Exness Account Types

Overall, Exness is considered low risk, with an overall Trust Score of 97% out of 100. Exness offers five retail investor accounts as well as Demo and Islamic accounts. Exness Account Types has a Sign-Up Bonus of $10 USD / 188 BWP offered to first-time traders

- Louis Schoeman

Jump to:

Account Types Overview

Account Types

Account Features

Pros and Cons

Final Verdict

FAQ

Exness at a Glance

| 🏛 Headquartered | Cyprus |

| 🌎 Global Offices | South Africa, Cyprus, United Kingdom, Seychelles |

| 🏛 Local Market Regulators in Botswana | • Ministry of Finance and Economic Development (MFED) • Bank of Botswana (BoB) • Non-Bank Financial Institutions Regulatory Authority (NBFIRA) |

| ✔️ Accepts Botswana Traders? | Yes |

| 📊 Year Founded | 2008 |

| 📞 Botswana Office Contact Number | None |

| 📱 Social Media Platforms | • Facebook • YouTube |

| ⚖️ Regulation | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA |

| 1️⃣ Tier-1 Licenses | Financial Conduct Authority (FCA) |

| 2️⃣ Tier-2 Licenses | • Cyprus Securities and Exchange Commission (CySEC) • Financial Sector Conduct Authority (FSCA) |

| 3️⃣ Tier-3 Licenses | • Financial Services Authority (FSA) Seychelles • Financial Services Commission of the British Virgin Islands (FSC BVI) • Financial Services Commission (FSC) Mauritius • Central Bank of Curaçao and Sint Maarten (CBCS) |

| 🪪 License Number | • Seychelles – SD025 • Curaçao – 0003LSI • British Virgin Islands – SIBA/L/20/1133 • Mauritius – GB20025294 • South Africa – FSP 51024 • Cyprus – 178/12 • United Kingdom – 730729 |

| ⚖️ MFED, BoB, or NBFIRA Regulation | None |

| ✔️ Regional Restrictions | The United States |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 5 |

| ✔️ PAMM Accounts | No |

| ✔️ Affiliate Program | Yes |

| 📱 Order Execution | Market |

| 📊 Starting spread | 0.0 pips EUR/USD |

| 📉 Minimum Commission per Trade | From $0.1 per side, per lot |

| 💰 Decimal Pricing | 5th decimal pricing after the comma |

| 📞 Margin Call | 60% |

| 🛑 Stop-Out | 0% |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | Unlimited |

| ✔️ Offers a BWP Account? | No |

| 📉 Dedicated Botswana Account Manager? | No |

| 📈 Maximum Leverage | Unlimited |

| 📊 Leverage Restrictions for Botswana? | No |

| 💳 Minimum Deposit (BWP) | 188 or an equivalent to $10 |

| ✔️ Botswana Pula Deposits Allowed? | Yes |

| 📊 Active Botswana Trader Stats | 250,000+ |

| 👥 Active Botswana-based Exness customers | Unknown |

| 🔁 Botswana Daily Forex Turnover | Unknown, Forex overall is $6.6 Trillion |

| 💰 Deposit and Withdrawal Options | • Debit Card • Credit Card • Internet Banking • Skrill • Neteller • Bank Wire |

| 💻 Minimum Withdrawal Time | Instant |

| ⏰ Maximum Estimated Withdrawal Time | Up to 72 hours |

| 💳 Instant Deposits and Instant Withdrawals? | Yes |

| 🏛 Segregated Accounts with Botswana Banks? | No |

| 📱 Trading Platforms | • MetaTrader 4 • MetaTrader 5 • Terminal • Trader app |

| 💻 Tradable Assets | • Forex • Metals • Energies • Indices • Stocks |

| ✔️ Offers USD/BWP currency pair? | No |

| 📊 USD/BWP Average Spread | N/A |

| ✅ Offers Botswana Stocks and CFDs | No |

| 💻 Languages supported on the Website | English, French, Indonesian, Portuguese, Spanish, Vietnamese, Arabic, Thai, Chinese (Simplified), Japanese, Korean, Urdu, Bengali, Hindi |

| ☎️ Customer Support Languages | Multilingual |

| 👥 Copy Trading Support | Yes |

| ⏰ Customer Service Hours | 24/7 |

| 📞 Botswana-based customer support? | No |

| 💸 Bonuses and Promotions for Botswanans? | No |

| 📚 Education for Botswanan beginner traders | No |

| 📱 Proprietary trading software | Yes |

| 🤝 Most Successful Trader in Botswana | Unknown |

| ✔️ Is the broker a safe broker for Botswana Traders? | Yes |

| 🎖 Rating for Exness Botswana | 8/10 |

| 🥇 Trust score for Exness Botswana | 97% |

| 👉 Open Account | 👉 Open Account |

Exness Overview

Overall, Exness is considered low-risk, with an overall Trust Score of 97 out of 100. Exness is licensed by one Tier-1 Regulator (high trust), two Tier-2 Regulators (average trust), and four Tier-3 Regulators (low trust). Exness offers five different retail trading accounts namely a Standard Account, Standard Cent Account, Raw Spread Account, Zero Account, and Pro Account.

Exness has been in business for 14 years and it now has over 340,000 registered members all around the globe. This demonstrates how swiftly and effectively the broker has gained control of the market.

In 2008, Exness was established, and almost immediately thereafter, it started its lightning-fast expansion. Exness is committed to maintaining the highest level of financial openness possible and publishes the company’s financial disclosures on its website.

The broker also offers a minimum deposit requirement of just 188 BWP, making it very accessible to new traders who are just starting their trading journey.

MetaTrader 4 and MetaTrader 5 are available for Windows, Mac, Linux, Android, and iOS systems, and there is also a mobile application available for both Android and iOS. Exness provides a diverse range of trading platforms, from which customers may choose the one that best meets their needs.

In addition, Exness provides access to a total of 278 popular traded assets, among which are 100 forex pairs.

In addition, traders are provided with free VPS hosting, the most recent financial news from the Dow Jones, a trader’s calculator, and a currency converter.

The staggering amount of trading volume that Exness completes every year is a clear indicator of the company’s meteoric rise, as can be seen in the graph below.

In 2015, Exness was responsible for more than $2.33 trillion worth of foreign exchange operations that were conducted via its worldwide network of customers.

In July 2024, Exness reported an overall trading volume of $2.2 trillion, with a total of $984.9 million in client withdrawals and $88.6 million in partner rewards for the second quarter of the year.

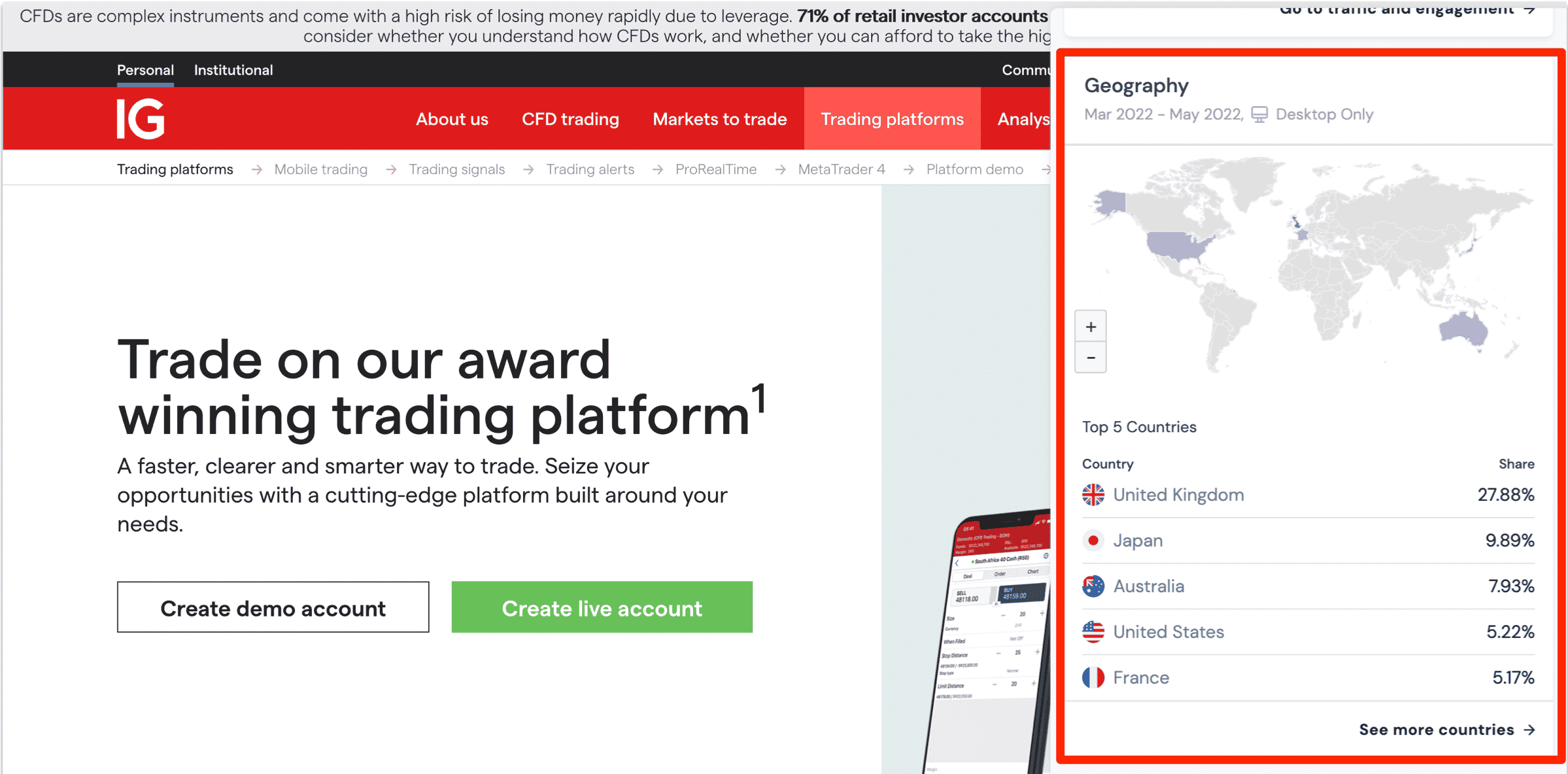

Exness has clients from around the world and these areas have the largest distributions:

➡️ Thailand – 32.8%

➡️ Vietnam – 21.8%

➡️ India – 12.2%

➡️ Philippines – 7.06%

➡️ South Africa – 5.2%

What is an Overview of Exness as a Broker?

Exness is a well-established online forex and CFD broker that offers traders access to a wide range of financial instruments, including currency pairs, commodities, and indices. The broker is known for its commitment to transparency and regulatory compliance, being authorized and regulated by reputable financial authorities.

What Factors Should I Consider in Understanding Exness’ Overview?

Regulatory status is crucial for the safety of your funds, and Exness is regulated by reputable authorities. Trading conditions, including spreads, leverage, and available instruments, impact your trading experience. The choice of account types should align with your trading style and goals. The availability of trading platforms, their features, and user-friendliness contribute to the overall trading experience. Fees, customer support quality, educational resources, and user feedback all play roles in shaping your perspective of the broker.

Exness Account Types

Exness is a well-known worldwide broker that provides a total of five distinct trading accounts, including one of the most cost-effective Cent Accounts in the business.

In addition, Exness enables Botswana investors to create trading accounts in BWP and provides access to over one hundred different currency pairings, far more than most other brokers. The live accounts that Botswanans can expect are:

➡️ Standard Account

➡️ Standard Cent Account

➡️ Raw Spread Account

➡️ Zero Account

➡️ Pro Account

| 💻 Live Account | 💳 Minimum Dep. | 📊 Average Spread | 💸 Commissions | 💰 Average Trading Cost |

| Standard | 188 BWP/$10 | 0.3 pips | None | 10 USD |

| Standard Cent | 188 BWP/$10 | 0.3 pips | None | 10 USD |

| Raw Spread | 9405 BWP or $500 | 0.0 pips | $3.5 | 7 USD |

| Zero | 9405 BWP or $500 | 0.0 pips | $0.1 | 7 USD |

| Pro | 9405 BWP or $500 | 0.0 pips | None | 6 USD |

Exness Account Features

Standard Account

A standard account is an account that is suitable for any trader, regardless of experience level, skill level, or trading style. They are the most common kind of account offered by the vast majority of forex and CFD brokers nowadays.

| Account Feature | Value |

| 💳 Minimum Deposit Requirement | 188 BWP or an equivalent to $10 |

| 📈 Spreads | Variable, from 0.3 pips |

| 💰 Commission Charges | None |

| 📈 Maximum Leverage offered | Unlimited leverage |

| 📊 Instruments Available | Forex major pairs, minor currency pairs, exotic pairs, energies, stocks, indices |

| 📊 Minimum lot size | 0.01 lot |

| 📈 Maximum Lot Size | 200 lots from 7 am to 8h59 pm (GMT +0) 20 lots from 9 pm to 6h59 am (GMT +0) |

| 📈 Maximum positions | Unlimited |

| ✴️ Hedged Margin (%) | 0 |

| ✴️ Margin Call (%) | 60 |

| 🔎 Stop-out Level (%) | 0 |

| 📊 Order Execution | Market Execution |

| ☪️ Islamic Account | Yes |

Standard Cent Account

This account is well suited for novice traders who want to develop a feel for the market but are unwilling to risk their own funds.

This account is also suitable for experienced traders who wish to test their trading techniques in real-time market circumstances without the danger of losing money.

| Account Feature | Value |

| 💳 Minimum Deposit Requirement | 188 BWP/$10 |

| 📈 Spreads | Variable, from 0.3 pips |

| 💰 Commission Charges | None |

| 📈 Maximum Leverage offered | Unlimited leverage |

| 📊 Instruments Available | Forex, Metals |

| 📊 Minimum lot size | 0.01 lot |

| 📈 Maximum Lot Size | 200 lots from 7 am to 8h59 pm (GMT +0) 20 lots from 9 pm to 6h59 am (GMT +0) |

| 📈 Maximum positions | 1000 |

| ✴️ Hedged Margin (%) | 0 |

| ✴️ Margin Call (%) | 60 |

| 🔎 Stop-out Level (%) | 0 |

| 📊 Order Execution | Market Execution |

| ☪️ Islamic Account | Yes |

Raw Spread Account

A raw spread account is perfect for a variety of trading strategies, including scalping, day trading, and algorithmic trading, amongst others.

| Account Feature | Value |

| 💳 Minimum Deposit Requirement | 9405 BWP or $500 |

| 📈 Spreads | Variable, from 0.0 pips |

| 💰 Commission Charges | Up to $3.5 per side, per lot |

| 📈 Maximum Leverage offered | Unlimited leverage |

| 📊 Instruments Available | Forex, metals, energies, stocks, indices |

| 📊 Minimum lot size | 0.01 lot |

| 📈 Maximum Lot Size | 200 lots from 7 am to 8h59 pm (GMT +0) 20 lots from 9 pm to 6h59 am (GMT +0) |

| 📈 Maximum positions | Unlimited |

| ✴️ Hedged Margin (%) | 0 |

| ✴️ Margin Call (%) | 30 |

| 🔎 Stop-out Level (%) | 0 |

| 📊 Order Execution | Market Execution |

| ☪️ Islamic Account | Yes |

Zero Account

The Zero Account ensures market execution with no requotes, and it also provides Botswana traders with the lowest fees possible together with the narrowest spreads available in the industry.

| Account Feature | Value |

| 💳 Minimum Deposit Requirement | 9405 BWP or $500 |

| 📈 Spreads | Variable, from 0.0 pips |

| 💰 Commission Charges | From $0.1 per side, per lot |

| 📈 Maximum Leverage offered | Unlimited leverage |

| 📊 Instruments Available | Forex, metals, energies, stocks, indices |

| 📊 Minimum lot size | 0.01 lot |

| 📈 Maximum Lot Size | 200 lots from 7 am to 8h59 pm (GMT +0) 20 lots from 9 pm to 6h59 am (GMT +0) |

| 📈 Maximum positions | Unlimited |

| ✴️ Hedged Margin (%) | 0 |

| ✴️ Margin Call (%) | 30 |

| 🔎 Stop-out Level (%) | 0 |

| 📊 Order Execution | Market Execution |

| ☪️ Islamic Account | Yes |

Pro Account

Botswana traders who have the most comprehensive grasp of the financial sector are the target audience for the Professional Accounts.

| Account Feature | Value |

| 💳 Minimum Deposit Requirement | 9405 BWP or $500 |

| 📈 Spreads | Variable, from 0.1 pips |

| 💰 Commission Charges | None |

| 📈 Maximum Leverage offered | Unlimited leverage |

| 📊 Instruments Available | Forex, metals, energies, stocks, indices |

| 📊 Minimum lot size | 0.01 lot |

| 📈 Maximum Lot Size | 200 lots from 7 am to 8h59 pm (GMT +0) 20 lots from 9 pm to 6h59 am (GMT +0) |

| 📈 Maximum positions | Unlimited |

| ✴️ Hedged Margin (%) | 0 |

| ✴️ Margin Call (%) | 30 |

| 🔎 Stop-out Level (%) | 0 |

| 📊 Order Execution | Instant Execution on Forex currency pairs, metals, energies, stocks, and indices |

| ☪️ Islamic Account | Yes |

What Are the Account Types Offered by Exness?

Exness offers a variety of trading account types designed to cater to different trading preferences and experience levels. The primary account types include Standard, Pro, and Raw Spread accounts. The Standard account generally offers fixed spreads and is suitable for beginners or traders looking for simplicity.

The Pro account provides lower spreads and is intended for more experienced traders who require tighter pricing. The Raw Spread account features variable spreads with a commission per lot traded, appealing to traders seeking direct market access and the lowest possible spreads.

Additionally, Exness may offer specialized account types, such as Islamic (swap-free) accounts for those who adhere to Islamic finance principles. It’s important to carefully review the features, trading conditions, and fees associated with each account type to select the one that aligns with your trading strategy and objectives.

How Do Exness Account Types Impact My Trading Experience?

Exness’ account types have a direct impact on your trading experience. The choice of account type determines factors like spreads, commissions, and available trading instruments.

Exness Demo Account

Trading on financial markets exposes investors to a certain level of risk. However, Exness provides its customers with a risk-free trading platform on which they can test trading strategies.

With this practice account, Botswanans can also engage in trading simulations, and investigate the services provided by the broker in a protected setting that replicates real market conditions.

At Exness, you can expect a trading environment that is regulated and safe. Here, you may open a demo account to try out different trading strategies, or you can open a real account to begin participating in the currency markets.

In addition to providing current financial news from Dow Jones, Exness also provides a free Demo account, a comprehensive assortment of teaching tools, and Web TV that displays the most recent updates.

What is the Exness Demo Account, and How Does It Work?

The Exness Demo Account is a virtual trading account designed for traders to practice and familiarize themselves with the broker’s trading platforms and features without using real money. It provides a risk-free environment where traders can execute trades, test strategies, and explore the markets using virtual funds.

How Can the Exness Demo Account Benefit Traders?

It provides a safe space to practice trading strategies, helping traders learn from their mistakes without risking real money. Traders can experiment with different trading techniques, risk management strategies, and market analysis methods.

Exness Islamic Account

Forex traders can keep their trading positions open for more than 24 hours on a trading day. This length of time is determined by the trading style and trading strategy of the forex trader.

This indicates that the trader may be responsible for paying an overnight or rollover charge. As a result of the fact that this type of interest is forbidden under the Riba principles of Sharia law, Muslim traders often face restrictions while engaging in forex trading.

Exness makes the Islamic Account option accessible on all its live trading accounts. This makes it possible for Muslim traders of any experience level and with any trading objective to participate in a range of financial markets without the risk of being exposed to diverse types of interest.

What is an Exness Islamic Account?

An Exness Islamic Account, also known as a swap-free account, is a trading account designed to accommodate traders who adhere to Islamic principles of finance. Islamic finance prohibits the payment or receipt of interest, which conflicts with conventional trading practices involving overnight swaps or rollover fees.

How Does the Exness Islamic Account Work?

The Exness Islamic Account operates similarly to other trading accounts, with the key distinction being the absence of interest-bearing swaps. When a trader holds a position overnight, instead of earning or paying interest, an administrative fee may be applied to cover the costs associated with maintaining the position.

Exness Botswana Pros and Cons

| ✔️ Pros | ❌ Cons |

| Exness is known as one of the best brokers in Africa for beginners and professional traders | Exness has a very limited range of tradable instruments |

| Exness offers a range of accounts that benefit different experience levels | There is no educational material for beginners |

| Botswanans can choose between MT4 or MT5 on the web, desktop, or mobile | |

| Exness is reputable, and all client funds are kept secure | |

| Botswanans can register a BWP account with Exness | |

| Instant withdrawals are available | |

| Exness offers 24/7 customer support to its traders |

Verdict on Exness

Overall, Exness is very competitive in terms of its trading fees and spreads.

What is the General Verdict on Exness as a Broker?

The consensus on Exness as a broker is generally positive. Exness is recognized for its transparency, regulatory compliance, and competitive trading conditions. The broker offers multiple account types designed to cater to various trading styles and experience levels. Exness is known for its competitive spreads, fast order execution, and availability of popular trading platforms like MetaTrader 4 and MetaTrader 5.

You might also like: Exness Review

You might also like: Exness Account Types

You might also like: Exness Demo Account

You might also like: Exness Fees and Spreads

You might also like: Exness Fund Withdrawal Process

Frequently Asked Questions

Can I trust Exness with my money?

Yes, Exness is one of the most secure and trusted CFD and Forex brokers that are multi-regulated around the world. However, to maintain its operating licenses, Exness must ensure client fund security.

Which live accounts can I register with Exness?

You can choose from these live account options with Exness:

- Standard Account

- Standard Cent Account

- Raw Spread Account

- Zero Account

- Pro Account

Does Exness offer a Cent Account?

Yes, Exness offers a Standard Cent Account that caters to beginners learning to trade and professionals evaluating their strategies.

Can I open an Islamic Account with Exness?

Yes, Exness offers the option for an Islamic Account across all its live trading accounts.

Does Exness offer an unlimited demo account?

Yes, Exness offers a free and unlimited demo account to new and existing traders.

Conclusion

Now it is your turn to participate:

Do you have any prior experience?

What was the determining factor in your decision to engage?

Was it because of the minimum deposit, regulation, retail trading accounts, or any other factors?

Have you experienced any issues such as difficulty withdrawing funds, inability to verify regulations, irresponsive customer support, etc.?

Regardless, please share your thoughts in the comments below

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review