10 Best Trading Robots in Botswana

The 10 Best Trading Robots for Auto Traders in Botswana revealed. We tested and verified the forex trading robots for Botswana Traders.

This is a complete list of trading robots for auto traders in Botswana.

In this in-depth guide you’ll learn:

- What is a trading robot?

- How are trading robots used by auto traders?

- Which trading robots are free to use in Botswana?

- Which trading robots operate on the MetaTrader 4/ MT4 or MetaTrader 5 / MT5 platform?

- Our recommended Auto Trader Forex Robots for Beginner Trader?

- How to compare auto trader robots to each other?

And lots more…

So if you’re ready to go “all in” with the best-tested trading robots for auto traders in Botswana…

Let’s dive right in…

- Louis Schoeman

10 Best Forex Brokers in Botswana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

What is a trading robot, and how does it work?

A trading robot is a basic (or complex) computer program that connects to your trading platform, does market analysis using different mathematical methods, and executes trades automatically on your behalf.

Subsequently, all you must do is add them to your trading platform. Trading robots constantly monitor the market, factoring in each new price tick to determine whether a trading opportunity exists.

In other words, once the trading bot’s calculations indicate that it is a good moment to buy or sell a financial instrument, it will tell your trading platform to enter the trade and keep it open until the price indicates that the setup is no longer valid, which is when the trade will be closed at a profit.

In today’s market, you may choose from hundreds of automated trading programs available on the web. Some robots are available at no cost, while others need payment or a subscription to a service.

10 Best Trading Robots in Botswana

1. bitcoinprime

Overview

bitcoinprime is the greatest trading bot accessible right now. bitcoinprime can trade over 75 different CFD pairs for Bitcoin automatically. This offers pairings with many major currencies and a broad range of popular cryptocurrencies.

Therefore, bitcoinprime may locate trade opportunities in any market state. Furthermore, the program employs a deep learning algorithm to identify setups and monitor cryptocurrency news to remain one step ahead of market changes.

Features and Fees

➡️ bitcoinprime is as secure as trading bots can get. A third-party broker guarantees the security of client money.

➡️ bitcoinprime can establish and execute orders in a fraction of a second.

➡️ bitcoinprime will execute the trading strategy as predetermined by the trader.

➡️ You can employ stringent risk management procedures to reduce loss while maximizing profit.

➡️ With sub-second trading at your disposal, you may capitalize on market inefficiencies that were previously inaccessible.

➡️ bitcoinprime supports USD, GBP, and EUR deposits through bank transfers, credit and debit cards, and electronic wallets like PayPal.

➡️ Botswanans must pay a 3,300 BWP / 250 USD minimum deposit to use bitcoinprime.

➡️ There are up to 10 free withdrawals per month.

➡️ Botswanans pay a trading fee of 2% once they start making profitable trades.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Botswanans can trade 14 cryptocurrencies. | There is no mobile app available. |

| Traders only pay a trading fee when their trades become profitable. | The minimum deposit is high. |

| Traders can link a supporting third-party broker, allowing them access to CFD trading. | |

| There are several positive reviews. |

2. TechBerry

Overview

TechBerry is a social trading platform that functions as an expert adviser. Its technique includes evaluating more than one hundred thousand trading accounts using artificial intelligence to produce profitable transactions. It yields an average monthly profit of around 11.2%.

TechBerry has demonstrated its value since its launch in 2015 by maintaining constant profit margins and attracting a rising user base. The AI examines the data and produces strategies based on the most lucrative transactions using deep learning.

In addition, it tailors them to individual user requirements. Everyone is welcome to join, and the application procedure is uncomplicated.

Features and Fees

➡️ TechBerry is suitable for beginners as it simplifies the overall automated trading process. When Botswanans buy an annual subscription, they can easily start earning from their EA activities.

➡️ TechBerry can be integrated with MT4 and MT5 easily, allowing the AI to analyze trading data daily.

➡️ TechBerry has an excellent reputation among the top online forex audit websites.

➡️ TechBerry uses artificial intelligence extensively. These systems can evaluate enormous volumes of trade data and develop profitable strategies based on this analysis.

➡️ Members are protected against trading losses thanks to the loss recovery program.

➡️ There are six subscription options available. “Infinite” is the most expensive at 6,500 BWP / $499 per year, while “Green” is the cheapest at 250 BWP / $19 per year.

➡️ Members with a “Gold” or higher subscription are granted a personal manager.

➡️ TechBerry exclusively deducts service costs from earnings produced.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The bot is a simple way for retail traders and individuals to earn money. | Botswanans can only use this bot with MT4 or MT5. |

| Botswanans have various subscription choices accessible to them. | There is an extremely long registration process involved. |

| Loss protection is offered. | |

| Since 2015, the bot has consistently generated earnings of 11.2%. | |

| Over 50 top forex brokers and other financial institutions are compatible with the trading bot. |

3. Quantum AI

Overview

The Quantum AI robot was developed as an automated trading system to help crypto traders capitalize on market openings. The bot proposes the trading load to maximize earnings via automated trades and guidance in determining optimal entry and exit points.

It is believed that Quantum AI was created by a group of professional traders and mathematicians who are driven to assist as many traders as possible in making a profit on the market. With Quantum AI, the emphasis is on utilizing the trade volume to increase your profits.

The bot uses artificial intelligence and machine learning to analyze the market and identify patterns. From then, it determines the optimal entry and exit moments in trade and concentrates on maximizing your profits.

Features and Fees

➡️ The Quantum AI Bitcoin robot employs artificial intelligence and machine learning for successful trading.

➡️ The bot indicates that users can configure the trading bot according to their preferences.

➡️ The bot claims that it works with licensed brokers that execute and oversee trades. These brokers are an important component of Quantum AI since they are the ones that assist the bot in ensuring your profitability.

➡️ Quantum AI is an automated trading bot designed to study market data in search of successful trading trends.

➡️ Traders of all levels should be able to utilize the platform. However, it is essential to include trade management measures to protect against market downturns.

➡️ There is a 3,300 BWP / 250 USD minimum deposit with a commission charge of 0.01% per successful transaction.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| There are minimal fees charged. | Quantum AI does not have a mobile app. |

| There is a 90% success rate. | There is an extremely high minimum deposit. |

| With Quantum AI, Botswanans can take both long and short positions. |

4. Hedge Forex Robot

Overview

Hedge Forex Robot is a forex trading robot that generates profits using a hedging strategy: buying and selling simultaneously and trend monitoring. You could anticipate enormous profits with Hedge Forex Robot’s automated trading method.

The business claims its forex robot utilizes a trend-based strategy and an integrated hedging system to ensure successful transactions. In addition, the Hedge Forex Robot is a trend-trading expert advisor (EA) compatible with MetaTrader 4.

This bot is appropriate for new and seasoned traders due to its user-friendliness and configurability. It takes just a few minutes to set up. The system is fully automated and accompanied by clear and plain instructions.

Features and Fees

➡️ The Hedge Forex Robot is based on the hedging principle, which entails establishing different positions to safeguard against bad market moves.

➡️ Hedge Forex Robot is an EA for trend trading compatible with MetaTrader 4 and can function with any currency pairings.

➡️ This EA can function with eight timeframes concurrently.

➡️ The robot currently costs 921 BWP / $49.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Hedge Forex Robot is an immensely popular alternative compatible with many brokers that provide hedging methods. | The bot is only compatible with MT4 |

| The trading robot can operate over eight timeframes. | |

| Installation and initial use are simple and quick. | |

| The robot is compatible with many stocks and currencies. |

5. GPS Forex Robot 3

Overview

GPS Forex Automated Trading Platform focuses on the market’s most actively traded currency pair, EUR/USD. The vendor provides a completely automated platform in the form of a computer program that can be installed on a user’s computer. After that, MT4 installation is necessary.

The file will then begin making trades on your behalf around the clock after you do so. According to the developers, the GPS Forex program has an impressive 98% success record, suggesting that the platform is expected to generate a profit in 98 of every 100 trades.

Additionally, GPS Forex asserts that they use a reverse method to lessen vulnerability. When a transaction seems like it will not turn a profit and is likely to instead end with a minor loss, this strategy comprises initiating a position in the opposite direction.

Features and Fees

➡️ GPS Forex does not need a membership fee or subscription of any kind. Instead, a single payment of 1,900 USD / $149 is required.

➡️ There is a 60-day refund policy available at GPS Forex. Therefore, you will have plenty of time to use a brokerage’s risk-free sample account to get a feel for the platform.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| GPS Forex Robot has a history of accomplishments showing profitable trades. | There are mixed negative/positive reviews from current and previous users. |

| A full refund 60-day guarantee ensures that Botswanans can get their money back if they are not satisfied. | |

| The bot is compatible with MT4, and there is a demo account. |

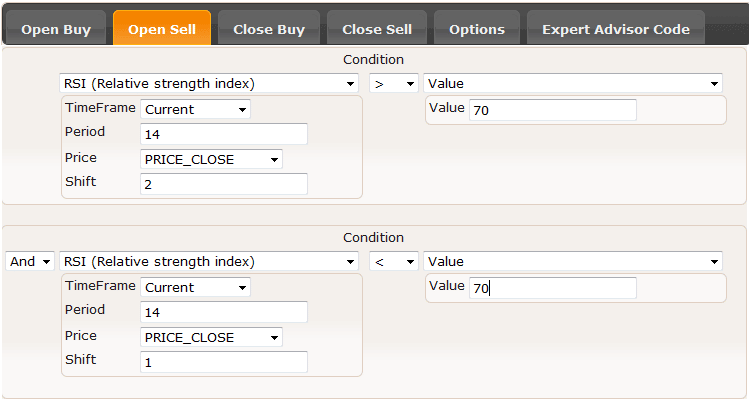

6. EA Builder

Overview

One of the best features of EA Builder is that you do not need to know how to code or program to use it, and the platform uses a “drop and drag” method instead.

Your trading approach and comfort level with risk will inform the strategy you develop. Price, candlesticks, and timeframes are criteria you could set when using EA Builder.

Combine these variables with technical indicators to give your trade the greatest chance of outperforming the market.

Importantly, you can use EA Builder’s demo mode to run a back-test on your own bespoke approach. In addition, you can test the system’s efficacy in real-world market situations before committing any real funds.

Strategy adjustments can be made whenever you see fit. In addition, the platform can be used to trade in foreign exchange, commodities, and indexes.

Features and Fees

➡️ EA Builder seamlessly integrates with Tradestation, MetaTrader 4, and MetaTrader 5.

➡️ Traders can easily convert manual trading systems to automated trading.

➡️ The trading bot offers access to all financial markets.

➡️ Botswanans can easily use the EA Builder to set up trading strategies.

➡️ There is a cost of 1824 BWP / 97 USD.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| MetaTrader 4, MetaTrader 5, and Trade Station are compatible with EA Builder. | The website does not provide any live chat. |

| Botswana does not need programming knowledge to design its indicators and tactics using EA Builder. | |

| The robot has several video lessons that can teach Botswanans how to use the bot. | |

| There are free and premium versions available. |

7. 1000pip Climber System

Overview

The 1000pip Climber robot is the greatest solution for traders who want powerful and consistent results but do not have the time or technical expertise to modify different parameters and filters continuously daily.

Many retail traders agree that this robot is among the finest and most sophisticated ones on the market. However, this trading robot is simpler to use than its competitors.

The robot has performed well throughout the course of its lifetime. In addition, it has done well in a wide range of market situations, and Botswanans should note that MyFXBook has confirmed the robot’s accuracy.

The 1000pip Climber System’s robust algorithm is the driving force behind its impressive record as a Forex trading platform.

The algorithm is the brainchild of a seasoned Forex trader and is continually revised to reflect the latest market trends. The robot is surprisingly simple to set up and operate, considering its high level of sophistication.

Not surprisingly, the 1000pip Climber system is a frontrunner among the best and most widely used robots.

Features and Fees

➡️ The 1000Pip Climber System is a program that performs automated Forex market analysis according to a set of rules.

➡️ For convenience and accessibility, alerts may be sent through email, push notifications, or even directly inside the program.

➡️ With the inclusion of a “beginners guide to trading” with every purchase, the 1000Pip Climber System is well suited for those new to Forex trading.

➡️ The 1000Pip Climber System is more of a passive background system, with its predetermined rules and simple setup.

➡️ The website’s record is transparent, and it is evident that the streamlined method presents a more concentrated choice than more comprehensive or time-consuming memberships and applications.

➡️ It costs between 1,200 / 97 USD and 5,200 BWP / 397 USD for 1000Pip Climber.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Information is sent immediately to your phone or mailbox, streamlining the signalling process. | The only signals provided are for forex. |

| An intuitive interface that even trading novices can use. | |

| Proven record of performance according to data from MyFXBook. |

8. FXMasterBot

Overview

The automated trading system community is familiar with FXMasterBot, also known as Binary Options Bot. Binary options trading is the bread and butter of this automated trading platform’s business model. In addition, FXMasterBot caters to both the forex and cryptocurrency markets.

In terms of the latter, the platform will facilitate the exchange of Litecoin, Bitcoin, Ethereum, Tether, and USD Coin. Furthermore, no additional software is needed to use this system.

Your FXMasterBot account may instead serve as a hub for all your trading needs. Once you have signed up, you will be asked to choose the currency pair (forex or cryptocurrency) you want to trade.

The next step is to choose a trading approach and put it into action. An FXMasterBot demo account is available with virtual currency worth $10,000. Therefore, you can put your selected approach to the test without worrying about losing money.

Features and Fees

➡️ The foundation of FXMasterBot is a trading algorithm developed by a dedicated group of professionals. As a result, each trader signing up for this program can access various tools, features, and settings that make the algorithm adaptable to their own needs.

➡️ Traders can trade counter to the FXMasterBot algorithm. They can easily adjust parameters such as stop loss and take profit levels, trade volume, signal intensity, and more.

➡️ Also, both manual and automated trading are available to traders. When set to automatic trading, the FXMasterBot will instantly execute the deal in the trading terminal. Manual traders will never have to leave the trading area. However, they must accept every indication that they wish to trade manually.

➡️ You could restrict your daily profit and the number of deals you can make simultaneously, forcing you to be more careful with your money.

➡️ For convenience and ease of use, all elements of trading may be accessed from a single interface.

➡️ FXMasterBot is free, and traders are not subject to fees, memberships, or other charges. However, traders must pay the minimum deposit required by their linked broker.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| FXMasterBot is completely free, and there are high levels of transparency. | FXMasterBot does not currently have a native mobile app. |

| Several forex brokers can be linked. | |

| There are superior customization features. |

9. Forex Fury

Overview

Forex Fury stands out as a top choice among the many forex robots available. This robot uses a low-risk trading strategy with a drawdown of less than 20%, and it has a 93% success record in trading, according to verified accounts on Myfxbook.

Forex Fury works with several systems, including MT4, MT5, NFA, and more. In addition, the 5-minute installation process is a breeze with Forex Fury, thanks to in-depth video tutorials and written directions.

Another strength of this bot is its helpful and quick customer care staff. In addition, you can use various filters to protect yourself against unfavorable market circumstances.

Features and Fees

➡️ The robot employs ECN connectivity and sophisticated money management to safeguard trading accounts.

➡️ If market volatility is mild, Forex Fury could trade many currency pairs with relative stability by opening all trades in about an hour.

➡️ Forex Fury’s trading method mixes scalping with a time-based strategy.

➡️ The designers of Forex Fury have given the trader complete control by allowing them to choose their lot size, stop limit, and trading days, even though the default settings generate substantial profits.

➡️ There are two plans from which to choose: the Gold Package (3,000 BWP / 229.99 USD) and the Diamond Plan (8276 BWP / 439.99 USD).

Pros and Cons

| ✔️ Pros | ❌ Cons |

| There is a high 93% success rate and transparent trading history. | Forex Fury does not offer a free trial. |

| Forex Fury is compatible with verified Myfxbook accounts. | |

| The bot uses low-risk strategies and offers superior customer support. |

10. BinBotPro

Overview

BinBot is an advanced and artificially intelligent trading system built specifically for binary options traders.

The software automates all aspects of forex trading, including market research, interpreting graphs and charts to map and anticipate market movement, and monitoring market trends to decide the optimal moment to trade.

BinBot Pro’s sophisticated analytical engine is geared toward gathering market insights and data that may be utilized to forecast market movements.

Currently, the robot trader assists binary options investors in achieving noteworthy accuracy and generating a continual stream of profits, ranging from 125%+ on invested amounts, depending on the desired individual bot trader.

Features and Fees

➡️ BinBotPro is a trading robot created by the firm that operates Finpari and BinaryMate.

➡️ BinBot PRO is equipped with algorithms that enable it to identify trading opportunities.

➡️ BinBot Pro is open about the binary options brokers with whom it has collaborated. Included in this group are BinaryCent, Videforex, RaceOption, and IQCent. The minimum deposit across all approved brokers is 3,300 BWP / $250, and the minimum trading value begins at 0.1 USD.

➡️ There are several robots available for use. This feature is advantageous as many automated trading platforms provide a single robot.

➡️ You can easily operate any robot in demo mode before employing it in the real world.

➡️ You can also develop robots that trade on your behalf according to your specifications.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| BinBotPro is affordable and has trading fees of 0.1 USD per trade. | Only binary options traders can use BinBotPro. |

| There are attractive returns on investment. | The only way to contact support is through email. |

| The bot is versatile and provides Botswanans control over their trades and position sizes. |

How to Choose the Right Trading Robot in Botswana

Botswanan traders must evaluate the following components of a forex broker to decide whether the broker is suited to their unique trading objectives or needs.

Regulations and Licenses

This is the first vital component that Botswanan traders must thoroughly evaluate. Reputable brokers are regulated by market regulators such as FCA, ASIC, CySEC, FSCA, and others.

Botswanans must beware when dealing with brokers with only offshore regulations such as FSA, SVG BVI, FSC, and others.

Account Features

Account Features include leverage trading and margin requirement, commissions and spreads, initial deposit, additional features on retail investor accounts, and so on.

Deposits and Withdrawals

Botswanans must evaluate the payment options available, the processing times on withdrawal requests, deposit currencies offered, the withdrawal fee, deposit fees, and minimum withdrawal limits, among other trading and non-trading fees.

Range of Markets

The range of markets offered refers to the number and range of tradable instruments the broker offers. Therefore, Botswanans must consider what they wish to trade and what is available.

Customer Support

Customer Support is another crucial factor. Botswanans must check the availability of support (trading hours), the quality of support, and the promptness with which the customer support team responds to queries.

Trading Platform

A trading platform is the Botswanan trader’s portal to the financial markets. Therefore, traders must ensure that the trading platform has the necessary technical indicators, fundamental analysis, technical analysis, economic calendar, charting, newsfeed, and other tools they may need.

Education and Research

Education and Research come in handy to both novice traders and experienced investors. Education includes some of the following:

➡️ eBooks

➡️ Trading guides

➡️ Trading knowledge on leveraged products

➡️ A risk warning on complex instruments

➡️ Educational videos

Research can include some of the following:

➡️ Trading tools

➡️ Commentary

➡️ Status of International Markets

➡️ Price movements

➡️ Market sentiments

➡️ Whether there is a volatile market

➡️ Exchange Rates

➡️ Expert opinions and other resources can help experienced traders make informed trading decisions.

How to compare auto trader robots to each other

Comparing auto trader robots involves a systematic evaluation of their features, performance, and suitability for your trading goals. Firstly, examine the robot’s trading strategy and algorithm. Understand the indicators and parameters it uses to make trading decisions. Backtesting is crucial—look for robots that offer robust historical performance data, demonstrating consistency across various market conditions. Analyze the risk management tools provided by each robot, including stop-loss and take-profit mechanisms, to protect your investments.

Compare the level of customization offered, as some robots allow you to adjust strategies to better suit your preferences. Transparent reporting is vital—robots that provide detailed trade reports and performance metrics offer a clearer understanding of their effectiveness.

Consider user-friendliness and ease of setup, especially if you’re not experienced in algorithmic trading. Reliable customer support is essential in case of technical issues or questions about the robot’s functionality. Lastly, be cautious of exaggerated claims of guaranteed profits; reputable robots emphasize realistic expectations and risk disclosure. By meticulously comparing these factors, you can select an auto trader robot that aligns with your trading style, risk tolerance, and investment objectives.

The Best Forex Brokers in Botswana

In this article, we have listed the best brokers that offer forex trading to traders in Botswana. In addition, we have further identified the brokers that offer additional services and solutions to Botswanan traders.

Best MetaTrader 4 / MT4 Forex Broker in Botswana

Min Deposit

USD 25

Regulators

FCA UK

Trading Platform

MT5, MT4, OctaTrader

Crypto

Yes

Total Pairs

28

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, OctaFX is the best MT4 forex broker in Botswana. OctaFX is an MT4 and MT5 broker that provides Botswanans with various markets. OctaFX offers a choice of accounts via MT4, including ECN and STP accounts, with superior trade execution.

Best MetaTrader 5 / MT5 Forex Broker in Botswana

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, AvaTrade is the best MetaTrader 5 forex broker in Botswana. In addition, AvaTrade is regarded as one of the most secure MT5 forex brokers.

No commission is charged for trading currency pairings, only leaving the spread to be paid. A demo account is also available for traders to sharpen their abilities via MT5 and several other platforms.

Best Forex Broker for beginners in Botswana

Min Deposit

$100

Regulators

CFT, NFA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FOREX.com is the best forex broker for beginners in Botswana. FOREX.com is a broker renowned for low trading fees and beginner-friendly solutions. In addition, FOREX.com offers several educational materials and a helpful demo account.

Best Low Minimum Deposit Forex Broker in Botswana

Min Deposit

$10 / 134 BWP

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Exness is the best Low Minimum Deposit Forex Broker in Botswana. Exness has a minimum deposit requirement of 10 USD / 130 BWP, making it easy for Botswanans to start trading 278 instruments.

Exness also offers MT4 and MT5 through which trades can be made. In addition, it offers some of the best trading tools, charting capabilities, technical indicators, expert advisors, and more.

Best ECN Forex Broker in Botswana

Min Deposit

USD 0

Regulators

CySEC, FCA, DFSA, FSCA, FSA, CMA

Trading Desk

MT4, MT5, HFM APP

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

0

Account Activation Time

24 Hours

Overall, HFM is the best ECN forex broker in Botswana. HFM is a hybrid forex and CFD broker that uses STP and ECN technology to ensure that Botswanans get the best pricing, minimal slippage, no requotes, and the fastest trade execution.

HFM uses the best liquidity providers who aggregate the pricing that Botswanans can see on MT4, MT5, and the HF App for Android and iOS.

Best Islamic / Swap-Free Forex Broker in Botswana

Min Deposit

USD 10 / 136 BWP

Regulators

CySec, FCA

Trading Desk

None

Crypto

Yes

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, eToro is the best Islamic / Swap-Free forex broker in Botswana. eToro is a renowned social trading platform that offers Muslim traders an Islamic Account.

eToro does not charge any interest on positions held for over 24 hours. However, registering an Islamic Account can be expensive initially, requiring a 1,000 USD / 18810 BWP deposit.

Best Forex Trading App in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

ASIC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

300

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, CMC Markets is the best forex trading app in Botswana. In addition, CMC Markets offers a user-friendly mobile app with research tools, powerful charts, customizable watch lists, news reports, and a range of educational materials.

Best Lowest Spread Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

FCA, CySEC, IFSC, KNF

Trading Desk

No Trading Desk

Crypto

Yes

Total Pairs

48

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, XTB is the best lowest-spread forex broker in Botswana. XTB is a well-known forex and CFD broker with low and competitive forex spreads from 0.1 pips depending on the financial instrument and the market conditions.

XTB is also a good broker in terms of educational materials and research capabilities, providing traders with comprehensive market analysis across markets.

Best Nasdaq 100 Forex Broker in Botswana

Min Deposit

USD 10

Regulators

CySec, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

60

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXTM is the best Nasdaq 100 forex broker in Botswana. FXTM is a multi-regulated forex and CFD broker that accommodates Botswanan traders with a keen interest in Nasdaq. Traders can expect low and competitive spreads, a choice between accounts, and powerful trading platforms.

Best Volatility 75 / VIX 75 Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

IGRs

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, IG is Botswana’s best Volatility 75 / VIX 75 forex broker. IG is one of the best CFD brokers with powerful proprietary trading technology.

IG is well-regulated and offers Botswanans access to VIX75, with spreads from 0.04 pips / 0.13% and zero commission charges.

Best NDD Forex Broker in Botswana

Min Deposit

USD 50 / 672 BWP

Regulators

FCA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

–

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXCM is the best NDD forex broker in Botswana. FXCM is a No-Dealing Desk broker with STP and ECN execution across several markets.

In addition, FXCM offers a choice between third-party platforms in addition to technical indicators, charting tools, and competitive trading conditions.

Best STP Forex Broker in Botswana

Min Deposit

USD 10

Regulators

IFSC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

36

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, RoboForex is the best STP forex broker in Botswana. RoboForex is popular forex and CFD broker with competitive trading conditions. RoboForex offers STP execution with liquidity sourced from top providers.

Botswanans can expect access to over 12,000 instruments via powerful and innovative third-party platforms.

Best Sign-up Bonus Broker in Botswana

Min Deposit

50 USD / 682 BWP

Regulators

CYSEC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Windsor Brokers is the best sign-up bonus broker in Botswana. Windsor Brokers is a well-regulated broker that offers Botswanans a welcome account funded with 30 USD in trading credit. With this account, Botswanans can explore the platform or risk-free test their strategies.

Conclusion

Automated trading software, or “robots,” are useful tools that can be added to a trading platform. Trading bots use automated trading procedures to analyze the market and automatically initiate, manage, and close deals.

Even though this could seem like the Holy Grail of trading, you must be aware that robots have restrictions that prohibit them from being consistently lucrative.

In addition, before using a robot in trade, Botswanans must analyze its performance. Profitability, growth rate, and maximum drawdown are key indicators that must be assessed.

You might also like: ACY Securities Review

You might also like: Admirals Markets Review

You might also like: Alpari Review

You might also like: AvaTrade Fees and Spreads

You might also like: Axi Review

Frequently Asked Questions

Do trading robots in Botswana work?

Forex robots do “work” because they can execute transactions automatically. However, they are not without flaws and cannot provide consistent profits.

Foreign exchange market indicators are a helpful tool that may be utilized to make more educated trading selections.

Is it profitable for Botswanans to use trading robots?

The profit potential is dependent on a variety of variables. Whether or whether a Forex EA robot trades successfully depends on market price activity and the parameters set in the software.

How much will a forex trading bot cost Botswanan traders?

Forex trading bots can come with a monthly, annual, or lifetime price, with many starting from 1881 BWP / 100 USD.

What is the most profitable trading bot in Botswana?

One of Botswana’s most profitable trading bots today is 1000Pip Climber, among others, like those discussed in our list.

Can trading bots in Botswana lose money?

How likely you are to lose relies on the trading strategy you use with a trading robot, attributable to the fact that the bot trades according to predetermined rules. Because the bot cannot adjust the selected plan, Botswanans must be careful.

How are trading robots used by auto traders?

Forex trading robots are automated software programs that generate trading signals. Most of these robots are built with MetaTrader, using the MQL scripting language, which lets traders generate trading signals or place orders, and manage trades.

Which trading robots are free to use in Botswana?

- FXMasterBot

Which trading robots operate on the MetaTrader 4/ MT4 or MetaTrader 5 / MT5 platform?

- TechBerry

- Hedge Forex Robot

- GPS Forex Robot 3

- EA Builder

Our recommended Auto Trader Forex Robots for Beginner Trader?

- Forex Fury

- 1000pip Climber System

- IG

- Coinrule

- GPS Forex Robot

- Forex Gump

- ForexVPS

- Centobot

- Forex Trendy

- EA Builder

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review