Weltrade Review

Overall, Weltrade is very competitive regarding its trading fees and spreads. Weltrade is a multi-regulated forex broker headquartered in South Africa. SVG FSA and the FSCA regulate Weltrade. Exness has a Trust Score of 89% out of 100.

- Louis Schoeman

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

13 BWP / 1 USD

Regulators

FSA

Trading Desk

MT4, MT5

Overall Rating

Crypto

Yes

Total Pairs

0

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overview

Overall, Weltrade is considered low risk, with an overall Trust Score of 89 out of 100. Weltrade is licensed by zero Tier-1 Regulator (high trust), one Tier-2 Regulator (average trust), and one Tier-3 Regulator (low trust). Weltrade offers six retail trading accounts: a Micro Account, Universe Account, Premium Account, Pro Account, Digital Account, and ZuluTrade Account.

Investor Warning: Foreign currency trading on margin is associated with an elevated risk and may not be appropriate for all Botswanan investors. Before engaging in foreign currency or Contract for Difference (CFD) trading, you must evaluate your investing goals, expertise, appetite for risk, and willingness to be exposed to risk. In addition, you should not start investing capital that you cannot afford to lose because you could incur a loss of part or your entire original investment.

Weltrade accepts Botswanan clients and has an average spread from 0.0 pips with commissions of 1.5 points on the ZuluTrade CopyTrading Account. In addition, Weltrade has a maximum leverage ratio of up to 1:1000, and a demo and Islamic account are available.

Weltrade Terminal, MetaTrader 4, and MetaTrader 5 platforms are supported. Weltrade is headquartered in Saint Vincent and the Grenadines and regulated by SVG FSA and FSCA.

Top 3 Weltrade User Reviews

On Forex Peace Army, Weltrade has 11 reviews with an overall rating of 1.5/5.

On Myfxbook, Weltrade has 70 votes and an overall rating of 3.7/5.

On Trustpilot, Weltrade has 21 reviews and an overall rating of 3.8/5.

- “Weltrade is a partner with HitBTC so I open an Crypto account with them. So far, I like how their Price Quote feeds. It seems it’s an ECN or bots quotes and re quoting which is great for advance market players!” – risingzombi – Orjansted, Aruba (quoted verbatim from Forex Peace Army)

- “I am absolutely satisfied with how it works. Especially their localisation for Ukraine and, of course, the withdrawal speed.” Kostyantyn – November 2019 (quoted verbatim from Myfxbook)

- “Best ecn broker . I always get withdrawal to skrill under 30 minutes. Lowest spreads at there pro account from 0.0 and i have been there client from 2014 no any issues best customer support” Manjunath – March 2024 (quoted verbatim from earnforex)

Weltrade At a Glance

| 🏛 Headquartered | Saint Vincent and the Grenadines |

| 🌎 Global Offices | Saint Vincent and the Grenadines, South Africa |

| 🏛 Local Market Regulators in Botswana | • Ministry of Finance and Economic Development (MFED) • Bank of Botswana (BoB) • Non-Bank Financial Institutions Regulatory Authority (NBFIRA) |

| 💳 Foreign Direct Investment in Botswana | 115.89 BWP Million in 2021 |

| 💰 Foreign Exchange Reserves in Botswana | 5270 USD Million in 2021 |

| ✔️ Local office in Gaborone? | No |

| 👨⚖️ Governor of SEC in Botswana | None, Moses Dinekere Pelaelo is the Governor of the Bank of Botswana |

| ✔️ Accepts Botswana Traders? | Yes |

| 📊 Year Founded | 2006 |

| 📞 Botswana Office Contact Number | None |

| 📱 Social Media Platforms | |

| ⚖️ Regulation | SVG FSA, FSCA |

| 1️⃣ Tier-1 Licenses | None |

| 2️⃣ Tier-2 Licenses | • Financial Sector Conduct Authority (FSCA) |

| 3️⃣ Tier-3 Licenses | • Saint Vincent and the Grenadines Financial Services Authority (SVG FSA) |

| 🪪 License Number | • Saint Vincent – 24513 • South Africa – 50691 |

| ⚖️ MFED, BoB, or NBFIRA Regulation | No |

| ✔️ Regional Restrictions | United States, Canada, Russia, Belarus |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 3 |

| ✔️ PAMM Accounts | No |

| 💻 Liquidity Providers | Unknown |

| ✔️ Affiliate Program | Yes |

| 📱 Order Execution | Market |

| 📊 Starting spread | 0.0 pips |

| 📉 Minimum Commission per Trade | 1.5 points |

| 💰 Decimal Pricing | Up to 5 digits after the comma |

| 📞 Margin Call | 20% – 40% |

| 🛑 Stop-Out | 10% – 20% |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | 150 lots |

| ✅ Crypto trading offered? | Yes |

| ✔️ Offers a BWP Account? | No |

| 📉 Dedicated Botswana Account Manager? | No |

| 📈 Maximum Leverage | 1:1000 |

| 📊 Leverage Restrictions for Botswana? | No |

| 💳 Minimum Deposit (BWP) | 13 BWP / 1 USD |

| ✔️ Botswana Pula Deposits Allowed? | No |

| 📊 Active Botswana Trader Stats | 250,000+ |

| 👥 Active Botswana-based Weltrade customers | Unknown |

| 🔁 Botswana Daily Forex Turnover | Unknown, Forex overall is $6.6 Trillion |

| 💰 Deposit and Withdrawal Options | • Credit/Debit Card • Skrill • Neteller • Crypto • Perfect Money • Indonesian Local Bank • Fasapay |

| 💻 Minimum Withdrawal Time | 30 minutes |

| ⏰ Maximum Estimated Withdrawal Time | Several days |

| 💳 Instant Deposits and Instant Withdrawals? | Yes, Deposits |

| 🏛 Segregated Accounts with Botswana Banks? | No |

| 📱 Trading Platforms | • Weltrade terminal • MetaTrader 4 • MetaTrader 5 |

| 💻 Tradable Assets | • Forex • Share CFDs • Indices • Cryptocurrency • Metals • Energies |

| ✔️ Offers USD/BWP currency pair? | No |

| 📊 USD/BWP Average Spread | No |

| ✅ Offers Botswana Stocks and CFDs | No |

| 💻 Languages supported on the Website | Multilingual |

| ☎️ Customer Support Languages | Multilingual |

| 👥 Copy Trading Support | Yes |

| ⏰ Customer Service Hours | 24/7 |

| 📞 Botswana-based customer support? | No |

| 💸 Bonuses and Promotions for Botswanans? | Yes |

| 📚 Education for Botswana beginner traders | Yes |

| 📱 Proprietary trading software | Yes |

| 🤝 Most Successful Trader in Botswana | Currently unknown |

| ✔️ Is Weltrade a safe broker for Botswana Traders? | Yes |

| 🎖 Rating for Weltrade Botswana | 8/10 |

| 🥇 Trust score for Weltrade Botswana | 89% |

| 👉 Open Account | 👉 Open Account |

Regulation and Safety of Funds

Regulation in Botswana

The local market regulators in Botswana are as follows:

Ministry of Finance and Economic Development (MFED)

Bank of Botswana (BoB)

Non-Bank Financial Institutions Regulatory Authority (NBFIRA)

While Weltrade is regulated globally, the broker does not yet have local regulations or licenses in Botswana. However, Weltrade is a popular and trustworthy broker that accommodates Botswanan traders.

Global Regulations

Systemgates Ltd., of which Weltrade is a subsidiary, is a Saint Vincent and the Grenadines corporation that abides by all applicable laws and regulations. Accordingly, for both Systemgates and Weltrade, the rules are as follows:

Saint Vincent and the Grenadines Financial Services Authority (SVG FSA) license #24513 for Systemgates Ltd.

Financial Sector Conduct Authority (FSCA) license #50691 for Weltrade SA (PTY) Ltd, a company incorporated in South Africa.

How Weltrade Protects Traders and Client Funds

Since its inception, Weltrade has prioritized safeguarding its customers’ funds. As a result, customers of Weltrade can rest easy knowing that their funds are protected by multi-factor authentication (2FA) and other safeguards.

Security while Trading

Client data is encrypted and protected with two-factor authentication and other measures on Weltrade.

Separation of client funds is guaranteed.

Protection against a negative balance is provided for consumer checking accounts.

A client’s account will be subject to a Margin Call and Stop-out if the balance drops below a predetermined threshold.

Pros and Cons Regulation and Safety of Funds

| ✔️ Pros | ❌ Cons |

| Weltrade has an 89% trust score based on its Tier-2 and Tier-3 regulation | If Weltrade goes bankrupt or cannot fulfil its financial obligations, investors are not protected |

| Traders’ satisfaction with Weltrade’s handling of their funds has been attested to in several reviews | Lack of Tier-1 Regulation |

| The Financial Sector Conduct Authority (FSCA) of South Africa, a reputable Tier-2 regulator, oversees Weltrade | There is no evidence that Weltrade undergoes third-party audits to guarantee that it follows all applicable laws and regulations |

| Weltrade ensures that client funds are kept in accounts held with top-tier banks, separate from its own funds |

Is Weltrade a regulated financial entity?

Yes, Weltrade is a regulated financial institution. The company adheres to strict regulatory frameworks to ensure transparency and the protection of clients’ interests.

Which regulatory bodies oversee Weltrade’s operations?

The broker is typically regulated by respected financial authorities in the jurisdictions where it operates. The regulatory bodies may include but are not limited to the International Financial Services Commission (IFSC) or other relevant entities.

Awards and Recognition

In 2021, Weltrade was named one of Asia’s most dependable Forex brokers. Furthermore, Weltrade has been lauded by the Competition Committee for having unparalleled service in the Asian region.

The success of Weltrade in Asia can be attributed to the company’s international team members’ ability to effectively communicate with and understand the cultural norms and values of their Asian clients. It is just one of many accolades Weltrade has won recently.

➡️ The Asia Forex Expo presented its annual Best Foreign Broker award to Weltrade in 2019.

➡️ Weltrade was awarded Best Customer Service 2017 from Forex Choice.

➡️ An award for “Best Trade Executions 2015” was presented to Weltrade at the China FX Expo.

➡️ The Global Financial Market Review honoured Weltrade in 2014 with the best customer service award.

Has Weltrade received any industry awards for its services?

Yes, Weltrade has been recognized with various industry awards for its outstanding services. The company has earned accolades in categories such as brokerage excellence, customer service, and technological innovation.

How can I verify Weltrade’s awards and recognitions?

Clients interested in verifying Weltrade’s awards and recognitions can do so by checking the official announcements and press releases on the company’s website. Additionally, industry-specific websites and publications often list award-winning brokers, providing an independent validation of Weltrade’s achievements.

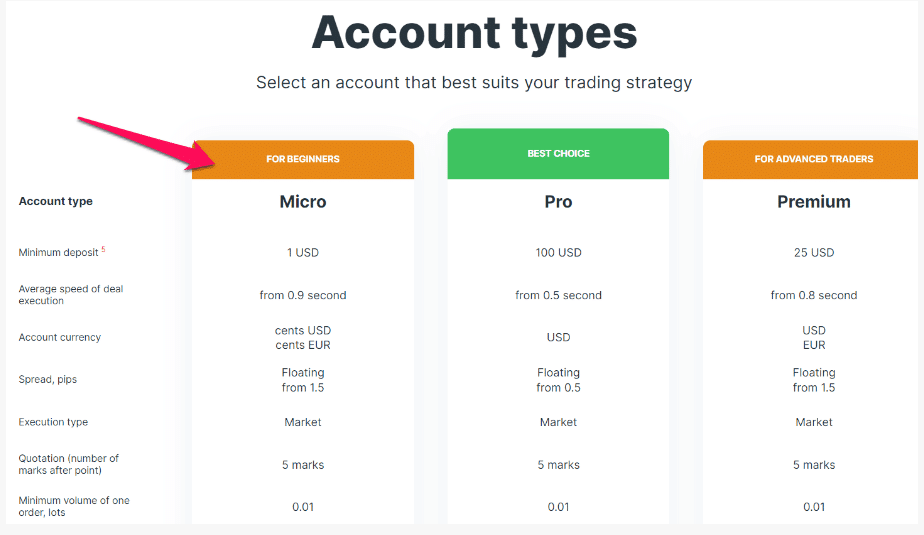

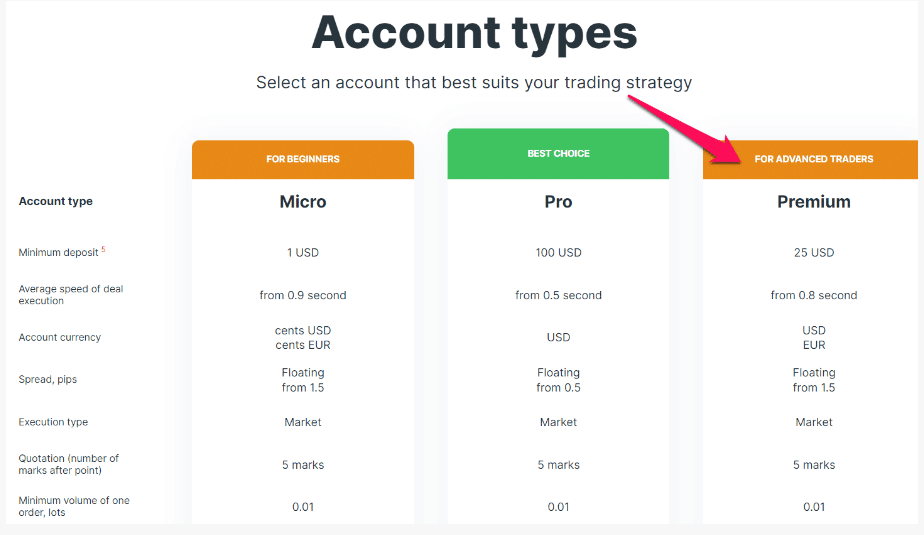

Weltrade Account Types and Features

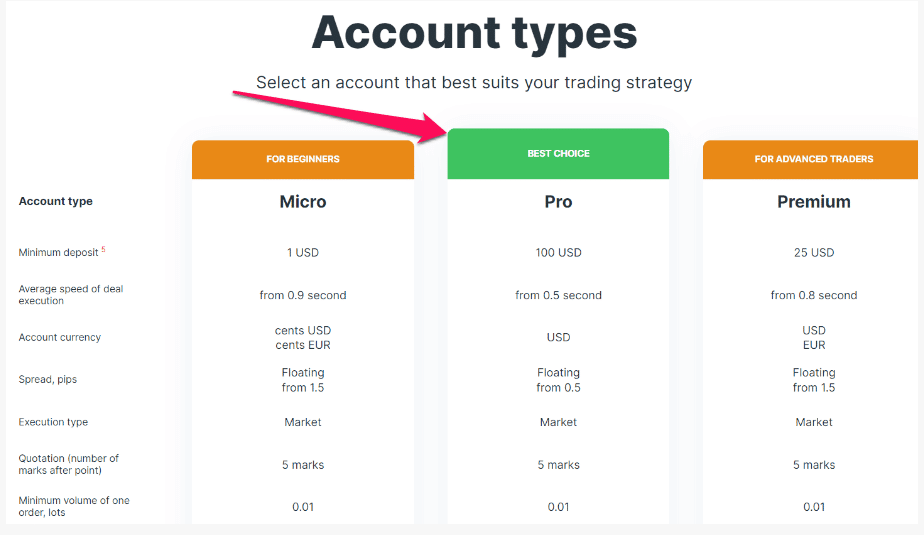

Numerous types of trading accounts exist, including “Micro,” “Premium,” “Pro,” and “ZuluTrade” (automated trading). Leverage ratios range from 1:1 for some accounts to 1:1000 for others. The table below compares some of the conditions and costs of the Weltrade account types.

| 💻 Live Account | 💳 Minimum Dep. | 📊 Average Spread | 💸 Commissions | 💰 Average Trading Cost |

| Micro | 13 BWP / 1 USD | 1.5 pips | None | 15 USD |

| Premium | 341 BWP / 25 USD | 1.5 pips | None | 15 USD |

| Pro | 1367 BWP / 100 USD | 0.5 pips | None | 5 USD |

Live Trading Account Details

Micro Account

With a minimum deposit of just 13 BWP, micro accounts are a wonderful way for novice traders to get their feet wet without taking on too much risk (or the equivalent in Euro cents).

To gain a sense of the market and how orders are processed, a Botswanan trader should open a micro account. Traders can count on the following amenities from this account:

| Account Feature | Information |

| 💰 Account Currency | USD or EUR cents |

| 💳 Average trade execution | 0.9 seconds |

| 💸 Minimum Deposit | 13 BWP / 1 USD |

| 📊 Average Spread | Variable, from 1.5 pips |

| 📈 Trade Execution Type | Market Execution |

| 💵 Commissions charged | No, only the spread |

| 📉 Quote | 5th decimal pricing |

| 💵 Maximum lots per order | 1,000 cent lots |

| 💰 Maximum open orders | 100 lots |

| 📊 Maximum pending orders | 100 lots |

| 📈 Maximum Leverage Ratio | 1:33 to 1:1000 |

| 📞 Margin Call Percentage | 20% |

| 🛑 Stop-Out Level | 10% |

| 💻 Trading Platform Available | MetaTrader 4 and MetaTrader 5 |

| ✔️ Access to Auto Trading? | Yes |

| 🔁 Swap-Free Available? | Yes |

| 🔧 Instruments Available on this Account | • Forex • Metals |

Premium Account

The Weltrade Premium Account is designed for more experienced traders who want narrower spreads and faster trade execution than the standard account offers. Traders from Botswana who use this account can also anticipate having access to the following features:

| Account Feature | Information |

| 💰 Account Currency | USD |

| 💳 Average trade execution | From 0.8 seconds |

| 💸 Minimum Deposit | 341 BWP / 25 USD |

| 📊 Average Spread | Variable, from 0.0 pips |

| 📈 Trade Execution Type | Market Execution |

| 💵 Commissions charged | No, only the spread |

| 📉 Quote | 5th decimal pricing |

| 💵 Maximum lots per order | 100 lots |

| 💰 Maximum open orders | 100 lots |

| 📊 Maximum pending orders | 100 lots |

| 📈 Maximum Leverage Ratio | 1:1 to 1:1000 |

| 📞 Margin Call Percentage | 20% |

| 🛑 Stop-Out Level | 10% |

| 💻 Trading Platform Available | MetaTrader 4 and MetaTrader 5 |

| ✔️ Access to Auto Trading? | Yes |

| 🔁 Swap-Free Available? | Yes |

| 🔧 Instruments Available on this Account | • Forex • Metals • Commodities • Stock CFDs • Index CFDs |

Pro Account

Traders already well-versed in the market and know exactly what they want from a broker will thrive with a Pro Account.

This account has no commission fees and provides fast trade execution and low spreads. Traders who use MetaTrader 4 and MetaTrader 5 will find this account particularly useful.

| Account Feature | Information |

| 💰 Account Currency | USD |

| 💳 Average trade execution | From 0.5 seconds |

| 💸 Minimum Deposit | 1367 BWP / 100 USD |

| 📊 Average Spread | Variable, from 0.0 pips |

| 📈 Trade Execution Type | Market Execution |

| 💵 Commissions charged | No, only the spread |

| 📉 Quote | 5th decimal pricing |

| 💵 Maximum lots per order | 100 lots |

| 💰 Maximum open orders | 150 lots |

| 📊 Maximum pending orders | 100 lots |

| 📈 Maximum Leverage Ratio | 1:1 to 1:1000 |

| 📞 Margin Call Percentage | 20% |

| 🛑 Stop-Out Level | 10% |

| 💻 Trading Platform Available | MetaTrader 4 and MetaTrader 5 |

| ✔️ Access to Auto Trading? | Yes |

| 🔁 Swap-Free Available? | Yes |

| 🔧 Instruments Available on this Account | • Forex • Metals • Commodities • Stock CFDs • Index CFDs |

Demo Account

With the demo account, Botswanans can quickly and easily create a training account with USD 100,000 in virtual currency to perform real-time trades and hone a strategy.

The demo accounts are available indefinitely and come at no cost so users can try out the platform risk-free. The broker also regularly runs contests, such as the Hot 100 and Hot 200, for those with sample accounts.

Islamic Account

Islamic Accounts are important to Muslim Botswanan traders who follow the Sharia Law as it exempts them from overnight fees, which is prohibited. In addition, Weltrade offers a Swap-Free Account conversion option on all trading accounts provided.

No additional costs or admin fees are indicated when Muslim traders convert a live trading account into an Islamic Account.

Professional Account

Experienced traders can sign up for a Premium or Pro Account on Weltrade. Some of the following benefits accrue to Botswanans with these accounts:

➡️ Trades are executed in 0.5 to 0.8 seconds, which is extremely fast.

➡️ Spreads on major instruments as low as 0.5 pips.

➡️ Zero trading commission charges cover the broker fee for facilitating the trade.

➡️ Trades are carried out at the prevailing market price.

➡️ Benefit from leverage of up to 1:1000 on the most popular currency pairs.

➡️ With no cap on how much money you can have in your account.

➡️ A 20% margin requirement with a 10% stop-loss.

Spread Betting Account

EU/UK traders cannot open a spread betting account with Weltrade.

Base Account Currencies

Unlike other brokers, Weltrade only offers two base currencies: the Euro and the US Dollar. However, multiple base currencies are used for various trading accounts. For instance, US dollars are the sole currency accepted by the Pro, Zulutrade, and Digital accounts.

Traders in Botswana who utilize Weltrade will be at a disadvantage because of the fees associated with making deposits and withdrawals when using bank accounts denominated in BWP.

Basic Order Types

No matter what type of account a Botswana-based trader opens with Weltrade, their orders will be executed on the market. If you are a trader in Botswana, here is what you should expect in terms of average trade execution times:

➡️ Micro Account – from 0.9 seconds

➡️ Universe Account – from 0.4 seconds

➡️ Premium Account – from 0.8 seconds

➡️ Pro Account – from 0.5 seconds

➡️ Digital Account – from 0.7 seconds

➡️ ZuluTrade Account – from 0.7 seconds

Pros and Cons Account Types and Features

| ✔️ Pros | ❌ Cons |

| A little initial investment is required, yet leverage rates can reach up to 1:1000 | The trading costs charged by Weltrade are high when compared to competitors |

| Commissions are waived for all but one trading account at Weltrade | ECN accounts are not offered |

| Six different retail accounts are available from Weltrade | Only the digital account can trade cryptocurrencies |

| Retail accounts have competitive trade conditions starting from 0.0 pips | |

| Botswanan traders have access to both a demo account and an Islamic Account |

What types of trading accounts does Weltrade offer?

The broker provides a range of trading accounts to cater to different investor needs. The specific account types may include Standard, Pro, and ECN accounts, each designed with distinct features to accommodate varying trading preferences.

Are there any minimum deposit requirements for Weltrade’s different account types?

Yes, each Weltrade account type may have its own minimum deposit requirement. Standard accounts typically have a lower minimum deposit, making them accessible to a broader range of traders, while Pro and ECN accounts may have higher entry thresholds due to additional features and lower spreads.

How to open an Account with Weltrade step by step

Step 1: Click on “OPEN AN ACCOUNT” or click the button as below.

Go to Weltrade official website. Open New Weltrade Account

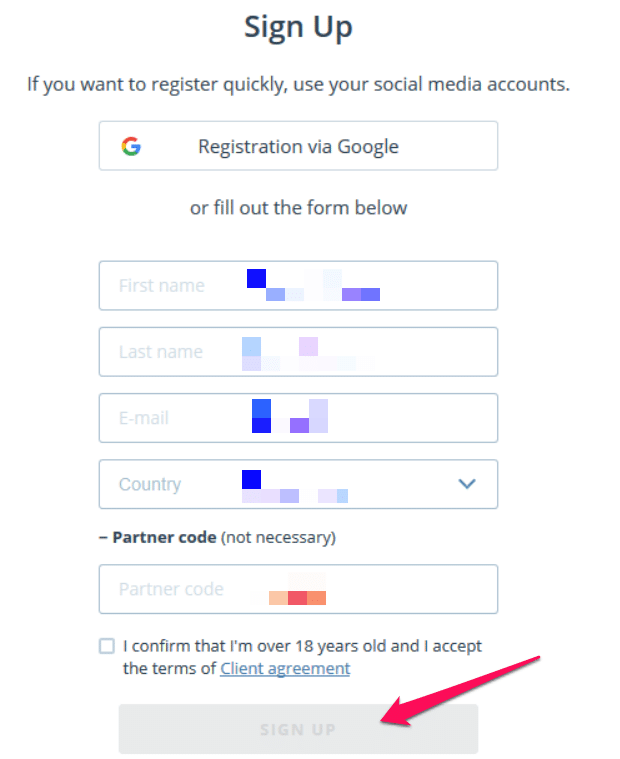

Step 2: Click on “Registration via Google”

Or fill out the form below, then click on “SIGN UP”. (The system will send “4-digit code” to your email.)

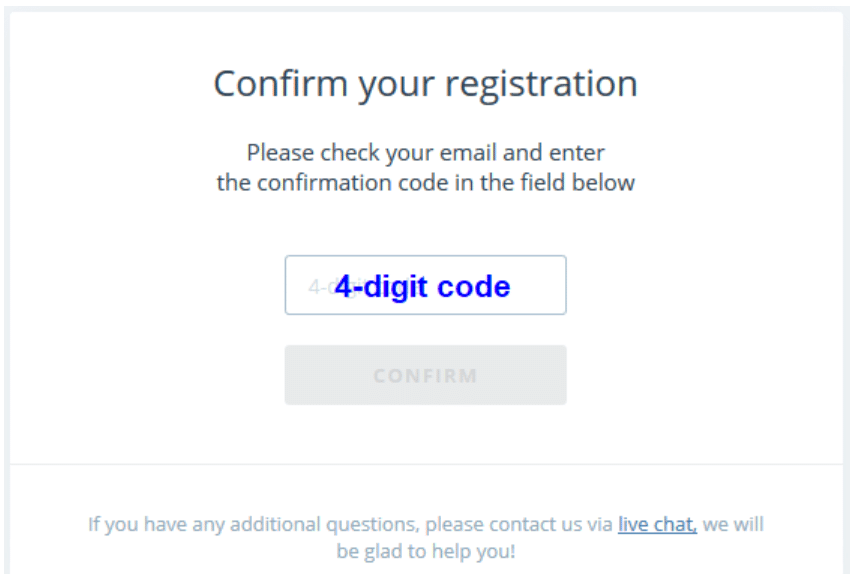

Step 3: Check your email

Enter the confirmation code in the field “4-digit code”, then click on “CONFIRM”. (The system will send a password to your email.)

Step 4: click on “CONFIRM”

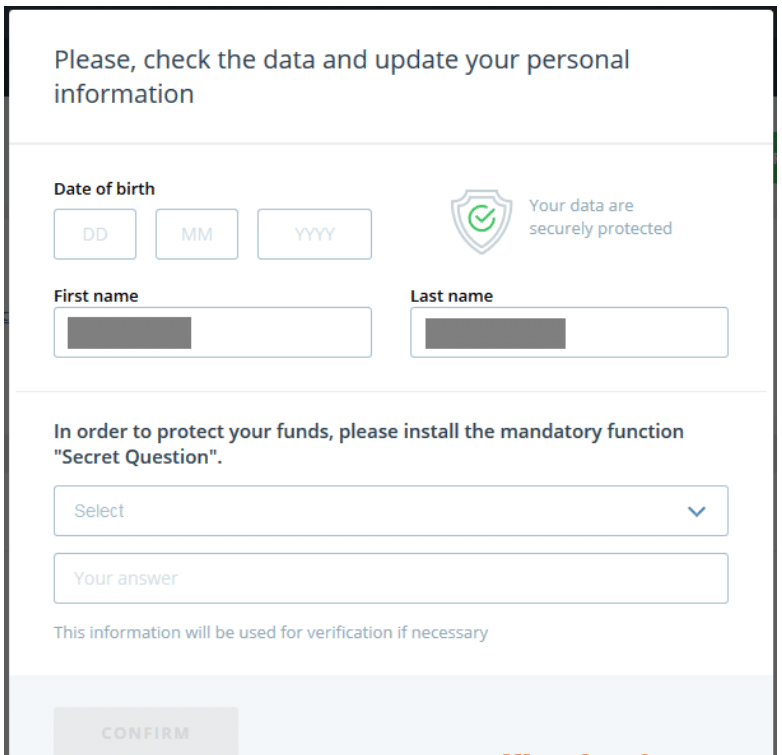

Member Area : Check the data and update your personal information, then click on “CONFIRM”. – Complete the process for opening an account.

Step 5: Upload Documents

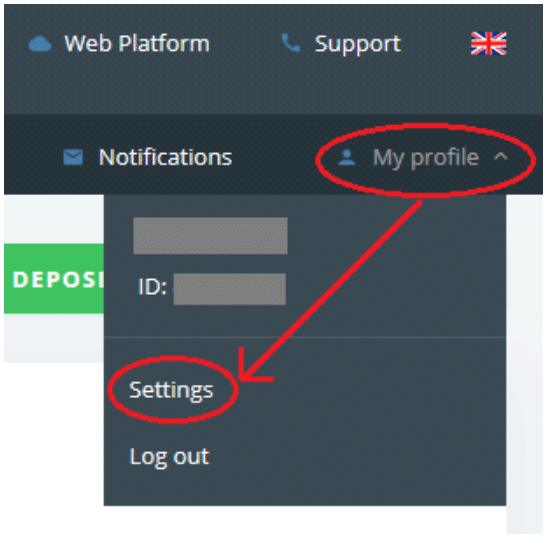

Go to “My Profile > Settings”. Upload the document confirming your identity and address

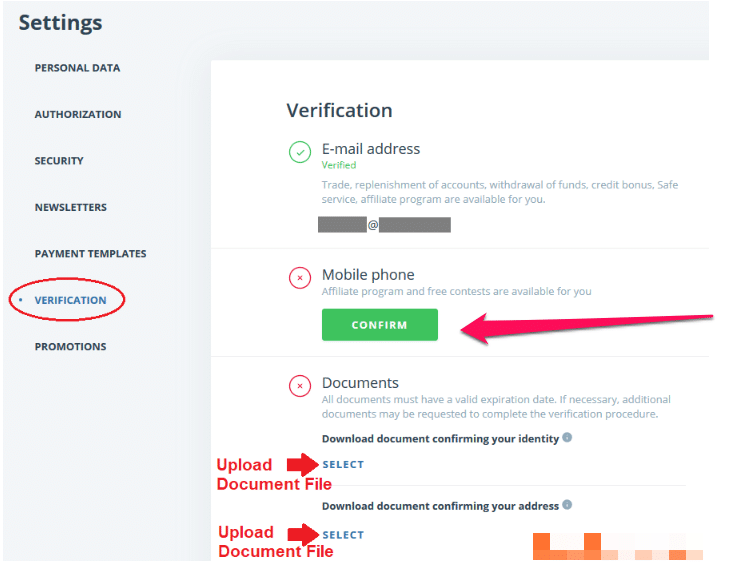

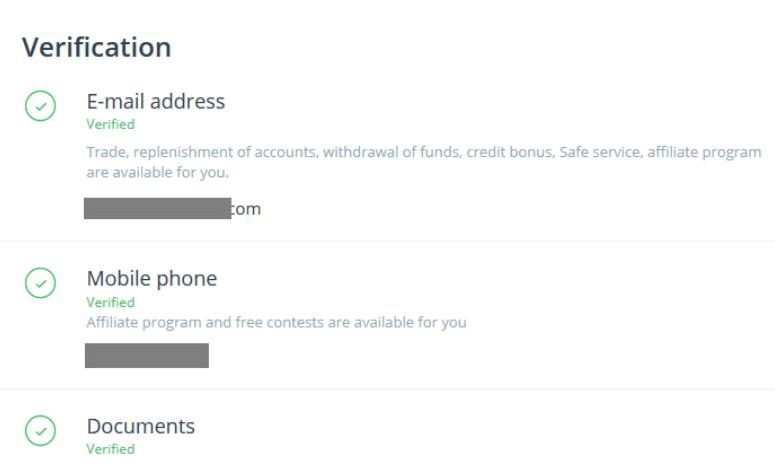

Step 6: Click on “verification”, then upload your document confirming your identity and address.

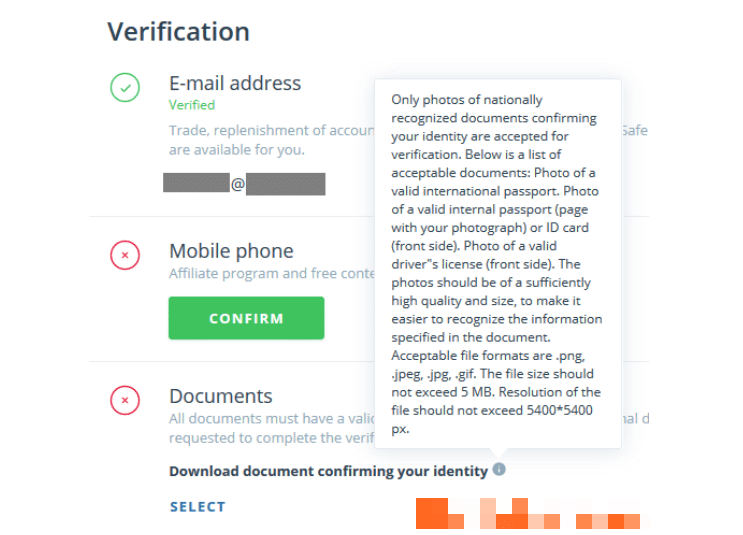

Download document confirming your identity : Only photos of nationally recognized documents confirming your identity are accepted for verification. Below is a list of acceptable documents: Photo of a valid international passport. Photo of a valid internal passport (page with your photograph) or ID card (front side). Photo of a valid driver’s license (front side). The photos should be of a sufficiently high quality and size, to make it easier to recognize the information specified in the document. Acceptable file formats are .png, .jpeg, .jpg, .gif. The file size should not exceed 5 MB. Resolution of the file should not exceed 5400*5400 px.

Download document confirming your address : Photos of the documents confirming your address are accepted for verification: Color scan/photo of any paper document not older than 3 months with your full name and full address of residence (utility bill/telephone/internet, bank account statement/contract, etc.). The photos should be of a sufficiently high quality and size, to make it easier to recognize the information specified in the document. Acceptable file formats are .png, .jpeg, .jpg, .gif. The file size should not exceed 5 MB. Resolution of the file should not exceed 5400*5400 px.

Step 8: Wait for approval

Wait for approval within 1-3 business days. (If your document is approved, the status will be displayed as “Verified”.) – Complete the verification process.

Weltrade Vs easyMarkets Vs Admirals – Broker Comparison

| 🥇 Weltrade | 🥈 easyMarkets | 🥉 Admirals | |

| ⚖️ Regulation | SVG FSA, FSCA | BVI FSC, CySEC, ASIC, FSA | FCA, ASIC, CySEC, EFSA, JSC, FSCA |

| 📱 Trading Platform | • Weltrade Terminal • MetaTrader 4 • MetaTrader 5 | • easyMarkets Platform • MetaTrader 4 • MetaTrader 5 • TradingView | • MetaTrader 4 • MetaTrader 5 • Admirals Mobile App |

| 💰 Withdrawal Fee | Yes | No | Yes |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | 13 BWP / 1 USD | 341 BWP ($25) | 13 BWP ($1) |

| 📊 Leverage | 1:1000 | Up to 1:400 | • 1:30 Retail • 1:500 Professional |

| 📊 Spread | From 0.0 pips | Fixed, 0.03 USD | From 0.0 pips |

| 💰 Commissions | 1.5 pips | None | From $0.02 |

| ✴️ Margin Call/Stop-Out | • 20% – 40% • 10% – 20% | 70%/30% | 100%/50% |

| 💻 Order Execution | Market | Market | Market, Exchange |

| 💳 No-Deposit Bonus | No | No | No |

| 📊 Cent Accounts | Yes, Micro | No | No |

| 📈 Account Types | • Micro Account • Premium Account • Pro Account | • Standard Account (Web/App and MT4) • Premium Account (Web/App and MT4) • VIP Account (Web/App and MT4) | • Trade.MT5 • Invest.MT5 • Zero.MT5 • Bets.MT5 • Trade.MT4 • Zero.MT4 |

| ⚖️ CBN Regulation | No | No | No |

| 💳 BWP Deposits | No | Yes | Yes |

| 📊 Botswana Pula Account | No | No | No |

| 👥 Customer Service Hours | 24/7 | 24/5 | 24/5 |

| 📊 Retail Investor Accounts | 3 | 3 | 6 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 📉 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | 150 lots | 50 lots | 200 lots |

| 💰 Minimum Withdrawal Time | 30 Minutes | Instant | Instant |

| 📊 Maximum Estimated Withdrawal Time | Several Days | Up to 5 Days | Between 3 to 5 working days |

| 💸 Instant Deposits and Instant Withdrawals? | Yes, Deposits | Yes | Yes |

Weltrade Trading Platforms

Offers Botswanan Traders a choice between these trading platforms:

➡️ Weltrade Terminal

➡️ MetaTrader 4

➡️ MetaTrader 5

Desktop Platforms

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4

Regarding trading platforms, MT4 is hard to beat because of its robust and automatic analytic tools. With support for more than 38 technical indicators, multiple chart kinds, and timeframes, tracking prices is now straightforward and accurate.

In addition to placing orders in the traditional order book, traders can now use the Market Watch window to track market activity and the History Centre to examine price trends over time. And if you are using Windows, you may download MT4 from the broker’s site.

MetaTrader 5

For advanced technical analysis, professional traders use the MT5 terminal, built with even more power than MT4.

Traders can access 21 different timeframes, a sketching tool, and over 80 pre-loaded indicators. In addition, investors can use the platform’s built-in economic calendar, Depth of Market view, and automated trading robots to their advantage.

In addition, the broker’s website makes it simple to download MT5 for use on Windows computers.

WebTrader Platforms

➡️ Weltrade Terminal

➡️ MetaTrader 4

➡️ MetaTrader 5

Weltrade Terminal

The brand-new Weltrade Terminal boasts an elegant and user-friendly UI and innovative features. Additionally, the Weltrade Terminal provides traders with sophisticated charting capabilities and a straightforward interface.

This version of the Terminal is intended for use by experienced traders only. To aid students in this endeavour, it provides over 50 different sketching tools and 100 different indicators. For this reason, Botswanans find trading on the Terminal a breeze.

With no sacrifice to the terminal’s essential functions or benefits, the user interface has been streamlined to make it more intuitive. If you want to trade online, your best bet is Weltrade Terminal, which gives you access to more than a hundred of the most liquid assets.

MetaTrader 4 and 5

Web-based access to MetaTrader 4 and MetaTrader 5 makes them available to individuals who choose not to download the trading platforms.

The online platform is just as dependable and quick as the desktop counterparts. In addition, it has all the extra features necessary for novice and experienced traders.

Trading App

➡️ MetaTrader 4

➡️ MetaTrader 5

MetaTrader 4 and 5

Botswanans can download MetaTrader4 (MT4) or MetaTrader5 (MT5) for use on their iOS, Android, or Windows mobile device.

By linking the mobile app to the same account as the desktop software, users may enjoy a fully synchronized trading experience regardless of where they happen to be.

Traders can still change orders, calculate profit and loss, and trade directly from the charts. However, they should be aware that several features are missing compared to desktop trading platforms.

Pros and Cons Weltrade Trading Platforms

| ✔️ Pros | ❌ Cons |

| Botswanans can use MT4 and MT5 across devices, depending on their Weltrade account | The proprietary trading platform is not available as a desktop app |

| Weltrade offers a powerful proprietary web-based platform for the Universe account | When Botswanans use mobile trading apps, they lose much functionality |

| Traders can choose from a desktop, mobile, or web version of MT4 and MT5, or they can use a combination across devices for perfect account integration | Botswanans can only use the platform dedicated to each account type |

What trading platforms does Weltrade offer?

The broker provides a selection of advanced and user-friendly trading platforms to accommodate diverse trading styles. Common platforms include the MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both renowned for their extensive charting tools, technical analysis capabilities, and algorithmic trading options.

Can I access Weltrade’s trading platforms on mobile devices?

Yes, the broker ensures accessibility by offering mobile versions of their trading platforms. Clients can download and install mobile applications compatible with both Android and iOS devices, enabling them to trade on the go.

Trading App

Botswanan Traders can expect the following range of markets:

➡️ Forex

➡️ Share CFDs

➡️ Indices

➡️ Cryptocurrency

➡️ Metals

➡️ Energies

Financial Instruments and Leverage offered

| 💻 Instrument | 💵 Number of Assets Offered | 💸 Max Leverage Offered |

| Forex | 37 | 1:1000 |

| Share CFDs | 214 | 1:33 |

| Indices | 14 | 1:100 |

| Cryptocurrency | 39 | 1:2 |

| Metals | 4 | 1:100 |

| Energies | 2 | 1:100 |

Pros and Cons Weltrade Range of Markets

| ✔️ Pros | ❌ Cons |

| There is a choice between 214 stocks from exchanges across the world | Each account has different asset classes that can be traded, and not all accounts can trade all instruments |

| Botswanans can trade using up to 1:1000 leverage | Leverage restrictions are applied |

| Cryptocurrency trading is offered via the Digital Account | Weltrade does not offer individual shares |

Does Weltrade provide a mobile trading app for smartphones?

Yes, the broker offers a mobile trading app that allows clients to trade on the go using their smartphones.

Can I execute all types of trades using the Weltrade mobile app?

Yes, the brokers mobile trading app is designed to facilitate the execution of various types of trades, including market orders, limit orders, and stop orders. Clients can access the full range of trading functionalities available on the desktop platform through the mobile app.

Broker Comparison for a Range of Markets

| 🥇 Weltrade | 🥈 easyMarkets | 🥉 Admirals | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | No | Yes |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | Yes | Yes | Yes |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | No | No |

Trading and Non-Trading Fees

Spreads

When Botswanans carry out trades on Weltrade, they will encounter spreads that vary depending on a few factors, including the type of trading account used, the financial instrument being traded, and the market state. The following are the typical spreads for EUR/USD on each account type:

➡️ Micro Account – from 1.5 pips

➡️ Universe Account – from 0.0 pips

➡️ Premium Account – from 1.5 pips

➡️ Pro Account – from 0.5 pips

➡️ Digital Account – from 0.0 pips

➡️ ZuluTrade Account – from 2.9 pips

Botswanans can also expect the following typical spreads per the account type and the financial instrument they trade.

| 💻 Micro | 💰 Premium | 📱 Pro | |

| EUR/USD | 1.5 pips | 1.5 pips | 0.5 pips |

| XAG/USD | 3 pips | 3 pips | 1.4 pips |

| XAU/USD | 41 pips | 41 pips | 9 pips |

| NDXUSD | – | 2 pips | 2 pips |

| XBR/USD | – | 10.7 pips | 6.7 pips |

| Apple, Inc. | – | 11 pips | 11 pips |

| BTC/USD | – | – | – |

Commissions

Weltrade has 5 accounts available, all of which are commission-free and only charge a spread. For Botswanans using ZuluTrade, commissions start at 1.5 pips.

Overnight Fees, Rollovers, or Swaps

Botswanans can view there overnight costs on the platform’s “Trading Instruments” section for easy reference. Overnight commissions for trading EUR/USD and BTC/USD can look like this:

| 💻 Account Type | 🔧 Instrument | 🔁 Swap Long (Buy) | 📈 Swap Short (Sell) |

| Micro Account | EUR/USD | -0.75 pips | 0.10 pips |

| Universe Account | EUR/USD | -0.006% | 0.00084% |

| Premium Account | EUR/USD | -0.75 pips | 0.10 pips |

| Pro Account | EUR/USD | -0.75 pips | 0.10 pips |

| ZuluTrade Account | EUR/USD | -0.75 pips | 0.10 pips |

| Digital Account | BTC/USD | -20% | -20% |

Deposit and Withdrawal Fees

When a customer from Botswana funds an account to begin trading, The broker does not impose any fees. But there are certain costs associated with making a withdrawal.

➡️ Debit/Credit Card

➡️ 2% plus 3 USD

➡️ 2% plus 3 EUR

➡️ 9% and a minimum of 50 RUB

➡️ Skrill – 1%

➡️ Neteller – 2% with a minimum of 1 USD

➡️ Crypto

➡️ BTC – 1%, minimum 0.0003 BTC

➡️ ETH – 1%, minimum 0.01 ETH

➡️ LTC – 1%, minimum 0.01 LTC

➡️ USDT (TRC-20) – 1%, minimum 0.01 USDT

➡️ Perfect Money – 0.5%

➡️ Fasapay – 0.5%, minimum 0.01 USD and maximum 5 USD

Inactivity Fees

After three months of inactivity, traders are charged USD 15 in inactivity fees if they let their trading account sit idle.

Currency Conversion Fees

When Botswanans make deposits or withdrawals in a currency other than USD (or EUR on the Micro Account), they will be subject to currency conversion costs.

These costs are according to the deposit and withdrawal amount, depending on the exchange rate between the USD and their deposit/withdrawal currency.

Pros and Cons Weltrade Trading and Non-Trading Fees

| ✔️ Pros | ❌ Cons |

| Weltrade provides all information regarding trading and non-trading fees on the website | Spreads are marked-up, and there are several non-trading fees charged |

| There are transparent overnight fees and spread schedules | Botswanans whom deposit/withdraw in BWP will face currency conversion fees |

| Weltrade does not charge commissions on all accounts, only the ZuluTrade account | |

| The commissions charged are competitive | |

| Weltrade charges competitive spreads |

What are the trading fees associated with Weltrade?

The broker charges trading fees in the form of spreads and, in certain account types, commissions. Spreads are the differences between the buying and selling prices, and commissions may apply based on the chosen account type.

Are there overnight or swap fees for holding positions overnight with Weltrade?

Yes, the broker may apply overnight or swap fees for positions held overnight. These fees, also known as rollover or financing fees, are incurred when a position is kept open beyond a certain time, and they vary based on the instrument and account type.

Weltrade Deposits and Withdrawals

Offers the following deposit and withdrawal methods:

➡️ Credit/Debit Card

➡️ Skrill

➡️ Neteller

➡️ Crypto

➡️ Perfect Money

➡️ Indonesian Local Bank

➡️ Fasapay

Broker Comparison: Deposit and Withdrawals

| 🥇 Weltrade | 🥈 easyMarkets | 🥉 Admirals | |

| Minimum Withdrawal Time | 30 Minutes | Instant | Instant |

| Maximum Estimated Withdrawal Time | Several Days | Up to 5 Days | Between 3 to 5 working days |

| Instant Deposits and Instant Withdrawals? | Yes, Deposits | Yes | Yes |

Weltrade Deposit Currencies, Deposit and Withdrawal Processing Times

| 💳 Payment Method | 💵 Deposit Currencies | 💳 Deposit Processing | 💸 Withdrawal Processing |

| Credit/Debit Card | USD, RUB, EUR | Instant | 30 minutes |

| Skrill | USD | Instant | 30 minutes |

| Neteller | USD, EUR, RUB | Instant | 30 minutes |

| Crypto | BTC, ETH, LTC, USDT TRC-20 | Instant | 30 minutes |

| Perfect Money | USD, EUR | Instant | 30 minutes |

| Indonesian Local Bank | IDR | 24 hours | 30 min to a few days |

| Fasapay | USD, IDR | Instant | 30 minutes |

Pros and Cons Weltrade Deposits and Withdrawals

| ✔️ Pros | ❌ Cons |

| Weltrade offers instant deposits on several payment methods, allowing Botswanans to start trading instantly | Withdrawals attract fees |

| There are flexible funding options offered | There are no instant withdrawals, and while they are processed quickly, it could take days for funds to reflect |

| Botswanans can deposit and withdraw using crypto wallets | Botswanans pay currency conversion fees on Botswanan deposits and withdrawals |

| Withdrawals are processed quickly as opposed to other brokers who take up to 48 hours to process withdrawals | |

| Withdrawals are processed around the clock and not only on business days during business hours | |

| Deposits are free |

Are there any fees associated with deposits at Weltrade?

The broker generally does not charge fees for deposits; however, clients should be aware that third-party payment providers or banks may have their own transaction fees.

Are there any withdrawal fees at Weltrade?

The broker aims to keep withdrawal fees to a minimum, and in many cases, the broker does not charge withdrawal fees. However, clients should be aware that third-party payment providers or banks may impose their own fees.

How to Deposit Funds with Weltrade

To deposit funds to an account with Weltrade, Botswanan Traders can follow these steps:

➡️ Traders can make deposits into their accounts by logging into the client site and selecting “Deposit” from the options menu.

➡️ Traders can select the deposit method that is most convenient for them and the account they intend to fund.

➡️ Botswanans can then choose a currency; input the minimum amount of money they desire to deposit, and continue with the process.

➡️ Traders are free to complete any additional steps necessary to validate and complete their deposits.

What precautions should I take to ensure a smooth deposit process with Weltrade?

To ensure a smooth deposit process with Weltrade, consider the following precautions:

- Verified Account: Ensure that your Weltrade trading account is fully verified. This often involves submitting identification documents as part of the account verification process.

- Secure Connection: Use a secure and stable internet connection when initiating the deposit to prevent disruptions during the transaction.

- Correct Information: Double-check all details, including the deposit amount and payment method, before confirming the transaction to avoid errors.

- Deposit Limits: Be aware of any deposit limits imposed by Weltrade or your chosen payment provider to align your deposit amount accordingly.

- Contact Support: If you encounter any issues during the deposit process, promptly contact Weltrade’s customer support for assistance. They can provide guidance and resolve any potential challenges.

How long does it take for funds to reflect in my Weltrade account after a deposit?

The processing time for deposits with Weltrade depends on the chosen deposit method. Bank transfers may take a few business days, while credit/debit card transactions and electronic payment systems often result in immediate fund availability.

Weltrade Fund Withdrawal Process

To withdraw funds from an account with Weltrade, Botswanan Traders can follow these steps:

➡️ Botswanan clients can access their Client Portal on the Weltrade website by logging in using their credentials.

➡️ Traders can select the “Withdraw” option and the payment method they utilized for their most recent deposit.

➡️ Traders can verify and complete their withdrawal requests by entering their withdrawal amounts and following any additional instructions that may be displayed.

Education and Research

Education

Customers interested in developing their trading abilities can take advantage of the instructional content provided by a growing number of brokers in the form of articles, videos, webinars, and courses.

For instance, Weltrade allows registered account holders to access live or on-demand lectures explaining various financial markets’ complexities. These seminars can be seen whenever the account holder chooses.

Offers the following Educational Materials:

➡️ Training

➡️ Seminars

Research and Trading Tool Comparison

| 🥇 Weltrade | 🥈 easyMarkets | 🥉 Admirals | |

| ➡️ Economic Calendar | Yes | Yes | Yes |

| ➡️ VPS | No | No | No |

| ➡️ AutoChartist | No | No | No |

| ➡️ Trading View | No | Yes | No |

| ➡️ Trading Central | No | Yes | Yes |

| ➡️ Market Analysis | Yes | Yes | Yes |

| ➡️ News Feed | Yes | Yes | Yes |

| ➡️ Blog | Yes | Yes | Yes |

Traders are always looking for any advantage they can get. Weltrade provides its clients with several helpful additional tools to increase their likelihood of correctly predicting market movements.

Users can get a preview of margin size, spreads, and swap rates with the help of a trading calculator, and investors can keep track of forthcoming market events with the assistance of an economic calendar.

In addition, Weltrade is unlike many of its rivals because it does not provide traders with a free virtual private server (VPS). Weltrade also offers Botswanan traders the following additional Research and Trading Tools:

➡️ Economic Calendar

➡️ Trading Calculator

Pros and Cons Weltrade Education and Research

| ✔️ Pros | ❌ Cons |

| Botswanans can access a range of advanced tools and features via the Weltrade, MT4, and MT5 trading platforms | There is a lack of educational material and advanced tools on the website |

| Weltrade offers trading calculators and a proprietary economic calendar | A subscription is needed to access the training materials offered |

Are Weltrade’s educational resources suitable for beginners?

Yes, Weltrade’s educational resources are designed to cater to traders of all levels, including beginners. The platform offers introductory materials covering the basics of trading, market dynamics, and risk management.

Does Weltrade provide research reports or market commentaries?

Yes, Weltrade often provides research reports and market commentaries to keep traders informed about market developments.

10 Best Forex Brokers in Botswana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

Bonuses and Promotions

➡️ Users of the Weltrade Terminal can participate in a contest to win $20,000 in cash and prizes.

➡️ By referring new customers to the Weltrade platform, Introducing Brokers can enter the World Partner Contest 2024 and be eligible to win up to $25,000.

➡️ Traders who successfully transact 300 lots are entered into a drawing for a free iPhone 13 Pro Max.

➡️ Astro Cards – Traders who fund an MT5 account with at least 50 USD will receive a free Astro Cards game.

➡️ Bonuses and cash awards can be won on the Spinner when traders deposit money into their MT5 account.

➡️ Botswanan traders could open larger positions thanks to the 100% Credit Bonus offered on MT5 accounts.

How to open an Affiliate Account with Weltrade

To register an Affiliate Account, Botswanan Traders can follow these steps:

➡️ Visit the Weltrade website and click the “Partners” tab.

➡️ The first step is to sign up for an IB account with Weltrade and enable the affiliate program.

➡️ Spread the word about your special affiliate link by sending it to your loved ones.

➡️ Use Weltrade’s resources and innovative analytic tools to track the development of your affiliates.

➡️ Suitably expect compensation.

Weltrade Affiliate Program Features

Traders who take part in the affiliate program increase their earning potential. The volume of business establishes a partner’s monthly take-home pay. The system checks the partner’s sales numbers every month and adjusts their status accordingly.

Affiliates in Botswana can make money through Weltrade’s three tiers of commission sharing:

➡️ Standard – up to 65% of earnings per client.

➡️ Professional – up to 75% earnings per client.

➡️ Expert – 85% earnings per client.

What is the Weltrade affiliate program?

The affiliate program offers individuals the opportunity to earn commissions by referring new clients to Weltrade. Affiliates can promote services through various channels, such as websites, social media, and email marketing.

How do affiliates earn commissions with the Weltrade affiliate account?

Affiliates earn commissions through the affiliate account by referring new clients to the platform. When referred clients open trading accounts and execute trades, affiliates receive commissions based on the trading volume generated by their referrals.

Customer Support

Traders can reach out to Weltrade anytime, thanks to the broker’s 24/7 support and locations worldwide. In addition, customers can contact Weltrade via various channels, including a live chat function on the website, email, and phone.

| Customer Support | Weltrade’s Customer Support |

| ⏰ Operating Hours | 24/7 |

| 🗣 Support Languages | English |

| 🗯 Live Chat | Yes |

| 📧 Email Address | Yes |

| ☎️ Telephonic Support | Yes |

| 📞 Local Support in Botswana? | No |

| 🥇 Overall quality of Weltrade Support | 3/5 |

You might also like: Axiory Review

You might also like: OANDA Review

You might also like: OctaFX Review

You might also like: Pepperstone Review

You might also like: JustMarkets Review

Pros and Cons

| ✔️ Pros | ❌ Cons |

| With Weltrade, you can get your money out quickly with multiple bonus options. | Tier-1 regulation is inadequate. |

| Trading costs are low, most accounts are commission-free, and the minimum deposit to open an account is manageable even for novices. | You can only trade in a small number of financial markets. |

| There is a fee for making a withdrawal. |

Corporate Social Responsibility

Weltrade does not currently address its CSR on the official website.

Our Final Verdict

The organization has provided brokerage services for 16 years and has a broad network of branches and representative offices. In addition, the broker prioritizes high-quality service, is constantly evolving and operates transparently.

There is some concern regarding the offshore location of the company. However, if, according to the Forex market regulation, Weltrade meets all its requirements, this issue is irrelevant.

Funding can be accomplished through a variety of techniques, including Bitcoin. Plus, withdrawals are handled within 30 minutes, 24 hours a day, 7 days a week. On the downside, every withdrawal option has associated fees.

Weltrade incorporates a fun element into the bonus-earning process by providing many unique games that provide an opportunity to earn substantial incentives.

Examining the Weltrade overall, there are both evident benefits and drawbacks. Since trading charges can increase for certain account types, it is essential to analyze this broker’s accessible possibilities thoroughly.

Conclusion

Our Review Methodology

For each of our broker evaluations, we investigate, evaluate, analyze, and compare what we feel to be the most crucial criteria to consider when selecting a broker.

This evaluation comprises positives, disadvantages, and an overall score based on our findings. We want to assist you in locating the ideal broker for your requirements.

Our broker review should not be considered financial advice. However, Botswanan traders are urged to seek professional financial advice before making any investment or trading decisions.

Now it is your turn to participate:

➡️ Do you have any prior experience with Weltrade?

➡️ What was the determining factor in your decision to engage with Weltrade?

➡️ Was it because of the minimum deposit, regulation, retail trading accounts, or other factors?

➡️ Have you experienced issues with Weltrade, such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

Regardless, please share your thoughts in the comments below.

Frequently Asked Questions

Is Weltrade Safe or a Scam?

According to its regulatory history and user feedback, they are a dependable broker.

For how long can I use the Weltrade demo account?

You have unlimited access to the demo account, as it does not expire.

Is Weltrade regulated?

In Saint Vincent, the broker is governed by the SVG FSA, while the FSCA governs South Africa.

Can I get a no-deposit bonus from Weltrade?

The broker does not offer a no-deposit or sign-up bonus to newly-registered traders.

How long will my withdrawal from Weltrade take?

When you ask for a withdrawal, it will be completed in no more than 30 minutes. It could take anywhere from a few minutes to a few days for the funds to appear in your bank account after making a payment, depending on the method you used.

Can I trade micro lots with Weltrade?

You can trade position sizes from 0.01 lots with a there Account.

Does Weltrade have Volatility 75?

Volatility 75 is not available through Weltrade’s Index CFDs.

Does Weltrade have Nasdaq?

To trade the Nasdaq on Weltrade, go to “NDXUSD,” where it is listed. Spreads on most accounts start at 2 pips.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review