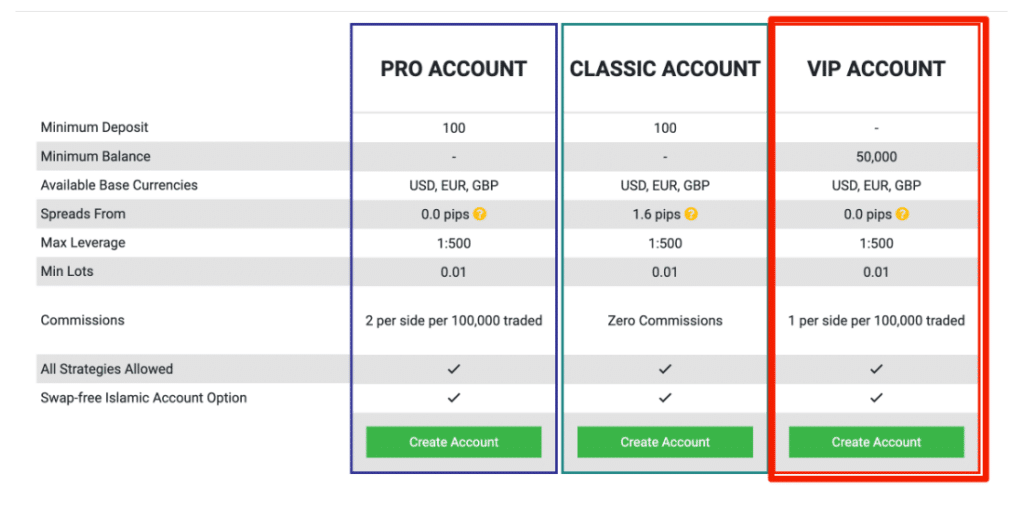

The broker uses a no-dealing desk concept with ECN pricing to provide three different account types for trading FX and CFDs. The Pro, Classic and VIP accounts are all available. Each of these account kinds is appropriate for a particular level of experience in trading.

Each of the accounts is designed to meet the needs of both novice and experienced traders. There is also the option of swap-free Islamic accounts, which is a convenient addition that enables even more traders to make use of the company’s offerings.

| 💻 Live Account | 📉 Minimum Dep. | 📊 Average Spread | 💰 Commissions | 💸 Average Trading Cost |

| ➡️ Pro | 1 343 BWP/$100 | 0.0 pips | $2 per side, per lot | 4 USD |

| ➡️ Classic | 1 343 BWP/$100 | 1.6 pips | None | 16 USD |

| ➡️ VIP | Min balance of 600,000 BWP or $50,000 | 0.0 pips | $1 per side, per lot | 2 USD |

Live Trading Account Details

Pro Account

The Pro Account is designed for more seasoned market participants. As a result of the cheap commission rate and the close spreads, this account is the one that is preferred by many traders.

| Account Feature | Value |

| 💰 Minimum Deposit | 1 343 Botswanan Pula or an equivalent to $100 |

| 💻 Minimum Account Balance | None |

| 📈 Base Currency Options | • USD • EUR • GBP • PLN (Tickmill UK Ltd. and Tickmill Europe Ltd.) |

| 📊 Spreads From | 0.0 pips |

| 📉 Maximum Leverage Ratio | • Seychelles: 1:500 UK: 1:30 (Retail), 1:500 (Pro) • Cyprus: 1:30 (Retail), 1:300 (Pro) • Malaysia: 1:500 • South Africa: 1:500 |

| 💰 Minimum Lots that can be traded | 0.01 lots |

| 💸 Commission charges | $2 per side per standard lot of 100,000 |

| ✔️ Strategies Allowed | Scalping, hedging, expert advisors, algorithmic trading, auto trading, etc. |

| ☪️ Swap-Free Islamic Account Option | Yes |

Classic Account

A Classic account can accommodate both novice traders and those with more expertise. The Classic Account is equivalent to the Standard account that is provided by a few different brokers. This eliminates the need for you to pay any commission fees.

| Account Feature | Value |

| 💰 Minimum Deposit | 1 343 Botswanan Pula or an equivalent to $100 |

| 💻 Minimum Account Balance | None |

| 📈 Base Currency Options | • USD • EUR • GBP • PLN (Tickmill UK Ltd. and Tickmill Europe Ltd.) |

| 📊 Spreads From | 1.6 pips |

| 📉 Maximum Leverage Ratio | • Seychelles: 1:500 • UK: 1:30 (Retail), 1:500 (Pro) • Cyprus: 1:30 (Retail), 1:300 (Pro) • Malaysia: 1:500 • South Africa: 1:500 |

| 💰 Minimum Lots that can be traded | 0.01 lots |

| 💸 Commission charges | None |

| ✔️ Strategies Allowed | Scalping, hedging, expert advisors, algorithmic trading, auto trading, etc. |

| ☪️ Swap-Free Islamic Account Option | Yes |

VIP Account

The VIP Account is an invitation-only account designed specifically for high-volume traders. You are not needed to make a minimum deposit to open a VIP Account but, to trade using this account, you will need a minimum account balance of 600,000 BWP or $50,000. Because of this, an experienced trader would benefit more from using this trading account than beginners.

| Account Feature | Value |

| 💰 Minimum Deposit | None |

| 💻 Minimum Account Balance | 600,000 Botswanan Pula or an equivalent to $50,000 |

| 📈 Base Currency Options | • USD • EUR • GBP • PLN (Tickmill UK Ltd. and Tickmill Europe Ltd.) |

| 📊 Spreads From | 0.0 pips |

| 📉 Maximum Leverage Ratio | • Seychelles: 1:500 • UK: 1:30 (Retail), 1:500 (Pro) • Cyprus: 1:30 (Retail), 1:300 (Pro) • Malaysia: 1:500 • South Africa: 1:500 |

| 💰 Minimum Lots that can be traded | 0.01 lots |

| 💸 Commission charges | $1 per side per standard lot of 100,000 |

| ✔️ Strategies Allowed | Scalping, hedging, expert advisors, algorithmic trading, auto trading, etc. |

| ☪️ Swap-Free Islamic Account Option | Yes |

Base Account Currencies

The broker does not provide a trading account in the Botswanan Pula (BWP). All five of Tickmill’s worldwide organizations accept just USD, GBP, and EUR as base currencies. Tickmill UK Ltd. and Tickmill Europe Ltd., on the other hand, accept PLN as an extra currency across all accounts.

This is a let-down for Botswanans with BWP bank accounts, given most other overseas brokers provide a more extensive set of services. Conversion fees can increase trading expenses and have a substantial influence on profitability.

Demo Account

Demo accounts are available for both forex and CFD trading. Test out the MT4 and MT 5 platforms, experiment with new trading techniques and investigate extra features with the help of a practice account.

The brokers demo account allows traders to simulate real-world market situations, test tools and trading methods, and hone their talents without risking their money. Tickmill’s trading platforms are full-featured and provide custom tools and features to improve overall trading success.

You can easily create a demo account directly from the webpage of the broker. The demo server also has a wealth of data on market history.

Islamic Account

In a Forex Islamic account, there are no swaps or rollover interest charges on overnight holdings, which is against Islam. All Muslim clients who open a Classic, Pro, or VIP account and convert it to an Islamic kind will have access to Tickmill’s best trading conditions.

Islamic trading accounts have the same trading terms and conditions as conventional trading accounts. Except for trading instruments, which do not have swaps, storing many complicated instruments overnight for more than three nights in a row incurs a handling cost.

You will receive an email confirmation once Tickmill’s Customer Support staff has processed your request for Islamic account status. Tickmill will categorize all future trading accounts you create as swap-free by default, removing the need for traders to contact Tickmill.

What types of trading accounts does Tickmill offer to its clients?

The broker provides a variety of trading accounts designed to cater to different trading preferences. The primary account types include the Classic Account, Pro Account, and VIP Account.

What features are included with Tickmill trading accounts?

The brokers trading accounts come with a range of features to enhance the trading experience. Across various account types, traders have access to the popular MetaTrader 4 (MT4) trading platform, known for its user-friendly interface and advanced charting tools. Tickmill accounts offer competitive spreads, fast order execution, and access to a diverse range of financial instruments, including forex, indices, and commodities.

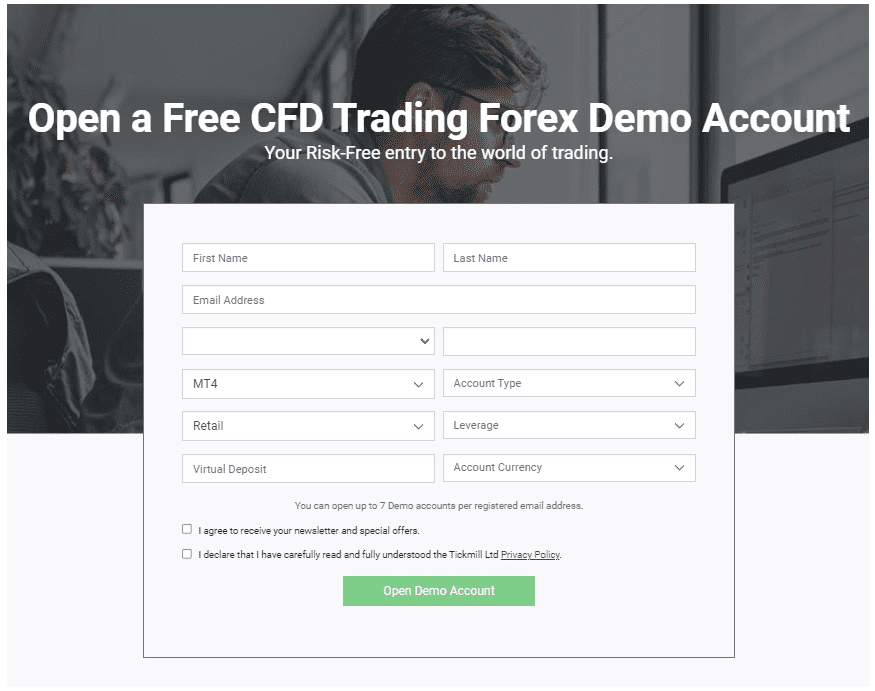

How to open a Tickmill Demo Account step by step

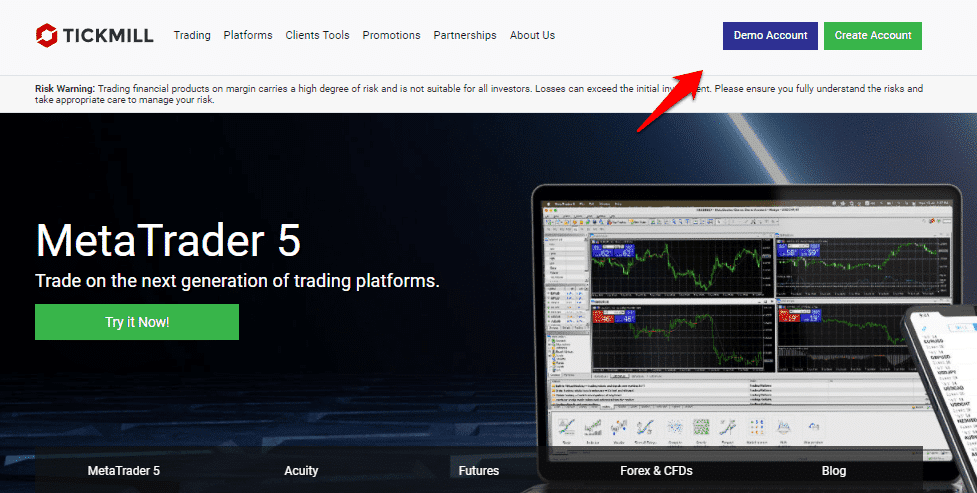

Step 1: Click on the Demo Account button.

The account button, colored blue, is available throughout the website, regardless of which page the trader might be browsing on.

Step 2: Fill in the online form.

Traders will be required to provide their personal information in order for the sign-up process to be completed.

Step 3: Download the platform, Connect to the server and log in.

Once the online form has been completed, the Demo Platform will be available for download and log-in completed.

Tickmill Vs Exness Vs Pepperstone – Broker Comparison

| 🥇 Tickmill | 🥈 Exness | 🥉 Pepperstone | |

| ⚖️ Regulation | Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA | ASIC, BaFin, CMA, CySEC, DFSA, FCA and SCB |

| 📱 Trading Platform | • MetaTrader 4 • MetaTrader 5 | • MetaTrader 4 • MetaTrader 5 • Exness App • Exness Terminal | • MetaTrader 4 • MetaTrader 5 • cTrader • TradingView • Myfxbook • DupliTrade |

| 💰 Withdrawal Fee | No | No | No |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 1 343 BWP | 120 BWP | 1,700 BWP |

| 📊 Leverage | 1:500 | Unlimited | 1:400 |

| 📊 Spread | Variable, from 0.0 pips | Variable, from 0.0 pips | Variable, from 0.0 pips |

| 💰 Commissions | $1 per side per 100,000 traded | From $0.1 per side, per lot | From AU$7 |

| ✴️ Margin Call/Stop-Out | 100%/30% | 60%/0% | 90%/20% |

| 💻 Order Execution | Market | Market | Market |

| 💳 No-Deposit Bonus | Yes | No | No |

| 📊 Cent Accounts | No | Yes | No |

| 📈 Account Types | • Pro Account • Classic Account • VIP Account | • Standard Account • Standard Cent Account • Raw Spread Account • Zero Account • Pro Account | • Standard Account • Razor Account |

| ⚖️ CBN Regulation | No | No | No |

| 💳 BWP Deposits | No | Yes | No |

| 📊 Botswana Pula Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/7 | 24/5 |

| 📊 Retail Investor Accounts | 3 | 5 | 2 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 📉 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | 100 lots | Unlimited | 100 lots |

| 💰 Minimum Withdrawal Time | 1 business day | Instant | 1 business day |

| 📊 Maximum Estimated Withdrawal Time | 2 to 7 Business Days | Up to 72 hours | Up to 7 business days |

| 💸 Instant Deposits and Instant Withdrawals? | Instant Deposits | Yes | No |

Min Deposit

$100 / 1 343 BWP

Regulators

CySEC, FCA, FSA, FSCA, Labuan FSA

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

62

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Tickmill Trading Platforms

Offers Botswanan Traders a choice between these trading platforms:

➡️ MetaTrader 4

➡️ MetaTrader 5

Desktop Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4

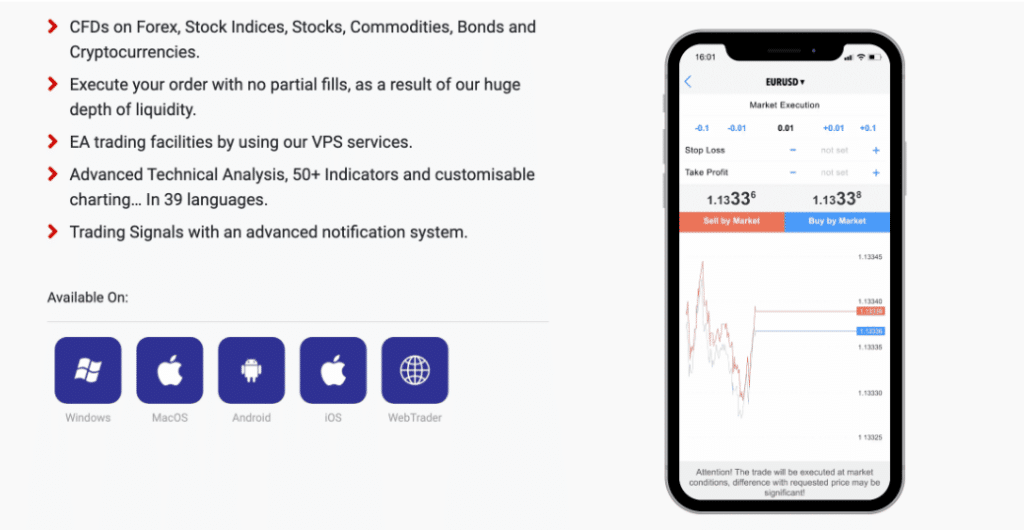

MetaTrader 4 is MetaQuotes Software’s first and most widely used trading platform. MetaTrader 4 is a user-friendly, configurable platform that allows you to trade with ease on your PC or mobile device (including iOS and Android).

Because of its comprehensive level of trading analytical tools, configurable interface, charting capability, and availability to Expert Advisors through the accompanying MetaTrader marketplace, this platform is the preferred choice of many forex traders across the world.

You may benefit from numerous advantages of the MetaTrader 4 trading platform in addition to Tickmill’s sophisticated trading conditions:

➡️ Fast order execution on forex, stock indices, commodities, and bonds, among other CFDs.

➡️ Scalping-friendly Expert Advisor trading capabilities and sophisticated trading signals (run on Tickmill VPS)

➡️ Over 50 indicators and configurable charting are available as part of the fundamental and technical analysis tools.

MetaTrader 5

Tickmill gives you access to the MetaTrader 5 platform, which you may use to trade and invest in a variety of asset types. MT5’s multi-asset broker is perfect for trading equities, bonds, and foreign currency base currencies. Tickmill offers AutoChartist, an innovative trading tool.

Customers may use the AutoChartist tools to evaluate market circumstances in real-time using graphs and charts that properly portray Tickmill trading conditions and occurrences.

WebTrader Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

It is possible to trade the markets right from your web browser using MetaTrader 4 and 5. It is easier to trade using Tickmill’s WebTrader trading platform since it incorporates the MetaTrader system into your browser.

The WebTrader version includes all the same features as the desktop application, but it is more secure thanks to data encryption.

Trading App

➡️ MetaTrader 4

➡️ MetaTrader 5

The brokers MetaTrader 4 and 5 mobile apps are the quickest and fastest method to trade across all the platforms available. You can get live price quotations on all there marketplaces, in addition to using different timeframes and carrying out comprehensive technical analysis.

You can easily use the mobile app to verify positions from trades made on the desktop or online platform, as well as to create and manage new transactions.

What trading platforms does Tickmill offer to its clients?

The broker provides its clients with access to the widely acclaimed MetaTrader 4 (MT4) trading platform, a robust and user-friendly platform that is popular among traders worldwide.

Can I trade on Tickmill using my mobile device, and what features are available on the mobile platforms?

Absolutely. The broker understands the importance of mobile trading in today’s fast-paced markets. Traders can trade on the go using the mobile versions of MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

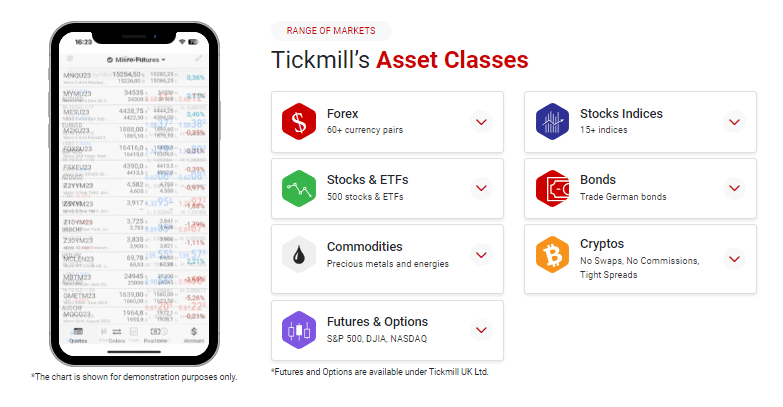

Range of Markets

Botswanan Traders can expect the following range of markets:

➡️ Forex

➡️ Stock Indices

➡️ Energies

➡️ Precious Metals

➡️ Bonds

➡️ Cryptocurrencies

Financial Instruments and Leverage

| 🔨 Instrument | 💰 Number of Assets Offered | 📈 Max Leverage Offered |

| ➡️ Forex | 62 | • FCA, CySEC: 1:30 • FSA, LFSA, FSCA: 1:500 |

| ➡️ Precious Metals | 4 | • FCA, CySEC: 1:20 • FSA, LFSA, FSCA: 1:500 |

| ➡️ Indices | 23 | • FCA, CySEC: 1:20 • FSA, LFSA, FSCA: 1:100 |

| ➡️ Stocks | 98 | • FCA, CySEC: 1:20 • FSA, LFSA, FSCA: 1:20 |

| ➡️ Cryptocurrency | 8 | • FCA, CySEC: 1:20 • FSA, LFSA, FSCA: 1:20 |

| ➡️ Energies | 3 | • FCA, CySEC: 1:20 • FSA, LFSA, FSCA: 1:20 |

| ➡️ Bonds | 4 | • FCA, CySEC: 1:20 • FSA, LFSA, FSCA: 1:20 |

Broker Comparison for Range of Markets

| 🥇 Tickmill | 🥈 Exness | 🥉 Pepperstone | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | No | Yes |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | No | Yes |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | Yes | No | No |

What financial instruments can I trade on Tickmill?

The broker offers a diverse range of financial instruments across various asset classes. Traders can participate in the dynamic foreign exchange market (forex) with a wide range of currency pairs, including majors, minors, and exotic pairs.

Does Tickmill offer cryptocurrency trading, and what cryptocurrencies are available on the platform?

Yes, they recognize the growing interest in cryptocurrencies and offers trading opportunities in this market. Traders can access a selection of popular cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP).

Trading and Non-Trading Fees

Spreads

Depending on one’s trading strategy, the type of spreads one might expect will change. There will also be a role played by the trading account, trading circumstances, and the general market conditions on the day of the trades.

The following are some of the most common spreads that traders see regularly:

➡️ Pro Account – 0.0 pips

➡️ Classic Account – 1.6 pips

➡️ VIP Account – 0.0 pips

Commissions

Classic Account, which features marked-up spreads to pay the broker’s cost for making the trade, offers commission-free trading. Tickmill, on the other hand, charges commission fees for the following trading accounts:

➡️ Pro Account – $2 per side, per 100,000 (standard lot) traded

➡️ VIP Account – $1 per side, per 100,000 (standard lot) traded

In addition, even though the Islamic Account does not charge an overnight fee, commissions are still due when holdings are kept overnight. The following is a list of these commissions:

| 🔨 Financial Instrument | 🔃 Charge Per lot in USD |

| BRENT, XTI/USD | 0.01 USD |

| LTC/USD | 0.01 USD |

| ETH/USD | 1 USD |

| EUR/CZK, EUR/DKK, EUR/HKD, GBP/CZK, GBP/HKD, USD/CZK, USD/HKD, USD/SEK | 5 USD |

| EUR/HKD, EUR/NOK, EUR/PLN, EUR/SEK, EUR/SGD, GBP/DKK, GBP/HUF, GBP/NOK, GBP/PLN, GBP/SEK, NZD/SGD, USD/CNH, USD/DKK, USD/HUF, USD/NOK, USD/PLN, USD/SGD | 10 USD |

| EUR/MXN, EUR/ZAR, GBP/ZAR, USD/MXN, USD/ZAR | 20 USD |

| BTC/USD | 25 USD |

| EUR/TRY, GBP/TRY, USD/TRY | 50 USD |

Overnight Fees, Rollovers, or Swaps

To keep a position open the next day, a forex trader must pay the overnight interest known as a swap. Traders may, however, receive credit if they maintain open positions in specific circumstances.

Botswanan traders must pay interest on the currency they sold and get interested on the currency they bought to keep a transaction open overnight.

Tickmill’s swap rates are calculated by factoring in the interest rates of the countries involved in a currency pair, as well as the present state of the market.

According to the platform’s time, swap prices are executed at midnight EST. A normal lot of 100,000 base currency units is used to calculate an exchange rate swap for each currency pair.

If a trader leaves a position open overnight, it will receive a new “value date” because of the swaps. Every Wednesday night there will be a threefold swap rate when the exchange’s new value date is changed to Monday.

charges the following fees on a nightly basis as a guideline:

➡️ EUR/USD – a long swap of -3.54 pips and a short swap of 0.39 pips

➡️ USD/JPY – a long swap of -1.21 pips and a short swap of -2.62 pips

➡️ GBP/USD – a long swap of -1.89 pips and a short swap of -3.44 pips

➡️ USD/CHF – a long swap of 0.39 pips and a short swap of -3.71 pips

➡️ USD/CAD – a long swap of -2.42 pips and a short swap of -1.84 pips

➡️ AUD/USD – a long swap of -1.96 pips and a short swap of -1.75 pips

➡️ NZD/USD – a long swap of -0.67 pips and a short swap of -1.96 pips

Deposit and Withdrawal Fees

On any of the offered payment options, the broker does not charge a fee for deposit or withdrawal.

Inactivity Fees

The broker does not impose inactivity fees if a trading account is inactive.

Currency Conversion Fees

A currency conversion fee will be charged to Botswanan traders whose accounts are funded and funded in BWP.

What are the trading fees associated with Tickmill?

The broker employs a transparent fee structure primarily based on spreads for forex trading.

Are there any non-trading fees on Tickmill, and what should I be aware of?

In addition to trading fees, they may charge non-trading fees that traders should be aware of. These may include overnight financing fees (swap rates) for positions held overnight, withdrawal fees, and inactivity fees for dormant accounts.

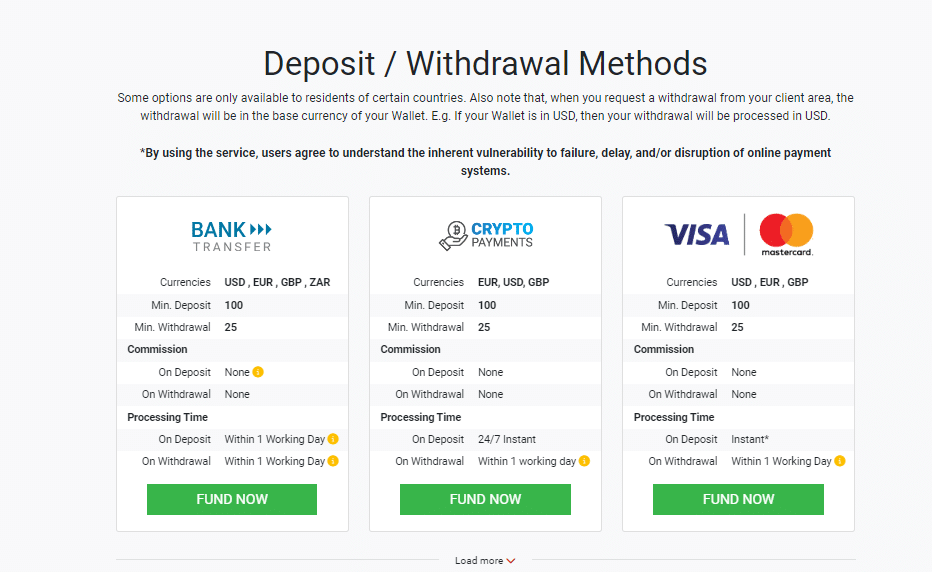

Tickmill Deposits and Withdrawals

Offers the following deposit and withdrawal methods:

➡️ Bank Transfer

➡️ Debit Card

➡️ Credit Card

➡️ Skrill

➡️ Neteller

➡️ Sticpay

➡️ Fasapay

➡️ UnionPay

➡️ Nganluong

➡️ QIWI

➡️ WebMoney

Broker Comparison: Deposit and Withdrawals

| 🥇 Tickmill | 🥈 Exness | 🥉 Pepperstone | |

| Minimum Withdrawal Time | 1 business day | Instant | 1 business day |

| Maximum Estimated Withdrawal Time | 2 to 7 Business Days | Up to 72 hours | Up to 7 business days |

| Instant Deposits and Instant Withdrawals? | Instant Deposits | Yes | No |

Deposit Currencies, Processing Times, and Minimum Deposit/Withdrawal

| 💳 Payment Method | 💰 Deposit Currencies | 🔁 Deposit Processing | 💳 Withdrawal Processing | 💰 Min Deposit | 💵 Min Withdrawal |

| Bank transfer | USD, EUR, GBP | 1 working day | 1 working day | 100 USD, EUR, GBP | 25 USD, EUR, GBP |

| Debit Card | USD, EUR, GBP | Instant | 1 working day | 100 USD, EUR, GBP | 25 USD, EUR, GBP |

| Credit Card | USD, EUR, GBP | Instant | 1 working day | 100 USD, EUR, GBP | 25 USD, EUR, GBP |

| Skrill | USD, EUR, GBP | Instant | 1 working day | 100 USD, EUR, GBP | 25 USD, EUR, GBP |

| Neteller | USD, EUR, GBP | Instant | 1 working day | 100 USD, EUR, GBP | 25 USD, EUR, GBP |

| Sticpay | USD, EUR, GBP | Instant | 1 working day | 100 USD, EUR, GBP | 25 USD, EUR, GBP |

| Fasapay | USD, IDR | Instant | 1 working day | 100 USD, EUR, GBP | 25 USD |

| UnionPay | CNY | Instant | 1 working day | 700 CNY, 100 EUR, USD, GBP | 25 USD, EUR, GBP |

| Nganluong | VND | Instant | 1 working day | 2,000,000 VND | 25 USD |

| QIWI | USD, RUB, EUR | Instant | 1 working day | 100 USD, EUR, RUB | 25 USD, EUR, RUB |

| WebMoney | USD, EUR | Instant | 1 working day | 100 USD, EUR | 25 USD, EUR |

How can I make a deposit into my Tickmill trading account, and what payment methods are supported?

Making a deposit into your trading account is a straightforward process. The platform supports various payment methods, including bank wire transfers, credit/debit cards, and popular e-wallet options such as Skrill and Neteller.

How can I initiate a withdrawal from my Tickmill trading account, and what withdrawal options are available?

Withdrawing funds from your trading account is a user-friendly process. Simply log in to your account, go to the withdrawal section, and select your preferred withdrawal method. They support various withdrawal options, including bank transfers and e-wallets, providing flexibility for users.

Min Deposit

$100 / 1 343 BWP

Regulators

CySEC, FCA, FSA, FSCA, Labuan FSA

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

62

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

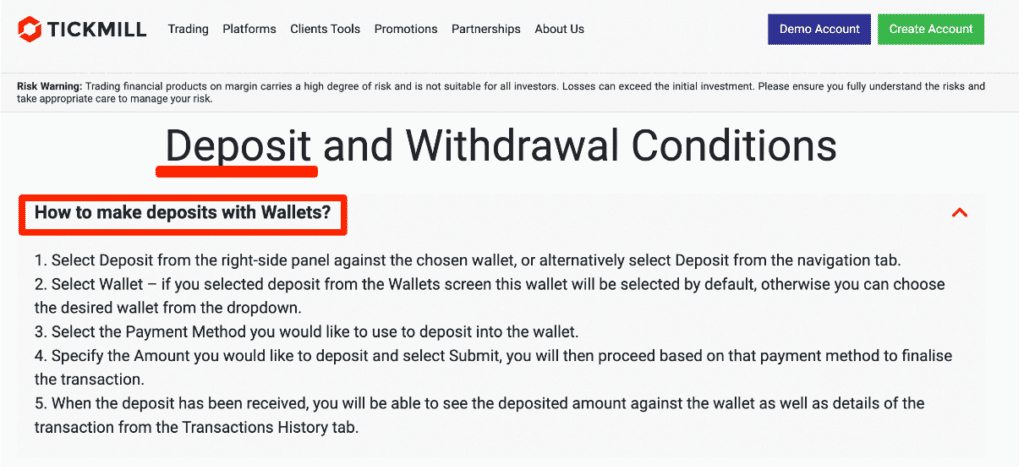

How to Deposit Funds with Tickmill

To deposit funds to an account with Tickmill, Botswanan Traders can follow these steps:

➡️ Sign into the Client Area from the website.

➡️ Select the option for funding and withdrawals and choose “Deposit.”

➡️ Choose a deposit method from the list of available options and indicate the account that must be funded.

➡️ Choose a deposit currency and continue with any additional steps that may be required according to the payment provider that is being used for the deposit.

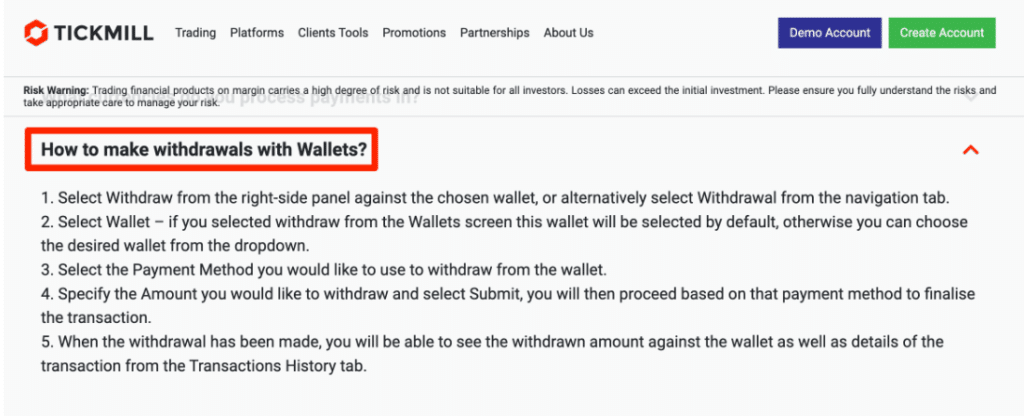

Tickmill Fund Withdrawal Process

Traders can use the withdrawal request form by logging into their client area on the official website. Traders can submit their request after completing the form and wait for their cash to be released into their bank account.

The Finance Department will process all requests received within one working day. Requests received after office hours, on weekends, or holidays will be handled the next working day.

Traders should be aware that they may only utilize the payment method that they used to fund their trading accounts. Additionally, traders with open positions can move cash from their trading accounts.

The trader’s free margin must exceed the amount requested when moving funds from the trading account to the wallet. If traders do not have enough free margin in their account, they will be unable to move funds from their account to their wallet until they submit the right account.

Education and Research

Education

Offers the following Educational Materials:

➡️ Webinars

➡️ Seminars

➡️ eBooks

➡️ Video Tutorials

➡️ Infographics

➡️ Forex Glossary

➡️ Fundamental Analysis

➡️ Technical Analysis

➡️ Educational Articles

➡️ Market Insights

Research and Trading Tool Comparison

| 🥇 Tickmill | 🥈 Exness | 🥉 Pepperstone | |

| ➡️ Economic Calendar | Yes | Yes | Yes |

| ➡️ VPS | Yes, not free | Yes | Yes |

| ➡️ AutoChartist | Yes | No | Yes |

| ➡️ Trading View | No | Yes | Yes |

| ➡️ Trading Central | No | Yes | No |

| ➡️ Market Analysis | Yes | Yes | Yes |

| ➡️ News Feed | Yes | Yes | Yes |

| ➡️ Blog | Yes | Yes | Yes |

Also offers Botswanan traders the following additional Research and Trading Tools:

➡️ Access to AutoChartist

➡️ Access to Myfxbook Copy Trading

➡️ Economic Calendar

➡️ Forex Calculators

➡️ Tickmill VPS

➡️ Pelican Trading

➡️ Advanced Trading Toolkit

➡️ Acuity Trading

What educational resources does Tickmill offer to traders?

The broker is dedicated to supporting the educational needs of traders. The platform provides a range of educational resources, including webinars, video tutorials, and informative articles. These resources cover various topics, from basic trading concepts to advanced strategies.

What research tools are available on Tickmill to assist traders in making informed decisions?

The broker equips traders with a variety of research tools designed to facilitate informed decision-making. The platform offers daily market analysis, economic calendars, and expert commentary to keep traders updated on market trends and events.

10 Best Forex Brokers in Botswana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

Bonuses and Promotions

Offers Botswanan Traders the following bonuses and promotions:

➡️ Trader of the Month Contest

➡️ Tickmill’s NFP Machine

➡️ $30 Welcome No-Deposit Bonus Account

➡️ The chance to get paid to trade

Does Tickmill offer bonuses to its traders, and how can traders avail them?

The broker does not typically offer deposit bonuses or promotions. The company prioritizes transparent and fair trading conditions, and as a result, it refrains from providing bonuses that may come with certain conditions or restrictions.

Are there any ongoing promotions on Tickmill, and how can traders participate?

The broker occasionally runs promotions and contests that traders can participate in to enhance their trading experience. These promotions may include trading competitions, where traders can showcase their skills and compete for various prizes.

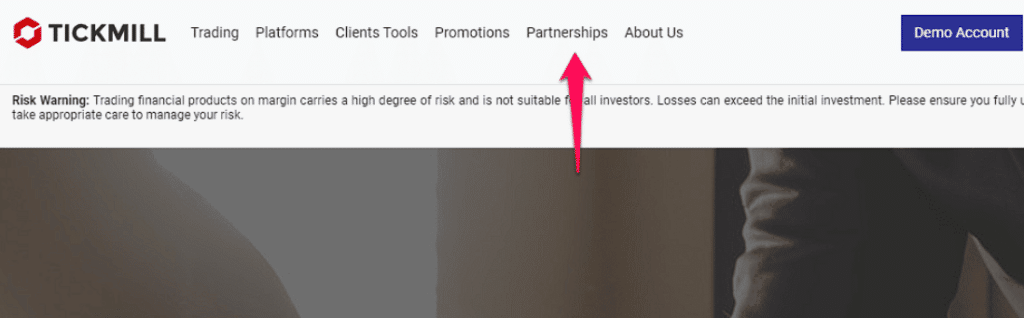

How to open an Affiliate Account

To register an Affiliate Account, Botswanan Traders can follow these steps:

Step 1 – Click on the “Partnerships” tab at the top menu of the website.

On the website locate the “Partnerships” tab at the top menu bar then click on it then click on “Introducing broker”.

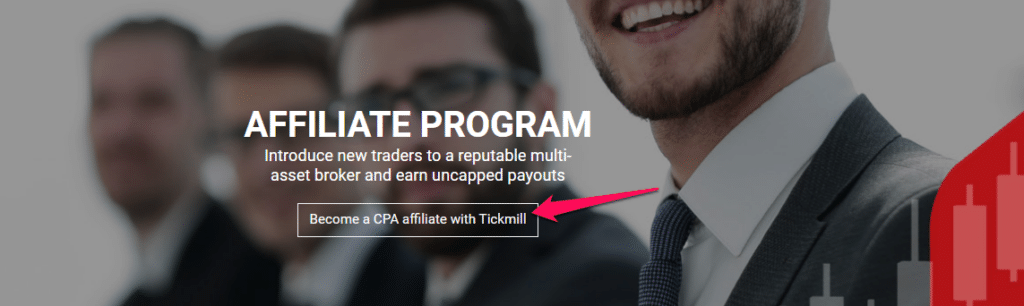

Step 2 – Click on the “Become a CPA Affiliate” button.

After clicking on the “Partnerships” tab you can click on the “Become a CPA Affiliate” button located close to the bottom of the page.

Step 3 – Fill in the form

Fill in all your required personal details to complete the form.

The affiliate account has been created.

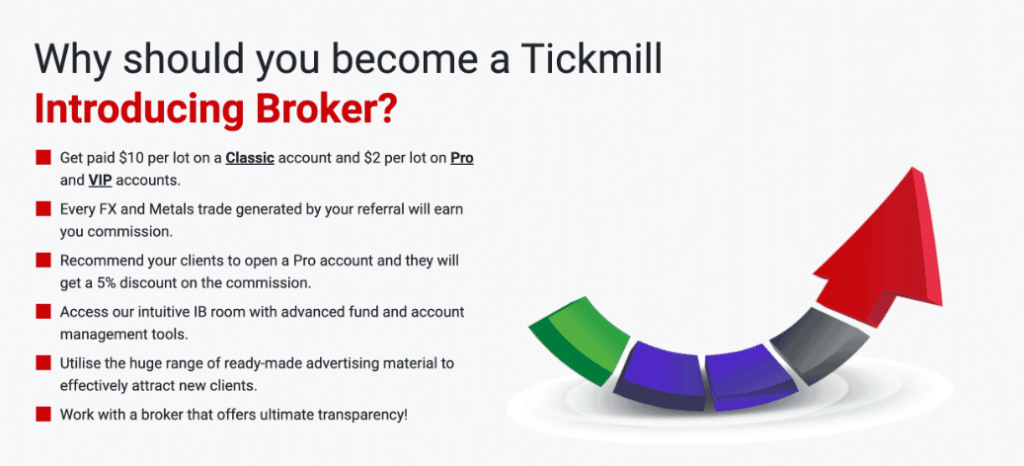

Affiliate Program Features

The following are some of the advantages they offer its partners:

➡️ When referring a new client, partners may earn $10 for each regular account transaction and $2 for each Pro or VIP account transaction.

➡️ If a partner recommends that their referral join up for a Pro account, the partner can earn an extra 5% commission.

➡️ All partners have access to the IB room, which includes comprehensive fund and account administration features.

➡️ To attract new clients, pre-made advertising and promotional materials are provided.

Customer Support

With its headquarters in London, the United Kingdom, the broker offers broad trading services and client support. From 7 am to 4 pm GMT Monday to Friday, traders can contact them on any of the available communication channels.

The broker also has a help email with a 24-hour response time on business days. A live chat option is also accessible on the official website, with 14 different languages to pick from.

| Customer Support | Tickmill’s Customer Support |

| ⏰ Operating Hours | 24/5 |

| 🗣 Support Languages | English, Malay, Polish, Indonesian, Arabic, Thai, Chinese, Vietnamese, Portuguese |

| 🗯 Live Chat | Yes |

| 📧 Email Address | Yes |

| ☎️ Telephonic Support | Yes |

| 📞 Local Support in Botswana? | No |

| 🥇 Overall quality of Tickmill Support | 4.2/5 |

Corporate Social Responsibility

The broker believes that greater societal impact can be achieved through dedicated efforts toward Corporate Social Responsibility initiatives as well as projects. They have a diverse CSR portfolio that benefits worldwide communities, as well as individual social welfare and sports potential.

There most significant initiatives include a pledge to the Gajusz Foundation for Terminally Ill Children and donations to Germany’s Bärenherz Children’s Hospice.

Min Deposit

$100 / 1 343 BWP

Regulators

CySEC, FCA, FSA, FSCA, Labuan FSA

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

62

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Our Verdict

The broker is a good forex broker for traders of all levels of expertise, with a commission-free Classic account and ECN pricing accounts that all offer hedging, scalping, and EAs.

There crew has decades of expertise in a variety of markets, as well as a deep grasp of what makes a transaction successful.

The success of the client is the most crucial consideration. The business has developed a space where you may learn about yourself as an investor or trader by combining technical innovation, ultra-low spreads, quick execution, and great customer care.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Tickmill offers dedicated, prompt customer support 24 hours a day, 5 days a week | There are only a few asset classes and financial instruments offered |

| There is a selection of funding and withdrawal options offered by Tickmill | There are no fixed spreads offered by Tickmill |

| Tickmill offers a no-deposit bonus to new traders | There are currency conversion fees when Botswanan traders deposit or withdraw in BWP |

| There are low spread costs and high leverage ratios offered | Additional commissions are applied to the Islamic account when positions are held for longer than three days |

| Tickmill is well-regulated and has a good reputation | |

| There are several tools provided to advanced traders including AutoChartist, FIX API, and more | |

| MetaTrader 4 and MetaTrader 5 are both offered by Tickmill | |

| There is a commission-free trading account offered to Botswanan traders |

You might also like: ACY Securities Review

You might also like: Admirals Markets Review

You might also like: BDSwiss Review

You might also like: CMTRADING Review

You might also like: easyMarkets Review

Conclusion

Now it is your turn to participate:

➡️ Do you have any prior experience with Tickmill?

➡️ What was the determining factor in your decision to engage with Tickmill?

➡️ Was it because of the minimum deposit, regulation, retail trading accounts, or any other factors?

➡️ Have you experienced any issues with Tickmill such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

Regardless, please share your thoughts in the comments below.

Frequently Asked Questions

Is Tickmill regulated?

Yes, they are regulated in Cyprus by CySEC (278/15), the United Kingdom by FCA (733772), South Africa by FSCA (FSP 49464), Seychelles by FSA (SD008), and Malaysia by LFSA (MB/18/0028).

What is the withdrawal time with Tickmill?

There withdrawal time ranges from a business day on most payment methods up to seven days on bank wire transfers.

What type of broker is Tickmill?

The broker is a global forex and CFD broker that works according to a No-Dealing Desk model, which means that traders opened by traders are sent to liquidity providers where they are filled, with traders expecting the best possible pricing.

Is Tickmill safe or a scam?

They are a safe broker with a high trust score, high rating, and overall good reputation in the forex and CFD industry.

Does Tickmill have Nasdaq?

Yes, Tickmill offers Nasdaq.

Does Tickmill have Volatility 75?

No, the broker does not currently offer Volatility 75 to traders.

What is the Pro Account with Tickmill?

It is a trading account geared toward high volume traders who need the tightest spreads and competitive trading conditions, allowing them to use fast-paced trading strategies to cash in on profitable trading opportunities in the financial markets.

Is Tickmill Swap-Free?

Yes, Tickmill is swap-free as it allows the conversion of a live account into an Islamic Account free of charge, exempting Muslim traders from overnight fees and other forms of interest prohibited by Sharia law.

How do I withdraw my Tickmill bonus profits?

The Welcome Account earnings will be credited to the amount of the wallet that is held by Tickmill Ltd (FSA SC Regulated) and can be withdrawn instantly using any of the various withdrawal methods indicated in the Client Area.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review