13 Best Forex Brokers in Botswana

The 13 Best Forex Brokers for Botswana traders revealed. We tested the best forex brokers for Botswana Traders.

This is a complete guide to forex brokers in Botswana.

In this in-depth guide you’ll learn:

- What is a Forex Broker?

- Which forex brokers offer the best trading platforms for Botswana traders?

- Which trading platforms can you use with M-PESA?

- Which Forex Brokers are best for beginner Botswana Traders?

- Which brokers offer a sign-up bonus for first-time traders in Botswana?

- Which brokers offer a low minimum deposit of $5 (64 BWP) to start trading?

- Which brokers offer a mobile app on IOS and Android for Botswana Traders?

And lots more…

So if you’re ready to go “all in” with the best-tested forex brokers…

Let’s dive right in…

- Louis Schoeman

13 Best Forex Brokers in Botswana

| 🏅 Broker | 💰 Minimum Deposit | 👉 Open Account | ✅ Botswana Pula Account? | 💻 Botswana Pula Deposits Allowed? |

| 1. Pepperstone | $0 / 0 BWP | 👉 Open Account | Yes | Yes |

| 2. OctaFX | $25 / 335 BWP | 👉 Open Account | Yes | No |

| 3. CM Trading | $100 / 1 342 BWP | 👉 Open Account | Yes | Yes |

| 4. Tickmill | $100 / 1 342 BWP | 👉 Open Account | Yes | Yes |

| 5. OANDA | $0 / 0 BWP | 👉 Open Account | Yes | No |

| 6. FBS | $5 / 96 BWP | 👉 Open Account | Yes | No |

| 7. BDSwiss | $10 / 134 BWP | 👉 Open Account | Yes | Yes |

| 8. FP Markets | $100 / 1 342 BWP | 👉 Open Account | Yes | No |

| 9 Exness | $10 / 134 BWP | 👉 Open Account | Yes | Yes |

| 10. XM | $5 / 67 BWP | 👉 Open Account | Yes | Yes |

| 11. HFM | $0 / 0 BWP | 👉 Open Account | Yes | Yes |

| 12. Axiory | $10 / 134 BWP | 👉 Open Account | Yes | No |

| 13. AvaTrade | $100 / 1 342 BWP | 👉 Open Account | Yes | Yes |

10 Best Forex Brokers in Botswana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

What is a Forex Broker?

A forex broker is a financial services company that provides traders access to a platform for buying and selling foreign currencies. Forex is short for foreign exchange. Transactions in the forex market are always between a pair of two different currencies.

13 Best Forex Brokers in Botswana

- ✔️ Pepperstone – Overall, Best Forex Broker in Botswana

- ✔️ OctaFX – Best Copy Trading Broker in Botswana

- ✔️ CM Trading – Top Broker for Beginner Traders

- Tickmill – Best Regulated Broker in Botswana

- OANDA – Top Regulatory Broker in Botswana

- FBS – Best Broker for Any Experience Level

- BDSwiss – Most Tradable Asset Broker

- FP Markets – Top ECN Broker in Botswana

- Exness – Lowest Deposit Broker

- XM – Best Lowest Spread Broker

- HFM – Top CFD Broker in Botswana

- Axiory – Best MetaTrader4/MT4 Broker

- AvaTrade – Top Mobile App Broker in Botswana

1. Pepperstone

Overview

Since opening its doors in 2010, Pepperstone Group, located in Australia, has risen to the forefront of the online brokerage industry, constructing a highly competitive and feature-rich trading site that concentrates on Forex, shares, indices, metals, commodities, and even cryptocurrencies.

Min Deposit

0 USD / 0 BWP

Regulators

ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB

Trading Desk

MetaTrader 4, MetaTrader 5, cTrader and TradeView

Crypto

Yes (Not available in Africa)

Total Pairs

60+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Clients can focus on the challenging task of trading successfully thanks to Pepperstone’s simple market access.

Pepperstone is ideal for traders that want a wide range of affordable services, a flexible user interface, many account type possibilities, and efficient customer support.

Features

| Account Feature | Value |

| 💰 Minimum Deposit | $0 / 0 BWP |

| 💻 Minimum Trading Size | 0.01 lots |

| 📈 Maximum Trading Size | 100 lots in a single trade |

| 💵 Base Account Currency | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, and HKD |

| ✅ Trading Strategies Supported | All including scalping, hedging, and Expert Advisors (EAs) |

| 🗞 News Trading Offered? | Yes |

| ➡️ Trade Execution | No-Dealing Desk (NDD) |

| 📊 Average EUR/USD Spread | From 0.6 pips |

| 💸 Commissions | None |

| 🔃 Rollover Swaps | Yes, according to the market rates |

| ⬆️ Maximum Leverage per region | • Australia – 1:30 • Bahamas – 1:200 • Cyprus – 1:30 • Dubai – 1:30 • Germany – 1:30 • Botswana – 1:400 • United Kingdom – 1:30 |

| ❌ Negative Balance Protection Offered | Yes, only for retail clients |

| ✅ Margin Close-Out (%) | 50% |

| 🔨 Trading Instruments offered | 1,200+ |

| 💻 Trading Platforms offered | MetaTrader 4, MetaTrader 5, cTrader, TradingView, Myfxbook, DupliTrade |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Pepperstone offers competitive spreads that start from 0.0 pips on EUR/USD | There are restrictions on the countries that may use Pepperstone’s Islamic account |

| Pepperstone is well-regulated and offers an extremely secure trading environment with transparent trading fees | There is no BWP-denominated account offered, subjecting Botswanans to currency conversion fees |

| Investor protection is offered to EU clients through the FSCS | There are additional administrative fees applied to the Islamic account |

| Pepperstone offers a choice between some of the best trading platforms | |

| Negative balance protection is offered for clients in certain regions | |

| There is an Islamic account offered to Muslim traders | |

| There is a demo account offered by Pepperstone | |

| There are several trading tools offered |

2. OctaFX

Overview

OctaFX began accepting customers in 2011, and their spreads on trades fluctuate. It is important to note that OctaFX is a Metatrader-only forex broker.

Min Deposit

USD 25

Regulators

FCA UK

Trading Platform

MT5, MT4, OctaTrader

Crypto

Yes

Total Pairs

28

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

In addition to MetaTrader 4 (MT4) and the newest MT5 platforms, they also have their own forex trading and copy trading applications. Furthermore, they provide the Metatrader platform, which works on several devices (computers, smartphones, etc.).

Features

| Feature | Information |

| ⚖️ Regulation | FSA SVG, CySEC |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | $25 / 335 BWP |

| Average spread from | 0.0 pips EUR/USD |

| 📈 Maximum Leverage | 1:500 |

| 👥 Customer Support | 24/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Fixed spread accounts are offered to retail traders | US clients are restricted |

| The broker accepts hedging and scalping strategies | There are only a few financial markets that can be traded |

| Negative balance protection is applied to retail investor accounts | |

| The broker is well-regulated and has a decent trust score | |

| There is commission-free trading |

3. CM Trading

Overview

Since its inception in 2012, CM Trading has operated as Blackstone Marketing SA (PTY) LTD subsidiary in South Africa. Its major market is African countries, but it also serves clients all around the globe with a broad range of innovative trade solutions.

Min Deposit

USD100

Regulators

FSA

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

154

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

When you use CM Trading, you may easily and quickly access the market from your desktop computer, web browser, or mobile device. However, suppose you are new to online trading and are a novice. In that case, you may find a few useful educational materials on the topic.

Features

| Account Feature | Value |

| 💳 Minimum Deposit | $100 / 1 342 BWP |

| 📊 Demo Account | Yes |

| 📈 Educational materials | Yes, Trading eBook, Webinars |

| ✴️ Market Reviews | Yes |

| 📈 Spreads from | Regular spreads |

| 🔎 Live Trading Signals | No |

| 📊 Risk-Free Trades offered | No |

| 🎓 Personal Assistant offered? | No |

| 📈 Trading Central Trading Signals | No |

| 👨💼 Trading Central Live Trading Signals | No |

| 🚀 Cashback Rebates | No |

| 🔎 Access to ECN? | No |

| 📊 Market News and Analysis For Fundamental Analysis | No |

| 📈 Special Offers | No |

| Dedicated Trading Room | No |

| 📊 Trading specialist offering investment advice | No |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| CM Trading is a good option for Botswanan beginners | CM Trading does not have Tier-1 regulations |

| The customer support offered by CM Trading is outstanding | Withdrawals can be expensive |

| There are copy trading opportunities offered to traders | Traders must register for a live account to opt for a demo account |

| CM Trading has user-friendly trading platforms for mobile, desktop, and web browsers | |

| CM Trading does not charge any commissions | |

| Hedging, scalping, and EAs are allowed | |

| There is an Islamic account offered to Muslim traders | |

| CM Trading offers daily market analysis |

4. Tickmill

Overview

Tickmill is an NDD broker authorized by Seychelles FSA, FCA, CySEC, Labuan FSA, and FSCA. Tickmill is a Metatrader-only FX and CFD broker that has been around since 2014 and provides access to the MT4, MT5, and WebTrader platforms.

Min Deposit

$100 / 1 343 BWP

Regulators

CySEC, FCA, FSA, FSCA, Labuan FSA

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

62

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

There are 62 different currency pairs available for forex trading, 23 different stock index CFDs, 3 oil CFDs, 4 metal CFDs, 8 cryptocurrency CFDs, 98 stock CFDs, and 4 bonds to trade.

In addition, Botswanan traders can get up to 1:500 leverage according to the financial instrument they trade and the region in which they reside.

Features

| Feature | Information |

| ⚖️ Regulation | FSA, FCA, CySEC, Labuan FSA, FSCA |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | $100 / 1 343 BWP |

| 📈 Average spread from | 0.0 pips EUR/USD |

| 📈 Maximum Leverage | 1:500 |

| 👥 Customer Support | 24/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The broker offers commission-free trading across financial instruments | The broker does not accept clients from the United States and some other regions |

| There are powerful trading platforms to choose from | Fixed spread accounts are not offered |

| The broker is well-regulated in several regions | |

| There is a selection of popular financial instruments that can be traded | |

| There are several advanced trading tools offered |

5. OANDA

Overview

Even though local market authorities do not approve OANDA in Botswana or local offices in Gaborone, novice and expert traders in the region should expect OANDA to provide competitive trading conditions.

Min Deposit

USD 0

Regulators

ASIC, BVI, CFTC, FCA, FFAJ, FSC, IIROC, MAS, NFA

Trading Desk

Metatrader 4 and Metatrader 5

Crypto

Yes

Total Pairs

45

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

In addition to a vast selection of tradable products, OANDA provides advantageous trading circumstances to its traders. OANDA has offices all around the globe, from Japan to Singapore, with local regulation and authorization commensurate with global operations.

Providing an Islamic Swap-Free account, which gives Muslim Botswanan traders extraordinary trading conditions and privileges, is one of the greatest advantages of OANDA.

Features

| Account Feature | Value |

| ✔️ Full Account Verification Needed? | No |

| 📈 Average Spreads | Variable, from 1 pip |

| 🔎Commissions (Per 1 mil traded) | None |

| 📈 Maximum Leverage | 1:200 |

| ✴️ Minimum lot size | 0.01 lots |

| 📊 Instruments | 81 |

| 🔎Stop-Out | 50% |

| 🌐 One-Click Trading offered? | Yes |

| 📈 Strategies allowed | All |

| 📊 Base Account Currency | USD, EUR, HKD, SGD |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Proprietary desktop trading platforms offered alongside MetaTrader 4 and 5 | Fixed spreads are not offered |

| Offers an impressive array of financial instruments including most currency pairs | There is a monthly inactivity fee applied |

| Innovative mobile trading apps and mobile platforms provided | |

| There are several advanced charting tools and charting features offered | |

| Negative balance protection is applied to accounts | |

| The broker accepts a wide range of trading strategies including algorithmic trading, hedging, scalping, and more | |

| There is a comprehensive range of trading tools and analytical tools offered | |

| Deposit fees are not charged and there are several deposit options | |

| Offers a decent selection of educational materials including educational articles | |

| Client funds are kept in segregated accounts |

6. FBS

Overview

Originally established in Belize, FBS has now opened an office in Cyprus. FBS also has a presence in Australia and South Africa through owned subsidiaries. This aids and promotes the company’s goal of catering to traders of all experience levels worldwide.

Min Deposit

USD 5 / 67 BWP

Regulators

IFSC, FSCA (South Africa), ASIC, CySEC

Trading Desk

MetaTrader 4, MetaTrader 5, FBS Trader – all in one mobile trading platform.

Crypto

Yes

Total Pairs

250

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

FBS is an excellent choice for traders because of its long service history, low spreads, and extensive teaching center.

Among the many trading choices available via FBS, some of the most noteworthy include the crypto-only account, the basic account with no fees, the trading of over a hundred different cryptocurrency pairings, and the use of a simple mobile trading interface.

Features

| Feature | Information |

| ⚖️ Regulation | IFSC, CySEC |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | USD 5 / 96 Pula |

| 📊 Average spread from | 0.0 pips EUR/USD |

| 📈 Maximum Leverage | 1:3000 |

| 👥 Customer Support | 24/7 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| FBS offers competitive trading conditions with some of the lowest spreads | There are wide spreads charges on some accounts |

| There are several account types to choose from | There is a limited number of tradable instruments |

| There are many social trading opportunities | There are several regional restrictions applied |

| There is an ultra-low minimum deposit requirement | |

| The broker is well-regulated and trusted |

7. BDSwiss

Overview

BDSwiss is a multi-regulatory, award-winning broker having offices in Cyprus and Mauritius, regulated by CySEC, FSC, BaFIN, and FSA.

Min Deposit

$10 / 136 BWP

Regulators

CySec, FSC, FSA, BaFin, NFA

Trading Desk

MetaTrader 4 , MetaTrader 5

Crypto

Yes

Total Pairs

50 Forex Pairs and 20 Crypto Pairs

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

When creating a live account, Botswana traders get access to a few tradable products, including Forex. The minimum necessary deposit of 1,300 BWP is typical compared to brokers that provide comparable trading conditions.

In addition, BDSwiss supports MetaTrader 4 and MetaTrader 5. As a result, traders may take advantage of leverage of up to 1:1000, tight and variable spreads, and incredibly cheap trading fees.

Features

| 💠 Account Feature | 💰 Value |

| 📈 Average Spread on EUR/USD | 1.5 pips |

| 📈 Maximum Leverage | 1:500 |

| 🔆 Tradable Instruments | Over 250 |

| 📈 Available Assets | Forex CFDs Stocks CFDs Indices CFDs Commodities CFDs Cryptocurrencies CFDs |

| 🔎 Commissions per round lot | $2 on Indices 0.15% on Shares |

| ✴️ Margin Call | 50% |

| 📊 Stop-out level | 20% |

| 💳 Instant Withdrawals offered? | Yes, only on credit cards up to 2,000 €/$/£ |

| 💳 0% fees on Deposits and CC Withdrawal? | Yes |

| 💻 Platforms available | All |

| 📊 Are trading alerts offered? | Limited Access granted |

| 📈 AutoChartist Performance Stats offered? | Yes, with a 6,400 BWP minimum deposit |

| 🎓 Personal Account Manager | Yes, with a 12,900 BWP minimum deposit |

| Priority Service | No |

| 📈 AutoChartist Standard Tools | Yes |

| 🚀 Access to Trading Central? | Yes |

| 📊Trading Academy and Live Webinars | Yes |

| 📊Trade Companion offered? | No |

| ☪️ Islamic Account option? | Yes |

| 🔎 VIP Webinars | No |

| 👨💼 24/5 Customer Service and Support? | Yes |

| 💳 Minimum deposit requirement | $10 / 134 BWP |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| BDSwiss is multi-regulated and offers high liquidity | Withdrawal fees are charged |

| There is a range of markets that can be traded | There are no local deposit or withdrawal methods offered to Botswanan traders |

| BDSwiss offers competitive trading conditions and a choice between account types | There is no desktop version of the BDSwiss trading platform |

| There is optimal service offered by prompt and dedicated customer support | |

| There are user-friendly and flexible trading platforms offered | |

| BDSwiss offers a large range of trading tools and research | |

| There are educational materials offered to beginner Botswanan traders | |

| There is an industry-standard deposit requirement when Botswanan traders register an account |

8. FP Markets

Overview

FP Markets has been operating since 2005, making it an industry veteran with a wealth of experience thanks to its global clientele.

In addition, FP Markets invests heavily in research and development and uses innovative trading technologies, including electronic bridges, to strengthen its value offering.

Min Deposit

100 USD/1 343 BWP

Regulators

ASIC, CySEC, FSCA, CMA

Trading Desk

MetaTrader 4, MetaTrader 5

Crypto

Yes

Total Pairs

63

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

FP Markets stands out as a great option when it comes to currency exchange (FX) and contracts for difference (CFDs). MetaTrader and Raw ECN accounts on a commission basis with very tight spreads are available via FP Markets.

FP Markets offers MT4 and MT5, allowing traders to access over 12,000 distinct symbols.

Features

| Account Feature | Value |

| 💰 Minimum Deposit | 100 USD / 1 343 BWP |

| 📊 Average Spreads | Variable, from 1 pip |

| ✔️ Instruments Available | 60+ Forex pairs, metals, indices, commodities |

| 📈 Maximum Leverage Ratio | 1:500 |

| 📱 Execution Type | ECN |

| 💵 Commissions | None |

| 👥 Expert Advisors Offered? | Yes |

| 📲 Mobile App Offered? | Yes |

| ✔️ VPS Available? | Yes |

Pros and Cons

| ✔️ PROS | ❌ CONS |

| fpmarkets is a well-established Australian broker regulated by ASIC and CySEC | Fixed spreads are not available |

| Botswanan traders can choose from an impressive range of markets that can be traded through powerful platforms | There are withdrawal fees charged on most payment methods that are supported |

| fpmarkets offers comprehensive mobile trading opportunities | There are administration fees which apply to the Islamic accounts and trading |

| Botswanan traders can expect superior ECN pricing that includes raw and tight spreads and low commissions | |

| fpmarkets is known for its fast trade execution that is delivered through the Equinix servers | |

| There are commission-free accounts offered that still feature competitive spreads | |

| There are dedicated Islamic accounts for Muslim traders | |

| fpmarkets offers a range of educational materials and advanced trading tools |

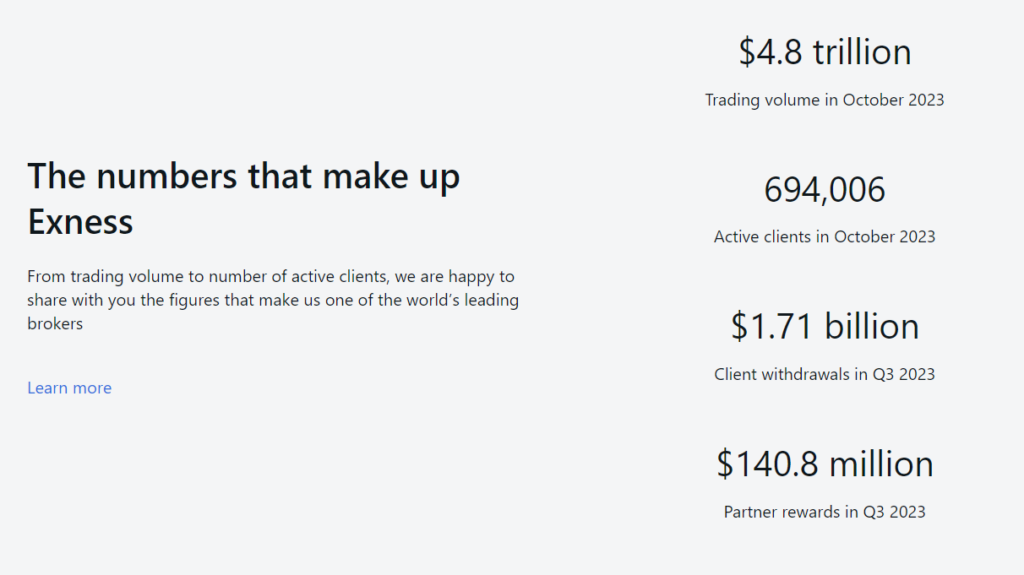

9. Exness

Overview

Exness is a globally known broker with two primary offices in Seychelles, South Africa, and the UK. In addition, Exness is also recognized as a Cyprus-based broker regulated and licensed by FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, and FCA.

Min Deposit

$10 / 134 BWP

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Exness requires a minimum deposit of 130 BWP to create an account. By creating a live trading account, Botswana traders have access to a wide range of tradable financial products, including Forex and other CFDs.

MetaTrader 4 and MetaTrader 5 are also supported, along with unlimited leverage on some accounts, tight spreads, and no hidden commission fees.

Features

| Feature | Information |

| 📈 Account Base Currencies | AED, ARS, AUD, AZN, BDT, BHD, BND, BRL, CAD, CHF, CNY, EGP, EUR, GBP, GHS, HKD, HUF, IDR, INR, JOD, JPY, KES, KRW, KWD, KZT, MAD, MXN, MYR, NGN, NZD, OMR, PHP, PKR, QAR, SAR, SGD, THB, UAH, UGX, USD, UZS, VND, XOF, ZAR |

| 📊 Minimum Spread | 0.0 pips EUR/USD |

| 💳 Botswanan Deposits/Withdrawals | Yes |

| ⚖️ CBN Regulation | No |

| 📊 Account Types | Standard Account, Standard Cent Account, Raw Spread Account, Zero Account, Pro Account |

| ⚖️ Regulation | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA |

| 📈 Leverage | Unlimited |

| 📊 Micro Account Offered? | No |

| 📈 Trading Tools | Analytical tools, Trading calculators, currency converter, tick history, economic calendar |

| 💻 Educational Material | None |

| 👥 Botswanan-Based Customer Support | No |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The broker has a global presence and has authorization and regulation with market regulators around the globe | There is a limited selection of tradable instruments and only a few asset classes |

| Offers instant withdrawals and deposits | There are only a few funding options offered |

| Botswanan traders have a choice between several dynamic account types | |

| Client fund safety is guaranteed and there is investor protection offered | |

| Offers 24/7 customer support that is both prompt and helpful | |

| There are tight and variable spreads offered with competitive commissions |

10. XM

Overview

XM is a respected ECN and STP broker tightly regulated by FSCA, CySEC, DFSA, IFSC, and ASIC. Its services are available in over 196 countries to over 2.5 million customers for trading Forex, commodities, metals, and indices, among other financial instruments.

Min Deposit

USD 5 / 67 BWP

Regulators

IFSC, CySec, ASIC

Trading Desk

Desktop MT4 and MT5, Mobile MT4 and MT5, XM mobile app, Web platform

Total Pairs

57

Islamic Account

Yes

Trading Fees

No (Just spread)

Account Activation Time

24 Hours

Botswana traders may anticipate minimal deposits of 66 BWP, tight and variable spreads, ultra-low transaction commissions, a maximum leverage of 1:888, and access to the greatest trading platforms when opening a real account.

Features

| Feature | Information |

| ⚖️ Regulation | FSCA, IFSC |

| ⚖️ CBN Regulation | No |

| ✔️ Accepts Botswanan Traders? | Yes |

| 💳 Minimum deposit (BWP) | $5 / 67 BWP |

| Average spread from | 0.0 pips EUR/USD |

| 📈 Maximum Leverage | 1:1000 |

| 👥 Customer Support | 24/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Negative balance protection is applied to retail investor accounts | US clients are restricted from accessing XM’s trading services |

| There are several secure payment methods to choose from | There are no fixed spread accounts offered |

| The broker is known for low spreads, low commissions, and reliable trade execution speeds | There is an inactivity fee applied to dormant accounts |

| Traders can use hedging, scalping, and expert advisor trading strategies | |

| The broker offers personal customer service to its clients |

11. HFM

Overview

HFM is an international CFD broker that allows its clients to trade foreign exchange, cryptocurrencies, metals, energy, indices, shares, commodities, bonds, and exchange-traded funds, among other financial products.

Min Deposit

USD 0

Regulators

CySEC, FCA, DFSA, FSCA, FSA, CMA

Trading Desk

MT4, MT5, HFM APP

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

0

Account Activation Time

24 Hours

The entry-level account requires just 0 USD / 0 BWP in funding, while more advanced traders provide up to a thousand to one leverage.

HFM has developed over 500,000 active trading accounts. The firm has achieved several honors from the industry and the backing of key sponsors, such as Best Clients Funds Security Broker, Best Forex Provider, Top 100 Companies, etc.

Features

| Features | Information |

| ⚖️ Regulation | FSCA, CySEC, DFSA, FSA, FCA, CMA, and FSC, with registration in ACPR, BaFin, MNB, CONSOB, CNMV, FI, FMA, FSC, and other regions |

| 💸 Minimum Withdrawal Time | – |

| 📈 Maximum Withdrawal Time | 2 to 4 working days |

| 💰 Instant Deposits/Withdrawals? | Yes, deposits |

| 💳 BWP-Denominated Account? | No |

| 📱 Minimum Deposit Amount | $0 / 0 BWP |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| HFM is a trusted broker that ensures client fund safety | There are only a few payment methods offered |

| Electronic payment gateways ensure quick deposits | HFM only accepts two deposit currencies |

| HFM does not keep client funds in its broker account | Conversion fees will apply to BWP deposits |

| The deposit is low and affordable, even for beginners | |

| There are flexible deposit methods offered |

12. Axiory

Overview

Axiory is an international CFD and FX broker that works with MetaTrader 4 and cTrader. The year 2021 witnessed the introduction of Axiory’s new social trading platform.

Min Deposit

10 USD / 133 BWP

Regulators

IFSC, MFSC and FSC

Trading Desk

MetaTrader4, MetaTrader5, CopyTrade and cTrader

Crypto

No

Total Pairs

62

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

To copy the trades of Master Traders, users with a Max account can download the free mobile app. With Axiory, you may get some of the lowest floating forex spreads of any major broker.

Purple Technology, a global leader in financial technology, supports the brand by providing innovative server management and optimization, web application development, and payment solutions to brokers throughout the globe.

Features

| Feature | Value |

| 💳 Minimum Deposit Requirement | $10 / 134 BWP |

| 📈 Platforms Available for Account Type | MetaTrader 4 |

| 📊 Average Spreads on Major Forex Pairs | None |

| 🚀 Maximum Leverage Ratio | 1:777 |

| 🔎 Commission Charges on Trades | From $1.5 per lot |

| 📈 Commissions on Stock CFDs | None |

| 💰 Account Base Currency Options | EUR or USD |

| 🔨 Negative Balance Protection Offered | No |

| 💸 Minimum Forex Trading Volume | 1 Lot |

| 💵 Islamic Account Conversion Offered? | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Axiory is well-regulated and a member of the Financial Commission | Botswana traders do not have access to local deposit and withdrawal options |

| Axiory guarantees client fund safety and provides investor protection | Botswana Pula is not a supported base account currency |

| Traders have a choice between retail investor accounts and powerful trading platforms | Botswana cannot deposit funds in local currency |

| There is a range of tradable instruments offered | Crypto trading is not supported |

| There is an Islamic account offered and an unlimited demo account | There are holding commissions applied to the Islamic Account |

| There is unlimited access to AutoChartist | |

| Traders can use a range of trading strategies | |

| The broker accepts Botswana traders |

13. AvaTrade

Overview

AvaTrade is a regulated market maker that facilitates trade in various assets, such as foreign currency, commodities, cryptocurrencies, exchange-traded funds, options, bonds, and vanilla options.

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

AvaTrade delivers one of the most intuitive and forward-thinking trading environments for Botswanan traders, thanks to its support for all the industry’s top platforms, including MT4, MT5, and its award-winning app, AvaTradeGO.

Compared to other brokers, AvaTrade had the lowest trading costs associated with their account. The average spread for a Retail account in EUR/USD is 0.9 pips, and AvaTrade provides a fixed spread account.

Features

| Feature | Information |

| ⚖️ Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, FRSA, CySEC, ISA |

| ⚖️ CBN Regulation? | No |

| 📊 Trading Accounts | Retail Investor Account, Professional Account Option |

| 📊 Trading Platform | AvaTradeGO, AvaOptions, AvaSocial, MetaTrader 4, MetaTrader 5, DupliTrade, ZuluTrade |

| 💰 Minimum Deposit (BWP) | $100 / 1343 BWP |

| 💰 Trading Assets | Foreign currencies, Cryptocurrencies, Commodities, Treasuries, Bonds, Indices, Stocks, ETFs, Options, CFDs, Precious Metals |

| 🔎 Botswanan Pula-based Account? | No |

| 💳 BWP Deposits Allowed? | No |

| 💰 Bonuses for Botswanan traders? | Yes |

| 📈 Minimum spread | 0.9 pips EUR/USD |

| 📊 Demo Account | Yes |

| ☪️ Islamic Account | Yes |

| ✴️ Social Trading Offered | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| AvaTrade is multi-regulated and one of the most trusted online trading brokers in the world | Variable spreads are not offered |

| There is a wide range of financial instruments that can be traded across financial markets | There is a limited choice between account types |

| There are several technical indicators, economic indicators, and other solutions for advanced traders | Inactivity fees are applied |

| There are several trading platforms to choose from | Currency conversion fees may be applied |

| There is a decent selection of educational material that helps beginner traders navigate complex instruments and lower the degree of risk they are often exposed to | There is a limited number of base currency options offered on accounts |

| There is a multitude of social trading opportunities offered | |

| The broker accepts any trading strategy including automated trading, expert advisors, scalping, hedging, and others. |

How to Choose the Right Forex Broker in Botswana

Botswanan traders must evaluate the following components of a forex broker to decide whether the broker is suited to their unique trading objectives or needs.

Regulations and Licenses

This is the first vital component that Botswanan traders must thoroughly evaluate. Reputable brokers are regulated by market regulators such as FCA, ASIC, CySEC, FSCA, and others.

Botswanans must beware when dealing with brokers with only offshore regulations such as FSA, SVG BVI, FSC, and others.

Account Features

Account Features include leverage trading and margin requirement, commissions and spreads, initial deposit, additional features on retail investor accounts, and so on.

Deposits and Withdrawals

Botswanans must evaluate the payment options available, the processing times on withdrawal requests, deposit currencies offered, the withdrawal fee, deposit fees, and minimum withdrawal limits, among other trading and non-trading fees.

Range of Markets

The range of markets offered refers to the number and range of tradable instruments the broker offers. Therefore, Botswanans must consider what they wish to trade and what is available.

Customer Support

Customer Support is another crucial factor. Botswanans must check the availability of support (trading hours), the quality of support, and the promptness with which the customer support team responds to queries.

Trading Platform

A trading platform is the Botswanan trader’s portal to the financial markets. Therefore, traders must ensure that the trading platform has the necessary technical indicators, fundamental analysis, technical analysis, economic calendar, charting, newsfeed, and other tools they may need.

Education and Research

Education and Research come in handy to both novice traders and experienced investors. Education includes some of the following:

➡️ eBooks

➡️ Trading guides

➡️ Trading knowledge on leveraged products

➡️ A risk warning on complex instruments

➡️ Educational videos

Research can include some of the following:

➡️ Trading tools

➡️ Commentary

➡️ Status of International Markets

➡️ Price movements

➡️ Market sentiments

➡️ Whether there is a volatile market

➡️ Exchange Rates

➡️ Expert opinions and other resources can help experienced traders make informed trading decisions.

The Best Forex Brokers in Botswana

In this article, we have listed the best brokers that offer forex trading to traders in Botswana. In addition, we have further identified the brokers that offer additional services and solutions to Botswanan traders.

Best MetaTrader 4 / MT4 Forex Broker in Botswana

Min Deposit

USD 25

Regulators

FCA UK

Trading Platform

MT5, MT4, OctaTrader

Crypto

Yes

Total Pairs

28

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, OctaFX is the best MT4 forex broker in Botswana. OctaFX is an MT4 and MT5 broker that provides Botswanans with various markets. OctaFX offers a choice of accounts via MT4, including ECN and STP accounts, with superior trade execution.

Best MetaTrader 5 / MT5 Forex Broker in Botswana

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, AvaTrade is the best MetaTrader 5 forex broker in Botswana. In addition, AvaTrade is regarded as one of the most secure MT5 forex brokers.

No commission is charged for trading currency pairings, only leaving the spread to be paid. A demo account is also available for traders to sharpen their abilities via MT5 and several other platforms.

Best Forex Broker for beginners in Botswana

Min Deposit

$100

Regulators

CFT, NFA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FOREX.com is the best forex broker for beginners in Botswana. FOREX.com is a broker renowned for low trading fees and beginner-friendly solutions. In addition, FOREX.com offers several educational materials and a helpful demo account.

Best Low Minimum Deposit Forex Broker in Botswana

Min Deposit

$10 / 134 BWP

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Exness is the best Low Minimum Deposit Forex Broker in Botswana. Exness has a minimum deposit requirement of 10 USD / 130 BWP, making it easy for Botswanans to start trading 278 instruments.

Exness also offers MT4 and MT5 through which trades can be made. In addition, it offers some of the best trading tools, charting capabilities, technical indicators, expert advisors, and more.

Best ECN Forex Broker in Botswana

Min Deposit

USD 0

Regulators

CySEC, FCA, DFSA, FSCA, FSA, CMA

Trading Desk

MT4, MT5, HFM APP

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

0

Account Activation Time

24 Hours

Overall, HFM is the best ECN forex broker in Botswana. HFM is a hybrid forex and CFD broker that uses STP and ECN technology to ensure that Botswanans get the best pricing, minimal slippage, no requotes, and the fastest trade execution.

HFM uses the best liquidity providers who aggregate the pricing that Botswanans can see on MT4, MT5, and the HF App for Android and iOS.

Best Islamic / Swap-Free Forex Broker in Botswana

Min Deposit

USD 10 / 136 BWP

Regulators

CySec, FCA

Trading Desk

None

Crypto

Yes

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, eToro is the best Islamic / Swap-Free forex broker in Botswana. eToro is a renowned social trading platform that offers Muslim traders an Islamic Account.

eToro does not charge any interest on positions held for over 24 hours. However, registering an Islamic Account can be expensive initially, requiring a 1,000 USD / 13,400 BWP deposit.

Best Forex Trading App in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

ASIC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

300

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, CMC Markets is the best forex trading app in Botswana. In addition, CMC Markets offers a user-friendly mobile app with research tools, powerful charts, customizable watch lists, news reports, and a range of educational materials.

Best Lowest Spread Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

FCA, CySEC, IFSC, KNF

Trading Desk

No Trading Desk

Crypto

Yes

Total Pairs

48

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, XTB is the best lowest-spread forex broker in Botswana. XTB is a well-known forex and CFD broker with low and competitive forex spreads from 0.1 pips depending on the financial instrument and the market conditions.

XTB is also a good broker in terms of educational materials and research capabilities, providing traders with comprehensive market analysis across markets.

Best Nasdaq 100 Forex Broker in Botswana

Min Deposit

USD 10

Regulators

CySec, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

60

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXTM is the best Nasdaq 100 forex broker in Botswana. FXTM is a multi-regulated forex and CFD broker that accommodates Botswanan traders with a keen interest in Nasdaq. Traders can expect low and competitive spreads, a choice between accounts, and powerful trading platforms.

Best Volatility 75 / VIX 75 Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

IGRs

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, IG is Botswana’s best Volatility 75 / VIX 75 forex broker. IG is one of the best CFD brokers with powerful proprietary trading technology.

IG is well-regulated and offers Botswanans access to VIX75, with spreads from 0.04 pips / 0.13% and zero commission charges.

Best NDD Forex Broker in Botswana

Min Deposit

USD 50 / 672 BWP

Regulators

FCA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

–

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXCM is the best NDD forex broker in Botswana. FXCM is a No-Dealing Desk broker with STP and ECN execution across several markets.

In addition, FXCM offers a choice between third-party platforms in addition to technical indicators, charting tools, and competitive trading conditions.

Best STP Forex Broker in Botswana

Min Deposit

USD 10

Regulators

IFSC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

36

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, RoboForex is the best STP forex broker in Botswana. RoboForex is popular forex and CFD broker with competitive trading conditions. RoboForex offers STP execution with liquidity sourced from top providers.

Botswanans can expect access to over 12,000 instruments via powerful and innovative third-party platforms.

Best Sign-up Bonus Broker in Botswana

Min Deposit

50 USD / 682 BWP

Regulators

CYSEC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Windsor Brokers is the best sign-up bonus broker in Botswana. Windsor Brokers is a well-regulated broker that offers Botswanans a welcome account funded with 30 USD in trading credit. With this account, Botswanans can explore the platform or risk-free test their strategies.

You might also like: Best PAMM Account Forex Brokers in Botswana

You might also like: Scam Forex Brokers in Botswana

You might also like: Best Cent Account Forex Brokers in Botswana

You might also like: Best Volatility 75 Forex Brokers in Botswana

You might also like: Best ECN Forex Brokers in Botswana

Conclusion

These brokers serve a range of traders regardless of their differing degrees of ability, knowledge, and experience, as well as millions of traders residing in different nations.

These brokers provide Botswana traders with comprehensive and alluring trading circumstances that fulfil the interests of both novice and experienced traders. Trading costs are straightforward and reasonable.

In addition, these brokers use only trustworthy, well-known, and user-friendly trading platforms, such as MetaTrader 4 and MetaTrader 5, two of the most prominent trading platforms in the trading world.

Frequently Asked Questions

Is Forex allowed in Botswana?

Forex trading in Botswanan is legal in addition to trading CFDs on Forex. To trade currencies in Botswana, you must use a locally licensed and authorized dealer. However, you can use any international CFD broker to trade forex CFDs.

Can I use Exness in Botswana?

Exness accepts Botswanan traders, and while the broker does not have a BWP-denominated account, Botswanans can choose from several other currencies.

Is AvaTrade regulated in Botswana?

AvaTrade is not locally regulated in Botswana. However, AvaTrade is well-regulated by FRSA, CySEC, Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, and ISA.

Can I trade using OANDA in Botswana?

OANDA, along with hundreds of other Forex and CFD brokers, accept and welcome Botswanan traders.

When should I avoid trading forex in Botswana?

The Foreign Exchange (Forex) market operates around the clock, five days a week. However, there are times when you should avoid participating.

Examples of such times are when banks are closed, when major news is released, when central banks have major meetings, and when markets are closed due to holidays.

Which forex brokers offer the best trading platforms for Botswana traders?

- Pepperstone

- Tickmill

- Exness

- XM

- HFM

- AvaTrade

Which trading platforms can you use with M-PESA?

- Pepperstone

- XM

- Exness

Which Forex Brokers are best for beginner Botswana Traders?

- AvaTrade

- Exness

- Pepperstone

Which brokers offer a sign-up bonus for first-time traders in Botswana?

- AvaTrade

- FBS

- OctaFX

- Tickmill

Which brokers offer a low minimum deposit of $5 (67 BWP) to start trading?

- FBS

- XM

Which brokers offer a mobile app on IOS and Android for Botswana Traders?

- AvaTrade

- Exness

- XM

- Pepperstone

- Oanda

- BDSwiss

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review