14 Best Forex No-Deposit Bonus Brokers in Botswana

The 14 Best No Deposit Forex Bonuses in Botswana were revealed. We tested and verified the best welcome no-deposit bonuses for Botswana Traders.

This is a complete list of forex brokers with a no-deposit signup bonus in Botswana.

In this in-depth guide you’ll learn:

- What is a No Deposit Bonus?

- Which brokers offer the best no-deposit bonus to Botswana Traders?

- Our recommended ECN and STP forex brokers for Botswana Beginner Traders?

- How to compare forex trading brokers against each other to find the best no-deposit bonus?

- Which Forex Brokers offer a no deposit bonus that has local offices in Gaborone?

- Which broker is best for beginner Botswana traders?

- Which broker offers a sign-up bonus for first-time traders?

- How Does a No Deposit Forex Bonus Work?

And lots more…

So if you’re ready to go “all in” with the best-tested No Deposit Bonus Forex Brokers for Botswana…

Let’s dive right in…

- Louis Schoeman

Best Forex No-Deposit Brokers in Botswana

| 🏅 Broker | 👉 Open Account | 💰 Minimum Deposit | 🎁 Additional Bonusses / Promotions | 🎉 Trading Platform |

| 1. XM | 👉 Open Account | $5 / 93 BWP | 50% Deposit Bonus 20% Deposit Bonus | MT4 & MT5 |

| 2. Tickmill | 👉 Open Account | $100 / 1866 BWP | Trader of the Month Intoducing Broker Contest | MT4 & MT5 , MetaTrader WebTrader MetaTrader 4 for Mac Tickmill Mobile App |

| 3. SuperForex | 👉 Open Account | $1 / 13 BWP | 50% Welcome Bonus 300% Hot Bonus 75% Energy+ Bonus 3000% Easy Deposit Bonus | MetaTrader 4 |

| 4. FBS | 👉 Open Account | $1 / 13 BWP | Activate 100% Deposit bonus and make your trading x2 more efficient | FBS Trader, MetaTrader 4, MetaTrader 5 |

| 5. JustMarkets | 👉 Open Account | $10 / 136 BWP | 120% Deposit Bonus | MetaTrader 4 MetaTrader 5 |

| 6. HFM | 👉 Open Account | $0 | HFM 30% Rescue Bonus HFM 100% Credit Bonus | MetaTrader 4 MetaTrader 5 |

| 7. InstaForex | 👉 Open Account | $1 / 13 BWP | 100% Deposit Bonus 55% Deposit Bonus 30% Bonus Bonus Instaforex Club Bonus | MetaTrader 4 MetaTrader 5 MultiTerminal WebTrader |

| 8. FreshForex | 👉 Open Account | $100 / 1866 BWP | +10% Crypto Deposit 300% Deposit Bonus 101% Drawdown Bonus | MetaTrader 4 MetaTrader 5 WEB-TERMINAL METATRADER |

| 9. ForexChief | 👉 Open Account | $100 / 1866 BWP | +10% Crypto Deposit 300% Deposit Bonus 101% Drawdown Bonus | MetaTrader 4 MetaTrader 5 |

| 10. Admiral Markets | 👉 Open Account | $100 / 1866 BWP | 100% bonus program 100% Welcome bonus | MetaTrader 4 MetaTrader 5 |

| 11. AvaTrade | 👉 Open Account | $100 / 1866 BWP | Welcome bonus promotions dedicated for new clients | MetaTrader 4 |

| 12. FXCM | 👉 Open Account | $50 / 933 BWP | Welcome bonus of $25 USD Deposit Bonus of up to $300. | Meta Trader 4 |

| 13. FXGiants | 👉 Open Account | $100 / 1866 BWP | Email Verification bonus gives traders a 10 USD credit bonus. The phone Verification bonus provides a 15 USD credit bonus. | MetaTrader 4 FXGiants’ mobile trading |

| 14. Windsor Brokers | 👉 Open Account | $50 / 933 BWP | Trading Challenge Deposit Bonus Loyalty Programme | MetaTrader 4 MT4 Multiterminal MT4 WebTrader Windsor Brokers App Android |

10 Best Forex Brokers in Botswana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

What is a Forex No-Deposit Bonus?

Various Financial Brokers give many other types of welcome bonuses. However, the Forex No-Deposit-Bonus is a traditional and typical kind. Since no minimum deposit is required to get the bonus, we call it a “no-deposit” bonus.

An opening trading account with funds is provided. No client’s money is in danger with this offer since the money is a freebie from the Broker.

14 Best Forex No-Deposit Brokers in Botswana

- ✔️ XM – Overall, Best ECN Broker in Botswana

- ✔️ Tickmill – Top STP Broker

- ✔️ SuperForex – Verified Broker with No Needed Starting Capital

- FBS – 100% Deposit bonus

- JustMarkets – Largest Welcome Bonus Broker

- HFM– High Botswana Trust Score

- InstaForex – Best Broker for Beginner Traders

- FreshForex – Top Customer Support Broker

- ForexChief – Easy Withdrawal Process Broker

- Admiral Markets– $100 No-Deposit Sign-Up Bonus Offer

- AvaTrade – Best Broker in Botswana

- FXCM – Excellent Technical Tools

- FXGiants – Best Regulated Broker

- Windsor Brokers – Top Broker for Experienced Traders in Botswana

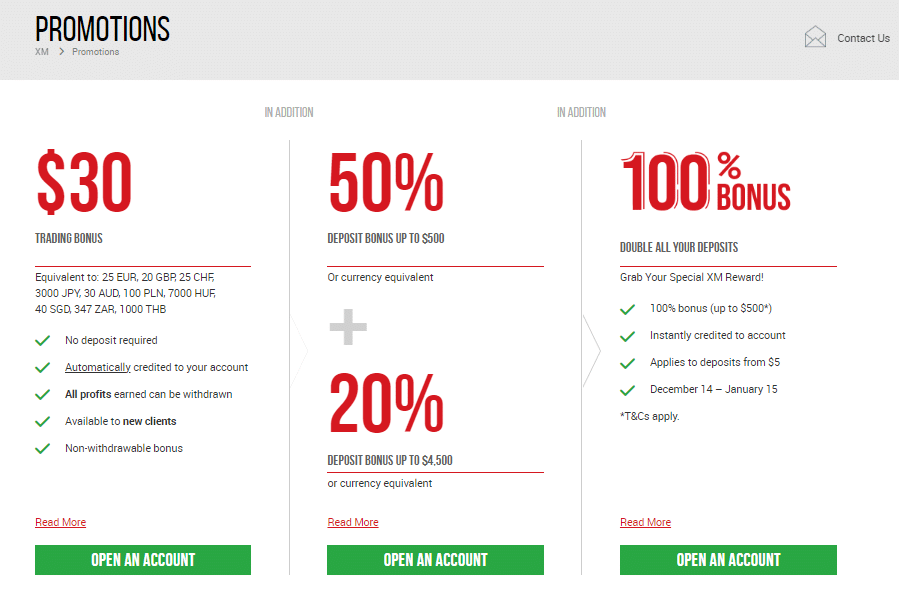

1. XM

Overview

If you join up with XM Broker from their official website, you will get a $30 /405 BWP “No-Deposit-Bonus.” As a well-known broker, XM is a reliable option. Simple registration and account verification are all required to get XM Broker’s $30 / 405 BWP No-Deposit Bonus.

Min Deposit

USD 5 / 67 BWP

Regulators

IFSC, CySec, ASIC

Trading Desk

Desktop MT4 and MT5, Mobile MT4 and MT5, XM mobile app, Web platform

Total Pairs

57

Islamic Account

Yes

Trading Fees

No (Just spread)

Account Activation Time

24 Hours

You may begin trading immediately with this bonus if you have access to the MT4 or MT5 platforms. With this account, you can easily engage in live trading on MT4 or MT5 without making any further deposits.

It is important to note that the bonus itself cannot be cashed out, only the profits produced from it, subject to specific volume requirements and other restrictions and conditions.

Unique Features

| Feature | Information |

| ⚖️ Regulation | FSCA, IFSC |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | $5 / 67 BWP |

| Average spread from | 0.0 pips EUR/USD |

| 📈 Maximum Leverage | 1:1000 |

| 👥 Customer Support | 24/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Negative balance protection is applied to retail investor accounts | US clients are restricted from accessing XM’s trading services |

| There are several secure payment methods to choose from | There are no fixed spread accounts offered |

| The broker is known for low spreads, low commissions, and reliable trade execution speeds | There is an inactivity fee applied to dormant accounts |

| Traders can use hedging, scalping, and expert advisor trading strategies | |

| The broker offers personal customer service to its clients |

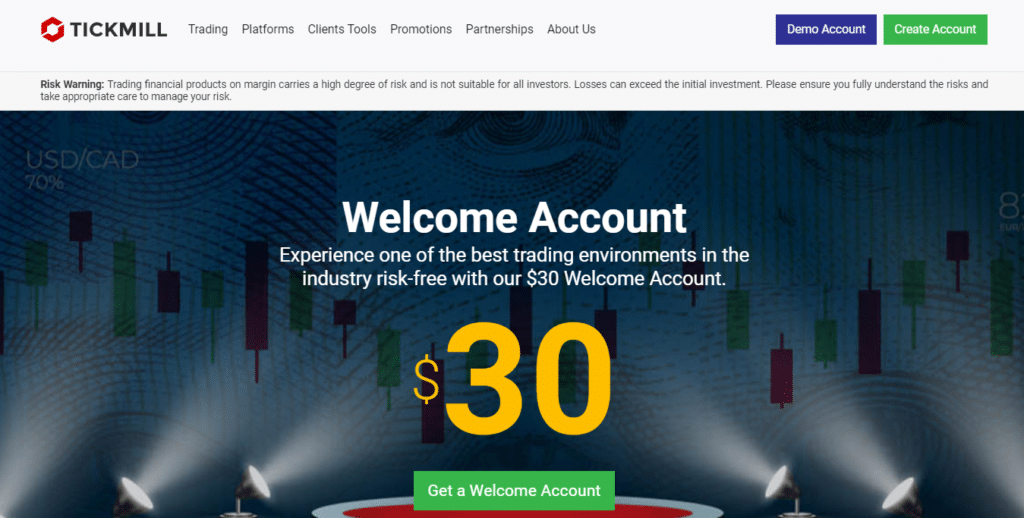

2. Tickmill

Overview

The Tickmill No-Deposit Bonus is a promotional offer provided by Tickmill, a forex and CFD broker, to attract new traders to their platform. This bonus typically allows traders to start trading without making an initial deposit of their own funds. Instead, Tickmill provides a certain amount of bonus funds to the trader’s account upon successful registration. This bonus can be used to trade in the financial markets, giving traders an opportunity to experience real trading conditions and potentially generate profits without risking their own money.

Min Deposit

$100 / 1 343 BWP

Regulators

CySEC, FCA, FSA, FSCA, Labuan FSA

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

62

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

However, it’s important to note that such no-deposit bonuses often come with terms and conditions, including trading volume requirements and withdrawal restrictions, which traders must fulfill before being able to withdraw any profits generated from the bonus. Traders interested in the Tickmill No-Deposit Bonus or similar offers should carefully review the terms and consider how it aligns with their trading goals and strategies.

Unique Features

| Feature | Information |

| ⚖️ Regulation | FSA, FCA, CySEC, Labuan FSA, FSCA |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | $100 / 1 343 BWP |

| 📈 Average spread from | 0.0 pips EUR/USD |

| 📈 Maximum Leverage | 1:500 |

| 👥 Customer Support | 24/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The trading platforms are robust and user-friendly | United States Clients cannot register with Tickmill |

| There are three dynamic Tickmill accounts offered, featuring competitive spreads and a commission-free classic account | There are no fixed spread accounts offered |

| Tickmill is well regulated in several regions with a proven track record of excellent trading services | Currency conversion fees may be deducted |

| There are flexible funding options provided including Skrill, Neteller, bank wire transfer, and others | The spreads are not the tightest |

| Traders are given access to AutoChartist, VPS, and FIX API trading | |

| There are industry standard initial deposits required to register an account | |

| There is a commission-free trading account offered and the minimum balance amounts are reasonable | |

| Negative balance protection is applied to retail accounts | |

| There is no deposit fee or withdrawal fee charged | |

| Educational videos and other educational resources are available | |

| Retail traders have access to several tools to help them navigate complex instruments | |

| Social trading opportunities are provided |

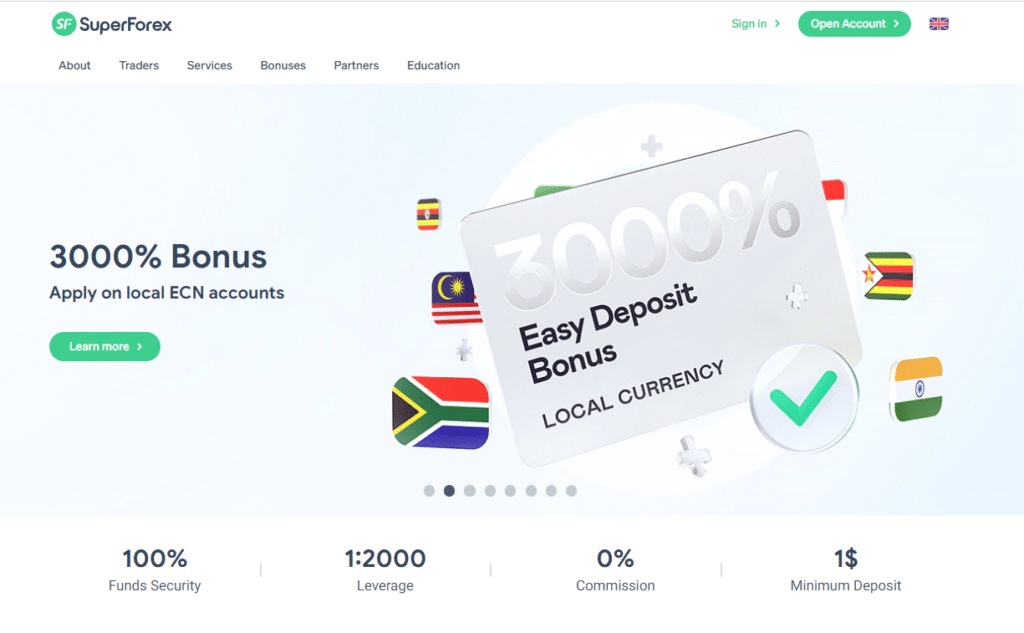

3. SuperForex

Overview

SuperForex was founded in 2013 to make currency exchange more accessible to the public. Although the broker’s headquarters are in Belize (Central America), its operations span more than 150 countries.

SuperForex enables residents of Botswana to engage in foreign exchange trading with no necessary starting capital. This is a great chance for prospective clients to assess SuperForex’s services without risking their own money.

Min Deposit

USD 1 / 13 BWP

Regulators

IFSC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

300

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Botswanan traders can receive a $88 bonus with no investment, plus another $99 bonus with only a $10 deposit.

Unique Features

| Feature | Information |

| ⚖️ Regulation | IFSC |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | 13 Botswanan Pula equivalent to $1 |

| Average spread from | Variable spread |

| 📈 Maximum Leverage | 1:1000 |

| 👥 Customer Support | 24/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| SuperForex offers user-friendly trading software | US clients are restricted from registering with SuperForex |

| There is a low minimum deposit requirement | |

| Traders have access to wide range of training resources | |

| SuperForex offers a range of useful trading tools | |

| There are social trading opportunities provided |

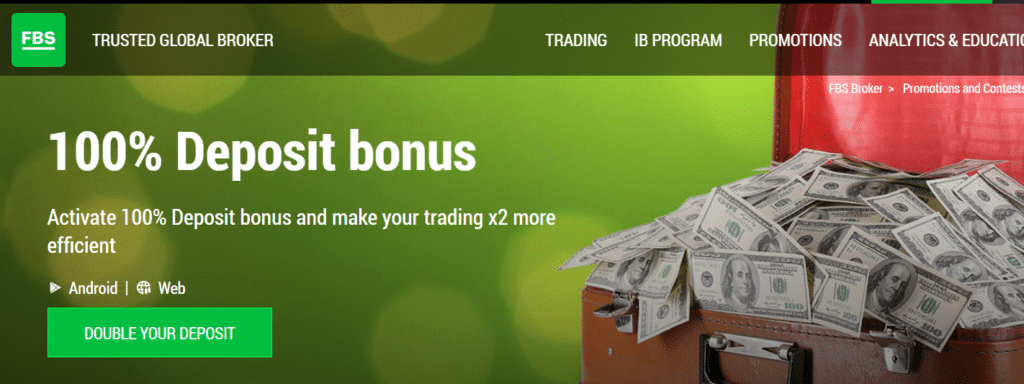

4. FBS

Overview

FBS is a globally recognized and well-regulated broker. With FBS, traders can trade foreign exchange (Forex), metals, commodities, indices, stocks, and more than 35 digital assets.

In addition to its FBS Trader App, FBS provides complete support for the trading platforms MetaTrader 4 and MetaTrader 5.

Additionally, Botswanans who trade more than three lots each month are entitled to a free virtual private server and the copy trading platform provided by FBS.

There are three types of no-deposit promotions offered by FBS. First, FBS makes it possible for novice traders to get some expertise without putting their own money on the line by providing a Level Up Bonus Account funded with 70 USD.

Min Deposit

USD 5 / 67 BWP

Regulators

IFSC, FSCA (South Africa), ASIC, CySEC

Trading Desk

MetaTrader 4, MetaTrader 5, FBS Trader – all in one mobile trading platform.

Crypto

Yes

Total Pairs

250

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

In addition, if you follow the guidelines that FBS gives, there is a possibility that you may be qualified to get a free $140 bonus without having to make a deposit first.

Furthermore, Botswanans can qualify for a Quick-Start bonus of $100 / 1350 BWP when they sign up for an account on the FBS Trader.

The Quick Start Bonus helps traders get started in trading forex through a 7-step program that will teach traders about the risks involved with trading.

Traders get the trading credit to explore the FBS trader app and live market conditions, allowing them to make their first profits risk-free.

Another benefit is that the FBS no-deposit bonus may be withdrawn if certain conditions have been met. However, until those requirements have been met, the bonus can only be used as trade credit for trading activities.

Unique Features

| Feature | Information |

| ⚖️ Regulation | IFSC, CySEC |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | USD 5 / 96 Pula |

| 📊 Average spread from | 0.0 pips EUR/USD |

| 📈 Maximum Leverage | 1:3000 |

| 👥 Customer Support | 24/7 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| There is a very low minimum deposit required | Several regions are restricted from service |

| FBS is an online broker with regulation through IFSC and the Cyprus Securities and Exchange Commission | The spreads on some accounts are very high |

| There is a choice between investor accounts | Inactivity fees apply to dormant accounts |

| Traders have access to fast, flexible payment methods | The demo account expires after 40 days |

| The trading conditions are favourable and competitive | Withdrawal fees and deposit fees are charged |

| There are demo accounts and Islamic Accounts | There is a limited selection of funding options and there are only two base account currencies |

| Customer service is available 24/7 | Currency conversion fees are charged on deposits made in currencies other than USD and EUR |

| The broker is reputable and has a high trust score | |

| FBS is an official trading partner that offers a comprehensive affiliate program | |

| There are several bonuses and promotions offered |

5. JustMarkets

Overview

Just Global Markets, a brokerage business based in Seychelles and created in 2012, is the parent company of JustMarkets, founded the same year.

You can choose from seven trading accounts on JustMarkets, each with features and conditions tailored to a certain trader style. In addition, JustMarkets offers Botswanan traders a unique advantage by granting them a Welcome Account loaded with 30 USD.

Min Deposit

USD 10

Regulators

FSA, CySec

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

240

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

All traders must provide a valid cellphone number to qualify for this account. Traders can use this credit to trade at least 5 standard lots (100,000 units of the base currency) within 30 days. In addition, traders must make a profit or loss of at least 6 pips (60 points or 60 USD).

Profits can be transferred from the JustMarkets Welcome Account to either a Standard Cent, Standard, Pro or Raw Spread Account via internal transfer, after which traders can withdraw their profits to a bank account.

Unique Features

| Feature | Information |

| ⚖️ Regulation | Seychelles Financial Services Authority (FSA), Cyprus Securities and Exchange Commission (CySec) |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | $10 / 136 BWP |

| 📊 Average spread from | N/A |

| 📈 Maximum Leverage | 1:3000 |

| 👥 Customer Support | 24/7 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| JustMarkets offers a huge range of deposit methods and withdrawal options including bank wire transfers, bank transfers, Skrill, Neteller, and more | There is a limited choice of trading instruments |

| Demo trading and Islamic Swap-Free Accounts are offered | Inactivity Fees may apply after following several days of dormancy |

| JustMarkets offers mobile trading through powerful mobile trading apps | The broker does not have regulation through a reputable and trusted regulatory body |

| JustMarkets offers competitive cryptocurrency spreads across crypto pairs including Bitcoin, Ethereum, and others | |

| JustMarkets’s non-trading fees are reasonable | |

| The broker offers a risk warning, training webinars, an array of articles and education for inexperienced traders | |

| There is a wide choice between different types of accounts and excellent trading conditions | |

| One-click trading is offered in addition to insights to help Botswanan traders make better trading decisions | |

| Real-time market analysis is offered alongside analysis tools and several other additional tools | |

| Client funds are kept in segregated bank accounts | |

| There are several research and resources that can help traders make improved independent investment decisions | |

| JustMarkets’s account-opening process is quick and easy | |

| JustMarkets offers several innovative features including a range of services | |

| There are several trading account currencies to choose from | |

| There is no fee for withdrawals |

6. HFM

Overview

HF Markets, also known as HotForex, is a well-established online forex and commodities broker that offers trading services to clients worldwide. With a reputation for reliability and innovation in the financial industry, HF Markets provides a range of trading instruments, including forex currency pairs, commodities, indices, stocks, and cryptocurrencies. The broker is known for its user-friendly trading platforms, advanced trading tools, and competitive trading conditions, such as tight spreads and flexible leverage options.

Min Deposit

USD 0

Regulators

CySEC, FCA, DFSA, FSCA, FSA, CMA

Trading Desk

MT4, MT5, HFM APP

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

0

Account Activation Time

24 Hours

HF Markets places a strong emphasis on customer support, offering multilingual assistance, educational resources, and market analysis to help traders make informed decisions. The company’s commitment to transparency is evident through its regulatory status, as it is authorized and regulated by reputable financial authorities. This commitment, coupled with its comprehensive offerings and client-centric approach, has positioned HF Markets as a popular choice among both beginner and experienced traders seeking a reliable platform for their trading activities.

Unique Features

| Features | Information |

| ⚖️ Regulation | FSCA, CySEC, DFSA, FSA, FCA, CMA, and FSC, with registration in ACPR, BaFin, MNB, CONSOB, CNMV, FI, FMA, FSC, and other regions |

| 💸 Minimum Withdrawal Time | – |

| 📈 Maximum Withdrawal Time | 2 to 4 working days |

| 💰 Instant Deposits/Withdrawals? | Yes, deposits |

| 💳 BWP-Denominated Account? | No |

| 📱 Minimum Deposit Amount | $0 / 0 BWP |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| HFM is well-regulated and features registrations from several countries worldwide, which adds to its reputation and trustworthiness | HFM’s spreads are wide on entry-level accounts |

| HFM’s overall reputation and reach are unparalleled | HFM does not support a large array of deposit and withdrawal options |

| The HFM brand has won over 60 accolades in its field throughout the years | Botswanans pay currency conversion fee as there is no BWP-denominated trading account |

| HFM’s demo accounts for MT4 and MT5 are unrestricted | |

| Botswanan Muslim traders who prefer Islamic accounts can make the switch at any time | |

| Botswanans can choose an account that suits their trading strategy and experience level the best | |

| Traders have access to a plethora of learning materials and innovative trading platforms | |

| The versatility of the trading platforms means that more people in Botswana can make use of them, even if they do not have previous trading experience | |

| Botswanans pay an extremely low minimum deposit of 65 BWP, and the market circumstances are favourable for trading |

7. Instaforex

Overview

Instaforex delivers the solution from the world’s leading developers, allowing Botswanans to trade with the best counteragents offering direct market access. Foreign exchange trading platform InstaForex is headquartered in Limassol, Cyprus. In 2007, the business first opened for business.

However, InstaForex is used by over 7 million traders, making it a worldwide platform. InstaForex’s overarching mission is to serve traders honestly and respectfully while offering numerous services.

This broker provides a full suite of educational and support materials, in addition to its great technical solutions and some of the best market trading conditions. The No-Deposit Bonus from InstaForex is an excellent chance to begin Forex trading.

This is your entry point to the world’s biggest and most liquid market, which has become many traders’ primary source of reliable income.

With a $1,000 incentive, you can assess our unrivaled order execution quality in actual trading situations with no risk or personal investment. The bonus is promptly paid upon request and is immediately accessible for trade.

Min Deposit

USD 1

Regulators

CySEC, FSC

Trading Desk

MetaTrader 4

MetaTrader 5

MultiTerminal

WebTrader

Crypto

Yes

Total Pairs

100

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Botswanans must note that the following bonus terms and conditions apply:

- The Instaforex Startup Bonus requires no initial funding from the trader. This offer is available to all new customers that sign up with the Company.

- The Client must provide their identification information when establishing the account to which the Instaforex Startup Bonus will be awarded.

- After the Bonus has been awarded, all changes made to the Full Name field will be invalid.

- You cannot cash out the bonus money. However, profit from trading the bonus money is, nevertheless, withdrawable subject to the provisions of Instaforex’s bonus agreement.

- This Instaforex Welcome Bonus is for Clients who are just getting started with Forex trading. When Botswanans deposit funds into the account, the Bonus is immediately nullified.

- Suppose the Client does not deposit into the account credited with the Instaforex Startup Bonus within 7 days of receiving the Bonus. In that case, the Client acknowledges that the account will be turned into a demo account.

- The Instaforex Startup Bonus and any profits made while trading with the Bonus funds are treated as virtual money once the first trading period has ended.

- If the Client reloads an account that was first funded with an InstaForex Startup Bonus, the bonus amount will increase to 100% of the Client’s initial deposit.

- As an added incentive, if the client achieves a profit of 10% trading their Instaforex Startup Bonus and makes their first deposit within 7 days of receiving the Bonus, they will get a 110% bonus on their first investment.

Unique Features

| Feature | Information |

| ⚖️ Regulation | FSC, BVI, SIBA |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | Botswanan Pula ($1 / 13 BWP ) |

| Average spread from | 0.0 pips EUR/USD |

| 📈 Maximum Leverage | 1:1000 |

| 👥 Customer Support | 24/7 |

Pros and Cons

| ✔️ Pros | ❌ Cons | |||

| The broker offers commission-free trading | There are restrictions on leverage for European Union clients | |||

| MetaTrader 4 and 5 are both offered, available across devices | US clients are not accepted | |||

| The broker is well-regulated and offers competitive trading conditions | ||||

| There is a choice between retail investor accounts, each suited to different types of traders | ||||

| There is a wide range of tradable assets offered |

8. freshforex

Overview

FreshForex, run by Riston Capital Ltd, is a Saint Vincent and the Grenadines-based offshore brokerage founded in 2004. FreshForex is a forex broker that offers Forex and CFD trading through many account types and the MT4 trading platform.

Bonuses, demo accounts, leverage, and deposits are discussed in this study. FreshForex provides each new customer with $2021 for fully-fledged Forex trading. Free bonus monies are credited immediately after account registration, and no personal information verification is required.

Min Deposit

USD 0

Regulators

CRFIN

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

50+

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

This special incentive requires no personal investment and yields cashable profits. In addition, Botswanans can follow these steps to withdraw their FreshForex No-Deposit Bonus:

- Save the earned profit by filling the Forex trading account with a sum equal to or more than the obtained profit within seven days of receiving the bonus.

- Complete 1 lot for every $5 of earnings saved within 30 days.

- Contact firm management using the Client Area feedback form to transfer earnings to Balance.

- Withdraw the earnings gained with the assistance of the bonus or invest it.

Unique Features

| Feature | Information |

| ⚖️ Regulation | N/A |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | 0 Botswanan Pula |

| Average spread from | 0.0 pips EUR/USD |

| 📈 Maximum Leverage | 1:2000 |

| 👥 Customer Support | 24/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The broker offers both variable and fixed spreads | Unregulated and offshore broker |

| There is no minimum deposit requirement | There are several regions restricted from accessing SuperForex’s services |

| There are daily analysis tools and trading signals available | Spreads are marked-up |

| VPS access is provided to eligible clients | There is a limited selection of markets offered |

| There are several flexible account types to choose from |

9. ForexChief

Overview

ForexChief offers a variety of assets on trusted and user-friendly MetaTrader platforms to facilitate online trading in Forex and CFDs. In addition, the broker supports several trading techniques, account payment mechanisms, and account types for all trading strategies.

ForexChief is a certified securities dealer to deliver high-quality, low-cost Forex and CFD trading services through the Internet. It was founded in 2014, and its headquarters are in Vanuatu, with additional representative offices in Switzerland, Singapore, and Nigeria.

ForexChief offers a free 100 USD bonus. It is the ideal approach to evaluate the company’s offerings and your selected trading technique. The No-Deposit-Bonus will be instantly granted inside the ForexChief mobile application upon completing account Verification.

Min Deposit

$0

Regulators

VFSC

Trading Desk

MetaTrader 4, MetaTrader 5, Mobile Trading

Crypto

Yes

Total Pairs

40

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Botswanans must note that the following terms and conditions apply:

- To get the $100 No-Deposit Bonus, you must open an MT4.DirectFX, MT4.Classic+, MT5.DirectFX, or MT5.Classic+ account.

- Install the ForexChief application from Google Play or Huawei AppGallery and finish the internal verification process.

- The No-Deposit-Bonus may only be claimed inside the application when the customer has been properly verified.

- Maximum Profit, which may be withdrawn after meeting turnover requirements, is $100. When withdrawing the Profit for the first time, all monies, including the Bonus, will be deducted from the account.

- The MT4/MT5 account with the No-Deposit-Bonus is a standard trading account that may be refilled without limitation. On the contrary, only your cash may be withdrawn from the account if the Bonus is active (meaning the requisite turnover has not been met).

- The MT4/MT5 account with the No-Deposit-Bonus is a standard trading account that may be refilled without limitation. On the contrary, only your cash may be withdrawn from the account if the Bonus is active (meaning the requisite turnover has not been met).

Unique Features

| Feature | Information |

| ⚖️ Regulation | Dealer in Securities (Principal’s License) issued by VFSC |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | $0 |

| Average spread from | from 0.9 pips EUR/USD |

| 📈 Maximum Leverage | 1:500 |

| 👥 Customer Support | 24/7 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Traders need not deposit funds into an account to start trading. | No trading credits (analog of bonus for depositing) on МТ5 |

| The 100 USD is automatically credited to the ForexChief app once account verification is completed. | No swap-free trading for cent accounts |

| ForexChief does not restrict traders in terms of trading strategies or trading robots. | No welcome bonuses on opening cent accounts |

| Once traders have achieved the required trading volume, they can withdraw their 100 USD. | |

| The no-deposit bonus does not expire. |

10. Admiral Markets

Overview

Admirals, also known as Admiral Markets, offers access to Trading Security, a large selection of Financial Instruments, First Class Trading Conditions, and trusted customer support. Admiral Markets is a leading online trading service provider with a wide-reaching global presence.

Min Deposit

339 BWP or an equivalent of $25

Regulators

FCA, ASIC, CySEC, EFSA, JSC

Trading Desk

MT4, MT5, Admirals Mobile App

Crypto

Yes

Total Pairs

35 Forex Currency Pairs

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Admiral Markets makes a $100 No Deposit Bonus available across the Trade.MT5, Trade.MT4, Zero.MT5, and Zero.MT4 account options. Interested parties can simply register with one of the accounts on offer in order for the bonus to be received.

Unique Features

| Feature | Information |

| ⚖️ Regulation | MiFID |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | 339 Botswanan Pula equivalent to $25 |

| Average spread from | 0.5 |

| 📈 Maximum Leverage | 1:30 |

| 👥 Customer Support | 24/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Multiple account choices | There is an inactivity fee charged |

| Admirals offer commission-free options | There are deposit and withdrawal fees charged |

| There are user-friendly platforms available across devices | Admin fees charged on the Islamic account |

| There is a wide range of tradable markets, complex instruments, and leveraged products | There is only one account type that can be converted to an Islamic Account |

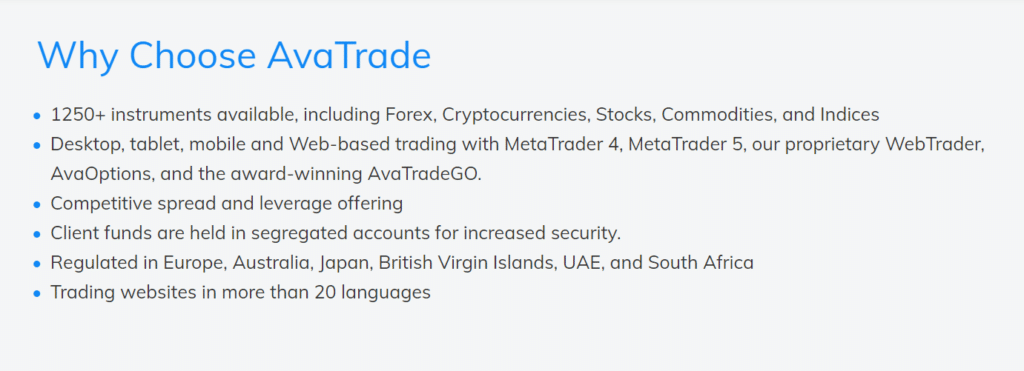

11.AvaTrade

Overview

According to Country Specific Data, users in Botswana account for roughly 0.72% of user Traffic on the AvaTrade Website.

Avatrade is considered a low-risk and can be summarized as a trustworthy forex broker. Regarding spread and security, Avatrade guarantees fast trading speeds and secure trading conditions. In terms of users, Avatrade has more than 500 000 registered clients globally.

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

AvaTrade is a leading Forex and CFD broker committed to its core values of integrity, innovation, and empowering investors to trade with confidence.

AvaTrade does offer a sign-up bonus. A minimum of $200 has to be deposited to earn a deposit bonus of $40.

Unique Features

| Feature | Information |

| ⚖️ Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, FRSA, CySEC, ISA |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Retail Investor Account, Professional Account Option |

| 📊 Trading Platform | AvaTradeGO, AvaOptions, AvaSocial, MetaTrader 4, MetaTrader 5, DupliTrade, ZuluTrade |

| 💰 Minimum Deposit (BWP) | $100 / 1343 BWP |

| 💰 Trading Assets | Foreign currencies, Cryptocurrencies, Commodities, Treasuries, Bonds, Indices, Stocks, ETFs, Options, CFDs, Precious Metals |

| 🔎 Botswanan Pula-based Account? | No |

| 💳 BWP Deposits Allowed? | No |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 0.9 pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| AvaTrade is multi-regulated and one of the most trusted online trading brokers in the world | Variable spreads are not offered |

| There is a wide range of financial instruments that can be traded across financial markets | There is a limited choice between account types |

| There are several technical indicators, economic indicators, and other solutions for advanced traders | Inactivity fees are applied |

| There are several trading platforms to choose from | Currency conversion fees may be applied |

| There is a decent selection of educational material that helps beginner traders navigate complex instruments and lower the degree of risk they are often exposed to | There is a limited number of base currency options offered on accounts |

| There is a multitude of social trading opportunities offered | |

| The broker accepts any trading strategy including automated trading, expert advisors, scalping, hedging, and others. |

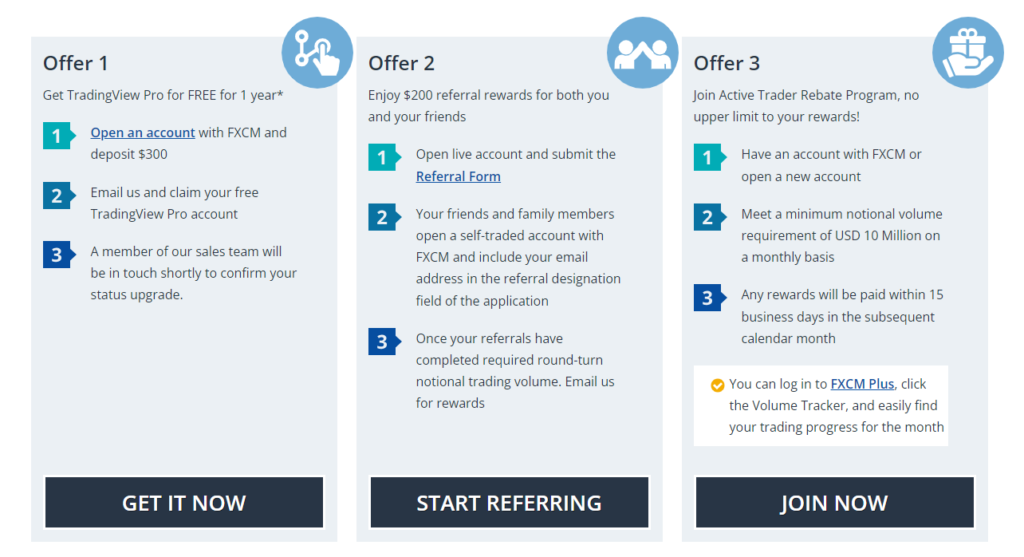

12.FXCM

Overview

FXCM is a well-established broker that offers trading facilities on shares, stock indices, forex, commodities, and cryptos to a global market. FXCM has offices in multiple global locations, including Berlin and Sydney. More than 130’000 customer accounts are registered worldwide.

Min Deposit

USD 50 / 672 BWP

Regulators

FCA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

–

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

FXCM does offer both a Sign-Up / Welcome bonus of $25 USD plus a Deposit Bonus of up to $300 USD respectively. A Trader has to deposit a minimum of $50 USD to earn a deposit of up to $300 USD.

Unique Features

| Features | Information |

| ⚖️ Regulation | FCA, ASIC, CySEC, FSCA |

| 💸 Minimum Withdrawal Time | – |

| 📈 Maximum Withdrawal Time | 2 to 4 working days |

| 💰 Instant Deposits/Withdrawals? | Yes, deposits |

| 💳 BWP-Denominated Account? | No |

| 📱 Minimum Deposit Amount | USD 50 / 672 BWP |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| FXCM supports both CFD and forex trading and offers several trading options | There are high commission charges |

| Botswanans can access leverage up to 1:400 | An inactivity fee and currency conversion fee are charged |

| Several asset classes can be traded | There is a limited choice between retail accounts |

| FXCM offers several trading platforms and trading tools that Botswanans can use to their advantage | Does not support MT5 |

| There are competitive spreads on the CFD account | There is no option to register an account denominated in BWP |

| There is a demo and Islamic account | Withdrawal fees apply |

| FXCM is well-regulated by four reputable entities | The Islamic Account faces additional fees |

| Client fund security and investor protection are guaranteed |

13. FXGiants

Overview

Notesco UK Limited, doing business as FXGiants, is a company with its headquarters in London and is authorized and regulated by the Financial Conduct Authority (FCA). Trading as Notesco Pty Ltd, a company authorized by the Australian Securities and Investments Commission (ASIC).

FXGiants is a fictitious company called Notesco SVG Limited. Traders must use the office associated with their country of registration. FXGiants BM serves traders from more than 150 countries across the world.

After signing up, traders can access the Hub, FXGiants’ client site. After logging in, customers may engage in financial market transactions utilizing the platform’s unified interface.

Min Deposit

USD 100 / 1360 BWP

Regulators

FCA, ASIC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

70

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

FXGiants offers two no-deposit bonuses as follows:

- Email Verification bonus gives traders a 10 USD credit bonus.

- The phone Verification bonus provides a 15 USD credit bonus.

- Botswanan traders who are interested in these bouses must note the following terms and conditions:

- The no-deposit bonus runs from January to December 2024.

- Traders must register either FXGiants Live Floating or Live Fixed Spread Accounts.

- The no-deposit bonus will not be credited if the account is already associated with another bonus.

- Traders with an account funded via an Introducing Broker are not eligible for the bonus.

- The no-deposit bonus is only credited to a verified trading account.

- FXGiants can terminate any client profile when traders create multiple new accounts with the same IP to exploit or misuse the no-deposit bonus.

Unique Features

| Feature | Information |

| ⚖️ Regulation | FCA, ASIC |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | $100 / 1356 BWP |

| Average spread from | 1.0 pips |

| 📈 Maximum Leverage | up to 1:1000 |

| 👥 Customer Support | 24/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The broker is regulated by respected financial authorities | FXGiants might have a limited selection of cryptocurrencies available for trading |

| FXGiants offers competitive leverage | Some traders may find that FXGiants charges withdrawal fees or imposes certain conditions on withdrawals, |

| Offers traders user-friendly interfaces, advanced charting tools, and automated trading capabilities. | FXGiants might impose inactivity fees on accounts that remain dormant for a certain period |

| FXGiants provides educational materials such as webinars, tutorials, and market analysis | The broker’s spreads can be variable, meaning they might widen during periods of high market volatility |

| The broker offers responsive customer support |

14. Windsor Brokers

Overview

Windsor Brokers has been around since 1988, making them a major player in the CFDs and forex trading markets. Any trader using this online platform can be certain that they will get first-rate brokerage assistance while dealing in foreign currency.

While it has been active in the financial markets since 1988, the firm just started using its current FX business strategy in 2005. For those looking for a reliable FX and CFD trading platform that also serves institutional investors, Windsor Brokers is among the best options.

Windsor Brokers’ tried-and-true business strategy, which places special emphasis on the Middle East, is still strong. Windsor Brokers offers all newly registered traders a 30 USD Free Account to get them started.

Interested traders must register a Prime Account and set the base currency to USD, EUR, GBP, or JPY.

Min Deposit

50 USD / 682 BWP

Regulators

CYSEC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Botswanan traders who are eligible for the Windsor Brokers 30 USD no-deposit bonus must note that the following terms and conditions apply:

Any amounts credited to your Account by the Company are a type of trade credit that cannot be withdrawn or transferred and expires six months from the date the credit was issued.

Withdrawals from the Client’s Account are permitted after the Client’s closed lots have reached 0.5 and the Client’s total number of deals has reached 10.

Trading credits will be canceled without notice if a withdrawal request is received that violates the terms outlined above.

The awarded amount will be nullified if the Account is dormant for 30 days or longer within the 6-month validity period.

Should the Account be blocked, the credit balance will be paid off.

Unique Features

| Feature | Information |

| ⚖️ Regulation | FSC, CYSEC, JSC, FSA,CMA |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | $50 / 680 BWP |

| Average spread from | from 1.0 pips |

| 📈 Maximum Leverage | 1:1000 |

| 👥 Customer Support | 24/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Windsor Brokers is multi-regulated in several regions | There is only one account that can be converted into an Islamic Account |

| The broker offers several markets that can be traded via MetaTrader 4 | Withdrawal fees apply to several payment methods |

| Multilingual customer support is available | Botswanans face currency conversion fees on BWP deposits and withdrawals |

| Windsor Brokers offers several educational materials | |

| Expert Market Analysis is available on the platform | |

| Windsor Brokers has a transparent fee schedule across all accounts and subsequent financial markets | |

| Windsor Brokers has been in operation for more than 30 years, proving that it has been battle-tested and that it is trusted |

How to Choose the Right Forex Broker in Botswana

Botswanan traders must evaluate the following components of a forex broker to decide whether the broker is suited to their unique trading objectives or needs.

Regulations and Licenses

This is the first vital component that Botswanan traders must thoroughly evaluate. Reputable brokers are regulated by market regulators such as FCA, ASIC, CySEC, FSCA, and others.

Botswanans must beware when dealing with brokers with only offshore regulations such as FSA, SVG BVI, FSC, and others.

Account Features

Account Features include leverage trading and margin requirement, commissions and spreads, initial deposit, additional features on retail investor accounts, and so on.

Deposits and Withdrawals

Botswanans must evaluate the payment options available, the processing times on withdrawal requests, deposit currencies offered, the withdrawal fee, deposit fees, and minimum withdrawal limits, among other trading and non-trading fees.

Range of Markets

The range of markets offered refers to the number and range of tradable instruments the broker offers. Therefore, Botswanans must consider what they wish to trade and what is available.

Customer Support

Customer Support is another crucial factor. Botswanans must check the availability of support (trading hours), the quality of support, and the promptness with which the customer support team responds to queries.

Trading Platform

A trading platform is the Botswanan trader’s portal to the financial markets. Therefore, traders must ensure that the trading platform has the necessary technical indicators, fundamental analysis, technical analysis, economic calendar, charting, newsfeed, and other tools they may need.

Education and Research

Education and Research come in handy to both novice traders and experienced investors. Education includes some of the following:

- eBooks

- Trading guides

- Trading knowledge on leveraged products

- A risk warning on complex instruments

- Educational videos

- Research can include some of the following:

- Trading tools

- Commentary

- Status of International Markets

- Price movements

- Market sentiments

- Whether there is a volatile market

- Exchange Rates

Expert opinions and other resources can help experienced traders make informed trading decisions.

How Does a No Deposit Forex Bonus Work?

A No Deposit Forex Bonus is a promotional offering provided by some forex brokers to attract new clients. This might involve providing personal information and verifying your identity.

Bonus Credit:

Once your account is verified, the broker will credit a specific bonus amount to your trading account. This bonus is essentially “free” trading capital that you can use to place trades.

Trading:

You can use the bonus funds to trade in the forex market just like you would with your own money. This provides an opportunity to experience real trading conditions and strategies without risking your own funds.

Profit Generation:

Any profits you make from trading with the bonus funds can be withdrawn, subject to certain terms and conditions set by the broker. Some brokers allow you to withdraw a portion of the profits, while others require you to meet specific trading volume requirements.

Terms and Conditions:

No Deposit Forex Bonuses come with terms and conditions that you need to follow. These conditions can include minimum trading volumes, time limits, and withdrawal restrictions. Be sure to read and understand these terms before accepting the bonus.

Verification and Withdrawal:

To withdraw profits generated from the bonus, you may need to fulfill certain requirements, such as verifying your identity and making a deposit of your own funds. This is often done to ensure the legitimacy of the account and prevent fraudulent activities.

Risks and Restrictions:

While a No Deposit Forex Bonus provides an opportunity to trade without making an initial deposit, it’s important to be aware that trading carries risks, and not all profits made are guaranteed to be withdrawable. Additionally, some brokers might limit the instruments you can trade or impose restrictions on certain trading strategies.

How to compare forex trading brokers against each other to find the best no-deposit bonus?

Comparing forex trading brokers to find the best no-deposit bonus involves thorough research and consideration of various factors. Here’s a step-by-step guide to help you make an informed decision:

Research:

Start by researching different forex brokers that offer no-deposit bonuses. Look for reputable brokers with a track record of reliability, regulation, and positive customer feedback.

Regulation:

Ensure the broker is regulated by a reputable financial authority.

Bonus Amount:

Compare the bonus amounts offered by different brokers. Keep in mind that a higher bonus amount doesn’t necessarily mean it’s the best option, as it might come with stricter terms.

Eligibility:

Check if you are eligible for the no-deposit bonus based on your location and trading experience. Some brokers might restrict bonuses to certain countries or only offer them to new traders.

Trading Instruments:

Consider the range of trading instruments available for use with the no-deposit bonus. If you’re interested in trading specific assets like forex pairs, cryptocurrencies, or commodities, ensure the broker offers those options.

Trading Platforms:

Evaluate the trading platforms provided by the broker. Popular platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5) are user-friendly and offer various trading tools.

Customer Support:

Look into the broker’s customer support quality and availability. You’ll want responsive and knowledgeable support in case you have questions or issues.

Educational Resources:

Assess the broker’s educational resources, such as webinars, tutorials, and market analysis. A broker that provides educational content can help you improve your trading skills.

Reviews and Reputation:

Read reviews from other traders to get insights into their experiences with the broker and its no-deposit bonus. However, be cautious of biased or overly negative reviews.

Withdrawal Process:

Understand the withdrawal process for the profits generated from the no-deposit bonus. Ensure it’s transparent, straightforward, and aligns with your preferences.

Overall Package:

Consider the no-deposit bonus as part of the broker’s overall package. A good bonus should be complemented by other important factors like trading conditions, reliability, and customer support.

The Best Forex Brokers in Botswana

In this article, we have listed the best brokers that offer forex trading to traders in Botswana. In addition, we have further identified the brokers that offer additional services and solutions to Botswanan traders.

Best MetaTrader 4 / MT4 Forex Broker in Botswana

Min Deposit

USD 25

Regulators

FCA UK

Trading Platform

MT5, MT4, OctaTrader

Crypto

Yes

Total Pairs

28

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, OctaFX is the best MT4 forex broker in Botswana. OctaFX is an MT4 and MT5 broker that provides Botswanans with various markets. OctaFX offers a choice of accounts via MT4, including ECN and STP accounts, with superior trade execution.

Best MetaTrader 5 / MT5 Forex Broker in Botswana

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, AvaTrade is the best MetaTrader 5 forex broker in Botswana. In addition, AvaTrade is regarded as one of the most secure MT5 forex brokers.

No commission is charged for trading currency pairings, only leaving the spread to be paid. A demo account is also available for traders to sharpen their abilities via MT5 and several other platforms.

Best Forex Broker for beginners in Botswana

Min Deposit

$100

Regulators

CFT, NFA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FOREX.com is the best forex broker for beginners in Botswana. FOREX.com is a broker renowned for low trading fees and beginner-friendly solutions. In addition, FOREX.com offers several educational materials and a helpful demo account.

Best Low Minimum Deposit Forex Broker in Botswana

Min Deposit

$10 / 134 BWP

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Exness is the best Low Minimum Deposit Forex Broker in Botswana. Exness has a minimum deposit requirement of 10 USD / 130 BWP, making it easy for Botswanans to start trading 278 instruments.

Exness also offers MT4 and MT5 through which trades can be made. In addition, it offers some of the best trading tools, charting capabilities, technical indicators, expert advisors, and more.

Best ECN Forex Broker in Botswana

Min Deposit

USD 0

Regulators

CySEC, FCA, DFSA, FSCA, FSA, CMA

Trading Desk

MT4, MT5, HFM APP

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

0

Account Activation Time

24 Hours

Overall, HFM is the best ECN forex broker in Botswana. HFM is a hybrid forex and CFD broker that uses STP and ECN technology to ensure that Botswanans get the best pricing, minimal slippage, no requotes, and the fastest trade execution.

HFM uses the best liquidity providers who aggregate the pricing that Botswanans can see on MT4, MT5, and the HF App for Android and iOS.

Best Islamic / Swap-Free Forex Broker in Botswana

Min Deposit

USD 10 / 136 BWP

Regulators

CySec, FCA

Trading Desk

None

Crypto

Yes

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, eToro is the best Islamic / Swap-Free forex broker in Botswana. eToro is a renowned social trading platform that offers Muslim traders an Islamic Account.

eToro does not charge any interest on positions held for over 24 hours. However, registering an Islamic Account can be expensive initially, requiring a 1,000 USD / 13,400 BWP deposit.

Best Forex Trading App in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

ASIC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

300

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, CMC Markets is the best forex trading app in Botswana. In addition, CMC Markets offers a user-friendly mobile app with research tools, powerful charts, customizable watch lists, news reports, and a range of educational materials.

Best Lowest Spread Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

FCA, CySEC, IFSC, KNF

Trading Desk

No Trading Desk

Crypto

Yes

Total Pairs

48

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, XTB is the best lowest-spread forex broker in Botswana. XTB is a well-known forex and CFD broker with low and competitive forex spreads from 0.1 pips depending on the financial instrument and the market conditions.

XTB is also a good broker in terms of educational materials and research capabilities, providing traders with comprehensive market analysis across markets.

Best Nasdaq 100 Forex Broker in Botswana

Min Deposit

USD 10

Regulators

CySec, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

60

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXTM is the best Nasdaq 100 forex broker in Botswana. FXTM is a multi-regulated forex and CFD broker that accommodates Botswanan traders with a keen interest in Nasdaq. Traders can expect low and competitive spreads, a choice between accounts, and powerful trading platforms.

Best Volatility 75 / VIX 75 Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

IGRs

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, IG is Botswana’s best Volatility 75 / VIX 75 forex broker. IG is one of the best CFD brokers with powerful proprietary trading technology.

IG is well-regulated and offers Botswanans access to VIX75, with spreads from 0.04 pips / 0.13% and zero commission charges.

Best NDD Forex Broker in Botswana

Min Deposit

USD 50 / 672 BWP

Regulators

FCA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

–

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXCM is the best NDD forex broker in Botswana. FXCM is a No-Dealing Desk broker with STP and ECN execution across several markets.

In addition, FXCM offers a choice between third-party platforms in addition to technical indicators, charting tools, and competitive trading conditions.

Best STP Forex Broker in Botswana

Min Deposit

USD 10

Regulators

IFSC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

36

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, RoboForex is the best STP forex broker in Botswana. RoboForex is popular forex and CFD broker with competitive trading conditions. RoboForex offers STP execution with liquidity sourced from top providers.

Botswanans can expect access to over 12,000 instruments via powerful and innovative third-party platforms.

Best Sign-up Bonus Broker in Botswana

Min Deposit

50 USD / 682 BWP

Regulators

CYSEC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Windsor Brokers is the best sign-up bonus broker in Botswana. Windsor Brokers is a well-regulated broker that offers Botswanans a welcome account funded with 30 USD in trading credit. With this account, Botswanans can explore the platform or risk-free test their strategies.

Conclusion

No-deposit forex bonuses meet traders’ demands, including novice and seasoned traders. Beginners may study the tactics on the platform of intermediary operations with the aid of the no-deposit bonus.

However, before signing up with a Forex No-Deposit Broker, Botswanans must ensure that they are dealing with a legit and trusted entity to avoid the risk of loss when they deposit funds eventually.

You might also like: Best Forex Brokers in Botswana

You might also like: Best Brokers with Minimum $1 Deposit in Botswana

You might also like: Best cTrader Brokers in Botswana

You might also like: Best High Leverage Forex Brokers in Botswana

You might also like: Best Low Minimum Deposit Brokers in Botswana

Frequently Asked Questions

Can Botswanans trade Forex without a deposit?

Traders can get a free head start in forex trading thanks to the no-deposit incentives provided by several brokers.

These incentives are designed for traders who like to experiment with different strategies in a risk-free setting before committing any real money.

How can I find a good no-deposit forex broker in Botswana?

Traders can use demo accounts, evaluate forex broker reviews, visit forex forums, and conduct Google searches to find the best no-deposit forex brokers.

Is Forex a good place to start for beginners?

Forex has a low entry barrier because it is the largest financial market. However, trading forex may be a challenging endeavour that is not a good fit for everyone.

Whether foreign exchange (FX) is a suitable choice for you depends on your current financial situation, your long-term objectives, and your level of investment expertise. Since many forex traders lose money, prudence is essential for newcomers.

How can I withdraw my withdrawal bonus in Botswana?

To become eligible for withdrawal, you must fulfil the trading volume requirements set out by your broker in their bonus terms and conditions.

Which broker offers a sign-up bonus for first-time traders?

Tickmill, Admiral Markets, InstaForex, SuperForex

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.