9 Best Forex Trading Platforms in Botswana

The 9 Best Forex Trading Platforms for Botswanans revealed. We tested the best forex trading platforms for Botswana Traders.

This is a complete guide to forex trading platforms in Botswana.

In this in-depth guide you’ll learn:

- What is a Trading Platform, and how do they work?

- Which forex brokers offer the best trading platforms for Botswana traders?

- Which trading platforms can you use with M-PESA?

- How to compare the best trading platforms against each other.

- Which Trading Platforms are best for beginner Botswana Traders?

- Which brokers offer a sign-up bonus for first-time traders in Botswana?

And lots more…

So if you’re ready to go “all in” with the best-tested forex trading platforms…

Let’s dive right in…

- Louis Schoeman

10 Best Forex Brokers in Botswana for 2024

Rank

Broker

Review

Regulators

Min Deposit

Official Site

What is a Trading Platform, and how do they work?

The Foreign Exchange (Forex) trading software is a computer program suite that helps traders overcome various obstacles.

The program is loaded with tools designed to aid traders in their endeavors and increase their profits from each deal. Moreover, unlike other markets, Forex traders do not typically have to pay for any software they use.

Training classes, trading coaches and mentors, and even trader secrets may all be found in these free programs, making them invaluable to novice traders.

Trading platforms, techniques, and market psychology can typically be investigated and implemented with the aid of this technology. However, software that streamlines the trading process and performs in-depth research of currency pairings is essential for investors.

Forex trading software is designed to analyze market data in real-time, pick out trends, spot important news, and propose the best currency pairs to trade. In addition, this program evaluates the potential earnings of a given currency pair, which is a financial instrument.

Using this program, one could make short-term and long-term investments in various currencies. However, due to the extreme volatility of the foreign exchange market, this program operates entirely in the cloud. In addition, it runs in the background to constantly update the user.

This program is often provided at no cost by brokerage houses. Since the program is included in the brokerage’s free customer service, anybody may use it without cost. Traders use this program to execute deals and manage their accounts.

Most of the software can be downloaded and is widely accessible worldwide. It also works without compatibility problems on traditional PCs and mobile devices. Internet-based trading systems also provide portability and remote access to desktop applications.

Many forex trading systems also allow for user customization. In addition, the use of open-source software in their development has enabled the addition of functionality provided by other developers.

These third-party plugins could be purchased by experienced traders and added to the trading program to boost their actions and results. In addition, these trading add-ons provide extra tools for dealing with and studying various currency pairings.

In addition, add-ons can automatically monitor the value of currencies in the form of financial instruments, allowing Botswanans investors to spot profitable trends.

9 Best Forex Trading Platforms in Botswana

- ✔️ AvaTradeGO – Overall, Best Forex Trading Platforms in Botswana

- ✔️ TradingView – Top Charting Platform

- ✔️ cTrader – Platform with Complete Forex Trading Solution

- eToro – Best Social Trading Platform in Botswana

- XM – Top NDD Forex Broker

- MetaTrader 5 – Best Trading Platform for Beginner Traders

- IQ Option – Top Variety of Assets in Botswana

- MetaTrader 4 – Best Automation Platform

- NinjaTrader – Top Mobile Trading App in Botswana

1. AvaTradeGO

Overview

AvaTradeGO is the mobile app of one of the most popular, reputable forex and CFD brokers in the world, AvaTrade. AvaTradeGO allows users to decrease risk, capitalize on market movements, and remain current.

This app is exclusive to AvaTrade and provides user-friendly features and a secure method for monitoring social trading. According to customer evaluations, AvaTradeGO provides an exceptional user experience.

AvaTradeGO’s notification, price alert, and charting features enable traders to get crucial financial information for detailed market research.

A Botswanan trader can easily build a watchlist and examine alerts, live prices, and technical charts using this tool. The traders may pick from various trading products, including commodities, stock indexes, and foreign exchange.

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

This application is compatible with both iOS and Android. In addition, AvaTrade’s app is user-friendly for traders, providing them with a superior mobile experience.

Botswanans can use AvaTradeGo to observe social trends from the AvaTrade community of active traders in real-time. In addition, its technical skills provide you access to essential financial data for conducting lucid analyses of what concerns now.

All your trading instruments are linked on AvaTradeGo to provide insights into what other traders purchase and sell, trading behaviour, and visualizations with current information so that you can make more informed and precise choices.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| AvaTrade is multi-regulated and one of the most trusted online trading brokers in the world | Variable spreads are not offered |

| There is a wide range of financial instruments that can be traded across financial markets | There is a limited choice between account types |

| There are several technical indicators, economic indicators, and other solutions for advanced traders | Inactivity fees are applied |

| There are several trading platforms to choose from | Currency conversion fees may be applied |

| There is a decent selection of educational material that helps beginner traders navigate complex instruments and lower the degree of risk they are often exposed to | There is a limited number of base currency options offered on accounts |

| There is a multitude of social trading opportunities offered | |

| The broker accepts any trading strategy including automated trading, expert advisors, scalping, hedging, and others. |

2. TradingView

Overview

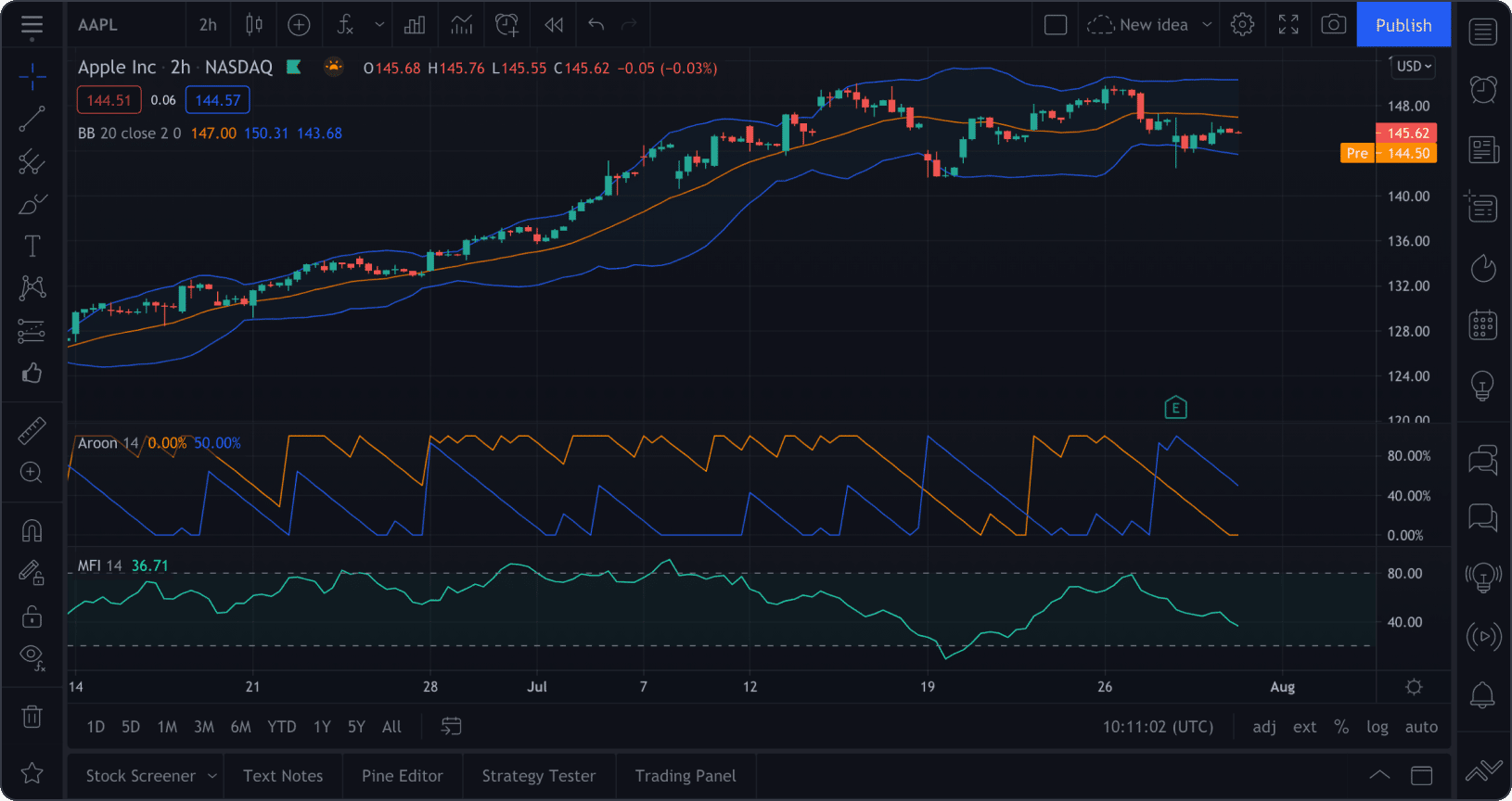

More than 30 million monthly traders and investors use TradingView, making it the most popular charting platform. In addition, TradingView is regarded as the top choice among stock screeners and analysis tools.

When compared to other investment, trading, and analytical tools, TradingView’s features are among the finest and most comprehensive. In addition, the Basic package includes several ad-free services that you can try for free.

When additional features such as numerous charts, specific time intervals, real-time market data, different periods, data exports, and sophisticated chart kinds are required, upgrading to a subscription plan such as Pro, Pro+, or Premium makes sense.

TradingView also has a helpful community and allows you to trade during off-market hours and do customized scans based on your trading strategy.

TradingView is accessible through a browser version on all devices. In addition, TradingView is downloadable as desktop software and a mobile app.

Botswanans should note that technical analysis is the main emphasis of TradingView. Subsequently, it is a platform that features advanced charting and in-depth data mining tools.

Multiple chart formats, timeframes, technical indicators, insights into trade volumes, and research tools are available to users. As a bonus, both a bright and dark option for visualizing data and robust sketching tools are available.

A single chart is included in TradingView Basic. At the same time, the premium version of TradingView allows for up to 8 charts to be shown on the screen, each with its own stock symbols, timeframes, and technical indicators.

Pro and premium customers can select their own unique time intervals from one-minute to monthly charts. Botswanans also have the option to trade straight from the chart using broker connections and live trading tools.

However, TradingView Desktop takes things further by providing much more raw power, speed, and customization options. Traders using the desktop platform may use native multi-monitor functionality and establish several tabs, each of which can display various charts.

For example, with six screens, Botswanans could easily set up six distinct layouts, one for each display. In addition, various designs could display unique informational graphics simultaneously.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| TradingView is extremely versatile and hosts a massive library of indicators | Customer support falls short compared to industry standards |

| There is a decent collection of advanced trading tools | There is a limited selection of supporting brokers that offer TradingView |

| The mobile app is an advanced and critically acclaimed | |

| There are affordable price plans offered | |

| Traders get access to a few features using the free plan | |

| TradingView has one of the best stock and forex screeners in the industry |

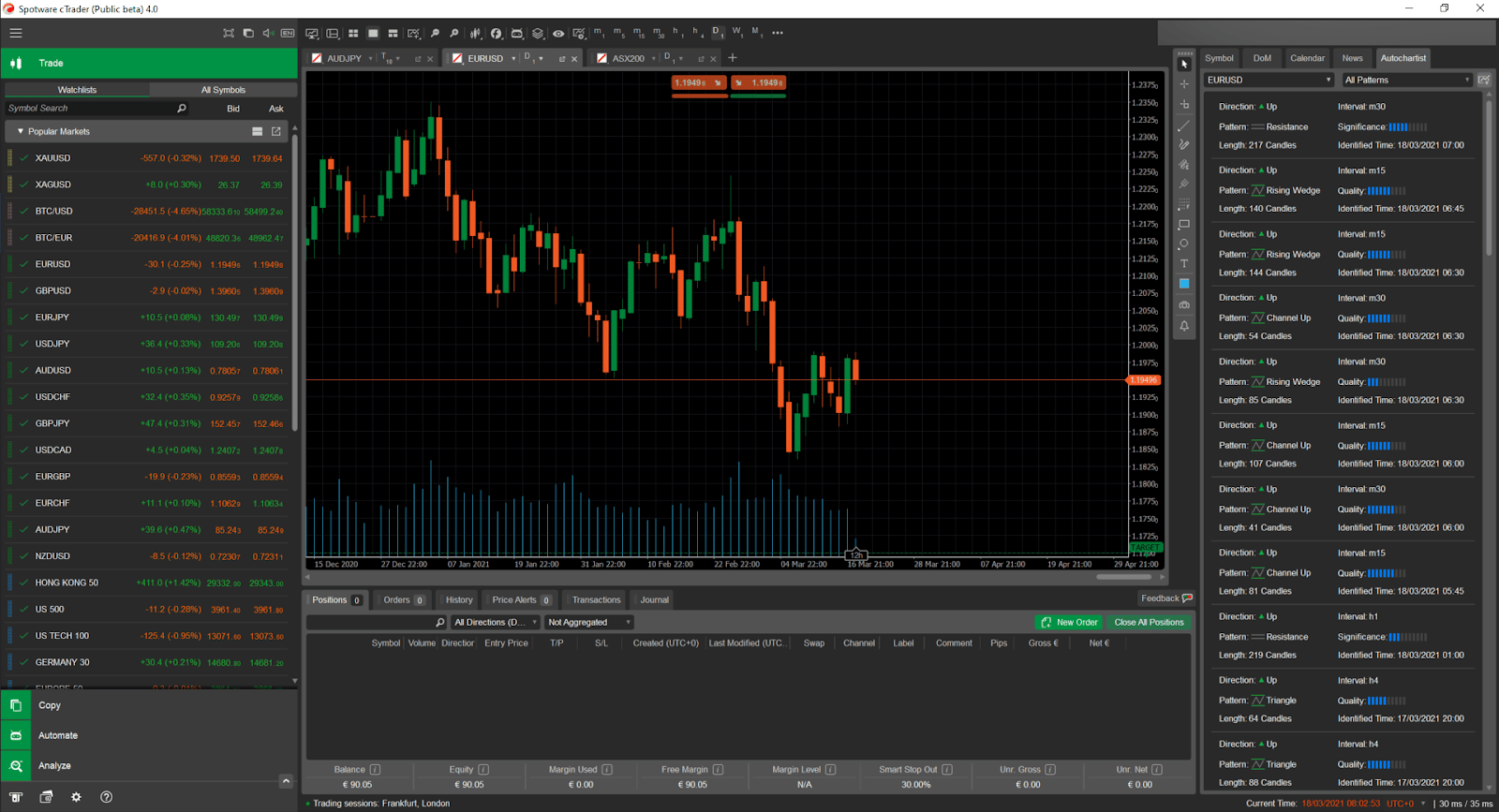

3. cTrader

Overview

Software Systems Ltd developed the cTrader online trading platform for foreign exchange and contracts for difference to provide brokers with a complete Forex trading solution.

The flexibility to place an order, prompt order cancellation, asynchronous order processing, level II pricing, and advanced order security are all features of cTrader.

cTrader Automate, an all-in-one, powerful, and user-friendly algorithmic trading solution, can assist traders in automating their trading processes.

Every kind of trader has access to a wide range of choices on the cTrader multi-asset trading platform. Through the side menu of the platform, traders utilizing cTrader have access to all these tools and detailed information about their trading performance.

Trading manually has several advantages, including quick order entry and execution, level II pricing, the opportunity to execute various orders, asynchronous order processing, and strong order security.

For its sophisticated charting features, which include various chart types, time frames, zoom levels, pre-installed and user-created indicators for technical analysis, and more, cTrader is renowned among trading platforms.

cTrader Automate includes all the tools you want for algorithmic trading. cTrader Automate, a reliable and user-friendly solution, now allows traders to automate their processes.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| cTrader is the ideal platform for more experienced social traders in Botswana | cTrader’s best strategies require a subscription |

| Traders can access a free stock trading facility via the cTrader platform | There are no additional social trading tools offered other than a forum |

| cTrader offers multilingual support | |

| There is a large range of custom and built-in technical indicators | |

| There are many free strategies that Botswanans can use |

4. eToro

Overview

As a multi-asset brokerage firm and cryptocurrency exchange, eToro is renowned for its copy and social trading features. A distinctive social trading environment serves as the centrepiece of eToro’s revolutionary trading platform.

Botswanans can research and mimic the moves of more seasoned investors for crypto, stock, and ETF assets using eToro’s social trading network.

The platform excels with a user-friendly site layout that enables investors to rapidly choose traders they want to follow or make their own trades. In addition, more than 140 countries are served by eToro, demonstrating the platform’s capacity to draw a wide spectrum of users.

Min Deposit

USD 10 / 136 BWP

Regulators

CySec, FCA

Trading Desk

None

Crypto

Yes

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Botswanans can effortlessly switch between trading on their chosen device thanks to the app’s and website’s identical features and capabilities.

You may rapidly find and imitate the cryptocurrency transactions of well-known investors with the CopyTrade tool. In addition, through the Popular Investor Program, which fosters the exchange of trading ideas and information, traders may interact with other platform users.

Members of the popular investor program get compensation based on the number of copiers they own; pay-outs can amount to up to 2% of the assets a trader has on the platform.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| eToro has a strict and solid regulatory framework | There are limitations on leverage for retail traders |

| Client fund safety is guaranteed and there is consumer protection offered | There is a limited selection of retail investor accounts |

| eToro offers commission-free trading | Fixed spreads are not offered |

| There are over 2,000 complex instruments that can be traded | The spreads are not the tightest |

| The broker offers several trading opportunities and a social trading feature | There is a high minimum deposit on the Islamic Account |

| There is an award-winning proprietary platform offered | There is an inactivity fee charged on dormant accounts |

| eToro offers 24/6 dedicated customer services | |

| eToro offers a demo account and an Islamic Account | |

| Algorithmic trading and margin trading supported | |

| Real time quotes are offered alongside a wide range of benefits | |

| The mobile app is secure and features robust security such as two-factor authentication | |

| The app can be used as a wallet app for digital currencies | |

| Offers several resources that help traders make improved financial decisions with confidence | |

| Offers several helpful tools and services as a solid basis for investment decision along with investment advice | |

| Provides access to several popular cryptocurrencies that can be traded and crypto staking services | |

| There is a comprehensive portfolio management service and popular investor program offered |

5. XM

Overview

Since 2009, the XM Group has been a group of licensed internet brokers selling their services. 2015 saw Trading Point of Financial Instruments Pty Ltd register as a service provider. As a result, a sizable audience of internet traders uses the brokering services XM offers.

There are millions of XM subscribers worldwide, spread over 196 countries. So far, it has completed more than 1.4 billion transactions with zero rejections or requotes, which is remarkable.

To interact with partners and customers, the executive team of XM has travelled to more than 120 places. As a result, the broker provides an innovative trading platform and flexible trading terms to suit a variety of international clientele.

XM has an extensive understanding of and experience with the international financial markets. In addition, the operational philosophy of XM is another argument in favor of using it as a broker. Its guiding principle is to cultivate loyalty to guarantee customer happiness.

Min Deposit

USD 5 / 67 BWP

Regulators

IFSC, CySec, ASIC

Trading Desk

Desktop MT4 and MT5, Mobile MT4 and MT5, XM mobile app, Web platform

Total Pairs

57

Islamic Account

Yes

Trading Fees

No (Just spread)

Account Activation Time

24 Hours

Credibility and reputation are intertwined, according to XM. Customers of XM may trade without requotes and with real-time execution. Since the policy’s implementation in 2010, XM has had zero order rejections, and zero requotes.

All orders are filled in full, with an amazing 99.35 percent being filled in less than a second. Throughout the trading hours, you can place orders on the platforms provided by XM at any time. Positions remain open until the execution of your closing trade.

In addition, your account’s balance will be updated in real-time to reflect the most current market rates.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Negative balance protection is applied to retail investor accounts | US clients are restricted from accessing XM’s trading services |

| There are several secure payment methods to choose from | There are no fixed spread accounts offered |

| The broker is known for low spreads, low commissions, and reliable trade execution speeds | There is an inactivity fee applied to dormant accounts |

| Traders can use hedging, scalping, and expert advisor trading strategies | |

| The broker offers personal customer service to its clients |

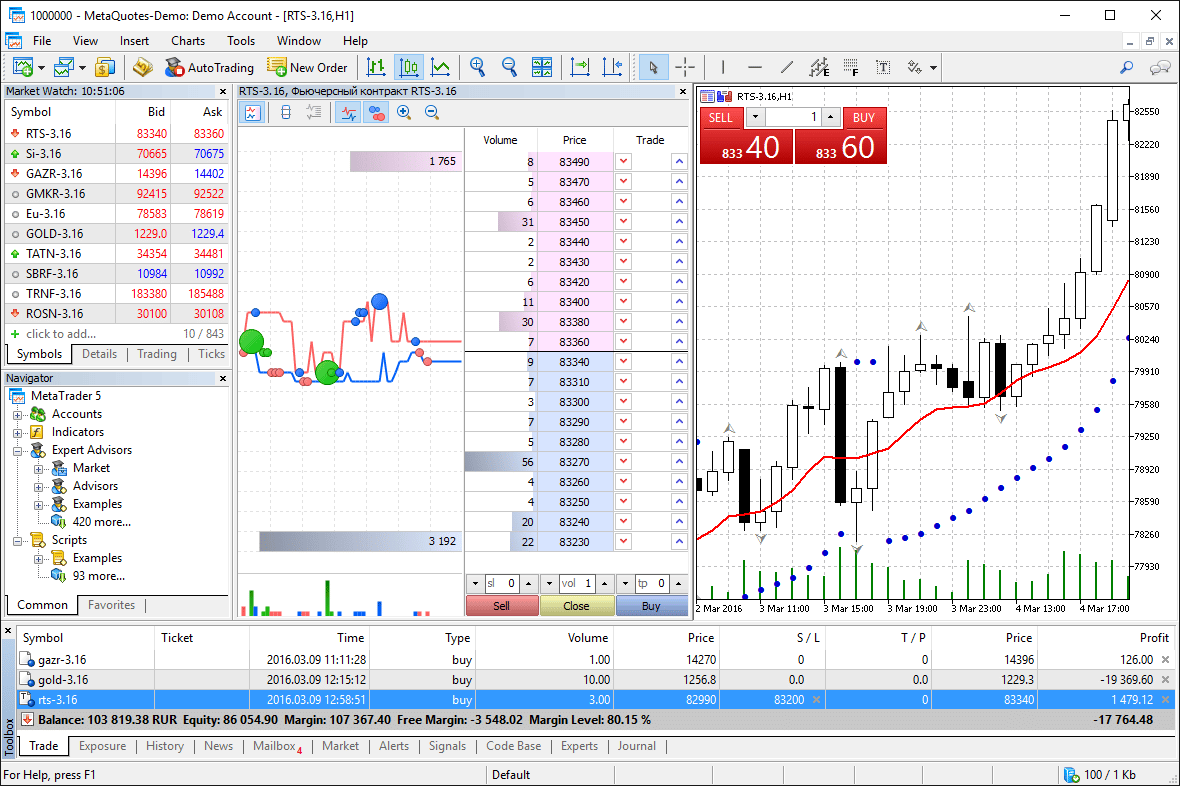

6. MetaTrader 5

Overview

MetaTrader 5 is an industry-standard multi-asset trading and analysis tool that may function alone or in tandem with a suitable online broker.

The platform’s extensive capability, with several add-ons available via its vast marketplace of third-party services, allows users to do foundational, qualitative, technical, and quantitative analyses.

With millions of users in over 190 countries, MetaTrader has become the industry standard for automated trading. The MT5 base software is free to download. However, data feeds (quotes and news) are necessary to make the most of the platform.

MetaQuotes is the place to go to get your hands on them. You may easily try out, purchase, or rent ‘Trading Robots,’ also known as algorithms, for any purpose you may have.

For desktop trading, a standalone version of MT5 is available for download. In addition, foreign currency, stock, and futures trading are all readily available via the MT5 Web terminal platform, which can be accessed using any web browser.

If your broker allows it, you can also use the MT5 Mobile app on your Android or iOS device. Over 38 technical indicators, 44 analytical items, 21 timeframes from 1-minute history, and unlimited charts are included in the MT5 basic platform.

Data feeds are required to use them in real-time. However, remember that these are only the fundamentals of the system. Additional indications and features may be added to improve the platform via the marketplace.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| MetaTrader 5 is beginner friendly | Traders cannot hedge on exchange markets |

| 21 timeframes can be applied to charts | The advanced tools and features might be confusing for beginners |

| There is a comprehensive suite of analytical tools provided to traders | |

| Several asset classes can be traded using MT5 | |

| MT5 is offered on mobile, web, and desktops |

7. IQ Option

Overview

IQ Option is a complete trading platform that offers a variety of assets, such as stocks, currency pairs, and cryptocurrencies, to its customers.

Since its inception in 2013, IQ Option has assisted over 80 million participants in taking charge of their financial futures and achieving their investment objectives.

Usability is one reason behind IQ Option’s appeal. The platform is designed to be intuitive and user-friendly, making it ideal for those new to online trading.

Several IQ Option features facilitate online trading; even if you have no previous trading expertise, you can rapidly learn how to use IQ Option and begin trading. The platform is intended for both novice and experienced traders.

A demo account with virtual money is available for novices to practice trading. Additionally, IQ Option provides a few instructional tools, including video lessons, webinars, and e-books.

There are over 300 assets available for skilled traders to trade, including currency pairings, equities, indexes, commodities, and cryptocurrencies.

This platform also provides competitive spreads and the IQ Option VIP account, which includes a personal account manager and a monthly review of your trading behaviour. In addition, IQ Option offers a mobile trading app compatible with Android and iOS smartphones.

Botswanans could quickly and easily download the application from the App Store or Google Play. In addition, a comprehensive tutorial on the IQ Option website may assist you if you encounter any issues throughout the procedure.

Once the installation is complete, you need to connect to your account to begin trading CFDs and other options from anywhere.

The IQ Option app provides additional capabilities, such as push notifications for price alerts and economic calendar events. You may also use it to communicate with other traders in real-time and to avoid missing any significant market changes.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| IQ Option is modern and user-friendly, with highly practical graph analysis | The web app can be slow |

| IQ Option is regulated and offers dedicated customer support | There is a limited range of tradable instruments |

| IQ Option has competitive trading and non-trading fees | An inactivity fee applies to dormant accounts |

| Professional traders have access to options trading via IQ Option | |

| The app and platform are both dependable and easy to use, even for beginners |

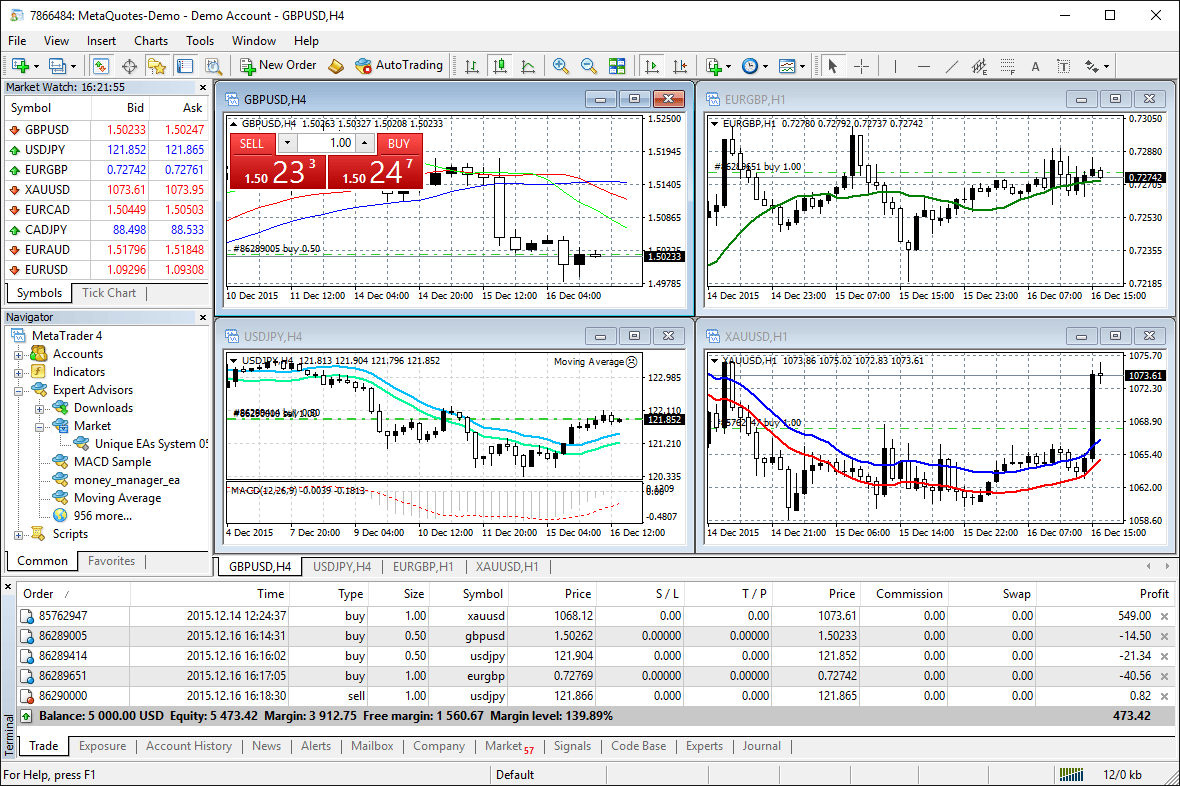

8. MetaTrader 4

Overview

MetaTrader 4 is a sophisticated trading platform that enables users to make and automate complicated deals. It is owned by MetaQuotes Software and offers customers a variety of market indicators for use in trading.

It is particularly beneficial for contracts for differences and foreign currency (forex) trading. However, it may also be used in other markets.

MetaTrader is free to use and download, and the fully-functional MT4 demo account allows novice traders to hone their trading skills without incurring any financial risk.

Additionally, this trading platform has a copy trading system and automated Expert Advisor applications. Meanwhile, experienced traders will value MT4’s comprehensive analytics and charting capabilities.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| MetaTrader 4 is beginner-friendly and offers an advanced trading suite | MT4 is not traditionally a copy-trading platform |

| Traders can access several trading strategies via third-parties | There are no inherent social trading features, and it depends on the broker that Botswanans use |

| Traders can use MT4 on mobile, desktop, and web browsers | Traders must connect with MT4 through a broker |

| There is a demo account offered along with educational materials | |

| There are more than 750 brokers that already use MT4 |

9. NinjaTrader

Overview

A wealth of information is available on this trading platform for anyone interested in futures trading and Forex trading. The automatic trading options and the 100+ built-in technical indicators make NinjaTrader one of the best in the business.

Suppose you are interested in looking at indicators and tactics developed by other parties. In that case, the platform provides access to a dedicated network of resources.

You may choose from hundreds of available indicators, signals, and techniques to tailor your trading environment to your specific needs, such as automated systems for order executions, training, and education.

NinjaTrader’s user base of 60,000+ traders has created a wealth of free, user-developed applications. For example, suppose you are just starting your forex journey. You can easily use NinjaTrader for free, unrestricted access to current and past market data.

Min Deposit

USD 0

Regulators

CFTC

Trading Desk

No Trading Desk

Crypto

Yes

Total Pairs

9

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Subsequently, it is a great platform for novice traders who want to practice with a simulator before diving into the real market and may benefit from the site’s extensive charts and tools.

Although NinjaTrader is still smaller than MetaTrader 4 and 5, many traders are switching from MT4 to NinjaTrader because of its superior charting, expanded customization options, and access to many data sources.

Traders can practice their skills using a market replay function that lets them download data from the past and make virtual deals.

There is a learning curve for novice traders using NinjaTrader due to its more complex interface and additional capabilities.

NinjaTrader provides a wealth of helpful learning resources, including daily training webinars for new users, hundreds of on-demand training videos, assistance manuals, and an illuminating YouTube channel.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| NinjaTrader offers discounts on commissions as well as lower margins on futures | There are only a few payment methods for deposits and withdrawals |

| Botswanans can customize their platform with signals, strategies, and indicators | The overall fee structure is expensive |

| There is unlimited support and daily training offered | There is no Islamic account offered to Muslim traders |

| Traders can expect access to professional market data and unlimited simulated trading | There is no BWP-denominated account, and this subjects traders to currency conversion fees |

| There is a comprehensive and helpful community forum where traders can connect with others | |

| There are over 100 indicators offered on the platform | |

| NinjaTrader offers thousands of third-party apps that can be integrated into the platform | |

| There is award-winning charting and analysis offered to all traders |

How to Choose the Right Forex Broker in Botswana

Botswanan traders must evaluate the following components of a forex broker to decide whether the broker is suited to their unique trading objectives or needs.

Regulations and Licenses

This is the first vital component that Botswanan traders must thoroughly evaluate. Reputable brokers are regulated by market regulators such as FCA, ASIC, CySEC, FSCA, and others.

Botswanans must beware when dealing with brokers with only offshore regulations such as FSA, SVG BVI, FSC, and others.

Account Features

Account Features include leverage trading and margin requirement, commissions and spreads, initial deposit, additional features on retail investor accounts, and so on.

Deposits and Withdrawals

Botswanans must evaluate the payment options available, the processing times on withdrawal requests, deposit currencies offered, the withdrawal fee, deposit fees, and minimum withdrawal limits, among other trading and non-trading fees.

Range of Markets

The range of markets offered refers to the number and range of tradable instruments the broker offers. Therefore, Botswanans must consider what they wish to trade and what is available.

Customer Support

Customer Support is another crucial factor. Botswanans must check the availability of support (trading hours), the quality of support, and the promptness with which the customer support team responds to queries.

Trading Platform

A trading platform is the Botswanan trader’s portal to the financial markets. Therefore, traders must ensure that the trading platform has the necessary technical indicators, fundamental analysis, technical analysis, economic calendar, charting, newsfeed, and other tools they may need.

Education and Research

Education and Research come in handy to both novice traders and experienced investors. Education includes some of the following:

➡️ eBooks

➡️ Trading guides

➡️ Trading knowledge on leveraged products

➡️ A risk warning on complex instruments

➡️ Educational videos

Research can include some of the following:

➡️ Trading tools

➡️ Commentary

➡️ Status of International Markets

➡️ Price movements

➡️ Market sentiments

➡️ Whether there is a volatile market

➡️ Exchange Rates

➡️ Expert opinions and other resources can help experienced traders make informed trading decisions.

The Best Forex Brokers in Botswana

In this article, we have listed the best brokers that offer forex trading to traders in Botswana. In addition, we have further identified the brokers that offer additional services and solutions to Botswanan traders.

Best MetaTrader 4 / MT4 Forex Broker in Botswana

Min Deposit

USD 25

Regulators

FCA UK

Trading Platform

MT5, MT4, OctaTrader

Crypto

Yes

Total Pairs

28

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, OctaFX is the best MT4 forex broker in Botswana. OctaFX is an MT4 and MT5 broker that provides Botswanans with various markets. OctaFX offers a choice of accounts via MT4, including ECN and STP accounts, with superior trade execution.

Best MetaTrader 5 / MT5 Forex Broker in Botswana

Min Deposit

$100 / 1 342 BWP

Regulators

ASIC, FSA

Trading Desk

MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, AvaTrade is the best MetaTrader 5 forex broker in Botswana. In addition, AvaTrade is regarded as one of the most secure MT5 forex brokers.

No commission is charged for trading currency pairings, only leaving the spread to be paid. A demo account is also available for traders to sharpen their abilities via MT5 and several other platforms.

Best Forex Broker for beginners in Botswana

Min Deposit

$100

Regulators

CFT, NFA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FOREX.com is the best forex broker for beginners in Botswana. FOREX.com is a broker renowned for low trading fees and beginner-friendly solutions. In addition, FOREX.com offers several educational materials and a helpful demo account.

Best Low Minimum Deposit Forex Broker in Botswana

Min Deposit

$10 / 134 BWP

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Exness is the best Low Minimum Deposit Forex Broker in Botswana. Exness has a minimum deposit requirement of 10 USD / 130 BWP, making it easy for Botswanans to start trading 278 instruments.

Exness also offers MT4 and MT5 through which trades can be made. In addition, it offers some of the best trading tools, charting capabilities, technical indicators, expert advisors, and more.

Best ECN Forex Broker in Botswana

Min Deposit

USD 0

Regulators

CySEC, FCA, DFSA, FSCA, FSA, CMA

Trading Desk

MT4, MT5, HFM APP

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

0

Account Activation Time

24 Hours

Overall, HFM is the best ECN forex broker in Botswana. HFM is a hybrid forex and CFD broker that uses STP and ECN technology to ensure that Botswanans get the best pricing, minimal slippage, no requotes, and the fastest trade execution.

HFM uses the best liquidity providers who aggregate the pricing that Botswanans can see on MT4, MT5, and the HF App for Android and iOS.

Best Islamic / Swap-Free Forex Broker in Botswana

Min Deposit

USD 10 / 136 BWP

Regulators

CySec, FCA

Trading Desk

None

Crypto

Yes

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, eToro is the best Islamic / Swap-Free forex broker in Botswana. eToro is a renowned social trading platform that offers Muslim traders an Islamic Account.

eToro does not charge any interest on positions held for over 24 hours. However, registering an Islamic Account can be expensive initially, requiring a 1,000 USD / 18714 BWP deposit.

Best Forex Trading App in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

ASIC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

300

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, CMC Markets is the best forex trading app in Botswana. In addition, CMC Markets offers a user-friendly mobile app with research tools, powerful charts, customizable watch lists, news reports, and a range of educational materials.

Best Lowest Spread Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

FCA, CySEC, IFSC, KNF

Trading Desk

No Trading Desk

Crypto

Yes

Total Pairs

48

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, XTB is the best lowest-spread forex broker in Botswana. XTB is a well-known forex and CFD broker with low and competitive forex spreads from 0.1 pips depending on the financial instrument and the market conditions.

XTB is also a good broker in terms of educational materials and research capabilities, providing traders with comprehensive market analysis across markets.

Best Nasdaq 100 Forex Broker in Botswana

Min Deposit

USD 10

Regulators

CySec, FSCA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

60

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXTM is the best Nasdaq 100 forex broker in Botswana. FXTM is a multi-regulated forex and CFD broker that accommodates Botswanan traders with a keen interest in Nasdaq. Traders can expect low and competitive spreads, a choice between accounts, and powerful trading platforms.

Best Volatility 75 / VIX 75 Forex Broker in Botswana

Min Deposit

USD 0 / 0 BWP

Regulators

IGRs

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, IG is Botswana’s best Volatility 75 / VIX 75 forex broker. IG is one of the best CFD brokers with powerful proprietary trading technology.

IG is well-regulated and offers Botswanans access to VIX75, with spreads from 0.04 pips / 0.13% and zero commission charges.

Best NDD Forex Broker in Botswana

Min Deposit

USD 50 / 672 BWP

Regulators

FCA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

–

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, FXCM is the best NDD forex broker in Botswana. FXCM is a No-Dealing Desk broker with STP and ECN execution across several markets.

In addition, FXCM offers a choice between third-party platforms in addition to technical indicators, charting tools, and competitive trading conditions.

Best STP Forex Broker in Botswana

Min Deposit

USD 10

Regulators

IFSC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

36

Islamic Account

No

Trading Fees

Low

Account Activation Time

24 Hours

Overall, RoboForex is the best STP forex broker in Botswana. RoboForex is popular forex and CFD broker with competitive trading conditions. RoboForex offers STP execution with liquidity sourced from top providers.

Botswanans can expect access to over 12,000 instruments via powerful and innovative third-party platforms.

Best Sign-up Bonus Broker in Botswana

Min Deposit

50 USD / 682 BWP

Regulators

CYSEC

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

50

Islamic Account

Yes

Trading Fees

Low

Account Activation Time

24 Hours

Overall, Windsor Brokers is the best sign-up bonus broker in Botswana. Windsor Brokers is a well-regulated broker that offers Botswanans a welcome account funded with 30 USD in trading credit. With this account, Botswanans can explore the platform or risk-free test their strategies.

Conclusion

Trading software is intended to improve a trader’s trading performance. Trading software may provide market knowledge and even trade on your behalf when utilized properly. Testing every piece of software on the market would be impossible.

Subsequently, we have compiled an exhaustive list of the top forex trading platforms for Botswanans.

You might also like: CFD Trading Platforms in Botswana

You might also like: Best Forex Trading Apps in Botswana

You might also like: Best Social Trading Platforms in Botswana

You might also like: Best Forex Trading Platforms in Botswana

You might also like: Best Futures Trading Platforms in Botswana

Frequently Asked Questions

What is forex trading software in Botswana?

Automated forex trading software operates in the forex market using a program that examines currency price charts and other market activity over several periods.

The program identifies lucrative currency pair trades based on indications such as spread disparities, price patterns, and news that may affect the market.

Can Botswanans automate their forex trading?

Trading foreign exchange, or forex, involves following a predetermined set of rules to buy and sell currency pairings.

While manual implementation of such systems is possible, many traders rely on computer-based automated methods that remove human emotion from the trading process.

What is the most popular forex trading platform among Botswanans?

You can track the markets and make trades in real time using MetaTrader, the industry-standard online trading platform.

Can Botswanans trade forex without a broker or software?

Botswanans cannot trade forex without a broker or software. Forex brokers facilitate the trade, and a trading platform connects the trader with their broker and international financial markets.

How much does it cost to use a trading platform in Botswana?

Most trading platforms offered by brokers are free. However, some additional features are typically charged.

Which forex brokers offer the best trading platforms for Botswana traders?

AvaTrade is the best Trading Platform.

Which Trading Platforms are best for beginner Botswana Traders?

FOREX.com is the best for beginners.

Which brokers offer a sign-up bonus for first-time traders in Botswana?

Windsor Brokers is the best sign up bonus.

Which trading platforms can you use with M-PESA?

- LiteFinance

- Pepperstone

- Exness

- FXPesa

- Scope Markets

- SuperForex

- Axi

- CM Trading

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Exness Review

Exness Review